Airline industry slowly moving toward

recovery from record losses inflicted by

COVID-19

The airline industry could take years to recover from the coronavirus

pandemic, experts say, as it is heavily dependent on how quickly the

rest of the economy recovers.

“Until everyone who considers taking a trip believes it’s safe to do, and

will be able to travel and have the all things they expected to do at a

destination, whether it’s a hotel, restaurant, sporting event, theme park

or whatever, it will take a while,” said Robert Mann, an analyst with

New York-based R.W. Mann & Co.

U.S. airlines suffered historic swings from profits to losses in the first

quarter as air travel quickly plummeted when the country shut down

to prevent the spread of the virus. As the airline industry tries to regain

its footing in the second quarter, it will also be faced with continuing

customer fears about whether it’s safe to fly.

A survey by Deloitte Insights showed just 24% of prospective travelers

thought it was safe to travel by air as of May 15.

“That is a staggering statistic,” said Mann, a former executive with the

old Pan American airlines and a longtime airlines consultant. “I don’t

think it was ever that bad, even in the 1940s and ’50s, when airplanes

were dropping out of the sky.”

A slow recovery from record lows

Recent data from the Airline Reporting Corp. shows that air travel

ticket purchases are down about 80%, and the average airfare is down

about 35% compared with the prior year.

Mann attributes much of those declines to the shutdown on corporate

travel.

“You have very risk-averse general counsels and big corporations and

HR organizations,

who have said we’re not confident that we wouldn’t be risking our

employees’ safety by telling them to go on the road to get more deals

or support more customers,” he said.

Mann said that leisure travel, particularly domestic travel, will recover

more quickly, and that those customers are already responding to

aggressively low fares — some as low as $49 — by some airlines.

He said he expects airline travel will improve to only 50% of pre-

pandemic levels by the end of 2020.

“I think that will continue through ’21 and ’22, so the industry will

probably be down 20% from where it was in 2019,” he said.

Mann said another factor is how well the airlines enforce safety

protocols to keep travelers safe. If they don’t, “it undercuts their own

arguments that they’re making it safe for air travel,” he said.

Post-pandemic face of air travel foggy

Kevin Foley, executive director of the Des Moines International Airport,

said airline traffic at the airport “just fell off” after Gov. Kim Reynolds

issued her initial emergency declaration on March 17. By early April,

the airport was operating at only about 5% of normal traffic compared

with the previous year, Foley said.

“The airlines really cut back in May, but through March and most of

April, airlines were flying aircraft with very few passengers,” Foley said.

“There was a cost to flying those aircraft basically empty, and without

the CARES Act, where the airlines received a total of a $58 billion

package, I don’t think some of the airlines would survive.”

He also said he is hopeful that by the end of 2020, air travel will return

to 50% to 65% of the traffic compared with last year, but said, “A lot of

that depends on the virus itself.

“If there’s a second surge, if there’s a vaccine that comes out early, all

those types of things will determine how quickly that traffic comes

back,” he said.

Foley said it could take three to five years for the airline industry to

fully recover, but once it does, what it will look like is anyone’s guess.

Some of the things airports will potentially be looking at are enhanced

health screenings for passengers before boarding, reducing

touchpoints to decrease the physical contact between passengers and

airline or airport employees, resizing of baggage claim areas, and

considering how much space is needed for restaurants and shops.

Another thing being considered is a self-screening process for

passengers that uses facial recognition to reduce the risk of

transmitting germs.

“I think those types of technological advances will be sped up,” Foley

said. “I think as an industry, we are searching for ways of touchless

processing where I’m not running the chance of exchanging germs

through handing boarding passes, or handling licenses.”

While some measures may be regulated, the industry will also have to

meet social expectations to ensure passenger comfort, he said.

“We’re not far enough long yet to know the answers to those things,

but they are being discussed,” Foley said.

Much of the future will depend on airlines’ financial situation, but

Foley doesn’t envision mergers or consolidations being on the table.

“Will the big four – [American, United, Delta and Southwest] – all look

like they did prior to the pandemic? I think they look smaller,” he said.

He said airlines are retiring the largest aircraft, such as the Boeing 777s

and Airbus 380s and using smaller, more profitable aircraft.

Foley also said it’s possible fewer routes will be flown, with more direct

flights replacing connecting flights.

Before the pandemic, the Des Moines airport had 21 point-to-point, or

direct, routes, but that had dropped to 12 direct routes in May, Foley

said. Some of those routes may not return, he said.

“There’s going to be many airports that had routes prior to the

coronavirus, that they may not have after the recovery,” Foley said.

“And we’re going to have to compete … with other airports to gain

those routes back.”

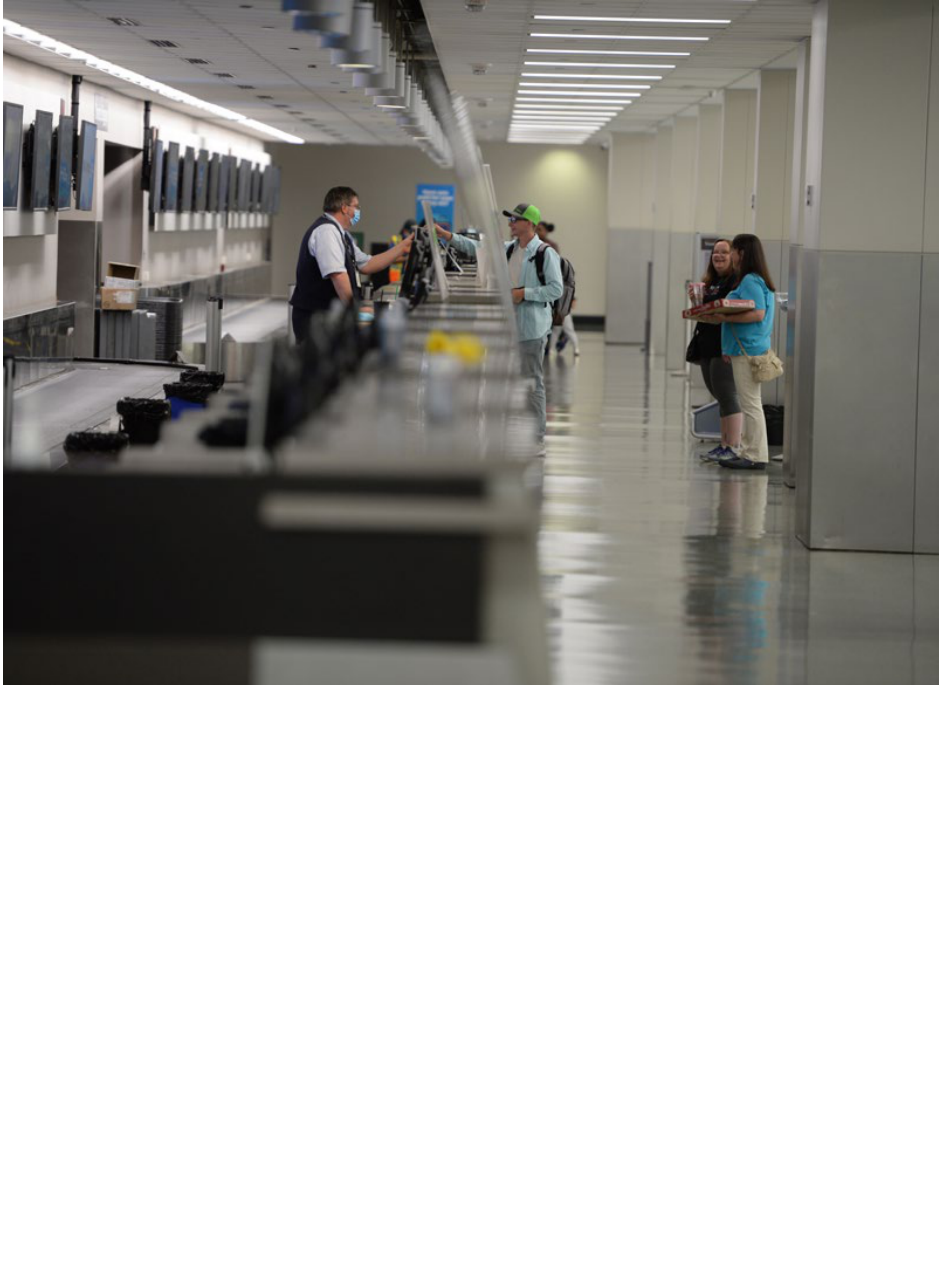

Restoring customer confidence

Representatives from three of the airlines that serve Des Moines all

touted measures they are taking to keep travelers safe.

That includes deep-cleaning ticket counter areas, sanitizing the inside

of planes between flights, asking customers to wear face masks,

providing hand sanitizer and wipes, and encouraging passengers to

load boarding passes on their smartphones to avoid physical contact

with airline employees.

A spokesperson for Delta Airlines said those protocols will remain in

place even after air travel begins to increase. The spokesperson said

that Delta is moving slowly in making decisions on restoring flights to

destinations where travel has been put on hold, and that more clarity

may be reached in July and August.

But as travelers return, Delta is committed to maintaining social

distancing on its planes to make passengers feel comfortable flying

again, the spokesperson said.

Part of that will be blocking sales of middle seats, only filling first-class

seating to 50%, and adding more flights to a destination rather than

filling a flight, the spokesperson said.

Delta is also boarding flights from the back to the front to reduce

contact as much as possible; passengers are being boarded 10 at a

time; and passengers are provided care kits that include hand sanitizer

wipes and masks.

Dan Landson, a spokesperson for Southwest Airlines, said the airline

has also enhanced cleaning, implemented social distancing protocols,

such as blocking one-third of seats on every flight, and adding

requirements for face masks. Restrictions on number of passengers on

a flight will continue through at least July 31, he said.

Southwest saw passenger demand fall to its lowest level in the

company’s history as the coronavirus spread, and despite modest

recovery, travel on Southwest remained at record lows in May,

Landson said, with up to 30% of seats filled.

In the company’s first-quarter earnings report, Southwest Chairman

and CEO Gary C. Kelly called it an “unprecedented time for our nation

and the airline industry.”

Kelly said the airline significantly reduced its flights through July, as

well as reduced salaries of executive officers, suspended noncontract

salary increases, implemented voluntary time-off programs, canceled

or deferred capital spending projects, and cut all nonessential

spending. Combined, the measures resulted in $2 billion in reduced

annual operating costs in 2020, and more than $1 billion in reduced

capital spending, Kelly said.

Data for American Airlines shows the airline also experienced record

low demand, cutting domestic flights by 70% and reducing

international travel by 80% in June. Nichelle Barrett, a spokesperson

for American, said July schedules were being worked on.

To incentivize business travel, American has added promotions for its

Business Extra customers, awarding enough bonus points for a round-

trip domestic ticket for travelers who book in June. The airline also has

lowered the cost of enrolling in the prepaid travel membership Airpass

program from $10,000 to $5,000.

“Those are things that hopefully will make small businesses feel better,

feel more comfortable … to travel again if possible,” she said. “It’s just

one way we’re thinking of small businesses and trying to help them

out.”

While American announced the reopening of customer lounges at 10

major airports across the country, Barrett said uncertainty remains

high.

“As we see the rest of the world and what that new normal looks like,

then we’ll be part of that process,” Barrett said. “The sooner people are

comfortable … getting back to normal life, then I think you’ll see the

same thing from an airline perspective. We’re still in the thick of it, so

it’s hard to say what will happen in two or three years, because it’s

something we’ve never seen before.”

Industry recovery will be complex

“It really has to be as seamless as it was [before the pandemic], which

is to say nobody worried about it, and now everybody’s worried about

it, and they’re worried about every individual piece of it,” said Mann,

the industry analyst.

That includes Uber or Lyft rides to and from the airport, whether

restaurants are open, and what services will be available at a hotel,

among everything else a traveler would normally take for granted, he

said.

“It’s every single aspect of things you never even worried about, and

nobody has, to my knowledge, acknowledged how big the problem is,

or how it’s interrelated,” Mann said.

The focus of the design for the proposed $240 million terminal

construction project at the Des Moines International Airport may shift

as a result of the coronavirus pandemic as airlines and their customers

continue to prioritize traveler safety, even after the airline industry

recovers from the coronavirus pandemic.

The terminal project is still in the programming, or discussion phase,

where projections for space needs are being talked about with

engineers and architects, said Kevin Foley, the airport’s executive

director.

That process includes a space analysis for checked luggage,

restaurants, gift shops and for TSA screening, among other things,

Foley said.

“Certainly, some of those things have now changed,” Foley said. “In

the industry, and certainly here locally with the board of directors as

well as internally with our own staff to pull ideas together.”

The project is part of an overall $500 million project, which includes

“enabling projects,” such as relocating fixed-based operators and

relocating the airport entrance road, to support construction of the

terminal.

Foley said no design has been created, “but we know we’re going to

have to look at some of those spaces and see what comes down the

road.”

Some of those changes would be technological advancements, such as

facial recognition screening rather than handing boarding passes to

ticket counter employees, to avoid possible transmission of germs,

Foley said.

Another issue is whether an area would be needed for passenger

health screening before they board a plane. And then there is social

distancing for travelers.

“There’s the social expectations, where Americans require more personal space than many

other cultures,” Foley said. “People will go so far as to place their bags in the seat next to

them so that no one else can sit next to them. Even if once we get on the plane we’re

sitting right next to them, unless I know someone well, I don’t want them that close. That’s

a cultural issue with Americans, that we require more personal space. Are we going to

have to have our seats [in the terminal] spread further apart, just because society demands

it?”

Despite the unknowns moving forward, the terminal project remains

on track, with design beginning in 2023. The design phase is

scheduled to last two years, with two years for construction, and

completion slated for 2028, Foley said.

“We’re pushing ahead with that schedule,” he said. “That’s eight years

from now, and I’m confident that we will be back to the past year’s

traffic that we saw in 2019 long before 2028. We were in a position last

year and have grown to the point where we had a capacity issue

within our terminal, both to park aircraft around the gates as well to

accommodate passengers, so we’re pushing ahead and the timeline

has not changed.”