Age of Insured

RISK INFORMATION

Occupation : (For Individual Customers Only)

Chartered Accountant Defense & Paramilitary Services

Central / State Govt. Employee Govt. recognized Medical Professionals

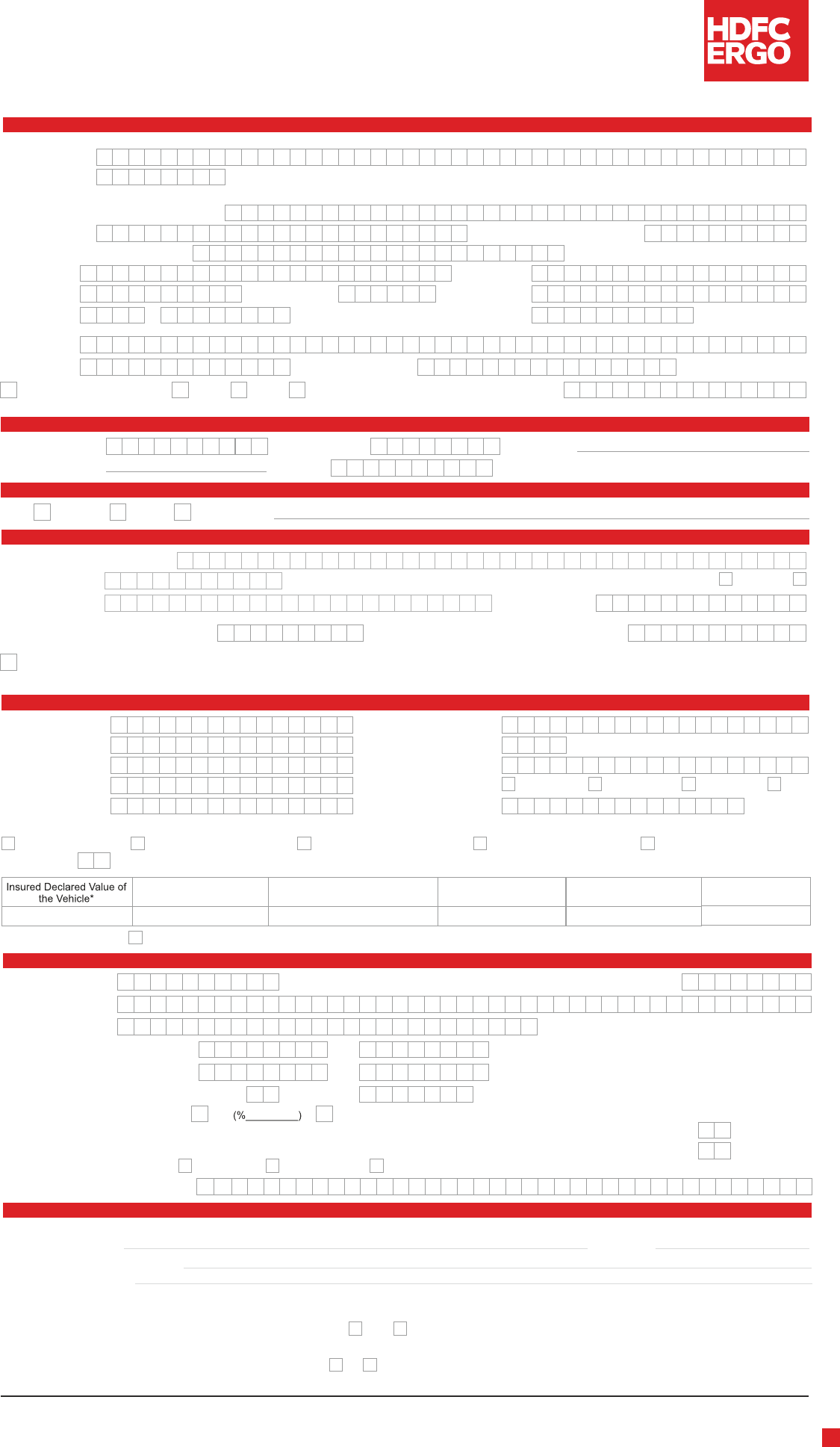

HDFC ERGO General Insurance Company Limited

MOTOR INSURANCE - PRIVATE CAR PACKAGE POLICY - PROPOSAL FORM

(Please fill in CAPITALS only)

CUSTOMER INFORMATION

SOURCES OF FUND

For Individual Customers only

For Corporate Customers only

Name of the Insured (Full Registered Name)*

Contact Person

Corr. Add : Building Name / Block No.*

Street Name* Locality*

City*

Salary

Business

Other

(Please Specify)

Pin Code* State*

Tel.* Mobile*

STD Code

Email *

Name of Insured*

Date of Birth

(First Name)

(Middle Name)

(Last Name)

BANK ACCOUNT DETAILS

D D M M Y Y Y Y

Name of the Bank Account Holder

Name of Bank

MICR Code (9 digit MICR code number of the bank and

branch appearing on the cheque issued by the bank)

IFSC Code (11 character code

appearing on your cheque leaf)

Bank Account No.

Account: Savings Current

Branch

ADDITIONAL INFORMATION

Registration No.* Date of Registration*

Previous Insurer*

Previous Policy No.*

Previous Period of Insurance* From

to

to

Claims lodged during the preceding year Number* Amount (`) (approximate)

Current Period of Insurance* From

D D M M Y Y Y Y

D D M M Y Y Y Y

D D M M Y Y Y Y

D D M M Y Y Y Y

D D M M Y Y Y Y

1

Non-Electrical Accessories

fitted to the Vehicle

Electrical & Electronic Accessories

fitted to the Vehicle

Side Car (Two-Wheeler)

Trailer (Pvt. Cars)

Value of CNG / LPG Kit

` ` ` ` `

`

Type of Cover required

Package Policy

Vehicle Manufacturer* Vehicle Model*

Registration Location* Year of Manufacture*

Engine No.* Chassis No.*

Petrol Diesel

CNG LPG

Y Y Y Y

Colour of the Vehicle

Seating Capacity* Cubic Capacity(CC)*

(If yes, please submit/attach proof thereof. Please read the declaration below.)

Whether the use of the vehicle is limited to own premises?

Are you entitled to No Claim Bonus*

No

Lease Agreement

Is the vehicle proposed for insurance under:

Hire-Purchase Hypothecation Agreement

Y N

Y N

D D M M Y Y Y Y

PAYMENT DETAILS

Cheque / Instrument No.

Amount:

Date of Instrument Bank Name

Branch Name / Location:

eIA Aadhar Card

PAN

Fuel Type*

Teacher in Govt. Recognized Insitutes

Total Value*

Yes

Whether the vehicle is designed for the use of Blind/ Handicapped/ Mentally - challenged persons and duly endorsed by RTA?

If Yes, give the name of the concerned parties

Printing Code: 2W(CP)/PF/1112/JAN2020 PF/Ver - 1

I would like to apply for eIA with Karvy CAMS NSDL CDSL

I hereby agree to receive all monies due from the Insurance Company towards any refund of premium, claims, etc. into my bank account as specified in the instrument tendered towards insurance premium and such

electronic transfer will constitue full and final discharge of the aforesaid obligation by the Insurance Company, unless specifically intimated by me in writing to the Insurance Company about the change in bank account.

COVERAGE INFORMATION

Personal Accident Cover for Owner Driver is compulsory in the Package policies. Please give details of nomination:

(a) Name of Nominee and Age

(c) Name of Appointee (if nominee is a Minor)

(d) Relationship to the Nominee

Note: 1. Personal Accident Cover for owner driver is compulsory for Sum Insured of ` 15 Lakhs

2. Compulsory Personal Accident Cover for owner driver cannot be granted where a vehicle is owned by a company, a partnership firm or a similar body corporate or where the owner driver does not hold an

effective driving license

(b) Relationship

1. Do you have a Personal Accident cover with a minimum sum insured of Rs 15 Lakhs? Yes No

If yes, then please provide policy number_____________________________________________________________________________________________________________________________

2. Do you have a Personal Accident policy with a sum insured of Rs < Rs 15 lakhs? Yes No

If yes, then please provide policy number _____________________________________ and sum insured ___________________________________

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer

Experience Management, Customer Happiness Center: D-301, 3rd Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. For Claim/Policy related queries call us at +91 22 6234 6234/+91 120 6234 6234 or Visit Help

Section on www.hdfcergo.com for policy copy/tax certificate/make changes/register & track claim. Trade Logo displayed above belongs to HDFC Bank Ltd and ERGO International AG and used by the Company under license. UIN: Zero Depreciation Claim –

IRDAN125A0021V01201415 | Loss of Use - Down Time Protection - IRDAN125A0012V01201213 | Emergency assistance Cover – IRDAN125A0016V01201314 | No Claim Bonus Protection – IRDA/F&U/HDFC/Motor Add-ons/09-10/2 | Return To Invoice –

IRDAN125A0013V01201213 | Cost Of Consumable Items – IRDAN125A0003V01201213 | Engine & Gear Box Protector – IRDAN125A0004V01201213 | Motor Insurance - Pricing Revision - Private Cars -IRDAN125RP0001V02201415.

GSTN No.

Please select the higher deductible if you wish to opt for over and above the compulsory deductible (`1000 - for vehicles not exceeding 1500 cc, `2000 for vehicles exceeding 1500 cc)

`2500 `5000 `7500 `15000

Maximum CSI (Capital Sum Insured) per person is `2 Lakhs

In case of named persons, give name and CSI opted for:

No

MOTOR ADD-ON COVERS

DECLARATION ON BEHALF OF ALL PERSONS TO BE INSURED

Do you wish to opt for any of the below add on covers:

I/We hereby understand, declare, consent and authorize the Company to use personal health details and financial information, as provided to the Company for underwriting the risk.

Silver Plan (Zero Depreciation)

Titanium Plan (Zero Depreciation Claim, Engine & Gear Box, NCB Protection, Cost of Consumables)

Gold Plan (Zero Depreciation & Loss of Use) Platinum Plan (Zero Depreciation, Engine & Gear Box and NCB Protection)

Emergency Assistance

Return to Invoice

Emergency Assistance Wider

Diamond Plan (Zero Deprecation & Cost of consumables)

2

Unnamed Passengers :

No. of Persons :

CSI opted for: `

Paid Driver :

No. of Paid Drivers :

CSI opted for: `

Name

CSI opted for: ` Nominee Relationship

Legal Liability

No. of Persons

Driver / Conductor / Cleaner

Other Employee

The policy provides Third Party Property Damage (TPPD) of `7.5 Lakhs (private cars)

Do you wish to opt for statutory TPPD liability coverage of `6000/- only?

Yes

NCB Protection

Zero Depreciation

Engine & Gear Box Loss of Use

Cost of Consumables

Do you wish to include the following Personal Accident coverage:

TERMS AND CONDITIONS: I/We hereby declare that the statement made by me/us in the proposal form are true to the best of my/our knowledge and belief and I/We hereby agree that this declaration shall form the basis

of contract between me/us and HDFC ERGO General Insurance Company Limited. I/We also declare that, if any additions or alterations are carried out after the submission of this proposal form, then the same would be

conveyed to the insurers immediately. I/We hereby declare that the contents of the form and documents have been fully explained to me/us and that I/We have fully understood the significance of the proposed contract. 1)

I/We declare that the rate of NCB stated above by me/us is correct and that no claim has arisen in the expiring policy (copy of the policy enclosed). I/We further undertake that, if this declaration is found to be incorrect, all

benefits under the policy in respect of Section I of the policy will stand forfeited. 2) I/We further understand and agree that HDFC ERGO General Insurance will seek confirmation of above stated details from my/ our previous

insurers. Pending receipt of necessary confirmation, I/We agree that, though coverage under the policy will be available to me/us, HDFC ERGO General Insurance will be liable to release the payment towards any claims

under Section I of the policy only after a confirmation in this regard is received. In the event this declaration is found to be incorrect, any and all coverage available under Section I of the policy form the date of commencement

of the policy shall stand automatically forfeited. Further, any survey arranged/allowed by HDFC ERGO General Insurance of the motor vehicle, pending confirmation of this declaration from my/our previous insurers, shall

be without prejudice to any of the rights and remedies available to HDFC ERGO General Insurance as contained herein and relevant laws and regulation. 3) I/We acknowledge and agree that, pending receipt of

confirmation of this declaration from my/our previous insurers, the “cash-less repair facility” provided by HDFC ERGO General Insurance shall stand suspended. 4) I/We also shall endeavour to procure the renewal notice &

pass on the same to HDFC ERGO General Insurance immediately upon the receipt of such renewal notice. 5) I/we authorize HDFC ERGO General Insurance and associate partners to contact me via email, phone, SMS.

Declaration on behalf of all Persons to be Insured: I/We hereby understand, declare, consent and authorize the Company to use personal health details and financial information, as provided to the Company for

underwriting the risk. I/We hereby also understand, declare, consent and authorize the Company that the Company shall have right to retain the aforementioned information and disseminate the same to its service

provider(s) for providing services related to insurance. I hereby declare that I do hold Personal Accident cover of Capital Sum Insured `15 lakhs or above

For Pvt Car proposal form: I / We declare and confirm having a valid PUC. For Commercial proposal form: I / We declare and confirm having a valid PUC and Vehicle Fitness certificate.

VERNACULAR DECLARATION: The content of this form and its particulars have been explained by me in vernacular to the proposer who has understood and confirmed the same. Declaration in case the proposal is filled other than the

proposer/ the proposer sign in vernacular language/ proper is illiterate (to be certified by someone other than agent/ employee of the company)

FRAUD WARNING: This policy shall be voidable at the option of the Company in the event of mis-representation, mis-description or non-disclosure of any material particulars by the Applicant. Any person who, knowingly

and with intent to defraud the insurance company or any other person, files a proposal for insurance containing any false information, or conceals for the purpose of misleading, Information concerning any fact material there

to, commits a fraudulent insurance act, which will render the policy voidable at the sole discretion of the insurance company and result in a denial of insurance benefits.

Note: The liability of the company does not commence until the acceptance of the proposal has been formally intimated by the insured and full premium has been realized by the company.

ANTI - MONEY LAUNDERING: The Company believes in adherence to Anti Money Laundering (AML) guidelines/rules as it aids in ensuring that financial institution like ours are not used as vehicle for money laundering.

The policyholder/ nominee are thus bound to provide such information as may be required by the Company for ensuring the adherence of AML guidelines/rules.

SHARING OF INFORMATION CLAUSE: The information sought from the insured Is strictly for the purpose of policy issuance and policy servicing. This information sought and the details of policy are kept confidential and

will not be shared with any external party in any circumstances whatsoever. However, in instances when such information/ details is sought by any governmental bodies / regulatory authorities or when the Company is

directed to share such information in accordance with any law/regulations or direction from any such governmental bodies/regulatory authorities, the Company will be bound to abide to such directions.

DATA PROTECTION: I/We hereby understand, declare, consent and authorize the Company that vehicle details and financial information, as provided to the company may be utilized for processing the claim made under

the Policy. I/We hereby also understand, declare and consent that the Company shall have right to retain and disseminate the same to any service provider for providing services related to insurance.

Prohibition of Rebates (Section 41 of Insurance Act, 1938 as amended):

1. No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India, any rebate

of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebate as may be allowed in

accordance with the published prospectuses or tables of the insurer: provided that acceptance by an insurance agent of commission in connection with a policy of life insurance taken out by himself on his own life shall not

be deemed to be acceptance of a rebate of premium within the meaning of this sub-section if at the time of such acceptance the insurance agent satisfies the prescribed conditions establishing that he is a bona fide

insurance agent employed by the insurer.

2. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to `10 Lakhs.

MODE OF PAYMENT: Cheque and Demand Draft. Payment by cash will not be accepted. This policy shall be voidable at the option of the Company in the event of mis-representation, mis-description or non-disclosure of

any material particulars by the proposer. Any person who, knowingly and with intent to defraud the Insurance Company or other person, files a proposal for insurance containing any false information, or conceals for the

purpose of misleading, information concerning any fact materials thereto, commits a fraudulent act which will render the policy voidable at the Company’s sole discretion and result in a denial of insurance benefits.

1. Persons or classes of persons entitled to drive: Any person including the Insured: Provided that the person driving holds an effective driving licence at the time of the accident and is not disqualified from holding

or obtaining such a licence; Provided also that the person holding an effective learner’s licence may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles

Rules, 1989.

2. Any limitations as to use of motor vehicle: The insurance covers use of the vehicle for any purpose other than: (a) Hire or reward; (b) Driving tuition; (c) Organised racing; (d) Pace making; (e) Speed testing;

(f) Reliability trials; (g) Any purpose in connection with Motor Trade. In addition to this, the insurance does not cover (1) Carriage of goods (other than samples or personal luggage), in case of Private Car (2) Use

whilst drawing a greater number of trailers in all than is permitted by law, in case of Agricultural Tractors; (3) Use whilst drawing a trailer except the towing (other than for reward) of any disabled mechanically

propelled vehicle, in case of Goods Carrying Tractors.

Place

Date

D D M M Y Y Y Y

Signature of theTranslator

Name of the

Translator

Signature/ Thumb impresser of Proposer

Place

Date

D D M M Y Y Y Y

Name of the

Proposer

Channel Partner Code Branch Location

Signature of Channel Partner

*Mandatory Information

FOR OFFICE USE

Place

Date

Signature of Proposer

I agree to receive a one pager policy document.

I hereby declare that I do not hold an effective driving license.

D D M M Y Y Y Y

IhavereadandunderstoodandagreewiththetermsandconditionsmentionedoverleafofthisProposalForm.

IherebydeclarethatIdohaveAlternatePA/StandaloneCPApolicywithminimumsuminsuredofRs15lakhs

TERMS AND CONDITIONS

HDFC ERGO General Insurance Company Limited. IRDAI Reg. No.146. CIN: U66030MH2007PLC177117. Registered & Corporate Office: 1st Floor, HDFC House, 165-166 Backbay Reclamation, H. T. Parekh Marg, Churchgate, Mumbai – 400 020. Customer

Experience Management, Customer Happiness Center: D-301, 3rd Floor, Eastern Business District (Magnet Mall), LBS Marg, Bhandup (West), Mumbai - 400 078. For Claim/Policy related queries call us at +91 22 6234 6234/+91 120 6234 6234 or Visit Help

Section on www.hdfcergo.com for policy copy/tax certificate/make changes/register & track claim. Trade Logo displayed above belongs to HDFC Bank Ltd and ERGO International AG and used by the Company under license. UIN: Zero Depreciation Claim –

IRDAN125A0021V01201415 | Loss of Use - Down Time Protection - IRDAN125A0012V01201213 | Emergency assistance Cover – IRDAN125A0016V01201314 | No Claim Bonus Protection – IRDA/F&U/HDFC/Motor Add-ons/09-10/2 | Return To Invoice –

IRDAN125A0013V01201213 | Cost Of Consumable Items – IRDAN125A0003V01201213 | Engine & Gear Box Protector – IRDAN125A0004V01201213 | Motor Insurance - Pricing Revision - Private Cars -IRDAN125RP0001V02201415.