NBER WORKING PAPER SERIES

GENERATIVE AI AND FIRM VALUES

Andrea L. Eisfeldt

Gregor Schubert

Miao Ben Zhang

Working Paper 31222

http://www.nber.org/papers/w31222

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

May 2023

Gregor Schubert gratefully acknowledges funding from the UCLA Fink Center for Finance and

the UCLA Easton Technology Management Center. The views expressed herein are those of the

authors and do not necessarily reflect the views of the National Bureau of Economic Research.

NBER working papers are circulated for discussion and comment purposes. They have not been

peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies

official NBER publications.

© 2023 by Andrea L. Eisfeldt, Gregor Schubert, and Miao Ben Zhang. All rights reserved. Short

sections of text, not to exceed two paragraphs, may be quoted without explicit permission

provided that full credit, including © notice, is given to the source.

Generative AI and Firm Values

Andrea L. Eisfeldt, Gregor Schubert, and Miao Ben Zhang

NBER Working Paper No. 31222

May 2023

JEL No. E0,G0

ABSTRACT

What are the effects of recent advances in Generative AI on the value of firms? Our study offers

a quantitative answer to this question for U.S. publicly traded companies based on the exposures

of their workforce to Generative AI. Our novel firm-level measure of workforce exposure to

Generative AI is validated by data from earnings calls, and has intuitive relationships with firm

and industry-level characteristics. Using Artificial Minus Human portfolios that are long firms

with higher exposures and short firms with lower exposures, we show that higher-exposure firms

earned excess returns that are 0.4% higher on a daily basis than returns of firms with lower

exposures following the release of ChatGPT. Although this release was generally received by

investors as good news for more exposed firms, there is wide variation across and within

industries, consistent with the substantive disruptive potential of Generative AI technologies.

Andrea L. Eisfeldt

Anderson School of Management

University of California at Los Angeles

110 Westwood Plaza

Suite C4.10

Los Angeles, CA 90095

and NBER

Gregor Schubert

UCLA Anderson

School of Management

Miao Ben Zhang

University of Southern California

701 Exposition Blvd

HOH-722

Los Angeles, CA 90089

Recent advances in Generative Artificial Intelligence are widely seen as a major technology

shock with important implications for firm values. Relative to earlier artificial intelligence

models, Generative AI models can digest more complex inputs, and can produce human-

like output, making Generative AI more versatile and scalable than prior innovations in AI

and machine learning. As a result, Generative AI has the potential for widespread corporate

adoption, with implications for firm values both across and within a wide array of industries.

One of the biggest questions surrounding advances in Generative AI is what effect these

technologies will have on corporate valuations as a result of the impact of Generative AI on

firms’ labor inputs. We construct a novel dataset containing firm-level workforce exposures

to Generative AI. We provide a quantitative measure of the impact of Generative AI based

on our firm-level exposure data combined with financial market data. Using this measure

we compute the first estimates of the effect of Generative AI on firm values by studying the

impact of the release of ChatGPT on firms with varying exposures to the technology shock.

1

We measure the impact of a major event in the advancement and dissemination of Gen-

erative AI technology, namely, the public release of ChatGPT, on equity returns at the firm

level. This event had a substantial impact on firm returns, consistent with Generative AI

advancement representing a major technological shock, one for which we can measure the

arrival and impact in real time. While firms may progressively adopt the technology, the

unmatched media attention and user base that ChatGPT has garnered within just months

indicates that firms and investors are actively assessing the potential fast diffusion of this

technology. We show that Twitter mentions and earnings call mentions of Generative AI

increased substantially following the release of ChatGPT. Moreover, the massive information

gathering and processing ability of ChatGPT itself allows us to assess each firm’s exposure

to ChatGPT’s disruption in real-time.

Our key finding is that the arrival of ChatGPT had a sizable positive effect on the value

of firms whose labor forces are more exposed to Generative AI and related Large Language

Models (LLMs). Firms with higher exposure to the release of ChatGPT, as measured by

the exposure of their labor force to being made more productive by tools like ChatGPT,

outperform firms with lower exposures by over 40 basis points in daily excess returns during

the two weeks following its release. Notably, these return differences are not only due to

differences in labor force exposures across industries. Returns of firms with high labor

force exposures also outperform firms with low exposures by about 40 basis points daily in

1

Recent studies of Generative AI include Eloundou, Manning, Mishkin, and Rock (2023) who study the

impact of Generative AI on industries’ labor forces, Noy and Zhang (2023) who study the displacement

effects of Generative AI on professional writing tasks, and Brynjolfsson, Li, and Raymond (2023) who study

the effects of Generative AI on customer support agents, and Felten, Raj, and Seamans (2023) who consider

heterogeneity in occupational exposure.

1

industry-neutral portfolios.

Our methodology builds on the idea that ChatGPT and related technologies will in-

crease firm-level free cash flows through a labor effect that can work through two potential

channels. First, firms whose labor force can be substituted for with cheaper Generative

AI-based capital will experience higher free cash flows by lowering input costs.

2

Second,

firms whose labor inputs are more complementary to Generative AI will experience higher

cash flows due to the technological improvement in an input that is complementary to their

workforce.

3

While we do not take a stand on whether (and for which workers) Generative AI

is a substitute for, or a complementary to, labor, we are able to show that firms that have

a higher share of occupations exposed to Generative AI experience gains in value across a

wide array of industries. At the same time, the effect of the release of ChatGPT on firm

values varies widely across industries, as well as within industries across firms. Indeed, we

find a significantly negative impact from the release of ChatGPT for some industries. Value

losses for incumbents are consistent with the idea that for some industries Generative AI

will lead to new entrants and displacement of existing firms. While advances in Generative

AI can have effects through the product market as well as through the labor market (for

example, increasing demand for cloud computing services), our results support the idea that

AI advances will have a broad impact on the economy through its effects on labor inputs.

The fact that the overall impact of the arrival of ChatGPT on firms with more exposure

to Generative AI is significantly positive is consistent with recent studies showing that it is

increasingly more difficult for new entrants to displace incumbent firms.

4

We measure firm-level exposure to Generative AI in two steps. First, we build on Eloun-

dou et al. (2023) and use ChatGPT itself to assess whether each of the 19,265 tasks cur-

rently performed by various occupations can be done by the current ChatGPT or by future

ChatGPT after investment in additional capabilities. Following Eloundou et al. (2023), we

aggregate the task-level exposure measures to the occupations in the O*NET database. Sec-

ond, and novel to our analysis, we map occupations to publicly-traded firms using data from

Revelio Labs. This dataset is constructed from millions of public employee profiles such as

LinkedIn. Our firm-level exposure measure thus captures the ability of the tasks currently

performed by labor at those firms to be performed (or made more efficient) by Generative

AI. To the best of our knowledge, our study is the first to create a firm-level measure of

exposure to Generative AI.

We next validate our labor-based measure of firms’ exposure to Generative AI by examin-

2

See Autor, Levy, and Murnane (2003) and Zhang (2019) for measures of firm exposure to automation

and Webb (2019) and Lane and Saint-Martin (2021) for the impact of AI on firms.

3

See Krusell, Ohanian, R´ıos-Rull, and Violante (2000) and Eisfeldt, Falato, and Xiaolan (2022).

4

See, for example, Guti´errez and Philippon (2019) and Akcigit and Ates (2020).

2

ing firms’ earnings call transcripts in 2023. We document a strong relationship between our

measure of exposure to Generative AI and firms’ discussions of Generative AI and related

technologies in firms’ earnings calls following the release of ChatGPT. In contrast, firms with

higher exposure to Generative AI do not increase discussions common technological topics

such as Engineering following the release of ChatGPT. Moreover, these findings remain even

after we exclude all firms from the most IT-related sectors,

5

suggesting that firms’ recent

discussions about Generative AI go beyond its impact on related products, and extend to

the impact on operations including labor inputs.

We start by showing the types of occupations that will be affected by advances in Gen-

erative AI. We find that the most affected occupations are those that involve non-routine

cognitive tasks. This is in stark contrast with prior findings that automation mainly dis-

places occupations involving routine tasks (Autor et al. (2003)). Indeed, the most affected

occupations are those with a high share of non-routine cognitive analytical tasks or routine

cognitive tasks, while manual physical tasks are relatively unaffected. Interpersonal tasks lie

in between cognitive and manual tasks in terms of their exposure to Generative AI. Occupa-

tions with higher wages also have higher exposure to Generative AI. Our result is consistent

with recent findings by Kogan, Papanikolaou, Schmidt, and Seegmiller (2019), who find that

technological advances impact workers at the higher end of the wage distribution.

Exposure to Generative AI through firms’ labor inputs has an intuitive relationship to

average firm characteristics across and within industries. At the industry level, more exposed

sectors have higher wages, consistent with those sectors employing more workers in higher-

paid occupations that also tend to be more exposed to Generative AI. Regarding labor

inputs, firms in more exposed industries tend to have higher labor intensity in terms of the

number of employees per unit of capital, and lower asset tangibility. More exposed firms also

have higher ratios of organizational to total capital.

6

For the characteristics related to firm

valuation, more exposed sectors have lower average firm size as measured by total assets and

higher Tobin’s Q. Importantly, we also observe similar relationships between firms’ exposure

to Generative AI and firm characteristics within industry sectors. The robust patterns of

variation in industry and firm-level exposures with firm characteristics support our study of

stock returns both across and within industries.

Firms with higher exposure to Generative AI experience higher volatility around the

release of ChatGPT. However, it appears that it takes some time for the information in

ChatGPT’s release to be impounded into stock prices. The cumulative excess returns for

5

To be precise, we exclude the NAICS 51 “Information” and NAICS 54 “Professional, Scientific, and

Technical Services” sectors.

6

See Eisfeldt and Papanikolaou (2014) and Eisfeldt and Papanikolaou (2013).

3

Figure 1: Generative AI exposure quintile portfolio returns over time: market factor-

adjusted. The graph shows the cumulative excess realized returns on portfolios based on value-weighted

sorts. All portfolio returns shown are net of the risk-free rate. The data set consists of daily stock returns

from Yahoo Finance for Nov. 15, 2022 - March 31, 2023. The figure shows returns adjusted for market factor

exposure.

the highest-exposure quintile of firms vs. the lowest-exposure quintile diverge for several

weeks following the release of ChatGPT. Figure 1 plots the returns of the highest-exposure

quintile, the lowest-exposure quintile, and a long-short portfolio, which we denote AMH for

“Artificial Minus Human”. Cumulative returns to holding the AMH portfolio that is long

the highest-exposure quintile, and short the lowest-exposure quintile from the released date

through March 31, 2023, are over 9%.

We study the effect of Generative AI on firm values by comparing the returns of firms with

higher and lower occupational exposure to Generative AI during and outside the two-week

window following the release of ChatGPT on November 30, 2022. The effects are substantial,

and monotonic, within industries across Generative AI-exposure quintiles. Adjusting for the

market factor, the excess returns to quintile portfolios formed based on firm-level occupa-

tional exposure to Generative AI are monotonically increasing, with the highest-exposure

quintile of firms within industries earning positive excess daily returns of over 40 basis

points while the lowest exposure quintile experiences negative excess returns of around 25

basis points. The fact that these strong effects exist within industries for many industries

provides evidence that Generative AI can have a broad impact on firm values through the

effects on their labor inputs.

4

Across industries, the effects of Generative AI on firm value also vary widely. Publishing,

information and computing-related industries have positive returns following the release of

ChatGPT, while finance and transportation-related industries experience negative returns

overall. Dispersion in industry returns is much higher during the two-week period following

the release of ChatGPT than over the full sample from November 30, 2022 to March 31,

2023 overall.

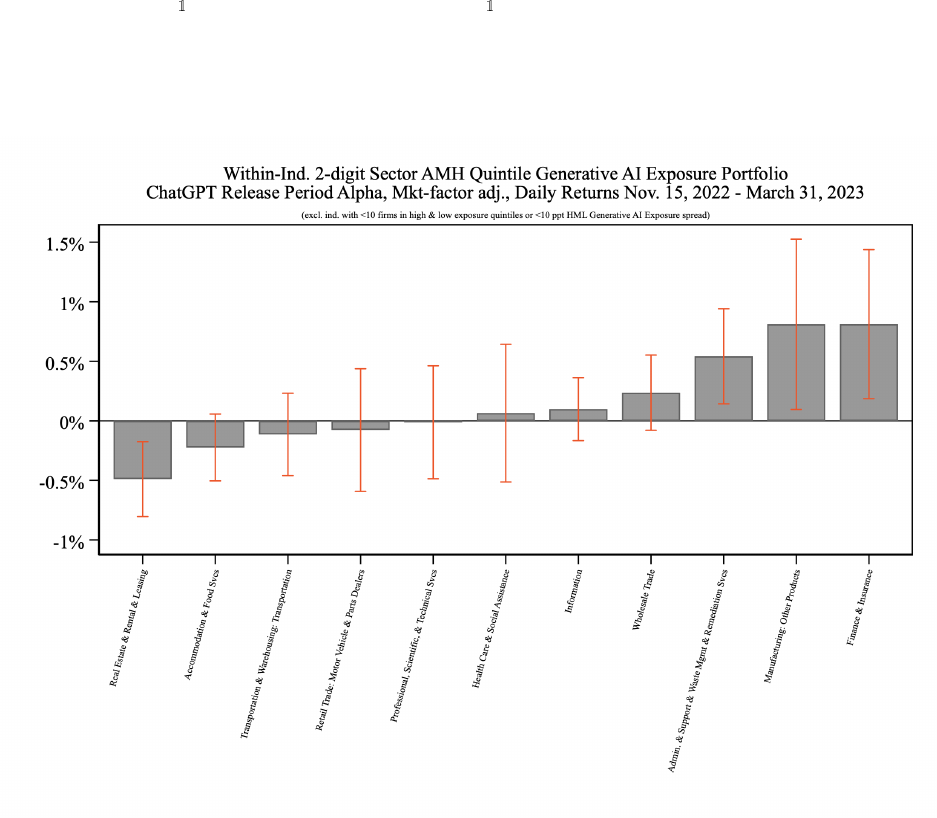

Our within-industry results also display striking differences across industry sectors. Within

finance, the return of more exposed firms relative to less exposed firms is substantially and

significantly positive. Combined with the overall negative industry effect, this is consistent

with some firms benefitting greatly from Generative AI advances while overall the impact

of the release of ChatGPT was negative for value in the finance industry. Firms with higher

exposures to Generative AI within manufacturing as well as the administrative support,

waste management, and remediation services industry also significantly outperform firms

with lower exposures. On the other hand, firms with higher exposures in the real estate

and rental and leasing industry significantly underperform firms with lower exposures. This

could mean that existing firms with large exposures to Generative AI may be displaced by

new entrants in those industries. Finally, several industries do not display significant re-

turn spreads following the release of ChatGPT, including construction of buildings, mining,

and heavy and civil engineering construction. The negligible impact in these industries is

consistent with manual tasks’ lower exposure to Generative AI.

Our study contributes to the literature studying the impact of disruptive technologies on

firm valuations.

7

Papanikolaou (2011) and Kogan and Papanikolaou (2014) study the effects

of investment-specific technological changes on asset prices. Eisfeldt and Papanikolaou (2013)

and Eisfeldt and Papanikolaou (2014) study firms’ exposure to the organization capital

technology frontier. Zhang (2019) studies firms’ exposure to routine-biased automation.

In a series of papers, Babina, Fedyk, He, and Hodson (2020), Babina, Fedyk, He, and

Hodson (2021), and Babina, Fedyk, He, and Hodson (2022) study the effects of AI on firm

growth, compensation, and workforce composition. See also Webb (2019) for the impact

of AI on firms. Kelly, Papanikolaou, Seru, and Taddy (2021) study firms’ exposure to

disruptive technological shocks using patent textual data, and Kogan et al. (2019) assesses

worker displacement from technological change over a very long sample. These studies offer

important insights into investors’ and firms’ responses to technological shocks in historical

samples.

Our study departs from these works by focusing on measuring firms’ exposure to Gen-

7

See Greenwood, Hercowitz, and Krusell (1997) for an early contribution on the long-run impacts of

investment-specific technological change.

5

erative AI and assessing investors’ reaction to the technology shock upon its arrival. We

argue that the release of ChatGPT in November of 2022 is an observable, large technology

shock. We also highlight our contribution of measuring investors’ reactions to this shock in

real-time. Indeed, the information in market prices can potentially inform employees’ and

firms’ ultimate responses to technological disruption. Timely assessment of the market’s

expectations of Generative AI’s impact on firms can also help policy makers to effectively

evaluate regulatory policies in response to the arrival of the new technology.

While other contemporaneous or recent studies such as Eloundou et al. (2023) also address

the exposure of occupations to Generative AI advances, our paper is novel in its contributions

to the effect on firms. Our use of the Revelio Labs data to link occupations to firms yields

a unique opportunity to study corporate outcomes.

8

.

The paper proceeds as follows: Section I describes our data and measure of firms’ expo-

sure to Generative AI. Section II provides descriptive facts about Generative AI exposures

across occupations, industries, and firms. Section III documents corporate communications

to investors regarding Generative AI, and the relationship between those communications

and our measure of Generative AI exposures. Section IV presents our results documenting

the substantial changes in firm valuations following the introduction of ChatGPT. Finally,

Section V concludes.

I. Data and Measurement

We measure a firm’s labor exposure to Generative AI in two steps. First, we measure

each occupation’s exposure to Generative AI based on the occupation’s task statements from

the O*NET database. Second, we aggregate the occupation-level Generative AI exposure

measure to the firm level using the firm-occupational employment data from the Revelio

Labs Workforce Dynamics database.

A. Measuring occupational exposure to Generative AI

Occupational task data To assess whether an occupation will likely experience a change

in absolute or relative productivity as a result of Generative AI models becoming widely

available and used, we use a task-based approach. That is, similar to Eloundou et al. (2023),

8

Indeed, as we draft this study, IBM, the company ranked #1 in our exposure to Gen-

erative AI measure among the largest U.S. firms (see Table II) announced to halt hir-

ing of 7,800 jobs that could be replaced by AI. See https://www.businessinsider.

com/ibm-halts-hiring-for-7800-jobs-that-could-be-replaced-by-ai-report-2023-5?

utm_source=superhuman.beehiiv.com&utm_medium=newsletter&utm_campaign=

ibm-starts-replacing-jobs-with-ai&r=US&IR=T

6

we consider an occupation to be a set of tasks-to-be-done and evaluate for each task whether

it can be done more productively using ChatGPT and similar large language models (LLMs)

or future applications that will be built based on their capabilities.

We obtain information on the tasks involved in each occupation from the O*NET database,

which provides a list of task statements created by practitioners or experts.

9

A task state-

ment is usually one sentence, and an occupation has on average 22 tasks. The 19,265 pairs

of task statements and the occupations that they belong to then need to be coded as being

exposed to Generative AI technologies or not.

Task scoring We build on the approach for scoring tasks that was suggested and validated

by Eloundou et al. (2023). In particular, we use GPT itself to score exposure of tasks based

on whether the task can already be done directly using the ChatGPT interface, or can be

done with additional tools built on top of it. Two advantages of using an LLM to assess task

statements are that it allows for better replicability of the research in terms of cost and speed

of execution, and rapid scaling of the method to the full set of 19,265 task statements.

10

Specifically, we use Open AI’s GPT 3.5 Turbo model to classify the full set of task

statements and validate its reliability on a smaller subsample of tasks.

11

The model is given

an overall rubric for scoring LLM exposure, as well as two example interactions between a

user and an assistant that showcase the kind of output it is expected to produce. Then, a task

statement is submitted together with its O*NET title, and the model returns a score. The

scores capture whether the time taken to complete task is reduced by at least half, at constant

quality, if the worker can access ChatGPT-like tools. The scores fall into the following

categories: E0 indicates no exposure as the tool is either insufficiently useful for this task,

or cannot be brought to bear as a result of the intrinsic nature of the task, e.g. if it involves

physical activities; E1 is applied if a 50% reduction in completion time is already feasible

with the existing large language model interfaces; E2 requires that such a productivity gain

is feasible, but only once the current capabilities of the model can be deployed through

applications with further inputs (e.g. access to internet or proprietary databases), or if it is

trained on domain-specific issues or data; E3 is applied when the productivity increase would

require image processing capabilities in addition to current text processing. Importantly, the

9

This data can be accessed via the O*Net database at https://www.onetonline.org/

10

While similar large-volume classification tasks in the past often relied on crowd-workers on online plat-

forms such as Amazon Mechanical Turk (MTurk), ChatGPT has recently been shown to outperform human

crowd-workers in accuracy in text classification tasks, while also exhibiting lower variability in scores across

multiple runs of the program (Gilardi, Alizadeh, and Kubli, 2023). Economists have also recently used other

large language models to classify unstructured text from job postings and found that they outperformed

other machine learning methods Hansen, Lambert, Bloom, Davis, Sadun, and Taska (2023).

11

The structure of the prompt submitted to the Open AI GPT API is shown in Appendix A.

7

model is asked not only to respond with the score but also to explain its reasoning, which

allows the researcher to audit whether GPT is in fact understanding the prompt as intended

and interpreting the task correctly. Note that this exceeds the auditing capabilities that are

available in many instances of human text classification - and that outputting this additional

information is enabled by the feature of LLMs that text generation is relatively cheap in terms

of time cost.

12

A random sample of scored tasks together with the model’s explanations can

be found in Table C1.

Consistency of Generative AI scoring To validate the consistency and replicability

of our procedure, we compare the scores assigned across 3 different GPT runs (which may

vary in results due to the randomized order of example cases provided, or non-deterministic

features of the underlying LLM) for a randomly selected subsample of 100 task statements.

We compare the different sets of scores as follows: First, we construct 3 different classi-

fications for each task based on the assigned score: (1) “Current exposure”: score 1 has

been assigned. (2) “Expected exposure:” Either score 1 or 2 has been assigned. (3) “Broad

exposure:” Any score other than 0 has been assigned (this includes exposure conditional on

image capabilities becoming further developed). Then, we compute the agreement between

different scoring runs with regard to which tasks belong in these categories. The compar-

ison between different runs is shown in Appendix Table C2. We find that the agreement

between different GPT runs is very high - they arrive at the same score for at least 88%

of all cases independent of the exposure classification considered. This validates that GPT

reliably provides classifications that are highly consistent across different runs.

Scoring occupations’ exposure to Generative AI We next aggregate tasks’ exposure

to Generative AI to the occupation level. For each 8-digit Standard Occupational Classifi-

caltion (SOC) occupation from the O*NET, we calculate the share of the total number of

tasks for each occupation that are affected by Generative AI. We follow Eloundou et al.

(2023) and focus on an aggregation that takes into account that scores of 1 represent the

current direct feasibility of productivity improvements, while exposure scores of 2 rely on

investment in additional capabilities, such as interaction through custom-built applications

or the ability to search local or online databases, that complement the current LLM chat

interface. Therefore, our main measure of the share of an occupation’s exposed tasks counts

both the number of tasks with exposure rubric 1, (N

1

) and those with exposure rubric 2

(N

2

) but applies half the weight to the latter. That is, our exposure score at the occupation

12

The model was also asked to return a confidence score (low/medium/high) for its prediction, but while

this may have led the LLM to focus on refining its answer in this regard, we do not use this dimension of

the response. In the large majority of cases, the model expresses “high confidence” in its assessment.

8

level for each occupation o is:

E

o

=

X

tasks in o

N

1

+ 0.5 ∗ N

2

N

0

+ N

1

+ N

2

+ N

3

.

Finally, we aggregate across 8-digit O*Net occupation codes to the 6-digit SOC level to match

the occupation-level exposure measure to firms’ occupational data. Note that the Gener-

ative AI exposure measure is bounded by 100% on the upper end, which would represent

that all tasks in that occupation can be done at least 50% faster with the already-existing

functionality of ChatGPT and similar tools. On the lower end, 0% indicates that none of

the tasks involved in the occupation are likely to be more productive now, or even after

additional applications have been built on top of current Generative AI technology. The

full set of 6-digit occupations for which we compute Generative AI exposures consists of 778

occupations, of which 678 are also contained in the firm-level employment structure data

described below. The mean and median exposure in the latter set of occupations are 23%

and 18%, respectively, with a standard deviation of 21 ppt. The inter-quartile range extends

from 6% to 38% exposure.

B. Measuring firms’ exposure to Generative AI

To estimate a firm’s exposure to Generative AI, we use data on firms’ occupational struc-

ture to aggregate our occupational exposure measure. We obtain data on firms’ occupational

employment from Revelio Labs, which collects information on job titles and employers from

LinkedIn and other resume profiles and constructs occupation-by-firm employment counts.

Our customized data define a firm at the unique Compustat identifier gvkey and define an

occupation using the 6-digit SOC. We use the employment counts for each gvkey-SOC6 as

of March 2022, which is the latest month in our data.

We construct a firm’s Generative AI exposure as the weighted average of its occupations’

Generative AI exposure, using the firm’s occupational employment as weights. That is,

E

f

=

X

occupations in f

EmpShare

f,o

∗ E

o

,

where EmpShare

f,o

=

emp

f,o

emp

f

is the employment share of occupation o in firm f. The result

of this procedure is a cross-section of 2,518 publicly-traded firms with predicted exposure to

Generative AI and basic company characteristics from Compustat. Summary statistics for

the distribution of Generative AI exposure across this set of firms are shown in Table I.

9

C. Other data

Firm earnings call transcripts data We manually collect firm earnings call transcripts

from the Seeking Alpha website for the tickers of all S&P 500 firms over the 2018-2023

period. To account for variations in the word forms, we applied standard natural language

pre-processing techniques to the text data, such as tokenizing and lowercasing. We then

counted the frequency of each keyword in each transcript and created a panel data set that

contained each ticker, quarter, year, and word counts for particular topics as variables.

Social media attention data To measure social media attention to GPT and related

technologies, we obtain data on Twitter mentions of “GPT” and “ChatGPT” by day for

2022 and 2023 from the media search platform Media Cloud.

13

II. Descriptive Facts about Generative AI Exposures

A. Generative AI Exposure and occupation characteristics

Table C3 shows an overview of the 20 occupations with the highest and lowest Genera-

tive AI exposure scores.

14

Note that among the highest exposure occupations, many, such

as “Telemarketers”, “ Computer programmers”, and “Interpreters and translators”, map

closely onto some of the key recent technological advances in Generative AI regarding its

ability to hold natural text-based conversations, generate functioning code based on high-

level descriptions of a programming task, and translate texts accurately between languages

and styles.

15

To better understand which occupation characteristics are associated with higher expo-

sure, Panel A of Figure 2 shows the relationship between the average wage level of each 2-digit

major occupation group in 2021 and our estimated Generative AI exposure. As the graph

shows, higher-wage occupations are generally more likely to be exposed to ChatGPT-like

technological advances making their constituent tasks more productive. One notable excep-

tion are the relatively low-wage “Office and Administrative Support” occupations, which are

13

URL: https://mediacloud.org/

14

Note that the lowest score category only shows a subset of a larger set of occupations with zero Generative

AI exposure.

15

While “Mathematicians” might seem out-of-place among occupations with high exposure to Generative

AI, note that Fields Medal winner Terence Tao of UCLA remarked in April, 2023, that “GPT-4 has saved

[him] a significant amount of tedious work”, noting that “while these AI tools do not directly assist [him]

in core tasks such as trying to attack an unsolved mathematical problem, they are quite useful for a wide

variety of peripheral (but still work-related) tasks (though often with some manual tweaking afterwards).”

(Source: https://pandaily.com/mathematician-terence-tao-comments-on-chatgpt/)

10

also predicted to be highly exposed. The positive relation between Generative AI exposure

and wage is also observed at the industry level. In Panel B of Figure 2, we aggregate oc-

cupational Generative AI exposure and occupational wages to the NAICS 2-digit industry

level using the 2021 BLS National Employment Matrix. We observe a similar pattern that

high-wage industries also tend to have high exposure to Generative AI.

Occupational skills and Generative AI exposure Our measure of exposure to Gen-

erative AI technologies is based on the ability of tools like ChatGPT to make certain tasks

more productive. Thus, we would like to understand how our exposure measure relates to

other classifications of occupations which have been previously been defined based on the

tasks that are involved in them. In particular, Acemoglu and Autor (2011) suggest that

technology-based productivity changes of past decades can be understood by scoring oc-

cupations based on the skills they involve. They suggest a characterization based on the

degree to which an occupation involves particular combinations of routine vs. non-routine,

cognitive vs. manual, and analytical vs. interpersonal aspects. To understand how their

categories map onto occupations that can be made more productive by ChatGPT-like tech-

nologies, we regress our 6-digit occupation Generative AI exposure measure jointly on the

set of occupational skill scores defined by Acemoglu and Autor (2011). That is, we run the

following regression:

E

o

= α +

X

S

β

S

∗ Skill

o

+ ε

o

The results are shown in Figure 3. We find that occupations with higher Generative AI

exposure are more likely to involve non-routine cognitive analytical skills or routine cognitive

skills, and less likely to involve different kinds of manual skills, or interpersonal skills.

The literature on previous waves of computer-based automation argued that routine work

was most likely to be substituted by computers and to complement non-routine communica-

tion and problem-solving tasks (Autor et al., 2003). This “routinization” hypothesis assumed

that “computers and computer-controlled equipment are highly productive and reliable at

performing the tasks that programmers can script - and relatively inept at everything else”

(Acemoglu and Autor, 2011). While routine tasks and jobs were taken over by comput-

ers, workers skilled in “abstract” tasks were in high demand, leading to wage polarization.

However, while in the past abstract jobs requiring “problem-solving, intuition, persuasion,

and creativity” (Acemoglu and Autor, 2011) appeared safe from substitution by comput-

ers, Figure 3 suggests that the labor market impact due to recent Generative AI advances

may be different. Tools like ChatGPT can interpret and respond to relatively unstructured

inputs, display a surprising amount of common sense in filling in gaps in instructions, and

11

can respond with relatively complex outputs, such as texts in different styles, or – in the

case of image generators like Stable Diffusion or Midjourney – even with new and original

images (Bubeck, Chandrasekaran, Eldan, Gehrke, Horvitz, Kamar, Lee, Lee, Li, Lundberg,

et al., 2023). As a result, this wave of technological change may differ from previous waves

in that many tasks in non-routine cognitive analytical jobs that were safe from automation

by previous technologies are now suddenly more likely to be substituted for by software and

computers. Combined with the unprecedented speed with which this wave of computer-based

automation tools is being adopted, this portends that the effects on wages and inequality

across different demographic groups may look very different this time around than for the

automation waves of the past.

B. Summary of firms’ Generative AI exposure

Table I shows the summary statistics of our sample which includes 2,518 publicly traded

firms in the cross-section of 2022. On average, the firms in our sample have a mean and

median task exposure score of 35%, with a standard deviation of 8 ppt. The firm-level

measure of exposure to Generative AI spans from 27% at the 10th percentile to 44% at the

90th percentile. Figure 4 shows that the variation of firm-level exposure to Generative AI

has both across-industry and within-industry components. While industry sectors such as

“Information” and “Professional, Scientific, and Technical Services” have an average firm

exposure to Generative AI of about 13 ppt greater than industries such as “Accommodation

and Food Services,” there are substantial variations of firms’ exposure to GPT within each

industry. A variance decomposition shows that industry differences explain about 18% of

the firm-level variation in exposure to Generative AI.

Table II lists the 15 firms with the highest and lowest exposure to Generative AI, re-

spectively, among the top 100 largest U.S. firms by market capitalization in 2022. While

many IT firms, such as IBM and Intuit, not surprisingly have a large fraction of employees

exposed to Generative AI, we also observe manufacturing firms, such as 3M, and adminis-

trative conglomerates, such as S&P Global, in this high-exposure category. The large U.S.

firms ranked at the bottom of the exposure distribution include restaurants, such as Star-

bucks and McDonald’s, retail firms, such as Target and Walmart, transportation firms, such

as UPS, and manufacturing firms, such as Tesla, suggesting that they have a smaller fraction

of employees exposed to Generative AI.

The rich cross-industry and within-industry variations in firms’ exposure to Generative

AI motivate us to explore our firm-level empirical analyses within and across industries.

Importantly, our within-industry analyses also help to differentiate our labor-based mech-

12

anism from the product-based mechanism when studying the effects of firms’ exposure to

Generative AI on firm values.

How do firms’ and industries’ exposure to Generative AI relate to their other character-

istics? Panel A of Table III shows that firms with higher exposure to Generative AI tend

to be smaller, have greater Tobin’s Q, and are less profitable. These findings are consistent

with the notion that such small and high-growth firms tend to focus their workforce on

cognitive tasks such as R&D. Indeed, we also observe that firms with high R&D intensity

are more exposed to Generative AI. Moreover, we also observe that firms with higher la-

bor intensity, higher organizational capital ratio (Eisfeldt and Papanikolaou, 2013) and less

tangible capital are more exposed to Generative AI. These cross-firm findings hold consis-

tently within-industry and cross-industry as well. Panel B of Table III shows that the above

findings are qualitatively similar after we include NAICS 2-digit industry fixed effects in

the regressions. Figure 5 plots the relationship between industry sectors’ mean exposure to

Generative AI (averaged across Compustat firms) and industries’ other characteristics. In

line with the firm-level patterns, we observe a consistent picture that industries with higher

exposure to Generative AI have firms that are smaller, have higher Tobin’s Q and lower

current profitability, and feature higher organizational capital and lower tangible capital.

III. Investor Communication and Exposure to

Generative AI Technology

To understand whether firms communicate that they are affected by the technological

change as a result of the evolution of large language models and other Generative AI tools,

and to validate our bottom-up measure of language model exposure based on firms’ employ-

ment structure, we first analyze the public communication between firms and investors. We

focus on earnings conference calls, as firms use earnings conference calls to communicate

their views regarding risks and opportunities, (see, e.g. Hassan, Hollander, Van Lent, and

Tahoun (2019)) as well as past and expected future performance. Moreover, they respond

to questions by analysts who may reflect investors’ perspectives of which issues particular

firms should focus on. If the technological change resulting from the recent rapid evolution

of large language models is indeed affecting firms as we postulate, we should see both a time

pattern of increasing communication regarding these issues that coincides with the launch of

ChatGPT, as well as a cross-sectional pattern of larger increases in this kind of firm-investor

communication among firms for which our bottom-up measure predicts higher Generative

AI exposure.

13

A. Measuring earnings conference call mentions of technologies

We use the Seeking Alpha website to manually collect a panel of the earnings conference

call transcripts for S&P 500 firms, for calls that were held from July 2018 to March 2023. For

each of these earnings calls, we assign a calendar month, quarter, and year (as distinct from

the fiscal year and quarter referenced in the call), based on the time stamp of the earnings

call transcript. We process each transcript by converting it into a list of lower-case tokens,

creating separate lists of unigrams (one-word tokens) and bigrams (two-word tokens).

Topic definitions We define four categories of words (incl. their plural form where ap-

plicable) that we compare to the list of unigrams and bigrams in each earnings call: (1)

Machine learning-related words that are not specific to Generative AI technologies.

16

(2)

Generative AI -specific words: “LLM”, “ChatGPT”, “GPT”, “GPT3”, “GPT4”, “genera-

tive”, “language model”. (3) Generic engineering-related words: “engineer”, “engineering”.

Our sample size and composition vary somewhat across years, and we may not fully cap-

ture all earnings calls for each firm, but we capture the vast majority of relevant earnings

calls, with the number of unique S&P 500 companies with calls in our sample in each quar-

ter varying from 377 to 474. Moreover, our sampling procedure of hand-collecting publicly

available transcripts from Seeking Alpha is unlikely to be biased with regard to Generative

AI exposure - which would be the selection bias of relevance.

B. Aggregate trends in earnings call mentions

To see how mentions of these topics evolve over time, we compute two aggregate variables

for each month and topic: First, we capture the share of calls in our sample that mention

a word from that category, which captures the extensive margin of whether there is any

sufficiently large perceived firm exposure for investors or firm management to mention it.

Second, we compute the mean number of category words per call in our sample, which

additionally captures the intensive margin of longer discussions of the topics. The aggregate

trend in these variables for the Generative AI topic, which is our proxy for firms discussing

ChatGPT-like technologies, is shown in Figure 6. For comparison, each graph also shows the

equivalent trends for other machine learning topics, and for generic mentions of engineering.

To allay concerns that only investors in software companies are likely to be knowledgeable

about, or have an interest in, the Generative AI topic, we also show the same trends excluding

the “Information” (NAICS 51) and “Professional, Scientific, and Technical Services” (NAICS

16

These are: “deep learning”, “ML”, “machine learning”, “deep learning”, “natural language”, “neural

net”, “neural network”, “NLP”.

14

54) sectors in Panels B and D, as determined by Compustat industry codes.

While the sample only reflects companies that had earnings calls before March 2023, there

is an unmistakeable break in the trend shortly after the release of ChatGPT in November

2022: both measures show that an increasing number of firms seem to consider language

models and generative AI as important enough that they are discussed in earnings conference

calls. Moreover, these trends are separate from discussions of machine learning or engineering

in general, which do not show a large increase in 2023 – so this is not simply a reflection of

companies in general - or in our sample - becoming more technical in their language over

time. Generative AI-related topics were discussed in 27% of all earnings conference calls

by March 2023, and in 13% of calls outside the software-related sectors. The number of

mentions per call in Panel C rises even more steeply than the share of firms discussing the

topic, suggesting that discussions of the topic increase at the intensive margin in addition to

the extensive margin. Overall, earnings call mentions show that the rapid rise in importance

of language model technologies is reflected in the communication between firms and analysts

- suggesting that they are also likely to influence valuations by investors.

C. Firm-level Generative AI exposure and earnings call topics

While Figure 6 shows that general interest in LLM-related topics is on the rise following

the release of ChatGPT in November 2022, we also want to understand which firms are more

likely to discuss related topics. To see how our firm-level predicted Generative AI exposure

relates to these changes in earnings call mentions, we run repeated cross-sectional regressions

of the form,

[Topic X]

i,t

= α

t

+ β

X

t

E

f

i

+ γ [Topic X]

i,2019

+ ε

i,t

(1)

where the dependent variable is a binary indicator for whether company i’s earnings calls

in quarter t have any mentions of topic X, and E

f

i

is the firm’s Generative AI exposure.

We also control for whether the firm already mentioned the topic in any 2019 earnings calls.

This means that the coefficient β

X

t

here estimates the degree to which firms with higher

Generative AI exposure are more likely to start (or stop) discussing topic X in earnings calls

in comparison to 2019.

The quarterly β

X

t

coefficients over 2020-2023 for each topic are shown in Figure 7. The

findings validate our Generative AI exposure measure’s ability to pick up on firms’ exposure

to a technology shock driven by Generative AI. Panels A and B confirm that exposed firms

– according to our bottom-up measure – were more likely to discuss Generative AI topics

than other firms, both in the full sample and when we exclude sectors with many software

15

and technology companies. Moreover, they only became more likely to discuss Generative

AI topics after the recent wave of innovation in those fields in Q4 of 2022 - so our exposure

measure does not identify companies that were involved in discussions about these technolo-

gies before ChatGPT was released. Put differently, the fact that our Generative AI exposure

measure does not predict a higher likelihood of mentioning these technologies before the re-

cent productivity shock suggests that it does a reasonable job of identifying companies that

are newly exposed to this particular way of using AI to improve productivity. Moreover, the

similar patterns in Panels B and D, where we exclude firms in the “Information” (NAICS 51)

and “Professional, Scientific, and Technical Services” (NAICS 54) sectors, confirms that this

pattern is not limited to investor communication for IT companies. The effect on mentions

of generic engineering topics in Panels C and D shows that the break in trend with regard to

the effect of our Generative AI exposure measure on whether a firm mentions Generative AI

does not extend to higher mentions of engineering topics more generally. This validates our

firm-level exposure measure capturing the potential impact of technologies like ChatGPT in

particular.

The magnitude of these effects is large: The β

X

t

coefficients indicate the percentage point

change in the probability that the firm mentions the topic in an earnings call in that year,

relative to 2019, for each percentage point change in the share of tasks in that firm that is

exposed to Generative AI . That is, the March 2023 coefficient in Panel A suggests that a 1

ppt increase in firm exposure is associated with a more than 1 ppt higher likelihood in 2023

of the firm mentioning Generative AI relative to 2019.

Firm-level panel regressions of earnings call topics on Generative AI exposure

In order to be able to more flexibly control for different firm characteristics in determining

the association between our Generative AI exposure measure and topics mentioned in firm

earnings conference calls, we also estimate firm-level panel regressions. We aggregate our

monthly data into a firm-quarter panel in order to ensure that most firms have a continu-

ous time series of earnings calls over the period of Q3 2018–Q1 2023. Then, we estimate

regressions of the form

[Gen. AI Topic Mentioned]

i,t

=α

t

+ α

i

+ β

1

E

f

i

+ β

2

E

f

i

× [Post-ChatGPT] (2)

+ γ [Post-ChatGPT] + ε

i,t

(3)

where we regress whether a firm mentions Generative AI related words in an earnings con-

ference call in that quarter on the measure of firm exposure to to the technology and its

interaction with an indicator of whether the quarter is “post-ChatGPT”, which corresponds

16

to Q4 2022 and Q1 2023 in our sample. This specification allows us to quantify the precise

degree to which higher exposure under our measure is associated with a higher likelihood of

mentioning Generative AI technologies after the launch of ChatGPT compared to before –

which was not possible in the repeated cross-sectional regressions in Figure 7.

The results of estimating Equation 3 in our sample are shown in Table IV. In the first four

columns, we add increasingly stringent combinations of fixed effects to the baseline regression.

In column 1 we control for calendar quarter fixed effects, which will capture the degree to

which people are in general more likely to speak about the topic in particular periods. We

also add first industry sector fixed effects, and then firm fixed effects, to control for the degree

to which particular sectors and firms are more likely to mention particular technology topics

at all times. The most stringent specification in column 4 suggests that a 10 ppt increase in

Generative AI exposure is associated with a 7.6 ppt increase in the likelihood of mentioning

the Generative AI topic – or that the interquartile range of exposure to Generative AI is

associated with about a 7 ppt difference in the likelihood of talking about the topic. To

ensure that this pattern is not limited to software companies, we repeat the most stringent

estimation in column 5, and exclude NAICS sectors 51 and 54. The result shows that,

even outside of these sectors, more exposed firms are significantly more likely to mention

Generative AI after the ChatGPT launch, but the coefficient is smaller, suggesting a 3.1 ppt

increase in the share of firms mentioning it for a 10 ppt increase in exposure. In general,

our results on investor communication reveal that the technological advances in question are

salient to investors, rapidly rising in importance based on their prevalence in communication,

and more likely to be mentioned by firms that our bottom-up measure predicts to be more

exposed.

IV. Stock Market Impact of Generative AI Exposure

A. Stock return volatility, social media attention, and firms’ Generative AI

exposure

Our measure of firm-level Generative AI exposure is intended to capture the relative

degree to which tasks in a firm can be made more productive by advances in language models.

However, it is ex-ante ambiguous whether greater exposure should be associated with higher

returns: while higher productivity should lead to lower costs of producing the output of firms

in a particular industry, the degree to which this cost improvement is captured by incumbent

firms can vary. For instance, if new entrants are more likely to be flexible enough to take

advantage of the benefits of large language models, incumbent profits could actually fall in

17

response to the technology shock.

Even if the sign of the impact of Generative AI exposure on stock returns is unclear, the

release of new information about the technology can be expected to increase the volatility

of returns for affected companies. Conversely, if our exposure measure is a valid proxy for

firm-level characteristics that are specific to GPT-like technologies, higher return volatility

associated with this exposure should be associated with new information about these tech-

nologies. First, we explore whether Generative AI exposure is in fact associated with higher

stock return volatility on the days after the release of ChatGPT on November 30th, 2022,

which was the beginning of the period when the technological advances around large lan-

guage models started to become widely known. For each trading day from November 15th

to March 31st, we run separate regressions of the form

|r|

it

= α

t

+ α

ind

+ β

t

GenAIExposure

i

+ ε

it

,

where β

t

captures the degree to which our firm-level measure of Generative AI exposure

predicts higher return volatility on that day, and we control for 2-digit industry sector fixed

effects α

ind

to capture the degree to which Generative AI exposure might simply correlate

with industry news coming out around the same time. The time series of t-statistics testing

whether this coefficient is zero on each day are shown in Panel A and B of Figure 8 for

the specifications without and with industry fixed effects. There are only a small number

of periods when the stock return volatility effect of Generative AI exposure clearly exceeds

conventional significance thresholds with a t-statistic well above 2, but in both graphs they

include November 30th, 2022, which is the day that ChatGPT was released to the public, and

at least one other day in the two weeks after the release, which corresponds to the period

when many major news outlets were first covering the surge in interest in large language

models, that resulted from encounters with ChatGPT’s capabilities. Note that, even though

our exposure measure uses no information other than a firm’s employment structure, its

association with stock returns actually identifies the relevant period when the capabilities of

ChatGPT were first becoming known, suggesting that it captures exposure to this particular

technology.

Panels C and D of Figure 8 confirm that the days on which our firm employment-structure

based measure of Generative AI exposure predicts higher stock return volatility around the

release of ChatGPT closely coincide with surging social media attention to the technology:

Twitter mentions of “ChatGPT” and “GPT” spike relative to their trend right after the

release of ChatGPT, supporting the argument that the higher association between stock

volatility and Generative AI exposure in this period indeed reflects investor incorporating

18

new information into stock prices. The fact that the volatility impact of our Generative AI

exposure measure reliably identifies the key period when major related news was released

validates that it captures a dimension of exposure to the associated technologies that is

relevant to market participants.

Defining the ChatGPT “event” period In order to identify the effect of Generative

AI exposure on firm returns in this relatively short time series, we want to focus on days

when market participants were incorporating substantial news about related technologies

into their valuation of firms. The method above suggests that Generative AI exposure was

associated with high stock return volatility particularly during the initial ChatGPT launch

and in the weeks thereafter as the market discerned the likely impact of this technological

advance and aggregated relevant information. This period also coincides with a time period

when the growth in Twitter mentions of the topic suggests a high level of interest and new

information. We, therefore, focus on the “ChatGPT release period” consisting of November

30, 2022, and the two weeks following it in our main analysis of the stock return impact of

the new technology.

17

B. Realized returns and Generative AI exposure

Forming Generative AI exposure portfolios To estimate whether Generative AI ex-

posure affects the realized returns of stocks during the event window, we first form value-

weighted high and low exposure quintile portfolios, and also a high-minus-low portfolio (H-L)

– which we will also refer to as the “Artificial Minus Human” (AMH ) portfolio – that repre-

sents the zero net investment portfolio long high exposure (H) stocks and short low exposure

(L) stocks.

18

All portfolios are formed based on market capitalization weights as of October

31, 2022, and exposure measures based on March 2022 firm-level employment structures,

and weights are adjusted daily to mimic passive buy-and-hold exposure. The returns data

set consists of daily stock returns from Yahoo Finance for Nov. 15, 2022 - March 31st,

2023, as well as Fama-French 5-Factor data and risk-free returns from Ken French’s web-

site. We also form industry-neutral portfolios by first forming within-2-digit NAICS industry

value-weighted quintile portfolios, and then averaging portfolio returns for the same quintiles

across industries while applying industry market capitalization as weights.

Generative AI exposure returns after ChatGPT release We compute realized excess

daily stock returns across Generative AI exposure portfolios during different time periods,

17

To be precise, we use returns on all trading days from Nov. 30, 2022 to Dec. 14, 2022.

18

See the Appendix for details on the portfolio construction.

19

estimated from regressions of the form

r

pf

it

− r

f

t

=α

release

i

[ChatGPT release period]

t

+ α

not release

i

[Not ChatGPT release period]

t

+ β

i

(Mkt

t

− r

f

t

) + ε

it

,

where the intercept represents either the mean return for the full period, or is allowed to vary

with whether the day is part of the ChatGPT release period or not, as defined above. Table

V shows the mean excess realized returns by portfolio for different specifications, comparing

returns for the full time period of Nov. 15, 2022 - March 31, 2023, and returns on the days

when we would expect the Generative AI exposure to matter for returns, i.e. the two weeks

after the ChatGPT release.

Panel A of Table V shows raw excess returns: The AMH high-minus-low exposure port-

folio has positive daily excess returns of 0.4% (t-statistic > 3) on average during the post-

ChatGPT release dates, but not outside of that period. This key finding – that highly

exposed companies have higher average returns only on days when advances in language

model technology become known – also validates our bottom-up measure of technology ex-

posure, as it predicts higher returns if, and only if, the dates are likely to be associated with

updating about the potential of the recently released technology.

In Panel B of Table V, we additionally control for each portfolio’s exposure to the market

return factor. The magnitude of the positive return effect is largely unaffected, and continues

to be statistically highly significant and large. One additional concern might be that the

Generative AI exposure quintiles load on particular industries, such as technology companies,

and that the exposure to the relative performance of these industries drives the realized

return variation across exposure quintiles. While the fact that the portfolio outperformance

occurs only on GPT news release dates makes it unlikely that this is an important issue

in our analysis, in Panel C we show the performance of sector-neutral factor portfolios,

also adjusted for market factor exposure.

19

In this specification, the excess returns to the

AMH portfolio are almost identical to those in Panel B, suggesting that the Generative

AI exposure factor is not simply driven by an association between exposure and particular

industry sectors.

Note that, across the different models in Table V, mean daily excess returns across the

period as a whole and returns outside of the ChatGPT release period are small, statistically

indistinguishable from zero, and almost flat across Generative AI exposure quintiles for the

19

These portfolios are formed by sorting firms into quintiles within each industry and then forming quintile

portfolios by taking a weighted average of the corresponding quintile in each industry sector, thereby pre-

venting the quintiles from loading excessively on particular industries. See the Appendix for further details

on the portfolio construction.

20

period as a whole. This reduces concerns that Generative AI exposure spuriously correlates

with other firm characteristics that are driving differential returns over the period in question.

In contrast, on the days when exposure to large language model productivity changes should

actually matter, returns vary significantly with whether a firm is more or less exposed based

on our bottom-up task-based measure. In the two week period after the ChatGPT release,

excess returns monotonically increase across Generative AI exposure quintiles, as shown in

Figure 9 for the market-factor adjusted, industry-neutral exposure quintiles.

20

As a robustness check for our analysis, we also consider whether the excess returns on

the Generative AI-exposed stocks after the release of ChatGPT can be explained by an

association between this exposure and other risk factors. We replicate the previous portfolio

returns analysis but additionally control for the returns on the factors in the Fama French

5-factor model (Fama and French, 2015). The results are shown in Appendix Table C7.

We find that the 5-factor-adjusted excess returns (and the industry-neutral version) on the

AML portfolio during the ChatGPT release period are smaller, albeit still sizable, in this

specification, suggesting daily excess returns of 0.3%, and statistically highly significant.

Moreover, Appendix Figure B2 shows that excess return variation across Generative AI

exposure portfolios is highly monotonic even in this specification.

Time series of Generative AI exposure portfolio returns To further validate that

the Generative AI exposure factor returns are associated with the advances in the related

technology, we also consider the time series of daily excess returns on industry-neutral port-

folios in Figures 1 and 10 – which show the results for global sorts and industry-neutral sorts

– comparing the cumulative excess returns of the high, the low, and the high-minus-low

AMH portfolios. The graphs of the high and low exposure portfolios show that, if anything,

that the high exposure portfolio had lower returns in the two weeks preceding the release

of ChatGPT. On the other hand, the returns of the “A” and “H” portfolios diverge rapidly

thereafter, with most of the gains to the high exposure portfolio concentrated in the two-week

period after the release. The cumulative returns to the high-minus-low zero net investment

portfolio over the full time period through March 31st are large. Cumulative returns to

holding a portfolio that is long the highest-exposure quintile, and short the lowest-exposure

quintile from the release date (Nov. 30, 2022) through March 31, 2023 are 9.4% for the

global sort across all stocks, and 5.1% for the sector-neutral sorts (see Appendix Figure B4

for the time series of the cumulative excess returns without adjusting for market factors).

The corresponding values when adjusting for the market factor are 8.5% and 5.0%.

20

See Figure B1 for the variation across portfolios sorted jointly across all stocks (not industry-neutral) in

market-factor adjusted returns.

21

C. Heterogeneity in returns to Generative AI exposure

The results in the previous section showed our key result that, on average, a higher

exposure to Generative AI technology advances due to a prevalence of affected tasks in a firm

was associated with higher realized stock returns after the release of ChatGPT. However,

there is reason to believe that these effects might vary in size, and perhaps also in sign,

across different industries. On the one hand, our exposure measure focuses on the labor

cost and productivity dimensions of the impact of these technology shocks. However, there

will likely also be simultaneous effects on product market competitiveness for different firms,

depending on whether their product complements, or substitutes for, the capabilities of

products like ChatGPT for end-consumers. Similarly, some companies may have valuable

intangible capital that is made obsolete – e.g. because ChatGPT obviates the productivity

advantage of proprietary internal software and processes – or increases in value, for instance

if the company controls access to data sources that can be more effectively analyzed in

conjunction with large language model capabilities.

In addition, industry structure and contestability might affect the impact of higher Gen-

erative AI exposure on publicly traded incumbents. If entry into the product market becomes

easier as Generative AI technology lowers the cost of putting together minimum viable prod-

ucts, or if start-ups in an industry are more likely to have the organizational flexibility to

quickly incorporate these new technologies into their workflows, then incumbents with high

exposure to Generative AI technologies may lose out in relative terms, even if the overall

impact on the industry’s productivity is positive. While it is too early to make definitive

statements about which firms will be winners or losers as a result of recent technology ad-

vances, this section will provide early suggestive evidence of what industry characteristics

have been associated with higher return effects.

Industry portfolio heterogeneity in ChatGPT release period returns One way

of looking at industry heterogeneity is to consider which industry portfolios exhibit returns

after the release of ChatGPT that exceed or fall short of that predicted by their Generative

AI exposure. Figure 11 shows the variation in market factor-adjusted excess realized returns

of 3-digit industry portfolios either during the two weeks after the ChatGPT release (upper

panel), or on all other days of the Nov 15, 2022 - March 31, 2023, period (lower panel).

There is a positive association across industries between average industry level Generative

AI exposure and returns during the weeks after the ChatGPT release. Moreover, as the

lower panel confirms, this is not due to the fact that high Generative AI exposure industries

incidentally experienced systematically higher or lower returns over the nearly 5 months in

our study: the average excess daily returns of almost all 3-digit industry portfolios are small

22

and do not vary with Generative AI exposure over this period. That is, the Generative AI

-related returns effect is evident at the industry level only on the event days when ChatGPT

news is most likely being incorporated into valuations.

However, Figure 11 also shows that some industries with high Generative AI exposure

perform even better on news days than we would expect based on a simple linear relationship

between exposure and returns, i.e. their news day returns lie above the red line. For example,

the highest returns on news days among large subsectors accrue to firms in the industry

subsector “Publishing industry (except internet)”, in which the largest firms by market cap

are Microsoft, Salesforce, and Intuit. While Microsoft is directly associated with the success

of ChatGPT and related products through its investment in Open AI, the company releasing

this tool, Salesforce and Intuit operate software businesses focused on customer relationships,

tax, personal finance, and accounting data. It is intuitive that better analytical tools based

on Generative AI can, for instance, make the proprietary data resulting from these business

lines more valuable.

Within-industry Generative AI exposure effects While there is substantial variation

across industries in their overall exposure and performance after the release of ChatGPT,

there may also be differences in the degree to which high-exposure firms outperform low-

exposure firms relative to other firms within the same industry. That is, in some industries

the ability to convert relatively higher exposure to the technology shock into higher firm-

level returns may be better than in others, independent of whether the industry as a whole is

benefiting from higher Generative AI exposure or not. Moreover, exploring how the within-

industry outperformance varies also provides evidence for how widespread the Generative AI

technology effects are outside of the “Information” sector that is most likely to see impacts

distorted by simultaneous product market effects.

Figures 12 and 13 show the average daily return alpha during the ChatGPT release period

for H-L portfolios within each sector or subsector, respectively, for quintiles at the NAICS

2-digit sector and terciles at the 3-digit subsector level.

21

Although the standard errors for these within-industry portfolio regressions are necessar-

ily larger, as some industries have a limited number of firms in the sample, we do indeed find

that the Generative AI exposure effect is significantly different from zero in several sectors

and subsectors. Focusing on the more detailed categories in Figure 13, we find significant

21

Each graph only includes sector or subsectors that have (1) a large enough sample of firms in the data,

consisting of at least 10 firms across the high and low exposure quantile, and (2) a large enough Generative

AI exposure spread between the high and low exposure portfolio, with cutoffs set at a 10 ppt spread between

the high and low quintiles for 2-digit sectors, and at 5 ppt between the high and low tercile for 3-digit

subsectors.

23

positive returns within ‘credit intermediation & related activities”, which contains several

large banks and brokerages, “publishing industries (except internet)”, which contains Mi-

crosoft, Salesforce, and Intuit, as noted above, and also the “administrative and support

services” subsectors. In contrast, the “real estate”, “other information services”, and “food

manufacturing” subsectors” all show negative within-industry returns to higher Generative

AI exposure. Contrasting this with non-release period within-industry returns shown in

Appendix Figures B5 and B6, we can see that the latter are more precisely estimated and

small, as well as not significant with few exceptions. This suggests that the variation in

within-industry returns to Generative AI exposure are likely to be driven by information in-

corporated during the ChatGPT release period, rather than generally during our 4.5 month

sample period.

Industry characteristics and within-industry Generative AI exposure effects The

previous analysis raises the question of what industry characteristics can explain the observed

heterogeneity in whether industries are more likely to exhibit a high return on the within-

industry AMH exposure portfolio. We explore this question by running regressions of the

form

α

news,AMH

i

= η + γCharacteristic

i

+ ε

i

,

which relate the subsector AMH Generative AI exposure portfolio alpha to various industry

characteristics that are computed as either the average of the characteristics for the industry

(left panel of Figure 14), or the difference between the high and low Generative AI exposure

portfolios in the characteristic within that industry (right panel of Figure 14). In either case,

both the dependent and independent variables are transformed into standardized Z-scores,

such that coefficients capture the relationship between a change in the characteristic by one

standard deviation and a standardized change in within-industry returns to Generative AI

exposure.

As shown in Figure 14, industry subsectors with larger firms are more likely to have high

within-industry returns to differences in Generative AI exposure. Moreover, high Generative

AI exposure firms are more likely to outperform the low exposure firms in the same industry,

if the former have higher ROE, ROA, market capitalization, gross profitability, or organi-

zational capital. However, these associations are only suggestive: the precise characteristics

that allow some firms to take better advantage of language model-driven technological ad-

vances will hopefully be considered in future studies.

24

V. Conclusion

Market prices indicate that the arrival and diffusion of large language models and Gen-

erative AI represent a major technology shock with important effects on the overall value

of firms, as well leading to winners and losers. This paper uses occupational exposures to

Generative AI, along with firm-level measures of occupational composition, to assess the ex-

posure to Generative AI innovations at the firm level for publicly traded U.S. corporations.

We find that the effect of the release of ChatGPT on firm values was large, driving a differ-

ence in firm returns of approximately .4% daily, translating to over 100% on an annualized

basis. These differences were realized both within and across industries, and display wide

variation which is correlated with firm characteristics such as organizational capital or gross

profitability. According to investors, ChatGPT represents an important shock to corporate

valuations.

25

REFERENCES

Acemoglu, Daron, and David Autor, 2011, Skills, tasks and technologies: Implications for

employment and earnings, in Handbook of labor economics, volume 4, 1043–1171 (Elsevier).

Akcigit, Ufuk, and Sina T Ates, 2020, Slowing business dynamism and productivity growth

in the united states, in Kansas City Federal Reserve. Paper prepared for the 2020 Jackson

Hole conference.

Autor, David H, Frank Levy, and Richard J Murnane, 2003, The skill content of recent

technological change: An empirical exploration, The Quarterly journal of economics 118,

1279–1333.

Babina, Tania, Anastassia Fedyk, Alex He, and James Hodson, 2021, Artificial intelligence,

firm growth, and product innovation, Firm Growth, and Product Innovation (November

9, 2021) .

Babina, Tania, Anastassia Fedyk, Alex Xi He, and James Hodson, 2020, Artificial intelli-

gence, firm growth, and industry concentration, Firm Growth, and Industry Concentration

(November 22, 2020.

Babina, Tania, Anastassia Fedyk, Alex Xi He, and James Hodson, 2022, Firm investments

in artificial intelligence technologies and changes in workforce composition, Available at

SSRN .