SUPPORTING EUROPEAN AVIATION

1

8 December 2022

EUROCONTROL

Comprehensive Assessment

EUROPEAN AVIATION

2022 YEAR-TO-DATE

What happened in 2022?

(1 Jan – 6 Dec 2022)

The network recorded circa 25,569 daily flights on average in 2022 (year-to-date),

83.1% of 2019 levels.

Network traffic (flights) has been in line with the base EUROCONTROL Traffic

Scenario during Summer; and is now lying between the low and the base scenarios

since the start of the Winter schedules.

Ryanair was the busiest aircraft operator with 2,566 flights per day on average (+9%

vs 2019) accounting for 10% of European flights, followed by easyJet (1,347; -20%),

Turkish Airlines (1,249; -7%), Lufthansa (1,067; -29%), Air France (952; -21%), KLM

(709; -18%),and Wizz Air (667; +13%).

The United Kingdom was the busiest State in the network with 4,728 flights per day

on average (-20% vs 2019), followed by Germany (4,293; -25%), Spain (4,277; -9%),

France (3,763; -14%) and Italy (3,201; -12%).

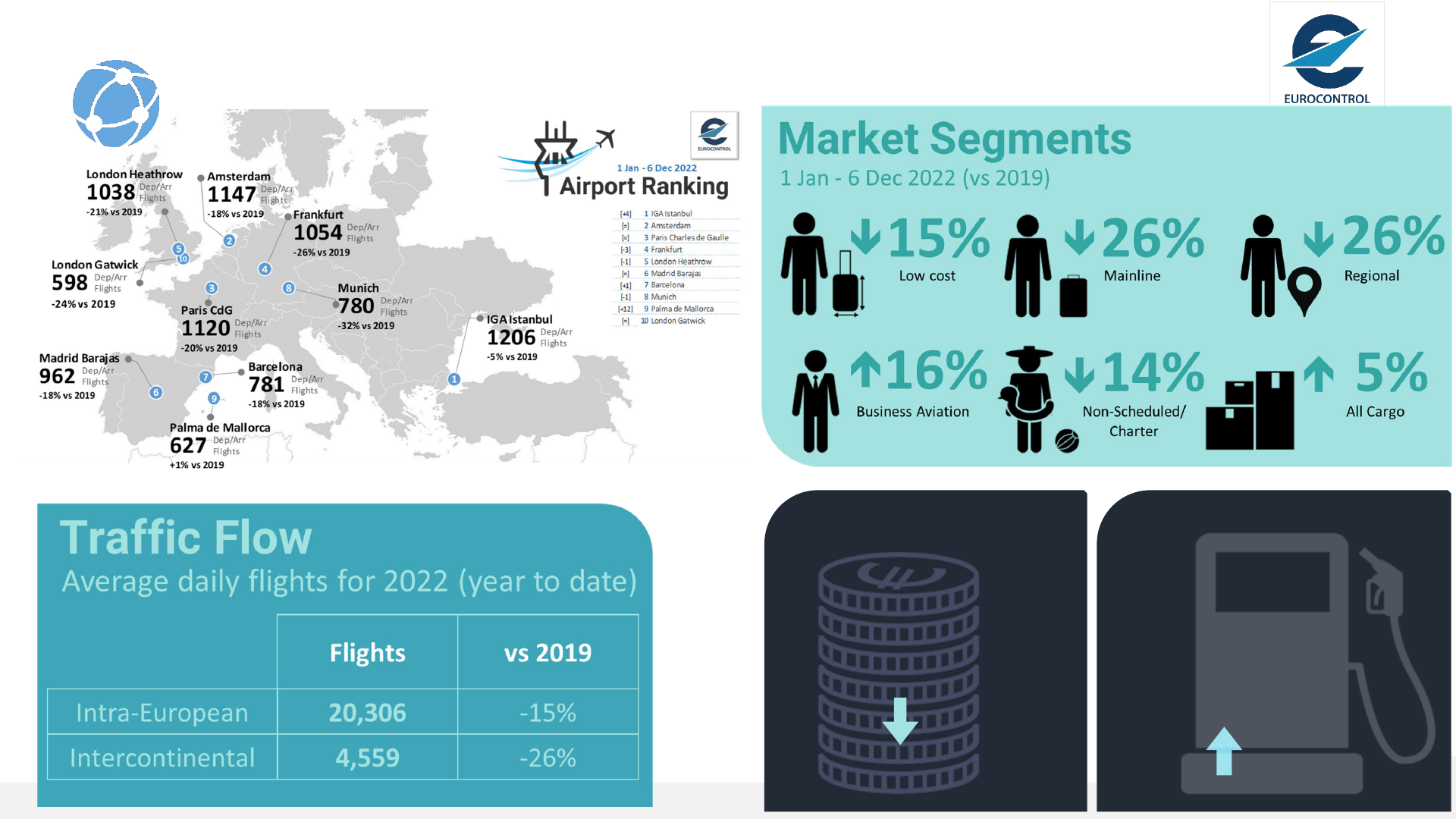

Intra-European traffic was 15% below 2019 levels. Inter-Continental flights were

26% below 2019 levels.

iGA Istanbul* (1,206; -5%), was the busiest airport within the network and is

ranked 10

th

globally. Amsterdam (1,147; -21%) and Paris Charles de Gaulle (1,120;

-20%) completed the top 3.

Arrival punctuality (within 15 min.) is ~72% while departure punctuality is ~66%,

both below 2019 levels.

The average share of non-operated schedules (~cancellations) for all European

operators was just below 7%.

Jet fuel prices averaged 337 cts/gallon in 2022, an increase of 88% on 2021 prices.

Statistics in this edition are covering the 2022 period : 1 Jan 2022 to 6 Dec 2022 and are compared to

the equivalent period in 2019, unless otherwise mentioned.

* Comprises combined figures for iGA Istanbul and Atatürk.

83.1%

vs 2019

Traffic Situation

Avg daily flights (including overflights)

(1 Jan – 6 Dec 2022)

3

Economics

Avg Fuel price:

cents/gallon

Jan-Nov 2022

Source: IATA/Platts

TOP 10 AIRPORTS, FLOWS AND MARKET SEGMENTS

Route charges

vs. Jan-Oct 2019

-5%

Jan-Oct 2022

Amount billed:

Source: EUROCONTROL

€ 6,462 million

337

+88%

vs. Jan-Nov 2021

*

*

OVERALL TRAFFIC SITUATION AT NETWORK LEVEL

On a year-to-date basis in

2022 (1 Jan – 6 Dec):

25,569 average daily flights.

83.1% of 2019 traffic levels.

At the early start of 2022, the

network traffic was affected by

the COVID-19 variant Omicron.

Then, flight levels were quite

strong during Summer, with

average numbers above

30,000. Since the change to

Winter schedules, traffic

volumes (flights) are much

lower (~22,000).

OVERALL SITUATION COMPARED TO THE

EUROCONTROL TRAFFIC SCENARIOS

The last EUROCONTROL

Traffic Scenarios were

published on 6 April 2022.

During Spring, actual traffic

within the network was in

line with the high scenario.

Over Summer, actual traffic

was quite in line with the

base scenario. Since

November, traffic is below

the base scenario.

For 2022, network traffic is

expected to stand at 84% of

2019 in the base scenario

(see

7-year forecast).

AVIATION SUSTAINABILITY

Network:

• Traffic variation -15%

• CO

2

variation -20%

MARKET SEGMENTS

So far in 2022, compared to 2019:

Business Aviation (+16%) and All-cargo

(+5%) were the only two segments

recording traffic constantly above 2019

levels (Cargo flights are currently slightly

below 2019 levels).

Charter (-14%) was recording more traffic

than in 2019 at the start of the year but

started to step back with the start of the

war in Ukraine.

Low-Cost (-15%) has been recovering

steadily from 50% below 2019 levels in

January to 11% below 2019 levels early

December.

Mainline and Regional (-26%, each) have

been recovering at a slower pace than

low-cost, from 40% below 2019 to

around 20% (below 2019) nowadays.

AIRCRAFT OPERATORS (AVERAGE DAILY FLIGHTS FOR 2022 YEAR-TO-DATE)

Within the top 10, only two airlines managed to

exceed their 2019 volumes:

Wizz Air (+13%): mainly due to increases on domestic

flows in Italy, flows between Italy and Albania, Spain

and the UK, Italy and the UK or Albania and Germany.

Ryanair (+9%) mainly due to increases on domestic

flows in Italy and Spain, as well as increases on flows

between Italy and Spain, Italy and Poland, France and

Spain or France and Italy.

Other airlines have not yet recovered their 2019 traffic

levels, amongst which:

SAS Group (-35%): mainly due to decreases on

domestic flows in Norway and Sweden, and on flows

between Finland and Sweden, Denmark and

Germany, Denmark and Sweden&Norway.

British Airways (-30%): mainly due to decreases on

domestic flows as well as decreases on flows between

the UK and Germany, Italy France and the US.

Ryanair was the busiest aircraft operator with 2,566 flights per

day on average (+9% vs 2019) in 2022 so far, followed by

easyJet (1,347; -20%), Turkish Airlines (1,249; -7%), Lufthansa

(1,067; -21%), Air France (952; -21%), KLM (709; -18%), Wizz

Air (667; +13%) and British Airways (642; -30%).

Ryanair, easyJet and Air France maintained their pre-covid

2019 rankings (1

st

, 2

nd

and 5

th

respectively). Turkish Airlines

moved up the 3

rd

busiest operator in 2022.

Aircraft Operators

Average Daily Dep/Arr Flights

Ryanair Group 2,566 +9%

easyJet Group 1,347 -20%

Turkish Airlines 1,249 -7%

Lufthansa Airlines 1,067 -29%

Air France Group 952 -21%

KLM Group 709 -18%

Wizz Air Group 667 +13%

British Airways Group 642 -30%

Vueling 547 -10%

SAS Group 536 -35%

Rank

evolution

over 2019

Top 10 AOs (1 Jan - 06 Dec 2022)

% vs 2019

AIRCRAFT OPERATORS (AVERAGE DAILY FLIGHTS 2022 YEAR-TO-DATE)

In 2022, so far:

Highest increases in flights

compared to 2019 for Wizz Air

(+13%), Loganair (+12%), Ryanair

(+9%) and Wideroe (+1%).

Largest decreases in flights

compared to 2019 for Norwegian

(-43%), Air Europa (-40%),

Eurowings (-37%), Brussels Airlines

(-36%), SAS (-35%) and Finnair (-

33%).

Top 28 Aircraft Operators

AIRCRAFT MANUFACTURERS (SHARE OF FLIGHTS 2022 YEAR-TO-DATE)

At European level, 38% of all flights in

2022 (YTD) were operated by Airbus

aircraft vs 32% by Boeing aircraft.

The situation varies for the top 20

aircraft operators. For these, Airbus’

share was 52% while Boeing’s share

was 35%.

Flights of the top 20 Aircraft operators

AIRCRAFT OPERATORS: SHARE OF NON-OPERATED

SCHEDULES IN 2022 (01 JAN - 06 DEC 2022)

Operational impact of non-

operated schedules for 2022, so far:

The average of non-operated

schedules at European level is 7%

on a year-to-date basis.

Highest proportion of the non-

operated schedules was during

Q1 2022 (Omicron).

Then, during summer, high non-

operated flights values were

recorded for SAS, KLM, easyJet

and Lufthansa.

Non-operated schedules is the percentage of airline schedules for which no ATC flight plan was matchedcompared to the total number of expected flights.

Top 10 Aircraft Operators

AIRCRAFT OPERATORS (AVERAGE DAILY FLIGHTS 2022 YEAR-TO-DATE)

Cargo, Legacy, Low Cost and Regional Carriers

In 2022, so far:

UK is the State with the highest number of dep/arr flights on average

over in 2022 (4,728; -20% vs 2019), followed by Germany (4,293;

-25%), Spain (4,277; -9%), France (3,763; -14%), Italy (3,201; -12%) and

Türkiye (2,634; -8%).

In this top 10, Greece(+1%) is the only State exceeding its 2019 traffic

volumes.

STATES (AVERAGE DAILY DEPARTURE/ARRIVAL FLIGHTS, 2022 YEAR-TO-DATE)

Within the top 10, all States but one posted

flight decreases compared to 2019:

Germany (-25%): mainly due to less flights

operated by Lufthansa, Eurowings, easyJet

and Ryanair. On domestic flows, and flows

with the UK, Russia, Italy and France.

UK (-20%): mainly due to the failure of

Flybe but also to decreases for British

Airways, easyJet and Stobart Air. Mainly on

domestic flows and flows with Germany,

France, the Netherlands and Spain.

Increase for:

Greece (+1%): mainly due to SkyExpress,

easyJet, Jet2 and Wizz Air. On flows with the

UK, Germany, France, Switzerland and the

US.

STATES (AVERAGE DAILY DEPARTURE/ARRIVAL FLIGHTS 2022 YEAR-TO-DATE)

STATES (AVERAGE DAILY DEPARTURE/ARRIVAL FLIGHTS 2022 YEAR-TO-DATE)

In 2022, so far:

Highest increases in flights

(vs 2019) for Albania

(+38%), Armenia (+31%),

Bosnia-Herzegovina

(+14%) and Greece (+1%).

Largest decreases for

Ukraine (-89%), Latvia

(-36%), Slovenia (-33%),

Finland (-32%) and Czech

Republic (-31%).

EUROCONTROL Member States

ARRIVAL & DEPARTURE PUNCTUALITY (AT TOP AIRPORTS FOR

2022 YEAR-TO-DATE)

Network punctuality in 2022 (Year-to-date):

Overall Arrival and Departure punctuality dropped in 2022, compared to 2019, although lower traffic volumes:

Reactionary delays contributed the most to the drop in schedule punctuality notably during the afternoon and evening.

Airline, ground handling and airport operator related delays also saw a strong increase compared to 2019, notably caused

by staff shortages and industrial actions.

There were significantly more En-Route ATFM delays in the network from a combination of ATC capacity, weather and

increased complexity due the Ukrainian crisis which generated additional ATFM delays as traffic flows shifted following the

closure of the Ukrainian FIR.

More detailed information be found on our new daily punctuality dashboards: main link, States link and Airports link.

EN-ROUTE ATFM DELAYS

In 2022, so far:

Major cause of en-route

ATFM delay was Capacity

and Staffing accounting for

47% of the delay causes.

Weather, especially during

the Summer season,

accounted for 23% of en-

route ATFM delays.

EN-ROUTE ATFM DELAYS

In 2022, so far:

Major contributors were :

Germany (36% of all en-

route ATFM delays), followed

by France (22%), Czech

Republic (5%), Poland (5%)

and Hungary (5%).

TOTAL ATFM DELAYS (ALL CAUSES, AIRPORTS AND EN-ROUTE)

EUROCONTROL Network, 2019 and 2022 (7-day average)

TRAFFIC FLOWS (AVERAGE DAILY DEPARTURE/ARRIVAL FLIGHTS FOR 2022 YTD)

The main traffic flow was intra-European with 20,339 flights on average in 2022, -15% over the same period in 2019.

The Inter-Continental flow, recording 4,569 daily flights on average in 2022, was 26% below 2019 levels.

Flows between Europe and Other Europe (incl. Russia) were at -71% compared to 2019.

Flows between Europe and Asia/Pacific were at -33% compared to 2019. Flows from, to and within China are still severely depressed

(see next slide).

REGION

(Average daily flights)

1 Jan - 6 Dec

2022

vs. 2019

Intra-Europe 20,339 -15%

Europe<->Asi a/Paci fi c 533 -33%

Europe<->Mid-Atlantic 172 -0%

Europe<->Mi ddl e-Eas t 1,195 -17%

Europe<->North Atlanti c 1,085 -10%

Europe<->North-Afri ca 854 -17%

Europe<->Other Europe 311 -71%

Europe<->South-Atlantic 145 -22%

Europe<->Southern Africa 275 -12%

Non Intra-Europe 4,569 -26%

OUTSIDE EUROPE: SITUATION IN CHINA OVER THE 2019-2022 PERIOD

Owing to the strict implementation

of a zero-COVID-19 policy, China

recorded a series of peaks and

troughs vis-à-vis its number of

flights since 2020. Early December

2022, the number of domestic

flights records is just above 4,000

daily flights, corresponding to a

66% decline (vs 1 Jan 2020).

It has been nearly three years the

international flights stagnated,

recording 1,223 flights early

December (-72% compared to 1

Jan 2020). Overflights remained

suppressed too with 905 flights

(-52% vs 1 Jan 2020).

OUTSIDE EUROPE: SITUATION IN MIDDLE-EAST OVER THE 2019-

2022 PERIOD

In March 2020 with the start of

COVID, traffic between Europe

and Middle East dropped by more

than 86%.

Since then, Intra traffic has

constantly and regularly increased

Since June 2022, the number of

domestic, international flights and

overflights in the Middle-East is

back to pre-COVID levels.

TRAFFIC FLOWS (SHARE OF FLOWS TO/FROM EUROPE FOR

2022 YEAR-TO-DATE)

So far in 2022, Intra-European

flights represented 82% of

total traffic.

Dealing with Inter-Continental

flows, the busiest partner with

Europe was the Middle-East

(accounting for 5%) followed

by North Atlantic (4%) and

North-Africa (3%). The

respective shares remained

stable compared to 2019.

However, in 2019, the third

busiest partner with Europe

was “Other Europe” (Russian

Federation) with 3.5%--now

1% (in 2022).

OUTSIDE EUROPE (SHARE OF FLOWS TO/FROM EUROPE FOR THE LAST WEEK)

Europe (30 Nov– 6 Dec)

Intra-European -14%

International -16%

Middle East (29 Nov – 4-6 Dec)

Domestic +7%

International - 5%

China (29 Nov – 5 Dec)

Domestic -72%

International -69%

USA (28 Nov – 4 Dec)

Domestic -15%

International

not available

Week 1 December – 7 December 2022 vs equivalent week in 2019

COUNTRY PAIRS (AVERAGE DAILY FLIGHTS FOR 2022 YEAR-TO-DATE)

Within the top 10, all flows posted a

decrease in 2022 YTD compared to 2019:

Germany-Germany (-37%) mainly due

to Lufthansa, Eurowings, easyJet and

Luxair.

UK-UK (-25%) mainly due to Flybe

(failure in March 2020), British Airways,

Eastern Airways and Ryanair.

Türkiye-Türkiye (-19%) mainly due to

Turkish Airlines, Pegasus, Atlasjet and

Onur Air.

France-France (-15%) mainly due to Air

France, school flights, Chalair, Eastern

Airways and ASL.

Eight of the top 10 flows in 2022 were domestic:

Spain-Spain is the country-pair with the highest number of dep/arr flights

(1,149) followed by France-France (939), Italy-Italy (822), UK-UK (766),

Norway-Norway (760) and Türkiye-Türkiye (753).

Country Pairs Average Daily Dep/Arr Flights

Spain <-> Spain 1,149 -4%

France <-> France 939 -15%

Italy <-> Italy 822 -1%

United Kingdom <-> United Kin

766 -25%

Norway <-> Norway 760 -2%

Türkiye <-> Türkiye 753 -19%

Spain <-> United Kingdom 697 -11%

Germany <-> Germany 587 -37%

Germany <-> Spain 475 -12%

Greece <-> Greece 331 -2%

Rank

evolution

over 2019

Top 10 Country Pairs (1 Jan - 06 Dec 2022)

% vs 2019

AIRPORTS (AVERAGE DAILY DEPARTURE/ARRIVAL FLIGHTS FOR 2022 YTD)

Top 10

Within the top 10, nine airports posted

decreases in 2022 YTD, compared to 2019:

Munich (-32%) due to Lufthansa,

Eurowings, easyJet and Swiss. On

domestic flows a well as flows with

Italy, the UK and Russia.

Frankfurt (-26%) due to Lufthansa,

Ryanair, Austrian and ITA. On domestic

flows and flows with Italy, Russia,

Austria and Poland.

London Gatwick (-24%) mainly due to

British Airways, Norwegian and easyJet.

On flows with the Spain and Italy.

Increase for:

Palma de Mallorca (+1%) mainly due to

Eurowings, Swiftair and Ryanair. On

domestic flows, as well as flows with

France, Italy and Switzerland.

iGA Istanbul is the airport with the highest number of dep/arr flights

(1,2006), followed by Amsterdam (1,147), Paris CDG (1,120), Frankfurt

(1,054) and London Heathrow (1,038).

Palma de Mallorca is the only airport in the top 10 which recorded traffic

levels above 2019 (+1%).

Airport Average Daily Dep/Arr Flights

iGA Istanbul*

1,206

-5%

Amsterdam 1,147

-18%

Paris Charles de Gaulle 1,120

-20%

Frankfurt 1,054

-26%

London Heathrow

1,038

-21%

Madrid Barajas 962

-18%

Barcelona

781

-18%

Munich 780

-32%

Palma de Mallorca 627 +1%

London Gatwick

598 -24%

* Comprises combined figures for IGA Istanbul and Atatürk

Rank

evolution

over 2019

Top 10 Airports (1 Jan - 06 Dec 2022)

% vs 2019

AIRPORTS (AVERAGE DAILY DEPARTURE/ARRIVAL FLIGHTS FOR 2022 YTD)

In 2022, so far:

Largest increase in flights

vs 2019 for Palma de

Mallorca (+1%).

Largest decreases for

Düsseldorf (-38%), Helsinki

(-32%), Rome Fiumicino

(-32%), Munich (-32%),

Vienna (-28%) and

Stockholm Arlanda(-28%).

Top 30

TOP 40 GLOBAL AIRPORTS (AVERAGE DAILY DEPARTURE FLIGHTS)

Comparing the 1 Jan to 4 Dec

2022 with the same period in

2019 (left):

8 European airports are

ranked in the Top 40 global

airports (vs 7 in 2019)

The first European airport

(rank 10) is iGA Istanbul*.

Two other airports in the Top

15: Amsterdam Schiphol and

Paris Charles de Gaulle.

11 of the Top 15 global

airports are currently located

in the US.

The highest Asian airport

currently is New Delhi (12

th

).

AIRCRAFT OPERATORS: FINANCIAL RESULTS FOR

THE FIRST NINE MONTHS (JAN-SEP)

During the first 9 months of

2022, and compared to 2021:

Turkish Airlines has recorded

the highest operating profits

for the first 9 months of 2022

(+2,329 M€).

Other flag carrier groups (Air

France/KLM, IAGand

Lufthansa) also posted

positive operating profits.

Ryanair has posted strongly

positive results. Pegasus

recorded profits too, to a

lesser extent.

U.S passenger airlines recorded $303 million pre-tax losses for the first 9 months of 2022 (source: A4A)

EN-ROUTE AIR NAVIGATION CHARGES

EUROCONTROLhas billed

6,462M€ on a year-to-date

basis (Jan-Oct 2022).

This is 5% below the

amount billed for the same

period in 2019.

FUEL & TICKET PRICES

Jet fuel prices averaged 337 cts/gallon in 2022 (January to November).

Jet fuel prices were stable at 254 cts/ gallon in January-February and

remained extremely volatile since the Russian invasion of Ukraine to

average 353 cts/gallon from March (+39% vs Jan-Feb).

Overall, average fuel prices increased by 88% in 2022, compared to

2021 (they averaged at 180 cents/gallon over the same period in 2021).

Compared to 2019, air ticket prices in Europe (EU27)

started to increase since May 2022. July 2022

recorded circa 15% increase on July 2019.

Since August, ticket prices have been on average 10%

above 2019 prices.

Air ticket prices here are deflated (we removed the effects of inflation).

© EUROCONTROL - December 2022

T hi s document is published by EUROCONT ROL for information purposes. It may be copi ed

in whol e or in part, provided that EUROCONTROL is mentioned as the source and it is not

used for commerci al purposes (i.e. for fi na ncial gai n). The information in thi s document may

not be modified without prior written permission from EUROCONT ROL.

www.eurocontrol.int

To further assist you in your analysis, EUROCONTROL provides the

following additional information on a daily basis (

daily updates at 7:30

CET for the first item and 12:00 CET for the second

) and every Friday

for the last item:

1. EUROCONTROL Daily Traffic Variation dashboard:

www.eurocontrol.int/Economics/DailyTrafficVariation

(or via the COVID-19 button on the top

of our homepage www.eurocontrol.int

)

• This dashboard provides traffic for Day+1 for all European States; for the largest airports;

for each Area Control Centre (ACC) and for the largest airline operators.

2. COVID Related-NOTAMS with Network Impact (i.e. summary of airspace restrictions):

https://www.public.nm.eurocontrol.int/PUBPORTAL/gateway/spec/index.html

• The Network Operations Portal (NOP) under “Latest News” is updated daily with a

summary table of the most significant COVID-19 NOTAMs applicable at 12.00 UTC.

3. NOP Recovery Plan.

https://www.public.nm.eurocontrol.int/PUBPORTAL/gateway/spec/index.html

• This report, updated every Friday, is a special version of the Network operation Plan

supporting aviation response to the COVID-19 Crisis. It is developed in cooperation with

the operational stakeholders ensuring a rolling outlook.

For more information please contact aviation.intelligence@eurocontrol.int