Property

Market Conditions

Discussion Topics

3

EPIC INSURANCE BROKERS & CONSULTANTS

• Property Insurance Market Overview

• U.S. and Global Insured Catastrophe Losses

• Treaty and Retro Market Impact

• Soft Market to Hard Market Insurance Cycle

• The Florida Factor

• The Impact of Inflation

• What to Watch For

• What’s Next?

U.S. Inflation-Adjusted Catastrophe Losses

4

EPIC INSURANCE BROKERS & CONSULTANTS

The 2020s are off to an

ominous start with $76B in

average annual insured

losses

Average Insured Loss per Year

1980-2021: $23.8 Billion

2012-2021: $44.1 Billion

44

40

85

112

57

28

70

1980s:$5 B

1990s: $16 B

2000s: $27 B

2010s: $37 B

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

$110

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 18 20

Billions, 2020 $

Average for Decade

Hurricane Andrew

WTC

Katrina, Rita, Wilma

*2022 total is estimated figure through Q3

Harvey, Irma, Maria

85

Ida ($36B)

TX Freeze ($15B)

21

22*

70

Ian

($50B)

Source: Insurance Information Institute

Global Insured Catastrophe Losses

5

EPIC INSURANCE BROKERS & CONSULTANTS

Structural changes, catastrophic losses and a capital shortfall for reinsurers set the stage for precipitous increases in

insurance costs in 2023 and beyond.

• $12.5bn - $15bn shortage in reinsurance capacity

• Reinsurance companies cannot buy enough retro

(retrocessional reinsurance) which limits their

capacity to the retail market.

• Poor returns

• Reinsurers blaming poor building valuations and

unmodeled losses

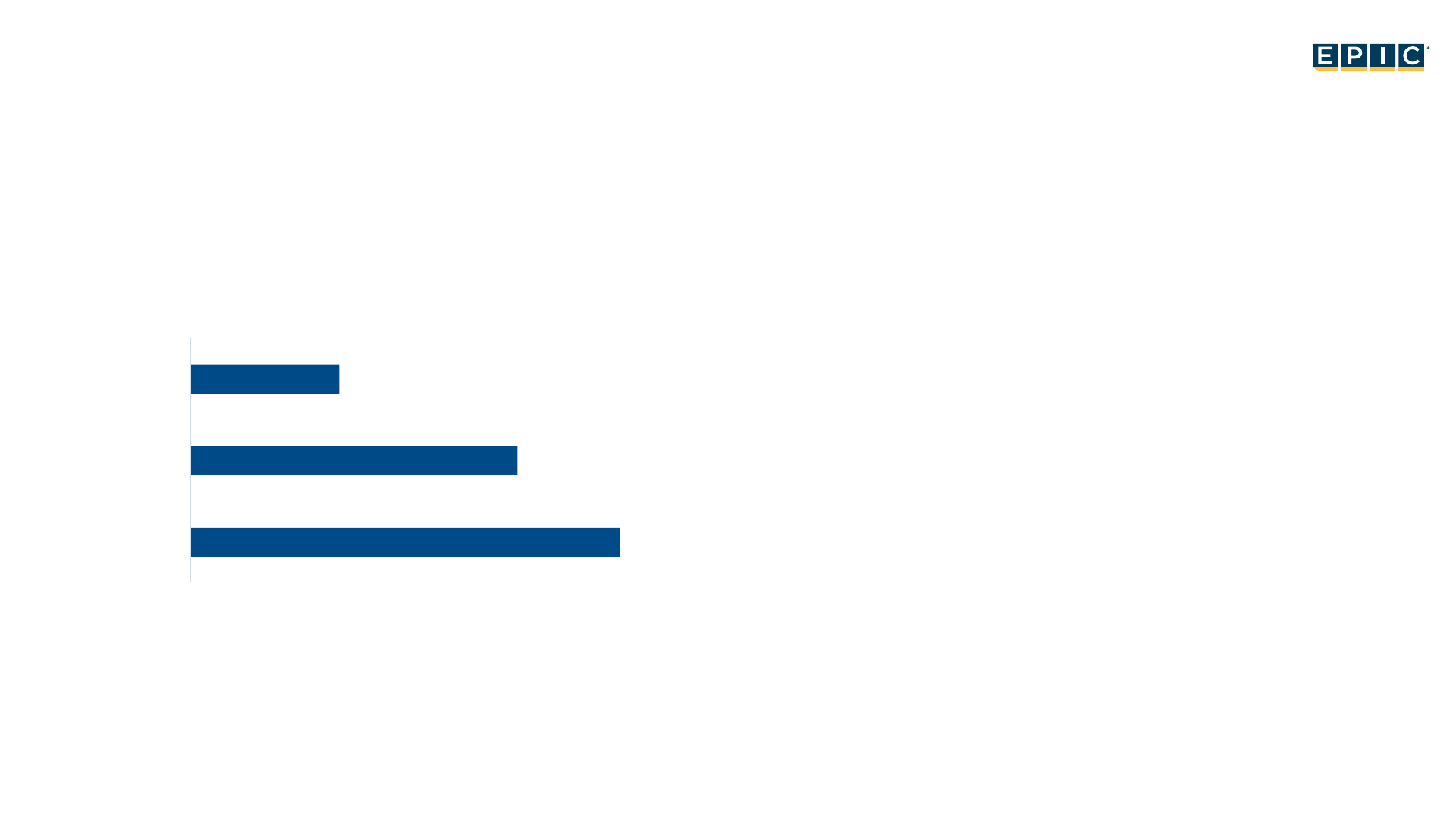

Global Insured Catastrophe Losses

$130BN

$99BN

$45BN

$0BN $50BN $100BN $150BN

2022

2017-2021

2012-2016

Average Annual Losses

Source: Swiss Re

Treaty and Retro Market Impact

6

EPIC INSURANCE BROKERS & CONSULTANTS

Retro Market

(Capital

Markets)

Treaty

Reinsurers

Direct Insurers

Reinsurance retentions roughly

doubled and pricing up 30% – 40%

at 1/1/23. Client values need to be

raised and increased cost passed

on

Returns for the Insurance Linked

Securities (ILS) market have

been poor, while risk free

interest rates are up

Reinsurers have paid numerous

losses and are pressuring

Insurers to get accurate

building valuations from

insureds

Structural changes, catastrophic losses and a capital shortfall for reinsurers set the stage for precipitous increases in

insurance costs in 2023 and beyond.

Soft Market to Hard Market Insurance Cycle

7

EPIC INSURANCE BROKERS & CONSULTANTS

Insurance is Cyclical

Cycles usually span a number of years.

We are currently in what is known as a ‘Hard Market’

A Hard Market is when there’s

high demand for insurance

coverage and a low appetite to

insure. During a hard market,

rates are high and coverage

is difficult to find.

A Soft Market is when insurance is

readily available. Rates are

stable or falling because of

healthy competition in the

market.

Capital

Flows into

Market

Rates Start

to Fall

Insurers Chase

Market Share

Rates go

into Freefall

Market

capacity

eroded

Strong Profits

Seller’s

Markets

Risk

Selection

Rejects Some

Activities and

Industries

Insurer

Realization of

Losses

More Large

Events and Poor

Investment

Returns

Rates Start

to Rise

Currently within

this range of the

cycle

The Florida Factor

8

EPIC INSURANCE BROKERS & CONSULTANTS

• Florida is perennially the most challenging catastrophe risk zone in the world

• Hurricane Ian (estimated $50B insured loss) was final major event to push the

market into true hard market territory

• Insurers are reducing their capacity and raising rates more significantly in

Florida

• Some insurers have exited writing any Florida business

• Property catastrophe treaty reinsurance pricing increased dramatically at

January 1

• Relief for Florida insurance/reinsurance buyers is unlikely to be immediate

• Impact of legislative reforms will not emerge before mid-year and capacity

providers remain cautious

The Impact of Inflation

9

EPIC INSURANCE BROKERS & CONSULTANTS

• Inflation has reached multi-decade highs, with the cost of labor, construction

materials and transportation rising sharply in recent years

• Insurers hyper-focused on accurate replacement cost valuations given

recent inflationary trends

• A building constructed for $1M five years ago would cost roughly $1.47M to

build today

1.00

1.07

1.08

1.10

1.35

1.47

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1/1/2018 1/1/2019 1/1/2020 1/1/2021 1/1/2022 1/1/2023

Source: FM Global

What to Watch For

10

EPIC INSURANCE BROKERS & CONSULTANTS

• Extreme discipline in capacity deployment by insurers

• Dramatic rate and premium increases

• Wind coverage sub-limits

• Higher Wind deductibles

• 5% now the minimum standard across entire state

• 10%+ deductibles are possible

• Shared Limits

• More programs with multiple insureds sharing a loss limit

• Use of alternative risk transfer

• Catastrophe bonds

• Parametric insurance

• Industry Loss Warranties

What to Watch For

11

EPIC INSURANCE BROKERS & CONSULTANTS

• Valuation restrictions – insurers now expect insureds to report

accurate replacement cost values

• If not, insurers will likely quote with restrictive terms including

• Coinsurance

• Occurrence Limit of Liability Endorsement (OLLE)

• Margin Clause

• Blanket limits are not a given

What’s Next?

12

EPIC INSURANCE BROKERS & CONSULTANTS

• It could very well get worse before it gets better

• June 1 and July 1 reinsurance treaties – mainly for U.S. carriers

• Inflation persists, however the rate of inflation has slowed

• Hopefully Florida insurance legislation attracts more insurance capital

to Florida

• Frequency and severity of “Secondary” catastrophe perils (tornadoes,

hail storms, winter storms) could determine when the market will turn

• 2023 hurricane season

• Do not expect El Niño to save the day

• Sea surface temperatures continue to be elevated

FLC Insurance Summit

• May 18, 2023

© 2023 WTW. All rights reserved.

wtwco.com

14

© 2023 WTW. Proprietary and confidential. For WTW and WTW client use only.

Employer confidence in sponsoring healthcare benefits

over the next ten years is at its highest point in two

decades

Sample: Companies with at least 1,000 employees.

Note: High Confidence represents responses of “Very confident”. Years 2003-2016 are based on prior years of the TW Survey.

Source: 2022 Emerging Trends in Healthcare Survey, United States

wtwco.com

Sharp increases in inflation and market forces driving

projected rise in healthcare costs

15

© 2023 WTW. Proprietary and confidential. For WTW and WTW client use only.

Note: Percentages of healthcare trend are median numbers

Sample: Companies with at least 1,000 employees.

Sources: WTW 2022 Best Practices in Healthcare Survey; Bureau of Labor Statistics, CPI-U, CES.

wtwco.com

16

Healthcare costs are rising…

© 2023 WTW. Proprietary and confidential. For WTW and WTW client use only.

Source: Levin-Scherz, J., 8 reasons why health care cost inflation is likely to escalate, The Hill, April 2, 2022. Bureau of Labor Statistics.

1

Higher overall inflation and increased labor costs

6

Aftermath of the pandemic

5

Missed preventive and non-emergency care

4

Worsening mental health

3

Escalating drug costs

2

Provider consolidation

Unit Cost Utilization

●

●

●

●

●

●

●

●

Drivers:

…and will further exacerbate

the financial stress that

low-wage earners are

experiencing

-5% 5% 15% 25% 35% 45%

Housing

Transportation

Groceries

Healthcare

Retirement

Lowest earning 20 percent Highest earning 20 percent

Share of annual expenditures

(select categories), 2020

wtwco.com

17

© 2023 WTW. Proprietary and confidential. For WTW and WTW client use only.

Employers struggle with rising costs and affordability

challenges while trying to increase investment in mental

health

What are your organization’s top health and wellbeing priorities over the next three years? (Select at most the top five options)

All industries

Public sector and

education

wtwco.com

18

• Nontraditional modalities of healthcare will transform the system

The health care delivery system is transforming at a rapid

pace

© 2023 WTW. Proprietary and confidential. For WTW and WTW client use only.

Primary Care

• Primary first models (e.g.,

Centivo)

• Virtual first models (14 virtual

first health plans in 2022)

• Shift towards more

Physicians Assistants and

broader

care teams

• Integration of point

solutions

High Performance

Networks

• Steerage to high quality

providers

• Transition from broad to

narrow provider networks

• Cost of care based on

provider selected

Precision Medicine

• Genetic testing

• Precise treatment journeys

Population Specific

Strategies

• Disease specific

(Alfie/Obesity, Oshi/GI)

• Population specific (Folx/

LGBTQ+, Hurdle/Black

mental health, Midi

Health/women

in midlife)

wtwco.com

19

Pharmacy evolution

© 2023 WTW. Proprietary and confidential. For WTW and WTW client use only.

How will employers need to respond?

• Cost transparency, plan design and formulary considerations

• Ensuring the appropriate clinical pathways are followed

• Explore specialty medication programs and channels, including maximizers (i.e., SaveOn, Prudent, Variable Copay, etc.),

and site of care options (i.e., medical vs Rx, home vs infusion, etc.)

Gene & Cell Therapies

Digital Therapeutics

Diabetes and Weight Loss

Biosimilar alternatives

Includes a deep pipeline with recent approvals launched

at record costs and will require new thinking around

payment models and delivery (i.e., pay overtime, pay for

performance)

Are currently being approved by the FDA and

prescribed by physicians (i.e., Mahana, Pear

Therapeutics, etc.)

In the pipeline to treat refractory depression, anxiety,

PTSD, etc., but will require additional provider visits in

addition to the drug cost

39 biosimilars approved and around 30 are on the market; launch

of highly anticipated autoimmune biosimilars in 2023

Psychedelics

Rapidly increasing utilization and significant cost for blockbuster

GLP-1 medications (Ozempic, Wegovy, Mounjaro, etc.) used for

diabetes treatment and weight loss; nearly $20,000/person/year