Frequently Asked Question's (FAQ's)

WHAT IS THIS PLAN ALL ABOUT

HDFC ERGO Sampoorna Suraksha is a one-stop shop for a multitude of insurance requirements. It offers policy buyers complete protection for a varied

range of services, including Health, Home, Travel and Cyber Security.

HDFC ERGO General Insurance Company Limited

This document is a summary of the benefits offered. The information mentioned above is illustrative and not exhaustive. Information must be read in conjunction with the policy wordings.

In case of any conflict between this document and the policy wordings, the terms and conditions mentioned in the policy wordings shall prevail.

Convenience at your fingertips

On the HELP section of our website, you can:

`

Get Policy Copy/

80D Tax Certificate

Make Changes on Policy

Track Claim Status

Update Contact Details

Ver.OCT19

my:health Mobile App

▪ Health Calculators

Features:

▪ Vaccination

▪ Blood Donations

▪ Physical Activities

▪ Reliable offers, discounts on services and consultation

▪ Complete data security

▪ Cashless OPD and reimbursement

▪ Improved interactions

Download the App now

WHAT ARE THE CHECKS TO BE DONE AFTER

RECEIVING THE POLICY?

¡ Correspondence Address (House number, Street name, Locality,

Check the correctness and completeness of below points in the

policy schedule:

¡ Insured’s Name or Proposer’s Name (Salutation, Gender, Spelling)

¡ Policy Period

¡ Coverage or Sum Insured Details

Pincode, City, Village, Landmark, etc.)

¡ Date of Birth of insured

¡ Mobile Number, Landline Number and Personal E-mail ID

WOULD I RECEIVE ANY CONFIRMATION ON THE CHANGES DONE IN MY POLICY?

You would receive an endorsed policy schedule reflecting the changes made in the policy details on your correspondence address as per policy. Same

would be captured in the policy under the section “List of endorsements”.

HOW DO I RENEW MY POLICY?

§ Visit our nearest branch or contact your agent

You can renew your policy through any of the below options:

§ Visit our website www.hdfcergo.com and go to the Instant Renewal section

§ Give us a missed call on 1800 315 7272 and get quick assistance from Renewal expert

§ Call us on 022 6234 6234 / 0120 6234 6234 and renew instantly

§ Courier the Cheque / Demand Draft in favour of “HDFC ERGO General Insurance Company Ltd” to our Customer service office

HOW TO CONTACT US?

HOW TO TRACK MY CLAIM STATUS?

You can track your claim status through any of the options below:

¡ Visit our website www.hdfcergo.com - > Help - > Track your claim section

¡ Download mobile app, link your policy and track real time status

¡ Visit Mobile App (IPO): Login into online insurance portfolio organizer (IPO) on the home page of our website www.hdfcergo.com

Kindly mention your claim number and/or policy/reference number in the correspondence

DO I GET INCOME TAX BENEFIT?

Yes, you can avail a Tax benefit under Section 80D of Income Tax Act 1961 (Subject to change in Income Tax law). Tax certificate is provided along with the

policy copy. You can mail the same on your registered Email Id through Insurance Portfolio Organiser , online .

WHAT IS THE CLAIM PROCEDURES?

1. DETAILS TO KEEP HANDY WHILE REGISTERING A CLAIM

¡ Policy Number

¡ Nature of disease/illness

¡ Brief history of diagnosis (first diagnosis date is mandatory)

2. HOW DO I FILE MY CLAIM?

¡ For Reimbursement claim intimation, customer should visit

www.hdfcergo.com > Help > Claim registration OR Send duly

signed claim form along with required documents to below address

HDFC ERGO General Insurance company Ltd, 5th floor, Tower 1,

Stellar IT Park, C-25, Sector-62, Noida, UP, India - 201301.

¡ For preauth claim write to us [email protected]

3. WHAT ARE THE BASIC DOCUMENTS REQUIRED IN CASE OF

A CLAIM?

¡ Duly filled and signed claim form (available on our website)

¡ Copy of Photo ID proof of insured and claimant

¡ Discharge card and original discharge summary

¡ Consultation note/ Relevant treatment papers

¡ All relevant medical reports along with supporting invoices and

doctors requisition advising the same

¡ Original and final hositalisation bills with detailed breakup

¡ Pharmacy bills along with prescriptions

Please note: This is not an exhaustive list. Additional docs may be

required on case to case basis.

For claim /Policy Related please calls us at 022 6234 6234 /0120 6234 6234 or Visit the Help Section on www.hdfcergo.com

1

HDFC ERGO General Insurance Company Limited

Policy Wordings

Sampoorna Suraksha

Insuring Clause

In consideration of payment of Premium by You and realized by Us, We

will provide insurance cover to the Insured Person(s) under this Policy

up to Sum Insured or limits mentioned on the Schedule of Coverage

in the Policy Schedule.

This Policy is subject to Your statements in respect of all the Insured

Persons in Proposal form, declaration and/or medical reports, payment

of premium and the terms and conditions of this Policy.

Denitions

Certain words used in the Coverage description have specic meanings

which are mentioned in Denitions and which impacts the Coverage. All

such words, where ever mentioned in this document are mentioned in

Bold to enable you to identify that particular word has a specic meaning

for which You need to refer Section II, Denitions.

I. Coverage

SECTION 1: MY:HEALTH SURAKSHA

Section I 1A: Hospitalization Cover

We will pay under below listed Covers On Medically Necessary

Hospitalization of an Insured Person due to Illness or Injury sustained

or contracted during the Policy Period. The payment is subject to Sum

Insured and limits including Cumulative Bonus if applicable as specied

on the Schedule of Coverage in the Policy Schedule. Subject to otherwise

terms and conditions of the Policy.

1. Medical Expenses

i. Room rent, boarding and Nursing charges

ii. Intensive Care Unit charges

iii. Consultation fees

iv. Anesthesia, blood, oxygen, operation theatre charges, surgical

appliances

v. Medicines, drugs and consumables

vi. Diagnostic procedures

vii. The Cost of prosthetic and other devices or equipment if implanted

internally during a Surgical Procedure.

Insured Person shall bear specied percentage of admissible Claim

amount under each and every Claim If Co-payment under Section

I1C-14 is opted and specied in the Schedule of Coverage in the

Policy Schedule

a) Mental Healthcare

If an Insured Person is hospitalized for any Mental Illness contracted

during the Policy period We will pay Medical Expenses under Section

I1 A in accordance with The Mental Health Care Act, 2017,subsequent

amendments and other applicable laws and Rules provided that;

i. The Hospitalization is prescribed by a Medical Practitioner for

Mental Illness

ii. The Hospitalization is done in Mental Health Establishment

2. Home Healthcare

Insured Person can avail Hospitalization at home under Home

Healthcare for Illnesses including but not limited to following Medically

Necessary Treatment, if prescribed by treating Medical Practitioner.

We will pay Medical Expenses under Section I1A-1 incurred for

treatment of such Illness where opted.

• Gastroenteritis

• Bronchopneumonia

• Respiratory tract infection

• Chemotherapy

• Pancreatitis

• Dengue

• COPD management

• Hepatitis

• Fever management

This Cover can be availed through Cashless Facility only as procedure

given under Claims Procedure - Section IV1.

Insured Person shall bear specied percentage of admissible Claim

amount under each and every Claim If Co-payment under Section I1

C-14 is opted and specied in the Schedule of Coverage in the Policy

Schedule

3. Domiciliary Hospitalization

We will pay the Medical Expenses incurred on Domiciliary

Hospitalization of the Insured Person provided that:

i. It has been prescribed by the treating Medical Practitioner

and

ii. the condition the Insured Person is such that he/she could not be

removed to a Hospital

or

iii. the Medical Necessary Treatment is taken at Home on account of

non-availability of room in Hospital

Expenses incurred on Domiciliary Hospitalization in respect to following

treatment are excluded under the Policy

a. Asthma, Bronchitis, Tonsillitis and Upper Respiratory Tract infection

including Laryngitis and Pharyngitis, Cough and Cold, Inuenza

b. Arthritis, Gout and Rheumatism

c. Chronic Nephritis and Nephritic Syndrome

d. Diarrhoea and all type of Dysenteries including Gastroenteritis,

e. Diabetes Mellitus and Insipidus,

f. Epilepsy,

g. Hypertension,

h. Psychiatric or Psychosomatic Disorders of all kinds,

i. Pyrexia of unknown Origin.

j. Post Hospitalization Expenses are excluded if Insured Person opts

for Domiciliary Hospitalization

Insured Person shall bear specied percentage of admissible Claim

amount under each and every ClaimIf Co-payment under Section I1C-14

is opted and specied in the Schedule of Coverage in the Policy Schedule

4. Pre-Hospitalization cover

We will pay for the Medical Expenses incurred during the 60 days

immediately before Hospitalization of an Insured Person, provided

that such Medical Expenses are incurred for the same Illness/Injury

for which subsequent Hospitalization was required and Claim under

Section I1A-1 or 1A- 6 is admissible under the Policy.

Where Insured Person has opted for Home Healthcare treatment under

Section I1 A-2, Pre-Hospitalization expenses are payable up to 60 days

prior to start of the Medical treatment.

Insured Person shall bear specied percentage of admissible Claim

amount under each and every Claim If Co-payment under Section

2

I1C-14 is opted and specied in the Schedule of Coverage in the

Policy Schedule

5. Post-Hospitalization cover

We will pay for the Medical Expenses incurred upto180 days from the

date Insured Person is discharged from Hospital provided that such

costs are incurred in respect of the same Illness/Injury for which the

earlier Hospitalization was required and Claim under Section I1A-1 or

1A6 is admissibleunder the Policy

Where Insured Person has opted for Home Healthcare treatment under

Section I1A-2, Post Hospitalization expenses are payable up to 180

days post completion of the medical treatment.

Insured Person shall bear specied percentage of admissible Claim

amount under each and every ClaimIf Co-payment under Section I1

C-14 is opted and specied in the Schedule of Coverage in the Policy

Schedule

6. Day Care Procedures

We will pay for the Medical Expenses under Section I1A-1 on

Hospitalization of Insured Person in Hospital or Day Care

CentreforDay Care Treatment.

Indicative list of Day Care Treatment is attached in Annexure I

Insured Person shall bear specied percentage of admissible Claim

amount under each and every ClaimIf Co-payment under Section I1

C-14 is opted and specied in the Schedule of Coverage in the Policy

Schedule

7. Road Ambulance

We will pay for expenses incurred on Road Ambulance Services if

Insured Person is required;

i. to be transferred to the nearest Hospital following an emergency

(namely a sudden, urgent, unexpected occurrence or event, bodily

alteration or occasion requiring immediate medical attention)

ii. or from one Hospital to another Hospital

iii. of from Hospital to Home (within same City) following Hospitalization

provided that Claim under Section I1 A1 and I1 A6 is admissible under

the Policy.

Insured Person shall bear specied percentage of admissible Claim

amount under each and every ClaimIf Co-payment under Section I1C-14

is opted and specied in the Schedule of Coverage in the Policy Schedule

8. Organ Donor Expenses

We will pay Medical Expenses as listed under Section I1A-1 towards

organ donor’s Hospitalization for harvesting of the donated organ where

an Insured Person is the recipient, provided that;

i. The organ donor is any person whose organ has been made available

in accordance and in compliance with The Transplantation of Human

Organ (amendment) Act, 2011,Transplantation of Human Organs and

Tissues Rules, 2014and other applicable laws and rules.

ii. Hospitalization Claim under Section I1 A-1 is admissible under

the Policy

iii. The Organ Donor’s Pre-Hospitalization and Post-Hospitalization

expenses are excluded under the Policy

iv. Any other Medical Expenses or Hospitalization consequent to the

harvesting is excluded under the Policy

Insured Person shall bear specied percentage of admissible Claim

amount under each and every ClaimIf Co-payment under Section I1

C-14 is opted and specied in the Schedule of Coverage in the Policy

Schedule

9. Alternative Treatments

We will pay Medical Expensesas listed under Section I1 A-1

on Hospitalization of Insured Person for following Alternative

Treatments prescribed by Medical Practitioner

• Ayurvedic

• Unani

• Siddha

• Homeopathy

provided that;

i. The procedure performed on the Insured Person cannot be carried

out on Outpatient basis

ii. The treatment has been undertaken in a government Hospital or in

any institute recognized by government and/or accredited by Quality

Council of India/National Accreditation Board on Health or authorised

medical council of the respective country/state as applicable

iii. In the event of admissible Claim under this Cover, no Claim shall

be admissible under SectionI1 A -1 for Allopathic treatment of same

Illness or Injury

Insured Person shall bear specied percentage of admissible Claim

amount under each and every ClaimIf Co-payment under Section I1

C-14 is opted and specied in the Schedule of Coverage in the Policy

Schedule

Section I 1 B: Renewal Benets

1. Preventive Health Check-Up

After every block ofevery four consecutive, continuous and Claim free

Policy Years with Us, We will pay towards cost of Preventive Health

Check- upto specied percentage (as mentioned on the Schedule of

Coverage) of Sum Insuredfor those Insured Persons who were Insured

under the previous 4 Policy years with Us.

Other terms and Conditions applicable to this Benet

• This benet will not be carried forward if not utilized.

• Eligibility to avail Health Check-up will be in accordance to lower of

expiring Policy Sum Insured or Renewed Policy Sum Insured.

• This cover is applicable only to Insured Person covered under all four

Policy Years and who continue to remain insured in the subsequent

Policy Year/Renewal.

• Availing of Claim under this Cover will not impact the Sum Insured or

the eligibility for Cumulative Bonus

2. Cumulative Bonus

On each Renewal of the Policy with Us, We will apply 5% of Basic

Sum Insured under expiring Policy as Cumulative Bonus in the Policy

provided that;

i. There has been no claim under the Policy in expiring year under

Section I1 A

ii. Cumulative Bonus will be reduced at the same rate as accrued in the

event of admissible Claim under Section I1 A of the Policy.

iii. Cumulative Bonus can be accumulated upto 50% of Basic Sum

Insured.

iv. Cumulative Bonus applied will be applicable only to Insured

Person covered under expiring Policy and who continue to remain

insured on Renewal.

v. In case of multiyear policies, Cumulative Bonus that has accrued

for the second and third Policy Year will be credited on Renewal.

Accrued Cumulative Bonus may be utilized in case of any Claim

during Policy tenure

3. my: Health Active

A. Fitness discount @ Renewal

Insured Person can avail discount on Renewal Premium by accumulating

Healthy Weeks as per table given below.

One Healthy Week can be accumulated by;

• Recording minimum 50,000 steps in a week subject to maximum 15,000

steps per day, tracked through Your wearable device linked to Our my:

health mobile app and Your Policy number

OR

• burning total of 900 calories upto maximum of 300 calories in one

exercise session per day, tracked Your wearable device linked to Our

my: health mobile app and Your Policy number

• Fitness discount @ Renewal is applicable for Adult Insured Persons

only. Any Person covered as Child Dependent, irrespective of the Age

is excluded.

3

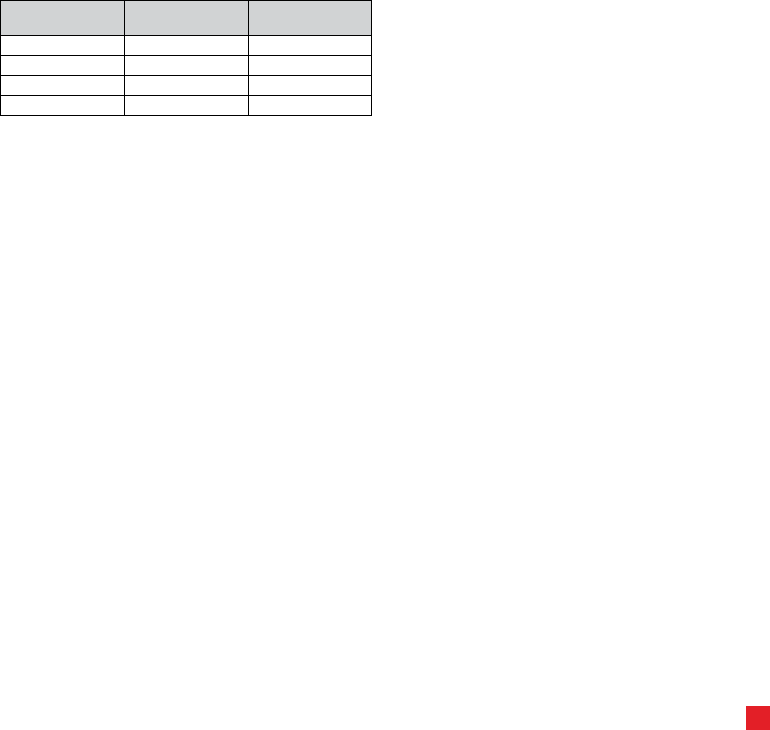

Healthy Weeks Discounts

No. of Healthy Weeks

Accumulated

Discount on Renewal

Premium

1-4 0.50%

5-8 1.00%

9-12 2.00%

13-16 3.00%

17-26 6.00%

27-36 7.50%

Above 36 10.00%

Steps to accumulate Healthy Weeks

Step 1 - The my: Health mobile App must be downloaded on the mobile.

Step 2 - You can start accumulating Healthy Weeks by tracking physical

activity trough the Wearable device linked to Our my: health mobile

app and Your Policy number

We encourage and recognize all types of exercise/tness activities

by making use of wearable devices to track and record the activities

Insured Person engages in.

Application of Fitness discount @ Renewal

• Annual Policy: Discount amount accrued based on Number of

accumulated Healthy Weeks during the expiring PolicyYear will be

applied on the Renewal Premium for expiring Policy Sum Insured and

for Insured Person covered under expiring Policy

• Multi Year Policy:

o Fitness discount earned on yearly basis will be accumulated till

Policy End date.

o On Renewal of the Policy, total discount amount accrued each Policy

Year will be applied on Renewal Premium of subsequent year and for

Insured Person covered under expiring Policy

• For Policiescovering more than one Insured Person,Healthy Weeks

for each Insured Person will be tracked and accrued. Such discount

will be applicable on individual Renewal Premium for both Individual

and Floater Sum Insured basis Policies.

• Premium will be discounted to the extent applicable to coverage

corresponding to expiring Policy.

• In case of Increase in Sum Insured at Renewal, discount amount will be

applied on the premium corresponding to expiring Policy Sum Insured.

• Fitness discount @ Renewal will be applied only on Renewal of Policy

with Us and only if accrued.

B. Health Incentive

This Program encourages Insured Persons to maintain good health and

avail incentives as listed below.

Under this Program, Insured Person having Pre-Existing Diseases

or Obesity (BMI above 30) as listed under table A below, will be eligible

for reduction in Medical Underwriting Loading applied on rst inception

of the Policy with Us provided that;

i. Insured Person shall undergomedical tests and/or BMIcheck-upas

listed belowminimum 3 months prior to expiry of Policy Year (For

Multiyear Policies) or before Renewal (For Annual Policies).

ii. Medical test shall be done at Your own cost through our Network

Provider on Our my: health mobile App.

iii. If the test parameters are within normal limits, We will apply 50%

discount on the Medical Underwriting loading applied for corresponding

Pre-Existing Disease or Obesity as applicable on Renewal of the

Policy with Us.

iv. If the test parameters at subsequent Renewal are not within normal

limits or Medical test reports are not submitted in accordance with

i and ii above, the discount amount applied on Medical Underwriting

loading will be zero

Table A

Pre-existing Diseases Test

Diabetes HbA1c

Hypertension Blood Pressure reading

Hyperlipidemia Total Cholesterol

Cardiovascular Diseases ECG

Hypothyroidism Thyroid function tests

Obesity BMI

Application of Health Incentive

• Annual Policy: Discount amount accrued during the expiring Policy

year will be applied on the Renewal Premium corresponding to

expiring Policy Sum Insuredand for Insured Person covered under

expiring Policy

• Multi Year Policy:

o Discount amount earned on yearly basis will be accumulated till

Policy End date.

• On Renewal of the Policy, total discount amount accrued each year will

be applied on Renewal Premium of subsequent yearand for Insured

Person covered under expiring Policy

• For Policies covering more than one Insure Person, tests shall be done

for each Insured Person basis which such reduction in loading where

ever applicable will be applied on individual Renewal Premium for both

Individual and Floater Sum Insured basis Policies.

• Medical Underwriting loading will be discounted only on Renewal

of Policy with Us and only for Insured Person covered under such

expiring Policy

• Discount on Medical Underwriting loading under this cover is

applicable only on next Renewal and cannot be utilized if Policy not

renewed with us.

C. Wellness services:

The services listed below are available to all Insured Person through

Our Network Provider on Our my: health mobile app only. Availing

of services under this Section will not impact the Sum Insured or the

eligibility for Cumulative Bonus.

i. Health Coach:

An Insured Person will have access to Health Coaching services in

areas such as:

• Disease management

• Activity and tness

• Nutrition

• Weight management.

These services will be available through Our my: health mobile app

as a chat service or as a call back facility.

ii. Wellness services

• Discounts: on OPD, Pharmaceuticals, pharmacy, diagnostic centres.

• Customer Engagement: Monthly newsletters, Diet consultation,

health tips

• Specialized programs: like stress management, Pregnancy Care,

Work life balance management.

These services will be available through Our my: health mobile app

Disclaimer applicable to my: health Mobile app and associated

services

It is agreed and understood that Our my:health mobile app and Wellness

services intention is not to provide specic medical advice but rather

to provide users with information to better understand their health and

their diagnosed disorders. The information is not a substitute for

professional medical care by a qualied doctor or other health care

professional.

4

The information provided is general in nature and is not specic to you.

You must never rely on any information obtained using this app for any

medical diagnosis or recommendation for medical treatment or as an

alternative to medical advice from your physician or other professional

healthcare provider. If you think you may be suffering from any medical

condition you should seek immediate medical attention.

Reliance on any information on this App is solely at your own risk. HDFC

EGRO General Insurance Company Limited do not assume any liability

towards any loss or damage arising out of or in relation to any opinion,

actual or alleged errors, omissions and representations, any decision

made or action taken or not taken in reliance upon the information.

Section I 1 C: Optional Covers

Insuring Clause

In consideration of payment of additional Premium or reduction in the

Premium as applicable, it is hereby declared and agreed that We will

pay/restrict the expenses under below listed Covers subject to all other

terms, conditions, exclusions and waiting periods applicable to the Policy.

These Covers are optional and applicable only if opted for and upto

the Sum Insured or limits mentioned on the Schedule of Coverage in

the Policy Schedule.

1. Preventive Health Check-Up - Booster

On opting this Cover, Insured Person will be entitled for Health Check-up

after each Policy Year with Us irrespective of Claims made under the

Policy in accordance with options given below.

i. We will reimburse the cost of Preventive Health Check-upup to limits

mentioned on the Schedule of Coverage.

Or

ii. Insured Person shall have the option to undergo Health Check-Up

at our Network Service Provider in accordance to criteria given below.

Sum Insured Tests

Upto 2 Lacs Medical Examination Report, Complete Blood

Count Urine R, Fasting Blood Sugar, Serum

Creatinine, Lipid Prole, Electro Cardio Gram

3 Lac and above Chest X Ray , 2D echo/ Stress test, PSA

for Males, PAP smear for Females, Medical

Examination Report, Complete Blood Count

Urine R, Fasting Blood Sugar, Serum

Creatinine, Lipid Prole, Electro Cardio Gram

Other Terms and Conditions applicable to this Cover

• This benet will not be carried forward if not utilized within 60 days of

Policy Anniversary/Renewal date.

• On opting this Cover, Renewal Benet 1, Preventive Health Check-up

under Section I1 B stands deleted.

2. Parent and Child care Cover - Basic

We will pay to the Insured Personsubject to waiting period as mentioned

in the Schedule of Coverage on the Policy Schedule under Covers as

given below.

I. Parent Care

i. Medical Expenses under Section I1 A1 for Maternity Expenses

limited up to 2 deliveries or 1 delivery and 1 termination or 2 terminations

during the lifetime of the Insured Person

ii. OPD Treatment in Pre-natal and Post-natal period provided Claim

under Maternity Expenses is admissible under the Policy.

II. Child Care

We will pay/coverfollowing expenses towards Child Care for New Born

Babyunder this cover if Claim for Maternity Expensesis admissible

under the Policy.

i. We will pay Medical Expenseslisted under Section I1 A1 withinSum

Insured for Parent Caretowards treatment of a New Born Babyas per

limit mentioned on Schedule of Coverage.

ii. New Born Baby Cover–We will cover New Born Baby immediately

after the birth as per original terms of the Policy on receipt of completed

proposal form and Premium received within 90 days of birth of Baby and

subject to acceptance by Us.

If this Cover is opted, General exclusion III b 1. ix) under General

Exclusions, Section III a 1 iv, stands deleted.

Exclusions applicable to this Cover.

i. Pre-Hospitalization and post-Hospitalization expenses are not

payable under this cover

ii. We will not pay any expenses related to ectopic pregnancy under

this cover. Ectopic pregnancy will be covered as a part of expenses

under SectionI 1A1 only.

iii. Treatment for impotency, treatment to effect infertility, surrogate or

vicarious pregnancy, voluntary termination of pregnancy, procedures to

assist birth control, contraceptive supplies.

3. Parent and Child care Cover – Booster

We will pay to the Insured Person subject to waiting period and limits

as mentioned in the Schedule of Coverage on the Policy Schedule under

Covers as given below.

I. Parent Care

i. Maternity Expenses - Medical Expenses for a delivery (including

caesarean section) on Hospitalization or the lawful medical termination

of pregnancy during the Policy Period.

ii. OPD Treatment in Pre-natal and post-natal periodup to the limit of

this cover, provided Claim under i. Maternity Expenses is admissible

under the Policy

iii. Infertility Treatment:Medical Expenseslisted under Section I1 A1

incurred for infertility treatment, assisted reproductive treatments like IVF

undertaken on advice of a Medical Practitioner, up to 50% of Normal

Delivery Sum Insured under this Cover. This cover is applicable for both

Male and Female Insured Person

II. Child Care

We will pay following expenses towards Child Care for New Born

Baby under this cover if Claim for Maternity Expenses is admissible

under the Policy.

i) New Born baby cover:

We will pay Medical Expenses listed under Section I1 A1 towards

treatment of a New Born Baby within the limit of Sum Insured under this

Cover as mentioned in Schedule of Coverage on the Policy Schedule

ii) Vaccination Charges:

We will pay expenses incurred on vaccination for New Born Baby

as per National Immunization Schedule until New Born Baby completes

1 year of age subject to maximum of sub limit of Sum Insured under

this Cover.

If opted, this cover General exclusion Section III b 1 .ix), x), xx) under

General Exclusions, Section III and Optional Cover 2 “Parent and Child

Cover – Basic” under Section I 1C stands deleted.

III. Waiting Period modication Option

On availing this option, Waiting Period listed under Section –III a 1, iv,

will stand modied as mentioned in the Schedule of Coverage on the

Policy Schedule.

All other terms and conditions of the Parent & Child Care Cover - Booster

shall remain unaltered.

Exclusions applicable to this Cover.

i. Pre-Hospitalization and post-Hospitalization expenses are not payable

under this cover

ii. We will not pay any expenses related to ectopic pregnancy under

this cover. Ectopic pregnancy will be covered as a part of expenses

under Section I1 A1 only.

iii. Treatment for impotency, treatment to effect infertility, surrogate or

vicarious pregnancy, voluntary termination of pregnancy, procedures to

assist birth control, contraceptive supplies.

5

4. Air Ambulance Cover

We will pay for Air Ambulance transportation in an airplane or helicopter

for Emergency Care which requires immediate and rapid ambulance

transportation as prescribed by a Medical Practitioner, from the site

of rst occurrence of the Illness/Accident to the nearest Hospital,that

ground transportation cannot provide. Claim would be reimbursed up to

the actual expenses subject to a maximum of Sum Insured as specied

on theSchedule of Coverage in the Policy Schedule.

Exclusion:

We will not pay for return transportation to the Insured Person’s home

by air ambulance

5. Recovery Benet

We will pay Sum Insured as specied on the Schedule of Coverage

in the Policy Schedule upon Medically Necessary Hospitalization of

an Insured Person exceeding 10 consecutive and continuous days

and for which Claim is admissible under Section I1 A– Hospitalization

Cover.

This benet is not applicable ifMedical treatment is taken under Section

I1 A2 – Home Health care and 1A3 – Domiciliary Hospitalization

6. Sum Insured Rebound

We will add to the Sum Insured, an amount equivalent to the admissible

Claim amount, subject to maximum of Basic Sum Insured, on subsequent

Hospitalization of the Insured Person during Policy Year subject to;

i. Total of Basic Sum Inured under Hospitalization Cover, Cumulative/

Extended Cumulative Bonus (if applicable) earnedand Sum Insured

Rebound will be available to all Insured Persons for all claims under

Section I1A during the current Policy Year and subject to the condition

that a single claim in a Policy Year cannot exceed the sum of Basic

Sum Insured and the Cumulative/Extended Cumulative Bonus (if

opted) earned

ii. In case of treatment for Chemotherapy and Dialysis, Sum Insured

Rebound will be applicable only once in lifetime of Policy

i. This cover will be applicable annually for policies with term more

than one year.

ii. Any unutilized amount of Sum Insured Rebound cannot be carried

over to next Policy Year or Renewal Policy

iii. The Sum Insured Rebound can be utilized for Claims under Section

I1 A only.

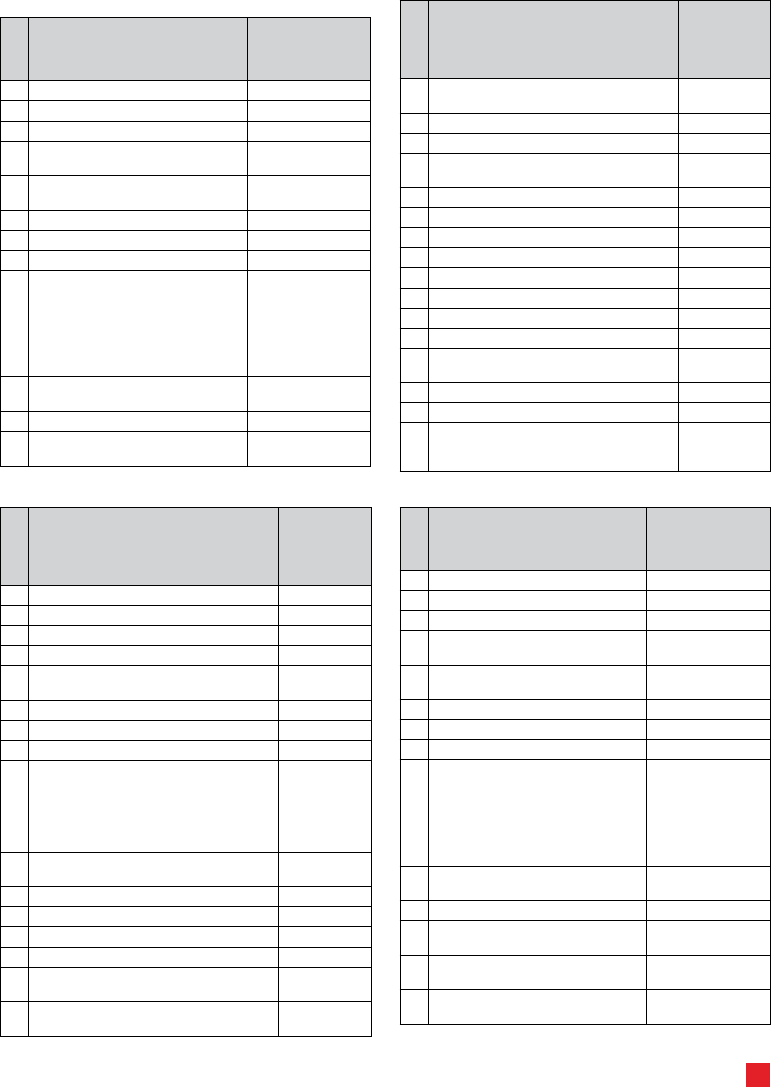

Illustration 1

Time Claim No.

Sum Insured

available

Cumulative Bonus

available

Admissible

Claim amount

SI Rebound

Available

Total SI Rebound

till date

Payable

amount

3 months

1

3,00,000 30,000 2,50,000 0 0 2,50,000

5 months 50,000 30,000 1,40,000 0 0 80,000

9 months 2 0 0 2,50,000 3,00,000 3,00,000 2,50,000

11 months 4 0 0 70,000 50,000 3,00,000 50,000

Illustration 2

Time Claim No.

Sum Insured

available

Cumulative Bonus Admissible

Claim amount

SI Rebound

Total SI Rebound

till date

Payable

amount

3 months 1 3,00,000 30,000 2,50,000 0 0 2,50,000

6 months 2 50,000 30,000 1,40,000 2,50,000 2,50,000 1,40,000

9 months 3 0 0 2,50,000

=250,000-

60,000+50,000

3,00,000 2,40,000

=240,000

11 months 4 0 0 70,000 0 3,00,000 0

7. Outpatient Dental Treatment

After threeconsecutive and continuous Policy Years with Us, We will pay

50% of Medical Expenses incurred by Insured Person towards Dental

Treatment prescribed by Medical Practitioner up to the amount as

mentioned in the Schedule of Coverage on the Policy Schedule. Claim

under this Section can be availed only through our Network Provider.

The Cover is applicable only to Insured Person covered under three

consecutive and continuous Policy Years and who continue to remain

insured in the subsequent Policy Year/Renewal

The Coverage is applicable only towards cost of X-rays, extractions,

amalgam or composite llings, root canal treatments and prescribed

drugs for the same.

Claim under this Section will not affect Cumulative Bonus under

Section I1 B2, condition ii.

Exclusions specic to Outpatient Dental Treatment

i. Cosmetic surgery, dentures, dental prosthesis, dental implants,

orthodontics, orthognathic surgery, jaw alignment or treatment for the

temporomandibular (jaw) joint, or upper and lower jaw bone surgery and

surgery related to the temporomandibular (jaw) unless necessitated by

an acute traumatic injury due to an accident or cancer

8. External Medical Aids

After every twoconsecutive and continuous Policy Year with Us, We

will pay up to 50% of cost incurred towards following Medical Expenses

subject to maximum of Sum Insured as mentioned in the Schedule of

Coverage, on the Policy Schedule;

i. One pair of spectacles or one pair of contact lenses,

ii. A hearing aid

Other terms

• The Cover is applicable only to Insured Person covered under two

consecutive and continuous Policy Years and who continue to remain

insured in the subsequent Policy Year/Renewal

• Under a Family Floater Policy, Our liability shall be limited to either one

pair of spectacles or contact lenses or hearing aid per family.

• Medical Expenses incurred under this Cover shall be prescribed by

our Network Provider and is payable only once after block of every

two consecutive and continuous Policy Year with Us.

• Claim under this Section will not affect Cumulative Bonus under

Section I1 B2, condition ii

9. Major Illness Hospitalization Expenses

We will payfor Medical Expenses incurred and admissible under Section

I1 A1,up to additional Sum Insured equivalent to Basic Sum Insured,on

Medically necessary Hospitalization of Insured Person for Major

illnesseslisted below whose diagnosis rst commence/occursafter the

applicable waiting period from commencement of the rst Policy with

Us, subject to the following;

i. Waiting Period – The coverage is subject to Waiting Period as

mentioned on Schedule of Coverage on the Policy Schedule

ii. Claim for each Major Illnessis payable only once during the lifetime

of Policy with Us. However, Insured Person will continue to be covered

under this Section for other Major Illnesses.

iii. Claim under this Cover is admissible only when total of Basic Sum

Insuredis completely utilized.

6

iv. The additional Sum Insured under this Cover is exclusive and specic

for the treatment of the rst occurrence of the above Critical Illness

undertaken in a Hospital/Nursing Home as an in-patient and will not be

available for other illnesses/hospitalization.

Major Illness Covered

1 Cancer of specied

severity

6 Major Organ/Bone Marrow

Transplant

2 Open Chest CABG 7 Stroke resulting in permanent

symptoms

3 Myocardial Infarction

(First Heart Attack of

specic severity)

8 Surgery of Aorta

4 Kidney Failure requiring

regular dialysis

9 Primary (Idiopathic)

Pulmonary Hypertension

5 Multiple Sclerosis with

Persisting Symptoms

10. Non-Medical Expenses cover

We will pay for Non-Medical Expenses upto the limit mentioned in

Schedule of Coverage in the Policy Schedule on Medically necessary

Hospitalization of Insured Person for claims admissible under Section

I1A1, 2 and 3.

In view of this Cover, Exclusion xxi) of Section III b , shall stand covered

upto the extent mentioned above.

11. Waiting period Modication Option

On availing this option, Waiting Periods listed under Section III a 1 – i,

ii and iii will stand modied as mentioned in Schedule of Coverage on

the Policy Schedule for following Sections;

Section I1 A – Hospitalization Cover

Section I1C4 – Air Ambulance

Section I1C5 – Recovery Benet

Section I1C9 – Major Illness Hospitalization Expenses

Section I1C17 –Hospital Cash

Section I1C18 – Global Health Cover

All other terms and Conditions of the respective Section and Policy

shall remain unaltered.

12. Extended Cumulative Bonus

On availing this cover, Cumulative Bonus percentage mentioned under

Section I1 B2 – Cumulative Bonus will stand modied as mentioned in

Schedule of Coverage on the Policy Schedule subject to;

i. Once the Extended Cumulative Bonus benet is availed by the

Insured Person, it cannot be opted out at subsequent Renewal.

ii. All other terms and Conditions of Renewal Benets Section I1 B, ii

shall remain unaltered.

13. Room Rent Modication Option

On availing this option, limits specied under Section I1 A1 i and I1A ii

will stand modied as below.

i. Room Rent, boarding and Nursing – limit of 1% of the Basic Sum

Insured subject to maximum of Rs. 5,000 per day

ii. Intensive care unit – limit of 2% of the Basic Sum Insured subject

to maximum of Rs. 10,000 per day

Proportionate deduction:

In case expenses incurred on i and ii above exceed respective applicable

limits under the Policy, expenses incurred under Section I1 A1, iii and

iv , shall be paid in the same proportion as the admissible rate per day

bears to the actual rate per day of Room Rent charges

14. Co-Payment

On availing this option, Co-Payment as mentioned on the Schedule

of Coverage in the Policy Schedule will be applied on each and every

admissible claim after Deductible/Excess wherever applicable under the

Policy. Once the Co-Payment option is availed by the Insured Person,

it cannot be opted out of at subsequent Renewal.

15. Major Illness – Benet

If the eldest Insured Person covered under the Policy suffers from Major

Illness as listed below, whose diagnosis rst commence/occurs after the

applicable Waiting Period from commencement of rst Policy with Us,

We will pay Sum Insured as mentioned on the Schedule of Coverage.

The Coverage under this benet shall cease to exist upon occurrence

of any one Major Illness covered for which Claim is admitted by the

Company.

Major Illness Covered

1 Cancer of specied severity 7 Permanent Paralysis of

Limbs

2 Open Chest CABG 8 Stroke resulting in

Permanent Symptoms

3 Myocardial Infarction(First

Heart Attack of specic

severity)

9 Surgery of Aorta

4 Kidney Failure requiring

regular dialysis

10 Primary (Idiopathic)

Pulmonary Hypertension

5 Major Organ/Bone Marrow

Transplant

11 Open Heart Replacement

or Repair of Heart Valves

6 Multiple Sclerosis with

Persisting Symptoms

Survival Period

Claim under this Cover is payable only if Insured Person survives 30

days from the diagnosis, fulllment of the denition of the Major illness

covered and with conrmatory diagnosis of the conditions covered

while the Insured Person is alive (A claim would not be admitted if the

diagnosis is made post mortem)

16. E-Opinion

We will pay expenses incurred towards second Medical Opinion availed

from Medical Practitionerin respect of Major Illness covered and listed

below under the Policy through our Network Provider.

The Coverage under this benet shall cease to exist upon availing

Second Opinion for any one Major Illness as listed below.

Major Illness Covered

1 Cancer of specied

severity

7 Permanent Paralysis of Limbs

2 Open Chest CABG 8 Stroke resulting in Permanent

Symptoms

3 Myocardial Infarction(First

Heart Attack of specic

severity)

9 Surgery of Aorta

4 Kidney Failure requiring

regular dialysis

10 Primary (Idiopathic)

Pulmonary Hypertension

5 Major Organ/Bone

Marrow Transplant

11 Open Heart Replacement or

Repair of Heart Valves

6 Multiple Sclerosis with

Persisting Symptoms

Disclaimer - E- Opinion Services are being offered by Network

providers through its portal/mail/App or what so ever electronic form

to Policyholders/Insured of HDFC ERGO GENERAL INSURANCE

COMPANY LIMITED. In no event shall HDFC ERGO be liable for any

direct, indirect, punitive, incidental, special consequential damages or

any other damages whatsoever caused to the Policyholders/Insured

of HDFC ERGO while receiving the services from Network providers.

17. Hospital Cash

We will pay per day Sum Insured up to maximum Number of days

and in manner as specied in Schedule of Coverage on the Policy

Schedule,for each continuous and completed period of 24 hours of

Medically Necessary Hospitalization of an eldest Insured Personin

the Policyand for which Claim is admissible under SectionI1 A –

Hospitalization Cover.

7

18. Global Health Cover

On availing this Cover,We will paythe Expenses incurred outside India

under Sections and Covers given below.

Section I1A: Hospitalization Cover

A1 Medical Expenses A7 Road Ambulance

A4 Pre-Hospitalization cover A8 Organ Donor Expenses

A5 Post-Hospitalization cover A9 Alternative Treatments

A6 Day Care Procedures

Section I1C: Optional Covers

C1 Preventive Health Check-Up

- Booster

C10 Non-Medical Expenses

cover

C2 Parent and Child care Cover

- Basic

C3 Parent and Child care Cover

– Booster

C15 Major Illness – Benet

C4 Air Ambulance Cover C16 E-Opinion

C5 Recovery Benet C17 Hospital Cash

C6 Sum Insured Rebound

C7 Outpatient Dental Treatment

C8 External Medical Aids

C9 Major Illness Hospitalization

Expenses

Global Cover is applicable subject to following terms and conditions

i. Global coverage for expenses towards all the listed covers is applicable

and effective only if mentioned on the Schedule of Coverage in the

Policy Schedule.

ii. A Deductible of USD 100 will apply for expenses under all the

respective covers separately for each and every claim.

iii. Claims on Reimbursement basis will be payable in INR only.

iv. All other terms and conditions of the respective Section and Covers

under the policy shall remain unaltered.

SECTION 2: MY:HEALTH CRITICAL SURAKSHA PLUS

Section I.2.A. Base Covers

I. Critical Illnesses Cover

1. Cancer Cover

If Insured Person suffers from Critical illnessor undergoesSurgical

Procedure as listed below, whose diagnosis rst commence/occurs

after the applicable Waiting Period from commencement of rst Policy

with Us, We will pay Sum Insured or percentage of Sum Insured in

accordance with table below:

Critical illness /

Surgical Procedure

Stage

Percentage of

Sum Insured

Payable

Waiting

Period

Applicable

1 Malignant Cancer of

specied Sites

Major

100% of Sum

Insured

90 days

Specied Sites-

Female

Breast

Cervix

Uterus

Fallopian Tube

Ovary

Vagina/Vulva

Critical illness /

Surgical Procedure

Stage

Percentage of

Sum Insured

Payable

Waiting

Period

Applicable

Specied Sites- Male

Major

100% of Sum

Insured

90 days

Head and Neck

Lung

Stomach

Colorectum

Prostate

2 Cancer of specied

severity

Major 100% of Sum

Insured

90 days

3 Aplastic Anemia Major 100% of Sum

Insured

90 days

4 Major Organ

Transplant – Bone

Marrow

Major 100% of Sum

Insured

90 days

5 Early Stage Cancer Minor 25% of Sum

Insured

subject to

maximum of

Rs. 1,000,000

180 days

6 Carcinoma in situ Minor

2. Heart Cover

If Insured Person suffers fromCritical illnessor undergoesSurgical

Procedure as listed below, whose diagnosis rst commence/occurs

after the applicable Waiting Period from commencement of rst Policy

with Us, We will pay Sum Insured or percentage of Sum Insured in

accordance with table below:

Critical Ailments/

Procedures

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

1 Open Chest CABG Major

100%

of Sum

Insured

90 days

2 Myocardial Infarction

(First Heart Attack of

specied severity)

Major

3 Open Heart Replacement

or Repair of Heart Valves

Major

4 Major Organ Transplant

– Heart

Major

5 Surgery of Aorta Major

6 Primary (Idiopathic)

Pulmonary Hypertension

Major

7 Other serious coronary

artery disease

Major

8 Dissecting Aortic

Aneurysm

Major

9 Cardiomyopathy Major

10 Eisenmenger’s

Syndrome

Major

11 Infective Endocarditis Major

12 Angioplasty Minor 25%

subject to

maximum

payout

of INR

1,000,000

180 days

13 Balloon Valvotomy or

Valvuloplasty

Minor

14 Insertion of Pacemaker Minor

3. Nervous System Cover

If Insured Personsuffers from Critical illnessor undergoes Surgical

Procedure listed belowafter the applicable Waiting Period from

8

commencement of rst Policy with Us, We will pay Sum Insuredin

accordance with table below:

Critical illness /

Surgical Procedure

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

1 Multiple Sclerosis with

persisting symptoms

Major

100%

of Sum

Insured

90 days

2 Permanent Paralysis

of Limbs

Major

3 Stroke resulting in

permanent symptoms

Major

4 Benign Brain Tumour Major

5 Coma of specied

severity

Major

6 Parkinson’s Disease Major

7 Alzheimer’s Disease Major

8 Motor Neurone Disease

with permanent

symptoms

Major

9 Muscular Dystrophy Major

10 Apallic Syndrome Major

11 Bacterial Meningitis Major

12 Creutzfeldt-Jakob

Disease (CJD)

Major

13 Encephalitis Major

14 Major Head Trauma Major

15 Progressive

Supranuclear Palsy

Major

16 Brain Surgery Major

17 Loss of Speech Major

4. Other Major Organ Cover

If Insured Personsuffers from Critical illnessor undergoesSurgical

Procedure listed below after the applicable Waiting Period from

commencement of rstPolicy with Us, We will pay percentage of Sum

Insured in accordance with table below:

Critical illness /Surgical

Procedure

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

1 Kidney failure requiring

regular dialysis

Major

100%

of Sum

Insured

90 days

2 Major Organ Transplant

– Kidney, Lung, Liver and

Pancreas

Major

3 End Stage Liver Failure Major

4 Medullary Cystic Disease Major

5 Systemic Lupus

Erythematous with Lupus

Nephritis

Major

6 End Stage Lung Failure Major

7 Fulminant Hepatitis Major

8 Chronic Adrenal

Insufciency (Addison’s

Disease)

Major

9 Progressive Scleroderma Major

10 Chronic Relapsing

Pancreatitis

Major

Critical illness /Surgical

Procedure

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

11 Elephantiasis Major

100% days

of sum

insured

90 days

12 HIV due to blood

transfusion and

occupationally acquired

HIV

Major

13 Terminal Illness Major

14 Myelobrosis Major

15 Pheochromocytoma Major

16 Crohn’s Disease Major

17 Severe Rheumatoid

Arthritis

Major

18 Severe Ulcerative Colitis Major

19 Deafness Major

20 Blindness Major

21 Third Degree Burns Major

22 Severe Osteoporosis Minor 25%

subject to

maximum

payout

of INR

1,000,000

180 days

Covers and General Conditions applicable to Section I2AI, 1 to 4

1. Reduced Premium Benet

If Insured Person is diagnosed with any covered Minor condition

covered under this section and for which Claim is admissible under the

Policy, We will waive 50% of the applicable Annual RenewalPremium

on subsequent Renewal of Policy with Us subject to:

i. Premium will be waived for the Renewal of Insured Personfor whom

the claim has been made, to the extent applicable to Coverage, terms

and conditions corresponding to expiring yearPolicy.

ii. Premium will be waived for subsequent Renewal of 5 PolicyYearsonly.

2. Survival Period

Claim under Section I2AI, 1 to 4is payable only if Insured Person

survives 7 days from the diagnosis and fulllment of the denition of

theCriticalIllness or Surgical Procedurecovered.

The Claim is admissible only with conrmatory diagnosis of the conditions

covered while the Insured Person is alive (A claim would not be admitted

if the diagnosis is made post mortem)

3. Number of Claims and Benets payable

Only one claim is payable under each of the stages given below during

lifetime of the Policy under this Sectionsubject to maximum 100% of

Sum Insured mentioned on the Policy Schedule irrespective of Number

of Sections opted and Number of Policies held by the Insured Person.

Minor Stage - On the admissibility of Claim under Minor Stage condition

under the Policy, coverage for all other Minor stage Conditions shall

cease to exist. The Policy shall continue to Cover Major Stage condition

for the Balance Sum Insured.

Major Stage – On the admissibility of Claim under Major Stage condition,

coverage under this Policy shall cease to exist.

In the event where an Insured Person holds multiple Policies insuring

different Covers under this Section of this product, Claim will be

admissible under one Cover only and Total Sum Insured as applicable

under such Cover across all policies of this product will be paid by the

Company. Insurance for other Covers, if applicable, shall cease to exist.

II. Multipay Critical Illnesses Cover

1. Cancer Cover

If Insured Person suffers fromCritical illnessor undergoesSurgical

9

Procedure as listed below, whose diagnosis rst commence/occurs

after the applicable Waiting Period from commencement of rst Policy

with Us, We will pay Sum Insured or percentage of Sum Insured in

accordance with table below:

Sr.

No.

Critical illness /

Surgical Procedure

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

1 Cancer of Specied

Severity

Major

100%

of Sum

Insured

90 days2 Aplastic Anemia Major

3 Major Organ Transplant

– Bone Marrow

Major

2. Heart Cover

If Insured Person suffers fromCritical illnessor undergoes Surgical

Procedure as listed below, whose diagnosis rst commence/occurs

after the applicable Waiting Period from commencement of rst Policy

with Us, We will pay Sum Insured or percentage of Sum Insured in

accordance with table below:

A

CriticalAilments /

Surgical Procedures

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

1 Open Chest CABG Major

100% of Sum

Insured

90 days

2 Myocardial Infarction

(First Heart Attack of

specied severity)

Major

3 Open Heart

Replacement or Repair

of Heart Valves

Major

4 Major Organ Transplant

– Heart

Major

5 Surgery of Aorta Major

6 Primary (Idiopathic)

Pulmonary

Hypertension

Major

7 Other serious coronary

artery disease

Major

8 Dissecting Aortic

Aneurysm

Major

9 Cardiomyopathy Major

10 Eisenmenger’s

Syndrome

Major

11 Infective Endocarditis Major

B* Angioplasty Minor 25% subject

to maximum

payout of

INR1,000,000

180 days

*B - Angioplasty

We will pay 25% of Sum Insured subject to maximum of INR 10,00,000

if Insured Person undergoes Angioplasty,whose diagnosis and/or

manifestation rst commence/occurs more than 180 days after the

commencement of rst Policy with Us.

On the admissibility of Claim under Angioplasty, coverage for Angioplasty

shall cease to exist. The Policy shall continue to cover other Critical

illnessor Surgical Procedureunder this cover, for Balance Sum

Insuredin accordance with table above.

3. Nervous System Cover

If Insured Personsuffers from Critical illnessor undergoes Surgical

Procedure listed below after the applicable Waiting Period from

commencement of rst Policy with Us, We will pay percentage of Sum

Insured in accordance with table below:

Critical illness /Surgical

Procedure

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

1 Multiple Sclerosis with

persisting symptoms

Major

100%

of Sum

Insured

90 days

2 Permanent Paralysis of

Limbs

Major

3 Stroke resulting in

permanent symptoms

Major

4 Benign Brain Tumour Major

5 Coma of specied

severity

Major

6 Parkinson’s Disease Major

7 Alzheimer’s Disease Major

8 Motor Neurone Disease

with permanent

symptoms

Major

9 Muscular Dystrophy Major

10 Apallic Syndrome Major

11 Bacterial Meningitis Major

12 Creutzfeldt-Jakob

Disease (CJD)

Major

13 Encephalitis Major

14 Major Head Trauma Major

15 Progressive Supranuclear

Palsy

Major

16 Brain Surgery Major

17 Loss of Speech Major

4. Other Major Organ Cover

If Insured Personsuffers from Critical illnessor undergoes Surgical

Procedure listed below after the applicable Waiting Period from

commencement of rst Policy with Us, We will pay percentage of Sum

Insured in accordance with table below:

Critical illness /Surgical

Procedure

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

1 Kidney failure requiring

regular dialysis

Major

100%

of Sum

Insured

90 days

2 Major Organ Transplant

– Kidney, Lung, Liver and

Pancreas

Major

3 End Stage Liver Failure Major

4 Medullary Cystic Disease Major

5 Systemic Lupus

Erythematous with Lupus

Nephritis

Major

6 End Stage Lung Failure Major

7 Fulminant Hepatitis Major

8 Chronic Adrenal

Insufciency (Addison’s

Disease)

Major

9 Progressive Scleroderma Major

10 Chronic Relapsing

Pancreatitis

Major

11 Elephantiasis Major

10

Critical illness /Surgical

Procedure

Stage

Percentage

of Sum

Insured

Payable

Waiting

Period

Applicable

12 HIV due to blood

transfusion and

occupationally acquired

HIV

Major

100%

of Sum

Insured

90 days

13 Terminal Illness Major

14 Myelobrosis Major

15 Pheochromocytoma Major

16 Crohn’s Disease Major

17 Severe Rheumatoid

Arthritis

Major

18 Severe Ulcerative Colitis Major

19 Deafness Major

20 Blindness Major

21 Third Degree Burns Major

Covers and General Conditions applicable to Section I2 AII, 1 to 4

1. Reduced Premium Benet

If Insured Person is diagnosed with any coveredCriticalIllness

under any Cover from Section I 2AII, 1 to 4 and for which Claim is

admissible under the Policy, We will waive 50% of the applicable

Annual RenewalPremium on subsequent Renewal of Policysubject to:

i. Premium will be waived for the renewal of Insured person for whom

the claim has been made, to the extent applicable to Coverage, terms

and conditions corresponding to expiring Policy.

ii. Premium will be waived for subsequent Renewal of 5 Policy Years,

following every admissible claim under each Cover.

2. Survival Period

Each Claim under Section I2AII, 1 to 4 is payable only if Insured Person

survives 7 days from the diagnosis and fulllment of the denition of

theCritical Illness or Surgical Procedure covered.

The Claim is admissible only with conrmatory diagnosis of the conditions

covered while the Insured Person is alive (A claim would not be admitted

if the diagnosis is made post mortem)

3. Number of Claims and Waiting Period

Coverage under this Section shall cease to exist; once a Claim has

been admitted under each of the Covers as opted by the Insured Person

and maximum 100% of the Sum Insured is paid by the Company under

such Covers subject to 12 months waiting period between Claims under

any two Covers.

In the event where an Insured Person holds multiple Policies under

this Section of this product, Total Sum Insured under this section

across all policies of this product will be paid by the Company for each

admissible claimsubject to 12 months waiting period between Claims

under any two Covers.

For Example: If an Insured Person suffers a Stroke resulting in

permanent symptoms and at any time within 12 months also suffers

from Myocardial Infraction (First Heart Attack of specied severity)

thereby triggering claims under both Nervous System Cover and Cardiac

Cover, the Company will pay maximum 100% of Sum Insured under one

Cover only. However, if the two incidences were separated by more than

12 months’ time period, theCompany will pay maximum 100% of Sum

Insured under each Cover.

Section B. my: health Active

1. Fitness discount @ Renewal

Insured Person can avail discount on Renewal Premium by

accumulating Healthy Weeks as per table given below.

One Healthy Week can be accumulated by;

• Recording minimum 50,000 steps in a week subject to maximum 15,000

steps per day, tracked through Your wearable device linked to Ourmy:

health mobile app andYourPolicy number

OR

• burning total of 900 calories up to maximum of 300 calories in one

exercise session per day, tracked Your wearable device linked to Ourmy:

health mobile appendYourPolicy number

Healthy Weeks Discounts

No. of Healthy Weeks

Accumulated

Discount on Renewal

Premium

1-4 0.50%

5-8 1.00%

9-12 2.00%

13-16 3.00%

17-26 6.00%

27-36 7.50%

Above 36 10.00%

Steps to accumulate Healthy Weeks

Step 1 - The my: Health App must be downloaded on the mobile.

Step 2 - You can start accumulating Healthy Weeks by tracking physical

activity trough the Wearable device linkedtomy: Health App

We encourage and recognize all types of exercise/tness activities

by making use of wearable devices to track and record the activities

Insured Person engages in.

Application of Fitness discount @ Renewal

• Annual Policy: Discount amount accrued based on Number of

accumulated Healthy Weeks during the expiring Policy year will be

applied on the Renewal Premium for expiring Policy Sum Insured.

· Multi Year Policy:

o Fitness discount earned on yearly basis will be accumulated till

Policy End date.

o On Renewal of the Policy, total discount amount accrued each year

will be applied on Renewal Premium of subsequent year.

• For Policiescovering more than one Insured Person, Healthy Weeks

for each Insured Person will be tracked andaccumulated. Such

discount will be applicable on individual RenewalPremium.Premium

will be discounted to the extent applicable to coverage corresponding

to expiring Policy.

• In case of Increase in Sum Insured at Renewal, discountpercentage

will be applied on the Sum Insured applicable under expiring Policy.

• Fitness discount @ Renewal will be applied only on Renewal of

Policy with Us.

2. Health Incentive

This Program encourages Insured Person to maintain good health and

avail incentives as listed below.

Under this Program, Insured Person having Pre-Existing Diseases

orObesity (BMI above 30)as listed under table A below, will be eligible

for reduction in Medical Underwriting Loading applied at rst inception

of the Policy with Us provided that;

i. Insured Person shall undergo medical tests and/or BMI check-up

below minimum 3 months prior to expiry of Policy Year (For Multiyear

Policies) or before Renewal (For Annual Policies).

ii. Medical test shall be done at Your own cost through our Network

Providerthrough Our my: health mobile app App.

iii. If the test parameters are within normal limits, We will apply 50%

discount on the Medical Underwriting loading applied for corresponding

Obesityas applicableon Renewal of the Policy with Us.

iv. If the test parameters at subsequent renewal is not within normal

limits or Medical test reports are not submitted in accordance with i

and ii above, the discount amount applied on Medical Underwriting

loading will be zero.

11

Table A

Pre-existing Diseases Test

Diabetes HbA1c

Hypertension Blood Pressure reading

Hyperlipidemia Total Cholesterol

Hypothyroidism Thyroid function tests

Obesity BMI

Application of Health Incentive

• Annual Policy: Discount amount accrued during the expiring Policy

year will be applied on the Renewal Premium for expiring Policy Sum

Insured.

• Multi Year Policy:

o Discount amount earned on yearly basis will be accumulated till

Policy End date.

o On Renewal of the Policy, total discount amount accrued each year

will be applied on Renewal Premium of subsequent renewal.

• For Policiescovering more than one Insure Person,tests shall be done

for each Insured Person basis which such reduction in loading will be

applicable on individual Renewal Premium.

• Medical Underwriting loading will be discounted only on Renewal of

Policy with Us

• Discount on Medical Underwriting loading under this cover is applicable

only on next Renewal and cannot be utilized if Policyis not renewed

with Us.

3. Wellness services:

The services listed below are available to all Insured Person through

Our Network Provider on Ourmy: health mobile apponly.

i. Health Coach:

An Insured Person will have access to Health Coaching services in

areas such as:

• Disease management

• Activity and tness

• Nutrition

• Weight management.

These services will be available through Our my: health mobile app

as a chat service or as a call back facility.

ii. Wellness services

• Discounts: on OPD, Pharmaceuticals, pharmacy, diagnostic centers.

• Customer Engagement: Monthly newsletters, Diet consultation,

health tips

• Specialized programs: like stress management, Pregnancy Care,

Work life balance management

These services will be available through Our my: health mobile app

Disclaimer applicable to my: health Mobile app and associated

services

It is agreed and understood that Our my:health mobile app and Wellness

services are not providing and shall not be deemed to be providing any

Medical Advice, they shall only provide a suggestion for the Insured

Person’s consideration and it is the Insured Person’s sole and absolute

choice to follow the suggestion for any health related advice. We do

not assume any liability towards any loss or damage arising out of

or in relation to any opinion, actual or alleged errors, omissions and

representations suggested under this benet.

Section C. Renewal Benet

1. Preventive Health Check Up

Insured Person will be entitled for Preventive Health Check-up

onRenewal of the Policy with Us, at our Network Diagnostic centers

or hospitals in accordance to r list of tests, eligibility criteria and waiting

period as specied below:

Health Checkup- on each Policy Renewal

Age / Expiring

Policy Sum

Insured

1 Lac to

10Lacs

11 Lacs to

50 Lacs

Above

50 Lacs

18 to 40 Years Set 1 Set 1, Thyroid,

USG abdomen

and pelvis

Set 1, Thyroid , USG

abdomen and pelvis,

Lipid Prole, Renal

Prole

41 Yrs and

Above

Set 1,

Sr Creat

Set 1,SrCreat,

Thyroid, USG

abdomen and

pelvis

Set 1, Thyroid, USG

abdomen and pelvis,

Lipid Prole,Renal

prole, ECG

Set 1 -Comprises of, Complete Blood Count, Urine R,FBS,Sr Cholesterol

Health Checkup – Additional Tests

Age Gender Type of Test Waiting Period

Sum

Insured

Below

40 years

Female PAP Smear &

Mammography

Once in two

years

All Sum

Insured

Male PSA

Above

40 years

Female PAP Smear &

Mammography

Once in four

years

All Sum

Insured

Male PSA

Other terms and Conditions applicable to this Benet

• This benet will not be carried forward if not utilized within 60 days of

RenewalPolicy Inception date.

• Eligibility to avail Health Check-up will be in accordance to expiring

Policy Sum Insured.

• The test reports received under this benet shall not be utilized for

re-underwriting the Policy

Procedure for availing this benet

i. Insured personwill be intimated to undergo the health check-up at

our Network Provider, through Our my: health App.

ii. Test reports from our Network Provider will be made available to

You on Our my: health App

iii. You havethe option to avail this benet at our Network Provider

through Phone/Email or other modes of communication available

time to time.

Section D. Optional Covers

Insuring Clause

In consideration of payment of additional Premium by You, We will

provide insurance to the Insured Person(s)under below listed Covers,

up toSum Insuredor limits mentioned on the Schedule of Coverage

in the Policy Schedule.These Covers are optional and applicable

only if opted for.

1. Pre Diagnosis Cover

If a Claim is admissible under Section I2A I or I2A II as opted, We will pay

the expenses incurred towards diagnostic tests/ procedures incurred up

to 30 days priorto the diagnosis of such Critical Illness or Undergoing

of such Surgical Procedure.

Indicative list of Procedures covered

Sr.

No.

List of Diagnostic tests/ Procedures

1 Renal/Cardiac Angiogram.

2 Intravenous Pyelogram.

3 Ultrasonagraphy.

4 Ultrasound Guided FNAC.

5 Colour Doppler.

6 Mammography.

12

Sr.

No.

List of Diagnostic tests/ Procedures

7 CT Scan.

8 MRI Scan.

9 Treadmill Test ECHO.

10 Cardiogram.

11 Electrophysiology.

12 Endoscopic Procedures.

13 Special Radiological Procedures such as barium meal

investigations

14 Arthrogram, ERCP, Intravenous Urogram, Cystourethrogram,

15 Nephrostogram.

16 Special Blood Investigations such as Assay of Various Blood

Factors.

17 Virology Markers, Complete Coagulation Work up

2. Post Diagnosis Support

a. Second Medical Opinion

We will pay expenses incurred towards second Medical Opinion availed

from Medical Practitionerin respect of Critical Illness/Surgical

Procedurefor which Claim is admissible under the Policy.

b. Molecular Gene Expression Proling Test

We will pay the expenses incurred towards the expenses for Molecular

Gene Expression Proling Test for Treatment Guidance on diagnosis

of any Major stage Cancer for which Claim is admissible under Section

I2A I.1or I2A II.1, Cancer Cover as opted. The benet under this cover

can be availed only once during lifetime of the Policy.

c. Post Diagnosis Assistance

We will paySum Insuredtowardsoutpatient counseling required upon

diagnosis ofCritical Illnessesand Surgical Proceduresfor which Claim

is admissible under Section I2 A I or I2A II as opted. The Cover is subject

to maximum number of sessions as specied on Schedule of Coverage.

Applicability of Cover (Applicable to a. and c.)

Section I 2A I – if Base Coverage is opted under Section I2A I, the

Claim under this cover is admissible only once in life time of the Policy

Section I 2 A II – if Base Coverage is opted under Section I2A II, the

Claim under this cover is admissible after every admissible Claim

under the Policy

3. Loss of Job

We will pay Sum Insured if Insured Person suffers from Loss of Job

due to his/her Voluntary Resignation or Termination from the employment

within six months of diagnosis of any of the Major stage Critical Illnesses

or undergoing any of the Major stage Surgical Proceduresfor which

Claim is admissible under Section I2A I or I2A II of the Policy.

SECTION 3: MY:HEALTH MEDISURE SUPER TOP UP

INSURANCE

If during the PolicyPeriod, You suffer from any illness or accident which

requires Hospitalization as an inpatient, We will reimburse the amount

of such Medical Expenses as per the benets given below, in excess of

Aggregate Deductible and subject to a maximum of the Sum Insured

as stated in the Schedule.

1. In-patient Hospitalization Expenses:

If any Insured Person suffers an Illness or Accident during the Policy

Period requiring Inpatient Hospitalization, We will pay the Medical

Expenses incurred for

1.1 Room Rent/ Boarding & Nursing;

1.2 ICU Rent/Boarding & Nursing;

1.3 Fees of Surgeon, Anesthetist, Nurses and Specialists;

1.4 Cost of Operation Theatre, diagnostic tests, medicines, blood, oxygen

and cost of prosthetic and other devices or equipment if implanted

internally like pacemaker during a surgical procedure.

Occurrence of same illness after a lapse of 45 days will be considered

as fresh illness for the purpose of this Policy

2. Pre-Hospitalization Medical Expenses –

The Medical Expenses incurred in the 30 days immediately before You

were Hospitalized, provided that:

i. Such Medical Expenses were in fact incurred for the same condition

requiring subsequent Hospitalization, and;

ii. We have accepted the Claim under Scope of Cover 1 “In-patient

Hospitalization expenses”.

3. Post Hospitalization Medical Expenses –

The Medical Expenses incurred in the 60 days immediately after You

were discharged, provided that:

i. Such Medical Expenses were in fact incurred for the same condition

for which Your Hospitalization was required, and;

ii. We have accepted the Claim under Scope of Cover 1, “In-patient

Hospitalization expenses”.

3. Post Hospitalization Medical Expenses –

The Medical Expenses incurred in the 60 days immediately after You

were discharged, provided that:

i. Such Medical Expenses were in fact incurred for the same condition

for which Your Hospitalization was required, and;

ii. We have accepted the Claim under Scope of Cover 1, “In-patient

Hospitalization expenses”.

4. Day Care treatment –

The Medical Expenses for a day care treatment where the procedure

or surgery

- is undertaken is under General or Local Anaesthesia in a Hospital/

Day care centre for less than 24 hours because of technological

advancement, and

- which would have otherwise required hospitalization of more than

24 hours

- does not cover any treatment in an outpatient department or diagnostic

procedures.

Please refer annexure 1 at the end of this document for indicative list

of covered Day Care treatments

SECTION 4: MY:HEALTH HOSPITAL CASH BENEFIT

ADD ON

Section I. 4. A: Coverage

1. Hospital Cash Benet

We will pay Sum Insured on Medically NecessaryHospitalization

of an Insured Persondue to Illnessor Injurysustained or contracted

during the Policy Period. The payment is subject to per day benet Sum

Insuredas specied on the Schedule of Coverage in the Policy Schedule

for up to maximum of 30 days.

2. Companion Benet:

We will pay additional amount upto the limit specied on the Schedule of

Coverage in the Policy Schedule towards expenses of an accompanying

person during Hospitalizationfor up to maximum of 30 days.

Section I. 4 B: Optional Cover

Insuring Clause

In consideration of payment of additional Premium, it is hereby declared

and agreed that We will pay under below listed Cover subject to all other

terms, conditions, exclusions and waiting periods applicable to the add

on and Policy on which this add on is attached.

The Cover is optional and applicable only if opted for and up to the

Sum Insured or limits mentioned on the Schedule of Coverage in the

Policy Schedule.

13

1. Hospital Cash benet - Global

On availing this option, Wewill pay Sum Insured on Medically

NecessaryHospitalization of an Insured Personoutside India due

to Illnessor Injurysustained or contracted during the Policy Period.

2. Waiting period Modication Option

On availing this option, Waiting Periods listed under Section III

a 1: Waiting Periods will stand modied as mentioned in Schedule of

Coverage on the Policy Schedule.

All other terms and Conditions of the respective Section and Policy

shall remain unaltered.

Section C: Renewal Benets

A. Fitness discount @ Renewal

Insured Person can avail discount on Renewal Premium by accumulating

Healthy Weeks as per table given below.

One Healthy Week can be accumulated by;

• Recording minimum 50,000 steps in a week subject to maximum 15,000

steps per day, tracked through Your wearable device linked to Ourmy:

health mobile appandYourPolicy number

OR

• burning total of 900 calories upto maximum of 300 calories in one

exercise session per day, tracked Your wearable device linked to Ourmy:

health mobile appandYourPolicy number

• Fitness discount @ Renewal is applicable for Adult Insured Persons

only. Any Person covered as Child Dependent, irrespective of the Age

is excluded

Healthy Weeks Discounts

No. of Healthy Weeks

Accumulated

Discount on Renewal

Premium

01-04 0.50%