Your Comprehensive Employee

BenefitsPackage

Cedars‑Sinai is committed to the health and wellbeing of our employees. Our benefits program helps you meet

your goals for a healthy lifestyle and provides superior healthcare for you and your family when you need it.

The passion for providing high‑value care to our patients begins with providing high‑value care for our staff.

Page

Medical Benets

•

Shared expense between you and Cedars‑Sinai.

•

Choose from three Anthem plans: Blue Cross PPO, Blue Cross HMO or Vivity HMO.

•

Medical premiums include pharmacy benefits.

12

Dental Benets

•

Shared expense between you and Cedars‑Sinai.

•

Choose either the DeltaCare USA (similar to an HMO) or Delta Dental PPO.

21

Vision Benets

•

Employee paid through payroll deduction.

•

Vision exams and prescription eyewear through Blue View Vision.

23

Wellness Matters

Program

•

Cedars‑Sinai paid.

•

Numerous onsite classes and programs that cultivate multidimensional wellness.

•

Opportunity to earn a Wellness Matters incentive contribution, if enrolled in a

Cedars‑Sinai medical plan.

24

Healthcare

Flexible Spending

Account

•

Contribute up to $3,050 pretax through payroll deduction from July 1, 2023–June 30, 2024.

•

Helps reduce the cost of out‑of‑pocket healthcare expenses.

28

Child/Adult Care

Flexible Spending

Account

•

Contribute up to $5,000 (or $1,200 if you earn more than $135,000/year) pretax through payroll deduction from

July 1, 2023–June 30, 2024.

•

Helps reduce the cost for child care or dependent adult care expenses so you can work.

28

Basic Life Insurance

Change as of 7/1/2023

•

Cedars‑Sinai paid.

•

Cedars‑Sinai provides 1.5x annual base pay ($50,000 minimum up to $400,000 maximum) of

life insurance for you.

31

Supplemental Life

Insurance

•

Employee paid with after‑tax dollars through payroll deduction.

•

Purchase additional life insurance for yourself, your spouse and/or children.

31

Basic AD&D

Insurance

Change as of 7/1/2023

•

Cedars‑Sinai paid.

•

Cedars‑Sinai provides 1.5x annual base pay ($50,000 minimum up to $400,000 maximum) of

accidental death & dismemberment insurance for you.

33

Supplemental AD&D

Insurance

•

Employee paid with after‑tax dollars through payroll deduction.

•

33

Basic LTD Insurance

•

Cedars‑Sinai paid.

•

Cedars‑Sinai provides 50% of basic monthly pay

Supplemental LTD

Insurance

•

Employee paid with after‑tax dollars through payroll deduction.

•

Purchase an additional 10% of basic monthly pay in long term disability insurance (buy‑up).

34

34

CS Staff v2e— 2023-2024 | Page

For new employees on page 3.

Eligibility and Enrollment

Starting on page 5.

Employee Assistance Program (EAP), entertainment benefits, cellular account

discounts, family support services, rideshare, Employee Referral Program,

Tuition Assistance Program and Credit Union on page 48.

Including holidays on page 51.

Page Page

403(b) Plan

•

Your pretax savings through payroll deductions,

matching contributions from

Cedars‑Sinai and

investment earnings.

•

Contribute up to the IRS maximum each year ($22,500

in 2023); if 50 or older, make additional catch‑up

contributions each year (up to $7,500 in 2023).

•

Cedars‑Sinai makes matching contributions to

employees eligible to participate in the Choice

Retirement Program and who contribute to the

37

Choice

Retirement

Program:

DB Plan or

DCPlan

•

100% funded by Cedars‑Sinai.

•

Choose to participate in either the DB Plan or

DC Plan (the first day of the quarter after one

year of service with a minimum of 1,000 paid

hours).

39

Vacation

Holiday

Time (VHT)

•

Year 1–3: 16 days of vacation/year

•

Year 4–9: 21 days of vacation/year

•

Year 10+: 26 days of vacation/year

•

6 national holidays/year

•

4 floating holidays/year

41

Sick Time

(SICA)

Approved

Leave Pay

(ALP)

•

5 sick days/year

•

1 ALP day/year

42

43

Voluntary coverage; employee paid with after‑tax dollars through payroll deduction.

Hospital

Indemnity

Insurance

•

Pays a daily benefit if you have a covered stay in a

hospital, critical care unit or rehabilitation facility.

45

Auto and

Home

Insurance

•

Personal auto and/or home insurance.

•

Employee‑paid payroll deduction or other payment

methods available.

47

Accident

Insurance

•

Pays you benefits for specific injuries and events

resulting from a covered accident.

46

Pet

Insurance

•

Insurance for veterinary fees.

•

Employee‑paid payroll deduction or other payment

methods available.

47

Critical

Illness

Insurance

•

Pays a lump‑sum benefit if you are diagnosed with a

covered disease or condition.

46

Legal Plan

•

Pay a flat monthly amount for legal services

(limits apply).

47

This guide presents an overview of the organization’s benefits program and is not intended to

be all-inclusive, nor is it to be used as a summary plan description, plan document or Policy. In

the event of any conflict between this guide and the official plan documents or policy, the official

documents or policy will govern. The organization reserves the right to change or modify its

benefit plans as appropriate, contingent on any required advance notice.

Si tiene preguntas de los beneficios que le ofrece Cedars‑Sinai o de como inscribirse a ellos, el Centro de Ayuda MBC HR tienerepresentantes en español

para asistir con cualquier dudaopregunta. Favor de llamar al 888‑302‑3941 o mande un correo electrónico a MBC.cshs@milliman.com.

Benefit Questions? Ask the

MBC HR Benefits Help Desk

•

Phone: 888-302-3941

•

Fax: 206-299-3158

•

Email: [email protected]

•

Web: Cedars-Sinai.MyBenefitChoice.com

•

Hours: Open Monday–Friday 5 a.m.–5 p.m. PT

(Closed major holidays)

CS Staff v2e— 2023-2024 | Page

Supplemental LTD Insurance

Cedars‑Sinai provides 50% of base pay

coverage; you can purchase an additional

10% of base pay coverage.

CS Staff v2e— 2023-2024 | Page

1

You have 30 days from your date of hire, rehire or transfer to a benefits‑eligible job to enroll for healthcare, insurance and flexible spending accounts (FSAs).

Enroll online: Cedars-Sinai.MyBenefitChoice.com*

Enroll by phone:

888‑302‑3941

COVERAGE OPTIONS FOR YOU AND YOUR FAMILY:

Employee Benefits Enrollment Checklist

If you’re new to Cedars‑Sinai, welcome! In addition to your wages, Cedars‑Sinai offers valuable compensation in the form of healthcare,

life insurance and disability benefits for you and you

r family. As a benefits‑eligible employee, you will automatically be enrolled in medical

coverage unless you decline. Most other benefits coverage is not automatic; you must enroll to be covered. Follow these steps to enroll:

*If you have any difficulty using the website, try logging in and enrolling from your home computer or tablet, or call the

MBC HR Employee Benefits Help Desk at 888-302-3941 and they can enroll you over the phone.

Supplemental employee life insurance

Purchase coverage from 1x to 7x your

annual base pay (up to $3 million

maximum)

1

Supplemental spouse/domestic partner

(DP) life insurance

Purchase coverage in $5,000 increments

up to $200,000 (not to exceed 50% of

your coverage)

1

One-time opportunity for life insurance

coverage without proof of good health

1

If you apply for supplemental life insurance

within 30 days of hire or first becoming eligible

for benefits, you can get up to the guaranteed

issue amount of coverage without insurer

approval:

•

You: 2x annual base pay (to $2 million

maximum)

•

Spouse/DP: $25,000

1

If you apply after your first 30 days, or for coverage

amounts over the guaranteed issue, you’ll need to complete

a health questionnaire (called an EOI form) and receive

insurance company approval for coverage.

Supplemental child life insurance

Purchase in $2,500 increments up to

$10,000 of coverage. One premium covers

all your children under 26. Be sure to add

your children on the benefits enrollment

site. (If they’re enrolled for healthcare

benefits, they’ll already be there.) To add a

dependent, go to: Make a Change > Update

Dependents > Add a Dependent.

Supplemental AD&D insurance

Designate beneficiaries for:

•

Basic life insurance

•

Basic AD&D insurance

•

Supplemental employee life insurance

•

Supplemental AD&D insurance

Dental benefits

Vision benefits

Healthcare FSA

To help you save on out‑of‑pocket healthcare

expenses.

Child/Adult care FSA

To help you save on child or dependent adult

care expenses that make it possible for you

Medical and prescription drug benefits

•

Cedars‑Sinai pays most of the premium;

you pay only a small portion through

payroll deduction; to keep coverage

affordable, your premium is based on

pay rates (see page 16).

•

When enrolling in medical, if you select

an HMO you may choose your Primary

Care Physician at that time, or do it later

(see page 13).

•

If you do not go on the enrollment site

and either elect or decline Cedars‑Sinai

medical coverage, you will be

automatically enrolled for employee‑only

coverage based on your home address:

Home Address: Default Medical Plan

Vivity HMO service

area (generally L.A.

and Orange counties)

Vivity HMO

In California, but not

in the Vivity HMO

service area

Blue Cross HMO

Outside California Blue Cross PPO

Benefit questions?

Visit the Benefits Portal at

Cedars‑Sinai.MyBenefitChoice.com

Your go‑to place for employee benefits in

one, convenient stop:

•

Access benefits information easily (no login

required)

•

Link to retirement plans and other benefit

vendors

•

Log in to enroll.

Benefits information at your fingertip with

two Cedars‑Sinai apps!

•

Cedars‑Sinai Employee App (download it

from csemployeeapp.com)

•

MyCS‑Link (download it from the Apple

app store or Google Play store)

Hospital indemnity insurance

Pays a $100 daily benefit if you (or a

covered family member) have a covered

stay in a hospital, critical care unit or

rehabilitation facility.

Accident insurance

Pays you (or a covered family member)

benefits for specific injuries and events

resulting from a covered accident.

Critical illness insurance

Pays a lump‑sum benefit if you (or a

covered family member) are diagnosed

with a covered disease or condition.

•

You: Purchase $10,000, $20,000 or

$30,000 in coverage

•

Spouse/DP: Purchase coverage in

$5,000 increments up to $30,000

•

Child(ren): Coverage = 50% of

employee coverage amount

Legal Plan

5

wellbeing program

To support you on your path to wellbeing,

Cedars‑Sinai offers onsite activities and

generous incentives. If you’re enrolled in a

Cedars‑Sinai medical plan, you can earn a

Wellness Matters incentive contribution each

benefit year (July 1–June 30) by taking certain

healthy actions.

Find out how to earn a Wellness Matters

incentive contribution to your HRA

account starting on page 25.

Create a personal account with TRI-AD,

our HRA account administrator:

•

Online at: tri-ad.com

•

Via mobile app (search for “TRI‑AD

Benefits on the Go” at your app

store and use client ID TIDCEDARS

4

To help you manage veterinary costs,

Cedars‑Sinai makes it possible to get coverage

for your pet at discounted rates. You may

Apply for Nationwide® pet insurance

Enroll online:

petinsurance.com/cedarssinai

Enroll by phone: 877‑738‑7874

3

Apply for auto and

Cedars‑Sinai makes it possible for you to

purchase home, renter’s, vehicle, boat and

umbrella insurance at group rates. You may

enroll anytime.

Apply for Farmers GroupSelect™

insurance

Enroll online:

myautohome.farmers.com

Enroll by phone:

800‑438‑6381

7

Activate your

MyCS-Link

™

account

This secure online tool connects you to important

information at Cedars‑Sinai about:

•

Your personal health information: If you are a

patient at Cedars‑Sinai, MyCS‑Link allows you

to communicate with your physician, request

appointments and access test results.

•

Employee Health Services: Complete your

annual clearance questionnaire in MyCS‑Link

before visiting with the Employee Health

Services nurse.

To activate your account go to:

•

Cedars-Sinai.org/MyCSlink

•

Select “New User Signup.”

•

Enter your access code as it appears

on your enrollment letter or email; if

you don’t have one, you may request

one online.

•

Create your ID, password and

password hint.

Get the MyCS-Link App!

After activating your online account,

download the app from your mobile

provider’s store (search “Cedars‑Sinai”).

Has your address or

phone number changed?

Be sure to let us know!

The quickest way is on the Cedars-Sinai

intranet:

> Click Service Center (under Helpful

Links)

> Click Changing Your Address and/or

Phone Number (under Frequently

Asked Questions)

> Click Change My Address or Phone

Number eForm in the article or under

Additional Resources near the bottom

of the page

> Complete the online eForm and click

the Submit button (on the right)

If you do not have access to the

Cedars-Sinai intranet or need help,

contact the HR Service Center:

•

Call: 424‑314‑myHR (6947)

•

Email: [email protected]g

2

Enroll in the

There’s no waiting period.

Enroll anytime!

The 403(b) Plan is a voluntary retirement

savings plan that allows you to save for

retirement on a pretax basis. You decide how

much to contribute (up to IRS limits) and it is

transferred directly from your paychecks to your

plan account.

Cedars‑Sinai matches 50% of what you

Enroll in the 403(b) Plan

Enroll online:

Cedars‑Sinai.BeReady2Retire.com

Enroll by phone:

800‑584‑6001

Plan Number: VFZ032

Verification Number: 246598

Location Code: 0001

Designate 403(b) beneficiaries

Voya Financial representatives can meet with

you to help with investment education and

retirement planning. Call for an appointment.

Phone: 310‑423‑0974

Location: Ray Charles Cafeteria

Suite 1631 A

regular business hours

6

retirement plan

•

The quarter after one year of service (with

a minimum 1,000 paid hours), you will have

an opportunity to select which Cedars‑Sinai

retirement plan you want to participate in,

either the:

–

Defined Contribution (DC Plan)

or

–

Defined Benefit (DB Plan)

•

Both plans are paid 100% by Cedars‑Sinai.

•

Once you meet the eligibility requirements,

Cedars‑Sinai will mail you a choice packet

with information to help you decide. Make

sure your address is up to date to ensure you

receive this packet (see right).

CS Staff v2e— 2023-2024 | Page

CS Staff v2e— 2023-2024 | Page

Who can enroll?

HEALTHCARE, INSURANCE AND SPENDING ACCOUNTS

If you are a benefits‑eligible employee who is regularly scheduled to

employee, you can enroll in the benefits described in this booklet.

The following types of employees are not eligible, or have limited eligibility

for benefits:

•

If you are a per diem employee who has worked an average of 30+

hours per week during a 12-month measurement period (also referred

to as full time per diem), you may enroll yourself (and eligible family

members) in any of the medical plan options offered and

Cedars‑Sinai

pays most of the premium. However, you are not eligible for a Wellness

Matters incentive contribution or any other healthcare, insurance,

wellbeing, FSA benefits or retirement benefits, except you are eligible

to make tax‑deferred contributions to the 403(b) Plan and use family

support services.

The initial 12‑month measurement period for medical coverage begins

measurement period is the previous May 1 to June 30.

•

If you are a per diem employee who hasn’t worked an average of

30hours per week during a 12-month measurement period, you may

enroll yourself (and eligible family members) in the Blue Cross HMO on

a self‑pay basis. However, you are not eligible for a Wellness Matters

incentive contribution or any other healthcare, insurance, wellbeing,

FSA benefits or retirement benefits, except you are eligible to make

tax‑deferred contributions to the 403(b) Plan and use family support

services.

•

If you are part time

per week), a visiting guest, a temporary employee or working on a project

basis, you are not eligible for a Wellness Matters incentive contribution,

healthcare, insurance, wellbeing, FSA benefits or retirement benefits,

except you are eligible to make tax‑deferred contributions to the

WELLNESS MATTERS INCENTIVE CONTRIBUTION

You must be a benefits‑eligible employee enrolled in a Cedars‑Sinai medical

plan to earn a Wellness Matters incentive contribution and reward.

CHOICE RETIREMENT PROGRAM

The following types of employees are not eligible to participate in the Choice

Retirement Program:

•

All per diem employees hired after June 30, 1989

•

Physicians in training

•

Executives and faculty members who participate in the grandfathered

executive retirement plan

Eligibility and Enrollment Q&As

May I enroll my family?

If you are eligible for benefits and you enroll, you may cover your

spouse or domestic partner and children, as defined below and on the

To cover your family members for medical benefits, you must provide their

Social Security Number or Federal Tax ID Number. Or, when enrolling on

Cedars-Sinai.MyBenefitChoice.com, you may complete the pop‑up screen

indicating why you won’t be providing it.

SPOUSE

You may cover your spouse (of any gender), as long as you provide evidence

of marriage. Otherwise, you are required to meet the criteria for domestic

partnership and complete a domestic partner affidavit.

Your spouse is not eligible if you are divorced or legally separated from them

or if your marriage has been annulled.

DOMESTIC PARTNER (DP)

Under the Cedars‑Sinai policy, DPs are defined as two adults (of any gender)

who reside together, sharing their lives in an intimate and committed

relationship with a mutual obligation of support. For your DP to be eligible for

benefits, you must either:

•

Be publicly registered as domestic partners under state or local law

or

•

Complete (and have notarized) a

Cedars‑Sinai DP affidavit and meet all of

the following criteria; you:

–

Have been sharing a common residence* for at least six months and

intend to do so indefinitely

–

Are not related by blood to a degree of closeness that would prohibit

marriage

–

Have assumed mutual responsibility for basic living expenses*

–

Are at least age 18 and capable of consenting to the domestic

partnership

–

Are not married to anyone else or in a declared domestic partnership

with anyone else.

You can get a

Cedars‑Sinai DP affidavit online at

Cedars-Sinai.MyBenefitChoice.com or

Help Desk.

* Although you don’t have to show proof of common residence or evidence of joint

responsibilityfor basic financial obligations to enroll, the insurance company may

require it before paying claims.

The premium you and Cedars-Sinai pay for your DP’s coverage is

considered taxable income, called “imputed income.” To find out how

imputed income affects your paycheck, see Do I pay income taxes on my

healthcare benefits?

on page 10.

CS Staff v2e— 2023-2024 | Page

(Domestic partner eligibility continued)

If you’re in a new domestic partnership, your DP (and children) become

eligible for benefits on the date you:

•

Have lived together for six months

or

•

Received your state‑issued domestic partnership certificate.

Within 30 days from the date your DP becomes eligible, you must do one

of the following:

•

Enroll online at

Cedars-Sinai.MyBenefitChoice.com (log on to the

Benefits Enrollment Site > Make a Change > Add a Life Event > Select

“Domestic Partner—New”)

•

Enroll by calling the MBC HR Employee Benefits Help Desk at

888‑302‑3941

For your DP’s coverage to become effective, you must submit your state‑

issued domestic partnership certificate or completed (and notarized)

Cedars‑Sinai DP affidavit to the MBC HR Employee Benefits Help Desk by

the documentation deadline (see below).

The Cedars‑Sinai DP affidavit is posted on the Benefits Enrollment Site:

About Our Benefits > Eligibility + Enrollment> Affidavit of Domestic

Partnership.

Spouse/domestic partner coverage ends the last day of the month they

lose eligibility due to divorce, legal separation, annulment or termination

of domestic partnership.

Documentation deadline: 45 days

When you enroll a family member, you must provide documentation

showing they are eligible (such as a birth certificate, marriage

certificate, etc.).

For a list of accepted documentation, see Family Member Eligibility

and Documentation posted on Cedars-Sinai.MyBenefitChoice.com

Log in >Get Answers > Enrollment and Eligibility

.

You have 45 days to submit required documents by:

•

Uploading them to the benefits enrollment site.

Cedars-Sinai.MyBenefitChoice.com

Log in > Get Answers > Upload Documents

You can upload the following types of files: .pdf, .jpg, .png, .bmp,

.gif, .doc or .docx.

•

Sending them to the MBC HR Employee Benefits Help Desk:

−

Email: HWFormsProcessing@milliman.com

−

Fax: 206-299-3158

−

Mail: Cedars-Sinai HR Benefits Department

c/o MBC Service Center

P.O. Box 600610

Dallas, TX 75360-0610

For the enrollment to become effective, you must submit the required

documentation within 45 days from your benefit start date; see

When does coverage start? on page 9.

CHILDREN

You may enroll your children under your medical, dental and vision coverage,

hospital indemnity insurance, accident insurance, critical illness insurance

and for supplemental child life insurance.

You can cover children until age 26 if they are your or your current

spouse’s/DP’s:

•

Biological children

•

Stepchildren (the children of your current spouse/DP)

•

Adopted children

•

Children placed with you for adoption

•

Children for whom you are the legal guardian

•

Children a court ordered you to cover under your healthcare plan

including a Qualified Medical Child Support Order (QMCSO); Cedars‑Sinai

determines whether an order qualifies as a QMCSO; you can obtain a free

copy of QMCSO procedures by emailing GroupHRBenefits@cshs.org.

Children age 26 and older can be covered if, in addition to meeting the

above requirements for children under age 26, all of the following apply:

•

A doctor certifies in writing that they are incapable of getting a self‑

supporting job because of a physical or mental condition (and the

certification is approved by the insurance company).

•

They are unmarried and chiefly dependent on you or your spouse/DP for

support and maintenance.

•

They have six months of creditable coverage or were already covered

under Cedars‑Sinai benefits when they turned age 26.

You must submit the doctor’s certification to the insurer/benefit provider

within 30 days of their request (or a later deadline, if accepted by the insurer/

benefit provider). To continue coverage, you may have to supply the doctor’s

certification once a year.

If enrolling in supplemental child life insurance, be sure to add your

children on the benefits enrollment site. (If they’re enrolled for healthcare

benefits, they’ll already be there.) To add a dependent, go to: > Make a

Change >Update Dependents > Add a Dependent.

Children’s benets end the month they turn 26.

When your youngest child listed on the enrollment site turns 26:

•

Your medical, dental and vision premiums will change automatically.

•

Child supplemental life insurance coverage (if any) will be canceled, and

premiums will automatically stop.

FAMILY OR DEPENDENTS NOT ELIGIBLE

You cannot enroll the following family members, even if they otherwise

meet the eligibility requirements:

•

Other family members (like parents, aunts, etc.), even if they are legal

dependents

•

Stepchildren from a previous marriage*

•

Grandchildren*

•

Foster children*

•

Family members in active service of the armed forces of any country or

subdivision of any country

•

Family members living outside the United States (the 50 states, District

Mariana Islands, Guam and American Samoa)

* Unless you or your (current) spouse/DP is their legal guardian or a court-ordered Qualified

Medical Child Support Order (QMCSO) requires you to cover them.

CS Staff v2e— 2023-2024 | Page

When can I enroll in or change healthcare,

insurance and flexible spending account (FSA)

benefits?

•

Within 30 days of being hired or rehired as a benefits‑eligible employee or

of becoming eligible for benefits

•

During open enrollment (held in May)

•

Within 30 days of having a qualified life event that changes your eligibility

for benefits

If you leave and then return to Cedars-Sinai employment:

•

Reinstatement: If you leave and then return within 30 days, you will be

automatically re‑enrolled in the same benefits you had when you left.

•

Rehire: If you leave

Cedars‑Sinai employment and then return after

insurance company approval for any supplemental life insurance).

If you miss the enrollment deadline(s), you will have to wait until next year’s

open enrollment to enroll or change benefits.

What’s a qualified life event?

It’s a situation that allows you to change some or all of your benefits

Healthcare, insurance and FSA benefit elections run from July 1 (or, for new

employees, from the first day of the month following your hire date) to the

next June 30. Generally, you cannot change benefits during the

enrollment right. Qualified life events and special enrollment rights are listed

If your family or job status changes,

family’s eligibility for benefits, it’s your responsibility to make the change

online at

Cedars-Sinai.MyBenefitChoice.com (Benefits Enrollment Site >

Make a Change) or to notify the MBC HR Employee Benefits Help Desk at

888‑302‑3941.

Benefit Changes — Action Required!

You have 30 days following any of these qualified

life events to change your coverage.

If you don’t enroll new family members (including new babies) within

30days of birth, marriage, etc., they won’t be covered.

•

Childbirth, adoption or placement for adoption (see Will my newborn

baby be automatically covered by the plan? on the next page)

•

New spouse or child (in this situation, you may enroll yourself and family

members if you have never enrolled)

•

Domestic partner (DP) becoming eligible for benefits

•

Family members becoming eligible

•

Child losing eligibility (turning 26)

•

Spouse/DP losing eligibility due to divorce, legal separation, annulment or

domestic partnership termination*

•

Death of spouse/DP or child

•

Involuntary loss of other healthcare coverage (for reasons other than

•

Gaining healthcare coverage under another employer’s plan (including

enrolling in your spouse’s/DP’s employer plan during their annual/open

enrollment)

•

Regular work schedule reduced to fewer than 30 hours per week and you

are enrolling in another health plan with minimum essential coverage

•

Going on or returning from an unpaid leave of absence

•

Enrolling in a state/federal marketplace plan during its open enrollment or

special enrollment period

•

Enrolling in Medicare

•

benefits

•

Changes in employment status that affect eligibility status

•

Change in residence so that you are no longer in the HMO provider area

•

Judgment, decree or order requiring coverage for dependent(s) (including

*You cannot cover your ex-spouse under Cedars-Sinai plans. If your divorce or legal separation

decree requires you to cover your ex-spouse, you’ll have to purchase a policy for your

ex-spouse elsewhere. COBRA will be offered if your ex-spouse had coverage under your

benefits and the MBC HR Employee Benefits Help Desk is notified within 60 days of the

divorce.

You have 60 days following these events to change your coverage:

•

Gaining premium assistance through Medicaid or a state Children’s Health

Insurance Program (CHIP)

•

Losing Medicaid or CHIP assistance

Life or job changes = benefit changes

Make sure you change your benefits to match your new situation in

time. You have 30 days after the qualified life event to change your

benefits through the MBC HR Employee Benefits Help Desk:

Web: Cedars‑Sinai.MyBenefitChoice.com

(Benefits Enrollment Site > View Your Benefits

>MakeChanges)

Phone: 888‑302‑3941

Email: [email protected]

Your total compensation …

… more than just a paycheck

Paycheck + benefits = total compensation

Log in to: Cedars‑Sinai.MyBenefitChoice.com to see your personalized report

showing the monetary value of your pay and benefits for:

•

Year‑to‑date (updated quarterly)

•

Previous years (2021, 2022)

Benefits can be worth up to 30% of your paycheck!

CS Staff v2e— 2023-2024 | Page

Can I be enrolled in two medical plans?

No double Cedars-Sinai coverage — If you and a family member both work

at

Cedars‑Sinai and you both enroll as employees, you cannot be enrolled

as a dependent at the same time. Children can be enrolled only under one

parent’s coverage. If anyone is double covered,

Cedars‑Sinai will cancel one

of the coverages.

Coordination of benefits — People often mistakenly think that with dual

coverage, the secondary plan will pay everything the primary plan does not

cover, but that’s not how it works.

If you are covered by more than one medical or dental plan (such as both

yours and your spouse/DP’s employer plan), usually the plans work together

so the total payment (from both plans) equals the total benefits from the

plan with the higher benefits.

The plan that covers you as an employee will be primary and the other plan

will pay only if it covers a higher benefit. For example, if your employer plan

covers 80% and the other plan covers 90%, your employer’s plan will pay

80% and the other plan will pay 10%. If both plans cover 80%, the other

Neither plan pays more than the allowed amount (maximum the insurer

pays). Rules are different for Medicare and some other situations. For details

about your plan, see your medical or dental Summary Plan Description

booklet posted on the Benefits Portal: About Our Benefits > Summary Plan

Descriptions.

How do I change my benefits if I have a

qualified life event?

Within 30 days of the life event, you may either:

•

Make the change online at

Cedars-Sinai.MyBenefitChoice.com:

–

Log in to the benefits enrollment site. Go to: > Make Changes > Create

Life Event.

–

Select the life event that matches your situation; you’ll be permitted to

–

You will be asked to upload documentation supporting the change (for

example a birth certificate, divorce decree or marriage certificate).

or

•

Contact the MBC HR Employee Benefits Help Desk

email [email protected] to report the change and have them enter

the change into the enrollment system for you.

Why can’t I change my benefits any time?

Because the IRS considers healthcare and flexible spending account benefits

tax‑free compensation, it sets the rules about when employees can enroll

and change benefits. Cedars‑Sinai must follow these rules so employees

can receive the tax breaks. Otherwise, the IRS could take away the plans’

tax‑free status and all employees would owe income tax, employment taxes

and penalties on the cost of healthcare benefits. We’re strict about following

these enrollment rules to protect your tax advantages.

Will my newborn baby be automatically

covered by the plan?

No! You have 30 days from the date of birth to enroll your child. You must

enroll your newborn, even if you’re covered by the medical plan. Note: If the

mother is enrolled in the medical plan, only childbirth is covered under the

medical plan.

See How do I change my benefits if I have a qualified life event? (above) for

enrollment instructions.

What if I don’t enroll my new child (or make

the qualified life event change) in 30 days?

Your next opportunity to enroll your child or make the election changes will

To avoid a lapse in coverage in the interim, you might be able to enroll

your child in a state marketplace health plan; these plans allow changes

coveredca.com or

healthcare.gov for more information.

For benefit plan summaries and

everything you need to know about

yourbenefits

Visit the Benefits Portal: Cedars‑Sinai.MyBenefitChoice.com

CS Staff v2e— 2023-2024 | Page

What happens if I don’t enroll?

HEALTHCARE, INSURANCE AND FLEXIBLE SPENDING

ACCOUNTS (FSAs)

If you are a newly hired or newly benefits‑eligible employee and you don’t

enroll for benefits:

You’ll automatically be enrolled for employee-only medical coverage based

on your home address:

Default medical plan

Vivity HMO service area

(generally L.A. and Orange counties)

Vivity HMO

In California, but not in the Vivity

HMO service area

Blue Cross HMO

Outside California

Blue Cross PPO

If you have other medical coverage and do not need it through

Cedars ‑Sinai,

you must log into the enrollment site and decline coverage.

You’ll automatically be provided with employer-paid:

•

Basic life insurance

•

Basic accidental death & dismemberment (AD&D) insurance

•

Basic long term disability (LTD) insurance

You won’t be covered under these Cedars-Sinai-sponsored benets:

•

Dental

•

Vision

•

Healthcare FSA

•

Child/Adult care FSA

•

Supplemental life insurance

•

Supplemental AD&D insurance

•

Supplemental LTD

•

Hospital indemnity insurance

•

Accident insurance

•

Critical illness insurance

•

Legal plan

•

Auto and home insurance

•

Pet insurance

RETIREMENT

•

You can enroll in the 403(b) Plan anytime. Unless you enroll you will not

participate.

•

You’ll automatically become a Choice Retirement Program participant the

first day of the calendar quarter after you have one year of service with at

least 1,000 paid hours. At that time you will be mailed a choice packet and

have the opportunity to select either the Defined Benefit Plan (DB Plan) or

the Defined Contribution Plan (DC Plan). If you do not choose a plan during

the enrollment period, you will be enrolled in the DC Plan by default.

When does healthcare, insurance and FSA

coverage start?*

•

Open enrollment for benefits is held every May. Your enrollment choices

•

New employee/newly benefits-eligible enrollment/rehired.

Usually, coverage starts on the first day of the month after your date of

•

Qualified life events or changing to a benefits-eligible status.

If you change your elections because of a qualified life event or new

job status, your new benefits usually start the first day of the month

after the life event. For example, if Jose gets married on Sept. 1, their

spouse’s coverage starts on Oct. 1.

•

Reinstatement. If you leave and then return to employment within

had before, starting on the first of the next month. For example, if Alex’s

last day was May 15 and they’re rehired June 14, the benefits Alex had

before would restart on July 1.

*EXCEPTIONS TO WHEN COVERAGE STARTS

Birth, adoption or placement of a child for adoption in your home:

In these situations, if you enroll your new child (and yourself and eligible

family members if not already covered) within 30 days of birth/placement,

medical, dental and vision coverage will be retroactive to the birth or

placement date; if you enroll in other benefits, coverage starts the first day

of the next month.

Life and disability insurance:

•

Insurers require employees to be actively at work (and family

members must not be disabled or hospitalized) for coverage to start.

If not actively at work when coverage is scheduled to start, basic and

supplemental life, basic and supplemental AD&D, hospital indemnity

insurance, accident insurance, critical illness insurance and basic LTD

insurance coverages will be delayed until you return to work. If not

actively at work when your supplemental LTD is scheduled to start,

the coverage will not become effective. If you want supplemental LTD,

you will need to enroll again during the next open enrollment. See

the insurance company booklets for more information, including how

actively at work is defined.

•

Pending supplemental life insurance evidence of insurability (EOI):

If you (or your spouse/DP) applied for new or additional supplemental

life insurance, you may need to complete an EOI form and receive

approval from our life insurance carrier, Voya Life. Voya Life will mail this

form to your home address at the end of your enrollment period. You’ll

application for this new or additional amount will be closed.

•

If you apply for supplemental life insurance for yourself or your

spouse/DP, amounts requiring insurer approval start the first day of the

month after receiving insurer approval and payment of premiums (or

July 1 for open enrollment changes).

•

During your first 12 months of coverage, LTD does not cover

conditions you’ve had for three months before your coverage started,

but it will cover new conditions. See the insurance company booklet for

more information.

Purchase an additional 10% of pay in supplemental LTD insurance.

If you don’t have a computer or have difficulty using the website, call the

MBC HR Employee Benefits Help Desk at

888‑302‑3941 and they can

CS Staff v2e— 2023-2024 | Page

When do I receive benefit ID cards?

Our healthcare insurers will mail you an ID card a few weeks after your

enrollment deadline, when you enroll as a new employee, or you enroll or

switch plans during open enrollment. (Otherwise, you should continue to use

your current card.)

•

Medical: Vivity HMO and pharmacy benefits: You’ll receive one card to use

for both medical and pharmacy, and vision (if you enroll).

•

Medical: Blue Cross HMO, Blue Cross PPO and pharmacy benefits:

You’ll receive two new cards:

–

Medical: from Anthem Blue Cross

–

Prescription drugs: from MedImpact

–

Vision: Blue View Vision (if you enroll)

For the Vivity and Blue Cross HMOs, review your benefit card to ensure

the correct medical group or Primary Care Physician (PCP) is listed; if not,

contact Anthem Blue Cross to change your PCP. To find out how, see

pages 13 and 14.

•

Dental: You’ll receive either a Delta Dental PPO or DeltaCare USA card.

If you enrolled in DeltaCare USA, you either selected or were assigned

a primary dentist. If you want to change the assigned dentist, search for

a DeltaCare USA primary dentist online at deltadentalins.com and call

DeltaCare USA at 800‑422‑4234 to make the change.

•

Healthcare FSA or HRA account: If you enroll in the healthcare FSA,

you’ll receive a benefits card from TRI‑AD. If you didn’t enroll, you’ll

receive a TRI‑AD benefits card upon earning a Wellness Matters

incentive contribution to your HRA account for the first time. (Both

accounts use the same card; see page29 for details.)

•

Vision: If enrolled in vision, you’ll be sent an Anthem ID card. If you’re

also enrolled in an Anthem medical plan, you’ll receive one card for both

medical and vision. Find a network provider at anthem.com/ca. When you

make an appointment with a network provider, tell them you’re covered

by Blue View Vision and give them your Anthem ID number, then bring

your card with you to your appointment.

Do I pay income taxes on my healthcare

benefits?

Usually, no. Although your employee benefits are part of your total

compensation from

Cedars‑Sinai, what Cedars‑Sinai pays for your

healthcare (medical and dental) benefits coverage is not treated as income

and isn’t taxed (except as noted below). Also, the amounts deducted from

your paycheck for your share of healthcare premiums are paid on a pretax

basis. You don’t usually owe income taxes on the part of your salary used to

If you cover your domestic partner (and their children who are not legally

your children) the premium you and

Cedars‑Sinai pay for your DP’s coverage

is considered taxable income, called “imputed income.” Imputed income is

added to your paycheck to determine your income taxes and Social Security

and Medicare taxes.

Cedars‑Sinai automatically withholds Social Security and Medicare taxes

on imputed income, but not federal or state income taxes. You may want to

increase your federal and state income tax withholding to cover the taxes

you will owe. If you have questions, please contact the MBC HR Employee

Benefits Help Desk at

888‑302‑3941 or: [email protected]

Do I need to take action during open

enrollment if I’m not making any changes?

YES! OPEN ENROLLMENT IS A PERFECT OPPORTUNITY TO:

Make sure Cedars-Sinai has your current address and phone

number. If they’ve changed, follow the instructions on page 54 to

update them.

Consider if your healthcare benet elections match your current

needs.

Open enrollment is your once‑a‑year opportunity to add, drop

or switch plans, or enroll or drop eligible family members from:

•

Medical

•

Dental

•

Vision

Reduce your out-of-pocket healthcare and/or dependent care

expenses by enrolling in the:

•

Healthcare FSA

•

Child/Adult care FSA

Note: Annual re-enrollment is required to continue FSAbenefits.

Adjust your supplemental life insurance to reflect your current life

and family situation by purchasing (or dropping):

•

Supplemental employee life insurance

•

Supplemental spouse life insurance

•

Supplemental child life insurance

New or increases in supplemental life insurance coverage require an

evidence of in

•

Supplemental AD&D insurance for yourself and your family

Update your life and AD&D insurance beneciaries if needed. Check

your coverages and beneficiaries and make benefit changes online:

Cedars-Sinai.MyBenefitChoice.com

NEW! Enroll for supplemental insurance to help pay for expenses not

covered by your medical plan, like deductibles or copays, lost wages,

child care, housecleaning or any of your regular household expenses.

You can purchase coverage for yourself only or for you and your

eligible spouse/DP and children:

•

Hospital indemnity insurance

•

Accident insurance

•

Critical illness insurance

Get help drafting a will or simply ensure peace of mind knowing you

have legal help by enrolling in the legal plan.

CS Staff v2e— 2023-2024 | Page

When you can enroll in or change benefits

Enrollment

Type

Enrollment

Period

Start

Coverage

Period

Open enrollment

Once-a-year

opportunity to

change benefits

•

Healthcare plans: medical/Rx, dental, vision

•

Supplemental insurance plans: life, accidental death &

dismemberment (AD&D) and/or supplemental long term

disability (LTD) insurance

•

Flexible spending accounts (FSAs):

healthcare and child/adult care

•

Legal plan

Friday, May 5–

2023

July 1, 2023

•

July 1–June 30

•

FSAs: yearly

re‑enrollment

required

New employee or

newly benets-

eligible enrollment

•

Healthcare plans

•

Insurance plans

•

FSAs

•

Legal plan

Within 30 days

after hire or

First day of the month

after date of hire (if you

enroll)

Through the next

June 30

Enroll anytime

•

•

Auto and home insurance

•

Pet insurance

Enroll anytime Varies by plan Stop anytime

Qualied

life events

Situations that allow

you to change some

of your healthcare,

insurance and FSA

benefits outside of the

enrollment periods

•

Childbirth, adoption or placement for adoption

•

New spouse or child

•

Family members becoming eligible

•

Child losing eligibility (turning 26)

•

Spouse/DP losing eligibility due to divorce, legal

separation, annulment or domestic partnership

termination

•

Death of spouse/DP or child

•

Gaining or involuntarily losing other group

•

Medicare enrollment

•

week and you are enrolling in another health plan with

minimum essential coverage

•

Enrolling in a state/federal marketplace plan during its

open enrollment or special enrollment period

•

Significant increase in healthcare premiums or decrease

in healthcare benefits

•

Marriage/domestic partnership

(meeting criteria on page 5)

•

Moving into or out of HMO service area

•

Going on or returning from an unpaid leave of absence

•

Judgment, decree or court order requiring coverage

Within 30 days after

the life event

First day of the month

after the event

For birth and adoption/

placement, coverage is

retroactive to date of

birth or placement

Through the next

June 30

•

Gaining or losing Medicaid or state Children’s Health

Insurance Plans (CHIP) premium assistance

Within 60 days after

the event

Choice

Retirement

Program

• You choose to participate in either the

The quarter after one

year and 1,000 paid

hours at Cedars‑Sinai

and eligible status

Retroactive to the

quarter after one year

and 1,000 paid hours at

Cedars‑Sinai

Until leaving

Cedars‑Sinai or

changing to

ineligible status

Action required!

Coverage is not automatic.

To be covered you must take action

and enroll yourself and/or your eligible

family members within 30 days of

becoming eligible or experiencing a

qualified life event.

CS Staff v2e— 2023-2024 | Page

•

You can see any licensed provider for covered medical services.

•

You and the plan share costs. The graphic below shows what you pay out

of pocket (in addition to your monthly premiums), and what the plan pays.

•

BlueCard (outside California) network doctors and providers.

* For out-of-network services, you pay the coinsurance and the difference between the

provider’s usual charges and the maximum allowed amount.

Healthcare Benefits

Cedars‑Sinai is committed to the health and wellbeing of our patients and employees. Our benefits are designed to help you meet your goals

for a healthy lifestyle, provide superior medical care for you and your family and protect you from catastrophic medical expenses.

Preventive care:

Plan pays 100%

Certain preventive care services are covered 100% without

paying the deductible first.

Calendar-year deductible:

You pay 100%

Each calendar year you must pay the annual deductible

before the plan starts covering your medical bills.

You may use your HRA account or healthcare FSA to help

pay your deductible.

Coinsurance:

You and the plan pay

•

In‑network: you pay 25% and the plan pays 75%

•

Out‑of‑network: you pay 60% and the plan pays 40%*

Once the deductible is paid, the plan usually pays a

percentage of the charges for medical services and you pay

the remainder. The plan pays a higher percentage if you use

a doctor or healthcare provider in the PPO network.

You may use the funds in your HRA account or healthcare

FSA to help pay your coinsurance.

Reach out-of-pocket maximum:

Plan pays 100%

If you meet the out-of-pocket maximum for the calendar

year, the plan pays 100% of your covered medical expenses

for the rest of that calendar year.

Deductibles run on a calendar year

When calculating your deductible and out-of-pocket maximum

under the healthcare plans, it’s important to understand that these

limits run on the calendar year. This means the deductible and

out‑of‑pocket maximum will reset back to zero every Jan. 1.

This is different from our benefit year, which is aligned with the

fiscal year (July 1–June 30).

For example, if you were newly hired and enrolled for employee‑

only coverage in the PPO Plan effective Aug. 1, 2023, your

deductible of $750 would apply to the rest of the calendar year

(Aug. 1–Dec. 31).

It would reset and start again on Jan. 1, 2024 and run through

Dec. 31, 2024.

MEDICAL BENEFITS

Our medical plans offer two ways to get coverage: an HMO or PPO.

Both offer comprehensive medical coverage. So what’s the difference?

A Health Maintenance Organization (HMO) is designed to:

•

Keep your out‑of‑pocket costs low and predictable.

•

Keep you healthy by having your Primary Care Physician (PCP)

coordinate your care. Your PCP focuses on your whole health. This

includes preventive care, guiding you through the healthcare system

when you need a specialist or hospital care and working with you to

make decisions about your health.

•

Find out more about HMOs on the next page.

A Preferred Provider Organization (PPO) is designed to:

•

Offer greater flexibility when it comes to choosing doctors and

other healthcare providers; however, you will usually pay more

out of pocket.

•

You’re not required to have a PCP (like the HMOs); however, it’s a

good idea to have a primary care doctor for regular check‑ups and

to help you manage your care.

CS Staff v2e— 2023-2024 | Page

•

For most office visits and medical services, your only charge is a small fee

(a copay), usually paid at the time of the appointment.

•

Everyone in an HMO must have a Primary Care Physician (PCP).

•

Your PCP provides general medical care such as annual check‑ups and

authorizes referrals to other doctors, specialists and facilities for services

your PCP does not provide.

HMOs: PCP SELECTION IS KEY

Upon enrolling in an HMO, you’ll choose a PCP; you may select any PCP

in the HMO network who is taking new patients; for children, you can

PCP selection determines which specialists, services, facilities and hospital

you may use. Every PCP is part of a group practice that is either:

•

A medical group staffed by a team of doctors, nurses and other healthcare

providers. Usually you can see other PCPs in the medical group without

a referral. (This can be helpful in urgent care situations when your doctor

has no openings.)

or

•

An independent practice association (IPA), which is a group of doctors

you can see only your PCP; you’ll need a referral to see other doctors in

the IPA.

Your PCP will refer you only to specialists and facilities who contract with

your PCP’s group practice.

REFERRALS FROM YOUR PCP REQUIRED

If you need services your PCP doesn’t provide, your PCP authorizes referrals

to the appropriate healthcare provider (for instance, imaging centers, labs,

hospitals or specialists).

If you get care without a referral from your PCP (or your PCP’s medical

group) you will likely have to pay for those expenses yourself. However, you

•

To get mental health or substance abuse services from another

provider

within your HMO’s network

•

For OB‑GYN specialist care within your medical group (the

OB‑GYN may be required to comply with certain procedures,

including obtaining prior authorization for certain services, following a

pre‑approved treatment plan or procedures for making referrals)

DIRECT ACCESS

Under the Vivity HMO and Blue Cross HMO, many medical groups allow you

to see dermatologists, ear, nose and throat doctors, OB‑GYNs and allergists

Vivity HMO referrals

Multisystem Super Medical Group

With Vivity’s Physician Directed Access, you may be able to see a

specialist at another Vivity health system.

•

Cedars-Sinai

•

Cedars-Sinai Marina del Rey

Hospital

•

Cedars-Sinai Valley Network

•

Huntington Hospital

•

MemorialCare

•

PIH Health

•

PIH Health Good Samaritan

Hospital

•

Providence

•

Torrance Memorial

•

UCLA Health

Care is best maintained when you see physicians in your own

medical group. However, cross‑system referrals are permitted

for second opinions or when another health system has a special

expertise. To see a Vivity specialist who is outside of your medical

group, first discuss it with your PCP and then request the referral.

Must everyone in my family have the same

PCP?

No. Each family member may have a different PCP. For instance, you can

select a

Cedars‑Sinai Medical Group™ (CSMG) or Cedars‑Sinai Health

Associates™ (CSHA) PCP for yourself and a PCP/medical group that is close

to home for your family.

How do I find a PCP?

Use the Find a Doctor search tool at anthem.com/ca. (Both the Blue Cross

HMO and Vivity HMO are Anthem medical plans.)

When selecting criteria in the Find a Doctor search tool, you’ll be asked to

select a plan/network. Choose either:

•

Blue Cross HMO (Cal Care)—Large Group

or

•

Vivity plan

Be sure to check the box that says “Able to Serve as Primary Care Physician”

when selecting the criteria for your search.

When you find a doctor you want to be your PCP, click on the name to see

that doctor’s group practice and hospital affiliation(s). Remember, if you

need medical services your PCP does not provide, your PCP will refer you to

doctors and specialists in that same medical group or facilities that contract

with that medical group. You will receive hospital services only from the

To receive Cedars-Sinai hospital services, you must select a PCP with

CSMG or CSHA.

If you want help selecting a CSMG or CSHA PCP, or for questions about

doctors and medical services, call Cedars‑Sinai Medical Network™ Patient

Services at 800‑700‑6424. (Tell the rep you’re a Cedars‑Sinai employee.)

CS Staff v2e— 2023-2024 | Page

Can any type of doctor be my Primary

Care Physician?

Your PCP must be an internist, family practitioner or pediatrician

who practices as a PCP. Specialists such as cardiologists, orthopedic

What if I don’t select a PCP when I

enroll?

If you do not select a PCP when you first enroll, Anthem will assign

you to a PCP close to your home. You may change your PCP through

Anthem. See below for details.

Can I change my PCP?

You may change your PCP anytime, as long as you are not in

the course of treatment with your current PCP or medical group.

Changes will take effect on the first of the following month if

requested by the 15th. Otherwise the effective date will be the first

of the month after.

When you find the PCP you want at anthem.com/ca:

•

Write down the numbers for the following fields (you’ll need

them to select or change your PCP):

–

PCP ID/Enrollment ID (paper/online)

–

PCP ID/Enrollment ID (phone)

•

Doctors may be affiliated with more than one HMO network. Be

sure the PCP numbers are for the medical group/IPA you want.

Contact your medical plan to change your PCP:

Blue Cross HMO

•

Phone: 800‑227‑3641

•

Web: anthem.com/ca

Vivity HMO

•

Phone: 844‑659‑6878

•

Web: anthem.com/ca

If an HMO has a service area, am I covered when I

am out of the service area?

You are covered for emergency care when you are out of the service area.

If you or a family member will be living outside of California for 90 days or longer,

you may be able to get a guest membership in the Blue Cross Blue Shield plan in

your temporary home area. Guest membership is offered by all our medical plans,

but covers only those living outside California.

The guest membership program offers comprehensive care at the best price

available

and is ideal for out‑of‑state college students or a spouse on an extended

out‑of‑state work assignment. However, it’s not available everywhere. To inquire,

call Anthem’s guest membership coordinator at 800‑827‑6422.

About 90 days before you want your guest membership to start, call Anthem’s

guest membership coordinator at 800‑827‑6422. (This isn’t a deadline. If you call

later, your guest membership may not start until a month or so later.)

What’s the difference between the Vivity and

BlueCrossHMOs?

The plans also have some important differences, shown in this table. For more

details, see the next page.

Comparing the HMOs

Vivity HMO Blue Cross HMO

Employee premiums Lower Higher

Medical network Vivity CalCare

Service area L.A. and Orange

counties

California

Pharmacy network

and formulary

CarelonRx MedImpact and

Walgreens (retail)

Out-of-pocket

maximum

+

Medical

Rx combined

+

Medical

Rx

$1,500

$6,100

$4,500

$11,700

= Total $1,500/1 person

$2,500/2 persons

$3,500/3 or more

= Total $7,600/

1 person

$16,200/

2 or more

Both the Vivity and Blue Cross HMOs offer care from Cedars-Sinai,

as long as you select a PCP from either:

•

Cedars‑Sinai Medical Group (CSMG)

•

Questions about what’s covered?

Visit the website (all plans): anthem.com/ca

Call customer service phone number | group number:

•

Vivity HMO 844‑659‑6878 | 57ANCA

•

Blue Cross HMO 800‑227‑3641 | 57ADZG

•

Blue Cross PPO 877‑800‑7339 | 1858RE (in CA)

(BlueCard) 1858RL (outside CA)

NEW! HINGE HEALTH

FOR JOINT AND MUSCLE PAIN

Hinge Health is a virtual exercise and therapy program to

help you overcome back and joint pain (knee, hip, neck,

shoulder, etc.) without surgery. Hinge Health offers:

•

Exercise therapy tailored to your condition

•

Wearable sensors for instant feedback in the app

•

A personal coach and physical therapist, as needed

•

Convenience: you can do it from the comfort of home, on

your schedule

It’s $0 cost to you and your family members (age 18+)

enrolled in a Cedars-Sinai medical plan.

To sign up or learn more:

•

Web: hingehealth.com/for/cedarssinai

•

Phone: 855-902-2777

•

Email: [email protected]

Enrollment starts July 1, 2023, and space is limited. Join the

waitlist at: hingehealth.com/for/cedarssinai

CS Staff v2e— 2023-2024 | Page

Below is a high‑level summary of how much you pay for each plan’s benefits and

coverage. For details, see each plan’s Summary of Benefits and Coverage or the Summary

Plan Description. You can find these documents, and the Uniform Glossary (of health

insurance terms), posted on the Benefits Portal at:

Cedars-Sinai.MyBenefitChoice.com

[email protected] or call 888‑302‑3941.

Plan Vivity HMO

Type of plan Health Maintenance

Organization

Health Maintenance Organization Preferred Provider Organization

Where available California only Anywhere in the U.S. and its territories

PCP or referrals

required?

Yes Yes No

You pay... In-Network Cedars-Sinai In-Network In-Network Out-of-Network

Covered providers and

networks

Vivity HMO Network CSMG or CSHA

PCP

Any Other

CaliforniaCare HMO

Network PCP

Prudent Buyer

(In California)

BlueCard (Outside

California)

Any Licensed

Provider

Access to

Cedars-Sinai care?

CSMG or CSHA PCP: Yes

Other PCPs:

No Cedars‑Sinai access

Yes No Check with your

provider

Check with your

provider

Deductible

Per calendar year

$0 $0 $750/1 person

$1,500/2 or more

1

$750/1 person

$2,250/3 or more

$1,500/1 person

$3,750/3 or more

Out-of-pocket

maximum

Per calendar year

$1,500/1 person

$2,500/2 persons

$3,500/3 or more

(medical and Rx combined)

$1,500/1 person

$4,500/2 or more

(medical only)

$1,500/1 person

$4,500/2 or more

(medical only)

$3,000/1 person

$9,000/3 or more

(medical only)

$5,000/1 person

$15,000/3 or more

(medical only)

Covered Services

You pay...

All PCPs

Copay

CSMG or CSHA PCP

Copay

Other PCPs

Copay

In-Network

Coinsurance

Out-of-Network

Coinsurance

3

Ofce visit

MD/professional

PCP: $20/visit

2

Specialist: $35/visit

2

PCP: $20/visit

2

Specialist: $35/visit

2

PCP: $30/visit

Specialist: $45/visit

25%

2

60%

Preventive care $0 $0 $0 $0 60%

Urgent care center $20/visit

2

$20/visit

2

$30/visit 25%

2

60%

Emergency department

Copay waived only if

admitted

CS and MDRH: $150/visit

Anywhere else: $250/visit

CS and MDRH:

$150/visit

Anywhere else:

$250/visit

CS and MDRH:

$150/visit

Other in‑network:

$250/visit + 25%

(after deductible)

$250/visit

+ 25%

(after deductible)

Diagnostic test

X-ray, blood work

$0 $10/test

2

$10

/

test

25%

2

60%

Advanced imaging

CT/PET scan, MRI

$100/test

4

$100/test

4

$100 /test

25%

4

60%

Outpatient surgery $100/procedure

4

$100/procedure

4

$100/procedure

25%

4

60% up to $5,000;

then you pay 100%

(after deductible)

Hospital

Facility

$200/day

($600/admit max)

4

$100/day

($300/admit max)

4

$200/day

($

600/admit max)

$375/admit

+ 25%

4

(after deductible)

$375/admit

+ 60%

(after deductible)

Hospital visit

MD/professional

$0 $0 $0 25%

(after deductible)

60%

(after deductible)

1. Deductible applies to hospital and outpatient facility services (no deductible for preventive, X-ray or lab services).

2. Some Cedars-Sinai and Cedars-Sinai Marina del Rey Hospital billed charges waived, including deductibles. Provider charges may or may not apply.

Questions about fees and waived charges must be submitted directly to your provider.

3. For out-of-network services, you pay the coinsurance and the difference between the provider’s usual charges and the maximum allowed amount.

4. Hospital copay waived at Cedars-Sinai, Cedars-Sinai Marina del Rey Hospital, Torrance Memorial and Huntington Hospital.

The following acronyms are used in the table below:

CSMG:

Cedars‑Sinai Medical Group

CSHA:

Cedars‑Sinai Health Associates

MDRH:

Cedars‑Sinai Marina del Rey Hospital

PCP: Primary Care Physician

For medical benefit purposes, your pay rate is your hourly rate of pay in the Cedars‑Sinai payroll system on April 1 each year, excluding shift differentials. For 12‑hour shift employees, your

rate is your eight‑hour equivalent rate of pay. If you are full‑time salaried, it’s your annual salary divided by 2,080 (hours). Your hourly pay rate or eight‑hour equivalent rate is shown on your

Personalized Current Benefit Summary or Personalized Benefit Enrollment Checklist. Your pay rate in effect on April 1 each year (or hire date, if later) determines your monthly premium amount

for the next benefit year starting July 1. Your monthly premium amount will not change during the year because of any increase or decrease in your payrate.

20232024

Employee

Employee and

Spouse/Domestic Partner

Employee and Children Employee and Family

You Pay

Cedars-Sinai

Pays

You Pay Cedars-Sinai

Pays

You Pay Cedars-Sinai

Pays

You Pay Cedars-Sinai

Pays

Pay rate under $25.00

Vivity HMO $7.00 $540.83 $42.00 $1,163.24 $29.00 $957.12 $82.00 $1,616.25

Blue Cross HMO $44.00 $606.84 $134.00 $1,297.83 $111.00 $1,060.52 $189.00 $1,828.61

Blue Cross PPO $145.00 $795.79 $478.00 $1,591.79 $401.00 $1,292.45 $700.00 $2,216.51

Pay rate $25.00–$44.99

Vivity HMO $28.00 $519.83 $66.00 $1,139.24 $53.00 $933.12 $114.00 $1,584.25

Blue Cross HMO $56.00 $594.84 $166.00 $1,265.83 $135.00 $1,036.52 $234.00 $1,783.61

Blue Cross PPO $163.00 $777.79 $500.00 $1,569.79 $424.00 $1,269.45 $728.00 $2,188.51

Pay rate $45.00–$59.99

Vivity HMO $56.00 $491.83 $110.00 $1,095.24 $93.00 $893.12 $161.00 $1,537.25

Blue Cross HMO $74.00 $576.84 $216.00 $1,215.83 $177.00 $994.52 $304.00 $1,713.61

Blue Cross PPO $191.00 $749.79 $543.00 $1,526.79 $460.00 $1,233.45 $778.00 $2,138.51

Pay rate $60.00–$74.99

Vivity HMO $95.00 $452.83 $162.00 $1,043.24 $144.00 $842.12 $264.00 $1,434.25

Blue Cross HMO $105.00 $545.84 $285.00 $1,146.83 $234.00 $937.52 $402.00 $1,615.61

Blue Cross PPO $229.00 $711.79 $589.00 $1,480.79 $507.00 $1,186.45 $842.00 $2,074.51

Pay rate $75.00–$89.99

Vivity HMO $99.00 $448.83 $169.00 $1,036.24 $149.00 $837.12 $274.00 $1,424.25

Blue Cross HMO $109.00 $541.84 $296.00 $1,135.83 $244.00 $927.52 $418.00 $1,599.61

Blue Cross PPO $238.00

$702.79 $612.00 $1,457.79 $527.00 $1,166.45 $875.00 $2,041.51

Pay rate $90.00–$149.99

Vivity HMO $100.00 $447.83 $172.00 $1,033.24 $152.00 $834.12 $279.00 $1,419.25

Blue Cross HMO $111.00 $539.84 $301.00 $1,130.83 $248.00 $923.52 $426.00 $1,591.61

Blue Cross PPO $243.00 $697.79 $624.00 $1,445.79 $537.00 $1,156.45 $891.00 $2,025.51

Pay rate $150.00 or more

Vivity HMO $112.00 $435.83 $191.00 $1,014.24 $169.00 $817.12 $310.00 $1,388.25

Blue Cross HMO $124.00 $526.84 $335.00 $1,096.83 $276.00 $895.52 $473.00 $1,544.61

Blue Cross PPO $270.00 $670.79 $693.00 $1,376.79 $597.00 $1,096.45 $990.00 $1,926.51

CS Staff v2e— 2023-2024 | Page

Cedars‑Sinai is keenly aware of the cost pressures in medicine—for hospitals,

clinics, doctors and for patients. Rising premiums can place a burden

on household budgets, especially for those who can least afford it. As a

healthcare organization, it’s important to us that medical coverage remains

accessible to all of our employees.

The cost of medical benefits is shared between you and Cedars‑Sinai; your

share is based on your pay rate, the plan you enroll in and which family

members you cover. The monthly amount under You Pay is divided in half and

taken from 24 of your 26 annual paychecks starting with your first paycheck

2024).

CS Staff v2e— 2023-2024 | Page

EMPLOYEE HEALTHCARE OPTIONS: KNOW BEFORE YOU GO GUIDE

As an employee of Cedars-Sinai, you have many options to receive healthcare. Get familiar with these options to

receive care in the right place.

Type of

care

For job‑related illness or injury, or when you think you

may be infectious to others.

When to

use

•

New hire/volunteer and annual screenings and

vaccinations

•

Medical evaluations of work‑related injuries and

subsequent follow‑up visits

•

Medical evaluations of any condition that may be

infectious

•

Fitness for duty evaluations

Copay None

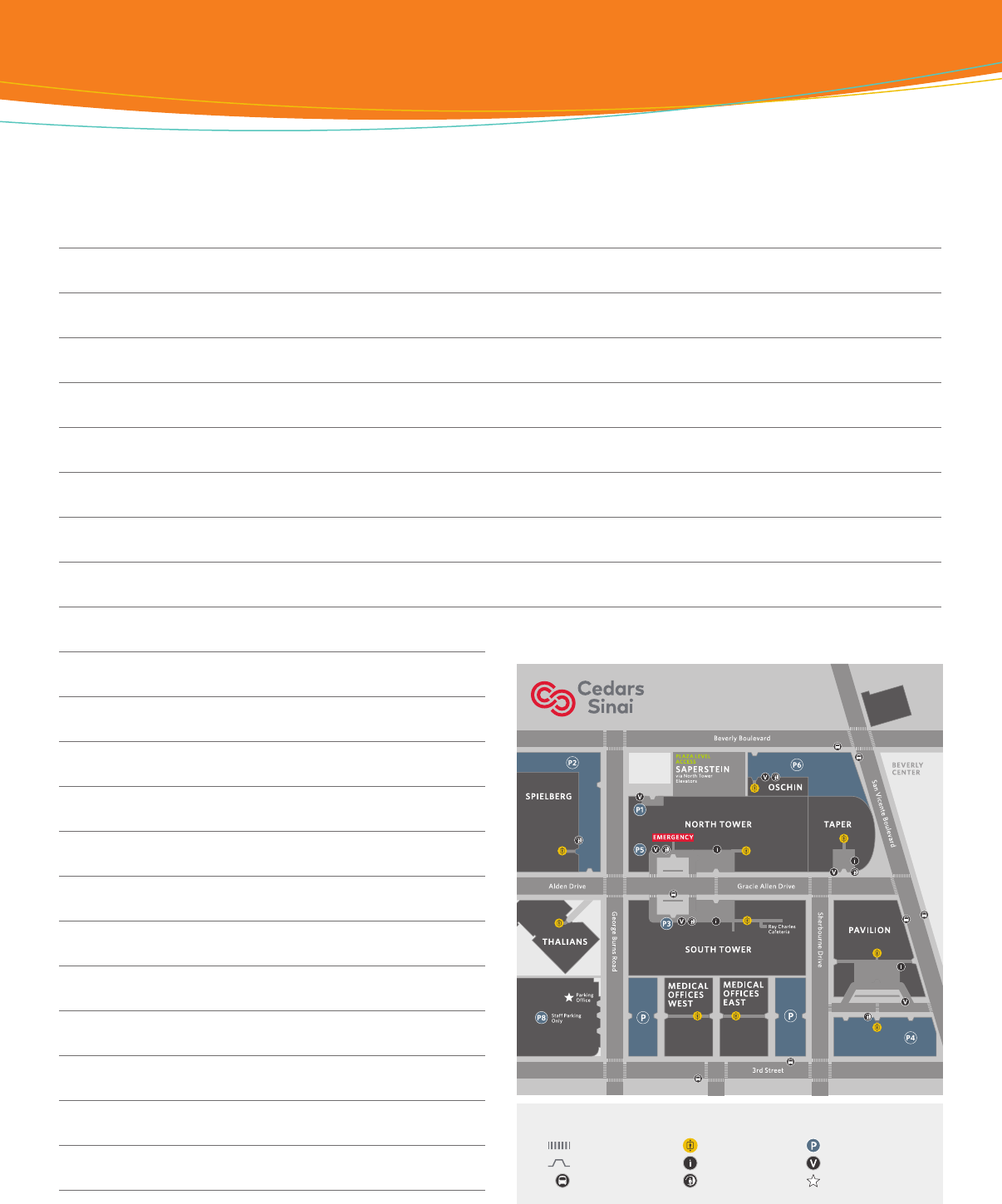

Contact Employee Health Services

Steven Spielberg Building

8723 Alden Drive, SSB‑200

Los Angeles, CA 90048

310‑423‑3322

Monday–Friday, 7 a.m.–5 p.m.

Type of

care

Your partner in managing your health 24/7. Online, by

phone or in person, they will provide the care you need or

help you get it.

When to use

•

Preventive care and wellness

•

First line of support for illness or injury

•

Disease management

•

Access to specialized care

Copay

Vivity HMO

and

Blue Cross HMO

•

PCP with

Cedars‑Sinai Medical Group™ (CSMG)

–

Will be waived

•

PCP with

Cedars‑Sinai Health Associates™ (CSHA)

–

$20/visit (may be waived)

•

PCP with other medical group

–

Vivity HMO: $20/visit

–

Blue Cross HMO: $30/visit

Coinsurance

Blue Cross PPO

•

PPO (you pay)

–

25% after deductible in‑network (waived at CSMG)

–

60% after deductible out‑of‑network

Contact For assistance with selecting the right PCP for you, call

800‑700‑6424.

Your PCP or pediatrician’s name and phone number are on

your medical ID card. We recommend entering this vital

information into your contacts for easy reference.

If you are experiencing COVID‑19 or flu‑like symptoms, please stay home

and seek care via Video Visit Now or your nearest Cedars‑Sinai urgent care

location. Contact Employee Health Services for advice on testing and return

to work.

MyCS-Link: Securely connect to your

Cedars-Sinai personal health information

You can access your Employee Health Services information:

Complete your annual clearance questionnaire on MyCS-Link before

visiting with the Employee Health Services nurse.

If you are a Cedars-Sinai patient, MyCS-Link allows you to:

•

Communicate with your physician

•

Request appointments

•

Access test results

•

Request prescription renewals

•

View information on your care

To activate your MyCS-Link account go to:

•

Cedars-Sinai.org/MyCSlink

•

Select “New User Signup.”

•

Enter your access code as it appears on your enrollment letter or

email; if you don’t have one, you may request one online.

•

Create your ID, password and password hint.

Get the MyCS-Link App!

After you have activated your MyCS-Link account from the website,

download the app from your mobile provider’s store (search

“Cedars-Sinai”).

Interpreter services available 24/7

All Cedars‑Sinai services (primary care physician (PCP) appointments,

Video Visit Now, urgent care) are available in different languages

through Interpreter Services. Interpreter Services is available 24/7

via video call, phone or on‑site visit. Requests can be made through

CS-Link or by calling 310‑423‑5353 or by fax at 310‑423‑0498.

CS Staff v2e— 2023-2024 | Page

Urgent Care

Type of

care

To get immediate medical care for a condition that is not

life‑threatening.

When to

use

•

Abdominal pain

•

Cold or flu

•

COVID‑19 testing

•

Cuts/lacerations with

contained bleeding

•

Dehydration

•

Diarrhea

•

Ear infections

•

Fever or chills

•

Muscle pain

•

Nausea and vomiting

•

Red eye

•

Respiratory infections

•

Sore throat or cough

•

Sprains

•

Uncomplicated OB‑GYN

complaints

•

Urinary tract infections

Copay

Cedars‑Sinai Urgent Care

•

Copay waived

Other in‑network urgent care facilities

•

Vivity HMO: $20/visit

•

Blue Cross HMO: $30/visit

•

Blue Cross PPO (you pay)

–

25% after deductible in‑network

–

60% after deductible out‑of‑network

Contact Cedars‑Sinai Urgent Care Locations

Beverly Hills

8767 Wilshire Blvd., 2nd Floor

Beverly Hills, CA 90211

310‑248‑7000

Culver City

10100 Culver Blvd., Suite E

Culver City, CA 90232

310‑423‑3333

Los Feliz

1922 Hillhurst Avenue, Second Floor

Los Angeles, CA 90027

424‑314‑5200

Playa Vista

2746 West Jefferson Blvd., 2nd Floor

Playa Vista, CA 90094

424‑315‑2240

As hours may change from time to time, visit

cedars-sinai.org/urgentcare for current information.

Anthem LiveHealth Online

Type of

care

•

To see an Anthem physician by video using your

computer or mobile device; available 24/7

•

For benefits‑eligible employees enrolled in a

Cedars‑Sinai medical plan.

When to

use

•

Any illness or injury (non‑life‑threatening)

•

Sick kids after hours

•

While traveling

•