May7,2024

THEWALTDISNEYCOMPANYREPORTS

SECONDQUARTERANDSIXMONTHSEARNINGSFORFISCAL2024

BURBANK,Calif.–TheWaltDisneyCompanytodayreportedearningsforitssecondquarterended

March30,2024.

FinancialResultsfortheQuarter:

• Revenuesforthequarterincreasedto$22.1billionfrom$21.8billionintheprior-yearquarter.

• Dilutedearningspershare(EPS)wasalossof$0.01forthecurrentquartercomparedtoincomeof

$0.69intheprior-yearquarter.DilutedEPSdecreasedtoanominallossduetogoodwillimpairments

inthequarter,partiallyoffsetbyhigheroperatingincomeatEntertainmentandExperiences.

• Excludingcertainitems

(1)

,dilutedEPSforthequarterincreasedto$1.21from$0.93intheprior-year

quarter.

KeyPoints:

• Inthesecondfiscalquarterof2024,weachievedstrongdoubledigitpercentagegrowthinadjusted

EPS

(1)

,andmetorexceededourfinancialguidanceforthequarter.

• Asaresultofoutperformanceinthesecondquarter,ournewfullyearadjustedEPS

(1)

growthtarget

isnow25%.

• Weremainontracktogenerateapproximately$14billionofcashprovidedbyoperationsandover

$8billionoffreecashflow

(1)

thisfiscalyear.

• Werepurchased$1billionworthofsharesinthesecondquarterandlookforwardtocontinuingto

returncapitaltoshareholders.

• TheEntertainmentDirect-to-Consumerbusinesswasprofitableinthesecondquarter.Whileweare

expectingsofterEntertainmentDTCresultsinQ3tobedrivenbyDisney+Hotstar,wecontinueto

expectourcombinedstreamingbusinessestobeprofitableinthefourthquarter,andtobea

meaningfulfuturegrowthdriverforthecompany,withfurtherimprovementsinprofitabilityinfiscal

2025.

• Disney+Coresubscribersincreasedbymorethan6millioninthesecondquarter,andDisney+Core

ARPUincreasedsequentiallyby44cents.

• Sportsoperatingincomedeclinedslightlyversustheprioryear,reflectingthetimingimpactof

CollegeFootballPlayoffgamesatESPN,offsetbyimprovedresultsatStarIndia.

• TheExperiencesbusinesswasalsoagrowthdriverinthesecondquarter,withrevenuegrowthof

10%,segmentoperatingincomegrowthof12%,andmarginexpansionof60basispointsversusthe

prioryear.Althoughthethirdquarter’ssegmentoperatingincomeisexpectedtocomeinroughly

comparabletotheprioryear,wecontinuetoexpectrobustoperatingincomegrowthatExperiences

forthefullyear.

FORIMMEDIATERELEASE

1

(1)

DilutedEPSexcludingcertainitems(alsoreferredtohereinasadjustedEPS)andfreecashflowarenon-GAAPfinancialmeasures.The

mostcomparableGAAPmeasuresaredilutedEPSandcashprovidedbyoperations,respectively.Seethediscussiononpages17

through21forhowwedefineandcalculatethesemeasuresandaquantitativereconciliationofhistoricalmeasuresthereofandthe

forward-lookingmeasureoffreecashflowtothemostdirectlycomparableGAAPmeasuresandwhytheCompanyisnotprovidinga

forward-lookingquantitativereconciliationofdilutedEPSexcludingcertainitemstothemostcomparableGAAPmeasure.

MessageFromOurCEO:

“OurstrongperformanceinQ2,withadjustedEPS

(1)

up30%comparedtotheprioryear,

demonstrateswearedeliveringonourstrategicprioritiesandbuildingforthefuture,”saidRobertA.

Iger,ChiefExecutiveOfficer,TheWaltDisneyCompany.“Ourresultsweredriveninlargepartbyour

Experiencessegmentaswellasourstreamingbusiness.Importantly,entertainmentstreamingwas

profitableforthequarter,andweremainontracktoachieveprofitabilityinourcombinedstreaming

businessesinQ4.

“Lookingatourcompanyasawhole,it’sclearthattheturnaroundandgrowthinitiativeswesetin

motionlastyearhavecontinuedtoyieldpositiveresults.Wehaveanumberofhighlyanticipated

theatricalreleasesarrivingoverthenextfewmonths;ourtelevisionshowsareresonatingwithaudiences

andcriticsalike;ESPNcontinuestobreakratingsrecordsaswefurtheritsevolutionintothepreeminent

digitalsportsplatform;andweareturbocharginggrowthinourExperiencesbusinesswithanumberof

near-andlong-termstrategicinvestments.”

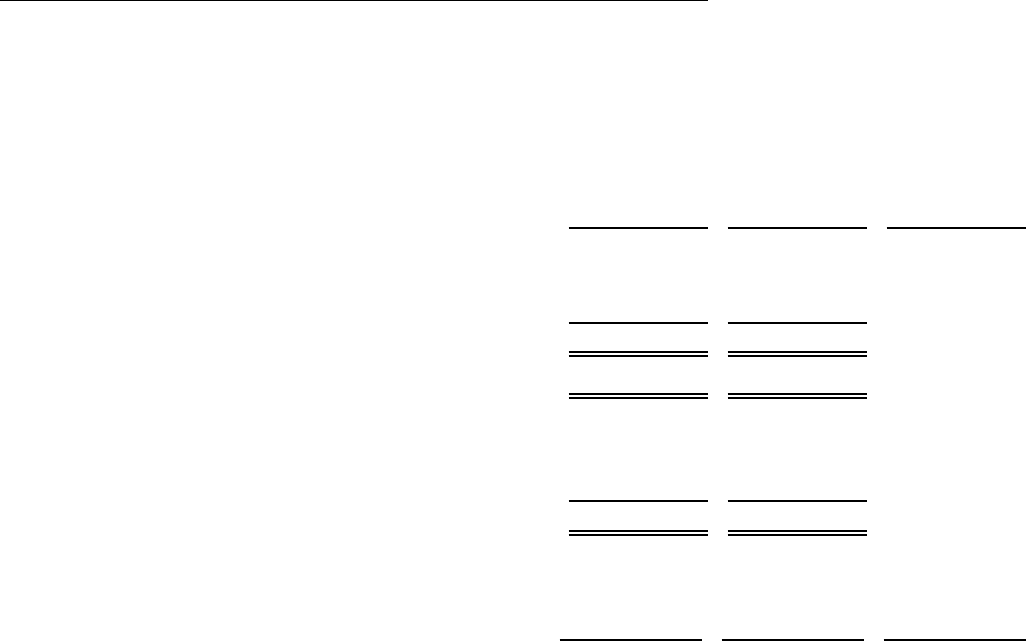

SUMMARIZEDFINANCIALRESULTS

Thefollowingtablesummarizessecondquarterresultsforfiscal2024and2023:

QuarterEnded SixMonthsEnded

($inmillions,exceptpershareamounts)

March30,

2024

April1,

2023 Change

March30,

2024

April1,

2023 Change

Revenues $ 22,083 $ 21,815 1% $ 45,632 $ 45,327 1%

Incomebeforeincometaxes $ 657 $ 2,123 (69)% $ 3,528 $ 3,896 (9)%

Totalsegmentoperatingincome

(1)

$ 3,845 $ 3,285 17% $ 7,721 $ 6,328 22%

DilutedEPS $ (0.01) $ 0.69 nm $ 1.03 $ 1.39 (26)%

DilutedEPSexcludingcertain

items

(1)

$ 1.21 $ 0.93 30% $ 2.44 $ 1.91 28%

Cashprovidedbyoperations $ 3,666 $ 3,236 13% $ 5,851 $ 2,262 >100%

Freecashflow

(1)

$ 2,407 $ 1,987 21% $ 3,293 $ (168) nm

(1)

Totalsegmentoperatingincome,dilutedEPSexcludingcertainitemsandfreecashflowarenon-GAAPfinancial

measures.ThemostcomparableGAAPmeasuresareincomebeforeincometaxes,dilutedEPSandcashprovidedby

operations,respectively.Seethediscussiononpages17through21forhowwedefineandcalculatethesemeasures

andareconciliationthereoftothemostdirectlycomparableGAAPmeasures.

2

SUMMARIZEDSEGMENTFINANCIALRESULTS

Thefollowingtablesummarizessecondquartersegmentrevenueandoperatingincomeforfiscal

2024and2023:

QuarterEnded SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023 Change

March30,

2024

April1,

2023 Change

Revenues:

Entertainment

$ 9,796 $ 10,309 (5)% $ 19,777 $ 20,984 (6)%

Sports

4,312 4,226 2% 9,147 8,866 3%

Experiences

8,393 7,646 10% 17,525 16,191 8%

Eliminations

(2)

(418) (366) (14)% (817) (714) (14)%

Totalrevenues

$ 22,083 $ 21,815 1% $ 45,632 $ 45,327 1%

Segmentoperatingincome(loss):

Entertainment

$ 781 $ 455 72% $ 1,655 $ 800 >100%

Sports

778 794 (2)% 675 630 7%

Experiences

2,286 2,036 12% 5,391 4,898 10%

Totalsegmentoperatingincome

(1)

$ 3,845 $ 3,285 17% $ 7,721 $ 6,328 22%

(1)

Totalsegmentoperatingincomeisanon-GAAPfinancialmeasure.ThemostcomparableGAAPmeasureisincome

beforeincometaxes.Seethediscussiononpages17through21.

(2)

ReflectsfeespaidbyDirect-to-ConsumertoSportsandotherEntertainmentbusinessesfortherighttoairtheirlinear

networksonHuluLiveandfeespaidbyEntertainmenttoSportstoprogramsportsontheABCNetworkandStar+.

DISCUSSIONOFSECONDQUARTERSEGMENTRESULTS

Entertainment

RevenueandoperatingincomefortheEntertainmentsegmentareasfollows:

QuarterEnded

Change

SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023

March30,

2024

April1,

2023 Change

Revenues:

LinearNetworks $ 2,765 $ 2,999 (8)% $ 5,568 $ 6,201 (10)%

Direct-to-Consumer 5,642 4,983 13% 11,188 9,805 14%

ContentSales/Licensingand

Other 1,389 2,327 (40)% 3,021 4,978 (39)%

$ 9,796 $ 10,309 (5)% $ 19,777 $ 20,984 (6)%

Operatingincome(loss):

LinearNetworks $ 752 $ 959 (22)% $ 1,988 $ 2,289 (13)%

Direct-to-Consumer 47 (587) nm (91) (1,571) 94%

ContentSales/Licensingand

Other (18) 83 nm (242) 82 nm

$ 781 $ 455 72% $ 1,655 $ 800 >100%

3

TheincreaseinEntertainmentoperatingincomeinthecurrentquartercomparedtotheprior-year

quarterwasduetoimprovedresultsatDirect-to-Consumer,partiallyoffsetbydeclinesatLinear

NetworksandContentSales/LicensingandOther.

LinearNetworks

LinearNetworksrevenuesandoperatingincomeareasfollows:

QuarterEnded

Change

($inmillions)

March30,

2024

April1,

2023

Revenue

Domestic $ 2,269 $ 2,440 (7)%

International 496 559 (11)%

$ 2,765 $ 2,999 (8)%

Operatingincome

Domestic $ 520 $ 635 (18)%

International 92 165 (44)%

Equityintheincomeofinvestees 140 159 (12)%

$ 752 $ 959 (22)%

Domestic

Thedecreaseindomesticoperatingincomeinthecurrentquartercomparedtotheprior-year

quarterwasdueto:

• Loweraffiliaterevenueprimarilyduetoadecreaseinsubscribersincludingtheimpactofthenon-

renewalofcarriageofcertainnetworksbyanaffiliate,partiallyoffsetbyhighercontractualrates

• Adeclineinadvertisingrevenueattributabletoadecreaseinimpressionsreflectinglower

averageviewership,partiallyoffsetbyhigherrates

International

Lowerinternationaloperatingincomewasduetoadecreaseinaffiliaterevenueprimarily

attributabletofewersubscribersandcontractualratedecreases.

EquityintheIncomeofInvestees

IncomefromequityinvesteesdecreasedduetolowerincomefromA+ETelevisionNetworks(A+E)

attributabletodecreasesinadvertisingandaffiliaterevenue.

Direct-to-Consumer

Direct-to-Consumerrevenuesandoperatingincome(loss)areasfollows:

QuarterEnded

Change

($inmillions)

March30,

2024

April1,

2023

Revenue $ 5,642 $ 4,983 13%

Operatingincome(loss) $ 47 $ (587) nm

Theimprovementinoperatingresultsinthecurrentquartercomparedtotheprior-yearquarterwas

dueto:

• Subscriptionrevenuegrowthattributabletohigherratesduetoincreasesinretailpricingacross

ourstreamingservices,andsubscribergrowthatDisney+Core

4

• Lowerdistributioncosts

• Anincreaseinadvertisingrevenueduetohigherimpressions,partiallyoffsetbylowerrates

• Highermarketingcosts

• Anincreaseinprogrammingandproductioncostsduetomoreprogrammingonourservicesand

highersubscriber-basedfeesforprogrammingtheHuluLiveTVservice,partiallyoffsetbylower

averagecostsperhourofcontentavailableonourservices

TheincreaseinHuluLiveTVsubscriber-basedfeeswasduetorateincreasesandmore

subscribers

SecondQuarterofFiscal2024ComparisontoFirstQuarterofFiscal2024

Inadditiontorevenue,costsandoperatingincome,managementusesthefollowingkeymetricsto

analyzetrendsandevaluatetheoverallperformanceofourDisney+andHuludirect-to-consumer(DTC)

productofferings

(1)

,andwebelievethesemetricsareusefultoinvestorsinanalyzingthebusiness.The

followingtablesandrelateddiscussionareonasequentialquarterbasis.

Paidsubscribers

(1)

at:

(inmillions)

March30,

2024

December30,

2023 Change

Disney+

Domestic(U.S.andCanada) 54.0 46.1 17%

International(excludingDisney+Hotstar)

(1)

63.6 65.2 (2)%

Disney+Core

(2)

117.6 111.3 6%

Disney+Hotstar 36.0 38.3 (6)%

Hulu

SVODOnly 45.8 45.1 2%

LiveTV+SVOD 4.5 4.6 (2)%

TotalHulu

(2)

50.2 49.7 1%

AverageMonthlyRevenuePerPaidSubscriber

(1)

forthequarterended:

March30,

2024

December30,

2023 Change

Disney+

Domestic(U.S.andCanada) $ 8.00 $ 8.15 (2)%

International(excludingDisney+Hotstar)

(1)

6.66 5.91 13%

Disney+Core 7.28 6.84 6%

Disney+Hotstar 0.70 1.28 (45)%

Hulu

SVODOnly 11.84 12.29 (4)%

LiveTV+SVOD 95.01 93.61 1%

(1)

Seediscussiononpage16—DTCProductDescriptionsandKeyDefinitions

(2)

Totalmaynotequalthesumofthecolumnduetorounding

DomesticDisney+averagemonthlyrevenueperpaidsubscriberdecreasedfrom$8.15to$8.00due

toahighermixofwholesalesubscribers,partiallyoffsetbyincreasesinretailpricing.

5

InternationalDisney+(excludingDisney+Hotstar)averagemonthlyrevenueperpaidsubscriber

increasedfrom$5.91to$6.66duetoincreasesinretailpricingandalowermixofsubscribersto

promotionalofferings.

Disney+Hotstaraveragemonthlyrevenueperpaidsubscriberdecreasedfrom$1.28to$0.70dueto

loweradvertisingrevenue.

HuluSVODOnlyaveragemonthlyrevenueperpaidsubscriberdecreasedfrom$12.29to$11.84due

toloweradvertisingrevenue,partiallyoffsetbyincreasesinretailpricing.

HuluLiveTV+SVODaveragemonthlyrevenueperpaidsubscriberincreasedfrom$93.61to$95.01

duetoincreasesinretailpricingandalowermixofsubscriberstopromotionalofferings,partiallyoffset

byloweradvertisingrevenue.

ContentSales/LicensingandOther

ContentSales/LicensingandOtherrevenuesandoperatingincome(loss)areasfollows:

QuarterEnded

Change

($inmillions)

March30,

2024

April1,

2023

Revenue $ 1,389 $ 2,327 (40)%

Operatingincome(loss) $ (18) $ 83 nm

Thedecreaseinoperatingresultswasdueto:

• Lowertheatricaldistributionresultsastherewerenosignificanttitlesreleasedinthecurrent

quartercomparedtoAnt-ManandtheWasp:Quantumaniaintheprior-yearquarter.Theprior-

yearquarteralsoincludedthebenefitoftheongoingperformanceofAvatar:TheWayofWater,

whichwasreleasedinDecember2022.

• Higherfilmcostimpairmentsinthecurrentquarter

6

Sports

Sportsrevenuesandoperatingincome(loss)areasfollows:

QuarterEnded

Change

($inmillions)

March30,

2024

April1,

2023

Revenue

ESPN

Domestic $ 3,866 $ 3,733 4%

International 341 366 (7)%

4,207 4,099 3%

StarIndia 105 127 (17)%

$ 4,312 $ 4,226 2%

Operatingincome(loss)

ESPN

Domestic $ 780 $ 858 (9)%

International 19 19 —%

799 877 (9)%

StarIndia (27) (99) 73%

Equityintheincomeofinvestees 6 16 (63)%

$ 778 $ 794 (2)%

DomesticESPN

LowerdomesticESPNoperatingresultsinthecurrentquartercomparedtotheprior-yearquarter

weredueto:

• AnincreaseinprogrammingandproductioncostsattributabletohighercostsforCollegeFootball

Playoff(CFP)programmingasaresultofairinganadditionalgameinthecurrentquarterdueto

timing.Inthecurrentquarter,weairedthechampionshipgame,twosemi-finalgamesandone

hostgamecomparedtotheairingofthechampionshipgameandtwohostgamesintheprior-

yearquarter.

• Loweraffiliaterevenuedrivenbyfewersubscribers,partiallyoffsetbycontractualrateincreases

• Advertisingrevenuegrowthprimarilyduetoincreasesinratesand,toalesserextent,average

viewership.TheseincreasesincludebenefitsfromtheadditionalCFPgameandanadditionalNFL

playoffgameinthecurrentquarter.

• GrowthinESPN+subscriptionrevenueduetohigherrates

7

StarIndia

ThedecreaseinoperatinglossatStarIndiawasduetolowerprogrammingandproductioncosts

attributabletothenon-renewalofBoardofControlforCricketinIndiarights,partiallyoffsetbyan

increaseincostsforIndianPremierLeaguematchesduetomorematchesairedinthecurrentquarter

comparedtotheprior-yearquarter.

SecondQuarterofFiscal2024ComparisontoFirstQuarterofFiscal2024

Inadditiontorevenue,costsandoperatingincome,managementusesthefollowingkeymetricsto

analyzetrendsandevaluatetheoverallperformanceofourESPN+DTCproductoffering

(1)

,andwe

believethesemetricsareusefultoinvestorsinanalyzingthebusiness.Thefollowingtableandrelated

discussionareonasequentialquarterbasis.

March30,

2024

December30,

2023 Change

Paidsubscribers

(1)

at:(inmillions) 24.8 25.2 (2)%

AverageMonthlyRevenuePerPaidSubscriber

(1)

forthe

quarterended: $ 6.30 $ 6.09 3%

(1)

Seediscussiononpage16—DTCProductDescriptionsandKeyDefinitions

TheincreaseinESPN+averagemonthlyrevenueperpaidsubscriberwasduetoincreasesinretail

pricingandhigheradvertisingrevenue.

Experiences

Experiencesrevenuesandoperatingincomeareasfollows:

QuarterEnded

Change

($inmillions)

March30,

2024

April1,

2023

Revenue

Parks&Experiences

Domestic

$ 5,958 $ 5,572 7%

International

1,522 1,184 29%

ConsumerProducts

913 890 3%

$ 8,393 $ 7,646 10%

Operatingincome

Parks&Experiences

Domestic

$ 1,607 $ 1,519 6%

International

292 156 87%

ConsumerProducts

387 361 7%

$ 2,286 $ 2,036 12%

DomesticParksandExperiences

Theincreaseinoperatingincomeatourdomesticparksandexperienceswasduetohigherresultsat

WaltDisneyWorldResortandDisneyCruiseLine,partiallyoffsetbylowerresultsatDisneylandResort.

• AtWaltDisneyWorldResort,higherresultsinthecurrentquartercomparedtotheprior-year

quarterweredueto:

Increasedguestspendingattributabletohigheraverageticketprices

Highercostsduetoinflation,partiallyoffsetbylowerdepreciationandcostsavinginitiatives

8

• GrowthatDisneyCruiseLinewasduetoanincreaseinaverageticketprices,partiallyoffsetby

highercosts

• ThedecreaseinoperatingresultsatDisneylandResortwasdueto:

Highercostsdrivenbyinflation

Anincreaseinguestspendingattributabletohigheraverageticketpricesanddailyhotelroom

rates

Highervolumesduetoattendancegrowth,partiallyoffsetbyloweroccupiedroomnights

InternationalParksandExperiences

Higherinternationalparksandexperiences’operatingresultsweredueto:

• AnincreaseinoperatingresultsatHongKongDisneylandResortattributableto:

Guestspendinggrowthduetoincreasesinaverageticketpricesandfood,beverageand

merchandisespending

Highervolumesresultingfromincreasesinattendanceandoccupiedroomnights.Volume

growthbenefittedfromadditionaldaysofoperationsinthecurrentquarteraswellasthe

openingofWorldofFrozeninNovember2023

Increasedcostsdrivenbyinflationandnewguestofferings

ConsumerProducts

Theincreaseinconsumerproductsoperatingresultswasdrivenbyhighergameslicensingrevenue.

OTHERFINANCIALINFORMATION

DTCStreamingBusinesses

RevenueandoperatinglossforourcombinedDTCstreamingbusinesses,whichconsistoftheDirect-

to-ConsumerlineofbusinessattheEntertainmentsegmentandESPN+attheSportssegment,areas

follows:

QuarterEnded

Change($inmillions)

March30,

2024

April1,

2023

Revenue $ 6,188 $ 5,514 12%

Operatingloss

(1)

$ (18) $ (659) 97%

(1)

DTCstreamingbusinessesoperatinglossisnotafinancialmeasuredefinedbyGAAP.ThemostcomparableGAAP

measuresaresegmentoperatingincomefortheEntertainmentsegmentandSportssegment.Seethediscussionon

page21forhowwedefineandcalculatethismeasureandareconciliationofittothemostdirectlycomparable

GAAPmeasures.

CorporateandUnallocatedSharedExpenses

Corporateandunallocatedsharedexpensesincreased$112millionforthequarter,from$279

millionto$391million,primarilyattributableto:

• Highercostsrelatedtoourproxysolicitationandannualshareholdermeeting

• Increasedcompensationcosts

• Othercostinflation

RestructuringandImpairmentCharges

Inthecurrentquarter,theCompanyrecordedchargesof$2,052millionduetogoodwill

impairmentsrelatedtoStarIndiaandentertainmentlinearnetworks.TheimpairmentatStarIndiawasa

9

resultoftheCompanyenteringintoabindingagreementinthecurrentquartertocontributeourStar

Indiaoperationsintoanewjointventure.Intheprior-yearquarter,theCompanyrecordedchargesof

$152millionprimarilyforseverance.

OtherIncome,net

Intheprior-yearquarter,theCompanyrecordeda$149milliongaintoadjustitsinvestmentin

DraftKings,Inc.tofairvalue.

InterestExpense,net

Interestexpense,netwasasfollows:

QuarterEnded

($inmillions)

March30,

2024

April1,

2023 Change

Interestexpense $ (501) $ (504) 1%

Interestincome,investmentincomeandother 190 182 4%

Interestexpense,net $ (311) $ (322) 3%

EquityintheIncomeofInvestees

Equityintheincomeofinvesteeswasasfollows:

QuarterEnded

($inmillions)

March30,

2024

April1,

2023 Change

Amountsincludedinsegmentresults:

Entertainment $ 138 $ 160 (14)%

Sports 6 16 (63)%

AmortizationofTFCFintangibleassetsrelatedtoequity

investees (3) (3) —%

Equityintheincomeofinvestees $ 141 $ 173 (18)%

Incomefromequityinvesteesdecreased$32million,to$141millionfrom$173million,dueto

lowerincomefromA+E.

IncomeTaxes

Theeffectiveincometaxratewasasfollows:

QuarterEnded

March30,

2024

April1,

2023

Incomebeforeincometaxes $ 657 $ 2,123

Incometaxexpense 441 635

Effectiveincometaxrate 67.1% 29.9%

Theincreaseintheeffectiveincometaxratewasduetoanunfavorableimpactfromthegoodwill

impairmentsrecognizedinthecurrentquarter,whicharenottaxdeductible,partiallyoffsetbythe

benefitfromadjustmentsrelatedtoprioryears,whichwerefavorableinthecurrentquarterand

unfavorableintheprior-yearquarter.

10

NoncontrollingInterests

Netincomeattributabletononcontrollinginterestswasasfollows:

QuarterEnded

($inmillions)

March30,

2024

April1,

2023 Change

Netincomeattributabletononcontrollinginterests $ (236) $ (217) (9)%

Theincreaseinnetincomeattributabletononcontrollinginterestswasprimarilyduetoimproved

resultsatHongKongDisneylandResort,partiallyoffsetbythecomparisontotheaccretionofNBC

Universal’sinterestinHuluintheprior-yearquarterwithnoaccretioninthecurrentquarteraswehad

fullyaccretedtotheamountpaidinDecember2023.

Netincomeattributabletononcontrollinginterestsisdeterminedonincomeafterroyaltiesand

managementfees,financingcostsandincometaxes,asapplicable.

CashFlow

Cashprovidedbyoperationsandfreecashflowwereasfollows:

SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023 Change

Cashprovidedbyoperations $ 5,851 $ 2,262 $ 3,589

Investmentsinparks,resortsandotherproperty (2,558) (2,430) (128)

Freecashflow

(1)

$ 3,293 $ (168) $ 3,461

(1)

FreecashflowisnotafinancialmeasuredefinedbyGAAP.ThemostcomparableGAAPmeasureiscashprovidedby

operations.Seethediscussiononpages17through21.

Cashprovidedbyoperationsincreased$3.6billionto$5.9billioninthecurrentperiodfrom$2.3

billionintheprior-yearperiod.Theincreasewasduetolowerfilmandtelevisionproductionspending

andthetimingofpaymentsforsportsrights.Theincreasealsoreflectedlowercollateralpayments

relatedtoourhedgingprogram,apaymentintheprior-yearperiodrelatedtotheterminationof

contentlicensesinfiscal2022andhigheroperatingincomeatExperiences.Theseincreaseswere

partiallyoffsetbypaymentinthecurrentperiodoffiscal2023federalandCaliforniaincometaxes,which

weredeferredpursuanttoreliefprovidedbytheInternalRevenueServiceandCaliforniaStateBoardof

Equalizationasaresultof2023winterstormsinCalifornia.

11

CapitalExpendituresandDepreciationExpense

Investmentsinparks,resortsandotherpropertywereasfollows:

SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023

Entertainment

$ 522 $ 541

Sports

1 7

Experiences

Domestic

1,198 1,024

International

466 410

TotalExperiences

1,664 1,434

Corporate

371 448

Totalinvestmentsinparks,resortsandotherproperty

$ 2,558 $ 2,430

Capitalexpendituresincreasedto$2.6billionfrom$2.4billionduetohigherspendonnew

attractionsandcruiseshipfleetexpansionattheExperiencessegment.

Depreciationexpensewasasfollows:

SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023

Entertainment

$ 332 $ 304

Sports

22 29

Experiences

Domestic

850 907

International

353 333

TotalExperiences

1,203 1,240

Corporate

105 100

Totaldepreciationexpense

$ 1,662 $ 1,673

12

THEWALTDISNEYCOMPANY

CONDENSEDCONSOLIDATEDSTATEMENTSOFOPERATIONS

(unaudited;$inmillions,exceptpersharedata)

QuarterEnded SixMonthsEnded

March30,

2024

April1,

2023

March30,

2024

April1,

2023

Revenues $ 22,083 $ 21,815 $ 45,632 $ 45,327

Costsandexpenses

(19,204) (19,540) (39,817) (41,059)

Restructuringandimpairmentcharges (2,052) (152) (2,052) (221)

Otherincome,net

— 149 — 107

Interestexpense,net (311) (322) (557) (622)

Equityintheincomeofinvestees 141 173 322 364

Incomebeforeincometaxes 657 2,123 3,528 3,896

Incometaxes (441) (635) (1,161) (1,047)

Netincome 216 1,488 2,367 2,849

Netincomeattributabletononcontrollinginterests (236) (217) (476) (299)

Netincome(loss)attributabletoTheWaltDisneyCompany

(Disney)

$ (20) $ 1,271 $ 1,891 $ 2,550

Earnings(loss)pershareattributabletoDisney:

Diluted $ (0.01) $ 0.69 $ 1.03 $ 1.39

Basic $ (0.01) $ 0.70 $ 1.03 $ 1.40

Weightedaveragenumberofcommonandcommon

equivalentsharesoutstanding:

Diluted 1,834 1,831 1,838 1,829

Basic 1,834 1,828 1,833 1,827

13

THEWALTDISNEYCOMPANY

CONDENSEDCONSOLIDATEDBALANCESHEETS

(unaudited;$inmillions,exceptpersharedata)

March30,

2024

September30,

2023

ASSETS

Currentassets

Cashandcashequivalents

$ 6,635 $ 14,182

Receivables,net

12,026 12,330

Inventories

1,948 1,963

Contentadvances

1,921 3,002

Othercurrentassets

2,106 1,286

Totalcurrentassets

24,636 32,763

Producedandlicensedcontentcosts

32,590 33,591

Investments

3,007 3,080

Parks,resortsandotherproperty

Attractions,buildingsandequipment

72,173 70,090

Accumulateddepreciation

(44,065) (42,610)

28,108 27,480

Projectsinprogress

6,243 6,285

Land

1,174 1,176

35,525 34,941

Intangibleassets,net

11,474 13,061

Goodwill

73,914 77,067

Otherassets

13,964 11,076

Totalassets

$ 195,110 $ 205,579

LIABILITIESANDEQUITY

Currentliabilities

Accountspayableandotheraccruedliabilities

$ 18,798 $ 20,671

Currentportionofborrowings

6,789 4,330

Deferredrevenueandother

7,287 6,138

Totalcurrentliabilities

32,874 31,139

Borrowings

39,510 42,101

Deferredincometaxes

6,860 7,258

Otherlong-termliabilities

12,103 12,069

Commitmentsandcontingencies

Redeemablenoncontrollinginterests

— 9,055

Equity

Preferredstock

— —

Commonstock,$0.01parvalue,Authorized–4.6billionshares,Issued–1.9billionsharesatMarch30,2024

and1.8billionsharesatSeptember30,2023

58,028 57,383

Retainedearnings

46,649 46,093

Accumulatedothercomprehensiveloss

(3,509) (3,292)

Treasurystock,atcost,27millionsharesatMarch30,2024and19millionsharesatSeptember30,2023

(1,916) (907)

TotalDisneyShareholders’equity

99,252 99,277

Noncontrollinginterests

4,511 4,680

Totalequity

103,763 103,957

Totalliabilitiesandequity

$ 195,110 $ 205,579

14

THEWALTDISNEYCOMPANY

CONDENSEDCONSOLIDATEDSTATEMENTSOFCASHFLOWS

(unaudited;$inmillions)

SixMonthsEnded

March30,

2024

April1,

2023

OPERATINGACTIVITIES

Netincome

$ 2,367 $ 2,849

Depreciationandamortization

2,485 2,616

Goodwillimpairment

2,038 —

Deferredincometaxes

(211) (46)

Equityintheincomeofinvestees

(322) (364)

Cashdistributionsreceivedfromequityinvestees

300 363

Netchangeinproducedandlicensedcontentcostsandadvances

1,699 (824)

Equity-basedcompensation

675 570

Other,net

(6) (320)

Changesinoperatingassetsandliabilities

Receivables

(156) (413)

Inventories

26 (107)

Otherassets

(185) (345)

Accountspayableandotherliabilities

(1,075) (2,133)

Incometaxes

(1,784) 416

Cashprovidedbyoperations

5,851 2,262

INVESTINGACTIVITIES

Investmentsinparks,resortsandotherproperty

(2,558) (2,430)

Other,net

5 (111)

Cashusedininvestingactivities

(2,553) (2,541)

FINANCINGACTIVITIES

Commercialpaperborrowings,net

42 714

Borrowings

133 70

Reductionofborrowings

(645) (1,000)

Dividends

(549) —

Repurchasesofcommonstock

(1,001) —

Contributionsfromnoncontrollinginterests

— 178

Acquisitionofredeemablenoncontrollinginterests

(8,610) (900)

Other,net

(194) (188)

Cashusedinfinancingactivities

(10,824) (1,126)

Impactofexchangeratesoncash,cashequivalentsandrestrictedcash

17 197

Changeincash,cashequivalentsandrestrictedcash

(7,509) (1,208)

Cash,cashequivalentsandrestrictedcash,beginningofperiod

14,235 11,661

Cash,cashequivalentsandrestrictedcash,endofperiod

$ 6,726 $ 10,453

15

DTCPRODUCTDESCRIPTIONSANDKEYDEFINITIONS

Productofferings

IntheU.S.,Disney+,ESPN+andHuluSVODOnlyareeachofferedasastandaloneserviceortogether

aspartofvariousmulti-productofferings.HuluLiveTV+SVODincludesDisney+andESPN+.Disney+is

availableinmorethan150countriesandterritoriesoutsidetheU.S.andCanada.InIndiaandcertain

otherSoutheastAsiancountries,theserviceisbrandedDisney+Hotstar.IncertainLatinAmerican

countries,weofferDisney+aswellasStar+,ageneralentertainmentSVODservice,whichisavailableon

astandalonebasisortogetherwithDisney+(Combo+).Dependingonthemarket,ourservicescanbe

purchasedonourwebsitesorthroughthird-partyplatforms/appsorareavailableviawholesale

arrangements.

Paidsubscribers

Paidsubscribersreflectsubscribersforwhichwerecognizedsubscriptionrevenue.Subscriberscease

tobeapaidsubscriberasoftheireffectivecancellationdateorasaresultofafailedpaymentmethod.

Subscriberstomulti-productofferingsintheU.S.arecountedasapaidsubscriberforeachservice

includedinthemulti-productofferingandsubscriberstoHuluLiveTV+SVODarecountedasonepaid

subscriberforeachoftheHuluLiveTV+SVOD,Disney+andESPN+services.InLatinAmerica,ifa

subscriberhaseitherthestandaloneDisney+orStar+serviceorsubscribestoCombo+,thesubscriberis

countedasoneDisney+paidsubscriber.Subscribersincludethosewhoreceiveanentitlementtoa

servicethroughwholesalearrangements,includingthoseforwhichtheserviceisavailabletoeach

subscriberofanexistingcontentdistributiontier.Whenweaggregatethetotalnumberofpaid

subscribersacrossourDTCstreamingservices,werefertothemaspaidsubscriptions.

InternationalDisney+(excludingDisney+Hotstar)

InternationalDisney+(excludingDisney+Hotstar)includestheDisney+serviceoutsidetheU.S.and

CanadaandtheStar+serviceinLatinAmerica.

AverageMonthlyRevenuePerPaidSubscriber

HuluandESPN+averagemonthlyrevenueperpaidsubscriberiscalculatedbasedontheaverageof

themonthlyaveragepaidsubscribersforeachmonthintheperiod.Themonthlyaveragepaid

subscribersiscalculatedasthesumofthebeginningofthemonthandendofthemonthpaidsubscriber

count,dividedbytwo.Disney+averagemonthlyrevenueperpaidsubscriberiscalculatedusingadaily

averageofpaidsubscribersfortheperiod.Revenueincludessubscriptionfees,advertising(excluding

revenueearnedfromsellingadvertisingspotstootherCompanybusinesses)andpremiumandfeature

add-onrevenuebutexcludesPay-Per-Viewrevenue.Advertisingrevenuegeneratedbycontentonone

DTCstreamingservicethatisaccessedthroughanotherDTCstreamingservicebysubscriberstoboth

streamingservicesisallocatedbetweenbothstreamingservices.Theaveragerevenueperpaid

subscriberisnetofdiscountsonofferingsthatcarrymorethanoneservice.Revenueisallocatedtoeach

servicebasedontherelativeretailorwholesalepriceofeachserviceonastandalonebasis.HuluLiveTV

+SVODrevenueisallocatedtotheSVODservicesbasedonthewholesalepriceoftheHuluSVODOnly,

Disney+andESPN+multi-productoffering.Ingeneral,wholesalearrangementshavealoweraverage

monthlyrevenueperpaidsubscriberthansubscribersthatweacquiredirectlyorthroughthird-party

platforms.

16

NON-GAAPFINANCIALMEASURES

ThisearningsreleasepresentsdilutedEPSexcludingcertainitems(alsoreferredtoasadjustedEPS),

totalsegmentoperatingincome,freecashflow,andDTCstreamingbusinessesoperatingincome(loss),

allofwhichareimportantfinancialmeasuresfortheCompany,butarenotfinancialmeasuresdefinedby

GAAP.

ThesemeasuresshouldbereviewedinconjunctionwiththemostcomparableGAAPfinancial

measuresandarenotpresentedasalternativemeasuresofdilutedEPS,incomebeforeincometaxes,

cashprovidedbyoperations,orEntertainmentandSportssegmentoperatingincome(loss)as

determinedinaccordancewithGAAP.DilutedEPSexcludingcertainitems,totalsegmentoperating

income,freecashflow,andDTCstreamingbusinessesoperatingincome(loss)aswehavecalculated

themmaynotbecomparabletosimilarlytitledmeasuresreportedbyothercompanies.

OurdefinitionsandcalculationsofdilutedEPSexcludingcertainitems,totalsegmentoperating

income,freecashflow,andDTCstreamingbusinessesoperatingincome(loss),aswellasquantitative

reconciliationsofeachofthesehistoricalmeasuresandtheforward-lookingmeasureoffreecashflowto

themostdirectlycomparableGAAPfinancialmeasureareprovidedbelow.

TheCompanyisnotprovidingtheforward-lookingmeasurefordilutedEPS,whichisthemost

directlycomparableGAAPmeasuretodilutedEPSexcludingcertainitems,oraquantitative

reconciliationofforward-lookingdilutedEPSexcludingcertainitemstothatmostdirectlycomparable

GAAPmeasure.TheCompanyisunabletopredictorestimatewithreasonablecertaintytheultimate

outcomeofcertainsignificantitemsrequiredforsuchGAAPmeasurewithoutunreasonableeffort.

InformationaboutotheradjustingitemsthatiscurrentlynotavailabletotheCompanycouldhavea

potentiallyunpredictableandsignificantimpactonfutureGAAPfinancialresults.

DilutedEPSexcludingcertainitems

TheCompanyusesdilutedEPSexcluding(1)certainitemsaffectingcomparabilityofresultsfrom

periodtoperiodand(2)amortizationofTFCFandHuluintangibleassets,includingpurchaseaccounting

step-upadjustmentsforreleasedcontent,tofacilitatetheevaluationoftheperformanceofthe

Company’soperationsexclusiveoftheseitems,andtheseadjustmentsreflecthowseniormanagement

isevaluatingsegmentperformance.

TheCompanybelievesthatprovidingdilutedEPSexclusiveofcertainitemsimpactingcomparability

isusefultoinvestors,particularlywheretheimpactoftheexcludeditemsissignificantinrelationto

reportedearningsandbecausethemeasureallowsforcomparabilitybetweenperiodsoftheoperating

performanceoftheCompany’sbusinessandallowsinvestorstoevaluatetheimpactoftheseitems

separately.

TheCompanyfurtherbelievesthatprovidingdilutedEPSexclusiveofamortizationofTFCFandHulu

intangibleassetsassociatedwiththeacquisitionin2019isusefultoinvestorsbecausetheTFCFandHulu

acquisitionwasconsiderablylargerthantheCompany’shistoricacquisitionswithasignificantlygreater

acquisitionaccountingimpact.

17

ThefollowingtablereconcilesreporteddilutedEPStodilutedEPSexcludingcertainitemsforthe

secondquarter:

($inmillionsexceptEPS)

Pre-Tax

Income/

Loss

Tax

Benefit/

Expense

(1)

After-Tax

Income/

Loss

(2)

Diluted

EPS

(3)

Changevs.

prior-year

period

QuarterEndedMarch30,2024

Asreported

$ 657 $ (441) $ 216 $ (0.01) n/m

Exclude:

Restructuringandimpairmentcharges

(4)

2,052 (121) 1,931 1.06

AmortizationofTFCFandHuluintangible

assetsandfairvaluestep-uponfilmand

televisioncosts

(5)

434 (101) 333 0.17

Excludingcertainitems $ 3,143 $ (663) $ 2,480 $ 1.21 30%

QuarterEndedApril1,2023

Asreported

$ 2,123 $ (635) $ 1,488 $ 0.69

Exclude:

AmortizationofTFCFandHuluintangible

assetsandfairvaluestep-uponfilmand

televisioncosts

(5)

558 (130) 428 0.23

Restructuringandimpairmentcharges

(4)

152 (35) 117 0.06

Otherincome,net

(6)

(149) 35 (114) (0.06)

Excludingcertainitems $ 2,684 $ (765) $ 1,919 $ 0.93

(1)

Taxbenefit/expenseisdeterminedusingthetaxrateapplicabletotheindividualitem.

(2)

Beforenoncontrollinginterestshare.

(3)

Netofnoncontrollinginterestshare,whereapplicable.Totalmaynotequalthesumofthecolumnduetorounding.

(4)

Chargesinthecurrentquarterincludedimpairmentsofgoodwill($2,038million).Chargesintheprior-yearquarter

wereprimarilyforseverance.

(5)

Forthecurrentquarter,intangibleassetamortizationwas$362million,step-upamortizationwas$69millionand

amortizationofintangibleassetsrelatedtoTFCFequityinvesteeswas$3million.Fortheprior-yearquarter,

intangibleassetamortizationwas$408million,step-upamortizationwas$147millionandamortizationofintangible

assetsrelatedtoTFCFequityinvesteeswas$3million.

(6)

DraftKingsgain($149million).

18

ThefollowingtablereconcilesreporteddilutedEPSfromcontinuingoperationstodilutedEPS

excludingcertainitemsforthesix-monthperiod:

($inmillionsexceptEPS)

Pre-Tax

Income/

Loss

Tax

Benefit/

Expense

(1)

After-Tax

Income/

Loss

(2)

Diluted

EPS

(3)

Changevs.

prioryear

SixMonthsEndedMarch30,2024:

Asreported

$ 3,528 $ (1,161) $ 2,367 $ 1.03 (26)%

Exclude:

Restructuringandimpairmentcharges

(4)

2,052 (121) 1,931 1.06

AmortizationofTFCFandHuluintangible

assetsandfairvaluestep-uponfilmand

televisioncosts

(5)

885 (206) 679 0.36

Excludingcertainitems $ 6,465 $ (1,488) $ 4,977 $ 2.44 28%

SixMonthsEndedApril1,2023:

Asreported

$ 3,896 $ (1,047) $ 2,849 $ 1.39

Exclude:

AmortizationofTFCFandHuluintangible

assetsandfairvaluestep-uponfilmand

televisioncosts

(5)

1,137 (264) 873 0.47

Restructuringandimpairmentcharges

(4)

221 (43) 178 0.10

Otherincome,net

(6)

(107) 18 (89) (0.05)

Excludingcertainitems $ 5,147 $ (1,336) $ 3,811 $ 1.91

(1)

Taxbenefit/expenseisdeterminedusingthetaxrateapplicabletotheindividualitem.

(2)

Beforenoncontrollinginterestshare.

(3)

Netofnoncontrollinginterestshare,whereapplicable.Totalmaynotequalthesumofthecolumnduetorounding.

(4)

Chargesforthecurrentperiodincludedimpairmentsofgoodwill($2,038million).Chargesfortheprior-yearperiod

includedseverance($125million)andexitingourbusinessesinRussia($69million).

(5)

Forthecurrentperiod,intangibleassetamortizationwas$742million,step-upamortizationwas$137millionand

amortizationofintangibleassetsrelatedtoTFCFequityinvesteeswas$6million.Fortheprior-yearperiod,intangible

assetamortizationwas$825million,step-upamortizationwas$306millionandamortizationofintangibleassets

relatedtoTFCFequityinvesteeswas$6million.

(6)

Fortheprior-yearperiod,otherincome,netwasduetotheDraftKingsgain($79million)andagainonthesaleofa

business($28million).

19

Totalsegmentoperatingincome

TheCompanyevaluatestheperformanceofitsoperatingsegmentsbasedonsegmentoperating

income,andmanagementusestotalsegmentoperatingincomeasameasureoftheperformanceof

operatingbusinessesseparatefromnon-operatingfactors.TheCompanybelievesthatinformationabout

totalsegmentoperatingincomeassistsinvestorsbyallowingthemtoevaluatechangesintheoperating

resultsoftheCompany’sportfolioofbusinessesseparatefromnon-operationalfactorsthataffectnet

income,thusprovidingseparateinsightintobothoperationsandotherfactorsthataffectreported

results.

Thefollowingtablereconcilesincomebeforeincometaxestototalsegmentoperatingincome:

QuarterEnded SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023 Change

March30,

2024

April1,

2023 Change

Incomebeforeincometaxes $ 657 $ 2,123 (69)% $ 3,528 $ 3,896 (9)%

Add(subtract):

Corporateandunallocated

sharedexpenses

391 279 (40)% 699 559 (25)%

Restructuringandimpairment

charges 2,052 152 >(100)% 2,052 221 >(100)%

Otherincome,net — (149) (100)% — (107) (100)%

Interestexpense,net

311 322 3% 557 622 10%

AmortizationofTFCFandHulu

intangibleassetsandfairvalue

step-uponfilmandtelevision

costs 434 558 22% 885 1,137 22%

Totalsegmentoperatingincome $ 3,845 $ 3,285 17% $ 7,721 $ 6,328 22%

Freecashflow

TheCompanyusesfreecashflow(cashprovidedbyoperationslessinvestmentsinparks,resorts

andotherproperty),amongothermeasures,toevaluatetheabilityofitsoperationstogeneratecash

thatisavailableforpurposesotherthancapitalexpenditures.Managementbelievesthatinformation

aboutfreecashflowprovidesinvestorswithanimportantperspectiveonthecashavailabletoservice

debtobligations,makestrategicacquisitionsandinvestmentsandpaydividendsorrepurchaseshares.

ThefollowingtablepresentsasummaryoftheCompany’sconsolidatedcashflows:

QuarterEnded SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023

March30,

2024

April1,

2023

Cashprovidedbyoperations $ 3,666 $ 3,236 $ 5,851 $ 2,262

Cashusedininvestingactivities (1,307) (1,249) (2,553) (2,541)

Cashusedinfinancingactivities (2,818) (83) (10,824) (1,126)

Impactofexchangeratesoncash,cashequivalentsandrestrictedcash (62) 33 17 197

Changeincash,cashequivalentsandrestrictedcash (521) 1,937 (7,509) (1,208)

Cash,cashequivalentsandrestrictedcash,beginningofperiod 7,247 8,516 14,235 11,661

Cash,cashequivalentsandrestrictedcash,endofperiod $ 6,726 $ 10,453 $ 6,726 $ 10,453

20

ThefollowingtablereconcilestheCompany’sconsolidatedcashprovidedbyoperationstofreecash

flow:

QuarterEnded SixMonthsEnded

($inmillions)

March30,

2024

April1,

2023 Change

March30,

2024

April1,

2023 Change

Cashprovidedbyoperations $ 3,666 $ 3,236 $ 430 $ 5,851 $ 2,262 $ 3,589

Investmentsinparks,resortsandother

property (1,259) (1,249) (10) (2,558) (2,430) (128)

Freecashflow $ 2,407 $ 1,987 $ 420 $ 3,293 $ (168) $ 3,461

ThefollowingtablereconcilestheCompany’sconsolidatedestimatedforward-lookingcashprovided

byoperationstoestimatedforward-lookingfreecashflowforfullyearfiscal2024:

(estimated$inbillions)

Fullyearfiscal

2024

Cashprovidedbyoperations $ 14

Investmentsinparks,resortsandotherproperty (6)

Freecashflow $ 8

DTCStreamingBusinesses

TheCompanyusescombinedDTCstreamingbusinessesoperatingincome(loss)becauseitbelieves

thatthismeasureallowsinvestorstoevaluatetheperformanceofitsportfolioofstreamingbusinesses

andtrackprogressagainsttheCompany’sgoalofreachingprofitabilityinthefourthquarteroffiscal

2024atitscombinedstreamingbusinesses.

ThefollowingtablesreconcileEntertainmentandSportssegmentoperatingincome(loss)totheDTC

streamingbusinessesoperatingloss:

QuarterEnded

March30,2024 April1,2023

($inmillions)

Entertainment Sports

DTCStreaming

Businesses Entertainment Sports

DTCStreaming

Businesses

LinearNetworks $ 752 $ 843 $ 959 $ 866

DTCstreamingbusinesses(Direct-to-

ConsumerandESPN+businesses) 47 (65) $ (18) (587) (72) $ (659)

ContentSales/LicensingandOther (18) — 83 —

Segmentoperatingincome(loss) $ 781 $ 778 $ 455 $ 794

SixMonthsEnded

March30,2024 April1,2023

Entertainment Sports

DTCStreaming

Businesses Entertainment Sports

DTCStreaming

Businesses

LinearNetworks $ 1,988 $ 818 $ 2,289 $ 771

DTCstreamingbusinesses(Direct-to-

ConsumerandESPN+businesses) (91) (143) $ (234) (1,571) (141) $ (1,712)

ContentSales/LicensingandOther (242) — 82 —

Segmentoperatingincome $ 1,655 $ 675 $ 800 $ 630

21

FORWARD-LOOKINGSTATEMENTS

Certainstatementsandinformationinthisearningsreleasemayconstitute“forward-lookingstatements”

withinthemeaningofthePrivateSecuritiesLitigationReformActof1995,includingstatementsregardingfinancial

performance,earningsexpectations,expecteddriversandguidance,includingfutureoperatingincome,adjusted

EPS,freecashflow,capitalallocation,includingsharerepurchases,plansfordirect-to-consumerprofitabilityand

timing;valueof,andopportunitiesforgrowthbasedon,ourintellectualproperty,contentofferings,businesses

andassets;businessplans;plans,expectations,strategicprioritiesandinitiatives,consumersentiment,behavior

ordemandanddriversofgrowthandprofitabilityandotherstatementsthatarenothistoricalinnature.Any

informationthatisnothistoricalinnatureincludedinthisearningsreleaseissubjecttochange.Thesestatements

aremadeonthebasisofmanagement’sviewsandassumptionsregardingfutureeventsandbusinessperformance

asofthetimethestatementsaremade.Managementdoesnotundertakeanyobligationtoupdatethese

statements.

Actualresultsmaydiffermateriallyfromthoseexpressedorimplied.Suchdifferencesmayresultfrom

actionstakenbytheCompany,includingrestructuringorstrategicinitiatives(includingcapitalinvestments,asset

acquisitionsordispositions,neworexpandedbusinesslinesorcessationofcertainoperations),ourexecutionof

ourbusinessplans(includingthecontentwecreateandIPweinvestin,ourpricingdecisions,ourcoststructure

andourmanagementandotherpersonneldecisions),ourabilitytoquicklyexecuteoncostrationalizationwhile

preservingrevenue,thediscoveryofadditionalinformationorotherbusinessdecisions,aswellasfrom

developmentsbeyondtheCompany’scontrol,including:

• theoccurrenceofsubsequentevents;

• deteriorationindomesticandglobaleconomicconditionsorfailureofconditionstoimproveas

anticipated;

• deteriorationinorpressuresfromcompetitiveconditions,includingcompetitiontocreateoracquire

content,competitionfortalentandcompetitionforadvertisingrevenue;

• consumerpreferencesandacceptanceofourcontent,offerings,pricingmodelandpriceincreases,and

correspondingsubscriberadditionsandchurn,andthemarketforadvertisingsalesonourDTCservices

andlinearnetworks;

• healthconcernsandtheirimpactonourbusinessesandproductions;

• international,politicalormilitarydevelopments;

• regulatoryandlegaldevelopments;

• technologicaldevelopments;

• labormarketsandactivities,includingworkstoppages;

• adverseweatherconditionsornaturaldisasters;and

• availabilityofcontent.

Suchdevelopmentsmayfurtheraffectentertainment,travelandleisurebusinessesgenerallyandmay,

amongotherthings,affect(orfurtheraffect,asapplicable):

• ouroperations,businessplansorprofitability,includingdirect-to-consumerprofitability;

• demandforourproductsandservices;

• theperformanceoftheCompany’scontent;

• ourabilitytocreateorobtaindesirablecontentatorunderthevalueweassignthecontent;

• theadvertisingmarketforprogramming;

• incometaxexpense;and

• performanceofsomeorallCompanybusinesseseitherdirectlyorthroughtheirimpactonthosewho

distributeourproducts.

AdditionalfactorsaresetforthintheCompany’sAnnualReportonForm10-Kfortheyearended

September30,2023,includingunderthecaptions“RiskFactors,”“Management’sDiscussionandAnalysisof

FinancialConditionandResultsofOperations,”and“Business,”quarterlyreportsonForm10-Q,includingunder

thecaptions“RiskFactors”and“Management’sDiscussionandAnalysisofFinancialConditionandResultsof

Operations,”andsubsequentfilingswiththeSecuritiesandExchangeCommission.

Theterms“Company,”“we,”and“our”areusedinthisreporttorefercollectivelytotheparentcompanyand

thesubsidiariesthroughwhichourvariousbusinessesareactuallyconducted.

22

CONFERENCECALLINFORMATION

Inconjunctionwiththisrelease,TheWaltDisneyCompanywillhostaconferencecalltoday,May7,

2024,at8:30AMEDT/5:30AMPDTviaaliveWebcast.ToaccesstheWebcastgotowww.disney.com/

investors.Thecorrespondingearningspresentationandwebcastreplaywillalsobeavailableonthesite.

CONTACTS:

DavidJefferson

CorporateCommunications

818-560-4832

AlexiaQuadrani

InvestorRelations

818-560-6601

23