Small Box Retail

Diversity Study

City of New Orleans

City Planning Commission

Robert D. Rivers, Executive Director

Leslie T. Alley, Deputy Director

Prepared on: November 27, 2018

Prepared By:

Emily Ramírez Hernández

Sabine Lebailleux

Aspen Nero

Amos Wright

Travis Martin

Paul Cramer

James Gillie

1

Table of Contents

A. Executive Summary....................................................................................................... 3

Introduction ................................................................................................................................................ 3

Key Findings ............................................................................................................................................... 4

Recommendations ................................................................................................................................... 6

Next Steps ................................................................................................................................................. 13

B. Scope of Study ............................................................................................................. 14

Motion (As Corrected) No. M-18-256 ............................................................................................. 14

Study Goals ............................................................................................................................................... 16

C. Small Box Discount Retail Overview ......................................................................... 17

Definition ................................................................................................................................................... 17

Small Box Discount Store Expansion & Economic Impacts ..................................................... 17

Small Box Discount Store Data .......................................................................................................... 24

History of Small Box Discount Stores in New Orleans .............................................................. 26

D. Public Input ................................................................................................................. 28

Public Comments Summary ............................................................................................................... 28

Stakeholder Meetings ........................................................................................................................... 29

E. Current Regulations .................................................................................................... 30

Comprehensive Zoning Ordinance .................................................................................................. 30

Plan for the 21

st

Century ...................................................................................................................... 38

City Code Regulations .......................................................................................................................... 43

F. Current Enforcement ................................................................................................... 44

Department of Safety & Permits ....................................................................................................... 44

Department of Sanitation .................................................................................................................... 46

Department of Code Enforcement ................................................................................................... 47

CleanUpNOLA .......................................................................................................................................... 48

Louisiana Department of Health ....................................................................................................... 48

G. Food Retail & Public Health ...................................................................................... 52

Health Landscape ................................................................................................................................... 52

Health Department Goals .................................................................................................................... 53

2

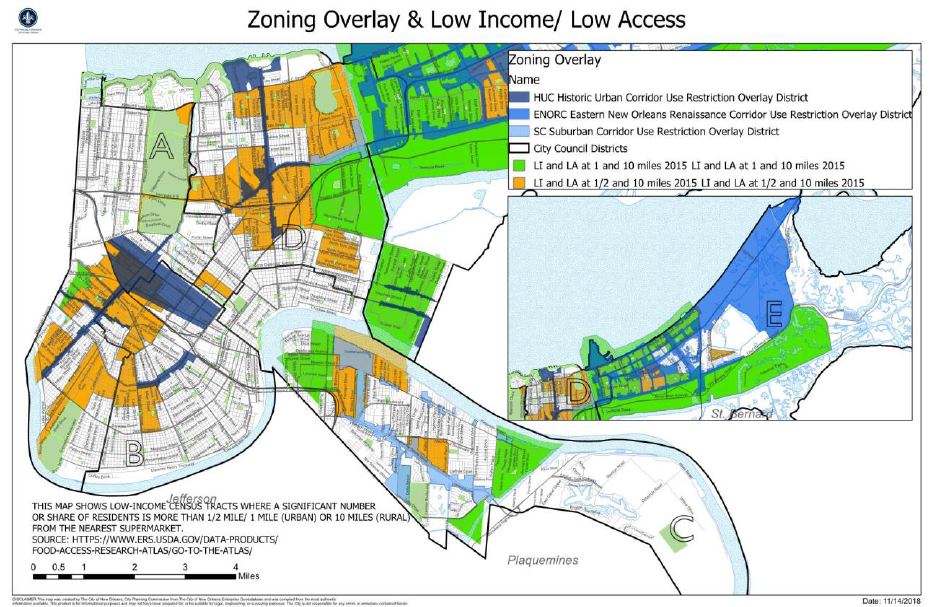

Food Access .............................................................................................................................................. 53

Small Box Discount Stores & Public Health Impacts ................................................................. 70

H. Case Studies ................................................................................................................. 73

Tulsa, Oklahoma ...................................................................................................................................... 73

Kansas City, Kansas ................................................................................................................................ 78

Minneapolis, Minnesota ....................................................................................................................... 80

Baltimore, Maryland .............................................................................................................................. 86

Local Policies ............................................................................................................................................ 86

Best Practice Findings ........................................................................................................................... 90

I. Small Box Discount Store Regulation Issues, Analysis, and Recommendations ... 91

Land Use Regulation Issues ................................................................................................................ 91

Neighborhood Character & Quality of Life Issues ...................................................................105

Permitting & Licensing Issues ..........................................................................................................107

Enforcement Limitations ....................................................................................................................112

J. Summary of Recommendations & Text Changes .................................................. 114

Proposed Comprehensive Zoning Ordinance Text ..................................................................114

Permitting & Licensing .......................................................................................................................119

Enforcement ...........................................................................................................................................119

Other Recommendations...................................................................................................................120

Further Study ..........................................................................................................................................120

Next Steps ...............................................................................................................................................121

3

A. Executive Summary

Introduction

Small box discount stores, commonly known as “dollar” stores, have operated across the United

States for well over a century. These original “five and dime” stores, such as Woolworths, have

since closed, but newer iterations such as Dollar General, Family Dollar, and Dollar Tree, all of

which emerged in the 1950s, have filled the gap. The small box discount industry is well-

established in New Orleans and has been for decades. According to Dollar General, for example,

the chain opened its first store in New Orleans in 1983.

Following national trends, small box discount stores have rapidly proliferated across the city in

recent years. New Orleans East, in particular, contains a disproportionate number of these stores

compared to other retail options—most notably full-line grocery stores. Currently, two grocery

stores and 12 small box discount stores operate in New Orleans East.

In an effort to address this rapid expansion citywide, but particularly in the East, including the

hypothesis that small box discount stores may impede the entry of full-line grocery stores, which

are a source for fresh food, City Council adopted Motion (As Corrected) M-18-256 on June 21,

2018 directing the City Planning Commission to produce this Small Box Retail Diversity Study.

The scope of the Small Box Retail Diversity Study is outlined in the motion and directs the City

Planning Commission to explore the following subject matter in its study:

Define “small box discount stores”

Explore regulations such as the following:

o Use standards:

Requirements to provide fresh food

Limitations on the sale of alcohol

Restrictions based on spacings/block-face

Any necessary restrictions to assist in curbing the proliferation of small

box discount stores that fail to offer fresh fruits and vegetables

Appropriate zoning districts where “small box discount stores” may be

permitted by right, conditional, and prohibited

For the purposes of the study, “small box discount stores” include businesses that have a

floor area of 5,000 to 10,000 square feet, which sells at retail physical goods, products, or

merchandise directly to the consumer, including food or beverages for off-premises

consumption, household products, personal grooming and health products, and other

consumer goods, with the majority of items being offered for sale at lower than the

typical market price, but does not:

o Dedicate at least 15% of floor area to fresh foods and vegetables

o Contain a prescription pharmacy, or

o Offer for sale gasoline or diesel fuel

4

Key Findings

Based on the review of practices in other communities and the analysis of the current situation in

New Orleans, the following key findings informed the proposed Small Box Retail Diversity

Study recommendations:

Small Box Discount Store Findings

Small box discount stores are prolific in New Orleans. There are 36 stores citywide,

including 12 in New Orleans East. Small box discount stores tend to cluster.

All retail uses, including small box discount stores, fall into the retail goods

establishment category; small box discount stores are permitted or conditional anywhere

that the retail goods establishment use is permitted or conditional.

Small box discount stores such as Dollar General, Family Dollar, and Dollar Tree range

in size from 7,800 to 12,000 square feet in floor area.

With the 2008 economic recession, small box discount stores began to attract more

customers outside of the low-income demographic.

Major small box discount store chains are continuing to open new stores and develop new

types of store formats.

Some small box discount stores poorly manage store exteriors, resulting in litter,

uncontained refuse in the dumpster area, and poorly maintained landscaping.

With one exception, existing small box discount stores in New Orleans that sell food

products do not provide fresh fruit and vegetables.

1

A retail goods establishment may not sell alcoholic beverages unless retail sales of

packaged alcoholic beverages is allowed within the district or if it is conditional upon

receiving conditional use approval. Only four districts (C-3 Heavy Commercial, LI Light

Industrial, HI Heavy Industrial and MI Maritime Industrial) allow retail goods

establishments to sell packaged alcoholic beverages by right.

Grocery Stores

Full-line grocery stores generally range from 25,000 to 60,000 square feet, though

smaller versions are also located in New Orleans.

Larger retail goods stores, such as grocery stores, are prohibited in districts such as

HMC-1 and other districts with low maximums for total floor area. The HU-B1, HU-

B1A, HU-MU, S-B1, S-LB1, S-LB2, and S-MU Districts permit uses up to 5,000 square

feet of total floor area, but uses exceeding that threshold are subject to conditional use

approval. In HMC-2, non-residential uses over 10,000 square feet, such as a grocery

store, are conditional uses. HU-B1, HU-B1A, HU-MU, S-LB1 and S-LB2 prohibit uses

over 10,000 square feet, effectively eliminating larger full-line grocery stores from those

districts.

Grocery stores have a wide range of location selection criteria in determining the best

areas to locate, including area demographics, existing and planned food sale

1

Dollar General Market at 2001 St. Bernard Avenue

5

developments, median home sales price, median incomes, location and size of

competitors, traffic counts, violent and property crime, and policy presence.

Public Health & Food Access

Obesity and associated diseases such as diabetes have increased threefold since 1990 as a

result of increased consumption of calorie-dense foods paired with insufficient physical

activity. African Americans are disproportionately more obese and suffer from associated

diseases than their white and Latino counterparts.

Many New Orleans residents have low access to healthy, nutritious food.

Studies are mixed when it comes to the linkage between availability of fresh food and

overall health as well as the availability of fresh food and the purchase of fresh food.

Stores can implement changes to the in-store environment to influence purchasing

behaviors, such as placing particular items in prime locations and promotional advertising

within the store.

All store types, including traditional, full-line grocery stores, devote more shelf space to

unhealthy items than to healthy items.

Local small box discount retailers such as Family Dollar, Dollar General, and Dollar Tree

all accept SNAP, but none accept WIC.

No causal link has been found between childhood obesity and the existence of small box

retail stores in their communities

Toxic chemicals have been found in the products of major small box discount store

chains. While many of these companies have yet to implement comprehensive chemical

management policies, unfortunately the presence of hazardous chemicals in retail

products is not limited to these types of stores.

General Land Use

New Orleans East, Gentilly, and parts of Algiers are more suburban and automobile-

centric in their development pattern than older parts of New Orleans; therefore, any

policy changes may need to be tailored to different areas of the city.

Current Comprehensive Zoning Ordinance regulations prevent retail sales associated with

an agricultural use not located in an Open Space, Rural Development, or non-residential

districts despite the fact that agriculture is permitted or conditional in several residential

districts, including the historic core, historic urban, and suburban residential districts.

There is a discrepancy in the interpretation of Section 21.6.A, which prohibits detached

accessory structures from being constructed prior to construction of the principal building

to which it is accessory. As agricultural uses typically rely on “accessory” structures such

as sheds and chicken coops and do not typically require a traditional principal structure,

this interpretation could negatively impact agricultural uses.

Case Studies

With the implementation of Tulsa’s Healthy Neighborhood Overlay, which requires at

least a one mile distance between small box discount stores, several small box discount

6

stores have located just outside the boundary of the overlay in order to avoid this

restriction.

Zoning is one tool that can assist in increasing the availability of healthy food in areas

with low access; however, for best results other initiatives or incentives should be

incorporated.

Research shows that Minneapolis’ Staple Foods Ordinance has not increased the

purchase of healthy “staple” foods. In addition, it has not been linked to an increase in

healthy food availability as retailers in St. Paul, which does not have a Staple Foods

Ordinance, are also getting healthier.

Programs with financial incentives, such as the Fresh Food Retailer Initiative and the

Healthy Corner Store Collaborative are providing access to fresh food in low-access

areas.

Enforcement

Existing small box discount stores are currently classified under four different

occupational license categories which may create inconsistencies with enforcement

especially if the City desires a change in policy that would specifically target this use.

Code Enforcement and the Department of Sanitation can also only enforce the City Code

on property owners and cannot write violations to the tenants of a property. This is an

issue, specifically as it relates to small box discount stores, because small box discount

stores are typically not the property owners of the buildings where they operate in New

Orleans.

Crime

Violent crime and property crime data retrieved from the New Orleans Police Department

indicates that perceptions of crime in New Orleans East may be just that, a matter of

perception and related to the image of this area of the city. The crime data reflects that the

violent and property crime rates per 100,000 residents is actually lower in New Orleans

East than in Orleans Parish as a whole.

Recommendations

Comprehensive Zoning Ordinance

Definitions (Article 26)

Small Box Variety Store: A retail store between 5,000 and 15,000 square feet that sells at

retail an assortment of physical goods, products, or merchandise directly to the consumer,

including food or beverages for off-premises consumption, household products, personal

grooming and health products, and other consumer goods. Small box variety stores do not

include small box stores that:

1. contain a prescription pharmacy;

2. sell gasoline or diesel fuel;

7

3. primarily sell specialty food items (e.g. meat, seafood, cheese, or oils and vinegars);

4. dedicate at least 15% of shelf space to fresh or fresh frozen foods; or

5. dedicate less than 5% of shelf space to food sales.

Other Definitions

Fresh or Fresh Frozen Food: Food for human consumption that is unprocessed, or

otherwise in its raw state; food that was quickly frozen while still fresh.

2

This includes

unprocessed meat and seafood.

Grocery Store: A retail establishment primarily engaged in the sale of items in multiple of

the following categories: a general line of groceries, packaged frozen food, dairy products,

poultry and poultry products, confectioneries, fish and seafood, meats and meat products,

fresh fruits and vegetables, and other grocery and related products where fresh or fresh foods

including fresh meat, poultry, seafood, and produce make up 25 percent or more of the shelf

space and display area. A grocery store with at least 20,000 square feet of gross floor area

may sell packaged alcoholic beverages.

Home Processed Food Products: “Low-risk foods” in accordance with LA Rev Stat §

40:4.9. Home processed food products do not include animal products.

Agriculture. Land on which crops are grown and/or livestock are raised for sale, commercial

use, personal food production, donation, or educational purposes. Retail sales and home

food processing are permitted for all agriculture uses, subject to Section 20.3.C.

3

Use Standards (Article 20)

Article 20.3.MMM – Small Box Variety Store

1. In the Neighborhood Conservation District, a small box variety store is prohibited within

one (1) mile, or 5,280 feet, of any other small box variety store. Outside of the

Neighborhood Conservation District, a small box variety store is prohibited within two

(2) miles or 10,560 feet, of any other small box variety store. The required separation

distance must be measured in a straight line from the nearest point on the lot line of the

other property occupied by a small box variety store.

2. One litter can shall be placed for every thirty (30) linear feet of street frontage. The litter

can shall be placed directly outside the primary entrance. Where more than one (1) litter

can is required, the operator may place additional cans according to their discretion.

3. The operator of the small box variety store shall provide daily litter clean-up of the site

and along the public rights-of-way abutting the property.

2

The proposed definition for fresh and fresh frozen food is based on the U.S. Food and Drug Administration’s fresh,

freshly frozen, fresh frozen, and frozen fresh definitions as described in Sec. 101.95 “Fresh,” “freshly frozen,” “fresh

frozen,” “frozen fresh,” Title 21, Volume 2 (Revised as of April 1, 2018), “Subchapter B: Food for Human

Consumption.”

3

Proposed text to the Comprehensive Zoning ordinance is noted in bold, underlined font. Proposed deletions from

existing language of the Ordinance is noted with a strikethrough.

8

4. Outside storage is prohibited except for propane tanks. All business, servicing,

processing, and storage operations shall be located within the structure.

Article 20.3.C – Agriculture

[…]

20.3.C.1 – Additional Bulk & Yard Regulations

All structures and other improvements are subject to the bulk and yard regulations of the district,

except as provided below:

a. There are no yard requirements for the planting of crops.

b. All structures used for the keeping of livestock shall be located a minimum of twenty-

five (25) feet from any lot line. This does not apply to apiaries, chicken coops, pigeon

coops, and aquaponic structures, which shall meet the accessory structure

requirements of Section 21.6.

c. Accessory structures associated with agricultural uses are permitted on lots

without a principal structure.

[...]

Article 20.3.C.3 – Food Preparation, Processing, and Packaging

a. No food or other products of any plants or livestock may be prepared, processed,

or packaged in any residential district, except in the R-RE District. However, the

canning of plants or plant products Home food processing is permitted as part of

any agricultural use.

b. Food may be prepared, processed, or packaged at an agricultural use located in

any non-residential zoning district in which food processing is a permitted use, or

in any zoning district where food processing is a conditional use, upon

approval.

c. In any zoning district in which food processing is classified as a conditional use, a

property owner may apply for a conditional use to permit the preparation,

processing, or packaging of food or other products of any plants or livestock

raised on the agricultural use.

[…]

Article 20.3.C.6 – Retail Sales

Retail sales for an agricultural use are permitted at farm stands within the Open Space Districts,

Rural Development Districts, and any non-residential district, in all zoning districts in which

agriculture is a permitted use, or, where it is a conditional use, upon approval, subject to the

following standards:

9

a. Farm stands shall conform to the provisions of Section 21.6.

b. Retail sales are limited to the following:

i. Crops grown and/or livestock raised on the farm where the farm stand is

located.

ii. Other unprocessed food products, or home processed food products such

as jams, jellies, pickles, sauces, or baked goods created on the farm where

the farm stand is located.

Permitted & Conditional Uses (Articles 7 to 17)

Small Box Variety Stores and Grocery Stores

Below are the use tables that show the zoning districts where the small box variety store and

grocery store uses are proposed as permitted (“P”), conditional (“C”), and prohibited uses (blank

space). The table also lists the retail goods establishment use. The retail goods establishment use

is not currently permitted in Open Space Districts (Article 7), Rural Development Districts

(Article 8), Historic Core Neighborhoods Residential Districts (Article 9), Historic Urban

Neighborhoods Residential Districts (Article 11), and Suburban Neighborhoods Residential

Districts (Article 13), and thus the use tables for these districts are not shown below.

In addition, the below use tables show the zoning districts where agricultural uses (with and

without livestock) are proposed as permitted (“P”), conditional (“C”), and prohibited uses (blank

space).

Table 1: Permitted & Conditional Uses – Small Box Variety Stores, Grocery Stores, and

Retail Goods Establishments District Permissions

Use Table: Historic Core Neighborhoods Non-Residential Districts (Article 10)

Uses

District

VCC-

1

VCC-

2

VC

E

VC

E-1

VCS

VCS

-1

VC

P

HMC

-1

HM

C-2

HM

-

MU

Use

Standa

rds

[…]

Retail Goods

Establishment

P

P

P

P

P

P

P

P

P

Grocery Store

P

P

P

P

P

P

P

P

P

Small Box

Variety Store

P

P

P

P

P

P

P

P

P

Section

20.3.M

MM

[…]

10

Use Table: Historic Urban Neighborhoods Non-Residential Districts (Article 12)

Uses

District

HU-B1A

HU-B1

HU-MU

Use

Standards

[…]

Retail Goods Establishment

P

P

P

Grocery Store

P

P

P

Small Box Variety Store

P

P

P

Section

20.3.MMM

[…]

Use Table: Suburban Neighborhoods Non-Residential Districts (Article 14)

Uses

District

S-B1

S-B2

S-LB1

S-LB2

S-LC

S-LP

S-LM

S-

MU

Use

Stand

ards

[…]

Retail Goods

Establishment

P

P

P

P

P

P

Grocery Store

P

P

P

P

P

P

Small Box

Variety Store

P

P

P

P

P

P

Secti

on

20.3.

MM

M

[…]

Use Table: Commercial Center & Institutional Campus Districts (Article 15)

Uses

District

C-1

C-2

C-3

MU-

1

MU-

2

EC

M

C

MS

LS

Use

Stan

dard

s

[…]

Retail Goods

Establishment

P

P

P

P

P

P

P

P

P

Grocery Store

P

P

P

P

P

P

P

P

P

Small Box Variety Store

P

P

P

P

P

P

P

P

P

Sect

ion

20.3

.M

MM

[…]

11

Use Table: Centers for Industry (Article 16)

Uses

District

LI

HI

MI

BIP

Use

Standards

[…]

Retail Goods Establishment

P

P

P

P

Grocery Store

P

P

P

P

Small Box Variety Store

P

P

P

P

Section

20.3.MM

M

[…]

Use Table: Central Business Districts (Article 17)

Uses

District

CBD-

1

CBD-

2

CBD-

3

CBD-

4

CBD-

5

CBD-

6

CBD-7

Use

Standar

ds

[…]

Retail Goods

Establishment

P

P

P

P

P

P

P

Grocery Store

P

P

P

P

P

P

P

Small Box Variety

Store

P

P

P

P

P

P

P

Section

20.3.M

MM

[…]

Maximum Total Floor Area for Commercial Uses

In food desert areas, the CPC staff recommends allowing an additional 5,000 square feet

of floor area by right in grocery stores on major streets, where the commercial zoning

district may restrict it to 5,000, 10,000, or 25,000 square feet. The CPC staff recommends

that a grocery store wishing to take advantage of this additional floor area allowance

should also provide an additional 5% shelf space to fresh and freshly frozen foods beyond

the grocery store definition.

Occupational Licenses

The Department of Safety & Permits and the Bureau of Revenue shall standardize the

small box variety store occupational license category to maintain consistency across

all existing and future small box variety stores;

The City Council shall budget adequate resources for personnel and training to the

Department of Safety & Permits and the Bureau of Revenue for occupational license

reviews and renewals; and

The One Stop Shop shall modify the occupational/general business license

application to include requests for floor area, percentage of shelf space dedicated to

12

fresh or frozen foods, and whether the store will offer gasoline or diesel fuel or

contain a prescription pharmacy;

The Department of Safety & Permits staff tasked with determining occupational

licenses categories prior to issuance of the licenses by the Department of Revenue

shall receive additional training about small box variety stores.

Enforcement

Provide more staffing power to the Department of Safety and Permits to hire and train

inspectors to enforce floor plans and site plans to ensure “small box discount stores”

are in compliance with submitted plans.

Allow the Department of Safety and Permits and the Department of Code

Enforcement the ability to enact multiple fines for multiple violations. A $500 fine for

each violation should be heard at the same adjudication hearing.

Define clear roles for the Department of Sanitation and the Department of Code

Enforcement to ensure proper minimum property maintenance upkeep for property

owners.

Promote the passage of the state law pertaining to right-of-way maintenance in order

to grant the Department of Sanitation, the Department of Public Works, and other

enforcement agencies the authority to issue citations for violations such as littering or

driving in the bike lane.

Other Recommendations

Fresh Food Retailer Initiative

In order to encourage grocery stores, and healthy food in general, to locate in the communities

that most need them, the staff recommends:

Continue the Fresh Food Retailer Initiative and examine the possibility of providing

additional incentives to areas with low food access, such as New Orleans East and the

Lower Ninth Ward.

Healthy Corner Store Program

In order to encourage sales of fresh produce within communities, the staff recommends:

Continue to fund the Healthy Corner Store Program, contributing $100,000 for years

three through five of the program, with the possibility of extension beyond five years.

Plastic Bags Ordinance

Litter is often mentioned as a major problem in New Orleans and around retail locations. Plastic

bags are often seen clogging gutters and trapped in tree branches, though this is certainly not the

only type of litter. To combat litter and for environmental benefits, many cities and some states

have enacted ordinances prohibiting the use of disposable plastic bags. Members of a previous

13

City Council including the current Mayor considered sponsoring a motion that would require

retailers to charge customers for both plastic and paper bags, thereby encouraging shoppers to

bring their own reusable bags. If such a law were enacted, it would best be implemented on a

state level to ensure a level playing field; however, a citywide ordinance may still be effective.

Next Steps

The Small Box Retail Diversity Study, directed by City Council Motion (As Corrected) M-18-

256, will be presented to the City Planning Commission on December 11, 2018. Before it

considers the Study, the CPC must first hold a public hearing. Taking public input into mind, the

CPC can choose to forward the Study to the City Council with or without changes to the staff

recommendations. If the CPC chooses to modify the recommendations, the staff will incorporate

those recommendations and forward the revised Study to the City Council by the deadline of

January 14, 2019. The City Council may choose to hold its own public hearing on the Study,

though it is not required. The City Council may then direct the City Planning Commission to

consider all or part of the recommendations as text changes to the Comprehensive Zoning

Ordinance. If that is done, CPC staff will docket the request and write a staff report with

recommendations for specific zoning text changes. The zoning docket would require an

additional public hearing before the City Planning Commission. The Commission may choose to

recommend text changes to the City Council with or without modification of the staff

recommendations, or they could recommend denial of the proposal. The City Council must hold

a public hearing before considering adoption of zoning text changes. Finally, the Council may

adopt, adopt with modifications, or deny the City Planning Commission’s recommendations.

The Small Box Retail Diversity Study also makes recommendations for changes to the

permitting, licensing, and enforcement process, regulations for which are contained in the City

Code, as well as State-level law changes. The City Planning Commission would not be formally

involved in implementation of those changes.

14

B. Scope of Study

Motion (As Corrected) No. M-18-256

15

16

Study Goals

▪ Define “small box discount store;”

▪ Determine zoning districts where small box discount stores should be permitted,

conditional, or prohibited;

▪ Develop use restrictions for small box discount stores, including possible requirements to

provide fresh food or limit the sale of alcoholic beverages;

▪ Determine whether a requirement for small box discount stores to sell fresh food is

practical and impactful;

▪ Determine whether a spacing requirement is warranted for small box discount stores;

▪ Determine whether small box discount stores negatively impact the plans of conventional

grocery stores;

▪ Encourage healthy food access in underserved communities;

▪ Ensure the safety of customers, employees, and neighbors;

▪ Promote exterior property and premises of commercial uses to be maintained in clean,

safe, and sanitary conditions;

▪ Propose enforceable regulations;

▪ Prioritize enforcement; and

▪ Create a balance between short-term goals, such as healthy food access, and long-term

goals such as ensuring conventional grocery stores in all neighborhoods.

17

C. Small Box Discount Retail Overview

Definition

For the purposes of the Small Box Retail Diversity Study, staff examined small box discount

stores that met the following definition, as outlined in Motion (As Corrected) No. M-18-256:

Small Box Discount Store: Businesses that have a floor area of 5,000 to 10,000 square feet,

which sell at retail physical goods, products, or merchandise directly to the consumer, including

food or beverages for off-premises consumption, household products, personal grooming and

health products, and other consumer goods, with the majority of items being offered for sale at

lower than the typical market price. Small box discount stores do not include businesses that:

1. dedicate at least 15% of floor area to fresh foods and vegetables;

2. contain a prescription pharmacy; or

3. offer for sale gasoline or diesel fuel.

Small Box Discount Store Expansion & Economic Impacts

Small box discount retailers have grown rapidly throughout the country in recent years, despite

the general decline of the retail industry. According to a 2012 study prepared by Deloitte

consulting firm, “the 2008 recession and post-recessionary consumer habits have contributed to

the success of dollar stores, which appeal to primarily low- and fixed-income consumers but also

growingly appeal to consumers of all incomes.”

4

Figure 1: Top Three Dollar stores revenues and growth

5

4

Pat Conroy, Anupam Narula, Kash Muthuranam, Rich Nanda, Dan Kinzler, “Dollar Store Strategies for national

brands. The evolving dollar channel and implications for CPG companies,” Deloitte, 2012.

5

Source: Company 10-Ks and 10Qs, 2003-2012. Retrieved from “Dollar Store Strategies for national brands. The

evolving dollar channel and implications for CPG companies,” Deloitte, 2012.

18

In its report from 2012, Deloitte states that the dollar store industry is a 55.6 billion dollar

industry in the United States, in which the top three dollar-store retailers (Dollar General, Dollar

Tree, and Family Dollar) account for a little over half of that share. It indicates that sales for

these three retailers have grown an average rate of 10 percent annually between 2003 and 2012,

and the number of stores has increased from 13,403 to over 21,000 in the same time period.

Additional data show that this trend has continued since 2012 and that dollar stores are still

thriving today. Overall, dollar stores in the U.S. have seen their sales increase approximately

50% between 2010 and 2015, from 30.4 billion dollars to 45.3 billion dollars.

6

Dollar General

CEO Todd Vasos stated at a Goldman Sachs retailing conference in September 2017 that as “the

middle-class continues to go away, unfortunately, to the lower end of the economic scale versus

the higher end”, and “as this economy continues to chug along and creates more of our customer,

[…] there’s going to be more and more opportunities for us to get in and build more stores.”

7

,

8

According to Dollar General, the fastest growing retailers in the U.S. are discount retailers.

While the revenues of department stores in suburban middle-class malls are declining, Dollar

General and Dollar Tree, which are the two major competitors of the dollar store format, were

growing at 6.4% and 7.5% respectively in 2017. Dollar Tree reported an average growth rate of

8.6 percent from 2015 to 2017, excluding sales from Family Dollar, which it bought in 2015. All

together, these three chains have opened more than 1,800 stores in 2017 alone. Dollar General

finished the first quarter of 2018 with 14,761 stores in 44 states, up from 13,601 a year earlier,

according to the company’s own data. Dollar Tree opened its 15,000

th

store in 2018, on par with

the number of Mc Donald’s in the U.S. These two main dollar chains combined have more stores

than the six biggest retailers in the country – Walmart, Kroger, Costco, Home Depot, CVS, and

Walgreens.

9

Louisiana is particularly affected by the rapid expansion of dollar stores, as it counts much more

dollar stores per capita than other states. “The mid South is one region where dollar stores are

becoming prominent features of the retail environment. […] Arkansas, Mississippi, and

Louisiana each have more than 140 dollar stores per million residents. This compares to only 14

stores per million residents in California, 37 stores per million residents in New York State, […]

and 86 stores per million residents in Texas.”

10

6

Mary Hanbury, “Dollar General is dominating America. Here’s how it keeps its prices low”, Business Insider,

August 30, 2018, https://www.businessinsider.com/dollar-general-low-price-strategy-2018-8 (accessed October 11,

2018)

7

Taylor Pipes, “How Dollar Stores Are Staying Competitive In A Changing Retail Climate”, Shiftonomics by

Branch Messenger, December 22, 2017, https://blog.branchmessenger.com/how-dollar-stores-are-staying-

competitive-in-a-changing-retail-climate-2/ (accessed October 11, 2018)

8

Kate Taylor, “Dollar stores are dominating retail by betting on the death of the American middle class”, Business

Insider, December 8, 2017, https://www.businessinsider.com/dollar-general-sales-soar-death-of-american-middle-

class-2017-12 (accessed October 11, 2018)

9

Warren Shoulberg, “Are Dollar Stores The True Retail Disrupters?”, Forbes, July 22, 2018,

https://www.forbes.com/sites/warrenshoulberg/2018/07/22/are-dollar-stores-the-true-retail-

disrupters/#25efd8467a6e (accessed October 11, 2018)

10

Andreas C. Drichoutis, Rodolfo M. Nayga, Jr., Heather L. Rouse and Michael R. Thomsen, “Food Environment

and Childhood Obesity: The Effect of Dollar Stores”, Health Economics Review, 2015.

19

In rural towns, the development of dollar stores is a two-faced issue. On one hand, the dollar

store companies claim that it benefits the communities because it offers customers more

affordable prices for everyday goods and employment in rural areas that might lack jobs. In

remote areas where customers would have to drive over 20 miles to reach a supermarket, a new

dollar store provides a more accessible way to find essential household and food items. As

declining small towns have seen their businesses close in recent years, a new dollar store is

sometimes the first commercial investment they have seen in many years.

11

On the other hand,

critics often say that “the stores hurt local businesses, drain money from local economies because

profits leave town, and contribute little to the communities where it does business.”

12

The few

small grocery stores that may still exist in these towns struggle to compete with the lower prices

offered by dollar stores.

In cities, mom-and-pop independent dollar stores, neighborhood corner stores, and small grocery

stores often struggle to survive as large chain dollar stores move in. Dollar stores’ growth

impacts other retailers by pressuring them to reduce their prices and by reducing their margins.

While in response some supermarkets have started to offer more dollar items in special sections

stocked with deals and generally inexpensive products, this disruption of the market can force

other retailers to sell some products at a loss, which eventually can drive them to close down.

Location Criteria / Marketing Model

Historically, dollar stores have predominantly served rural and suburban low-income

communities, and smaller communities where larger retailers like Walmart cannot implant

because of their footprint and/or the low population density. More specifically, Dollar General

tends to focus on rural areas, while Dollar Tree and Family Dollar are often found in urban and

suburban areas. All three chains try to open their stores closer to lower-income neighborhoods

than superstore rivals such as Walmart. The target shopper for Dollar General, for example, is a

household making $40,000 or less a year, and is often living several miles away from grocery

stores, in areas referred to as food deserts. “The strategy in the early 2000s, when Dollar General

started to grow, was to go where Walmart wasn't, David Perdue, Dollar General's chief executive

from 2003 to 2007, told The Wall Street Journal”.

13

The current CEO of Dollar General, Todd Vasos, indicated that because the U.S. economy is

facing stagnant wages and decreased job opportunities, the company has started to attract higher

income shoppers as well. Discount stores have growingly appealed to middle-class customers

who have become more conscious about spending. Typically, dollar stores, which are smaller

11

Frank Morris, “How Dollar General Is Transforming Rural America,” NPR, December 11, 2017,

https://www.npr.org/2017/12/11/569815331/loving-and-hating-dollar-general-in-rural-america (accessed October

17, 2018)

12

Blake Gumpercht, “Dollar General creates worry in small towns”, The Bismarck Tribune, December 10, 2017,

file:///H:/My%20studies/Small%20Box%20Retail/chain%20stores/Dollar%20General%20creates%20worry%20in%

20small%20towns%20_%20_%20bismarcktribune.com.html (accessed October 17, 2018)

13

Mary Hanbury, “Dollar General is dominating in America. Here’s how it keeps its prices so low,” Business

Insider, August 30, 2018, https://www.businessinsider.com/dollar-general-low-price-strategy-2018-8 (accessed

October 12, 2018)

20

than supermarkets or big box discounters, have targeted consumers seeking to quickly fill some

of their weekday foods or toiletries, and party supply needs.

14

The Retailer Expansion Guides of Spring 2015 and Spring 2016, which are published by the

retail advisor ChainLinks, provide information about the type of market that different discount

stores are looking at to expand their number of stores, as well as minimum and maximum square

footage of the buildings they wish to implant in.

Table 2: Small Discount Chain Retailers Market Information

RETAILER

# OF

STORES

2015

# OF

STORES

2016

# OF

STORES

PROJECTED

IN 12

MONTHS

(2017)

MIN

SQ. FT.

MAX

SQ. FT.

EXPANSION

COMMENTS

SUMMARY

OF

EXPANSION

99 Cents

Only

350

316

120

10,000

25,000

Downtown,

free standing,

neighborhood

strip, power

center, high

volume

markets, drug

and discount

stores

West coast,

Texas

Dollar

General

12,000

12,195

1,460

9,000

12,000

Downtown,

freestanding,

neighborhood

strip, regional

strip, special

strip, co-

tenancy (if

strip center)

consisting of

frequently

visited stores

(grocery,

drug store,

auto parts

store, video

store, etc)

Nationally

Dollar

Tree

4,000

4,900

600

8,000

12,000

Strong traffic

counts, free

standing,

Nationally

14

Sruthi Ramakrishan, “U.S. dollar stores stand their ground in escalating retail price war,” Reuters, August 18,

2017, https://www.reuters.com/article/us-usa-retail-dollarstores-idUSKCN1AY1XY (accessed October 12, 2018).

21

neighborhood

strip, regional

strip, special

strip, regional

or

neighborhood

centers,

anchored by

big box

discounters

or dominant

grocery

stores

Family

Dollar

7,500

7,847

600

7,800

10,000

Downtown,

free standing,

neighborhood

strip, regional

strip, special

strip, co-

tenants with

strong retail

synergy,

preferably

with a

grocery

anchor. 5

year with 5

year options

Nationally

Five

Below

200

192

50

7,000

10,000

Lifestyle

center,

neighborhood

strip, outlet

mall, power

center,

regional mall,

regional strip,

special strip,

regional and

super-

regional

power

centers

anchored by

national big

box and

junior anchor

South,

Southeast,

Northeast

22

tenants.

Lifestyle

centers

anchored by

value-

oriented big

box retailers.

Regional and

super

regional

enclosed

malls that

feature value-

oriented big

box retailer.

According to this table, the dollar store retailer chains found in New Orleans look to locate in

buildings that are between 7,800 square feet and 12,000 square feet. Overall, while each chain

has its own formula for determining what population and demographics are needed to support a

store, dollar store location criteria resemble those of other retailers: regional or neighborhood

centers, freestanding locations in a strong retail corridor with street presence, maximum street

frontage, easy ingress/egress, and ample parking, shopping centers that are highly visible and

have strong traffic counts, and acquisitions rather than ground-up construction.

15

Economic Impacts

The majority of small box discount stores are located in rural and suburban areas where they cost

less to operate. According to Dollar General’s senior vice president of real estate and

development, it costs the company around $250,000 to open a new leased space. The stores are

smaller than supermarkets, typically locate in metal buildings rather than masonry, and invest a

minimal amount of money in store aesthetics and design with typically metal shelving, strip

lighting, and inexpensive signage.

In a meeting that CPC staff held with representatives of Rouses Supermarkets on September 14

th

,

2018, Steve Black, CEO, and Charles Merell, Vice President of Real Estate, indicated that in

comparison, Rouses needs 4 to 5 million dollars to open a supermarket (which includes

refrigeration, lighting, etc.). As a result of the low cost of construction, dollar stores benefit from

the highest return on investment of any other retail, and they do not face the same risk of failure

since the company would not lose a significant amount of money in the event of a store’s failure.

Since the companies do not own real estate, they have much more flexibility to move less

successful stores to other locations. The cost of operation is also very low since smaller stores

require less staff, and there is less emphasis on service than in larger retailers or supermarkets.

Additionally, dollar stores operate on small margins, carrying a limited number of items, rather

than every brand and size of the same product, which allows them to have more buying power

15

https://www.dollartree.com/real-estate/

23

with suppliers by buying in bulk.

16

According to Rouses representatives, the low cost of

merchandise sold in dollar stores disrupts the market, forcing other retailers to sell the same

goods for less, and sometimes without profit.

While some products are sold in smaller quantities at higher prices in dollar stores than in larger

supermarkets, other items are more economical at dollar stores, and the dollar stores are still

cheaper for locals than the convenience stores and liquor shops they compete with. They have

the advantage of being more accessible to locals who do not own personal vehicles and are not

within reach of a larger supermarket. Dollar stores' success is based on their ability to provide

what lower-income households need when they have no other options. Instead of selling items in

bulk, allowing for long-term savings, dollar stores sell small quantities of items that customers

can afford — even if they end up paying more on a per-ounce or per-item basis in the long run.

Ultimately if people are budget constrained, they do not have the luxury to make better choices

in terms of spending. “Seen one way, dollar stores, like a layaway plan or payday loan, are yet

another manifestation of people of limited means getting around an unaffordable cost-of-entry by

paying more to get less.”

17

In a meeting with staff, Tom Hadir, a property owner who has been looking for a grocery store

operator to occupy a vacant commercial space in his shopping center in New Orleans East,

shared that a grocery store located on Michoud Boulevard closed down when a Dollar General

store opened next to it. He added that small grocery stores and corner stores cannot compete with

dollar stores because of the cost of operations. The cost of providing 15 employees and security

for a large, full-service grocery store is prohibitive when it has to compete with dollar stores that

often operate with minimal employees on-site and provide really inexpensive products. He added

that dollar stores on average lose approximately 40 shopping carts a month, at a cost of 150

dollars each, which is a loss that small, independent supermarkets cannot afford. Existing small

grocery stores on Bullard, Crowder and Read Avenues have allegedly all declined in sales since

dollar stores have multiplied in New Orleans East. According to him, the lack of existing large

grocery stores, and the lack of transportation options benefit dollar stores because people in the

area without access to reliable transportation rarely have the means to get to a large grocery

store.

Current / Future Marketing Efforts

While at the moment, the majority of dollar stores do not offer fresh food or perishable items,

both Dollar General and Dollar Tree are planning on developing their food and beverage

offerings with healthier consumable options, according to CEO Todd Vasos

18

. Dollar General

16

Mary Hanbury, “Dollar General is dominating in America. Here’s how it keeps its prices so low.” Business

Insider, August 30, 2018, https://www.businessinsider.com/dollar-general-low-price-strategy-2018-8 (accessed

October 12, 2018)

17

Joe Eskenazi, “Dollar stores are thriving – but are they ripping off poor people?” the Guardian, June 2018,

https://www.theguardian.com/us-news/2018/jun/28/dollar-store-ripping-people-off-poverty-inequality (accessed

October 12, 2018)

18

Russell Redman, “Dollar stores eyeing bigger helping of food,” Supermarket News, June 1, 2018,

https://www.supermarketnews.com/retail-financial/dollar-stores-eyeing-bigger-helping-food (accessed October 12,

2018).

24

plans to focus on upgrading its existing stores with more cooler doors. “These store remodels

typically drive amongst the highest returns” Vasos said. In fiscal year 2018, Dollar General was

planning to open 900 new stores, remodel 1,000 mature stores and relocate about 100 stores.

About 400 of the 1,000 planned remodels will be to the Dollar General Traditional Plus format

(DGTP), which is a traditional size store with expanded space dedicated to coolers that can

accommodate more perishable items.

One hundred and twenty five (125) of the stores that Dollar General remodeled in its first quarter

of 2018 followed the DGTP format, which added a fresh produce section in 45 stores in the U.S.

According to Dollar General’s CEO, the company now has more than 400 stores throughout the

chain which carry produce. Approximately half of these stores are Market format stores, while

the other half of these stores are DGTP format stores with a fresh produce section. The company

aims to bring these categories to more locations. In an archived conference call from May 2018,

Dollar General’s CEO stated that the company has experience in treating produce within its

Market stores, but that it is still learning to apply that experience to smaller store formats. “We

see it as a competitive advantage, especially in rural areas where there isn't a lot of competition

and/or food choices — especially healthy food choices — for our core consumers. I would tell

you it's not going to be for every store, somewhere down line, but could it be for thousands

eventually? Yes, it could.” This last statement indicates that the company seems to already plan

on expanding their healthy food options to stores located in areas where there is not much

competition in terms of food choice.

Small Box Discount Store Data

During the course of the study, staff identified 36 small box discount stores in New Orleans,

including 12 operating in New Orleans East.

Table 3: Existing Small Box Discount Stores by Council District

LOCATION

NEIGHBORHOOD

COUNCIL DISTRICT

3612 S. Carrollton Avenue

Hollygrove

A

8201 Earhart Boulevard

Hollygrove

A

4115 S. Carrollton Avenue

Mid-City

A

5201 Canal Boulevard

Navarre

A

2650 S Broad Street

Hoffman Triangle

B

2841 S Claiborne Avenue

Hoffman Triangle

B

230 N. Broad Street

Mid-City

B

3157 St Claude Avenue

St. Claude

C

2900 General De Gaulle Drive

Algiers

C

3620 Macarthur Boulevard

Algiers

C

3771 General De Gaulle Drive

19

Algiers

C

19

Permit status is “not operating-pending approval by Safety & Permits.”

25

4021 Behrman Place

Algiers

C

4300 Woodland Drive

Algiers

C

4840 General Meyer Avenue

Algiers

C

1919 St. Claude Avenue

New Marigny

Seventh Ward

C

2130 N. Claiborne Avenue

New Marigny

Seventh Ward

C

2125 Caton Street

Gentilly

D

2170 Filmore Avenue

Gentilly

D

4525 Old Gentilly Road

Gentilly

D

4774 Paris Avenue

Gentilly

D

1841 Almonaster Avenue

New Marigny Ninth

Ward

D

2001 St. Bernard Avenue

Seventh Ward

D

1111 Poland Avenue

Upper Ninth Ward

D

4314 Downman Road

New Orleans East

D

6500 Downman Road

New Orleans East

D

11020 Morrison Road

New Orleans East

E

11701 Morrison Road, Suite 106

New Orleans East

E

11902 I-10 W. Service Road

New Orleans East

E

13100 Chef Menteur Highway

New Orleans East

E

4511 Michoud Boulevard

New Orleans East

E

5700 Crowder Boulevard

New Orleans East

E

7300 Read Boulevard, Suite A

New Orleans East

E

7313 Chef Menteur Highway

New Orleans East

E

8400 Chef Menteur Highway

New Orleans East

E

9711 Chef Menteur Highway

New Orleans East

E

5523 Saint Claude Avenue

Lower Ninth Ward

E

26

Figure 2: Small Box Discount Retail by Council District

History of Small Box Discount Stores in New Orleans

In the post-Hurricane Katrina environment, the development of small box discount stores was

accelerated by the Great Recession a few years later. This development trend is not unique to

New Orleans, as small box variety stores have proliferated exponentially nationwide. Locally,

the phenomenon is especially acute in New Orleans East and other neighborhoods with

affordable commercial real estate.

The image below maps median household income against the locations of small box discount

scores. This map image suggests a strong correlation between median household income and

where small box discount stores choose to locate; specifically, small box discount stores are most

prevalent in areas where median household income is lowest. It is noteworthy that more affluent

neighborhoods such as Lakeview and Uptown have not been developed with small box discount

stores. Due to the heavy saturation of these small box retail stores in low-income areas in

particular, and the concomitant problems reported with their operations and management, the

present study has focused on those areas of greatest overlap between median household income

and small box retail locations.

The prevalence of discount stores in New Orleans East, for example, is partially a function of the

area’s Euclidean zoning and the separation of uses, which is autocentric in character, as the East

lacks the granular development pattern conducive to the traditional corner stores common in so

27

many of the City’s historic urban neighborhoods.

20

Small box discount stores tend to locate on

larger parcels with greater automotive access. Historic urban properties are more difficult to

retrofit in conformity with the building footprints and parking demands associated with their

business model.

Figure 3: Small Box Retail Stores & Median Household Income

However, Euclidean zoning is but one factor with repercussions for the prevalence of discount

stores. At some indeterminate threshold, the socioeconomic and demographic profiles of a

community may supersede the role of Euclidean zoning where real estate values are conducive to

the discount stores’ business model. A perception among stakeholders and interview subjects

implies that the stigmatizing ubiquity of discount stores is precluding full-service grocery stores

from penetrating markets in New Orleans East. This stigma is associated principally with crime

rates, lackluster operations and management, poorly maintained grounds and parking lots, and

the perception that discount stores only cater to low-income market segments of the population.

Because discount stores exhibit a penchant for locating in distressed communities, their

inordinate presence sometimes contributes to the conflation of cause and effect, but like most

highly visible signifiers of distressed communities, discount stores are oftentimes symptomatic

of more underlying structural physical design and socioeconomic conditions: correlation does

not imply causation.

20

Euclidean zoning is a zoning regime based on the landmark U.S. Supreme Court decision in Village of Euclid,

Ohio v. Ambler Realty Co. which inaugurated the principle of the separation of uses. This zoning regime sorts

particular uses into more generic land use categories such as residential, commercial, industrial, agricultural, etc.

28

D. Public Input

Public Comments Summary

Throughout the research and composition of this special study, the City Planning Commission

staff received public comments regarding the adverse impacts – perceived and actual – of

discount stores. Staff received both written comments, which are posted on the City Planning

Commission website and included in this report, as well as public testimony at the September 11,

2018 hearing. Comments can be tentatively categorized under complaints about products, use

standards, economy, and store operations and maintenance. There follows a synopsis of the most

common themes that emerged during the exploratory conversations and interviews with diverse

stakeholders.

Products

Inferior products

Discount stores purvey expired, damaged, or toxic goods

Unhealthy and processed foods

Use Standards

Parking lots are poorly maintained

Stores are poorly illuminated at night

Inadequate landscaping

Aesthetically unappealing buildings

Economy

Perception that discount stores adversely impact property values

Promote low-wage jobs

Market saturation of discount stores precludes larger grocery retailers from entering

the market

The prevalence of discount stores stymies the diversification of the retail economy in

New Orleans East

Operations and Maintenance

Poor customer service

Untrained staff

Insufficient staffing which results in excessive queuing at points of purchase

Litter

Inadequate security

Crime

Loitering

Parking lots of discount stores function as a staging area for a second market of

illegal vendors

29

All written public comments may be found beginning on page 123.

Stakeholder Meetings

In studying small box discount store issues, the City Planning Commission staff met with the

following offices, organizations, groups, and individuals:

City of Tulsa (phone conference)

City of Minneapolis (phone conference)

Tulane Prevention Research Center

Propeller

Hope Credit Union

Top Box Foods

Eastern New Orleans Neighborhood Advisory Commission

Robert Fresh Market

Rouses

Tom Hadir, Fresh Food Retailers Initiative Recipient

University of Minnesota School of Public Health - STaple foodsORdinance

Evaluation (STORE) study

Sanitarian Services, Louisiana Department of Health

Department of Sanitation, City of New Orleans

Department of Health, City of New Orleans

Department of Code Enforcement, City of New Orleans

Department of Safety & Permits, City of New Orleans

Bureau of Revenue, Department of Finance, City of New Orleans

30

E. Current Regulations

Comprehensive Zoning Ordinance

The Comprehensive Zoning Ordinance does not generally differentiate between different types

of retail; however, it does provide a comprehensive definition of a generalized retail zoning

category. Retail Goods Establishments are defined by Article 26 of the Comprehensive Zoning

Ordinance as “a business that provides physical goods, products, or merchandise directly to the

consumer, where such goods are typically available for immediate purchase and removal from

the premises by the purchaser. A retail goods establishment does not include any adult uses. A

retail goods establishment may not sell alcoholic beverages unless retail sales of packaged

alcoholic beverages is allowed within the district and a separate approval is obtained for such

use. A retail goods establishment that sells food products, such as a delicatessen, bakery, or

grocery, may offer ancillary seating areas for consumption of food on the premises.”

Retail goods establishments are permitted by right in a preponderance of the City’s zoning

districts. No use standards currently exist for Retail Goods Establishments.

Permitted and Conditional Uses – Retail Goods Establishments (Articles 7 to 17)

Below are use tables showing the zoning districts where Retail Goods Establishment are

permitted (“P”), conditional (“C”), and prohibited uses (blank space). Because discount stores

are currently classified as Retail Goods Establishments, such stores would be allowed in any of

the districts tabulated below which permit Retail Goods Establishments by right and conditional

in any district which limits Retail Goods Establishments to conditional use review.

Table 4: Permitted & Conditional Uses – Retail Goods Establishment

Use Table: Open Space Districts (Article 7)

Uses

District

OS-N

OS-G

OS-R

NA

GPD

[…]

Retail Goods Establishment

[…]

Use Table: Rural Development Districts (Article 8)

Uses

District

R-RE

M-MU

[…]

Retail Goods Establishment

[…]

Use Table: Historic Core Neighborhoods Residential Districts (Article 9)

Uses

District

VCR-1

VCR-2

HMR-1

HMR-2

HMR-3

31

[…]

Retail Goods Establishment

[…]

Use Table: Historic Core Neighborhoods Non-Residential Districts (Article 10)

Uses

District

VCC-1

VCC-

2

VCE

VCE-

1

VCS

VCS

-1

VCP

HMC

-1

HMC

-2

HM-

MU

[…]

Retail Goods

Establishment

P

P

P

P

P

P

P

P

P

[…]

Use Table: Historic Urban Neighborhoods Residential Districts (Article 11)

Uses

District

HU-RS

HU-RD1

HU-RD2

HU-

RM1

HU-RM2

[…]

Retail Goods Establishment

[…]

Use Table: Historic Urban Neighborhoods Non-Residential Districts (Article 12)

Uses

District

HU-B1A

HU-B1

HU-MU

[…]

Retail Goods Establishment

P

P

P

[…]

Use Table: Suburban Neighborhoods Residential Districts (Article 13)

Uses

District

S-

RS

S-

RD

S-

RM

1

S-

RM

2

S-

LRS

1

S-

LRS

2

S-

LRS

2

S-

LRD

1

S-

LRD

2

S-

LRM

1

S-

LRM

2

[…]

Retail Goods

Establishment

[…]

Use Table: Suburban Neighborhoods Non-Residential Districts (Article 14)

Uses

District

S-B1

S-B2

S-LB1

S-LB2

S-LC

S-LP

S-LM

S-MU

[…]

32

Retail Goods

Establishment

P

P

P

P

P

P

[…]

Use Table: Commercial Center & Institutional Campus Districts (Article 15)

Uses

District

C-1

C-2

C-3

MU-

1

MU-

2

EC

MC

MS

LS

[…]

Retail Goods Establishment

P

P

P

P

P

P

P

P

P

[…]

Use Table: Centers for Industry (Article 16)

Uses

District

LI

HI

MI

BIP

[…]

Retail Goods Establishment

P

P

P

P

[…]

Use Table: Central Business Districts (Article 17)

Uses

District

CBD-1

CBD-2

CBD-3

CBD-4

CBD-5

CBD-6

CBD-7

[…]

Retail Goods

Establishment

P

P

P

P

P

P

P

[…]

Maximum Total Floor Area for Commercial Uses by District

Below is a tabulation of the maximum total floor area requirements for commercial uses in each

applicable zoning district. Larger retail goods stores are prohibited in districts such as HMC-1

and other districts with low maximums for total floor area. Elsewhere, HU-B1, HU-B1A, HU-

MU, S-B1, S-LB1, S-LB2, and S-MU Districts permit uses up to 5,000 square feet of total floor

area, but uses exceeding that threshold are subject to conditional use approval.

Some of the tabulated district regulations can have the unintended consequence of

problematizing conditions for grocery stores; for example, non-residential uses over 10,000

square feet, such as a full-service grocery store are conditional uses in HMC-2. Even more

draconian for grocery stores are those districts, such as HU-B1, HU-B1A, HU-MU, S-LB1 and

S-LB2 which prohibit uses over 10,000 square feet, effectively eliminating larger full-service

grocery stores from those districts.

33

Table 5: Maximum Total Floor Area

for Commercial Uses by District

District

Maximum Total

Floor Area –

Commercial Use

HMC-1

3,000 SF

HMC-2

Any non-residential

use over 10,000 SF

is conditional

HU-B1A

Permitted up to

5,000sf of total floor

area

Conditional use

approval required

for 5,000sf to

10,000sf of total

floor area

Uses with over

10,000sf of total

floor area are

prohibited

HU-B1

Permitted up to

5,000sf of total floor

area

Conditional use

approval required

for over 5,000sf of

total floor area

Uses with over

10,000sf of total

floor area are

prohibited

HU-MU

Permitted up to

5,000sf of total floor

area

Conditional use

approval required

for over 5,000sf of

total floor area

Uses with over

10,000sf of total

floor area are

prohibited

S-B1

Permitted up to

5,000sf of total floor

area

34

Conditional use

approval required

for 5,000 or more

square feet of total

floor area

S-B2

Permitted up to

25,000sf of total

floor area

Conditional use

approval required

for 25,000 or more

square feet of total

floor area

S-LB1

Permitted up to

5,000sf of total floor

area

Conditional use

approval required

for 5,000 or more

square feet of total

floor area

S-LB2

Permitted up to

5,000sf of total floor

area

Conditional use

approval required

for 5,000 or more

square feet of total

floor area

S-LC

None

S-MU

Permitted up to

5,000sf of total floor

area (ground floor

only)

Conditional use

approval required

for 5,000 or more

square feet of total

floor area

No stand-alone

commercial uses are

allowed unless on

the same lot as

multi-family

residential

35

Permitted and Conditional Uses – Retail Sales of Packaged Alcoholic Beverages (Articles 7

to 17)

Below are use tables itemizing the zoning districts where Retail Sales of Packaged Alcoholic

Beverages are permitted (“P”), conditional (“C”), and prohibited uses (blank space). The CZO’s

definition of Retail Goods Establishment stipulates that “a retail goods establishment may not

sell alcoholic beverages unless retail sales of packaged alcoholic beverages is allowed within the

district and a separate approval is obtained for such use.” Only four of the districts tabulated

below (C-3 Heavy Commercial, LI Light Industrial, HI Heavy Industrial and MI Maritime

Industrial) allow Retail Goods Establishments to sell packaged alcoholic beverages by right; a

preponderance of the districts below either prohibit the use or subject it to the conditional use

process.

Table 6: Permitted and Conditional Uses – Retail Sales of Packaged Alcoholic Beverages

Use Table: Open Space Districts (Article 7)

Uses

District

OS-N

OS-G

OS-R

NA

GPD

[…]

Retail Sales of Packaged Alcoholic

Beverages

[…]

Use Table: Rural Development Districts (Article 8)

Uses

District

R-RE

M-MU

[…]

Retail Sales of Packaged Alcoholic Beverages

[…]

Use Table: Historic Core Neighborhoods Residential Districts (Article 9)

Uses

District

VCR-1

VCR-2

HMR-1

HMR-2

HMR-3

[…]

Retail Sales of Packaged Alcoholic

Beverages

[…]

Use Table: Historic Core Neighborhoods Non-Residential Districts (Article 10)

Uses

District

VCC-

1

VCC-

2

VCE

VCE-

1

VCS

VCS

-1

VCP

HMC

-1

HMC

-2

HM-

MU

[…]

Retail Sales of

C

C

C

C

C

36

Packaged Alcoholic

Beverages

[…]

Use Table: Historic Urban Neighborhoods Residential Districts (Article 11)

Uses

District

HU-RS

HU-RD1

HU-RD2

HU-

RM1

HU-RM2

[…]

Retail Sales of Packaged Alcoholic

Beverages

[…]

Use Table: Historic Urban Neighborhoods Non-Residential Districts (Article 12)

Uses

District

HU-B1A

HU-B1

HU-MU

[…]

Retail Sales of Packaged Alcoholic

Beverages

C

C

[…]

Use Table: Suburban Neighborhoods Residential Districts (Article 13)

Uses

District

S-

RS

S-

RD

S-

RM

1

S-

RM

2

S-

LRS

1

S-

LRS

2

S-

LRS

2

S-

LRD

1

S-

LRD

2

S-

LRM

1

S-

LRM

2

[…]

Retail Sales of

Packaged

Alcoholic

Beverages

[…]

Use Table: Suburban Neighborhoods Non-Residential Districts (Article 14)

Uses

District

S-B1

S-B2

S-LB1

S-LB2

S-LC

S-LP

S-LM

S-MU

[…]

Retail Sales of

Packaged Alcoholic

Beverages

C

C

C

C

C

C

[…]

37

Use Table: Commercial Center & Institutional Campus Districts (Article 15)

Uses

District

C-1

C-2

C-3

MU-

1

MU-

2

EC

MC

MS

LS

[…]

Retail Sales of Packaged

Alcoholic Beverages

C

C

P

C

C

C

[…]

Use Table: Centers for Industry (Article 16)

Uses

District

LI

HI

MI

BIP

[…]