2

EPIC INSURANCE BROKERS & CONSULTANTS

Discussion Topics

• 2023 – A Look Back

• U.S. and Global Insured

Catastrophe Losses

• The Impact of Inflation

• Hard Market to Soft Market

Insurance Cycle

• The Florida Factor

• What’s Next?

2023 Property Market – A Look Back

• Record-level global catastrophe insured losses in 2022 ($165B), including Hurricane Ian

($53B) led to first true hard market since 2006 post- Hurricane Katrina

• Carriers cut back capacity 10% - 25% on average

• Cutbacks in capacity driven by reduced availability of reinsurance

• Wind deductibles as high as 15%

• Forced Wind sub-limits on many policies

• Significant rate increases, especially for coastal exposures

• Continued focus on appraisals to ensure property valuations are keeping up with

hyper-inflation

3

EPIC INSURANCE BROKERS & CONSULTANTS

2023 Property Market – A Look Back – cont.

• Higher rates, tightening of terms and conditions, reduced limits, and higher deductibles

• Insurance market set up to better withstand catastrophe loss activity

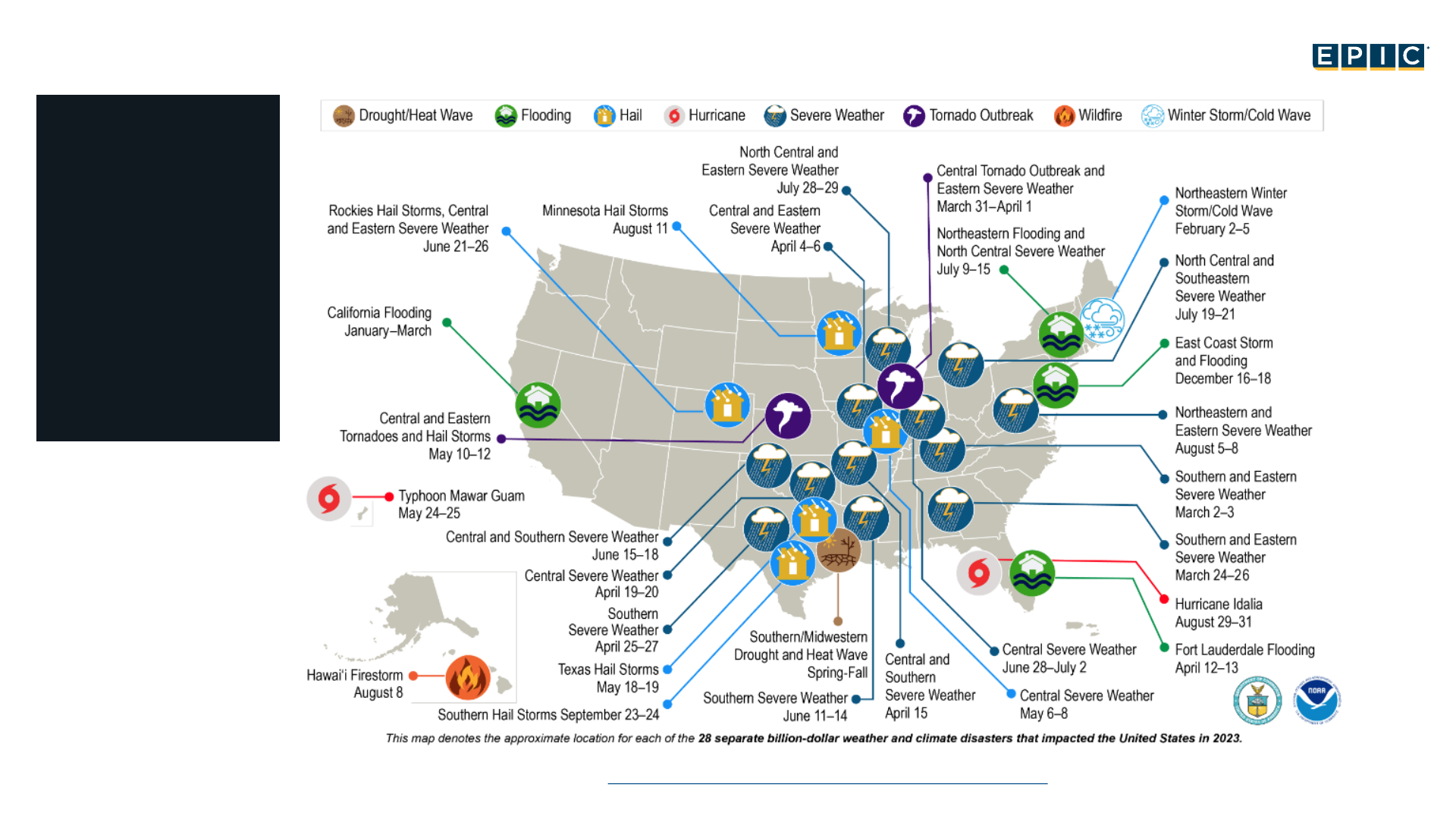

• 2023 saw record number (28) of CAT events >$1B

• Global insured CAT losses of $133B (less than 2022’s $165B, however historically high)

• U.S. Property & Casualty (P&C) industry’s net underwriting loss of $38B, a 10 year high,

per A.M. Best

• Personal lines at 110% combined ratio

• Commercial lines at 97.1% combined ratio

• P&C delivered operating profit due to boost in investment income

4

EPIC INSURANCE BROKERS & CONSULTANTS

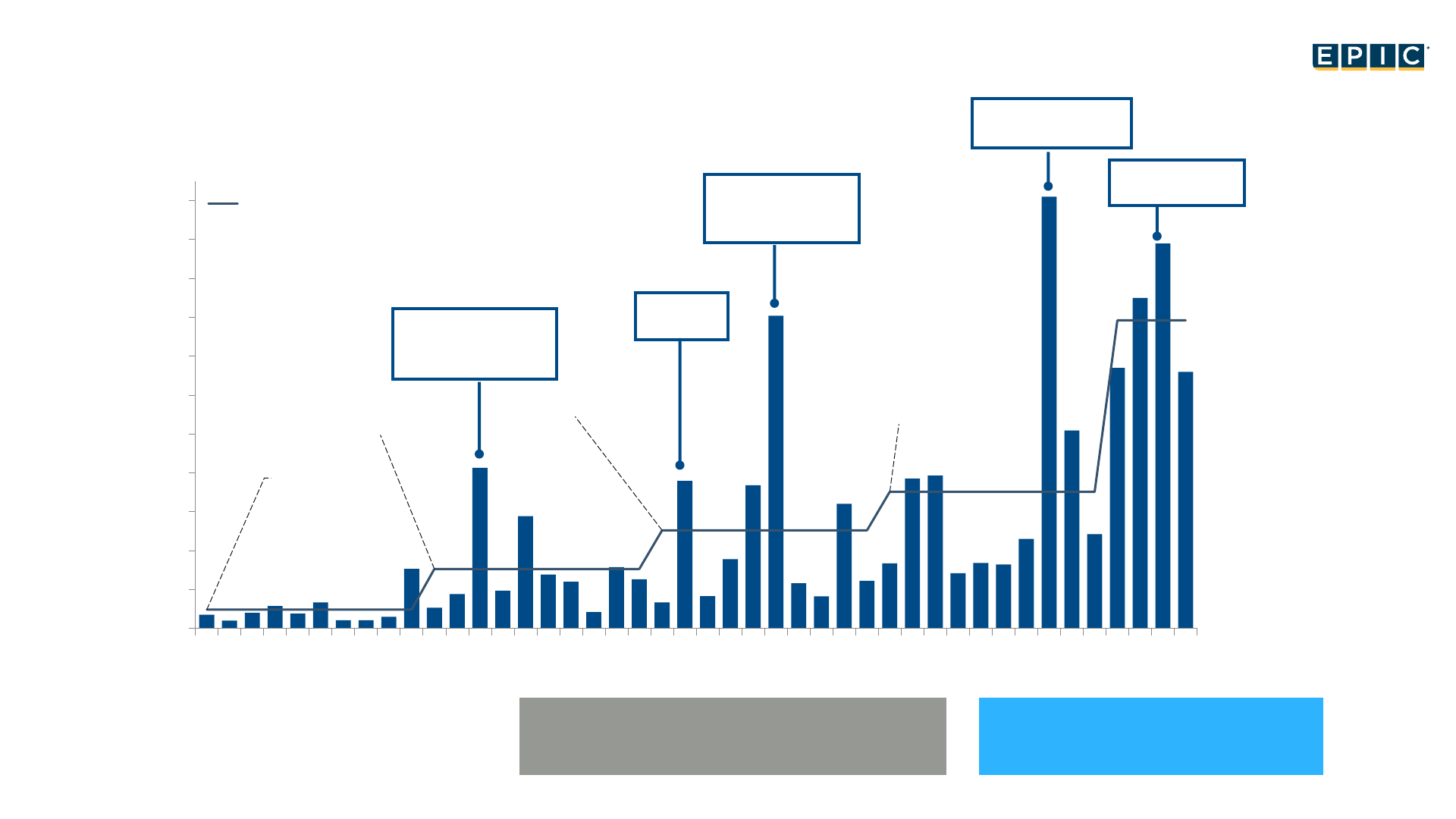

U.S. Inflation-Adjusted Catastrophe Losses

6

EPIC INSURANCE BROKERS & CONSULTANTS

The 2020s are off to an ominous start

with $80B in average annual insured

losses

Average Insured Loss per Year

1980-2021: $23.8 Billion

2012-2021: $44.1 Billion

1980s:$5B

1990s: $16B

2000s: $27B

2010s: $37B

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

$110

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 18 20 22

Billions, 2020 $

Average for Decade

Hurricane

Andrew

WTC

Katrina, Rita,

Wilma

Notes: 2023 total is estimated figure through Q3.

Source: Insurance Information Institute.

Harvey, Irma,

Maria

Ian ($53B)

7

EPIC INSURANCE BROKERS & CONSULTANTS

• Natural disasters resulted in global insured losses of $108B in 2023

• Well above 10 year average of $89B

• Fourth consecutive year with $100B+ losses

• Swiss Re forecasting 5% - 7% growth in losses, driven by exposure growth, especially in

areas of higher catastrophe risk (e.g., flood plains and coastlines)

$-

$50

$100

$150

$200

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Losses in USD Billions

Year

Global Natural Catastrophe Insured Losses

$89B

$105B

10 Year Average (2013-2023)

5 Year Average (2018-2023)

8

EPIC INSURANCE BROKERS & CONSULTANTS

2024 Property Insurance

Market Overview

• Property catastrophe treaty reinsurance

pricing stabilized at January 1, 2024

• No further reductions in capacity are

anticipated

• Stable rate environment thus far in 2024

• Market operating in more calm, orderly, and

rational manner

• Less scrutiny of terms and conditions, with most

policies renewing with no change in limits,

deductibles, sub-limits, etc.

• Model-driven, analytics-based industry

continues to push importance of accurate

replacement cost valuations

• While a far more stable marketplace and

outlook, property market remains somewhat

fragile

The Impact of Inflation

• While the rate of inflation has

moderated, building costs

remain at a multi-decades

high, with continuance of

elevated labor, construction

materials, and transportation

costs

• Insurers remain hyper-focused

on accurate replacement

cost valuations

• Carriers utilizing AI to validate

values adequacy

• A building constructed for

$1M six years ago would cost

roughly $1.48M to build today

9

EPIC INSURANCE BROKERS & CONSULTANTS

Source: FM Global

1.00

1.07

1.08

1.10

1.35

1.47

1.48

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1/1/2018 1/1/2019 1/1/2020 1/1/2021 1/1/2022 1/1/2023 1/1/2024

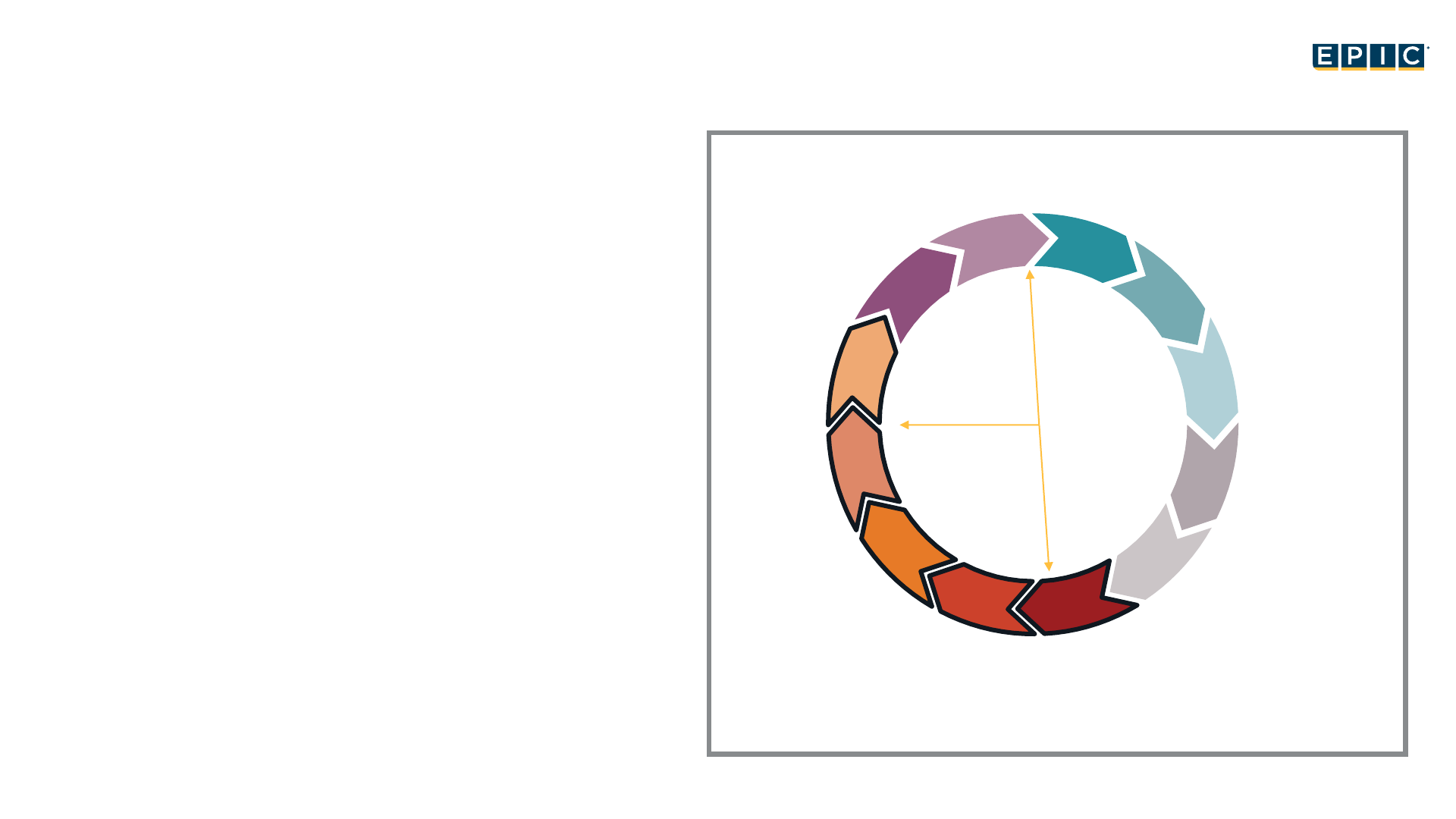

Hard Market to Soft Market Insurance Cycle

10

EPIC INSURANCE BROKERS & CONSULTANTS

Insurance is Cyclical

Cycles usually span a number of years.

We are currently in what is known as a ‘Hard Market’

A Hard Market is when there’s high

demand for insurance coverage and a

low appetite to insure.

During a hard market, rates are high

and coverage is difficult to find.

A Soft Market is when insurance is

readily available.

Rates are stable or falling because of

healthy competition in the market.

Direction of market cycle can change

following a high-loss year.

Capital

Flows into

Market

Rates Start

to Fall

Insurers Chase

Market Share

Rates go

into Freefall

Market

capacity

eroded

Strong

Profits

Seller’s

Markets

Risk

Selection

Rejects

Some

Activities

and

Industries

Insurer

Realization of

Losses

More Large

Events and Poor

Investment

Returns

Rates Start

to Rise

Moving

towards

buyer’s

market this

year

Last year was

a seller’s

market

The Florida Factor

11

EPIC INSURANCE BROKERS & CONSULTANTS

Florida continues to be the most challenging catastrophe risk zone in the world

Hurricane Idalia only landfalling hurricane in Florida in 2023 storm season

Treaty reinsurance pricing has flattened out

Insurers being selective in providing their limited Florida wind capacity

Despite legislative reforms to Florida insurance laws, insurers remain concerned about

potential claim inflation, public adjuster activity, and legal climate within the state

While Florida should see a more stable market this year, the 2024 hurricane season will drive

future market trends

What’s Next?

With quiet hurricane season, and no other major catastrophe losses,

quick transition into soft market environment is possible,

however…

• El Niño conditions of 2023 quickly dissipating

• National Oceanic Atmospheric Administration’s (NOAA) Climate

Prediction Center indicating:

• 83% chance of shifting from El Niño to neutral by April-June

• 62% chance of La Niña conditions by June-August

• 2024 hurricane season

• AccuWeather forecast of “potentially explosive” season

• 20 - 24 named storms, including 8 - 12 hurricanes, and 4 – 7 reaching

Category 3 strength or higher

• Cited abnormally warm sea surface temperatures and La Niña

conditions

12

EPIC INSURANCE BROKERS & CONSULTANTS

State of the Liability Market

14

EPIC INSURANCE BROKERS & CONSULTANTS

Impact of Inflation

• Rising claim & operating costs before considering the impact of “Social inflation”

• Pressure on insurers reserve & rate adequacy

Social Inflation and Litigation Funding

• High, “catastrophic like” jury and judge verdicts regardless of merit or facts of the case

• Unrelated 3

rd

parties seek out and fund the litigation in return for a portion of the lawsuit recovery

• Since 2016 there have been over $30 billion in claims driven through litigation funding

• An additional $2.7 billion of investment in the litigation finance industry was committed in FY23

Law Enforcement Liability (LEL)

• Increased frequency and severity of litigation

• Civil lawsuits as redress (versus criminal) resulting in large settlements

• Reduction in availability of coverage at substantially higher costs/attachment points

Automobile Liability Trends

• Auto rates have increased for 22 consecutive quarters and still appear to be inadequate

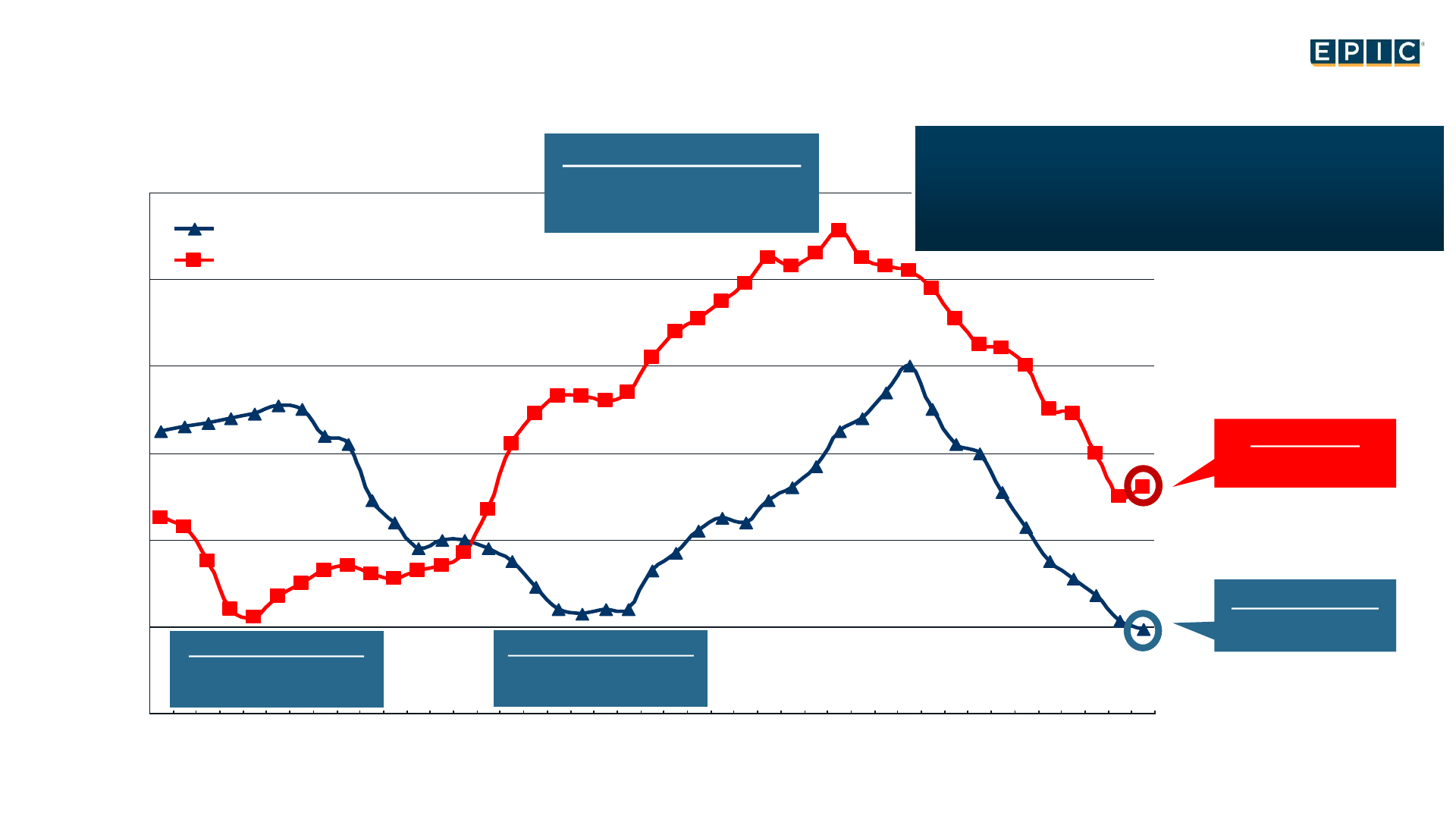

U.S. Inflation Rate: 2009-2025F*

Source: U.S. Bureau of Labor Statistics; Wells Fargo Securities (10/23); USC Center for Risk and Uncertainty Management.

Percentage Change (%)

0.1%

1.3%

2.1%

2.4%

1.8%

1.2%

4.7%

8.0%

4.2%

2.5%

2.4%

-0.4%

1.6%

3.2%

2.1%

1.5%

1.6%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

09 10 11 12 13 14 15 16 17 18 19 20 21 22 23F 24F 25F

There’s concern that the

Fed may need to keep

rates higher for longer to

achieve its 2% inflation

target

*Annual change in Consumer Price Index for All Urban Consumers (CPI-U).

Inflation accelerated

sharply in 2021 before

peaking at 9.1% in June

2022. Inflation should

moderate through 2023/24;

Forecast is highly

dependent of trajectory of

energy prices, Fed rate

hikes and labor market

tightness

15

Social Inflation: Many Interrelated Causes, Difficult to Manage

Source:Risk and Uncertainty Management Center, Univ. of South Carolina, adapted from Verisk “Social Inflation” presentation (2020).

INSURANCE CLAIM COSTS

Increasing

Propensity

to Sue

Size of Jury

Awards

Courts/

Juries

Favoring

Plaintiffs

Growing

Distrust of

Large

Orgs.

Litigation

Financing

Aggressive

Plaintiff Bar

Ads

Changes in

Regulatory and

Legal Environment

Bar Ads

Applied to a seemingly limitless number

of issues, these drivers are pushing tort

costs (and therefore claim costs upward)

16

Average Jury Awards, 1999 – 2020 (latest available)

$725

$747

$756

$800

$799

$1,018

$1,022

$950

$1,077

$1,046

$654

$806

$1,098

$1,010

$1,042

$1,135

$1,354

$1,813

$1,675

$1,758

$2,449

$500

$1,000

$1,500

$2,000

$2,500

$3,000

1999 2001 2003 2005 2007 2010 2012 2014 2016 2018 2020

Source: Jury Verdict Research; Current Award Trends in Personal Injury (61

st

Edition), Thomson Reuters; Risk and Uncertainty Management Center, Univ. of South Carolina.

The average jury award

reached an all-time record high

of $2.5M in 2020, up 39% from

2019 and 274% since 2010

Median Award in 2020 =

$125,366 (a record)

($000)

17

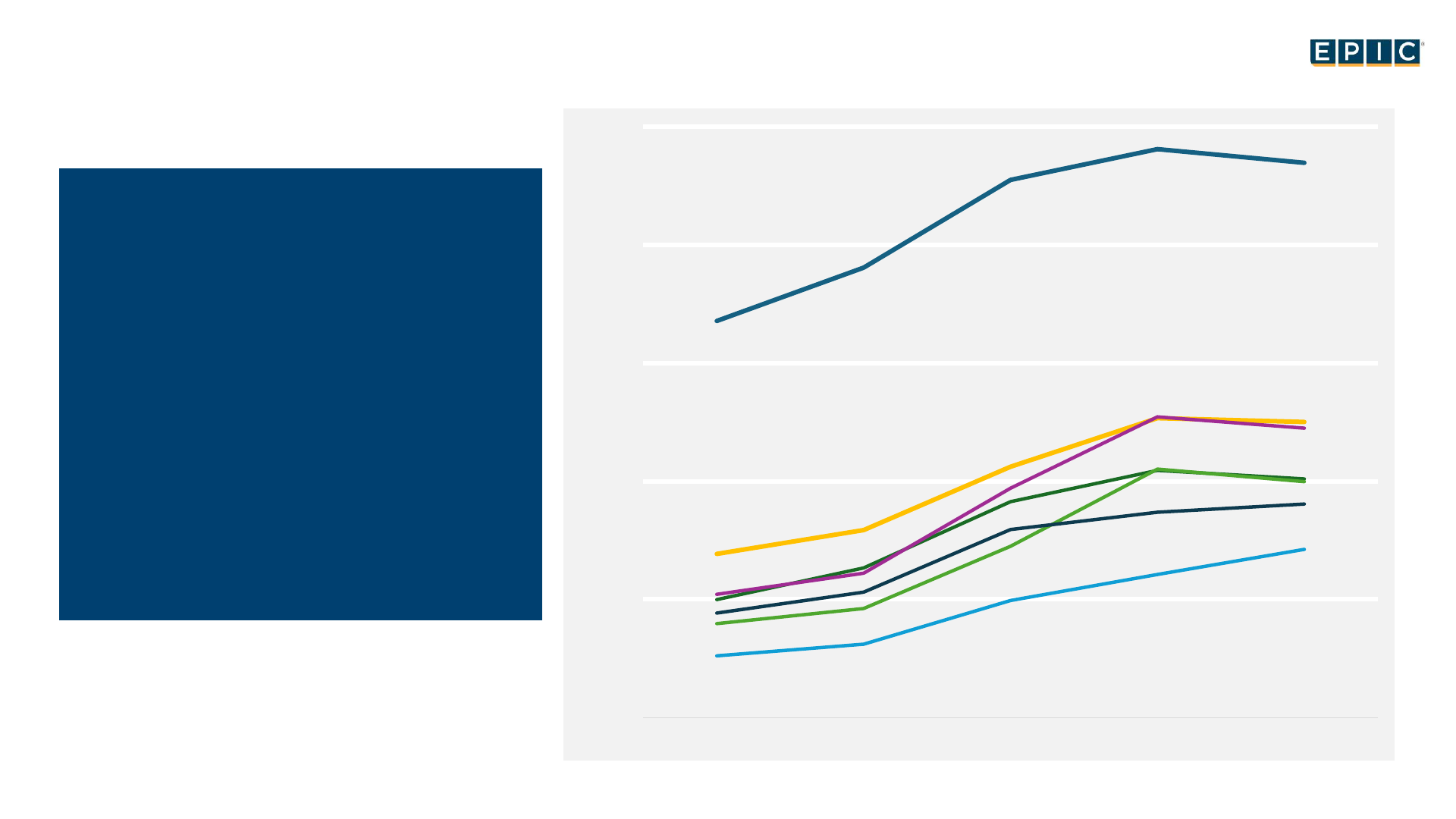

General Liability – Direct Premiums per $1M of GDP per State

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

2018 2019 2020 2021 2022

US

FL

• FL General Liability Direct

Premium rate per $1M of FL

Gross Domestic Product are

notably higher compared to the

U.S. average, AL, CA, GA, SC &

TX

• FL GL Rates peak in 2021

• It will be interesting to see the

impact of FL 2023 tort reforms

CA

TX

GA

SC

Sources:

GDP: USAfact.org

Premium Costs: S&P Capital IQ from NAIC Filings

AL

18

5 Forces Driving Commercial Auto Insurance Costs

5. Inexperienced Drivers

• Resignations and retirements leading to a shortage of

commercial drivers

4. Vehicle Repair and Replacement Costs

• Autos have become 24% more expensive to repair since

2019 – technology, labor, advanced materials

• Used car prices were up almost 50% in 2023 when

compared to the average between 2015-2019

• Increase in auto thefts

3. Distractions and Impairment

• Vehicle infotainment systems and mobile devices

• 30% of companies surveyed reported employee crashes

due to distraction

• Deaths due to preventable crashes up 15% versus pre-

pandemic levels

2. Attorney Involvement

• Increased legal representation

• Higher expenditures for medical

procedures and treatment

1. Bodily Injury Loss Costs

• Severity of loss is up 40% between 2018-2022 due to:

o Increase in deadly accidents

o Rising verdicts

o Increases in Medical Cost Inflation: +5.5% in 2022, +6%

in 2023, +7% forecast in 2024

Travelers – 5 Forces Driving Commercial Auto

19

20

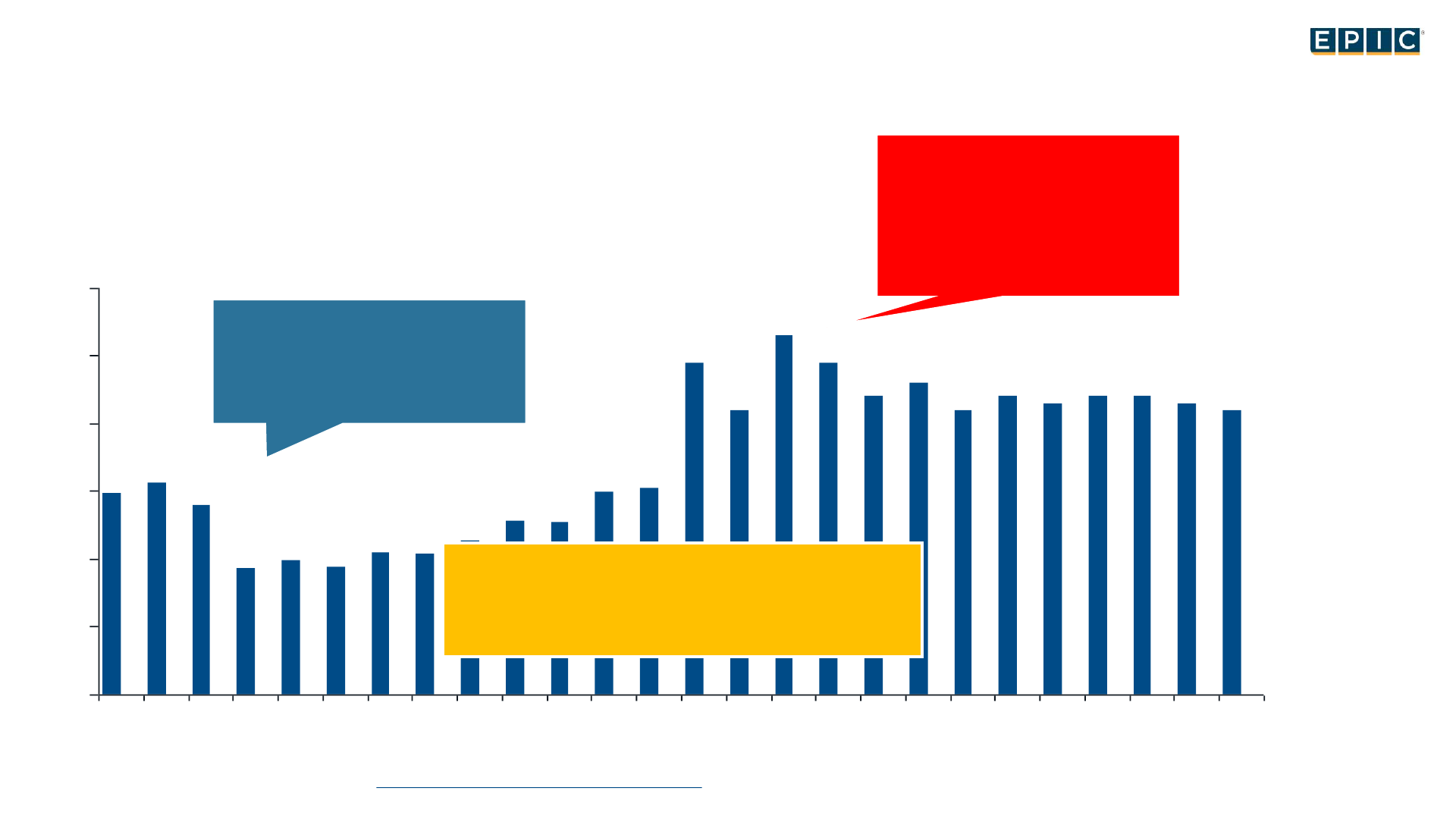

Collision Claim Severity: Rising to New Record Highs

$4,086

$3,764

$4,113

$4,206

$3,978

$4,460

$4,392

$5,045

$5,392

$5,744

$5,392

$5,585

$5,945

$5,995

$5,601

$5,678

$3,836

$4,521

$3,073

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

19:Q1 19:Q2 19:Q3 19:Q4 20:Q1 20:Q2 20:Q3 20:Q4 21:Q1 21:Q2 21:Q3 21:Q4 22:Q1 22:Q2 22:Q3 22:Q4 23:Q1 23:Q2 23:Q3

Average Loss, 2018:Q1 through 2023:Q3

Source: ISO/PCI Fast Track data; Center for Risk and Uncertainty Management, Univ. of South Carolina.

Severities Are Up Sharply—Inflation Is a Major Factor

Collision claim severity reached a

record high in 2023:Q1, up 42.6%

from 2020:Q1

Q3:2023 Collision claim

severity is still up 35.0%

since Q1:2020

State of the Workers’ Compensation Market

21

EPIC INSURANCE BROKERS & CONSULTANTS

The most stable line of coverage in the Casualty marketplace. However, it has been

impacted by:

• Medical Cost Inflation

• Wage Inflation

• Decreasing frequency; Increasing Severity

• Survival/Life Expectancy – due to medical advancements, survival rates and life expectancy have increased

• Fee Schedule Costs – ICU, durable medical equipment and new state-of-the-art attendant care is not covered by

the fee schedules

• Comorbidity – disease coupled with injuries escalates claim costs

The Public Entity risk profile for Workers’ Compensation has become more volatile

• First responders

• Pandemic impact on Public Entities Workers’ Compensation

• Legislation - Presumption

(2.0)

0.0

2.0

4.0

6.0

8.0

10.0

Jan

20

Mar

20

May

20

Jul

20

Sep

20

Nov

20

Jan

21

Mar

21

May

21

Jul

21

Sep

21

Nov

21

Jan

22

Mar

22

May

22

Jul

22

Sep

22

Nov

22

Jan

23

Mar

23

May

23

Jul

23

Change in Medical CPI

CPI-All Items

Medical Cost Inflation vs. Overall CPI Since COVID,

Jan. 2020 – July 2023 (Percent Change from prior year)

Sources: US Bureau of Labor Statistics; Risk and Uncertainty Management Center, University of South Carolina.

Jan 2020 – Feb 2021

Medical: 3.8%

Overall: 1.3%

COVID has completely flipped the

historical relationship between

overall and medical inflation

All Items CPI

July 2023: 3.2%

Medical Inflation

July 2023: -0.5%

Mar 2021 – Nov 2022

Medical: 2.6%

Overall: 6.8%

Jan 2020 – Dec 2022

Medical: 3.1

Overall: 4.6%

22

Annual Change in Average Hourly Wage, 2007– Sept. 2023

3.0%

3.1%

2.8%

1.9%

2.1%

2.3%

2.6%

2.5%

3.0%

3.1%

4.9%

4.2%

5.3%

4.9%

4.4%

4.6%

4.2%

4.4%

4.3%

4.4%

4.4%

4.3%

4.2%

2.1%

1.9%

2.0%

0%

1%

2%

3%

4%

5%

6%

07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 Q4

22

Jan

23

Feb

23

Mar

23

Apr

23

May

23

Jun

23

Jul

23

Aug

23

Sep

23

Sources: US Bureau of Labor Statistics at http://www.bls.gov/data/#employment; National Bureau of Economic Research

(recession dates); Risk and Uncertainty Management Center, Univ. of South Carolina.

Wage growth acceleration

obscured the massive loss in

WC payroll exposures in 2020

Wage growth fell

sharply during the

Great Recession

Very tight labor

market drove wage

gains in 2022 and

early (Peak was 5.9%

in March 2022)

23

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

2018 2019 2020 2021 2022

Workers’ Compensation

Direct Premiums per $1M of GDP per State

US

FL

• Florida has historically had higher

workers’ compensation rates than

the national average

• Florida’s rates have reduced to be

closer in line with the United

States average

CA

GA

SC

AL

TX

Sources:

GDP: USAfact.org

Premium Costs: S&P Capital IQ from NAIC Filings

24

Workers Compensation

Loss Cost

Per $100 of payroll

5.96

5.23

3.69

3.11

2.98

1.38

Georgia

California

Florida

Alabama

South Carolina

Texas

We aggregated the loss costs of public

service jobs like firefighters, police

officers, and sanitation workers.

Florida’s public service jobs have the

third highest loss costs among the

states analyzed.

Job Type

GA

FL

TX

AL

SC

CA

Fire

Department

7704

7704

7710

7711

7710

7711

7710

7711

7710

7711

Police

Department

7720

7720

7720

7720

7720

7720

Sanitation

Department

9403

9403

9403

9403

9403

9403

Job Codes

Source: NCCI, State specific Department of Insurance

25

Florida Legislative Updates

26

EPIC INSURANCE BROKERS & CONSULTANTS

SB 362 – Medical Treatment Under the Workers’ Compensation Law (effective 1/1/25)

Increases max reimbursement rates for all industries:

• Certain physicians from 110% to 175% of the Medicare rate

• Certain surgical procedures from 140% to 210% of the Medicare rate

• NCCI has estimated +7% impact on WC costs in Florida due to this change

SB 808 – (Heart & Lung Presumption) Treatment by a Medical Specialist (effective 10/1/24)

Expand physician access to allow the use of their physician of choice

• Limited to firefighters, law enforcement, and correctional officers

• Some physicians may charge up to 200% of the Medicare reimbursement rate

Other Presumptions:

Firefighter cancer presumption – 2019

• An alternative to the firefighter pursuing benefits through workers’ compensation

First Responder Post-Traumatic Stress Syndrome (PTSD) Presumption – 2019

• Bill was amended to include notice limitations (52 weeks after the qualifying event)

• The cost of PTSD presumption is hard to quantify due to the large number of municipalities that are self-insured

27

EPIC INSURANCE BROKERS & CONSULTANTS

THANK YOU

Questions?