IN THE UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF PENNSYLVANIA

UNITED STATES OF AMERICA : CRIMINAL NO. _____________________

v. : DATE FILED: _______________________

BARRYLEE PAUL BEERS, : VIOLATIONS: 18 U.S.C. §1343

a/k/a “Lee Paul Flyte” (Wire Fraud - 14

: counts)

MICKEY ALLEN WEICKSEL 18 U.S.C. §1344

(Bank Fraud - 3

counts)

18 U.S.C. §1956(h)

(Conspiracy to

Commit Money

Laundering - 1 count)

S U P E R S E D I N G I N D I C T M E N T

COUNTS ONE THROUGH FOURTEEN

THE GRAND JURY CHARGES THAT:

At all times material to this indictment:

1. Defendants BARRYLEE PAUL BEERS, a/k/a “Lee Paul Flyte,” and

MICKEY ALLEN WEICKSEL operated a business called Paul-Allen Enterprises, also known as

“PAE” or “PAE Properties.”

2. PAE was in the business of acquiring and renting residential properties.

3. Property Rehabilitation Consultants (“PRC”) and David Loechner

Enterprises (“DLE”) were companies controlled by defendants BEERS and WEICKSEL.

2

4. From in or about June, 1997, through in or about September, 1998, in the

Eastern District of Pennsylvania and elsewhere, defendants

BARRYLEE PAUL BEERS,

a/k/a “Lee Paul Flyte,”

and

MICKEY ALLEN WEICKSEL,

devised and intended to devise a scheme to defraud mortgage lenders and to obtain money and

property by means of false and fraudulent pretenses, representations, and promises.

5. It was part of the scheme that defendants BEERS and WEICKSEL

borrowed funds from mortgage lenders by providing false information about PAE and

themselves, by misrepresenting the true sale price of the purchased properties, and by concealing

the fact that sellers had agreed to kick back a substantial part of the sale proceeds to defendants at

closing.

It was further part of the scheme that:

6. Defendants BEERS and WEICKSEL purchased numerous residential

rental properties, primarily in the area of Lancaster, Pennsylvania. Although title to each of the

properties was taken in the individual name of either defendant WEICKSEL or defendant

BEERS, defendants treated the properties as belonging to PAE, their joint business, regardless of

which defendant’s name was on the title to any particular property.

7. Defendants BEERS and WEICKSEL entered into written contracts to

purchase the properties at prices substantially higher than the seller’s asking price.

8. In addition to the purchase contracts, defendants BEERS and WEICKSEL

entered into secret side agreements with the sellers in which the sellers agreed to return a portion

3

of the contract price to defendants BEERS and WEICKSEL at closing. The secret side

agreement was referred to as an “addendum.”

9. In the secret side agreements, defendants disguised the kickbacks of part of

the purchase prices as payments by the sellers to PRC, defendants’ sham company, purportedly

for consulting and repairs. PRC had no offices and no employees, and performed no work. It

existed only as a name under which defendants could receive kickbacks at the property

settlements.

10. During the later part of the scheme, the defendants changed the payee of

the purported repair bills to DLE. DLE had no offices and no employees, and performed no

work. It existed only as a name under which defendants could receive kickbacks at the property

settlements.

11. Defendants BEERS and WEICKSEL obtained mortgage loans to purchase

the properties based on the purchase price stated in the contract of sale, without disclosing the

part of the purchase price that the sellers agreed to return to defendants BEERS and WEICKSEL.

12. Defendants BEERS and WEICKSEL did not provide the secret side

agreements to the lenders, and did not disclose to the lenders that they were receiving large

amounts of money from the sellers at closing.

13. In support of their applications for mortgage loans, defendants BEERS and

WEICKSEL submitted false information to the lenders, including false loan applications, false

tax returns, and false leases purporting to show that the properties being purchased were rented to

tenants.

4

14. For each of tax years 1995 and 1996, defendants BEERS and WEICKSEL

hired two different tax preparers to prepare tax returns for PAE, BEERS, and WEICKSEL. The

defendants supplied one tax preparer with information indicating that PAE, BEERS, and

WEICKSEL had substantial income. They supplied the other tax preparer with information

indicating that they had minimal income or had incurred substantial losses. Neither tax preparer

was aware of the tax returns prepared by the other tax preparer.

15. The defendants gave the mortgage lenders the tax returns that showed

substantial income. The defendants filed with the Internal Revenue Service the tax returns that

reported losses or minimal income.

16. Defendants BEERS and WEICKSEL caused lenders to make mortgage

loans based on the false information.

17. At settlement, the defendants caused the closing documents falsely to

report the kickbacks of portions of the purchase price as charges to the sellers for repairs and

consultations. Defendants presented documents falsely purporting to be bills from PRC and DLE

for repairs and consultations, when in fact no significant work had been done. Defendants

caused the title agents to deduct the amount of the PRC and DLE payments from the proceeds

due to sellers and to issue checks payable to PRC and DLE.

18. At settlement, defendants BEERS, WEICKSEL, and PAE employees

acting at the direction of defendants BEERS and WEICKSEL, received the PRC and DLE

checks. Defendant BEERS and PAE employees acting at the direction of defendant BEERS

deposited some checks into PRC’s bank account and others into PAE’s bank account. Defendant

BEERS later transferred the funds deposited into the PRC account into PAE’s bank account.

5

19. Defendants received approximately $5,145,900 from kickbacks received at

property settlements.

20. Defendants BEERS and WEICKSEL used at least $3,800,000 of the

kickbacks to make down payments on the acquisition of additional properties. Defendants also

used kickback funds for personal expenditures, including renovations to, and decorating and

furnishing of, their personal residence.

21. Defendants BEERS and WEICKSEL performed no substantial

rehabilitation on the properties purchased by them, with the exception of minor improvements.

22. On or about each of the dates set forth below, in the Eastern District of

Pennsylvania and elsewhere, for the purpose of executing the scheme described above,

defendants

BARRYLEE PAUL BEERS,

a/k/a “Lee Paul Flyte,”

and

MICKEY ALLEN WEICKSEL,

caused to be transmitted by means of wire communication in interstate commerce the signals and

sounds described below for each count, each transmission constituting a separate count:

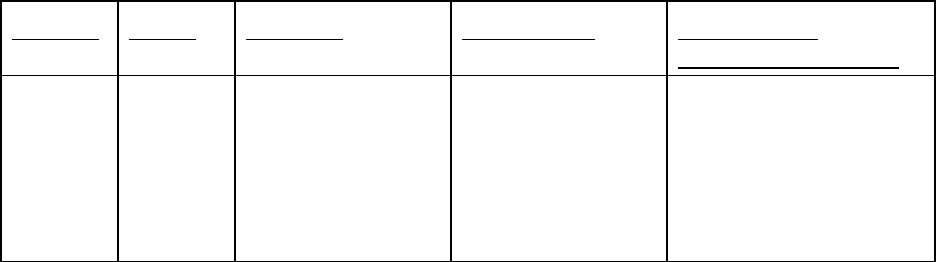

COUNT DATE SENDER RECIPIENT NATURE OF

COMMUNICATION

1 10/03/97 Texas Commerce

Bank (now known

as Chase Bank),

Houston, TX

(sender Fieldstone

Mortgage Co.)

Fulton Bank,

Lancaster, PA,

account of Orion

Abstract

Wire transfer of

$60,840.59 for closing of

417 Hamilton St.,

Lancaster, PA

6

2 11/07/97 Fleet Bank, New

York (sender Delta

Funding Corp.)

Fulton Bank,

Lancaster, PA,

account of Orion

Abstract

Wire transfer of

$53,479.00 for closing of

239 S. Ann St.,

Lancaster, PA

3 11/07/97 Fleet Bank, New

York (sender Delta

Funding Corp.)

Fulton Bank,

Lancaster, PA,

account of Orion

Abstract

Wire transfer of

$62,749.00 for closing of

230 W. James St.,

Lancaster, PA

4 11/10/97 Fleet Bank, New

York (sender Delta

Funding Corp.)

Fulton Bank,

Lancaster, PA,

account of Orion

Abstract

Wire transfer of

$68,929.00 for closing of

206 Pearl St., Lancaster,

PA

5 12/23/97 Keystone Property

Settlements, Inc.,

Willow Street, PA

Mortgage Closing

Department,

Fieldstone

Mortgage Co.,

Bethesda, MD

Facsimile transmission

of wiring instructions,

escrow information form,

and interim title binder

for closing of 771 Manor

St., Lancaster, PA

6 03/20/98 The Bankers Bank,

Atlanta, Georgia

(sender Habersham

Bank)

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$35,840.00 for closing of

537 Manor St.,

Lancaster, PA

7 4/17/98 Delaware Savings

Bank (now known

as Lehman

Brothers Bank),

Wilmington, DE

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$215,400.00 for closings

of 428 E. Grant St., 430

E. Grant St., 67 S.

Marshall St., and 521 E.

End Ave., Lancaster, PA

8 4/20/98 Delaware Savings

Bank (now known

as Lehman

Brothers Bank),

Wilmington, DE

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$190,189.00 for closings

of 546 Green St., 64

Locust St., 525 S. Plum

St., and 528 Green St.,

Lancaster, PA

7

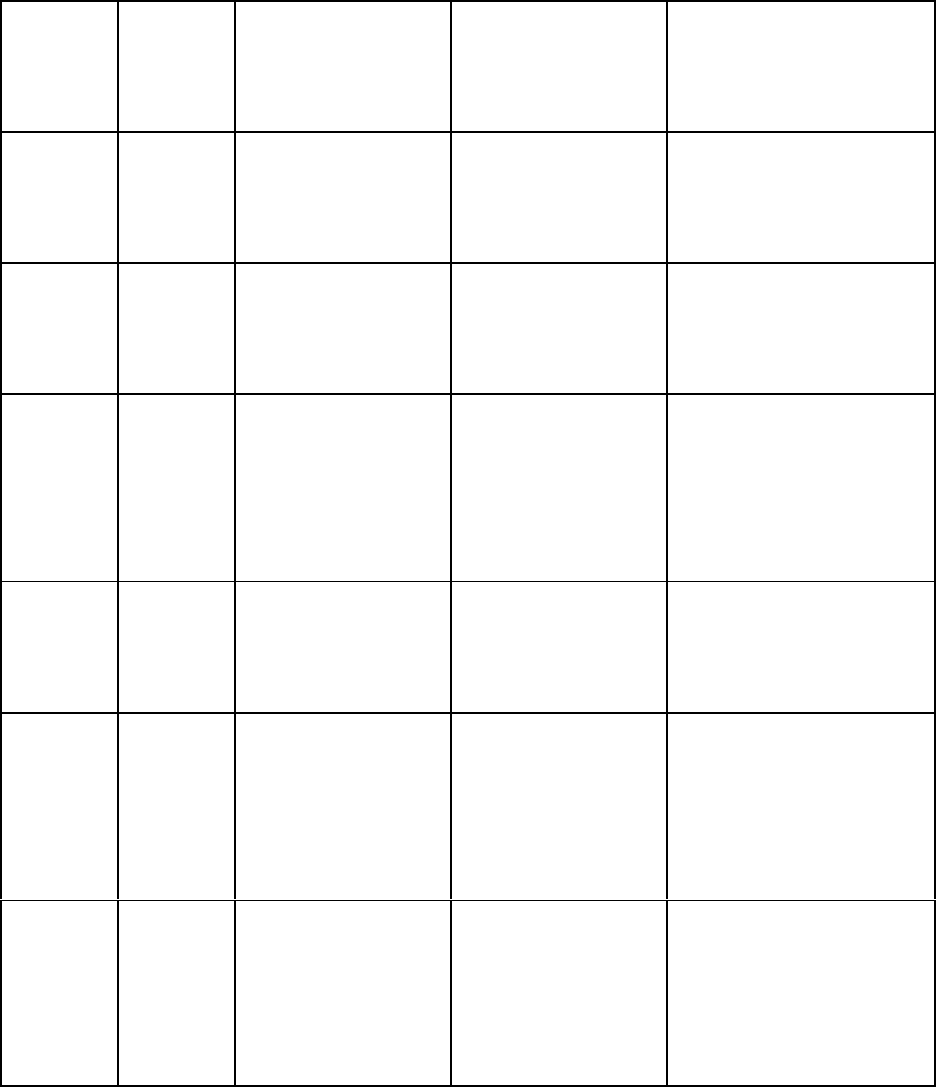

9 05/26/98 First National Bank

of Chicago (also

known as First

Chicago Bank, now

known as Bank

One), Chicago, IL

(sender WMC

Mortgage Co.)

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$31,503.16 for closing of

455 Atlantic Ave.,

Lancaster, PA

10 5/26/98 First National Bank

of Chicago (also

known as First

Chicago Bank, now

known as Bank

One), Chicago, IL

(sender WMC

Mortgage Co.)

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$29,365.21 for closing of

132 Jefferson Ave.,

York, PA

11 5/29/98 First National Bank

of Chicago (also

known as First

Chicago Bank, now

known as Bank

One), Chicago, IL

(sender WMC

Mortgage Co.)

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$40,808.49 for closing of

424 Howard Ave.,

Lancaster, PA

12 6/4/98 First National Bank

of Chicago (also

known as First

Chicago Bank, now

known as Bank

One), Chicago, IL

(sender WMC

Mortgage Co.)

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$51,102.40 for closing of

37 Hazel St., Lancaster,

PA

13 6/4/98 First National Bank

of Chicago (also

known as First

Chicago Bank, now

known as Bank

One), Chicago, IL

(sender WMC

Mortgage Co.)

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$38,741.18 for closing of

540 ½ Chester St.,

Lancaster, PA

8

14 6/5/98 First National Bank

of Chicago (also

known as First

Chicago Bank, now

known as Bank

One), Chicago, IL

(sender WMC

Mortgage Co.)

Sovereign Bank,

Wyomissing, PA,

account of

Wheatland Abstract

Wire transfer of

$44,062.91 for closing of

56 Campbell Ave.,

Lancaster, PA

All in violation of Title 18, United States Code, Section 1343.

9

COUNT FIFTEEN

THE GRAND JURY FURTHER CHARGES THAT:

1. The allegations of paragraphs 1 through 3 and 5 through 21 of Counts 1

through 14 are realleged here.

2. At all times material to this indictment, Crusader Bank, FSB, (“Crusader

Bank”) was a financial institution as defined in Title 18, United States Code, Section 20.

3. From in or about November, 1997, through in or about February, 1998,

defendants

BARRYLEE PAUL BEERS,

a/k/a “Lee Paul Flyte,”

and

MICKEY ALLEN WEICKSEL,

knowingly executed and attempted to execute a scheme to defraud Crusader Bank, and to obtain

funds owned by and under the care, custody, and control of Crusader Bank, by means of false and

fraudulent pretenses, representations and promises.

4. It was part of the scheme that defendants BEERS and WEICKSEL

borrowed funds by providing false information about PAE and themselves, by misrepresenting

the true sale price of the purchased properties, and by concealing the fact that sellers had agreed

to kick back a substantial part of the sale proceeds to defendants at closing.

It was further part of the scheme that:

5. Defendant BEERS applied for and received six mortgage loans totaling

approximately $565,100 from Crusader Bank for the purchase of the following properties: 750 N.

Pine Street, Lancaster, Pennsylvania; 521 West Frederick Street, Lancaster, Pennsylvania; 422

10

North Mary Street, Lancaster, Pennsylvania; 108 Coral Street, Lancaster, Pennsylvania; 6197

Main Street, East Petersburg, Pennsylvania; and 2310 Fruitville Pike, Lancaster, Pennsylvania.

6. Defendant WEICKSEL applied for and received a mortgage loan in the

amount of approximately $183,750 from Crusader Bank for the purchase of the property located

at 132 Mount Hope School Road, Willow Street, Pennsylvania.

7. For the purpose of obtaining these mortgage loans, defendants BEERS and

WEICKSEL submitted and caused to be submitted to Crusader Bank documents falsely

purporting to be tax returns filed with the Internal Revenue Service for tax years 1995 and 1996.

8. Defendants BEERS and WEICKSEL misrepresented the purchase price of

the properties by failing to disclose to Crusader Bank the existence of secret side agreements in

which the sellers agreed to refund to defendants BEERS and WEICKSEL a portion of the

purported purchase price in the form of a payment to “PRC,” an entity controlled by defendants.

9. Defendants defaulted on the loans, causing a loss of at least $131,858.

In violation of Title 18, United States Code, Section 1344.

11

COUNT SIXTEEN

THE GRAND JURY FURTHER CHARGES THAT:

1. The allegations of paragraphs 1 through 3 and 5 through 21 of Counts 1

through 14 are realleged here.

2. At all times material to this indictment, Delaware Savings Bank was a

financial institution as defined in Title 18, United States Code, Section 20.

3. From in or about September, 1997, through in or about April 1998,

defendants

BARRYLEE PAUL BEERS,

a/k/a “Lee Paul Flyte,”

and

MICKEY ALLEN WEICKSEL,

knowingly executed and attempted to execute a scheme to defraud Delaware Savings Bank, and

to obtain funds owned by and under the care, custody, and control of Delaware Savings Bank, by

means of false and fraudulent pretenses, representations and promises.

4. It was part of the scheme that defendants BEERS and WEICKSEL

borrowed funds by providing false information about PAE and themselves, by misrepresenting

the true sale price of the purchased properties, and by concealing the fact that sellers had agreed

to kick back a substantial part of the sale proceeds to defendants at closing.

It was further part of the scheme that:

5. Defendant BEERS applied for and received four mortgage loans totaling

approximately $213,500 from Delaware Savings Bank for the purchase of the following

properties: 428 East Grant Street, Lancaster, Pennsylvania; 430 East Grant Street, Lancaster,

12

Pennsylvania; 67 South Marshall Street, Lancaster, Pennsylvania; 521 East End Avenue,

Lancaster, Pennsylvania.

6. Defendant WEICKSEL applied for and received eight mortgage loans

totaling approximately $420,950 from Delaware Savings Bank for the purchase of the following

properties: 409 East Strawberry Street, Lancaster, Pennsylvania; 26 South Ann Street, Lancaster,

Pennsylvania; 238 South Ann Street, Lancaster, Pennsylvania; 310 East Fulton Street, Lancaster,

Pennsylvania; 546 Green Street, Lancaster, Pennsylvania; 64 Locust Street, Lancaster,

Pennsylvania; 525 South Plum Street, Lancaster, Pennsylvania; 528 Green Street, Lancaster,

Pennsylvania.

7. For the purpose of obtaining these mortgage loans, defendants BEERS and

WEICKSEL misrepresented the purchase price of the properties by failing to disclose to

Delaware Savings Bank the existence of secret side agreements in which the sellers agreed to

refund to defendants BEERS and WEICKSEL a portion of the purported purchase price in the

form of a payment to “PRC,” an entity controlled by defendants.

8. Defendants defaulted on the loans, causing a loss of at least $238,000.

In violation of Title 18, United States Code, Section 1344.

13

COUNT SEVENTEEN

THE GRAND JURY FURTHER CHARGES THAT:

1. The allegations of paragraphs 1 through 3 and 5 through 21 of Counts 1

through 14 are realleged here.

2. At all times material to this indictment, Habersham Bank was a financial

institution as defined in Title 18, United States Code, Section 20.

3. From in or about November, 1997, through in or about March, 1998,

defendants

BARRYLEE PAUL BEERS,

a/k/a “Lee Paul Flyte,”

and

MICKEY ALLEN WEICKSEL,

knowingly executed and attempted to execute a scheme to defraud Habersham Bank, and to

obtain funds owned by and under the care, custody, and control of Habersham Bank, by means of

false and fraudulent pretenses, representations and promises.

4. It was part of the scheme that defendants BEERS and WEICKSEL

borrowed funds by providing false information about PAE and themselves, by misrepresenting

the true sale price of the purchased properties, and by concealing the fact that sellers had agreed

to kick back a substantial part of the sale proceeds to defendants at closing.

It was further part of the scheme that:

5. Defendant BEERS applied for and received eleven mortgage loans totaling

approximately $1,088,650 from Habersham Bank for the purchase of the following properties: 8

Roseville Road, Lancaster, Pennsylvania; 51 South Franklin Street, Lancaster, Pennsylvania; 741

14

Beaver Street, Lancaster, Pennsylvania; 745 Beaver Street, Lancaster, Pennsylvania; 49 South

Franklin Street, Lancaster, Pennsylvania; 2595 State Street, East Petersburg, Pennsylvania; 344

West Orange Street, Lancaster, Pennsylvania; 324 East New Street, Lititz, Pennsylvania; 1345

Wabank Road, Lancaster, Pennsylvania; 911 West Poplar Street, York, Pennsylvania; 537 Manor

Street, Lancaster, Pennsylvania.

6. Defendant WEICKSEL applied for and received seven mortgage loans

totaling approximately $313,500 from Habersham Bank for the purchase of the following

properties: 559 Juniata Street, Lancaster, Pennsylvania; 533 Manor Street, Lancaster,

Pennsylvania; 215 South Main Street, Manheim, Pennsylvania; 1405 Mayflower Street,

Harrisburg, Pennsylvania; 125 North Summit Street, Harrisburg, Pennsylvania; 1722 Elm Street,

Harrisburg, Pennsylvania; 1612 Liberty Street, Harrisburg, Pennsylvania.

7. It was further part of the scheme that for the purpose of obtaining these

mortgage loans, defendants BEERS and WEICKSEL submitted and caused to be submitted to

Habersham Bank documents falsely purporting to be tax returns PAE filed with the Internal

Revenue Service for tax years 1995 and 1996.

8. It was further part of the scheme that defendants BEERS and WEICKSEL

misrepresented the purchase price of the properties by failing to disclose to Habersham Bank the

existence of secret side agreements in which the sellers agreed to refund to defendants BEERS

and WEICKSEL a portion of the purported purchase price in the form of a payment to “PRC,” an

entity controlled by defendants.

15

9. Defendants defaulted on the loans, causing a loss of approximately

$1,229,768.

In violation of Title 18, United States Code, Section 1344.

16

COUNT EIGHTEEN

THE GRAND JURY FURTHER CHARGES THAT:

1. The allegations of paragraphs 1 through 3 and 5 through 21 of Counts 1

through 14 are realleged here.

2. From in or about September, 1997, through in or about June, 1998, at

Lancaster, in the Eastern District of Pennsylvania, defendants

BARRYLEE PAUL BEERS,

a/k/a “Lee Paul Flyte,”

and

MICKEY ALLEN WEICKSEL,

conspired with each other and with others known and unknown to the grand jury to conduct

financial transactions affecting interstate commerce, knowing that the transactions involved

property representing the proceeds of some form of unlawful activity, which in fact involved the

proceeds of a specified unlawful activity, that is, bank fraud and wire fraud, with the intent to

promote the carrying on of the specified unlawful activity, in violation of Title 18, United States

Code, Section 1956(a)(1)(A)(i).

MANNER AND MEANS

It was part of the conspiracy that:

3. At the real estate closing transactions, defendants BEERS and

WEICKSEL, and PAE employees acting at their direction, received checks payable to PRC and

DLE from the closing agent. These checks represented the amount that the seller had agreed to

kick back to defendants from the purchase price stated in the sales agreements.

17

4. Defendant BEERS and PAE employees acting at defendants’ direction

deposited some of the checks into PRC’s bank account and others into PAE’s bank account.

Defendant BEERS later transferred the funds deposited into PRC’s bank account to PAE’s bank

account.

5. From on or about September 8, 1997, through on or about July 17, 1998, a

total of approximately $7,540,000 was deposited into PAE’s bank account. Of this amount,

approximately $5,145,900 came from kickbacks received at property settlements.

6. Defendant BEERS then wrote checks on the PAE bank account for down

payments on the purchase of additional properties, both in his name and in the name of defendant

WEICKSEL.

7. On occasion, rather than writing a check for the down payment on a

property, defendant BEERS used funds from the PAE bank account to purchase treasurer’s

checks, which BEERS then used as down payments for properties.

8. Through checks written on the PAE bank account and treasurer’s checks

purchased with funds from that account, the defendants used at least approximately $3,800,000

from the PAE bank account to make down payments on the acquisition of additional properties.

OVERT ACTS

In furtherance of the conspiracy, defendants BARRYLEE PAUL BEERS and

MICKEY ALLEN WEICKSEL, and others known and unknown to the grand jury, committed

the following overt acts in the Eastern District of Pennsylvania:

18

1. On or about October 4, 1997, defendant WEICKSEL caused check no.

6333, drawn on the bank account of PAE, to be used as a down payment on the acquisition of

417 Hamilton St., Lancaster, PA.

2. On or about October 10, 1997, defendant WEICKSEL caused check no.

6379, drawn on the bank account of PAE, to be used as a down payment on the acquisition of

409 E. Strawberry St., Lancaster, PA.

3. On or about October 22, 1997, defendant WEICKSEL caused check no.

6447, drawn on the bank account of PAE, to be used as a down payment on the acquisition of

532 Dauphin St., Lancaster, PA.

4. On or about November 7, 1997, defendant BEERS caused check no. 6556,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 239 S.

Ann St., Lancaster, PA.

5. On or about December 1, 1997, defendant BEERS caused check no. 6620,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 422 N.

Mary St., Lancaster, PA.

6. On or about January 9, 1998, defendant BEERS caused check no. 6695,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 1022 N.

Lime St., Lancaster, PA.

7. On or about January 30, 1998, defendant BEERS caused check no. 6742,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 207 S.

Ann St., Lancaster, PA.

19

8. On or about January 30, 1998, defendant BEERS caused check no. 6746,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 2310

Fruitville Pike, Lancaster, PA.

9. On or about February 4, 1998, defendant BEERS caused check no. 6755,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 741

Beaver St., Lancaster, PA.

10. On or about February 4, 1998, defendant BEERS caused check no. 6756,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 8

Roseville Road, Lancaster, PA.

11. On or about February 9, 1998, defendant BEERS caused check no. 6784,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 745

Beaver St., Lancaster, PA.

12. On or about February 13, 1998, defendant WEICKSEL caused check no.

6807, drawn on the bank account of PAE, to be used as a down payment on the acquisition of

533 Manor St., Lancaster, PA.

13. On or about February 19, 1998, defendant WEICKSEL caused check no.

6821, drawn on the bank account of PAE, to be used as a down payment on the acquisition of

132 Mt. Hope School Road, Willow Street, PA.

14. On or about March 2, 1998, defendant BEERS caused check no. 6846,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 2595

State St., East Petersburg, PA.

20

15. On or about April 17, 1998, defendant BEERS caused check no. 6917,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 521 E.

End Ave., Lancaster, PA.

16. On or about April 20, 1998, defendant WEICKSEL caused check no.

6935, drawn on the bank account of PAE, to be used as a down payment on the acquisition of 64

Locust St., Lancaster, PA.

17. On or about May 26, 1998, defendant WEICKSEL caused check no. 7018,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 455

Atlantic Ave., Lancaster, PA.

18. On or about May 29, 1998, defendant BEERS caused check no. 7028,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 424

Howard Ave., Lancaster, PA.

19. On or about June 4, 1998, defendant WEICKSEL caused check no. 7041,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 540 ½

Chester St., Lancaster, PA.

20. On or about June 4, 1998, defendant BEERS caused check no. 7042,

drawn on the bank account of PAE, to be used as a down payment on the acquisition of 37 Hazel

St., Lancaster, PA.

21. On or about December 26, 1997, defendant BEERS caused York Federal

Treasurer’s Check no. 440233, payable to Keystone Settlements in the amount of $23,000.00, to

be used as a down payment on the purchase of 771 Manor St., Lancaster, PA.

21

22. On or about December 30, 1997, defendant BEERS caused York Federal

Treasurer’s Check no. 440252, payable to Keystone Settlements in the amount of $44,233.30, to

be used as a down payment on the purchase of 6197 Main St., East Petersburg, PA.

All in violation of Title 18, United States Code, Section 1956(h).

A TRUE BILL:

__________________________________________

FOREPERSON

____________________________________

PATRICK L. MEEHAN

United States Attorney