2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

May 22, 2024

Federal Housing Finance Agency

400 Seventh Street, SW

Washington, DC 20219

Re: Proposed Enterprise New Product; Comment Request: Freddie Mac Single-Family Closed-

End Second Mortgages; FHFA No. 2024-N-5; Document Number 2024-08479; 89 FR

29329 (Apr. 22, 2024)

Dear Ladies and Gentlemen:

Better Markets

1

appreciates the opportunity to comment on a proposed new product

(“Proposal”) that would allow the Federal Home Loan Mortgage Corporation (“Freddie Mac”) to

purchase certain single-family closed-end second mortgages (“Home Equity Loans”).

2

The

Proposal explains that it is intended to provide mortgage borrowers with a new, cost-effective

alternative to existing loan products to access equity in their homes.

A home is many families’ most valuable financial asset. At the end of 2023, US households

had a near record $32 trillion in home equity.

3

Home prices were also near record highs.

4

This

combination of factors has created an increasingly strong temptation for families to access their

home equity and use the proceeds for other expenditures. These expenditures include things that

could increase a home’s value and potentially benefit the borrower such as home improvements

but also include things like debt consolidation or additional spending that would more likely lead

1

Better Markets is a non-profit, non-partisan, and independent organization founded in the wake of the 2008

financial crisis to promote the public interest in the financial markets, support the financial reform of Wall

Street, and make our financial system work for all Americans again. Better Markets works with allies—

including many in finance—to promote pro-market, pro-business, and pro-growth policies that help build a

stronger, safer financial system that protects and promotes Americans’ jobs, savings, retirements, and more.

2

Proposed Enterprise New Product; Comment Request: Freddie Mac Single-Family Closed-End Second

Mortgages; FHFA No. 2024-N-5; Document Number 2024-08479; 89 F

ED. REG. 29329 (Apr. 22, 2024),

https://www.federalregister.gov/documents/2024/04/22/2024-08479/freddie-mac-proposed-purchase-of-

single-family-closed-end-second-mortgages-comment-request#citation-16-p29331.

3

Board of Governors of the Federal Reserve System, Households; Owners’ Equity in Real Estate, Level,

FRED,

FEDERAL RESERVE BANK OF ST. LOUIS (May 17, 2024),

https://fred.stlouisfed.org/series/OEHRENWBSHNO

.

4

S&P Dow Jones Indices LLC, S&P CoreLogic Case-Shiller U.S. National Home Price Index, FRED,

FEDERAL RESERVE BANK OF ST. LOUIS (May 17, 2024), https://fred.stlouisfed.org/series/CSUSHPINSA.

Federal Housing Finance Agency

May 22, 2024

Page 2

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

to hardship or possible foreclosure if the borrower is unable to repay.

5

However, interest rates

remain historically high and as such introduce challenges for the typical avenues that homeowners

can currently use to extract home equity, namely refinancing. This Proposal claims to solve these

challenges with a new product that will result in cost saving for existing homeowners and also

minimize credit risk to Freddie Mac.

6

While it is possible that such a new product could indeed provide benefits to certain

individual homeowners with the knowledge, ability, and motivation to use it responsibly to build

wealth, the aggregate risks and costs of the Proposal are negative because of the evidence that

large shares of loan proceeds are used for debt consolidation or additional consumption that do not

lead to borrowers being better off or more financially stable in the long run.

7

Therefore, we cannot

and do not support the Proposal. We have several specific concerns about the Proposal, including:

• It would add to consumers’ already high debt burdens, which would result in increased

financial instability for society as a whole.

• It is unfair because the new product would only be made available to borrowers with

an existing first mortgage owned by Freddie Mac. These borrowers typically have

higher incomes and higher credit scores than average.

• It endangers financial stability because it would lead to increased taxpayer liability if

the housing market weakens, home prices decline, or borrowers default on their loans

in greater numbers and Freddie Mac requires additional support from the US Treasury.

• It is in direct conflict with Freddie Mac’s charter, specifically the requirement that

Freddie Mac provide stability to the secondary market for residential mortgages.

Increasing borrowers’ aggregate debt burden would decrease financial stability, not

increase or support it.

• It threatens to increase inflation with the new liquidity that new second mortgages

would inject into the financial system.

5

According to the Federal Reserve’s Survey of Consumer Finances, about one-third of households that

extracted home equity since 1995 used the money for home improvements and repairs. Another 30% to 40%

of households spent the money on consumption and the repayment of other debts. The remaining funds were

used to purchase vehicles, purchase vacation properties, and invest in other assets, with average response

rates of around 5%-10% for each. These shares are consistent with the uses of funds from home equity loans

made in the first quarter of 2024 by Lending Tree. See Alina K. Bartscher, Moritz Kuhn, Moritz Schularick,

& Ulrike I. Steins, Modigliani Meets Minsky: Inequality, Debt, and Financial Fragility in America, 1950-

2016 30, Federal Reserve Bank of New York (May 2020), https://www.newyorkfed.org

/medialibrary/media/research/staff_reports/sr924.pdf?sc_lang=en; Jacob Channel, Most Popular Reasons

Why Homeowners Across US Are Considering Home Equity Loans, Lending Tree (May 13, 2024),

https://www.lendingtree.com/home/mortgage/reasons-for-home-equity-study/.

6

Proposed Enterprise New Product; Comment Request: Freddie Mac Single-Family Closed-End Second

Mortgages, supra note 2 at 29330.

7

Bartscher et al., supra note 5 at 30.

Federal Housing Finance Agency

May 22, 2024

Page 3

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

• It primarily benefits Freddie Mac and financial institutions that will charge an array of

fees to borrowers.

We urge the Federal Housing Finance Agency (“FHFA”) not to move forward with the

Proposal. Homeowners already have several avenues by which they can access home equity; they

do not need another one.

BACKGROUND

In the last decade, and in particular in the years since 2020, home equity levels have surged

to a record high (see Chart 1). In the fourth quarter of 2023, households had about $32 trillion in

accumulated home equity, about a 400% increase from the recent 2012 low near $8 trillion.

Chart 1

Home equity is defined as the difference between a home’s market value and the amount

owed on mortgage loans for the property. Higher amounts of home equity benefit individual

borrowers as well as lenders, communities, and society in general. It provides a financial cushion

for families that are able and willing to use the home equity proceeds responsibly, greater

incentives for families to remain in their homes in the event of recession or financial system

distress, and lower incidence of foreclosure. Furthermore, home equity is a critical avenue by

which families pass along wealth to future generations. Research from the Urban Institute details

the importance of building home equity, particularly for minority homeowners:

Federal Housing Finance Agency

May 22, 2024

Page 4

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

Homeownership plays a bigger role in creating wealth for Black [and Hispanic]

families than it does for white families. Housing equity makes up nearly 60 percent

of total net worth for Black [and Hispanic] homeowners, compared with 43 percent

of total net worth for white homeowners.

8

In other words, while the typical level of home equity for Black and Hispanic homeowners

was lower than that of White homeowners, it represented a much larger share of the homeowners’

net worth, financial safety net, and wealth to transfer to future generations (see Chart 2).

9

Therefore, the negative effects of eroding this equity are proportionally larger for minority

families.

Chart 2

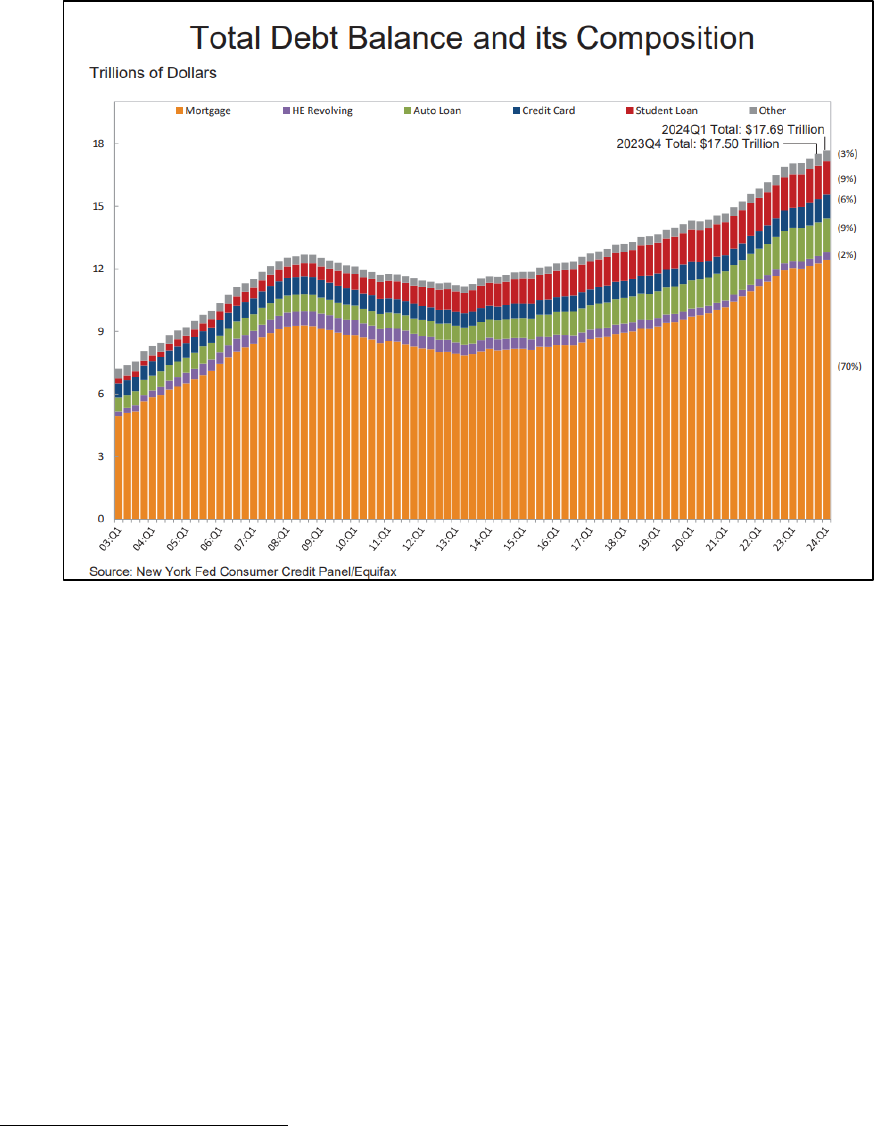

At the same time that home equity has grown, consumer indebtedness has also increased.

Consumers were weighed down by a record $17.7 trillion of debt in first quarter 2024 (See Chart

3).

10

8

Alanna McCargo & Jung Hyun Choi, CLOSING THE GAPS: BUILDING BLACK WEALTH THROUGH

HOMEOWNERSHIP 2, URBAN INSTITUTE (Nov. 2020),

https://www.urban.org/sites/default/files/publication/103267/closing-the-gaps-building-black-wealth-

through-homeownership_1.pdf.

9

Id. at 3.

10

FEDERAL RESERVE BANK OF NEW YORK, QUARTERLY REPORT ON HOUSEHOLD DEBT AND CREDIT 3 (May

2024), https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/HHDC_2024Q1

.

Federal Housing Finance Agency

May 22, 2024

Page 5

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

Chart 3

In addition to a growing level of consumer debt, extremely concerning consumer loan

delinquency trends have emerged in recent quarters, proving that consumers are increasingly

unable to afford their current debt payments. In the first quarter of 2024, 3.2% of all outstanding

consumer debt was in some stage of delinquency.

11

This measure has been on the rise for the past

four quarters and has reached the highest level since mid-2020. In particular, the rate of transition

into delinquency has accelerated for credit card, auto, and mortgage loans (see Chart 4).

12

The

transition rates for credit card and auto loans into delinquency are particularly alarming, reaching

the highest levels in more than a decade. These data clearly show that as pandemic-related

consumer support programs have expired, consumers have experienced increasing difficulty

affording payments on a range of debt.

11

Id. at 2.

12

Id. at 13.

Federal Housing Finance Agency

May 22, 2024

Page 6

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

Chart 4

Researchers from the Federal Reserve Bank of New York have studied the growing

indebtedness and linked it to increasing income inequality and financial fragility.

13

The results are

unquestionably troubling. The authors conclude:

The data show that increased borrowing by middle-class families with low income

growth played a central role in rising indebtedness. Debt-to-income ratios have

risen most dramatically for households between the 50th and 90th percentiles of the

income distribution. While their income growth was low, middle-class families

borrowed against the sizable housing wealth gains from rising home prices. Home

equity borrowing accounts for about half of the increase in U.S. housing debt

between the 1980s and 2007. The resulting debt increase made balance sheets

more sensitive to income and house price fluctuations and turned the American

middle class into the epicenter of growing financial fragility.

14

In conclusion, while home equity has increased so has consumer debt. It is not in

the best interest of Main Street America to provide yet another program for families to

increase their indebtedness, especially where the end result is an increased risk of default,

foreclosure, and the loss of a home. Home equity is far too important for the stability of

families and society at large and it should be protected in the aggregate for the good of both

current and future generations.

Federal Housing Finance Agency

May 22, 2024

Page 7

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

SUMMARY OF THE PROPOSAL

The Proposal would allow Freddie Mac to purchase certain single-family closed-end

second mortgages.

15

It recognizes that many mortgages were originated during a period of much

lower interest rates than exist today.

16

As a result, commonly used loan products such as a cash-

out refinances would result in significantly higher cost and debt payments for borrowers than they

had in the past because the entire loan would be rewritten at today’s higher interest rates.

The Proposal lists several criteria

17

that would restrict the number of loans that would be

eligible for the proposed new program, including:

• The mortgage lender must already be approved by Freddie Mac.

• The second mortgage would only be eligible for the new program if Freddie Mac

currently owns the first mortgage. In other words, only the subset of mortgage loans

that Freddie Mac currently owns would be eligible for the new program. As of 2023,

Freddie Mac owned $3 trillion of the nearly $14 trillion in US single-family mortgage

debt outstanding.

18

Borrowers for Freddie Mac’s loans had an average credit score of

752 in 2023, much higher than borrowers in other programs such as the Federal

Housing Administration (“FHA”), US Department of Agriculture (“USDA”), or US

Department of Veterans Affairs (“VA”).

19

• The Home Equity Loan would be a fixed-rate fully amortizing loan with up to a 20-

year term, secured by the borrowers’ primary residence.

13

Bartscher et al., supra note 5.

14

Id. at 2 (emphasis added).

15

Proposed Enterprise New Product; Comment Request: Freddie Mac Single-Family Closed-End Second

Mortgages, supra note 2 at 29329.

16

See, e.g., Freddie Mac, U.S. Economic, Housing and Mortgage Market Outlook – May 2024 (May 16, 2024),

https://www.freddiemac.com/research/forecast/20240516-economic-growth-moderated-start-year

; Bill

McBride, FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores,

CalculatedRisk Newsletter (Dec. 26, 2023), https://calculatedrisk.substack.com/p/fhfas-n

ational-mortgage-

database-89a.

17

Proposed Enterprise New Product; Comment Request: Freddie Mac Single-Family Closed-End Second

Mortgages, supra note 2 at 29332.

18

United States Securities and Exchange Commission, Federal Home Loan Mortgage Corporation Form 10-

K 13 (2023), https://www.freddiemac.com/investors/financials/pdf/10k_021424.pdf

.

19

Libby Wells, What credit score is needed to buy a house?, BANKRATE (Jan. 10, 2024),

https://www.bankrate.com/real-estate/what-credit-score-do-you-need-to-buy-a-house/

.

Federal Housing Finance Agency

May 22, 2024

Page 8

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

SUMMARY OF COMMENTS

We strongly oppose the implementation of the Proposal because it creates new risks and

costs—not only for borrowers with loans owned by Freddie Mac, but for all Americans. At the

same time, it offers limited benefits.

Consumer debt is already at record levels

20

and poses an increasing threat to financial

stability. Main Street Americans do not need yet another program offering promises of debt relief.

Therefore, we urge the FHFA to deny approval of the Proposal. The following comments provide

additional information and support for this denial:

• The Proposal would harm consumers and decrease financial stability. It would add to

consumers’ already high debt burdens.

• The Proposal is unfair because the new Home Equity Loans would only be made

available to borrowers with an existing first mortgage owned by Freddie Mac. These

borrowers typically have higher incomes and credit scores than the average mortgage

borrower. However, expanding the program to be available to all mortgage borrowers

or all homeowners to remedy the fairness concerns leads to even greater harm to

consumers who become more indebted.

• The Proposal endangers financial stability and threatens the need for another broad-

based taxpayer bailout. The Proposal is in direct conflict with Freddie Mac’s charter,

specifically the requirement that Freddie Mac provide stability to the secondary market

for residential mortgages. In addition, it would increase debt burdens for consumers

thus decreasing financial stability, not increasing or supporting it. Furthermore, it

would threaten to increase inflation with additional liquidity. Finally, Freddie Mac is

still in conservatorship and has drawn more than $70 billion in support from the US

Treasury since 2008.

21

This new program could lead to additional taxpayer liability if

the housing market weakens, home prices decline, borrowers default on their loans in

greater numbers, or Freddie Mac requires additional support from the US Treasury.

• The Proposal would disproportionately benefit Freddie Mac and banks through

increased fee income, thus incentivizing aggressive campaigns to promote borrowing.

The primary beneficiaries of this Proposal will be Freddie Mac and financial

institutions, who will all reap increased profits in the form of new application fees,

appraisal fees, credit check fees, and other application fees from potential Home Equity

Loan borrowers.

20

FEDERAL RESERVE BANK OF NEW YORK, QUARTERLY REPORT ON HOUSEHOLD DEBT AND CREDIT, supra

note 10.

21

CONGRESSIONAL RESEARCH SERVICE, FANNIE MAE AND FREDDIE MAC IN CONSERVATORSHIP: FREQUENTLY

ASKED QUESTIONS 10-11 (July 22, 2020), https://crsreports.congress.gov/product/pdf/R/R44525.

Federal Housing Finance Agency

May 22, 2024

Page 9

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

COMMENTS

I. THE PROPOSAL WOULD HARM CONSUMERS AND DECREASE FINANCIAL

STABILITY.

While we agree that it is possible that some individual borrowers could act rationally and

responsibly by using the proceeds from a Home Equity Loan originated under the Proposal to

consolidate high-cost debt or improve and add value to their home, in the aggregate the result of

the program would be increased consumer debt which leads to increased financial instability for

society as a whole. As detailed earlier, consumer debt is at record levels and delinquency levels

have increased sharply, demonstrating that consumers in aggregate are unable to manage their

current debt levels.

22

Simply put, the solution to some debt isn’t more debt, cloaked in the promise of lower

payments or a shorter repayment term relative to other loan options. This cycle results in a

dangerous game of musical chairs that ends with consumers having more debt than they can afford.

This becomes particularly problematic if the housing market reverses course and home prices fall

from the current high levels or if the economy weakens and homeowners lose their jobs. Just as

we saw during and after the Great Recession (“2008 Crash”), many homeowners were burdened

with high levels of mortgage debt. When they lost their jobs or couldn’t afford the debt payments,

the only choice was a devastating foreclosure. The Consumer Financial Protection Bureau warns

of the severe consequences if a borrower can no longer repay a Home Equity Loan, including

losing the home:

By taking out a second mortgage, you are adding to your overall debt burden.

Anytime you add on to your overall debt burden, you make yourself more

vulnerable in case you then experience financial difficulties that affect your ability

to repay your debts. It is important to know that a major risk with home equity loans

or home equity lines of credit is that if you cannot repay a home equity loan or

home equity line of credit, you could potentially lose your home because you are

using the equity in your home as collateral.

23

Researchers from the Federal Reserve Bank of New York recently released a new study

that explores the long-term negative consequences of foreclosures during the 2008 Crash.

24

22

FEDERAL RESERVE BANK OF NEW YORK, QUARTERLY REPORT ON HOUSEHOLD DEBT AND CREDIT, supra

note 10.

23

Consumer Financial Protection Bureau, What is a Second Mortgage Loan or “Junior-Lien”? (Sept. 4, 2020),

https://www.consumerfinance.gov/ask-cfpb/what-is-a-second-mortgage-loan-or-junior-lien-en-105/

(emphasis added).

24

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Belicia Rodriguez, Joelle Scally, & Wilbert van der

Klaauw, How Are They Now? A Checkup on Homeowners Who Experienced Foreclosure, F

EDERAL RESERVE

BANK OF NEW YORK LIBERTY STREET ECONOMICS (May 8, 2024),

https://libertystreeteconomics.newyorkfed.org/2024/05/how-are-they-now-a-checkup-on-homeowners-

who-experienced-foreclosure/.

Federal Housing Finance Agency

May 22, 2024

Page 10

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

Between 2000 and 2011, 4.8 million consumers experienced foreclosure.

25

The study shows that

borrowers that experienced a foreclosure during that period continue to be worse off decades

after the foreclosure—with lower credit scores and lower homeownership rates—compared with

borrowers that never foreclosed.

26

Policymakers should consider this example of long-term

financial scarring that continues to haunt millions of vulnerable households and deny this Proposal

which also threatens consumers with heavier, and potentially unaffordable and damaging, debt

loads that in turn increase the likelihood of foreclosure.

II. THE PROPOSAL IS UNFAIR BECAUSE THE NEW HOME EQUITY LOANS

WOULD ONLY BE MADE AVAILABLE TO BORROWERS WITH AN

EXISTING FIRST MORTGAGE OWNED BY FREDDIE MAC.

As explained earlier, borrowers with loans that Freddie Mac owns tend to have higher

credit scores and higher incomes than those with FHA, USDA, or VA loans.

While this structure is somewhat beneficial because it would shield lower-income

borrowers from becoming burdened with additional Home Equity Loans, it also leads to an unlevel

and unfair system in which only a subset of borrowers would able to access their home equity with

the proposed new product.

Of course, it is also possible that if the Proposal is approved—which we do not support—

it could result in other programs such as FHA, USDA, or VA also expanding the secondary market

for Home Equity Loans. This would improve the fairness problem, but would exacerbate the harm

to consumers, discussed above.

III. THE PROPOSAL ENDANGERS FINANCIAL STABILITY AND THREATENS

THE NEED FOR ANOTHER BROAD-BASED TAXPAYER BAILOUT.

This Proposal puts financial stability at risk in several ways.

First, the Proposal is in direct conflict with Freddie Mac’s charter, specifically the

requirement that Freddie Mac provide stability to the secondary market for residential mortgages.

The Proposal states that Freddie Mac believes that the new product will support its mission by

providing liquidity and stability in the secondary mortgage market.

27

We disagree with this claim.

Increasing borrowers’ debt burden decreases financial stability; it does not increase or support it.

Second, research from the Federal Reserve Bank of New York details how a wave of home

equity borrowing by middle-class families over several decades directly contributed to an erosion

of financial stability in America. Between 1950 and 2008, middle-class families experienced

25

Id.

26

Id.

27

Proposed Enterprise New Product; Comment Request: Freddie Mac Single-Family Closed-End Second

Mortgages, supra note 2 at 29332.

Federal Housing Finance Agency

May 22, 2024

Page 11

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

significant increases in housing wealth as a result of rising home prices.

28

One might expect that

this led to a more wealthy and resilient middle class. However, the exact opposite is true. Rather

than allowing this wealth to build, middle-class households extracted massive amounts of home

equity over the years. The study illustrates the size of the problem:

[T]he average incomes of households in the 50th to 90th percentiles of the income

distribution have grown by about 25% since the 1970s, or less than half a percent

per year. Over the same period, the amount of debt acquired by these households

grew by 250% until the 2008 crisis, about ten times faster than their incomes.

29

The researchers went on to prove that the buildup of debt on consumers’ balance sheets

resulted in a financial system that is more vulnerable and sensitive to shocks, such as unexpected

declines in household incomes.

30

In other words, extensive home equity borrowing increases

consumer debt loads and makes the middle class more financially fragile and susceptible to

external shocks. While the researchers used hypothetical scenarios to model this outcome, when

negative shocks occur in real life, vulnerable households who become unable to afford debt

payments experience a range of damaging outcomes, including the loss of their homes. They also

often turn to the public safety net that is funded by taxpayers for relief and recovery.

Third, the Proposal threatens to increase inflation with a new source of liquidity. Home

Equity Loans that would be originated under the proposed new program would inject new liquidity

into the financial system which would elevate inflation pressures. This would result in negative

impacts for Main Street Americans faced with higher prices for everyday goods and services.

While we do not support the Proposal, if the FHFA decides to move forward with it, we

recommend thoroughly analyzing the potential impact that such an injection of liquidity into the

financial system would have on inflation, which would negatively affect the entire economy. We

did not find this analysis in the Proposal and did not have the necessary data to do an independent

calculation.

Fourth, Freddie Mac is still in conservatorship. After the 2008 Crash, financial system

turmoil and mortgage delinquencies jeopardized the solvency of both Freddie Mac and the Federal

National Mortgage Association (Fannie Mae). Policymakers agreed that keeping Freddie Mac and

Fannie Mae operating was in the best interest of the American people and the financial system in

2008. To date, the US Treasury has provided Freddie Mac with more than $70 billion in financial

support and provided another $120 billion to Fannie Mae.

31

Expanding the responsibilities and

financial reach of Freddie Mac while it is still in conservatorship—before it has proven that it can

function on its own as a standalone entity—is a mistake. If the Proposal is implemented and there

is another downturn in the housing market or economy, the financial burden will once again fall

to the US Treasury and taxpayers. This is not appropriate and certainly not in the best interest of

financial stability.

28

Bartscher et al., supra note 5 at 2.

29

Id (emphasis added).

30

Id. at 40-44.

31

CONGRESSIONAL RESEARCH SERVICE, supra note 21 at 1.

Federal Housing Finance Agency

May 22, 2024

Page 12

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

IV. THE PROPOSAL INCREASES FEE INCOME FOR FREDDIE MAC AND

MORTGAGE ORIGINATORS, THUS INCENTIVIZING AGGRESSIVE

CAMPAIGNS TO PROMOTE BORROWING.

Financial institutions and Freddie Mac would benefit from numerous fees charged to

consumers associated with new Home Equity Loans, including application fees, appraisal fees,

and credit check fees. In total, fees are estimated to be between 2% and 5% of the total loan amount,

or between $2000 and $5000 for every $100,000 borrowed.

32

Researchers from the Federal Reserve Bank of New York explain how aggressive and

persuasive marketing efforts for Home Equity Loans have been, even though it is not in the best

interest of consumers or financial stability:

In the mid-1980s, nearly half of the country’s largest financial institutions spent

more advertising dollars on these products than on anything else. . . . For instance,

Citibank advertised its new ‘Equity Source Account’ by linking house prices to

individual achievement: ‘Now, when the value of your home goes up, you can take

credit for it. . . .’ Banks were successful in overcoming the negative connotation of

second mortgage products, which were traditionally seen as a last resort for

households in financial trouble. [Home equity loans] were now branded as a cheap

and convenient way to tap into home equity.

33

Misleading advertising slogans continued to urge consumers to withdraw home equity,

characterizing it as a benefit to which they are entitled, with no acknowledgment of the risks of

increasing debt burdens or increased fees:

In 2003, one from Citigroup said a home could be ‘the ticket’ to whatever ‘your

heart desires. It continued: ‘You’ve put a lot of work into your home. Isn’t it time

for your home to return the favor?’

In 2004, Banco Popular said in its ‘Make Dreams Happen’ ads: ‘Need Cash? Use

Your Home.’

‘Seize your someday,’ a Wells Fargo ad advised in 2007.

34

These marketing slogans and strategies are not a coincidence. They are a conscious

strategic effort by banks’ marketing departments to prey upon Americans with increasing debt:

32

See, e.g., Kacie Goff & Jennifer Calonia, How Much Are Home Equity Loan Closing Costs?, BANKRATE

(Nov. 21, 2023), https://www.bankrate.com/home-equity/home-equity-loan-closing-costs/

.

33

Bartscher et al., supra note 5 at 30; see also Glenn B. Canner, James T. Fergus, & Charles A. Luckett, Home

Equity Lines of Credit, 74 F

EDERAL RESERVE BULLETIN 361 (1988); Louise Story, Home Equity Frenzy Was

a Bank Ad Come True, NY

TIMES (Aug. 14, 2008), https://www.nytimes.com/

2008/08/15/business/15sell.html; Kim J. Kowalewski, Home Equity Lines: Characteristics and

Consequences, Federal Reserve Bank of Cleveland Economic Commentary (June 1, 1987),

https://www.clevelandfed.org/publications/economic-c

ommentary/1987/ec-19870601-home-equity-lines-

characteristics-and-consequences.

34

Story, supra note 33.

Federal Housing Finance Agency

May 22, 2024

Page 13

2000 Pennsylvania Avenue NW | Suite 4008 | Washington, D.C. 20006 | (202) 618-6464 | BetterMarkets.org

Marketing executives knew that ‘second mortgage’ had an unappealing ring. So

they seized the idea of ‘home equity,’ with its connotations of ownership and

fairness. The phrase was also used for lines of credit, which are sometimes taken

out by people who have already paid off their first mortgage.

35

We can expect this marketing pattern to continue if the Proposal is approved, without

sufficient accompanying cautions about the perils of increasing debt and the heightened risk of

foreclosure that comes with it. While lenders and Freddie Mac would profit from the resulting

fees—many of which can be fairly regarded as junk fees—the ultimate impact is likely to burden

many borrowers and contribute to financial instability. For these and all of the reasons set forth

above, we urge the FHFA to deny the Proposal.

CONCLUSION

We hope these comments are helpful as the FHFA considers its response to the Proposal.

Sincerely,

Shayna M. Olesiuk

Director of Banking Policy

Stephen W. Hall

Legal Director and Securities Specialist

shall@bettermarkets.org

Better Markets, Inc.

2000 Pennsylvania Avenue, NW

Suite 4008

Washington, DC 20006

(202) 618-6464

http://www.bettermarkets.org

35

Id.