B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

1

\

STRATEGIC ASSET

MANAGEMENT PLAN

2022

This Strategic Asset Management Plan documents Transmission’s

current state and maturity in asset management organization, people,

processes and systems. The SAMP recommends asset management

improvement actions to be implemented across the full asset lifecycle to

better create and deliver value for BPA’s ratepayers and stakeholders,

while also ensuring long term grid safety and reliability.

For Transmission

Category

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

2

Table of Contents

1.0 EXECUTIVE SUMMARY ..............................................................................................................................4

2.0 ACKNOWLEDGEMENTS .............................................................................................................................6

2.1 Senior ownership..................................................................................................................................6

2.2 Strategy Development Approach.............................................................................................................7

2.2.1 Key Contributors............................................................................................................................7

2.2.2 Key Activities.................................................................................................................................7

3.0 STRATEGIC BUSINESS CONTEXT ..................................................................................................................7

3.1 Alignment of SAMP with Agency Strategic Plan .........................................................................................7

3.2 Scope ..................................................................................................................................................8

3.3 Asset Description and Delivered Services..................................................................................................9

Table 3.3-1, List of Major Assets............................................................................................................................9

3.4 Demand Forecast for Services............................................................................................................... 11

3.5 Strategy Duration ............................................................................................................................... 13

4.0 STAKEHOLDERS ...................................................................................................................................... 13

4.1 Asset Owner and Operators ................................................................................................................. 13

4.2 Stakeholders and Expectations ............................................................................................................. 13

Table 4.2-1, Stakeholders ................................................................................................................................... 14

Table 4.2-2, Customer Breakdown ....................................................................................................................... 15

5.0 EXTERNAL AND INTERNAL INFLUENCES ..................................................................................................... 15

Table 5.0-1, External Influences (Opportunities & Threats) ...................................................................................... 16

Table 5.0-2, Internal Influences (Strengths & Weaknesses)...................................................................................... 17

5.1 SWOT Analysis ................................................................................................................................... 19

Table 5.1-1: SWOT ........................................................................................................................................... 20

6.0 ASSET MANAGEMENT CAPABILITIES AND SYSTEM....................................................................................... 21

6.1 Current Maturity level ......................................................................................................................... 22

6.2 Long Term Objectives .......................................................................................................................... 27

6.3 Current Strategies and Initiatives .......................................................................................................... 29

6.4 Resource Requirements ....................................................................................................................... 30

7.0 ASSET CRITICALITY .................................................................................................................................. 30

7.1 Criteria .............................................................................................................................................. 30

7.2 Usage of Criticality Model .................................................................................................................... 33

8.0 CURRENT STATE ..................................................................................................................................... 35

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

3

8.1 Historical Costs................................................................................................................................... 35

8.2 Asset Condition and Trends .................................................................................................................. 37

8.3 Asset Performance.............................................................................................................................. 40

8.4 Performance and Practices Benchmarking .............................................................................................. 42

9.0 RISK ASSESSMENT .................................................................................................................................. 42

10.0 STRATEGY AND FUTURE STATE ................................................................................................................. 51

10.1 Future State Asset Performance............................................................................................................ 52

10.2 Strategy............................................................................................................................................. 52

10.2.1 Sustainment Strategy ................................................................................................................... 53

10.2.2 Growth (Expand) Strategy ............................................................................................................. 60

10.2.3 Strategy for Managing Technological Change and Resiliency .............................................................. 62

10.3 Planned Future Investments/Spend Levels ............................................................................................. 62

Figure 10.3-1, Capital and Expense Future Spend................................................................................................... 64

Figure 10.3-2b, Capital Future Spend – Low Range..........................................................Error! Bookmark not defined.

Figure 10.3-3, Asset Management Expense Future Spend ....................................................................................... 65

10.4 Implementation Risks .......................................................................................................................... 65

Table 10.4-1, Implementation Risks ..................................................................................................................... 65

10.5 Asset Conditions and Trends................................................................................................................. 67

10.6 Performance and Risk Impact ............................................................................................................... 68

11.0 Addressing Barriers to Achieving Optimal Performance................................................................................ 70

12.0 DEFINITIONS.......................................................................................................................................... 72

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

4

1.0 EXECUTIVE SUMMARY

Transmission’s objective is to remain the transmission service provider of choice, by assuring we maintain financial

strength, safety, reliability and competitiveness, while continuing to meet our multiple statutory responsibilities and

delivering the public benefits that are so valuable to the region. Transmission’s Strategic Asset Management Plan (SAMP)

documents the current state and describes planned asset management improvements, maturity and competencies

needed to effectively and efficiently manage the entire lifecycle of BPA assets that deliver electric transmission services.

The SAMP was developed through coordination with numerous internal stakeholders and is aligned with the Agency

strategy, Transmission Business Model, stakeholder requirements, organizational objectives and resulting asset

management objectives.

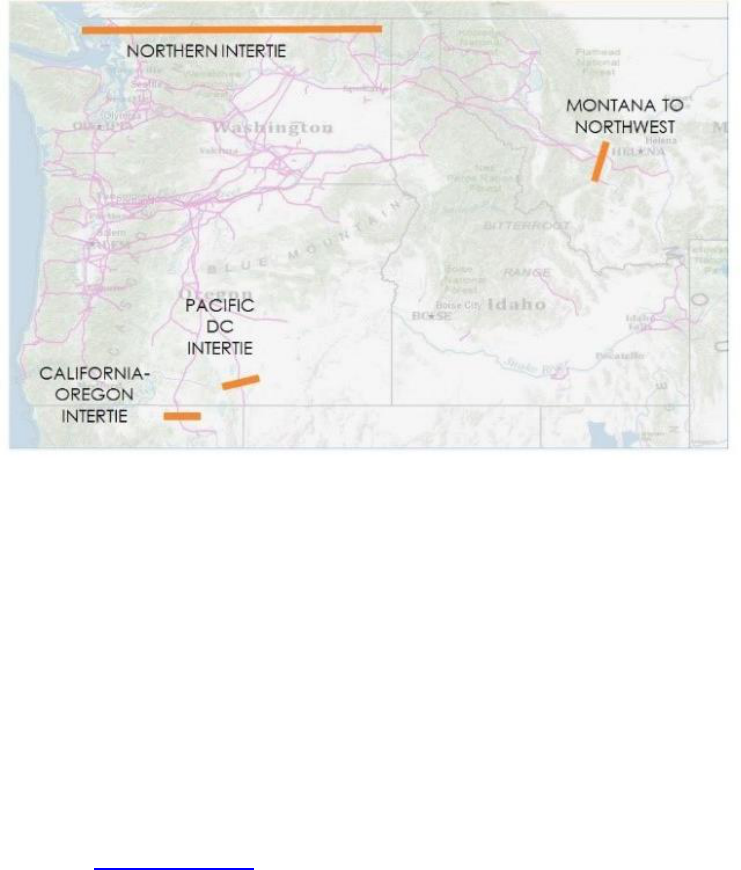

Transmission Services manages nearly $5 billion in depreciated assets for substations, transmission lines and

communication infrastructure that is critical to the Northwest economy. The system comprises about three-fourths of the

Northwest region’s high voltage transmission assets. BPA’s Transmission system spans approximately 300,000 square

miles and includes more than 15,000 circuit miles of transmission lines, 3,500 miles of fiber, over 260 substations and 732

telecommunication facilities. These assets deliver electric power, directly or indirectly, to a population of more than 12

million through four main product categories:

Transmission service to regional utilities and merchant entities

Generation and line & load interconnections

Interregional transfers of capacity and energy

Ancillary services, such as regulation and load following services

For the 2022 refresh, Transmission Services surveyed a broad cross section of internal stakeholders to assess asset

management maturity. The maturity scores ranged, on average, from 1.2 to 1.5 (out of a possible 4). In comparison, the

2020 scores averaged 1.5 to 1.9. The new maturity scores can be attributed to: more levels of the organization

represented; stakeholders more familiar with Institute of Asset Management (IAM); and a more accurate internal

capabilities rating due to increased knowledge of AM by staff. Though scores decreased slightly, continual cultural focus

at all levels of the organization has allowed for growth and continued maturation, with numerous plans for future

development over the next several years which is critical for the continued advancement of the AM Program.

Transmission was impacted by the COVID-19 pandemic, and execution rates decreased in 2020 due to pandemic impacts.

The supply of materials was challenging as well as the ability for labor to perform onsite work. Precautionary work stand-

downs also impacted project delivery in some locations during wildfire season.

Transmission continues to stay focused on strategic efforts to get more work done, get the right work done, and to do the

work at the right time. Recent accomplishments and future plans include:

SCM – Secondary Capacity Model - Get more work done

The Secondary Capacity Model, a scalable delivery model using external, contracted resources as an Owner's

Consultant and a Progressive Design Builder is now fully developed and operational. In FY22/FY23, we are

anticipating a ramp up in the amount of capital work that will get done using this new delivery model.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

5

CHR – Criticality, Health and Risk - Do the right work

Transmission continues to develop and mature our Criticality, Health and Risk methodologies and capabilities.

CHR has advanced in its analytics, with comprehensive health scoring and the ability to apply the Reliability and

Safety criticality dimensions at an asset level, for substation and line assets. Data is integrated into Cascade and

this capability represents an advancement in AM maturity in 2021. We are utilizing CHR data to inform our

decisions, discovering more, and continuing to add assets and aspects as appropriate for decision-making.

TPOT – Transmission Portfolio Optimization Tool - Do the work at the right time

As we look towards the future, we are developing a plan to optimize our portfolio of work. We are currently

benchmarking with other utilities to understand benefits and potential cost savings from this type of tool; and we

are preparing our business process documentation in order to get ready for determining what features are

required in an application. Though timing is uncertain based on budget and resource availability, Transmission

currently plans to begin the IT capital process in FY24 and to begin implementation of the tool.

Thereafter, Transmission’s capital program will ramp up at a progressive pace over the next few years to meet system

replacement (capital-sustain) program needs and to meet Project Funded in Advance (PFIA) (customer) program needs

(driven in part by Renewable Portfolio Standards (RPS)). Transmission system expansion will be dominated by

compliance and customer-driven interconnection requests to serve continuing growth in renewable generation and large

loads, specifically data centers. Energy storage projects are on the horizon and may require system reinforcement when

built. BPA and the region are increasingly looking to commercial and technical alternatives to meet dynamic system

demands and therefore large infrastructure builds will continue to be augmented with a scalable flexible approach until

they are ultimately required.

Transmission is continuing to mature its asset management program and capabilities and to monitor and mitigate

challenges (both internal and external) in order to respond to and adapt to an evolving industry and changing

environment.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

6

2.0 ACKNOWLEDGEMENTS

2.1 Senior ownership

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

7

2.2 Strategy Development Approach

2.2.1 Key Contributors

A review performed in Fall 2021 revealed that the primary strategic drivers articulated in the 2020 SAMP remain relevant

in our 2022 refresh. It was also clear that some changes were needed as a result of pandemic impacts, resource

availability, and other factors. Primary strategic feedback for the 2022 refresh have been provided by the Transmission

Asset Manager as well as by leaders in Transmission Engineering, Transmission Planning, Transmission Field, Supply

Chain, and Transmission Technology.

Transmission aspires to broaden the exposure of Asset Management within our workforce. Accordingly, over 40

individuals completed the Maturity Level Assessment across all areas of Transmission, and at various levels within the

organization.

While key contributors and specified owners are identified for key initiatives, programs and projects for the delivery of

Transmission’s strategy, every team member within Transmission plays a role, has responsibility and can add value to

implement the prescribed activities and methodologies to balance asset performance, identify and manage risks and

maximize Total Economic Value.

2.2.2 Key Activities

As mentioned in 2.2.1, the primary activities to prepare for the SAMP refresh were repeated strategy/dialogue

conversations with leaders, as well as the Maturity Level Assessment. Leaders and staff also provided written feedback,

and cross organizational collaboration between Transmission, Finance, and Risk also furthered the maturity of the SAMP.

The following topics helped facilitate the collaborative dialogue:

BPA Strategic Plan

Transmission Business Model (TBM)

Transmission Asset Plan

Internal and External Influences

SWOT analysis

Transmission Plan

3.0 STRATEGIC BUSINESS CONTEXT

3.1 Alignment of SAMP with Agency Strategic Plan

BPA’s vision is to be an engine of the Pacific Northwest’s economic prosperity and environmental sustainability through

delivering a safe grid, high reliability, low rates, responsible environmental stewardship and regional accountability. BPA

issued its 2018-2023 Strategic Plan in January 2018 and completed a reassessment and reconfirmation of its plan in 2020.

In July 2020, BPA adopted a fifth strategic goal: value people and deliver results. The five strategic goals are:

1. Strengthen financial health

2. Modernize assets and system operations

3. Provide competitive power products and services

4. Meet transmission customer needs efficiently and responsively

5. Value people and deliver results

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

8

As a major BPA business line, Transmission Services (Transmission) is instrumental in accomplishing BPA’s strategic

priorities, and the SAMP reflects alignment with these priorities. Transmission is focused on several business capability

initiatives in direct alignment with BPA strategic goals. A subset of these initiatives are detailed below.

BPA Strategic Goal

Transmission Asset Management Business Capability Initiative

#1 Strengthen

Financial Health

6A - Criticality, Health, and Risk (CHR) – Continue to develop asset strategies and

plans that are informed by asset condition, criticality and risk to ensure the right

investments are made.

#2 Modernize Assets

& System Operations

7A - Mission Critical IT - An ecosystem of applications and technology that align with

the core businesses of generation and transmission operations at BPA to unify and

streamline Critical Business System Ops (JC) and Transmission Technology Services

(TT) systems and processes for architecture, infrastructure and service management.

7B - Metering Review & Updates - New generation metering at multiple sites to

meet current target for BPA’s EIM (Energy Imbalance Market) participation.

#4 Meet

Transmission

Customer Needs

Efficiently and

Responsively

3A – Demand & Capacity Planning – Continue to develop tools and processes to

identify constrained resources enabling BPA to manage demand based upon

business priorities and make smart well-informed decisions. Implement a

centralized, comprehensive, and consistent demand planning and resource

management system will increase Capital work throughput.

3G - Interconnection Queue Responsiveness - Targets established; monitoring

completion time for customer studies, design, and construction; looking into new

contracting models to deliver customer projects faster.

Transmission will initiate a refresh to the Transmission Business Model in fiscal year 2022. The SAMP development will

be coordinated with pending updates to both the Transmission Business Model and BPA’s strategic plan. Maturing

Transmission’s asset management competencies in all areas will enable the modernization of assets to help BPA

maintain competitive advantage in the marketplace, enable BPA to predict and respond to industry changes and deliver

on public responsibilities; as well as strengthen financial health through the management of lifecycle costs and asset

value.

3.2 Scope

Transmission’s SAMP covers Transmission Assets as detailed in Section 3.3. It covers Transmission Asset Management

decision-making, project execution, and asset maintenance with focus from all Transmission organizations including

Planning, Engineering, Technology, Field Services, Marketing and Sales, and Operations. Transmission’s SAMP does not

include a discussion of the Facilities, Security, Environment, or Fleet programs. It does include a discussion of any

Transmission specific impacts as a result of work in those other programs. For example, Transmission equipment related

to Vancouver Control Center is included, whereas the building (and other Facilities components) is not.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

9

The Boardman to Hemingway project (B2H) is not included in the SAMP. BPA will engage in public processes to discuss

B2H with customers in 2022. BPA continues to evaluate the Grand Coulee Switchyard asset transfer, and specific impacts

are not yet included in this version of the SAMP. Further impacts may be identified through the BP-24 IPR process.

3.3 Asset Description and Delivered Services

Transmission manages more than 15,000 circuit miles of high voltage transmission lines, over 260 substations, 732

telecommunications sites, approximately 3,500 miles of Fiber, approximately 195,600 acres of right of way and two

control centers. See Table 3.3-1 for a summary of assets.

Table 3.3-1, List of Major Assets

Asset

Description

Alternating Current

Substations (AC Subs)

Over 260 substations with more than 32,000 major equipment items

including high value, critical items such as transformers, reactors and

circuit breakers.

High Voltage DC / Flexible

AC Transmission Systems

(HVDC/FACTS)

Specialized conversion and control equipment located at Celilo

Converter Station, Maple Valley, Keeler and Rogue Static VAR

Compensation sites, and numerous series capacitor installations on the

high voltage alternating current intertie transmission lines.

Control Centers

Two redundant and geographically distributed control centers

monitoring and controlling the grid and data systems. Over 85

automation systems.

Power System Control (PSC)

and System Telecomm

732 sites and ~ 11,000 pieces of equipment, 3,500 miles of fiber optic

cable, all vital to BPA’s ability to control and monitor the grid.

System Protection and

Control (SPC)

956 locations, approximately 28,000 major units of 33 equipment types,

all critically important to protect the grid for reliability and safety.

Access Roads

11,860 miles of access roads with bridges, culverts and gates

Land Rights

Approximately 80,000 tracts of easement plus fee-owned properties

Wood Lines

Approximately 4,800 miles total in 336 separate transmission lines with

73,500 wood poles.

Steel Lines

10,300 circuit miles with 43,500 lattice steel and engineered steel pole

transmission lines and all associated towers, hardware and components.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

10

Figure 3.3-2, Asset Locations

Transmission manages over 200,000 major unit assets, 732 telecommunication sites, and two control centers.

Depreciated (book) value is approximately $5 billion dollars. Maintenance activities are prioritized based on compliance

drivers and time. Corrective work is prioritized based on impact to system reliability and safety. All emergency and

compliance work are given highest priority.

Transmission assets deliver the following products and services:

Ancillary Services and Control Area Services (ACS):

This product supports the reliable transmission of energy from resource to load, by providing capacity flexibility

within BPA’s Balancing Authority Area to support customers’ generation interconnection, load-service, and

marketing, and by responding to Contingencies and generation/load deviations from schedules. Under the pro

forma tariff, the transmission provider is required to provide, and transmission customers are required to

purchase, certain Ancillary Services. The transmission provider is also required to offer other Ancillary Services

that the transmission customer must either purchase or self-supply through a customer’s own resources or

purchases from a third-party.

Generator Interconnection/Integration (GI):

GI projects are customer requests to interconnect/integrate to the BPA system, resulting in potential network

additions and/or interconnection facilities. A key objective of the Transmission Services product management

strategy is to interconnect customer projects as efficiently as possible, ultimately meeting customer timelines. In

doing so, BPA continues to fulfill its commitment to the region to provide an adequate, efficient, economical and

reliable power supply.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

11

Network Transmission (NT):

The NT Service product is intended for, and available only to, load serving entities requesting use of BPA’s

transmission system for delivery of generation to serve their loads. NT customers provide 10-year load and

resource forecasts so that BPA can fulfill its obligation to plan its system to serve NT customer load.

Point-to-Point (PTP):

Point to Point transmission is a transmission service that allows a customer to schedule energy from point A to

point B. PTP is highly valuable because of its unique flexibility. It can be used to market power to third parties as

well as to serve load. It can be resold, redirected to other firm or non-firm products, including different paths. It

can also be used for dynamic transfers both on the network and on interties.

Refer to the Open Access Transmission Tariff (OATT) for additional information pertaining to Transmission products and

services. Transmission also offers products and services not required by the OATT, such as BPA’s dark fiber lease program.

3.4 Demand Forecast for Services

Currently, over 90% of total transmission sales comes from rate segments that include Network, Intertie, and Ancillary

Services. Long-term (5 year and 10 year) forecasts project this same demand based on either Network loads or Point-to-

Point reserved transmission demands.

The Transmission Plan is a document developed by the Transmission Planning (TPP) organization, in which recommended

alternatives for transmission reinforcements are studied and documented. The plan is the output of an annual planning

process with a ten-year outlook. The recommended alternatives include transmission needs identified from the annual

reliability system assessment, transmission service requests, new generation and line & load interconnection

requests. Acknowledging the many uncertainties that exist in the evolving energy industry, the Transmission Plan is a

robust, yet flexible forecast of Transmission needs.

Transmission system expansion will be dominated by compliance and customer-driven interconnection requests to serve

continuing growth in renewable generation and large loads, specifically data centers. Energy storage projects are on the

horizon and may require system reinforcement when built. BPA and the region are increasingly looking to commercial

and technical alternatives to meet dynamic system demands and therefore very large infrastructure builds will become

less likely in the next decade.

Within Section 12 of the Transmission Plan a narrative description is provided of the transmission needs identified

through the transmission planning process. This includes the preferred alternative, an estimated cost, and estimated

schedule for completion of the preferred alternative. Reinforcement projects for the transmission system are identified

and described, along with proposed projects identified to meet the forecast requirements of BPA and other customers

over the ten-year planning horizon. This section provides the proposed new facilities organized by type of project. The

types of projects include the following:

Projects required to provide load service and meet Planning Reliability Standards

Projects to improve operational or maintenance flexibility

Projects required to meet requests for transmission service

Projects required to meet requests for Generator Interconnection/integration service

Projects required to meet requests for Line and Load Interconnection service

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

12

Refer to the Transmission Plan for detailed information regarding required products and services, as well as, market

factors that may affect delivery of service.

The current long range sales forecast is based on sales and revenues from the BP-22 Transmission Rate Case, with the

out-years adjusted for identified factors, particularly Network load and Network contract demand. Network transmission

service includes products used to either serve load to customers, or move transmission from a Point-of-Receipt to Point-

of-Delivery for load service and marketing usage. Network Integration (NT) sales serve load to customers and are based

on metered customer loads at the peak hour of the Transmission load in the month. The load forecast is based on

forecast developed by Agency Load Forecast, with an annual load growth applied to out-years. Point-to-Point service

(PTP) moves energy over transmission paths in the Network based on reserved demand (firm and non-firm). Long-term

service includes service for one year or more with the demand amount specified to move transmission from Point-Of-

Receipt (POR) to Point of Delivery (POD) over specified time duration. Short-term service includes service less than one

year and is market driven by hydro and pricing conditions.

Intertie sales (IS) likewise are based on demand and capacity. Long-term sales for IS include sales durations of one year

or longer and are based on confirmed reserved capacities and deferrals. The long-term capacity on the Southern Intertie

is almost fully subscribed from north-to-south with high rates of renewals (95%), so added sales are limited. Short-term

IS sales include demand for near-term service with regional price spreads as the primary inputs for customer behavior.

Another sales category includes required Ancillary Services. As described in Section 3 of the OATT, customers that

purchase Network and Intertie transmission are required to acquire Scheduling, Control, and Dispatch service

(SCD). Other Ancillary Services include products that apply to certain customers only.

Additionally, BPA has recognized an increasingly dynamic, uncertain and changing environment. We've seen changes in

traditional operational, marketing and planning practices including oversupply of energy, negative market prices, a

movement towards smart-grids, and an evolving regulatory environment responding to retail customer self-supply and

distributed energy. Across the Northwest, states are committing to carbon-free power. Washington, Oregon, Idaho and

California have pledged and adopted legislation to move to clean energy. To meet landmark clean energy goals, coal

plants will need to be retired and our Transmission system will need to adapt in order to supply clean, reliable, and

controllable resources that can meet energy demands across all hours. Energy storage projects could be on the horizon

and may require system reinforcement when built. BPA and the region are increasingly looking to non-wire (commercial

and technical alternatives) to meet dynamic system demands and therefore very large infrastructure builds might

become less likely in the next decade, while system adaptations may be required in new ways not yet determined. Due

to declining costs of renewable energy, Transmission needs to prepare to respond to potential variable energy

resources. Our Transmission assets may also need the ability to realize the value of sub-hourly dispatch with flexible and

low carbon hydro resources. Transmission is also seeing changes in use and system operations. With the emergence and

growth of the energy imbalance markets, the region needs a well-designed electricity market built on a foundation of

resource adequacy, intra-hour energy balancing, and the ability to compensate explicitly for capacity resources that

provide system reliability and flexibility. Our Transmission assets and systems will need to be modernized to

accommodate these shifts in the industry and in demand.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

13

3.5 Strategy Duration

Transmission’s SAMP duration is 10 years, with a refresh every 2 years. It provides a long-term view that takes into

consideration organizational needs, external expectations, current state of existing assets, and the agency’s asset

management capabilities. It is reviewed annually as part of Asset Plan development work.

4.0 STAKEHOLDERS

4.1 Asset Owner and Operators

Transmission provides services for generation and load interconnection to the Federal Columbia River Transmission

System. BPA interconnection procedures adhere to the requirements of its Open Access Transmission Tariff (OATT).

BPA also manages and responds to long-term firm transmission service requests (TSR) on the BPA network through the

Transmission Service Request (TSR) Study and Expansion Process (TSEP). Transmission also operates and manages

network assets owned by other entities. Management of those assets is handled through a rate case process with

segmentation and inter-business line budgeting. Customer service agreements with the asset owner(s)/operator(s) are

other tools used when work/coordination is required on assets that BPA does not own.

Transmission supports real-time dispatch of the system as well as coordinates with internal groups, western utilities and

groups needed for reliability (including the Reliability Coordinator), and complex outages. In addition, Transmission

develops systems for the control centers such as automatic generation control, load shedding, reactive switching and

remedial action schemes, standards and agreements to support interconnected operations, and manage data generated

in real-time.

Transmission coordinates system operation and planning issues with groups such as the Western Electricity Coordinating

Council (WECC), Institute of Electrical and Electronics Engineers, Inc. (IEEE), North American Electric Reliability Council

(NERC), Electric Power Research Institute (EPRI) and NorthernGrid (NG).

Transmission also works closely with the other BPA asset categories:, Facilities, Environment, Security, Fleet, and IT. For

example, the Facilities Asset Management program manages certain elements of the control house (the building, HVAC

systems, etc), whereas Transmission manages equipment replacement within the control house. The Environment and

Security capital programs manage improvements to Transmission assets, such as addressing oil containment concerns or

enhancing security fencing. The Fleet program procures vehicles used throughout the Transmission system.

4.2 Stakeholders and Expectations

BPA’s ratepayers and stakeholders expect reliable service at the lowest transmission rates consistent with a sustainable

business model. Internal to BPA, Finance and Risk expect prioritization of Transmission investments based on a net

economic benefit ratio (NEBR) while Transmission manages programmatic and execution risks. To deliver on these

requirements, Transmission must have effective methodologies for investment evaluation and decisions. Total Economic

Cost (TEC) modeling tools are used to inform investment levels by asset type. Transmission is investigating reliability

engineering and portfolio optimization methods and tools to improve decision making over the full asset lifecycle.

Transmission is also continuing to mature its Criticality, Health and Risk (CHR) capability. To meet internal and external

stakeholder expectations, Transmission must continue to implement improvements and achieve efficiencies.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

14

Table 4.2-1, Stakeholders

Stakeholders

Expectations

Current Data Sources

Measures

Customers (see

4.2-2)

Control Costs

Long Term Rates Forecasts,

Integrated Program Review (IPR)

Rate Forecast from Long Term

Planning / Marketing

Reliability

Reliability database, SCADA, OARS

System Average Interruption

Duration Index (SAIDI),

System Average Interruption

Frequency Index (SAIDI)

Transmission

Service and

Interconnection

Availability

Transmission Service Request queue,

Interconnection queue

Transmission Service Requests

granted vs. denied, queue

waiting time.

Request to Energization

duration for new

interconnections.

Government

Agencies (USFS,

USACE, FAA,

Reclamation,

USFWS)

Communication

Public Comment Records, Forums

including telephone meetings

Customer Satisfaction Surveys

Compliance with

Regulations

Public Comment Records,

Agreements, Documented Policies

NEPA Permitting duration

Joint Funding for

Shared Investments

Agreements

Request to Signed Agreement

duration for new

interconnections.

FERC

Open Access to

BPA’s Transmission

System

Proper Asset

Accounting

BPA’s Open Access Transmission

Tariff

Plant Accounting Policy and

Procedures

Transmission Service Request

Mgmt.

Interconnection Request Mgmt.

Timely Unitization

Environmental

Interests Parties

Compliance with

Regulations

Industry regulations and standards

(NEPA)

NEPA Permitting

Minimized Impacts

Environmental Assessment

Documents

Net Carbon Footprint, Visual

Rendering

Fish and Wildlife

Advocates

Transmission

operations help

support fish

passage

Outage and Remedial Action Scheme

records

Generating Unit forced outage

rate, RAS availability

Commercial

Energy Market

Entrants

Enable distributed

generation and

energy storage

Interconnection queue

Request to Energization

duration for new

interconnections and/or

metering and telemetering.

NERC/WECC

Compliance with

Regulations

Resolver

Internal/External Auditing, RSIPP

Decision Documentation, Self-

Reports

Staff

Job Security and

Satisfaction

Administrative database

Federal Employee survey

results, turnover figures

Safety database

Incident statistics

Health and Safety

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

15

Stakeholders

Expectations

Current Data Sources

Measures

Training

Administrative database

Agreed professional

development

Safety

Industry regulations and standards

Safety Metrics (Lost Time

Accident Rates, Days Away

Restricted or Transferred, Total

Case Incident Rate)

Public

Safety

Public safety management system

Non-conformance records

Public

Communication

Public Comment Records, Forums

including telephone meetings

Tribal Satisfaction Surveys

Cultural Interests

Compliance with

Regulations

Public Comment Records,

Agreements, Documented Policies

Number of cultural resource

disturbances

Number of realty actions on

Tribal land

Table 4.2-2, Customer Breakdown

Customer

Breakdown

1

Top Priorities

Preference

Customers

Load service responsibilities

Responsiveness to utilities’ end-use customers, their utility boards and political pressure

Keep the lights on – provide reliable service to their customers

Independent

Power Producers

Identify economical interconnections for their generation projects, including wind, solar and

battery storage

Develop generation projects in a timeframe that meet their customer’s needs and power

purchase agreements

Transmit generation output to their customers

Investor Owned

Utilities

Reliably serve customer loads at rates acceptable to Regulators

Effectively and efficiently utilize existing BPA transmission rights to access regional low cost

generation resources to deliver to IOU load

Optimize IOU marketing transactions to increase IOU revenue to offset operational costs that

impact IOU ratepayers and stockholders

BPA Power

Services

Utilize the BPA grid to market the output of the 31 federal hydro generation plants, the Columbia

Generation Station nuclear plant, and other resources to power purchasers throughout the west.

Keep transmission rates low to help Power Services remain competitive in the energy

marketplace.

5.0 EXTERNAL AND INTERNAL INFLUENCES

Transmission operates within complex external and internal environments. Table 5.0-1 details the primary External

Influences (Opportunities and Threats) as well as the affects to Transmission and actions we are taking. Table 5.0-2

details the primary Internal Influences (Strengths and Weaknesses) and also lists affects and actions. The SWOT

(Strengths, Weaknesses, Opportunities, Threats) Table 5.1-1 concisely presents these factors organized by internal

Strengths and Weaknesses and external Opportunities and Threats in a simple matrix. Some topics are considered both

opportunities and threats, and that has been depicted as well.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

16

Table 5.0-1, External Influences (Opportunities & Threats)

External Influences

Affects and Actions

Opportunities

Changing generation

mix and distributed

energy resources.

Affects: Generation production in the Pacific Northwest (and across WECC) are

changing from traditional and dependable coal and hydro methods to also include more

renewable sources such as wind and solar which can be somewhat less predictable. The

ongoing market advancement of distributed energy resources (DERs) is challenging

BPA’s ability to interconnect new systems in a timely, cost effective manner; however,

these DERs also offer BPA an opportunity to leverage voluntary non-BPA investments to

help address bulk grid problems.

Actions: The new mix of generation sources may require future investments in

transmission reinforcements for reliable load service. Transmission continues to

perform long term planning assessments to remain well connected to regional

developments.

Timely response to

customer

Interconnections for

new generation and

major load additions

Affects: Exemplified by new photovoltaic solar generation and data center loads, BPA’s

stakeholders demand ever-faster and cheaper interconnections to the grid. New Power

Contracts will be shaped, in part, by customer perceptions of the value of BPA’s

products and services, the availability of competitive market substitutions, and

challenges associated with long-term planning amidst the considerable and ongoing

transformation of the electric power industry landscape.

Actions: Transmission has implemented improvements to study, plan and execute

these interconnections in a much shorter timeframe, and will continue to do so on an

on-going basis. This work must be coordinated with Power Contract developments and

connected to customer needs.

Rapid technology

changes and new

potential guiding

legislation

Affects: Technological change is more substantial than previous decades and is

occurring at an accelerated pace. We have the opportunity to modernize our grid. New

guiding legislation for BPA is probable in this period of transformation.

Actions: Technological obsolescence will require Transmission to replace equipment

and systems in shorter cycles, likely increasing the cost of its communication and

control systems. Transmission is anticipating these changes and is planning sustain

program needs around technological obsolescence as one factor.

Power/Energy Industry

Analytical Tools

Affects: Increase of organizations focusing on Asset Management and lifecycle costing.

Actions: BPA has more opportunities to learn about (benchmark) or acquire tools to

help with identifying and implementing innovative, lower lifecycle cost alternatives to

provide better business value to the region. Transmission meets with other utilities

regularly for ongoing benchmarking and improvements.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

17

External Influences

Affects and Actions

Threats

Regularly reoccurring

natural catastrophe

events, such as fires,

earthquakes and grid

attacks

Affects: Load pattern changes due to temperature changes in SW and NW. Timing of

precipitation (earlier freshet/ perhaps bimodal freshets) and therefore generation

patterns for Federal Columbia River Power System (FCRPS) in the Northwest will affect

transmission bulk power flow.

Increased wildfire risk may affect transmission lines and other assets in the field, and

could influence public perception of BPA.

Actions: Transmission is currently maturing processes, tools, methodologies, and plans

to help prepare for weather-related events, including wildfire risk.

Pandemic supply chain

interruption and cost

escalation

Affects: Due to global supply chain factors, material pricing has been higher with

elongated schedules for delivery. Market conditions for human resources are also

constrained.

Actions: Continue to mature risk-based decision-making to ensure we are choosing the

best options for maintaining our assets.

Long-term (regional)

resource adequacy

Affects: Renewables and battery storage (along with some new transmission) are

expected to serve as substitutions for retiring fossil-fueled thermal generation serving

the Northwest and American West, exacerbating concerns over long-term (regional)

resource adequacy and transmission availability and reliability.

Actions: Continue to maintain close connection with resource adequacy efforts in the

region.

Evolving cyber security

threats

Affects: An emerging external influence is the threat of cyber-attacks from outside our

organization including hackers, cybercriminals, and other malicious persons who are

trying to do harm. Energy organizations are a prime target of growing and evolving

cybersecurity threats given the criticality of their infrastructure to our nation. Current

and future state architecture must evolve to account for these increased risks.

Actions: Continued Cyber Security diligence is required in order to protect networks,

devices, and data from unauthorized access or criminal use and ensure confidentiality

(limiting data access), integrity (ensuring your data is accurate), and availability (making

sure it is accessible to those who need it).

Table 5.0-2, Internal Influences (Strengths & Weaknesses)

Internal Influences

Affects and Actions

Strengths

Reliable Transmission Grid

Affects: Transmission demonstrates a long history of safe and reliable grid

operations, which satisfies customers in the region.

Actions: Continue to dedicate resources to maintaining system reliability and

compliance with NERC and WECC mandatory reliability standards.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

18

Internal Influences

Affects and Actions

Resiliency

Affects: Cultural response to unplanned outages has a time proven commitment to

rapid restoration for an event.

Actions: Continue to respond to unplanned outages for service restoration.

Low Cost Sources of Capital

Affects: BPA, as a public sector utility, is a nonprofit provider of transmission

services and has access to lower costs of capital than IOUs or other transmission

providers.

Actions: Utilize public sector status to employ the lowest cost of funding method

available to us. Continue to earn high credit scores.

Safety

Affects: Agency-wide commitment to safety-centric culture; where public service is a

daily driver for decision-making.

Actions: Carry-on safety-centric culture.

Weaknesses

Attraction/retention of

workforce, and high

number of experienced

workers eligible for

retirement.

Affects: High retirement rates and other attrition are contributing to Transmission

workforce being a top enterprise risk. Transmission’s workforce is highly

specialized, limiting opportunities to address workload peaks and adding cost to

scoping and preliminary engineering activities.

Actions: BPA must provide greater opportunities and competitive pay to keep and

attract a qualified workforce. Greater innovation and use of best industry practices

will not only help with retention but will also reduce project cost and duration.

Transmission will need to create sustainable organizational structures and develop

greater personnel competencies.

Lack of integrated asset

data repositories and

systems

Affects: With approximately 40 systems containing asset information, Transmission

is awash in data and the inability to integrate information systems automatically has

challenged employees to examine ways to integrate the information and

document/develop proposals for improvements.

Actions: Transmission is working on a holistic architecture for systems and data,

such as an Enterprise Architecture across BPA, which clearly defines asset

information and data strategy, governance, and systems.

Department alignment on

objectives and prioritization

factors throughout

execution

Affects: With numerous organizations working to support Transmission Asset

Management, alignment can be challenging and can result in a slower pace of

improvements, due to several priorities moving forward simultaneously.

Actions: Transmission has established cross-functional teams and communication

frameworks to continue to improve alignment for optimum use of constrained

resources. Efforts underway to improve processes and data will also support

departmental alignment.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

19

Internal Influences

Affects and Actions

Aging infrastructure

Affects: Transmission’s physical assets are aging, leading to high capital needs for

replacements. Telecom systems are End of Life/End of Service.

Actions: Continue to mature asset management capabilities to focus limited

resources on most critical replacements. Evaluate opportunities to change practices

to maximize limited resources.

IAM cultural awareness

Affects: Silos in organizations can create sub cultures where different organizations

work towards different, even opposing end states, which could lead to poor cross-

departmental interactions and sub-optimal performance.

Actions: Everyone has an impact to asset management and needs to be aware of

their role. Develop Asset Management discipline and increase knowledge base for all

Transmission organizations involved in the acquisition, operation and care of physical

assets for the benefit of Transmission, BPA, our customers and the general public.

5.1 SWOT Analysis

Transmission has been impacted by many global factors in the recent past, ranging from the COVID-19

pandemic, supply chain impacts, wildfire events and increased fire risks, to challenges with hiring/retention, as

well as high numbers of experienced workers eligible for retirement. Transmission’s SWOT analysis, below,

summarizes specific Strengths, Weaknesses, Opportunities, and Threats. The specific affects/actions are

explained in the preceding section (5.0-1 and 5.0-2).

Transmission is responding to and mitigating impacts of global factors, such as by ordering more equipment to

have in stock (to mitigate material delays). Transmission is also hiring additional employees in constrained

areas (such as in the field and in cyber security related areas).

Transmission’s continued work to mature Asset Management, such as by improving asset management data

and alignment (through Enterprise Architecture partnership, asset hierarchy maturation, and Criticality, Health

and Risk maturation, will continue to benefit Transmission as it works to manage these complexities.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

20

Table 5.1-1: SWOT

Favorable

Unfavorable

Strengths

Weaknesses

Reliable Transmission Grid: Long-term history of a

reliable system of uptime performance.

Resiliency: Cultural response to unplanned

outages has a time proven commitment to rapid

restoration for an event.

Low Cost Sources of Capital: BPA has access to

lower costs of capital than IOUs or other

transmission providers

Safety: Agency-wide commitment to safety-centric

culture; where public service is a daily driver for

decision-making.

Attraction/Retention of high quality talent, high

numbers of experienced employees eligible for

retirement- BPA is impacted by the tight labor

market, reinforcing the need to continue to enhance

work place culture and respond to employee

suggestions for improvement.

Lack of integrated asset data repositories and

systems- impacts decision support and employee

experience

Department alignment on objectives and

prioritization factors throughout execution-

Continuous improvement especially important due

to resource constraints.

Aging Infrastructure: Transmission’s physical assets

and telecom systems are aging and replacement

needs will be high over the coming decade

IAM Cultural Awareness: Everyone has an impact to

asset management and needs to be aware of their

role

Opportunities

Threats

Changing generation mix and distributed energy

resources: could lead to opportunities to reinforce

the system

Timely customer interconnections: opportunity to

meet customer needs quickly and responsively

Rapid technology changes and new potential

guiding legislation: opportunity to modernize

Transmission system and partner in the region

Power/Energy Industry Analytical Tools: BPA may

have more opportunities to learn about or acquire

tools to advance asset management

Regularly reoccurring natural catastrophe events;

potential fires, earthquakes and grid attacks: High

impact challenges ranging from grid operations to

wildfire season planning and response

Pandemic supply chain interruptions and cost

escalation: Impact BPAs ability to deliver work within

planned funding levels to achieve results.

Long-term (regional) resource adequacy: Potentially

affected by weather patterns and other system

changes and needs.

Evolving cybersecurity threats: An emerging external

influence is the threat of cyber-attacks from outside

our organization

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

21

6.0 ASSET MANAGEMENT CAPABILITIES AND SYSTEM

On the five-point Institute of Asset Management maturity scale, Transmission’s current asset management practices

range from 1.2 to 1.5, on a scale of 0 to 4. The visuals provided below are shown on a 3 scale to make variations of

scoring more visible. The organization has identified its asset management needs and has demonstrated progress by

committing to ongoing efforts that will continue to mature asset management capabilities.

Figure 6.0-1, Asset Management Maturity Radar Chart

While asset management responsibility resides throughout Transmission Services, accountability is placed with the BPA’s

Chief Engineer, the Vice President of Transmission Planning & Asset Management. Asset management delegation of

authority flows through TP’s Internal Operations Manager to the Strategy, Asset & Program Management (TPO) Manager,

who also serves as Transmission’s Asset Manager.

Transmission’s Asset Management Executive Council (TAMEC) is a strong supporter of asset management. The TAMEC

reviews and approves Transmission capital funding recommendations prior to submittal to the Agency Capital Project

Review Team (ACPRT) and the Finance Committee (FC). Through a charter, the TAMEC has authorized the Portfolio

Management Team (PfMT) to make the daily portfolio management decisions. In recognition of the importance and

value of full lifecycle asset management, the Asset Management Governance Team (AMGT) represents organizations

from the entire asset management lifecycle. Efforts and maturity initiatives are developed cross functionally to continue

to mature in Asset Management initiatives.

Transmission recognizes there is great opportunity in effectiveness and cost savings through integrated replacement and

maintenance decisions. Asset information is not fully integrated into Transmission’s capital process, and improving this

will improve visibility and alignment with other processes.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

22

6.1 Current Maturity level

The Asset Management Maturity Assessment was refreshed in October 2021. Forty+ people participated in giving their

feedback of the maturity level for all 39 Institute of Asset Management (IAM) Subjects and identified strengths and

weaknesses for the requirements they were knowledgeable of.

The results of the most recent Asset Management Maturity Assessment clearly indicate Transmission is well on our way

with our Asset Management journey. Transmission is aware of and acknowledges critical short-comings that need to be

addressed in each of the IAM Groups. Top priorities and dependencies have been identified and sequencing is occurring

to ensure coordinated plans for making improvements to the most important and foundational work.

Many of the initial Asset Management improvements are operational and teams are now working to ensure proper

documentation and incorporation between organizations. In the coming years, Transmission will continue the long-term

focus and continue the incremental improvements along our Asset Management journey to start realizing benefits and

then optimizing to obtain the greatest value from our assets.

Table 6.1-1 Maturity Level

Subject

Area

Maturity Level

Strategy &

Planning

Strategy & Planning Strengths

The AM Policy, the Strategic Asset Management Plan, and the Transmission Asset Plan have

been coordinated with multiple organizations and authorized by leadership.

Strategy & Planning Weaknesses

Strategic alignment between plan and communications of plan could still use improvement.

Quantitative demand analysis tools and techniques are not effectively utilized for forecasting

demand and demand analysis is not incorporated when developing alternative planning

scenarios.

Strategy & Planning Actions

Asset Management Initiatives are launching and underway to address alignment of plans and

to develop demand analysis capabilities.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

23

Strategy & Planning Subject Maturity Scores

Decision

Making

Decision Making Strengths

Capital Investment Acquisition (CIA) processes for capital investment decision-making are

operational. Decision records are maintained. Shutdown and outage strategy are in line with

the organization’s criteria for asset management decision-making.

Decision Making Weaknesses

The methods, processes, and criteria (including risk) for life cycle value realization are not

consistently available, aligned, documented or utilized. Records are not always available to

demonstrate conformance. Resources and a resourcing strategy to source the required

resources are not optimal.

Decision Making Actions

Groups working on improving Asset Management Decision Making are included in

requirements-gathering for Asset Information Initiatives and efforts (such as Asset Hierarchy),

to facilitate data-driven decisions. An effort is underway to create a cross organizational

resource strategy and proposed plan to improve visibility and the management of resources.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

24

Decision Making Subject Maturity Scores

Life Cycle

Delivery

Life Cycle Delivery Strengths

Capital Investment Acquisition (CIA) processes for asset create/acquisition is operational.

Documentation and systematic processes and/or plans are in place for managing unplanned

events.

Life Cycle Delivery Weaknesses

Life cycle costing in the acquisition and creation of assets is not available. Project management

controls to ensure the timely and cost efficient delivery of the asset management plan(s) are

not optimal.

Life Cycle Delivery Actions

Development of the life cycle costing capability will greatly benefit from the creation of the

Asset Hierarchy and structuring financial, non-financial, and technical information in a usable

structure and system. Improvements to MS Project will allow for better controls. The cross

organizational resource strategy will enable better resource management.

Life Cycle Delivery Subject Maturity Scores

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

25

Asset

Information

Asset Information Strengths

The organization has consistently identified the need for data, information and systems

improvements across many organizations.

Asset Information Weaknesses

Transmission has not fully integrated BPA’s Asset Information Policies into its processes and

tools. Some programs lack a defined Asset Hierarchy. Due to the number of systems, the

complexity of data, and the manual entry required, we are unable to consistently bring

together financial, non-financial, and technical asset information.

Asset Information Actions

Cross-organizational Initiatives are planned to address Enterprise Architecture, Asset

Information Strategy, Asset Information Systems, and data, including an Asset Hierarchy.

Asset Information Subject Maturity Scores

Organizatio

n & People

Organization & People Strengths

The organization identifies Asset Management activities that are appropriate for outsourcing

and those which should remain in-house. Top management promotes cross-functional working

and supports leadership in Asset Management.

Organization & People Weaknesses

Resource demand is unknown and unavailable to support all aspects of our Asset Management

System as it continues to mature. Roles and responsibilities aren't sufficiently understood in all

cases. Our organizational structure isn’t resourced consistent with roles, responsibilities, and

workload to enable effective delivery.

Organization & People Actions

Continue IAM training. Increase communications and awareness. Develop Asset Management

System framework and incorporate Enterprise Architecture and define roles. Continue hiring

staff as identified for successful Asset Management implementation.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

26

Organization & People Subject Maturity Scores

Risk &

Review

Risk & Review Strengths

Transmission has identified what is to be monitored and measured for asset performance and

health monitoring. Transmission has identified the people and organizations that can have an

impact on or experience the consequences of the asset management program.

Risk & Review Weaknesses

The organization hasn't fully determined methods or criteria for asset performance and health

monitoring. Risk tolerance in regards to asset performance is not well defined, therefore, risk

mitigation plans and internal controls are not yet developed. Asset cost assessments are

locally managed and not a cross-functional activity.

Risk & Review Actions

The Criticality, Health, and Risk Initiative remains top priority and will begin to incorporate

more organizations, systems, documentation, and communication. Asset Performance Metrics

are in various stages of operations and development.

Risk & Review Subject Maturity Scores

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

27

6.2 Long Term Objectives

In the 2020 SAMP, Transmission identified two primary long-term objectives. These continue to be primary objectives,

and together, they relate to all six IAM subject groups.

1. Risk based Planning & Prioritization (Group 1- Strategy and Planning, Group 2- Asset Management Decision

Making, Group 4- Asset Information, Group 6- Risk & Review)

2. Financial Effectiveness (Group 2- Asset Management Decision Making, Group 3- Life Cycle Delivery, Group 4-

Asset Information, Group 5- Organization & People, Group 6- Risk & Review)

Objective 1: Risk based Planning & Prioritization

Transmission continues to support the agency strategic plan, number 2a (Administer an industry leading asset

management program). Understanding and applying asset Criticality, Health & Risk (CHR) is the widely accepted best

practice for capital planning and prioritizing investments including maintenance. Transmission has continued to mature

this capability and a roadmap is presented in Figure 6.2-1). At its current maturity level, CHR is primarily applied in

decision making around a subset of sustain assets. The subset is based on assets currently in Cascade with the most

mature data. Ultimately, CHR will be an additional support tool to be used in prioritization decisions across expand and

sustain. This includes robust implementation of each of the three components: Criticality, Health, and Risk for each

program area (with any exceptions documented).

Specific: Transmission will quantify asset criticality, health & risk.

Measurable: Transmission will complete remaining logic sheets across identified impact dimensions, and will

complete scoring specific assets in Cascade based on these logic sheets.

Achievable: Transmission has dedicated resources assigned to this priority.

Relevant: Institute of Asset Management recognizes that understanding cost, performance and risk are the

fundamentals for effective business model and decision making. CHR is the adoption the IAM model and ISO-

31000 framework.

Time bound: Transmission will complete the scoring by FY24.

Figure 6.2-1 CHR Roadmap

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

28

Objective 2: Financial Effectiveness

Managing the lifecycle costs of federal assets is in direct alignment with the Agency strategic goals 1 & 2 (strengthening

financial health and modernizing assets and system operations). This is central to maintaining the long-term value and

reliability of the power and transmission systems. Transmission is continuing to expand its execution capability through

the Secondary Capacity Model (SCM) in order to support replacement of aging assets. Transmission is also embarking on

efforts to align asset information throughout the information lifecycle, so that decisions are based on current and

complete asset information data. This alignment would also allow Transmission to perform lifecycle costing. Figure 6.2-2

provides additional detail.

Specific: Transmission is documenting/defining an asset hierarchy for all managed assets. The existing

processes/systems will be mapped, resulting in improvement recommendations toward asset information

alignment and lifecycle costing. Transmission will partner with Enterprise Architecture for these maturity efforts.

Measurable: The asset hierarchy will be documented, and at least one identified gap toward lifecycle costing will

be addressed by the end of FY23. The remaining gaps will also be prioritized and scheduled and incorporated

into a maturity roadmap.

Achievable: Transmission’s cross-functional Asset Management Governance Team (AMGT) is actively prioritizing

and resourcing these initiatives.

Relevant: The IAM anatomy emphasizes the importance of asset data management in building an organization’s

asset management capability.

Time bound: This will be complete by the end of FY23.

Figure 6.2-2 Asset Information Roadmap

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

29

6.3 Current Strategies and Initiatives

Transmission is currently implementing several current initiatives, across all IAM subject areas. The three featured below

are of primary importance and align with all of the IAM subject areas.

1. Criticality Health & Risk (Objective 1: Risk based Planning & Prioritization)

2. Secondary Capacity Model (Objective 2: Financial Effectiveness)

3. Asset Hierarchy (Objective 2: Financial Effectiveness)

Initiative 1: Criticality, Health & Risk (CHR)

BPA continues to develop capabilities to understand asset criticality, health and risks. Defensible and proven

methodologies and analytical methods will be developed, tested and adopted to inform prioritization of capital

investments. CHR can be applied to specific maintenance decisions as needed, but is not applied

comprehensively at this time. Maintenance prioritization is primarily based on compliance, safety, and customer

service factors, as well as manufacturer recommendations and time. CHR analytics can be included as a factor in

the decision making, but specific timelines will be evaluated as part of coordination work in developing the

roadmap details. Transparent, objective CHR information and risk quantification will enable Transmission

decision makers to optimize the utilization of financial and human resources to deliver best value for BPA and the

region. Transmission’s objective is for each asset program to have robust implementation of Criticality, Health,

and Risk at the asset level. Transmission recognizes the complexity of this and maturation will continue over

many years.

1. Continue towards completing all criticality dimension logic sheets and scoring

2. Continue asset information collection

3. Continue to develop the Asset Management metrics for consistent reporting to customers

Initiative 2: Secondary Capacity Model (Portfolio Delivery)

Transmission’s backlog of assets needing replacement is increasing. Specific amounts of backlog varies by program, but

for example, in the Subs AC program, it increased by over 3000 units in 2019, compared to a total asset population of

around 32,000. Clear visibility of asset information will support this capability development. Increasing execution

throughput requires a systematic approach that addresses multiple constraint dimensions impacting the asset lifecycle.

Currently Transmission is striving to an ultimate goal of creating available and flexible resource capacity to meet the

demand delivered from asset management lifecycle planning, system expansion planning, and customer system needs.

1. Continue to operationalize the Secondary Capacity Model to augment the Primary Capacity Model (current

model) that offers flexibility as demand fluctuates and as other capacity models expand and contract.

2. Continue to mature the Demand Planning and Work Scheduling capability to enable centralized resource

assignments and task tracking across the Transmission portfolio of projects. The aggregation of the information

from the Work Scheduling service will produce information for strategic resource planning.

The combination of these efforts are expected to drive efficiencies in current processes and practices in the Portfolio

Delivery Model while simultaneously seeking out additional resourcing options in order to deliver on the demands

provided by Portfolio Planning.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

30

Initiative 3: Asset Hierarchy

Transmission is working to define an asset hierarchy for all managed programs. Certain Transmission programs have an

asset hierarchy defined but not documented, whereas other programs do not have a hierarchy defined at all. The Asset

Hierarchy effort will identify/document asset hierarchies specific to each program. Unique identifiers will also be

identified when possible. The asset hierarchy effort is currently being scoped but significant progress is expected in FY22.

Certain questions still being considered include whether to stage the effort, and to focus on certain assets before other

assets, or whether to structure the hierarchy to fit existing systems, or to be more general at this point in development.

The Asset Hierarchy is a foundational effort that will support future asset management systems and process

development. Ultimately, specific steps will include (as detailed in Figure 6.2-2):

1. Asset Hierarchy across all asset types

2. Asset Data and information; identify and define the technical, financial and other asset data required by the organization for

lifecycle costing

3. Asset information systems

4. Lifecycle costing

5. Asset Management decision making and value realization through implementation of the Transmission Portfolio

Optimization Tool (as described in more detail in section 10).

6.4 Resource Requirements

Transmission has leveraged additional contract options and resources to support the Portfolio Delivery Model, as part of

SCM (Secondary Capacity Model). Transmission has also recently stood up a standalone organization and hired additional

new resources to support Criticality, Health & Risk. Additional staff will continue to be required as part of continued

asset management maturity, for example, as part of standing up the Transmission Portfolio Optimization Tool. Financial

resource requirements are discussed in more detail in Sections 8 and 10.

7.0 ASSET CRITICALITY

7.1 Criteria

Transmission has adopted the ISO-31000 approach to managing risk. This incorporates the quantified health of an asset

and quantified impact to the business across five risk dimensions: Compliance, Environmental, Financial, Reliability, &

Safety. These five risk dimensions currently have equal weighting to one another. Transmission recognizes that part of

criticality is to be able to differentiate and prioritize investments based on an understanding of what is more critical or

less critical. Transmission will continue to mature the application of Criticality along with the maturation of other aspects

of CHR.

This is visualized by a 5x7 illustration of the aforementioned risk dimensions and the corresponding consequence impacts

on a scale of 1-7; where 1 = negligible and 7 = catastrophic. The scale applied to each consequence impact is the

criticality. The following figure provides the criteria for determining criticality based on these dimensions.

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

31

Figure 7.1-1 Impact/Consequence Scale

The Impact/Consequence scale has been applied to specific dimensions of risk, to create logic sheets. These logic sheets

offer more detail on what would cause an asset/site to move between impact dimensions.

The following logic sheets have been completed, through partnership with the SME organizations responsible for each

risk dimensions:

Compliance

Environmental (Natural Resources/Pollution and Abatement)

Reliability

Safety

The following logic sheets remain to be completed:

Environmental (Cultural)

Financial

B O N N E V I L L E P O W E R A D M I N I S T R A T I O N

32

Figure 7.1-2 Asset Risk Dimensions

When logic sheets are completed, the assets are then scored based on the criteria depicted in the logic sheets. While the

compliance logic sheet has been completed, assets have not yet been scored for that dimension. Heat maps in section 9