THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY

USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT

POLICY

Date:

GAIN Report Number:

Approved By:

Prepared By:

Report Highlights:

In 2016, retail food and beverage sales in Canada amounted to $73 billion, comprising 85 percent of

total food and alcohol beverage sales. Despite continued consolidation in the retail sector, Canada

remained the top destination for U.S. high-value agricultural exports in 2016, valued at more than $16

billion. This report focuses on retail food and non-alcoholic beverage sales in Canada.

Keywords: CA17054, Canada, Retail

Post:

Ottawa

Maria A. Arbulu, Senior Agricultural Marketing Specialist

Evan Mangino, Agricultural Attaché

Retail Sector Overview - 2017

Retail Foods

Canada

CA17054

3/06/2018

Required Report - public distribution

Page 2 of 45

Table of Contents

Overview of U.S. Agricultural Products in Canada ........................................................................ 3

Section 1: Market Summary .......................................................................................................... 3

1A. The Food Sector in Canada’s Retail Landscape .................................................................. 3

1B. Imported Foods in Canada ................................................................................................... 7

1C. The Canadian Shopper......................................................................................................... 9

1D. Trends Driving Grocery Purchases ................................................................................... 10

Section 2: Road Map for Market Entry........................................................................................ 14

2A. Overview ........................................................................................................................... 14

2B. Market Structure ................................................................................................................ 18

2C. Retail Food Distribution Channels ..................................................................................... 19

Section 3: Leading U.S. Products and the Competition ............................................................... 31

Section 4: Best Product Prospects................................................................................................ 38

Section 5: Additional Canadian Contacts and FAS/Canada Contacts ......................................... 39

Page 3 of 45

Overview of U.S. Agricultural Products in Canada

The United States and Canada maintain the world's largest bilateral agricultural trading relationship. In

2016, U.S. agricultural exports surpassed $20 billion to Canada, with more than $16 billion

comprised of high-value, consumer-oriented food products. As the top global market, Canada

accounted for over one-fourth of all U.S. consumer-oriented food exports; double the value of the

second leading market, Mexico, and greater than the combined value of consumer-oriented

exports to Japan, Hong Kong, South Korea, and China. U.S. products represent approximately 60

percent Canada’s total agricultural imports.

In 2016, the leading consumer-oriented agricultural categories were prepared foods, red meats, fresh

vegetables, fresh fruits, snack foods, and processed fruits and vegetables. These five categories were

prepared foods ($1.9 billion), red meats ($1.8 billion), fresh vegetables ($1.8 billion), fresh fruits ($1.6

billion), snack foods ($1.3 billion), and non-alcoholic beverages ($1.1 billion). In 2016, Canada became

the largest export market for U.S. fisheries products, surpassing the $1 billion mark.

Under the tariff elimination provisions of the North American Free Trade Agreement (NAFTA), the

majority of U.S. agricultural products have entered Canada duty-free since January 1, 1998. Canada’s

retailers have capitalized on opportunities under NAFTA, which has resulted in significant gains for

U.S. food companies. Since the signing of NAFTA, U.S. agricultural exports have quadrupled in value.

On average, more than 35 U.S. states count Canada as their number one food and agricultural export

market, and Canada remains a stable and attractive market for U.S. exporters, particularly to new-to-

market and new-to-export firms. Trade with Canada is facilitated by proximity, common culture,

language, similar lifestyle pursuits, and the ease of travel among citizens for business and pleasure.

Canadians are receptive to and familiar with most American products due, in part, to the 20 million

Canadians visiting the United States each year.

1

However, as similar as the United States and Canada

are, exporters need to recognize and to understand the nuances of the Canadian marketplace to ensure

sales traction in the retail sector.

Section 1: Market Summary

1A. The Food Sector in Canada’s Retail Landscape

Statistics Canada reported total 2016 retail sales of $416 billion, a three percent increase from 2015.

Food and alcohol beverage sales in Canada contributed $89 billion to Canada’s retail landscape; retail

food sales amounted to $73 billion (17 percent of total retail).

The Canadian retail landscape has changed considerably as consolidation, led by two major retail

grocery chains, has propelled the shift from independent retailers to regional and national chain stores.

A relatively stronger U.S. dollar has increased the challenges facing food retailers seeking to remain

competitive in the market.

1

In 2016, the U.S. Department of Commerce reported 20 million Canadians visited the U.S.

Page 4 of 45

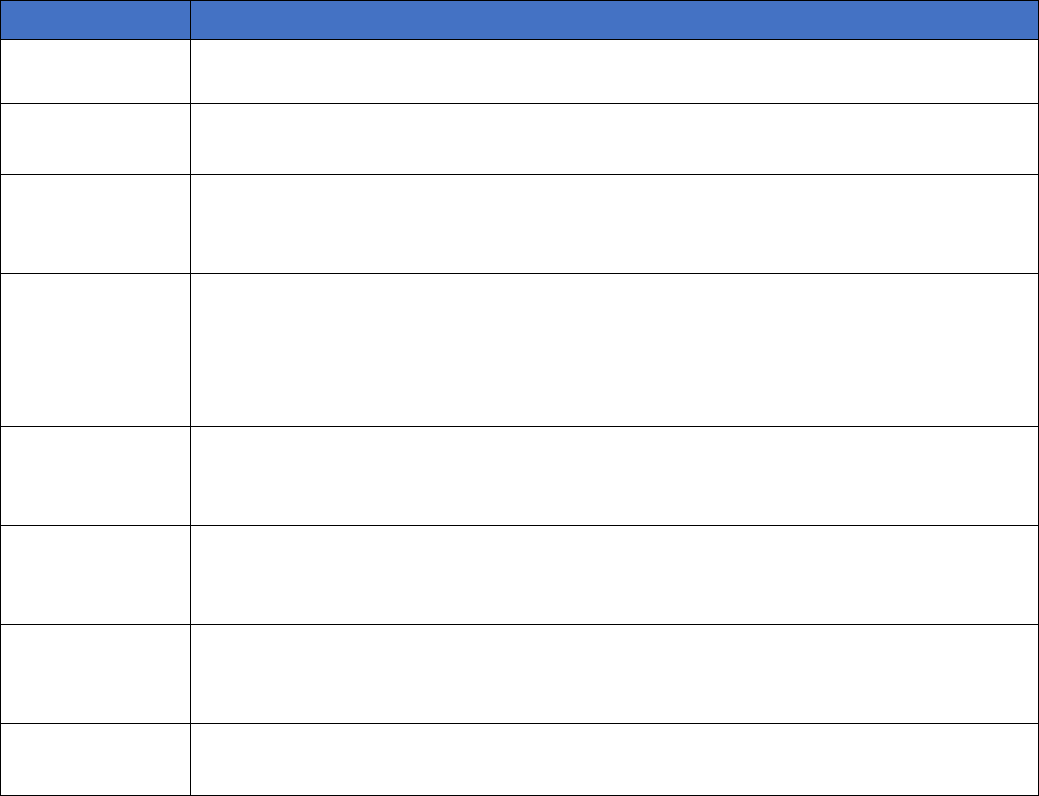

Table 1: Food Sales in Canada’s Retail Landscape in 2016

Source: Statistics Canada, Retail store sales by selected commodity

Table 2: Five Year Trend in Retail Food Sales in Millions of C$

Source: Statistics Canada

In 2016, approximately 58 percent of food sales occurred at traditional grocery stores, with the vast

majority under the umbrella of Canada’s ‘Three Majors’– Loblaws, Sobeys and Metro. However, non-

grocery retailers, particularly Costco and Walmart, have gained market share in the last five years,

accounting for 20 percent of the retail grocery market in 2016.

Page 5 of 45

Each of the Majors has a discount banner, such as Loblaws’ No Frills and Sobeys’FreshCo. The

discount channel grew from 27 percent in 2011 to 36 percent in 2016, and this trend is predicted to

grow, as discount merchandisers, such as Dollarama and Dollar Tree, continue to expand food offerings.

Table 3: Definition of Retail Channels

Channel

Description

Grocery Store

Any retail store selling a line of dry groceries, canned goods or non-food items plus

perishable items.

Supermarkets

A full-line, self-service grocery store with annual sales of

$2 million CAD or more.

Mass

Merchandiser /

Hypermarkets

A retailer of soft and hard goods, wherein the selling of grocery products have been

an add-on and not traditionally the prime focus of the retail format. Often 200,000

square feet or larger.

Warehouse

Clubs

A store with more than 1,500 items, primarily dry groceries with some perishables.

These stores are typically 100,000 square-feet or more and feature a majority of

general merchandise as well as a grocery line dedicated to large-size and bulk sales.

Low margin and labor ratio.

Convenience

Stores

A compact store offering a limited line of high-convenience items. Many sell

gasoline and fast food. They are usually less than 2,400 square-feet in size and are

open long hours.

Drug Stores

Stores (often chain) with retail pharmacies and specializing in Over-the-Counter

(OTC) medications and selling health and beauty aid products. Offering a limited

range of convenient groceries.

Specialty

Stores

Small specialized stores, often approximately 3,000 square feet or less specializing

in a specific food market sector, such as meats or health foods.

Gas Stations

Convenience stores operating under or in conjunction with a gasoline banner.

Source: Canadian Grocer 2017

Page 6 of 45

Table 4: Retail Channel Market Share in Canada

Source: Canadian Grocer 2017

Table 5: Top Food Retailers in Canada

Retailer

Estimated 2016 Food Sales ($ CAD)

Loblaw Cos. Ltd./Shoppers Drug Mart *

$28,919,000,000

Sobeys Inc. (Empire) /Safeway

$20,827,000,000

Metro Inc.*

$11,124,000,000

Costco Canada Inc.*

$10,162,000,000

Walmart Canada Corp.*

$ 7,004,000,000

Co-ops*

$ 3,574,000,000

Overwaitea Food Group*

$ 2,759,000,000

The Northwest Company*

$ 840,000,000

Alimentation Couche-Tard*

$ 556,000,000

Dollarama*

$ 525,000.000

Longo Brothers Fruit Market *

$ 400,000,000 e.

Source: Canadian Grocer Who’s Who 2017

*indicates food sales only; e=estimate

Page 7 of 45

Table 6: Average Retail Prices on Select Grocery Items

Selected Food Items

Unit

Avg. Retail Prices

$ CAD

October 2016

Avg. Retail Prices

$ CAD

October 2017

Round steak

1 kg

18.08

17.59

Sirloin steak

1 kg

23.74

22.76

Prime Rib Roast

1 kg

30.52

30.66

Stewing Beef

1 kg

16.17

15.87

Ground beef

1 kg

12.36

12.11

Pork Chops

1 kg

12.29

12.47

Bacon

500 g

6.58

7.10

Wieners

450g

4.48

4.50

Canned sockeye salmon

213 g.

4.23

4.40

Processed cheese food slices

250 g

2.83

2.68

Bread

675 g

2.86

2.81

Macaroni

500 g

1.46

1.45

Corn Flakes

675 g

4.71

4.68

Flour

2.5 kg

4.72

4.70

Apples

1 kg

3.99

4.25

Grapefruits

1 kg

3.24

4.11

Oranges

1 kg

3.40

3.47

Canned Apple Juice

1.36 liter

2.04

2.08

Orange juice, tetra-brick

1 liter

3.83

3.98

Baked beans, canned

398 ml

1.36

1.36

Tomatoes, canned

796 ml

1.56

1.55

Ketchup

1 liter

3.31

3.29

Roasted Coffee

300 g

6.23

6.47

Canned Soup

284 ml

1.11

1.16

Peanut Butter

500 g

3.42

3.20

Cooking or salad oil

1 liter

3.94

3.98

Soft drinks, lemon-lime type

2 liters

1.88

1.90

Soft drinks, cola type

2 liters

2.02

1.97

Source: Statistics Canada, Food and other selected items, average retail prices

January 1, 2017 to September 30, 2017 Average Exchange Rate $1USD=.1.31CAD/.76

1B. Imported Foods in Canada

The Conference Board of Canada, an established Canadian non-profit research organization, recognizes

the value of imported foods, stating, “global food supply chains allow (Canadians) to eat fresh fruits and

vegetables year-round with the use of transportation equipment and storage facilities with the right

temperature and environment to optimize freshness and taste.” They report, “imported foods doesn’t

imply compromising on the quality, nutrition, and safety of what we eat.” Much of the value of

Canada’s food imports in the last two decades have been fresh fruits and vegetables. Canadians have

changed their daily eating habits to include more fruits, and vegetables as well as cereal products and

nuts.

Page 8 of 45

Table 7: Canadian Consumer-Oriented Imports and Retail Sales ($ USD Millions)

Table 8: 2016 Top Canadian Food Imports ($ USD Millions)

Product

Value

Packaged Food Products*

$12,031.6

Fruits, nuts, and vegetables (includes intermediate)

$9,300.8

Meat Products

$4,243.2

Prepared and Packaged Seafood Products

$2,709.6

Dairy Products

$1,325.7

Coffee and Tea

$1,182.4

Fresh, frozen and canned fruit and vegetable juices

$1,268.3

Bottle water, carbonated soft drinks and other beverages

$1,070.5

Year

Total Consumer-

Oriented Food Imports

Total U.S.

Food Imports

U.S. Share of

Consumer-Oriented

Imports

Total Retail

Food Sales*

2013

$25,563

$16,420

64 percent

$86,037

2014

$26,264

$16,817

64 percent

$83,000

2015

$25,717

$16,452

64 percent

$73,201

2016

$25,307

$15,815

63 percent

$72,839

2017

$25,208 e.

$15,501 e.

62 percent e.

$75,429 e.

* Decreases in the retail market size in Canada are a reflection of annual exchange rate fluctuations. The U.S. dollar strengthened significantly against the

Canadian dollar in 2015 and 2016.

e. = estimate

Page 9 of 45

Product

Value

Fish, shellfish and other fishery products

$856.3

*Includes breakfast cereals, flour mixes, bread, rolls, flatbread, cookies, crackers, chocolate, confectionary products, snack food products,

flavorings, preserves, and frozen foods

Source: Statistics Canada, CANSIM, table 228-0059/ 12 month period of November 2015 to October 2016

1C. The Canadian Shopper

The popularity of certain foods appearing on store shelves has been directly related to Canada’s

changing demographics, lifestyles and attitudes towards foods.

Demographics

There are more Canadians over 65 than under 15 years of age, and seniors constitute the fastest-growing

age group. However, with nearly 1 in 5 Canadians born overseas, the increasing ethnic diversity of the

Canadian population is reflected in retail offerings and the spread of ‘ethnic foods.’

Graying Population

Canada has an aging population with 40 percent of the population 45 years-of-age or older; this segment

will increase to 48 percent by 2026. With more seniors and fewer children in the home, retail sales will

continue to reflect greater health consciousness attributed to increased health-related issues associated

with aging. The National Institute of Nutrition identified heart disease, cancer, diet, weight, diabetes,

and lack of exercise as the leading health issues among seniors.

Household Size / Women in the Labor Force

The average number of family members per household decreased from almost four in 1970 to less than

three people per household in 2016; there were more single-person households in 2016 than ever before.

This has created market opportunities for retailers and food manufacturers to offer single-serving

portions to their customers and a larger selection of prepared foods. In addition, the number of working

mothers with children under the age of 16 increased from 39 percent in 1976 to 73 percent in 2015. The

added time constraints on working women and mothers, who still remain the primary decision makers in

grocery purchases, has increased sales of convenient meal options offering nutritional value.

Ethnic Diversity

Cultural diversity has impacted the retail marketplace as new immigrants have boosted Canada’s

population. Consumers of Chinese, Filipino, and South Asian backgrounds make up the largest ethnic

groups, residing mostly in Ontario, Quebec, British Columbia, and Alberta. Statistics Canada projects

that by 2031, ethnic shoppers will represent 31 percent of total consumers. Nielsen estimated that retail

sales of ethnic foods were worth $5 billion CAD in 2017.

Canadian Purchasing Attitudes

In the 2016 consumer survey commissioned by FAS/Canada, over 1,500 Canadians were asked to rank

the top-five characteristics they look for when choosing foods. In priority order, consumers reported

Page 10 of 45

taste, price, nutrition, appearance, and safety; not far behind were nutritional information and available

discounts.

Taste/Freshness

Taste continued to be the driving force influencing most Canadians in retail aisles. In more affluent

households, shoppers have demonstrated a willingness to pay a premium for gourmet products, driving

the popularity of that segment. Also, freshness is becoming synonymous with quality among Canadians,

as it implies better flavor and nutritional content. The consumption of fruits and vegetables by

Canadians has increased significantly over the last decade, as more than 40 percent of Canadians

consume fruits and vegetables five or more times a day.

Price

Many Canadian consumers have become bargain shoppers due to the slow economic recovery and rising

food prices in 2015 and 2016. In the last two years, a weaker Canadian dollar has caused food prices at

the stores to increase. In 2017, Canadians paid three to five percent more on selected food items.

However, earlier food price spikes have led shoppers to be cautious in their spending habits as they

continue to practice more cost-saving measures, such as seeking on-line discount offers and weekly

promotions by retailers. The Royal Bank of Canada has reported that 57 percent of shoppers carefully

compare food prices and have reduced impulse purchases.

Health/Nutrition

Canadians increasingly educate themselves on the health benefits and the risks associated with the foods

they eat. This healthy-minded consumer takes the time to read food labels and evaluate the list of

ingredients on a food product. In a 2015 survey conducted by Nielsen, 59 percent of Canadians

considered themselves obese and 84 percent reported they intend to change their current diets. Healthy

eating is no longer a trend but is seen as a lifestyle choice.

Appearance

The 2016 FAS/Canada consumer study found appearance/labelling as the fourth leading characteristic

influencing Canadian consumer choices. In fact, eighty one percent of respondents reported that

appearance matters when choosing produce, while 75 percent reported being influenced by the physical

elements of a label when choosing packaged food products. The look of freshness continues to be

critical in the produce section. Also, a well-designed label on packaged food products remains essential

to attracting Canadian consumers.

Safety

While 88 percent of Canadians are somewhat confident in the overall safety of the food supply in

Canada, Food Safety News reported more Canadians interested in learning what the government is doing

to ensure all foods are safe. The Canadian government is currently modernizing food safety regulations

under one framework, called the Safe Food for Canadians Regulations (SFCR) which is expected to be

officially announced in mid- 2018.

1D. Trends Driving Grocery Purchases

Value

Private Label: Though generally perceived as lower quality and/or less desirable in the United States,

Canadian consumers are increasingly fond of private label products. In 2016, private label sales growth

outstripped national brands, increasing by five and two percent respectively.

Page 11 of 45

Economical Meal Solutions: A resurgence of traditional pre-packaged products that offer value, such as

dehydrated soups.

Promotionally Priced Products: Higher retail food prices have caused consumers to seek out

promotions and have encouraged more Canadians to shop at discount retailers, which captured 40 percent

of food retail sales in 2016.

Quality/Freshness

Fresh Foods: Consumption of fresh produce and demand for fresh ingredients are growing along with

greater interest in nutrition.

Frozen Foods: Frozen foods remain popular among consumers, with steady demand for single-serving

sizes of microwavable meals.

Convenience

Ready-to-Heat and -to-Eat Foods: Demand for foods that are easy and quick to prepare, yet tasty,

fresh and nutritious continues to grow.

Custom Quick and One-Dish Meals: Growth in quick one-dish meal kits, such as stir-fries and stews

continues. Consumers do not like to spend too much time preparing meals, but still like to feel that they

have contributed in the preparation.

Smaller Portions and Packages: With more single households, individual portion sizes are in demand.

Single portion sizes also cater to the trend of, "eating-where-you-are."

Flexible and Portable Packaging: Eating in vehicles, referred to as “Dashboard Dining,” along with

lunches at the work desk are increasingly common practices.

Snacks and Mini-Meals: Snacks account for 50 percent of total eating occasions. Demand for

nutritious, portable snacks helped push the retail snack market to nearly $4 billion CAD in 2016.

Innovation: Convenience will continue to be popular, but innovation drives sales.

Health and Wellness

Functional Foods: Consumption of specific ingredients to promote health and prevent disease is a

growing trend and leading demand for functional foods and nutraceuticals.

Physical and Emotional Energy: Sports drinks, energy bars and healthy snacks cater to consumers

looking to extract more ‘energy’ from their diet.

Healthy Foods for Kids: Approximately 26 percent of Canadians under 17 are obese. Parents are

seeking healthier snacks and products with key nutrients for their children.

Allergen Awareness: Consumers, especially parents of young and school-aged children are increasingly

conscious of allergies and food sensitivities. Nut-free and other allergen-free products represent a

growing segment in the pre-packaged, processed food industry.

Food Safety: Consumers are increasingly interested in the safety of their food, a trend that will continue

as the Safe Food for Canadians Regulations roll out in 2018.

Gluten-Free: The demand for gluten-free products has doubled since 2005.

Low Sodium: Though Canadian consumers are increasingly conscious of sodium in prepackaged

processed foods and in restaurants, voluntary industry efforts to reduce sodium in products have not had

much effect on national sodium consumption.

Page 12 of 45

Low Sugar: Canada’s Food Guide recommends moderate consumption of sugar, glucose, fructose, and

syrups, which are deemed as major contributors to weight gain.

Low Calorie: Interest in weight-loss products and lower calorie foods continues to be high.

Organics: Canada’s organic market is the fourth largest in the world at an estimated $4.3 billion,

including fresh and processed foods.

Trans-Fats and Saturated Fats: Canadians are concerned about fat intake and health concerns

associated with trans and saturated fats. Health Canada required the elimination of partially

hydrogenated oils from all foods by September 15, 2018.

Popular dietary components: Top dietary components are: fiber, whole grains, protein, calcium,

omega-3 fats, potassium, probiotics, and omega-6 fats.

Pleasure/Ethnic Foods

Indulgence and Comfort Foods: Despite growing concern about nutritional content, Canadians still

enjoy comfort foods, which are often considered a ‘reward’ for healthy eating or surviving the stresses

of everyday life.

Gourmet Products: New, unique, high-quality and premium products are small indulgences for

consumers who are seeking something different.

Regional Cuisines: Growing popularity of seasonal, regional and high-flavor foods.

Ethnic Foods: A number of independent restaurants are offering more ethnically diverse menus with

more options.

Ethical Buying

Food with Heart: A small but growing number of Canadians make decisions based on where and how

their food was grown. Going beyond taste and health concerns, this practice includes social concepts

like “fair trade,” “sustainable,” and “food miles.”

Buy Local: Consumer support for local economies and local farmers is booming. Though U.S. foods

are not viewed as local, Canadians are likely to choose U.S. when local is not available.

Clean Labels: More and more millennials and young parents are demanding products with clean labels

and more natural ingredients (e.g., no artificial coloring, preservatives, or flavors).

Recycled and Biodegradable Food Packaging: Many Canadian cities have extensive recycling

programs, and food manufacturers can capitalize on ‘green marketing.’

Non-Traditional Media Influencers

Mobile Devices: An FAS/Canada consumer survey reported that 55 percent of millennials use a mobile

device at the point-of-purchase compared to 31 percent of the general population.

Mobile Shopping Apps: 41 percent of millennials actively use shopping apps, and 64 percent of those

use apps to save money.

On-line Shopping: One-quarter of millennials expressed a high interest in online shopping.

Page 13 of 45

Table 9: Most frequent online sources searched by Canadians on food purchasing decisions.

Source: 2016 FAS Consumer Survey on Canadian Shopping Attitudes

Table 10: Advantages and Challenges Facing U.S. Exporters

Advantages

Challenges

Canadian consumers enjoy a high disposable

income, coupled with a growing interest in global

cuisine.

A higher cost of doing business in Canada (for

retailers and distributors) and a stronger U.S.

dollar further squeeze already narrow profit

margins.

Retailers, mass merchandisers and independents

expanding listings of food products with ‘clean’

ingredient labels.

U.S. exporters often face one national retail

buyer per category; often purchasing for all

banners under the retailer.

U.S. television and print media spills over into

most Canadian population centers; can reduce

advertising costs for companies with media

campaigns near the Canadian border.

Consumer ethnic diversity can be a challenge

for companies with products and marketing

campaigns targeted at the national U.S. market.

Ethnically diverse population provides

opportunities for specialty products.

Retailers and brokers/distributors may charge

high listing/placement fees.

Retail consolidation favors large-scale suppliers

and increases sales efficiency with fewer retailers

to approach.

Retailers are interested in category extension,

not cannibalization. Products entering the

market must be innovative, not duplicative.

Private label presents opportunities for custom

packers of high quality products.

Private label brands continue to grow in many

categories; sometimes taking shelf space from

American national brands.

Page 14 of 45

Geographic proximity, frequency of travel

to the United States supports, and a wide

exposure to U.S. culture.

Differences in standards may require special production

runs and packaging due to Canadian standard package

sizes.

High U.S. quality and safety perceptions.

Differences in approved chemicals and residue

tolerances.

Duty free tariff treatment for most products

under NAFTA.

Food labeling and nutritional content claims differ from

the United States.

U.S. products often rank as Canadians’ top

choice among imported foods.

Population of Canada is less than California and much

more spread out, making marketing harder and

distribution costs higher than in the United States.

Section 2: Road Map for Market Entry

2A. Overview

Entry Strategy

Food product manufacturers from the United States seeking to enter the Canadian marketplace have a

number of opportunities. Although Canadians continue to look for new and innovative U.S. products,

there are a number of challenges U.S. exporters must be prepared to meet. Some of them include

exchange rate fluctuation, customs procedures, regulatory compliance, and labeling requirements. To

facilitate initial export success, FAS/Canada recommends the following steps when entering the

Canadian market:

1. Contact an international trade specialist through your state department of agriculture.

2. Thoroughly research the competitive marketplace.

3. Locate a Canadian partner to help identify key Canadian accounts.

4. Learn Canadian government standards and regulations that pertain to your product.

For more information on these steps, please consult the FAS/Canada Exporter Guide.

Step 1: Contact an international trade specialist through your state department of agriculture.

FAS/Canada relies on the State Regional Trade Groups (SRTG) and the U.S. state departments of

agriculture they represent to provide one-on-one export counseling. These offices and their staff

specialize in exporting food and agricultural products around the world. Their export assistance

programs have been recognized by third party auditors to be highly effective in guiding new-to-market

and new-to export U.S. companies.

Some of the services available through SRTGs and state departments of agriculture include: one-on-one

counseling, business trade missions, support for participation in selected tradeshows, and identification

of potential Canadian partners. Through their Canadian market representatives, SRTGs offer a service

that strictly targets the food channels in Canada, similar to the U.S. Commercial Service’s International

Partner Search. Under the Market Access Program (MAP) Branded Program / Brand Promotion

Page 15 of 45

Program / FundMatch, financial assistance for small- and medium-sized firms may be available to

promote their brands in Canada and other foreign markets. This assistance may include partial

reimbursement for marketing/merchandising promotions, label modifications, tradeshow participation,

and advertising.

To reach an international trade specialist, please visit the appropriate SRTG website and/or the local

state department of agriculture website by navigating through the National Association of State

Departments of Agriculture (NASDA) website below.

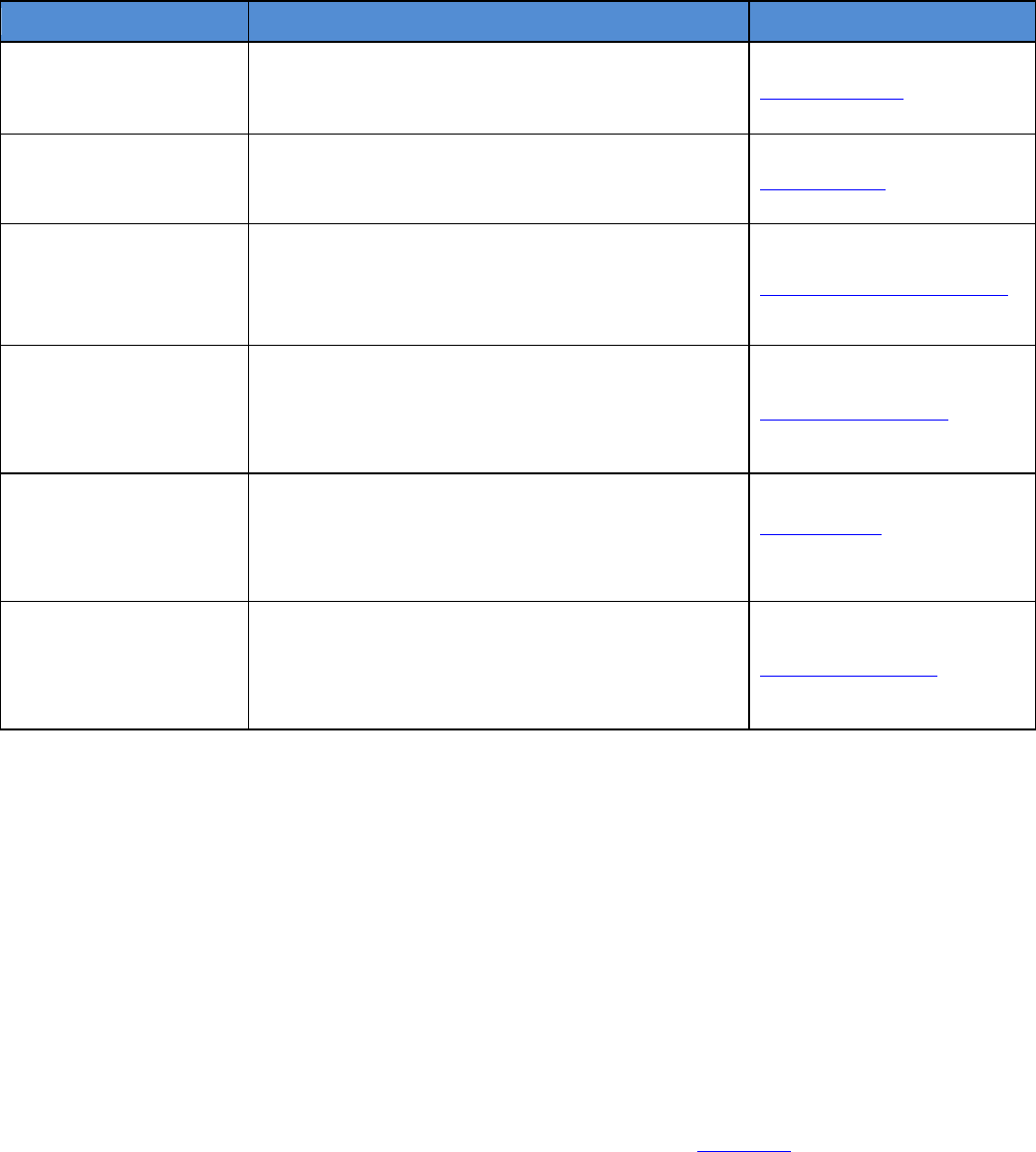

Table 10: State Regional Trade Groups

State Regional

Trade Group

Web Site

States

Food Export USA

Northeast

www.foodexport.org

CT, DE, ME, MA, NH,

NJ, NY, PA, RI, VT

Food Export

Association of the

Midwest USA

www.foodexport.org

IL, IN, IA, KA, MI, MN,

MO, NE, ND, OH, SD,

WI

Southern U.S.

Trade Association

(SUSTA)

www.susta.org

AL, AR, FL, GA, KY,

LA, MD, MI, NC, OK,

SC, TN, TX, PR, VA,

WV

Western U.S.

Agricultural Trade

Association (WUSATA)

www.wusata.org

AK, AZ, CA, CO, HI, ID,

MT, NV, NM, OR,

American Samoa, Guam

National Association of

State Departments of

Agriculture (NASDA)

http://www.nasda.org/cms/7195/8617.aspx

State Directory of the State

Departments of Agriculture

Step 2: Thoroughly research the competitive marketplace.

For those new to exporting, SRTGs offer a number of resources that are available on-line and through

special requests. These resources cover a range of exporting topics, from exporting terms to labelling

information. Some of the SRTGs retain in-country, Canadian representatives that can help in a number

of ways, including providing market intelligence specific to a particular product category. This type of

information may help a potential U.S. exporter price their products to the market and identify the most

appropriate food channel for their company. In coordination with SRTG services, FAS/Canada

publishes numerous market and commodity reports available through the Global Agricultural

Information Network (GAIN).

Page 16 of 45

Table 11. Organization and Data Sources within Canada

Organization

Function/Purpose

Website

Agriculture and

Agri-food Canada

(AAFC)

AAFC is the counterpart to the U.S. Department

of Agriculture.

www.agr.gc.ca

Food & Consumer

Products Canada

(FCPC)

FCPC is national, non-profit organization

representing the food and consumer products

industries.

www.fcpc.ca

Conference Board

of Canada – Food

Horizons Canada

FHC is the Conference Board’s food research

branch. The Conference Board is a non-for

profit applied research organization.

www.conferenceboard.ca

Association of

Importers and

Exporters

(I.E. Canada)

I.E. Canada is a national, non-profit

organization developing and enhancing

international trade activity and profitability.

www.iecanada.com

Canadian Federation

of Independent

Grocers

(CFIG)

CFIG represents Canada’s independently owned

and franchises supermarkets.

www.cfig.ca

Consumers'

Association of

Canada

Represents consumers to all levels of government

and to all sectors of society.

www.consumer.ca

Step 3: Locate a Canadian partner to help identify key Canadian accounts.

FAS/Canada recommends that exporters looking to enter the Canadian market consider appointing a

broker or develop a business relationship with a distributor or importer. Some retailers, and even

distributors, prefer working with a Canadian firm instead of working directly with U.S. companies

unfamiliar with doing business in Canada. U.S. companies are urged to closely evaluate their business

options and evaluate all potential Canadian business partners before entering into a contractual

arrangement. Factors such as previous experience, the Canadian firm’s financial stability, product

familiarity, account base, sales force, executive team commitment, and other considerations should all

be taken into account before appointing a Canadian partner and or entering into a business relationship.

FAS/Canada encourages U.S. exporters to be clear in their objectives and communications to avoid

confusion.

A partial listing of Canadian food brokers is available in GAIN Report CA11025. FAS/Canada can

provide assistance in identifying a broker, distributor, or importer, but cannot endorse any particular

firm. Canadian business partners may request certain aspects of a product and/or a level of commitment

from a U.S. exporter. Some of these criteria may include: product UPC coding; a proven track record of

retail sales and regional distribution in the United States; production growth capacity; and commitment

to offer a trade promotion program for Canada.

Page 17 of 45

SRTGs offer services that can help vet potential partners, though these services are not an endorsement

and we strongly recommend U.S. companies scrutinize the background of each potential Canadian

partner and obtain referrals from the potential partner. Another avenue to identify potential business

partners is to visit and/or participate in trade shows in Canada. Agriculture and Agri-Food Canada,

USDA’s Canadian counterpart, maintains a list of trade shows on this webpage.

USDA endorses SIAL Canada, one of the largest food trade shows in Canada. The annual event

alternates between Montreal and Toronto.

FAS/Canada recommends that U.S. firms electing to sell directly to retail or food service accounts, first

evaluate the Canadian accounts to avoid future strategic conflicts. For example, selling a brand into a

discount chain could limit that brand’s ability to enter higher-end retail outlets. In addition, large

grocers and mass merchandisers may demand minimum quantity orders from U.S. exporters.

Step 4: Learn Canadian government standards and regulations that pertain to your product.

Start by reviewing the latest FAS/Canada FAIRS Reports (CA17049 and CA17050) for information on

Canadian import policies pertaining to your product. In addition, the Canadian Food Inspection Agency

(CFIA) provides extensive information on the programs and services it offers for importing commercial

foods into Canada, including a Guide to Importing Food Products Commercially. In addition, the CFIA

Automated Import Reference System (AIRS) provides specific import requirements for food items by

the Harmonized System (HS) classification, and detailed by place of origin (i.e., a specific U.S. state),

destination in Canada (i.e., a specific province) and end use of the food item (e.g., for animal feed, for

human consumption, etc.). The CFIA Contact Us webpage covers a range of issues, including contact

information for regional offices and the National Import Service Centre, which can help ensure customs

paperwork accuracy and facilitate pre-clearance of some goods.

Canadian agents, distributors, brokers, and/or importers are also able to assist exporters through the

import regulatory process.

Page 18 of 45

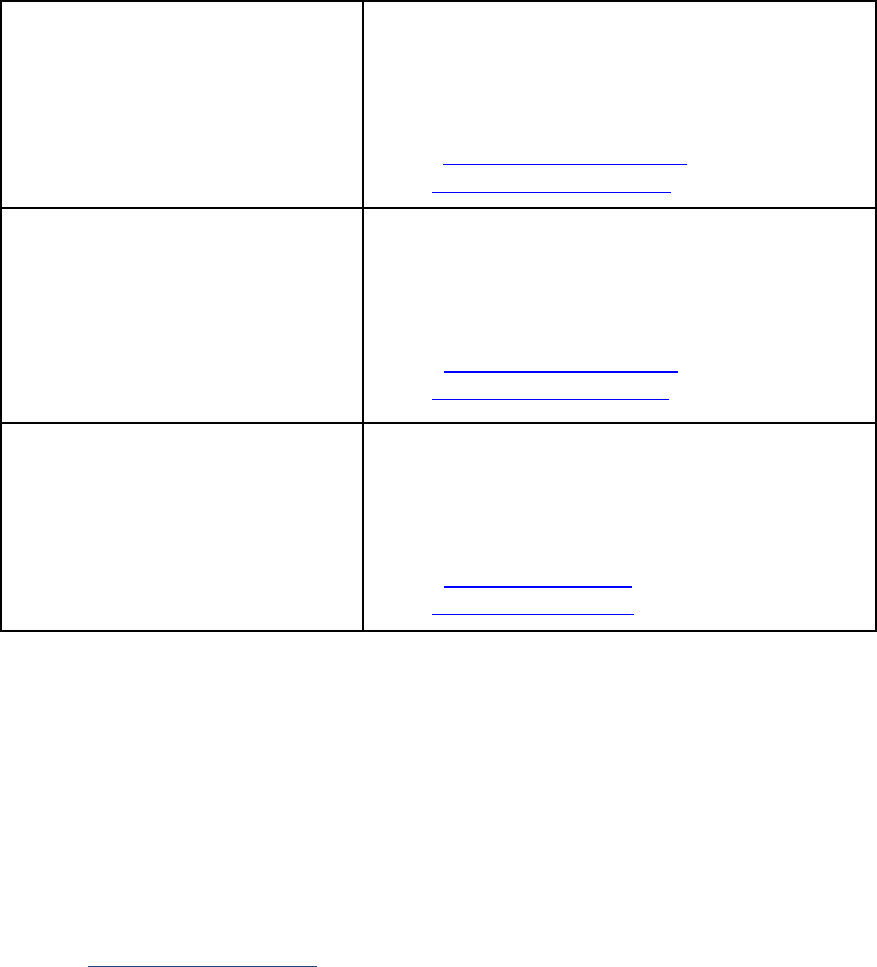

2B. Market Structure

Food products imported into the Canadian marketplace may be sold directly to the retailer or to

importers, brokers, distributors and wholesalers. A significant amount of U.S. agricultural and food

products are shipped as intra-company transfers to Canadian branches or subsidiaries.

Traditional supermarket outlets are split between chains and independent stores. All the larger Canadian

retail chains are involved in wholesaling and retailing operations. They maintain sizable distribution

centers strategically located across Canada. These distribution centers not only supply their own store

outlets but may also supply franchised stores and independent grocers. Some independent grocers may

be affiliated with a wholesaler through a voluntary buying group. Wholesalers and the distribution arm

of a leading grocery retailer often supply convenience stores and smaller grocery retail chains.

Importers, distributors and some wholesalers can sell a specific category or line of products to chain

store distribution centers, as these centers will breakdown the quantities to ship to individual stores. In

addition, as in the United States, some brokers, distributors, and importers sell directly to specified chain

units by providing a direct store delivery. However, the product and designated stores must be approved

by the chain’s head office.

Larger chains have the ability to procure directly from a foreign supplier, particularly for large quantities

of perishable products, such as dairy, produce, meat, and poultry as well as for some packaged goods.

Some retailers, such as Loblaws and Sobeys, employ procurement offices in the United States for this

sole purpose and educate U.S. suppliers to meet all Canadian government and store regulations. For the

U.S. Manufacturer

Brokers

Selling to importers,

distributors,

wholesalers,

distribution centers

and various retailers

Importers

Selling to distributors,

wholesalers,

distribution centers

and various retailers

Distributors &

Wholesalers

Selling to distribution

centers and various

retailers

Distribution Centers

Leading

Supermarket

Chains

Minor and

Specialty

Retailers

Other Chain

Retailers and

Independent

Grocers

Page 19 of 45

packaged good products found in the middle of a grocery store, a number of larger retailers rely on

brokers, importers and distributors to identify unique products from less recognized food suppliers.

Both retailers and suppliers are seeking efficiencies to reduce operational and labor costs in their

operations. As in other business sectors, the category buyers of larger retailers are looking to reduce

their list of food suppliers and prefer working with representatives that carry an extensive line of

products offering a range. In response to this trend, the broker/distributor industry is making an effort to

consolidate products while introducing unique novel products into the market. Larger

brokerage/distribution firms are acquiring smaller specialty brokers/distributors to offer national

coverage or enhance product offerings. For example, UNFI in Toronto is a leading distributor of

natural, organic, and specialty retail products specializing in more hard-to-find specialty products.

Brokers and distributors focus on selling to the appropriate category buyer at each head office, while

larger brokerage or distribution firms will offer added services to their food manufacturers, like

merchandising store checks. Merchandising staff will help to monitor the placement and turnover of the

products, as well as help negotiate sampling opportunities with the store chain.

To reduce costs and expand their retail channels, some Majors acquired other chains. For example,

Loblaws acquired Shoppers Drug Mart (1,095 units) in December of 2013, and Sobeys acquired 213

Canada Safeway stores in Western Canada in 2014. This consolidation in the grocery retail landscape

places pressure on other smaller retailers to either offer products at a competitive price or to offer unique

food offerings not found readily in the larger retailers. In the last two years, the small independent

channel has had a four percent growth rate, as more shoppers demand new and specialty food products

in the market.

2C. Retail Food Distribution Channels

Broker / Distributor / Importer Arrangements

U.S. firms, particularly small- to medium-sized firms are recommended to partner with a Canadian food

broker/distributor/importer. Most distributors and importers will import and take title of the goods. The

products will likely be stored in their warehouse and then sold to various store units. While the product

may be added to the distributor’s catalog of goods, the company or principal may still be responsible for

establishing new store accounts if the product is not ordered by the distributor/importers’ customers.

Brokers on the other hand, usually do not take title of the goods but act as your sales persons for their

principals. This means pitching the product and its unique features to potential buyers and possibly

setting up a network of various food distributors. Usually they charge a percentage of the product sales

revenue, ranging from 3 percent to 10 percent. The percentages are influenced by several factors: the

type of product line, expected sales volume, additional special services such as planning promotions or

data collection. In the beginning, a broker may request a monthly retainer fee until monthly sales are

well established, as they must ‘pioneer’ the product in the beginning. Once targeted sales volumes are

reached then the broker will switch to a percentage-of-sales program. All fees are negotiated between

the principal and their broker prior to future transactions.

In an effort to introduce new products and obtain a product listings, a broker will call on the head office

of key store chains and wholesale groups. Once a product listing is secured, there may be a listing fee

on new products unless the retailer views the product as a “must have” item. This fee will vary and will

be determined by the product’s uniqueness, the demand for the item, as well as the advertising and

promotional expenditures required to launch the product in a store.

Page 20 of 45

i. Retail Grocery Sector

Grocery Stores / Supermarkets / Superstores

Canada’s traditional grocery retailers continue to dominate retail grocery sales. Canadian-based retailers

Loblaws, Sobeys and Metro are responsible for 58 percent of retail food sales in the country, having

positioned themselves as the food specialists over their mass-merchandising competitors. They offer

discount banner stores and have been aggressive in developing their private label brands. As mentioned

earlier, both Loblaws and Sobeys have made strategic acquisitions with the goal of capturing more food

sales. Retail leaders will continue to offer discount promotions, specials and other amenities through

store loyalty programs to entice new customers and maintain loyal shoppers.

Loblaws is the largest grocery retailer in the country, with an estimated 26 percent share, which does not

include food sales through their national drug chain, Shoppers Drug Mart. The company’s 24 banners

cover the complete spectrum of stores: large superstores, conventional supermarkets, discount units,

convenience and club stores. The company has earned a strategic advantage among their competitors

with their private label brands. Some of their brands compete head-to-head with national brands.

Among their 13 private label brands, their most recognizable brands are “President’s Choice” (PC) and

the widely distributed “No Name” discounted brand, representing over 5,200 products. At the high end

of the price spectrum, Loblaw offers its “Black Label” products which primarily include specialty

products, such as artisan-style croutons and cherry Shiraz jelly.

Also, the company has invested more than $700 million in store improvements on 200 of their existing

retail units over the last three years. Some of the improvements included additional floor space in their

produce and seafood departments, along with more counter space for their prepared meal section, which

continues to be popular among shoppers on the go. To reach the growing Asian market, Loblaws

acquired specialty grocer T & T Supermarkets, which offer a range of Asian food products not found in

traditional stores. Today, there are 23 T & T Supermarket stores located primarily in British Columbia

and in Ontario.

Sobeys ranks 2

nd

behind Loblaws with approximately 22 percent of retail food market sales. However,

Sobeys offers more grocery stores than its leading competitor with 1,836 locations across the country,

including convenience stores. Sobeys’ success has been largely attributed to their number of store

locations as well as their strategic real estate acquisitions. As Canada has become increasingly

urbanized with greater population concentration and density in its five major cities, Sobeys was the first

retailer to introduce an urban-format store unit. Sobeys’ “Urban Fresh” stores appeal to single/double

households and are usually situated close to the downtown area in densely populated residential

neighborhoods. The stores are smaller, but operate efficiently with frequent product turnover. Sobeys

has also expanded its private label category and now offers seven brands, including their traditional

“Sensations Complements.” In addition, to capture the ethnic and discount shopper, Sobeys rebranded

one of their former banner stores, “Price Shopper” to “FreshCo.” The new stores were redesigned to

display more produce and baked goods as well as halal meats and ethnic packaged goods.

Metro represents over 10 percent of the retail market operating 1,136 food and convenience stores.

Conventional supermarkets, including their Food Basics (Ontario) and Super C (Quebec) discount

banners, make up most of Metro’s portfolio. The company continues to increase its’ private label

products to compete with other retailers. The most recognizable store brands are “Irresistibles” and

“Selection.” In response to the healthy eating trend, Metro has introduced “Sans Gluten Free” and

“Irresistibles-Bio Organics” brands. To compete with Loblaws and Sobeys in attracting ethnic shoppers,

Page 21 of 45

Metro partnered with an independent Quebec retailer Marché Adonis to incorporate a banner offering

Middle Eastern and Mediterranean-style foods. The company opened two stores, one each in the

suburbs of Toronto and Montreal consisting of 30-40,000 square-feet of floor space with both ethnic and

non-ethnic consumers.

Although, Loblaws, Sobeys and Metro continue to be the market leaders, regional retailers should not be

overlooked by U.S. exporters. Getting a product listed in one of the regional partners may be more

attainable when establishing a foothold in Canada. For example, the Overwaitea Food Group in

Western Canada, with 145 stores in Alberta and British Columbia, has made significant headway in

providing new product offerings. Longos in the Greater Toronto Area has gradually expanded in the last

few years, focusing on a better shopping experience for their customers by equipping several of their 26

stores with full-service restaurants. In addition, a few of the ethnic retailers have grown from mom and

pop family stores to upscale operations, such as Nations Fresh Food Market now with four locations in

the Greater Toronto Area including their most recent location which opened in the fall of 2017. Each

Nations Fresh store is large, offering up to 55,000 square feet of floor space, and equipped with

restaurants and a large section of prepared meals.

In total there are over 6,000 independent retailers across Canada accounting for more than $6 billion in

annual sales. While this segment of the market is fragmented, specialty stores such as the Toronto’s

Cheese Boutique or Pusateri’s, that recently aligned with Saks Fifth Avenue, maintain a loyal following

as their customers are willing to pay premium prices and know they can find one-of-a-kind food

products at these high-end boutique stores.

Club Stores

Warehouse club stores, such as Costco Canada and Loblaw Real Canadian Wholesale Club Stores, have

made a permanent foothold in Canada’s retail landscape. Among the club store formats, Costco has

been the most successful, commanding 11 percent of grocery sales in the retail market. In 2017, Costco

opened up seven new stores for a total of 102 stores across the country. Reports show a number of

Canadians regularly shop at Costco as they prefer to make fewer grocery trips by loading up once a

week. In addition, Costco consistently relies on product sampling, which has helped to drive up food

sales as demos, and food sampling make a difference. Although, the warehouse format does not offer

many frills, it does offer convenience and competitive unit pricing on bulk items. Club products carry

an average profit margin of about 11 percent, while other retailers mark up their goods anywhere from

25 to 50 percent.

Mass Merchandisers

Walmart Canada is the largest mass merchandiser in the country with 410 stores nationally. In recent

years, Walmart Canada has lost some ground in grocery food sales, falling from 9 percent in 2014 down

to 7.5 percent in early 2017. Nevertheless, Walmart Canada has made significant headway with their

Great Value private label brand in the frozen foods and packaged foods segments. Along with the other

retailers, Walmart Canada has introduced a number of healthy and ‘natural’ packaged food products

under its private label brand. The introduction of produce sections continues to attract shoppers looking

for fresh items, and Walmart produce buyers remain committed to providing a strong selection of

produce items throughout the year.

As more and more Canadians look for discounted items to cut their grocery bills, a select number of

shoppers have flocked to stores like Dollar Tree and Dollarama to buy basic dry goods, like cereals and

canned goods. The Canadian Financial Post has reported that growth of these types of stores has been

faster in Canada than in the United States. In 2016, Dollarama saw its food sales jump by 10 percent

with total reported food sales at over $400 million and growing.

Page 22 of 45

ii. Convenience Stores / Mini Marts / Gas Stations

The Canadian Convenience Store Association reported close to 11 million daily visits to Canada’s

32,000 convenience stores and gas stations. The sector accounts for 3 percent of total food sales. They

are particularly strong in offering non-alcoholic beverages, with those products accounting for up to 25

percent of a location’s grocery offerings. Floor space for new food products (e.g., fresh produce, sushi,

and baked goods) is growing and many store units are expanding their premises to accommodate these

products. The focus continues to be equipping stores with equipment, such as beverage stands, and

high-quality convenience foods, like snack foods and confectionary items. Even in these formats,

locations owners are trying to offer more healthy options, like fresh produce and healthier packaged

foods.

iii. Drug Chains

Grocery sales through the drug store channel continues to grow. Loblaws 2014 acquisition of the

national chain Shoppers Drug Mart has affected some retail food offerings across the 1,307 store

locations. Previously, Canadian drug stores only offered a minimal selection of basic grocery items, like

milk, cereal, and chips. However, Loblaws has invested heavily in selected urban stores to expand the

fresh, refrigerated and packaged products aisles. In 2017, Loblaws enhanced 34 locations across Canada

and it will enhance another 11 stores in the Vancouver area in 2018. FAS/Canada anticipates other drug

chains, such as London Drugs and the Jean Coutu Group, will duplicate some of these efforts in their

own stores.

iv. Online Shopping

Online grocery shopping continues to be slow to take off in Canada, despite Amazon’s early presence in

the Canadian market (2014). Total online retail food sales was a little over 1 percent in 2016, compared

to U.S. figures of 2.5 percent of the food market. Today Amazon.ca offers 15,000 grocery items and the

2017 acquisition of Whole Foods, foreshadows increasing online grocery sales in the coming years. The

Majors have had challenges with home delivery orders, and have therefore encouraged in-store pick-up

of on-line orders, rather than home delivery. For instance, Walmart Canada invested over $31 million

CAD to match Amazon by offering fresh produce through in-store pick-up orders. Other retailers have

followed this trend, with Loblaws introducing Click & Collect in 60 locations in 2016 and aggressively

promoting this platform through major advertising efforts.

Loblaws’ Click & Collect food lockers and Walmart.ca’s grocery webpage

Page 23 of 45

Other e-commerce retailers are largely regional. IGA (operated

by Sobeys in selected areas of Quebec), Metro Glebe (operated by Metro in Ottawa), and Grocery

Gateway (owned by Longo’s in the Greater Toronto Area) as well as a few smaller operations servicing

Vancouver Island in British Columbia (Quality Foods) and TeleGrocer (Southern Ontario) have made

notable contributions to online retail food sales.

Leading Retail Banners byd Location

The following table lists the leading retail chains and their major respective banner store as reported at

the end of 2016.

Provincial Abbreviations:

AB: Alberta

BC: British Columbia

MB: Manitoba

NB: New Brunswick

NL: Newfoundland and

Labrador

NT: Northwest Territories

NS: Nova Scotia

NU: Nunavut

ON: Ontario

PE: Prince Edward Island

QC: Quebec

SK: Saskatchewan

YT: Yukon

Canadian Regions:

Eastern: NB, NS, PEI, NL

Central: ON & QC

Western and Prairies: AB, BC, MB, SK

Store Type:

SS: Superstore

SM: Supermarket

SC: Super Centre

C: Convenience

Price Category:

D: Discount

L: Low

M: Medium

W: Wholesale

U: Upper

Page 24 of 45

Table 12: Grocery Stores/Supermarkets/Superstores Banners

Retailer

Banner Name

Store

Type

Price

Category

Total

Units

Location

Loblaws

Total Locations – 1,194 stores

Eastern Canada

Atlantic

Superstore

SS

D

50

NB, NS, PEI

Dominion

SM

M

11

NL

Save Easy Foods

SM

D

43

NB, NS, PEI, NL

National &

Central Canada

Cash & Carry

SM

W

15

ON, NS

Extra Foods

SM

D

66

BC, YT,NT, AB, SK,

MB, ON

Fortinos

SM / SS

M

21

ON

L’Intermarche

SM

M

64

QC

Loblaws

SM / SS

M

65

ON, QC

Maxi

SM

D

96

QC

Maxi & Cie

SM

D

21

QC

NoFrills

SM

D

213

BC, AB, ON, NB, NS,

NL, PEI

Presto

SM

M

11

QC

Provigo

SM / SS

M

78

QC

Real Canadian

Superstore

SS

D

112

BC, YT, AB, SK, MB,

ON

Real Canadian

Wholesale Club

SS

D

33

BC, AB, SK, MB, ON

Valu-Mart

SM

M

60

ON

Your

Independent

Grocer

SM

M

59

ON

Zehrs

SM / SS

M

44

ON

Western

Canada /

Prairies

Extra Foods

SM

D

66

BC, YT, NT, AB, SK,

MB,ON

Real Canadian

Wholesale Club

SS

D

33

BC, AB, SK, MB, ON

SuperValu

SM

D

11

BC, YT, SK

T & T

SM

M

22

BC, AB, ON

Page 25 of 45

Retailer

Banner Name

Store

Type

Price

Category

Total

Units

Location

Sobeys

(Empire Company

Ltd.)

Total Locations – 1,232 stores

2

All Provinces

Sobeys

SM

M

265

BC, AB, SK, MB, ON,

NB, NS, PEI, NL

Cash & Carry

SM

W

7

NB, NS, NL, MB

Foodland

SM

M

200

ON, NB, NS, NL

Freshco

SM

L/M

36

ON

IGA

SM

M/U

189

BC,AB,SK,MB,QC

IGA Express

SM

M

5

ON

IGA Mini

SM

M

6

QC

IGA Extra

SM

M

115

QC

Marché

Bonichoix

SM

M/U

92

QC, NB

Les Marché

Tradition

SM

M/U

37

QC

Price Chopper

SM

D

3

ON

Rachelle Béry

(Natural Health

Foods)

SM

M/U

21

QC

Thrifty Foods,

Inc.

SM

M

31

BC

Western

Canada

Canada Safeway

SM

M

202

BC, AB, MB, ON

Family Foods

SM

M

53

BC, AL, SK, MB

Metro Inc.

Total Locations – 1,136 stores

Central Canada

Food Basics

SM

D

95

ON

Marché

Richelieu

SM

M

78

QC (1 in ON)

Metro / Metro

Plus

SM

L/M

357

ON, QC

Super-C

SM

D

86

QC

Adonis

SM

M

2

ON & QC

2

This number indicates the food retail channel as Empire Company Ltd., owns 1,836 stores in various retail segments, such as the

convenience channel.

Page 26 of 45

Retailer

Banner Name

Store

Type

Price

Category

Total

Units

Location

Federated Co-

Operatives

Ltd.

Total Locations – 384 stores

Central /

Western /

Prairies

Federated Co-op

SM

M

220

BC, AB, SK, MB, ON,

YT

Super A Foods

SM

M

24

BC, AB, SK, MB,

NWT, YT, ON

The Grocery

People

SM

M

13

AB, NWT, YT

Cash and Carry

Depots

SM

D

5

AB,BC,

TAGS

SM

M

14

AB, SK, YT

Co-op Atlantic

Co-op Stores

SM

M

66

Atlantic Canada

Country Stores

SM

M

13

Atlantic Canada

Valu Foods

SM

M

22

Atlantic Canada

Village Stores

SM

M

7

Atlantic Canada

Overwaitea

Food Group

Total Locations – 145 stores

Cooper’s Foods

SM

M

16

BC

Overwaitea

Foods

SM

M

13

BC

PriceSmart

Foods

SM

L/M

5

BC

Save-On-Foods

SM

M

106

BC, AB

Urban Fare

SM

M

5

BC

H.Y. Louie

Company

Total Locations – 32 stores

IGA

SM

M

32

BC

Cash & Carry

SM

D

3

BC

Page 27 of 45

Regional and/or Privately Owned Retail Chains

Retailer

Banner Name

Store

Type

Price

Category

Total

Units

Location

Kitchen Food Fair

Kitchen Food

Fair

SM

M

55

ON

Rabba Fine Foods

Rabba Foods

SM

M/U

35

ON

Longo Brothers Fruit

Market Inc.

Longos

SM

M/U

26

ON

Farmboy Inc.

Farmboy

SM

M/U

17

ON

Quality Foods

Quality Foods

SM

M

12

BC

Whole Foods Market

Whole Foods

SM

M/U

10

BC &

ON

Source: Canadian Grocer, Who’s Who (2017) and 2016 Directory of Retail Chains in Canada

Table 13: Warehouse Club Store Banners

Retailer

Banner

Name

Store

Type

Price

Category

Total

Units

Location

Costco

Canada Inc.

Total Locations – 102 Stores

Costco

CW

W

102

BC, AB, SK, MB, ON,

QC, NS, NB, NL

Source: Canadian Grocer, Who’s Who (2017) and 2016 Directory of Retail Chains in Canada

Page 28 of 45

Table 14: Mass Merchandisers

Retailer

Banner Name

Store

Type

Price

Category

Total

Units

Location

Canadian Tire

Corporation

Canadian Tire

MM

MM

511

All provinces

Dollar Tree

Canada

Dollar Giant

MM

D

207

BC, AB, SK,

MB, ON

Dollarama Stores

Dollarama

MM

D

806

All

provinces

Giant Tiger Stores

Giant Tiger

MM

D

200

All provinces

The Northwest

Company

Northern

MM

M

149

All provinces

North Marts

L/M

QuickStop

L/M

Walmart Canada

Corporation

Walmart

MM /

SC

D

391

All provinces

Supercenters

D

Your Dollar Store

with More

Your Dollar Store

with More

MM

L/M

118

BC, YT, AB,SK,

MB,ON, NS

Source: Canadian Grocer, Who’s Who (2017) and 2016 Directory of Retail Chains in Canada

Page 29 of 45

Table 15: Convenience Stores, Mini Marts and Gas Stations

Retailer

Banner Name

Total Units

Location

Alimentation Couche-

Tard, Inc.

Couché-Tard

1,550

Across Canada

Metro

Marché Ami

72

QC

Marché Extra

194

QC

Sobeys

Needs

122

Eastern Canada

Quickie Convenience

Stores

Quickie

50

ON, QC

7-Eleven Canada Inc.

7-Eleven

470

BC, AB, SK,

MB, ON

Husky Oil Marketing

Company

Husky Food Stores / Husky Market /

Mohawk Stop ’N Go

326

BC, AB, SK,

ON

Suncor Energy

(Petro Canada)

SuperStop

1,496

All provinces

Shell Canada Products

Limited

Select

n/a

All provinces

Imperial Oil Ltd.

On the Run

424

All province

Parkland Industries LP

Fas Gas

Fas Gas Plus

Short Stop

Short Stop Express

266

BC, AB, SK,

MB

Source: Canadian Grocer, Who’s Who (2017) and 2016 Directory of Retail Chains in Canada

Page 30 of 45

Table 16: Leading Drug Chains

Retailer

Banner Name

Total

Units

Location

Shoppers Drug Mart

Shoppers Drug Mart

1,382

All provinces

PharmaSave

Pharmasave

493

BC,AB,SK,MB,

ON,NB,NS

Katz Group Canada

Ltd.

Rexall / Rexall Pharma

Plus

420

BC, AB, SK, MB, ON,

MB

Canadian Grocer, Who’s Who (2017) and 2016 Directory of Retail Chains in Canada

Table 17: Online Shopping

Retailer

Banner Name

Estimated

Customers

Location

Longo’s Brothers Fruit

Markets

Grocery

Gateway.com

50,000

Greater Toronto Area

Only

Amazon

Amazon.ca

N/A

All Canadian Provinces

Walmart Canada

Walmart.ca

N/A

All Canadian Provinces

Page 31 of 45

Section 3: Leading U.S. Products and the Competition

Product

Category

Major

Supply

Sources

Strengths of Key Supply

Countries

Advantages and

Disadvantages of Local

Suppliers

FRESH FRUITS

& VEGETABLES

VEGETABLES:

CANADIAN

GLOBAL

IMPORTS (2016):

USD $2.5.

BILLION

VEGETABLES:

1. U.S.: 62%

2. Mexico:

29%

3. China: 2%

Canada is the largest foreign buyer of

U.S. fruits and vegetables. The U.S.

benefits from relatively unimpeded export

access into Canada during Canada’s

winter or non-growing months.

Among imports, U.S. fruits and

vegetables are viewed by most Canadians

as their number one choice to other

imports.

Mexico and some South American

countries, like Chile over the last five

years have established themselves as

market leaders behind the fruits.

However, countries like Morocco have

shown double digit growth, in their

shipments of mandarins and oranges and

grapes. Peru has made significant into the

market in their grape shipments with a

36% increase from the previous year.

Mexico remains a major competitor due to

lower prices, along with some Canadian

produce companies with winter operations

in Mexico. Their leading products are

avocadoes, various types of berries,

tomatoes, cucumbers and watermelon.

Lettuce, onions, carrots,

tomatoes, potatoes, cauliflower,

and spinach are the leading

vegetables sold in the fresh

market.

Apples are the largest production

item, followed by blueberries,

cranberries, grapes and peaches.

Seasonality poses a constraint to

growers; Canada imports 80% of

its fresh vegetables between

November and June.

‘Buy Local’ is well supported by

the restaurant trade as more and

more menus highlight local

produce and meats.

FRUIT:

CANADIAN

GLOBAL

IMPORTS (2016):

USD$3.5 BILLION

FRUIT:

1. U.S.: 44%

2. Mexico:

16%

3. Chile: 7%

PROCESSED

FRUITS AND

VEGETABLES

CANADIAN

GLOBAL

IMPORTS (2016):

U.S. $2.3 BILLION

1. U.S.: 60%

2. China: 8%

3. Mexico: 4%

There is a full range of prepared and

frozen products. Major products are

prepared potatoes, tomato paste, mixes

fruits, and variety of processed

vegetables.

U.S. is a major player in the market with

established process brands, like Conagra

Foods and French’s Foodservice.

China’s products are dried and prepared

vegetables and fruits.

Mexico supplies prepared and frozen

strawberries and other prepared fruits and

vegetables.

Canadian companies process a

wide range of canned, chilled,

and frozen products.

Adoption of advanced

technologies in food processing

has been fairly extensive among

Canadian processors. Statistics

Canada reported almost 50%

companies adopted more than 5

new technologies in their

operations.

Higher manufacturing and

operation costs than in the U.S.

Page 32 of 45

Product

Category

(continued)

Major

Supply

Sources

Strengths of Key Supply

Countries

Advantages and

Disadvantages of Local

Suppliers

SNACK FOODS

CANADIAN GLOBAL

IMPORTS (2016):

USD $1.7 BILLION

1. U.S.: 60%

2. Mexico: 6%

3. U.K.: 4%

The U.S. dominates this category

with snack breads, pastry cakes,

pretzels, chips, cookies, and dried

fruits. Additional, the U.S.

maintains a 90% share of the

market in the potato chip category.

Competitors vary by sub category

with the main competitor and sub

category as follows: Mexico:

cookies and biscuits; U.K. ,

cookies, wafers, and pastry cakes.

Canada’s snack food imports have

grown by USD $122 million since

2013. The category includes breads,

pastry cakes, nuts, and prepared

potatoes.

The snack food industry is served

primarily by domestic manufacturers

however domestic market share is

being lost to imports. The rapid

increase in imports is due to the

number of new products in the

category, such as a variety of

crackers and other products targeted

at specific ethnic groups.

Canada does have domestic raw

materials for the grain based products

but has to import sugar, chocolate,

cacao, and nuts for manufacturing

and is not competitive on dairy and

egg ingredients used in some of the

processing.

RED MEATS

(Fresh/Chilled/Frozen)

CANADIAN GLOBAL

IMPORTS (2016):

USD$1.4 BILLION

RED MEATS

(Prepared/Preserved)

CANADIAN GLOBAL

IMPORTS (2016):

USD$988 MILLION

1. U.S.: 66%

2. Australia:

12%:

3. New

Zealand:

10%

1. U.S.: 91%

2. Thailand:

3%

3. Italy: 2%

Beef imports fall into two distinct

categories. The largest portion of

imports being chilled cuts

traditionally from the U.S. Midwest

heavily destined for the Ontario

region. The other part is frozen

manufacturing meat from Australia

(for grinding) and New Zealand

(largely for specific manufacturing

purposes).

Many parts of South America

remain ineligible for entry to

Canada (except as a supplier of

cooked and canned beef) due to

sanitary reasons.

U.S. competitors are limited by a

beef quota.

Canada maintains a narrow acquired

feed cost advantage.

Canada continues to grow as a key

U.S. pork export market.

The industry has worked its way out

of the inventory surge from the BSE

trade disruption.

Canadian per capita basis

consumption has declined since 2009,

falling by .7% to 23.4 kg.

The strong U.S. dollar, along with the

growing sentiment of

‘ Buy Local,’ has influenced a

number of restaurant independents to

be loyal to Canadian suppliers.

Page 33 of 45

Product Category

(continued)

Major

Supply

Sources

Strengths of Key

Supply Countries

Advantages and Disadvantages

of Local Suppliers

FISH & SEAFOOD

CANADIAN GLOBAL

IMPORTS (2016):

U.S. $2.5 BILLION

1. U.S.: 38%

2. China 15%

3. Thailand:

11%

Leading U.S. exports to

Canada are live lobsters,

salmon and prepared/

preserved fish.

Fish filleting is extremely

labor intensive, which

accounts for the rapid

penetration of China and

Thailand in this segment.

With ocean catches having

peaked, aqua culture is

becoming a more important

source of product and China is

the dominant producer of

farmed fish and seafood in the

world.

A growing concern among

consumers and retailers for

sustainable production

practices may help some U.S.

fish processors.

More than two-thirds of

seafood is sold by retailers.

Declining fish stocks have led to almost

zero growth in fish and seafood catch

over the last decade.

Lobster, crab and shrimp comprise 67%

of the landed value of all fish and

shellfish harvested in Canada.

At approximately 50 lbs. per person,

Canadian consumption of fish is

significantly higher than in the U.S. 16.5

lbs. per person, making Canada an

excellent export market for U.S.

exporters.

Frozen processed seafood grew by 6% in

the past year with demand for premium

products offering hormone-free and free

of antibiotic variants.

BREAKFAST

CEREALS/PANCAKE

MIXES

CANADIAN GLOBAL

IMPORTS (2016):

USD$519 MILLION

1. U.S.: 88%

2. Mexico:

6%

3. U.K.: 2%

The U.S. continues to

dominate imports with ready

to serve product that are

popular.

This past year, Mexico gained

significant ground with a

280% increase in sales of

mostly cereal products.

Sales and manufacturing in Canada is

largely controlled by U.S. based

companies.

Domestic non-U.S. owned competitors

tend to be in the specialty or organic

breakfast cereal business.

Cold breakfast cereals have decreased by

7% in volume as consumers choose other

breakfast options, as yogurts, protein

shakes and bars.

FRUIT & VEGETABLE

JUICES

CANADIAN GLOBAL

IMPORTS (2016):

USD$622 MILLION

1. U.S.: 57%

2. Brazil 20%

3. China 6%

Canada’s imports from both

the world and from the U.S.

Much of the juice is orange

juice as well other fruit and

vegetable juices.

U.S. represents 41% of the

fresh juice market while

Brazil maintains 54% of the

frozen orange juice

concentrate market.

China’s major juice export

to Canada is fortified apple

juice; China represents 90%

of the imports for this

category.

Canada is a major per capita consumer

of citrus juices but is unable to grow

these products. It will continue to be an

exceptional value added market for the

U.S.

Both Canada and the U.S. have

experienced major penetration by

Chinese apple juice due to the major

shift of Chinese agriculture toward

labor-intensive crops and labor intensive

processing.

Page 34 of 45

Product

Category

(continued)

Major

Supply

Sources

Strengths of Key Supply

Countries

Advantages and Disadvantages of Local

Suppliers

NUTS

CANADIAN

GLOBAL

IMPORTS

(2016):

Tree Nuts

USD$663

MILLION

Peanuts

USD$122

MILLION

Tree Nuts

1. U.S.:

55%

2. Turkey:

15%

3. Vietnam:

12%

Peanuts

1. U.S.: 80%

2. China:

17%

3.

Nicaragua:

2%

This category continues to

grow largely due to the

healthy snacking push.

Despite a slowdown in total

exports to Canada, tree nuts

continued to grow shipping a

total volume of 49 tonnes.

US products lead with

peanuts and almonds is

preferred by Canadian

importers as it meets

Canadian sanitary and

phytosanitary standards

consistently.

Turkey is a competitive

supplier of Hazelnuts and

Vietnam gained grown in

2016 with an 11% growth of

cashew nuts exports.

Growing trend of nut allergies

in Canadians caused the

Canadian Food Inspection

Agency and Health Canada to

set specific allergen labeling

regulations for all suppliers in

2012.

Canada has areas of Ontario, which can grow

peanuts, but it has not done so in commercial

quantities as the returns are not competitive with

other crop alternatives. Similarly British Columbia

and other provinces produce small quantities of a