June 28, 2023

National Stock Exchange of India Limited

Exchange Plaza

C-1, Block G, Bandra Kurla Complex

Bandra (E), Mumbai - 400 051

Through: NEAPS

Symbol: ASHOKLEY

BSE Limited

Phiroze Jeejeebhoy Towers

Dalal Street

Mumbai - 400 001

Through: BSE Listing Centre

Scrip Code: 500477

Dear Sir/Madam,

Submission of Annual Report for the year 2022-23

The Seventy Fourth Annual General Meeting (AGM) of the Company is scheduled to be held

through Video Conferencing (“VC”)/ Other Audio-Visual Means (“OAVM”) on Friday, July 21, 2023

at 2.45 p.m.

Pursuant to Regulation 34(1) of SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015, we submit herewith the Annual Report for the year 2022-23 along with AGM

Notice sent to the shareholders.

Kindly take the above on record.

Thanking you,

Yours faithfully,

for Ashok Leyland Limited

N Ramanathan

Company Secretary

Encl.: a/a

NATARAJAN

RAMANATHAN

Digitally signed by NATARAJAN RAMANATHAN

DN: c=IN, o=Personal,

pseudonym=76Ay9IaKzUopoDjMdQaYLKTIH8UEFDer,

2.5.4.20=22ebdb00708268080062bd623ed12444603631a4a

2c6396a6569847037804046, postalCode=600061, st=Tamil

Nadu,

serialNumber=e6c7e692a309c6eac78562d9913f554c20235b

2382a57b04952b55db37396323, cn=NATARAJAN

RAMANATHAN

Date: 2023.06.28 15:10:16 +05'30'

Driving towards a greener future

75 YEARS OF TURNING

DREAMS INTO REALITY

ANNUAL REPORT FY 2022 - 2023

FORWARD - LOOKING STATEMENT

In this Annual Report, we have disclosed forward-looking informaon

to enable investors to fully appreciate our prospects and take informed

investment decisions. This report and other statements – wrien and oral

– that we periodically make, contain forward-looking statements that set

our ancipated results based on management plans and assumpons.

We have tried, where possible to idenfy such statements by using such

words as ‘ancipate’, ‘expect’, ‘project’, ‘intend’, ‘plan’, ‘believe’ and

words of similar substance in connecon with any discussion of future

performance.

We cannot, of course, guarantee that these forward-looking statement

will be realized, although we believe we have been prudent in our

assumpons. Achievement of results is subject to risks, uncertaines,

or potenally inaccurate assumpons. Should known or unknown risks

or uncertaines materialize, or should underlying assumpons prove

inaccurate, actual results could vary materially from those ancipated,

esmated or projected. Readers should bear this in mind.

We undertake no obligaon to publicly update any forward- looking

statements, whether as a result of new informaon, future events, or

otherwise.

* * * * *

Over the last 75 years we have been at the forefront of technology, innovang and achieving

dreams that we thought were impossible at one me. Looking forward, the future of mobility is

going to be nothing like what we have seen. At Ashok Leyland, we have set our focus and we

are on the path to a more sustainable future. Our alternate fuel vehicles that were showcased

at Auto Expo 2023 are a posive step in that direcon and an indicaon of what the future of

mobility will be. We are condent that we will deliver world class products that are sustainable

and future forward.

Annual Report 2022-23 1

Dear Shareholders,

I have great pleasure in informing you that your Company has achieved

excellent results last year. Considering the uncertain industry outlook

which loomed at the beginning of the year, the performance truly

exemplies the immense resilience Ashok Leyland possesses in braving

the odds and emerging successfully. I would like to, on your behalf,

congratulate and thank the enre team in Ashok Leyland and its wider

ecosystem for their conscienous eorts to make it possible.

Reecng on our endeavour last year, it can be noted that our journey

has not been an easy one. There was volality in commodity prices

which pushed up costs, that could not be fully recovered in pricing

due to unprecedented compeve pressures. Due to a combinaon of

economic factors, the commercial vehicle industry had yet to gather

momentum in the laer part of FY22 and the residual eect remained

well into the inial period of FY23. Amid this turmoil, which had an

impact on our market share and protability, Ashok Leyland team

quickly rejigged its product-market eorts, revamped the customer

orientaon and was able to realise the high aspiraons that were set.

While stability in the market from the second half of the year buoyed

up the senment to an extent, our key success factors were superior

product performance, clinical eorts in cost reducon and above all

the “can do – will do” atude of the Ashok Leyland team.

To enumerate some of the high points across business units,

We sold 114,247 Medium and Heavy commercial vehicles in the

domesc market comprising 10,767 buses and 103,480 trucks

including Defence vehicles, registering a growth of 75.5% and

posng a market share increase of approximately 5% over the

previous year, closing at 31.8%. It is grafying that we have

gained share in every region and in almost all the product sub-

segments, aributable to the superior performance of AVTR

models, focused network development and addional thrust

given on customer centricity.

Our used vehicle business – ReAL- made good progress during

the year as was expected.

In the Light vehicle segment, with sales of 66,669 vehicles, the

growth was 27.7% over the previous year. The Bada Dost range

posted its highest ever sales volume since introducon and was

awarded ‘Pick up of the Year’ and a special edion model was

awarded the ‘Markeng campaign of the year’ by ET Now and

World Leadership Congress.

Despite dicult market situaon in target countries which faced

issues of currency depreciaon and forex availability, Internaonal

Operaons could achieve a growth of 2% year over year. We

expanded the reach by adding distributors in 12 countries and

launched 5 new products and their variants.

Power Soluons and Aermarket businesses had clocked a

growth of 9% and 31% respecvely in FY23.

Backing this spectacular market performance, the Operaons

team kept pace with the highest ever LCV producon and the

highest monthly overall vehicles producon along with the

highest ever material cost savings.

All these helped us achieve an all-me high revenue of ` 36,144

Crores with a 67% growth over previous year along with nearly 3

mes growth in EBITDA – from ` 995 Crores in FY22 to ` 2,931 Crores,

operang prot grew by 120 mes and a cash surplus of ₹ 243 Crores

at the end of FY23.

On the product and technology front, which is our passion, we are

making good progress in alternate propulsion development. At the

Auto Expo held in Delhi in January this year, a wide range of alternate

fuel driven products were displayed across our LCV, ICV and MDV

plaorms. This covered CNG, LNG, Hydrogen, Fuel Cell and Baery

Electric opons. Switch Mobility, through which we are posioning the

electric vehicles, has gained considerable momentum in FY23 and has

already made a mark in the industry. The electric LCV is slated for

introducon later this year.

Recognising the importance of building a talent pipeline in an

environment of homogenous culture, our HR team was on an overdrive

launching several iniaves and cascading them across the board. These

iniaves include dening the organisaon purpose as “Transforming

Lives & Businesses through Leadership in Mobility” and driving a new

culture throughout the organisaon. Preparing future leaders saw the

introducon of a new AL-Young Talent Program and the AL-Emerging

Leaders Program. Another signicant milestone in our gender diversity

pathway is the establishing of an all women-run engine assembly line

in our Hosur plant.

I would like to take this opportunity to present some of the key

iniaves in other areas that are relevant to our business. Our plants

have won 13 CII-Environment, Health, and Safety Excellence Awards.

Use of renewable solar power is at the top of the agenda. Renewable

energy now constutes 57% of our total requirement. Furthermore,

your Company believes sustainability is key to its overall strategy and is

consciously moving from compliance to compeveness in the overall

ESG approach. And as part of a holisc approach to sustainability, your

Company has developed an ESG vision: “To create and lead sustainable

pracces, across Environment, Social and Governance iniaves,

delivering outstanding stakeholder value.” This vision has been further

operaonalized into 10 Focus areas deep diving individually in E, S, and

G areas. Moving forward, your Company is also preparing for some

major commitments around becoming carbon-neutral in its operaons

in the medium term and becoming Net Zero in the long term.

CHAIRMAN’S MESSAGE

2 Ashok Leyland Limited

CHAIRMAN’S MESSAGE

Under CSR, our Road To School programme (RTS) is making strides

and the coverage has increased from 98,000 to over 150,000 children.

During the year, the RTS iniave has been extended to J&K and Assam

and is gaining ground gradually. RTS has also received awards from

the Tamil Nadu Government, ASSOCHAM, FICCI and SIAM. The Road to

Livelihood programme, which was introduced this year for Classes 9-12

has been well received by parents and the community. Your Company

is determined to expand this further, not just impacng a greater

number of students but also widening its reach to many more states.

You may recall we had a tagline Aap Ki Jeet Hamari Jeet for about

10 years. It symbolized a mission and a role for us as relevant then.

With the changed business dynamics and our heightened self-belief

together with our aspiraonal vision, Ashok Leyland management felt

that the tag line needs to be renewed and be reecve of our current

outlook. Also, this is our 75

th

year Anniversary and an occasion beng

a suitable tagline that galvanises the organisaon towards a limitless

horizon. On that basis, Koi Manzil Door Nahin (No Dream too far) has

been chosen, which will guide and power all our strategies and acons

from now on.

Moving on, it is reasonably expected that in FY24, the demand

is expected to exceed pre-COVID levels of 2018-19. Government

infrastructure spending, strong replacement demand and a healthy

tracon from core industries like steel, cement and mining are expected

to drive growth. You will be pleased to note that your Company is fully

prepared to take advantage of the ancipated opportunies without

compromising on market share and protability targets.

As we move forward in our aspiraons posively, I would like to gratefully

acknowledge your connued trust and faith in us and would like to

assure you of progressive growth in shareholder value year aer year.

Yours sincerely,

Dheeraj G Hinduja

Chairman

13 June 2023

Annual Report 2022-23 3

CORPORATE INFORMATION

BOARD OF DIRECTORS

Dheeraj G Hinduja, Execuve Chairman

Prof. Dr. Andreas H Biagosch

Dr. C Bhaktavatsala Rao

Jean Brunol

Jose Maria Alapont

Manisha Girotra

Sanjay K Asher

Saugata Gupta

Shom Ashok Hinduja

Shenu Agarwal, Managing Director & Chief Execuve Ocer

(appointed w.e.f. December 8, 2022)

Gopal Mahadevan, Whole-me Director and Chief Financial Ocer

Dr. Andrew C Palmer

(resigned w.e.f. November 3, 2022)

BANKERS

Axis Bank

Bank of Baroda

Central Bank of India

Ci Bank N A

DBS Bank

Federal Bank

HDFC Bank Limited

ICICI Bank Limited

IDBI Bank

Standard Chartered Bank

State Bank of India

MUFG Bank Limited

Yes Bank Limited

COMPANY SECRETARY

N Ramanathan

REGISTERED OFFICE

No.1, Sardar Patel Road, Guindy, Chennai- 600 032

SENIOR MANAGEMENT

Dr. N Saravanan

S Ganesh Mani

Raja Radhakrishnan

Amandeep Singh

Sanjeev Kumar

Sanjay Saraswat

K Ramkumar

Alok Verma

Mahesh Thakar

STATUTORY AUDITOR

Price Waterhouse & Co Chartered Accountants LLP

COST AUDITOR

Geeyes & Co

CORPORATE IDENTIFICATION NUMBER

L34101TN1948PLC000105

PLANTS

Tamil Nadu - Ennore (Chennai), Sriperumbudur (Foundry),

Vellivoyalchavadi (Technical Centre) and Hosur,

Maharashtra - Bhandara, Rajasthan - Alwar,

Uarakhand – Pantnagar, Andhra Pradesh - Vijayawada

WEBSITE

www.ashokleyland.com

REGISTRAR AND SHARE TRANSFER AGENT

Integrated Registry Management Services Private Limited

2

nd

Floor, Kences Towers

1 Ramakrishna Street, North Usman Road

T. Nagar, Chennai-600 017

Tel- +91 44 28140801/03

Fax- 91 44 2814 2479

Email: csdstd@integratedindia.in

4 Ashok Leyland Limited

CONTENTS

A Historical Perspecve of the Company .................................................................................................................................................................. 5

Noce to Shareholders ............................................................................................................................................................................................... 7

Board’s Report ............................................................................................................................................................................................................ 22

Report on Corporate Governance .............................................................................................................................................................................. 32

Management Discussion and Analysis Report .......................................................................................................................................................... 52

Business Responsibility and Sustainability Report .................................................................................................................................................... 66

Standalone Financial Statements (Pages 94 to 181)

Independent Auditors’ Report to the members ............................................................................................................................................ 94

Balance Sheet .................................................................................................................................................................................................. 104

Statement of Prot and Loss ................................................................ .......................................................................................................... 105

Statement of Cash Flows ................................................................................................................................................................................ 106

Statement of Changes in Equity ..................................................................................................................................................................... 108

Notes annexed to and forming part of the Standalone Financial Statements ............................................................................................ 109

Consolidated Financial Statements (Pages 182 to 299)

Independent Auditors’ Report to the members ............................................................................................................................................. 182

Balance Sheet ................................................................................................................................................................................................... 192

Statement of Prot and Loss ........................................................................................................................................................................... 193

Statement of Cash Flows ................................................................................................................................................................................. 194

Statement of Changes in Equity ...................................................................................................................................................................... 196

Notes annexed to and forming part of the Consolidated Financial Statements ........................................................................................... 198

Annual Report 2022-23 5

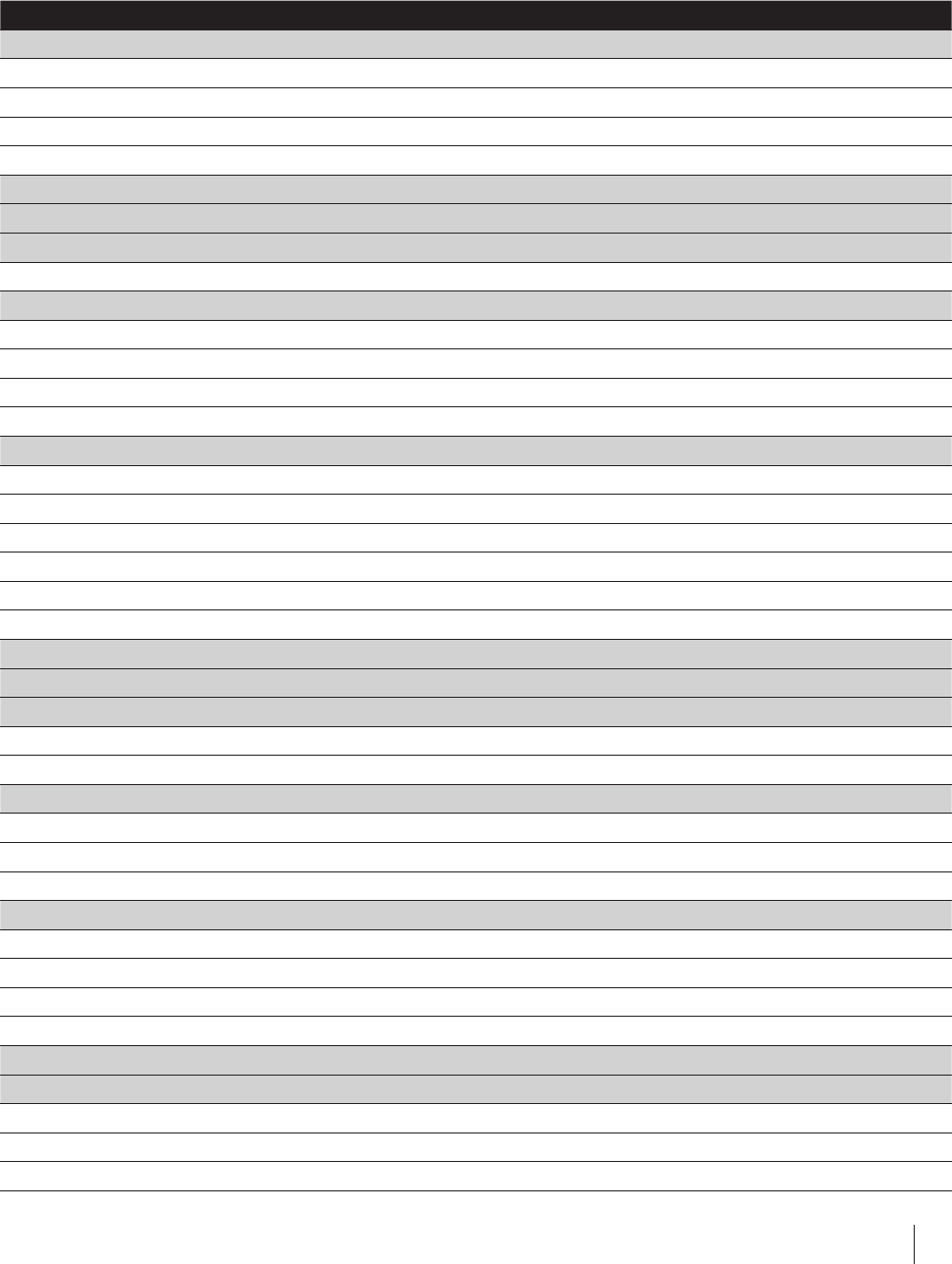

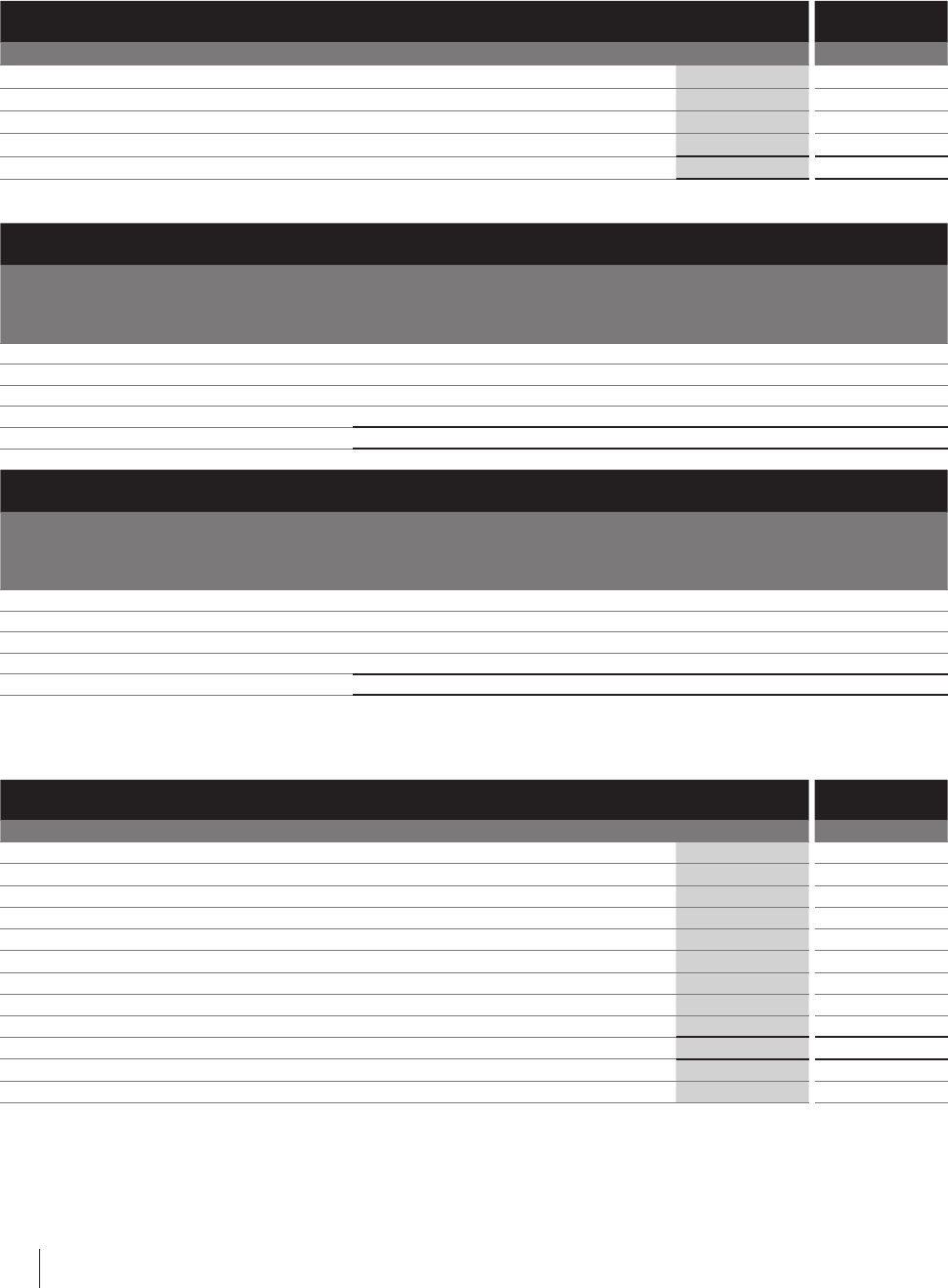

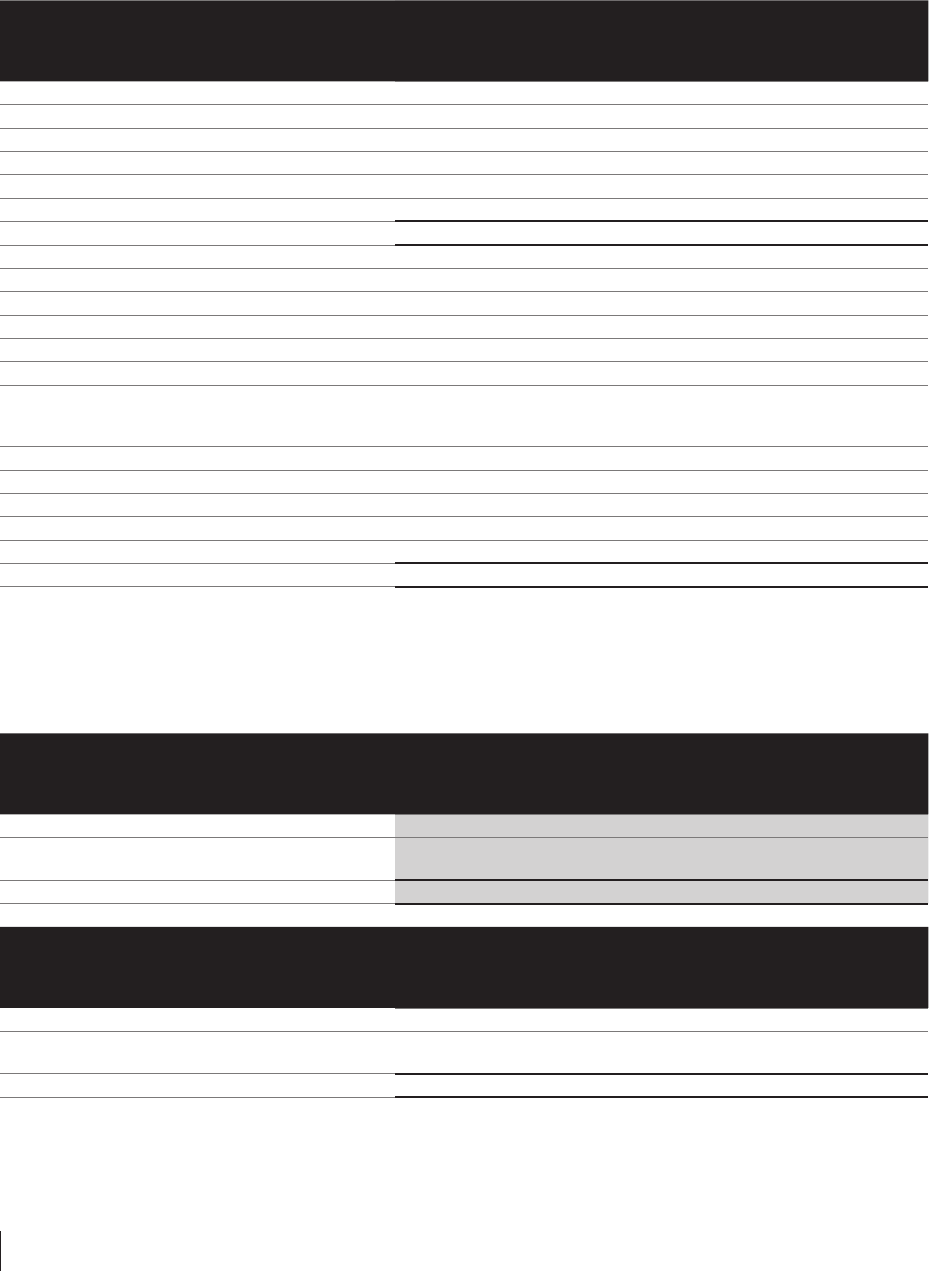

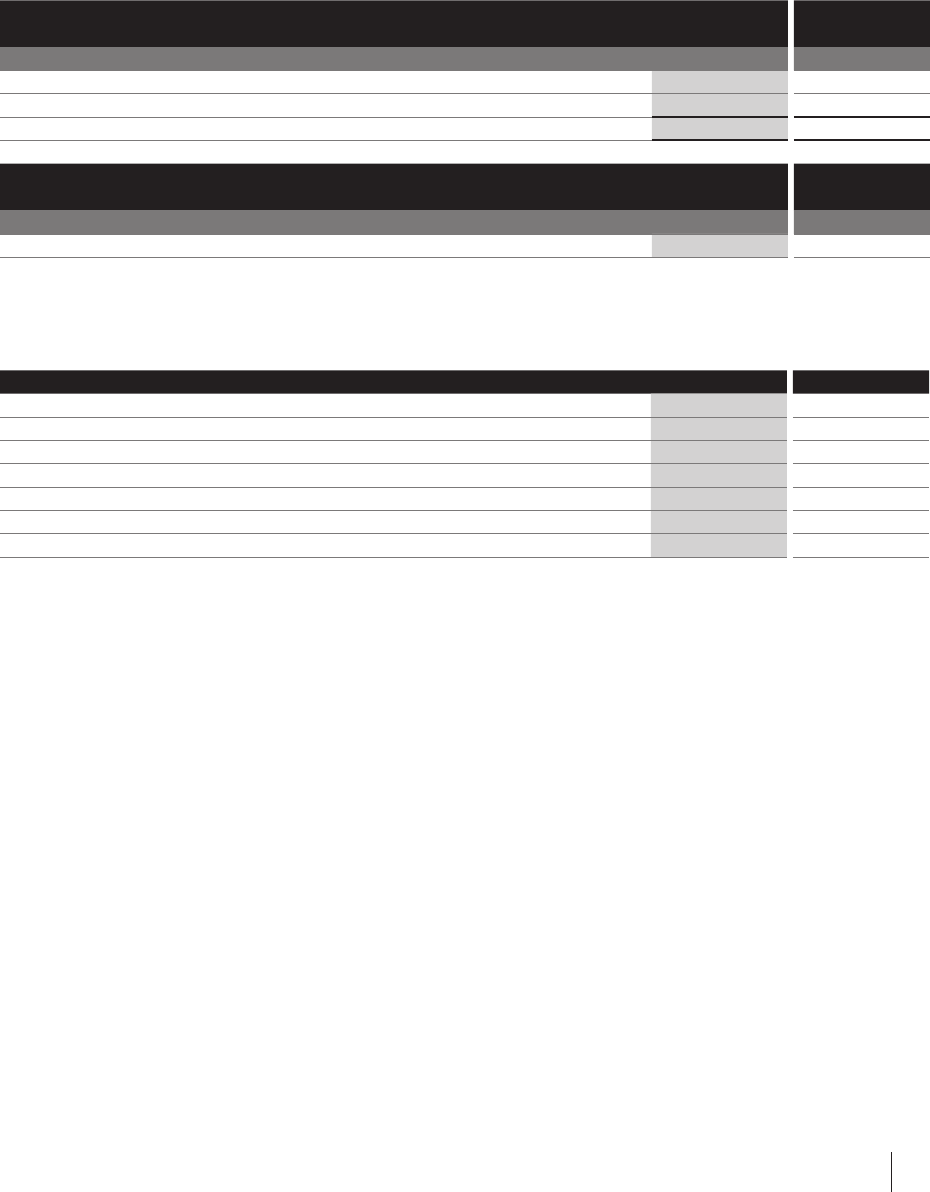

A HISTORICAL PERSPECTIVE OF THE COMPANY

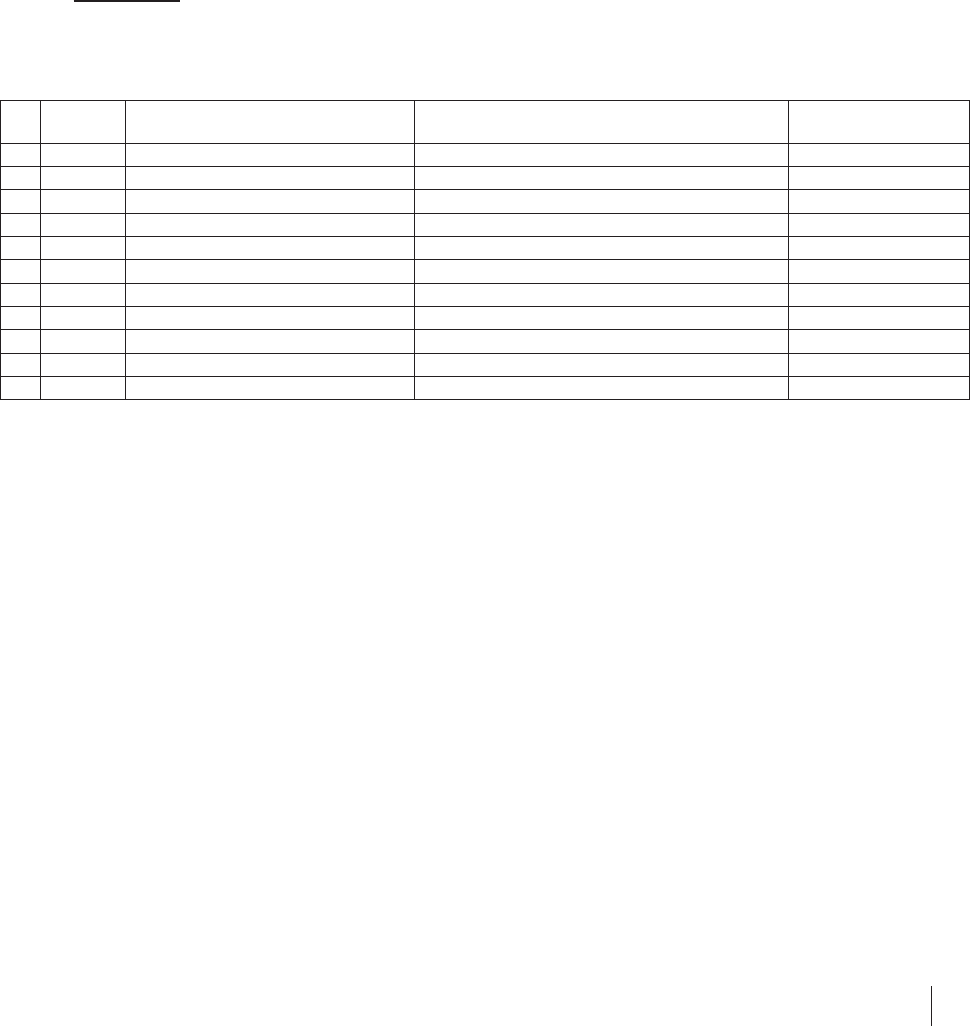

` Crores

Parculars 2013-14 2014-15

Sales Volume

Vehicles (numbers) 89,337 1,04,902

Engines (numbers) 17,441 14,023

Spare parts and others 1,213 1,392

Revenue (Gross sales) 10,561 14,486

Prot before tax (91) 442

Prot aer tax 29 335

Assets

Fixed assets 5,841 5,376

Non-Current Investments 2,405 2,240

Long term loans and advances 1,002 983

Other non-current assets 33 20

Non-Current Assets 9,281 8,619

Current Investments 384 408

Inventories 1,189 1,398

Trade Receivables 1,299 1,243

Cash and Bank balances 12 751

Short Term loans and Advances 472 564

Other current assets 171 328

Current assets 3,527 4,692

Total 12,808 13,311

Financed by

Share capital 266 285

Reserves and surplus 4,182 4,834

Shareholders funds 4,448 5,119

Long term borrowings 3,297 2,566

Deferred tax liability - Net 407 510

Long-term provisions and Liabilies 70 99

Non-current liabilies 3,774 3,175

Short-term borrowings 587 25

Trade payables 2,214 2,828

Other current liabilies 1,697 1,908

Short-term provisions 88 256

Current liabilies 4,586 5,017

Total 12,808 13,311

Basic Earnings Per Share (`) 0.11 1.20

Dividend per share (`) (Face value ` 1 each) - 0.45

Employees (numbers) 11,552 11,204

6 Ashok Leyland Limited

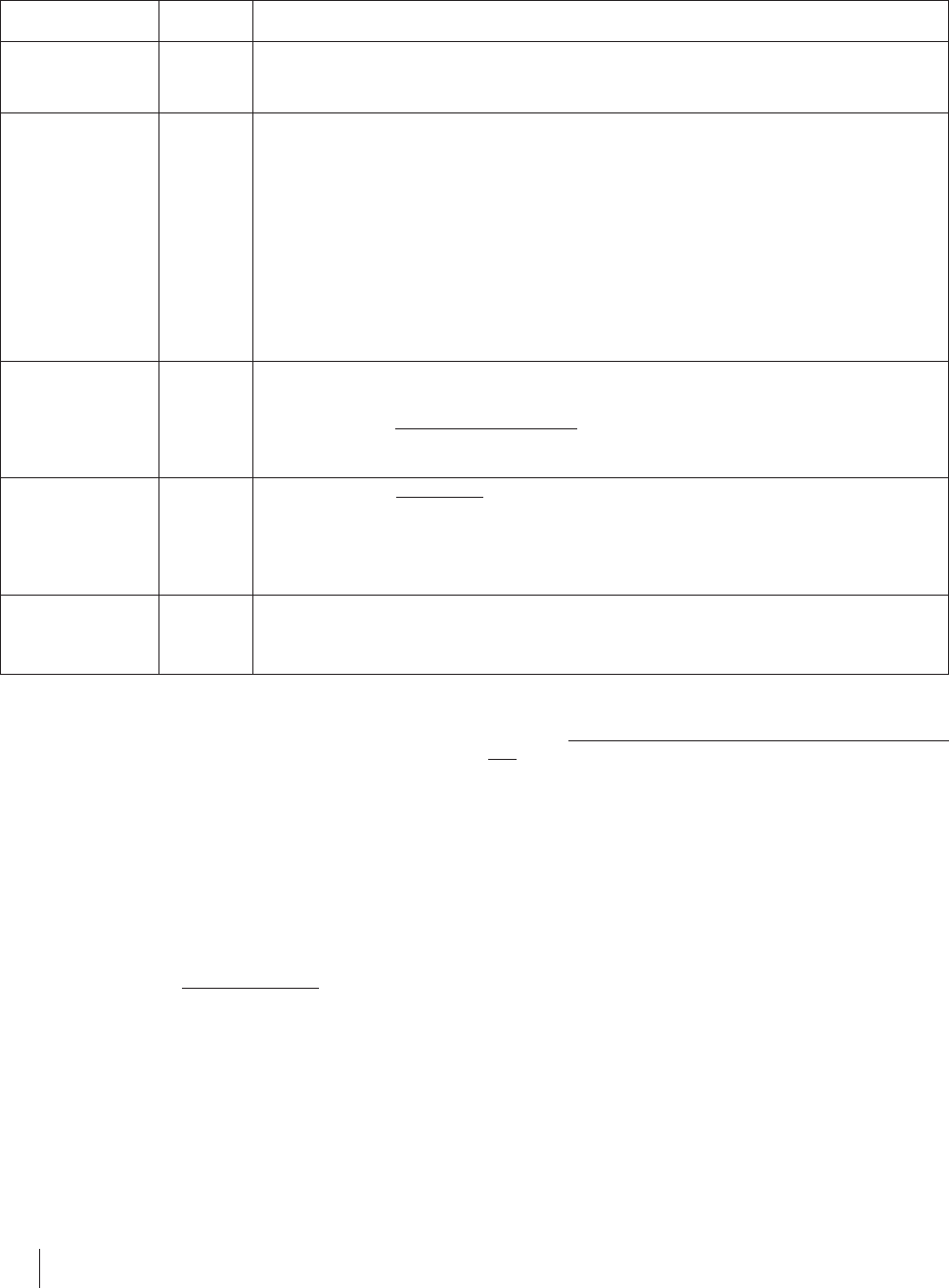

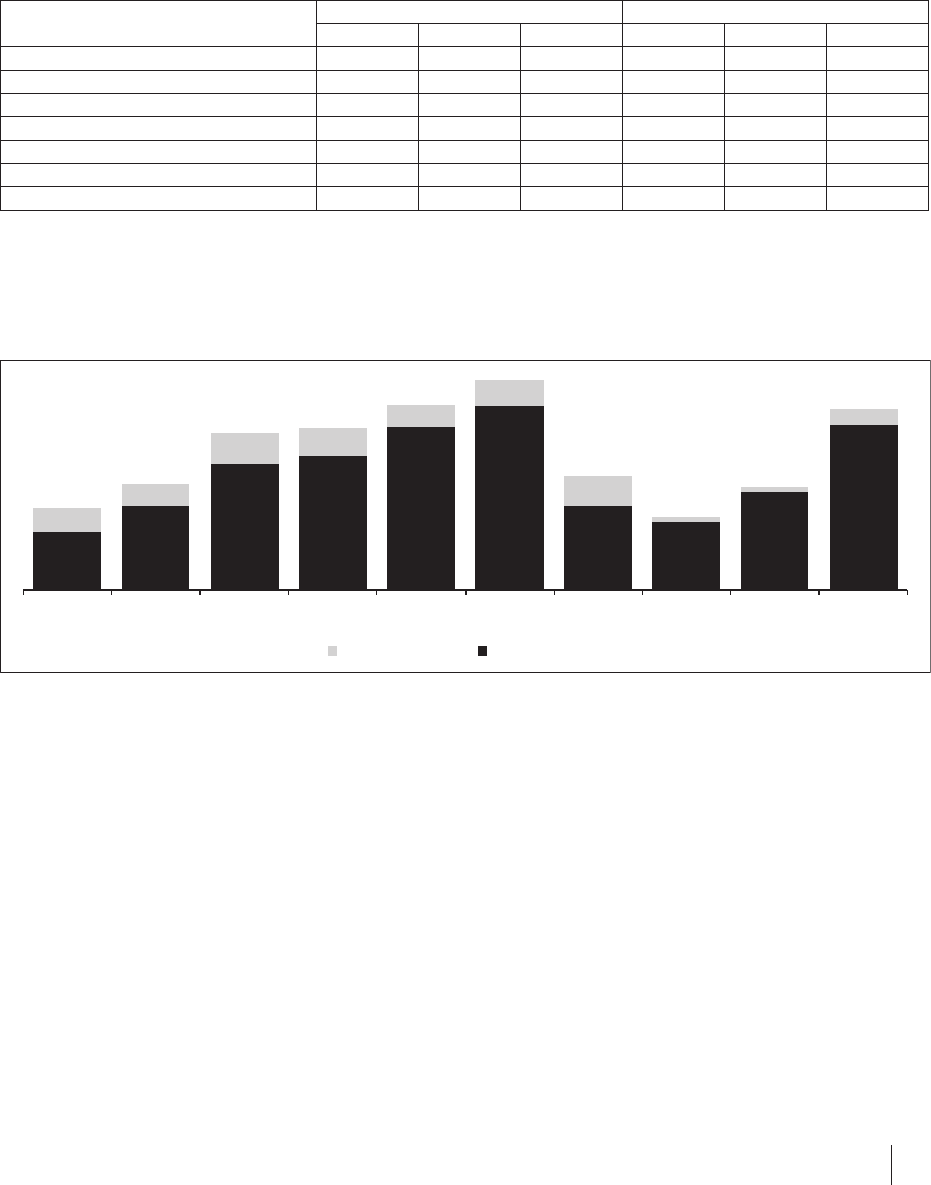

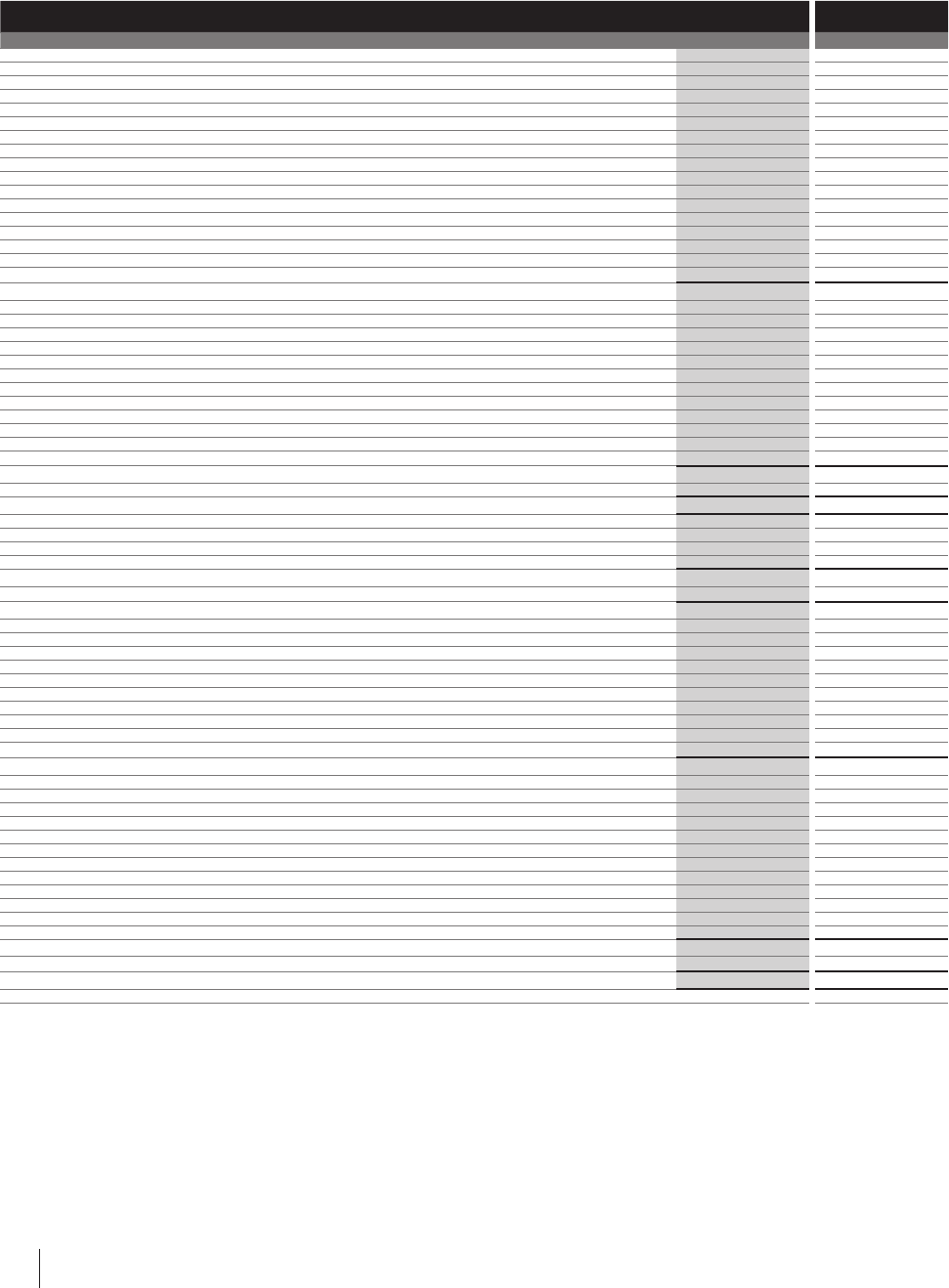

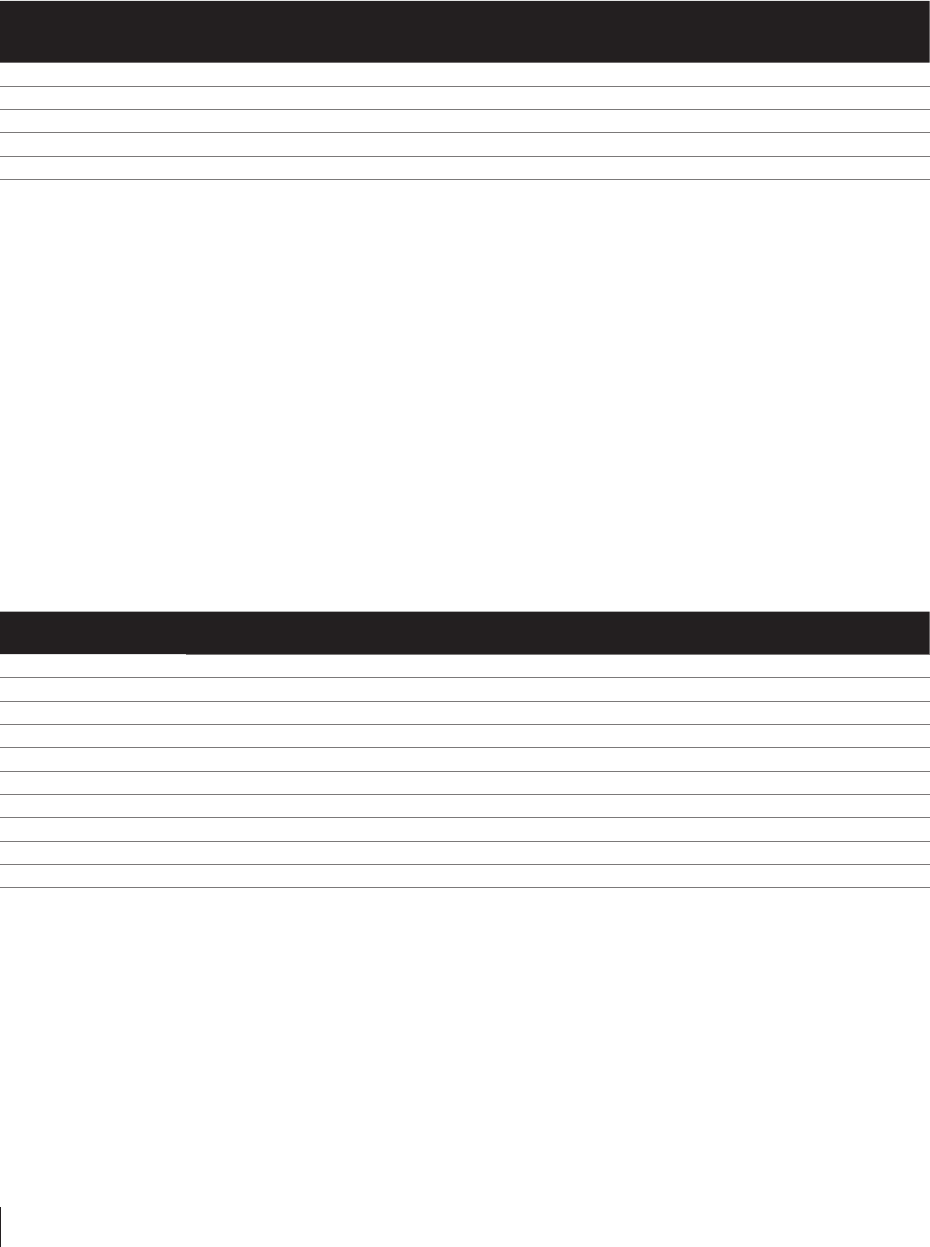

` Crores

Parculars 2015-16 2016-17 2017-18** 2018-19 2019-20 2020-21 2021-22 2022-23

Sales Volume

Vehicles (numbers) 1,40,457 1,45,066 1,74,873 1,97,366 1,25,200 1,00,725 1,28,326 1,92,205

Engines (numbers) 15,551 16,491 18,751 21,859 20,359 23,923 20,944 22,925

Spare parts and others 1,273 1,694 1,950 1,880 1,766 1,703 2,033 2,578

Revenue (Gross sales) 19,993 21,453 26,633 29,055 17,467 15,301 21,688 36,144

Prot before tax 827 1,330 2,386 2,497 362 (412) 528 2,110

Prot aer tax 390 1,223 1,718 1,983 240 (314) 542 1,380

Assets

Property, Plant and Equipment, CWIP, Right-of-use

asset, Goodwill - Intangible assets and IAUD

4,868 5,177 5,971 6,272 7,398 7,422 6,795 6,437

Investments 1,980 2,002 2,451 2,637 2,720 3,069 3,522 3,892

Trade Receivables# - - - - 1 - - 1

Loans and Other Financial assets 135 182 60 73 102 58 69 97

Income tax asset and other non-current assets 610 579 791 1,056 746 450 441 461

Non-Current Assets 7,593 7,940 9,273 10,038 10,967 10,999 10,827 10,888

Inventories 1,625 2,631 1,758 2,685 1,238 2,142 2,075 2,775

Investments - 877 3,155 - - - 1,298 2,771

Trade Receivables 1,251 1,064 945 2,505 1,188 2,816 3,096 4,062

Cash and Bank balances 1,593 912 1,042 1,374 1,322 823 1,047 501

Loans and Other Financial assets 196 211 414 487 926 829 996 582

Other current assets (including Contract assets) 516 282 749 1,135 749 841 931 941

Current assets 5,181 5,977 8,063 8,186 5,423 7,451 9,443 11,632

Assets classied as held for sale - 123 - - - - 64 72

Total 12,774 14,040 17,336 18,224 16,390 18,450 20,334 22,592

Financed by

Equity Share capital 285 285 293 294 294 294 294 294

Other Equity 5,123 5,841 6,953 8,039 6,970 6,683 7,043 8,132

Equity 5,408 6,126 7,246 8,333 7,264 6,977 7,337 8,426

Borrowings, Lease liabilies and other nancial

liabilies

1,995 1,194 514 333 1,431 2,625 2,914 1,820

Deferred tax liability - Net 329 127 298 249 265 171 144 504

Other Non-current liabilies and provisions

(including Contract liabilies)

152 172 459 520 431 403 391 769

Non-current liabilies 2,476 1,493 1,271 1,102 2,127 3,199 3,449 3,093

Borrowings, Lease liabilies and other nancial

liabilies

1,517 2,172 1,894 1,700 2,651 1,951 1,369 2,367

Trade payables 2,563 3,117 4,888 5,019 3,037 5,165 6,875 7,175

Other current liabilies and provisions (incl.Current

Tax liabilies-net and Contract liabilies)

810 1,132 2,037 2,070 1,310 1,158 1,292 1,520

Current liabilies 4,890 6,421 8,819 8,789 6,999 8,274 9,536 11,062

Liabilies directly associated with assets classied as

held for sale

- - - - - - 12 11

Total 12,774 14,040 17,336 18,224 16,390 18,450 20,334 22,592

Basic Earnings Per Share (`) 1.37 4.24 5.87 6.76 0.82 (1.07) 1.85 4.70

Dividend per share (`) (Face value ` 1 each) 0.95 1.56 2.43 3.10 0.50

@

0.60 1.00 2.60

$

Employees (numbers) 10,352 11,906 11,865 12,133 11,463 10,758 10,101 9,603

Contract asset and Contract liabilies is applicable from 2018-19.

Right-of-use asset and Lease liabilies is applicable from 2019-20.

Figures may not be strictly comparable due to presentaon changes

resulng from adopon of IND AS.

#amount is below rounding o norms adopted by the Group.

@Interim dividend declared by the Board during the year.

**Pursuant to amalgamaon of three wholly owned subsidiaries of

the Company with the Company from April 1, 2017.

$

Proposed Dividend

A HISTORICAL PERSPECTIVE OF THE COMPANY

As per Ind AS noed under the Companies (Indian Accounng Standards) Rules, 2015

Annual Report 2022-23 7

NOTICE is hereby given that the Seventy Fourth Annual General Meeng

(AGM) of Ashok Leyland Limited will be held on Friday, July 21, 2023

at 2.45 P.M. IST through Video Conferencing (‘VC’)/Other Audio-Visual

Means (‘OAVM’) to transact the following businesses:

ORDINARY BUSINESS

1. To receive, consider and adopt:

a) the Audited Standalone Financial Statements of the

Company for the nancial year ended March 31, 2023,

together with the Reports of the Board of Directors and

the Auditors thereon; and

b) the Audited Consolidated Financial Statements of the

Company for the nancial year ended March 31, 2023

together with the Report of Auditors thereon.

2. To declare a dividend for the nancial year ended March 31,

2023.

3. To appoint a Director in place of Mr. Gopal Mahadevan (DIN:

01746102) who reres by rotaon and being eligible, oers

himself for re-appointment.

SPECIAL BUSINESS

4. To consider and if thought t, to pass the following resoluon as

an Ordinary Resoluon:

“RESOLVED that pursuant to the provisions of Secon 148(3)

and other applicable provisions of the Companies Act, 2013

(‘the Act’) read with the Rules made thereunder [including any

statutory modicaon(s) or re-enactment(s) thereof for the me

being in force], the remuneraon payable to Messers. Geeyes

& Co., Cost & Management Accountants, (Firm Registraon No.

000044), appointed by the Board of Directors as Cost Auditors to

conduct the audit of the cost accounng records of the Company

for the nancial year ended March 31, 2023, amounng to

` 7,00,000/- (Rupees Seven lakhs only) plus applicable taxes and

reimbursement of out-of-pocket expenses incurred in connecon

with the aforesaid audit, be and is hereby raed.”

5. To consider and if thought t, to pass the following resoluon as

an Ordinary Resoluon:

“RESOLVED that pursuant to Regulaon 23 of the Securies

and Exchange Board of India (Lisng Obligaons and Disclosure

Requirements) Regulaons, 2015 [including any statutory

modicaon(s) or re-enactment(s) thereof for the me being

in force], the Company’s Policy on dealing with Related Party

Transacons and all other applicable laws and regulaons,

including but not limited to the relevant provisions of the

Companies Act, 2013 as may be applicable, the approval of

the Members, be and is hereby accorded for the Transacons

(whether an individual transacon or transacons taken together

or series of transacons or otherwise) with TVS Mobility Private

Limited, a ‘Related Party’ of the Company’s subsidiary as per

Secon 2(76) of the Companies Act, 2013, with respect to sale

of vehicles/spares/recondioned engines/services/ payment of

incenves & commission, warranty, sales promoon, etc., for FY

2024-25, for an aggregate value which would be in excess of `

1,000 Crores or 10% of the annual consolidated turnover as per

the Company’s last audited nancial statements, whichever is

lower, on such terms and condions as may be decided by the

Board of Directors/Audit Commiee from me to me, provided

that the said contract(s)/arrangement(s)/ transacon(s) shall be

carried out at arm’s length basis and are in the ordinary course

of business of the Company.”

“RESOLVED FURTHER that the Board of Directors of the Company/

the Audit Commiee be and is hereby authorized to do and

perform all such acts, deeds and things, as may be necessary,

including nalizing the terms and condions, modes and

execung necessary documents, including contracts, schemes,

agreements, le applicaons, make representaons thereof and

seek approval from relevant authories, if required and deal

with any maers, take necessary steps as the Board may in its

absolute discreon deem necessary, desirable or expedient, to

give eect to this resoluon and to sele any queson that may

arise in this regard and incidental thereto, without being required

to seek any further consent or approval of the Members and

that the Members shall be deemed to have given their approval

thereto expressly by the authority of this resoluon.”

“RESOLVED FURTHER THAT the Board of Directors be and is

hereby authorized to delegate all or any of the powers herein

conferred, to any Director(s), Chief Financial Ocer, Company

Secretary or any other Ocer(s) of the Company, to do all such

acts and take such steps, as may be considered necessary or

expedient, to give eect to the aforesaid resoluon(s).”

“RESOLVED FURTHER THAT all acons taken by the Board of

Directors/Audit Commiee in connecon with maers referred

to or contemplated in the foregoing resoluons, be and are

hereby approved, raed and conrmed in all respects.”

6. To consider and if thought t, to pass the following resoluon as

an Ordinary Resoluon:

“RESOLVED that pursuant to Regulaon 23 of the Securies

and Exchange Board of India (Lisng Obligaons and Disclosure

Requirements) Regulaons, 2015 [including any statutory

modicaon(s) or re-enactment(s) thereof for the me being

in force], the Company’s Policy on dealing with Related Party

Transacons and all other applicable laws and regulaons

including but not limited to the relevant provisions of the

Companies Act, 2013 as may be applicable, the approval of

the Members, be and is hereby accorded for the Transacons

(whether an individual transacon or transacons taken together

or series of transacons or otherwise) with the Company’s step

down subsidiary - Switch Mobility Automove Limited, a ‘Related

Party’ of the Company as per Secon 2(76) of the Companies

Act, 2013, with respect to sale & purchase of goods, availing

or rendering of services, providing any security or guarantee in

whatever form called, giving of loans, other expenses/income/

transacons etc. for the nancial year 2023-24 for an aggregate

value which would be in excess of ` 1,000 Crores or 10% of the

annual consolidated turnover as per the Company’s last audited

nancial statements, whichever is lower, on such terms and

condions as may be decided by the Board of Directors/Audit

Commiee from me to me, provided that the said contract(s)/

arrangement(s)/transacon(s) shall be carried out at arm’s length

basis and in the ordinary course of business of the Company.”

“RESOLVED FURTHER that the Board of Directors of the Company/

the Audit Commiee be and is hereby authorized to do and

perform all such acts, deeds and things, as may be necessary,

including nalizing the terms and condions, modes and

execung necessary documents, including contracts, schemes,

agreements, le applicaons, make representaons thereof and

seek approval from relevant authories, if required and deal

with any maers, take necessary steps as the Board may in its

NOTICE TO SHAREHOLDERS

8 Ashok Leyland Limited

absolute discreon deem necessary, desirable or expedient, to

give eect to this resoluon and to sele any queson that may

arise in this regard and incidental thereto, without being required

to seek any further consent or approval of the Members and

that the Members shall be deemed to have given their approval

thereto expressly by the authority of this resoluon.”

“RESOLVED FURTHER THAT the Board of Directors be and is

hereby authorized to delegate all or any of the powers herein

conferred, to any Director(s), Chief Financial Ocer, Company

Secretary or any other Ocer(s) of the Company, to do all such

acts and take such steps, as may be considered necessary or

expedient, to give eect to the aforesaid resoluon(s).”

“RESOLVED FURTHER THAT all acons taken by the Board of

Directors/Audit Commiee in connecon with maers referred

to or contemplated in the foregoing resoluons, be and are

hereby approved, raed and conrmed in all respects.”

7. To consider and if thought t, to pass the following resoluon as

a Special Resoluon:

“RESOLVED that pursuant to Secon 14 and other applicable

provisions of the Companies Act, 2013 read with the relevant

Rules made thereunder [including any statutory modicaon(s)

or re-enactment(s) thereof for the me being in force], the

consent of the Members be and is hereby accorded to amend

the Arcles of Associaon of the Company by inserng the

following Arcle 137A aer the exisng Arcle 137.”

137A. In the event of any default as stated in Regulaon 15(1)

(e) of the Securies and Exchange Board of India (Debenture

Trustees) Regulaons, 1993 (as amended from me to me),

the debenture trustee(s) may exercise the right and power to

appoint a person to be a Director of the Company liable to rere

by rotaon. Any person(s) so appointed, may at any me, be

removed by such debenture trustee(s) and any such appointment

or removal shall be in wring, signed by such debenture trustee(s)

and served on the Company.

By Order of the Board

Chennai N Ramanathan

May 23, 2023 Company Secretary

Registered Oce:

1, Sardar Patel Road, Guindy

Chennai - 600 032

CIN: L34101TN1948PLC000105

Tel: +91 44 2220 6000; Fax: +91 44 2220 6001

E-mail: [email protected]

Website: www.ashokleyland.com

NOTES:

1. A dividend of ` 2.60/- per share has been recommended by the

Board of Directors for the year ended March 31, 2023, subject

to approval of shareholders. Dividend, if approved at the Annual

General Meeng (AGM), shall be paid on or before August 19,

2023. The Company has xed Friday, July 7, 2023 as the Record

Date for determining entlement of Members to the dividend for

the nancial year ended March 31, 2023, if approved at the AGM.

2. The Register of Members and the Share Transfer books of the

Company will remain closed from Saturday, July 8, 2023 to Friday,

July 21, 2023 (both days inclusive) for the purpose of ensuing

AGM of the Company and payment of dividend.

3. The Ministry of Corporate Aairs (‘MCA’) has vide its circulars dated

April 8, 2020, April 13, 2020, May 5, 2020 read with circular dated

December 28, 2022 (collecvely referred to as ‘MCA Circulars’)

permied the holding of the AGM through VC/OAVM, without

the physical presence of the Members at a common venue.

In compliance with the provisions of the Companies Act, 2013

(the Act), SEBI (Lisng Obligaons and Disclosure Requirements)

Regulaons, 2015 (‘SEBI Lisng Regulaons’) and MCA Circulars,

the AGM of the Company is being held through VC/OAVM.

4. The relevant Explanatory Statement pursuant to Secon 102

of the Act, seng out material facts in respect of businesses

under item nos. 4 to 7 of the Noce, is annexed hereto. Details

pursuant to Regulaon 36(3) of the SEBI Lisng Regulaons and

Secretarial Standard on General Meengs issued by the Instute

of Company Secretaries of India, in respect of the Director

seeking re-appointment at this AGM are also annexed.

5. Pursuant to the provisions of the Act, a Member entled to

aend and vote at the AGM is entled to appoint a proxy to

aend and vote on his/her behalf and the proxy need not be a

Member of the Company. Since this AGM is being held through

VC/OAVM, physical aendance of Members has been dispensed

with. Accordingly, the facility for appointment of proxies by the

Members will not be available for the AGM and hence the Proxy

Form and Aendance Slip are not annexed to this Noce.

6. Instuonal/Corporate Shareholders (i.e., other than Individuals,

HUF, NRI, etc.) are required to send a scanned copy (PDF/JPEG

format) of its Board or governing body resoluon/authorisaon

etc., authorising its representave to aend the AGM through

VC/OAVM on its behalf and to vote through remote e-vong. The

said resoluon/authorisaon shall be sent to the Scrunizer by

e-mail at their registered e-mail address to scruniserbc@gmail.

com with a copy marked to evo[email protected].

7. Members are requested to note that, dividends if not encashed

for a period of seven years from the date of transfer to Unpaid

Dividend Account of the Company, are liable to be transferred

to the Investor Educaon and Protecon Fund (‘IEPF’). Further,

shares in respect of which dividends have remained unclaimed

for a period of seven consecuve years or more are also liable

to be transferred to the IEPF Authority. In view of this, Members/

claimants are requested to claim their dividends from the

Company, within the spulated meline. The Members, whose

unclaimed dividends/shares have been transferred to IEPF, may

claim the same by making an applicaon to the IEPF Authority,

in Form No. IEPF-5 available on www.iepf.gov.in. The Members/

claimants can le only one consolidated claim in a nancial year

as per the IEPF Rules.

8. In compliance with the MCA Circulars and SEBI Circular dated

January 5, 2023, Noce of the AGM along with the Annual Report

for the FY 2022-23 is being sent only through electronic mode

to those Members whose e-mail addresses are registered with

the Company/Depositories. Members may note that the Noce

and Annual Report for the FY 2022-23 is also available on the

Company’s website www.ashokleyland.com, websites of the Stock

Exchanges i.e., BSE Limited and Naonal Stock Exchange of India

Limited at www.bseindia.com and www.nseindia.com respecvely,

and on the website of NSDL – www.evong.nsdl.com.

NOTICE TO SHAREHOLDERS

Annual Report 2022-23 9

NOTICE TO SHAREHOLDERS

9. Members seeking any informaon with regard to the accounts

or any maer to be placed at the AGM, are requested to write

to the Company on or before July 14, 2023 through e-mail to

secret[email protected]. The same will be replied by the

Company suitably.

10. The Register of Directors and Key Managerial Personnel and

their shareholding, maintained under Secon 170 of the Act,

the Register of Contracts or Arrangements in which the Directors

are interested, maintained under Secon 189 of the Act and the

relevant documents referred to in the Noce will be available,

electronically, for inspecon by the Members during the AGM.

All documents referred to in the Noce will also be available for

inspecon from the date of circulaon of this Noce up to the

date of AGM. Members seeking to inspect such documents can

send an e-mail to secret[email protected].

11. Members holding shares in physical form and desirous of making

a nominaon in respect of their shareholding in the Company as

permied under Secon 72 of the Act, read with the Rules made

thereunder are requested to send the prescribed Form SH-13 to

the Corporate/Registered Oce of the Company. Any change or

cancellaon of the nominaon already given is to be submied

in Form SH-14. Form SH-13 and Form SH-14 are available on the

Company’s website in the Investors Secon for download.

12. Members are requested to inmate changes, if any, pertaining

to their name, postal address, e-mail address, telephone/

mobile numbers, Permanent Account Number, ECS mandate,

nominaons (together called 'KYC'), power of aorney, etc., to

their Depository Parcipant(s), in case shares are held by them

in electronic form and to Integrated Registry Management

Services Private Limited (‘RTA’), ‘Kences Towers’, 2

nd

Floor, No. 1,

Ramakrishna Street, North Usman Road, T Nagar, Chennai - 600

017, in case shares are held by them in physical form.

Members holding shares in physical mode, who have not

registered their above parculars are requested to register the

same with the Company/RTA in prescribed Form ISR-1. Any

claricaons in this regard may be addressed to the RTA at

csdstd@integratedindia.in.

Members are requested to note that in line with SEBI Circular

dated March 16, 2023, RTA will accept only operave PAN (those

linked with Aadhar) with eect from June 30, 2023 or such other

date as may be noed by Central Board of Direct Taxes (CBDT).

Those folios in which PAN is not linked with Aadhar subsequent

to the due date, shall be frozen by the RTA.

Further, in line with this circular, RTAs are required to freeze

folios wherein PAN, KYC and nominaon is not available on or

aer October 1, 2023. Any service request in respect of these

frozen folios will be undertaken only aer the complete details

are lodged with the RTA.

Members may note that with eect from April 1, 2024, the

Company will not be able to pay dividend, in respect of frozen

folios unl the complete details as required including bank account

details are furnished to the RTA. Further, from December 31, 2025

or such due date as may be noed by the Authority, the RTA is

required to refer the details of the frozen folios to the Administering

Authority under the Benami Transacons (Prohibions) Act, 1988

and/or Prevenon of Money Laundering Act, 2002.

Considering the aforemenoned restricons, Members whose

details are not updated with the RTA are urged to immediately

register their details with the RTA in Form ISR-1. Any claricaons

in this regard may be addressed to the RTA at csdstd@

integratedindia.in.

13. Members who hold shares in physical form in mulple folios in

idencal names or joint holding in the same order of names are

requested to send the share cercates to the Company/RTA for

consolidaon into a single folio.

14. As per Regulaon 40 of SEBI Lisng Regulaons, all requests for

transfer of securies including transmission and transposion,

issue of duplicate share cercate; claim from unclaimed suspense

account; renewal/exchange of share cercate; endorsement;

sub-division/spling of share cercate; consolidaon of share

cercate/folios shall be processed only in dematerialized form.

In view of this and to eliminate all risks associated with physical

shares and for ease of porolio management, Members holding

shares in physical form are requested to consider converng

their holdings to dematerialised form.

15. Members aending the AGM through VC/OAVM shall be counted

for the purpose of reckoning the quorum under Secon 103 of

the Act. Subject to receipt of requisite number of votes, the

resoluons shall be deemed to be passed on the date of the

AGM, i.e., Friday, July 21, 2023.

16. Since the AGM will be held through VC/OAVM, the Route Map is

not annexed in this Noce.

17. Vong and joining Annual General Meeng through electronic

means:

(i) Pursuant to the provisions of Secon 108 of the Act

read with Rule 20 of the Companies (Management and

Administraon) Rules, 2014 (as amended from me to

me) and Regulaon 44 of the SEBI Lisng Regulaons,

the Company is providing the facility of remote e-vong to

its Members in respect of the business to be transacted at

the AGM.

For this purpose, the Company has entered into an

agreement with Naonal Securies Depository Limited

(NSDL) for facilitang vong through electronic means, as

the authorized agency. The facility of casng votes by a

Member using remote e-vong system as well as vong on

the date of the AGM will be provided by NSDL.

(ii) The ‘cut-o date’ for determining the eligibility for vong

through electronic vong system is xed as Friday, July 14,

2023. The remote e-vong period commences on Tuesday,

July 18, 2023 at 9.00 a.m. IST and ends on Thursday, July

20, 2023 at 5.00 p.m. IST. During this period, a person

whose name is recorded in the Register of Members

or in the Register of Beneciary Owners maintained by

the Depositories, as on the cut-o date, i.e., Friday, July

14, 2023 shall be entled to avail the facility of remote

e-vong. The remote e-vong module shall be disabled by

NSDL for vong thereaer. Those Members, who will be

present in the AGM through VC/OAVM facility and have

not cast their vote on the resoluons through remote

e-vong and are otherwise not barred from doing so, shall

be eligible to vote through e-vong system during the

AGM. The vong rights of Members shall be in proporon

to their share in the paid-up equity share capital of the

Company as on the cut-o date, being July 14, 2023.

10 Ashok Leyland Limited

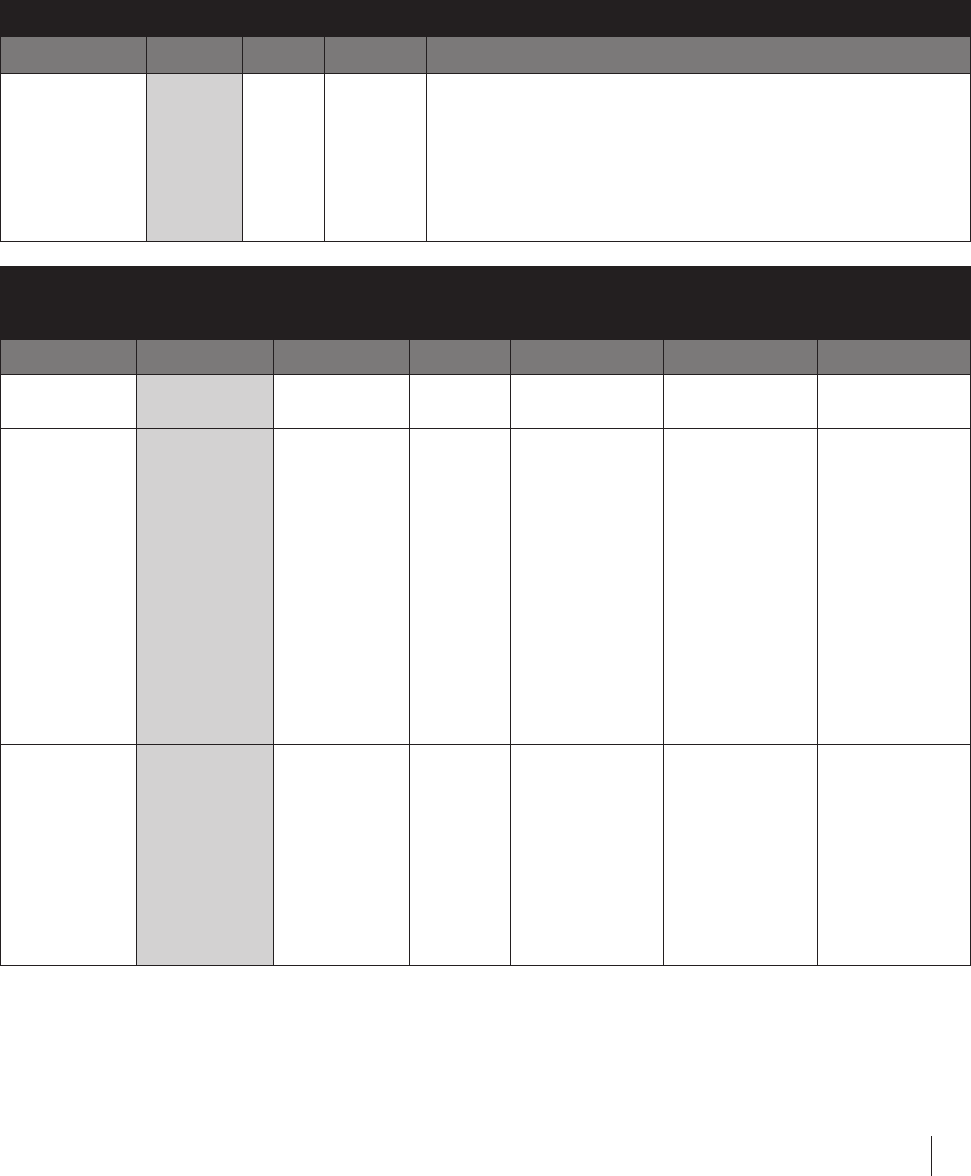

The details of the process and manner for remote e-vong and vong during the AGM are explained below:

Step 1: Access to NSDL e-vong system

Step 2: Cast your vote electronically on NSDL e-vong system

Step 1: Access to NSDL e-vong system

i. LOGIN METHOD FOR E-VOTING AND JOINING VIRTUAL MEETING FOR INDIVIDUAL MEMBERS HOLDING SECURITIES IN DEMAT MODE

In terms of SEBI circular dated December 9, 2020 on ‘e-vong facility provided by Listed Companies’, e-vong process has been enabled to all

the individual demat account holders, by way of single login credenal, through their demat account(s)/websites of Depositories/Depository

Parcipant(s) (“DPs”) in order to increase the eciency of the vong process. Individual demat account holders would be able to cast their

vote without having to register again with the e-vong service provider (“ESP”) thereby not only facilitang seamless authencaon but also

ease and convenience of parcipang in e-vong process.

Members are advised to update their mobile number and e-mail address in their demat accounts to access e-vong facility.

Login method for Individual shareholders holding securies in demat mode is given below:

Type of shareholders Login Method

Individual Shareholders

holding securies in

demat mode with NSDL

I. NSDL IDeAS facility:

i. In case you are registered with NSDL IDeAS facility, then –

a. Please visit hps://eservices.nsdl.com either on a personal computer or on a mobile phone.

b. The e-Services home page is displayed. On the e-Services home page, click on the ‘Benecial

Owner’ icon under ‘Login’ available under ‘IDeAS’ secon.

c. You will have to enter your exisng User ID and Password. Aer successful authencaon, you will

be able to see e-vong services.

d. Click on “Access to e-vong” under e-vong services and you will be able to see e-vong page.

e. Click on opons available against company name or e-vong service provider – NSDL and you will

be redirected to the NSDL e-vong website for casng your vote during the remote e-vong period

or vong during the meeng.

ii. If you are not registered for IDeAS e-Services -

a. The opon to register is available at hps://eservices.nsdl.com.

b. Select “Register Online for IDeAS Portal” or click on hps://eservices.nsdl.com/SecureWeb/

IdeasDirectReg.jsp

c. Upon successful registraon, please follow the steps given in point (a) to (e) above.

II. E-vong website of NSDL

a. Visit the e-vong website of NSDL. Open web browser by typing the following URL: hps://www.

evong.nsdl.com/ either on a personal computer or on a mobile phone.

b. Once the home page of e-vong system is launched, click on the ‘Login’ available under the

‘Shareholder/Member’ secon.

c. A new screen will open. You will have to enter your User ID (i.e. your 16-digit demat account number

held with NSDL), Password/OTP and a vericaon code as shown on the screen.

d. Aer successful authencaon, you will be redirected to NSDL Depository site wherein you can see

e-vong page.

e. Click on opons available against company name or e-vong service provider – NSDL and you will be

redirected to the e-vong website of NSDL for casng your vote during the remote e-vong period or

vong during the meeng.

f. Shareholders/Members can also download NSDL Mobile App “NSDL Speed-e” facility by scanning the

QR code menoned below for seamless vong experience.

NOTICE TO SHAREHOLDERS

Annual Report 2022-23 11

Individual Shareholders

holding securies in

demat mode with CDSL

1. Exisng users who have opted for Easi/Easiest can login through their user ID and password. The opon

to reach the e-vong page will be made available without any further authencaon. The URL for users to

login to Easi/Easiest are hps://web.cdslindia.com/myeasi/home/login or www.cdslindia.com and click on

New System Myeasi.

2. Aer successful login of Easi/Easiest, the user will be also able to see the e-vong menu. The menu will

have links of e-vong service provider i.e. NSDL. Click on NSDL to cast your vote.

3. If the user is not registered for Easi/Easiest, the opon to register is available at hps://web.cdslindia.com/

myeasi/Registraon/EasiRegistraon

4. Alternavely, the user can directly access e-vong page by providing demat Account Number and PAN

from a link in www.cdslindia.com home page. The system will authencate the user by sending OTP on

registered Mobile & E-mail as recorded in the demat Account. Aer successful authencaon, the user will

be provided links for the respecve ESP i.e. NSDL where the e-vong is in progress.

Individual Shareholders

(holding securies in

demat mode) login

through their depository

parcipants

1. You can also login using the login credenals of your demat account through your Depository Parcipant

registered with NSDL/CDSL for e-vong facility.

2. Once logged in, you will be able to see e-vong opon. Once you click on the e-vong opon, you will be

redirected to NSDL/CDSL depository site aer successful authencaon, wherein you can see e-vong feature.

3. Click on the opons available against company name or e-vong service provider - NSDL and you will be

redirected to the e-vong website of NSDL for casng your vote during the remote e-vong period or

vong during the meeng.

Important note: Members who are unable to retrieve User ID/Password are advised to use ‘Forget User ID’ and ‘Forget Password’ opon

available at abovemenoned website.

HELPDESK FOR INDIVIDUAL SHAREHOLDERS HOLDING

SECURITIES IN DEMAT MODE FOR ANY TECHNICAL ISSUES

RELATED TO LOGIN THROUGH DEPOSITORY I.E. NSDL AND CDSL.

Login type Helpdesk details

Individual Shareholders

holding securies in

demat mode with

NSDL

Members facing any technical issue

in login can contact NSDL helpdesk

by sending a request at evong@

nsdl.co.in or call at 022 - 4886 7000

and 022 - 2499 7000.

Individual Shareholders

holding securies in

demat mode with

CDSL

Members facing any technical issue

in login can contact CDSL helpdesk

by sending a request at helpdesk.

toll free no. 1800 22 55 33.

II. LOGIN METHOD FOR E-VOTING AND JOINING VIRTUAL MEETING

FOR SHAREHOLDERS OTHER THAN INDIVIDUAL SHAREHOLDERS

HOLDING SECURITIES IN DEMAT MODE AND SHAREHOLDERS

HOLDING SECURITIES IN PHYSICAL MODE.

1. Visit the e-vong website of NSDL. Open web browser by

typing the following URL: hps://www.evong.nsdl.com/

either on a personal computer or on a mobile phone.

2. Once the home page of e-vong system is launched, click

on the icon “Login” available under the ‘Shareholder/

Member’ secon.

3. A new screen will open. You will have to enter your User

ID, your Password/OTP and a vericaon code as shown on

the screen.

4. Alternavely, if you are registered for NSDL e-services

i.e. IDeAS, you can log in at hps://eservices.nsdl.com/

with your exisng IDeAS login. Once you log in to NSDL

e-services using your login credenals, click on e-vong and

you can proceed to Step 2 i.e. Cast your vote electronically

on NSDL e-vong system.

5. Your User ID details are given below:

Manner of holding

shares i.e. Demat

(NSDL or CDSL) or

Physical

Your User ID is:

a) For Members

who hold

shares in demat

account with

NSDL

8 Character DP ID followed by 8

Digit Client ID

For example: if your DP ID

is IN300*** and Client ID is

12****** then your user ID is

IN300***12******.

b) For Members

who hold

shares in demat

account with

CDSL

16 Digit Beneciary ID

For example: if your Beneciary ID

is 12************** then your

user ID is 12**************

c) For Members

holding shares

in physical form

EVEN Number followed by Folio

Number registered with the

Company

For example: if folio number is

001*** and EVEN is 101456 then

user ID is 101456001***

6. Password details for shareholders other than Individual

shareholders are given below:

a. If you are already registered for e-vong, then you

can use your exisng password to login and cast your

vote.

b. If you are using NSDL e-vong system for the rst

me, you will need to retrieve the ‘inial password’

which was communicated to you. Once you retrieve

your ‘inial password’, you need to enter the ‘inial

password’ for the system to prompt you to change

your password.

NOTICE TO SHAREHOLDERS

12 Ashok Leyland Limited

c. How to retrieve your ‘inial password’?

If your e-mail ID is registered in your demat account

or with the Company, your ‘inial password’ is

communicated to you on your e-mail ID. Trace the

email sent to you from NSDL from your mailbox.

Open the email and open the aachment i.e. a .pdf

le. Open the .pdf le. The password to open the

.pdf le is your 8-digit Client ID for NSDL account or

the last 8 digits of Client ID for CDSL account or Folio

Number for shares held in physical form. The .pdf le

contains your ‘User ID’ and your ‘inial password’.

7. If you are unable to retrieve or have not received the

‘Inial password’ or have forgoen your password:

a. Click on ‘Forgot User Details/Password?’(If you hold

shares in your demat account with NSDL or CDSL)

opon available on www.evong.nsdl.com.

b. Physical User Reset Password?” (If you hold shares

in physical mode) opon available on www.evong.

nsdl.com.

c. If you are sll unable to get the password by the

aforesaid two opons, you can send a request to

evo[email protected] menoning your demat account

number/Folio number, your PAN, your name and

your registered address.

d. Members can also use the OTP (One Time Password)

based login for casng the votes on the e-vong

system of NSDL.

8. Aer entering your password, ck on ‘Agree with Terms

and Condions’ by selecng on the check box.

9. Now, you will have to click on ‘Login’ buon.

10. Aer you click on the ‘Login’ buon, the homepage of

e-vong will open.

Step 2: Cast your vote electronically and join General Meeng on

NSDL e-vong system.

1. Aer successfully logging in following Step 1, you will be able

to see the EVEN of all companies in which you hold shares and

whose vong cycle and General Meeng is in acve status.

2. Select the EVEN of Ashok Leyland Limited. For joining virtual

meeng, you need to click on “VC/OAVM” link placed under

“Join Meeng”.

3. Now you are ready for e-vong as the vong page opens.

4. Cast your vote by selecng appropriate opons i.e. assent or

dissent, verify/modify the number of shares for which you wish to

cast your vote and click on ‘Submit’ and ‘Conrm’ when prompted.

5. Upon conrmaon, the message ‘Vote cast successfully’ will be

displayed.

6. You can also take the printout of the votes cast by you by clicking

on the ‘Print’ opon on the conrmaon page.

7. Once you conrm your vote on the resoluon, you will not be

allowed to modify your vote.

GENERAL GUIDELINES FOR MEMBERS

1. Instuonal/Corporate Shareholders (i.e., other than individuals/

HUF, NRI, etc.) are required to send a scanned copy (PDF/JPEG

format) of its Board or governing body resoluon/authorisaon

etc., authorising its representave to aend the AGM through

VC/OAVM on its behalf and to vote through remote e-vong.

The said resoluon/authorisaon shall be sent to the Scrunizer

by e-mail their registered e-mail address to scruniserbc@gmail.

com with a copy marked to evo[email protected]. Instuonal

shareholders (i.e. other than individuals, HUF, NRI etc.) can

also upload their Board Resoluon/Power of Aorney/Authority

Leer etc. by clicking on ‘Upload Board Resoluon/Authority

Leer’ displayed under ‘e-vong’ tab in their login.

2. It is strongly recommended that you do not share your password

with any other person and take utmost care to keep your password

condenal. Login to the e-vong website will be disabled upon

ve unsuccessful aempts to key in the correct password. In

such an event, you will need to go through the “Forgot User

Details/Password?” or “Physical User Reset Password?” opon

available on www.evong.nsdl.com to reset the password.

3. In case of any queries, you may refer the Frequently Asked

Quesons (FAQs) for shareholders and e-vong user manual for

shareholders available in the download secon of www.evong.

nsdl.com or call on help desk: 022-48867000 & 022-24997000

or send a request to evo[email protected], or contact Amit Vishal,

Assistant Vice President, or Pallavi Mhatre, Senior Manager,

Naonal Securies Depository Ltd., at the designated email IDs:

get your grievances on e-vong addressed.

PROCESS FOR THOSE MEMBERS WHOSE E-MAIL ADDRESS ARE NOT

REGISTERED WITH THE DEPOSITORIES FOR PROCURING USER ID AND

PASSWORD AND REGISTRATION OF E MAIL IDS FOR E-VOTING ON THE

RESOLUTIONS SET OUT IN THIS NOTICE:

1. In case shares are held in physical mode, please provide folio

no., name of shareholder, scanned copy of the share cercate

(front and back), PAN (self-aested scanned copy of PAN card),

AADHAR (self-aested scanned copy of Aadhar Card) by e-mail to

csdstd@integratedindia.in.

2. In case shares are held in demat mode, please provide DPID-

CLID (16-digit DPID + CLID or 16-digit beneciary ID), name,

client master or copy of consolidated account statement, PAN

(self-aested scanned copy of PAN card), AADHAR (self-aested

scanned copy of Aadhar Card) to csdstd@integratedindia.in.

3. If you are an Individual Member holding securies in demat mode,

you are requested to refer to the login method explained at Step

1 (A) i.e. Login method for e-vong and joining virtual meeng for

Individual shareholders holding securies in demat mode.

for procuring user ID and password for e-vong by providing

above menoned documents.

5. In terms of SEBI circular dated December 9, 2020, on e-vong

facility provided by Listed Companies, individual shareholders

holding securies in demat mode are allowed to vote through

their demat account maintained with Depositories and Depository

Parcipants. Shareholders are required to update their mobile

number and email ID correctly in their demat account in order

to access e-vong facility.

NOTICE TO SHAREHOLDERS

Annual Report 2022-23 13

INSTRUCTIONS TO MEMBERS FOR ATTENDING THE AGM THROUGH

VC/OAVM ARE AS UNDER:

1. Members will be provided with a facility to aend the AGM

through VC/OAVM through the NSDL e-vong system. Members

may access by following the steps menoned above for ‘Access

to NSDL e-vong system’. The link for VC/OAVM will be available

in ‘Shareholder/Member login’ where the EVEN of the Company

will be displayed. Aer successful login, Members will be

able to see the link of ‘VC/OAVM’ placed under the tab ‘Join

General meeng’ against the Company’s name. On clicking this

link, Members will be able to aend the AGM. Please note

that Members who do not have the User ID and Password for

e-vong or have forgoen the User ID/Password may retrieve the

same by following the remote e-vong instrucons menoned

above in the Noce, to avoid last minute rush.

2. Facility of joining the AGM through VC/OAVM shall open 30

minutes before the me scheduled for the AGM and will be

available for Members on rst come rst served basis.

3. Members may join the Meeng through Laptops, Smartphones

and Tablets. Further, Members will be required to allow Camera

and use Internet with a good speed to avoid any disturbance

during the Meeng. Members will need the latest version of

Chrome, Safari, Internet Explorer, MS Edge or Firefox. Please note

that parcipants connecng from Smartphones or Tablets or

through Laptops connecng via mobile hotspot may experience

Audio/Video loss due to uctuaon in their respecve network. It

is therefore recommended to use stable Wi-Fi or LAN connecon

to migate any glitches.

4. Members who would like to express their views or ask quesons

during the AGM need to pre-register themselves as a Speaker

by sending their request from their registered email address

menoning their name, DP ID and Client ID/folio number, PAN,

mobile number at secret[email protected] from July 11,

2023 (9:00 a.m. IST) to July 12, 2023 (5:00 p.m. IST). Those

Members who have registered themselves as a Speaker will

only be allowed to express their views/ask quesons during the

AGM. The Company reserves the right to restrict the number of

speakers depending on the availability of me for the AGM.

INSTRUCTIONS FOR MEMBERS FOR E-VOTING DURING THE AGM:

1. The procedure for e-vong during the AGM is same as the

instrucons menoned above for remote e-vong.

2. Only those Members/shareholders, who will be present at the

AGM through VC/OAVM facility and have not cast their vote on

the Resoluon(s) through remote e-vong and are otherwise not

barred from doing so, shall be eligible to vote through e-vong

system during the AGM.

3. Members who have cast their vote through remote e-vong prior

to the AGM will be eligible to aend the AGM. However, they

shall not be entled to cast their vote again.

4. The details of the persons who may be contacted for any

grievances connected with the facility for e-vong during the

AGM shall be the same as menoned for remote e-vong.

OTHER GUIDELINES FOR MEMBERS:

1. Any person holding shares in physical form and non-individual

shareholders who acquires shares of the Company and becomes

a Member aer the Company sends the Noce by e-mail and

thereaer holds shares as on the cut-o date i.e., July 14, 2023,

may obtain the User ID and password by sending a request to

csdstd@integratedindia.in. However, if you are already registered

with NSDL for remote e-vong, then you can use your exisng

user ID and password for casng your vote. If you have forgoen

your password, you can reset your password by using ‘Forgot User

Details/Password?’ or ‘Physical User Reset Password?’ opon

available on www.evong.nsdl.com. Individual shareholders

holding securies in demat mode, who acquire shares of the

Company and becomes a Member aer the Company sends the

Noce by e-mail and thereaer holds shares as on the cut-o

date i.e., July 14, 2023, may follow the steps menoned in the

e-vong instrucons.

A person who is not a Member as on the cut-o date is requested

to treat this Noce for informaon purpose only.

2. The Company has appointed B Chandra & Associates, Pracsing

Company Secretaries (Firm Reg. No. P2017TN065700), Chennai,

as the Scrunizer to scrunize the vong during the meeng and

the remote e-vong process, in a fair and transparent manner.

3. The Scrunizer shall aer the conclusion of e-vong at the

AGM, rst download the votes cast at the AGM and thereaer

unblock the votes cast through remote e-vong and shall make a

consolidated scrunizer’s report of the total votes cast in favour

or against, if any, to the Chairman or a person authorised by him

in wring, who shall countersign the same.

4. As per Regulaon 44 of the SEBI Lisng Regulaons, the results

of the e-vong are to be submied to the Stock Exchanges

within two working days of the conclusion of the AGM. The

results declared along with Scrunizer’s report will be placed

on the Company’s website www.ashokleyland.com and the

website of NSDL www.evong.nsdl.com. The results will also be

communicated to the Stock Exchanges.

NOTICE TO SHAREHOLDERS

14 Ashok Leyland Limited

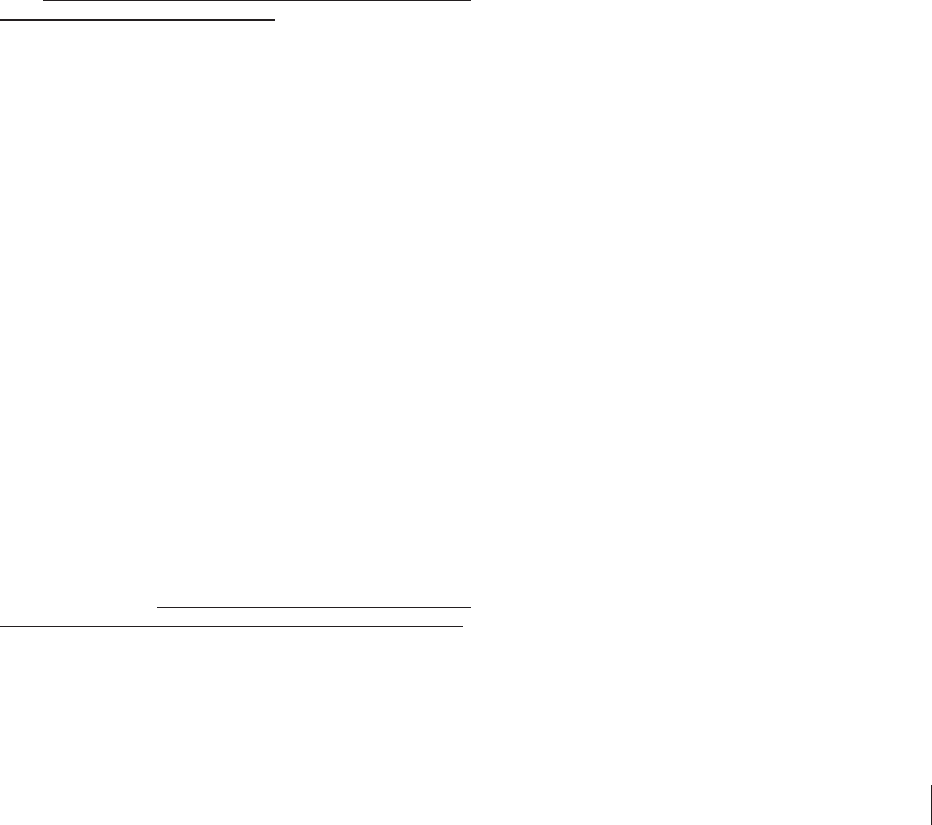

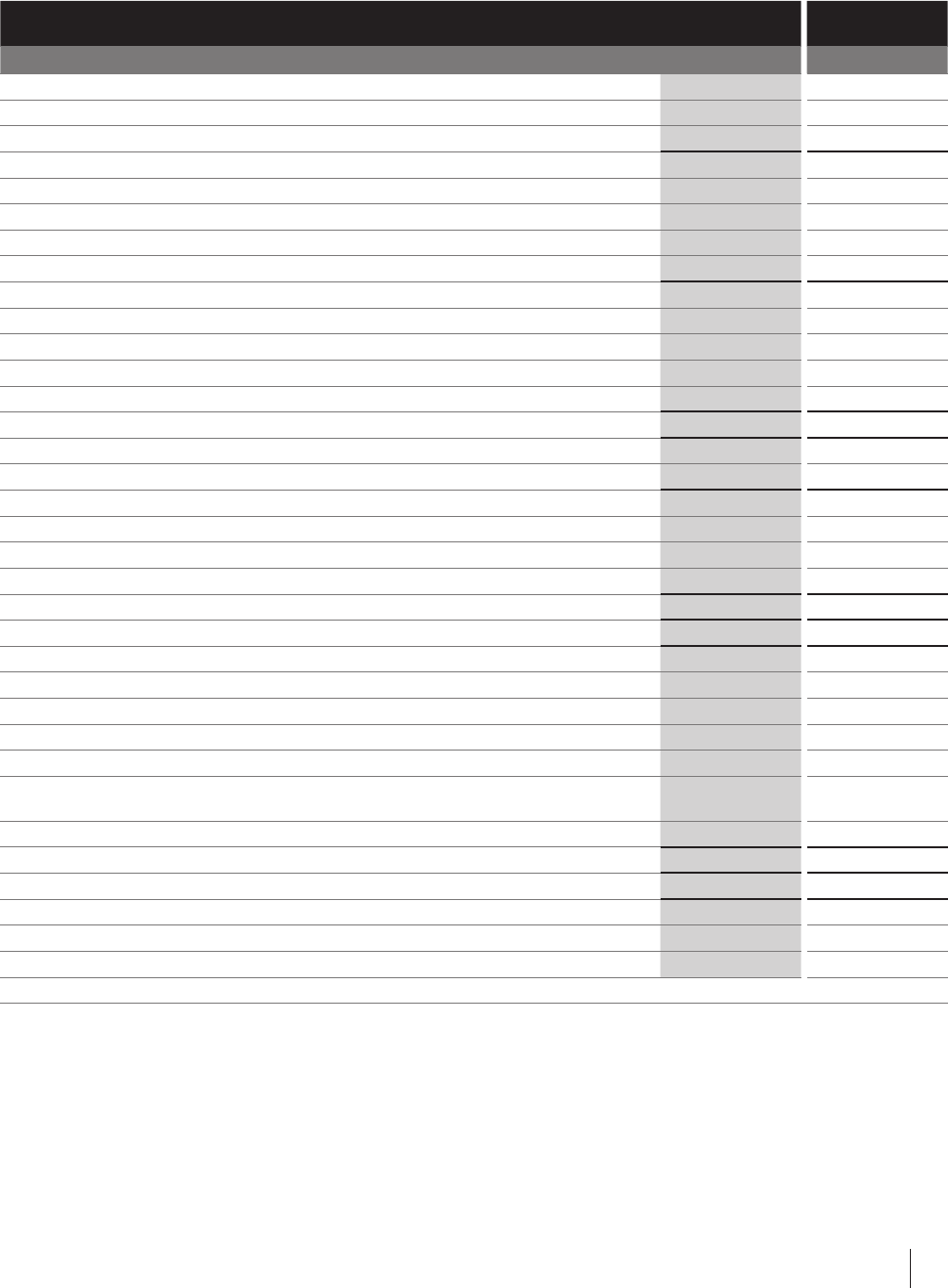

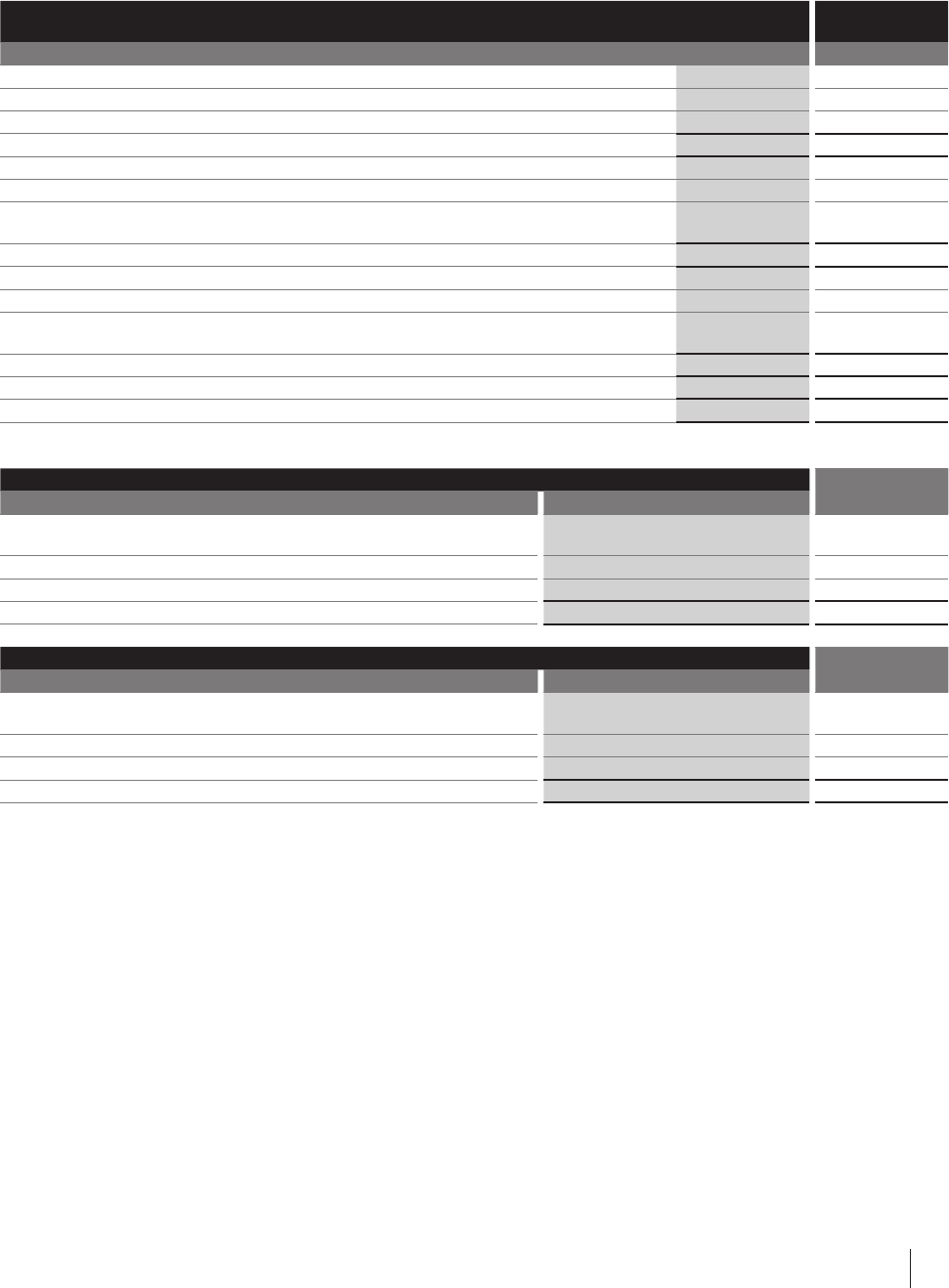

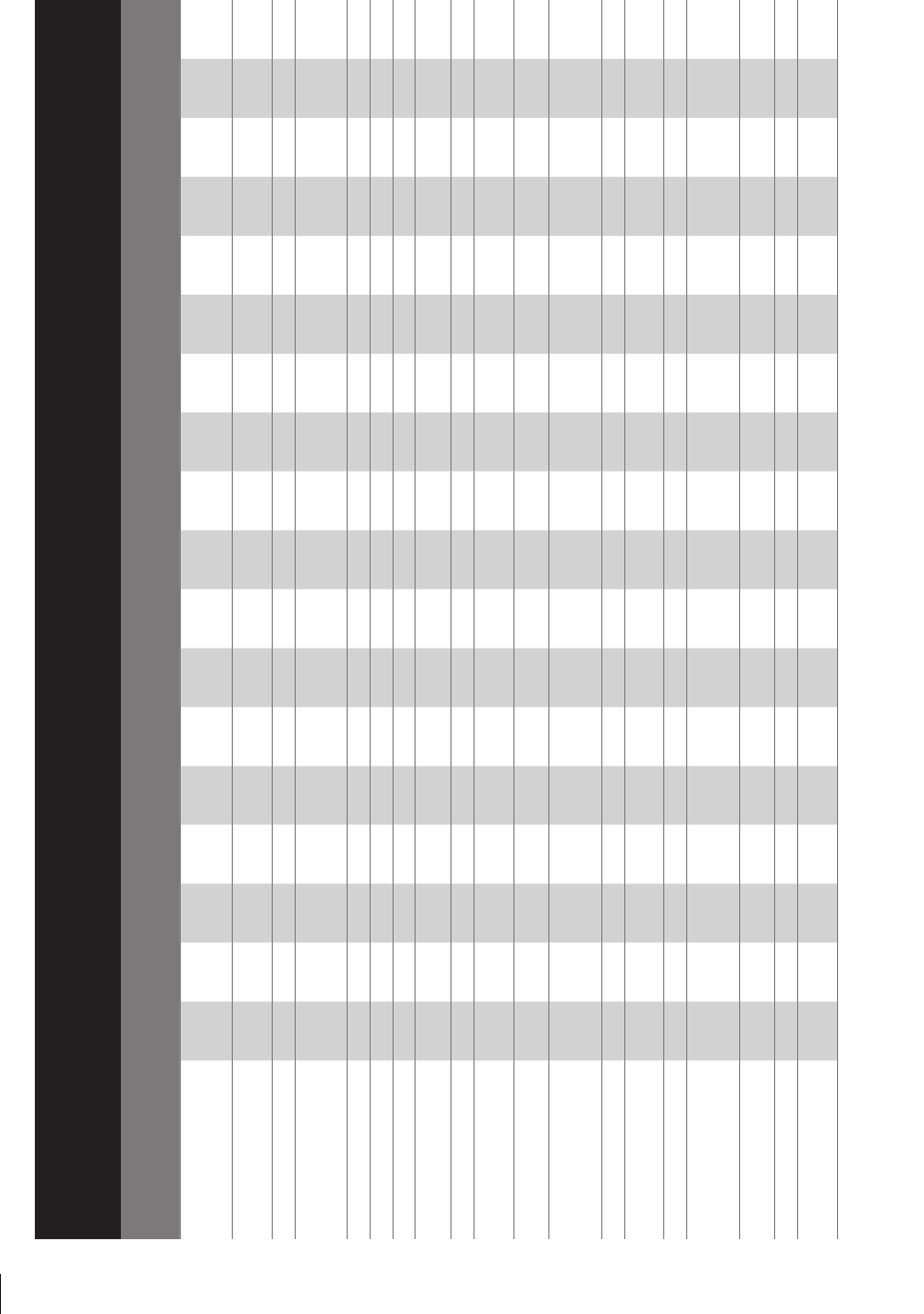

Details on Tax Deducon at Source (TDS) On Dividend Distribuon

Dividend income is taxable in the hands of Shareholders and the Company is required to deduct tax at source from dividend paid to Shareholders

at the prescribed rates under the provisions of the Income Tax Act, 1961. The rate at which the dividend is subject to withholding tax would vary

depending on the residenal status of the shareholders and the documents submied by them and accepted by the Company. We request all the

Shareholders to take note of the applicable TDS rates, as tabulated below and provide the documents to the Company, as applicable to them.

The Shareholders are requested to update their PAN with the Company/ Integrated Enterprises (India) Private Ltd (“Integrated”) (in case of shares

held in physical mode) and with the Depositories/ Depository Parcipants (in case of shares held in demat mode).

Category of

Shareholders

Tax Rate Exempon Applicability/ Documentaon Requirement

Any resident shareholder 10% – Update the valid PAN if not already done with depositories (in case of shares held in DEMAT mode)

and with the Company’s RTA (in case of shares held in physical mode). In case details are already

updated, the same need not be provided.

– No taxes will be deducted in the following cases:

If dividend income to the resident individual shareholder during FY 2023-24 does not exceed

₹ 5,000

If the Shareholder is exempted from TDS provisions through any circular(s) or nocaon(s)

and provides an aested copy of the PAN along with documentary evidence in relaon to the

same

Furnishing of validly lled and signed Form 15G (for individuals, with no tax liability on total

income and income not exceeding the maximum amount which is not chargeable to tax) or

Form 15H (for individuals above the age of 60 years with no tax liability on the total income)

– provided that all prescribed eligibility condions are met.

Note - All elds are mandatory to be lled up and Company may at its sole discreon reject the form

if it does not full the requirement of law

Mutual Funds specied

under clause (23D) of

secon 10 of the Act

Nil – For SEBI registered mutual funds, TDS would not be applied [NIL TDS].

– Declaraon (Annexure 1) to be provided along with self-aested copy of PAN Card and Registraon

cercate containing the SEBI registraon number duly updated in the demat account.

– Mutual Fund List of Folio numbers / accounts mapped to PAN

Insurance Companies Nil – No TDS would be applied for the dividend payable on the shares held by

Life Insurance Corporaon of India, the General Insurance Corporaon of India, the Naonal

Insurance Company Limited, the New India Assurance Company Limited, the Oriental Insurance

Company Limited and the United India Insurance Company Limited.

IRDA registered insurance companies, if Declaraon (Annexure 1) is provided along with self-

aested copy of PAN card and IRDA registraon number which is duly updated in the demat

account.

Category I and II AIF Nil – Declaraon (Annexure 1) that income of the AIF is exempt under secon 10(23FBA) of the Act as

it has been granted a cercate of registraon as a Category I or Category II AIF under the SEBI

(AIF) Regulaons, 2012

– Self-aested copy of PAN and valid SEBI registraon cercate

– Reference is drawn to Circular No. 18/2017 dated 29 May 2017 issued by the Government of India,

Ministry of Finance, Department of Revenue, Central Board of Direct Taxes as regards requirement

of tax deducon at source in case of enes whose income is exempt under secon 10 of the Act

Recognised Provident

Fund / Approved

Superannuaon Fund /

Approved Gratuity Fund

Nil – No TDS is required to be deducted as per Circular No.18/2017 dated 29 May 2017, issued by the

Government of India, Ministry of Finance, Department of Revenue, Central Board of Direct Taxes as

regards requirement of tax deducon at source in case of enes whose income is exempt under

secon 10 of the Act subject to specied condions.

– Self-aested copy of a valid order from Commissioner under Rule 3 of Part A or Rule 2 of Part B

or Rule 2 of Part C of Fourth Schedule to the Act, or self-aested valid documentary evidence (e.g.

relevant copy of registraon, nocaon, order, etc.)

Naonal Pension Scheme Nil No TDS is required to be deducted as per Secon 197A(1E) of the Act. A Self- declaraon (Annexure

1) stang that the NPS is exempt under Secon 10 (44) is required.

Corporaon established

by or under a Central

Act, which is, under

any law for the me

being in force, exempt

from income-tax on its

income

Nil – Declaraon (Annexure 1) that it is a corporaon established by or under a Central Act whereby

income- tax is exempt on the income and accordingly, covered under secon 196 of the Act

– Self-aested copy of PAN, registraon cercate and relevant extract of the secon whereby the

income is exempt from tax

NOTICE TO SHAREHOLDERS

Annual Report 2022-23 15

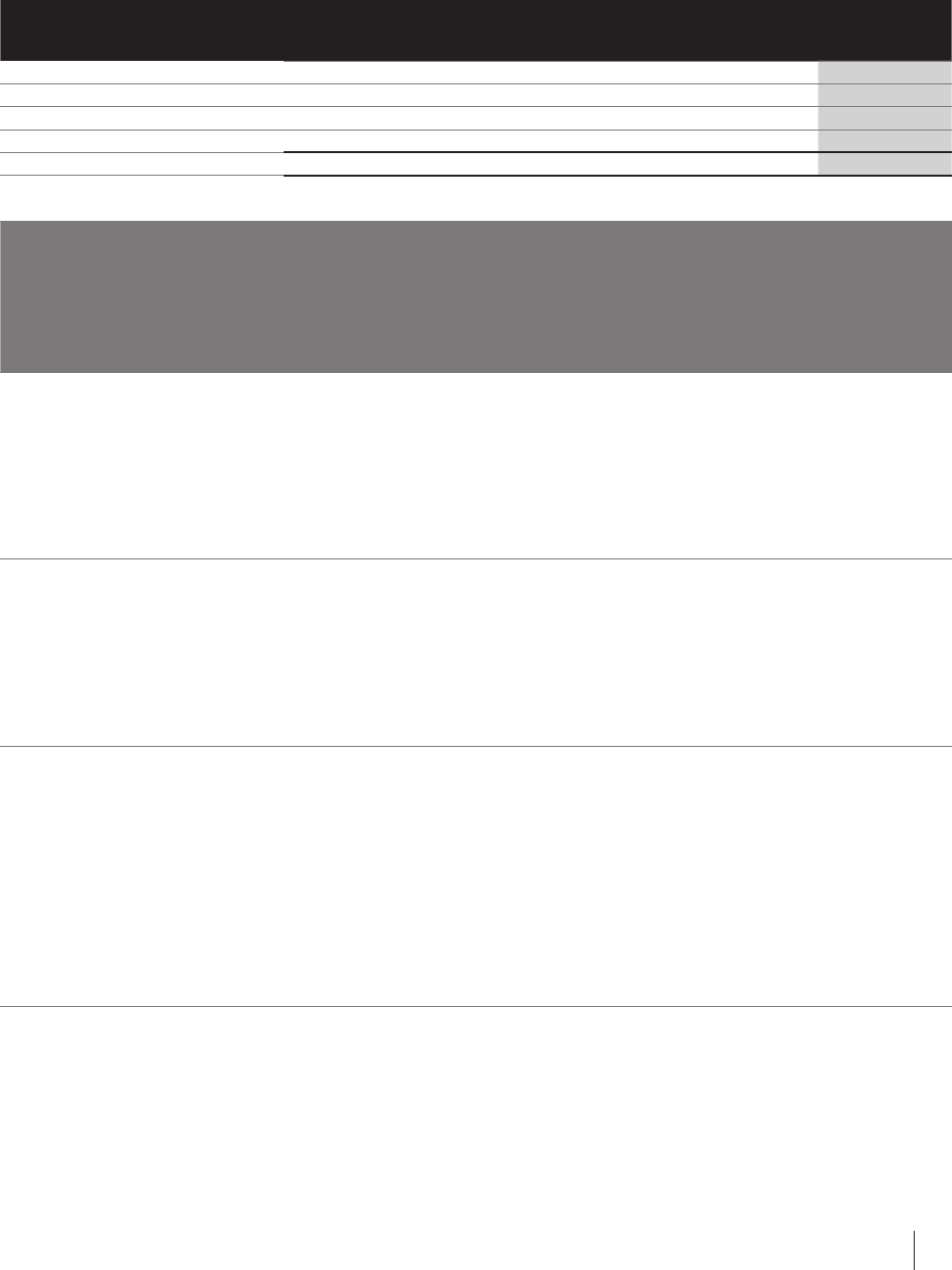

Category of

Shareholders

Tax Rate Exempon Applicability/ Documentaon Requirement

Government (Central/

State)/ RBI

Nil – No TDS is required to be deducted as per Secon 196(i) & (ii) of the Act

Any other enty entled

to exempon from TDS

Nil Declaraon of the nature of enty (Annexure 1) and Valid self-aested documentary evidence (e.g.

relevant copy of registraon, nocaon, order, etc.) in support of the enty being entled to TDS

exempon

Resident shareholder

having lower / nil

withholding Order under

secon 197 of the Act

Rate

provided

as per

Order

Copy of PAN card

Lower/ Nil withholding tax cercate obtained from the Income-tax Authories

Declaraon (Annexure 2) for Sikkimese resident shareholder covered u/s 10(26AAA) of the Act

Other resident

shareholders without

registraon of PAN or

Inoperave PAN (Upon

failure to link PAN-

Aadhaar as per secon

139AA r.w. Circular No

3 of 2023) or having

Invalid PAN or a person

who is considered as

specied person u/s

206AB

20%

without

threshold

limit

Update valid PAN if not already done with depositaries (in case of shares held in Demat mode) and with

the Company’s Registrar and Transfer Agent (in case of shares held in physical mode).

Shareholders are requested to le their appropriate declaraons in the prescribed format with necessary self-aested documentary evidence using

the link at hps://www.integratedindia.in/ExemponFormSubmission.aspx.

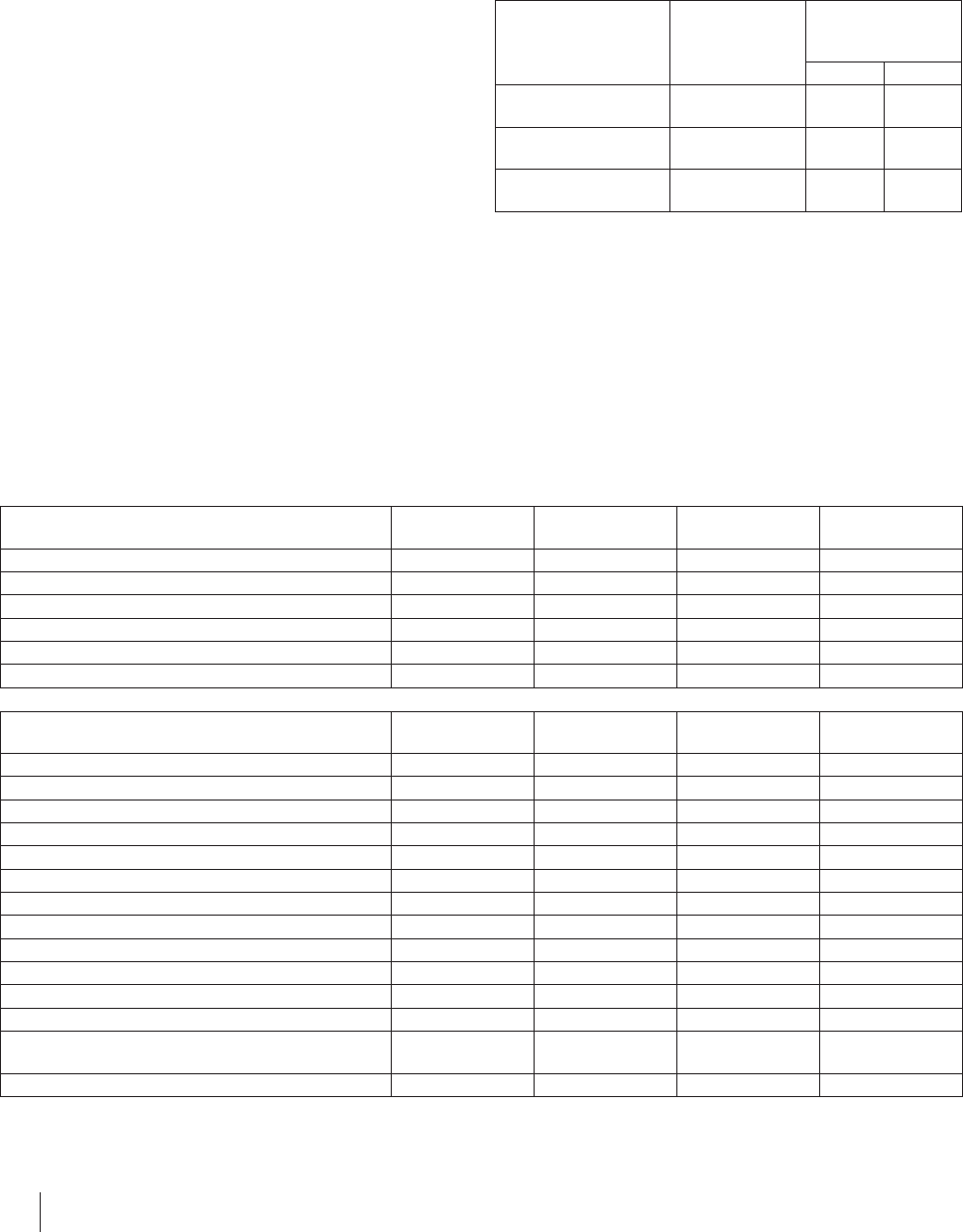

Non-resident Shareholders:

Category of

Shareholders

Tax Rate Exempon Applicability/ Documentaon Requirement

Any non-resident

shareholders, FPIs,

FIIs [Who are not

‘Specied Persons’ as

referred / covered by

provisions of secon

206AB of the Act]

20% (plus

applicable

surcharge

and cess)

or Tax

Treaty rate,

whichever

is lower

Non-resident shareholders may opt for tax rate under the Double Taxaon Avoidance Agreement (‘Tax

Treaty’). The Tax Treaty rate may be applied for tax deducon at source on dividend declared by the

Company subject to submission of the following documentaon:

– Self-aested copy of PAN Card, if any, alloed by the Indian authories. In a case where no PAN has

been alloed, requisite informaon as per Rule 37BC (Annexure 8) of the Income-tax Rules, 1962

shall be furnished.

– Self-aested copy of Tax Residency Cercate [‘TRC’], evidencing and cerfying shareholder’s tax

residenal status during the Financial Year 2023-24 or calendar year 2023 valid as on the AGM date,

obtained from the tax authories of the country of which the shareholder is a resident

– Form 10F electronically submied and downloaded from the Income Tax Portal (www.incometax.gov.

in) if PAN is available. In case, PAN is not available, self-declaraon in Form 10F for FY 2023-24

– Self-declaraon in prescribed format (Annexure 3 for FII, FPI) (Annexure 9 for other non-resident

shareholders) containing the following clauses along with adequate documentary evidence

substanang the nature of the enty and eligibility to avail treaty benets:

● The Shareholder does not have a taxable presence or a permanent establishment in India or a

place of eecve management in India during the FY 2023-24

● The transacon/ arrangement/ investments from which the dividend is derived by the

shareholder is not arranged in a manner, as one of its principal purposes whether directly

or indirectly, to result in obtaining a tax benet. The tax benet, if any, derived from such

transacon/arrangement /investments would be in accordance with the object and purpose

of the provisions of the relevant Tax Treaty (‘the Principle Purpose Test’, if applicable to the

respecve Tax Treaty);

● The shareholder is the benecial owner of its shareholding in the Company and dividend

receivable from the Company

● The shareholder has no reason to believe that its claim for the benets of the Tax Treaty is

impaired in any manner;

(Note: Applicaon of benecial Tax Treaty Rate shall depend upon the completeness and sasfactory

review by the Company of the documents submied by the shareholders. In case the documents are

found to be incomplete, the Company reserves the right to not consider the tax rate prescribed under

the tax treaty).

NOTICE TO SHAREHOLDERS

16 Ashok Leyland Limited

Category of

Shareholders

Tax Rate Exempon Applicability/ Documentaon Requirement

Any enty entled to

exempon from TDS

Nil – Valid self-aested documentary evidence (e.g. relevant copy of registraon, nocaon, order, etc.

by the Indian tax authories) in support of the enty being entled to exempon from TDS

– Self-declaraon substanang the applicability of the secon to the enty

Tax resident of any

noed jurisdiconal

area

30% or rate

specied in

the relevant

provision of

the Act or

at the rates

in force,

whichever

is higher

(plus

applicable

surcharge

and cess)

– Where any shareholder is a tax resident of any country or territory noed as a noed jurisdiconal

area under secon 94A (1) of the Act, tax will be deducted at source @ 30% or at the rate specied

in the relevant provision of the Act or at the rates in force, whichever is higher, from the dividend

payable to such shareholder in accordance with Secon 94A (5) of the Act

Sovereign Wealth

Funds and Pension

funds noed by

Central Government

u/s 10(23FE) of the

Act

NIL – Copy of the nocaon issued by CBDT substanang the applicability of secon 10(23FE) of the

Act issued by the Government of India.

– Self-Declaraon (Annexure 5 / Annexure 6) that the condions specied in secon 10(23FE) have

been complied with

Subsidiary of Abu

Dhabi Investment

Authority (ADIA) as

prescribed under

secon 10(23FE) of

the Act

NIL – Self-Declaraon (Annexure 7) substanang the fullment of condions prescribed under secon

10(23FE) of the Act

Other non-resident

shareholders having

Order under secon

197 of the Act

Rate

provided in

the Order

– Lower / Nil withholding tax cercate obtained from the income tax authories

General:

Shareholders holding shares in dematerialized mode, are requested

to update their records such as tax residenal status, permanent

account number (PAN), complete residenal address, registered email

addresses, mobile numbers and other details with their relevant

depositories through their depository parcipants.

Transferring credit to the benecial owner - As per Rule 37BA, in the

case where the dividend is received in the hands of one person but is

assessable in the hands of other person, the tax may be deducted in

the name of such other person if the rst-menoned person provides a

declaraon as prescribed in this regard. The aforesaid declaraon shall

contain (i) name, address, PAN, and residenal status of the person to

whom credit is to be given; (ii) payment in relaon to which credit is

to be given; and (iii) the reason for giving credit to such person etc.

in the format provided in Annexure 10 & 10A. We request you to

provide any such details latest by July 12, 2023 at 5.00 PM and no

request will be entertained for documentaon received beyond the

specied date and me.

Shareholders holding shares in physical mode are requested to

furnish details to the Company’s registrar and share transfer agent.

The Company is obligated to deduct tax at source (TDS) based on

the records available with RTA and no request will be entertained for

revision of TDS return.

In order to enable us to determine the appropriate tax rate at which

tax has to be deducted at source under the respecve provisions of

the Income-tax Act, 1961, we request Resident Shareholders and Non-

Resident Shareholders to upload the details and documents referred to

in this Noce in the format provided by us and as applicable to you on

the link at hps://www.integratedindia.in/ExemponFormSubmission.

aspx

No communicaon on the tax determinaon / deducon, except for

the declaraon under Rule 37BA, shall be entertained beyond 5.00

p.m. on July 07, 2023.

Deducon of tax at a rate lower than statutory rate or no deducon

of tax shall depend upon the completeness of the documents and the

sasfactory review of the forms and the documents, submied by

Resident Shareholders, to the Company/RTA.