MISSISSIPPI INSURANCE DEPARTMENT

Report of Examination

of

SOUTHERN FARM BUREAU CASUALTY

INSURANCE COMPANY

as of

December 31, 2010

TABLE OF CONTENTS

Examiner Affidavit .................................................................................................................................. 1

Salutation ................................................................................................................................................. 2

Scope of Examination .............................................................................................................................. 3

Comments and Recommendations of Previous Examination .................................................................. 3

History of the Company ........................................................................................................................... 3

Corporate Records ................................................................................................................................... 4

Management and Control ......................................................................................................................... 4

Stockholders ................................................................................................................................ 4

Board of Directors ...................................................................................................................... 5

Committees ................................................................................................................................. 6

Officers ....................................................................................................................................... 8

Conflict of Interest ...................................................................................................................... 8

Corporate Governance ................................................................................................................ 8

Holding Company Structure .................................................................................................................... 9

Organizational Chart .................................................................................................................. 9

Affiliated and Related Party Transactions ................................................................................ 11

Fidelity Bond and Other Insurance ........................................................................................................ 12

Pensions, Stock Ownership and Insurance Plans ................................................................................... 12

Territory and Plan of Operation ............................................................................................................. 12

Growth of Company .............................................................................................................................. 13

Mortality and Loss Experience .............................................................................................................. 13

Reinsurance ............................................................................................................................................ 13

Accounts and Records ............................................................................................................................ 15

Statutory Deposits .................................................................................................................................. 15

Financial Statements .............................................................................................................................. 16

Introduction .............................................................................................................................. 16

Statement of Assets, Liabilities, Surplus and Other Funds - Statutory..................................... 17

Statement of Income - Statutory ............................................................................................... 18

Reconciliation of Capital and Surplus - Statutory .................................................................... 19

Reconciliation of Examination Adjustments to Surplus - Statutory ......................................... 20

Market Conduct Activities ..................................................................................................................... 21

Commitments and Contingent Liabilities .............................................................................................. 21

Subsequent Events ................................................................................................................................. 21

Comments and Recommendations ......................................................................................................... 21

Acknowledgment ................................................................................................................................... 22

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 2

April 2, 2012

Honorable Mike Chaney

Commissioner of Insurance

Mississippi Insurance Department

1001 Woolfolk Building (39201)

Post Office Box 79

Jackson, Mississippi 39205

Dear Commissioner Chaney:

Pursuant to your instructions and authorization and in compliance with statutory provisions, an

examination has been conducted, as of December 31, 2010, of the affairs and financial condition of:

SOUTHERN FARM BUREAU CASUALTY INSURANCE COMPANY

1800 East County Line Road

Ridgeland, MS 39157

License #

NAIC Group #

NAIC #

FEETS#

ETS#

7700932

0483

18325

MS029-F4

MS120-M4

This examination was commenced in accordance with Miss. Code Ann. §83-5-201 et seq. and

was performed primarily in Ridgeland, Mississippi, at the statutory home office of the Company.

The report of examination is herewith submitted.

MIKE CHANEY

Commissioner of Insurance

State Fire Marshal

MARK HAIRE

Deputy Commissioner of

Insurance

MAILING ADDRESS

Post Office Box 79

Jackson, MS 39205-0079

TELEPHONE: (601) 359-3569

FAX: (601) 359-1951

MISSISSIPPI INSURANCE DEPARTMENT

501 N. WEST STREET, SUITE 1001

WOOLFOLK BUILDING

JACKSON, MISSISSIPPI 39201

www.mid.state.ms.us

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 3

SCOPE OF EXAMINATION

We have performed our full-scope financial examination of Southern Farm Bureau Casualty

Insurance Company (“SFBCIC” or “Company”). For purposes of this examination report, the

examination date is defined as December 31, 2010. The examination period is defined as January

1, 2008 through December 31, 2010, including material transactions and/or events occurring

subsequent to the examination date through April 2, 2012. The last examination was completed

as of December 31, 2007.

We conducted our examination in accordance with the NAIC Financial Condition Examiners

Handbook (“Handbook”). The Handbook requires that we plan and perform the examination to

evaluate the financial condition and identify prospective risks of the company by obtaining

information about the company, including corporate governance, identifying and assessing

inherent risks within the company, and evaluating system controls and procedures used to

mitigate those risks. An examination also includes assessing the principles used and significant

estimates made by management, as well as evaluating the overall financial statement

presentation, management’s compliance with Statutory Accounting Principles and annual

statement instructions, when applicable to domestic state regulations.

All accounts and activities of the Company were considered in accordance with the risk-focused

examination process.

COMMENTS AND RECOMMENDATIONS OF PREVIOUS

EXAMINATION

There were no comments and/or recommendations made by the Mississippi Insurance

Department (“MID”) examination team in the previous examination report, which covered the

period from January 1, 2005 through December 31, 2007.

HISTORY OF THE COMPANY

In 1947, the Farm Bureau Federations located in the states of Arkansas, Florida, Mississippi and

Texas organized individual investment corporations for the purpose of organizing the Company.

On September 25, 1947, the Company was incorporated under the laws of the State of

Mississippi as a property and casualty insurance company, with business commencing on

September 30, 1947. Subsequently, the Louisiana, South Carolina and Colorado Farm Bureau

Federations acquired equal shares of the Company’s capital stock and Florida sold its interest

back to the Company.

Through December 31, 2008, the outstanding shares of the Company were owned by the Farm

Bureau Federations in six states through the following investment/holding corporations:

Arkansas Casualty Investment Corporation, Mississippi Farm Bureau Holding Corporation,

Texas Farm Bureau Investment Corporation, Louisiana Farm Bureau Investment Corporation,

South Carolina Farm Bureau Investment Corporation and Colorado Farm Bureau Investment

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 4

Company. Each entity held 666.6 shares or 16.67% of the 4,000 authorized shares of the

Company.

The Texas parties withdrew from the Company as of December 31, 2008, and surrendered its

666.6 shares of the Company’s stock in exchange for the shares of the Company’s wholly-owned

subsidiary operating in the state of Texas formed for purposes of the withdrawal. Because of the

withdrawal of the Texas parties, the Company and its remaining shareholders desired to amend

the Articles of Association, the Bylaws and the Amended Membership Treaty under which it had

operated. On December 14, 2009, the Treaty was terminated and a new organization structure for

the Company was created (the “reorganization”). In connection with the reorganization, the

Company amended and restated its existing Articles and Bylaws and entered into a Shareholders

Agreement with the Farm Bureau State Organizations (other than the Florida Farm Bureau

Federation) and Investment Companies (other than Florida Farm Bureau Federation (“FFBF”)

Investment Corporation.) All existing shares of equity in the Company were exchanged for

newly-issued shares of the Company in connection with the reorganization. At the time of the

reorganization, shares were also issued to FFBF Investment Corporation pursuant to a

Subscription Agreement between FFBF Investment Corporation and the Company under which

FFBF Investment Corporation and Florida Farm Bureau Federation became parties to the

Shareholder Agreement. Subsequent to the reorganization, there are currently 10,428,000 shares

of $1 par value common stock authorized and 1,082,842 issued. Of the issued shares, 2,640

shares are voting and 1,080,202 are non-voting shares.

CORPORATE RECORDS

The Articles of Incorporation, Bylaws and amendments thereto were reviewed and duly applied

in other sections of this report where appropriate. Minutes of the meetings of the stockholders,

Board of Directors (“Board”) and various committees, as recorded during the period covered by

this examination, were reviewed and appeared to be complete and in order with regard to actions

brought up at the meetings for deliberation and appropriate action, which included the approval

and support of the Company’s transactions and events, as well as the review of the audit and

examination report.

MANAGEMENT AND CONTROL

Stockholders

During the time period covered by this examination, the Company reported as a member of an

insurance company holding system as defined by Miss. Code Ann. §83-6-1. Pursuant to these

filings, the Company’s outstanding shares are owned by the following: Arkansas Casualty

Investment Corporation, Mississippi Farm Bureau Holding Corporation, Louisiana Farm Bureau

Investment Corporation, South Carolina Farm Bureau Investment LLC, Colorado Farm Bureau

Investment Company and FFBF Investment Corporation. Shares owned by each of the

aforementioned entities are as follows:

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 5

There are 10,428,000 shares of $1 par value common stock authorized and 1,082,842 issued and

outstanding. Of issued shares, 2,640 are voting and 1,080,202 are non-voting. The Company

paid the following amounts as dividends to stockholders during the examination period.

2010

$5,467,010

2009

$ 44,000

2008

$ 52,800

Board of Directors

The Articles of Incorporation and Bylaws vest the management and control of the Company’s

business affairs with the Board. The Company’s Board is comprised of 24 members, all of whom

are chosen from among the states of Arkansas, Colorado, Florida, Louisiana, Mississippi or

South Carolina (each a “State Farm Bureau”). Each State Farm Bureau President is a member of

the Board. The members of the duly elected Board, along with their place of residence, year

elected/appointed, and principal occupation, at December 31, 2010, were as follows:

Name and Residence

Year

Elected/Appointed

Principal Occupation

Ronald Roy Anderson

Chairman of the Board

Ethel, LA

1985

Farmer and President of Louisiana

Farm Bureau Federation

John Lawrence Hoblick, Sr.,

Vice Chairman of the Board

DeLeon Springs, FL

2000

Farmer and President of Florida

Farm Bureau Federation

Mark Allen Byrd

Apopka, FL

2007 Nursery Owner

Joe Wayne Christian

Jonesboro, AR

2010 Farmer

Terry Glenn Dabbs

Stuttgart, AR

2010 Farmer

Douglas Wayne Duty

Monroe, LA

2010

Retired Senior Sales Specialist from

Bayou Crop Scientist and Farmer

Alan Lee Foutz

Akron, CO

2005

Farmer and President of Colorado

Farm Bureau Federation

Shares

Outstanding:

Arkansas Colorado Florida Louisiana Mississippi

South

Carolina

Total

Class A

220

220

220

220

220

220

1,320

Class B

370,765

1,316

--

321,893

229,104

157,124

1,080,202

Class C

550

--

--

440

220

110

1,320

Total

371,535

1,536

220

322,553

229,544

157,454

1,082,842

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 6

Donald Hubert Gant

Merigold, MS

2007 Farmer

Ben Martin Gramling II

Gramling, SC

1997 Agri-business / Development

Jim Toney Harper

Cheneyville, LA

2010 Farmer

Rich Edward Hillman II

Carlisle, AR

2009

Farmer and Vice President of

Arkansas Farm Bureau Federation

Thomas Scott Jones

Pottsville, AR

2010 Rancher

Randy Lee Knight

Pelahatchie, MS

2007 Farmer

Billy Regionald Magee

Mt. Olive, MS

2010 and

1999-2007

Self-Employed Farmer

Clinton Willie Sease

Lexington, SC

2009 Farmer

Donald James Shawcroft

Alamosa, CO

2010 Self-Employed Farmer

Russell McKinney Smith

Des Arc., AR

2010 Farmer

Leo Carl Sutterfield, Jr.

Mtn. View, AR

2010 Banker

Jackie Joseph Theriot

St. Martinville, LA

2003 General Manager

Harry Randall Veach

Manila, AR

2004

Farmer and President of Arkansas

Farm Bureau Federation

David Whitmire Waide

West Point, MS

1995

Farmer and President of Mississippi

Farm Bureau Federation

Scott McDonald Wiggers, Jr.

Winnsboro, LA

2010 Farmer

David Melton Winkles, Jr.

West Columbia, SC

1998

Farmer and President of South

Carolina Farm Bureau Federation

Linda Zaunbrecher

Gueydan, LA

1993 Farmer

Committees

During the time period covered by this examination, the following committees were utilized by

the Company to carry out certain specified duties: Executive Committee, Audit Committee,

Investment Committee and Compensation Committee.

Executive Committee:

The Executive Committee consists of the Presidents from each of the State Farm Bureaus who

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 7

serve on the Board. The Chairman of the Board is also the Chairman of the Executive

Committee. The Executive Committee has the power to exercise, conduct and control the

business of the Company between meetings of the Board. The Executive Committee has the sole

and exclusive power and authority to declare additional dividends.

Audit Committee:

The Audit Committee has six members, all of whom are outside directors which meets the

requirements set forth by the Model Audit Rule. The Audit Committee is responsible for

reviewing the audit report prepared by the outside accounting firm and making recommendations

to the Board regarding the audit report and the selection of an outside accounting firm. The Audit

Committee is also responsible for overseeing the Company’s compliance with the Annual

Financial Reporting Model Regulation and for making sure management establishes,

implements, and monitors the system of internal controls over financial reporting.

Investment Committee:

The Investment Committee is comprised of Board and non-Board members; however, one

member of the committee must be the Chairman of the Board. The committee delegates the

authority to transact the routine day to day investment duties including, but not limited to, the

sale, purchase, and transfer of stocks, bonds, securities, and other investments, both real and

personal. The Investment Committee reports to the Board regarding the condition of the funds,

securities and investments of the Company.

Compensation Committee:

The Compensation Committee is comprised of the Presidents from each of the State Farm

Bureaus. The Chairman of the Board is also the Chairman of the Compensation Committee. The

Compensation Committee duties include reviewing and making recommendations to the Board

with respect to compensation and to perform such other duties as appropriate for the committee

or as delegated by the Board.

The following members served on the committees mentioned above at December 31, 2010.

Executive Audit Investment Compensation

Ronald Roy

Anderson, Chairman

John Lawrence Hoblick,

Sr., Chairman

Dennis Ray Griffin,

Chairman

Ronald Roy

Anderson, Chairman

Alan Lee Foutz Ronald Roy Anderson

Ronald Roy

Anderson

Alan Lee Foutz

John Lawrence

Hoblick, Sr.

Alan Lee Foutz Thomas Arthur

John Lawrence

Hoblick, Sr.

Harry Randall

Veach

Harry Randall Veach

Judith Goodwin

Blackburn, Secretary

Harry Randall Veach

David Whitmire

Waide

David Whitmire Waide Robert Paul Jarratt

David Whitmire

Waide

David Melton

Winkles, Jr.

David Melton Winkles, Jr.

David Melton

Winkles, Jr.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 8

Officers

The officers of the Company at December 31, 2010 were:

Name of Officer

Number of Years

with Company

Title

Ronald Roy Anderson

25

Chairman of the Board

Robert Paul Jarratt

42

President and Chief Executive Officer

Dennis Ray Griffin

32

Senior Vice President - Chief Financial Officer

Steven Walter Ingram

28

Senior Vice President - Legal and Secretary

Judith Goodwin Blackburn

28

Senior Vice President and Treasurer

John Russell McCollough

15

Senior Vice President - Actuary

Mark Gerard Gianfrancesco

13

Senior Vice President - Marketing

Geoffrey Alan Mercer

25

Senior Vice President - Technology

Jack Carlton Williams, Jr.

22

Senior Vice President – State Manager –

Mississippi

Blaine Vernon Briggs

25

Senior Vice President - State Manager – Louisiana

William O’Neil Courtney

26

Senior Vice President – State Manager – Florida

Robert Duff Wallace

27

Senior Vice President - State Manager – Arkansas

Phillip Eugene Love, Jr.

26

Senior Vice President - State Manager - South

Carolina

Jack Pinkney Anderson

34

Senior Vice President – State Manager – Colorado

Conflict of Interest

The Company has formal procedures whereby disclosures were made to the Board of any

material interest or affiliation on the part of any officer or director that was, or would likely be, a

conflict with their official duties.

Corporate Governance

Upon review of the corporate governance structure, it was noted that the Company has a very

stable and experienced management team with the vast majority of officers having at least 15

years of experience with the Company. There did not appear to be any compensation

arrangements that caused unusual emphasis on earnings. Management records, such as Board

minutes, appeared to be in order.

The Board’s involvement and oversight was considered during the course of our examination.

Other key variables in our consideration of the Board’s involvement included but were not

limited to factors such as: (1) the frequency of Board meetings and attendance of the directors,

(2) the sufficiency and timeliness of information provided to the Board prior to meetings, (3) the

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 9

topics discussed along with the depth and quality of discussions, (4) key communication

channels between management and the Board, and (5) the Board’s role in setting the overall

“tone at the top”. Information regarding the Board members, committees and other related

information can be found in the Management and Control section of this report.

The appropriateness of the entity’s organizational structure and its ability to provide the

necessary information flow to manage its activities were considerations in obtaining our

understanding of the organizational structure. This includes consideration of the entity’s

decentralized structure and the Company’s move toward a more centralized organization. Our

consideration also encompassed understanding the assignment of authority and responsibility.

Our consideration of corporate governance encompassed the risk management function through

discussions with senior management and members of the Board and through gaining an

understanding of the risk management function including inspection of relevant risk management

documentation. Upon our review and consideration of these components and functions, there

were no material concerns or exceptions noted.

Management competence is a consideration in overall assessment of corporate governance. In

our review of this area, we considered factors such as management’s experience level and

management turnover. There were no material concerns noted upon our consideration of this

area. As indicated in the Management and Control section of this report, key management has

significant experience with the Company and the officer/employee turnover ratio was low.

HOLDING COMPANY STRUCTURE

During the time period covered by this examination, the Company reported as a member of an

insurance company holding system as defined by Miss. Code Ann. §83-6-1. Holding Company

Registration Statements, for the period under examination, were filed with the MID in

accordance with Miss. Code Ann. §83-6-5 and §83-6-9.

On April 2, 2012, the MID gave notice that it would conduct an examination of SFBCIC and

other Farm Bureau related entities pursuant to §83-6-27, Mississippi Code of 1972 (the “Code”)

and other applicable laws and regulations of the MID including, but not limited to, §83-6-1, et

seq. of the Code (the “Holding Company Act”). The examination will include a review of the

relationships between SFBCIC and other associated companies and entities to determine

compliance with applicable Mississippi laws and MID regulations.

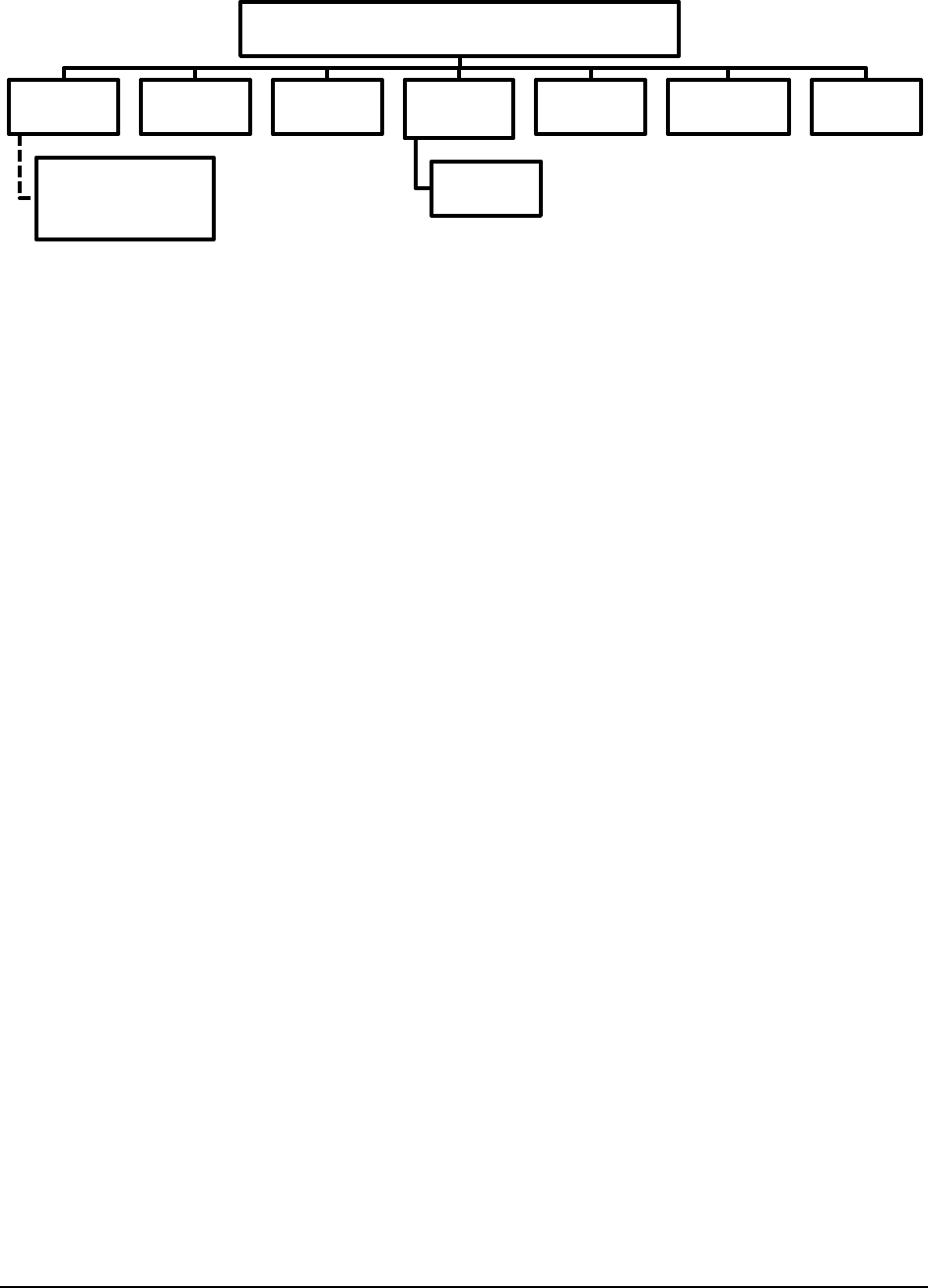

Organizational Chart

Pursuant to the Holding Company Registration Statements filed by the Company as of December

31, 2010, the organization chart below displays the identities of the members of the Company’s

holding company structure as reported by the Company, and is followed by a brief description of

the Company’s subsidiaries:

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 10

The Company reported SFBCIC as the ultimate controlling person in the Holding Company

Registration Statements filed by the Company with the MID as of December 31, 2010. Pursuant

to these filings, the Company’s outstanding shares are owned by the following: Arkansas

Casualty Investment Corporation, Mississippi Farm Bureau Holding Corporation, Louisiana

Farm Bureau Investment Corporation, South Carolina Farm Bureau Investment LLC, Colorado

Farm Bureau Investment Company and FFBF Investment Corporation.

Below is a description of the Company’s wholly owned subsidiaries at December 31, 2010:

Southern Farm Bureau Property Insurance Company (“SFBPIC”): This company was

incorporated on August 1, 1994, under the laws of the State of Mississippi. Effective January 1,

2007, the Company no longer conducted any active underwriting activities and essentially

became inactive. The sole reinsurance activities of SFBPIC consist of runoffs associated with

reinsurance contracts entered into and terminated prior to January 1, 2007. No new contracts

have been executed subsequent to January 1, 2007.

Southern Farm Brokerage Company: This company was incorporated on June 20,1994, under

the laws of the State of Mississippi, and its principal business is compiling, organizing and

analyzing insurance related data and statistics; soliciting, brokering, negotiating and/or placing

all forms of insurance contracts (except life, health and accident insurance); engaging in real

estate transactions, joint ventures, and real estate development; and engaging in any other lawful

activities of a Mississippi business corporation.

Mississippi Farm Bureau Casualty Insurance Company (“MFBCIC”): This company was

incorporated on May 19, 1986, under the laws of the State of Mississippi, and its principal

business is providing casualty insurance coverage (principally automobile and homeowner) and

property coverage in the State of Mississippi.

Florida Farm Bureau Casualty Insurance Company (“FFBCIC”): This company was

incorporated on April 16, 1974, under the laws of the State of Florida, and its principal business,

in association with its wholly owned subsidiary, Florida Farm Bureau General Insurance

Company, is providing casualty insurance coverage (principally automobile, property and

general liability) in the State of Florida.

Louisiana Farm Bureau Casualty Insurance Company (“LFBCIC”): This company was

Southern Farm Bureau Casualty Insurance Company

Southern Farm

Bureau Brokerage Co.

Highland Colony Land Company

Limited Liability Company

25% Membership Interest

Southern Farm

Bureau Property

Insurance Company

Louisiana Farm

Bureau Casualty

Insurance Company

Florida Farm Bureau

Casualty Insurance

Company

Florida Farm Bureau

General

Insurance Company

Mississippi Farm

Bureau Casualty

Insurance Company

Arkansas Farm Bureau

Casualty Insurance

Company

SFB Investments

Limited Liability

Company

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 11

incorporated on February 16, 1981, under the laws of the State of Louisiana, and its principal

business is providing casualty insurance coverage (principally automobile) and processing claims

in the State of Louisiana.

Arkansas Farm Bureau Casualty Insurance Company: This company was incorporated on

February 6, 2004, under the laws of the State of Arkansas and its principal business purpose is

providing casualty insurance in the State of Arkansas. At the report date, this company was

inactive.

SFB Investments, LLC: This company was incorporated on August 11, 1997, under the laws of

the State of Mississippi and was formed to take advantage of certain investment opportunities. At

the report date, this subsidiary was inactive. Subsequent to the examination date, this subsidiary

was administratively dissolved.

Affiliated and Related Party Transactions

The Company’s transactions with its related parties were reviewed and the following items were

deemed notable for purposes of this report:

• The Company filed consolidated federal income tax returns, which included the operating

results of SFBCIC and its subsidiaries; income taxes were allocated to the subsidiaries as

though separate tax returns had been filed.

• In order to protect its trade name the Company entered into a Limited Indemnity

Agreement with the Mississippi Farm Mutual Insurance Company which had been

significantly impacted by Hurricane Katrina. The beginning balance of the agreement

was $200,000,000, and as of the examination date, $179,330,000 has been paid out since

2005. The balance remaining under the agreement as of the examination date was

$20,670,000, which has been extended to December 31, 2012.

• The Company had a management contract with SFBPIC in which SFBCIC provided

services to SFBPIC in the areas of legal, accounting, claims, underwriting, information

services, etc. During 2010, SFBCIC received $315,000 as compensation for services

rendered.

• The Company entered into a Surplus Contribution Agreement in which MFBCIC issued

and sold to the Company a surplus note in the principal amount of $25 million. The

unpaid principle balance of the note accrues interest at the rate payable on a 20 year US

Treasury Bond as of the date of the surplus note. The rate is adjusted every two years

from the date the note was issued to the current rate of a 20 year US Treasury Bond.

• The Company had an expense agreement with MFBCIC and FFBCIC in which the

companies share in certain overhead expenses that the companies deem mutually

beneficial as they purport to allow for more efficient and economical operation.

The Company had agreements with other Farm Bureau companies that provide for the rental of

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 12

office facilities, equipment, automobiles, data processing, as well as the allocation of certain

operating and underwriting expenses. Management believes these agreements are beneficial to

the Company in providing greater operating efficiency and prompt service to its policyholders.

FIDELITY BOND AND OTHER INSURANCE

The Company was insured under various insurance policies to protect its interest. In particular, the

Company maintained directors and officers coverage, professional liability coverage, electronic and

computer crime coverage, and fidelity coverage. The Company had a financial institution bond with

a $5 million single loss limit of liability and a fiduciary liability policy with a $10 million single loss

limit of liability. These coverages exceeded the NAIC’s suggested minimum amount for fidelity

coverage.

PENSIONS, STOCK OWNERSHIP AND INSURANCE PLANS

The Company provided a noncontributory retirement plan, a 401(k) plan, a flexible spending

plan, as well as various insurance coverages, which included group term life, medical and

dental, accidental death, long-term disability and worker’s compensation. Provisions were made

within the financial statements for obligations in regard to the benefits and welfare programs

provided.

TERRITORY AND PLAN OF OPERATION

The Company specializes in personal lines, primarily casualty insurance coverages with an

emphasis on private passenger auto and farm general liability coverages. The Company is a

multi-line regional property and casualty insurance company operating in six states: Arkansas,

Colorado, Florida, Louisiana, Mississippi and South Carolina.

The Company direct writes the automobile business in the states of Arkansas, Louisiana and

South Carolina. Additionally, the Company assumes the automobile business from Farm Bureau

mutual companies in the states of Colorado, Louisiana and South Carolina. LFBCIC and

MFBCIC have written policies on a direct basis and is ceding all general liability and automobile

business to SFBCIC under a quota share agreement. No automobile business is written directly

by SFBCIC in the state of Florida, nor is any automobile business assumed from Florida.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 13

GROWTH OF COMPANY

2010 2009 2008

Total admitted assets 1,805,381,000$ 1,767,435,000$ 2,648,754,000$

Total liabilities 741,719,000$ 730,696,000$ 1,062,990,000$

Total capital and surplus 1,063,662,000$ 1,036,739,000$ 1,585,764,000$

Net cash from operations 38,632,000$ (202,436,000)$ (34,669,000)$

Total adjusted capital 1,063,662,000$ 1,036,740,000$ 1,585,764,000$

Authorized control level risk-based capital 105,799,000$ 102,322,000$ 102,496,000$

Direct premiums written 235,413,000$ 232,874,000$ 565,300,000$

Assumed premiums written 588,233,000$ 594,637,000$ 798,535,000$

Ceded premiums written 38,203,000$ 35,951,000$ 45,179,000$

Net premiums written 785,443,000$ 791,560,000$ 1,318,656,000$

Net underwriting loss (10,284,000)$ (50,418,000)$ (140,607,000)$

Investment income 49,607,000$ 42,639,000$ 78,948,000$

Net income (loss) 32,771,000$ (2,121,000)$ (29,784,000)$

Net loss ratio 80.8% 86.5% 91.2%

Expense ratio 20.6% 20.0% 19.4%

Investment yield 2.8% 2.6% 3.6%

MORTALITY AND LOSS EXPERIENCE

The MID contracted with Merlinos & Associates, Inc. to review the actuarial analysis supporting

the Company’s carried loss and loss adjustment expense reserves. Based on the examination

actuarial evaluation, the Company’s estimates for gross and net unpaid loss and loss adjustment

expenses appear to be reasonably stated in all material aspects.

REINSURANCE

The Company has various reinsurance agreements with their wholly owned subsidiaries and

other companies. The effect of the agreements is for SFBCIC to carry only the casualty

exposures on its books and the Farm Bureau entities in the respective states to carry the property

exposures on their books, regardless of which company issues the policy.

Ceded:

The Company limits the maximum net loss that can arise from large risks or risks in concentrated

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 14

areas of exposure by reinsuring (ceding) certain levels of risk with other insurers or reinsurers,

either on an automatic basis, under general reinsurance contracts known as “treaties,” or by

negotiation for substantial individual risks. The Company maintains various forms of reinsurance

on essentially all lines. Ceded reinsurance is treated as the risk and liability of the assuming

companies.

The liability for losses and loss adjustment expenses at December 31, 2010 has been reduced for

reinsurance ceded of approximately $23,790,000. These amounts would represent a liability of

the Company if the reinsures were unable to meet their obligation for existing unpaid losses

ceded under reinsurance agreements.

At the examination date, the principle reinsurers and respective premium amounts ceded and

total amounts recoverable at December 31, 2010 were as follows:

Ceded

Premiums

Recoverable

Premiums

American Agricultural Insurance Company 14,805,000$ 25,751,000$

National Flood Insurance Program 22,971,000$ 16,588,000$

Platinum Underwriters RE, Inc. 171,000$ 361,000$

Partner RE US 86,000$ 180,000$

Berkley Insurance Company 86,000$ 18,000$

Assumed:

SFBCIC assumes the following lines of business from its related parties, as defined in the

Holding Company Registration Statements filed with the MID, and other Farm Bureau

companies: 100% of automobile, umbrella, flood and a portion of the casualty piece of the

property line (“excess casualty”). Excess casualty is the portion of the general liability coverage

that is provided in a package policy that also provides property insurance. For the excess casualty

piece, each had $500,000 loss retention in 2010.

At the examination date, the principle companies with which business was assumed and

respective premium amounts assumed at December 31, 2010 were as follows:

Mississippi Farm Bureau Casualty Insurance Company 190,776,000$

Louisiana Farm Bureau Casualty Insurance Company 187,907,000$

South Carolina Farm Bureau Mutual Insurance Company 111,213,000$

Louisiana Farm Bureau Mutual Insurance Company 38,031,000$

Colorado Farm Bureau Mutual Insurance Company 26,766,000$

Farm Bureau Mutual Insurance Company of Arkansas 18,901,000$

Florida Farm Bureau Casualty Insurance Company 10,546,000$

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 15

ACCOUNTS AND RECORDS

The Company utilized a computerized accounting system on which general ledger information

was maintained. Detailed general ledger information was traced to the trial balance and the

December 31, 2010 annual statement, without material exception.

The Company’s accounting and record keeping system was built around an IBM 2064-1CM

mainframe computer which administered server major application programs, as well as

proprietary software packages. Detailed premium and loss information was maintained at the

Farm Bureau state offices and was periodically uploaded to the Company’s mainframe for

financial reporting.

In lieu of a traditional internal audit function, employees from the Company’s state operations

and senior staff from the home office perform peer reviews which examine and review methods

and procedures utilized and standards followed in each state operation. The Company was

audited annually by an independent CPA firm.

STATUTORY DEPOSITS

The Company’s statutory deposits with the state of Mississippi complied with Miss. Code Ann.

§83-19-31(2). The following chart displays the Company’s deposits at December 31, 2010.

State Par Carrying Fair

Description Deposited Value Value Value

State Bond Mississippi 2,000,000$ 2,072,109$ 2,379,720$

Total Held in Mississippi 2,000,000 2,072,109 2,379,720

State Bond Arkansas 175,000 176,015 183,109

State Bond South Carolina 200,000 200,992 213,386

Total Held in all Other States 375,000 377,007 396,495

Total of all States 2,375,000$ 2,449,116$ 2,776,215$

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 16

SOUTHERN FARM BUREAU CASUALTY INSURANCE COMPANY

FINANCIAL STATEMENTS

EXAMINATION AS OF DECEMBER 31, 2010

Introduction

The following financial statements reflect the same amounts reported by the Company and

consist of a Statement of Assets, Liabilities, Surplus and Other Funds - Statutory at December

31, 2010, a Statement of Income - Statutory for year ended December 31, 2010, a Reconciliation

of Capital and Surplus as Regards Policyholders - Statutory for examination period ended

December 31, 2010, and a Reconciliation of Examination Changes to Surplus - Statutory at

December 31, 2010.

Southern Farm Bureau Casualty Insurance Company

Statement of Admitted Assets, Liabilities,

Surplus and Other Funds – Statutory

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 17

December 31, 2010

Assets

Bonds 977,316,928$

Preferred stocks 200,000

Common stocks 531,438,976

Mortgage loans on real estate 6,811,444

Real estate occupied by the company 15,601,303

Properties held for sale 2,381,491

Cash, cash equivalents and short-term investments 31,030,526

Other invested assets 63,284,707

Receivables for securities 4,671

Investment income due and accrued 12,829,461

Uncollected premiums and agents' balances in the course of collection 2,649,109

Deferred premiums, agents' balances and installments booked but deferred and not yet due 91,661,100

Amounts recoverable from reinsurers 211,478

Funds held by or deposited with reinsured companies 15,554,984

Current federal and foreign income taxes recoverable and interest thereon 1,308,630

Net deferred tax assets 40,317,806

Guaranty funds receivable or on deposit 4,946

Electronic data processing equipment and software 4,917,007

Receivable from parent, subsidiaries and affiliates 2,535,326

Received from associated companies and other 5,321,433

Total admitted assets

1,805,381,326$

Liabilities, Surplus and Other Funds

Losses 299,932,835$

Reinsurance payable on paid losses and loss adjustment expenses 25,000

Loss adjustment expenses 55,083,001

Commissions payable, contingent commissions and other similar charges 7,568,108

Other expenses 1,876,155

Taxes, licenses and fees 1,944,053

Current federal and foreign income taxes 1,194,997

Borrowed money 18,708,242

Unearned premiums 218,746,051

Advanced premiums 20,187,824

Funds held by company under reinsurance treaties (227,698)

Amounts withheld or retained by the company for account of others 63,421,082

Drafts outstanding 306,231

Payable to parent, subsidiaries and affiliates 1,098,050

Liability under limited indemnity agreement 20,670,000

Postretirement benefit - other underwriting accrual 12,728,810

Postretirement benefit - loss adjustment expense accrual 11,707,638

Postretirement transitional adjustment 3,755,124

Payable to associated companies and other 2,993,838

Total liabilities 741,719,341

Capital common stock 1,082,842

Gross paid in and contributed surplus 620,491

Unassigned funds (surplus) 1,061,958,652

Surplus as regards policyholders 1,063,661,985

Total liabilities and surplus as regards policyholders 1,805,381,326$

Southern Farm Bureau Casualty Insurance Company

Statement of Income - Statutory

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 18

For the Year Ended December 31, 2010

Underwriting income

Premiums earned 785,776,356$

Deductions

Losses incurred 531,394,477

Loss adjustment expenses incurred 103,200,223

Other underwriting expenses incurred 161,465,244

Total underwriting deductions 796,059,944

Net underwriting gain (loss) (10,283,588)

Investment Income

Net investment income earned 44,059,596

Net realized capital gains 5,547,564

Net investment gain 49,607,160

Other income

Net gain or (loss) from agents' or premium balances charged off (122,400)

Finance and service charges not included in premiums 66,108

Assumed finance charges assumed under reinsurance contracts 3,448,544

Other miscellaneous income 1,660,834

Total other income 5,053,086

Net income before dividends to policyholders, after capital gains tax

and before all other federal and foreign income taxes 44,376,658

Federal and foreign income taxes incurred 11,605,274

Net income 32,771,384$

Southern Farm Bureau Casualty Insurance Company

Reconciliation of Capital and Surplus - Statutory

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 19

For the examination period ended December 31, 2010

2008 2009 2010

Surplus as regards policyholders, beginning of the year 1,628,674,161$ 1,585,763,538$ 1,036,739,792$

Net income (loss) (29,783,575) (2,120,835) 32,771,384

Change in net unrealized capital gains or (losses) 1,235,931 16,125,424 5,776,381

Change in net deferred income tax 11,447,550 8,088,038 3,745,841

Change in non-admitted assets (25,757,729) (8,234,979) (9,904,403)

Capital changes paid in (237,158)

Surplus adjustments paid in 203,825

Dividends to stockholders (52,800) (44,000) (5,467,010)

Withdrawal of shareholder (531,888,032)

Distributions under reorganization (30,916,029)

Change in surplus for the year (42,910,623) (549,023,746) 26,922,193

Surplus as regards policyholders, end of the year 1,585,763,538$ 1,036,739,792$ 1,063,661,985$

Southern Farm Bureau Casualty Insurance Company

Reconciliation of Examination Adjustments to Surplus - Statutory

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 20

There were no changes made to the assets, liabilities or surplus balances reported by the

Company for the year ended December 31, 2010. The surplus as regards policyholders, which

totaled $1,063,661,985 as of the examination date, was determined to be reasonably stated and in

compliance with Miss. Code Ann. §83-19-31.

Southern Farm Bureau Casualty Insurance Company

MID Examination as of December 31, 2010 Page 21

MARKET CONDUCT ACTIVITIES

A full scope market conduct examination was not performed; however, limited procedures were

performed on certain areas of the Company’s market conduct. The areas in which limited

procedures were performed included operations/management, complaint handling, producer

licensing, underwriting and rating, and claims. No significant exceptions with regard to the

limited procedures performed were noted.

COMMITMENTS AND CONTINGENT LIABILITIES

During and subsequent to the examination period, the Company was not involved in litigation

outside the normal course of business.

SUBSEQUENT EVENTS

On April 2, 2012, the MID gave notice that it would conduct an examination of SFBCIC and

other Farm Bureau related entities pursuant to §83-6-27, Mississippi Code of 1972 (the “Code”)

and other applicable laws and regulations of the MID including, but not limited to, §83-6-1, et

seq. of the Code (the “Holding Company Act”). The examination will include a review of the

relationships between SFBCIC and other associated companies and entities to determine

compliance with applicable Mississippi laws and MID regulations.

COMMENTS AND RECOMMENDATIONS

There were no comments and/or recommendations deemed necessary for purposes of this

examination report.