1

Final Report of the Special Commission to Study the

Financial and Economic Impacts of Crumbling Concrete

Foundations due to the Presence of Pyrrhotite

December 31, 2019

2

Special Commission Membership

Senator Anne M. Gobi, Spencer, Co-Chair

Representative Brian M. Ashe, Longmeadow, Co-Chair

Representative Todd Smola, Palmer, Minority Leader of the House designee

Senator Donald Humason, Westfield, Minority Leader of the Senate designee

Gabrielle Viator, Senior Policy Advisor to Massachusetts Attorney General Maura

Healey, Attorney General designee

Stephen Crane, Town Manager for the town of Longmeadow, Governor appointee from

the Massachusetts Municipal Association, Inc.

Craig Dauphinais, Executive Director of the Massachusetts Concrete and Aggregate

Producers Association, Governor appointee from the Massachusetts Concrete and

Aggregate Producers Association, Inc.

John Murphy, Executive Director of the Massachusetts Insurance Federation, Governor

appointee from the Massachusetts Insurance Federation, Inc.

Vincent Walsh, past President of the Realtor Association of Pioneer Valley and currently

serving as the Massachusetts Association of Realtors State Political Coordinator for

Senator Eric Lesser, Governor appointee from the Massachusetts Association of Realtors

Douglas Brunner, Esq., Board Member of the Real Estate Bar Association in

Massachusetts and member of the Executive Committee of the Real Estate Section of the

Connecticut Bar Association, Governor appointee from the Real Estate Bar Association

Michelle Loglisci, founding member of the Massachusetts Residents Against Crumbling

Concrete, Governor appointee as a homeowner from the town of Monson

Russell Dupere, Esq., founding member of the Massachusetts Residents against

Crumbling Concrete, Governor appointee as a homeowner from the town of

Longmeadow

3

Table of Contents

Executive Summary……………………………………………………5

Introduction………………………………………………………… …6

Special Commission Charge…………………………………………...7

Background Information……………………………………………….8

Findings…………………..…………………………………………….9

Special Commission Recommendations………………………………17

Appendix………………………………………………………………18

4

Acknowledgements

As chairs of this Special Commission, we thank each appointed member for offering their time,

commitment, expertise and experience, all of which were integral to the work of the Special Commission

and the creation of this final report. Our gratitude also goes to: Lena Holleran, Homeowner Advocate in

the Connecticut Department of Housing, for her presentation on the efforts taken in Connecticut; Dr.

Stephen Mabee, Massachusetts State Geologist, for his work in plotting the geographic areas of

Massachusetts where pyrrhotite may be found; Paul Nutting, Outreach Coordinator in the Massachusetts

Executive Office of Technology Services and Security, for his efforts in creating a map of the affected

areas in Massachusetts; and Michael Maglaras, Superintendent of the Crumbling Foundation Solution

Indemnity Company, for his presentation on the procedures and operations of the Connecticut Captive

Insurance company. Finally, we thank our staff for their diligent work supporting the mission of this

Special Commission and for their efforts in marshaling the information and feedback that helped to

inform this final report.

Anne M. Gobi Brian M. Ashe

State Senator State Representative

5

Executive Summary

The Special Commission to Study the Financial and Economic Impacts of Crumbling Concrete

Foundations due to the Presence of Pyrrhotite was established in section 103 of chapter 154 of the Acts of

2018. The Special Commission was charged with studying the financial and economic impacts of

crumbling concrete foundations due to the presence of pyrrhotite, a naturally occurring mineral that

causes a slow but irreversible deterioration of concrete over the course of many years. The Special

Commission was also charged with making recommendations for legislative changes based on its findings

back to the General Court

Concrete containing pyrrhotite originated from JJ Mottes Concrete Company in Stafford Springs,

Connecticut and was delivered and used in residential and commercial foundations in an area extending

as far as 44 miles from the quarry, including many towns in central Massachusetts. The impacts of the use

of this concrete have been significant in the state of Connecticut, which the Special Commission focused

much of its study on.

The Special Commission held five public meetings over a six month period, inviting state officials,

scientists and professionals from the State of Connecticut to present their findings and actions taken to

address and remediate the impacts of crumbing concrete foundations in Connecticut. The Special

Commission also drew upon the expertise of the Special Commission members themselves, which

included legislators, Massachusetts residents impacted by crumbling foundations, local officials, and

professionals in the construction, insurance, real estate industries.

Based on its findings, the Special Commission recommends that the General Court passes legislation to

enable Captive Insurance Companies to conduct business in for the purpose of overseeing the evaluation,

repair, replacement and reimbursement of qualified residential crumbling foundations, as well as create a

state Crumbling Foundations Assistance Fund. It also makes recommendations focused on increasing

awareness and remedies available to residents and impacted industries, testing and prohibiting the use of

all concrete originating from quarries containing pyrite and pyrrhotite, requiring home sellers to disclose

any foundation inspections or testing, and further collaboration with the insurance and real estate

industries to assess and remediate the issue.

6

Introduction

The Special Commission to Study the Financial and Economic Impacts of Crumbling Concrete

Foundations due to the Presence of Pyrrhotite was established pursuant to Section 2A of Chapter 4 of the

Acts of 2018. The statute authorized up to 11 members of the Special Commission: 1 person to be

appointed by the President of the Senate, who shall serve as co-chair; 1 person to be appointed by the

Speaker of the House of Representatives, who shall serve as co-chair; 1 person to be appointed by the

minority leader of the senate; 1 person to be appointed by the minority leader of the house of

representatives; the attorney general or a designee; the secretary of public safety and security or a

designee; the commissioner of insurance or a designee; and 7 persons to be appointed by the governor, 1

of whom shall be nominated by the Massachusetts Municipal Association, Inc., 1 of whom shall be

nominated by the Massachusetts Concrete & Aggregate Producers Association, Inc., 1 of whom shall be

nominated by the Massachusetts Insurance Federation, Inc., 1 of whom shall be nominated by the

Massachusetts Association of Realtors, 1 of whom shall be nominated by The Real Estate Bar

Association for Massachusetts, Inc. and 2 of whom shall be residents of municipalities in which

crumbling concrete foundations that have deteriorated due to the presence of pyrrhotite have been found.

The statue required the Special Commission to conduct a study on the degree to which concrete

foundations in the Commonwealth are crumbling due to the presence of pyrrhotite — taking into account

a review of the affected locations, an estimation of costs to restore, the effect the issue has on property

values and tax revenue, its effect on the real estate industry and the best practices taken in other states in

order to offer potential remedies and recommendations to residential homeowners affected by the issue.

This report reflects the recommendations of the Special Commission, which held five public meetings

over the course of their deliberation at the Helliwell Conference Room at Bay Path University on May 13,

2019 at 6:30 P.M, and in the Monson Town Offices on June 10th, July 22nd, October 7th, and November

18

th

at 6:30 P.M. Additionally, the Special Commission welcomed input and information through written

correspondence throughout its existence.

7

Special Commission Charge

SECTION 103 OF CHAPTER 154 OF THE ACTS OF 2018

There shall be a special commission, governed by section 2A of chapter 4 of the General Laws, to study

the financial and economic impacts of crumbling concrete foundations due to the presence of pyrrhotite.

The commission shall consist of: 1 person to be appointed by the President of the Senate, who shall serve

as co-chair; 1 person to be appointed by the Speaker of the House of Representatives, who shall serve as

co-chair; 1 person to be appointed by the minority leader of the Senate; 1 person to be appointed by the

minority leader of the House of Representatives; the attorney general or a designee; the Secretary of

Public Safety and Security or a designee; the commissioner of Insurance or a designee; and 7 persons to

be appointed by the governor, 1 of whom shall be nominated by the Massachusetts Municipal

Association, Inc., 1 of whom shall be nominated by the Massachusetts Concrete & Aggregate Producers

Association, Inc., 1 of whom shall be nominated by the Massachusetts Insurance Federation, Inc., 1 of

whom shall be nominated by the Massachusetts Association of Realtors, 1 of whom shall be nominated

by The Real Estate Bar Association for Massachusetts, Inc. and 2 of whom shall be residents of

municipalities in which crumbling concrete foundations that have deteriorated due to the presence of

pyrrhotite have been found.

The study shall include, but not be limited to: (i) an examination of the degree to which concrete

foundations are crumbling due to the presence of pyrrhotite in the Commonwealth; (ii) a review of the

affected locations within the Commonwealth; (iii) an estimate of the total cost to fully restore concrete

foundations damaged due to the presence of pyrrhotite; (iv) an analysis of the effect that the presence of

pyrrhotite has on property values and the resulting fiscal impact on property tax revenues; (v) an analysis

of the impact on the real estate industry; (vi) a review of best practices undertaken in other states to deal

with crumbling foundations that have deteriorated due to the presence of pyrrhotite; and (vii) an

examination of potential remedies for residential homeowners affected by crumbling foundations that

have deteriorated due to the presence of pyrrhotite. The commission shall meet not less than 4 times and

shall conduct at least 1 public hearing in a region where concrete foundations have deteriorated due to the

presence of pyrrhotite.

The commission shall submit the results of its study and its recommendations, including drafts of

legislation necessary to carry those recommendations into effect, by filing the same with the clerks of the

House of Representatives and the Senate, the Joint Committee on Consumer Protection and Professional

Licensure and the House and Senate Committees on Ways and Means no later than December 31, 2019.

8

Background Information

Thousands of homes in a radius stemming from Stafford Springs, Connecticut, are facing the potential for

a failed concrete foundation due to the possible presence of a naturally occurring iron sulfide, pyrrhotite,

in their foundation.

It has been determined that the concrete originated from the JJ Mottes Concrete Company in Stafford

Springs, Connecticut, during the years 1983 – 2015, and was sourced from Becker’s Quarry in

Willington, Connecticut- a quarry that no longer supplies aggregate for residential foundations under an

agreement of voluntary compliance between the State of Connecticut and Becker’s Quarry. Pyrrhotite is

rare, and this location is one of the few in North America where the mineral may be found. Since the early

1980’s, Becker’s Quarry was the primary source of the stone aggregate used by JJ Mottes to produce

concrete, and they have been the only company identified that produced material connected to the

deteriorating foundations. No foundations produced outside of this timeframe have been reported to have

deteriorating concrete as of this writing.

Pyrrhotite causes the slow deterioration of the concrete when exposed to oxygen and water. When present

in the aggregate material used to make concrete, the building material itself becomes compromised as

water and air enter through small cracks and holes, allowing the iron sulfides to begin breaking down,

expanding and allowing more water and air to enter. While the presence of pyrrhotite indicates the

potential for concrete deterioration, its existence alone does not necessarily cause it. At this time there is

no minimum level of pyrrhotite that is deemed acceptable for use, and homes with small amount of

pyrrhotite (less than 0.3%) can still experience crumbling foundations.

The cracking starts small and may take more than 10 years to over 30 years to appear. Horizontal cracks

or cracks that splinter out like a web are the most concerning. A rust-colored residue or white powder

may appear, and the walls are often described as flaking in texture and appearance. The sheetrock walls of

a finished basement may need to be removed to examine the concrete. As the concrete deteriorates, it

often becomes structurally unsound.

The damage is irreversible. The repair is to fully replace the impacted foundation with a new foundation

that does not contain pyrrhotite. While technological improvements may offer alternative solutions in the

future, this is the only permanent fix available at this time.

9

Findings

The Special Commission was charged with studying the following matters associated with the

overarching issue to form a basis in its recommendations :

1. An examination of the degree to which concrete foundations are crumbling due to the presence of

pyrrhotite in the Commonwealth;

In the process of determining the degree to which concrete foundations are crumbling due to the presence

of pyrrhotite in the Commonwealth and reviewing the affected locations, the Special Commission sought

to determine the number of homes potentially affected by reviewing data from a foundation testing

reimbursement program administered by the Department of Professional Licensure and encouraging

homeowners to come forward and have their foundations tested. The testing program reimburses

homeowners within a 20-mile radius of JJ Mottes Concrete Company for visual testing conducted by a

licensed professional engineer at 100% for up to $400, and for core testing at a 75% rate up to $5,000.

Diagnosis of pyrrhotite damage in the field may be confirmed by visual inspection of the concrete, cracks

in the concrete on the outside of the foundation or on the interior, or by core sample testing. Visual

inspections may be conducted by a licensed professional engineer, and core testing must be conducted by

a lab that specializes in pyrite testing, typically involving a two-stage method of petrographic analysis that

detects pyrrhotite by testing for its magnetic properties.

At the date of this report’s publication the reimbursement program has received a total of 21 applications,

with ten receiving the reimbursement funds and eleven still pending approval. These tests came from the

towns of Holland (x3), East Longmeadow (x5), Longmeadow (x2), Feeding Hills, Monson (x2),

Sturbridge, Brimfield (x2), Ludlow, Springfield, Wales, and Hampden. It is unclear how many of these

tests came up positive for pyrrhotite, as the reimbursement is not predicated on the results but the testing

only.

The Special Commission found a number of reasons for the low response rate to the testing

reimbursement in the past year, including a lack of awareness of the program and of the issue, and

individual fear over the ramifications of having their homes determined to have the problem. These fears

are not unfounded, as homeowners will likely need to have their homes reassessed before they are able to

sell which will certainly mean a loss of value to the owners. Realtors in the region are already starting to

advocate for foundation testing for homes in the region before they are listed, and have provided an

advisory and disclosure form for sellers and buyers, which is included in Appendix M.

Additionally, some potentially affected homeowners may have been excluded from the program due to

the 20 mile radius limit, a limitation that will be addressed in the next section.

2. A review of the affected locations within the Commonwealth

10

In reviewing the affected locations within the Commonwealth, the Special Commission utilized GIS and

industry standards

1

for the transportation of concrete to develop a map detailing the potentially affected

areas and the structures that were built during the outlined time period. Included on the map, developed

by Paul Nutting from the Executive Office of Technology Services and Security , are radius’ extending 20

and 30, and 40 miles from the source of the tainted aggregate, Becker’s Quarry, as well as town

boundaries, major roads and highways, and the residential structures for which building permits were

issued during the given years. The map is located in Appendix G.

In regards to the estimated number of affected homes, the Special Commission recognized that the

problem would likely extend beyond the 20-mile radius, as Connecticut found evidence of the problem

extending as far as 44 miles from Becker’s Quarry. A more accurate measure is a 90-minute travel time,

and thus the boundary was extended to 40 miles here, although the outliers at those distances would likely

be located along major roadways.

Inside of these boundaries are a total of 95,073 residential structures built between the years 1983-2015,

with building permit data obtained by Paul Nutting from available census and building permit data. It is

important to note that building permits only indicate the year a house was built- while some may include

the name of the general contractor, they will not list the name of the subcontractors who do the foundation

work or the company that supplied the concrete. In evaluating the information, the Special Commission

was additionally hindered by the lack of documentation from JJ Mottes on the projects they supplied

concrete to during this time period. This was due to a fire that destroyed the majority of their files,

although Special Commission Member Dauphinais estimated that they worked on 1,500 - 2,000 homes

during this timeframe.

Contractors in the region proved additionally unwilling to offer information on the amount they may have

contracted JJ Mottes Company or the properties they would have worked on during the time without a

written release from culpability, although as the case in Connecticut showed they likely would have been

free from any liability.

Towns within the 20-mile radius were deemed to be the most at-risk by the Special Commission, These

towns include Wales, Holland, Southbridge, Sturbridge, Brimfield, Palmer, Monson, Hampden,

Wilbraham, Springfield, Longmeadow, East Longmeadow, as well as parts of Dudley, Charlton,

Brookfield, Warren, Ludlow, Ware, Belchertown, and Agawam. Within these cities and towns, a total of

20,704 residential structures were built during the aforementioned timeframe. Springfield saw the largest

amount of construction, with 4,050 homes being created in this time.

Towns within the 30-mile radius, marked at moderate risk by the Special Commission, include

Southwick, Westfield, West Springfield, Holyoke, South Hadley, Granby, New Braintree, North

Brookfield, Spencer, Leicester, Webster, Oxford, and Hardwick. These cities and towns saw a total of

15,846 homes created.

1

Industry standards allow for concrete to be mixed and delivered within a 90-minute window before it begins to set.

11

Additionally, to the charge of reviewing the potentially affected locations in the Commonwealth the

Special Commission enlisted the help of Massachusetts State Geologist, Dr. Stephen Mabee from the

University of Massachusetts Amherst.

Dr. Mabee sought to outline the potential areas in Massachusetts where pyrrhotite may be found. This was

accomplished by examining the 1983 state geographic maps and plotting the points where the words

‘sulfide, pyrite, and pyrrhotite’ appeared in the descriptions, as well as areas that were described as

having a ‘rusted’ appearance. He found that roughly 14% of Massachusetts bedrock contained sulfide

minerals, with another 1% having the ‘rusted’ appearance. The two sections of bedrock he thought are of

primary concern are the Partridge and Paxton formations in Central Massachusetts. This map is located in

Appendix H.

There are no active quarries in the aforementioned locations.

3. An estimate of the total cost to fully restore concrete foundations damaged due to the presence of

pyrrhotite;

The most effective remediation is to replace the existing foundation with a new one that does not contain

pyrrhotite. This process involves having the home lifted off of the existing foundation and placed on

stilts, removing the affected concrete, and having a new foundation poured- a process that typically takes

a minimum of six-eight weeks.

Foundation repairs differ in costs based on multiple factors, but current estimates range between $150,000

and $250,000 per affected residential building, inclusive of allowable concrete costs and dependent on the

size of the home in question.

While there may be technological advances in the future that are effective at remediating the issue, at this

time the only approved standard is to lift and replace the foundation with a new one that does not contain

the tainted aggregate.

Given this range of possible costs for remediation, and the amount of potential homes affected, the cost to

the Commonwealth to fully restore foundations may be roughly estimated at $350,000,000. This estimate

is based on the percentage of homes that JJ Mottes could have potentially supplied concrete for

2

,

multiplied by the maximum payout allowed by the Connecticut Captive Insurance Company ($175,000),

which we will discuss later on.

4. An analysis of the effect that the presence of pyrrhotite has on property values and the resulting

fiscal impact on property tax revenues;

The Special Commission recognized the importance of the effect that the presence of pyrrhotite has on

property values and the resulting fiscal impact on property tax revenues, as the lost value equates to a

greater financial burden for these localities and the homeowners affected.

2

For this estimate the Special Commission used the total estimated by Special Commission Member Dauphinais, at

2,000 homes, and multiplied by the maximum payout allowed by the Connecticut Captive Insurance Company.

12

There will be a reduction in municipal tax collection as homeowners begin to apply for property tax

abatements and the lower assessments will yield less revenue for the affected towns, forcing them to

choose between raising property taxes or cutting services in their upcoming budgets. The new

assessments are valid for five years and will affect revenues several years in the future.

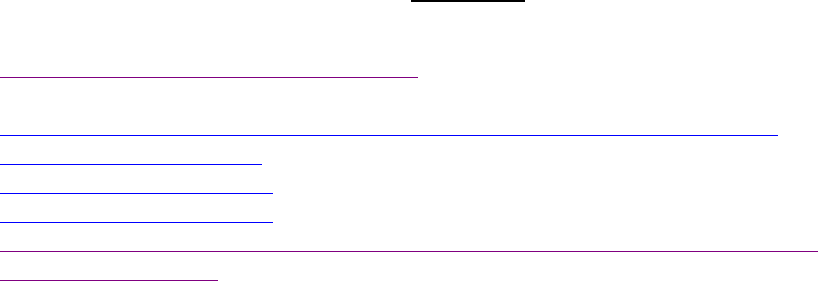

At the second committee meeting Special Commission Member Brunner stated that Connecticut has seen

an estimated $81 million decrease in tax revenue due to the reduction in home assessment value. This

information was gathered from the Coventry, CT assessor’s office, which was able to share with us the

total number of properties and reduction in assessment from the 26 affected towns in Connecticut. The

position of the Vernon, CT assessor is included in the Appendix I. Their method of reassessment was

created in the absence of a database of sales having crumbling foundations, with the model estimating a

percentage of the value reduction based on the percentage of foundation deterioration. With this method,

the percentage of deterioration is based on a visual inspection by the assessor or their designee, with a

10% reduction being given to any unit not having any evidence of foundation failure, and levels of 20%,

40%, 50%, 60%, 75%, and 100% being given for greater examples of deterioration. In this manner,

homes on average saw a reduction in their property values of approximately $90,000 after reassessment.

Special Commission Member Crane noted that he disagreed with this approach as it is entirely subjective;

reiterating that a core test should be required as opposed to an engineering report and that assessors need

to be educated in how to properly assess pyrrhotite damage and severity. It is important to note that while

the loss in assessed value may look dramatic, in context it appears slightly less catastrophic. In Vernon,

CT there was $24 million in lost value, resulting in a .5% loss in revenue over the past three years. In

Longmeadow, a .5% of property tax revenue would equate to a loss of about $250,000 per year. The

official statement from the Longmeadow Board of Assessors for real estate abatement is included in

Appendix K.

In Connecticut, the towns affected averaged a loss of approximately $89,000 in assessed value per

household affected. If applied to only the towns located within the 20-mile radius in Massachusetts, this

would amount to 20,704 homes, with a reduction in assessed value that is difficult to measure at this time.

Longmeadow adopted a policy on August 6th, 2018 to reimburse all town fees related to building permits

and associated inspections for work on crumbling foundations containing pyrrhotite, with the

reimbursement including fees for electrical, plumbing, or other building fees. It is unclear at the time of

this writing the approximate loss to the Commonwealth this could amount to.

5. An analysis of the impact on the real estate industry;

There will be a significant impact on the real estate industry in the region, particularly as homeowners

undergo the process of reassessment and decide to either work towards repair/replacement or sell as-is.

Homes in towns affected by the issue saw an average decline in property value of approximately $89,000

in the state of Connecticut, and several sales in Massachusetts have already shown the large degree of

impact the issue has on the evaluation of a property.

Special Commission Member Walsh noted that at the current time the issue has not appeared to have

adversely affected the home sale price averages in Hampden County, but we do expect this to change

13

when more homes are determined to have the problem. He also pointed out that buyers and sellers are

becoming more aware of the issue and are beginning to make decisions based on location/age of the home

and adjusting their search criteria accordingly, possibly avoiding certain areas where the problem is more

wide-spread. Moving forward, Special Commission Member Walsh touched on the need for the real

estate community, inspectors, and appraisers to be educated and well versed on the issue, and that

foundation advisories and disclosures must be utilized to ensure that buyers and sellers are making

decisions with the most up-to-date information available.

The Special Commission discussed the need for several pieces of legislation to be passed immediately to

ensure that homeowners faced with this issue do not pass it on to an unknowing buyer, which will be

discussed in detail later on in this report.

6. A review of the best practices undertaken in other states to deal with crumbling foundations that

have deteriorated due to the presence of pyrrhotite;

In reviewing the best practices undertaken in other states to address the issue, our efforts focused on the

state of Connecticut. Beginning in 2014-15, the Connecticut Department of Consumer Protection (DCP)

began to receive reports of deteriorating residential home foundations. In August of 2015, then-Governor

Malloy called on the DCP and the office of the Attorney General to conduct an investigation into the

issue, with the scope of the investigation being to determine whether or not there was a claim under the

Connecticut Unfair Trade Practices Act (CUPTA). This concluded in December of 2016, resulting in their

“Report on Deteriorating Concrete in Residential Foundations”, which stated that pyrrhotite is the main

cause of the deteriorating foundations and established a direct link between Becker’s Quarry, JJ Motes,

and the affected homes. While the Attorney General was unable to find sufficient evidence to commence

an action by the State under the CUPTA, the DCP and the Attorney General were able to leverage the

investigation to secure an assurance of voluntary compliance from JJ Mottes to cease using aggregate

stone from the quarry in any concrete poured for residential foundations.

During this time, the state of Connecticut moved forward to protect homeowners from having their

insurance adjusted in light of their circumstances, issuing a notice on October 6, 2015 from the

Department of Insurance Commissioner, Katherine Wade, to all insurers writing homeowners insurance

in Connecticut, directing that no insurer take any action to cancel or non-renew an affected homeowner’s

insurance coverage as the result of a foundation found to be crumbling or otherwise deteriorating.

The state of Connecticut then began to address the issue through legislative means, allocating $5 million

for foundation testing reimbursement in their FY 17 state budget. The eligibility requirements include that

the testing be conducted by a licensed professional engineer; that the home was built between 1983 and

2015; and that the home is within a 20-mile radius of JJ Mottes Concrete Company in Stafford Springs,

with a waiver application being required for homes outside the 20-mile zone. Core testing in their

program is reimbursed at 50%, up to $2,000, for testing of two samples, and visual inspection by a

licensed professional engineer is reimbursed at 100% for up to $400. Under their testing program,

homeowners are eligible to receive reimbursement for both visual and core testing on the same property.

After the parameters for the testing program had been established, the legislature then moved to pass

Public Act 16-45, an act concerning concrete foundations. This law makes various changes related to

14

residential and commercial concrete foundations, requiring municipalities to reassess residential

properties with foundation issues at the owner’s request. The law additionally required the DCP to

investigate the cause of concrete foundation failure, and mandated that the Executive branch agencies

maintain records related to failing residential concrete foundations as confidential for at least seven years.

The property must be inspected and its assessment adjusted within 90 days after the report has been

submitted or the next assessment year, and the new assessment is valid for five years or until the

foundation is repaired or replaced. It went into effect in May, 2016.

Connecticut then moved to establish an omnibus foundation replacement and reimbursement program

through the legislature

3

to assist owners of residential buildings with concrete foundations damaged by

the presence of pyrrhotite, using a non-profit Captive Insurance Company and a separate, non-lapsing

fund known as the Crumbling Foundations Assistance Fund, to help homeowners repair or replace

crumbling concrete foundations with the lowest amount of borrowed money. Working with a volunteer

board of directors, the Captive developed and administers the process by which homeowners apply for

and receive reimbursement for work associated with crumbling concrete foundations.

The legislation prohibits the Captive from spending more than 10% of the money allocated on

administrative costs, and subjects the employees, directors, agents, consultants, and contractors to state

ethics provisions to ensure fair practices. Additionally, the Captive is required to file quarterly reports to

legislative committees on its operations, including town by town information on claims, claim amounts,

applications, and application approvals. There is a process for appealing applications that are denied.

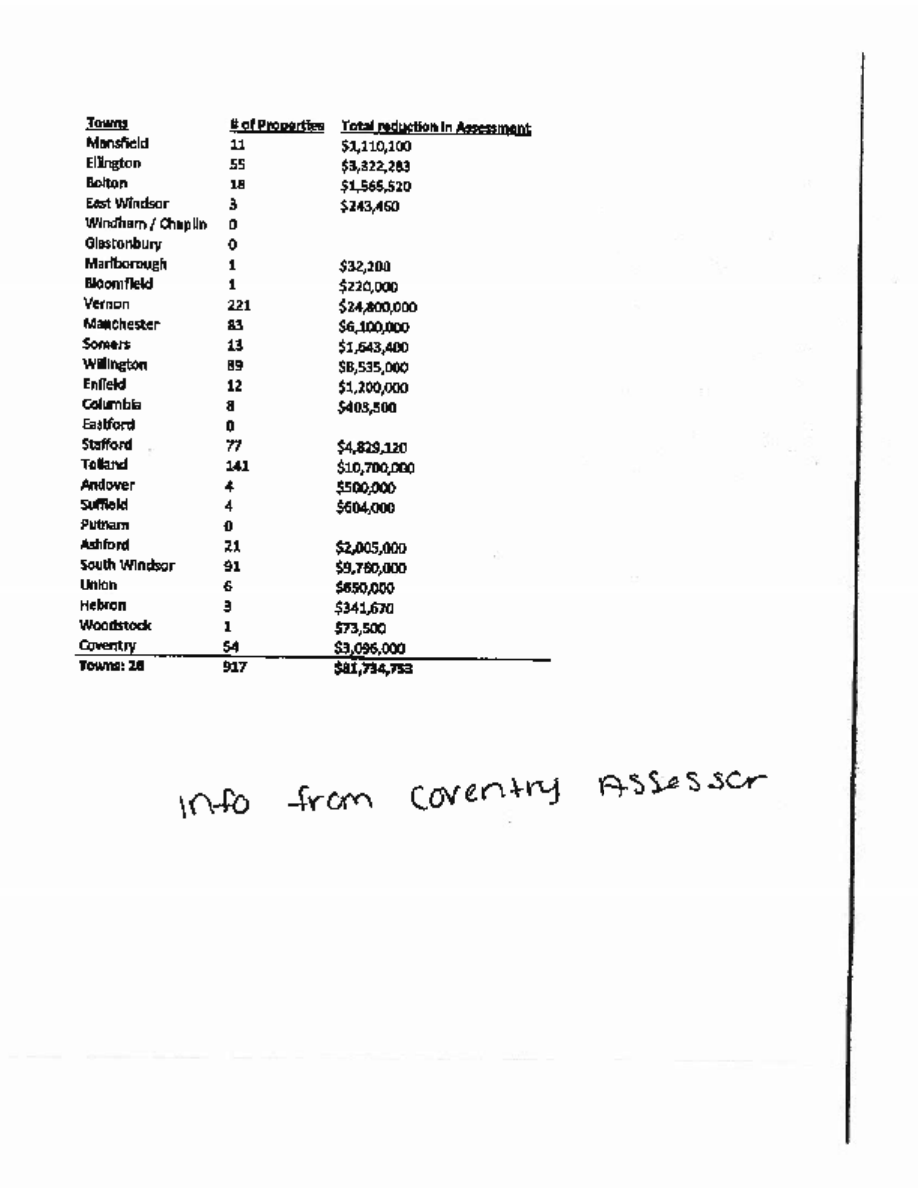

The act required the DCP Commissioner to include in the residential property condition disclosure report

a recommendation that the prospective purchaser have any concrete foundation inspected by a state

licensed structural engineer for deterioration caused by the presence of pyrrhotite, a question as to

whether the seller has knowledge of any testing or inspection by a licensed professional related to the

property's foundation, and a question as to whether the seller has any knowledge of any repairs related to

the property's foundation.

Taxpayers were allowed to reduce their adjusted gross income by the amount of financial assistance

received from the Crumbling Foundations Assistance Fund, and it allows municipalities to jointly borrow,

or individually bond, to fund projects to abate deleterious conditions caused by crumbling concrete.

The legislation established a special homeowner advocate within DOH responsible for, among other

things, coordinating state efforts to assist homeowners with crumbling concrete foundations, helping

resolve complaints concerning the Captive, working with the federal government and reporting to the

General Assembly, and established a training program for contractors repairing or replacing these

foundations.

Further, the act prohibits the use of recycled material containing pyrrhotite to make structural concrete

unless the State Building Inspector develops a standard, making a violation punishable under their

CUPTA laws.

3

Connecticut Senate Bill No. 1502, Public Act no. 17-2 Sec. 334-338.

15

As of September 2019, the Captive has identified 1,112 cases in Connecticut, with a potential liability of

$121,541,521. Paid liability at that point totaled $13,084,661

4

. While the Captive Insurance Company has

served as Connecticut’s primary outlet for repair and replacement in the aftermath of the legislation

passing, further efforts were undertaken by the legislature, with the passage of Public Act 18-179, to

codify the residential disclosure report home sellers must provide to purchasers, expanding it to include

disclosures on the building’s structures and any improvements made to it, as well as stating that

prospective buyers may have a concrete foundation inspected by a licensed professional engineer for

pyrrhotite before purchase.

The most recent action undertaken in Connecticut was the passage of Public Act 18-160, which imposed a

$12 surcharge on certain homeowners insurance policies issued, renewed, amended, or endorsed between

January 1, 2019 and December 31, 2029 to be deposited into the Healthy Homes Fund which the bill

establishes. The Healthy Homes Fund is a separate non lapsing General Fund account to collect insurance

surcharge funds to, in part, help homeowners with concrete foundations damaged from pyrrhotite. Under

the bill, within 30 days of receiving the deposit of surcharge funds, 85% of the deposits must be

transferred to the Crumbling Foundations Assistance Fund, which is used by the Connecticut Foundation

Solutions Indemnity Company, LLC to assist homeowners with crumbling concrete foundations.

7. An examination of potential remedies for residential homeowners affected by the crumbling

foundations that have deteriorated due to the presence of pyrrhotite;

To examine potential remedies that may be available to homeowners affected by the issue, the Special

Commission spoke with experts in the field, and leaned on the experience of Special Commission

Members Dupere and Loglisci, the former having already replaced their affected foundation and the latter

in the beginning stages of the quoting process.

Special Commission Member Dupere received three quotes for the repair on his home measuring

approximately 4,900 square feet- one for an experimental fiberglass replacement and two for the

traditional method of lift/remove/replace. The fiberglass replacement, estimated at $265,000 for their

home, would have allowed them to stay in the home while the work was done, saving them an estimated

$8,000 in rental costs while the home was repaired. Due to the limited track record of this process, and

the inability to replace footings underneath chimneys, Dupere opted for the traditional replacement

method at a cost of $325,000.

Special Commission Member Loglisci has received two quotes thus far for their 2,016 square foot home-

one in the amount of $38,500 for the lifting of the home and another in the amount of $225,400 for the

removal and replacement of the defective foundation.

In terms of payment for these repairs, it is important to note that many homeowner insurance policies will

not provide coverage for foundations that are deteriorating due to pyrrhotite, in part because such

deterioration is excluded from the policy’s definition of “collapse”. While the insurance will not cover

foundation replacement, an additional concern that the Connecticut legislature sought to prevent was the

cancelation or non-renewal of policies by the insurers, opting to issue a notice from the Department of

Insurance to ensure that this did not occur.

4

See https://crumblingfoundations.org/wp-content/uploads/2019/09/1.-Memo_CFSIC_Annual_Report-1.pdf./.

16

Fortunately, in Massachusetts, such fear is unfounded. First, existing Massachusetts law restricts the

ability of insurers to cancel policies during the policy term to a few limited situations

5

. Second, even if the

policyholder’s situation allows for the cancelation, he or she will not be left without a coverage option. In

1968 the Legislature created the Massachusetts Property Insurance Underwriting Association, more

commonly referred to as the FAIR (Fair Access to Insurance Requirements) plan, whose mission is to

provide property insurance coverage to those unable to obtain it from the usual sources.

6

5

M.G.L. Chapter 175, Section 99

6

M.G.L. Chapter 175C

17

Special Commission Recommendations

Based on its findings, the Special Commission recommends the following actions be taken in order to

assess and remediate the overall impact of the presence of pyrrhotite in concrete foundations in

Massachusetts:

1. Enable a Captive Insurance Company to conduct business in Massachusetts for the purpose of

overseeing the evaluation, repair, replacement and reimbursement of qualified residential

crumbling foundations.

2. Create a Crumbling Foundations Assistance Fund. Contributions to the Fund shall be used

exclusively for the repair and replacement of qualified residential foundations. The Fund shall be

administered by a Captive Insurance Company.

3. Increase awareness and educate residents and professionals in impacted industries. This can be

done by establishing a training program for inspectors, assessors, and real estate professionals to

educate them on the issue and aid in establishing an accurate method of assessment for affected

properties, establishing a contact person knowledgeable about the process to provide assistance to

residents with questions or issues, and by creating and distributing flyers in affected areas.

4. Continue the Concrete Testing Reimbursement program established in line item 7006-0142 of

chapter 154 of the Acts of 2018, and expand the distance range from 20 to 50 miles.

5. Prohibit all concrete from Becker’s Quarry in Willington, Connecticut to be used in

Massachusetts for residential or commercial purposes, and require a core test for the presence of

pyrrhotite for all current and future quarries within Massachusetts. This test will be in addition to

all physical quality tests currently being performed.

6. Engage with insurance companies with emphasis on: (a) Encouraging insurance companies to

contribute to the Crumbling Foundations Assistance Fund; and, (b) Provide wrap-around

coverage offered by other insurance (i.e., replace landscaping, deck, walkways, etc., ruined by

foundation replacement).

7. Wave building permit fees for all work associated with crumbling concrete foundations

replacement.

8. Require all Massachusetts home sellers to disclose to the prospective buyer any testing,

inspection or repairs performed to their foundation and require, at the point of sale, core testing

on any Massachusetts home foundation built between 1983 and 2015 located within 30 miles of

Becker’s Quarry in Wellington, Connecticut as defined by the map in Appendix G.

9. Develop a standard tax abatement to be used by all towns impacted. Any impacted town will

work with homeowners with a crumbling foundation on a plan to make the repairs within a

reasonable time in order to get the home back on the tax roll. If no plan for foundation

replacement is in place within 5 years, the tax abatement process should continue until the

foundation is replaced.

10. Advise the Massachusetts Commissioner of Insurance to discourage the cancelation of policies

for homes with crumbling concrete foundations and remind carriers of their obligation to strictly

adhere to the statutes governing cancelation of property insurance policies.

18

APPENDIX

A. Section 103 of Chapter 154 of the Acts of 2018 – Massachusetts FY19 State Budget, including language

creating the Special Commission

B. State of Connecticut Report on the Deterioration of Concrete in Residential Foundations

C. Connecticut Public Act 16-45

D. Connecticut Public Act 18-179

E. Connecticut Public Act 18-160

F. Assurance of Voluntary Compliance between State of Connecticut and JJ Mottes and Becker

Construction Companies

G. Map of affected locations within the Commonwealth

H. Map of locations where pyrrhotite may be found

I. Position of the Vernon, Connecticut Assessor, and a list of their affected towns and associated reduction

in assessed value

J. Tax abatement policy from the Longmeadow Board of Assessors

K. Longmeadow Select Board Building Permit Policy

L. Realtor Association Disclosure Form

M. Massachusetts Home Sale

N. First Meeting Minutes

O. Second Meeting Minutes

P. Third Meeting Minutes

Q. Fourth Meeting Minutes

R. Fifth Meeting Minutes

1

G. Map of Affected Locations within the Commonwealth

2

H. Map of Locations Where Pyrrhotite May Be Found

1

I. Position of the Vernon, Connecticut Assessor, and a list of their affected towns and

associated reduction in assessed value

2

3

J. Tax Abatement Policy from the Longmeadow Board of Assessors

4

K. Realtor Association Disclosure Form

5

6

L. Massachusetts Home Sale

7

8

Special Commission to Study the Financial and Economic Impacts of Crumbling Concrete Foundations

First Meeting 05/13

13 May 2019 / 6:30 PM / Helliwell Conference Room at Bay Path University

ATTENDEES

Senator Anne Gobi, Representative Brian Ashe, Representative Todd Smola, Gabrielle Viator, Douglas Brunner,

Vincent Walsh, Stephen Crane, Michelle Loglisci, Russell Dupere

AGENDA

❖ Welcome and Introductions

➢ The Chairs will welcome the group, introduce themselves and ask the members to introduce

themselves to the rest of the group.

❖ Open Meeting Requirements/Joint Rule 29A Requirements

➢ Outline the Joint Rule 29A and how the Special Commission will abide by those requirements.

❖ Review of Charge to Special Commission

➢ One of the Co-Chairs should read the purpose of the group as defined by the statute and have an

initial discussion as to the areas they are charged with looking into, as well as discussing the

feasibility of the reporting deadline.

❖ Discussion of Workflow Steps and Process

➢ The group should come up with objectives for the second and subsequent meetings and discuss the

next steps they should take in order to meet those objectives

■ Divide up the work between Special Commission members

■ Form sub-committees on area topics to conduct research and report findings to the entire

Special Commission, as necessary

❖ Discuss dates for subsequent meetings

❖ Adjournment

NOTES

❖ The meeting began at 6:36 P.M with Senator Anne Gobi offering opening remarks to the group before

going around the room for a brief round of introductions.

➢ In attendance were Senator Anne Gobi, Representative Brian Ashe, Representative Todd Smola,

Gabrielle Viator, Douglas Brunner, Vincent Walsh, Stephen Crane, Michelle Loglisci, Russell

Dupere

■ Legislative staff members present

● Robin Frechette from Representative Ashe’s office

● Derek Silver from Senator Gobi’s office

● Michael Clark from Senator Lesser’s office

■ The following Special Commission members were unable to attend: Senator Don

Humason and Craig Dauphinais

❖ After introductions the group reviewed the Open Meeting/Joint Rule 29A requirements that the Special

Commission must adhere too

9

➢ The chairs suggested that future meetings be open to the public unless a majority of the members

should vote otherwise

➢ Motion raised by Stephen Crane to make this official

■ Motion seconded and passed unanimously

❖ Following a review of the open meeting rules, Senator Gobi and Representative Ashe led the group in a

brief review of the purpose of the Special Commission while mentioning that we would be divvying up

tasks for the members

➢ Senator Gobi also mentioned a possible extension for the Special Commission

➢ Senator Gobi stated we must have at least 4 meetings

❖ From here the group moved to a discussion of workflow steps and process to try and narrow down

objectives for the second and subsequent meetings while discussing the next steps that should be taken

➢ It was agreed that we could divide tasks based on individual expertise

➢ Brief discussion of individuals who may be willing to come and present to the group

■ Brad Papalardo, Director of the Massachusetts Bankers Association

● Contact information

◆ bpapalardo@massbankers.org

◆ (617)523-7595

■ Lena Holleran, Homeowner Advocate in the Department of Housing in Connecticut

● Contact Information

◆ (860) 260-8090

■ State Geologist (UMass Amherst) - Stephen Mabee

● Contact Information

◆ (413)-545-2286

➢ Stephen Crane recommended the Special Commission look into the insurance and banking

industry and how they can play a role in assisting homeowners. CT asked largest insurance

companies to pay into a fund which would be used to repair foundations. Special Commission

agreed to discuss at a future meeting.

➢ Rep. Smola stated he knew of water contamination issues which prevented people from selling

their homes. DEP advised residential homeowners do a downgrade status filing with the state -

suggested Special Commission look into as possibility for homeowners with pyrrhotite

➢ Senator Gobi moved from here to start breaking up the tasks for the group, asking Derek Silver to

coordinate

➢ The following is a list of tasks assigned to each individual:

Michelle Loglisci - Homeowner Advocate via MA Residents Against Crumbling Concrete Group

10

Gabrielle Viator - Department of Consumer Protection - review any insurance issues/problems

raised by Special Commission or residents. Provide her with info. regarding impacted homes so

DCP can update records

Craig Dauphinais, Russ Dupere - examine degree to which concrete foundations in the

Commonwealth are crumbling due to pyrrhotite

Craig Dauphinais, Russ Dupere - Review affected locations within the Commonwealth

Stephen Crane, Michelle Loglisci, Vincent Walsh, Russ Dupere, Craig Dauphinais - Estimate

the total cost to fully restore concrete foundations damaged due to pyrrhotite

Stephen Crane, Vincent Walsh - Analyze the effect the presence of pyrrhotite has on property

values and the resulting fiscal impact on property tax revenues

Doug Brunner, Vincent Walsh - Analyze the impact on real estate industry

Senator Gobi, Rep. Ashe, Senator Humason, Rep. Smola, Stephen Crane - Review of best

practices undertaken in other states to deal with crumbling foundations due to pyrrhotite

Russ Dupere - Examine potential remedies for residential homeowners affected by crumbling

foundations due to pyrrhotite

❖ The meeting adjourned with a group photo and the decision to meet in the evening on Monday June 10th at

6:30 P.M at the Town Hall in Monson, MA.

NEXT MEETING AGENDA

No agenda has been set at this time.

11

Special Commission to Study the Financial and Economic Impacts of Crumbling

Concrete Foundations

Second Meeting 06/10

10 June 2019 / 6:30 PM / Monson Town Hall

ATTENDEES

Senator Anne Gobi, Representative Todd Smola, Douglas Brunner, Vincent Walsh, Michelle Loglisci, Craig

Dauphinais, Representative Brian Ashe (remotely)

Absent

Gabrielle Viator, Stephen Crane, Senator Don Humason

AGENDA

❖ Welcome and brief introductions

➢ Chair will welcome the group and ask individual members to introduce themselves to those in

attendance

❖ Presentation by Lena Holleran, Homeowner Advocate in the Connecticut Department of Housing

➢ Brief Q/A

❖ Presentation by Brad Papalardo, Director of Government Affairs and Trust Services for the Massachusetts

Bankers Association

❖ Reading of the first meeting minutes

❖ Review of the tasks assigned at the first meeting

❖ Discussion of future meeting/hearing dates

❖ Adjourn

NOTES

❖ The second meeting began at 6:33 P.M with Senator Anne Gobi offering opening remarks to the group

before going around the room for a brief round of introductions

➢ In addition to those listed in attendance above, the group was joined by Lena Holleran from the

Department of Housing in Connecticut and Brad Papalardo from the Massachusetts Bankers

Association

■ Legislative staff members present

● Robin Frechette from Representative Ashe’s office

● Henry Kahn from Senator Gobi’s office

● Derek Silver from Senator Gobi’s office

➢ Absent from the meeting were Gabrielle Viator and Stephen Crane

12

❖ After introductions Lena Holleran was given the floor to present a brief overview of the legislative actions

that she believes were done well and the areas she would have differently in hindsight.

➢ Things that went well

■ In their first year they put in a requirement stating that documentation of the concrete

producer and installer must be kept on record with the towns and held for a minimum of

50 years

■ Instituted a statewide law that allowed for a reassessment of property values on a

statewide level

● To this point she did state that the towns should have been compensated for their

loss of revenue that resulted from the reduced assessments (More on this to

follow)

■ Prohibited the recycling of materials containing the tainted aggregate

■ Required that anyone who had their homes tested or inspected to notify prospective

buyers

● Simultaneously, any individual interested in purchasing a home became allowed

to do their own test of the foundation if one had not already been completed

■ They waved building permit fees for those who choose to replace their foundations

■ This year they started to require that houses sold in foreclosure would need testing

reports, as previously individuals were walking away from their homes and the homes

were selling undisclosed

■ 100% reimbursement for low-moderate income residents

➢ Things she would have done differently

■ There should have been one central location/agency in charge of holding all testing

reports on a statewide level

● As it stands, each town hall is currently holding these records on paper for HUD,

and their state run testing program is similarly random

■ In regards to the estimated amount of affected homes, Ms. Holleran urged that we

recognize that the problem extends beyond the initial 20-mile radius, with their furthest

affected home being 44 ½ miles away

● While this is considered an outlier, she recommends that we look for clusters

surrounding major highways and stated that a 90 minute travel time is a more

accurate measure

◆ Craig Dauphinais noted that they would go 35-40 miles depending on

the direction/route

■ Another change she recognized is to their FOI exemption, which seals the records for 7

years beginning at the end of their investigation, at which point it will need to be renewed

13

● However, they forgot to include descriptions on how property record cards

should be handled

◆ Currently there is no standard for marking the cards and each town is

operating on their own. Believes this should be standardized.

■ A major issue she brought up earlier and circled back to are the reassessment of

homes/property values

● They allowed the local assessors association to develop a formula to determine

the amount of lost revenue, which has been substantial for the towns affected.

■ There is a lot of confusion in regards to the use of visual inspections. The initial purpose

was to determine whether or not you should conduct a core test and to decide if the home

is structurally safe to live in.

■ Do not compensate towns for lost revenue

■ Have one person in charge of coordinating information between state agencies since there

are multiple agencies involved (i.e., State Building Inspector, State Geologist, DOT

Engineers, etc.)

■ Standardize forms - currently there are no standardized reports which ask or provide the

same information including lab reports. Forms should all ask for the same information to

make it easier for comparison and to ensure the information needed is received.

➢ Lena Holleran mentioned that CT only covered homes not detached garages, septic tanks or

commercial/municipal buildings which is something the Special Commission may want to

consider.

➢ Another issue Lena raised was regarding condominiums. CT is currently working to get coverage

for condos however, a problem exists because when applying for reimbursement the owner of the

foundation must apply and technically the owner of the condo does not own the foundation just

the unit.

➢ At this Time, Senator Gobi asked if there was a better sense of how many homes have been

affected, to which Ms. Holleran did not have a firm number for, but she did state that the initial

34,000 estimation was based off a 20-mile radius that was much too small.

❖ At this time Senator Gobi introduced Brad Papalardo from the MA Bankers Association and Steve Lowell

from Monson Savings Bank.

➢ Brad gave a quick intro on behalf of the association before turning over to Steve for a more in

depth perspective.

■ They are currently requiring a visual inspection for any mortgage when they request an

appraisal, and some banks are also starting to require core testing as well.

■ Most of the mortgages they hold are sold on the secondary market to Fannie Mae.

■ Michelle Loglisci asked if the appraisers the banks are using are trained to look for

pyrrhotite damage and the short answer is no.

14

■ Steve mentioned that banks may be willing to work together to help some homeowners

with loans for repairs, depending upon the number of people affected, but if the mortgage

was sold to another lender then their hands are tied.

❖ Rep. Smola suggested keeping uniformity within the banking industry - provide standards.

❖ Craig Dauphinais stated that businesses who pour but not produce concrete want release signed stating they

are not responsible for problems before they will provide information on any known concrete problems.

Senator Gobi stated the A.G.’s office should be contacted regarding legality and release form.

❖ Do a possible on-line poll to do legislation stopping deliveries from Becker’s Quarry into Mass (homes,

commercial or municipal). CT has voluntary agreement. The Special Commission will approach the AG’s

office regarding voluntary agreement.

❖ Doug Brunner stated CT had an estimated $81 million drop in tax revenue due to the reduction in home

assessments. Vincent Walsh added he estimated Longmeadow had $900,000/year reduction in tax revenue.

If values keep going down, taxes will need to be increased to make up for lost revenue.

❖ Senator Gobi motioned to accept the minutes from the first meeting and the motion passed.

❖ From here the group moved on to discuss to-do items and possible presenters for subsequent meetings.

➢ Among those listed were the DPL, administrators of the Connecticut CRCOG, The Mass

Municipal Association and the State Geologist.

➢ Contacting GIS to request a map of the state depicting towns that are potentially affected, with

20/30/40 mile radiuses shown.

❖ The group motioned to accept July 22nd as the next meeting date.

❖ Representative Smola motioned to extend the Special Commission deadline to December 31st and the

motion passed unanimously.

·

NEXT WEEK’S AGENDA

No Agenda was set at this time.

15

Special Commission to Address the Financial and Economic Impacts of Crumbling

Concrete Foundations

Third Meeting 07/22

22 July 2019 / 6:30 PM / Monson Town Meeting Room

ATTENDEES

Russell Dupere, Douglas Brunner, Vincent Walsh, Michelle Loglisci, Craig Dauphinais, Representative Brian Ashe

(remotely), Senator Anne Gobi (remotely), Gabrielle Viator (remotely)

Absent

Stephen Crane, Senator Don Humason, Representative Todd Smola

AGENDA

❖ Welcome and introductions

➢ Chair will welcome the group and confirm a quorum before having individuals members introduce

themselves to those in attendance

❖ Presentation by Dr. Stephen Mabee, Massachusetts State Geologist and Senior Lecturer at the University of

Massachusetts Amherst

➢ Brief Q/A

❖ Review of map displaying the communities, structures and parcels potentially affected by faulty concrete

❖ Review of tasks assigned to the Special Commission

❖ Discussion of future meeting/hearing dates and potential presenters

❖ Adjournment

Notes

❖ The third meeting of the Special Commission began at 6:30 P.M in the Monson Town meeting room with

Russell Dupere acting as chair. A motion was made to suspend the reading of the previous meeting

minutes until the next meeting. Motioned was seconded and passed.

➢ In addition to those in attendance listed above, the group was joined by Dr. Stephen Mabee from

the University of Massachusetts Amherst

➢ Legislative staff members present included Derek Silver, Lucas McDiarmid, and Robin Frechette

➢ Senator Anne Gobi, Representative Brian Ashe, and Gabrielle Viator attended remotely

❖ After a brief round of introductions the group allowed Dr. Mabee to come forward and present on the

possible locations of pyrrhotite in the Commonwealth and the different testing methodologies that could be

employed at the UMass labs.

16

➢ Dr. Mabee is the Massachusetts State Geologist, in charge of conducting the MA Geological

survey while also serving as a senior lecturer at the University of Massachusetts Amherst

➢ Per Senator Gobi’s request, Dr. Mabee sought to outline the potential areas in Massachusetts

where pyrrhotite might be found.

■ He sought to do this by examining the 1983 state geographic maps and plotting the points

where the words sulfide, pyrite, and pyrrhotite appeared in the description, as well as

areas that might have been labeled ‘rusted’

■ Roughly 14% of the MA Bedrock contained sulfide minerals, and another 1% would be

described as having a rusted appearance.

■ The two areas he thought were most concerning were the Partridge and Paxton

Formations in central Massachusetts.

■ Absent on the map he created which he believed would be helpful to see are the areas

where there are active quarries along with information on where their aggregate is

sourced from.

➢ From here, Dr. Mabee moved to a discussion on the various methods for testing, which required

answering the following questions: Are we testing for just the presence of pyrrhotite? How much

is in the concrete? And is it reactive?

■ Trinity College in Connecticut currently uses magnetic susceptibility and a total sulfur

analysis

● The magnetic susceptibility test has been found to yield false positive results

● The total sulfur analysis gives you the total weight percent of sulfur present, but

unfortunately they don’t specify the type of sulfide mineral

■ A third type of testing is call X-Ray Fluorescence Analysis

● This technique only offers the chemical composition of the sample but it doesn’t

give you the identifying phases

■ The fourth type is x-ray diffraction analysis

● This will give you the presence and amount of minerals and their species in the

sample, as well as their identifying phases

◆ Likely the most effective

➢ From here the group moved into a Q/A with Dr. Mabee

■ He indicated that UMass has full capability to complete these tests for about $125, with

complete element mapping being completed for ~$500

■ When asked whether two core tests would be sufficient, he remarked that there should be

a test taken in each wall to account for variance in moisture content

● Connecticut recommends that you take one test above and below grade for

accuracy

17

■ Gabrielle Viator asked how old the technology was that Dr. Mabee had culled his

information from

● While the bedrock map of Massachusetts was compiled in 1983, Dr. Mabee

indicated that the largest advancements have been in their ability to analyze

mineral content

❖ At the conclusion of the group’s questioning with Dr. Mabee, they moved to a discussion of the map that

Representative Ashe’s office had compiled with the help of GIS.

➢ The map outlined a 20, 30, and forty mile radius extending from the J.J Mottes Concrete Plant and

into Massachusetts, displaying the communities, structures, and land parcels that could potentially

affected by faulty concrete.

■ Included are markers indicating the area concrete plants, the building and parcels

created/approved between 1983-2010, and the major roads intersecting the radiuses

■ From there a discussion arose on how the map may be modified to make a more accurate

prediction on the number of homes affected, with it being generally agreed upon that the

inside of the 30 mile distance would likely have the vast majority of problem homes. It

was agreed that commercial properties would be taken off the map and only reflect

residential buildings.

■ The map will likely be combined in some form with those presented by Dr. Mabee at the

start of the meeting.

❖ Craig Dauphinais moved the group at this time towards a discussion on how to best approach

Massachusetts foundation contractors to persuade them into cooperating with the Special Commission, with

the idea that they would be unlikely to participate fully without at least an affirmation of anonymity in the

final report.

➢ Ms. Viator indicated that such a guarantee would be unlikely from the Attorney General’s office

and that there isn’t any sort of precedent from which they might approach this from. She also

noted it wouldn’t bind 3rd party to put in claim.

➢ Senator Gobi asked if the contractors’ cooperation was critical, to which Dauphinais responded

that it may not be necessarily, but their participation would give us the most accurate count in the

long run. Craig would be able to track the information without names attached if we decide to do

anonymously.

➢ It was noted by Ms. Viator that some members would be subject to Public Records Law.

➢ It was decided to discuss a possible anonymous release at the next meeting.

❖ At the conclusion of this point, Michelle Loglisci took the floor to thank the legislative members for their

work in the budget process before turning to address the topic of increasing public knowledge/interest

around the issue

➢ Ms. Loglisci mentioned the desire to have an informational briefing at the State House before

turning to discuss a potential site-visit for the state and federal legislators

18

■ She noted that Senators Warren and Markey had expressed interest, as well as

Representative Neal.

■ There will be a large gathering on October 5th in Connecticut regarding pyrrhotite and

the invitation has been extended to Special Commission members as well.

■ It was noted from Ms. Loglisci and Senator Gobi that a possible future forum similar to

the one done earlier may be helpful in giving the public an update as well as hear further

issues.

❖ From here the group moved to adjourn with the next meeting date set for Monday, September 16th, 6:30

p.m. at the Monson Town Meeting Room.

No agenda for the next meeting was set at this time.

19

Special Commission to Address the Financial and Economic Impacts of Crumbling

Concrete Foundations

Fourth Meeting 10/7

07 October 2019 / 6:30 PM / Monson Town Meeting Room

ATTENDEES

Representative Brian Ashe, Senator Anne Gobi, Representative Todd Smola, Russell Dupere, Douglas Brunner,

Vincent Walsh, Michelle Loglisci, John Murphy, Gabrielle Viator (remotely)

Absent

Stephen Crane, Senator Don Humason, Craig Dauphinais

AGENDA

❖ Welcome and introductions

➢ Chair will welcome the group and confirm a quorum before having individuals members introduce

themselves to those in attendance

❖ Presentation by Michael Maglaras, Superintendent, Crumbling Foundation Solution Indemnity Company

➢ Brief Q/A

❖ Discussion of future meeting/hearing dates and potential presenters

❖ Adjournment

Notes

❖ The fourth meeting of the Special Commission began at 6:30 P.M in the Monson Town meeting room with

Senator Gobi and Representative Ashe acting as chairs.

❖ Senator Gobi introduced Michael Maglaras to present on the Crumbling Foundation Solution Indemnity

Company (CFSIC) in Connecticut.

❖ Michael Maglaras gave a thorough, detailed presentation of the history of the CFSIC - website

www.crumblingfoundations.org

➢ He explained that CFSIC is a captive insurance company and a 501(c)(3) tax exempt corporation,

a single purpose insurance company licensed in just one state (CT)

■ 27 states have statutory framework to allow for captive insurance companies,

Massachusetts currently does not

■ CFSIC is structured that it could cover crumbling foundations in other states within 90

days of that state passing enabling legislation

■ There is a very detailed FAQ on the CFSIC website explaining Captive insurance

➢ General Information on Connecticut Program

■ Currently, CFSIC is permitted to reimburse homeowners up to $175,000 for already-

replaced foundations and for future foundation

20

■ The current average replacement cost is $143,000

■ Current best data indicates that 5,000-7,000 homes are affected in Connecticut, they have

received claims for 1195 homes as of now

■ Average loss of equity in homes affected is 70%

➢ How CFSIC Operates -

■ Identifies the problem, rates the degradation of each foundation on a scale of 1 (no

current risk) to 3 (significant degradation in need of replacement as soon as possible)

■ Connects homeowners with contractors

■ Establish cost estimates

■ Put people in line to receive funding

■ Complete the work

➢ Additional notable takeaways and issues to be aware of moving forward

■ CFSIC has lowered remediation costs significantly as the work has progressed -

contractors have become more efficient, more competition for the work, etc.

■ Condos present a different issue, as multiple units are built on the same concrete

foundation, but are owned individually. Need to process through the condo association,

not individual condo owners

■ Funding has been a significant issue in Connecticut. While there are multiple streams of

funding into the program (bond authorizations, home insurance surcharges), CFSIC has

processed and disbursed reimbursements for homeowners at a far faster rate than they

have received funding from the state, so there have been multiple stops and starts in the

processing of claims. They are currently on hold right now, awaiting bond authorizations

to be released.

● Michael Maglaras emphasized that this was the most important takeaway of the

presentation, that the funding needs to be fully allocated first before beginning

the reimbursement process

● He also emphasized the importance of managing the public’s expectations with

the program - the stops and starts in funding in CT have made this very difficult

for them.

■ CFSIC reimburses homeowners for foundation replacement only. Additional associated

costs, such as property damage (deck removal, destruction of landscaping and driveways,

etc.) is not covered.

■ CFSIC has negotiated with homeowners insurance providers to commit to provide up to

$25,000 per home to cover these additional damages

● It is in the best interest of the insurance companies to provide this coverage, and

he recommends that the same thing be done in Massachusetts

■ Bank Owned Homes

21

● CFSIC did not want to cover these homes, as they funding is limited and they

did not want to create a system that would enrich banks.

● Problems have arisen with condos in this situation, as there are multiple condos

on one foundation - some owned by a bank, some not. Important to sort out

these situations early on.

■ There is currently a gray area in tax law whether receiving reimbursement is a taxable

event. It was not the intention of CFSIC for it to be taxable - they are working on

resolving this now.

■ Emphasized that the website has far more extensive background information on

everything presented today www.crumblingfoundations.org

➢ Current estimates for Massachusetts are about 100 homes are affected, which will come to the

states attention over the next 12 years, costing about $185 million to replace.

❖ After Michael Maglares’ presentation, Sen. Gobi and Rep. Ashe shifted the discussion to next steps to be

taken by the Special Commission.

➢ They requested that each member submit their top 10 issues or items that they wanted the Special

Commission report to address by November 1st.

❖ The Special Commission adjourned with a tentative meeting scheduled for November 18th.

22

Special Commission to Study the Financial and Economic Impacts of Crumbling

Concrete Foundations

Fifth Meeting 11/18

18 November 2019 / 6:30 PM / Monson Town Offices

ATTENDEES

Representative Brian Ashe, Senator Anne Gobi, Gabrielle Viator, Craig Dauphinais, Michelle Loglisci, Vincent

Walsh, John Murphy, Douglas Brunner

Absent

Representative Todd Smola, Senator Don Humason, Stephen Crane

AGENDA

● Welcome and brief introductions

● Discussion of report outline

● Scheduling of Special Commission hearing and State House briefing

● Adjournment

NOTES

● At 6:30 P.M Senator Gobi opened the 5th meeting of the crumbling foundation Special Commission with a

brief statement on the meeting agenda and the scheduling of our Special Commission hearing, as mandated

in statute.

○ It was decided that the Special Commission would conclude their report by the end of December,

and use the public hearing to unveil their findings and recommendations to the public.

○ The public hearing will be scheduled for a date in January, and will likely be held at Memorial

Hall in the town of Monson.

● The Special Commission, members, having received a draft copy of the report outline earlier in the day,

then moved to a discussion of the report’s structure and salient findings.

● There was a discussion of materials to be included in the appendix

○ Among those listed were the agreement of voluntary compliance established by the State of

Connecticut and J.J Mottes, the reduction in tax assessments seen in affected CT towns.

● From here, Senator Gobi asked for individual member’s input on the report draft outline

○ Michelle Loglisci began by looking at the recommendations of the draft report, stating that there

should be a requirement for quarries to test for the presence of pyrrhotite before they are allowed

to open.

■ Craig Dauphinais stated that companies will do a core test when they are set to open a

new quarry, and will subsequently test each new cell that is opened, but it may be worth

explicitly stating the need to test for pyrrhotite.

23

○ Michelle noted on page five of the report that GAO interviewers indicated to her the existence of

blocks made from dry aggregate taken from Becker’s Quarry in Rhode Island- another state to be

listed as having the issue.

○ For additional recommendations, Mrs. Loglisci reaffirmed the need to establish an agreement with

J.J Mottes and Becker’s Quarry of voluntary compliance that they will not supply any material or

product containing aggregate from Becker’s Quarry for use in projects in the State.

■ Ms. Viator indicated that she would be willing to work towards such an agreement in her

capacity at the Attorney General’s Office.

○ Mrs. Loglisci further recommended the inclusion of an Owner’s Project Manager on the Captive

Insurance Company if that is the route the Special Commission inevitably chooses to pursue.

○ Vincent Walsh noted the need to strike a figure referencing a reduction in tax collection for the

town of Longmeadow from the sixth page of the report, as the numbers he provided at the time

were mainly speculative.

○ Craig Dauphinais spoke next to address the potential agreement for voluntary compliance, stating

that it should include verbiage covering any type of cement/masonry products.

○ Mr. Dauphinais proceeded to mention that there needed to be a scoring system established that

would be uniform for engineers and assessors charged with rating homes, and suggested a

mandatory training program for these individuals and a ⅕ rating system.

○ To further address the need to collect data on the amount of homes affected, Mr. Dauphinais

suggested we could lobby the Governor for an executive order to force contractors to supply their

records of building permits and concrete producers used.

■ He estimates that 832 homes were built in Monson during the time period, and that with

three main contractors doing the work we should be able to estimate based on the

producers each employed.

● Senator Gobi then moved to discuss a possible lobby day at the State House in late January/early February,

with the agreement that her staff members would coordinate.

● The meeting concluded with an agreement for members to submit written testimony to the points outlined

in the draft report by Monday, December 16th.