2021

UNIVERSAL REGISTRATION

DOCUMENT

INCLUDING

THE ANNUAL FINANCIAL REPORT

1.1

Six generations of craftspeople

10

1.2

Group governance

13

1.3

Strategy

14

1.4

Simplified organization chart and Group locations

17

2.1

Business model

47

2.2

People: teams

67

2.3

People: savoir-faire

89

2.4

The planet: raw materials

109

2.5

The planet: environment

129

2.6

Communities: suppliers & partners

167

2.7

Communities: stakeholders and transparency

181

2.8

Ethics – Compliance

198

2.9

Report by one of the Statutory Auditors, appointed as an

independent third party, on the consolidated non-financial

information statement

212

2.10

Reasonable assurance report by one of the Statutory

Auditors on a selection of environmental and social

information

217

4.1

Risk factors

328

4.2

Insurance policy and risk hedging

347

4.3

Risk management, internal control and internal audit

348

5.1

Consolidated income statement

360

5.2

Consolidated statement of comprehensive income

360

5.3

Consolidated balance sheet

361

5.4

Consolidated statement of changes in equity

362

5.5

Consolidated statement of cash flows

363

5.6

Notes to the consolidated financial statements

364

5.7

Statutory Auditors’ report on the consolidated financial

statements

404

6.1

Income statement

412

6.2

Balance sheet

413

6.3

Change in equity

414

6.4

Statement of cash flows

414

6.5

Notes to the financial statements

415

6.6

Table of results over the last five years

430

6.7

Information on payment terms

431

6.8

Other information on the parent company financial

statements

432

6.9

Statutory Auditors’ report on the financial statements

433

7.3

Dividend policy

461

7.4

Stock market information

462

7.5

Shareholder information

466

3.1

The Company’s Corporate Governance Code

223

3.2

Ambitious and balanced governance

226

3.3

Administrative and management bodies

229

3.4

Organisation of the Supervisory Board

241

3.5

Functioning of the Supervisory Board

276

3.6

Specialised committees

284

3.7

Evaluation of the Supervisory Board and Committees

290

3.8

Compensation and benefits of Corporate Officers

293

3.9

Other information

315

3.10

Other information from the Executive management report

324

8.1

Agenda

472

8.2

Explanatory statements and draft resolutions

474

8.3

Supervisory Board report to the Combined General Meeting

of 20April 2022

496

8.4

Statutory Auditors’ reports

498

9.3

Consultation of regulatory information

507

9.4

Information included by reference

507

9.5

Cross reference tables

510

9.6

Glossary

527

CONTENTS

MESSAGE FROM THE EXECUTIVE

MANAGEMENT

5

HIGHLIGHTS 2021

6

1

PRESENTATION OF THE GROUP AND ITS

RESULTS

9

AFR

Key financial figures

1.5

24

AFR

1.6

Revenue and activity by métier

26

AFR

1.7

Revenue and activity by geographical area

35

AFR

1.8

Comments on the consolidated financial statements

38

AFR

1.9

Significant events since the end of the financial year

40

AFR

1.10

Outlook

41

1.11

Fondation d’entreprise

42

NFPS

2

CORPORATE SOCIAL RESPONSIBILITY

45

AFR

4

RISK FACTORS AND MANAGEMENT

327

AFR

5

CONSOLIDATED FINANCIAL STATEMENTS

359

AFR

6

PARENT COMPANY FINANCIAL STATEMENTS

411

7

INFORMATION ON THE COMPANY AND ITS

SHARE CAPITAL

439

Presentation of Hermès International

7.1

440

AFR

7.2

Information on share capital and shareholders

450

AFR

3

CORPORATE GOUVERNANCE

221

AFR

Supervisory Board corporate governance report

223

8

COMBINED GENERAL MEETING

OF 20 APRIL 2022

471

9

ADDITIONAL INFORMATION

505

AFR

9.1

Persons responsible for the universal registration document

506

AFR

Persons responsible for auditing the financial statements

9.2

507

The sections of the Annual Financial Report are identified in the contents with the pictogram.

AFR

Elements constituting the statement of non-financial performance are clearly identified in the contents with the pictogram.

NFPS

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 1

The digital version of this document is compliant with the PDF/UA (ISO 14289-1), WCAG 2.1 level AA and RGAA 4.1 accessibility standards

with the exception of the colour criteria. Its design enables people with motor disabilities to browse through this PDF using keyboard

commands. Accessible for people with visual impairments, it has been tagged in full, so that it can be transcribed vocally by screen

readers using any computer support.

Accessible PDF powered by

This document is a free translation into English of the “Document d’enregistrement universel”, originally prepared in French, and has no other value than an

informative one. Should there be any difference between the French and the English version, only the French language version shall be deemed authentic and

considered as expressing the exact information published by Hermès.

The French language version of this Document d’Enregistrement Universel (Universal

Registration Document) was filed on March23

rd

,2022 with the French Financial

Markets Authority (Autorité des Marchés Financiers), as the competent authority

under Regulation (EU) 2017/1129, without prior approval in accordance with Article

9 of said Regulation.

This Document d’Enregistrement Universel (Universal Registration Document) may

be used for the purposes of a public offer of financial securities or the admission of

financial securities to trading on a regulated market only if supplemented by a

transaction note and, if applicable, a summary and all amendments to the Document

d’Enregistrement Universel (Universal Registration Document). The group of

documents then formed is approved by the French Financial Markets Authority in

accordance with Regulation (EU) 2017/1129.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL2

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 3

2021

UNIVERSAL

REGISTRATION

DOCUMENT

Including the Annual Financial Report

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL4

5

MESSAGE FROM THE EXECUTIVE MANAGEMENT

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL

A wonderful human odyssey

2021 was marked by strong growth and exceptional results. In the

face of the pandemic, Hermès’ artisanal model has once again

demonstrated its resilience and relevance.

We owe this success to the House’s 17,600 employees who, with

their talents, know-how and human values, adapted to a new

paradigm without ever compromising their high standards or

integrity. We rewarded this universal commitment by granting an

exceptional bonus of €3,000 to every employee worldwide and a monthly pay increase of

€100 for employees in France.

In the new dynamics of a world where the physical and the digital coexist, Hermès has

consolidated

its

multi-local approach and successfully nurtured and renewed its bonds with

customers in each country. In increasingly polarised markets, its rich collections and

abundant creativity have enabled the House to offer sustainable objects adapted to individual

desires. Innovation, whether in the development of new materials, in support functions, or

in the agility of our services, has played a key role. Maintaining investments in production

capacity and training – such as through the creation of the École Hermès des Savoir-Faire –

is a sign of the House’s deep attachment to the regions and local communities in which it

operates, and of the need and willingness to act in a socially and economically accountable

way. The Group’s commitments to managing its environmental impact and contributing to

responsible growth have been welcomed by all stakeholders, as borne out by the high scores

received from non-financial rating agencies.

It is therefore with pride and gratitude that we close 2021, a year that we announced as an

odyssey

– a journey that, despite the world’s vicissitudes, reminds us of who we are.

Axel Dumas Émile Hermès SAS

EXECUTIVE CHAIRMAN EXECUTIVE CHAIRMAN

REPRESENTED BY HENRI-LOUIS BAUER

◆

Asia excluding Japan (+45% and +65% over two years) pursued its

dynamic growth, driven particularly by the sustained performance in

Greater China, Australia and Singapore, despite new restrictions in

some of the region’s countries. The Shanghai Plaza 66, Suzhou and

Ningbo stores reopened after renovation and extension, after the

Beijing China World store in spring, and new stores were inaugurated in

Macao and Shenzhen. In Australia, the Brisbane store also reopened

after being extended;

◆

Japan (+25% and +20% over two years) posted a sustained and regular

increase in sales, thanks to the loyalty of local customers, while

benefitting from the end of the health state of emergency in October. A

new store opened in February on Omotesando Avenue and the Shinjuku

Isetan store in Tokyo was renovated following extension work in

November;

◆

America (+57% and +24% over two years) achieved a strong

performance, despite the sanitary restrictions imposed in several US

cities in the fourth quarter. Two new stores opened, in Troy near Detroit

in June and in Aventura Mall near Miami in October;

◆

Europe excluding France (+37% and +10% over two years) recorded a

strong second half, with a remarkable development of the local

customer base, which partly offset the tourist traffic. Several stores

were renovated and extended, Zurich in May, Milan in July, and Istanbul

in October, and the Luxembourg store moved to a new address in

November;

◆

France (+35% and -3% over two years) confirmed its recovery, with a

fourth quarter marked by fewer tourists in the Paris stores. The stores in

Lyon and rue de Sèvres in Paris reopened in February and March after

being renovated and extended.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL6

HIGHLIGHTS 2021

HIGHLIGHTS 2021

In 2021, the Group’s consolidated revenue reached €8,982million, up

42% at constant exchange rates and 41% at current exchange rates

compared to 2020. Over two years, this increase was 33% at constant

exchange rates, in the first as in the second half of the year. Recurring

operating income was up 78% and amounted to €3,530million (39% of

sales). Net profit (Group share) reached €2,445million, up 77% compared

to 2020.

Axel Dumas, Executive Chairman of Hermès, said: “I thank above all the

passion and quality of our teams’ work, because together we have made

2021 an exceptional year. Abundant creativity, unique know-how and the

quality of materials have driven the growth of our sixteen métiers. Hermès

is very dedicated to its role as a committed and responsible company and

continues its commitments to job creation around the world and to regional

regeneration in France, while reinforcing its ambitious environmental

objectives.”

Sales by geographical area at the end of December

(at constant exchange rates, unless otherwise indicated)

Asia and America recorded the highest growths, compared to 2020 as well

as to 2019, and Europe returned to growth compared to 2019. Sales in the

Group’s stores increased by 44% at constant exchange rates compared to

2020 and 41% over two years. Hermès continued to selectively develop its

distribution network and online sales increased worldwide, with the rollout

of new services and sustained growth in traffic. Wholesale activities (+24%)

increased despite constraints faced by travel retail:

Sales by métier at the end of December

(at constant exchange rates, unless otherwise indicated)

At the end of December2021, all the métiers confirmed their growth, with a

noteworthy increase in Ready-to-wear and Accessories, Watches and Other

Hermès Business Lines (Jewellery and Homeware).

In the Leather Goods & Saddlery métier (+29% and +23% over two years)

sales were exceptional. After the strong acceleration in the first nine

months, sales in the 4

th

quarter reflected as anticipated the capacity

constraints. Demand both for new bags like Della Cavalleria and 24/24

and the Hermès classics is very sustained. The increase in production

capacities continued, with the opening of the Louviers site (Eure) in 2022,

the Sormonne site (Ardennes) in 2023 and a new one in Riom

(Puy-de-Dôme) scheduled for 2024. Hermès continued to strengthen its

local presence in France and to create jobs. In September, in line with our

commitments to knowledge transfer and education, Hermès opened the

École Hermès des Savoir-Faire (Hermès school of know-how), which is

accredited by the French education department and will award a

State-approved diploma in leatherworking expertise.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 7

The Ready-to-wear and Accessories métier (+59% and +44% over two

years) pursued its dynamic growth, thanks to the success of the

Ready-to-wear, Fashion accessories and Shoes collections. The Men’s and

Women’s Spring-Summer 2022 collection, presented respectively in July

and October, met with great success.

The Silk and Textiles métier (+49% and +15% over two years) performed

well. A new printing line was inaugurated as part of the development of the

site near Lyon to meet demand.

Perfume and Beauty (+47% and +19% over two years) benefitted from the

successful launches of the H24 perfume for men and Twilly Eau Ginger,

and the development of the Beauty line with the autumn rollout of the third

chapter in Beauty, Les Mains Hermès.

The Watches métier (+73% and +77% over two years) confirmed its strong

growth, which results from the exceptional watch-making expertise and the

success of the new men’s watch H08 alongside other classics of the

House.

Other Hermès sectors (+57% and +95% over two years) confirmed their

momentum, both in Jewellery and Homeware.

Outstanding results and free cash flow progression in 2021

Recurring operating income amounted to €3,530million, rising 78% from

€1,981million in 2020. Thanks to the collections remarkable sell-through

and an exceptional leverage effect, the recurring operating margin reached

an historical high of 39% of sales, up 8points compared to 2020 and

5points compared to 2019.

Consolidated net profit (Group share) amounted to €2,445million (27% of

sales), up 77% from €1,385 at the end of December2020.

Operating investments amounted to €532million. Thanks to the

outstanding increase in results and the favourable impact of the change in

working capital, the adjusted free cash flow reached a record-high

€2,661million, i.e. 2.7times that of 2020.

After distribution of the ordinary dividend (€476million) and inclusion of

shares redeemed (€162million for 142,131shares, excluding the liquidity

contract), the restated net cash position increased by €2,166million to

€7,070million.

A responsible and sustainable model

The Hermès Group has continued to recruit and added nearly 1,000people

to its workforce this year. At the end of December2021, the Group

employed 17,595people, including 10,969 in France. True to its

commitment as a responsible employer, in 2022 Hermès will pay an

exceptional €3,000 bonus to all the employees to reward them for their

engagement and their contribution to the results in a challenging context.

In 2021, the outstanding improvement in non-financial ratings reflected the

speeding-up of CSR commitments and the sustainable dimension of

Hermès’ craftsmanship model. MSCI published an “A” rating in its analysis

of the firm’s resilience to environmental, social and governance risks. The

Group was included in the CAC40 ESG index, after Hermès was ranked by

Vigeo-Eiris in the “Advanced” category. Sustainalytics ranked Hermès the

second best player in the Textiles and Clothing sector. Hermès’

commitment to fighting climate change was particularly recognised by the

CDP rating for which Hermès scored “A-”.

Hermès Group reasserted its commitment to fighting climate change by

reviewing its reduction targets at year end, to align with a global warming

pathway below 1.5°C. These targets were calculated scientifically and

validated by the Science Based Target initiative (SBTi). Hermès thus

committed to reducing emissions by 50.4% on scopes1 and 2 in absolute

value and by 58.1% in intensity (per €m of gross margin) on scope3, over

the 2018-2030 period.

1.1

SIX GENERATIONS OF CRAFTSPEOPLE

10

1.2

GROUP GOVERNANCE

13

1.3

STRATEGY

14

1.4

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

17

1.4.1

Summary description of the Group as at 31December 2021

17

1.4.2

Production sites

18

1.4.3

Distribution network

20

1.4.4

Real estate

23

1.5.1

Revenue by métier for 2021 (2020)

24

1.5.2

Revenue by geographical area for 2021 (2020)

24

1.5.3

Key consolidated data

24

1.6.1

Leather Goods & Saddlery

26

1.6.2

Ready-to-wear and Accessories

28

1.6.3

Silk and Textiles

29

1.6.4

Other Hermès sectors

30

1.6.5

Perfume and Beauty

31

1.6.6

Watches

32

1.6.7

Other products and brands

32

1.6.8

Group partnerships

35

1.7.1

Europe

35

1.7.2

Asia-Pacific

36

1.7.3

Americas

37

1.7.4

Digital strategy

37

1.8.1

Income statement

38

1.8.2

Cash flows and investments

39

1.8.3

Financial position

39

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 9

1

PRESENTATION OF THE GROUP

AND ITS RESULTS

AFR

1.5

KEY FINANCIAL FIGURES

24

AFR

REVENUE AND ACTIVITY BY MÉTIER

1.6

26

AFR

REVENUE AND ACTIVITY BY GEOGRAPHICAL AREA

1.7

35

AFR

COMMENTS ON THE CONSOLIDATED FINANCIAL STATEMENTS

1.8

38

AFR

SIGNIFICANT EVENTS SINCE THE END OF THE FINANCIAL YEAR

1.9

40

AFR

1.10

OUTLOOK

41

1.11

FONDATION D’ENTREPRISE

42

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL10

1

PRESENTATION OF THE GROUP AND ITS RESULTS

SIX GENERATIONS OF CRAFTSPEOPLE

1.1

SIX GENERATIONS OF CRAFTSPEOPLE

The Hermès adventure began in 1837 when the harness-maker Thierry

Hermès opened a workshop in rue Basse-du-Rempart in Paris. Gradually,

generation after generation, the House followed a dual thread – on the

one hand the painstaking work of the craftspeople in his workshop, and

on the other the active lifestyles of its customers. Carried by an enduring

spirit of freedom and creativity, Hermès remains highly sensitive and

attentive to the changing nature and needs of society.

ln 1880, Charles-Émile Hermès, the founder’s son, moved the workshops

to 24, rue du Faubourg Saint-Honoré, and set up an adjoining store. At

this now-emblematic address, harnesses and saddles were made to

measure. The business was already standing out for the excellence of its

creations.

AN INNOVATIVE HOUSE PASSIONATE ABOUT

ITS ERA

During the interwar period, lifestyles changed and the House broke new

ground under the management of Thierry’s grandson, Émile Hermès. He

decisively influenced the family firm’s destiny when, while travelling in

Canada, he discovered the opening and closing system of an automobile

hood. ln 1922 he obtained exclusive rights to this American “universal

fastener” – known today as the zip – which was used extensively in the

House’s luggage and other designs. Under the impetus of Émile Hermès,

the House opened up to other métiers, while retaining a close connection

with the equestrian world, drawing on its mastery of raw materials and its

artisanal culture to create its first ready-to-wear collections. ln 1937, the

famous silk scarf was born with the Jeu des omnibus et dames blanches

design, the first in a long series.

Robert Dumas – one of Émile Hermès’ sons-in-law, who took the helm of

the House in 1951 – was a regular visitor to the workshops and designed

objects whose details (buckles, fasteners, saddle nails and anchor

chains) exuded an elegance that in no way diminished their practicality.

Hermès objects stand out for their noble materials, their mastery of

savoir-faire, and their bold creativity, stimulated by the House’s keen

vision of the world. The Silk métier now invites artists to create unique

designs.

AVISIONARY HOUSE

From 1978 onwards, Robert Dumas’ son Jean-Louis gradually

revolutionised the House, diversifying it and projecting it onto the world

map. Hermès embraced new métiers founded on unique savoir-faire, with

watchmaking from 1978, along with the integration of new Houses into

the Group – the bootmaker John Lobb in 1975, Puiforcat silversmiths in

1993, and the Cristalleries Saint-Louis in 1995. Hermès has also

created its own footwear, designed by Pierre Hardy, since 1990.

ln 1987, for the House’s 150

th

anniversary, Parisians were treated to a

memorable firework display that launched the first theme, a tradition that

has been perpetuated annually ever since to nourish all forms of

creativity with a shared source of inspiration.

Jean-Louis Dumas also supported the development of Hermès around

the world with the opening of numerous stores, which all ingeniously

combined the identity of 24 Faubourg with local culture. Among these

stores, several Maisons Hermès were inaugurated: on Madison Avenue,

New York in 2000, in Ginza, Tokyo – in a building of glass bricks designed

by Renzo Piano – in 2001, and in Dosan Park, Seoul, in 2006.

From 2006, Patrick Thomas decentralised the strategic organisation of

the métiers and reorganised Hermès’ presence across the world into

geographical regions. He also ensured the transition to the sixth

generation of the family.

HERMÈS TODAY

ln 2005, Pierre-Alexis Dumas, son of Jean-Louis Dumas, was appointed

Artistic Director. The House expanded its range of savoir-faire,

complementing its jewellery product offer with a first haute joaillerie

collection in 2010. Creativity, combining innovation and imagination,

became ever more abundant within the different métiers. ln 2008,

Pierre-Alexis Dumas also created the Fondation d’Entreprise Hermès,

which supports artistic creation, supports artisanal savoir-faire, and

promotes the conservation of biodiversity.

Executive Chairman since 2013, Axel Dumas, nephew of Jean-Louis

Dumas, strengthened the dynamic growth of the Group with the

inauguration of the fifth Maison Hermès in Shanghai in 2014. He is

accompanying the Group’s digital roll-out, which led to the redesign of the

hermes.com website in 2018. Axel Dumas has also taken Hermès into

the new technological era, in keeping with the expectations of customers,

who are becoming more and more connected. The Apple Watch Hermès,

initiated in 2015, bears witness to a bold and innovative partnership with

Apple. ln addition, the Group is stepping up the omnichannel dynamic

within its organisation.

In 2018, Hermès International entered the CAC40 index followed, in

2021, by the Euro Stoxx 50 index. This demonstrates the Group's

remarkable industrial trajectory and stock market performance of an

independent, family-run House of artisans that distributes its objects

through a dynamic network of 303stores around the world. For over

150years, Hermès has enriched its métiers without deviating from its

strict quality standards. ln this regard, the House attaches great

importance to pursuing the development of its production in France, with

its 19 production units.

Defying the trend for industrial standardisation and globalisation, Hermès

stands out for its unique business model.

◆

Robert Dumas creates the Chaîne d’ancre bracelet.

◆

The creation of the Eau d’Hermès fragrance marks the founding of a

new métier.

◆

Jean-Louis Dumas, Robert Dumas’s son, takes the reins of the House.

◆

Creation of the La Montre Hermès watchmaking subsidiary in Bienne,

Switzerland.

◆

Jean-Louis Dumas creates the Birkin bag, named after the singer and

actress Jane Birkin.

◆

Creation of the first dinner service, Les Pivoines.

◆

A Maison Hermès opens in Ginza, Tokyo.

◆

Launch of the first e-commerce website in the United States.

◆

Patrick Thomas becomes Executive Chairman of Hermès.

◆

A Maison Hermès opens in Dosan Park, Seoul.

◆

Creation of petit h.

◆

Creation of the first haute joaillerie collection, designed by Pierre

Hardy.

◆

The first Saut Hermès at the Grand Palais takes place in Paris.

Axel Dumas, nephew of Jean-Louis Dumas and sixth generation family

member, is appointed Executive Chairman.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 11

PRESENTATION OF THE GROUP AND ITS RESULTS

SIX GENERATIONS OF CRAFTSPEOPLE

1

HERMÈS IN KEY DATES

1837

◆

The workshop of craftsman saddIer- and harness-maker Thierry

Hermès opens in the Grands Boulevards district in Paris.

1867

◆

Thierry Hermès receives an award at the Universal Exhibition in Paris

for the excellence of his work.

1880

◆

Thierry Hermès’ son, Charles-Émile Hermès, moves the workshops to

24, rue du Faubourg Saint-Honoré and opens a store selling bespoke

harnesses and saddles.

1900

◆

Creation of the Haut à courroies bag.

1922

◆

Émile Hermès, son of Charles-Émile Hermès, brings the American

“universal fastener”, later known as the zipper fastener, to France,

with exclusive rights for its development.

1925

◆

Creation of a golf jacket, the first ready-to-wear garment.

1927

◆

Creation of the first piece of jewellery, the Filet de selle bracelet.

1937

◆

Creation of the first silk scarf, Jeu des omnibus et dames blanches.

1945

◆

The Duc attelé, groom à l’attente design by Alfred de Dreux from the

Émile Hermès collection, representing a horse-drawn carriage,

becomes the Hermès emblem.

1949

◆

Creation of the first tie.

1951

1956

◆

The bag created by Robert Dumas in 1930 is named the Kelly in

tribute to Grace Kelly.

1967

◆

Presentation of the first women’s ready-to-wear collection.

1973

◆

Launch in Germany of the publication Die Welt von Hermès. Le Monde

d’Hermès is created two years later in France.

1978

1984

1987

◆

Hermès celebrates its 150thanniversary with a firework display on

the Pont-Neuf bridge in Paris. Ever since, an annual theme has guided

inspiration for all of the House’s métiers.

1992

◆

Leather workshops established in Pantin.

1993

◆

Flotation of Hermès International on the stock exchange.

2000

◆

A Maison Hermès opens on Madison Avenue in New York.

2001

2006

2008

◆

Creation of the Fondation d’Entreprise Hermès under the impetus of

the House’s Artistic Director Pierre-Alexis Dumas, son of Jean-Louis

Dumas.

2010

2013

◆

◆

Hermès International enters the CAC40.

◆

Launch of the new hermes.com website in Europe and China.

◆

As at 31 December 2021, Hermès had 303 stores worldwide.

◆

The hermes.com website is the leading store, with online sales now

operating in 29 countries.

◆

Inauguration of the leather goods workshops of Montereau

(Seine-et-Marne) and Saint-Vincent-de-Paul (Gironde), the Group's

18

th

and 19

th

production units in France.

◆

Hermès International enters the Euro Stoxx 50.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL12

1

PRESENTATION OF THE GROUP AND ITS RESULTS

SIX GENERATIONS OF CRAFTSPEOPLE

2014

◆

A Maison Hermès opens in Shanghai.

2015

◆

Apple and Hermès launch the Apple Watch Hermès.

2018

2019

◆

A new market launches in Poland with the opening of a store in

Warsaw.

2020

◆

Launch of the 16

th

métier: Beauty.

2021

◆

to involve Senior Executives in the Group’s major issues and strategic

orientations;

◆

to promote communication, sharing and reasonable exchanges

amongst its members in their area of responsibility;

◆

to enable the Executive Committee to take certain decisions.

13

1

1.2

GROUP GOVERNANCE

The Executive Management ensures the management of Hermès

International. The role of Executive Chairman is to manage the Group and

act in its general interest, within the scope of the corporate purpose and

subject to those powers expressly granted by law or by the Articles of

Association to the Supervisory Board, to the Active partner and to

Shareholders’ General Meetings.

The Executive Chairmen’s roles are distributed as follows: Axel Dumas is

in

charge of strategy and operational management, and Émile Hermès

SAS, through its Executive Management Board, is responsible for vision

and strategic priority areas.

The Executive Chairmen are supported in their management of the Group

by

the Executive Committee. This consists of Managing Directors, each of

whom has well-defined areas of responsibility. The role of Group

Management is to oversee the Group’s strategic and operational

management. Its composition reflects the Group’s main areas of

expertise.

PRESENTATION OF THE GROUP AND ITS RESULTS

GROUP GOVERNANCE

The Operations Committee, which reports to the Executive Management,

is made up of the Executive Committee and the Senior Executives of the

main métiers and geographical areas of the Group.

Its duties are:

Detailed information on the administrative and management bodies is

provided in chapter 3 "Corporate governance", § 3.2 and § 3.3.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL

The Supervisory Board exercises ongoing control over the Company’s

management. For this purpose, it has the same powers as the Statutory

Auditors and receives the same documents as they do, at the same time.

Detailed information on the composition and work of the Supervisory

Board is provided in chapter3 «Corporate governance», § 3.2 and § 3.4.

1

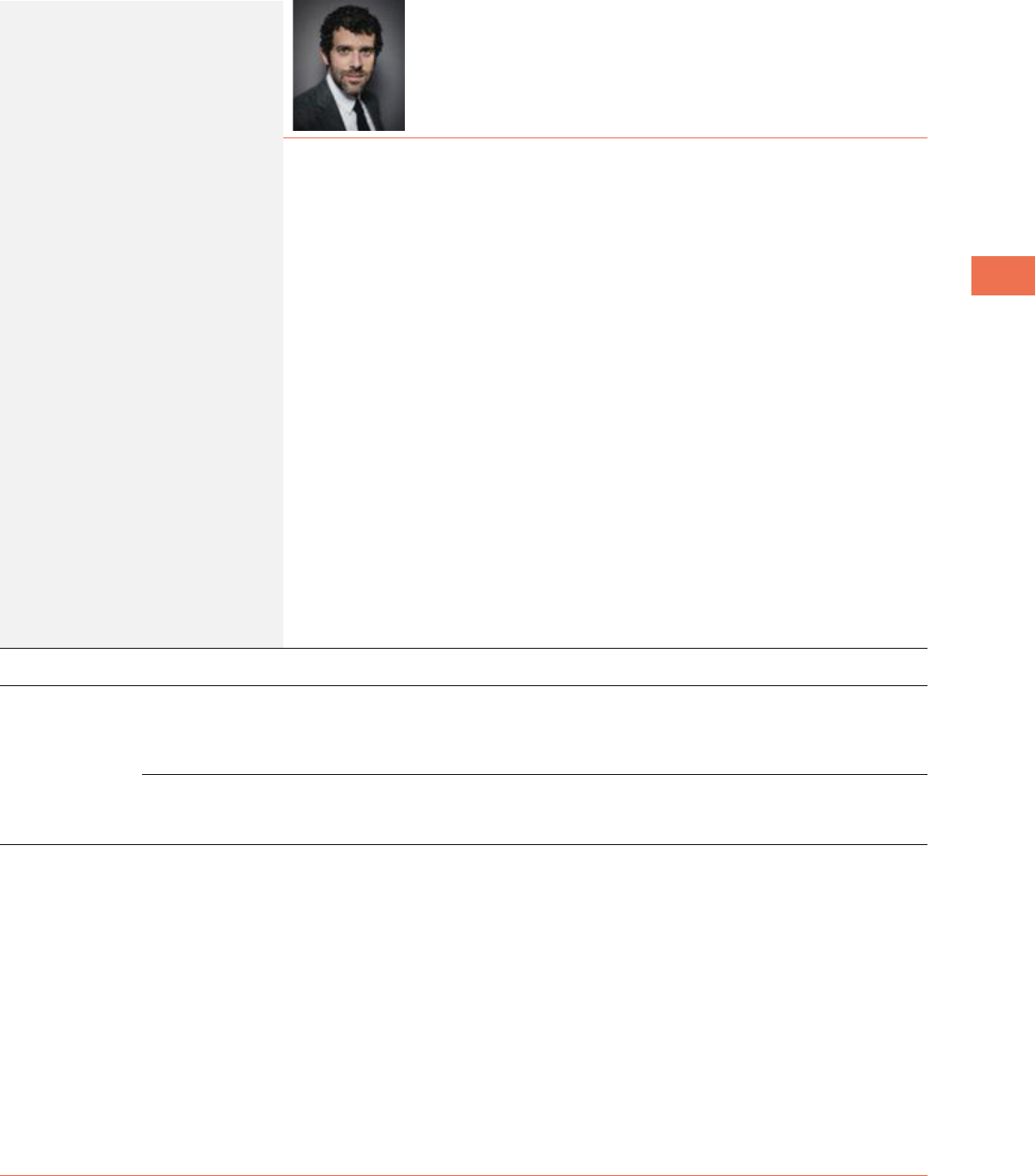

The members of the Executive Committee in the Hermès store on Avenue George-V, Paris. From left to right:Éric du Halgouët,

Catherine Fulconis, Wilfried Guerrand, Axel Dumas, Olivier Fournier, Charlotte David, Guillaume de Seynes,

Pierre-Alexis Dumas and Florian Craen

2

Agnès de Villers

3

Sharon MacBeath

Two new members

joined the Executive Committee

on 1 March 2022.

4

Éric de Seynes

Chairman of the Supervisory Board

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL14

1

PRESENTATION OF THE GROUP AND ITS RESULTS

STRATEGY

1.3

STRATEGY

Hermès is an independent company backed by family shareholders. Its

strategy is based on three pillars: creation, craftsmanship and an

exclusive distribution network.

Since 1837, the Group has remained true to its values of freedom,

demanding craftsmanship savoir-faire, quality, authenticity and

responsible growth.

CREATION AT THE CORE OF HERMÈS’ STRATEGY

Hermès creates and manufactures quality objects designed to last, to be

passed on from one generation to the next, and to be repaired. This

approach requires these issues to be taken into account at every stage,

from design to sales.

Hermès’ strategy is based on creative freedom. Each year, a theme

inspires creators and Artistic Directors. Driven by a history spanning

nearly 200years, during which the House has continued to develop with

audacity and ingenuity, Hermès paid homage to the theme of the

Odyssey in 2021. In the face of challenges and successes, the Group

has continued its journey, true to its identity and the Saddler’s Spirit.

High standards in design and manufacturing encourage the creation of

objects that aim to surprise and amaze customers. This creativity,

revolving around traditional savoir-faire, is coupled with innovative

processes to revisit timeless models and create exceptional pieces,

without departing from Hermès’ trademark humour and imaginative flair.

The unbridled creativity flourishes in each métier, as reflected in the

numerous scarf designs printed every year. It is then expressed through

over 50,000 references, developed around a unique identity and a style

blending exceptional quality, innovation, surprise, elegance and

simplicity. In 2021, it was revealed in new territories with the successful

launch of the new Beauty chapters, the H08 men’s watch and the H24

perfume.

Hermès’ mission is to create unique and original objects to elegantly

satisfy the needs and desires of its customers.

Its goal is the pursuit of excellence, in each of its métiers and services,

with craftsmanship at the heart of its model.

PERFORMANCE OF THE INTEGRATED

CRAFTSMANSHIP MODEL

Hermès leverages its craftsmanship division, the second pillar of its

strategy, with nearly 6,000 craftspeople in France. Backed by the

House's rich history shaped by six generations of craftspeople, Hermès is

resolutely turned to the future through its values, which address the

concerns of our modern societies. Hermès moves with the times, but

always respecting tradition, transmission and innovation.

The House works alongside those who master, preserve and transmit

craftsmanship savoir-faire through their knowledge of materials and their

exceptional techniques. Each new leather goods workshop is an

architectural project in its own right, enabling around 300 jobs to be

created and promoting a pleasant working environment on a human

scale.

Hermès continued its investments to expand its production capacity in

2021, to satisfy its 16 métiers.

The House ensures that it continually nurtures improvements in the

gestures and savoir-faire of its craftspeople. In 2021, true to its

commitment to education, Hermès opened an apprentice training centre,

the Centre de Formation d'Apprentis (CFA), which awards a State diploma

in leather work. The craftsmanship model is at the heart of all the métiers

of Maison Hermès, drawing on exceptional materials.

To ensure the durability of this craftsmanship model, the House takes

particular care to secure its supplies of materials. Vertical integration,

through partnerships and acquisitions, supports the development

strategy, with regards to materials as well as techniques and savoir-faire.

More than 58% of production is integrated and 78% is located in France.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 15

PRESENTATION OF THE GROUP AND ITS RESULTS

STRATEGY

1

The vertical integration and sustainable relationships with its partners

ensure traceability of its supply chains and reinforce the House’s

responsible development strategy with regard to materials, techniques

and savoir-faire.

THE DYNAMICS OF AN EXCLUSIVE OMNICHANNEL

DISTRIBUTION NETWORK

Hermès' in-house distribution model, with its network of stores and

e-commerce sites, proved its effectiveness during the health crisis. The

House’s tools were adapted to a transformed customer relationship in

order to respond to rapid changes in demand and maintain a special

relationship with customers.

The exclusive distribution network consists primarily of branches run by

the Group around the Hermès brand. Each of the 303 stores across the

world offers a personalised selection of objects, to exceed the specific

expectations of its customers and offer a distinct purchasing experience

in each and every store. Each store enables its customers to explore and

discover the most beautiful products, and extends the House’s lustre

worldwide.

The importance of e-commerce has increased since the start of the

Covid-19 crisis. For the past six years, Hermès has made the strategic

choice of ramping up online sales, with the successful rollout of its

proprietary platform worldwide, the attraction and retention of new

customers, and the development of services. This strategy supports the

House’s customers and accelerates the digitisation of uses. This digital

flagship is designed like any Hermès store with its spirit of fantasy,

authenticity and diversity, its windows, its products, its services and its

stories gathered in a single virtual place.

Customers are placed at the core of the omnichannel network, so as to

best meet their expectations and offer them a unique experience. Around

the world, Hermès stores are veritable “homes for Hermès objects”,

offering customers a unique experience, complementary to its website

hermes.com. This offer is backed by innovative services aimed at

welcoming and serving customers in the best possible manner at all

times. The House also hosts special occasions, revolving around events

in the world, and dynamic and animated set designs. Its unique

communication ensures that it stands out, while nurturing the link with its

customers.

Hermès, present in 45 countries, has an omnichannel network that is

geographically balanced, with measured development and a constant

search for prime locations.

AN ENTREPRENEURIAL SPIRIT

AND INDEPENDENCE

The entrepreneurial spirit has been at the heart of Hermès since its

creation. It is illustrated by its abundant creativity, a capacity for constant

innovation, new métiers, new production workshops and store openings.

This strategy offers store managers freedom of purchase, to meet the

specific needs of their customers. Two podiums are organised every year

to present the fall-winter and spring-summer collections. These bring

together all store and country managers, managers of the different

métiers, as well as designers, to present all collections to the sales

teams, who are thus responsible for compiling their own collections and

making their store unique, with a special mix of products. The

presentation of the collections adapted successfully to the health

constraints, turning to digital presentations of the collections. This

freedom means that in each country the Group’s customers are

presented with a diversified and unique mix of products resulting from

this flurry of creativity, blending emblematic products and the House’s

new references, chosen, to best meet local expectations and dedicated

to the elegance of its customers.

In order to continue this strategy, Hermès asserts its independence,

underpinned by a strong family-based shareholding structure, committed

to retaining most of its production in France and preserving its culture.

This independence, and the House’s financial strict management, allow it

to accelerate operational investments, both in production capacities and

network and cross-functional projects, and to preserve its long-term

strategy.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL16

1

PRESENTATION OF THE GROUP AND ITS RESULTS

STRATEGY

RESPONSIBLE GROWTH AND HUMANIST VALUES

The Group is stepping up its efforts in terms of social, societal and

environmental performance. The “All artisans of sustainable

development” strategic framework serves as a roadmap for all

Management Committees and makes it possible to systematise and

scale up actions and better measure their effects.

Hermès’ highly integrated craftsmanship model promotes the creation of

skilled jobs in France and social inclusion. Hermès is convinced that the

diversity of talents is a source of wealth, creativity and innovation. These

women and men who guarantee the quality of the objects, constitute a

heritage for the House. To affirm its commitment to education, the House

is developing its training schools for its major craftsmanship métiers.

The profit-sharing and incentive agreements, as well as the granting of

free shares, enable all employees in France to share in the Group’s

success.

As a company that respects the nature that inspires it, Hermès ensures

the preservation of its resources and its impact on natural environments

and local ecosystems, with a low carbon-emission artisanal production

model. The Group’s environmental policy is based on major commitments

related to the reduction of greenhouse gas emissions and their offset,

the use of renewable energies, the reduction of industrial water

consumption, biodiversity and defossilisation of industrial sites.

In 2021, the House notably strengthened its commitments against

climate change with new targets for a climate trajectory below 1.5°C,

validated by the Science Based Targets initiative (SBTi). The House is

continuing its concrete actions to minimise its impact on biodiversity, in

particular by conducting an exhaustive inventory of its impacts using the

GBS method, in partnership with the WWF and CDC Biodiversité, with the

aim of initiating action plans on the significant impacts identified.

Hermès places responsibility and sustainability in all its actions and

creations, such as real estate, which uses a “sustainable real estate”

approach, or IT, with the “responsible digital” approach.

Through its engagement with local authorities and communities where its

production sites are located, Hermès contributes to revitalising regions,

and provides working conditions that offer proximity and stable

employment. Thanks to the "Fondation d’entreprise Hermès", the

Company is expanding its philanthropic actions through artistic creation,

education and transmission, solidarity and the preservation of

biodiversity. The Group is an economic player that is committed to its

ecosystem and its stakeholders. Hermès is committed to support its

suppliers in meeting requirements in terms of traceability, certification,

carbon trajectory, reduction in water consumption and the use of

plastics. These supply chain briefs were published on the House’s

website.

Hermès, a family business, has been able to adapt to changes while

favouring a long-term approach. The Group, on the strength of its

craftsmanship savoir-faire, its exclusive distribution network and its

creative heritage, will continue its sustainable and responsible

development.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 17

PRESENTATION OF THE GROUP AND ITS RESULTS

SIMPLIFIED ORGANISATION CHART AND GROUP LOCATIONS

1

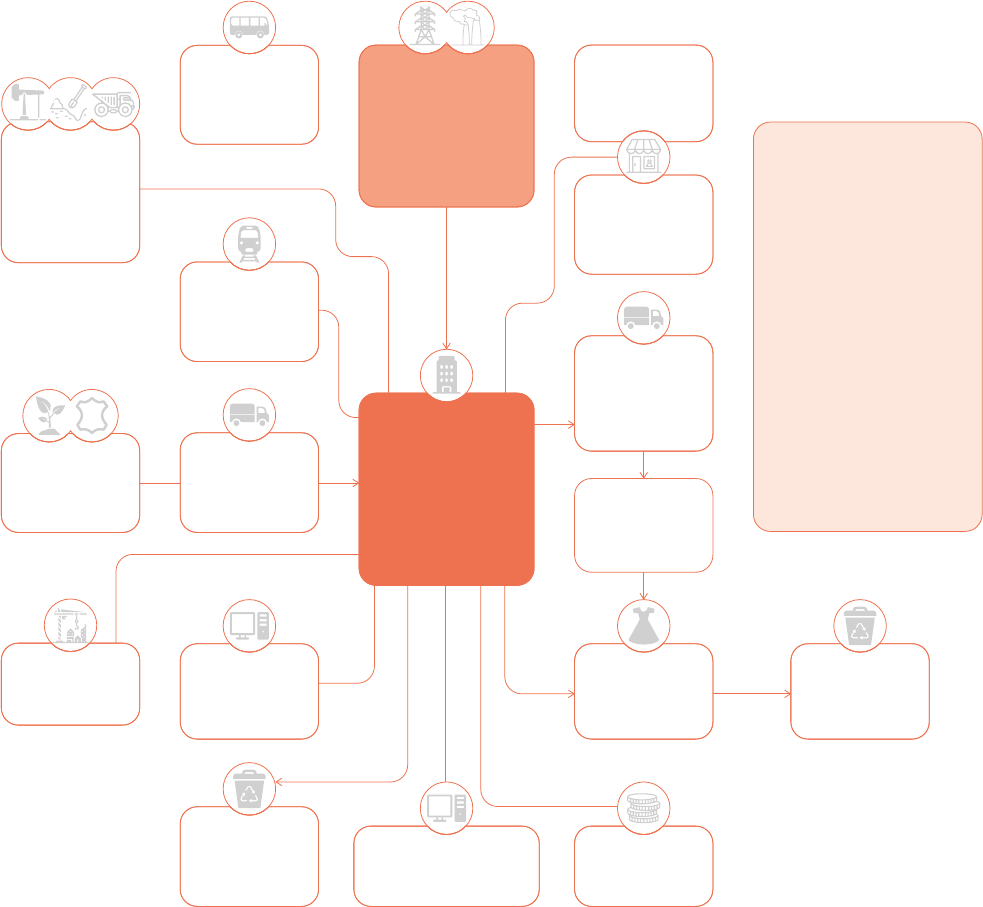

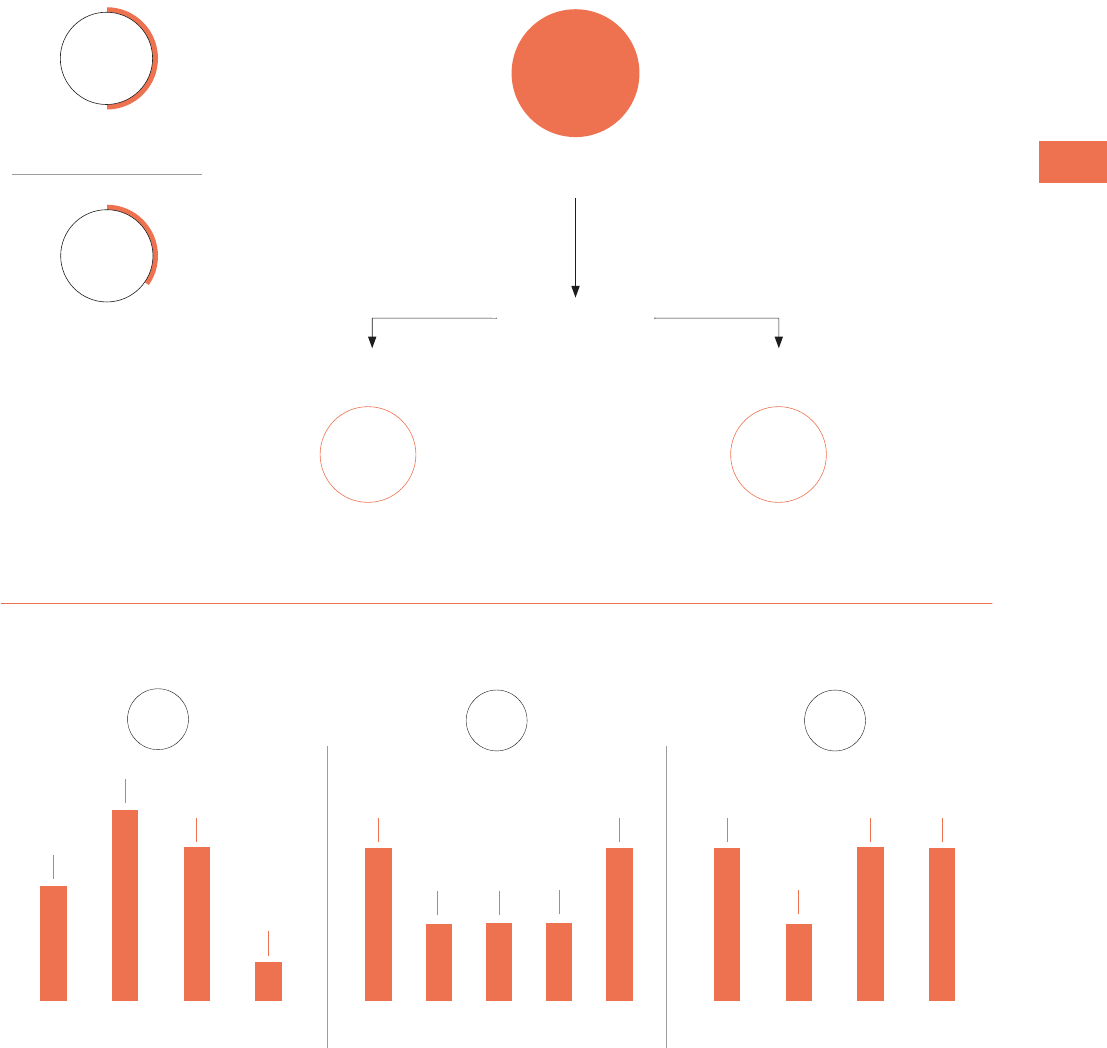

1.4

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

1.4.1

SUMMARY DESCRIPTION OF THE GROUP AS AT 31DECEMBER 2021

HERMÈS INTERNATIONAL

SUBSIDIARIES

HERMÈS

BRAND

OTHER

PRODUCTS

AND BRANDS

RETAIL

Germany

Argentina

Australia

Belgium,

Netherlands

Brazil

Canada

China,

Hong Kong,

Taïwan,

Macau

South Korea

Denmark

•

•

•

•

•

•

•

•

•

Spain

USA

France

Greece

Guam

India

Italy

Japan

Malaysia

Mexico

Norway

Poland

Portugal

Principality

of Monaco

Czech Republic

United Kingdom

Russia

Singapore

Sweden

Switzerland

Thailand

Turkey

MÉTIERS

WHOLESALE PRODUCTION AND DISTRIBUTION

OTHER PRODUCTS

WHOLESALE PRODUCTION AND DISTRIBUTION

BESPOKE DESIGN

OTHER BRANDS

RETAIL AND WHOLESALE PRODUCTION AND DISTRIBUTION

Leather goods and

equestrianism

Women’s

Ready-to-wear

Men’s Ready-to-wear Belts

Hats

Men’s silk

Gloves

Jewellery

Shoes

Furniture and

Art of Living

Women’s silk

Tableware

Beauty Watches Petit h

Perfume

Hermès

Horizons

Internet of Things

(IoT)

Tanneries and

Precious Leathers

Metal parts

(J3L)

Crystal Saint-Louis

Textiles and furnishing fabrics

Bootmaker John Lobb

Silversmith Puiforcat

The main consolidated companies as at 31December 2021 (distribution subsidiaries and holding companies of the divisions) are listed in Note16 of

the consolidated financial statements.

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL18

1

PRESENTATION OF THE GROUP AND ITS RESULTS

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

1.4.2

PRODUCTION SITES

The Hermès Group operates 66 production sites, including 52 in France. The Group also operates production sites in Switzerland, the United States,

Australia, Italy, Portugal and the United Kingdom.

Métiers

Leather Hermès Sellier (Paris Faubourg Saint-Honoré, Pantin-Pyramide, Pantin-CIA, Pierre-Bénite)

Les Maroquineries des Alpes (Aix-les-Bains, Belley, Fitilieu, Les Abrets)

Maroquinerie de Saint-Antoine (Paris)

Maroquinerie des Ardennes (Bogny-sur-Meuse, Charleville-Mézières)

Manufactures d’Auvergne (Sayat, Riom)

Manufacture de Franche-Comté (Seloncourt, Héricourt, Allenjoie)

Maroquinerie du Sud-Ouest (Nontron, Saint-Junien, Montbron)

Maroquinerie de Normandie (Val-de-Reuil, Louviers)

Maroquinerie de Guyenne (Saint-Vincent-de-Paul)

Maroquinerie de Montereau (Montereau)

Tanneries and Precious

Leathers

Tannerie de Montereau (Montereau)

Tannerie de Vivoin (Vivoin)

Tannerie d’Annonay (Annonay)

Mégisserie Jullien (Chabris)

Conceria di Cuneo (Cuneo/Italy)

Tanneries du Puy (Le Puy-en-Velay)

United States division

Australia division

Comptoir Nouveau de la Parfumerie (CNP) (Le Vaudreuil)

Métaphores (Bourgoin-Jallieu)

Société d’Impression sur Étoffes du Grand-Lemps (SIEGL) (Le Grand-Lemps)

AteliersAS (Pierre-Bénite)

Holding Textile Hermès (HTH) (Pierre-Bénite, Bourgoin-Jallieu)

Établissements Marcel Gandit (Gandit) (Bourgoin-Jallieu)

Ateliers de Tissage de Bussières et de Challes (ATBC) (Bucol, Le Crin) (Bussières, Challes)

Société Novatrice de Confection (SNC) (Nontron, Bourgoin-Jallieu)

Ateliers d’Ennoblissement d’Irigny (AEI) (Irigny)

Compagnie des Cristalleries de Saint-Louis (Saint-Louis-lès-Bitche)

Puiforcat (Pantin-CIA)

Compagnie des Arts de la Table et de l’Émail (CATE) (Nontron)

Beyrand (Saint-Just-le-Martel)

La Montre Hermès (LMH) (Bienne/Switzerland)

Les Ateliers Hermès Horloger (Noirmont/Switzerland)

Lasco (Champigny-sur-Marne)

Juléa (Champigny-sur-Marne)

Scap (Roye)

Goulard (Châtillon-le-Duc)

Polissage Brun (Bonnétage)

J3LP – Fabrico de produtos metálicos (Fundão/Portugal)

John Lobb (Paris Mogador, Northampton/United Kingdom)

Atelier HCI (Milan/Italy)

Hermès Sellier (Bobigny, Saint-Priest)

Perfume and Beauty

Textiles

Crystal Saint-Louis

Silversmith Puiforcat

Porcelain and Enamel

Watches

Metal parts (J3L)

Bootmaker / Shoes

Logistics

Company (production sites)

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 19

PRESENTATION OF THE GROUP AND ITS RESULTS

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

1

Roye

Bogny-sur-Meuse

Charleville-Mézières

Saint-Louis-lès-Bitche

Val-de-Reuil

Louviers

Le Vaudreuil

Bobigny

Paris

Pantin

Champigny-sur-Marne

Vivoin

Challes

Montereau

Chabris

Montbron

Saint-Junien

Saint-Just-

le-Martel

Nontron

Saint-Vincent-de-Paul

Annonay

Le-Puy-en-Velay

Sayat

Riom

Bussières

Irigny

Saint-Priest

Pierre-Bénite

Belley

Fitilieu

Les Abrets

Aix-les-Bains

Le Grand-Lemps

Bourgoin-Jallieu

Châtillon-le-Duc

Seloncourt

Héricourt

Allenjoie

Bonnétage

Leather goods workshop /

Saddlery / Glove-making

Tanneries / Tawery

Perfume and Beauty

Textiles

Metal parts (J3L)

Crystal Saint-Louis

Silversmith Puiforcat

Porcelain and Enamel

Bootmaker John Lobb

Logistics

◆

Baden-Baden

◆

Berlin KaDeWe

◆

Berlin Kudamm

◆

Cologne

◆

Düsseldorf

◆

Frankfurt

◆

Hamburg

◆

Kampen

◆

Munich

◆

Nuremberg

◆

Stuttgart

◆

Antwerp

◆

Brussels

◆

Knokke-le-Zoute

◆

Barcelona Paseo de Gracia

◆

Madrid Canalejas

◆

Madrid Ortega y Gasset

◆

Marbella

◆

Aix-en-Provence

◆

Biarritz

◆

Bordeaux

◆

Cannes

◆

Deauville

◆

Lille

◆

Lyon

◆

Marseille

◆

Paris Faubourg Saint-Honoré

◆

Paris George V

◆

Paris Sèvres

◆

Saint-Tropez

◆

Strasbourg

◆

London Bond Street

◆

London Harrods

◆

London Royal Exchange

◆

London Selfridges

◆

London Sloane Street

◆

Manchester

◆

Bologna

◆

Capri

◆

Florence

◆

Milan

◆

Naples

◆

Padua

◆

Palermo

◆

Porto Cervo

◆

Rome

◆

Turin

◆

Venice

◆

Amsterdam De Bijenkorf

◆

Amsterdam P.C. Hooftstraat

◆

Moscow Gum

◆

Moscow Stoleshnikov

◆

Moscow Vremena Goda

◆

Basel

◆

Crans

◆

Geneva

◆

Gstaad

◆

Lausanne

◆

Lugano

◆

St Moritz

◆

Zurich

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL20

1

PRESENTATION OF THE GROUP AND ITS RESULTS

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

1.4.3

DISTRIBUTION NETWORK

Hermès objects are available worldwide through a network of 303 exclusive stores. Hermès watches, perfumes and tableware are also sold through

networks of specialised stores. The branches are located in the following geographical areas: 73 in Europe (including 13 in France), 47 in the Americas

(including 31 in the United States), 95 in Asia (including 29 in Japan), and 6 in Oceania.

Europe

Germany: 14

11 branches:

3 concessionaires

Austria: 2

2 concessionaires

Belgium: 3

3 branches:

Denmark: 2

1 branch:

◆

Copenhagen

1 concessionaire

Spain: 4

4 branches:

France: 29

13 branches:

16 concessionaires

United Kingdom: 8

6 branches:

2 concessionaires

Greece: 1

1 branch:

◆

Athens

Ireland: 1

1 branch:

◆

Dublin

Italy: 14

11 branches:

3 concessionaires

Luxembourg: 1

1 concessionaire

Norway: 1

1 branch:

◆

Oslo

Netherlands: 3

2 branches:

1 concessionaire

Poland: 1

1 branch:

◆

Warsaw

Portugal: 1

1 branch:

◆

Lisbon

Principality of Monaco: 1

1 branch:

◆

Monte Carlo

Czech Republic: 1

1 branch:

◆

Prague

Russia: 3

3 branches:

Sweden: 1

1 branch:

◆

Stockholm

Switzerland: 10

8 branches:

2 concessionaires

◆

Istanbul Emaar

◆

Istanbul Istinye Park

◆

Istanbul Nisantasi

◆

Rio de Janeiro

◆

Sao Paulo Cidade Jardim

◆

Sao Paulo Iguatemi

◆

Calgary

◆

Montreal

◆

Toronto

◆

Vancouver

◆

Beijing China World

◆

Beijing Peninsula

◆

Beijing SKP

◆

Changsha

◆

Chengdu

◆

Chongqing

◆

Dalian

◆

Guangzhou

◆

Hangzhou Hubin

◆

Hangzhou Tower

◆

Harbin

◆

Kunming

◆

Atlanta

◆

American Dream

◆

Aventura

◆

Beverly Hills

◆

Boston

◆

Chicago

◆

Costa Mesa South Coast Plaza

◆

Dallas

◆

Denver

◆

Greenwich

◆

Hawaii Ala Moana

◆

Hawaii Waikiki

◆

Houston

◆

Las Vegas Bellagio

◆

Las Vegas Crystals

◆

Las Vegas Wynn

◆

Miami

◆

New York Madison

◆

New York Meatpacking

◆

New York Men on Madison

◆

New York Wall Street

◆

Nanjing

◆

Ningbo

◆

Qingdao

◆

Shanghai IFC

◆

Shanghai Maison

◆

Shanghai Plaza 66

◆

Shenyang

◆

Shenzhen Bay Mixc

◆

Shenzhen Mixc

◆

Suzhou

◆

Wuhan

◆

Xi’An

◆

Xiamen

◆

Orlando

◆

Palm Beach

◆

Palo Alto

◆

Philadelphia King of Prussia

◆

San Diego

◆

San Francisco

◆

Seattle

◆

Short Hills

◆

Troy

◆

Washington

◆

Cancún

◆

Guadalajara

◆

Mexico Artz

◆

Mexico Masaryk

◆

Mexico Moliere

◆

Mexico Santa Fe

◆

Monterrey

◆

Busan

◆

Daegu

◆

Seoul Dosan Park

◆

Seoul Galleria

◆

Seoul Hyundai Apkujung

◆

Seoul Hyundai Coex

◆

Seoul Lotte World Tower

◆

Seoul Shilla

◆

Seoul Shinsegae Gangnam

◆

Seoul Shinsegae Main

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 21

PRESENTATION OF THE GROUP AND ITS RESULTS

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

1

Turkey: 4

3 branches:

1 concessionaire

Americas

Argentina: 1

1 branch:

◆

Buenos Aires

Brazil: 3

3 branches:

Canada: 5

4 branches:

1 concessionaire

Caribbean: 1

1 branch:

◆

Saint-Barthélemy

Asia

Mainland China: 28

25 branches:

Chile: 1

1 concessionaire

United States: 38

31 branches:

3 concessionaires

7 concessionaires

Mexico: 7

7 branches:

Panama: 1

1 concessionaire

South Korea: 18

10 branches:

8 concessionaires

◆

Hong Kong Elements

◆

Hong Kong Harbour City

◆

Hong Kong International Airport

◆

Hong Kong Landmark Prince’s

◆

Hong Kong Lee Gardens

◆

Hong Kong Pacific Place

◆

Hong Kong Sogo

◆

Mumbai

◆

New Delhi

◆

Chiba Sogo

◆

Fukuoka Hakata Hankyu

◆

Fukuoka Iwataya

◆

Hiroshima Sogo

◆

Kobe Daimaru

◆

Kyoto Takashimaya

◆

Nagoya JR Takashimaya

◆

Nagoya Matsuzakaya

◆

Nagoya Mitsukoshi

◆

Okayama Takashimaya

◆

Osaka Hilton

◆

Osaka Shinsaibashi Daimaru

◆

Osaka Takashimaya

◆

Osaka Umeda Hankyu

◆

Brisbane

◆

Gold Coast Pacific Fair

◆

Sapporo Daimaru

◆

Sendai Fujisaki

◆

Tokyo Ginza

◆

Tokyo Ikebukuro Seibu

◆

Tokyo Marunouchi

◆

Tokyo Nihombashi Mitsukoshi

◆

Tokyo Nihombashi Takashimaya

◆

Tokyo Omotesando

◆

Tokyo Shibuya Tokyu

◆

Tokyo Shinjuku Isetan

◆

Tokyo Shinjuku Takashimaya

◆

Tokyo Tamagawa Takashimaya

◆

Urawa Isetan

◆

Yokohama Sogo

◆

Yokohama Takashimaya

◆

Macao Four Seasons

◆

Macau Galaxy

◆

Macao Wynn

◆

Macao Wynn Palace

◆

Kuala Lumpur Pavilion

◆

Kuala Lumpur The Gardens

◆

Melbourne Chadstone

◆

Melbourne Collins Street

◆

Sydney

◆

Singapore Changi Airport T1

◆

Singapore Changi Airport T2

◆

Singapore Changi Airport T3

◆

Singapore Liat Tower

◆

Singapore Marina Bay Sands

◆

Singapore Takashimaya

◆

Kaohsiung

◆

Taichung

◆

Taiwan

◆

Taipei Bellavita

◆

Taipei Regent

◆

Taipei Sogo Fuxing

◆

Bangkok Central Embassy

◆

Bangkok Icon Siam

◆

Bangkok Siam Paragon

◆

Phuket Floresta

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL22

1

PRESENTATION OF THE GROUP AND ITS RESULTS

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

Hong Kong: 7

7 branches:

India: 2

2 branches:

Indonesia: 2

2 concessionaires

Japan: 36

29 branches:

Middle East

Bahrain: 1

1 concessionaire

United Arab Emirates: 5

5 concessionaires

Oceania

Australia: 6

5 branches:

7 concessionaires

Kazakhstan: 1

1 concessionaire

Macao: 4

4 branches:

Malaysia: 3

2 branches:

1 concessionaire

Kuwait: 1

1 concessionaire

Lebanon: 1

1 concessionaire

1 concessionaire

Philippines: 1

1 concessionaire

Singapore: 6

6 branches:

Taiwan: 9

6 branches:

3 concessionaires

Thailand: 5

4 branches:

1 concessionaire

Vietnam: 2

2 concessionaires

Qatar: 2

2 concessionaires

Guam: 1

1 branch:

◆

Guam

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 23

PRESENTATION OF THE GROUP AND ITS RESULTS

SIMPLIFIED ORGANIZATION CHART AND GROUP LOCATIONS

1

1.4.4

REAL ESTATE

The surface areas set out below correspond to the gross floor space,

measured on plans by an architect, for all of the Group’s buildings in and

around Paris.

In Paris, the Group now occupies office space of approximately

31,400m

2

mainly near its historical registered office of 24, rue du

Faubourg Saint-Honoré and 19-21, rue Boissy d’Anglas, which it owns.

Staff work in office premises in rue de la Ville-l’Évêque, rue d’Anjou and

rue de Penthièvre in Paris 8

th

arrondissement, leased from third parties

under commercial leases. The building on rue de Penthièvre underwent

major interior work to accommodate the Hermès Perfume and Beauty

and digital teams in April2021.

In Pantin, Hermès occupies 84,500m

2

of manufacturing premises and

office space, most of which is owned by the Group, including the Espace

Jean-Louis Dumas, which opened in 2015, and the Cité des Métiers,

which won the Prix de l’Équerre d’Argent 2014. The Group leases an

office building located in Pré-Saint-Gervais to provide a surface of

6,200 m . In 2020, the Group also leased a building located near the

Espace Jean-Louis Dumas, for an additional surface area of 4,800m ,

which underwent major redevelopment work to accommodate the

activities of petit h and Hermès Horizons from the end of 2021.

In Bobigny, the Group owns its logistics site, with a total surface area of

approximately 32,100m2.

The Group is the owner of 61 of the 66 production sites that it operates

(see § 1.4.2).

Hermès products are sold worldwide through 303 exclusive stores

(see § 1.4.3). A total of 221 stores are operated as branches., most of

which have commercial leases intended primarily to ensure the continuity

of operations over time.

However, the Group also owns the buildings that house certain stores,

including those in Paris, Ginza in Tokyo, Dosan Park in Seoul, Beverly

Hills, Sydney and Geneva. In addition, the Group owns a commercial

building and offices in London.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL24

1

PRESENTATION OF THE GROUP AND ITS RESULTS

KEY FINANCIAL FIGURES

AFR

1.5

KEY FINANCIAL FIGURES

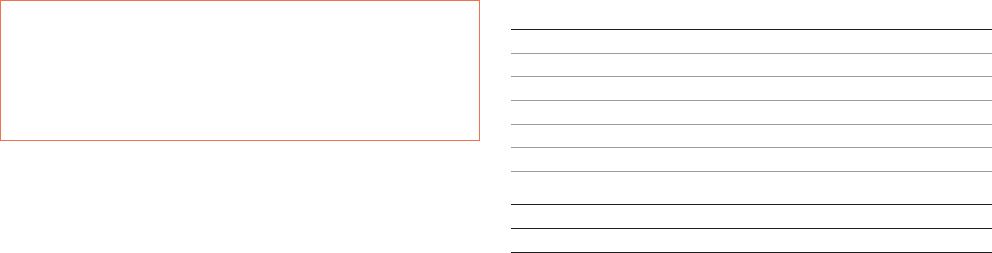

1.5.1

REVENUE BY MÉTIER FOR 2021

(2020)

Silk and Textiles

7% (7%)

Ready-to-wear

and Accessories

25% (22%)

Other Hermès

sectors

11% (10%)

Perfume

and Beauty

4% (4%)

Watches

4% (3%)

Other products

3% (4%)

Leather Goods

& Saddlery

46% (50%)

1.5.2

REVENUE BY GEOGRAPHICAL AREA

FOR 2021 (2020)

Asia-Pacific

(excl. Japan)

47% (46%)

Americas

16% (15%)

Other

2% (1%)

France

9% (10%)

Europe

(excl. France)

15% (15%)

Japan

11% (13%)

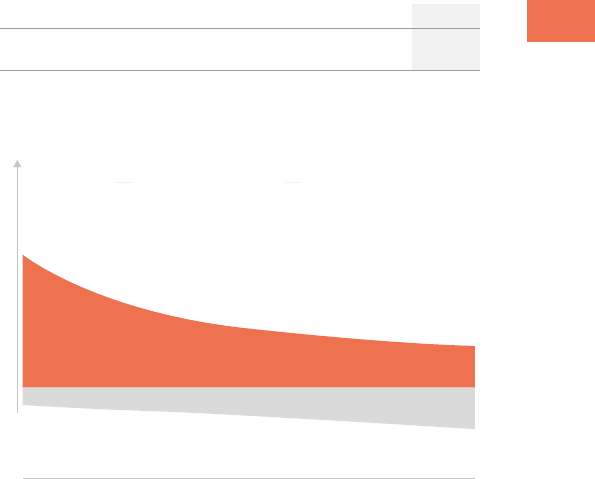

1.5.3

KEY CONSOLIDATED DATA

In millions of euros

2021 2020 2019

2018

Restated * 2017

Revenue 8,982 6,389 6,883 5,966 5,549

Growth at current exchange rates vs. n-1 41% (7)% 15% 8% 7%

Growth at constant exchange rates vs. n-1

1

42% (6)% 12% 10% 9%

Recurring operating income

2

3,530 1,981 2,339 2,075 1,922

in % of revenue 39% 31% 34% 35% 35%

Operating income 3,530 2,073 2,339 2,128 1,922

in% of revenue 39% 32% 34% 36% 35%

Net income attributable to owners of the parent 2,445 1,385 1,528 1,405 1,221

in % of revenue 27% 22% 22% 24% 22%

Operating cash flows 3,060 1,993 2,063 1,863 1,580

Operating investments 532 448 478 312 265

Adjusted free cash flow

3

2,661 995 1,406 1,447 1,340

Equity attributable to owners of the parent 9,400 7,380 6,568 5,470 5,039

Net cash position

4

6,695 4,717 4,372 3,465 2,912

Restated net cash position

5

7,070 4,904 4,562 3,615 3,050

Headcount (number of people) 17,595 16,600 15,417 14,284 13,483

* Including the impact of IFRS16 on leases. In accordance with IAS8, Hermès has applied the new standard on a full retrospective basis, and has restated the financial*

statements for the period ended 31December 2018.

(1) Growth at constant exchange rates is calculated by applying, for each currency, the average exchange rates of the previous period to the revenue for the period.

(2) Recurring operating income is one of the main performance indicators monitored by Group management. It corresponds to operating income excluding non-recurring

items having a significant impact that may affect understanding of the Group’s economic performance.

(3) Adjusted free cash flow is the sum of cash flows related to operating activities, less operating investments and the repayment of lease liabilities recognised in

accordance with IFRS16 (aggregates in the consolidated statement of cash flows).

(4) Net cash position includes cash and cash equivalents presented under balance sheet assets, less bank overdrafts which appear under short-term borrowings and

financial liabilities on the liabilities side. Net cash position does not include lease liabilities recognised in accordance with IFRS16.

(5) Restated net cash corresponds to net cash plus cash investments that do not meet the IFRS criteria for cash equivalents due in particular to their original maturity of

more than three months, less borrowings and financial liabilities.

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 25

PRESENTATION OF THE GROUP AND ITS RESULTS

KEY FINANCIAL FIGURES

1

1.5.3.1

CHANGE IN CONSOLIDATED

REVENUE

In millions of euros

2017 202020192018 2021

5,549

5,966

6,883

6,389

8,982

1.5.3.2

CHANGE IN RECURRING OPERATING

INCOME

In millions of euros

2021

1,922

2,075

2,339

1,981

2017 202020192018

restated*

3,530

1.5.3.3

CHANGE IN OPERATING INVESTMENTS

In millions of euros

2017 202020192018 2021

265

312

478

448

532

1.5.3.4

CHANGE IN THE NUMBER OF HERMÈS

EXCLUSIVE STORES

92

212

91

219

88

223

82

221

2017 202020192018 2021

304

310

311

85

221

306

303

Concessionnaires

Branches

1.5.3.5

CHANGE IN NET INCOME ATTRIBUTABLE

TO OWNERS OF THE PARENT

In millions of euros

2017 202020192018

restated*

2021

1,221

1,405

1,528

1,385

2,445

1.5.3.6

CHANGE IN ADJUSTED FREE CASH FLOW

In millions of euros

2017 202020192018

restated*

2021

1,340

1,447

1,406

995

2,661

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL26

1

PRESENTATION OF THE GROUP AND ITS RESULTS

REVENUE AND ACTIVITY BY MÉTIER

AFR

1.6

REVENUE AND ACTIVITY BY MÉTIER

1.6.1

LEATHER GOODS & SADDLERY

Leather Goods & Saddlery, Hermès’ original métier, encompasses bags

for men and women, clutches, briefcases, luggage, small leather goods,

diaries and writing objects, saddles, bridles and a full range of

equestrian products and clothing.

The Leather Goods & Saddlery métier represents 46% of consolidated

sales. In 2021, it generated €4,091million in revenue.

Hermès saddlery and leather goods articles are born of an alchemy of

authentic materials, selected according to rigorous standards, and the

skilled hands of the saddler-leather workers, who apply traditional

savoir-faire passed down from generation to generation. The care taken

by the craftspeople each day patiently crafting and fashioning the raw

leather gives these unique objects a distinctive additional measure of

personality.

Today, they are made by over 4,300 saddler-leather craftspeople in 19

production units and workshops spread over Paris, Pantin and six

regions across France. To meet sustained high demand, Hermès

opened two new leather goods workshops in 2021, one in Gironde and

the other in Seine-et-Marne. Two other leather goods workshops are

under construction: one in the Eure, with opening scheduled for the end

of 2022, and the other in the Ardennes for 2023. The construction of

the new glove and leather goods building in Saint-Junien (Haute-Vienne),

which will be completed in 2023, will double the number of craftspeople

on this site. Hermès is also preparing to start work on its new production

unit in Riom (Puy-de-Dôme), which is scheduled to open in 2024. These

establishments are set up in close collaboration with the various local

stakeholders and regional administrative and economic development

bodies. In this way, Hermès reaffirms its commitment to regions with a

strong manufacturing savoir-faire, and its will to provide high-quality

jobs.

The House is also continuing to perfect the skills and savoir-faire of its

craftspeople through a range of training and professional qualification

programmes. These programmes are delivered within the École Hermès

des Savoir-Faire and through a range of partnerships with training

structures in the regions concerned.

1.6.1.1

WOMEN’S BAGS

A new style of clasps inspired by equestrian silversmithing has been

introduced in the collections of women’s bags. On the Hermès Della

Cavalleria bag, the clasp is in the shape of a boldly assertive bridle bit,

following the smooth curves of the leather perfectly, revealing an

astonishing construction and highlighting the work in the contours. In the

same vein, a bit straight from the discipline of dressage gives its

structure to a new small bag with straight lines, called the Mors de

Bride.

The Hermès Perspective Cavalière bag is a new leather shoulder bag

with a nomadic touch, available in two sizes. Its clean lines and

construction are reminiscent of the curves of a saddle, a lineage

underlined by the saddler’s rivet that serves as a closure. The collection

of everyday bags welcomes the H en Biais tote bag, which reinterprets

an emblematic design from the 1970s in an original jacquard canvas or

in a raised embroidery tufted canvas.

The Birkin continues to reinvent itself and its uses. As an ode to its

original function, the Birkin Fray Fray 35 reinterprets the large tote bag

in a light and cheerful canvas version, with its edges frayed by hand to

create coloured fringes. As for the Birkin 3 in 1, it offers a play on

deconstruction and reconstruction around its emblematic flap, allowing

several uses as a tote bag to be carried with or without its clutch bag.

The reinterpretation of the great classics is expressed through

exceptional versions, designed in an “Arts & Crafts” spirit. Like the Kelly

Padded whose embossed leather work evokes the seats of vintage cars

and illustrates the savoir-faire of the upholsterer. The Kelly and Birkin

25 In and Out bags inaugurate a new technique of detailed printing on

leather, which reveals playful designs. The Picnic story, which celebrates

the meeting of savoir-faire in basketry and leather goods, continues with

the Birkin 25 Picnic. The Birkin 35 Faubourg Tropical calls upon the

exceptional skills of Indian embroiderers to cover the bag entirely with

lush vegetation, embroidered using the point de Lunéville technique and

requiring 53 colours of thread. Two other odysseys continue, that of the

Birkin Faubourg, proposed this year in an “in the snow” version, and

that of the Birkin Shadow, an optical illusion made from embossed

leather on the size 25. The “Studio 24” evening look transposes

the

Change

2021

Revenue in

millions of euros

2021

mix in %

2020

Revenue in

millions of euros

2020

mix in %

at current

exchange

rates

at constant

exchange

rates

Leather Goods & Saddlery 4,091 46% 3,209 50% 27% 29%

Ready-to-wear and Accessories 2,219 25% 1,409 22% 58% 59%

Silk and Textiles 669 7% 452 7% 48% 49%

Other Hermès sectors 1,001 11% 643 10% 56% 57%

Perfume and Beauty 385 4% 263 4% 46% 47%

Watches 337 4% 196 3% 72% 73%

Other products 279 3% 218 4% 28% 29%

CONSOLIDATED REVENUE 8,982 100% 6,389 100% 41% 42%

2021 UNIVERSAL REGISTRATION DOCUMENT HERMÈS INTERNATIONAL 27

PRESENTATION OF THE GROUP AND ITS RESULTS

REVENUE AND ACTIVITY BY MÉTIER

1

disco spirit of the 1970s to the Constance and Mosaïque au 24 bags,

whose clasps are faceted with a polished-mirror finish.

Lastly, combinations of textiles and leathers are in the spotlight and

bring a light touch to certain models. This is the case of the 24-24 in its

size 35 or the Picotin Pocket, which acquires an “adventurous”

character with its exterior pockets. A new canvas called Quadrille, in a

three-colour fabric made of 100% cotton, makes its appearance on the

Victoria tote bag, the Herbag Zip and the Kelly Sellier

.

1.6.1.2

MEN’S BAGS

The men’s collections have multiplied the offering in response to

contemporary uses, and revisit the identity codes of the great classics.

The emblematic Sac à Dépêches features a new 29 cm messenger

format that can be worn in different ways, including as a clutch bag,

thanks to its removable shoulder strap.

The Hermès Open 24 bag is a new sports bag made entirely of leather,

whose side handles make it easy to grab and draw an H in contrasting

materials or colours. The line also includes two models of small leather

goods, a wallet and a card holder, whose signature is found in the folds

and juxtaposition of leathers.

Among the large formats ready for travel, the Galop tote bag, created in

1992, has been revived in a tweed wool tartan version, combined with

leather.

A special place has been given to the emblematic Haut à Courroies 40

bag. First, with a “western” design, transposing an embroidery inspired

by the world of cowboys onto the leather. But also in a new Cargo

version in canvas and leather inspired by military clothing, with

multifunctional pockets on the front and back.

1.6.1.3

TRAVEL

The world of travel has shaped Hermès’ history throughout its

development. These roots in facilitating travel have spurred the creation

of the new rolling luggage, the RMS (Rolling Mobility Suitcase).

Bridging tradition and modernity, this luggage is inspired by both

traditional leather suitcases, with its reinforced corners, and the urban

and contemporary universe, with its skateboard wheels. Resolutely

innovative, it has taken several years of research to create its

particularly smooth wheeling experience and ease of use. It is available

in a wide choice of materials and colours, including printed canvas, and

offers the possibility of personally selecting the colours of the wheels

and handle.

1.6.1.4

ACCESSORIES AND SMALL LEATHER GOODS

The collections of small leather goods continue to be renewed in order

to respond to the multiplicity of uses, in a joyful and colourful spirit,

without forgetting to ensure timelessness.

The Béarn and Calvi lines welcome new formats. The Béarn Combiné

wallet offers all the functionality of a compact wallet in an even smaller

format, still closed by a leather tab slipped into a metal H buckle. Calvi

Duo retains its folding leather style and its original format, but adds a