EUROPEAN COMMISSION

DG Competition

Case M.8569 -

EUROPCAR /

GOLDCAR

Only the English text is available and authentic.

REGULATION (EC) No 139/2004

MERGER PROCEDURE

Article 6(1)(b) NON-OPPOSITION

Date: 05/12/2017

In electronic form on the EUR-Lex website under

document number 32017M8569

Commission européenne, DG COMP MERGER REGISTRY, 1049 Bruxelles, BELGIQUE

Europese Commissie, DG COMP MERGER REGISTRY, 1049 Brussel, BELGIË

Tel: +32 229-91111. Fax: +32 229-64301. E-mail: COMP-MERGE[email protected].

EUROPEAN COMMISSION

Brussels, 5.12.2017

C(2017) 8396 final

To the notifying party :

Dear Sir or Madam,

Subject: Case M.8569 – Europcar/Goldcar

Commission decision pursuant to Article 6(1)(b) of Council

Regulation No 139/2004

1

1

OJ L 24, 29.1.2004, p. 1 (the "Merger Regulation"). With effect from 1 December 2009, the Treaty on

the Functioning of the European Union ("TFEU") has introduced certain changes, such as the

replacement of "Community" by "Union" and "common market" by "internal market". The

terminology of the TFEU will be used throughout this Decision.

In the published version of this decision, some

information has been omitted pursuant to Article

17(2) of Council Regulation (EC) No 139/2004

concerning non-disclosure of business secrets and

other confidential information. The omissions are

shown thus […]. Where possible the information

omitted has been replaced by ranges of figures or a

general description.

PUBLIC VERSION

2

Table of contents

1. THE PARTIES AND THE OPERATION .................................................................. 3

2. EU DIMENSION ........................................................................................................ 3

3. MARKET DEFINITION ............................................................................................ 4

3.1. Product market definition .................................................................................. 4

3.1.1. Distinction between short-term and long-term car rental

services ................................................................................................ 4

3.1.2. Distinction between rental services for passenger cars and

industrial vehicles ................................................................................ 4

3.1.3. Distinction between corporate and leisure short-term car

rental services ...................................................................................... 5

3.1.4. Distinction between low cost, value and premium car rental

services ................................................................................................ 5

3.1.5. Distinction between on-airport and off-airport car rental

services ................................................................................................ 6

3.1.6. Conclusion ........................................................................................... 8

3.2. Geographic market definition ............................................................................ 8

4. COMPETITION ASSESSMENT ............................................................................... 9

4.1. Elements common to the assessment of the markets for the supply of

short-term car rental services ............................................................................. 9

4.1.1. Market structure ................................................................................... 9

4.1.2. Closeness of competition ................................................................... 10

4.1.3. The role of brokers ............................................................................ 12

4.1.4. Barriers to entry or expansion ........................................................... 13

4.2. Overview of the Parties' market shares ........................................................... 17

4.2.1. Methodology for estimating market shares at local and

national levels .................................................................................... 17

4.2.2. Overlapping markets ......................................................................... 17

4.3. Market-specific analysis .................................................................................. 20

4.3.1. France ................................................................................................ 20

4.3.2. Italy .................................................................................................... 23

4.3.3. Portugal .............................................................................................. 39

4.3.4. Spain .................................................................................................. 45

4.4. Coordinated effects .......................................................................................... 78

5. CONCLUSION ......................................................................................................... 80

3

(1) On 27 October 2017, the European Commission received a notification of a

proposed concentration pursuant to Article 4 of the Merger Regulation by which

Europcar Groupe S.A. ("Europcar", France) acquires within the meaning of

Article 3(1)(b) of the Merger Regulation control of the whole of Car Rentals

Topco, S.L. and its subsidiaries (together "Goldcar", Spain) by way of purchase

of shares (the "Transaction").

2

Europcar and Goldcar are collectively referred to as

the "Parties".

1. THE PARTIES AND THE OPERATION

(2) Europcar is mainly active in the short-term vehicle rental market, with an average

fleet of around 200 000 vehicles and a presence in more than 140 countries

worldwide. Europcar offers rental vehicles through its brands Europcar as well as

InterRent, which focuses on lower cost services. In addition, Europcar is active in

the mobility markets and, to a minor extent, in the sale of used cars.

(3) Goldcar is active in the leisure segment of the short-term vehicle rental market,

with an average fleet of around 35 000 vehicles and 76 offices opened in the EU

(Spain, Portugal, France, Italy, Greece and Croatia). In addition, Goldcar is

marginally active in the sale of used cars.

(4) The Transaction consists in the acquisition by Europcar of 100% of the shares of

Goldcar and, as a result, in the acquisition of sole control over Goldcar.

(5) Therefore, the Transaction constitutes a concentration within the meaning of

Article 3(1)(b) of the Merger Regulation.

2. EU DIMENSION

(6) The undertakings concerned have a combined aggregate world-wide turnover of

more than EUR 2 500 million (Europcar:

3

EUR [>4 000] million; Goldcar: EUR

[>300] million).

4

Each of them has an EU-wide turnover in excess of EUR 100

million (Europcar: EUR […]; Goldcar: EUR […]).

(7) The combined aggregate turnover of Europcar and Goldcar exceeds EUR 100

million in […], […] and […], and each of them has a turnover in excess of EUR

25 million in each of these three Member States.

(8) The two undertakings concerned do not achieve more than two-thirds of their

aggregate EU-wide turnover within one and the same Member State.

(9) The Transaction has therefore an EU dimension according to Article 1(3) of the

Merger Regulation.

2

Publication in the Official Journal of the European Union No C 376, 08.11.2017, p. 6.

3

Based on Europcar's shareholding structure and attendance rate at past shareholders' meetings, it is

assumed, for the purpose of this Decision, that Eurazeo S.A. exercises de facto control over Europcar.

Nevertheless, the Transaction would have an EU dimension even if Europcar were deemed not

controlled by Eurazeo.

4

Turnover calculated in accordance with Article 5 of the Merger Regulation.

4

3. MARKET DEFINITION

(10) The Parties' activities essentially overlap in the supply of short-term car rental

services in France, Italy, Portugal and Spain, in particular at airports, where they

serve airline passengers.

5

3.1. Product market definition

3.1.1. Distinction between short-term and long-term car rental services

(11) The Commission has found in previous decisions that it may be appropriate to

distinguish between short-term car rental services (e.g. provision of cars for an

individually agreed duration for business or leisure trips) and long-term car rental

services (e.g. with a rental period of more than one year).

6

In addition, it has

considered whether other mobility solutions such as car sharing form part of

short-term car rental services.

7

(12) Europcar defines the relevant market as the short-term vehicle rental market.

8

(13) In any case, for the purpose of this Decision, the question of the distinction

between short-term and long-term car rental services and, within the short term

car rental services, between the different mobility solutions can be left open, as

the Transaction would not raise serious doubts as to its compatibility with the

internal market under any plausible market definition.

(14) Considering that Goldcar does neither offer long-term car rental services

9

nor

other mobility services than short-term car rental,

10

the Commission will focus its

analysis on the market for short-term car rental services.

3.1.2. Distinction between rental services for passenger cars and industrial vehicles

(15) The Commission has also considered in previous decisions the possibility of

further dividing the short-term car rental market between passenger cars and

industrial vehicles, i.e. trucks.

11

(16) Europcar considers that there is an overall short-term rental product market.

12

5

The Transaction also relates, to a minor extent, to the sale of used cars. However, given the negligible

activity of the Parties, the Transaction would not lead to any affected market in relation to the sale of

used cars. Therefore, the sale of used cars will not be further considered in this Decision.

6

See e.g. Cases M.6333 BMW/ING Car Lease, paragraph 17; M.4613 Eurazeo S.A./Apcoa Parking

Holdings Gmbh, paragraph 16.

7

See e.g. Cases M.8309 – Volvo Car Corporation/First Rent A Car, paragraph 44; M.6333 BMW/ING

Car Lease, paragraph 18.

8

Form CO, paragraphs 92 and 100.

9

Form CO, paragraph 102.

10

Form CO, Annex 16 Europcar's reply to QP1 of 14 July 2017.

11

See e.g. Case M.5347 Mapfre/Salvador Caetano/JVs, paragraph 9.

12

Form CO, paragraph 92.

5

(17) In any case, for the purpose of this Decision, the question of the distinction

between passenger cars and industrial vehicles can be left open, as the

Transaction would not raise serious doubts as to its compatibility with the internal

market under either plausible market definition.

(18) Considering that Goldcar does not offer rental services for industrial vehicles,

13

the Commission will focus its analysis on the market for rental services for

passenger cars.

3.1.3. Distinction between corporate and leisure short-term car rental services

(19) Within the market for short-term car rental services, the Commission has defined

separate markets according to customer groups, differentiating between corporate

and leisure car rentals. Corporate car rentals would mainly be the result of

corporate agreements concluded between major car rental companies and large

corporations. While leisure customers in general rent cars from a wide range of

companies, corporate car rentals are usually book on the basis of corporate

agreements from a small group of large, international reliable rental companies

that have the requisite airport network, reputation, and service levels.

14

(20) Europcar submits that, from the demand-side perspective, there are leisure

customers with similar preferences to corporate customers, while there is a high

degree of supply-side substitutability.

15

(21) In any case, for the purpose of this Decision, the question of the distinction

between corporate and leisure short-term car rental services can be left open, as

the Transaction would not raise serious doubts as to its compatibility with the

internal market under either plausible market definition.

(22) Considering that Goldcar addresses only leisure customers, the Commission will

assess the effects of the Transaction on the basis of (i) all customers (corporate

and leisure rentals), and (ii) leisure customers only.

3.1.4. Distinction between low cost, value and premium car rental services

(23) By analogy to air carriers, some car rental operators (such as Goldcar) market

their services as a "low cost" product, as opposed to value or premium services.

The low cost segment aims at addressing the customers' needs and expectations

through a "no-frills" strategy by which any cost which is not an absolute need is

cut.

16

(24) The Commission has not considered a distinction between car rental companies

based on their operating models yet.

(25) Europcar submits that the market for car rental services should not be divided

between the low cost, value and premium segments, since there are no structural

13

Form CO, paragraph 102.

14

See e.g. Case M.2510 Cendant/Galileo, paragraph 21.

15

Form CO, paragraphs 93-94.

16

Form CO, Annex 16 Europcar's reply to QP1 of 14 July 2017.

6

differences between low cost and other brands in the car rental industry.

According to Europcar, the products offered by low cost, value and premium

brands are homogeneous. In addition, they are distributed through the same

channels, very often over the internet, and brokers present the products to

customers in the same way.

17

Finally, Europcar has submitted a "Price

comparison analysis" according to which the differences between the low cost,

value and premium categories are very limited.

18

(26) On this topic, the market investigation is inconclusive. A number of car rental

operators and brokers having expressed a view consider that low cost car rental

services are not interchangeable with value or premium car rental services

provided at the same location.

19

One respondent submitted that "a client booking

with a premium brand would expect a higher level of service, faster pick up

process, better quality of vehicle and transparency in pricing", while "a client

booking with a low cost company should expect longer pick up process, hidden

extras and in certain cases a lower quality of vehicle".

(27) However, a comparable number of market participants highlight that the validity

of this distinction depends on the customers. One competitor noted that, since

"customers base their purchase decision mainly on price the distinction between

low cost, value for money or premium is irrelevant, therefore all companies are

interchangeable." Another competitor indicated that in the country where it

operates, "the difference between low cost services and high-level services is

reduced more and more and the customer looks for the lowest price as first

choice."

20

(28) Overall, the Commission has not found solid-enough evidence to distinguish a

low cost market for car rental services. Therefore, for the purpose of this

Decision, the Commission considers that low cost, value and premium car rental

services form part of one and the same market. The differences between low cost,

value and premium services will nevertheless be taken into account in the

competitive assessment, in particular when looking at closeness of competition.

3.1.5. Distinction between on-airport and off-airport car rental services

(29) Considering the focus of Goldcar's activities on services to airport passengers, the

Commission has assessed whether the services provided by car rental companies

located within the airport and operating under a concession agreement ("on-

airport" services) and the services provided by car rental companies operating in

the surrounding of the airport without a concession agreement ("off-airport"

services) are substitutable.

21

17

Form CO, Annex 16 Europcar's reply to QP1 of 14 July 2017.

18

Form CO, Annex 19 Price comparison analysis report prepared by Charles River Associates of 5

September 2017.

19

Replies to Questionnaire 1 to market participants, question 6.

20

Replies to Questionnaire 1 to market participants, question 6.1.

21

Off-airport operators may provide car rental services from a rental station located at a walking distance

from the airport terminal, or through a courtesy bus (free shuttle bus transportation), or through "meet

& greet" services if an assistant receives the customers at the airport to deliver/collect the car.

7

(30) Europcar considers that no distinction should be made between the car rental

services offered on-airport and off-airport. It argues that there are no significant

differences between the products offered by concession holders and non-

concession holders in any of the three phases of the customers' experience

(reservation, pick-up and drop-off).

22

(31) On this topic, the market investigation yielded mixed results. The majority of the

car rental companies having expressed a view submit that customers consider on-

airport and off-airport services as interchangeable, while the majority of brokers

having expressed a view are of the opposite opinion.

23

A number of respondents

explain that the main driver for customers to choose a car rental company is price,

and that the off-airport location of the service does not necessarily drive their

decision, particularly in the leisure segment.

24

(32) Likewise, car rental companies and brokers bring forward the importance of the

location of the car pick-up point (and its distance from the point of interest, such

as the airport) in customers' choice of service providers. They notably indicate

that airport passengers typically prefer on-airport locations. However, they also

rank price as the most important criterion of choice for customers, ahead of the

distance of car pick-up.

25

(33) In this context, only a minority of respondents having expressed a view submit

that customers of on-airport car rental services would not be willing to switch to

off-airport car rental services if the current prices of on-airport services were to

increase by 5%-10% on a permanent basis.

26

(34) In terms of competitive landscape, the Commission notes that car rental

companies holding a network of stations switch from on-airport to off-airport

operations (and vice-versa) depending on business opportunities and profitability.

(35) In addition, the websites of car rental companies and brokers, which are the main

distribution channel of car rental services,

27

advertise similarly on-airport and

off-airport services.

28

(36) Therefore, for the purpose of this Decision, the Commission considers that it is

not appropriate to consider on- and off-airport services as distinct markets, at least

for leisure customers targeted by Goldcar. The differences between on-airport and

off-airport car rental services will nevertheless be taken into account in the

competitive assessment, in particular when looking at closeness of competition.

22

Form CO, paragraph 235 and following.

23

Replies to Questionnaire 1 to market participants, question 8.

24

Replies to Questionnaire 1 to market participants, question 8.1.

25

Replies to Questionnaire 1 to market participants, questions 5 and 5.1.

26

Replies to Questionnaire 1 to market participants, question 10.

27

For example, approximately […]% of the Parties' reservations at airports are done online (Form CO,

paragraph 239).

28

See examples of screenshots provided by Europcar (Form CO, paragraph 240 and following).

8

3.1.6. Conclusion

(37) In light of the above, for the purpose of this Decision, the Commission defines

two relevant product markets, on which it will base its competitive assessment: (i)

the overall market for the short-term passenger car rental services, (ii) the market

for short-term car rental services to leisure customers only.

29

3.2. Geographic market definition

(38) The Commission has considered in previous decisions that the market for short-

term car rental services is national in scope.

30

(39) Europcar submits that there is a strong local angle from the customers'

perspective, since choice is heavily based on location, and to a certain extent price

competition takes place at local level to a certain extent.

31

(40) In this context, and taking into consideration Goldcar's focus on leisure services

provided at airports, the Commission has assessed whether the local dimension is

relevant for the market of short-term car rental services.

(41) The results of the market investigation tend to confirm the local features of the

provision of short-term car rental services. In particular, the majority of car rental

companies and brokers submit that customers do not consider car rental services

offered at airports as interchangeable with car rental services offered downtown.

32

Likewise, all the airport managers that participated in the market investigation

confirm that the car rental services offered at airports are not interchangeable with

the services offered downtown.

33

(42) For the purpose of this Decision, the question of whether the geographic scope of

the market for short-term car rental services is national or local can be left open,

as the Transaction would not raise serious doubts as to its compatibility with the

internal market under either plausible market definition.

(43) The Commission will assess the effects of the Transaction on short-term car rental

services at national level and at local level, the latter defined as services provided

either (i) at the airport (including both on- and off-airport services), or (ii)

downtown.

34

29

The majority of the car rental operators and brokers does not deem relevant any further distinction

between the different services offered by car rental operators (replies to Questionnaire 1 to market

participants, question 12).

30

See e.g. Case M.8309 – Volvo Car Corporation/First Rent A Car, paragraph 45; M.3090

–

Volkswagen/Offset/Crescent/LeasePlan/JV, paragraph 12.

31

Form CO, paragraph 111.

32

Replies to Questionnaire 1 to market participants, questions 7 and 7.1. For instance: "Most of the

services offered at the airports are for inbound tourism whereas downtown is mainly for the domestic

market. The needs of each market differ completely."

33

Replies to Questionnaire 2 to airport managers, question 3.

34

For the purpose of this Decision, car rental services offered at railway stations will be considered as

downtown stations.

9

4. COMPETITION ASSESSMENT

(44) Under Article 2(2) and (3) of the Merger Regulation, the Commission must assess

whether a proposed concentration would significantly impede effective

competition in the internal market or in a substantial part of it, in particular as a

result of the creation or strengthening of a dominant position.

(45) The assessment of the compatibility of the Transaction with the internal market

will focus on the non-coordinated horizontal effects in the markets for short-term

car rental services where the Parties' activities overlap, according to the

framework set out in the Guidelines on the assessment of horizontal mergers

under the Council Regulation on the control of concentrations between

undertakings.

35

(46) For that purpose, the Commission will first analyse the elements common to the

different geographic markets (section 4.1), before providing an overview of the

Parties' market shares (section 4.2) and a more detailed analysis of the national

and local markets where the Parties are both active (section 4.3).

(47) In addition, considering the level of concentration of certain local markets, the

Commission will assess whether the Transaction is likely to give rise to

coordinated effects (section 4.4).

4.1. Elements common to the assessment of the markets for the supply of short-

term car rental services

(48) Given the high number of markets impacted by the Transaction, certain elements

which are common to all the markets are presented in the following sections 4.1.1

to 4.1.4. Those arguments apply to all markets assessed in section 4.3.

4.1.1. Market structure

(49) Europcar considers that the relevant markets and segments are highly

competitive.

36

(50) According to respondents to the market investigation, the market for car rental

services is dynamic and relatively fragmented in the Member States where the

Parties' activities overlap (France, Italy, Portugal and Spain).

(51) Generally, there are five large multi-national car rental companies that operate

under well-established brands and through an extensive footprint of stations

disseminated nation-wide.

37

These largest car rental companies in the EU not only

service corporate customers, but also leisure travellers to a large extent,

38

either

directly under their more recognisable brand or under subsidiary brands, under

35

OJ C 31, 5.2.2004 (the "Horizontal Merger Guidelines"), paragraphs 24 to 38.

36

Form CO, paragraph 205.

37

The five largest car rental companies are Avis, Enterprise, Europcar, Hertz and Sixt.

38

For example, Europcar generated 79% and 73% of its revenues from leisure customers in Portugal and

Spain respectively in 2016 (Europcar's reply to RFI4, question 3).

10

which low cost offerings notably are marketed.

39

In some instances, these large

car rental companies operate in a geographical area through franchisees.

40

(52) In addition to these large multi-national car rental companies, there are currently

other medium-size car rental operators operating national or regional networks of

stations, which generate a sizable volume of sales.

(53) Finally, there are also local car rental companies, which mostly service leisure

customers traveling to touristic destinations. The volume of sales generated by

these smaller players can however be rather significant in certain areas, such as in

certain islands in Portugal and Spain.

(54) The market investigation confirms that large companies like the Parties and

smaller-scale car rental companies compete with each other. A majority of

respondents to the market investigation consider that local and regional car rental

companies exert a strong competitive pressure on national and international car

rental companies, in particular in touristic areas where demand is mainly driven

by price.

41

They notably point to the fact that brokers increase the competitive

pressure exerted by local or regional car rental companies on national or multi-

national car rental companies.

42

(55) In addition, the Commission notes that […].

43

(56) As a consequence, the Commission considers that local and regional car rental

companies do exert a significant competitive constraint on the Parties in France,

Italy, Portugal and Spain.

4.1.2. Closeness of competition

(57) Europcar submits that the Parties are not close competitors because they compete

for different segments. While Europcar is active in both the corporate and leisure

segments (directly or through InterRent), Goldcar is a pure leisure player focusing

mainly on airports.

44

(58) According to respondents to the market investigation, short-term car rental

services, more particularly their leisure segment, tend to be commoditised. The

importance of price was underlined by car rental operators and brokers in the

market investigation, since they both consider that the most important criterion

39

For example, Enterprise caters for leisure customers through its subsidiary brand Alamo, while Avis

does so with Maggiore; in addition Hertz offers value car rental services through its subsidiary brands

Dollar and Thrifty, and low cost services through Firefly – Form CO, paragraph 71, in conjunction

with the Competitive assessment submitted by the Parties to the Commission on 16 November 2016.

40

[…] (Form CO, paragraph 193), the Commission considers that franchises should be treated as third

parties for the purpose of this Decision. In any case, the question of franchises does not have any

material impact on the competitive assessment, […] (Form CO, paragraphs 194-195).

41

Replies to Questionnaire 1 to market participants, question 15; Questionnaire 2 to airport managers,

question 9.

42

Replies to Questionnaire 1 to market participants, question 16.

43

Form CO, Annex 41.

44

Form CO, paragraph 18.

11

for customers in their choice of car rental is by far the price, while the brand of

the car rental operator would play the least important role.

45

The hierarchy in

these criteria was actually confirmed by the consumer associations that

participated in the market investigation.

46

(59) The Parties' competitors and airport managers that participated in the market

investigation did not list Goldcar as a close competitor of Europcar in any of the

Member States where the two Parties operate. They rather identify Avis,

Enterprise, Hertz and Sixt as the closest competitors to Europcar.

47

Conversely,

the respondents to the market investigation considered that a number of car rental

companies, especially with their low cost brands, are close competitors of

Goldcar, particularly in Portugal and Spain. Respondents for instance refer to (i)

Avis' brand Maggiore, Europcar's brand InterRent, Centauro, Hertz, or Guerin

48

in Portugal, and (ii) Budget, Hertz's brands Dollar and Firefly, or Record Go (in

Spain).

49

(60) These responses to the market investigation are linked to the different positioning

of the Europcar group as a multi-brand full-service provider, operating in the low

cost segment through the InterRent brand, and of Goldcar as a pure low cost

player. Goldcar and InterRent are thus perceived as addressing the specific needs

and expectations of customers targeted by low cost services, while the Europcar

group would rather focus value and premium services.

50

(61) The different customers' needs and expectations addressed by the low cost brands

Goldcar and InterRent against the value or premium brand Europcar are also

reflected in the internal documents analysed by the Commission. In the M&A

presentation to Europcar's Supervisory Board of 30 March 2017,

51

it is stated that

[…] (Slide 3). In the same presentation, and in the strategic analysis presented to

the Supervisory Board of 22 May 2017,

52

there are references to the operators

positioned as low cost car rental suppliers […]. Moreover, […] according to the

presentations to the Supervisory Board. Overall, Europcar does not appear to

consider Goldcar as a close competitor according to these internal documents, but

rather as a brand complementary to its current portfolio.

(62) Given that Goldcar is only active in the leisure segment and is positioned as a low

cost operator, compared to the full-range offering of Europcar, and that Europcar

sees the acquisition of Goldcar as fulfilling a gap in its offering, the Commission

45

Replies to Questionnaire 1 to market participants, question 5.

46

Replies to Questionnaire 3 to customer associations, question 3.

47

Replies to Questionnaire 1 to market participants, question 17.

48

Guerin operates in Portugal through their own brands Guerin and Drive for less, as well as through an

exclusive franchise agreement with Enterprise, including the brands National and Alamo – Replies to

Questionnaire 1 to market participants, question 2.

49

Replies to Questionnaire 1 to market participants, question 18.

50

See section 3.1.4 for the definition of low cost, value and premium car rental services.

51

Form CO, Annex 14(b).

52

Form CO, Annex 14(e).

12

considers that Goldcar does not compete as closely against Europcar (as a whole)

as other multi-brand actors, such as Hertz or Avis.

4.1.3. The role of brokers

(63) A large share of leisure car rental services is distributed through internet

aggregators or intermediaries (together "brokers").

53

Brokers can act as (i) agents

of the car rental companies (receiving a commission), or as (ii) resellers that

usually commit to purchase certain volumes from different car rental companies

and then sell the product to the final customer, deciding on the rental price based

on their capacity of purchase and sale.

54

(64) Europcar submits that brokers compete directly against car rental operators in the

market, at least for leisure customers.

55

(65) In this regard, Europcar further submits that the use of technology and

digitalisation has enabled leisure customers to easily compare online rental rates

available from various car rental operators for any given product at any given

location. Customers frequently use on-line price comparison engines and book car

rental services through on-line brokers, which offer services at very competitive

prices and drive price competition.

56

(66) The majority of the car rental operators that participated in the market

investigation submit that they distribute their services through at least one

broker.

57

The features of their distribution agreements with brokers vary, but the

market investigation shows that brokers work mostly as resellers, and they are

capable of setting the final price to be paid by the customer to a large extent.

(67) In their replies to the market investigation, the majority of car rental operators

submitted that brokers compete head-to-head against them,

58

mostly because

brokers acting as resellers can offer rates below the prices set by the pure car

rental companies through their own direct distribution channels.

(68) One competitor to the Parties noted that "customers compare different available

offers and normally choose the lowest price for the same product", while another

competitor added that "internet aggregators can make pressure on car rental

players pricing strategy thanks to their investment on the web as well as their

popularity".

59

53

As a way of example, the revenue generated by Europcar and Goldcar through brokers was [≥40]%

and [≥60]% respectively over their total revenues generated in 2016 (Form CO, Annex 34).

54

Europcar and Goldcar's revenues generated through brokers were split […]% and […]% between the

agent and reseller models respectively in 2016 (Form CO, Annex 34).

55

Form CO, paragraph 11.

56

Form CO, paragraph 9.

57

Replies to Questionnaire 1 to market participants, question

13.

58

Replies to Questionnaire 1 to market participants, question 14.

59

Replies to Questionnaire 1 to market participants, question 14.1.

13

(69) In addition, the majority of the car rental operators that participated in the market

investigation submit that brokers have a significant negotiating power vis-à-vis

car rental operators.

60

Indeed, both car rental operators and brokers note that

brokers distributing significant volumes have a correspondingly high influence on

the car rental market. Since an important volume of the car rental reservations is

distributed through brokers (particularly for leisure customers), they can use their

position in the market to negotiate lower prices and more advantageous

conditions.

61

(70) With regard to the effects of the Transaction over the brokers' negotiating power,

none of the car rental companies nor brokers that participated in the market

investigation consider that the Transaction will decrease the negotiating power

that brokers exert vis-à-vis the entity combining Europcar and Goldcar, or more

generally vis-à-vis car rental companies.

62

(71) As a result, even if brokers differ from car rental operators for not having a

physical presence or a fleet of vehicles in the locations where they offer their

services, brokers control a large share of the on-line distribution channel

(particularly for leisure customers) and decide or influence the price paid by end

customers. In addition, resellers possess a strong countervailing power over car

rental operators.

(72) Brokers therefore exercise a significant competitive constrain over car rental

companies and are likely to continue exerting competitive pressure over the

merged entity after the Transaction.

4.1.4. Barriers to entry or expansion

General

(73) Europcar submits that barriers to enter (or expand within) the car rental markets

are low.

63

(74) First, Europcar submits that brokers lower barriers to entry and expansion (at least

on the leisure segment) by (i) enabling new entrants to quickly get access to

customers, (ii) enabling regional or local operators with limited physical presence

to compete with national/multinational companies without incurring in significant

marketing costs, and (iii) committing to purchase certain fleet volumes allowing

car rental companies (especially local players) to manage their fleet exposure

risk.

64

60

Replies to Questionnaire 1 to market participants, question 25.

61

Replies to Questionnaire 1 to market participants, question 25.1.

62

Replies to Questionnaire 1 to market participants, question 26.

63

Form CO, paragraph 17.

64

Form CO, paragraph 15.

14

(75) Second, Europcar submits that the constitution of a sizable fleet of vehicles is

manageable from a financial perspective due to leasing or buy-back agreements.

65

(76) The results of the market investigation support the influence of brokers over the

barriers to enter the market. The majority of car rental operators and brokers that

participated in the market investigation notably submit that brokers increase the

competitive pressure exerted by local or regional car rental companies over

national or international car rental companies.

66

(77) In this respect, one competitor to the Parties noted that "brokers increase the

competitive pressure exerted by local/regional car rental companies on

national/international companies as they display these companies on their

websites alongside the national/ international companies leading to increased

competition on pricing". The same competitor added that "[i]n Southern Europe

in particular this is even more the case as the brokers are the main distribution

channel for the locals and have high market share of this business".

67

(78) Along the same line, another respondent submitted that "[b]rokers provide a way

for customers (particularly from foreign countries where local and regional car

hire brands may not be well known) to find local and regional companies,

understand their product and prices and book them in a safe and reliable

environment. This lowers barriers to entry or to compete for such companies,

increasing competitive pressure".

68

(79) With regard to the difficulty to constitute a sizable fleet of vehicles, respondents

to the market investigation do not fully concur with Europcar's arguments. The

main barrier to enter the market for car rental services would be the financial

investment required to acquire a proper vehicle fleet.

69

(80) However, the Commission notes that, as far as the leisure segment is concerned,

new entrants would not be confronted to the barrier to entry constituted by brand

loyalty. Indeed, according to Europcar, transactions on the leisure segment are

[…].

70

(81) As regards the effects of the Transaction on the barriers to enter or expand in the

provision of car rental services to leisure customers, the market investigation

yielded mixed results. The Parties' competitors submitted that the effects of the

Transaction over the barriers to entry will mostly depend on the strategy of the

merged entity to consolidate its operations. One competitor noted that any cost

65

Form CO, paragraph 17. Buy-back agreements include a commitment by the car manufacturer to buy-

back the vehicles at a pre-agreed repurchase price; as opposed to the purchase of vehicles "at risk", by

which car rental operators purchase cars to manufacturers without a buy-back commitment.

66

Replies to Questionnaire 1 to market participants, question 16.

67

Replies to Questionnaire 1 to market participants, question 16.1.

68

Replies to Questionnaire 1 to market participants, question 16.1.

69

Replies to Questionnaire 1 to market participants, question 19.

70

For instance, less than […]% of Europcar's leisure customers in Spain in 2016 were also customers in

the previous year – Competitive assessment submitted by the Parties to the Commission on 16

November 2016.

15

saving in the management of the merged entity's fleet might translate in a drop of

the price paid by customers.

71

Specific barriers to entry or expansion at airports

(82) In order to offer their services within the airport terminal (on-airport), car rental

companies need to enter into a concession agreement with the airport manager.

Airport managers generally launch competitive tender procedures for the

commercial exploitation of car rental services within their premises, and grant

licenses or concessions to the car rental operators fulfilling some minimum

requirements and offering the most economically advantageous conditions to the

airport manager. Once the airport operator grants a licence to a car rental

operator, and according to the terms of the concession agreement, on-airport

operators have to pay the airport manager (i) a fixed amount to the airport

manager for the commercial exploitation of a retail space or counter and a parking

area, plus (ii) a variable amount for a value that depends on the turnover

generated from the car rental activities.

(83) Europcar submits that car rental companies can operate at an airport without

holding a concession, from counters and parking slots located outside the airport

facilities, or alternatively they can make use of additional rear parking space at a

short distance from the airport main parking spaces.

72

(84) Respondents to the market investigation indicate that barriers start offering car

rental services on-airport are higher than at other locations, since airport managers

generally grant licenses to operate on-airport through competitive public tenders

that might take place every few years.

73

In addition, once a car rental operator

enters into a licence agreement with an airport manager, it has to commit to pay

the operational fees agreed upon, including any fixed remuneration.

(85) With regard to the time it actually takes to enter into operations in an airport, the

Parties' competitors note some differences between the different countries where

the Parties overlap, most notably related to the tender procedure and criteria

followed by the airport managers. Nevertheless, the majority of the competitors

that participated in the market investigation state that the time between the

business decision to enter an airport and the moment they would be available to

offer car rental services to leisure customers would take between a few days and

one year on average.

74

(86) The market investigation further confirms that, in the case of car rental stations

located off-airport or downtown, there is no such burden to obtain a license and

pay operational fees to the airport manager, and therefore the barriers to enter car

rental operations are lower.

71

Replies to Questionnaire to market participants, question 19.1.

72

Form CO, paragraph 17.

73

Replies to Questionnaire 1 to market participants, question 19. A detailed description of on-airport and

off-airport operation is included in section 3.1.5.

74

Replies to Questionnaire 1 to market participants, question 22.

16

(87) Moreover, over the last two years, a number of new suppliers have entered into

operations at some of the airports where the two Parties offer their car rental

services. New entrants operate either on-airport through an agreement with the

airport managers, or off-airport from counters located in the vicinity of the

airport's terminal.

(88) With regard to the possibility for existing car rental operators to expand their

activities on-airport by using rear parking space located outside the airport

premises, the market investigation did not produce conclusive results, since it

mostly depends on the availability of land in the vicinity of a given airport.

75

The specific case of on-airport car rental services in Spain

(89) In Spain, where Goldcar is mostly active,

76

all airports in which the Parties

overlap are managed by AENA, S.A., which recently organised a competitive

public tender procedure and granted new lease contracts to operate car rental

services in its airports as from October 2016 for the period 2016-2022.

77

(90) However, AENA submits that there remains available car rental space in all the

airports where the Parties' activities overlap, except in Tenerife South.

78

Therefore, any extra demand to operate on-airport car rental services may still be

granted to a new operator through a complementary tender, as long as the new

entrant accepts to pay the maximum fee paid by the operators currently present at

a given airport (i.e. the new entrant must align its offer with the highest bid

received during the 2016 tender).

(91) For instance, at Girona and Jerez airports, Goldcar resumed operations in June

2017, after having exited in October 2016 for not having bid for operating in

these airports.

79

Conclusion

(92) Overall, given that brokers increase the competitive pressure exerted by local and

regional car rental companies, the fact that the main barrier to enter the market is

the constitution of a sizable fleet of vehicles, the limited period of time it takes to

enter into car rental operations, and the large availability of commercial space at

most overlapping airports (either on-airport or off-airport), low barriers to entry

and expansion would be present within the market for the provision of car rental

services.

75

Replies to Questionnaire 1 to market participants, question 23.

76

Goldcar generated more than […] of its 2016 total turnover in Spain – Form CO, Table 4.

77

The lease contracts granted by AENA for the period 2016-2022 can be renewed for two additional

periods of 2 years – See agreed non-confidential minutes with AENA of 17 October 2017, paragraphs

3 and 4.

78

See agreed non-confidential minutes with AENA of 17 October 2017, paragraph 12.

79

See agreed non-confidential minutes with AENA of 17 October 2017, paragraph 12.

17

4.2. Overview of the Parties' market shares

4.2.1. Methodology for estimating market shares at local and national levels

(93) Europcar has provided an estimate of their competitors' market shares at local

level based on an approximation of the number of cars and of the revenue

generated per car by each of their competitors at their rental stations. Given the

reduced visibility of the Parties over their competitors' complete fleet and revenue

at local level, however, the methodology used by Europcar to estimate local

market shares does not appear to be fully reliable.

(94) The Commission has therefore undertaken a market reconstruction exercise to

obtain a more precise overview of the competitive landscape at local level. Within

the frame of the market investigation, the Commission has asked the Parties and

their competitors for the revenues generated during 2016 from short-term car

rental services at all the stations located where the Parties' activities overlap.

80

(95) In addition, airport managers have also provided the revenue reported by the car

rental companies operating on-airport within their premises, which has allowed

the Commission to verify and complement where necessary the data reported by

car rental operators.

(96) Since the Commission could not gather turnover data from the entirety of the

competitors present at each location (particularly from small local or regional

players offering car rental services off-airport or downtown), the market

reconstruction exercise provides a reliable, yet conservative value of the Parties'

combined shares at local level, both at the airports (including off-airport

locations) and at the downtown locations where their activities overlap.

(97) At national level, the market shares reported by Europcar in the Form CO are

more reliable for being based on its competitors' audited annual accounts, data

from national car rental industry associations and publicly available information

(such as press releases or communications to shareholders).

4.2.2. Overlapping markets

(98) The Parties' combined market shares in all of the overlapping markets are listed in

Table 1 below. These market shares have been computed by the Commission on

the basis of confidential turnover data provided by the Parties' competitors and

airport managers under the condition that only the Parties' combined market

shares would be displayed in ranges of 25%.

81

80

In order to ensure the coherence of the data computed, the Commission has collected net turnover data,

– i.e. total sales after deduction of VAT.

81

Considering that the turnover of competitors, hence the total market size, are confidential vis-à-vis the

Parties, the use of ranges for the Parties' combined market shares is necessary to respect the

confidentiality claims of participants to the market reconstruction exercise.

18

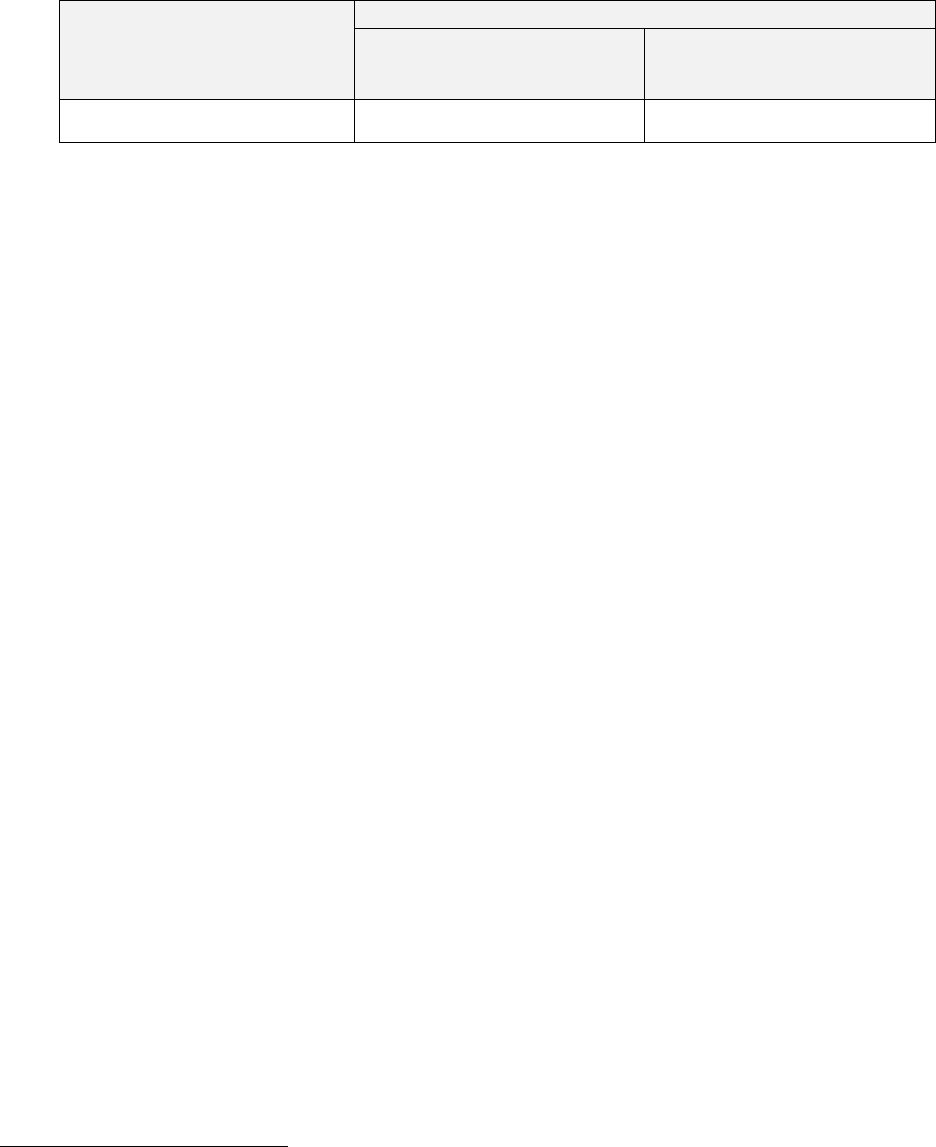

Table 1: Overlapping markets by type of services and location (2016)

82

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

France (national)

< 20%

< 20%

Bordeaux airport

[25-50]%

[25-50]%

Marseille airport

[25-50]%

[25-50]%

Nice airport

[25-50]%

[25-50]%

Toulouse airport

[25-50]%

[25-50]%

Italy (national)

[20-30]%

< 20%

Bari airport

[0-25]%

[25-50]%

Bergamo airport

[0-25]%

[25-50]%

Bologna airport

[25-50]%

[25-50]%

Brindisi airport

[0-25]%

[25-50]%

Cagliari airport

[25-50]%

[25-50]%

Catania airport

[25-50]%

[25-50]%

Florence airport

[0-25]%

[0-25]%

Lamezia Terme airport

[0-25]%

[25-50]%

Milan Linate airport

[0-25]%

[0-25]%

Milan Malpensa airport

[0-25]%

[25-50]%

Olbia airport

[25-50]%

[25-50]%

Palermo airport

[0-25]%

[25-50]%

Pisa airport

[25-50]%

[25-50]%

Rome Ciampino airport

[0-25]%

[25-50]%

Rome Fiumicino airport

[0-25]%

[25-50]%

Trapani airport

[0-25]%

[0-25]%

Treviso airport

[0-25]%

[25-50]%

Venice airport

[0-25]%

[0-25]%

Verona airport

[0-25]%

[25-50]%

Portugal (national)

[20-30]%

[20-30]%

Faro airport

[25-50]%

[25-50]%

Lisbon airport

[25-50]%

[25-50]%

Madeira airport

[25-50]%

[25-50]%

Ponta Delgada airport

[0-25]%

[0-25]%

Porto airport

[25-50]%

[25-50]%

Spain (national)

[20-30]%

[20-30]%

Alicante airport

[25-50]%

[25-50]%

Alicante downtown

[25-50]%

[25-50]%

82

The value of the national market shares was provided by Europcar in the Form CO. The value of the

local market shares was computed by the Commission on the basis of the turnover data gathered in the

frame of the market investigation. The same applies to all the tables in section 4.3 below.

19

Almeria airport

[50-75]%

[75-100]%

Asturias airport

[25-50]%

[25-50]%

Barcelona airport

[25-50]%

[25-50]%

Barcelona downtown

[0-25]%

[0-25]%

Benidorm downtown

[0-25]%

[0-25]%

Bilbao airport

[25-50]%

[25-50]%

Fuerteventura airport

[0-25]%

[0-25]%

Girona airport

[50-75]%

[50-75]%

Gran Canaria airport

[25-50]%

[25-50]%

Granada airport

[25-50]%

[50-75]%

Ibiza airport

[25-50]%

[25-50]%

Jerez airport

[25-50]%

[25-50]%

La Linea downtown

[25-50]%

[25-50]%

Lanzarote airport

[0-25]%

[0-25]%

Madrid airport

[25-50]%

[25-50]%

Madrid downtown

[0-25]%

[0-25]%

Malaga airport

[25-50]%

[25-50]%

Malaga downtown

[25-50]%

[25-50]%

Mallorca downtown

[0-25]%

[0-25]%

Menorca airport

[25-50]%

[0-25]%

Murcia airport

[25-50]%

[25-50]%

Palma de Mallorca airport

[25-50]%

[25-50]%

Reus airport

[50-75]%

[50-75]%

Sancti Petri downtown

[50-75]%

[50-75]%

Santander airport

[25-50]%

[25-50]%

Santiago airport

[25-50]%

[25-50]%

Seville airport

[25-50]%

[25-50]%

Seville downtown

[25-50]%

[25-50]%

Tenerife North airport

[25-50]%

[0-25]%

Tenerife South airport

[25-50]%

[25-50]%

Valencia airport

[25-50]%

[25-50]%

Valencia downtown

[0-25]%

[0-25]%

(99) A detailed competitive assessment market is provided in the market-specific

section below.

(100) The Commission will assess each market according to the Parties' combined

market share range in the table above, considering that, according to the

Horizontal Merger Guidelines, concentrations where the market share of the

20

undertakings concerned does not exceed 25% are not liable to impede effective

competition.

83

4.3. Market-specific analysis

4.3.1. France

4.3.1.1. At national level

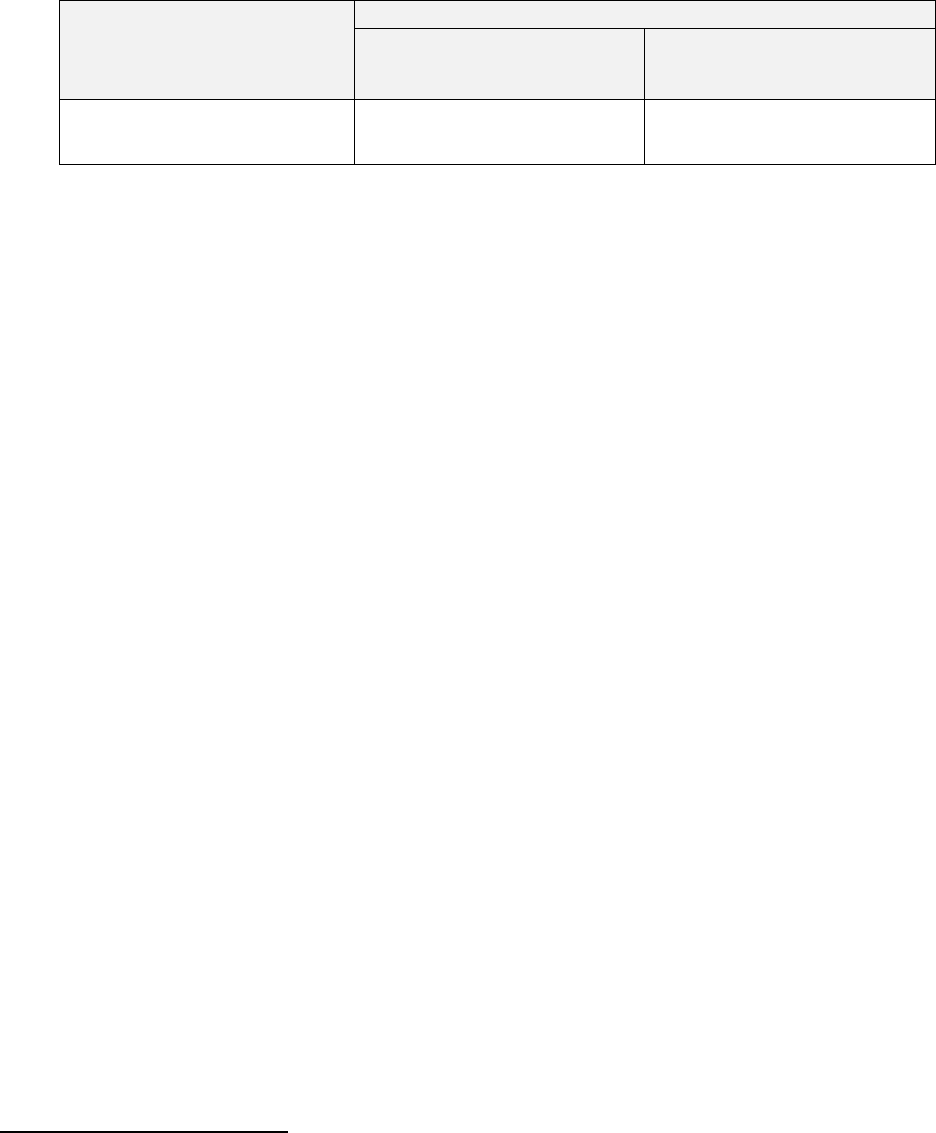

Table 2 - Overlaps in France

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

France

< 20%

< 20%

(101) The Transaction does not give rise to an affected market in France, since the

Parties' combined market shares would remain below 20% at national level.

(102) Therefore, the Commission considers that the Transaction does not raise serious

doubts as concerns the market for short-term car rental services in France, under

any plausible segmentation.

4.3.1.2. Bordeaux airport

Table 3 - Overlaps at Bordeaux airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Bordeaux Airport

[25-50]%

[25-50]%

(103) The market share of the merged entity on the market for short-term car rental

services would reach [25-50]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

(104) Significant competitors such as Avis, Hertz or Sixt are active in the market for

short-term car rental services and short-term leisure car rental services at

Bordeaux airport.

84

(105) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Bordeaux airport.

85

83

Horizontal Merger Guidelines, paragraph 18.

84

Form CO, Annex 27; and replies to Questionnaire 1 to market participants, question 4.2.

85

Replies to Questionnaire 1 to market participants, question 29.2; replies to Questionnaire 2 to airport

managers, questions 15 and 18; and replies to Questionnaire 3 to customer associations, question 18.

21

(106) Overall, given the market shares of the Parties, the presence of significant

competitors and the fact that no material concern was expressed during the market

investigation, the Commission considers that the Transaction is unlikely to lead to

any significant competition concerns for the market for short-term car rental

services at Bordeaux airport, under any plausible segmentation.

Conclusion

(107) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Bordeaux airport, under any plausible segmentation.

4.3.1.3. Marseille airport

Table 4 - Overlaps at Marseille airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Marseille Airport

[25-50]%

[25-50]%

(108) The market share of the merged entity on the market for short-term car rental

services would reach [25-50]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

(109) Significant competitors such as Avis, Hertz or Sixt are active in the market for

short-term car rental services and short-term leisure car rental services at

Marseille airport.

86

(110) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Marseille airport.

87

(111) Overall, given the market shares of the Parties, the presence of significant

competitors and the fact that no material concern was expressed during the market

investigation, the Commission considers that the Transaction is unlikely to lead to

any significant competition concerns for the market for short-term car rental

services at Marseille airport, under any plausible segmentation.

Conclusion

(112) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Marseille airport, under any plausible segmentation.

86

Form CO, Annex 27; replies to Questionnaire 1 to market participants, question 4.2.

87

Replies to Questionnaire 1 to market participants, question 29.2; replies to Questionnaire 2 to airport

managers, questions 15 and 18; and replies to Questionnaire 3 to customer associations, question 18.

22

4.3.1.4. Nice airport

Table 5 - Overlaps at Nice airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Nice Airport

[25-50]%

[25-50]%

(113) The market share of the merged entity on the market for short-term car rental

services would reach [25-50]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

(114) Significant competitors such as Avis, Hertz or Sixt are active in the market for

short-term car rental services and short-term leisure car rental services at Nice

airport.

88

(115) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Nice airport.

89

(116) Overall, given the market shares of the Parties, the presence of significant

competitors and the fact that no material concern was expressed during the market

investigation, the Commission considers that the Transaction is unlikely to lead to

any significant competition concerns for the market for short-term car rental

services at Nice airport, under any plausible segmentation.

Conclusion

(117) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Nice airport, under any plausible segmentation.

4.3.1.5. Toulouse airport

Table 6 - Overlaps at Toulouse airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Toulouse Airport

[25-50]%

[25-50]%

(118) The market share of the merged entity on the market for short-term car rental

services would reach [25-50]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

88

Form CO, Annex 27; replies to Questionnaire 1 to market participants, question 4.2.

89

Replies to Questionnaire 1 to market participants, question 29.2; replies to Questionnaire 2 to airport

managers, questions 15 and 18; and replies to Questionnaire 3 to customer associations, question 18.

23

(119) Significant competitors such as Avis, Hertz or Sixt are active in the market for

short-term car rental services and short-term leisure car rental services at

Toulouse airport.

90

(120) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Toulouse airport.

91

(121) Overall, given the market shares of the Parties, the presence of significant

competitors and the fact that no material concern was expressed during the market

investigation, the Commission considers that the Transaction is unlikely to lead to

any significant competition concerns for the market for short-term car rental

services at Toulouse airport, under any plausible segmentation.

Conclusion

(122) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Toulouse airport, under any plausible segmentation.

4.3.2. Italy

4.3.2.1. At national level

Table 7 - Overlaps in Italy

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Italy

[20-30]%

< 20%

(123) The market shares of the merged entity on the market for short-term car rental

services would remain limited at [20-30]%. The plausible narrower market for

short-term leisure car rental services would not be affected.

(124) Significant competitors such as Avis, Hertz, Locauto or Sicily by Car are active in

the market for short-term car rental services at national level in Italy.

92

(125) In addition, a majority of the respondents to the market investigation submitted

that there will be sufficient competition post-transaction in Italy to prevent the

merged entity from raising prices.

93

(126) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction in Italy.

94

90

Form CO, Annex 27; replies to Questionnaire 1 to market participants, question 4.3.

91

Replies to Questionnaires to market participants, question 29.2; replies to Questionnaire 2 to airport

managers, questions 15 and 18; and replies to Questionnaire 3 to customer associations, question 18.

92

Form CO, Annex 27; and replies to Questionnaire 1 to market participants, question 4.5 and/or to a

Request for Information by the Commission.

93

Replies to Questionnaire 1 to market participants, question 28; replies to Questionnaire 2 to airport

managers, question 16; and replies to Questionnaire 3 to customer associations, question 16.

24

(127) Overall, given the limited market shares of the Parties, the presence of significant

competitors, the fact that the Parties' competitors expect sufficient competition to

prevent the merged entity from raising prices, and the fact that no material

concern was expressed during the market investigation, the Commission

considers that the Transaction is unlikely to lead to any significant competition

concerns for the market for short-term car rental services in Italy, under any

plausible segmentation.

Conclusion

(128) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services in Italy, under any plausible segmentation.

4.3.2.2. Bari airport

Table 8 - Overlaps at Bari airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Bari airport

[0-25]%

[25-50]%

(129) The market share of the merged entity on the market for short-term car rental

services would reach [0-25]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

(130) Significant competitors such as Avis, Hertz or Sicily by Car are active in the

market for short-term car rental services and short-term leisure car rental services

at Bari airport.

95

(131) In addition, a majority of the respondents to the market investigation submitted

that there will be sufficient competition post-transaction at Bari airport to prevent

the merged entity from raising prices.

96

(132) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Bari airport.

97

(133) Overall, given the market shares of the Parties, the presence of significant

competitors, the fact that the Parties' competitors expect sufficient competition to

prevent the merged entity from raising prices, and the fact that no material

94

Replies to Questionnaire 1 to market participants, question 29.2; replies to Questionnaire 2 to airport

managers, questions 15 and 18; and replies to Questionnaire 3 to customer associations, question 18.

95

Form CO, Annex 27; replies to Questionnaire 1 to market participants, question 4.3.

96

Replies to Questionnaire 1 to market participants, question 28; replies to Questionnaire 2 to airport

managers, question 16; and replies to Questionnaire 3 to customer associations, question 16.

97

Replies to Questionnaire 1 to market participants, question 29; replies to Questionnaire 2 to airport

managers, questions 15 and 17; and replies to Questionnaire 3 to customer associations, question 17.

25

concern was expressed during the market investigation, the Commission

considers that the Transaction is unlikely to lead to any significant competition

concerns for the market for short-term car rental services at Bari airport, under

any plausible segmentation.

Conclusion

(134) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Bari airport, under any plausible segmentation.

4.3.2.3. Bergamo airport

Table 9 - Overlaps at Bergamo airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Bergamo airport

[0-25]%

[25-50]%

(135) The market share of the merged entity on the market for short-term car rental

services would reach [0-25]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

(136) Significant competitors such as Avis, Hertz or Sicily by Car are active in the

market for short-term car rental services and short-term leisure car rental services

at Bergamo airport.

98

(137) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Bergamo airport.

99

(138) Overall, given the market shares of the Parties, the presence of significant

competitors and the fact that no material concern was expressed during the market

investigation, the Commission considers that the Transaction is unlikely to lead to

any significant competition concerns for the market for short-term car rental

services at Bergamo airport, under any plausible segmentation.

Conclusion

(139) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Bergamo airport, under any plausible segmentation.

98

Form CO, Annex 27; replies to Questionnaire 1 to market participants, question 4.3.

99

Replies to Questionnaire 1 to market participants, question 29.2; replies to Questionnaire 2 to airport

managers, questions 15 and 18; and replies to Questionnaire 3 to customer associations, question 18.

26

4.3.2.4. Bologna airport

Table 10 - Overlaps at Bologna airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Bologna airport

[25-50]%

[25-50]%

(140) The market share of the merged entity on the market for short-term car rental

services would reach [25-50]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

(141) Significant competitors such as Avis, Hertz, Locauto, Sicily by Car or WinRent

are active in the market for short-term car rental services and short-term leisure

car rental services at Bologna airport.

100

(142) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Bologna airport.

101

(143) Overall, given the market shares of the Parties, the presence of significant

competitors and the fact that no material concern was expressed during the market

investigation, the Commission considers that the Transaction is unlikely to lead to

any significant competition concerns for the market for short-term car rental

services at Bologna airport, under any plausible segmentation.

Conclusion

(144) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Bologna airport, under any plausible segmentation.

4.3.2.5. Brindisi airport

Table 11 - Overlaps at Brindisi airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Brindisi airport

[0-25]%

[25-50]%

(145) The market share of the merged entity on the market for short-term car rental

services would reach [0-25]%. On a plausible narrower market for short-term

100

Form CO, Annex 27; replies to Questionnaire 1 to market participants, question 4.3.

101

Replies to Questionnaire 1 to market participants, question 29.2; replies to Questionnaire 2 to airport

managers, questions 15 and 18; and replies to Questionnaire 3 to customer associations, question 18.

27

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

(146) Significant competitors such as Avis, Hertz, Locauto or Sicily by Car are active in

the market for short-term car rental services and short-term leisure car rental

services at Brindisi airport.

102

(147) In addition, a majority of the respondents to the market investigation submitted

that there will be sufficient competition post-transaction at Brindisi airport to

prevent the merged entity from raising prices.

103

(148) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Brindisi airport.

104

(149) Overall, given the market shares of the Parties, the presence of significant

competitors, the fact that the Parties' competitors expect sufficient competition to

prevent the merged entity from raising prices, and the fact that no material

concern was expressed during the market investigation, the Commission

considers that the Transaction is unlikely to lead to any significant competition

concerns for the market for short-term car rental services at Brindisi airport, under

any plausible segmentation.

Conclusion

(150) In view of the above, and considering all evidence available to the Commission,

the Transaction does not raise serious doubts as concerns the market for short-

term car rental services at Brindisi airport, under any plausible segmentation.

4.3.2.6. Cagliari airport

Table 12 - Overlaps at Cagliari airport

Overlapping market

Combined market share (%)

Short-term car rental

services

Short-term leisure car

rental services

Cagliari airport

[25-50]%

[25-50]%

(151) The market share of the merged entity on the market for short-term car rental

services would reach [25-50]%. On a plausible narrower market for short-term

leisure car rental services, the combined market share of the merged entity would

be [25-50]%.

102

Form CO, Annex 27; replies to Questionnaire 1 to market participants, question 4.3.

103

Replies to Questionnaire 1 to market participants, question 28; replies to Questionnaire 2 to airport

managers, question 16; and replies to Questionnaire 3 to customer associations, question 16.

104

Replies to Questionnaire 1 to market participants, question 29; replies to Questionnaire 2 to airport

managers, questions 15 and 17; and replies to Questionnaire 3 to customer associations, question 17.

28

(152) Significant competitors such as Avis, Hertz, Locauto or Sicily by Car are active in

the market for short-term car rental services and short-term leisure car rental

services at Cagliari airport.

105

(153) Moreover no respondent to the market investigation raised any material concern

as to the effect of the Transaction at Cagliari airport.

106

(154) Overall, given the market shares of the Parties, the presence of significant