USING TECH TO

ANNUAL REPORT 2023-24

INSURE MORE

SERVE MORE

REACH MORE

VISION AND VALUES

Our Values

To be the most admired insurance company that enables the continued progress of customers by being

responsive to their needs.

Our Vision

We will build our business

on empathy and an inherent

understanding of both our internal

and external customers’ needs.

SENSITIVITY

We will honour our commitments

and be transparent in our dealings

with all our stakeholders.

ETHICS

We will always strive to oer innovative

products and services and endeavour

to set new benchmarks to do things

better each time.

EXCELLENCE

We will be proactive with a “can

do” approach.

DYNAMISM

2

17

th

Annual Report

The Parliamentary Standing Committee on Finance issued their

recommendations for the sector, proposing structural changes and

expanding the ambit of insurance to include value added services.

These recommendations, along with the reforms announced by

IRDAI, are expected to significantly impact the industry dynamics in

the coming years.

Ritesh Kumar

MD & CEO

3

CUSTOMER

TESTIMONIALS

I have experienced excellent

service from your company. No

company in the market can settle

claims so fast - thank you very

much! Your oce application

sta is also very helpful in

responding to us properly at the

time of claim process.

Health Insurance Customer (Optima

Restore Insurance)

Policy No. 2805204526716900

Thank you for settling the

claim for the full amount in

the fastest, hassle-free, and

seamless way. The Customer

Service representative guided

well in terms of navigating the

website to register and submit

the documents. It was a great

experience.

Health Insurance Customer (Health

Suraksha Individual Policy - Classic)

Policy No. 2828100853410200

Doing excellent work HDFC

ERGO, keep it up! We are very

happy and privileged to be with

you since the last six years.

Best of luck and thank you for

your best services.

Health Insurance Customer (Optima

Restore Insurance)

Policy No. 2805205481362000

Out of the world customer

service. All agents that I spoke

to were ecient, helpful, and

courteous. More importantly

they are customer service

oriented. Hats o to the reps

and their commitment. I will

surely recommend you to family

and friends.

Motor Insurance Customer (Private

Car Comprehensive Policy)

Policy No. 2311100315659900

Your services are very good.

Your team is excellent in

answering, guiding, and helping

us. I am very happy with your

services. Expecting the same in

future also. Thank you.

Motor Insurance Customer

(Private Car Liability Only)

Policy No. 2319100828422900

I am thankful of your quick

service on my application.

The experience with you so

far is very good. Thank you.

Motor Insurance Customer (Two-

Wheeler Comprehensive Policy)

Policy No. 2312910122819700

So far, I have had a fast and

supportive experience with

HDFC ERGO - service is prompt,

team is respectful of customers’

time, they provide clear and

necessary guidelines as well, so

that really helps.

Travel Insurance Customer (Retail

Travel Insurance Policy - Platinum)

Policy No. 2919205637980500

No worry as of now, your team is

great. I had called the Customer

Executive on two occasions.

Very helpful, knowledgeable, no

escalation delay. Nice support.

Keep it up!

Travel Insurance Customer (Travel

Explorer) - Senior Citizen

Policy No. 3367101409793600

The customer experience is

commendable.

Travel Insurance Customer (Retail

Travel Insurance Policy - Silver)

Policy No. 2919101390257100

4

17

th

Annual Report

TABLE OF CONTENTS

Chairman’s

Message

MD & CEO’s

Message

Board of Directors

& Key Management

Personnel

06 07 08

Company

Highlights

Directors’

Report

Insure More, Serve

More, Reach More

14 15 18

Balance

Sheet

Profit and

Loss Account

Independent

Auditors’ Report

92 9382

Revenue Account Schedules

Receipts and

Payments Account

95 9694

GlossaryOur ProductsManagement

Report

172170163

Awards

174

5

CHAIRMAN’S

MESSAGE

Keki M. Mistry

Chairman

In FY 2023-24, IRDAI continued to undertake

various regulatory reforms to strengthen the

GI industry and facilitate sectoral growth

over the medium term.”

Foremost among the regulatory developments this year was the

Parliamentary Standing Committee on Finance recommending various

major reforms in their report, including introduction of composite

license, open architecture for individual agents and allowing value-

added services ancillary to insurance. IRDAI consolidated various

regulations into nine principle-based regulations – the new regulations

simplify processes to make them more policyholder-friendly and

improve ease of doing business for the insurance industry. IRDAI also

extended de-tarication to all product segments other than Motor

Third Party, enabling insurers further freedom in policy wordings and

premium pricing.

The broad-based growth of the economy resulted in motor, health

and commercial lines insurance segments registering double-digit

growth in FY24. The GI industry grew by

~

13% to

~

`

290,000

crore in FY24. Accident & Health insurance continued to be the

fastest growing and largest segment, reflecting the low levels of

health insurance penetration.

Your Company achieved a 11% growth in Gross Written Premium to

` 18,802 crore, ending the year as the fifth largest General Insurer

in India with a 6.4% market share and the third largest General

Insurer in the private sector with a 9.9% market share. The Profit

After Tax for the year was

` 438 crore, as the Company continued

to be prudent in reserving in light of recent industry trends.

According to the RBI, the Indian economy is projected to grow by

7.2% in FY25 driven by domestic demand. Likewise, inflation is

expected to further ease to 4.5% driven largely by food inflation

levels (assuming a normal monsoon). This outlook continues to be

dependent on geopolitical developments.

The ongoing regulatory changes are expected to encourage

further innovation and support strong growth of the insurance

industry in the coming years, especially in the under-penetrated

geographies and segments.

I would like to thank IRDAI for introducing various reforms aimed

at further development of the insurance industry and improvement

in insurance penetration. I would also like to thank our customers,

partners, shareholders and employees for their support to the

Company and look forward to their continued support in the

coming years.

I also want to take this opportunity to thank our MD & CEO, Ritesh

Kumar, for his leadership and contribution in transforming this

Company into an admired institution. After successfully leading

this Company for 16 years, Ritesh would be superannuating in

June 2024. I also congratulate Anuj Tyagi for his elevation as the

MD & CEO with eect from July 1, 2024. Anuj has been with the

Company since 2008, and has been an integral part of the success

of the Company. I am confident that he will lead the Company to

even greater heights in its next phase of growth.

Although global growth remained resilient and inflation levels

started receding in FY24, the last mile of disinflation was slow.

Therefore, major central banks kept policy rates on hold to ensure

inflation levels stay on target. Ongoing geopolitical conflicts,

disruptions in trade routes and high public debt burden continue

to pose downside risks to the global growth outlook in FY25.

In FY24, India’s GDP grew by 8.2%, marking the third consecutive

year of 7%+ growth. This was mainly driven by significant uplift

in investments. In addition, inflation levels moderated to 5.4%

as core inflation (excluding food and fuel) continued on a steady

declining path.

Last year, the IRDAI had announced its vision of “Insurance for All

by 2047”. I wish to reiterate that your Company is fully committed

to and aligned with this vision and the various initiatives of IRDAI.

6

17

th

Annual Report

MD & CEO’S

MESSAGE

Ritesh Kumar

MD & CEO

The Company achieved a 6.4% market

share in FY 2023-24 and is now the fifth

largest general insurance company in India

and third largest in the private sector.”

prominent ones being de-tarication of product segments and

consolidation of various regulations into nine regulations. The

Parliamentary Standing Committee on Finance issued their

recommendations for the sector, proposing structural changes and

expanding the ambit of insurance to include value added services.

These recommendations, along with the reforms announced by IRDAI,

are expected to significantly impact the industry dynamics in the

coming years.

Your Company further upgraded its oerings this year to meet the

evolving customer needs. The key initiatives included launching the

next version of the flagship health insurance product Optima Secure,

institutionalising an internal ombudsman process for repudiations in

health claims, early discharge from hospital for patients undergoing

cashless hospitalisation, etc.

As a Digital Insurer operating at scale, your Company continued to

leverage digital and artificial intelligence to further elevate customer

experience. I am pleased to share that ‘here’, our ecosystem platform

aimed at providing convenience & savings and addressing anxiety,

was well received with over 5 million downloads and over 300,000

policy-related transactions. We continued on our journey of migration

of core technology system to cloud.

As regards our Diversity and Inclusion journey, our gender diversity

ratio improved from 23% in FY23 to 25% this year. As a recognition

of our people practices, we were recognised in ‘India’s Top 25 Best

Workplaces in BFSI sector’ for the second year in a row.

Your Company registered an 11% growth in premiums to

`

18,802 crore

in FY24, ending the year with a 6.4% market share and a 9.9% market

share in the private sector. We are now the fifth largest general insurance

company in the country, and the third largest in the private sector.

Our expense ratio was stable at 24.4% in FY24. In line with our

philosophy of prudence, the Company undertook a strengthening of its

claim reserves basis recent industry trends. As a result, the Combined

Ratio increased from 103.3% in FY23 to 112.1% in FY24. The Profit After

Tax was

`

438 crore in FY24 vis-à-vis

`

653 crore in FY23.

I would like to take this opportunity to congratulate Anuj Tyagi for his

elevation as the Managing Director & CEO w.e.f. July 1, 2024. Anuj has

been a key member of the management team since joining in 2008,

has rich experience across diverse functions and is currently the Joint

Managing Director of our company. I am confident that he will lead

the Company to greater success and that he will enjoy the continued

patronage of all our stakeholders.

I would like to once again thank all our customers, partners, employees

and our shareholders for their support in shaping this Company to its

present level. Lastly, I would also like to express my gratitude to IRDAI

and the fellow members of our Board of Directors for their continued

guidance over the years.

The Indian economy achieved a robust growth of 8.2% in FY24.

The economy is expected to grow by 7.2% in FY25 on the back of

rural demand; however adverse macroeconomic or geopolitical

developments may slow down these growth prospects.

The General Insurance industry registered a growth of 12.8% in

FY24, growing to Gross Direct Premium of

~

`

290,000 crore.

Accident & Health insurance segment grew by 20%, Motor

insurance segment by 13%, while Commercial lines registered

a growth of 10%. While the number of farmers availing Crop

insurance increased, the premiums witnessed a 4% de-growth

due to a change in structure of the Crop insurance schemes

implemented in few states. Private sector insurers (including

standalone health insurers) further improved market share and

now have a 65% market share in the industry.

IRDAI announced further regulatory reforms in FY24, with the

7

BOARD OF

DIRECTORS

Keki M. Mistry (DIN: 00008886) is a qualified Chartered Accountant and a Fellow

Member of the Institute of Chartered Accountants of India.

He was the Vice Chairman & CEO of Housing Development Finance Corporation

(HDFC) Limited. With the amalgamation of HDFC Limited with HDFC Bank Limited,

he superannuated from HDFC Limited and has been appointed as a Non-Executive

Director on the Board of HDFC Bank Limited from June 30, 2023.

He is the Non-Executive Chairman of HDFC ERGO General Insurance Company

Limited and HDFC Life Insurance Company Limited. He is also a Director of several

Companies. Some of these include Tata Consultancy Services Limited, The Great

Eastern Shipping Company Limited and Flipkart Private Limited – Singapore. He is a Senior Advisor to the Ontario Teachers’

Pension Plan (OTPP), a Canada-based pension fund. He has been appointed as a Strategic Advisor for Cyrus Poonawalla

Group’s Financial Services Ventures.

He is a Member of the Primary Market Advisory Committee (PMAC) constituted by the Securities and Exchange Board of

India (SEBI).

He is currently a member of the Expert Committee constituted by SEBI for facilitating ease of doing business and harmonisation

of the provisions of ICDR and LODR Regulations and is the Chairman of Working Group 1 of the Expert Committee. He is also

a member of Standing Committee on Primary Markets, which has been constituted by the International Financial Services

Centres Authority (IFSCA).

Keki M. Mistry

Renu Sud Karnad (DIN: 00008064) was Managing Director of Housing Development

Finance Corporation Limited till June 30, 2023. From July 1, 2023, she is a Non-

Executive and Non-Independent Director on the Board of HDFC Bank Ltd.

She is the Chairperson of GlaxoSmithKline Pharmaceuticals Limited and a director

on the boards of HDFC Asset Management Company Limited, HDFC ERGO

General Insurance Company Limited, HDFC Capital Advisors Limited, Bangalore

International Airport Authority Limited and EIH Limited. She is also a director on the

board of Nudge Lifeskills Foundation and PayU Payments Private Limited.

She holds a Master’s degree in Economics from the University of Delhi and a Bachelor’s degree in Law from the University of

Mumbai. She is a Parvin Fellow – Woodrow Wilson School of Public and International Aairs, Princeton University, USA. She

has to her credit, numerous awards, and accolades. Prominent among them being featured in the list of ‘25 Top Non Banking

Women in Finance’ by U.S. Banker magazine, listed by Wall Street Journal Asia as among the ‘Top Ten Powerful Women to

Watch Out for in Asia’, ‘Outstanding Woman Business Leader’ by CNBC TV18, and ‘25 Most Influential Women Professionals

in India’ by India Today.

Renu Sud Karnad

8

17

th

Annual Report

Dr. Oliver Martin Willmes (DIN: 08876420) is a Non-Executive Director of the Company.

He has studied Business Administration at the University of Cologne. He has done his

MBA from Eastern Illinois University, USA. He is currently the Chairman of the Board of

Management and Chief Operating Ocer at ERGO International AG.

Edward Ler (DIN: 10426805) is a Non-Executive Director of the Company. He holds a

Bachelor of Arts (with distinction) in Risk Management from the Glasgow Caledonian

University in the UK and is a Chartered Insurer from the Chartered Insurance

Institute, UK. He is currently the Chief Underwriting Ocer and a Member of the

Board of Management of ERGO Group AG (“ERGO”), responsible for ERGO Group’s

Consumer Insurance Portfolios and Commercial Property/Casualty Portfolios, Global

Competence Centres for Life, Health, Property/Casualty Product Management, Claims

and Reinsurance.

Bernhard Steinruecke (DIN: 01122939) was the Director General of Indo-German

Chamber of Commerce from 2003 till 2021. He studied Law and Economics in Vienna,

Bonn, Geneva and Heidelberg and has a Law Degree from the University of Heidelberg

in 1980 (Honours Degree) and passed his Bar exam at the High Court of Hamburg in

1983. He was the former Co-CEO of Deutsche Bank India and Co-Owner and Speaker

of the Board of ABC Privatkunden-Bank, Berlin. He was appointed as an Independent

Director of the Company for a period of five years w.e.f. September 9, 2016 and was

re-appointed as an Independent Director for another term of five consecutive years

w.e.f. September 9, 2021.

Mehernosh B. Kapadia (DIN: 00046612) holds a Master’s degree in Commerce

(Honours) and is a Member of The Institute of Chartered Accountants of India and

The Institute of Company Secretaries of India. Most of his corporate career of 36

years has been with GlaxoSmithKline Pharmaceuticals Limited (GSK) where he has

worked for over 27 years. He retired as the Senior Executive Director and Chief

Financial Ocer of GSK w.e.f. December 1, 2014. Over the years, he has been

responsible for an extensive range of finance and company secretarial matters.

He has also held management responsibility for other functions during his tenure

with GSK, including Investor Relations, Legal and Compliance, Corporate Aairs,

Corporate Communications, Administration and Information Technology, and

held the position of Company Secretary for many years. He was appointed as an

Independent Director of the Company for a period of five years w.e.f. September

9, 2016 and was re-appointed as an Independent Director for another term of five

consecutive years w.e.f. September 9, 2021.

Bernhard Steinruecke

Edward Ler

Mehernosh B. Kapadia

Dr. Oliver Martin Willmes

9

Arvind Mahajan (DIN: 07553144) is an Independent Director of the Company. He is

a graduate (B.Com. Hons) from Shriram College of Commerce, Delhi University and

has a Post Graduate Diploma in Management from IIM, Ahmedabad.

He has more than 36 years of experience in management consulting and industry.

His management consulting experience includes more than 22 years as partner

with AF Ferguson & Co, Price Waterhouse Coopers, IBM Global Business Services

and most recently with KPMG. His industry experience was with Procter and Gamble

in financial management and management reporting.

In his career at KPMG India, he has led business consulting services and later the Energy, Infrastructure, Government and

Healthcare practices of the firm. He also had the privilege of being a member of KPMG’s Global Business Consulting and Global

Infrastructure Sector Leadership teams. His specialisation is in advising CEOs & Boards in the area of business strategy and

helping “make strategy happen” through growth and transformation initiatives. He also has a strong background in corporate

finance, enterprise risk management, people and change. He has advised clients in diversified portfolio sectors including

consumer, financial services, technology, media, telecom, energy, infrastructure & government.

He was appointed as an Independent Director of the Company for a second term for a period of five years w.e.f. November 14,

2016 and was re-appointed as an Independent Director for another term of five consecutive years w.e.f. November 14, 2021.

Dr. Rajgopal Thirumalai (DIN: 02253615) is a qualified health care professional with more

than three decades of experience in preventive medicine, public health, occupational

health, and health & hospital administration and in dealing with health insurance products,

brokers, and providers.

He has around 30 years of experience with the Unilever Group, the last position being

Vice President, Global Medical and Occupational Health of Unilever Plc responsible

for providing strategic inputs and leadership in comprehensive health care, including

public health and global health insurance for over 155,000 employees worldwide. Dr.

Rajgopal represented Unilever as a member of the Leadership Board of the Workplace

Wellness Alliance of the World Economic Forum and under his leadership, Unilever

won the Global Healthy Workplace Award in 2016.

He was also the Independent Director at Apollo Hospitals Enterprise Limited and Apollo Super Specialty Hospitals Ltd from

August 2017 to March 2021. He served as the COO for Breach Candy Hospital, Mumbai from April 2021 to March 2022. He is

currently on the Board of Zywie Ventures Ltd., a subsidiary of Hindustan Unilever Ltd. and heads the advisory board of Fitterfly

(a digital therapeutics company). Dr. Rajgopal is also an Adjunct Faculty with the Public Health Foundation of India.

Dr. Rajgopal was awarded the Dr. B. C. Roy National Award (Medical field), which was bestowed by the President of India in 2016.

Ameet Hariani (DIN: 00087866) has over 35 years of experience advising clients

on corporate and commercial law, mergers and acquisitions, real estate and real

estate finance transactions. He has represented large organisations in international

real estate transactions, arbitrations and prominent litigations. He was a partner at

Ambubhai and Diwanji and Andersen Legal India, as well as the founder and managing

partner of Hariani & Co. He has now transitioned to practising as a senior legal counsel

doing strategic legal advisory work. He also acts as an arbitrator, mediator and as an

independent, non-executive director on the boards of several well reputed companies.

He holds a Law degree from Government Law College, Mumbai and Masters in Law

degree from the University of Mumbai. He is a Solicitor enrolled with the Bombay

Incorporated Law Society and the Law Society of England and Wales. He is also a

member of the Bar Council of Maharashtra and the Bombay Bar Association. He was appointed as an Independent Director

of the Company for a period of five years w.e.f. July 16, 2018 and was re-appointed as an Independent Director for another

term of five consecutive years w.e.f. July 16, 2023.

Arvind Mahajan

Ameet Hariani

Dr. Rajgopal Thirumalai

10

17

th

Annual Report

Sanjib Chaudhuri (DIN: 09565962) has over 40 years of experience in the

Indian non-life insurance and reinsurance market. As a Cost & Management

Accountant and trained in Systems Analysis from the UK, he started o in heavy

engineering companies viz., Guest Keen & Williams Ltd. and Garden Reach

Shipbuilders & Engineers Ltd. and then as an Associate of the Insurance Institute

of India switched to insurance in 1979. He served National Insurance Co. Ltd.

(NICL) for 19 years in a diverse set of roles including addressing the challenge

of introducing computerised data processing across the industry. He left NICL

as Assistant General Manager in 1997 and joined Munich Reinsurance Company,

Munich, Germany as the Chief Representative for India. Besides setting up a

permanent oce of Munich Re in India in the restricted PSU regime, he was also

responsible for reinsurance business development in India, Sri Lanka, Bangladesh and Nepal. He set up Munich Re’s

India Representative Oce in 1999 as one of the first foreign reinsurers’ permanent presence in the Indian market and

his superannuation in 2014 coincided with the opening of the Munich Re India Branch. He served the General Insurance

Council of India as a member of the Executive Committee during 2015-18. He was nominated by IRDAI as the Policyholders’

Representative and has also served in various committees of IRDAI including Health Insurance Forum and Committee to

Recommend Amendments to the Regulations regarding Foreign Reinsurers’ Branches.

Sanjib Chaudhuri

Samir H. Shah (DIN: 08114828) is a Fellow member of The Institute of Chartered

Accountants of India (FCA), an Associate member of The Institute of Company

Secretaries of India (ACS) and The Institute of Cost Accountants of India (ACMA).

He joined the Company in 2006 and has about 33 years of work experience, of

which over 17 years is in the general insurance sector. He was re-appointed for

another term of five years as Executive Director & CFO w.e.f. June 1, 2023 and

currently oversees/mentors various functions including finance, accounts, tax,

secretarial, legal, compliance, risk management and internal audit.

Samir H. Shah

Vinay Sanghi (DIN: 00309085) has been the driving force of CarTrade Tech since

its inception in 2009 and he recently took the company public.

With more than three decades of experience, he is a leading figure in the Indian

auto industry. He has a demonstrated track record of excellence in the industry

and has been responsible for conceptualising and executing numerous successful

business ventures.

In his current role, he has been instrumental in CarTrade Tech establishing market

leadership and eecting consolidation in the space by acquiring CarWale, BikeWale,

Adroit Auto, Shriram Automall and OLX India. CarTrade Tech Ltd. is a multi-channel

auto platform with a presence across all vehicle types and value-added services. The platform gets 70 million average

monthly unique visitors, facilitates over 32 million listings annually, engages with approximately 30,000 dealers and has 1.2

million listings for auction. The platform operates under several brands: CarWale, CarTrade, Shriram Automall, BikeWale,

CarTrade Exchange, Adroit Auto and OLX India. These platforms enable new and used automobile customers, vehicle

dealerships, vehicle OEMs, and other businesses to buy and sell vehicles in a simple and ecient manner.

Before starting CarTrade Tech, he was the CEO of Mahindra First Choice Wheels Ltd.

Vinay Sanghi

11

Ritesh Kumar (DIN: 02213019) is the Managing Director and CEO of the Company

since 2008. He has about 32 years of experience in the financial services sector,

of which the first 10 years were in Banking and the last 22 years in Insurance. He

is a commerce graduate from Shriram College of Commerce, Delhi and holds an

MBA degree from Faculty of Management Studies (FMS), Delhi. Considering the

applicable IRDAI requirements, he would be required to superannuate by close of

business hours on June 30, 2024.

Ritesh Kumar

Anuj Tyagi (DIN: 07505313) is a Post Graduate Diploma in Business Management

and a Chemistry (H) graduate. He has worked in banking and insurance services

for over 26 years with leading financial institutions and insurance groups in the

country and has held various leadership positions during his tenure. He has been

associated with the Company since 2008 and was appointed as a Whole-time

Director (designated as Executive Director & CBO) of the Company for a period

of 5 years w.e.f. May 1, 2016. On November 13, 2020, he was re-appointed as

Executive Director and he was later designated as the Deputy Managing Director

w.e.f. April 20, 2021 and as Joint Managing Director w.e.f. April 27, 2023. He is

appointed as the Managing Director & CEO of the Company w.e.f. July 1, 2024.

Anuj Tyagi

12

17

th

Annual Report

KEY MANAGEMENT

PERSONNEL

CUSTOMER SERVICE ADDRESS

D-301, 3rd Floor, Eastern Business District

(Magnet Mall), LBS Marg, Bhandup (West),

Mumbai 400078.

Customer Service No.:022-6234 6234/0120-6234 6234

[email protected] | www.hdfcergo.com

REGISTERED & CORPORATE OFFICE

HDFC House, 1st Floor, 165-166, Backbay Reclamation,

H. T. Parekh Marg, Churchgate, Mumbai- 400 020

Website: www.hdfcergo.com

E-mail: [email protected]

Tel. No: +91 22 6638 3600

CIN: U66030MH2007PLC177117

IRDAI Reg. No. 146

DEBENTURE TRUSTEE

IDBI Trusteeship Services Limited

Universal Insurance Building, Ground Floor,

Sir P.M.Road, Fort, Mumbai – 400 001

Tel. No: +91 22 40807008/0

Fax No: +91 22 66311776

AUDITORS

G. M. Kapadia & Co.

Chartered Accountants

B S R & Co. LLP.

Chartered Accountants

BANKERS

HDFC Bank Ltd.

Ankur Bahorey

President –Bancassurance

Chirag Sheth

Chief Risk Ocer

Anshul Mittal

Appointed Actuary

Sudakshina Bhattacharya

Chief Human Resources Ocer

Hiten Kothari

Chief Underwriting Ocer

Sriram Naganathan

Chief Technology Ocer

Parthanil Ghosh

President - Retail Business

Sanjay Kulshrestha

Chief Investment Ocer

Vyoma Manek

Company Secretary & Chief

Compliance Ocer

13

COMPANY

HIGHLIGHTS

Large agency and geographical presence

multi-line agents, including Point

of Sales Personnel (PoSPs)

~

1.1 Lac

branches

266

digital oces

497

Spread across

509

districts of

the country

5.32

million

claims serviced

policies issued,

11.6 million

90% +

policies issued digitally

with

largest private

general insurer

3

rd

Eective turnaround

time. Our score card

in/under a minute:

Customer queries serviced:

22

Queries resolved by digital bots:

17

here app downloads:

11

Customer visits to self-help

customer portal

8

No. of health claims settled:

2

No. of motor claims settled:

1

Net Promoter Score (NPS) of

55

₹ 18,802 crore

With a Gross Written

Premium of

6.4%

market share

basis GDP

of assets in Sovereign and AAA or

equivalent rated assets

86%

High degree of

safety with

1.68 times

Solvency

ratio of

vis-a-vis IRDAI’s required

solvency ratio of 1.50 times

Business Continuity Management

System and Information Security

Management System

ISO certified

processes for: Claims

Services, Operations,

Customer Services,

empanelled hospitals and

diagnostic centres across

590+ districts of the country

13,000 +

CRISIL/AAA, ICRA/AAA,

Credit Rating

Stable outlook for Non-Convertible

Debentures (Subordinated Debt)

14

17

th

Annual Report

INSURE MORE, SERVE

MORE, REACH MORE

Leveraging its strengths in building robust digital capabilities, HDFC ERGO has established itself as a ‘Digital Insurer at Scale’

today. In FY 2023-24, the Company continued its path of facilitating seamless customer journeys, introducing diverse product

oerings, and enabling faster claims processing via a host of digital platforms.

In the larger background of the transformation that is occurring within India’s Digital Public Infrastructure (DPI), HDFC ERGO

is well poised to harness technology to insure more, serve more, and reach more. Here is a quick snapshot of how the

Company’s digital platforms are at the forefront of customer interaction and how the Company ensures it ‘reaches the last mile’.

The Company has significantly expanded its digital business by optimising digital marketing and sales, fostering

collaborations with digital partners and aggregators, and leveraging robust integration capabilities.

Insure More

IMPACT

Digital Oces (DO)

–

497 have helped

increase the Company’s

presence in upcountry

locations, contributing

~

6% of the Company’s

retail business

Digital Business

Group has

contributed

~

13%

to the Company’s

retail GWP

15

Serve More

Rolled out HDFC ERGO 3.0, a tech modernisation initiative to enable better

service to stakeholders. At the heart of HDFC ERGO 3.0 lies a profound

understanding of customer needs, driving meticulous issue resolution and

proactive engagement through timely interventions across all phases of the

consumer lifecycle.

AI-led break-in pre-inspection has reduced

time from

2 hours to 5 minutes

90% of health policies and 98% of motor

policies are issued digitally

~

80% of motor and

~

70% of health claims

are now intimated digitally, aiding faster

claim processing

~

75% of service requests are self-serviced

of which 16% are AI-led

IMPACT

Launched India’s unique insurer-led ecosystem — the ‘here’ app. It hosts

updated and verified requirements of customers’ healthcare & mobility needs,

thus being ‘Seriously Helpful’ in times of need.

Over 5 million downloads Over 300,000 policy-related transactions

Innovative Mobile App of the Year at

the ET DigiPlus Awards

Best Customer Experience Initiative and

Best Digital Transformation Initiative at

InsureNext Conference & Awards

IMPACT

Introduced HEIQ, an AI-powered SME insurance platform designed to simplify

SMEs’ complex insurance requirements.

Leveraging AI algorithms, HEIQ generates insurance

quotes by analysing vast amounts of unstructured data

received via emails, PDFs, or document file proposals

Quote generation has reduced

from days to seconds

IMPACT

16

17

th

Annual Report

Reach More

Introduced “1UP”, an AI-driven application that provides advisors with

AI-powered contextual prompts for sales, retention, and daily planning,

optimising their workflow.

Personalised pitches for each

customer, shareable by advisors in

their preferred language

Seamless customer journeys across

the lifecycle

IMPACT

As the ‘Lead Insurer’ for the states of Tamil Nadu and Puducherry

under IRDAI’s State Insurance Awareness initiative, rolled out

medical camps and rural outreach programmes to enhance

insurance awareness in these regions. Additionally, launched a first-

of-its-kind state-level quiz in vernacular language.

A 360-degree insurance awareness drive spanning across 392 villages and 40 towns in Tamil

Nadu and Puducherry

Launched a first-of-its-kind ‘Kapitu Varaam’ or ‘Insurance Week’ initiative, involving 30 non-life insurers

to promote insurance awareness at the grassroots level

IMPACT

State Level: 211 teams from 124 Government schools of 42 districts of Tamil Nadu and

Puducherry participated

Rolled out the eight edition of the

immensely popular Insurance Awareness

Awards - Junior Quiz.

National Level: The programme reached out to over 550,000 students; 4,410 students in the

8

th

and 9

th

grades from 2,205 schools across 150 cities in India participated

IMPACT

17

DIRECTORS’

REPORT

TO THE MEMBERS

Your Directors are pleased to present the Seventeenth Annual Report of your Company together with the audited financial

statements for the financial year ended March 31, 2024.

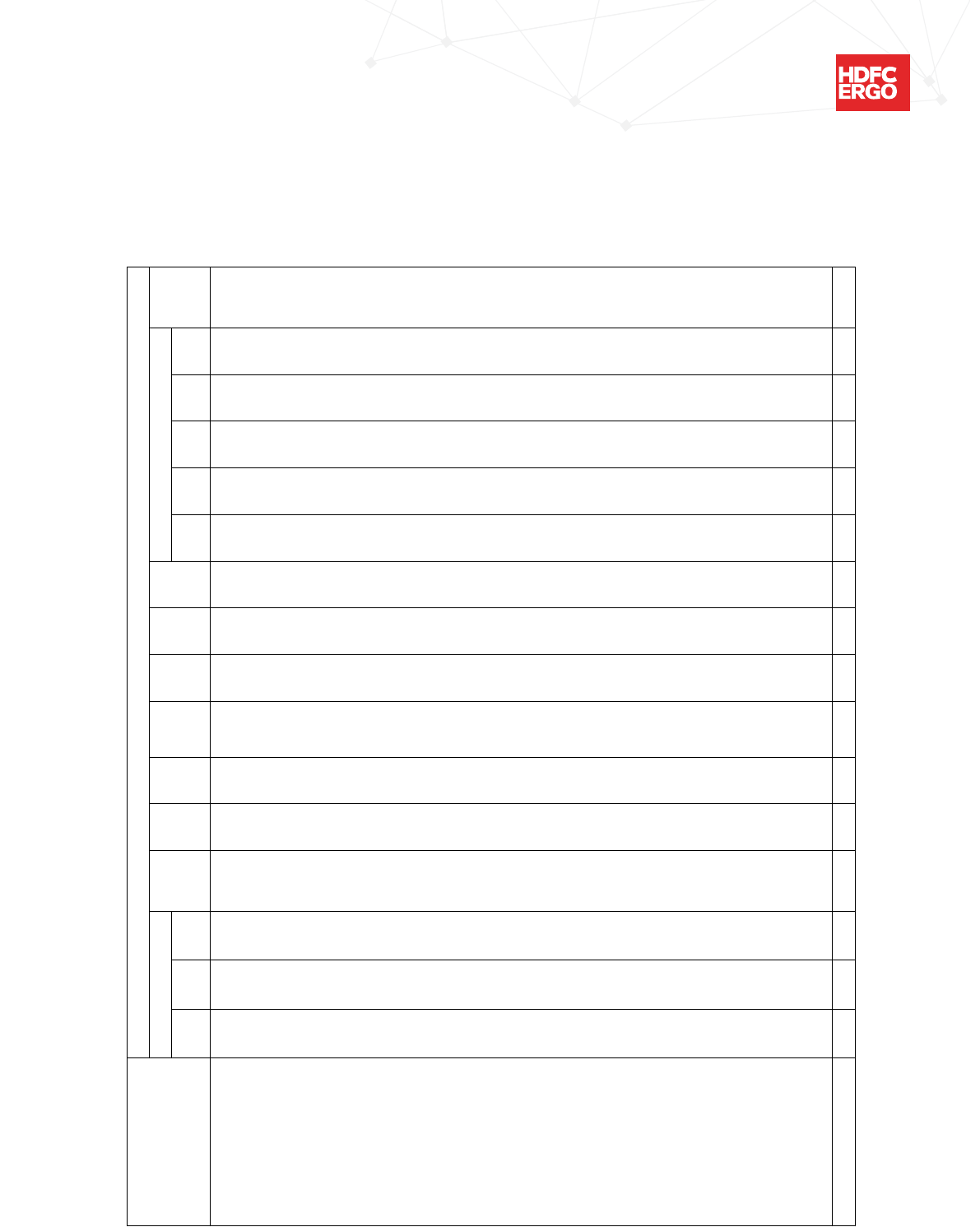

Financial Results:

The Company’s financial performance for the financial year ended March 31, 2024 is summarised below:

Performance

The Gross Written Premium (GWP) of the Company

increased to

` 18,801.7 crore (PY: ` 16,873.1 crore). The Net

Earned Premium increased to

` 9,573.6 crore (PY: ` 8,035.0

crore). The Company achieved a Profit before Tax of

` 578.4

crore (PY:

` 868.4 crore). The Profit after Tax for the year is

` 437.7 crore (PY: ` 652.7 crore).

Transfer to reserve

The Board of Directors of the Company have not transferred

any amount to the Reserves for the financial year.

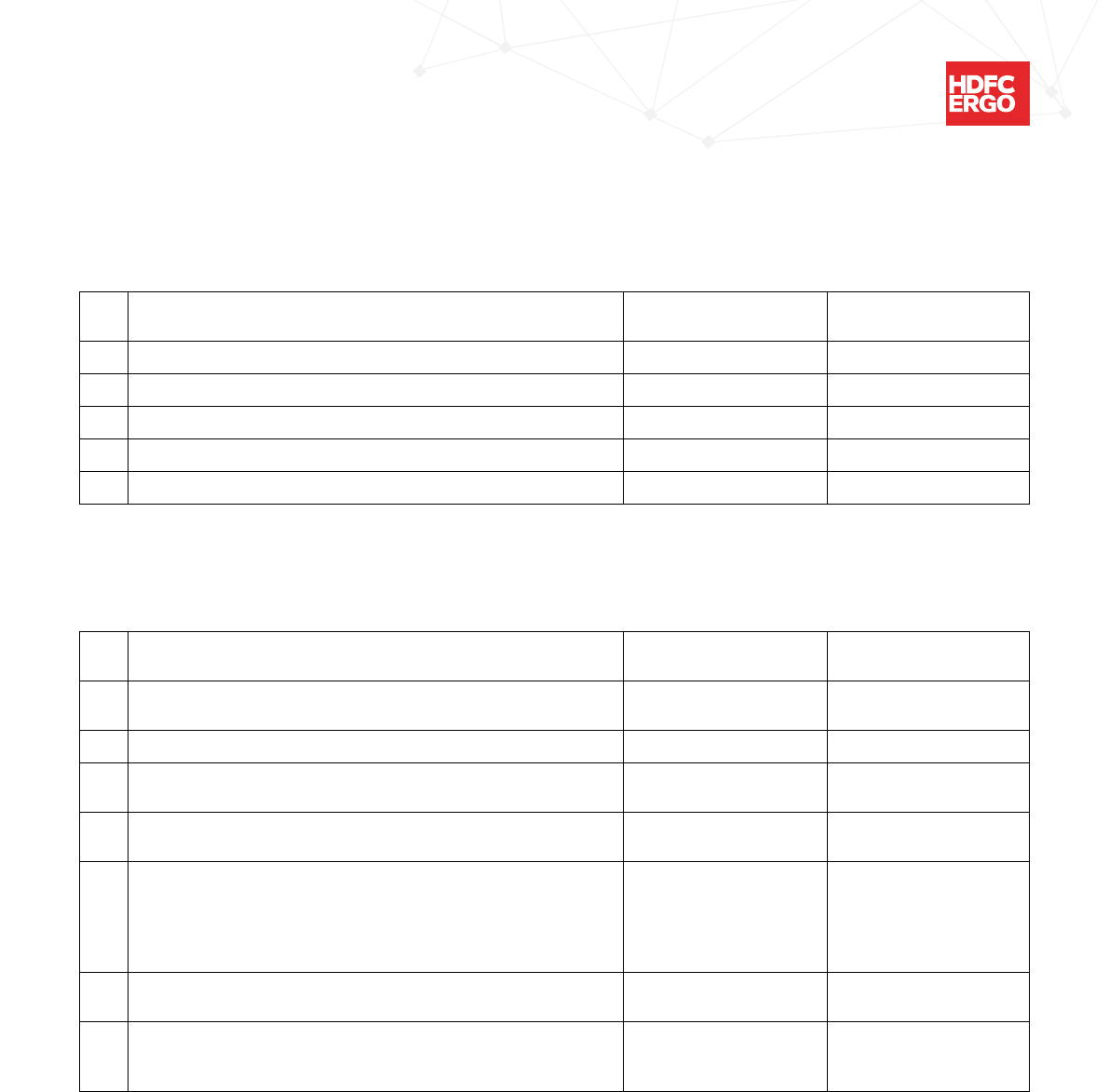

Particulars Year ended

March 31, 2024 March 31, 2023

Gross Written Premium 18,801.7 16,873.1

Net Written Premium 10,438.6 8,880.8

Net Earned Premium 9,573.6 8,035.0

Other Income/Liabilities written back 1.6 5.4

Net Incurred Claims 8,396.4 6,423.0

Net Commission (Income)/ Expenses 915.3 (238.5)

Expenses of Management 1,738.17 2,406.1

Investment Income – Policyholders 1,656.5 1,129.0

General Insurance Result 181.8 578.9

Investment Income – Shareholders 384.9 272.1

Profit before Tax - Before providing for diminution in value of investments &

write-o of Bad and Doubtful Investments

566.7 851.0

Provision towards diminution in value of investments & write-o of Bad and Doubtful

Investments

(11.69) (17.5)

Profit before Tax - After providing for diminution in value of investments &

write-o of Bad and Doubtful Investments

578.4 868.4

Provision for Tax 140.7 215.8

Profit after Tax 437.7 652.7

Interim Dividend 250.2 249.5

Profit carried to Balance Sheet 187.5 403.2

Credit balance in P & L account at the year end 1,637.6 1,450.1

(` in crore)

18

17

th

Annual Report

Dividend

During the year, the Board of Directors had approved the

payment of interim dividend @25% and @10%, (previous

year total 35% per equity share); the said dividend was

declared and paid in September, 2023 and December,

2023, respectively, and paid to the concerned shareholders.

The Board of Directors have not recommended any final

dividend for FY24.

Merger of HDFC Limited with and into HDFC Bank

Limited

The Board of Directors of erstwhile Housing Development

Finance Corporation Limited (HDFC Limited) had approved

a composite scheme of amalgamation (Scheme) which inter-

alia approved the amalgamation of HDFC Limited with and

into HDFC Bank Limited (HDFC Bank) under Sections 230

to 232 of the Companies Act, 2013 (the “Act”) and the Rules

made thereunder, subject to receipt of requisite approvals.

Consequently, HDFC Limited / HDFC Bank were required

to increase its shareholding in the Company to more than

50% prior to the eective date of the Scheme, as per the

direction of the Reserve Bank of India.

On June 30, 2023, pursuant to receipt of approval from

the Insurance Regulatory and Development Authority

of India (IRDAI), erstwhile HDFC Limited had acquired

shares totalling 0.5097% of the paid-up share capital of

the Company from ERGO and consequently, the Company

became the subsidiary of erstwhile HDFC Limited as on the

said date.

Consequent to the amalgamation of HDFC Limited with and

into HDFC Bank eective from July 1, 2023, HDFC Bank

became the holding company and the Indian Promoter of

the Company.

Increase in Paid-up Share Capital

During the year, the Company allotted 21,88,229 equity

shares of

` 10 each pursuant to exercise of stock options

under the Employees Stock Option Plan-2009 (ESOP-2009).

The Paid-up equity share capital and Share Premium Account

of the Company stood at ` 714.97 crore and ` 1,463.8 crore,

respectively, as on March 31, 2024. HDFC Bank Limited

(HDFC Bank), Indian Promoter, holds 50.48% of the paid-

up share capital of the Company, ERGO International AG

(ERGO), Foreign Promoter holds 49.08% and balance 0.44%

are holders of shares issued pursuant to the Company’s

Employee Stock Option Plan.

Non-Convertible Debentures

On September 18, 2023, in terms of IRDAI (Other Forms

of Capital) Regulations, 2015 (‘OFC Regulations’), the

Company exercised the call option on 740 Unsecured,

Subordinated, Fully Paid-up, Listed, Redeemable, Non-

Convertible Debentures (‘NCDs’) of the face value of

` 10,00,000 each, aggregating to ` 74 crore bearing interest

of 10.25% per annum, issued on September 18, 2018. All the

NCD holders holding the said NCDs as on the Record Date

were paid the redemption amount along with the interest

accrued thereon.

On September 26, 2023 the Company issued and allotted

32,000 Unsecured, Subordinated, Fully Paid-up, Listed,

Redeemable, Non-Convertible Debentures of the face value

of

` 1,00,000 each, at par, aggregating to ` 320 crore, on a

private placement basis, with a coupon of 8.15% per annum,

in accordance with OFC Regulations and SEBI (Issue and

Listing of Non-Convertible Securities) Regulations, 2021.

The aforementioned NCDs are redeemable at the end of 10

years from the date of allotment, for cash at par, with a call

option at the end of five years from the date of allotment and

annually thereafter. The said NCDs are rated by CRISIL and

ICRA and were assigned the highest ratings of CRISIL AAA/

Stable and ICRA AAA/ Stable, respectively.

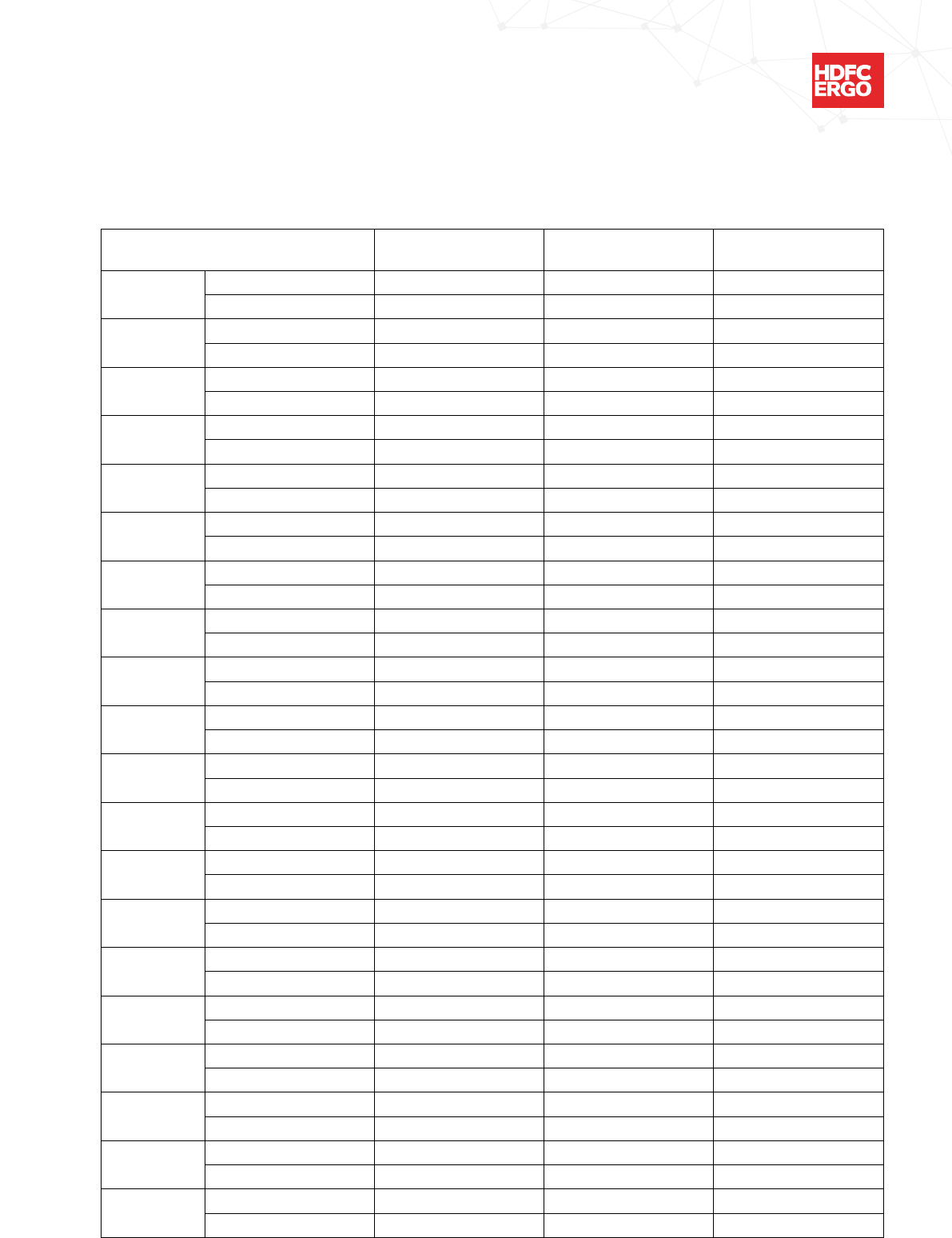

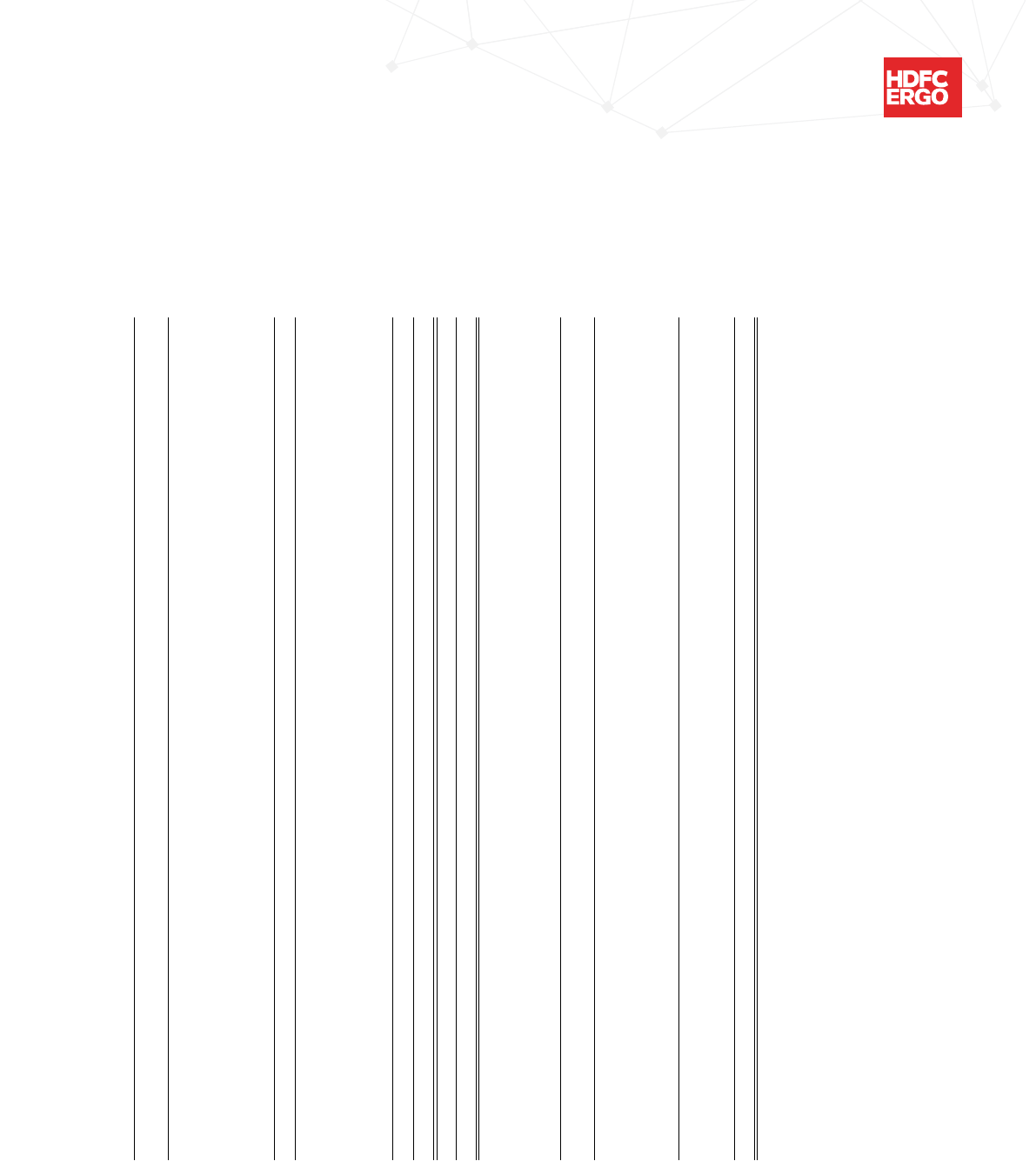

Date of

Allotment

No. of

NCDs

Face Value

(` per NCD)

Total value of

NCDs (` in crore)

Coupon

Rate

Date of

Redemption

Credit Ratings

November 9,

2021

3,750 10,00,000 375 7.10% p.a. November 9,

2031

CRISIL AAA/Stable and

ICRA AAA/Stable

September 19,

2022

800 10,00,000 80 7.72% p.a. September 19,

2032

CRISIL AAA/Stable and

ICRA AAA/Stable

February 20,

2023

30,000 1,00,000 300 8.15% p.a. February 20,

2033

CRISIL AAA/Stable and

ICRA AAA/Stable

September 26,

2023

32,000 1,00,000 320 8.15% p.a. September

26, 2033

CRISIL AAA/Stable and

ICRA AAA/Stable

Total 1,075

As at March 31, 2024, the Company’s outstanding Unsecured, Subordinated, Fully Paid-up, Listed, Redeemable NCDs stood

at

` 1,075.00 crore consisting of:

19

All the above NCDs are listed on the Whole Sale Debt Market

Segment of BSE Limited.

The Company has been regular in servicing its interest

obligation towards the aforementioned NCDs.

Debenture Redemption Reserve

As required under Section 71(4) of the Act read with Rule 18(7)

(b)(iv)(B) of the Companies (Share Capital and Debentures)

Rules, 2014, as amended, the Company is required to create

a Debenture Redemption Reserve (DRR) out of the profits

available for payment of dividend. As at March 31, 2024, the

balance in DRR stands at

` 35.6 crore.

Annual Return

The Annual Return in prescribed Form MGT- 7 for FY24 can

be accessed on the website of the Company (at https://www.

hdfcergo.com/docs/default-source/default-document-library/

hdfc-ergo---2023-24--mgt-7.pdf).

Report on Corporate Governance

The Company is committed to maintain the highest standards

of Corporate Governance and adheres to the Corporate

Governance requirements set out by SEBI (Listing Obligations

and Disclosure Requirements) Regulations, 2015 (LODR

Regulations) and the Guidelines on Corporate Governance for

the Insurance Sector issued by IRDAI (CG Guidelines), a report

on which forms part of the Annual Report. Further, IRDAI vide

its notification dated March 20, 2024 notified IRDAI (Corporate

Governance for Insurers) Regulations, 2024, eective from

April 1, 2024. Further, IRDAI had on March 20, 2024 notified

IRDAI (Corporate Governance for Insurers) Regulations, 2024,

which are eective from April 1, 2024. Updates about relevant

aspects, as applicable and available, on the date of this report

have been incorporated in the relevant sections of this Report.

Number of meetings of the Board

During the year, the Board met five (5) times on April 27,

2023, July 25, 2023, October 12, 2023, January 13, 2024

and March 1, 2024.

The details of attendance of the Directors at the Board

and Committee meetings are provided in the Report of the

Directors on Corporate Governance, which forms part of this

Annual report.

Policy on Director’s appointment and remuneration

The Company has in place a Board approved Policy on

Appointment of Directors, Key Management Personnel

and Members of Senior Management (Appointment Policy)

and Remuneration Policy for the Directors, Key Managerial

Personnel and Senior Management and other Employees

(Remuneration Policy).

The objective of the Appointment Policy is to inter-alia

provide a framework and set standards for the appointment

of Directors, Key Managerial Personnel (KMP) and Senior

Management (SMP) who should have the capacity and ability

to lead the Company towards achieving its stated goals and

strategic objectives, taking into account the interest of all

stakeholders including shareholders, policyholders, channel

partners and employees. The Policy also aims to achieve

an appropriate balance of skills, experience, knowledge and

expertise among its Directors.

The objective of the Remuneration Policy is inter-alia to

ensure that (i) the level and composition of remuneration

is in line with other companies in the industry, sucient to

attract and retain right talent at all levels and keep them

motivated enough to meet the organisation’s objectives;

(ii) a reasonable balance is maintained in the composition

of remuneration (fixed and variable component); and (iii)

performance measurement parameters are in place to

assess the overall performance of Directors, KMPs, Members

of Senior Management and other employees.

During the year the Board had approved amendment to

the Remuneration Policy of the Company to align the same

to the requirements prescribed in the IRDAI Guidelines on

Remuneration of Directors and Key Managerial Persons

of Insurers and the same is hosted on the website of the

Company at https://www.hdfcergo.com/docs/default-

source/policies/policy-on-remuneration-of-directors.pdf

Comments on Auditor’s Report

Neither the Secretarial Auditor nor the Joint Statutory

Auditors have made any qualification, reservation or

adverse remark or disclaimer in their reports. The reports of

the Secretarial Auditor and the Joint Statutory Auditors are

appended to this Report.

Further, during the year under review, the Joint Statutory

Auditors have not reported any incidents of fraud to the

Audit and Compliance Committee of Directors.

Particulars of Loans, Guarantees or Investments

The Company has not given any loan or guarantee to any

person or body corporate.

The investments of the Company are made in accordance

with the IRDAI (Investment) Regulations 2016, as amended,

and circulars issued by IRDAI, from time to time and

the Investment Policy of the Company. The particulars

of Investment Assets are provided in the Management

Discussion and Analysis Report section, which forms part of

this Annual report.

20

17

th

Annual Report

Related Party Transactions

Transactions/ arrangements entered into by the Company

with its related parties are in the ordinary course of

business and primarily includes sale of various insurance

policies, selling of insurance policies by related parties

appointed as Corporate Agents, receipt of premium

and payment of claim thereon, banking arrangements,

purchase/sale of securities directly or indirectly through

a related party, payment of premium, reinsurance ceded,

receipt of commission on reinsurance ceded, etc.

The Audit and Compliance Committee of Directors has

granted omnibus approval to enter into related party

transactions which are recurring in nature and in the

ordinary course of business.

The Related Party transactions entered into during the

year were in the ordinary course of business and on an

arm’s length basis. The details of transactions with related

parties were placed before the Audit and Compliance

Committee of Directors at its quarterly meetings. The

Company had not entered into any contract / arrangement

/ transaction with related parties which is required to be

reported in Form No. AOC-2 in terms of Section 134(3)

(h) read with Section 188 of the Act and Rule 8(2) of the

Companies (Accounts) Rules, 2014.

The Policy on related party transactions of the Company

is hosted on the Company’s website at https://www.

hdfcergo.com/docs/default-source/policies/policy-on-

related-party-transaction-policy.pdf

During the year, there were no material, financial or

commercial transactions by the Senior Management

having personal interest and that had a potential conflict

with the interest of the Company at large.

Pursuant to provisions of Regulation 23 of LODR

Regulations, the Company has taken requisite approval

of Members for entering into material related party

transactions with HDFC Bank and Munich Re. during FY24.

As required under Regulation 53(f) read with Para A of

Schedule V of LODR Regulations and Accounting Standard

(AS) 18 on Related Party Disclosures, the details of related

party transactions entered into by the Company during

the year are included in the Notes to Accounts.

Material Changes and Commitments aecting

the Financial Position

There were no material changes or commitments,

aecting the financial position of the Company between

the end of the financial year and the date of this Report.

Particulars regarding Conservation of Energy,

Technology Absorption and Foreign Exchange

Earnings and Outgo

Since the Company does not carry out any manufacturing

activity, the provisions with respect to disclosure of

particulars regarding conservation of energy and

technology absorption are not applicable to the Company.

During the year, the Company incurred an expenditure of

` 254.44 crore in foreign exchange (PY: ` 226.13 crore)

mainly on account of reinsurance premium and claims

payment. Premium paid, claims and commission received

on reinsurance ceded in foreign exchange during the year

was

` 106.51 crore (PY: ` 244.37 crore).

Risk Management Framework

The Company recognises that risk is an integral element

of insurance business and realises the criticality of

institutionalised risk management practices to meet its

objectives. The Company has therefore established an

eective and robust enterprise wide Risk Management

Framework (RMF), which addresses all relevant risks

including strategic risk, operational risks, investment risks,

insurance risks and information & cyber security risks.

The material aspects with regard to Environmental, Social

and Governance (ESG) are mapped into and integrated

with the RMF.

The Risk Management Committee of Directors (RMC) has

laid down the risk management philosophy and policy of

the Company. The RMC oversees the functioning of the

RMF which has been designed in line with the aforesaid

philosophy and policy. The Chief Risk Ocer (CRO) is

responsible for the consistent implementation of the RMF.

The CRO reports to the RMC. The CRO inter-alia presents

the key and top risks to the RMC at its quarterly meetings.

The RMC is further assisted by a Sub-Committee comprising

the Managing Director & CEO, Executive Directors, CRO

and Heads of various business units which ensures the

implementation of the Company’s Risk Management

Philosophy, Strategies, Policies and Procedures.

Under RMF, the Company has entrusted designated Risk

Owners to periodically identify, assess, manage and

mitigate the risks pertaining to their respective areas of

responsibility.

The material risks identified by the Company and the

mitigation measures are as under:

21

Underwriting and Reserving Risks

Underwriting Risk is the risk of change in value due to a

deviation of the actual claims payment from the expected

amount of claims payment. Underwriting Risk encompasses

risk of concentration and insucient diversification.

Reserving Risk is the risk of eventual cost of claims diverging

from the booked reserves due to under-reserving which

can make certain classes of business look profitable than

they really are. Conversely, over-reserving tends to lock in

unnecessary capital and could result in portfolio steering in

the wrong direction.

The following controls and mitigation measures have been

established to eectively mitigate aforesaid risks:

• The Underwriting Guidelines are used as a basis for

underwriting of risks and basis for pricing charged to

the proposer;

• Prudent margins are built in reserves and a regular

monitoring of its adequacy is done;

• Adequate protection is ensured through a well-

designed Reinsurance Programme with financially

sound reinsurers;

• Catastrophe (CAT) protection has also been ensured to

mitigate the risks of large losses arising from probable

catastrophic events;

• Detailed Reserving Guidelines are documented for all

classes of business which define the procedures to be

adhered to; and

• The default reserve values are reviewed on a periodic

basis to identify any significant changes in loss

development patterns/IBNR utilisation trends and

formulas are adjusted if deemed necessary and agreed

by all stakeholders.

• Reserves are also peer reviewed annually by

Independent Actuary.

Credit and Market Risk

Adverse change in financial situation due to fluctuation

in the market price of investment assets, its liquidity and

credit quality are some of the material risks faced by the

General Insurers.

The Company’s Investment Function is overseen by

the Investment Committee, duly assisted by the Chief

Investment Ocer (CIO). The investments of the Company

are made as per the Board approved Investment Policy,

Investment Strategy Document and the Standard

Operating Guidelines and are compliant with the

provisions of IRDAI (Investment) Regulations, 2016 and

circulars issued thereunder.

The Investment Policy and the Standard Operating

Guidelines have been designed to be more conservative

than regulatory provisions relating to investment in debt

and equity instruments.

Market risk is managed by maintaining exposure in equity

within the limits set out in the Investment Policy and

guidelines thereunder. Exposure to debt is managed by

maintaining a modified duration of the debt portfolio within

the limits set by the Investment Policy.

Liquidity risk is managed by maintaining investments in

money market instruments upto the desired level as required.

Credit risk or risk of default of counter parties is managed

by investing a substantial portion of the investible corpus

in securities with prescribed Credit Rating (Sovereign and

AAA rated securities).

The aforementioned risks are reviewed and monitored on

a regular basis by the Management, Investment Committee

and the Risk Management Committee.

Credit risk also arises on the reinsurance protection taken

by the Company. The Company ensures that it enters into

reinsurance agreements with reinsurers who comply with

the prescribed minimum Financial Strength Rating (FSR).

This minimises its credit risk exposures in reinsurance

protection arrangements.

Operational Risks

The Company faces varied operational risks in the

various processes it operates in the course of its day-

to-day business such as Premium, Claims, Commission,

Investments, Reinsurance, HR & Payroll, Customer

Experience, etc. Operational risks majorly arise from

breakdowns in internal processes, people and systems.

Operational risks are mitigated by developing

comprehensive policies and processes and by

implementing both automated and manual controls across

various activities performed by various departments.

Business Continuity risks are managed by implementing

a robust Business Continuity Policy and Processes to

ensure safety of human resources and continuity of

key services and oering from bouquet of products at

minimum acceptable level of business. The Company has

an alternate Disaster Recovery (DR) site and the identified

critical business processes are tested periodically at the

DR site to assess its operational preparedness in case of

any eventuality. The Company has been certified under ISO

22301:2019 standard for its Business Continuity practices.

22

17

th

Annual Report

Information & Cyber Security

The Company assigns critical importance to information and

cyber security risks. Insurance business is highly information

driven where information is recognised as a critical

business asset. Due to emerging information and cyber

security threats in the Insurance Industry, it is imperative

that business information is protected adequately through

appropriate controls and proactive measures.

To manage the existing and emerging information and cyber

security risks, following controls are in place:

• Board approved Information and Cyber Security Policy;

• Board approved Information and Cyber Security Crisis

Management Plan;

• ISO 27001:2013 Certified Information Security

Management System;

• Awareness programme for employees such as awareness

mailers, simulation and tabletop exercises, etc; and

• Vulnerability Assessment and Penetration Testing

exercise on a periodic basis.

Further, the Company constantly endeavours towards

improvement of the Information & Cyber Security posture given

the dynamic and complex cyber security threat landscape.

Corporate Social Responsibility (CSR)

The CSR Committee comprises seven members – four

Independent Directors, two Non–Executive Directors and

one Executive Director. The Chairman of the Committee is

an Independent Director. The composition of the Committee

is in conformity with the provisions of Section 135 of the Act.

The Company’s CSR Policy is hosted on its website https://

www.hdfcergo.com/docs/default-source/about-us/legal-

and-compliance/csrpolicy.pdf. The Policy inter-alia specifies

the broad areas of CSR activities that could be undertaken

by the Company, the approach and process for undertaking

CSR projects and the monitoring mechanism.

During the year, the Company has completely spent the

mandated amount of ₹ 15.29 crore on various CSR activities.

The Annual Report on CSR activities including summary

of Impact Assessment Report is annexed and marked as

“Annexure I” to this Report.

The Company is committed to serving society and has

aligned its CSR interventions under four major pillars for FY

2023-24 which are as given below:

Vidya - Education

• Through its flagship programme of Government school

reconstruction – ‘GAON MERA’, the Company has

undertaken the revamp of two new Government schools

and completed two schools in FY24, cumulatively

impacting more than 1,200 students.

• The Company has also contributed towards improving

the infrastructure facilities of all educational institutions,

expecting to benefit 800 students.

Niramaya - Healthcare

• In FY24, the Company has commenced reconstruction

and upgradation of one Government hospital in addition

to two completed in FY23, aiming to serve

~

3.7 lakh

people with improved healthcare facilities.

• The Company has funded 2,084 critical surgeries for the

underprivileged in FY24, towards treatment of cataract,

bone marrow and cochlear transplant, facial deformities

and congenital heart diseases.

• Further, interventions towards cancer care were

undertaken in rural areas by setting up cancer diagnostic

labs and upgradation of facilities in cancer hospital,

expected to benefit over 7,000 patients.

• Mobile Medical Vans and Health camps were deployed

in rural and tribal areas to extend medical facilities,

benefitting

~

70,000 people.

Roshini - Women’s Welfare

• Over 1,000 destitute women were supported with

sustainable livelihood solutions and capacity building in

remote areas of West Bengal.

• The Company has also supported 2,000 women in North

East and Tamil Nadu through livelihoods interventions in

entrepreneurship development and climate resilient farm

practices.

• Additionally, 35 women collectives were provided solar

powered equipments for running their enterprises,

impacting 320 women.

• The Company also upgraded skills of 373 ASHA

(Accredited Social Health Activist) workers to enable

them to graduate to nursing assistants.

• Supplementary education through learning centres was

provided to 1,100 girls, with an aim to get them back to

formal education system.

Supath - Road Safety

• The Company has adopted two high-fatality blackspots

on Karnataka Silk Board Highway to transform them

to ‘Zero Fatality Corridors’ through tactical urbanism,

benefiting

~

2.6 lakh commuters.

• The Company has also set up a training centre at Indore

RTO to provide road safety training to new license

applicants through a physical training and two-wheeler

23

simulator learning experience and this has benefitted

over 9,000 prospective motorists.

The Company’s CSR initiatives are expected to reach out to

more than 7 lakh lives.

Employee volunteering

In its endeavour to establish a culture of volunteering

within the organisation and increase its social footprint, the

Company furthered its volunteering programme – ‘SAATHI’.

Under this programme, during the year, the employees

have volunteered for over 40,000 hours through various

activities in areas like environment, inclusiveness, women

welfare, healthcare, elderly care, children’s welfare, animal

welfare and road safety. The Company dedicated the week

of September 21 to 27, 2023, as Volunteering Week, during

which employees across the country came together to

clock over 23,000 volunteering hours.

The other details about the CSR Committee are provided in

the Report of the Directors on Corporate Governance which

forms part of this Annual Report.

Board Evaluation

The evaluation of the Board and the Board Committees

was carried out on the basis of various parameters like

optimum mix, quality and experience of Board members,

regularity and frequency of meetings, cohesion in the

Board/Committee meetings, constitution and terms of

reference of various Board Committees, contribution in

shaping the Company’s strategy, protecting legitimate

interest of various stakeholders, implement best corporate

governance practices, follow up on implementation of

decisions taken at Board/Committee meetings, Board

Committee’s promptness and ecacy to report issues

requiring Board’s attention, quality, quantity and timeliness

of flow of information, etc.

The evaluation of Directors (including Independent

Directors) was carried out based on parameters like

attendance, active participation, exercise of independent

judgement, knowledge and competency, commitment,

initiative, high levels of integrity, understanding and

fulfillment of functions assigned by the Board and the law,

awareness and observance of governance, etc.

The Independent Directors at its separate meeting

evaluated the performance of the Non-Independent

Directors, Whole-time Directors, Chairman, Board as whole

and the Board Committees and the views were shared with

the Chairman of the Board.

The evaluation was shared with the Chairman of the

Board. The overall performance evaluation exercise was

completed to the satisfaction of the Board.

Particulars of Employees and other related

disclosures

The total employee strength of the Company as on March

31, 2024 stood at 11,181.

During the year, 26 employees, including Whole-time

Directors, employed throughout the year were in receipt

of remuneration of

` 1.02 crore or more per annum or

` 8.50 lakh or more per month. In accordance with the

provisions of Rule 5(2) of the Companies (Appointment

and Remuneration of Managerial Personnel) Rules, 2014,

the names and other particulars of such employees

including the names of the top ten employees in terms

of remuneration drawn are set out in the annexure to the

Directors’ Report. In terms of the provisions of the Act read

with the said Rule, the Directors’ Report is being sent to

the shareholders excluding the annexure. Any shareholder

interested in obtaining a copy of the said annexure may

write to the Company Secretary of the Company. Further,

the Managing Director of the Company did not receive any

remuneration from the holding company.

Further, the disclosures on managerial remuneration as

required under Rule 5(1) of the said Rules are provided in

“Annexure II” appended to this Report.

Disclosures on remuneration of Managing Director

and Key Managerial Persons as mandated under

IRDAI Guidelines on Remuneration of Directors

and Key Managerial Persons of Insurers dated

June 30, 2023 (IRDAI Remuneration Guidelines)

(i) Qualitative Disclosures:

(a) Information relating to the composition and mandate of

the Nomination and Remuneration Committee (NRC):

The details about the composition and mandate of the

Committee are provided in the Report of the Directors

on Corporate Governance which forms part of the

Annual Report.

(b) Information relating to the design and structure of

remuneration policy and Key Features and Objectives

of the Remuneration Policy:

NRC reviews the principles and practices of the

Company with respect to salary increase, promotions,

performance management and bonus to all employees

of the Company. The Remuneration Policy provides

that the level and composition of remuneration is in line

24

17

th

Annual Report

with other companies in the industry, sucient

to attract and retain the right talent at all levels

and keep them motivated enough to meet the

organisational objectives and a reasonable balance

is maintained in the composition of remuneration

(fixed and variable component). The performance

measurement parameters are in place to assess the

overall performance of Directors, KMPs, Members of

Senior Management and other Employees. NRC, whilst

recommending remuneration of the Managing Director

and CEO and other Whole-time Directors to the Board,

considers the above factors, which are subject to the

approval of IRDAI.

(c) Description of the ways in which current and future risks

are taken into account in the remuneration policy which

include the nature and type of the key measures used to

take into account of these risks:

The remuneration fixing process of Whole-time

Directors including that of the Managing Director

and CEO, includes evaluation of performance against

performance objectives defined by NRC which includes

performance criteria covering the enterprise wide Risk

Management Framework.

(d) Description of the ways in which the Company seeks to

link performance, during a performance measurement

period, with levels of remuneration:

The level of remuneration of Whole-time Directors

including Managing Director and CEO for any financial

year is inter-alia linked to the following performance

objectives set by NRC:

a. Top line and bottom line targets of the Company

including portfolio steering;

b. Overall financial position of the Company including

adherence to IRDAI stipulations on Minimum

Solvency Margin and Expenses of Management

Limits;

c. Key strategic and operational deliverables for the

year and progress on the mid-term deliverables;

d. Satisfactory claim settlement and repudiation

performance;

e. Eectiveness of the Grievance Redressal

Mechanism; and

f. Overall compliance to applicable laws including CG

Guidelines and other statutory bodies.

The remuneration payable to the Whole-time Directors

including Managing Director and CEO is subject to approval

from the IRDAI.

(ii) Quantitative Disclosures:

The details of elements of remuneration paid to Managing

Director & Chief Executive Ocer and Whole-time Directors

are disclosed under ‘Managerial Remuneration’ section

of the Notes to Accounts forming part of the financial

statements.

Secretarial Audit

In accordance with the provisions of Section 204 of the Act

and the Companies (Appointment and Remuneration of

Managerial Personnel) Rules, 2014, the Company appointed

Messrs. Bhandari & Associates, Practicing Company

Secretaries for conducting Secretarial Audit for FY 2023-24.

The Secretarial Audit Report is appended to this Report as

“Annexure III” and does not contain any qualifications.

Employees Stock Option Plan (ESOP)

During the year, the Company granted 22,73,970 stock

options at an exercise price of

` 539 per option under

ESOP (Options) to eligible employees. The total number

of options that have been exercised by the grantee was

21,88,229 having exercise price in the range of

` 50 to

` 536 per option. Further, ` 49.42 crore was realised by

way of exercise of options.

The Options granted vest in tranches - 25% on completion

of two years from grant date, 25% at the end of three years

from the grant date and the balance 50% on completion of

four years from the grant date and are exercisable within

a period of five years from the date of respective vesting.

During the year, Options vested aggregated to 11,92,399.

During the year, 2,66,352 Options lapsed and the Options in

force as on March 31, 2024 were 66,17,495.

There has been no variation in the terms of the Options granted.

The diluted Earnings Per Share (EPS) is

` 6.11 against a basic

EPS of

` 6.12.

Two employees, being the key managerial personnel of the

Company, were granted Options aggregating to more than

5% of the total Options granted during the year.

Further, no employee was granted Options in excess of 1% of

25

the issued share capital of the Company at the time of grant.

During the year, the Company has granted 1,90,000,

1,45,000, 95,000, and 8,400 number of Stock Options to

Ritesh Kumar, Anuj Tyagi, Samir H. Shah and Vyoma Manek,

being the key managerial personnel of the Company,

respectively.

Public Deposits

The Company did not accept any deposits from the public

during the year.

Change in the nature of business

During the year under review, there has been no change in

the nature of business of the Company.

Maintenance of Cost Records

Being an Insurance Company, the cost records as specified

by the Central Government under Section 148(1) of the Act,

are not required to be maintained by the Company.

Auditors

At the fifteenth Annual General Meeting (AGM) held on July

21, 2022, the Members had re-appointed Messrs. G. M.

Kapadia & Co., Chartered Accountants (Registration No. of

the firm with ICAI: FRN 104767W) and appointed Messrs.

B S R & Co. LLP, Chartered Accountants (Registration No.

of the firm with ICAI: 101248W/W-100022), as the Joint

Statutory Auditors of the Company to audit the accounts

of the Company upto FY 2026-27 and hold oce as such

upto the conclusion of the twentieth AGM of the Company.

Subsidiary, Joint Ventures and Associate

Companies

The Company has no subsidiary, joint venture or

associate companies.

Directors and Key Managerial Personnel

Superannuation of Ritesh Kumar as Managing Director

and Chief Executive Ocer (CEO)

In terms of the IRDAI Remuneration Guidelines dated June

30, 2023, the position of Whole-time Director can be held

for a continuous period of upto 15 years and if a Director(s)

has already completed a period of 15 years on the date of

issue of the said Guidelines, the Company shall appoint the

new incumbent in place of such Director(s) within a period

of one year from the date of issue of these Guidelines.

Ritesh Kumar (DIN: 02213019) was appointed as the

Managing Director & CEO of the Company w.e.f. June 10,

2008 and his current term is till June 9, 2025.

However, consequent to the aforementioned Guidelines,

since Kumar has already served as a Whole-time Director

of the Company for fifteen years on the date of these

Guidelines, and pursuant to the provisions of these

Guidelines he would superannuate by close of business

hours on June 30, 2024.

The Board acknowledges and places on record its gratitude

and appreciation for the invaluable contributions, vision and

unwavering commitment made by Kumar during his tenure

towards the growth and success of the Company.

Appointment of Anuj Tyagi as Managing Director and

Chief Executive Ocer

In view of the above IRDAI Remuneration Guidelines and

in accordance with the succession plan of the Company,

the Board pursuant to the provisions of the Act and based

on the recommendation of NRC, appointed Anuj Tyagi,

who currently serves as the Joint Managing Director, as

the Managing Director & CEO of the Company, for a period

of five years, with eect from July 1, 2024, subject to the

approval of Members and IRDAI.

Tyagi has been with the Company since 2008 and has

held various positions over his tenure and was elevated

as the Joint Managing Director in April 2023.

Further, the Members at its Extraordinary General

Meeting held on March 15, 2024 approved the aforesaid

appointment of Tyagi, with eect from July 1, 2024.

Appointment / Cessation of Non-Executive Director(s)

Dr. Clemens Matthias Muth (DIN: 07824451) resigned as

a Director of the Company, w.e.f. the closing of business

hours of December 31, 2023, for the reasons of his other

commitments.

The Board pursuant to the recommendation of NRC,

approved the appointment of Edward Ler (DIN: 10426805)

as an Additional Non-Executive Director of the Company,

w.e.f. January 1, 2024 for a term upto the next AGM.

Further, the Members at its Extraordinary General Meeting

26

17

th

Annual Report

held on March 15, 2024 approved the appointment of Ler

as a Non-Executive Director of the Company, liable to

retire by rotation, with eect from January 1, 2024.

The Board acknowledges and places on record its

appreciation for the invaluable contribution and

commitment made by Dr. Clemens during his tenure as a

Director of the Company.

Re-appointment of Directors retiring by rotation

In accordance with the provisions of the Act and the

Articles of Association of the Company, Dr. Oliver Willmes

(DIN: 08876420), Non-Executive Director and Samir H.