ASIAN DEVELOPMENT BANK

ASIAN DEVELOPMENT BANK

6 ADB Avenue, Mandaluyong City

1550 Metro Manila, Philippines

www.adb.org

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

Motorcycles are a major component of road transport in Indonesia with more than 120 million estimated to

be in use. While the number of motorcycles operating in the country has steadily grown in recent years, the

proportion of electric motorcycles remains very low. A shift away from fossil-fuel-based motorcycles will

provide considerable benefits for Indonesia by reducing air and noise pollution, greenhouse gas emissions,

and reliance on fuel imports. This report examines how such a shift can be achieved with a focus on electric

motorcycle charging infrastructure. It draws on best practices from other economies to provide a road map

and policy recommendations for developing this infrastructure.

About the Asian Development Bank

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific,

while sustaining its eorts to eradicate extreme poverty. Established in 1966, it is owned by 68 members

—49 from the region. Its main instruments for helping its developing member countries are policy dialogue,

loans, equity investments, guarantees, grants, and technical assistance.

ELECTRIC MOTORCYCLE

CHARGING INFRASTRUCTURE

ROAD MAP FOR INDONESIA

OCTOBER 2022

ASIAN DEVELOPMENT BANK

OCTOBER 2022

ELECTRIC MOTORCYCLE

CHARGING INFRASTRUCTURE

ROAD MAP FOR INDONESIA

Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO)

© 2022 Asian Development Bank

6 ADB Avenue, Mandaluyong City, 1550 Metro Manila, Philippines

Tel +63 2 8632 4444; Fax +63 2 8636 2444

www.adb.org

Some rights reserved. Published in 2022.

ISBN 978-92-9269-474-6 (print); 978-92-9269-475-3 (electronic); 978-92-9269-476-0 (ebook)

Publication Stock No. TCS220426

DOI: http://dx.doi.org/10.22617/TCS220426

The views expressed in this publication are those of the authors and do not necessarily reflect the views and policies

ofthe Asian Development Bank (ADB) or its Board of Governors or the governments they represent.

ADB does not guarantee the accuracy of the data included in this publication and accepts no responsibility for any

consequence of their use. The mention of specific companies or products of manufacturers does not imply that they

are endorsed or recommended by ADB in preference to others of a similar nature that are not mentioned.

By making any designation of or reference to a particular territory or geographic area, or by using the term “country”

inthis document, ADB does not intend to make any judgments as to the legal or other status of any territory or area.

This work is available under the Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO)

https://creativecommons.org/licenses/by/3.0/igo/. By using the content of this publication, you agree to be bound

bytheterms of this license. For attribution, translations, adaptations, and permissions, please read the provisions

andterms of use at https://www.adb.org/terms-use#openaccess.

This CC license does not apply to non-ADB copyright materials in this publication. If the material is attributed

toanother source, please contact the copyright owner or publisher of that source for permission to reproduce it.

ADB cannot be held liable for any claims that arise as a result of your use of the material.

Please contact pubsmarketing@adb.org if you have questions or comments with respect to content, or if you wish

toobtain copyright permission for your intended use that does not fall within these terms, or for permission to use

theADB logo.

Corrigenda to ADB publications may be found at http://www.adb.org/publications/corrigenda.

Notes:

In this publication, “$” refers to United States dollars.

ADB recognizes “China” as the People’s Republic of China.

On the cover: Electric mobility can help make transportation more sustainable. Many elements, charging stations,

batteries, operators must come together to enable the electric transport transition.

Cover design by Claudette Rodrigo.

Printed on recycled paper

iii

Contents

TABLES, FIGURES, BOXES, AND MAPS v

ABBREVIATIONS viii

WEIGHTS AND MEASURES ix

ELECTRIC TWOWHEELER DEFINITIONS x

SUMMARY xi

INTRODUCTION AND BACKGROUND

FOCUS OF THE REPORT

2.1 Vehicle Category Focus 3

2.2 Geographical Focus 4

CLIMATE CHANGE BACKGROUND

3.1 Greenhouse Gas Emissions 5

3.2 National GHG Commitments and Electric Vehicle Policies 6

3.3 Electricity Generation 7

ASIA’S EXPERIENCE WITH ELECTRIC MOTORCYCLES

4.1 Experiences with Promotion Policies for Electric Motorcycles 9

4.2 Experiences with Charging Infrastructure for Electric Motorcycles 12

ELECTRIC TWOWHEELER USER CATEGORIES

MOTORCYCLE CLASSIFICATION AND COMPARISON

6.1 Private Users 23

6.2 Commercial Users 28

6.3 Summary Electric Two-Wheeler Usage Type 30

CONVERSION OF GASOLINE MOTORCYCLES AND BATTERY STANDARDIZATION

7.1 Conversion of Motorcycles 32

7.2 Battery Standardization 33

ELECTRIC MOTORCYCLE PROJECTIONS

8.1 Ocial Scenarios 34

8.2 Scenario Modelling 36

8.3 Impact of Decreasing Electric Motorcycle Prices 37

8.4 Impact of a Carbon Tax 38

8.5 Conclusions on Business-As-Usual Development 39

8.6 Subsidy Scenario 39

8.7 Regulatory Scenario 41

iv

Contents

8.8 Comparison of Electric Motorcycle Deployment of Scenarios in JABODETABEK and Bali 42

8.9 Viewpoint of Manufacturers 43

ELECTRIC MOTORCYCLE CHARGING SYSTEMS FOR INDONESIA

9.1 Battery Swapping Infrastructure 47

9.2 Battery Charging Infrastructure 54

GRID IMPACTS

10.1 Impact of Charging Electric Motorcycles on the Power System 59

10.2 Connections 66

10.3 Quality of Power Supply 70

10.4 Summary and Conclusion on Grid Impact 73

10.5 Investments Required 74

REUSING AND RECYCLING BATTERY

11.1 International Electric Vehicle Battery Standards 77

11.2 Regulations in Indonesia 79

PROPOSED POLICIES AND ACTIONS

OUTLINE ROAD MAP FOR ELECTRIC MOTORCYCLES IN INDONESIA

13.1 Environmental and Economic Benefits 97

APPENDIXES

1 Standards 99

2 Data Details 100

FURTHER READING

v

Tables, Figures, Boxes, and Maps

TABLES

S1 E-Motorcycle Characteristics for Urban Usage xiii

1 Main Components of Taipei,China’s E-Motorcycle Road Map 2018–2022 10

2 Technical Properties of a Typical Swappable Electric Vehicle Battery and a Typical Swap Station 19

3 Sample of Electric Two-Wheelers Sold in Indonesia 23

4 Main Features and Cost Components of Gasoline and Electric Motorcycles 24

5 Cost Comparison Electric and Gasoline Motorcycle Indonesia, 2021 26

6 Cost Components of High-Powered Electric Scooters for Urban Usage 26

7 Cost Comparison of High-Powered Electric Scooters and Gasoline Motorcycles in Indonesia, 2021 27

8 Are E-Motorcycles Attractive for Clients? 28

9 Cost Components of Commercial Electric Motorcycles for Urban Usage 28

10 Cost Comparison between Electric and Gasoline Motorcycles for Commercial Usage, 2021 29

11 E-Scooter Characteristics 30

12 E-Motorcycle Characteristics 31

13 Tentative Target of Electric Two-Wheeler Production and Sales in Indonesia 34

14 Electric Vehicle Deployment Target Based on the Draft Grand Strategy for Energy 35

15 Electric Vehicle Deployment Target Based on the Public Launching Commitment 35

16 Core Elements and Impacts of a Carbon Tax on Fuels 38

17 Estimated Subsidy Requirement to Achieve Target of 2.1 Million E-Motorcycles by 2025 39

18 Subsidy Level versus Economic Benefits of Emission Reductions per E-Motorcycle 40

19 Projected Population 41

20 Projected Number of E-Motorcycles with Regulatory Interventions 41

21 Projected Number of E-Motorcycles in JABODETABEK with Dierent Scenarios 42

22 Projected Number of E-Motorcycles in Bali with Dierent Scenarios 43

23 Docking Station Plans Swap Energi 46

24 General Assumptions for Swapping and Charging Infrastructure 48

25 Overview JABODETABEK 49

26 Scenarios for 2025 in JABODETABEK 49

27 Projected Number of Swapping Stations in JABODETABEK under Scenario 2 50

28 Overview of Bali 51

29 Scenarios for 2025 in Bali 51

30 Projected Number of Swapping Stations in Bali under Scenario 2 52

31 Potential Size of Charging Locations 55

32 Number of Chargers in JABODETABEK and Bali in 2025 for E-Motorcycle Scenarios 57

33 Projected Electricity Usage of E-Motorcycles with Regulatory Interventions 59

34 Limit of Harmonic Distortion – Flow in Indonesian Distribution Code CC3.0 72

35 Impact of Chargers on the Electricity Network 73

vi

Tables, Figures, Boxes, and Maps

36 Expected Investment Related to Charging Infrastructure for E-Motorcycles in Indonesia 74

37 Overview of Central Government Agencies’ Roles and Responsibilities Related to the Transport Sector 81

38 Derivative Regulations from Presidential Decree 55/2019 82

39 Other Relevant Regulations Concerning Electric Vehicles 83

40 Local Government Regulations on Electric Vehicle in Jakarta and Bali 84

41 Expected Regulations Concerning Electric Vehicles to be Released 84

42 Summary of Incentives for Electric Vehicles 85

43 Targeted Electric versus Gasoline Motorcycles for Private and Commercial Urban Usage 90

A2.1 General Parameters used for Calculations of the Impact of E-Motorcycles 100

A2.2 Environmental Impact per E-Motorcycle Lifespan 100

A2.3 Cost of Gasoline Fueled Motorcycles 101

A2.4 Projections of Cost of E-Motorcycles of Same Power as Gasoline Motorcycles Used Currently 101

A2.5 Impact on Total Cost of Ownership of Applying a Carbon Price in Indonesia 101

A2.6 Projected Number of E-Motorcycles in Total Indonesia with a BAU Scenario, 102

an Urban Regulation Scenario and a Financial Incentive Scenario

A2.7 Motorcycle Total and E-Motorcycle Sales Projections 103

A2.8 Estimated Subsidy Requirement to Achieve Target of 2.1 Million E-Motorcycles by 2025 103

A2.9 Scenarios of Number of Swapping Stations for E-Motorcycles in JABODETABEK 104

A2.10 Scenarios of Number of Swapping Stations for E-Motorcycles in Bali 104

A2.11 Destination Chargers 105

A2.12 Scenario Calculations 105

A2.13 Scenario Calculations 105

A2.14 Charging Infrastructure 106

A2.15 Scenarios for 2025 in JABODETABEK 107

A2.16 Scenarios for 2025 in Bali 107

FIGURES

S1 User Categories and Charging Infrastructure xii

S2 Projected E-Motorcycle Market in Indonesia xvi

1 Vehicle Registration in Indonesia, 2015–2019 3

2 Greenhouse Gas Emissions in Indonesia, 1990–2018 5

3 Greenhouse Gas Transport Emissions in Indonesia, 1990–2018 6

4 Source of Electricity Generation in Indonesia, 2019 7

5 Development of the National Carbon Grid Factor in Indonesia, 2000–2016 8

6 Electric Vehicle with Swappable Batteries without an On-Board Charger 12

7 Swapping Station with Charger 13

8 Overview of Electric Vehicle Charging Infrastructure 14

9 Mode 1 Charging 15

10 Mode 2 Charging 15

11 Mode 3 Charging 16

12 Mode 4 Charging 16

13 Connectors for Mode3 Charging (IEC 62196) 17

14 Electric Two-Wheeler User Categories 21

15 Usage of Electric Two-Wheelers 30

16 E-Motorcycle Scenarios for Indonesia 36

17 Price and Cost Comparison of Higher Powered Electric versus Gasoline Motorcycles 37

vii

Tables, Figures, Boxes, and Maps

18 Required Subsidy for E-Motorcycles versus Potential Revenue from Carbon Tax on Gasoline Fuel 40

19 E-Motorcycle Scenarios in JABODETABEK 42

20 E-Motorcycle Scenarios in Bali 43

21 Indonesia Battery Corporation Production Plans 44

22 Projected Service Area per Swap Station with Non-Standardized Batteries, JABODETABEK 50

23 Projected Service Area per Swap Station with No Standardization, Bali 52

24 Typical Charging Profile of Swap Station with 20 Docks of 1 kW Each 53

25 Indicative Charging Pattern for Home Charging 55

26 Indicative Charging Pattern for Small Area Charging 56

27 Indicative Charging Pattern for Medium- to Large-Sized Area Charging 56

28 Simplified Overview of Power System and Connection Level of Charging Sites 58

29 Electricity Usage of E-Motorcycles for Scenario 2 and Forecasted Total Electricity Sales in Indonesia 60

30 Net Peak Demand Projections Compared with Generation in the Power System of Bali and Java 61

31 Reserve Margin for Bali and Java 61

32 Total 150-Kilovolt Transformer Capacity Projections, 2019–2028 63

33 Typical Distributions Network for JABODETABEK 64

34 Distribution of Connection Capacity of PLN Customers in Jakarta and Bali in 2021 68

35 Power Ratings of Selected Household Appliances Applied in Indonesia 69

36 Reliability of Power Supply Indicators SAIDI and SAIFI, 2014–2019 70

37 Used Battery Options 75

38 Electric Two-Wheeler User Segments 89

39 Projected E-Motorcycle Market in Indonesia 92

40 Projected E-Motorcycle Market in JABODETABEK and Bali 92

41 Projected Destination Electric Vehicle Charger Market 93

42 Projected E-Motorcycle Battery Swap Station Market 94

43 Reduced Emissions Due to E-Motorcycles in Indonesia 97

44 Reduced Emissions Due to E-Motorcycles in JABODETABEK 98

45 Reduced Emissions Due to E-Motorcycles in Bali 98

BOXES

1 An Introduction to Smart Charging 65

2 Smart Charging in Indonesia 66

3 What is Harmonic Distortion? 72

MAPS

1 Java-Bali Electricity Transmission Map 62

2 Potential Initial Location of Swap Sites in JABODETABEK 95

3 Potential Initial Location of Swap Sites in Bali 96

viii

Abbreviations

ADB Asian Development Bank

BAPPENAS Badan Perencanaan dan Pembangunan Nasional (National Development Planning Agency)

BAU business-as-usual

BMS battery management system

CO

2

carbon dioxide

CAGR compound annual growth rate

CAPEX capital expenditure

CNG compressed natural gas

DEN National Energy Council

EU European Union

GHG greenhouse gas

GSE Grand Strategy for Energy

IEC International Electrotechnical Commission

JABODETABEK DKI Jakarta, Bogor, Depok, Tangerang, and Bekasi

MEMR Ministry of Energy and Mineral Resources

OPEX operational expenditure

PRC People's Republic of China

PLN PT Perusahaan Listrik Negara

RUEN Rencana Umum Energi Nasional (Ministry of National Development Planning)

SoH state of health

SOE state-owned enterprise

TCO total cost of ownership

ix

Weights and Measures

km kilometer

kg kilogram

kV kilovolt

kW kilowatt

kWh kilowatt-hour

tCO

2

ton of carbon dioxide

V volt

x

Electric Two-Wheeler Definitions

Electric vehicle. This is any vehicle using 100% electricity (battery electric vehicle) including all types of electric

two-wheelers.

Electric two-wheeler. This includes all types of electric vehicles with two wheels such as electric bicycles, electric

scooters, and electric motorcycles.

Electric bicycle. This is an electric two-wheeler with a support engine but with

the possibility to also use muscular power to move the vehicle.

Electric scooter. This is an electric two-wheeler with limited engine power

and speed (25–35 km/h maximum), which does not need vehicle registration.

In some places such as the People’s Republic of China, electric scooters may

have pedals, although they cannot be used. There are countries that do not

classify vehicles with pedals as motorcycles, thus they can still be allowed even if

motorcycles are restricted.

Electric motorcycle. This is an electric two-wheeler or e-motorcycle with an

engine power above 500W and maximum speeds higher than 35 km/h. Such

vehicles require registration as a motorcycle.

Note: This publication focuses on electric motorcycles. The term “electric two-wheelers” applies to electric

scooters as well as electric motorcycles.

xi

Summary

Background

More than 120 million motorcycles operate in Indonesia, of which an estimated 12,000 are electric motorcycles.

The numbers continue to grow. Motorcycles are used for private as well as commercial purposes including

ride-hailing and delivery services. Electrification of motorcycles would result in improved air quality and reduced

greenhouse gas (GHG) emissions, fuel imports, and noise. Indonesia therefore aims to increase the share of

electric motorcycles or e-motorcycles.

The report focuses on Greater Jakarta, i.e., DKI Jakarta, Bogor, Depok, Tangerang and Bekasi (JABODETABEK),

and Bali. This allows for developing the characteristics required for a charging infrastructure for an urban area,

as well as for a densely populated nonurban area. Results from these “typical” areas can then be extrapolated to

other areas of the country, dierentiating between urban and nonurban zones.

The total GHG emissions of Indonesia in 2016 were 1,458 metric tons of carbon dioxide equivalent (MtCO

2

e).

Transport GHG emissions in 2018 are estimated at 154 MtCO

2

e, representing 16% of total emissions excluding

land use change and forestry emissions, or 26% of energy emissions. Emissions from motorcycles are estimated to

contribute around 20% of total transport emissions.

In its nationally determined contribution (NDC), Indonesia has committed to reduce its GHG emissions unconditionally

by 29% compared to a business-as-usual scenario by 2030. To achieve this, Indonesia focuses on land use change and

forestry emissions and the energy sector. E-mobility is on top of the political agenda in Indonesia to achieve the NDC

target. The focus of the e-mobility strategy is on electric two-wheelers and on electrifying public transport buses.

Details on objectives, study focus, and climate change background can be found in Chapters 1–4.

Types of Motorcycles

Three distinct types of electric two-wheelers exist: (i) electric bicycles with a support engine plus the possibility

to use muscular power to move the vehicle; (ii) electric scooters with a limited engine power and speed

(25–35kilometers per hour [km/hr] maximum), which do not need vehicle registration; (iii) e-motorcycles with

an engine power above 500 watts (W) and maximum speeds higher than 35 km/h, which require registration as

a motorcycle. E-motorcycles are dierentiated from electric scooters, which have a limited engine power and

speed and generally do not require vehicle registration. Converted e-motorcycles can be of any category. The

focus of this report is on e-motorcycles.

Summary

xii

Standard motorcycles as purchased in Indonesia are 110 to 150 cc (cubic centimeter), with a maximum power

of 6.5 to 12 kilowatts (kW) (9 to 16 horsepower [HP]). A same power e-motorcycle requires a 2.5x higher initial

investment. This incremental investment is not recovered during the e-motorcycle lifespan. Urban trips could,

however, be made just as quickly and conveniently with a lower-powered e-motorcycle of around 2,000 W with

speeds of 70–80 km/h. This type of e-motorcycle has sucient power to comply with urban requirements and

can thus be considered comparable in terms of convenience or usage value to a fossil-fuel-based motorcycle.

The initial investment for such an e-motorcycle is 40% higher than for a gasoline motorcycle. This incremental

investment is recovered during its lifespan due to having 80% lower operational expenditures. However, this type

of e-motorcycle is not in line with the aspirations of customers concerning power and speed and additionally has

range issues. Technology trends and lower battery costs will not resolve this customer preference issue.

Based on a purely rational purchase choice, lower-powered e-motorcycles are financially attractive and sucient

for urban trips. From a societal point of view, e-motorcycles are beneficial due to reduced air and noise pollution.

Therefore, it could be justified that the government introduces regulations that swap the emotional benefits of

high power and speed for reduced environmental pollution and improved health outcomes. As lower-powered

e-motorcycles are profitable, this would not result in an additional financial cost to users, and it would generate

considerable economic, social, health, and environmental benefits.

Details on motorcycle types, costs, and operation conditions are found in Chapter 7.

User Categories and Charging Infrastructure

E-motorcycles can be dierentiated based on user category (private or commercial) and usage purpose.

This results in dierent two-wheeler types and charging systems relative to user and usage purpose.

Figure S: User Categories and Charging Infrastructure

User

Private

Commercial

Usage Purpose

Regular

Student

Goods transport

Passenger transport:

rent and ride-hailing

Vehicle Type

e-scooter

e-Motorcycle with

1 battery

e-Motorcycle with

2 batteries

Charging Type

Home +

destination

Home /

destination +

swapping

Source: Grutter Consulting.

Summary

xiii

Private users can be dierentiated in regular or standard electric two-wheeler users and students. Regular

owners use their vehicle for daily trips to work, shopping, visiting friends, or other activities. The average trip

length is 9–13kilometers (km) in the urban area of Jakarta. Students are an important segment of the motorcycle

user population. Low-powered and low-speed e-scooters are popular among students as they do not require

a license. In practice, low-powered e-scooters often replace bicycles, ride-hailing services, or public transport.

Private e-motorcycles will be charged at home and at the destination. Battery swapping is not a necessity or a

big advantage for private users except for long-distance rides. Charging facilities at work or school (so-called

destination chargers) are critical to reduce range anxiety issues of private users.

Commercial users can be divided into ride-hailing services for passengers, rental services, and goods transport. On

average, commercial users drive 80–100 km per day. Commercial clients would therefore purchase an e-motorcycle

with two batteries. For commercial users, battery swapping has an advantage as daily mileage is higher and it reduces

the recharging time. The batteries of e-motorcycles cannot receive a high-powered charge and therefore require

a minimum charging time of 1–2 hours, far too long for commercial applications; thus, battery swapping is an ideal

option for commercial users to not have range issues and to allow for short “charging” times.

Table S: E-Motorcycle Characteristics for Urban Usage

Parameter Private Usage Commercial Usage

Average engine power (watt) 1,800–2,500 1,800–2,500

Maximum speed (kilometer per hour) 70–80 70–80

Driving range (kilometer) 50 (one battery) 100 (two batteries)

CAPEX e-scooter Rp24 million (with one battery) Rp29 million (with two batteries)

Battery cost per unit Rp5 million Rp5 million

Electricity usage (kilowatt hour per kilometer) 0.025 0.025

Average daily trip length (kilometer) 45 80

CAPEX = capital expenditure.

Source: Grutter Consulting based on market assessment.

Details on user categories and necessities of former can be found in Chapters 6 and 7.

Experience of Economies in Asia

The electric two-wheeler market is estimated at around 300 million units by 2030. The People’s Republic of

China (PRC) dominates the electric two-wheeler market, with around 90% of both vehicle stock and sales.

In many economies, a large share of electric two-wheelers are electric scooters with a maximum speed of 25

km/h which are not registered, making ocial data dicult to obtain.

Taipei,China has been subsidizing e-motorcycles since 1996. Since 2013, the subsidy level is $240 for electric

scooters and up to $1,200 for e-motorcycles, with a slight decline since 2020. Swapping-cum-charging stations

are also subsidized, with up to 50% of construction costs and free publicly accessible land. Battery swap sites are

placed every 500 meters in urban Taipei,China, and turn up every 2–5 km in rural areas. Nonfinancial incentives

include exclusive parking spaces, preferential parking fees, and prohibition for two-strokers in certain areas. The

large subsidies had a positive impact on e-motorcycle sales but have not resulted in a paradigm change. The

market share of e-motorcycle sales grew from 3% in 2017 to 15% in 2019 but dropped back to 10% in 2020. This

loss of market share came at the same time as subsidy levels were decreased.

Summary

xiv

In the PRC, electric two-wheelers dominate the market without massive subsidies, with more than 200 million units,

the majority of which are deemed to be electric scooters. Nearly every major PRC city has banned gasoline-powered

motorcycles. Thus, the driver of the electric two-wheeler boom in the PRC has been the local motorcycle bans.

As of 2014, Viet Nam had around 43 million registered motorcycles. The electric two-wheeler market peaked in

2016 and then dropped again, basically due to frustration of users over the low quality of vehicles. Most units in

Viet Nam are low-powered e-scooters used by students as they do not require a license and have a lower cost.

Promotion of e-motorcycles has only had limited success in other economies to date, although at first glance

e-motorcycles seem to be comparable in purchase costs and have lower operational costs. Viet Nam only achieved very

limited sales of e-motorcycles, with the market only taking up low-powered electric scooters used primarily by students.

In Taipei,China, massive subsidies in swapping stations and vehicles have resulted in a stagnating market share of 10% of

e-motorcycles. The only success case for widespread adoption of electric two-wheelers is the PRC, where gasoline units

have been replaced with electric ones due to banning fossil-fuel-based motorcycles in most cities.

In the absence of either high financial subsidies or regulations, customers will prefer to purchase gasoline

motorcycles, which have more power and speed than their same-cost electric equivalents. While the limited

driving range and the absence of charging infrastructure is a challenge, it is not the core issue with e-motorcycles.

This is clearly shown, for example, in Taipei,China, which has established a very dense swapping network without

e-motorcycles increasing their market share beyond 10%–15% and still requiring massive subsidies. The core

critical point for why customers prefer gasoline units is the “need for speed.”

Some lessons from other economies concerning the promotion of e-motorcycles are clear: (i) without

government intervention, the market for electric two-wheelers in the next few years will focus on low- powered

e-scooters that do not replace primarily gasoline motorcycles but bicycles and public transport; (ii) financial

incentives need to be (very) high to persuade customers to choose e-motorcycles; and (iii) regulations limiting

the usage of gasoline motorcycles result, on the other hand, in a swift uptake of electric units.

Details on the experiences of other economies can be found in Chapter 5.

Conversion Kits

Trials have been realized in Indonesia to convert used gasoline motorcycles to electric units. The conversion kit

includes the engine, the battery pack, a main controller, and a speed regulator.

The client receives an old motorcycle with an outdated chassis, brakes, lights, etc., combined with new electric

components without the original manufacturer guarantee. The resultant e-motorcycle costs as much as a new

gasoline motorcycle. For a 50% additional investment (RP24 million), the client could get a same-powered new

e-motorcycle with brand-new components and a manufacturer warranty. For a similar price, the client could

purchase a 2- to 3-year used e-motorcycle or a new gasoline motorcycle. Converted e-motorcycles are therefore

not considered to be a technically and commercially attractive option for clients and subsidizing such eorts is not

recommended as a strategy to increase the uptake of e-motorcycles. Conversions, oered initially

in Viet Nam, have not proven to be popular. The same is also true for all other electric road vehicles, where initially

some conversions were made but as soon as manufacturers started mass-producing electric units,

the market for such backyard ventures disappeared.

Details on conversion from fossil-fuel-based -fuel to e-motorcycles can be found in Section 8.1 of Chapter 8.

Summary

xv

Battery Standardization

Indonesia has plans to standardize batteries for two-wheeler usage. Standardized batteries have the advantage

of allowing for easy interchange and for a higher density of swapping stations as all motorcycles would have the

same battery. Taipei,China included standardization of batteries in its road map without achieving this target.

Standardization of batteries had also been tried in the PRC when battery swapping was made with buses and

passenger cars; however, the PRC also dropped this approach.

Battery standardization is problematic due to the dynamics of market forces. The battery is a core element of

an e-motorcycle and a main competitive distinction and cost parameter. Standardization reduces competition

between e-motorcycle/battery manufacturers, which diminishes the innovation speed and again results in fewer

price decreases. Standardization can thus hamper instead of promote the uptake of e-motorcycles.

Standardization is only required for battery swapping not demanded by private users, i.e., by commercial clients

with long driving distances that want to recharge or swap batteries within minutes. However, commercial

customers can realize a cooperation agreement with a manufacturer to standardize their fleet and thus have a

sucient e-motorcycle density with identical batteries to warrant the set-up of battery swap stations.

The analysis also showed that the required number of identical e-motorcycles for ecient battery swapping is

not very high and can be achieved quickly.

Details on battery standardization can be found in section 8.2 of Chapter 8.

Policies for Promoting Electric Motorcycles

From a market perspective, e-motorcycles will succeed if they oer a higher value than a conventional unit.

Without government intervention, the share of e-motorcycles is marginal, since fossil-fuel-based units have

lower costs and are more convenient. Sticker price parity of an electric and a gasoline motorcycle will only be

achieved by around 2030. The impact of a planned carbon tax of Rp30,000 per ton of carbon dioxide (CO

2

) will

be negligible as it influences cost structures by less than 1%.

Without massive financial subsidies or restrictions on fossil-fuel-based motorcycle usage, the e-motorcycle

market will not grow; Indonesia will not achieve its e-motorcycle targets by 2025.

An estimate of the required subsidies to achieve the target (2.1 million e-motorcycles operating in 2025) results in a

price tag of around $1.1 billion (Rp1.6*10

13

), most of which would be subsidies for motorcycles and a smaller part for

charging stations. This subsidy would be around Rp7.5 million per e-motorcycle. The economic value of emission

reductions is less than the subsidy cost, i.e., from an economic viewpoint, the subsidy is not justified.

Instead of subsidies, the government could make regulations favoring e-motorcycles and restricting the usage of

fossil-fuel-based motorcycles. The regulatory scenario would prescribe that motorcycles need to be electric to

enter specific zones or areas from a given year onward. The regulatory scenario requires no subsidies. Swapping

stations can be established without subsidies as they can cover service costs due to having a captive demand.

Lower-powered e-motorcycles would be chosen by the people and commercial agents as they can fulfil the

urban transport demands. Ride-hailing and delivery service companies could be obliged to gradually increase the

share of electric kilometers driven. Regulations would aect neither private nor commercial users financially due

to comparable total costs of ownership of electric and gasoline units. For low-income residents that live within

Summary

xvi

or commute to areas with restrictions and are dependent on their motorcycle, the government can establish an

initial purchase subsidy paid against scrapping of the fossil-fuel-based motorcycle on a one-time basis.

Details on policies can be found in Chapters 9 and 13.

Proposed Road Map for Electric Motorcycles for Indonesia

E-motorcycles will outpace fossil-fuel-based units in terms of market share of newly sold units by 2030.

E-motorcycles result in less air pollution, climate gases, and noise compared to fossil-fuel-based units.

This improves the health and social well-being of citizens. The Indonesian motorcycle industry can profit by

having a strong and growing domestic market demanding e-motorcycles thereby positioning themselves in a

future growth market.

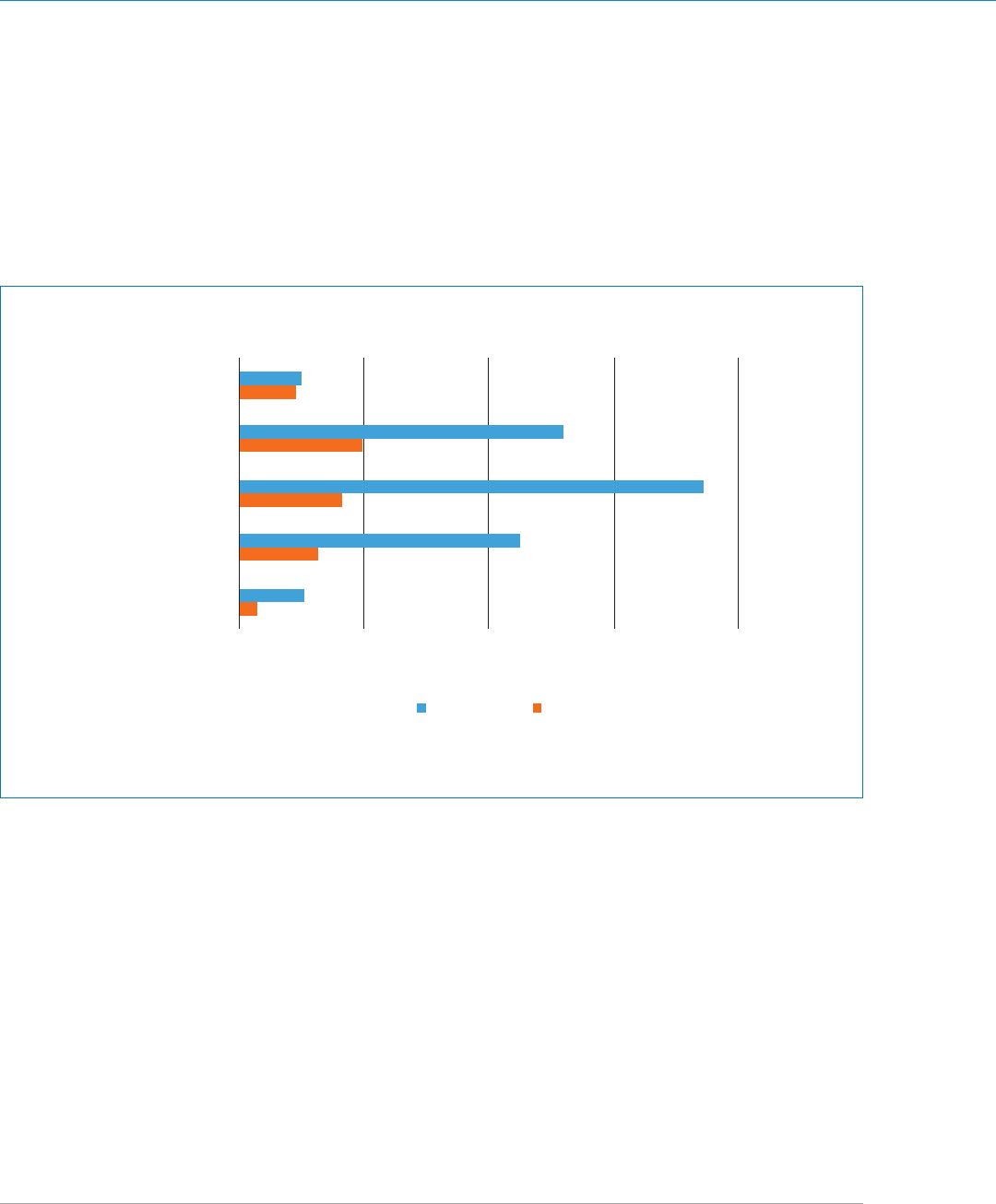

The projections are based on following a policy clearly favoring e-motorcycles by restricting usage of fossil-

fuel-based motorcycles, initially in urban areas and thereafter also in rural areas. The following figure shows the

projected market share of e-motorcycles for Indonesia until 2030 under the stated strategy. By 2030, 80% of

newly sold motorcycles would be electric and the share of e-motorcycles in the total stock of vehicles would be

around 45%, representing some 55 million units.

Charging is divided into home charging, destination charging, and battery swapping, with the latter being

used predominantly by commercial users. Home charging is a feature of all e-motorcycles. However, not all

e-motorcycles are charged simultaneously and every day. Charging at home or at work could be done just

by plugging into a wall socket, with no need for a dedicated charging infrastructure. In total, some 5.5 million

Figure S: Projected E-Motorcycle Market in Indonesia

0

1

0

2

0

3

0

4

0

5

0

6

0

Number of e-motorcycles (million)

0

.00

0

.00

0

.00

0

.00

0

.00

0

.00

0

.00

2019

2020 2021 2022 2023 2024 2025 2026 202

7

7

2028 20

2

0

%

5

%

1

0

1

5

2

0

2

5

3

0

3

5

4

0

4

5

2

9 2030

%

%

0

%

5

%

0

%

5

%

0

%

5

%

0

%

5

%

Market Share

Number of E-Motorcycles (million) Market Share

Note: Data presented are for road map scenario.

Source: Grütter Consulting.

Summary

xvii

destination chargers would be required by 2030 to meet the projected e-motorcycle numbers. Battery centers

allow swapping a low-energy battery with a new, fully loaded battery. This system is predominantly used by

commercial users. It is feasible to operate with various battery types and sizes, either within the same battery

swapping site or at dierent locations if the number of e-motorcycles is large enough. Typically, such sites

handle 10–30 batteries and are densely distributed, having a swap point every 4–6 km. Business models used for

swapping often include monthly subscriptions or payments per swap, with batteries often owned by the swapping

company or the motorcycle manufacturer.

Policy steps proposed to restrict area usage

of fossil-fuel-based motorcycles would start

in 2023. Motorcycle rental services in Bali

and other selected islands should be obliged

to have an electric fleet that is a minimum

of 20% of their total oered for rental. For

ride-hailing and delivery services, a certain

minimum share of e-motorcycles operating

in urban areas should be requested.

An initial target for 2023 could be that 10%

of each ride-hailing or delivery company’s

motorcycles in JABODETABEK and in Bali

must be electric. Restricting the usage of

fossil-fuel-based motorcycles is justified

in economic and social terms as: (i) trips

can be made also with e-motorcycles with

comparable convenience levels;

(ii) e-motorcycles have a comparable cost

or are even less expensive than fossil-fuel-

based units over their entire lifespan; (iii)

the environmental impact of fossil-fuel-

based motorcycles is highly negative due

to emission of air pollutants, climate gases,

and high noise levels; and (iv) in the absence

of such policies, private and commercial

users will continue using fossil-fuel-based

motorcycles.

There are numerous environmental and

economic benefits of e-motorcycles under

the road map scenario for Indonesia. By

2030, e-motorcycles could reduce 39million

tons of CO

2

, 10,000 tons of particulate

matter 2.5 (PM

2.5

), and 65,000 tons of

nitrogen oxides. This results in economic

benefits of Rp50,000 billion ($3.4billion)

annually due to reduced emissions. Reducing

GHG emissions by 39 MtCO

2

e is highly

relevant for Indonesia considering that 2018

total transport emissions were 154 MtCO

2

e

INDONESIA’S ROAD MAP ON

ELECTRIC MOTORCYCLE

CHARGING INFRASTRUCTURE

TARGET

By 2030: E-motorcycles shall

outpace fossil units in terms of

market share of newly sold units.

POLICY

CHARGING INFRASTRUCTURE

BENEFITS

E-MOTORCYCLES

FOCUS

Private and commercial users (ride-hailing and delivery services)

• The Government of Indonesia takes decisive steps to increase

significantly the market share of e-motorcycles based

on a phased approach.

• Access to urban areas being limited to e-motorcycles

with a gradual expansion of these spatial areas.

By 2025: 12 million units in Indonesia

• 1.7 million in JABODETABEK

• 0.4 million in Bali

By 2030: 55 million units in Indonesia

• 8 million in JABODETABEK

• 2 million in Bali

By 2030

• 38 million tons CO

2

less emitted

• 10,000 tons PM

2.5

mitigation

• 65,000 tons NO

x

reduction

• $3.4 billion savings due to reduced emissions

• Home charging

• Destination charging

• Battery swap for commercial users

Summary

xviii

and would be around 301 MtCO

2

e by 2030, assuming the same average annual growth rate as in the period 1990

to 2018; this would represent a 13% reduction relative to a business-as-usual GHG scenario.

Total additional electricity demand in 2030 due to e-motorcycles would be around 21 terawatt-hours, or 4% of

the national consumption. The grid impact is limited. Additional investments for generation or transmission are

only required after 2025. Total investments until 2030 for grid upgrades are estimated at less than $9 billion while

being able to sell an additional 21 terawatt-hours of electricity per year. Investments will primarily be required in

upgrading home connections. Smart charging flexibility could reduce loads and reduce the need for upgrades.

Details on the road map can be found in Chapter 14.

1

1. Introduction and Background

More than 120 million motorcycles currently operate in Indonesia, and the number continues to grow. Motorcycles

are used for both private and commercial purposes, including ride-hailing and delivery services. The electrification

of motorcycles would improve air quality and reduce greenhouse gas emissions, fuel imports, and noise. Indonesia,

therefore, aims to significantly increase the share of electric motorcycles or e-motorcycles in the coming years.

The issuance of Presidential Decree 55 of 2019, which provides the framework legislation for the introduction of

electric vehicles, charging infrastructure, and battery technology, is an important initial step in promoting electric

vehicles in Indonesia’s transportation system. Charging infrastructure will be developed based on projections for

electric transportation deployment, the availability and reliability of grid-based electricity service, and conducive

taris for electric transportation.

The Ministry of Energy and Mineral Resources’ release of Ministerial Regulation 13 of 2020 specifically regulates

the provision of charging infrastructure, from private to public charging stations, including battery swapping

facilities. The State Electricity Company (PLN), has been tasked with kickstarting the deployment of charging

stations across the country, starting with the capital city of Jakarta.

To provide the technical framework and assistance for charging infrastructure, Indonesia, represented by the

Ministry of Energy and Mineral Resources, requested the Asian Development Bank (ADB) to study a realistic

road map for the deployment of e-motorcycles. ADB supports Indonesia’s ambitious plan for e-mobility, as

it is consistent with multiple Sustainable Development Goals, as well as the operational priorities set forth in

ADB’s Strategy 2030. This report was prepared under the technical assistance grant to Indonesia for Electric

Transportation and Charging Infrastructure and was administered by ADB with grant-based financing from the

Republic of Korea’s e-Asia and Knowledge Partnership Fund.

This report highlights best practices and assesses lessons learned in the implementation of e-motorcycle charging

infrastructure experiences elsewhere in Asia. The report proposes policies and a strategy to foster electric

motorcycle usage in Indonesia in line with governmental targets, focusing on private and commercial uses. It does

not cover other electric vehicle categories due to dierences in technologies, policies, strategies, and targets.

The study area focuses on Greater Jakarta (DKI Jakarta, Bogor, Depok, Tangerang and Bekasi) and Bali, so

characteristics for both urban areas and a densely populated nonurban area can be identified and incorporated

in planning.

Focusing on e-motorcycles, the report covers (i) experiences elsewhere in Asia, (ii) projections on deployment,

(iii) strategies and a conceptual plan for a charging infrastructure road map, (iv) grid impacts of charging

infrastructure, (v) an analysis of dierent battery policies, (vi) policies and strategies for the promotion of

charging infrastructure, and (vii) core elements of a road map for the deployment of charging infrastructure.

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

2

Indonesia has taken steps to promote the deployment of electric vehicles in its transportation system.

Presidential Decree 55 of 2019 provides the framework legislation for the introduction of electric vehicles,

charging infrastructure, and battery technology in Indonesia. Of key importance is the development of charging

infrastructure based on projections for electric transportation deployment and the availability and reliability of

grid-based electricity service, as well as conducive electricity taris for electric transportation.

The Ministry of Energy and Mineral Resources (MEMR) has released Ministerial Regulation 13 of 2020 that

specifically regulates the provision of charging infrastructure, from private to public charging stations, including

battery swapping facilities. As a state-owned enterprise (SOE), the State Electricity Company (PLN) was given the

task to kickstart the deployment of charging stations across the country, starting from the capital city of Jakarta.

The Asian Development Bank (ADB) is supportive of Indonesia’s ambitious plans for e-mobility, as it is consistent

with multiple Sustainable Development Goals, as well as the operational priorities in ADB’s Strategy 2030.

The MEMR has requested a study on a realistic road map for the deployment of e-motorcycles and charging

infrastructure.

The report was prepared under the technical assistance (TA) grant to Indonesia for Electric Transportation and

Charging Infrastructure. The TA was administered by ADB with grant-based financing from the Republic of

Korea's e-Asia and Knowledge Partnership Fund.

3

2. Focus of the Report

2.1 Vehicle Category Focus

Charging infrastructure is linked with specific vehicle categories. Buses, passenger cars, or motorcycles each

need dierent types of chargers, as well as business models related to the charging infrastructure. The focus of

this report is on charging infrastructure for e-motorcycles. This includes privately as well as commercially used

e-motorcycles, which might require dierent types of charging infrastructure.

Indonesia has a total population of around 256 million, with an expected population in 2030 of 294 million.

1

In 2019, the country had some 134 million vehicles, 84% of which (113 million) were motorcycles. Motorcycles

also have the largest increase in vehicle numbers, with an annual increase between 2015 and 2019 of 6.2%

(Figure1).

2

This clearly shows the importance of initiating the electrification of motorcycles in the country.

1

National Development Planning Agency (BAPPENAS), Statistics Indonesia (BPS), and United Nations Population Fund (UNFPA). 2018. Indonesia

Population Projection 2015-2045. UNFPA Indonesia | Indonesia Population Projection 2015-2045.

2

BPS. 2019. Statistik Indonesia 2019. https://www.bps.go.id/publication/2019/07/04/daac1ba18cae1e90706ee58a/statistik-indonesia-2019.html.

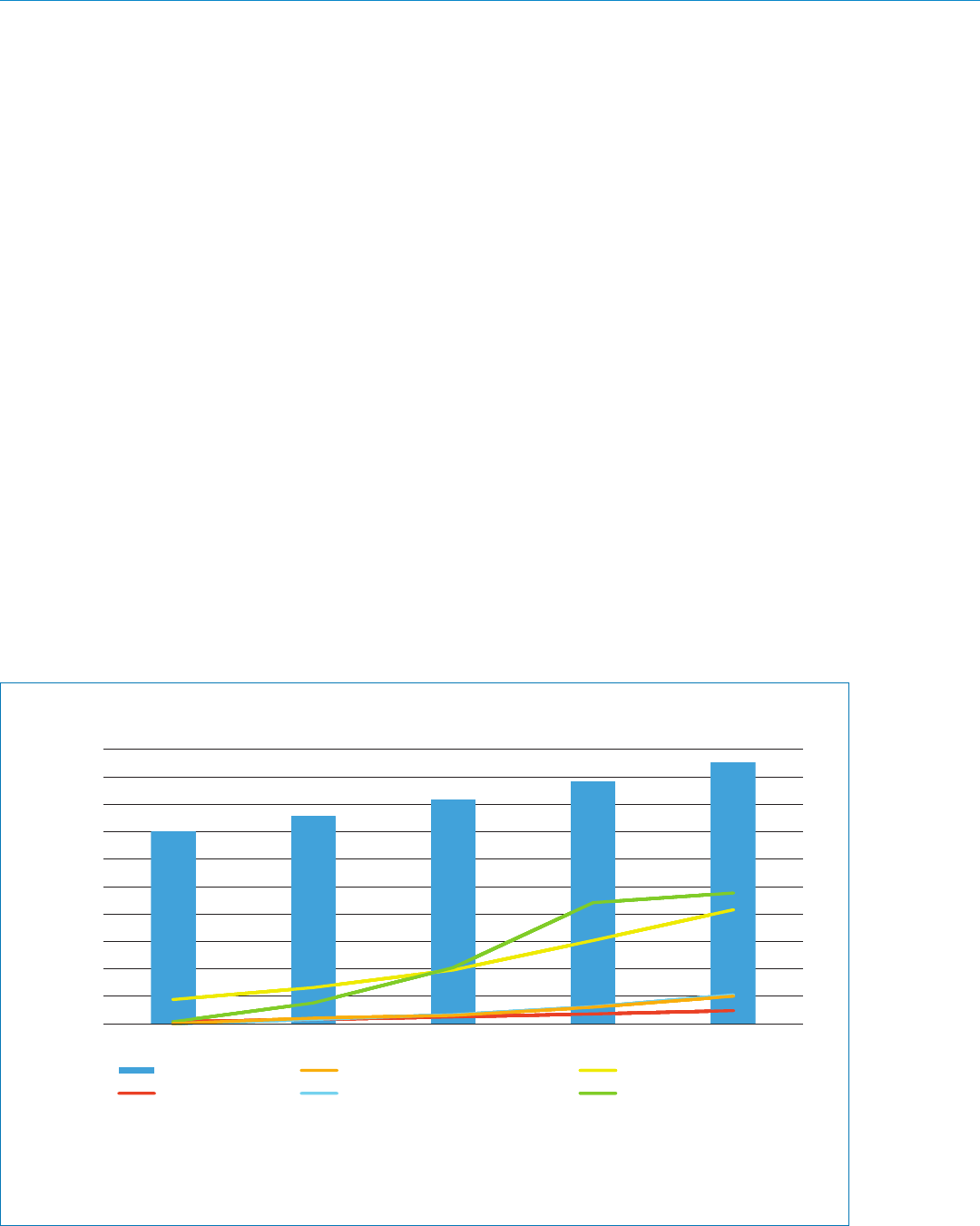

Figure : Vehicle Registration in Indonesia, –

Registered Vehicles

2015

0

20,000,000

40,000,000

60,000,000

80,000,000

100,000,000

120,000,000

2016

Bus Truck

2

Car

2

017 2018 2019

Motorcycle

Source: Statistics Indonesia (BPS). 2019. Statistik Indonesia 2019. https://www.bps.go.id/publication/2019/07/04/

daac1ba18cae1e90706ee58a/statistik-indonesia-2019.html.

4

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

The actual operating number of motorcycles is probably significantly lower than the ocial registration statistic

as the annual sales figures of new motorcycles in Indonesia prior to the coronavirus disease (COVID-19) was

6–6.5 million units and is expected to reach 9.5 million units by 2025.

3

This is an indication of a total market

of operational motorcycles of around 70–80 million units (the lifecycle of motorcycles is estimated to be at

a maximum of 15 years). Based on actual motorcycle sales statistics, it is estimated that perhaps 30% of the

registered motorcycles are either not operating anymore or are seldom operated, with a very low mileage. This is

a common phenomenon in vehicle registration data if not based on annual vehicle taxes, as old vehicles are not

taken out of registries.

2.2 Geographical Focus

The report focuses on (i) Greater Jakarta: DKI Jakarta, Bogor, Depok, Tangerang, and Bekasi (JABODETABEK);

and (ii) Bali. This allows developing the characteristics required for a charging infrastructure for an urban area,

as well as for a densely populated nonurban area. Results from these “typical” areas can then be extrapolated to

other areas in the country dierentiating between urban and nonurban zones.

JABODETABEK has an estimated population of 35 million in 2020, around 30% of which is in DKI Jakarta,

27% in Bogor, 23% in Tangerang, and 20% in Bekasi. By 2030, the population is expected to be at 42 million, with

89% of households owning at least one motorcycle, 36% owning two, and 11% owning three or more.

4

Greater

Jakarta has some 20 million motorcycles responsible for 63% of all trips and 76% of all motorized trips in 2018

(footnote 4). This is thus clearly the dominant transport mode. The number of ride-hailing motorcycles in

Greater Jakarta is estimated at 1.25 million units.

5

Bali has an estimated population of 4.3 million in 2020, with the city of Kota Denpasar having some 0.7 million

residents (17% of the total) and the rest distributed in eight districts.

6

By 2030, the population is expected to

reach 4.9 million. More than 6 million tourists also visit the island annually.

7

This could result in

around 100,000 additional visitors to the island during the peak season.

8

As of 2019, Bali had some 3.7 million

motorcycles operating.

3

Association of Indonesia Motorcycle Industry (AISI). Statistic Distribution. Jakarta: AISI. https://www.aisi.or.id/statistic/ (accessed 5 July 2021);

Statista. Motorcycles - Indonesia. https://www.statista.com/outlook/mmo/motorcycles/indonesia (accessed 5 July 2021).

4

Japan International Cooperation Agency (JICA). 2019. Annex 02: JABODETABEK Urban Transportation Master Plan.

5

Government of Indonesia. 2021. Accelerating e-Mobility Adoption and GESI Mainstreaming in e-Mobility Adoption. Presentation. 9 March.

Jakarta: Ministry of Transport.

6

Sensus Penduduk 2020 BPS. Jumlah Penduduk Hasil SP menurut Wilayah dan Jenis Kelamin, Indonesia 2020. https://sensus.bps.go.id/topik/

tabular/sp2020/83 (accessed 5 July 2021).

7

R. Woods. 2020. A Brief Review of Bali Tourism in 2019. Hotel Investment Strategies. 4 February. http://hotelinvestmentstrategies.com/a-brief-

review-of-bali-tourism-in-2019/.

8

Based on peak month of arrivals of tourists 2018 and 2019 with around 620,000 arrivals (July) and average stay of 5 days. Bali Hotels Association.

Visitors Statistics. https://www.balihotelsassociation.com/media-centre/stats/ (accessed 5 July 2021).

5

3. Climate Change Background

3.1 Greenhouse Gas Emissions

Total greenhouse gas (GHG) emissions of Indonesia were 1,458 metric tons of carbon dioxide equivalent (MtCO

2

e),

in 2016, 538 MtCO

2

e of which were from the energy sector.

9

The country is one of the world’s largest GHG emitters.

Energy sector emissions increased between 2000 and 2016 by a factor of 1.7. Transport GHG emissions in 2018 are

estimated at 154MtCO

2

e, representing 16% of the total, excluding land use change and forestry emissions (LUCF) or

26% of energy emissions (Figure 2). Land transportation accounted for more than 90% of total transport emissions.

Figure 3 shows how transport emissions in Indonesia have grown fivefold, or with a compound annual growth

rate (CAGR) of nearly 6%, since 1990. Energy emissions in the same period have “only” grown by 4% and total

emissions by 2%, i.e., the share of transport emissions is clearly growing.

9

Government of Indonesia. 2018. Second Biennial Update Report.

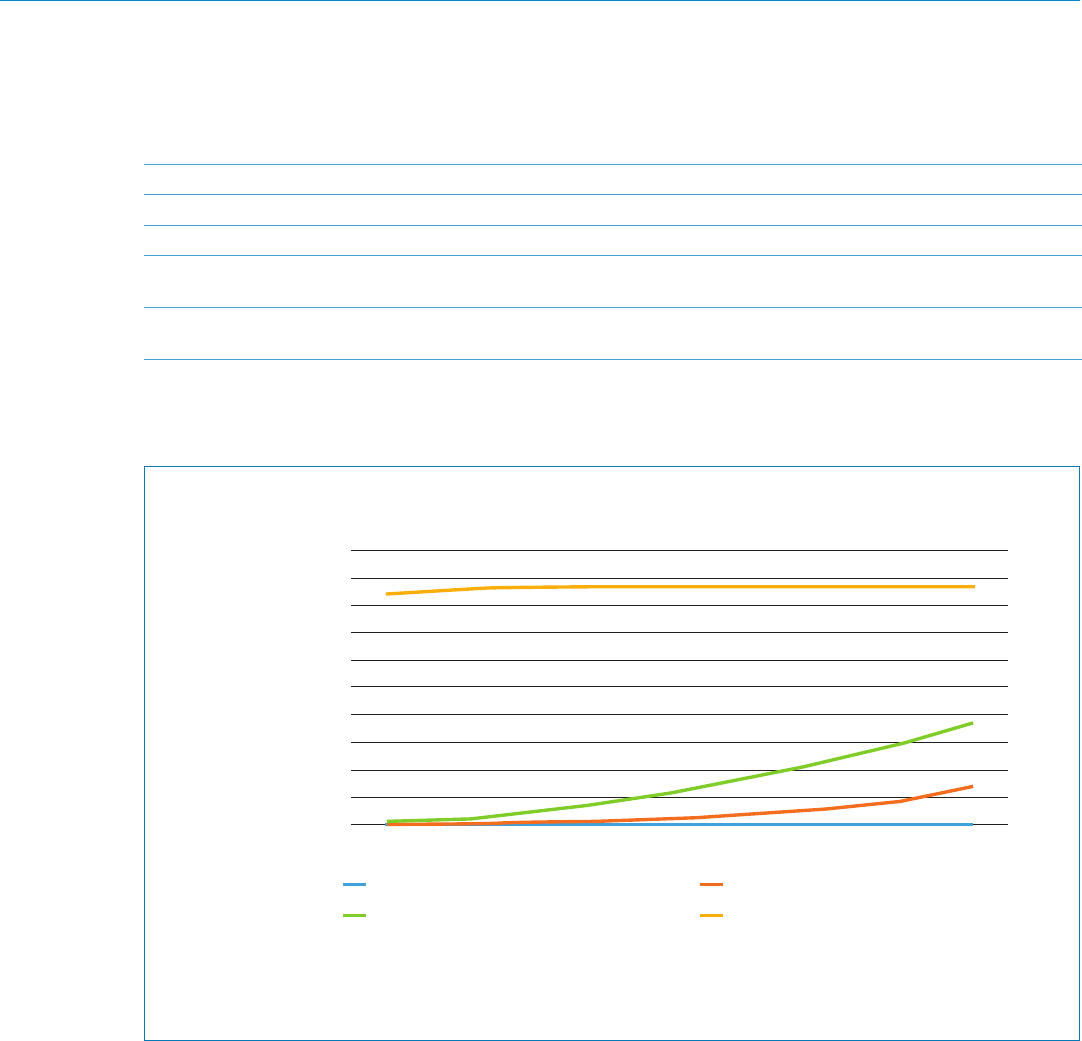

Figure : Greenhouse Gas Emissions in Indonesia, –

1990 1992

Total excluding LUCF Energy Transportation

1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

CO

2

e

1.0Gt

750Mt

500Mt

250Mt

0

CO

2

e = carbon dioxide equivalent, Gt = gigaton, LUCF = land use change and forestry emissions, Mt = metric ton.

Source: Climate Watch Data. Historical GHG Emissions. Indonesia. https://www.climatewatchdata.org/ghg-

emissions?breakBy=sector&end_year=2018®ions=IDN§ors=total-excluding-lucf%2Ctransportation%2Cenergy&source=CAI

T&start_year=1990 (accessed 7 May 2021).

6

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

Figure : Greenhouse Gas Transport Emissions in Indonesia, –

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

CO

2

e

160Mt

120Mt

80Mt

40Mt

0

CO

2

e = carbon dioxide equivalent, Mt = metric ton.

Source: Climate Watch Data. Historical GHG Emissions. Indonesia. https://www.climatewatchdata.org/ghg-emissions?end_year=201

9®ions=IDN§ors=transportation&start_year=1990 (accessed 11 July 2022).

An initial estimate of GHG emissions of two-wheelers results in around 32 MtCO

2

(direct emissions) or 20% of

the total from transport in Indonesia.

10

3.2 National GHG Commitments

and Electric Vehicle Policies

Indonesia has committed in its nationally determined contribution (NDC) to reduce its GHG emissions

unconditionally by 29% compared to a business-as-usual (BAU) scenario by 2030.

11

To achieve this target,

Indonesia has focused on two sectors, i.e., LUCF and the energy sector.

E-mobility tops the political agenda in Indonesia. The Government of Indonesia's strategy on the promotion of

electric vehicles aims at (i) decreasing the number of fossil-fuel-based vehicles to reduce emissions; (ii) reducing

the growth of oil consumption and imports to increase energy security; and (iii) promoting innovative new

technologies that ensure that Indonesia remains competitive as a vehicle manufacturer. The government also

recommends the development of electric vehicles and its supporting charging infrastructure to boost electricity

demand and resolve problems of oversupply at PLN.

12

Presidential Regulation No. 55 on the acceleration of

battery-based electric vehicles for road transport was decreed in 2019. The regulation, which includes fiscal

and non-fiscal incentives, focuses on electric two-wheelers and on electrifying public transport buses. In order

to improve air quality and to create jobs, Indonesia plans to introduce a fiscal scheme that will oer tax cuts to

electric vehicle battery producers and automakers, as well as preferential tari agreements with other economies

10

Calculation by Grütter Consulting.

11

Republic of Indonesia. 2021. 2nd Nationally Determined Contribution. The target has not changed with the updated NDC published in 2021.

12

BAPPENAS. 2020. Rencana Pembangunan Jangka Menengah Nasional Tahun 2020-2024.

7

Climate Change Background

Figure : Source of Electricity Generation in Indonesia,

Coal

Oil

Natural

Gas

Biofuels

Hydro

Geothermal

59%

4%

4%

7%

5%

21%

Source: International Energy Agency. Data and Statistics. Data Tables. https://www.iea.org/data-and-statistics/data-tables (accessed

5July 2021).

that have a high electric vehicle demand. The Ministry of Industry has set targets that, by 2025, 20% of all

manufactured vehicles should be low carbon.

13

3.3 Electricity Generation

The current electricity generation matrix of Indonesia is still dominated by coal (Figure 4), resulting in a

high-carbon grid factor of 0.825 kilograms of carbon dioxide equivalent per kilowatt-hour (kgCO

2

e/kWh).

14

The grid factor has, however, been decreasing in the last 2 decades, as can be seen in Figure 5, and the renewable

energy potential of the country excluding bioenergy is very high at 410 gigawatts.

15

Based on the historic trend, the targets set in the NDC, and the renewable energy potential of Indonesia, a

significant decrease of the country’s electricity production carbon factor can be expected in the next decade.

13

E. Gui and F. Theda. 2021. Indonesia Has Set an Ambitious Target for Electric Vehicles: What Factors Can Support the Nation’s Shift to an Electric-

Dominated Transport Sector? Climateworks Centre. 26 April. https://www.climateworksaustralia.org/news/indonesia-has-set-an-ambitious-target-

for-electric-vehicles-what-factors-can-support-the-nations-shift-to-an-electric-dominated-transport-sector/.

14

Calculation by Grutter Consulting Based on IEA/OECD data for 2018; calculated with GHG emissions of net electricity production. International

Energy Agency. Data and Statistics. Data Tables. https://www.iea.org/data-and-statistics/data-tables (accessed 5 July 2021).

15

Government of Indonesia. 2018. Second Biennial Update Report.

8

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

Figure : Development of the National Carbon Grid Factor in Indonesia, –

kgCO

2

e/kWh

2000

0.00

0.20

0.40

0.60

0.80

1.00

1.20

2010 20162005

kgCO

2

e/kWh = kilogram of carbon dioxide equivalent per kilowatt-hour.

Source: International Energey Agency, calculated and compiled by Grütter Consulting.

9

4. Asia’s Experience with

Electric Motorcycles

This chapter assesses strategies followed by other Asian Development Bank members to foster e-motorcycles

and looks at their experiences. In Asia, e-motorcycles are widely used in the People’s Republic of China;

Taipei,China; and Viet Nam. This chapter assesses their strategies to foster e-motorcycles and looks at their

experiences with charging infrastructure. Others that may be well-known for their proactive e-mobility policies—

such as Iceland, the Netherlands, and Norway, as well as the state of California in the United States—have a

relatively small number of motorcycles used, thus they are not considered in this chapter.

4.1 Experiences with Promotion Policies

for Electric Motorcycles

Experiences in the People’s Republic of China and Taipei,China

Taipei,China has been subsidizing e-motorcycles since 1996. Between 1998 and 2002, Taipei,China’s

Environmental Protection Agency spent $60 million on e-motorcycle subsidies, reducing purchase prices to a

level comparable to gasoline-powered units. However, the program ineciently stimulated demand because of

a lack of consumer confidence in battery reliability, insucient charging infrastructure, and e-motorcycles’ lack

of convenience. From 2009 to 2012, Taipei,China promoted lithium battery e-motorcycles, subsidizing some

26,000 units. Since 2013, central and local governments oered new electric two-wheeler subsidies from $240

(small scooter) to $1,200 (e-motorcycles; central plus local subsidies, including if a two-stroker is eliminated).

Subsidies have been declining gradually to $1,000 in 2020 and $800 in 2021. Charging stations are also

subsidized with up to 50% of construction costs, along with publicly accessible land.

16

The Ministry of Economic

Aairs picked Gogoro over other e-motorcycle brands to set up Taipei,China’s 1,300 battery swap stations.

Battery swap sites are placed every 500 meters (m) in urban Taipei,China and turn up every 2–5 kilometers (km)

in other parts of the island. Nonfinancial incentives include exclusive parking spaces, preferential parking fees,

and prohibition for two-strokers in certain areas. Table 1 shows the main components of Taipei,China’s e-scooter

development road map from 2018 to 2022.

16

B. M. Lin. 2018. Presentation on Taipei,China for Session 1: E-Vehicles and New Transport Technology. 12 September. Manila: ADB.

10

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

The large subsidies did have a positive impact on e-motorcycle sales but have not resulted in a paradigm change

of purchase practices. Gogoro sales (by far the largest electric scooter manufacturer in Taipei,China) plummeted

43% in 2020, while overall motorcycle sales increased by 3.3% in the same period and dropped another 25% in

the first quarter of 2021, with the overall market growing by 13%.

17

Total market share of e-motorcycle sales grew

from 3% in 2017 to 10% in 2018, to 15% in 2019, and then back to around 10% in 2020.

18

This loss of market share

coincided again with decreased subsidy levels.

In the PRC, electric two-wheelers dominate the market without massive subsidies, with more than 200 million

units, the majority of which are deemed to be electric scooters. Unique to the PRC is that it uses nonfinancial

incentives that in fact have not been targeted toward e-scooters but have eectively favored them. Nearly

every major PRC city has banned gasoline-powered motorcycles but electric bicycles (e-bikes) and scooters are

frequently classified as nonmotorized transportation due to being equipped with (decorative) pedals and thus

exempt from the motorcycle prohibition. In the 1990s, the PRC had also attempted to foster e-motorcycles but

without much success. The rapid expansion of e-scooters came when this was the only alternative for customers

if they wanted to use a two-wheeler in cities. Thus, the ultimate driver of the electric two-wheeler boom in the

PRC has been the local motorcycle bans. E-scooters do create less air pollution, but have no dierent impact

than gasoline motorcycles on congestion and safety. The loosely enforced e-scooter standards allowed them to

continue operations, although some cities since 2010 started banning or restricting them.

19

17

MotorCyclesData. 2021. https.//MotorCyclesData.com.

18

J. Quartly. 2019. Electric Scooters Could be the Future of Mobility. 23 October. https://topics.amcham.com.tw/2019/10/electric-scooters-future-of-

mobility/; G. Liao. 2020. KYMCO has been the best-selling brand for the first nine months of 2020. 6 October.

19

C. J. Yang. 2010. Launching Strategy for Electric Vehicles. Technological Forecasting and Social Change. 77 (2010). pp. 831–834; W. Shepard.2016.

Why Chinese Cities Are Banning the Biggest Adoption of Green Transportation in History. Forbes. 18 May. https://www.forbes.com/

sites/wadeshepard/2016/05/18/as-china-chokes-on-smog-the-biggest-adoption-of-green-transportation-in-history-is-being-

banned/?sh=7c4a4b5141b1.

Table : Main Components of Taipei,China’s E-Motorcycle Road Map –

Area

a

Targets

a

Current Status

b

Promote common

components of e-motorcycle

manufacturing

Common batteries (by 2018),

engines (by 2019) and other

components (by 2020)

Some manufacturers share Gogoro batteries, but

the major competitor (KYMCO) is putting up its

own battery swap stations with dierent battery

types. The goal of common components could

thus not be achieved.

Foster charging or swapping

stations

Targeted number of charging stations:

2,100 by 2018, 3,500 by 2020, and

5,000 by 2022

Some 2,100 battery swap stations of Gogoro are

operational in 2021 and KYMCO plans to install

another 1,500 units in 2021.

Lower price of e-motorcycles Target price below $2,300 for

higher-powered and below $1,500 for

lower-powered electric two-wheeler

prior to 2020

The lowest cost and most popular Gogoro model

in 2021 is VIVA Mix with a price tag of $2,200 but

this excludes batteries and a riding and battery

plan needs to be made.

Establish non-price incentives Preferential parking spaces and

lower parking costs and from

2020 prohibition for two-stroke

motorcycles in some areas

Two-stroke vehicles are basically only mopeds

while motorcycles are all four-stroke—thus, the

impact of this incentive is very limited.

a

B. M. Lin. 2018. Presentation on Taipei,China for Session 1: E-Vehicles and New Transport Technology. 12 September. Manila: ADB.

b

Grütter Consulting.

Source: Authors.

11

Asia’s Experience with Electric Motorcycles

The following conclusions can be learned:

• The PRC is dominated by slow, low-powered electric scooters or mopeds, and not motorcycles comparable

to the fossil-fuel-based 100-cc units dominating the streets of Indonesia.

• The surge of electric scooters in the PRC has been due to fossil-fuel-based motorcycles not being allowed to

operate in most cities. Thus, electric scooters were the only motorized option instead of a car or public transport.

• Taipei,China tried twice to foster e-motorcycles through financial incentives and succeeded in increasing the

market share to around 15% of sales. However decreasing subsidies have been paired with decreasing market

shares of e-motorcycles. The sustainability of support measures seems to be limited and e-motorcycles

are seemingly still not competitive in terms of price and convenience to customers, despite having a dense

battery swap network.

Experiences in Viet Nam

As of 2014, Viet Nam had around 43 million registered motorcycles.

20

The electric two-wheeler market peaked in

2016 and then started dropping again due to frustration of users over vehicles’ low quality.

Gasoline motorcycles are four-stroke in Hanoi and Euro 2 or 3 with an engine displacement of 110 cc. Average

urban fuel consumption is around 2.5 liters (l) per 100 km with an average annual mileage of 4,100 km.

21

Good

quality gasoline motorcycles cost between $700–$1,400, while low-powered e-scooters are available at a lower

price. However, even good quality e-scooters that have a comparable investment cost still do not have the

convenience of a gasoline unit in terms of power, speed, and driving range. Also, batteries need to be replaced

around every 1–2 years and are lead-acid units with a high potential for environmental damage. The majority of

electric two-wheelers in Viet Nam are low-powered e-scooters used by students. E-motorcycles are

not frequent.

20

Viet Nam National Trac Safety Committee. Trang thông tin điện tử Uỷ ban An toàn Giao thông Quốc gia (antoangiaothong.gov.vn).

21

World Bank. 2014. Motorcycle, Motor Scooter and Motorbike Ownership & Use in Hanoi. Washington, DC: World Bank; original household survey data.

Motorcycle use in Viet Nam. More people use conventional motorcycles than e-scooters in Hanoi (photo by Grütter Consulting).

12

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

E-scooters have lead-acid batteries and are charged overnight. Battery swap facilities are not available.

A Swiss-financed electric scooter and e-bike sharing program was of limited success and folded due to high

prices and limited public interest. The system was based on a few fixed points, i.e., not free floating and thus of

limited convenience for users. Also, most students (which were the target group) already owned an electric or

conventional scooter.

4.2 Experiences with Charging Infrastructure

for Electric Motorcycles

Electric Vehicle Batteries—Fixed and Swappable

A battery needs to be recharged when it is (almost) empty.

22

In many electric vehicles, the batteries are fixed

and the charger is also on board . The number of battery packs varies with the size and the required range of the

vehicle. The charging cable generally has a plug at each end, so it can be carried in the cargo space of the vehicle.

The charging plug can simply be plugged into a normal wall socket (in houses, oces, commercial spaces, etc.).

If the electric vehicle has swappable batteries, no charger is needed on board (Figure 6). Batteries are charged

outside the electric vehicle in a swapping station, i.e., the swapping station is at the same time a charging station.

The swapping station can have a plugged grid connection or a fixed grid connection, depending on the size and

power need (Figure 7).

22

Only lithium-ion batteries are assumed in this report, no other types of chemistries.

Figure : Electric Vehicle with Swappable Batteries without an On-Board Charger

Electric

motor

Battery

bank

Battery

bank

Battery

bank

Power

converter

Source: Delft University of Technology, Det Norske Veritas.

13

Asia’s Experience with Electric Motorcycles

A simple charging cable and plug will suce for a two- or three-wheeler. However, for larger electric vehicles like

passenger cars or trucks, a dedicated charging point is needed for power supply and safety. For these cables, plugs

and charging points, various international standards of the International Electrotechnical Commission (IEC) are

adhered to (the latter is working on standards for swappable batteries in two-wheelers).

23

Technical Properties of Electric Vehicle Chargers

In this section, the hardware-related technologies of charge points are enumerated. The terms mentioned

in this section are applicable to nonswappable batteries, hence the charging of the e-motorcycle (or electric

vehicle) occurs onboard with the battery present in the e-motorcycle during the charging process. Charging of

an e-motorcycle can be conducted either by alternating (AC) or direct (DC) current charging technology; in

both approaches, the power from the grid is converted from AC to DC and is used to charge the battery that is

present in the e-motorcycle. Technologies of electric vehicle charging stations can be dierentiated based on the

charging level, the charging mode and the charging system (Figure 8).

23

The IEC is aninternational standardsorganization that prepares and publishesinternational standardsfor allelectrical, electronic, and related

technologies, collectively known as "electrotechnology."

Figure : Swapping Station with Charger

Battery

bank

Battery

bank

Battery

bank

Battery

bank

Battery

bank

Battery

bank

Battery

bank

Battery

bank

Battery

bank

Charger

Charging plug

Source: Det Norske Veritas.

14

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

Charging Levels, SAE J1772

AC charging of an e-motorcycle is executed utilizing the AC/DC power converter that is present on board. AC

charging can also be listed based on charging levels. AC Level 1 refers to a 120-volt single phase AC charging

capability of maximum 16 A. Level 1 charging can hence be carried out by a line cord charger that can be plugged

into the e-motorcycle and a wall socket at home. Level 2 charging refers to a 240-volt single phase AC charging

capability of maximum 80 A. Level 2 charging is hence carried out by a dedicated e-motorcycle charger from

which a cord can be plugged into the e-motorcycle.

Charging Modes, IEC 61851-1

The IEC standard 61851-1:2017 “Electric Vehicle Conductive Charging System - Part 1: General Requirements”

defines AC and DC charging modes for all electric vehicle supply equipment for charging electric road vehicles,

with a rated supply voltage up to 1,000 volts (V) AC or up to 1,500 V DC and a rated output voltage up to 1,000

V AC or up to 1,500 V DC. The AC charging modes are listed as Mode 1, Mode 2, and Mode 3; the DC charging

mode is Mode 4. In summary: Mode1 and Mode2 are suitable for charging an emotorcycle or an e-scooter.

Mode3 charging would require special adaptations to the e-motorcycle connector or plug. Mode4 DC charging

is unsuitable for two or three-wheelers.

Figure : Overview of Electric Vehicle Charging Infrastructure

Private Charging

Inductive Charging

Future/

Upcoming

Type 1

1ϕ - SAE J1772

Type 2

1ϕ and 3ϕ

VDE-AR-E2623-2-2

Type 3

1ϕ and 3ϕ

EV Plug Alliance

Type 4

CHAdeMO

Charging

Level

Charging

System

Charging

Mode

EV

Charging

Standards

Public Fast

AC Charging

Public Fast

DC Charging

Level 1

Level 2

Level 3

Mode 1

AC Slow Charging

without safety

functionality

AC Slow Charging

with safety

functionality

Wired AC Charging Wired DC Charging

Mode 2 Mode 3 Mode 4

AC = alternating current, DC = direct current, EV = electric vehicle, IEC = International Electrotechnical Commission, SAE = society of

automotive engineers.

Note: Charging Levels (left side of the figure) are defined in the United States-based standard SAE J1772. Charging modes (lower

side) are defined in the international standard IEC61851-1. Charging system types (plugs and sockets) are defined in IEC62196,

referring to other standards.

Source: Det Norske Veritas .

15

Asia’s Experience with Electric Motorcycles

Mode 1 (AC)

This mode entails slow AC charging via a regular electrical socket (e.g., in the house or oce). There is no

communication between the vehicle and the charging point. It is therefore required to provide an earth wire to

the electric vehicle and have an external means of protection against faults. In many places, this form of charging

is considered unsafe and is not allowed due to the lack of communication and protection devices. However, in

the case of two/three-wheelers, Mode1 charging could be considered due to the limited battery capacity (and

therefore a lower safety risk; Figure 9).

Mode 2 (AC)

This mode provides for slow AC charging from a regular electricity socket. In addition, the charging cable is

equipped with an In-Cable Control and Protection Device, that is responsible for control, communication and

protection (including residual current protection). This is the preferred charging mode for two or three-wheelers

(Figure 10).

Mode 3 (AC)

This mode entails both slow and semi-fast charging via a dedicated electrical socket (a wall box or a charge pole)

for electric vehicle/e-motorcycle charging. The charger (or the charging point) has an electric vehicle specific

socket, generally corresponding to Type 1 or Type 2 (see below). A charging cable permanently fixed to the

charger, or with an electric vehicle plug on both sides, is used to connect the electric vehicle to the charger.

The charging station is responsible for the control, communication, and protection of the charging process

Figure : Mode Charging

AC

Source: Delft University of Technology.

Figure : Mode Charging

Control and

Communication

AC

Source: Delft University of Technology.

16

Electric Motorcycle Charging Infrastructure Road Map for Indonesia

(including residual current protection). This mode is commonly used for public charging stations for four-

wheelers (passenger cars and small trucks/vans; see Figure 11).

Figure : Mode Charging

AC

Control and

Communication

Source: Delft University of Technology.

Mode 4 (DC)

DC enables charging power levels beyond 50 kilowatts (kW) for electric vehicles. DC charging is defined under

Mode4 according to IEC 61851-1. Mode 4 uses a dedicated electrical socket for electric vehicle charging. The

charger has a permanently fixed cable with an electric vehicle plug. Mode 4 is specifically used for DC, which is

recommended for fast charging of larger electric vehicles; it is not suitable for two- or three-wheelers because

their batteries are relatively small and cannot handle the power. In the case of DC, the AC/DC converter is

located within the charging station. The control, communication, and protection functions are built into the

charging station (Figure 12).

Figure : Mode Charging

AC DC

Control and

Communication

Cable connected to charger

Source: Delft University of Technology.

17

Asia’s Experience with Electric Motorcycles

Charging Types: Connectors (Plugs and Sockets)

The types of AC charging connectors for Mode3 are listed as Type 1 and Type 2 and are used globally (Figure 13).

Mode1 and Mode2 charging cables and plugs are connected to regular wall sockets in the oce, commercial,

or residential building.

Type 1 refers to a single-phase charger that is primarily used in the US, which is defined according to the standard