Georgia

Surplus Property

Manual

Revised January 2021 Reduce, Reuse, Recycle

Department of Administrative Services

200 Piedmont Ave. Ste. 1804 West Tower

Atlanta, GA 30334-9010

J. Alexander Atwood, Commissioner

Georgia Surplus Property Manual 1: Overview and General Information

Department of Administrative Services

January 2021

1

Table of Contents

Chapter 1: Purpose and Application of Surplus Property Manual ......................................................2

1.1 Purpose ..................................................................................................................................... 2

1.2 Applicability of Surplus Property Manual ................................................................................. 2

Chapter 2: About Surplus ................................................................................................................2

2.1 Surplus Mission ......................................................................................................................... 2

2.2 Surplus Contact Information ..................................................................................................... 3

Chapter 3: Understanding Property Management and Surplus Definitions .......................................3

3.1 Key Elements of Property Management ................................................................................... 3

3.2 Property Definitions .................................................................................................................. 4

Chapter 4: Surplus Property Laws and Regulations ..........................................................................4

4.1 Laws pertaining to State Owned Property ................................................................................ 4

4.2 Laws and Regulations Pertaining to the Federal Surplus Property Program ............................ 7

Section 2. Surplus Program Eligibility, Applicability and Responsibilities ........... 8

Chapter 5: Applicability and Eligibility .............................................................................................8

5.1 Eligibility Applicability ............................................................................................................... 8

5.2 Eligibility Determination ........................................................................................................... 8

5.3 Redistribution Hierarchy ........................................................................................................... 9

Chapter 6: State Entity Responsibilities ...........................................................................................9

6.1 Entity Responsibilities ............................................................................................................... 9

6.2 Property Management Role Definitions ................................................................................. 10

6.3 Restrictions for Acquired State Property ................................................................................ 10

6.4 Sales to State Employees ........................................................................................................ 11

Chapter 7: Transaction Proceeds ................................................................................................... 11

7.1 Asset Disposal Proceeds .......................................................................................................... 11

7.2 Conditional Property Title Transfer......................................................................................... 12

Section 3. Disposing of State Property ............................................................. 13

Chapter 8: Overview of Disposal Process ....................................................................................... 13

8.1 Virtual Disposal ....................................................................................................................... 15

8.2 Asset Works (AW) ................................................................................................................... 15

Chapter 9: Surplus Disposal – Creating the Transaction.................................................................. 16

9.1 What Information is included in the Transaction Request? ................................................... 16

9.2 Tips for taking photos to accompany Transaction Request .................................................... 16

9.3 Additional Information to Include with Transaction Request ................................................ 17

Georgia Surplus Property Manual 1: Overview and General Information

Department of Administrative Services

January 2021

2

Chapter 10: Redistribution ............................................................................................................ 18

10.1 Intra-Agency Transfer ............................................................................................................. 18

10.2 Inter-Agency Transfer ............................................................................................................. 18

10.3 How to Complete a Surplus Inter-Agency Transfer- T (State to State) ................................... 18

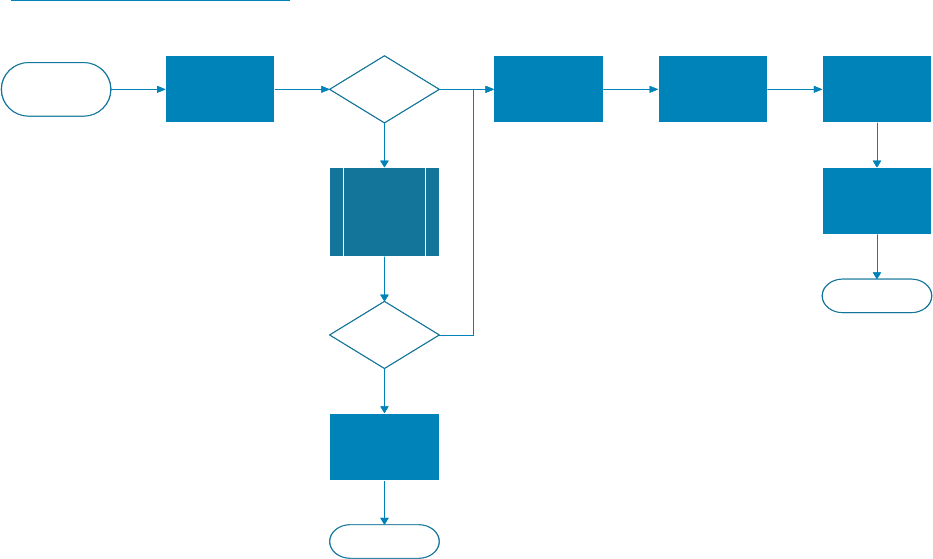

10.4 Diagram of Inter-Agency Transfer Process ............................................................................. 19

10.5 Direct Negotiated Sale (DNS) (State to Eligible Donee) .......................................................... 19

10.6 Restrictions on Direct Negotiated Sales .................................................................................. 19

10.7 How to Complete a Surplus Direct Negotiated Sale - DNS (State to Eligible Donee) ............. 20

10.8 Direct Negotiated Sale Diagram .............................................................................................. 20

10.9 Vendor Return (State to Vendor) ............................................................................................ 21

10.10 How to Complete a Surplus Vendor Return - V (Trade-in)) .................................................... 21

10.11 Diagram of Vendor Return/Trade-In Process ......................................................................... 22

Chapter 11: Sales to the Public ...................................................................................................... 22

11.1 Internet Auctions .................................................................................................................... 22

11.2 Considerations when dealing with public buyers: .................................................................. 22

11.3 How to Complete an Internet Auction – IS (State to Public) .................................................. 23

11.4 “Retail” or Fixed Price Sales .................................................................................................... 23

11.5 How to Complete a Retail Sale – RS ........................................................................................ 23

11.6 Diagram of Public Internet /Retail Sales Process .................................................................... 24

Chapter 12: Disposal Authorization (Previously Destruction Authorization) .................................... 24

12.1 Authorized Disposal Guidelines .............................................................................................. 25

12.2 How to Complete an Authorized Disposal/Destruction .......................................................... 25

12.3 Affidavit of Disposal Form ....................................................................................................... 26

Chapter 13: Surplus Vehicles ......................................................................................................... 26

13.1 Vehicle Accidents .................................................................................................................... 27

13.2 How to Complete a Surplus Vehicle Transaction .................................................................... 27

13.3 Vehicle Disposal – Supplier Option ......................................................................................... 28

13.4 Vehicle Disposal - On-Site Disposal Option ............................................................................. 28

13.5 Completing the Title ................................................................................................................ 30

13.6 Vehicle Photo Requirements .................................................................................................. 31

13.7 Acquisition of Surplus Vehicles ............................................................................................... 33

Chapter 14: Electronics Disposal.................................................................................................... 34

14.1 Data Security ........................................................................................................................... 34

14.2 Environmental Considerations ................................................................................................ 35

14.3 Electronic Equipment Disposal Authority ............................................................................... 35

14.4 Electronic Disposal Options .................................................................................................... 35

14.5 Electronics Disposal Vendor .................................................................................................... 37

Chapter 15: Property Not Addressed by Surplus ............................................................................. 37

15.1 Missing or Stolen Property ...................................................................................................... 37

15.2 Trash, Scrap, Recyclables and Hazardous Materials ............................................................... 38

15.3 Lost and Found ........................................................................................................................ 39

Georgia Surplus Property Manual 1: Overview and General Information

Department of Administrative Services

January 2021

3

Chapter 16: Special Disposal Issues ............................................................................................... 39

16.1 Other Disposal Methods ......................................................................................................... 39

16.2 International Disposal ............................................................................................................. 39

16.3 Unique Disposal Items – Books ............................................................................................... 39

16.4 Weapons ................................................................................................................................. 40

Section 4. Federal Surplus Property ................................................................. 41

Chapter 18: Federal Surplus Program Overview ............................................................................. 41

18.1 Federal Redistribution Hierarchy ............................................... Error! Bookmark not defined.

18.2 Eligibility to Receive Federal Surplus Property ....................................................................... 41

Chapter 19: Acquiring Federal Surplus Property ............................................................................. 41

19.1 Considerations ........................................................................................................................ 41

19.2 How to Obtain Federal Surplus Property ................................................................................ 41

19.3 Costs of Acquiring Federal Surplus Property .......................................................................... 44

19.4 Federal Property Restrictions ................................................................................................. 44

Section 5. Other Terms and Conditions for Donee Surplus Acquisition ............ 45

Chapter 19: Property Condition/Return/Exchange ......................................................................... 45

19.1 State Property ......................................................................................................................... 45

19.2 Federal Property ..................................................................................................................... 45

Chapter 20: Limitations on Quantity ............................................................................................. 45

Chapter 21: Payment .................................................................................................................... 45

21.1 Forms and Terms of Payment ................................................................................................. 45

21.2 Payments by Check ................................................................................................................. 46

Appendix A - Surplus Forms .............................................................................. 47

Completing Affidavit of Disposal .................................................................................................... 48

Completing Agency Change Request ............................................................................................. 50

Designation of Certifying Officials and Property Selectors ............................................................ 51

Missing or Stolen Property Report ................................................................................................ 52

Appendix B - Federal Property Terms and Conditions ....................................... 54

Appendix C - Internet Online Sales Terms and Conditions ................................. 56

Appendix D - Glossary ....................................................................................... 59

Georgia Surplus Property Manual Section 1: Overview and General Information

Overview and General Information

Department of Administrative Services

January 2021

2

“To ensure the equitable and appropriate redistribution and disposal of Georgia

state and federal personal property to state and municipal government entities,

and eligible nonprofit organizations.”

Overview and General Information

Chapter 1: Purpose and Application of Surplus Property Manual

1.1 Purpose

The purpose of this Surplus Property Manual (hereinafter the “Manual”) is to publish the

administrative rules and regulations issued by the Department of Administrative Services

(DOAS), through its Surplus Property Division (Surplus). These administrative rules govern the

activities that Georgia State executive branch entities use to dispose of state surplus personal

property and are intended to support the following purposes:

1. Save the state (taxpayers) money through centralized redistribution and disposal of

unneeded property.

2. Create an audit trail that verifies and validates appropriate property disposal as required by

legislation, Generally Accepted Accounting Principles (GAAP) and Governmental Accounting

Standards Board (GASB).

3. Maximize the return for the disposal of state property.

4. Make the surplus property regulations consistent among eligible participants and entities in

the state.

5. Provide guidance and facilitate the acquisition of federal surplus/excess property by state

participants.

6. Ensure the fair and equitable treatment of all persons who deal with the surplus property

system of Georgia.

1.2 Applicability of Surplus Property Manual

This manual supersedes the Surplus Property Disposal Guide (Guide) and any revisions to the

Guide or the Manual issued prior to the effective date of the Manual.

Chapter 2: About Surplus

2.1 Surplus Mission

The mission of the Department of Administrative Services, Surplus Division is:

With limited exceptions, surplus is responsible for the final disposition of all state personal

property. Additionally, it serves as the State Agency for Surplus Property (SASP), and acts as the

federal government’s agent for eligible recipients to acquire federal surplus property.

Georgia Surplus Property Manual Section 1: Overview and General Information

Overview and General Information

Department of Administrative Services

January 2021

3

2.2 Surplus Contact Information

Surplus is centrally managed out of the administrative office in Atlanta:

200 Piedmont Avenue, S.E.,

Suite 1804 West Tower

Atlanta, Georgia 30334-9010

For more information, visit the Surplus web site at http://doas.ga.gov/surplus-property/

Chapter 3: Understanding Property Management and Surplus Definitions

3.1 Key Elements of Property Management

A review of the key property management life cycle process and roles should provide

background for how decisions about surplus property are made.

1. Property Management Life Cycle

The key stages of managing state property are:

1. Needs assessment and requirements definition

(What do we need?)

2. Procurement

(Did we acquire the best value for the need?)

3. Utilization and property tracking

(Are we using it efficiently?)

4. Disposal

(What is the best manner of disposal?)

2. Property Roles of the State and State Agencies

The State and its entities have distinct property management roles. The key definitions are

provided below:

• State’s property role

All property purchased by or donated to the State, regardless of the funding source is

owned by the State. As the owner, the State has final decision-making authority over all

property management aspects, especially procurement and disposal.

• Ownership is defined as “having a legal, rightful title to property.”

• State agencies’ property role

As good stewards of taxpayer funds, all state agencies and employees are responsible

and accountable to ensure that state personal property is utilized, tracked, and

disposed of in an efficient and effective manner.

Requirements

$

$

$

Purchasing

Tracking &

Utilization

Disposal

Georgia Surplus Property Manual Section 1: Overview and General Information

Overview and General Information

Department of Administrative Services

January 2021

4

• Accountability is to “possess and have use of property with delegated

duties and responsibilities.”

• Responsibility is “to be answerable for a trust or obligation.”

3. Surplus Property

The state’s surplus property management process addresses the final step of the property life

cycle. Once a state entity no longer has a use for property, DOAS Surplus Property Division is

responsible for determining the best utility of that property, which could include inter-entity

transfer, sale, or destruction. Understanding key parts of property management helps agencies

make informed decisions regarding surplus property.

3.2 Property Definitions

Real property is assets or property that includes land and buildings, and anything affixed to the

land.

Personal property is “any fixed or movable tangible property used for operations, the benefits

of which extend beyond one year from the date of acquisition.” Essentially, personal property

refers any item that is owned by the state, and is not real estate, regardless of acquisition cost

or method.

Capital assets may be either real or personal property that have a value equal to or greater than

the capitalization threshold for the classification of the asset, and have an estimated life greater

than one year. The personal property capitalization threshold is currently $5,000. (Additional

information can be found in the Department of Audits, Capital Asset Guide.)

Surplus property is non-consumable personal property that the state no longer requires.

Chapter 4: Surplus Property Laws and Regulations

4.1 Laws pertaining to State Owned Property

The purpose of this section is to provide the legal authority for state surplus property in the

State of Georgia, as set forth in the Official Code of Georgia Annotated (O.C.G.A.).

§ 50-5-140. Department to request lists of surplus property

It shall be the duty and responsibility of the head of each department, institution, or agency of

the state to furnish, upon written request by the Department of Administrative Services on such

forms as provided by it, a list of all surplus personal property held by that department,

institution, or agency at the time of the request. These requests may be made by the

Department of Administrative Services as often as it deems necessary.

Georgia Surplus Property Manual Section 1: Overview and General Information

Overview and General Information

Department of Administrative Services

January 2021

5

§ 50-5-141. Transfer, sale, trade, or destruction authorized; prohibition of certain employee

purchases

(a) The Department of Administrative Services is authorized and it shall be its duty to dispose of

surplus property by one of the following means:

(1) Transfer to other state agencies;

(2) Sell to the highest responsible bidder for cash;

(3) Sell by fixed price; provided, however, that surplus property sold by fixed price shall have

been originally purchased by the state for an amount of $5,000.00 or less;

(4) Trade in such surplus property on the purchase of new equipment if the Department of

Administrative Services shall determine that such action is for the best interest of the

state; or

(5) Where the Department of Administrative Services shall determine that the surplus

property has no value or that the cost of maintaining and selling the surplus property

exceeds the anticipated proceeds from the sale of the surplus property, by destruction

and disposal and order of removal from the inventory of the department, institution, or

agency with such action noted thereon.

(b) No employee of the Department of Administrative Services or such employee's immediate

family member shall purchase surplus property sold by fixed price or negotiated sale; nor

shall any person purchase surplus property by fixed price or negotiated sale for the direct or

indirect benefit of any such employee or employee's immediate family member.

§ 50-5-142. Commissioner to promulgate rules and regulations

The commissioner of administrative services shall promulgate such rules and regulations as may

be required to carry out Code Sections 50-5-140, 50-5-141, 50-5-143, 50-5-144, and 50-5-146

and shall establish procedures for the disposition of surplus property, including the manner

whereby the sale of surplus property shall be advertised and competitive bids for the purchase

thereof shall be secured.

§ 50-5-143. Transfer to political subdivision by negotiated sale; conditions

(a) As used in this Code section, the term "political subdivision" means any county or

municipality or any county or independent board of education.

(b) In addition to the authority provided in Code Section 50-5-141, the Department of

Administrative Services shall be further authorized to dispose of surplus property by the

transfer of the property to any political subdivision through a negotiated sale if the

Department of Administrative Services determines that such sale would be in the best

Georgia Surplus Property Manual Section 1: Overview and General Information

Overview and General Information

Department of Administrative Services

January 2021

6

interests of the state, and, under the circumstances, the negotiated sales price would

constitute a reasonable consideration for the property.

(c) When any surplus property is transferred to a political subdivision, pursuant to subsection (b)

of this Code section, such transfer shall be subject to the following conditions:

(1) The property shall not be resold by any such political subdivision within one year after the

transfer without the written consent of the Department of Administrative Services; and

(2) The Department of Administrative Services shall have the right, which shall be exercised at

its discretion, to supervise the resale of the property at public outcry to the highest

responsible bidder if the resale of the property is within one year after such transfer.

§ 50-5-144. Transfer to charitable institutions or public corporations by negotiated sale;

conditions

(a) As used in this Code section, the term:

(1) "Charitable institution" means any nonprofit tax-exempt person, firm, or corporation .

(2) "Public corporation" means any public authority or other public corporation created by or

pursuant to the laws of any state.

(b) In addition to any other authority provided by Code Sections 50-5-140 through 50-5-143, this

Code section, and Code Section 50-5-146, the Department of Administrative Services shall

be authorized to dispose of surplus property, including surplus property subject to

paragraph (7) of Code Section 50-5-51, by the transfer of the property to any charitable

institution or public corporation through a negotiated sale if the department determines

that such sale would be in the best interests of the state, and, under the circumstances, the

negotiated sales price would constitute a reasonable consideration for the property.

(c) When any surplus property is sold to a charitable institution or to a public corporation

pursuant to subsection (b) of this Code section, the sale shall be subject to the following

conditions:

(1) The property shall not be resold by the purchaser within one year after the sale without

the written consent of the Department of Administrative Services; and

(2) The Department of Administrative Services shall have the right and obligation to supervise

the resale of the property at public outcry to the highest responsible bidder if the resale is

within one year after the sale and, if the resale price exceeds the original negotiated sales

price, the amount of the excess shall be paid to the Department of Administrative

Services.

§ 50-5-145. Limited application of provisions

Georgia Surplus Property Manual Section 1: Overview and General Information

Overview and General Information

Department of Administrative Services

January 2021

7

Nothing contained within Code Sections 50-5-140 through 50-5-144 and 50-5-146 shall be

construed so as to apply to any real property owned by the state, and such Code sections shall

not apply to such property, nor shall such Code sections be construed so as to prohibit the

Attorney General from distributing or selling the published reports of the opinions of the

Attorney General.

§ 50-5-146. Penalty

Any person who causes state property having a value of less than $200.00 to be disposed of in

violation of this article shall be guilty of a misdemeanor. If such property has a value of $200.00

or more, he or she shall be guilty of a felony and, upon conviction thereof, shall be punished by

imprisonment for not less than one year nor more than five years.

4.2 Laws and Regulations Pertaining to the Federal Surplus Property Program

The purpose of this section is to provide reference to the legal authority for the acquisition and

use of federal surplus property in the State of Georgia as primarily set forth in the 41 CFR § 101-

42.000, § 101-43.000, §101-45.000 and cross-referenced to the Federal Management Regulation

(FMR) (41 CFR chapter 102, parts 102–1 through 102–220).

O.C.G.A. § 50-5-51. Power, authority, and duty of department

The Department of Administrative Services shall have the power and authority and it shall be

the department's duty, subject to this part: …

(7) To establish and operate the state agency for surplus property for the purpose of distributing

surplus properties made available by the federal government under Pub. L. 152, 81st Congress,

as amended, to institutions, organizations, agencies, and others as may be eligible to receive

such surplus properties pursuant to applicable provisions of federal law. The commissioner may

enter into or authorize the aforesaid state agency for surplus property to enter into cooperative

agreements with the federal government for the use of surplus properties by the state agency.

The commissioner is authorized to enter into contracts with other state, local, or federal

agencies, or with other persons with respect to the construction, operation, maintenance,

leasing, or rental of a facility for use by the state agency. Further, the commissioner may acquire

real or personal property for such purposes;

Listed below are key regulations associated with federal surplus property:

41 CFR 102 Subchapter B--Personal Property

102-33.5 to 102-33.460

Management of Government Aircraft

102-34.5 to 102-34.350

Motor Vehicle Management

Georgia Surplus Property Manual Section 1: Overview and General Information

Overview and General Information

Department of Administrative Services

January 2021

8

102-35.5 to 102-35.30

Disposition of Personal Property

102-36.5 to 102-36.475

Disposition of Excess Personal Property

102-37.5 to 102-37.580

Donation of Surplus Personal Property

102-38.5 to 102-38.370

Sale of Personal Property

102-39.5 to 102-39.85

Replacement of Personal Property Pursuant to the

Exchange/Sale Authority

102-41.5 to 102-41.235

Disposition of Seized, Forfeited, Voluntarily

Abandoned, and Unclaimed Personal Property

Section 2. Surplus Program Eligibility, Applicability and Responsibilities

Chapter 5: Applicability and Eligibility

5.1 Eligibility Applicability

This information is provided so state entities will have a better understanding of the disposal

options available, and how surplus property can be used by other eligible recipients. It is not

intended to replace donee eligibility regulations or utilization and compliance restrictions or any

other applicable laws or regulations.

5.2 Eligibility Determination

Georgia’s Surplus Program is not an entitlement program. Donee eligibility is determined on a

case-by-case basis in accordance with state and federal laws and regulations. Eligible program

participants are called “donees.” Interested entities must complete the appropriate eligibility

application process and must comply with the requirements of periodic updating to retain their

eligibility. The following classifications of entities will be considered for participation:

• All state government agencies, commissions, authorities, and universities are eligible to

receive state and federal surplus property. State entities (primarily authorities) authorized

by law and electing to manage their own property disposal are still eligible to receive state

and federal surplus. However, transactions will be conducted the same as a local

government and state property will be conveyed as a Direct Negotiated Sale.

• All local government (county, city, town, etc.) entities are eligible to participate in the state

and federal surplus property.

Georgia Surplus Property Manual Section 2. Surplus Program

Eligibility, Applicability and Responsibilities

Department of Administrative Services

January 2021

9

• Nonprofit organizations classified by the Internal Revenue Service (IRS) as a 501 (c)

organization may be considered to receive state and federal surplus property.

• Veteran Service Organizations (VSO) designated by the Secretary of the US Veteran

Administration are eligible to participate in the federal surplus property program and may

be eligible for the state program depending on their business status and service(s) provided.

• Service Education Activities (SEA) designated by the Secretary of Defense may be eligible

for federal DOD property.

• Small Business Administration (SBA), 8A program participants may be eligible to

participate in the federal surplus property program. Eligibility is established by the SBA.

5.2(a) Direct negotiated sales to out of state political subdivisions and charitable institutions are

processed on a case-by-case basis. These customers are not considered eligible program

participants, except under limited circumstances where Surplus has determined such sale would

be in the best interest of the state.

5.3 Redistribution Definition and Precedence

For state surplus property, redistribution is defined as transfers between state entities and/or

direct negotiated sales to eligible donees and vendor returns.

In keeping with the mission of equitable and appropriate redistribution of surplus property, the

following precedence will be generally adhered to for the redistribution of all state surplus

property.

1. State Entities

2. Municipal Government Agencies

3. Eligible Nonprofit Organizations (including VSO)

4. Service Education Activities (federal DOD property only)

5. Small Business Administration (federal property only)

Chapter 6: State Entity Responsibilities

6.1 Entity Responsibilities

Consistent with their fiduciary responsibility, entity heads must:

1. Establish entity policies, procedures, and systems for the appropriate procurement and

tracking of personal property.

2. Delegate responsibility and authority for property oversight to their entity Property

Coordinator (PC).

Georgia Surplus Property Manual Section 2. Surplus Program

Eligibility, Applicability and Responsibilities

Department of Administrative Services

January 2021

10

• PC is designated by an entity head and is responsible for the entity’s property

management. In some agencies, responsibility for vehicle management is delegated to

a Fleet Manager.

• For the purposes of property transfer or disposal, the PC is the primary entity contact,

and will always hold the surplus designation as an “authorized” user.

3. Ensure compliance with State Properties Commission SPC 01 - Asset Management: Proper

Shutting Down of Vacant Buildings in the disposal of assets related to a building closure.

4. Surplus employees do not have access to entity asset inventory management tracking

systems. It is the individual entity’s responsibility to update their property and asset (e.g.

vehicles, trailers, etc.) disposition records for audit purposes.

6.2 Property Management Role Definitions

1. Donee. A donee is any eligible organization that is enrolled in the state and/or federal

surplus property program.

2. Surplus Authorizations. There are two primary designations of users in the Surplus system

whose status is recorded on the entity Selector list:

1. Authorized User

o Has authority to conduct all matters of business pertaining to the acquisition,

utilization, and disposal of surplus. Can obligate entity funds.

o Delegates entity personnel as Property Selector.

o Entity heads are always Authorized Users.

Note: Agencies may have more than one Authorized user.

2. Property Selector

o Authorized to select property and obligate entity funds.

o May not authorize other entity personnel.

Note: Surplus maintains lists of other key entity officials, such as the entity head and Chief

Information Officer (CIO), for the disposal of electronic materials.

6.3 Restrictions for Acquired State Property

For a period of twelve (12) months from the date of transfer, all state surplus property is subject

to the following restrictions:

1. Property may only be used for official entity purposes; personal use is not authorized.

2. Only donee employees listed in the entity selector list may sign for receipt of property.

3. The state reserves the right to approve or deny property transfers based on equitable and

appropriate redistribution. Appropriateness for donee use is also assessed. Property

Georgia Surplus Property Manual Section 2. Surplus Program

Eligibility, Applicability and Responsibilities

Department of Administrative Services

January 2021

11

acquired must be used by the donee organization for the intended purpose. Personal use of

donated property is prohibited.

4. Property title and custody must be maintained by the donee for the restriction period.

Property may not be sold, traded, loaned, cannibalized, or destroyed without permission

from Surplus.

5. Surplus personnel may conduct utilization visits any time during the restriction period.

Donees found noncompliant may be required to return the property, forfeit the service fee

paid, and/or have accessorial fees assessed at the discretion of DOAS.

6.4 Sales to State Employees

State employees other than DOAS employees are permitted to participate in the public sale of

surplus property. To prevent the appearance of impropriety and in keeping with the Governor’s

Code of Ethics, DOAS employees and their immediate family members are prohibited from

participating in any sale, auction, or transfer of surplus property to the public (O.C.G.A. §50-5-

141(b).

All other purchasers (including but not limited to state employees and their family members)

must certify that any transactions in which they are involved do not and will not violate the

provisions of OCGA §45-10-20 et seq. in any respect.

A state entity may offer the opportunity for state employees to purchase state property that is

being disposed of if the expected return is less than $50. If the expected value of the property is

greater than $50, a state entity should submit the items to public auction, in which state

employees can also participate. See section 14.4 for special instructions on the sale of

electronic equipment.

Chapter 7: Transaction Proceeds

7.1 Asset Disposal Proceeds

DOAS retains only the funds needed to operate the program and will return the remaining

proceeds to all state agencies utilizing the program in an equitable manner.

The expected reimbursement rate will normally range between 40-60%. The reimbursement

rate is evaluated each fiscal year and adjusted, if necessary, to cover fluctuating operating

expenses. Reimbursement payments to agencies will be made through monthly ACH payment.

The parameters DOAS utilizes to calculate payments are:

• The first $100 of all transactions (by piece or lot) will be retained by DOAS as a basic service

charge.

• All inter-agency transfers of state assets will be conducted at zero cost.

Georgia Surplus Property Manual Section 2. Surplus Program

Eligibility, Applicability and Responsibilities

Department of Administrative Services

January 2021

12

• If there are excess funds which more than cover operating costs at fiscal year-end, DOAS will

conduct a “true-up” and reimburse all participating agencies during that fiscal year on a pro-

rata basis based on total transactions.

• Proceeds of high value assets, for example heavy equipment or aircraft sold, after the first

$100 will be processed as follows:

Sale Amount

Percent to Entity

Surplus Cap

$101 to $9,999

55%

N/A

$10,000 - $49,999

75%

$7,500

≥$50,000

90%

$10,000

• Agencies are responsible for transportation and equipment preparation fees (e.g. decal and

“wrap” removal, towing, etc.).

• There is no reimbursement for the disposal of “scrap” electronics (see Chapter 14 for

additional information.)

7.2 Conditional Property Title Transfer

The Surplus Property program is not an entitlement program. Enrolled participants (state and

local government entities and nonprofit organizations) must meet specific eligibility criteria and

are known as “donees”. “Direct Negotiated Sales” to donees are technically a donation with a

service charge. This stems from the fact that transfer of property title (ownership) does not

occur until certain conditions are met as stated in Section 6.3 Restrictions for Acquired State

Property of this manual. Property title transfers to public buyers as soon as payment is

received, and the item(s) are removed. The chart below describes the conditional restriction

period:

Property From

Property To

Title Transfer Restrictions

State

State

None

Local Government

After 12-month restrictions are met

Nonprofit

After 12-month restrictions are met

Public

None

Federal

State

Restrictions based on property

Local Government

Restrictions based on property

Nonprofit

Restrictions based on property

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

13

Section 3. Disposing of State Property

Chapter 8: Overview of Disposal Process

Once a state entity decides that property is no longer needed, Surplus will work with the entity

to ensure that the selected disposal method returns the most value to the state. According to

state law, there are five basic disposal options:

1. Transfer between state entities

2. Negotiated sale to eligible donees

3. Trade in on the purchase of new equipment

4. Sale to the public through a bidding process

5. Destruction

The disposal process typically flows through the following transaction options:

Redistribution (Transfer, Direct Negotiated Sale, Vendor Return)

Public Sale (Internet Auction, “Retail” Sale, Live Auction, Other)

Destruction/Disposal

The disposal process is managed for each individual piece of property and entity. Depending on

the situation, these processes and other disposal methods may be employed as necessary and in

any order. The Surplus Division is responsible for determining the disposal method that is in the

state’s best interest. Not all property will be offered for transfer to state entities.

Note: Regardless of the type, all requests for disposal authorization must be received prior to the

actual disposal. Requests after-the-fact will not be authorized

The diagram below provides a high-level overview of the disposal process.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

14

Agency enters

transaction into

Asset Works

Received?

Transaction

reviewed by

Surplus

StopRedistribute

Sell to Public

Scrap

Electronics

Stop

Stop

Stop

Authorized

Disposal

Agency correct

and reenter

On-site Disposal Process Overview

• All transactions are processed through the

Asset Works system.

• Agencies do not collect any money and

should not release any material without a

Bill of Sale or other release authorization

from the Surplus Property Division

Go

To

Go

To

Go

To

Go

To

- Transfer

- Direct Negotiated Sale

- Vendor Return

- Internet Sale

- Retail Sale

- Live Auction

- Public Sale other

- Electronics Disposal (ELC

- On-site destruction

- Off-site destruction

- Donation if original acquisition

cost is

Yes

Yes

Yes

Yes

Yes

No

The actual disposal process for all the transaction types is comprised of four basic steps:

1. State entity enters the transaction request with market quality photos into the Asset

Works (AW) system.

2. Surplus virtually receives the property and determines the best disposal method.

3. Surplus conducts the transaction(s); entity is notified throughout the process by the AW

system. State entity releases/disposes of property.

4. Once disposed of, the entity references the AW transaction number as authorization to

remove the asset from its inventory.

Typically, this process takes between 10 to 22 business days, depending on the type of

transaction, the accuracy of the information provided by the entity, and other factors. The

public sale option has the longest turnaround time as depicted below.

Average Turnaround for the Disposal Process

Surplus recieves

transction in AW

1 -2 business days

Posts property to

DOAS website

5 business days

Posts property for

Public Sale

3-5 business days

Buyer pays &

removes property

5-10 business days

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

15

This represents the “typical” sales process time frame. Depending on circumstances, some

transactions may be processed in as little as one day, while others may be intentionally held for

longer periods to allow for marketing or other reasons that are in the state’s best interest.

8.1 Virtual Disposal

Surplus property transactions are “virtual disposals,” meaning that the property remains with

the custodian entity while it is processed and disposed. The virtual disposal process is:

• Cost effective – Reduces transportation and handling costs

• Flexible – Entity determines the disposal start times

• Available statewide – Assets available within the local community

8.2 Asset Works (AW)

The Surplus Property Division utilizes Asset Works (AW), a web-based program, to process the

disposal of all surplus property. This allows for single point access to all surplus processes and

information. State entities must designate personnel to have access to the program. The

program tracks the entire disposal process, creating an audit trail that shows each step in the

process and who initiated it. There are three User Profiles for entity property personnel:

User

• Enters disposal requests

• Runs entity reports

Manager

• Enters disposal requests

• Approve disposal requests

• Runs entity reports

(If an entity elects to allow only one individual to enter

and approve disposal, they must have the manager

profile.)

Director

• Runs entity reports

Note: The AW User Profiles are different than the previously discussed Property Management

Roles. Authorized Users and Property Selectors may dispose of and acquire state and federal

surplus property for an entity. AW Users, Managers, and Directors profile only denote

permission in the AW system. Individuals may hold both Property Management and AW User

roles but require separate entity designation.

The system also allows agencies to manage asset disposal at individual locations as well as entity

wide. Agencies may also elect to control disposal through pre-established approval processes.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

16

Personnel assigned to manage entity assets must enroll in an online training program. Once

successfully completed, authorized individuals will be provided with program access.

Chapter 9: Surplus Disposal – Creating the Transaction

Regardless of the disposal method, the first step in the process is entering the disposal request

into the Asset Works system. Since the assets are located throughout the state, the information

that is sent to Surplus must be complete and accurate. Specific instructions for completing the

Transaction Request are found in the Asset Works User Guide

9.1 What Information is included in the Transaction Request?

Surplus can process the request more efficiently if these steps are taken:

• All fields are required – property must be identifiable to be sold.

• List addresses and contact information where the property is physically located.

• Keep like items on single requests – do not mix disposal processes like electronics with

furniture.

• Enter complete “packages” including photos, product information sheets, etc. at one

time.

• Inform Surplus of convenient inspection and removal times, barriers to, or facilities for

removing property. Caution: Parts and components must not be removed once an

item is reported. If this occurs, contact the Surplus Property Division immediately.

Note: Unique circumstances may require special handling, additional information and/or

photos.

9.2 Guidelines for taking photos to accompany Transaction Request

When photographing an item for disposal, think of what visual information should be captured

to best communicate the details and condition of the item to a potential customer. A picture is

worth a thousand words.

1. Designate a staging area. This area should allow pictures to be taken without other items in

the background. The background should not have activity and should be clear; for example,

when taking vehicle pictures, other vehicles should not be in the background. Inside a

warehouse, use a tarp to cover background items that cannot be easily moved. Customers

will assume that all items pictured are being offered for sale, even if the camera is focused

on one item and the written description is specific.

2. Capture key details. Take as many views as necessary to accurately show the item. Take

close shots that show item details such as data plates, control panels, mechanical or

electrical components, and connection points of items that must be disconnected or

disassembled for removal. Photograph the wire plug end, if applicable, and any item

damage.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

17

3. Use correct lighting. Any lighting or sun should be behind the camera. Watch for shadows

that hide details.

4. Save in the correct file format. The picture format must be .jpg and sized to 600 x 400 (1

MB). In MS Office Picture Manager (if available) resize to “Pre-Defined” selection, Web-

Large (640x480). If the photo is taken with a mobile phone, size the photo to “Medium” and

attach it to the transaction request. Turn off Date/Time stamp.

5. Name pictures for easy identification. When submitting multiple items on a request (system

limits 5 attachments per line), rename photos in the same way the items are listed by line

item on the Transaction Request. Additional photos may be added to separate lines.

6. Designate folder(s) to store the pictures on your PC. This will help navigate to this folder to

attach your photos to the Transaction Request.

Note: There are special photo requirements for vehicles. See Section 7.6 of this Manual for

details.

9.3 Additional Information to Include with Transaction Request

When surplusing equipment, the following list includes other information that is helpful to know

and may be requested when describing the property.

• Date taken out of service

• Was this item known to be operational when last in service?

• Acquisition cost if known

• Any kind of damage

• Engine type –how may cylinders?

• Motor – Size, HP, Hours

• Fuel type– Gas, Diesel, Propane, Electric

• Voltage 110 or 220

• Hertz

• Single or 3 Phase?

• What type of plug does the item have?

• Brand

• Manufacturer

• Model

• Year

• Serial Number

• VIN (Vehicle Identification Number)

• HIN (Hull Identification Number Boats)

• Weight

• Size – provide dimensions: height, length, and width

• Tank size? Number of gallons

• Type of tank? Material made of, Fiberglass, Metal, Poly, etc.

• Generator – What is the KW size?

• Is the item skid mounted or trailer mounted?

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

18

• All data plate information that is available

Chapter 10: Redistribution

Redistribution of state assets is a primary goal of Surplus. Frequently, assets that are no longer

needed in one entity may still have useful life in another. The state saves not only through

acquisition cost avoidance, but in the purchasing administration costs as well.

Agencies are encouraged to develop business relationships with other state entities, local

governments, and participating nonprofit entities in their communities. Redistribution within

local communities strengthens the entity’s standing and supports the economy as well as saves

the entity time and other disposal costs. Redistribution options include Intra-Agency Transfer,

Inter-Agency Transfer (T), Direct Negotiated Sale (DNS) and Vendor Return (V).

10.1 Intra-Agency Transfer

Intra-Agency Transfer occurs when property is moved between internal business units of the

same entity. Before submitting a surplus property request, each entity should ensure that the

property cannot be used by someone else in the entity, including other physical sites. If the

property physically resides within the custodian entity, property that is being moved between

internal business units does not require DOAS approval. Examples:

• Georgia Department of Corrections (GDC) moves property between facilities (the

property remains within GDC)

• Atlanta Technical College moves property to Wiregrass Technical College (TCSG to TCSG)

• University of Georgia moves property to Georgia State University (BOR to BOR)

Note: The Surplus Property Division will not issue transfer authorization numbers for these

transactions.

10.2 Inter-Agency Transfer

Inter-Agency Transfers occur when property is moved between state agencies or entities. Since

the property is owned by the state, Transfers are conducted at no cost to either entity.

10.3 How to Complete a Surplus Inter-Agency Transfer- T (State to State)

1. Custodian entity enters the Transaction Request in Asset Works, selects Transfer under the

Method.

2. Entity manager approves transaction.

3. Surplus virtually receives the request and verifies receiving entity eligibility.

4. Surplus completes the transfer in Asset Works.

5. Custodian entity completes the physical transfer.

6. Receiving entity adds asset to property inventory records.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

19

7. Surplusing entity removes assets from property inventory records.

10.4 Diagram of Inter-Agency Transfer Process

Agency enters

transaction into

Asset Works

Receive

Transaction

request in Asset

Works

Verify

receiving

agency

approval

authority

Complete the

Transfer in Asset

Works

Agencies

conduct physical

transfer and

update records

Stop

Inter Agency Transfer Process

10.5 Direct Negotiated Sale (DNS) (State to Eligible Donee)

Direct Negotiated Sales are used for redistribution from a state entity directly to an eligible local

government or nonprofit. There is always a fee for a DNS. When discussing property with the

receiving entity, do not promise “free” or “$1.00” fee. Price and conditions are established by

the Surplus Property Division who must approve the transaction, generate the invoice, and

collect the funds. The price must constitute a reasonable consideration for the property and is

established by comparing market value, quantity, condition and may consider extenuating

circumstances.

10.6 Restrictions on Direct Negotiated Sales

For a period of twelve (12) months from the date of transfer or sale, all state surplus property

will be subject to the following restrictions:

1. Property may only be used for official entity purposes; personal use is prohibited.

2. Only donee employees listed on the entity selector list may sign for receipt of property.

3. The state reserves the right to approve or deny property transfers based on equitable and

appropriate redistribution, and appropriateness for donee use.

4. Property acquired must be used by the donee organization for the intended purpose.

5. Property title and ownership must be maintained by the donee for the restriction period.

Property may not be sold, traded, loaned, cannibalized, or destroyed without permission

from Surplus Property Division.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

20

The Surplus Property Division may conduct utilization visits any time during the restriction

period. Donees found noncompliant may be required to return the property, forfeit the service

fee paid, and/or have accessorial fees assessed at the Department of Administrative Services’

discretion.

10.7 How to Complete a Surplus Direct Negotiated Sale - DNS (State to Eligible Donee)

1. Custodian entity enters the Transaction Request in Asset Works, selects DNS under the

Method. Provides receiving entity contact information.

2. Entity manager approves transaction.

3. Surplus virtually receives the request, verifies receiving entity eligibility and establishes

negotiated price.

4. Surplus will collect the service charge and issue a Bill of Sale.

5. Donee presents Bill of Sale and Custodian entity completes the physical transfer.

6. Custodian entity removes assets from property inventory records.

10.8 Direct Negotiated Sale Diagram

Agency enters

transaction into

Asset Works

Receive

Transaction

request in Asset

Works

Receiving

entity

eligible?

Assist

receiving

entity with

Eligibility

process

Agency

eligible?

Stop

Establish FMV

Issue DNS,

generate invoice

collect payment

Notify both

agencies of

authorization

Stop

Transfer the

property

Find new donee

or disposal

process

Yes

Yes

No

No

Direct Negotiated Sale (DNS) Process

Agency enters

transaction into

Asset Works

Receive

Transaction

request in Asset

Works

Receiving

entity

eligible?

Assist

receiving

entity with

Eligibility

process

Agency

eligible?

Stop

Establish FMV

Issue DNS,

generate invoice

collect payment

Notify both

agencies of

authorization

Stop

Transfer the

property

Find new donee

or disposal

process

Yes

Yes

No

No

Direct Negotiated Sale (DNS) Process

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

21

10.9 Vendor Return (State to Vendor)

Vendor Return/Trade-In occurs when state agencies trade-in material in exchange for some

concession when acquiring new, like property. Vendor return transactions must be submitted

to and authorized by Surplus. Requests for Vendor Return will not be approved by Surplus

without documented benefit to the state. For instance, the advantage can be a discount on the

new material, cost avoidance on the removal/disposal of the old property, or a combination.

Examples of transactions are:

• IT/Computer replacement procurements (vendor agrees to remove old equipment)

• Capital equipment procurement (e.g. tractors)

• Building systems replacements (e.g. HVAC removal)

• “Totaled” vehicle damage where other party pays for liability

• Weapon upgrades from State Wide Contract

10.10 How to Complete a Surplus Vendor Return - V (Trade-in))

1. Custodian entity enters the Transaction Request in Asset Works, selects V under the method

and enters the supplier contact information with supporting documentation describing the

benefit(s).

2. Entity manager approves transaction.

3. Surplus virtually receives” the request, verifies receiving entity is authorized, request is

appropriate for “new, like property”, and that provisions of agreement convey a benefit to

the state.

4. Surplus will issue the authorization via email.

5. Custodian entity completes the physical transfer.

6. Custodian entity removes assets from property inventory records.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

22

10.11 Diagram of Vendor Return/Trade-In Process

Agency enters

transaction into

Asset Works

Receive

Transaction

request in Asset

Works

Vendor Return (V) Process

Replace like

equipment?

Select other

disposal method

Demonstrate

benefit to State?

Issue Vendor

Return

Stop

Go

To

Yes

Yes

No

No

Chapter 11: Sales to the Public

Items that have not been redistributed or destroyed are normally offered via the internet to the

public through either auction sale or fixed price.

In keeping with the mission to redistribute property, all materials may be listed for 5 days to

eligible donees prior to authorizing the sale to the public. Agencies should plan for this cycle

when developing their disposal schedule.

11.1 Internet Auctions

Internet auction services are the preferred method for public sale of property because it is:

• Wide reaching, international audience promotes competition and generally higher

prices.

• Fast, specific sales criteria can be programmed into the sale such as starting price,

reserves or selling time.

• Different sites have niche markets allowing Surplus to better focus sales.

11.2 Considerations when dealing with public buyers:

• Ensure that the property is accounted for and available before the sale is posted.

• Inform Surplus of convenient inspection and pick-up days and times. Personnel must be

available during these times.

• Inform Surplus of any pick-up restrictions or facilities so customers are prepared with the

correct equipment (i.e. on 2

nd

floor, no elevator, have loading dock, etc.)

• Read the public sale Terms and Conditions (Appendix C) to better understand the

agreement between the buyer and state. It is written to protect both parties.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

23

• Do not discuss, promise, or guarantee condition, parts, pricing, etc. It is the buyers’

responsibility to inspect the items prior to bidding.

• Do not release property to anyone without the signed bill of sale.

• Do not accept any form of payment.

• Contact Surplus if there are any issues with a customer, including dissatisfaction with item

condition or description. Once property is removed, Surplus has limited options to resolve

any issues.

11.3 How to Complete an Internet Auction – IS (State to Public)

1. Custodian entity enters the Transaction Request in Asset Works, selects IS under the

Method.

2. Entity manager approves transaction.

3. Surplus virtually receives the request, posts to appropriate auction site.

4. Surplus, answers customer questions, conducts the sale, contact winning bidder, collect

payment, etc.

5. After submitting payment, winning buyers will be issued a Bill of Sale. They should contact

the custodian to arrange a pick-up appointment. They will present the bill of sale at the

appointed pick-up time as proof of payment to remove property. Buyers have 5 business

days to pay and 5 days to remove the property.

6. Custodian entity completes the physical transfer and returns a copy of the signed Bill of Sale

to the Surplus Division.

7. Custodian entity removes assets from property inventory records.

11.4 “Retail” or Fixed Price Sales

Retail Sales are intended to give agencies an opportunity to offer low cost property to the local

community. It is particularly suited for the disposal of office furniture and small items, not

including electronics such as cellular devices, laptops, tablets, storage devices, etc. The original

acquisition value must be less than $5,000 to qualify for a retail sale.

Any items with an expected return of $50 or more should be offered through an Internet Sale,

not Fixed Price. It is not intended to by-pass other disposal methods that generate higher

returns or ensure equitable opportunity.

State employees may participate in retail sales, but the sales opportunities must be available to

all employees.

11.5 How to Complete a Retail Sale – RS

1. Custodian entity enters the Transaction Request in Asset Works, selects RS under the

Method. Provide buyer contact information under “Receiving Agency.”

2. Entity manager approves transaction.

3. Surplus virtually receives” the request.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

24

4. Surplus conducts the sale and sends buyer an invoice.

5. Buyer will pay through online payment portal and will be issued a Bill of Sale. Buyer will

present the bill of sale at the appointed pick-up time as proof of payment to remove

property. Buyers have 5 business days to pay and remove the property.

6. Custodian entity completes the physical transfer.

7. Custodian entity removes assets from property inventory records.

11.6 Diagram of Public Internet /Retail Sales Process

Chapter 12: Disposal Authorization (Previously Destruction Authorization)

Destruction of property is frequently the most appropriate method of disposal. Destruction

should be considered when property is damaged, and repair is either not feasible,

inappropriate, or the cost exceeds the fair market value (FMV).

The Affidavit of Disposal (AD) permits disposal options other than destruction. Issuing the AD is

required before any property disposal.

Agency enters

transaction into

Asset Works

Receive

Transaction

request in Asset

Works

Public Sales Process

Surplus sends

individual

invoice

Buyer pays via

PayPal

Surplus issues

Bill of Sale to

agency and

buyer

Retail

Internet

Agency releases

property

Removes asset

from record

End

Notes:

• In order to be considered for a

Retail Sale, the original acquisition

cost must be ≤$5000

• Internet Sales that default will

either be offered to next winning

bid or reposted.

• Items that still don’t sell may be

offered through the AD process.

Surplus posts to

internet site,

highest bidder

wins

Internet or

Retail Sale?

Agency enters

transaction into

Asset Works

Receive

Transaction

request in Asset

Works

Public Sales Process

Surplus sends

individual

invoice

Buyer pays via

PayPal

Surplus issues

Bill of Sale to

agency and

buyer

Retail

Internet

Agency releases

property

Removes asset

from record

End

Notes:

• In order to be considered for a

Retail Sale, the original acquisition

cost must be ≤$5000

• Internet Sales that default will

either be offered to next winning

bid or reposted.

• Items that still don’t sell may be

offered through the AD process.

Surplus posts to

internet site,

highest bidder

wins

Internet or

Retail Sale?

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

25

Note: All requests for disposal authorization must be received prior to destruction and disposal.

Requests after-the-fact will not be authorized.

12.1 Authorized Disposal Guidelines

1. Generally speaking, any property with a FMV less than $20.00 that cannot be redistributed

within the custodian entity should be considered for disposal. This excludes highly pilfered

items or electronic equipment capable of storing data (i.e. flash drives).

2. When an entity requests disposal authorization, the intrinsic value must be considered.

Frequently an item may not be useful for its intended purpose (i.e. metal desk with a broken

leg) but still has scrap or recycle value. In this case, it is in the state’s best interest to

destroy through scrap or recycling rather than paying disposal costs.

3. It is in the state’s best interest that all disposals are conducted in the most environmentally

appropriate and friendly manner. Redistribution is preferred to recycling and recycling is

preferred to trash. The goal is to minimize the state’s waste as much as possible.

4. DOAS has contracted with a vendor to dispose of electronics (see Section 3.Chapter 14:

Electronics Disposal). The disposal of trash, scrap, or recycling (other than electronic) is an

entity responsibility and as such, the entity bears any cost and collects any proceeds.

5. It is the entity’s responsibility to complete the destruction/disposal as soon as practical after

approval is given. For audit purposes, the completed affidavit must be retained according to

records retention regulations.

12.2 How to Complete an Authorized Disposal/Destruction

1. Custodian entity enters the Transaction Request in Asset Works, selects AD under the

Method.

2. Entity manager approves transaction.

3. Surplus virtually receives the request.

4. If approved, surplus will issue the AD number and notify the custodian by email.

5. Custodian entity disposes of the material through either

a. Witnessed on-site destruction

b. Removal by approved vendor (i.e. scrap metal)

6. Custodian entity completes the Affidavit of Disposal and files for inventory records.

7. Custodian entity removes assets from property inventory records.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

26

12.3 Affidavit of Disposal Form

The Affidavit of Disposal (AD) provides two options for disposal—destruction or donation—

described below. Prior approval from Surplus is required before destruction/disposal. See

instructions for completing the form in Appendix A.

1. When property is designated for destruction, it must be rendered unserviceable and

disposed of in an environmentally appropriate manner (i.e. placed in a dumpster). The

Property Coordinator or custodian should check the appropriate box on the affidavit and

execute the remainder of the form.

2. For items that are unsold, but are still serviceable, the custodian entity may elect to contact

a local nonprofit (IRS 501(c)) organization and donate the property in lieu of adding to and

paying for waste disposal. This option may also be used for equipment that has scrap value

but is not physically destroyed on site. Agencies are encouraged to develop a network of

groups for donation and are cautioned when exercising this option to not show favoritism to

any specific entity.

Chapter 13: Surplus Vehicles

The process for the disposal of state vehicles is the same as any other property, except that

there may be conditions that suggest a specific disposal method. Vehicles that are damaged in

an accident or have mechanical failure may require immediate removal and/or storage.

Additionally, some agencies do not have vehicle storage capability. Surplus has a contract

vehicle auction company to manage many of these issues. State agencies have two options for

disposing of vehicles—supplier disposal and on-site disposal. Regardless of the disposal option

selected, the entity will be responsible for:

• Ensuring the original title and keys are with the vehicle.

• Ensure the vehicle is safe to operate and notify DOAS anytime a vehicle meets the

criteria of “salvage” defined by the Georgia Department of Revenue

• Clearing any confidential vehicle with Department of Revenue.

• Removing all state markings (decals and/or vehicle wraps) and the license plate. (The

entity may retain plate for a future vehicle or destroy/discard it.)

• Paying all transportation costs.

• Once disposed, remove the asset from custodian asset record.

• Entering one vehicle per Transaction Request in Asset Works.

Note: Redistribution to eligible entities (state entities must comply with Policy 10, Rules,

Regulations and Procedures Governing the Use and Assignment of Motor Vehicles, Purchase,

Operation and Disposal of Motor Vehicles and Associated Record-keeping, Not all vehicles will be

offered for transfer to state entities.) is always the first consideration. If a state entity has a local

government contact that could be interested in a vehicle, they are encouraged to notify the

surplus office at the time the disposal request is submitted. Do not however, arrange or agree to

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

27

any price or conditions. Items that are not redistributed are sold to the public through

contracted internet auction providers.

Salvage vehicle definition

In Georgia, a salvage vehicle is any motor vehicle:

• Damaged to the extent that its restoration to an operable condition would require the

replacement of two or more component parts.

• That an insurance company has paid a ‘total loss claim’ and the vehicle has not been

repaired, regardless of the extent of damage or the number of major parts damaged.

• Imported and was damaged in shipment and disclaimed by the manufacturer as a result of

the damage:

▪ Has never subject of a retail sale, and

▪ Has never been issued a title.

• Titled in another state and branded as “Total Loss,” “Salvage,” “Fire,” “Flood,” or “Water.”

Salvage vehicles cannot be operated legally on public roads in Georgia.

13.1 Vehicle Accidents

Report all vehicle accidents within 48 hours to DOAS Fleet Management by calling toll free

1-877-656-7475. The staff is trained to assist you by ensuring that the entity is properly

represented and that the state vehicle is repaired or replaced in a cost-effective manner.

If the vehicle is totaled and is not covered under the state’s Auto Physical Damage (APD)

program, it is the entity’s responsibility to conduct the surplus disposal by entering the disposal

request into Asset Works.

13.2 How to Complete a Surplus Vehicle Transaction

The general process consists of the following steps:

1. Custodian entity enters the Transaction Request in Asset Works, selects T under the

method. The listing must contain:

o Vehicle Description (Make, Model, Year)

o Vehicle Identification Number (VIN)

o Mileage

o General Condition (Excellent, Good, Fair, Poor)

o Copy of front and back of original title as an attachment.

2. Entity manager approves transaction.

3. Surplus “receives” the request.

Georgia Surplus Property Manual Section 3: Disposing of State Property

Department of Administrative Services

January 2021

28

4. Surplus staff will determine the disposal method that best meets the state’s needs,

including redistribution or public sale. The transportation costs will be established as

part of this decision.

5. Office of Fleet Management (OFM) will move or remove the asset record in VITAL when

a vehicle is transferred or sold