COMPREHENSIVE HOUSING MARKET ANALYSIS

U.S. Department of Housing and Urban Development,

Oce of Policy Development and Research

As of November 1, 2020

Share on:

The COVID-19 pandemic has resulted in unprecedented large and rapid

changes in many data series, and similarly unprecedented large policy

responses, making analysis of, and longer run predictions for, the economy

and housing markets exceptionally difficult and uncertain. HUD will continue

to monitor market conditions in the HMA and provide an updated report/

addendum in the future.

Greenville, South Carolina

Executive Summary 2Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Executive Summary

Housing Market Area Description

The Greenville Housing Market Area (HMA) is coterminous

with the Greenville-Anderson-Mauldin, SC Metropolitan

Statistical Area (MSA), which is defined as Anderson,

Greenville, Laurens, and Pickens Counties in South Carolina.

The former textile manufacturing capital of the world is now

focused mainly on automotive manufacturing and home to

large manufacturers such as Michelin North America, Inc., and

Robert Bosch LLC. Clemson University, downtown Greenville,

and the natural scenery of upstate South Carolina attract

tourists and retirees from across the country.

Tools and Resources

Find interim updates for this metropolitan area, and select geographies nationally,

at PD&R’s Market-at-a-Glance tool.

Additional data for the HMA can be found in the supplemental tables of this report.

For information on HUD-supported activity in this area, see the Community Assessment Reporting Tool.

Executive Summary 3Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Market Qualifiers

As a result of the COVID-19 pandemic, the

economy in the Greenville HMA weakened

significantly during the past 12 months. Job

losses during the period occurred primarily in

the professional and business services and the

leisure and hospitality sectors, which accounted

for more than 70 percent of total jobs lost. The

unemployment rate reached a high near the

beginning of the pandemic—at 12.3 percent in

April 2020—but has since declined to 3.5 percent

in October 2020. Nonfarm payrolls are expected

to increase an average of 1.5 percent annually

during the 3-year forecast period, as economic

conditions continue to improve.

Sales housing market conditions in the Greenville

HMA are currently balanced, with an estimated

vacancy rate of 1.2 percent—down from

2.9 percent in April 2010. Recently, responses

to the COVID-19 pandemic have contributed to

a decrease in the supply of homes for sale. In

October 2020, a 2.5-month supply of homes were

for sale, compared with a 3.5-month supply a year

ago. During the next 3 years, demand is estimated

for 13,700 new homes. The 2,400 homes currently

under construction will meet a portion of the

demand during the first year of the forecast.

Overall rental housing market conditions in the

Greenville HMA are currently balanced, with an

estimated rental vacancy rate of 7.5 percent—

down from 11.4 percent in 2010, when the

market was soft. The apartment market is also

currently balanced, with vacancy rates during the

third quarter of 2020 averaging 4.3 percent—

unchanged from the same period a year ago.

During the 3-year forecast period, demand is

estimated for 5,350 additional rental units in the

HMA. The 2,300 units currently under construction

are expected to meet part of that demand during

the first year of the forecast.

Economy

Weak: Nonfarm payrolls declined by

12,600 jobs, or 2.9 percent, during

the 12 months ending October 2020.

Rental Market

Balanced: Apartment market

vacancy rates have remained

around 4.3 percent since 2018.

Sales Market

Balanced: The average existing

home sales price increased

7 percent during the 12 months

ending October 2020.

TABLE OF CONTENTS

Economic Conditions 4

Population and Households 10

Home Sales Market 13

Rental Market 17

Terminology Definitions and Notes 20

Notes: Total demand represents estimated production necessary to achieve a balanced market at the end of the forecast period. Units under

construction as of November 1, 2020. The forecast period is November 1, 2020, to November 1, 2023.

Source: Estimates by the analyst

3-Year Housing Demand Forecast

Sales Units Rental Units

Greenville HMA

Total Demand 13,700 5,350

Under Construction 2,400 2,300

Economic Conditions 4Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Conditions

Largest Sector: Professional and

Business Services

Proximity to the BMW Manufacturing Co.,

LLC (BMW) production facility in the adjacent

Spartanburg, SC MSA has a large effect on

the economy in the Greenville HMA.

Primary Local Economic Factors

Since the 1990s, the Greenville HMA has

transitioned from being the textile manufacturing

capital of the world to a location known for

advanced manufacturing. A more diverse

manufacturing sector, with a focus on the

automobile industry, has replaced the textile

industry. The main cause of this shift toward

the automobile industry has been the growth of

the BMW production facility in the neighboring

Spartanburg, SC MSA. The growth of BMW since

2000 has prompted many tier-1 automotive

suppliers to move to the HMA and has promoted

the growth of major employers already in

the HMA, such as Michelin North America,

Inc. (Michelin) and Robert Bosch LLC (Bosch).

Professional and business services is the largest

sector in the HMA, at 17 percent of nonfarm

payroll jobs (Figure 1); the temporary-help services

industry typically accounts for the largest share

of jobs in this sector, at 33 percent in 2019.

Across the nation, approximately 85 percent of

temporary-help service production jobs are manufacturing-related and would otherwise be classified as

jobs in the manufacturing sector but are not because they are contracted through employment agencies

(Quarterly Census of Employment and Wages [QCEW], Bureau of Labor Statistics). MAU Workforce Solutions,

one of the largest temporary-help service production companies in the HMA, hires contractors for BMW,

Michelin, Bosch, and other manufacturers in the metropolitan area. The categorization of contractors in

the professional and business services sector is partly reflected in the American Community Survey (ACS)

data for the HMA, in which approximately 18 percent of respondents worked at a manufacturer and

10 percent worked at a company in the professional and business services sector (IPUMS USA 2019 1-year

ACS estimates)—a contrast to the sector distribution of jobs.

Mining, Logging, & Construction 5%

Manufacturing 14%

Wholesale 5%

Retail 11%

Transportation & Utilities 3%

Information 2%

Financial Activities 4%

Professional & Business Services 17%

Leisure & Hospitality 10%

Other Services 3%

Federal 1%

State 3%

Local 11%

Education

& Health

Services

12%

Education 2%

Health 10%

Government

15%

Trade 15%

Total

420.3

Notes: Total nonfarm payroll is in thousands. Percentages may not add to 100 percent due to rounding. Wholesale and Retail do not sum to the

Trade sector percentage due to rounding. Based on 12-month averages through October 2020.

Source: U.S. Bureau of Labor Statistics

Figure 1. Share of Nonfarm Payroll Jobs in the Greenville HMA, by Sector

Economic Conditions 5Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Name of Employer Nonfarm Payroll Sector Number of Employees

Prisma Health Education & Health Services 16,450

Clemson University Government 5,400

Michelin North America, Inc. Manufacturing 4,725

Bon Secours Health System, Inc. Education & Health Services 4,450

AnMed Health Education & Health Services 4,050

Duke Energy Corporation Transportation & Utilities 3,600

State of South Carolina Government 3,425

GE Power Manufacturing 3,400

ZF Transmissions Gray Court, LLC Manufacturing 2,500

Robert Bosch LLC Manufacturing 2,200

Table 1. Major Employers in the Greenville HMA

Note: Excludes local school districts.

Source: Upstate SC Alliance

The HMA has also become a popular retirement

destination, leading to fast growth in the leisure

and hospitality and the education and health

services sectors once the economy began

recovering from the Great Recession. Those

sectors increased by averages of 1,500 jobs

each—or 3.6 and 3.3 percent, respectively—

annually from 2013 through 2019, adding the

largest number of jobs after the professional

and business services sector. The education and

health services sector has grown almost every

year since 2000 and was the fastest growing

sector in the HMA, largely due to continued

expansions at Prisma Health—the largest

employer in the HMA (Table 1)—to keep up with

strong net in-migration and the aging population.

The government sector is the third largest sector

in the HMA and contains the second largest

employer, Clemson University. Since 2012,

Clemson University has averaged a 3-percent

annual enrollment increase and a 3-percent

increase in the number of employees (Clemson

University). The university currently employs

5,400 people and had a $1.3 billion operating

budget for the 2020–2021 academic year. The

Clemson Tigers football team has made it to the

College Football Playoffs every year since 2015,

helping drive leisure and hospitality growth and

tourism to the HMA.

Nonfarm Payroll Trends

Total nonfarm payrolls declined by an average

of 6,200 jobs, or 1.7 percent, annually from 2001

through 2003, as the recession during the early 2000s affected the already struggling manufacturing

sector, which declined by 5,100 jobs, or 7.1 percent, annually during that period. Despite the still-declining

manufacturing sector, total nonfarm payrolls increased by 4,600 jobs, or 1.3 percent, from 2004 to 2008,

led by the professional and business services sector, which increased by 1,900 jobs, or 3.6 percent,

annually. Nonfarm payrolls had just recovered from losses during the early 2000s when the effects of the

Great Recession of 2007–2009 pushed nonfarm payrolls in the HMA to their lowest levels since before

2000. From 2009 through 2010, nonfarm payrolls declined by an average of 12,100 jobs, or 3.2 percent,

annually. Manufacturing led the declines again, but the mining, logging, and construction sector declined

by 3,100 jobs, or 15.9 percent, making it the fastest declining sector, as housing and other construction

came to a standstill.

The economy began recovering in 2011, and total nonfarm payrolls grew every year from 2011 through

2018, increasing by an average 9,200 jobs, or 2.4 percent, annually, with growth in each sector. During

that period, the recovery of jobs in the manufacturing sector helped nonfarm payrolls surpass the 2008

high. Professional and business services was the fastest growing sector and added the most jobs,

increasing by an average 3.5 percent, or 2,200 jobs, annually from 2011 through 2018; that increase was

due to growth in the manufacturing sector and expansions and the additions of several call centers and

headquarters. Growth in the manufacturing sector slowed significantly in 2018, as the United States began

Economic Conditions 6Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

National Recession Nonfarm Payrolls

345

360

375

390

405

420

435

Oct-00

Oct-01

Oct-02

Oct-03

Oct-04

Oct-05

Oct-06

Oct-07

Oct-08

Oct-09

Oct-10

Oct-11

Oct-12

Oct-13

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Oct-19

Oct-20

Nonfarm Payrolls (in Thousands)

Note: 12-month moving average.

Sources: U.S. Bureau of Labor Statistics; National Bureau of Economic Research

Figure 2. 12-Month Average Nonfarm Payrolls in the Greenville HMA

Table 2. 12-Month Average Nonfarm Payroll Jobs (1,000s) in the Greenville HMA, by Sector

12 Months Ending

October 2019

12 Months Ending

October 2020

Absolute Change Percentage Change

Total Nonfarm Payroll Jobs 432.9 420.3 -12.6 -2.9

Goods-Producing Sectors 77.1 76.3 -0.8 -1.0

Mining, Logging, & Construction 19.1 19.3 0.2 1.0

Manufacturing 58.0 57.0 -1.0 -1.7

Service-Providing Sectors 355.8 344.0 -11.8 -3.3

Wholesale & Retail Trade 64.9 65.0 0.1 0.2

Transportation & Utilities 12.8 12.8 0.0 0.0

Information 6.8 6.4 -0.4 -5.9

Financial Activities 19.3 18.8 -0.5 -2.6

Professional & Business Services 75.1 71.0 -4.1 -5.5

Education & Health Services 52.3 51.5 -0.8 -1.5

Leisure & Hospitality 46.9 42.0 -4.9 -10.4

Other Services 14.9 14.2 -0.7 -4.7

Government 62.9 62.4 -0.5 -0.8

Notes: Based on 12-month averages through October 2019 and October 2020. Numbers may not add to totals due to rounding. Data are in thousands.

Source: U.S. Bureau of Labor Statistics

imposing tariffs on goods that manufacturing

suppliers and producers use and sell, such as

steel, aluminum, electronics, and appliances.

Bosch, Electrolux AB, and other manufacturing

companies applied for exemption from the

tariffs that affected them, but exemptions were

generally denied (Office of the United States Trade

Representative). Nonfarm payroll growth was

accelerating—increasing by 11,400 jobs,

or 2.7 percent, in 2018—but during 2019, growth

slowed to 1.2 percent, with the addition of only

5,200 jobs. Manufacturing jobs began declining

from several rounds of tariffs and retaliatory

tariffs, increasing producer costs and reducing

manufacturing employment around the country

(Federal Reserve Board). Investment into the

HMA also fell—from $3.69 billion to $2.37 billion—

from 2017 through 2018, as companies delayed

projects due to uncertainty surrounding the tariffs

(Upstate SC Alliance).

Current Conditions—

Nonfarm Payrolls

During the 12 months ending October 2020, total

nonfarm payrolls decreased by 12,600 jobs, or

2.9 percent (Figure 2). Declines in the leisure and

hospitality and the professional business and

services sectors made up 71 percent of those job

losses (Table 2), mostly due to COVID-19-related

restrictions. During the 12 months ending October

2020, the leisure and hospitality sector declined

by 4,900 jobs, or 10.4 percent. Countermeasures

to slow the spread of COVID-19

did not include

Economic Conditions 7Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Manufacturing

Before the national recession in 2001 and the concurrent decline in manufacturing jobs across the nation,

the number of jobs in the manufacturing sector in the HMA had been slowly declining since 1990. The

recession in 2001 exacerbated the decline in textile and textile-related product manufacturing. From

2002 through 2004, textile and textile-related manufacturing jobs declined by an average 2,100 jobs,

or 15.2 percent, annually and accounted for nearly one-half of the manufacturing sector decline during

Economic Sectors of Significance

Note: Based on the 12-month moving average.

Source: U.S. Bureau of Labor Statistics

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

11.0

12.0

Oct-00

Oct-01

Oct-02

Oct-03

Oct-04

Oct-05

Oct-06

Oct-07

Oct-08

Oct-09

Oct-10

Oct-11

Oct-12

Oct-13

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Oct-19

Oct-20

Unemployment Rate (%)

Greenville HMA Nation

Figure 3. 12-Month Average Unemployment Rate in the Greenville HMA and the Nation

restrictions on restaurants until August 2020,

when the allowed capacity for restaurants became

limited. On October 2, 2020,

restrictions were

eased and restaurants could open

at full capacity,

however limitations on in-restaurant alcohol sales

remained. Since August 2020, entertainment

venues have been required to reduce capacity to

50 percent, or a maximum of 250 people. Those

restrictions, combined with a general reduction in

consumer spending on leisure and entertainment,

have slowed recovery in the leisure and hospitality

sector, averaging 4.5-percent monthly growth from

July through August 2020 and 0.7 percent from

September through October 2020. The professional

and business services sector also declined

significantly during the past 12 months due to layoffs

from companies such as MAU Workforce Solutions,

which laid off roughly 1,425 workers who were

contracted out to BMW in March and April 2020.

During the 12 months ending October 2020, the

professional and business services sector declined

by 4,100 jobs, or 5.5 percent. The manufacturing

sector declined by 1,000 jobs, or 1.7 percent, during

the 12 months ending October 2020, but during the

3 months ending October 2020, the sector grew by

200 jobs, or 0.3 percent, from a year ago. Payrolls

in the retail trade subsector suffered a relatively

small decline relative to the nation; payrolls

declined by 200 jobs, or 0.4 percent, during the

12 months ending October 2020, compared with

a 4.2-percent decline in the nation, as business

restrictions to slow the spread of COVID-19 were

not generally applied to retail stores in the HMA.

Current Conditions—Unemployment

The unemployment rate averaged 5.6 percent during the 12 months ending October 2020—up from 2.7 percent

during the previous 12 months (Figure 3). During April 2020, the unemployment rate rose to 12.3 percent

from 2.7 percent during March 2020 and surpassed the 12-month peak of 10.9 percent during mid-2010. The

unemployment rate has declined every month since April 2020, as restrictions to slow the spread of COVID-19

eased. The unemployment rate declined to 3.5 percent in October, compared with 6.6 percent for the nation.

Economic Conditions 8Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

that period. During the 2001-through-2009 period, the manufacturing sector

contracted in tandem with national trends, averaging 3,000 jobs lost, or

4.7 percent, annually. Larger companies in the HMA began moving production

overseas to save on labor costs. The appliance maker Electrolux laid off

approximately 3,000 workers in 2005 and moved production abroad. By

2011, manufacturing sector growth had shifted toward the automotive sector,

which had been heavily influenced by the constant investment of BMW in the

neighboring Spartanburg, SC MSA automobile production plant. The plant,

which operates in the city of Greer, increased employment from approximately

2,000 workers when the plant was fully operational in the early 2000s to 11,000

workers in 2019, which led to dozens of automotive suppliers moving to the

HMA to be closer to the BMW production facility. In addition, the Greenville-

Spartanburg International Airport and Inland Port Greer made the HMA an

attractive location for automotive suppliers because of lower transportation

costs. The growth of the BMW plant led the transportation equipment

manufacturing industry to increase by an average of 270 jobs, or 3.5 percent,

annually from 2011 through 2019. Suppliers to BMW make up some of the largest

companies in the HMA, including Michelin and ZF Transmissions Gray Court,

LLC, the latter of which opened in 2013. Despite the deep job losses during the

late 2000s and the above-mentioned overlap between the manufacturing and

professional and business services sectors, the manufacturing sector increased

by an average of 1,100 jobs, or 2.1 percent, annually from 2011 through 2019 and

was responsible for 12.5 percent of overall job growth during the period.

Professional and Business Services

The professional and business services sector is the largest sector in the

HMA. The sector added the most jobs from 2001 through 2019, increasing

by 1,400 jobs, or 2.3 percent, annually, making it the second fastest growing

sector in the HMA. More than one-half of the growth during that period came

from the employment services industry, which increased by 725 jobs, or

4.2 percent, annually from 2002 through 2019 and more than doubling in size.

The employment services industry is largely made up of temporary jobs, which

often are the first jobs to decline during recessionary periods and the first jobs

to recover after a recession ends. During the Great Recession, the professional

and business services sector lost the most jobs, declining by 7,000 jobs, or

12.2 percent, during 2009, and the employment services industry declined

by 2,550 jobs, or 15.1 percent. By 2011, professional and business services

was one of only two sectors that had recovered job losses, but total nonfarm

payrolls did not completely recover until early 2014. From 2012 through 2019,

the professional and business services sector added the most jobs of any

sector, increasing by an average 1,800 jobs, or 2.6 percent, annually.

Several well-known companies in the professional and business services

sector have offices in the Greenville HMA, including Michelin, Verizon

Communications Inc, and GE Power. In addition, several customer-support

call centers for larger employers—such as Alorica Inc. (owned by Samsung

Electronics Co., Ltd.); Toronto Dominion Bank (TD Bank); and Verizon

Communications Inc

—contribute jobs to the professional and business

services sector.

Education and Health Services

Prisma Health—formerly known as Greenville Health System before merging

with Palmetto Health in 2019 under the new Prisma Health brand name—is the

largest employer in the HMA, with approximately 16,450 workers. Prisma Health

has consistently expanded since 2010, increasing employment by an average

of 670 employees, or 5 percent, annually. The popularity of the HMA as a

retirement destination has been the main contributor to growth in the healthcare

and social assistance industry, which has increased every year by an average

of 1,100 jobs, or 3.7 percent, from 2000 through 2019—nearly doubling in size.

From 2001 through 2008, the education and health services sector added the

most jobs of any sector in the HMA, increasing by an average of 1,300 jobs,

or 4.1 percent, annually. During the Great Recession, the education and health

services sector was the only sector to add jobs during 2009, increasing by

500 jobs, or 1.3 percent. Growth slowed slightly after that recession compared

with the previous decade, but the healthcare and social assistance industry

still added an average of 1,150 jobs, or 3.3 percent, annually from 2010 through

2018. During 2019, the industry added only 400 jobs, or 1.0 percent.

Economic Conditions 9Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Employment Forecast

During the forecast period, nonfarm payrolls are expected to increase an

average of 1.5 percent annually. Total nonfarm payrolls at the end of the first

year of the forecast period are expected to return to pre-pandemic levels. In

2020, announcements of new companies or expansions in the HMA amounted

to more than 1,800 jobs expected to be added during the forecast period.

Techtronic Industries Co. Ltd., a Hong Kong-based power tool manufacturer,

is expanding facilities and creating 525 jobs by the fourth quarter of

2022. Majorel Group Luxembourg S.A., a customer service company,

completed its new call center in August 2020 and is expected to hire

500 workers by 2021.

Population and Households 10Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population and

Households

Current Population: 936,100

Net in-migration has been strong since

2014, whereas net natural change

has steadily declined since the Great

Recession due to the aging population.

Population Trends

As of November 1, 2020, the population of

the Greenville HMA is estimated at approximately

936,100 (Table 3). Since April 2010, population

growth has averaged 10,600 people, or

1.2 percent, annually. Net in-migration has

accounted for 80 percent of growth during that

period, averaging 8,475 people annually (Figure 4).

Net natural change (resident births minus resident

deaths) has slowed nearly each year since 2010

because of an aging population. Population

change for those ages 55 years and older has

increased irrespective of economic conditions

since 2010, whereas population change in

younger age cohorts has fluctuated with economic

conditions (see Age Cohort Trends on page 11).

From 2000 to 2005, population growth increased

by an average of 7,125 people, or 1.0 percent,

annually (Census Bureau population estimates as

of July 1). After the recession of the early 2000s

and once declines in manufacturing slowed,

population growth increased to an average of

Population

Quick Facts

2010 Current Forecast

Population 824,112 936,100 973,300

Average Annual Change 9,850 10,600 12,400

Percentage Change 1.3 1.2 1.3

Household

Quick Facts

2010 Current Forecast

Households 321,113 367,400 382,900

Average Annual Change 3,825 4,375 5,175

Percentage Change 1.3 1.3 1.4

Notes: Average annual changes and percentage changes are based on averages from 2000 to 2010, 2010 to current, and current to forecast.

The forecast period is from the current date (November 1, 2020) to November 1, 2023.

Sources: 2000 and 2010—2000 Census and 2010 Census; current and forecast—estimates by the analyst

Table 3. Greenville HMA Population and Household Quick Facts

Notes: Net natural change and net migration totals are average annual totals over the time period. The forecast period is from the current date

(November 1, 2020), to November 1, 2023.

Sources: U.S. Census Bureau; current to forecast—estimates by the analyst

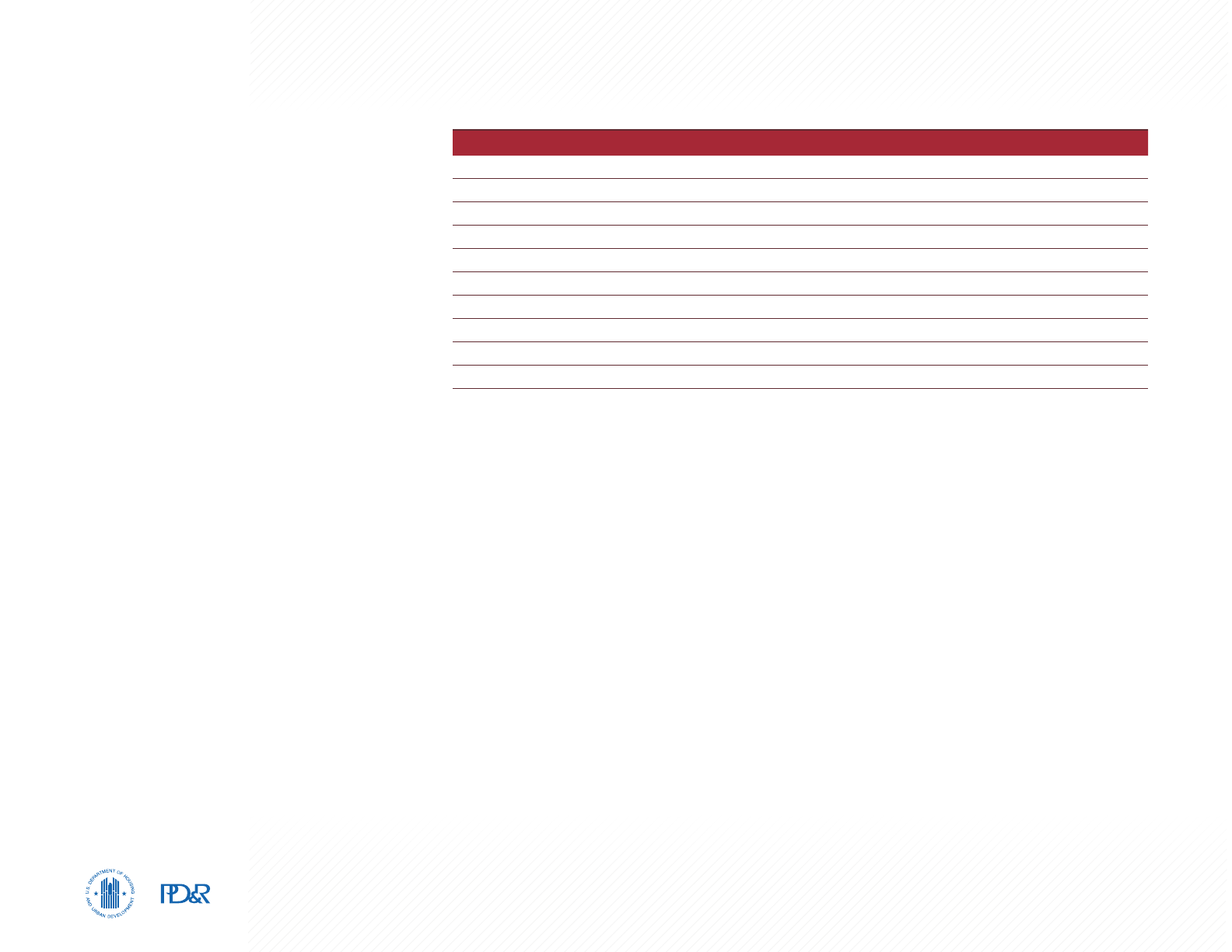

Net Natural Change Net Migration Population Growth

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

2000-2001

2001-2002

2002-2003

2003-2004

2004-2005

2005-2006

2006-2007

2007-2008

2008-2009

2009-2010

2010-2011

2011-2012

2012-2013

2013-2014

2014-2015

2015-2016

2016-2017

2017-2018

2018-2019

2019-Current

Current-Forecast

Population Change

Figure 4. Components of Population Change in the Greenville HMA, 2000 Through the Forecast

15,250 people, or 2.0 percent, annually from 2005 to 2008. The rebound in manufacturing from the

automotive industry and the revitalization of downtown Greenville during 2004 and 2005 contributed to

the higher-than-average population growth rate. The Great Recession caused population growth to slow

Population and Households 11Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Sources: U.S. Census Bureau; 2010 and 2019 ACS 1-year estimates

2010 2019

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

Under 25 25 to 54 55 and Older

Figure 5. Population by Age Range in the Greenville HMA

to previous recession levels, increasing by

an average of 7,925 people, or 1.0 percent,

annually from 2008 to 2013. From 2010 to 2013,

79 percent of the population growth came from

the 55-years-and-older age cohort, increasing

by an average 6,500 people, or 3.0 percent,

annually during the period. As economic

conditions strengthened, with nonfarm payrolls

completely recovered from the recession-induced

job decline in 2014, population growth averaged

12,000, or 1.4 percent, annually from 2013 to

2019. Net migration averaged 9,925 people

annually, accounting for 83 percent of population

growth, from 2013 to 2019. During the same

period, net natural change slowed to an average

of 2,075 people a year—down from 2,925 people

a year during the 2008-to-2013 period.

Age Cohort Trends

The largest age cohort in the HMA is the 25-to-

54-years group, which makes up 38 percent

of the population—a decline from 40 percent

in 2010 (Figure 5). From 2010 to 2014, this

age cohort increased much more slowly than

the 55-years-and-older cohort, averaging an

increase of 690 people, or 0.2 percent, annually,

compared with the 55-years-and-older cohort,

which increased by an average 6,750 people,

or 3.0 percent. From 2014 to 2019, the 25-to-

54-years age cohort increased by an average

of 3,025 people, or 0.9 percent, annually, as

economic conditions strengthened. The fastest

growing cohort was the age-55-and-older cohort, which increased by an average of 7,100 people,

or 2.8 percent, from 2014 to 2019. These trends have contributed to slowing net natural change in the

HMA since 2008.

Household Trends

Currently, an estimated 367,400 households live in the HMA, reflecting an average annual increase of

4,375 households, or 1.3 percent, since 2010 and a continuation of the 1.3-percent growth rate from

2000 to 2010. Household growth has been slightly higher than population growth due to growth in the

55-and-older age cohort, which has caused the average household size to decrease since 2010. The

homeownership rate in the HMA has declined to an estimated 67.6 percent from 69.0 percent in 2010

due, in part, to demographic trends and the aftereffects of the Great Recession (Figure 6). The rate of

homeownership declined to an estimated low of 62.2 percent by 2016 and has increased every year since

then as the working age cohort has been more willing to buy during the stronger economic conditions.

Among those aged 25 to 54, homeownership increased from 59.6 percent in 2012 to 64.6 percent in 2019,

whereas among those aged 55 and older, homeownership increased from 78.8 to 79.4 percent (IPUMS

USA; 2012 and 2019 ACS 1-year estimates).

Population and Households 12Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population and

Household Forecast

Population growth during the first and second years

of the forecast period is expected to be slightly

slower than recent years, with growth picking

up during the third year of the forecast period.

Overall, the population is estimated to increase

by an average of 12,400 people, or 1.3 percent, a

year. Net in-migration is expected to remain similar

to recent years, as economic conditions continue

to improve from the recent downturn. Households

are expected to increase by an average of 5,175,

or 1.4 percent, annually during the forecast period,

continuing the trend of slightly higher household

growth compared with population growth.

Note: The current date is November 1, 2020.

Sources: 2000 and 2010—2000 Census and 2010 Census; current—estimates by the analyst

RenterOwner

Homeownership Rate

71.7

69.0

67.6

65.0

66.0

67.0

68.0

69.0

70.0

71.0

72.0

73.0

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

2000 2010 Current

Homeownership Rate (%)

Households

Figure 6. Households by Tenure and Homeownership Rate in the Greenville HMA

Home Sales Market 13Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales Market

Market Conditions: Balanced

Existing home sales price growth has

recently increased because changes in

seller behavior—in response to the COVID-19

pandemic—have restricted supply.

Current Conditions

Sales housing market conditions in the Greenville

HMA are currently balanced, with an estimated

vacancy rate of 1.2 percent (Table 4)—down from

2.9 percent in April 2010. The months’ supply of

homes in the HMA is currently low, at 2.5 months

in October 2020—down from 3.5 months a year

ago (CoreLogic, Inc.). Recently, low mortgage

interest rates have supported demand despite

the economic contraction.

Existing Home

Sales and Prices

During the 12 months ending October 2020,

existing home sales (including single-family

homes, townhomes, and condominiums)

increased by 950 homes, or 7 percent, to

17,300 (Zonda). Growth increased from the

12 months ending October 2019, when sales

increased by 520, or 3 percent, from the year

prior (Figure 7). Existing home sales declined

by an average 1,775 homes, or

14 percent,

annually from 2007 through 2011

due to the

Home Sales

Quick Facts

Greenville HMA Nation

Vacancy Rate

1.2% NA

Months of Inventory

2.5 2.8

Total Home Sales

21,200 5,536,000

1-Year Change

6% -3%

New Home Sales Price

$273,400 $401,900

1-Year Change

1% -1%

Existing Home Sales Price

$236,200 $338,000

1-Year Change

7% 9%

Mortgage Delinquency Rate

3.0% 4.0%

NA = data not available.

Notes: The vacancy rate is as of the current date; home sales and prices are for the 12 months ending October 2020; and months of inventory and

mortgage delinquency data are as of October 2020. The current date is November 1, 2020.

Sources: CoreLogic, Inc.; Zonda

Table 4. Home Sales Quick Facts in the Greenville HMA

REO = real estate owned.

Source: Zonda

0

5,000

10,000

15,000

20,000

25,000

Oct-07

Oct-08

Oct-09

Oct-10

Oct-11

Oct-12

Oct-13

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Oct-19

Oct-20

Sales Totals

Regular Resales New Home Sales REO Sales

Figure 7. 12-Month Sales Totals by Type in the Greenville HMA

Home Sales Market 14Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Great Recession and slowing net in-migration, to

a low of 2,925 homes sold. From 2012 through

2017, when economic conditions and net in-

migration were strong, existing home sales

increased by an average of 1,350 homes, or

13 percent, annually, to 12,150. As the inventory of

homes for sale declined to 3.5 months of supply

in 2018, sales growth was flat for the year, with

almost no change. Approximately 49 percent of

total home sales during the 12 months ending

October 2020 were existing homes priced from

$100,000 to $300,000 (Figure 8). Existing homes

priced below this range accounted for 15 percent

of total sales and homes priced higher than

$300,000 accounted for 18 percent of total sales.

Supply constraints and stable demand have

caused existing sales prices to increase by

$15,250, or 7 percent, during the 12 months

ending October 2020, to an average price of

$236,200 (Figure 9). The growth in existing home

prices slowed in the months leading up to May

2020, when there were fewer willing buyers and

seller behavior restricted inventory in response to

the pandemic. During the 3 months ending May

2020, existing home sales price growth slowed to

an average 2 percent from 5 percent during the

3 months ending May 2019. From 2007 through

2009, economic conditions and population

growth slowed, causing prices to decline by an

average of $2,125, or 1 percent, annually, to a low

of $156,900. As population growth and economic

conditions began improving after the recession,

Note: New and existing sales include single-family homes, townhomes, and condominium units.

Source: Zonda

REO = real estate owned.

Source: Zonda

Existing Sales New Sales

0

5

10

15

20

25

30

35

$99k and Less $100k to $199k $200k to $299k $300k to $399k $400k to $499k $500k and More

Share of Sales (%)

90,000

105,000

120,000

135,000

150,000

165,000

180,000

195,000

210,000

225,000

240,000

255,000

270,000

285,000

Oct-07

Oct-08

Oct-09

Oct-10

Oct-11

Oct-12

Oct-13

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Oct-19

Oct-20

Average Sales Price ($)

Regular Resales New Home Sales REO Sales

Figure 8. Share of Sales by Price Range During the 12 Months

Ending October 2020 in the Greenville HMA

Figure 9. 12-Month Average Sales Price by Type of Sale in the Greenville HMA

Home Sales Market 15Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

home prices gradually increased by an average of

$3,925, or 2 percent, annually from 2010 through

2015, to $180,500. As net in-migration improved

from strengthening economic conditions and excess

inventory was absorbed, existing home sales prices

increased by an average of $10,100, or 5 percent,

annually from 2016 through 2019, to $220,900.

New Home Sales and Prices

New home sales increased by 290 homes, or

8 percent, during the 12 months ending October

2020, to 3,875 (Zonda)—slower than the year-

over-year increase of 550 homes, or 18 percent,

during the 12 months ending October 2019.

Sales construction has kept up with increasing

demand, contributing to relatively flat new home

sales price growth since 2018. New home sales

declined from 2007 through 2011 by an average

of 670 homes, or 24 percent, annually, to a low of

1,125 because of the Great Recession. From 2012

through 2019, new home sales increased by an

average of 320 homes, or 16 percent, annually,

to 3,675, as the economy strengthened.

New home sales price growth was relatively

slow compared with growth in existing home

sales prices during the 12 months ending

October 2020, increasing by an average $2,100,

or 1 percent, to $273,400 despite the increase

in sales during this period. This growth is a slight

increase from flat prices during 2018 through

2019 despite a 17-percent increase in sales

during this period. New home sales prices

declined sharply from 2009 through 2011 because of the Great Recession, decreasing by an average of

$14,700, or 6 percent, annually, to a low of $208,500. From 2012 through 2017, new home sales prices

increased by an average $10,150, or 4 percent, annually, to $269,500, before prices stabilized.

Seriously Delinquent Home Mortgages and REO Properties

The number of seriously delinquent mortgages and real estate owned (REO) properties has increased

significantly since May 2020. As of October 2020, 3.6 percent of home loans were seriously delinquent or

had transitioned into REO status—up from 1.2 percent during October 2019 (CoreLogic, Inc.). The increase

in the rate began in June 2020, when the rate rose to 2.7 percent from 1.4 percent in May 2020. Since

then, the percentage of seriously delinquent mortgages and REO properties has gradually increased

every month. The sudden increase reflects the number of borrowers who were unable to make mortgage

payments because of a loss of income during the pandemic, becoming severely delinquent on their

mortgages by June. That trend occurred on the national level as well, with the percentage of seriously

delinquent mortgages and REO properties increasing from 1.6 percent in May 2020 to 4.0 percent in June

2020. The current percentage of seriously delinquent mortgages in the HMA is still much lower than the

6.3-percent peak that occurred in January 2010 during the Great Recession.

Sales Construction Activity

Sales construction activity—as measured by the number of single-family homes, townhomes, and

condominiums permitted (hereafter, homes)—in the Greenville HMA has steadily increased since 2011

and has nearly returned to pre-recession levels (Figure 10). From 2001 through 2005, the number of

homes permitted increased by an average 380 homes, or 7 percent, annually, to a peak of 6,700 homes,

despite economic conditions being relatively weak. The Great Recession led to construction declining

significantly from 2006 through 2010, averaging a decline of 990 homes, or 23 percent, annually, to a

low of 1,750. Much of the growth in permitting in the 2000s was in Greenville County, which made up

70 percent of permitting activity in 2010. As economic conditions and population growth improved, the

number of homes permitted increased by an average of 440, or 14 percent, annually from 2011 through

2019. The fastest growing area during this period was the city of Greer, where the number of homes

permitted increased by an average of 70 units, or 24 percent, annually from 2011 to 2019, to 750 homes

in 2019. During the 12 months ending October 2020, sales construction increased by 840 homes, or

16 percent, from a year ago, to 6,050 homes. Sales construction in the city of Greer increased to 1,070

units permitted—an increase of 340 units, or 47 percent, from a year ago.

Home Sales Market 16Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Notes: Includes single-family homes, townhomes, and condominiums. Data for 2020 are through October 2020.

Sources: U.S. Census Bureau, Building Permits Survey; 2000 through 2019—final data and estimates by the analyst; 2020—preliminary data and

estimates by the analyst

Single-Family Homes/Townhomes Condominiums

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Figure 10. Average Annual Sales Permitting Activity in the Greenville HMA

Table 5. Demand for New Sales Units in the Greenville HMA During the Forecast Period

Sales Units

Demand 13,700 Units

Under Construction 2,400 Units

Note: The forecast period is from November 1, 2020, to November 1, 2023.

Source: Estimates by the analyst

The Verdae development in the city of Greenville

is a large-scale project that the developer

estimates will have 10,000 residents by

completion during the next 15 years. Currently,

the Chelsea Townes neighborhood of the

development will have a total of 78 three-

bedroom townhomes, with 24 homes left to

construct. Prices start from the mid-$300,000s

and sizes range from 2,025 to 2,325 square feet.

Pinecrest will feature 68 single-family homes and

construction is currently underway. Prices will

start from the high $300,000s, with sizes ranging

from 2,125 to 2,375 square feet. Roughly 300 of

the 900 acres to be used for residential purposes

have been developed. In the city of Greer,

Katherine’s Garden will be offering 108

single-

family homes priced between $184,000

and $326,000. The homes range from 1,200 to

2,750 square feet, with three to four bedrooms.

Forecast

During the next 3 years, demand is estimated for

13,700 new homes (Table 5). The 2,400 homes

currently under construction are expected to

meet a portion of the demand during the first

year of the forecast. Demand is expected to be

lower during the first year of the forecast and increase in the second and third years, as the economy

recovers from the current downturn. Growth is expected to continue to be concentrated in Greenville

and Anderson Counties.

Rental Market 17Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market

Market Conditions: Balanced

Strong net in-migration and increasing

enrollment at Clemson University have led to

increased rental construction and decreasing

vacancy rates in the HMA since the economy

recovered from the Great Recession.

Current Conditions

and Recent Trends

Overall rental housing market conditions (which

includes single-family homes, townhomes, and

mobile homes for rent) in the Greenville HMA are

currently balanced, with an estimated rental vacancy

rate of 7.5 percent—down from 11.4 percent in 2010,

when the market was soft (Table 6). Multifamily

structures with five or more units, typically

apartments, made up 38.5 percent of occupied

rental housing in the HMA in 2019—a significant

increase from 34.9 percent in 2010. The apartment

market is currently balanced, with vacancy rates

during the third quarter of 2020 averaging

4.3 percent—unchanged from the same period a

year ago (RealPage, Inc., with adjustments by the

analyst). Despite the slowdown in economic activity

during 2020, increasing enrollment at Clemson

University, strong net in-migration, and the order

from the Centers for Disease Control and Prevention

to temporarily halt residential evictions have kept

vacancy rates from increasing during 2020.

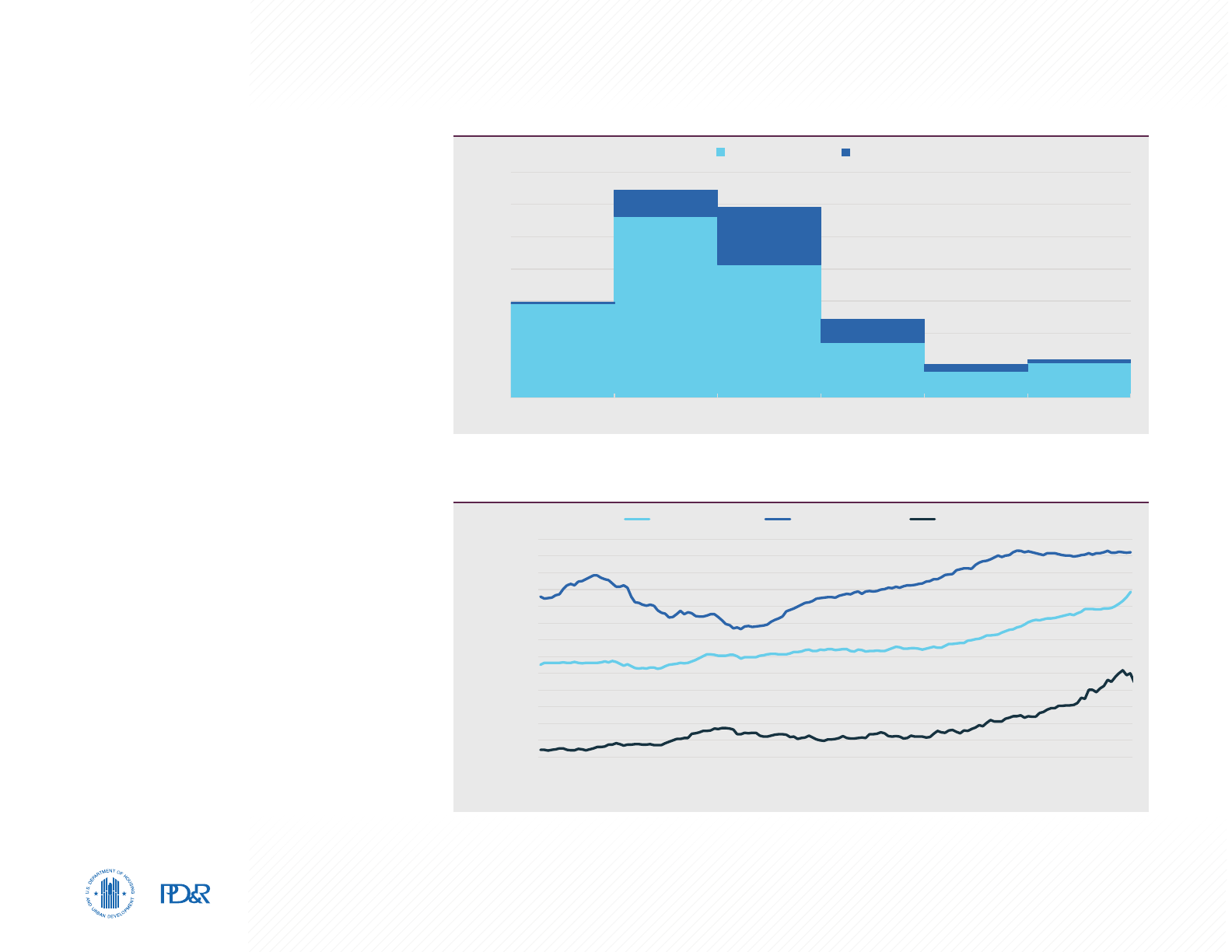

Vacancy rates in the Greenville HMA apartment market, where approximately 91 percent of apartment

supply is located in Greenville County, declined quickly after the Great Recession, from 9.1 percent in

2009 to 4.2 percent by 2015 (Figure 11) because of strong net in-migration and increasing enrollment

in Clemson University. Since 2015, vacancy rates have remained relatively low; however, an increase

Rental Market

Quick Facts

2010 (%) Current (%)

Rental Vacancy Rate

11.4 7.5

Occupied Rental Units by Structure

Single-Family Attached & Detached

33.2 31.4

Multifamily (2–4 Units)

13.5 14.6

Multifamily (5+ Units)

34.9 38.5

Other (Including Mobile Homes)

18.4 15.4

Notes: The current date is November 1, 2020. Percentages may not add to 100 due to rounding. For Occupied Rental Units by Structure, the current

date is 2019.

Sources: 2010 and 2019 ACS 1-year data; estimates by the analyst

Table 6. Rental and Apartment Market Quick Facts in the Greenville HMA

Q3 = third quarter.

Source: RealPage, Inc.

Average Monthly Rent Vacancy Rate

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

600

650

700

750

800

850

900

950

1,000

1,050

Vacancy Rate (%)

Average Monthly Rent ($)

Q3 2005

Q3 2006

Q3 2007

Q3 2008

Q3 2009

Q3 2010

Q3 2011

Q3 2012

Q3 2013

Q3 2014

Q3 2015

Q3 2016

Q3 2017

Q3 2018

Q3 2019

Q3 2020

Figure 11. Apartment Rents and Vacancy Rates in the Greenville HMA

Rental Market 18Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

in construction activity during 2015 and 2016

contributed to a rise in the vacancy rate, which

was 5.4 percent in 2017; the vacancy rate then

declined to 4.4 percent in 2018. Rents have

steadily increased since 2009, increasing by an

average of $34, or 4 percent, annually due to

generally decreasing or low vacancy rates during

that period, in combination with strengthening

economic conditions. Rents averaged $630 in

2009 and have increased to an average of $1,000

during the third quarter of 2020. Although rent

growth has steadily increased since 2009, growth

has slowed during the past year. The average rent

increased 2 percent

during the past year, slowing

from an increase of 6 percent a year earlier.

The apartment markets in Anderson and Pickens

Counties have tightened during the third quarter

of 2020, as construction has occurred primarily

around the city of Greenville in Greenville

County. The vacancy rate in Anderson County

was 2.9 percent during the third quarter of 2020,

increasing slightly from 2.8 percent in 2019, but

rent increased 4 percent, to $880. In Pickens

County, where Clemson University is located, the

vacancy rate was 2.0 percent during the third

quarter of 2020—declining from 3.2 percent

during the third quarter of 2019, although rent

declined 2 percent, to $975.

Rental Construction Activity

Rental construction activity in the Greenville

HMA, as measured by the number of rental units

Notes: Includes apartments and units intended for rental occupancy. Data for 2020 are through October 2020.

Sources: U.S. Census Bureau, Building Permits Survey; 2000–2019—final data and analyst estimates; 2020—preliminary data and estimates by the analyst

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2000-2014

2015-2016

2017-2020

Figure 12. Average Annual Rental Permitting Activity in the Greenville HMA

permitted, was relatively low until 2015, when economic activity and net migration began to strengthen.

From 2000 through 2014, an average of 880 units were permitted annually (Figure 12). As net in-migration

increased and once the economy fully recovered, construction activity rose to 3,425 units permitted

during 2016 to keep pace with demand. After that surge in construction, levels slowed to an average of

1,600 units annually from 2017 through 2019. During the 12 months ending October 2020, an average

of 1,675 units were permitted—a 37-percent increase from the 1,225 units permitted a year earlier.

Approximately 87 percent of the units built since 2011 were in Greenville County, with the majority of those

in the cities of Greenville and Simpsonville.

Old textile mills have become popular buildings to repurpose to multifamily or mixed-use structures

since 2004, when South Carolina passed the Textile Communities Revitalization Act. That act added tax

credits to historic buildings such as Monaghan Mill, the first repurposed mill, which became The Lofts of

Greenville in 2006. The 144-unit Cotton Mill Luxury Apartments in Simpsonville was completed in 2019.

Builders repurposed parts of an old mill, adding housing units onto the structure of a cotton mill.

Rental Market 19Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

One-, two-, and three-bedroom apartment rents

start at $1,000, $1,275, and $1,375, respectively.

Student Housing

Student households in the HMA made up an

estimated 9 percent of total rental households

in 2019—down from 11 percent in 2012;

approximately 62 percent of students in the HMA

resided in dormitory housing in 2019 (IPUMS USA

ACS 1-year estimates). Clemson University is the

only higher education institution in the HMA to

have had increasing enrollment since the Great

Recession. The lack of rental construction near

campus after the recession led the university to

turn away 850 students who wanted to live on

campus in 2015. In 2018, the university completed

the Douthit Hills mixed-use development on

campus to increase the supply of student

housing. Douthit Hills has the capacity to house

approximately 1,750 students and includes restaurants and retail shops. Apartments in Pickens County,

where Clemson University is located, had an average vacancy of 2.0 percent during the third quarter

of 2020—down from 3.3 percent a year earlier (Real Page, Inc.). Due to low vacancy rates in student

housing, students have paid gross rents that have increased from $790 in 2012 to $1,000 in 2019, or

4 percent annually. Those rents are compared with an average increase of 3 percent annually, from

$700 to $860, for all rental housing in the HMA during the same period (IPUMS USA ACS 1-year estimates).

Forecast

During the 3-year forecast period, demand is estimated for 5,350 additional rental units in the HMA

(Table 7). The 2,300 units currently under construction are expected to meet demand during the first year

of the forecast. Demand is expected to be stronger in the second and third years of the forecast period,

primarily a result of improving economic conditions.

Note: The forecast period is November 1, 2020, to November 1, 2023.

Source: Estimates by the analyst

Rental Units

Demand 5,350 Units

Under Construction 2,300 Units

Table 7. Demand for New Rental Units in the Greenville HMA During the Forecast Period

Terminology Definitions and Notes 20Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Terminology Definitions and Notes

A. Definitions

Building Permits

Building permits do not necessarily reflect all residential building activity that occurs in an HMA. Some units are constructed or created without a building

permit or are issued a different type of building permit. For example, some units classified as commercial structures are not reflected in the residential building

permits. As a result, the analyst, through diligent fieldwork, makes an estimate of this additional construction activity. Some of these estimates are included in

the discussions of single-family and multifamily building permits.

Demand

The demand estimates in the analysis are not a forecast of building activity. They are the estimates of the total housing production needed to achieve a

balanced market at the end of the 3-year forecast period given conditions on the as-of date of the analysis, growth, losses, and excess vacancies. The

estimates do not account for units currently under construction or units in the development pipeline.

Forecast Period 11/01/2020–11/01/2023—Estimates by the analyst.

Home Sales/

Home Sales

Prices

Includes single-family home, townhome, and condominium sales.

Other Vacant

Units

In this analysis conducted by the U.S. Department of Housing and Urban Development (HUD), other vacant units include all vacant units that are not available

for sale or for rent. The term therefore includes units rented or sold but not occupied; held for seasonal, recreational, or occasional use; used by migrant

workers; and the category specified as “other” vacant by the Census Bureau.

Rental Market/

Rental Vacancy

Rate

Includes apartments and other rental units, such as single-family, multifamily, and mobile homes.

Terminology Definitions and Notes 21Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Seriously

Delinquent

Mortgages

Mortgages 90+ days delinquent or in foreclosure.

B. Notes on Geography

1.

The metropolitan statistical area definition noted in this report is based on the delineations established by the Office of Management and Budget (OMB) in the

OMB Bulletin dated April 10, 2018.

2. Urbanized areas are defined using the U.S. Census Bureau 2010 Census Urban and Rural Classification and the Urban Area Criteria.

3. The census tracts referenced in this report are from the 2010 Census.

C. Additional Notes

1.

The NAHB Housing Opportunity Index represents the share of homes sold in the HMA that would have been affordable to a family earning the local median

income, based on standard mortgage underwriting criteria.

2.

This analysis has been prepared for the assistance and guidance of HUD in its operations. The factual information, findings, and conclusions may also be

useful to builders, mortgagees, and others concerned with local housing market conditions and trends. The analysis does not purport to make determinations

regarding the acceptability of any mortgage insurance proposals that may be under consideration by the Department.

3.

The factual framework for this analysis follows the guidelines and methods developed by the Economic and Market Analysis Division within HUD. The analysis

and findings are as thorough and current as possible based on information available on the as-of date from local and national sources. As such, findings or

conclusions may be modified by subsequent developments. HUD expresses its appreciation to those industry sources and state and local government officials

who provided data and information on local economic and housing market conditions.

Terminology Definitions and Notes 22Greenville, South Carolina Comprehensive Housing Market Analysis as of November 1, 2020

Comprehensive Housing Market Analysis Greenville, South Carolina

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Contact Information

David E. Kelley, Economist

Atlanta HUD Regional Office

678–732–2721

david.e.kelley@hud.gov

D. Photo/Map Credits

Cover Photo iStock