ERNST R. BERNDT

Massachusetts Institute

of Technology and

National Bureau of

Economic Research

IAIN M. COCKBURN

University of British

Columbia

and

National Bureau of

Economic Research

ZVI GRILICHES

Harvard University

and

National Bureau of

Economic Research

Pharmaceutical

Innovations

and

Market

Dynamics:

Tracking

EJfects

on

Price

Indexes

for

Antidepressant

Drugs

THE CONSTRUCTION

AND PUBLICATION of measures

of

price

inflation are

important tasks carried

out

by governmental

statistical

agencies.

In

the

United

States

the

Department

of

Labor's

Bureau of

Labor Statistics

(BLS) publishes price

indexes

measured at

the

point of final

consumer

demand (the

consumer

price index, CPI)

and

at the initial transaction

We

gratefully

acknowledge

the

cooperation

of

officials

from the

U.S. Bureau

of

Labor

Statistics,

in

particular

Commissioner

Katharine

Abraham,

as

well

as Assistant

Commissioner John

M.

Galvin,

Irwin

Gerduk,

and

Douglas

Kanoza in the

Office

of

Industrial Prices

and

Dennis

Fixler,

Division of Price

and Index

Number Research.

We

have also benefited

from

the

timely

and able research assistance of Gillian Currie and

Mark Moore.

We

thank

Martin

Baily,

Stan

Finkelstein,

Richard

Frank,

Theodore Keeler,

Peter

Reiss,

Jack

Triplett,

and Cliff

Winston for

comments.

Research

support

from

the

National Science Foundation,

the

U.S.

Bureau

of

Economic

Analysis,

the

Alfred

P.

Sloan

Foundation,

and

Eli

Lilly

Inc.

is

gratefully

acknowledged,

as

is

the considerable

data

support

from

Stephen Chappell

and Robert Plefka at IMS

International

and from

Rhea

Mihalison, Phyllis

Rausch,

Ditas

Riad,

and Paul

Snyderman

at

Merck & Co.

The

opinions

and

conclusions

expressed

in

this

paper

are those of the authors and do

not

necessarily

reflect views

or

positions

of

any

of the

organizations

with

which the authors

are affiliated or

those of

any

of

the

research

sponsors.

133

134

Brookings Papers: Microeconomics 1996

point,

that

is, prices

received

by producers

from

whomever makes the

first purchase (the producer price index,

PPI). These price measurement

tasks are difficult ones, particularly because

new goods embody scien-

tific discoveries and technological

progress; inherent difficulties exist

in measuring the output

of

services that themselves

combine goods and

time, and dynamic structural

and

compositional changes occur in the

underlying markets

for

production,

distribution, and sale.

The

marketplace

for health

care contains all these features

and

pre-

sents

particularly

difficult

challenges

for

price

measurement.

Health

care expenditures represent

a

significant

portion

of

gross

domestic

prod-

uct

(GDP) and are likely

to become

increasingly important

as

the U.S.

population ages.

The

conceptual

foundations for

a health care-related

CPI are

clouded,

not

only

because

physicians typically

act as

agents

for

consumers, but

also because insurance

plans pay

for

many,

but not

all, health care products

and

services.

Thus,

for

example,

the

CPI

for

prescription pharmaceutical products

currently weights only cash pay-

ment transactions from drugstores and mail-order

outlets;

it

excludes

prescription drugs purchased by managed

care

plans, Medicaid,

or

other

third

parties on behalf

of an

individual.'

Here

we focus

attention

on the

measurement

of

a

health-care-related

PPI, which,

while

arguably simpler

than

a

CPI, nonetheless presents

enormous measurement

difficulties

and obstacles.2 A PPI

measures

changes

in

selling prices

that domestic

producers

receive

for

their out-

put.

It

is

frequently

used

in

deflating

current

dollar

expenditures

to

obtain a

measure

of real

output growth

by industry.

The

reliability

and

accuracy

of

PPIs

are therefore critical

to

understanding

the

substantial

growth

in

health

care

expenditures

during

the last

ten

years.

Growth

rates

in

PPIs

by industry

are also

used

to assess

inflationary pressures

and

pricing

behavior

in

the health care sectors or to

make international

comparisons.

While

the PPI is

an

output price

index for a

specific

industry, say, pharmaceuticals,

it

is also

an

input price

index for whole-

salers who in turn sell

to

retail

drugstore

chains, hospitals,

mail-order

1. For further discussion, see

Cleeton, Goepfrich,

and

Weisbrod

(1992), and

U. S.

General Accounting Office

(1996).

2. For a recent discussion

on

problems

involved in

interpreting

various

measures

of

wholesale prices such as the

average

wholesale

price (AWP, also

known

as "Ain't

What's Paid"), see Bill

Alpert, "Hooked on Drugs: Why Do Insurers Pay such Outra-

geous Prices for Pharmaceuticals?"

Barron's,

June

10, 1996, pp.

15-19.

Ernst

R.

Berndt,

Iain M.

Cockburn, and

Zvi

Griliches

135

firms, and

managed care

organizations.3

Because issues of

pharmaceu-

tical pricing and health care cost containment

are

currently

of

great

importance to

public policy

analysts, government

statisticians, con-

sumers'

groups, and

industry

officials,

it

is

particularly timely

to

audit

closely

the

accuracy

and

reliability

of

one of the BLS health

care-

related PPIs.

That is

our

purpose

in this

paper.

Although

we

focus on

the PPI, many of

the

issues we

address

are also

germane

to

concerns

cited

by

the

Advisory

Commission To

Study

the Consumer

Price

Index

in its

final

report, released

in

December 1996.

The market on which we focus

our

audit is

that for

antidepressant

prescription

pharmaceuticals

sold between

January 1980

and

February

1996. We have

chosen

this market

segment

and

time

period

for

several

reasons,

all

relating

to the

high likelihood

of

there

being substantial

challenges

here

in

tracking price

changes.'

First,

several

very

successful new

products

have been

introduced

in

the

antidepressant drug class, with well-known

brand names such

as

Prozac, Zoloft,

and

Paxil

having

combined annual sales of

more than

$3

billion

in

the mid-

I

990s

.5

Eight

of the

twenty-one

currently marketed

chemical

entities

(molecules)

are new branded

products

launched

since

1988. Thus,

issues concerning

the

incorporation

of

new

goods

into

price

measurement,

as well as

adjustments

for

quality change,

could be

very

important

in

this

market

class.

Second,

not

only

has new

product

entry

been

substantial,

but

within

the

last

ten

years, seven branded

antidepressants

lost

patent

protection,

and

each

has

subsequently

faced

competition

from

lower-priced

generic

entrants.

Those

buyers

who

regard

the branded

and

generic

versions of

a chemical

entity

as more

or less

perfect

substitutes

realize a

substantial

price decline after

generic

entry. Although

the

BLS

has

been

making

changes

in its

CPI

procedures

for several

years,

until

mid-1996

its PPI

methods did not

adequately

link

generic products

to their

patented

an-

tecedents and

instead

generally

treated

generics

as

entirely

new

goods;

3. In

the United

States, the vast

majority of

pharmaceutical

manufacturer

sales are

to

wholesalers, not to

hospitals,

drugstore chains,

or

managed

care

organizations.

4. For

related

studies on issues in

the economics

of

mental

health,

see

Frank

and

Manning

(1992), and

Jonsson

and

Rosenbaum

(1993).

Keith

and Berndt

(1994)

provide

an overview of

price

measurement

issues in the

pharmaceutical

industry.

5.

Ellen Joan

Pollock, "Side

Effects: Managed

Care's Focus on

Psychiatric

Drugs

Alarms

Many Doctors,"

Wall Street

Journal, December

1, 1995,

p.

Al.

136 Brookings Papers. Microeconomics 1996

thus these older PPI methods failed to record price declines realized by

some purchasers of generic drugs.

Recently the BLS

announced that the

May 1996 pharmaceutical PPIs

would incorporate linking procedures for generic drugs that treat ge-

nerics and their branded antecedents as perfect

substitutes.

The overall

implications of this significant change are not yet clear. Our analysis

of

1980-96 data

in

the antidepressant prescription drug marketplace

provides important information

on

what BLS-measured price growth

for

antidepressants

would have been

had

these

changes

been

introduced

earlier. We also assess the

sensitivity

of

measured

aggregate price

growth to alternative linking and weighting assumptions

that the

BLS

could

have employed.

Because

we

report findings

for an entire

thera-

peutic class, namely, antidepressants,

this

research extends that of Gril-

iches and Cockburn, who provided illustrative empirical evidence con-

cerning

two

systemic

anti-infective

drugs.6

A third

reason for focusing

on

antidepressant drugs

is that

they are

but one

component

in the treatment of

depression, along

with

psycho-

therapy and medical management.

To some

extent, psychotherapy

and

antidepressant drugs

are substitutes for each

other; indeed, controversy

surrounds the extent

to which

managed

care

organizations

are substi-

tuting prescription drugs

for talk

therapy.7

The research

findings

re-

ported here compose

one element of a

larger

research effort

in

which

we

are

creating

a

price

index for the

treatment of

depression

that

incor-

porates

both

drug

and talk

therapy components.

In

this

paper

we

begin

with a

background

discussion on the

nature

of the

medical

condition called

depression

and

provide

a historical

overview on the

evolving

medical

understanding

of

psychotherapeutic

drugs

used for the treatment

of

depression.

We

then outline data sources

and describe the

changing marketplace

for

antidepressant drugs

from

1980 to 1996, particularly

new

product

introductions and

postpatent

expiration entry by generic

firms. We review BLS

procedures

for track-

ing producer prices

in

general

and

antidepressant drugs

in

particular.

We

next

consider issues

from

economic

theory

and then

present

results

6. Griliches and Cockburn (1994).

7. See, for example, Carol Hymowitz

and Ellen Joan

Pollock, "Cost-Cutting

Firms

Monitor Couch Time as Therapists

Fret," Wall Street Journal, July 13, 1995, p.

Al;

and Pollock, "Managed Care's

Focus

on

Psychiatric Drugs

Alarms

Many Doctors,"

p.

Al. For empirical evidence, see Berndt,

Frank, and McGuire (forthcoming).

Ernst R. Berndt,

Iain

M.

Cockburn,

and

Zvi Griliches

137

on alternative

procedures

for measuring

price inflation,

including those

involving hedonic

price adjustment.

Finally

we discuss

implications

of

our results

and offer suggestions

for

further

research.

Depression:

Diagnosis

and Prevalence

Whether

depressive disorders

are discrete

and distinguishable

from

'subclinical" depressive

symptoms

is

a question

clinicians

and

re-

searchers

have long debated;

it still has no definitive answer.

Almost

everyone

at some

time or another

has

experienced

melancholy

or

been

depressed

as

a mood,

affect,

or emotion.

To be human is to know about

a

variety

of emotions, including

sadness,

disappointment,

and

despond-

ency.

Many such

affective

occurrences are

within the normal

range

of

human experience.

It is only

with

greater

degrees

of

severity

or

longer

durations

that

such affective

states come

to be viewed

clinically

as

symptomatic

of depression.

The American

Psychiatric

Association has

issued

and updated

clin-

ical guidelines

for diagnosing

depression.8

The current

guidelines,

known as

DSM-IV,

list nine symptoms

of

depression:

(1) a depressed

mood; (2)

diminished

interest

or

pleasure

in most

activities; (3) signif-

icant unintentional

weight

loss or weight

gain,

or a decrease

or

increase

in

appetite;

(4) insomnia

or hypersomnia

nearly every

day; (5) psycho-

motor agitation

or

retardation

nearly

every day; (6)

fatigue

or loss of

energy

nearly every day;

(7) feelings

of worthlessness

or

excessive

or

inappropriate

guilt; (8)

diminished

ability

to think or

concentrate,

or

indecisiveness;

and (9)

recurrent thoughts

of death or suicide.

To

be

diagnosed

as having

a

major depressive

episode,

a

person

must show

at

least five of

these

symptoms

(including

either

a

depressed

mood or

diminished interest

in

most

activities)

for

two or more

weeks.9 These

symptoms

must

also

represent

a

change

from the individual's

previous

functioning.

A

chronic

but milder form

of

depression

is known

as

dysthymia

and

is diagnosed

when the patient

has a

depressed

mood that

persists

for

at

8.

See

American

Psychiatric

Association

(1968, 1980,

1987, 1993).

9.

It must also

be the

case

that

an organic

factor cannot

be established

as

initiating

and maintaining

the

disturbance

or

that the disturbance

is not a normal reaction

to

the

death of

a loved one.

138

Brookings

Papers:

Microeconomnics 1996

least two years

and has at least

two other

symptoms.

'"

Both

forms of

depression are

serious. Even

moderate

levels of

depression

significantly

impair

functioning

in work

and

school settings and in

social

situations.

"

Survey

evidence suggests that

in a

given

year, 9 percent

of

the

employed labor force

experiences

a

depressive

episode

and

that 80

percent

of

these workers are below the

age

of

45.1

Depression

is

widely

believed to be

an

underdiagnosed

condition;

patients

suffering

from

depression

often

present

themselves to clinicians

as

having

other

med-

ical symptoms

such as lower

back pain,

gastrointestinal

disorders, and

headaches.

1'

Depression is a

treatable condition;

modern

treatment suc-

cess rates

approach

80 to

90

percent.

'

Episodes

of illness

come and

go,

last from

several weeks to several

months,

and are

followed

by

periods

of

relatively

normal mood and behavior.

Untreated,

the

average

depressive episode lasts about four to

six

months.

Between 50 and 85

percent

of

patients

who seek

treatment

for

depression

will have

at

least

one

subsequent

episode

of

depression

in

their

lifetimes, usually

within

two or

three

years.'5

The

lifetime

average

for

depressive episodes is

five

to

seven,

but

as many as

forty episodes

have been

reported."6

Although

the

reasons are

still

not

fully

understood,

women

are about

twice as

likely

to

suffer

from

depression

as

are men.

17

Alternative

Drug

Treatments for

Depression

Before

discussing

alternative

drug

treatments for

depression,

we

briefly

review

several

medical terms.

A

synapse

is

the

point

of

contact

between

adjacent

neurons,

where

nerve

impulses

are transmitted from

one

to the

other. Neurotransmitters are

the

chemical

"messengers"

in

10.

A

tenth

symptom

associated

with dysthymia

is

feelings of hopelessness.

11.

See, for example,

the

studies and clinical

trial

findings referenced by Nolen-

Hoeksema (1990, p. 5).

12. For further

discussion

and

references, see

Greenberg, Stiglin, and others (1993)

and

Greenberg, Kessler,

and others

(1996, p. 328).

13. See

Eisenberg (1992)

for

discussion and references

documenting

the

somatiza-

tion

phenomenon, and Katon

and

others (1992)

for a

discussion of the underdiagnosis

of

depression.

14.

Regier and others (1988).

15.

American Psychiatric

Association

(1993, p. 11).

16.

Papolos

and

Papolos (1992, p. 7).

17. For an

extended discussion,

see

Nolen-Hoeksema

(1990).

Ernst R.

Berndt, Iain M.

Cockburn, and

Zvi

Griliches

139

the brain

that transmit signals

across synapses,

setting

in

motion com-

plex

neural interactions that

shape behaviors,

feelings, and thoughts.

Although

there are many different

neurotransmitters,

the

vast majority

of them

monoamines, three

of

particular importance

are

norepineph-

rine,

serotonin, and dopamine.

Today

it

is

known

that low levels of

these

monoamines are associated

with

depression.

Moreover, after per-

forming

their messenger

activities,

these

monoamines are

eventually

destroyed by monoamine oxidase

(MAO),

a

liver

and brain

enzyme,

through

a bodily absorption

process

called

reuptake.

In

this reuptake

phase,

however, MAO also

destroys

another amine

called

tyramine, a

molecule that affects blood

pressure.

Modern

biological

theories

of

depression

apparently emerged

from

several

chance discoveries.

Clinicians testing

the

antituberculosis

drug

iproniazid in

the early 1950s

observed

that subjects

experienced

relief

from

any depression, and some

even experienced

euphoria. Several

years

later,

this

drug

was shown to

inhibit the

MAO

enzyme."

About

the same

time, clinicians

prescribing reserpine,

a

drug commonly

used

to treat

hypertension,

noted that about

15

percent

of

patients taking

this

medication

became seriously

depressed. Subsequent research demon-

strated

that

reserpine

led

to

the

depletion

of all three of

the

important

monoamine neurotransmitters.

In

1957 isoniazid was

introduced;

it

was a

more

effective

antituber-

culosis

drug

than

iproniazid

and did

not inhibit MAO.

Although

the

manufacturer had

planned

to

cease

production

of

the less

effective

iproniazid,

the

coincident publication

of

psychiatric

research

linking

MAO inhibitors to the treatment of

depression

resulted

in

an

unexpected

surge

in

demand for

it;

in

1957

alone,

unmet

needs were

so

large

that

physicians

prescribed iproniazid

for more than

400,000 depressed pa-

tients.19

Because the MAO

enzyme

also inhibited

tyramine, however,

it was

soon discovered that

iproniazid, by

inhibiting MAO,

could

in-

directly

increase the amount

of

tyramine present

in

the

body,

sometimes

with lethal

consequences.

Excess

tyramine

can cause a sudden

increase

in

blood

pressure

so severe

it

on

occasion

hemorrhages

blood

vessels

in

the

brain and causes death.

The

potential

frequency

with which

this

fatal

response

could

occur

for

patients taking

MAO inhibitors was

quite

18. Baldessarini

(1990, pp.

414-18); Hyman,

Arana,

and

Rosenbaum

(1995, p. 82).

19.

Turkington-Kaplan (1994, p.

49).

140

Brookings Papers: Microeconomics

1996

large, for tyramine is present

in

common foods such as chicken

liver,

aged cheese, broad-bean pods,

soy sauce, and pickled

herring. For this

reason, MAO inhibitors (MAGIs)

were taken

off the

U.S.

market for a

time. Eventually modified MAOIs

were reintroduced,

in large part be-

cause some depressed patients

did not

respond

to

any

other medication.

Today the

MAOIs

are used

most often when other antidepressant

drugs

yield unsatisfactory results

and when electroconvulsive

treatment is

inappropriate

or

refused.20

Because of these complexities,

psychiatric

specialists currently

write about 90 percent

of

MAOI prescriptions;

general practitioners

or

internist physicians

write

only

a small

portion.2'

During the 1950s much

pharmaceutical research began

to

focus on

various mental illnesses.

Although initially analyzed by Swiss

research-

ers for

use as

an

antihistamine,

a tricyclic drug called

imipramine was

tentatively hypothesized to

be

successful

in

treating

schizophrenia. Re-

searchers soon found

that

although imipramine

was

relatively

ineffec-

tive

in

quieting agitated patients,

it

apparently

bestowed

remarkable

benefits upon

certain

depressed

individuals.22

Instead of

stimulating

the

central

nervous system (which

amphetamines do)

or

inhibiting

mono-

amine

oxidase reuptake (a

property

of the

MAGIs),

imipramine

in-

creased the brain's supply

of

norepinephrine

and

serotonin; remarkably,

about

70 percent

of

depressed

patients responded

to this

drug.

The

introduction of imipramine

(brand name Tofranil)

in

1958 was

soon

followed

by

market introductions

of numerous

related

tricyclic

com-

pounds.

These

compounds

include

amitriptyline (Elavil,

1961),

nor-

triptyline (Aventyl, 1963),

protriptyline (Vivactil, 1967),

trimipramine

(Surmontil, 1969),

and

doxepin (Sinequan, 1969).

The

tricyclic antidepressant

class of

drugs

has been

enormously

suc-

cessful

in

treating depression,

and

experience

with

these

drugs

has

been

extensive.

Today

it is known

that the various members

of

this

class

of

drugs

differ

in the

extent to

which

they

affect

the

three

monoamines.

Although

on

average

there

is

no

statistically significant

difference

in

efficacy

rates

among

the

various tricyclics,

often

patients

who

do

not

respond

to

one tricyclic

do respond

to another. About two-thirds of

people

find relief

with the first

tricylic they

are

prescribed.23

20. Baldessarini (1990,

p. 414);

American.

Psychiatric

Association (1993, p.

2).

21. [MS America (1993).

22. Baldessarini (1990,

p. 405).

23. Turkington and Kaplan

(1994, p. 91).

Ernst R. Berndt, Iain M. Cockburn, and Zvi Griliches

141

Not all patients can tolerate these drugs, however. Because they

affect several neurotransmitters other than serotonin, dopamine, and

norepinephrine, as well as receptors, the tricylic drugs are often asso-

ciated with

side effects. Although

the

side-effect

profiles

of the indi-

vidual tricyclic drugs differ slightly, common side effects include an-

ticholinergic effects (dry mouth, constipation, urinary hesitance,

blurred vision), weight gain,

increased heart

rate,

drowsiness

(which

may be a beneficial side effect initially for those depressed patients

experiencing insomnia),

increased heart

rate,

decreased blood

pressure,

dizziness

when

standing up,

and sexual

dysfunction;

side-effect

profiles

are

given

in

table 1.

The

tricyclics

also differ

in their

half-lives and

in

daily dosing frequency.

Patient

compliance

in

taking

medications

is of

course

negatively affected by

adverse side

effects

and

more

frequent

required daily dosing. A significant unattractive characteristic of the

tricyclic drugs is that overdoses are potentially lethal,

a factor

quite

important for depressed patients with suicidal tendencies.24

The

most

recent major therapeutic development

is

the 1988

launch

of

fluoxetine (brand

name

Prozac),

the

first of the

selective

serotonin

reuptake inhibitors (SSRIs); subsequent

SSRI introductions include ser-

traline (Zoloft, 1992), paroxetine (Paxil, 1993),

and

fluvoxamine

(Lu-

vox, 1994). In contrast to

the

MAOIs

and

tricyclics

that affect several

neurotransmitters, the SSRIs are selective

and

specific

in

that

they

inhibit the reuptake only

of

serotonin. Thus,

side effects associated

with the

reuptake

of

norepinephrine

or

dopamine

are reduced with the

SSRIs, and serotonin

levels are increased.

The

70

percent efficacy

rates

of the

SSRIs are

not

statistically significantly

different

from

the

MAOIs

and

tricyclics,

but adverse

interactions

with

other

drugs

occur less

frequently,

and

the

consequences

of overdoses

are

much less severe.25

With the

SSRIs, anticholinergic effects, drowsiness,

dizziness

when

standing up,

interaction

with the

cardiovascular

system,

and

weight

gain

side effects are

very

rare. Nausea is still a common side effect of

the

SSRIs, as are headaches, nervousness, anxiety,

and

various forms

24. American Psychiatric Association (1993, p. 9);

as the same

article notes,

how-

ever, "the vast majority

of

studies suggest

that all available

antidepressants decrease,

rather than increase, suicidal thoughts and indicate

no

predilection on the part of a

particular agent to

either ameliorate or

aggravate

suicidal tendencies." Also see

Potter,

Rudorfer, and Manji (1991, p. 636).

25. American Psychiatric Association (1993, pp.

7-10).

Also see

Potter, Rudorfer,

and Manji (1991).

Table

1.

Characteristics

of

Drugs

Prescribed

for

the

Treatment

of

Depression

Typical

Ha

lf-

Index

of

side

effects

Chemical

daily

dose

life

Daily

FDA

(0

=

rare,

4

=

common)

entity

(milligrams)

(hours)

frequencv

OCD

AC

DR

IA

OH

CA

GI

WTG

MAOIs

isocarboxazid

20

2

1

0

1

1

2

2

0

1

2

phenelzine

45

2

1

0

1

1

2

2

0

1

2

tranylcypromine

50

2

3

0

1

1

2

2

0

1

2

TCAs

amitriptyline

75

24

1

0

4

4

0

4

3

0

4

amoxapine

200

10

1

0

2

2

2

2

3

0

1

clomipramine

100

24

1

1

3

4

1

2

2

0

3

desipramine

150

18

1

0

1

1

1

2

2

0

1

doxepin

100

17

1

0

3

4

0

2

2

0

3

imipramine

100

22

1

0

3

3

1

4

3

1

3

maprotiline

100

43

1

0

2

4

0

0

1

0

2

nortriptyline

100

26

1

0

1

1

0

2

2

0

1

protriptyline

30

76

3.5

0

2

1

1

2

2

0

0

trimipramine

100

12

1

0

1

4

0

2

2

0

3

SSRIs,

related

drugs

fluoxetine

20

168

1

1

0

0

2

0

0

3

0

paroxetine

30

24

1

0

0

0

2

0

0

3

0

sertraline

50

24

1

0

0

0

2

0

0

3

0

fluvoxamine

100

15

1

1

1

3

3

1

0

3

0

nefazodone

300

18

2

0

3

4

1

1

0

3

0

Others

bupropion

225

14

3

0

0

0

2

0

1

1

0

trazodone

300

8

3

0

0

4

0

1

1

1

1

venlafaxine

112.5

5

3

0

2

3

2

1

1

3

0

Sources:

Depression

Guideline

Panel

(1993.

tables

7,

8,

pp.

56.

59);

for

clomipramine,

fluvoxamine,

nefazodone,

and

venlafaxine,

Physicians'

Desk

Reference

Generics

(1996.

pp.

735-39.

1383-1683,

2246-50,

3071-76).

Notes:

See

text

for

discussion

of

typical

daily

dosages

in

milligrams.

Half-life

is

average

of

elimination

half-lives

in

hours.

Daily

frequency

is

that

recommended

for

maintenance

therapy

alter

titration

has

determined

daily

dosages.

FDA

OCD

=

I

if

FDA

has

approved

obsessive-compulsive

disorder

indication.

For

side

effects,

AC

=

anticholinergic

(dry

mouth.

blurred

vision.

urinary

hesitancy,

constipation);

DR

=

drowsiness,

IA

=

insomnia-agitation;

OH

=

orthostatic

hypotension

(abnormally

low

blood

pressure):

CA

=

cardiac

arrhythmia:

GI

=

gastrointestinal

disease:

and

WTG

=

weight

gain

(more

than

6

kg).

144

Brookings

Papers:

Microeconomics

1996

of sexual dysfunction;

some

patients

encounter insomnia,

while a small

portion experience drowsiness.

In addition to their use

as

antidepressants,

two of the SSRIs-Prozac

and

Luvox, along

with a

tricyclic,

Anafranil-have received Food and

Drug Administration (FDA)

approval

for use in

treating

obsessive-

compulsive disorders (OCD).

Within

the class of

SSRIs,

Prozac has

the

longest

half-life

(see

table 1);

this has

disadvantages

for

those who

experience negative side effects

but

can be beneficial

for

those who

occasionally might forget

to

take

their medication.

Three related

drugs

have

recently

been introduced

into

the antide-

pressant

market: nefazodone

(brand

name

Serzone),

a

serotonin-related

compound

that

may

cause less sexual dysfunction;

venlafaxine

(Ef-

fexor),

a

compound

that inhibits

reuptake

of

norepinephrine

and

sero-

tonin, but not dopamine,

and thus exhibits some of the features

of both

the tricyclics and SSRIs;

and

bupropion (Wellbutrin),

a

compound

whose mechanisms

of action

are

still

not

well understood. More

gen-

erally,

researchers of the central nervous system

still do not

understand

precisely

how

the SSRIs

affect

depressive

moods and

the role of

sero-

tonin

in

this

process. Although

serotonin

levels increase within

several

days

of

taking

SSRI

(and

other

antidepressant) medications,

typically

a

change

in

depressive

moods manifests itself much

later,

after

two,

four,

or

perhaps

even

six

weeks. It

is

possible

that serotonin

causes

slight effects

in

other

neurotransmitter

systems,

which

in

turn

relieve

depression. Apparently

the serotonin neurotransmitter

system

is

very

complex.

Although

much

progress

has been

made in

developing psychothera-

peutic drugs

for

treating depression,

the

causes

and

optimal

treatments

of

depression

remain unresolved.

This has lead the American

Psy-

chiatric Association

to

issue the

following

current medical

practice

guidelines:

No one

medication

can be recommended

as

optimal

for all

patients

be-

cause

of

the substantial

heterogeneity among patients

in their

likelihood

of beneficial

response

to these medications

and

the

nature,

likelihood,

and

severity

of side

effects.

Furthermore, patients vary

in the

degree

to

which

particular side

effects and other

inconveniences of

taking

medi-

cations

(e.g.,

cost and

dietary

restrictions)

affect

their

preferences.26

26. American Psychiatric

Association

(1993, p. 7).

Ernst R. Berndt, Iain M.

Cockburn, and

Zvi

Griliches

145

Finally,

it

is

widely believed that

psychotherapy, drug

therapy, or

their

combination is

an effective

treatment

for

cases of mild to

moderate

depression. Although this consensus is based on extensive

clinical ex-

perience,

and on clinical trial data

for

drugs,

evidence

concerning

the

efficacy

of

psychotherapy based

on

controlled

experiments

is not as

extensive,

in

part

because controlled

experiments

involving

uniform

and consistent

forms

of

psychotherapy

have

proved

difficult to

design

and conduct.27 For

the more

severe forms of

depression, both

drug

treatment

and electroconvulsive treatments

appear

to

be more effica-

cious

than

psychotherapy

alone.28

The Changing

Marketplace

for

Antidepressant Drugs

Our

description

of the

changing

marketplace

for

antidepressant

drugs

is

based on the

following data sources.

Monthly price and

quantity data

for

drugstore purchases

of

antidepressant

drugs

are from

IMS

America,

a

Pennsylvania

firm that

collects

and

sells

data on the

sales and mar-

keting

of

pharmaceutical

products.

The transactions monitored

by

this

data are from wholesalers and manufacturers to

drugstores

(or

their

purchasing agents)

and are based on actual

invoices;

IMS tracks

more

than

99 percent

of

manufacturer

and wholesaler

transactions and thus

provides a near-census universe

of

drugstore

purchases.29

These in-

voices

reflect slightly

imperfectly

the

prices

manufacturers receive.

The

invoice data provide a

dollar

sales amount and

quantity

number for each

type

of

transaction;

they

include

chargebacks

(credits

to

wholesalers for

any

special price agreements

negotiated

among drug stores,

manufac-

turers,

and

wholesalers),

but rebates

(direct

payments

from

manufac-

turers to health

care providers

and

others,

such as health

maintenance

organizations

and

pharmaceutical

benefit

management

firms)

are not

always included,

nor do

the dollar

purchase

amounts on the

invoices

reflect

prompt payment

cash discounts

(usually

2

percent off).30

Further

27. See, however, the seminal

study by Elkin, Parloff, and others (1985) and

Elkin,

Shea, and others (1989).

28. See Depression Guideline Panel

(1993).

29. lMS America (1996b, p.

39-6).

30. Rebates occur in part because

health maintenance organizations and

pharmaceu-

tical benefit management companies

can affect market shares, but often these organi-

zations do not

actually take possession

of

drug products.

146

Brookings Papers. Microeconomics

1996

discussion

of the IMS

price

data is

given

in

Berndt,

Griliches,

and

Rosett,

who report that from

1986 through

1991,

the

period covered in

their

study,

the IMS data and

price

data

provided

them

by

four manu-

facturers had

very

similar

growth

rates.3'

In the

paragraphs that

follow,

we

report

sales

data,

measured

in

both

dollars and

daily dosage

units.32

Frequently

a

drug

is available in

var-

ious

strengths; considerable differences

also

occur

in

the total

daily

dosage

taken

by

individuals. To

develop

a

quantity

measure

providing

some

comparability

across diverse chemical entities and

dosage

strengths, we first take

the

midpoint

of

the

normal recommended

daily

milligram

dosage range

during

the

maintenance

phase,

as

specified

for

each chemical

entity

in

the

1996

Physicians'

Desk

Reference

and then

assess

what

integer

number

of

equal-strength

tablets at

recommended

daily

frequencies

could

feasibly

make

up

the

total

daily dosage

closest

to

this

midpoint.33

In cases of

ambiguity,

we consulted

IMS data on

volume

sales by tablet

strength. The resulting

"typical daily

dosages"

are listed

in

table

1

for each

chemical

entity.

To

express quantities

in

total number of

daily

dosages,

we divide the total

number

of

milligrams

of

active

ingredient

sold over the various

presentations

of

the

drug by

this

typical daily dosage.

The

typical daily

dosage price

is

then

com-

puted

as

sales

in

dollars divided

by

total

typical

daily dosages.

The

Overall Market

for

Antidepressant

Drugs

Growth

in

the overall market for

antidepressant

drugs

since

1980 has

been sustained and substantial.

In

1980

about 452 million

daily

dosage

units

of

antidepressant

drugs

were

sold; by

1995 this number

had

in-

creased to

about

2.44

billion,

a

factor

of more

than

five;

the

implied

average

annual

growth

rate

(AAGR)

is

11.9

percent.

Growth of

dollar

revenues

has been even

stronger,

from

a

$128

million market

in

1980

to

$3

billion in

1995,

for

an AAGR

of

23.5

percent; using

the

GDP

deflator to

convert into constant

1980

dollars,

the

1995

sales are

$1.65

billion, implying

an

AAGR of

18.6

percent.

Growth has

accelerated

31. Berndt,

Griliches, and

Rosett (1993, p. 255).

32. Because

their uses are

often for very

different purposes and

because their

vol-

umes

are

relatively small,

all

liquid

forms,

such as oral

solutions and

injections,

are

excluded.

33. The

midpoint dosage was often an infeasible

number, unless

patients broke up

tablets into

smaller units. Thus we

sought

an

integer

value.

Ernst R. Berndt,

Iain

M. Cockburn, and Zvi Griliches 147

dramatically since 1988, the year

in

which

the first SSRI

was intro-

duced.

From

1980 to

1987,

for

example,

the

AAGR in

daily dosage

quantities

was about 5.3

percent,

but

from

1987

to

1995

this

AAGR

more than tripled to 18.3 percent;

in

real dollars, these AAGRs are 9.5

percent

and

26.9 percent.

Entry and Exit

There has been much

entry

and some

exit

in

the market for

antide-

pressant drugs. Two types of entry occurred,

one

involving introduc-

tions of

patented products

and

products newly approved by

the

FDA,

and the other

involving generic

introductions after

patent protection

expired.

In

some cases branded

products

left the

market,

while both

entry

and exit

occurred

for

generic products.

This

entry

and exit

behav-

ior is

summarized

in

table 2.

Of

the twenty-one antidepressant chemical

entities on the market

in

February 1996,

fifteen were either new branded

products

or

generic

versions introduced

within the

past

ten

years.

All

three

MAOI products

were introduced

in

the

1959-61 time

pe-

riod,

and

although patent protection

has

expired,

the

market for these

products

is

apparently so

small and

unattractive that generic entry has

not been

induced.

Among

the ten

tricyclics

and

related

tetracyclic (hereafter, TCA)

chemical

entities,

the two oldest

are

imipramine

and

amitriptyline.

The

branded

pioneers,

Elavil and

Tofranil,

not

only

faced

competition

from

generic entry beginning

in the

1970s,

but from 1975 on

they

also ex-

perienced

branded

competition

from

other

major pharmaceutical

man-

ufacturers

(Endep

for

Elavil,

and

Janimine for

Tofranil).34

The

com-

petition

these

secondary

brands

encountered from the

primary

branded

products and the generics must

have been

considerable,

for

Janimine

exited

in

1985,

and

Endep

in

1988.35

The

TCA

class of

drugs

attracted considerable branded

entry, espe-

cially

in the

1960s,

but in

the

1980s

generic entry

was

predominant,

reflecting

in

part

the

reduced

costs of

generic entry made possible by

34.

Although

the distinction

is not

completely clear,

we

distinguish

branded

products

from those

generics sold primarily by

their chemical

entity name,

often under a

private

label; thus Endep is distinguished from, say, Walgreen imipramine.

35.

It

is

possible

that

these brands exited

only

from the

IMS data

base,

not from

the

market,

in

that their sales

may

have fallen below

a

minimum

reporting

threshold

imposed

by

IMS.

Table

2.

Entry

and

Exit

in

the

Antidepressant

Drug

Market

Orginator

brand

Seconidary

brand

Genieric

distributors

Generic

name

Name

Year

Name

Entry

Exit

Entry

1988

1996

MAOIs

isocarboxazid

Marplan

1959

None

0

0

phenelzine

Nardil

1959

None

0

0

tranylcypromine

Parnate

1961

None

0

0

TCAs

amitriptyline

Elavil

1961

Endep

1975

1988

1977

13

24

amoxapine

Asendin

1980

1989

0

14

clomipramine

Anafranil

1990

None

0

0

desipramine

Pertofrane

1971

Norpramin

1975

1989

1987

9

20

doxepin

Sinequan

1969

Adapin

1973

1991

1986

12

22

imipramine

Tofranil

1958

Janimine

1975

1985

1975

12

16

maprotiline

Ludiomil

1981

1988

7

11

nortriptyline

Aventyl

1963

Pamelor

1977

1992

0

17

proptriptyline

Vivactil

1967

None

0

0

trimipramine

Surmontil

1969

1988

5

0

SSRIs,

related

drugs

fluoxetine

Prozac

1988

None

0

0

fluvoxamine

Luvox

1994

None

0

0

nefazodone

Serzone

1995

None

0

0

paroxetine

Paxil

1993

None

0

0

sertraline

Zoloft

1992

None

0

0

Others

bupropion

Wellbutrin

1989

None

0

0

trazodone

Desyrel

1981

1986

22

22

venlafaxine

Effexor

1994

None

0

0

Sources:

IMS

America,

Inc.,

and

Food

and

Drua

Administration

(annual).

Ernst R. Berndt,

Iain M. Cockburn, and

Zvi Griliches

149

passage

of

the

1984

Waxman-Hatch Act.36

By

1996

eighteen

or so

distributors were

offering generic products

for

each of the

TCA drugs

facing generic

competition, up

sharply

from about ten in

1988. Not

all

generic entry has been

sustained;

although

Surmontil

faced

generic

entry in 1988, in

1992

the

generic

competition

exited,

and

none has

emerged since then.

The introduction

of Prozac

in

1988

marked

the

entry of an

entire new

class of

antidepressants,

the

highly

successful SSRIs. Other

SSRI

branded drugs were

Zoloft,

introduced

in

1992, Paxil

in

1993,

Luvox

in

1994, and

Serzone

in

1995;

Effexor,

a

related

product, was also

introduced

in

1994.

Prices and

Market Shares

Next we

look at

market share

and

price movements,

first

among the

four classes of

antidepressant drugs

listed

in

table 2.

During 1980-88

the

MAOIs

had

only

a

very

minor unit and

revenue

market

share,

between

1.4

percent

and

2.4

percent,

and after 1988 this share

dropped

even

further;

the

1996

share was but

0.3

percent.

In

1980

the

TCAs

accounted for about

98

percent

of

both the

daily

dosage quantities

sold and

total

antidepressant

revenues.

By

1987 the

TCA

unit share

fell

slightly,

to

90

percent,

as trazodone

(from

a differ-

ent class of

drugs)

increased

its unit market share to

about

8

percent;

the

corresponding

TCA

revenue

shares

were 77

percent

and 21

percent.

Among

the

TCAs,

three dominated

in

1980:

amitriptyline

had a 50

percent

unit

share,

doxepin

22

percent,

and

imipramine

18

percent,

for

a combined share of

90

percent. By

1987

this

combined share

fell to

80

percent,

as sales of

products

such as

desipramine,

amoxapine,

and

nortriptyline

(having fewer

and less

severe

side effects-see

table

1)

increased to a combined

14

percent

unit share. The three

largest

TCAs

accounted

for

about

82

percent

of total

TCA

dollar

sales

in

1980,

but

only 49 percent

in

1987,

in

large part

because

all three

products

faced

increased

generic

competition

in

the

1980s.

The launching of Prozac was a

huge

success. Not

only

did

this first

SSRI

take market share

away

from the

TCAs,

but

it

also

expanded

enormously

the size of the overall

antidepressant

drug marketplace.

36. For

discussion of

this legislation and its

consequences, see Grabowski

and Ver-

non

(1992).

150 Brookings Papers: Microeconomics 1996

General practitioners and internists, not just psychiatrists, were now

able to prescribe antidepressants comfortably,

for

concerns about side

effects and adverse interactions

with

Prozac were much less intense

than with the TCAs. Moreover, because the daily dosage for Prozac

was

the same

for

almost everyone, specialist knowledge

and

experience

concerning optimal patient-specific dosages, typically required for

many of the TCA drugs, were

no

longer necessary.

At

the end of

its

first year on the market (1988), the Prozac daily dosage share among

all

antidepressants

was

11

percent,

and

given

its

higher price,

its dollar

market share

was 21

percent; by

1991 these shares

had

increased to

29

percent and 51 percent, respectively.

The SSRI market continued

to

grow rapidly following entry by ad-

ditional

SSRIs,

and

by 1996

the SSRI market share

among

all antide-

pressants was 63 percent

in

daily dosage

units and a

remarkable

84

percent

in

dollars;

unit market shares

for

the

TCAs

fell

from 90 percent

in 1987 to 27 percent in 1996, while revenue shares dropped even more

dramatically, from 77 percent

to 7

percent. Clearly, for many physi-

cians and patients dealing with

the

treatment

of

depression, the SSRIs

were enormously successful

in

fulfilling unmet

needs.

Within the SSRI subclass of drugs, unit

sales of

Prozac continued to

grow, from 340 million daily units

in

1991 to 645 million in 1995. But

the

great success

of

Zoloft

and Paxil in

expanding the overall SSRI

market has implied

a

loss

in Prozac's

market share;

in

1996 SSRI daily

dosage market shares for Prozac, Zoloft,

and Paxil were

41.6 percent,

41.5 percent, and 12.6 percent, respectively,

while

corresponding

dol-

lar market shares

were

48.0

percent,

29.8

percent,

and 17.8

percent.

Moreover,

the unit shares

of

Prozac, Zoloft,

and Paxil

prescriptions

written

by nonpsychiatrists

were

39

percent,

51

percent,

and

49

percent,

respectively, indicating proportionally

more

nonspecialist prescriptions

written

for Zoloft and Paxil than

for

Prozac.37

Prozac and other SSRI

entrants have been

tremendously

successful

despite

their

higher daily dosage prices.

When Prozac was launched

in

1988,

for

example,

its

daily price

was about

$1.18,

almost double the

$0.60 daily price

of

the

branded version

of the

leading selling tricyclic,

amitriptyline,

and more

than

twenty

times

the

$0.05 daily price

for

generic

versions

of

that chemical

entity; doxepin,

the second

best-

37. IMS (1996a).

Ernst R. Berndt,

lain M. Cockburn,

and Zvi

Griliches

151

selling tricyclic,

was also

much cheaper

than Prozac-$0.70

a day in

its branded

version and $0.21

in generic form.

When Zoloft,

the second

SSRI entrant,

was launched

in 1992, its

daily price was set at about

25

percent

lower

than that of

Prozac-$1.26

compared

with

$1.69.

Ser-

zone, the most

recent

SSRI, is priced

in between Prozac and Zoloft.

In

constructing

a price

index,

what happens

following entry

of

ge-

neric competition

is very

important.38 In

table

3

we summarize

price

and market

share developments

at twelve,

twenty-four,

and thirty-six

months following

initial

generic entry

for the seven

chemical entities

experiencing

initial

generic

competition

since 1980. The

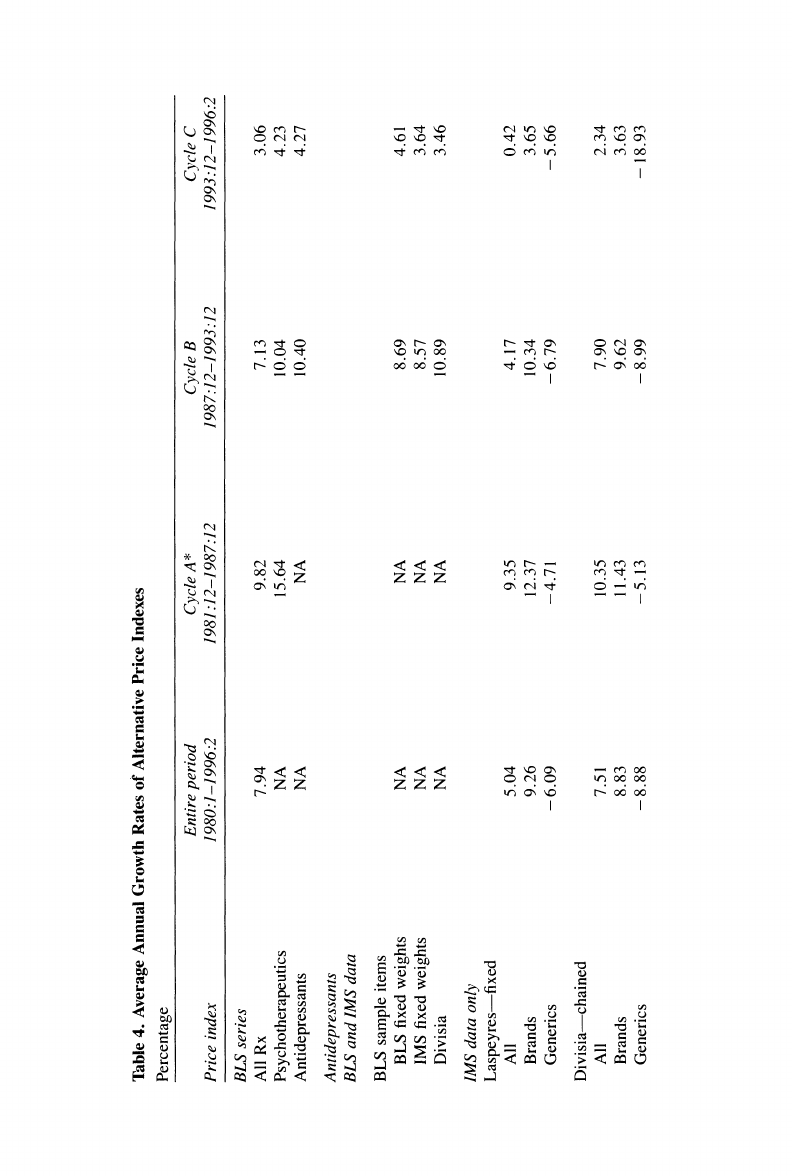

top panel

shows

that

although

considerable variability

is

present,

unweighted

average generic

prices

are

about

57

percent,

43

percent,

and

35

percent

of

brand prices

after

one,

two,

and three

years.3

Substantial differences

in

market share

penetration

are

also

present.

Measured in

daily units,

generic

market

shares

vary

from 5

percent

to

68

percent

of brand shares

after

one year

and

average

about

27

percent,

while

they

average

about

44

percent

and

54

percent

after

two

and

three

years,

respectively.

There does

not

appear

to

be

any

dominant

time

trend

to

generic

penetration

rates, although

the market share

of

the most recent

generic

entrant, nortriptyline,

is the largest

after

one, two,

and

three years.

Because generic

prices

are

lower than brand

prices,

dollar shares are

smaller

than

unit

shares;

even

so,

after

just

one

year

the

nortriptyline

dollar share

is

56 percent.

The generic

price

can

fall relative to

the

brand

price

if

the

generic

price decreases,

the

brand

price

increases,

or both.

As

the second

panel

of table 3

shows,

manufacturers

have tended

to

increase

the

price

of

branded

products

following generic

entry, apparently

focusing

on the

price inelastic

market

segment

and

letting generics gain

market share

from the elastic

segment;

after

one,

two,

and

three

years,

the

average

38. For

discussion

of generic

pricing and

responses by

incumbents,

see Caves,

Whinston,

and Hurwitz

(1991); Frank

and Salkever

(1992);

Grabowski

and Vernon

(1992);

Griliches and

Cockburn (1994);

Hurwitz

and Caves

(1988); and

Masson and

Steiner (1985).

39. These trends

in

prices

of generic drugs

for treatment

of a

relatively

chronic

condition such as depression

differ

considerably

from

those

reported by

Griliches and

Cockburn

(1994)

for systemic infectives,

which tend

to be used in the treatment of

more

acute conditions.

For

generic antidepressants

(except nortriptyline),

the initial price

discount

is larger, but

after that the

relative

price

is

flatter

than that

of

generic

systemic

anti-infectives.

Table

3.

Relative

Prices

and

Market

Share

Penetration

of

Generic

Antidepressant

Drugs

Introduced

since

1986

IWelve,

TWenty-four,

and

Thirty-six

Months

after

Introduction

Percentage

Relative

price

generic

Generic

market

share

Generic

market

share

Chemical

Entry

to

brand

in

units

in

dollars

entity

year

12

24

36

12

24

36

12

24

36

doxepin

1986

38

30

25

39

54

67

20

26

34

trazodone

1986

62

42

18

23

44

70

16

25

29

desipramine

1987

61

37

31

29

61

58

20

37

30

maprotiline

1988

61

54

42

10

22

33

6

13

17

trimipramine

1988

60

53

58

5

11

11

3

6

7

amoxapine

1989

58

51

50

14

37

51

9

23

35

nortriptyline

1992

61

36

22

68

80

85

56

58

56

Pioneer

brand

price

after

generic

entry

(Generic

entry

date

=

1.00)

Nominal

price

per

day

Real

GDP-deflated

price

12

24

36

12

24

36

doxepin

1986

1.11

1.35

1.50

1.08

1.27

1.35

trazodone

1986

1.01

1.22

1.58

0.98

1.14

1.42

desipramine

1987

1.13

1.35

1.60

1.09

1.25

1.42

maprotiline

1988

1.14

1.21

1.28

1.08

1.11

1.12

trimipramine

1988

1.14

1.23

1.43

1.09

1.12

1.25

amoxapine

1989

0.97

1.39

1.45

0.94

1.33

1.29

nortriptyline

1992

1.04

1.06

1.11

1.01

1.01

1.05

Source:

IMS

America,

Inc.

Ernst R.

Berndt, lain M.

Cockburn, and

Zvi

Griliches

153

nominal

price increases

for

the

branded

products

are

about

1 1

percent,

26 percent, and

42

percent

(average

real

price

increases are

about 7

percent,

18

percent,

and

27

percent,

respectively).

With

this data as

background, we now

summarize

procedures

the

BLS has

used to

track and

measure

price indexes in

this

rapidly

chang-

ing

antidepressant

drug

marketplace.

BLS

Procedures

and

Samples for

Tracking

the

Antidepressant

Drug

Market

Currently

the PPI

program at the BLS

encompasses

the

construction

of

monthly

aggregate

price

indexes

for almost five

hundred

mining

and

manufacturing

industries,

including

approximately ten

thousand

in-

dexes for

specific product

categories,

based on

reports

from

approxi-

mately

twenty-five thousand

companies that

respond

voluntarily.

For

the

specific

product

category

called

prescription

pharmaceutical

prep-

arations,

the BLS

has

been

publishing

a PPI

since

January 1961.

In

June

1981

the BLS

began

publishing

a

price

index for

a

category

of

drugs

called

psychotherapeutics.

The

specific products

the BLS sam-

pled

for

this price

index were

drawn

in

1980

and

are known

as

"Cycle

A"

items.

Although

the

psychotherapeutic

category

consisted

of

sub-

categories

for

tranquilizers

and

antidepressants,

separate

price

indexes

for

these

distinct

and

more

disaggregated

subcategories were not

offi-

cially published.

Unfortunately,

the

BLS

has not

kept

files

on

which

particular

psychotherapeutic

drugs

and

presentations

made

up

the

Cycle

A

sample

and what

their

index

weights

were.

About six

years

later,

in

December

1987, the

BLS

drew

up

a

new

sample,

implementing

where

possible

a

sampling procedure

in

which

items

were

chosen

in such

a

way that

the

probability

of

selection was

proportional

to

a

product's value

of

shipments.40

A

separate

antide-

pressant

drug

subcategory

was

created,

and

specific

items

were

chosen

for

that

subcategory

in

what the

BLS

calls

its

"Cycle

B"

sample.

For

six

years

beginning

in

December

1987,

the BLS

computed

and

pub-

lished a

PPI for

antidepressant

drugs

based on

this

Cycle

B

sample.

In

0

.-

C#7

0

0

~0

~0

ID

0

0

.-

X _E;

Cd

0

It

0_

C0

;o

'C7

'I

_E _7E

154

Brookings Papers: Microeconomics

1996

December 1993 the BLS

again updated its sample; the items

making up

this new

sample of

antidepressant drugs

are

called "Cycle C"

products.

Under

strict

confidentiality agreements,

BLS officials

have made

available to

us

information

concerning

the set

of

antidepressant

drugs,

and their

item weights, that

make

up

the

Cycle

B

and

Cycle

C

samples.

As best we can

determine, six items were originally

in

Cycle B, and

one

additional item

was linked

in

around

May 1990.

Two of

the seven

items may be

misclassified, because the FDA has not

approved them

for treatment of

depression,

nor does

the American Medical Association

list them as as

antidepressant treatments.4'

All seven

Cycle

B

items

apparently

were branded

products;

when the

Cycle

B item

sample

was

implemented, three of the six brands faced

generic competition.

Ge-

nerics as a group accounted

for

11

percent

of total

antidepressant

rev-

enues and 44

percent

of

total

daily dosage

units sold.

Prozac,

the

pi-

oneer

SSRI,

did

not

enter

the market

until

January 1988,

and thus none

of

the

new

generation

of

SSRIs