WP/21/219

Stock Returns and Inflation Redux: An Explanation from

Monetary Policy in Advanced and Emerging Markets

by Zhongxia Zhang

IMF Working Papers describe research in progress by the author(s) and are published to

elicit comments and to encourage debate. The views expressed in IMF Working Papers are

those of the author(s) and do not necessarily represent the views of the IMF, its Executive

Board, or IMF management.

© 2021 International Monetary Fund WP/21/219

IMF Working Paper

European Department

Stock Returns and Inflation Redux: An Explanation from Monetary Policy in

Advanced and Emerging Markets

Prepared by Zhongxia Zhang

Authorized for distribution by Rachel van Elkan

August 2021

Abstract

Classical theories of monetary economics predict that real stock returns are negatively

correlated with inflation when monetary policy is countercyclical. Previous empirical

studies mostly focus on a small group of developed countries or a few countries with

hyperinflation. In this paper, I examine the stock return-inflation relation under different

monetary policy regimes and conditions using an expanded dataset of 71 economies.

Empirical evidence suggests that the stock return-inflation relation is partially driven by

monetary policy. If a country’s monetary authority conducts a more countercyclical

monetary policy, the stock return-inflation relation becomes more negative. In addition,

the results differ by monetary policy framework. In exchange rate anchor countries, stock

markets do not respond to monetary policy cyclicality. In inflation targeting countries,

stock markets react more strongly to inflation. A key contribution of this paper is to

classify inflation targeters by their behaviors, and illustrate that behavior matters in

shaping market perceptions: markets react to inflation and monetary policy cyclicality

when central banks are able to control inflation within their target bands. In this case

markets are sensitive to inflation dynamics when inflation is above the announced target

bands. Finally, when monetary policy is constrained by the Zero Lower Bound (ZLB), a

structural break is introduced and real stock returns no longer respond to inflation and

monetary policy cyclicality.

JEL Classification Numbers: G12, E31, E52.

Keywords: Stock Return, Inflation, Monetary Policy.

Author’s E-Mail Address: zzhang2@imf.org

IMF Working Papers describe research in progress by the author(s) and are published to

elicit comments and to encourage debate. The views expressed in IMF Working Papers are

those of the author(s) and do not necessarily represent the views of the IMF, its Executive

Board, or IMF management.

Stock Returns and Inflation Redux: An

Explanation from Monetary Policy in Advanced

and Emerging Markets

∗

Zhongxia Zhang

International Monetary Fund

August 4, 2021

Abstract

Classical theories of monetary economics predict that real stock returns are neg-

atively correlated with inflation when monetary policy is countercyclical. Previous

empirical studies mostly focus on a small group of developed countries or a few coun-

tries with hyperinflation. In this paper, I examine the stock return-inflation relation

under different monetary policy regimes and conditions using an expanded dataset

of 71 economies. Empirical evidence suggests that the stock return-inflation relation

is partially driven by monetary policy. If a country’s monetary authority conducts

a more countercyclical monetary policy, the stock return-inflation relation becomes

more negative. In addition, the results differ by monetary policy framework. In

exchange rate anchor countries, stock markets do not respond to monetary policy

∗

Zhang: European Department, International Monetary Fund, 700 19th Street, N.W., Washing-

Tara Sinclair, Chao Wei, Michael Bradley, Pamela Labadie, Frederick Joutz, Robert Phillips, Va-

lerie Ramey, Carl Walsh, Aart Kraay, Tamim Bayoumi, Rachel van Elkan, Xingwei Hu, Evridiki

Tsounta, Dong Wu, Xin Xu, Peichu Xie, Dun Jia, and participants at the 2018 Asian Meeting of

the Econometric Society, IMF EUR seminar, GWU Macro-International seminar, 3rd international

Workshop on Financial Markets and Nonlinear Dynamics, 22nd EBES Conference, Workshop on Fi-

nancial Econometrics and Empirical Modeling of Financial Markets, 43rd EEA Annual Conference

for their valuable comments. The views expressed in this paper are those of the author. All errors

are my own.

1

cyclicality. In inflation targeting countries, stock markets react more strongly to in-

flation. A key contribution of this paper is to classify inflation targeters by their

behaviors, and illustrate that behavior matters in shaping market perceptions: mar-

kets react to inflation and monetary policy cyclicality when central banks are able

to control inflation within their target bands. In this case, markets are sensitive to

inflation dynamics when inflation is above the announced target bands. Finally, when

monetary policy is constrained by the Zero Lower Bound (ZLB), a structural break is

introduced and real stock returns no longer respond to inflation and monetary policy

cyclicality.

JEL Classification: G12, E31, E52.

Keywords: Stock Return, Inflation, Monetary Policy.

2

1 Introduction

The subject of stock returns and inflation enjoys a decades-long research history.

Academic interests in this topic have waxed and waned with the importance of in-

flation on the macroeconomy. The high inflation episodes in the 1970s have imposed

heavy costs on living standards and economic stability. Stock returns were dismal

during this period, which in turn sparked extensive studies in stock returns and in-

flation. The COVID-19 pandemic has triggered renewed interest in the relationship

between stock returns and inflation. To mitigate the impact of the pandemic, central

banks and finance ministries around the world have taken unprecedented policy ac-

tions. While such actions were pivotal in preventing a free fall of the world economy

and supporting a robust recovery, there could be side effects such as asset bubbles

and widening inequality. As Consumer Price Indices rebound strongly in many parts

of the world, concerns arise on whether the pick-up in inflation is temporary or per-

manent and the associated implications for the financial markets.

The topic of stock returns and inflation covers a joint research area of finance and

macroeconomics. For financial economists, the relationship between stock returns and

inflation quantifies the extent to which stocks can hedge against inflation risk. It is

important for trading and risk management purposes. Monetary economists are keen

to understand whether inflation and monetary policy have any effect on stock returns.

The stock market is a primary source of direct financing for firms, and stock price

fluctuations affect real economic activity and financial stability, including corporate

borrowing and investment decisions (Baker et al., 2003; Pastor and Veronesi, 2003),

and household consumption and saving decisions induced by changes in net worth.

Therefore, central banks that aim at stabilizing prices have to take into account the

effects of inflation on asset returns.

Historically, real stock prices decline when inflation rises in developed countries.

Equity shares, which are claims on future output of firms, do not prove to be a good

hedge against inflation risk as researchers find a negative correlation between real

stock return and inflation in the short run in developed countries. This phenomenon

has intrigued the economics profession to investigate why inflation as a nominal vari-

able has an impact on real stock prices or the real value of claims on physical assets.

Among various theories to explain the negative stock return-inflation correlation,

3

existing hypotheses in monetary economics assert that the negative relationship is a

result of central bank’s countercyclical policy reaction: when inflation rises, a central

bank that aims to maintain price stability and conducts countercyclical monetary

policy will lift its policy rate. Therefore, changes in inflation affect real interest rates.

As the stock price is equal to the current value of all future cash flows, an increase in

interest rate (discount rate) lowers the net present value of stocks. In addition, higher

interest rates lead to larger borrowing costs for firms, increase the attractiveness of

competing assets such as bonds and deposits, dry up liquidity in the stock market,

and put downward pressures on stock returns.

Previous work on this issue mostly focuses on either one country (Fama, 1981), a

small group of industrialized countries, with just a few studies focusing on emerging

markets (Spyrou, 2004; Gultekin, 1983 and Erb et al., 1995 are exceptions), despite

the rising importance of emerging markets (Cubeddu et al., 2014). Gultekin (1983)

investigates stock returns and inflation in 26 countries for the postwar period, and

Erb et al. (1995) study stock returns and inflation in 41 developed and emerging eq-

uity markets over 22 years. These studies appear less representative given the rapidly

changing developments in the international monetary and financial system, especially

the rise of emerging market economies, as well as inflation developments from previ-

ous hyperinflation concerns have been superseded by the subsequent deflation risk.

Indeed, in recent years, policymakers and investors are increasingly wary of stock

market spillover effects from emerging markets to the rest of the world, while more

emerging markets’ central banks are moving towards inflation targeting regimes.

This paper aims to revisit the important policy question of how monetary policy

affects the way stock returns react to inflation. In this paper, I expand the research

to a quarterly panel dataset of 71 advanced and emerging economies over a period of

35 years. This dataset contains not only rich information on stock returns and infla-

tion, but also substantial variations of other macroeconomic variables and financial

indicators. It makes comparisons among countries and across several monetary policy

dimensions possible. This paper dissects monetary policy into different regimes and

conditions to understand its role on stock returns and inflation (Figure 1). It focuses

on three key elements of monetary policy: monetary policy cyclicality, monetary pol-

icy framework and monetary policy flexibility. Doing so can show a comprehensive

picture of the effectiveness of monetary policy in driving the stock return-inflation

4

Figure 1: Key Monetary Policy Elements that Affect Stock Returns and Inflation

relations. To the best of my knowledge, this is the first paper that studies stock re-

turns and inflation, tests hypotheses of monetary policy cyclicality in the literature,

and documents differences between the advanced and emerging markets from such a

broad set of countries. It examines the outcomes of monetary policy frameworks with

an emphasis on inflation targeters’ behaviors, as well as the Zero Lower Bound.

I first examine the stock return-inflation relationship based on monetary policy

cyclicality. I augment the panel regressions by including monetary policy cyclicality

measures and a monetary aggregate factor. To address the econometric issues of serial

correlation, heteroskedasticity, and cross-sectional dependence, I apply the Driscoll-

Kraay standard error estimators. By testing an existing hypothesis in the literature,

results confirm that monetary policy cyclicality can partly explain why stock markets

respond differently to inflation. Results indicate that real stock returns decline when

inflation increases, with larger reactions to inflation in advanced markets than emerg-

ing markets. The differences between advanced and emerging markets are interesting

but they have not been highlighted enough in the literature before. They imply that

practitioners and policymakers in emerging markets should use caution when borrow-

ing the experience from advanced markets. Moreover, if a country pursues a more

countercyclical monetary policy, stock markets will react more negatively to inflation.

I then study the stock return-inflation relationship across monetary policy frame-

works. Under an exchange rate anchor regime, real stock returns do not pay attention

5

to the monetary policy cyclicality. In contrast, under an inflation targeting regime,

real stock returns react extremely negatively to inflation, compared to the baseline

findings. When central banks have the capacity to control inflation within their an-

nounced target bands, markets are sensitive to inflation dynamics when inflation is

above the target band. I show that inflation targeting countries exhibit a large degree

of heterogeneity regarding the amount of time inflation stays within the central bank’s

target bands. And stock markets do differentiate behavior by reacting differently to

inflation and monetary policy cyclicality.

Finally, I analyze the role of monetary policy flexibility on stock return and in-

flation. When the policy rate is constrained by the Zero Lower Bound, a structural

break is revealed and markets disregard inflation and monetary policy cyclicality. The

results illustrate how limited monetary policy flexibility alters the way stock returns

react to inflation.

The remainder of the paper is organized as follows: Section 2 provides a brief

and selective literature review on previous studies. Section 3 documents the under-

lying data and presents some key stylized facts. Section 4 describes the analytical

framework and displays the main results from panel regressions. It examines the

role of monetary policy by testing an existing hypothesis in the literature. It also

runs augmented regressions and shows how monetary policy cyclicality shapes the

stock return-inflation relation. Different monetary policy frameworks and the out-

come of Zero Lower Bound are also studied. Section 5 performs several robustness

checks. Section 6 discusses policy implications, possible avenues for future research,

and concludes.

2 Literature Review

It is empirically well documented in the literature that nominal stock returns re-

act negatively to inflation in the United States and several industrialized countries

(Lintner, 1975; Fama and Schwert, 1977; Fama, 1981). This is a long-standing phe-

nomenon that has attracted economists’ attention, because people do not expect real

stock return is affected by a nominal variable such as inflation. According to the clas-

sical view of Irving Fisher (1930), expected nominal return on an asset should equal

6

the expected real return plus expected inflation. Therefore, stocks, which represent

claims on real output of firms, should be a good hedge against both expected and

unexpected inflation. In the “best of all possible worlds”, one should observe that

the nominal interest rate co- move in a one-to-one relationship with inflation if the

real interest rate is constant in the short term.

Research on the stock return-inflation relation from an international perspective

produce similar findings. Gultekin (1983) investigates the relation between common

stock returns and inflation in 26 countries for the postwar period, and shows that

the results do not support the Fisher Hypothesis. Erb et al. (1995) study inflation

and stock returns in 41 developed and emerging equity markets over 22 years and

document a significant negative relation for most countries.

The empirical anomaly has sparked a number of hypotheses attempting to explain

the phenomenon, most notably the inflation illusion hypothesis (Modigliani and Cohn,

1979; Campbell and Vuolteenaho, 2004), the proxy hypothesis (Fama, 1981), the tax

hypothesis (Feldstein, 1980), the time-varying risk aversion hypothesis (Brandt and

Wang, 2003), and the sticky discount rate hypothesis (Katz et al., 2017). The inflation

illusion hypothesis proposed by Modigliani and Cohn (1979) states that stock market

investors fail to understand the effect of inflation on nominal dividend growth rates

and extrapolate historical growth rates even in periods of changing inflation. From

a rational investor’s perspective, this implies that stock prices are undervalued when

inflation is high and overvalued when inflation is low. Campbell and Vuolteenaho

(2004) find that the regression coefficient of the mispricing component on inflation

is positively and statistically significant, and their results provide strong support to

the inflation illusion hypothesis. Fama (1981) considers the negative correlation be-

tween stock returns and inflation as the consequence of proxy effects. He explains in

his proxy hypothesis that there is no causal relationship between the two variables.

Instead, both variables are driven by real economic activity. Stock returns are de-

termined by forecasts of relevant real variables, and negative stock return-inflation

relations are induced by negative relations between real activity and inflation. The

negative stock return-inflation relations are induced by negative relations between

inflation and real activity which in turn are explained by a combination of money

demand theory and the quantity theory of money.

Feldstein (1980) argues that an important adverse effect of increased inflation on

7

share prices results from basic features of the current U.S. tax laws, particularly his-

toric cost depreciation and the taxation on nominal capital gains. When prices rise,

the historic cost method of depreciation causes the real value of depreciation to fall

and real taxable profits to be increased. As a result, real profits net of the corporate

income tax vary inversely with inflation. Inflation further reduces net earnings by

imposing an additional tax on nominal capital gains. Therefore, inflation raises the

effective tax rate on corporate income and lowers the share price. In a recent attempt,

Brandt and Wang (2003) put forward a time-varying risk aversion hypothesis. They

formulate a consumption-based asset pricing model in which aggregate risk aversion

is time-varying in response to news about consumption growth and inflation. They

document a robust correlation between aggregate risk aversion and unexpected infla-

tion. Katz et al. (2017) investigate why local stock markets adjust slowly to changes

in local inflation. They find that when the local rate of inflation increases, local in-

vestors subsequently earn lower real returns on local stocks, suggesting that the local

stock market investors use sticky long-run nominal discount rates that are too low

when inflation increases because they are slow to update the inflation expectations in

discount rates. They show that small amounts of stickiness in inflation expectations

are sufficient to match the real stock return predictability induced by inflation in the

data.

There is another strand of the literature that emphasizes the role of monetary

policy in determining stock returns and inflation. The rationale is that central banks

that are targeting inflation will respond to inflation shocks. As a result, the changing

stance of monetary policy prompts stock market revaluations. Sellin (2001) gives a

comprehensive review of the literature on the interaction between stock returns, infla-

tion, and money growth, with a special emphasis on the role of monetary policy. Kaul

(1987) hypothesizes that the relation between stock returns and inflation is caused

by equilibrium processes in the monetary sector. He shows that the negative stock

return-inflation relations are caused by money demand and countercyclical money

supply effects. Geske and Roll (1983) argue that this puzzling empirical phenomenon

is due to the fiscal and monetary linkage. Exogenous shocks in real output, signaled

by the stock market, induce changes in tax revenue, then the Treasury borrows more

and the central bank monetizes the increased debt. Rational investors adjust prices

accordingly without a delay. Using Markov regime-switching models, Chen (2007)

points out that monetary policy has asymmetric effects on stock returns.

8

In a thought-provoking paper, Bakshi and Chen (1996) show that there exists a

negative correlation between real equity return and inflation within a general equi-

librium, unless both money growth is procyclical and its covariance with output

growth dominates the variance of output growth. In a Cash-in-Advance model, Boyle

and Peterson (1995) show that equity returns are negatively correlated with inflation

when monetary policy is countercyclical or weakly procyclical. In another equilibrium

monetary asset pricing model, Marshall (1992) predicts that the inflation-asset return

correlation will be more strongly negative when inflation is generated by fluctuations

in real economic activity than when it is generated by monetary fluctuations. In an

influential paper, Christiano et al. (2010) show that historically, inflation is low dur-

ing stock market booms in the United States and Japan. The authors use the concept

of a news shock, i.e., a disturbance to information about next period’s innovation in

technology, to interpret the evidence. They argue that an interest rate rule that is too

narrowly focused on inflation destabilizes asset markets and the broader economy.

The paper revisits the existing monetary economics hypotheses in the stock return-

inflation literature and contribute to the literature by highlighting the role of mon-

etary policy. It intends to confirm monetary policy as a determining factor in the

stock return-inflation relationship based on empirical findings under different mon-

etary policy regimes and conditions. It empirically confirms that central banks can

shape the way stock markets react to inflation from three different angles: mone-

tary policy cyclicality, monetary policy framework, and whether monetary policy is

constrained by the Zero Lower Bound. In addition, this paper contributes to the in-

flation targeting literature by revealing that inflation targeting countries are different.

Based on a stark comparison of central banks’ track record of controlling inflation,

results show that inflation targeting countries are heterogeneous and stock markets

differentiate inflation targeting countries by their behaviors.

3 Data Description and Stylized Facts

I compile a quarterly dataset using readily available data from the first quarter of

1980 to the second quarter of 2015. The sample includes 71 economies, including 33

advanced markets and 38 emerging markets. It integrates data from the International

Monetary Fund (IMF), Bloomberg, Haver Analytics, Thomson Reuters Datastream,

9

Consensus Forecasts, and other sources. The dataset is an unbalanced panel, that is,

countries do not have the same number of observations in the study. For example, the

stock market has a long history in advanced markets, while for emerging markets it

is a recent phenomenon. The issue of data availability is also true for other variables.

The variable construction and data source of key variables are as follows (see

details in appendix). Equity index data is from Bloomberg, and nominal stock return

is the change in equity index logarithm from one year ago. Consumer price index

data is from the IMF’s INS database, and inflation is defined as the change in the

Consumer Price Index (CPI) logarithm from one year ago. Real equity index is

derived by deflating nominal equity index by consumer price index accordingly, and

real stock return is the change in real equity price logarithm from one year ago.

Inflation forecasts are current-year and next-year market forecasts from Consensus

Forecasts. Industrial production data is obtained from combining Thomson Reuters

Datastream and the IMF’s data. M2, a measure of aggregate money supply, comes

from Haver Analytics and the IMF. Financial sector risk ratings are provided by the

International Country Risk Guide (ICRG). The United States three-month Treasury

bill yield rate in secondary markets is downloaded from the Board of Governors of

the Federal Reserve System. Finally, the VIX index is retrieved from Bloomberg.

Table 1 summarizes the basic statistics for key indicators used in this paper.

1

Nominal stock returns on average are 0.11, and the standard deviation is 0.40 with

a minimum of -2.47 and a maximum of 5.23. Since the nominal stock return is the

change in logarithm, the mean value represents an 11% increase on an annual basis,

the minimum value represents a 92% drop on an annual basis (Iceland in 2009) and

the maximum value represents an 18,535% increase on an annual basis (Argentina

in 1989)! The shocking numbers represent several formidable stock market crashes

and hyperinflation episodes in emerging market economies. Real stock returns on

average are 0.04, with minimum -2.63 and maximum 2.23. This means real stock

return on average is about 4% annually. When adjusted for inflation, the large stock

market gains at the positive tail of the distribution are smaller in real terms but

still very sizable. Inflation is as volatile as stock returns, and its mean is 0.11. The

minimum value -0.41 and the maximum value 4.95 suggest there are serious deflation

and hyperinflation episodes. Industrial production is an index that measures the real

1

Several key variables are transformed into log forms to avoid extreme values. Hyperinflation

periods are dropped for robustness check on the regression, and the result is included in the appendix.

10

Table 1: Summary Statistics

Variable Observation Mean Std. dev. Min Max

Nominal stock return (log) 6,304 0.105 0.399 -2.469 5.227

Real stock return (log) 6,304 0.038 0.347 -2.627 2.231

Inflation (log) 8,855 0.114 0.333 -0.414 4.950

Industrial production growth (log) 6,443 0.028 0.079 -0.675 0.730

Monetary aggregate growth (log) 6,399 0.147 0.237 -0.378 4.138

Improvement in financial risk rating 7,960 0.022 1.536 -17 17

U.S. Treasury bill rate 10,082 4.594 3.589 0.01 15.49

VIX 7,242 19.89 7.45 11.26 44.14

output of certain industrials, and it has smaller fluctuations compared to the above-

mentioned financial and nominal variables. Industrial production on average grows

2.9% per annum for the selected sample countries. On the other hand, M2 growth

rate exhibits a rather heterogeneous distribution. It has a mean of 0.15 with its lowest

value being -0.38 and the highest value being 4.14. The ICRG’s financial sector risk

ratings are ranging from 0 to 50, where 50 indicates the least risk and 0 indicates

the highest risk. The change in financial risk is the quarter-over-quarter difference in

financial sector risk ratings, and a positive change indicates a reduction in financial

sector risk. On average the variable is quite stable, but the top and bottom values

certainly show that there are periods associated with large upgrades or downgrades

of financial risk. Lastly, the VIX index, which is a volatility index calculated by the

Chicago Board Options Exchange (CBOE) is a key measure of market expectations of

near-term volatility conveyed by the S&P 500 stock index option prices. It has been

considered by many to be the world’s premier barometer of investor sentiment and

market volatility. Its average is 19.9 and volatility is low during most of the times.

However, during times of market stress such as the Global Financial Crisis and the

European sovereign debt crisis, the index rises above a high level of 40.

Figure 2 plots the key series together. Over the long run, nominal equity indices

and consumer price indices mimic each other. In advanced markets such as the United

States, the stock index tracks the consumer price index quite closely in the long term.

Typically for an advanced market, the consumer price index is very stable and the

equity index is volatile. This is because inflation is well-anchored in advanced mar-

kets, as a result, real stock returns track closely with the nominal stock returns. In

11

Figure 2: Country Examples

12

13

emerging markets, there exists a larger degree of heterogeneity. Usually stock markets

have experienced large swings of price movements, as well as boom and bust episodes.

The heterogeneity is partly due to differentiated inflation dynamics across emerging

markets. Central banks face big challenges to tame inflation and maintain macroeco-

nomic stability. Several countries, including Argentina and Brazil, have experienced

hyperinflation in the past decades. Nominal equity indices rise passively in response

to high inflation. Real stock returns, on the other hand, have diverged from nominal

stock returns under such circumstances. The divergence between nominal and real

stock returns is only observed during high inflation periods.

To prepare for regression analysis, the literature typically breaks down inflation

into two terms: expected and unexpected inflation. Two classes of expected inflation

are considered in this study: survey measures of expected inflation from Consensus

Forecasts, and derived expected inflation from time series models. I use predicted

values of inflation based on the AR(4) model as the default measure of expected

inflation. The unexpected inflation is actual inflation minus expected inflation. In

the robustness check, survey measures of expected inflation from Consensus Forecasts

are used to examine whether the main results are sensitive to the measure of expected

inflation.

2

4 Empirical Results

Figure 3 shows that over time, the evolution of inflation was very different in

emerging markets compared to advanced markets. The early 1970s have witnessed

the collapse of the Bretton Woods System. It was followed by a time of turmoil,

amid large exchange rate fluctuations and high inflation pressures. For advanced

countries, the 1980s was a decade of high inflation. Starting in the mid-1980s, inflation

was tamed in advanced countries: the Great Moderation period started and since

then inflation was low and macroeconomic volatility was small. Emerging markets’

inflation development was more volatile. The 1985-1995 period marked a decade of

high inflation, with crises in Latin America and difficulties faced by the transition

2

It is useful to consider alternative measures of inflation such as core inflation. However, not all

countries publish core inflation data and it is more difficult to quantify expected core inflation as

survey forecasts of core inflation are less prevalent.

14

economies. Since 2000, emerging markets embraced a golden period for growth, their

inflation was largely controlled ever since. However, emerging markets in general

have always experienced higher inflation levels than advanced markets. Stopping high

inflation was particularly challenging for them during the 1980s and 1990s. Reining

in inflation becomes a key objective for the central banks, and central banks are

searching for a new nominal anchor. A number of countries have adopted inflation

targeting as their new monetary policy regime.

Figure 4 plots the correlations between real stock returns and inflation across

countries. Given the x-axis is in logarithm, inflation is strikingly high in a number

of emerging countries. When inflation is low, advanced markets and a few emerging

markets tend to have negative or close-to-zero correlations between real stock returns

and inflation. As inflation increases, the correlation becomes more dispersed among a

group of emerging markets. In extreme cases of hyperinflation, Argentina and Brazil’s

correlations are close to zero. This is because under this case, real stock returns

are trivial compared to inflation. Therefore, nominal stock returns are dominated

by inflation and the Fisher equation holds almost perfectly. More notably, there

seems to exist an upper bound for the correlation, where countries are capped at

0.2. Without any frictions, the correlation between real stock returns and inflation

should be zero. Previously, the literature has focused mostly on the low inflation

cases or a few hyperinflation countries. This figure gives a more comprehensive view.

It also highlights the differences between advanced and emerging markets, and the

heterogeneity within emerging markets.

4.1 Initial Empirical Results on Real Stock Returns

Since real stock returns truly matter to investors, I examine the relationship be-

tween real stock returns and inflation. The real stock index is derived from deflating

the nominal stock index by the consumer price index, and the real stock return is the

year-on-year difference of real stock index in natural logarithm.

3

The baseline regres-

sion applies panel regressions with fixed effects to evaluate the effect of inflation on

real stock returns:

3

Country-level stock market indices may not capture the sectoral idiosyncrasies in the stock

market. Using granular firm-level data could overcome this limitation. I leave this issue to future

research.

15

Figure 3: Evolution of Average Inflation in Logarithm by Income Group

Figure 4: Scatter Plots of Average Inflation in Logarithm (x-axis) and the Uncondi-

tional Correlation between Real Stock Return and Inflation (y-axis)

16

Y

i,t

= β

0

+ β

1

π

e

i,t

+ β

2

π

u

i,t

+ XB + u

i

+

i,t

, (1)

where Y

i,t

is real return on equity index for country i at time t, π

e

and π

u

are

expected and unexpected inflation

4

, and X is a vector of standard control variables in

the literature (Fama, 1981; Chen, Roll, and Ross 1986; Schmeling, 2009; Schmeling

and Schrimpf, 2011), including industrial production growth rate, change in financial

risk, the U.S. three-month Treasury bill yield and the VIX. The first two control

variables are country-specific factors: the industrial production growth rate accounts

for the changes in the real economic activity; and change in financial risk considers

the movements of the financial sector factors. The last two control variables capture

the external conditions, where the U.S. three-month Treasury bill yield represents

the level of the global liquidity condition, and the VIX is a measure of global finan-

cial market volatility. By examining the estimated coefficients β

1

and β

2

from the

regression, one can investigate whether there exists a positive or negative correlation

between stock market return and inflation across countries.

Table 2 shows the results from baseline regression without monetary policy fac-

tors.

5

Results from a panel regression model with fixed effects suggest that real stock

returns are positively correlated to expected inflation, industrial production growth,

improvement in financial risk ratings, and negatively correlated to the VIX index.

When the sample is split by income group, the asymmetric responses of real stock

returns to inflation are highlighted: in advanced markets the relation is negative

whereas in emerging markets it is positive. In advanced markets, real stock returns

respond very negatively to expected inflation. Changes in financial risk ratings are

no longer determining real stock returns, but in emerging markets they are still the

determinants. The U.S. three-month Treasury bill yield appears to be positively

correlated with real stock returns in advanced markets, however, the correlation is

4

The literature hypothesizes that stock returns react differently to expected and unexpected

inflation. For example, Brandt and Wang (2003) concentrate on unexpected inflation and aggregate

risk aversion to explain stock returns. I just follow the literature to break down inflation into two

components. However, the readers do not need to focus too much on the decomposition of inflation.

In the first robustness check, I report the core regression results using the actual inflation.

5

Before the regressions, unit root tests are performed using Augmented Dickey–Fuller, DF-GLS

and Phillips–Perron tests on each variable by country, as well as Im-Pesaran-Shin and Fisher-type

tests. Given the panel data is unbalanced in nature, several panel unit root tests are not applicable.

Detailed results are available upon request.

17

insignificant in emerging markets.

Results from the above panel regressions with fixed effects provide a general idea

of how real stock returns react to inflation and other control variables. However,

given the nature of the panel data, the results may be biased due to several econo-

metric issues. The first issue with the panel regressions is serial correlation, because

the dependent variable stock return is a financial variable that is typically exposed to

such a problem. The Wooldridge Test for autocorrelation in panel data suggests that

the null hypothesis that there is no first-order autocorrelation is rejected at the 1%

significance level. The second weakness that the panel regressions may suffer from is

heteroscedasticity. This is because countries at different stages of stock market devel-

opment can have distinct variability of the error terms. The modified Wald Test for

groupwise heteroscedasticity has confirmed the conjecture, and the null hypothesis

that all the variances are identical across the units is rejected at the 1% significance

level. A third potential source of estimation bias is from cross-sectional dependence.

Intuitively, stock returns in major financial markets can cause significant spillover

effects upon other markets. Unfortunately, the popular tests for cross-sectional de-

pendence including the Breusch-Pagan LM Test are not applicable given the panel

data employed here are highly unbalanced. Standard panel data techniques that fail

to account for cross-sectional or spatial dependence will result in inconsistently es-

timated standard errors. To address serial correlation, heteroskedasticity, and the

potential bias from cross-sectional dependence, I apply the Driscoll-Kraay standard

error estimators to the same panel regression. Driscoll and Kraay (1998) estimate

standard errors by employing a nonparametric estimation procedure to obtain consis-

tent covariance matrix estimation with spatially dependent panel data when the time

dimension is large.

6

Given the quarterly panel dataset is long in the time dimension,

the Driscoll-Kraay estimator is appropriately here.

7

The last three columns of Table 2 present the results of panel regressions using

the Driscoll-Kraay standard error estimator. The findings are largely consistent with

previous ones and the standard errors do not change dramatically. For the full sam-

6

For a recent implementation and discussion, see Hoechle (2007).

7

Cluster standard error estimator assumes independence across clusters but correlation within

clusters. It does not account for cross-sectional dependence. Since stock market returns are of-

ten spatially dependent, e.g., U.S. stock market returns affect stock market performance in other

countries, the Driscoll-Kraay standard error estimator is the best approach given the nature of the

dataset. Running regressions using clustered standard errors yield similar results.

18

Table 2: Regressions without Monetary Policy Factors

Dependent variable: real stock return (1) (2) (3) (4) (5) (6)

Expected inflation -0.141 -6.236*** -0.111 -0.141 -6.236*** -0.111

(0.111) (1.180) (0.103) (0.0984) (1.155) (0.0957)

Unexpected inflation 0.450** -1.323 0.522*** 0.450* -1.323 0.522**

(0.193) (1.249) (0.161) (0.263) (1.249) (0.257)

Industrial production growth rate 1.288*** 0.993*** 1.533*** 1.288*** 0.993*** 1.533***

(0.162) (0.197) (0.196) (0.158) (0.183) (0.180)

Improvement in financial risk rating 0.00973*** 0.00135 0.0198*** 0.00973 0.00135 0.0198***

(0.00327) (0.00371) (0.00443) (0.00597) (0.00624) (0.00596)

U.S. 3-month Treasury bill yield rate 0.00209 0.0219*** -0.00551 0.00209 0.0219** -0.00551

(0.00413) (0.00616) (0.00649) (0.0107) (0.00925) (0.0138)

vix -0.0168*** -0.0149*** -0.0164*** -0.0168*** -0.0149*** -0.0164***

(0.00100) (0.000835) (0.00146) (0.00340) (0.00245) (0.00392)

Constant 0.340*** 0.395*** 0.346*** 0.340*** 0.395*** 0.346***

(0.0214) (0.0323) (0.0344) (0.0750) (0.0637) (0.0856)

Estimation method FE FE FE DK DK DK

Sample full AM EM full AM EM

Observations 4,573 2,557 2,016 4,573 2,557 2,016

R-squared 0.288 0.405 0.288 0.288 0.405 0.289

Number of countries 63 31 32 63 31 32

Note: Robust standard errors in parentheses. *** p < 0.01; ** p < 0.05; * p < 0.1. FE = Panel Regressions with Fixed

Effects; DK = Panel Regressions with Fixed Effects and Driscoll-Kraay standard errors; AM = Advanced Markets; EM

= Emerging Markets. Hausman test suggests using fixed effects model, instead of random effects model.

19

ple, on average one percentage point increase in the growth rate of expected inflation

is correlated with a 0.14 percentage point decrease in the growth rate of real stock

returns, and one percentage point increase in the growth rate of unexpected inflation

is correlated with a 0.45 percentage point increase in the growth rate of real stock

returns. One percentage point increase in the growth rate of industrial production

is associated with a 1.29 percentage point increase in the growth rate of real stock

returns. Neither improvement in financial risk rating nor the U.S. three-month Trea-

sury bill yield rate matters given the estimated coefficients are not significant. Lastly,

one unit increase in the market volatility, as indicated by the VIX index, lowers the

growth rate of real stock returns by 1.7 percentage points.

8

Markets react more acutely to inflation in advanced countries. In advanced mar-

kets, real stock returns react negatively to expected inflation. A one percentage point

increase in the growth rate of expected inflation lowers the growth rate of real stock

returns by 6.24 percentage points. In emerging markets, unexpected inflation is posi-

tively associated with real stock returns. One percentage point increase in the growth

rate of unexpected inflation boosts the growth rate of real stock returns by 0.52 per-

centage points. One reason to explain how markets respond to inflation is because

inflation is controlled within a much smaller range in advanced markets than that of

the emerging markets. Therefore, markets are less sensitive to one unit of inflation

shock in emerging markets. Comparing the two classes of countries, improvements in

financial risk ratings positively drive real stock returns in emerging markets, but not

significant in advanced markets; the U.S. Treasury bill yield positively raise real stock

returns in advanced markets, but not significant in emerging markets. The differences

may be linked to the extent of vulnerabilities in the financial sectors, since emerging

markets are perceived to be exposed to greater financial risk. The differences may

also come from the level of financial development, since stock markets in advanced

countries are more mature. Investors are more rational and have better access to

information.

8

Since the functional form is log-level, i.e., the dependent variable is in logs and the independent

variable is in levels, we need to multiply the estimated coefficient on the VIX index by 100% to

interpret the economic meaning. The same logic holds for the change in financial risk rating and

the Treasury bill yield rate.

20

4.2 Augmented Regressions on Stock Returns with Mone-

tary Policy Considerations

While many economists argue for nonmonetary factors contributing to the nega-

tive stock return-inflation correlation, there is another strand of the literature which

attributes to monetary policy the role of shaping the stock return-inflation relations.

Monetary economists argue that the observed relationship between stock returns and

inflation is largely spurious. Instead, the relationship is driven by monetary policy,

since central banks around the world aim at controlling inflation and their actions

towards fighting inflation often have unintended consequences on stock prices. When

inflation rises, a central bank who is “leaning against the wind” hikes its policy rate

to combat inflation. This is bad news for stock markets since increases in policy rates

will tighten market liquidity and put downward pressure on stock returns. However,

if monetary policy is acyclical, the monetary authority does nothing against inflation

movements thus stock markets are not affected. If monetary policy is procyclical,

then the monetary authority instead lowers the policy rate when inflation increases,

which boosts stock market performance.

As noted by researchers such as Kaminsky, Reinhart and Vegh (2005), monetary

policy is usually countercyclical in advanced markets and procyclical in emerging

markets. Therefore, an interesting question is whether the relations between real

stock returns and inflation in developed and developing countries can be explained

by how their central banks pursue monetary policies. Previously, due to data limita-

tions, researchers are constrained by testing the existing hypotheses in the literature

in a cross-country setting. This newly compiled dataset made testing the existing

hypotheses from an international perspective possible. Specifically, I test the role

of monetary policy from three aspects. First, I allow various degrees of policy rate

cyclicality across countries to investigate whether monetary policy cyclicality mat-

ters. Second, I examine different monetary policy frameworks, i.e., inflation targeting

versus exchange rate anchor. Third, I study the Zero Lower Bound episodes when

monetary policy is constrained.

In the spirit of the monetary policy hypothesis in the literature, I augment the

panel regressions by introducing monetary factors and making two changes to the

previous regressions. Monetary aggregate (M2) growth rate is included as an extra

21

control variable and then interaction terms between monetary policy cyclicality and

inflation are added to the regressions. The augmented regression with country fixed

effects has the following setup:

Y

i,t

= β

0

+ β

1

π

e

i,t

+ β

2

π

u

i,t

+ β

3

π

e

i,t

C

i

+ β

4

π

u

i,t

C

i

+ ZΓ + u

i

+

i,t

, (2)

where C

i

is a measure of monetary policy cyclicality for country i, and Z is a vector

of control variables including monetary aggregate (M2) growth rate. The monetary

aggregate growth rate variable captures the direct effect of increases in monetary

aggregate on stock market returns.

Introducing the interaction terms between monetary policy cyclicality and infla-

tion is key to disentangle how monetary policy cyclicality affects the stock return-

inflation relation. Without the interaction terms, the effects of expected and unex-

pected inflation on stock returns are β

1

and β

2

. When interaction terms are added, the

effects of expected and unexpected inflation on stock returns are now β

1

+ β

3

∗ C

i

and

β

2

+ β

4

∗ C

i

. If β

3

and β

4

statistically significant, monetary policy cyclicality changes

the way stock return responds to inflation. Following Vegh and Vuletin (2012), the

measure of monetary policy cyclicality is computed as the correlation between the

cyclical components of real output and a central bank’s policy rate. The Hodrick-

Prescott (HP) filter is applied to derive the trend and the cyclical components, and

the smoothing parameter is set at 6.25 for the annual data.

9

A positive correlation

between the cyclical components of real output and policy rate suggests that mone-

tary policy is countercyclical. On the other hand, a negative correlation between the

cyclical components of real output and policy rate suggests that monetary policy is

procyclical.

10

In most countries, the correlation between the cyclical components of real output

and policy rate is mostly positive, with an average of 0.26. Among the 61 sample

countries, 45 of them have positive correlations and the rest have negative correla-

tions. Figure 5 plots the policy rate cyclicality measure for each country based on the

9

Annual data is used here because output gaps in annual frequency are more reliable. The

smoothing parameter 6.25 is based on the recommended value of the hprescott command in Stata.

Alternatively, the parameter is set at 100 and the results are very similar.

10

Alternatively, monetary cyclicality can be computed as the correlation between the cyclical

components of real output and monetary aggregates (M2). The issue with this measure is that

monetary aggregate is endogenous, and it is determined by both supply and demand factors.

22

Figure 5: Policy Rate Cyclicality Measure

full sample period. To complement the result in regressions, I define a countercyclical

policy dummy variable. This dummy variable equals one if the above correlation is

greater than 0.2 and dummy variable equals zero otherwise. According to this defini-

tion, almost all advance markets pursue countercyclical monetary policies (31 out of

33, except Norway and Israel), while for emerging markets only about a third of them

conduct countercyclical monetary policies (12 out of 31). Kaminsky, Reinhart and

Vegh (2005) coin the phenomenon that most developing countries conduct procyclical

monetary policies as “when it rains, it pours”.

When monetary aggregate growth rate is included as a control variable, panel

regressions show that real stock returns react negatively to inflation (Table 3). In

addition, real stock returns in all the sample countries are positively correlated to

industrial production growth, improvement in financial risk ratings, monetary aggre-

gate growth and negatively correlated to expected and unexpected inflation, and the

VIX index. On average a one percentage point increase in the growth rate of expected

(unexpected) inflation is correlated with a 0.69 (0.70) percentage point decrease in

23

the growth rate of real stock returns. A one percentage point increase in the growth

rate of industrial production is associated with a 1.19 percentage point increase in the

growth rate of real stock returns. One unit of improvement in financial risk rating

increases the growth rate of real stock return by 1.2 percentage points. One unit

increase in the VIX index, lowers the growth rate of real stock returns by 1.7 percent-

age points. Finally, a one percentage point increase in the growth rate of monetary

aggregate is associated with a 0.63 percentage point increase in the growth rate of real

stock returns. When monetary aggregate growth is introduced as a control variable,

the responsiveness of real stock returns to inflation is dampened.

When the countries are split by income levels, real stock returns respond nega-

tively in a substantial manner to expected inflation only in advanced markets. The

relationship is less negative in emerging markets.

11

The financial risk rating is a de-

terminant of real stock returns in emerging markets but not in advanced markets.

The U.S. Treasury bill yield only matters for stock returns in advanced markets. The

fact that monetary aggregate growth is significant in emerging markets but not in

advanced markets is interesting. One conjecture to explain this phenomenon is that

in recent decades advanced markets have witnessed a disconnect between monetary

aggregate growth and economic fundamentals, as well as the stock market. Observing

the structural break, a number of central banks have shifted their monetary policy

framework from intermediate variable targeting (e.g., monetary targeting) to final

variable targeting (e.g., inflation targeting). This is one of the reasons for central

banks to rely more on the policy rate tool rather than the monetary aggregate tool.

Results from augmented regressions reveal an important role of monetary policy:

monetary policy cyclicality alters how stock returns react to inflation. The monetary

policy cyclicality measure based on the policy rate is highly negative and statistically

significant, and confirms that indeed the monetary policy cyclicality changes the way

real stock returns react to inflation. The estimated coefficient on the interaction

term between expected inflation and monetary policy cyclicality is -5.47, suggesting

that as monetary policy becomes more countercyclical, stock returns respond more

negatively to inflation.

12

For instance, when monetary policy switches from acycli-

11

See the result of augmented regressions using actual inflation in the robustness check section.

A formal test on whether real stock returns react less negatively to inflation in emerging markets

is done by adding an additional interaction term between inflation and emerging market dummy

variable.

12

The sample includes Eurozone countries, since the focus of the paper is not on monetary policy

24

Table 3: Baseline Regressions on Real Stock Returns with Monetary Policy Factors

Dependent variable: real stock return (1) (2) (3) (4) (5) (6) (7) (8) (9)

Expected inflation -0.686*** -6.407*** -0.849*** -1.887*** -2.561** -1.335*** -0.802*** -2.498 -0.863***

(0.149) (1.090) (0.173) (0.338) (0.990) (0.302) (0.280) (1.558) (0.292)

Unexpected inflation -0.696* -1.765 -0.878*** -1.288** -2.399 -1.216** -0.960 -3.096 -0.863*

(0.377) (1.488) (0.325) (0.535) (1.657) (0.463) (0.611) (2.127) (0.517)

Expected inflation × policy rate cyclicality -5.468*** -8.284*** -2.349**

(0.916) (1.704) (1.054)

Unexpected inflation × policy rate cyclicality -0.595 2.390 -0.927

(1.316) (2.687) (1.410)

Expected inflation × countercyclical policy dummy -4.445*** -4.387** -2.268***

(0.706) (1.768) (0.734)

Unexpected inflation × countercyclical policy dummy -1.325 2.615 -2.179**

(0.844) (2.063) (0.948)

Industrial production growth rate 1.187*** 0.928*** 1.351*** 1.181*** 0.872*** 1.428*** 1.185*** 0.818*** 1.445***

(0.165) (0.193) (0.214) (0.165) (0.185) (0.229) (0.158) (0.192) (0.221)

M2 growth rate 0.634*** 0.0265 0.838*** 0.415** 0.0307 0.632*** 0.400** 0.0168 0.621***

(0.145) (0.278) (0.160) (0.191) (0.273) (0.174) (0.192) (0.285) (0.172)

Improvement in financial risk rating 0.0124** 0.00143 0.0232*** 0.0120** 0.00141 0.0210*** 0.0119** 0.00161 0.0209***

(0.00561) (0.00627) (0.00517) (0.00480) (0.00539) (0.00537) (0.00481) (0.00547) (0.00528)

U.S 3-month Treasury bill yield rate -0.00241 0.0204** -0.0113 0.00882 0.0190** -0.00186 0.00967 0.0198** -0.00149

(0.0108) (0.0102) (0.0134) (0.0101) (0.00953) (0.0131) (0.00993) (0.00994) (0.0128)

VIX -0.0168*** -0.0155*** -0.0151*** -0.0161*** -0.0163*** -0.0153*** -0.0159*** -0.0163*** -0.0151***

(0.00348) (0.00254) (0.00371) (0.00279) (0.00240) (0.00345) (0.00282) (0.00245) (0.00345)

Constant 0.316*** 0.418*** 0.264*** 0.383*** 0.442*** 0.310*** 0.382*** 0.438*** 0.310***

(0.0763) (0.0690) (0.0828) (0.0729) (0.0653) (0.0808) (0.0718) (0.0675) (0.0792)

Sample full AM EM full AM EM full AM EM

Observations 3,975 2,147 1,828 3,498 1,944 1,554 3,498 1,944 1,554

R-squared 0.3286 0.4278 0.3531 0.4038 0.4704 0.3932 0.4053 0.4633 0.3958

Number of countries 59 29 30 55 27 28 55 27 28

Note: Driscoll-Kraay standard errors in parentheses. *** p < 0.01; ** p < 0.05; * p < 0.1.

25

cal to perfectly countercyclical, stock market-inflation responsiveness becomes more

negative by 5.47 units. The estimated coefficient on expected inflation is -1.9, which

means if monetary policy is acyclical, one percentage point increase in the growth rate

of expected inflation is correlated with a 1.9 percentage point decrease in the growth

rate of real stock returns. This result echoes the theoretical findings of Bakshi and

Chen (1996), as well as Boyle and Peterson (1995). In both advanced and emerging

markets, real stock returns respond negatively to inflation and policy rate cyclicality,

however the estimated effects of expected inflation and expected inflation interacted

with policy rate cyclicality on real stock returns are larger in advanced markets than

those in emerging markets. This may be due to better monetary policy transmission

in advanced markets so that markets are more sensitive to policy cyclicality and rate

changes. In addition to that, advanced markets have lower inflation compared to

emerging markets, and therefore markets are more responsive to one unit of change

in inflation. Lastly, regressions using interaction terms between inflation and counter-

cyclical policy dummy yield similar results. In countries which pursue countercyclical

monetary policies, real stock returns react more negatively to inflation.

Results here explain the puzzling differences of stock return-inflation dynamics

in advanced and emerging markets. On the surface, the two income groups have

experienced very distinct stock return-inflation patterns. Beneath the surface, the

root of the problem partly lies in the cyclicality of monetary policy and the monetary

policy transmission channels. Most advanced markets pursue countercyclical mone-

tary policies. They have either adopted an inflation targeting framework or implicitly

targeted inflation. Monetary aggregate as an intermediate variable has delinked from

real economic activities, and central banks have considered M2 as a less important

indicator.

13

To the contrary, emerging markets are hindered by pursuing counter-

cyclical monetary policies. In addition, emerging markets are undergoing changes in

action, but on market reaction. Including individual member countries in the Eurozone provides

additional information on how markets react to inflation and monetary policy cyclicality. In the

robustness check section, I re-run the regression by dropping the observations after countries joined

the Eurozone.

13

Adrian and Shin (2010) argue this has to do with the changing nature of financial intermediation

in advanced markets. Before 1980, the monetary policy literature primarily focused on the role of

monetary aggregates in the supply of credit. However, with the emergence of the market-based

financial system, the ratio of high-powered money to total credit (the money multiplier) became

highly unstable. As a consequence, monetary aggregates faded from both the policy debate and the

monetary policy literature.

26

the monetary policy frameworks, and a number of EMs are still under a monetary

aggregates target framework.

4.3 Results by Monetary Policy Framework

This section further refines the results by monetary policy framework. Each year,

the International Monetary Fund surveys central banks around the world and re-

ports their de facto monetary policy framework in its Annual Report on Exchange

Arrangements and Exchange Restrictions (AREAER). The AREAER database classi-

fies countries’ monetary policy framework into the following four categories: exchange

rate anchor, monetary aggregate target, inflation targeting, and other frameworks.

We expect the stock return-inflation relation differ when the central banks target

different nominal anchors. In particular, the exchange rate anchor and inflation tar-

geting are two regimes of interest. They are two extreme cases of whether monetary

policy responds directly to inflation or not. The conjecture is that if monetary policy

solely focuses on stabilizing the exchange rate, policy cyclicality will not change how

real stock returns react to inflation. On the other hand, if monetary policy targets

inflation only, policy cyclicality will have strong and unintended consequences on

market responses to inflation.

Results show that under exchange rate anchor regime, real stock returns do not

respond to monetary policy cyclicality in both advanced and emerging markets (Ta-

ble 4). Interaction terms between inflation and monetary policy cyclicality are not

statistically significant.

14

This may be due to the reason that markets clearly un-

derstand that stabilizing exchange rate is the sole objective of the central bank, so

that the central bank will not respond directly to inflation movements. At the same

time, the estimated coefficients of expected and unexpected inflation are negative and

statistically significant. This means when inflation rises, real stock return decreases,

suggesting that there are other frictions at work.

Among all monetary policy frameworks, inflation targeting is one interesting

group, since the assumption is that markets should react more sharply to inflation if

inflation is the sole explicitly stated nominal anchor in conducting monetary policy.

14

The significance of the interaction term in Column (8) is driven by outliers, since only 2 out of

33 advanced markets do not pursue countercyclical monetary policies.

27

Table 4: Regressions on Real Stock Returns by Monetary Policy Framework: Exchange Rate Anchor, 1990-2014

Dependent variable: real stock return (1) (2) (3) (4) (5) (6) (7) (8) (9)

Expected inflation -1.017*** -5.892*** -1.086*** -2.866*** -3.989* -2.727*** -2.299*** 2.565 -2.564***

(0.256) (1.202) (0.277) (0.621) (2.265) (0.593) (0.724) (2.120) (0.727)

Unexpected inflation -1.220*** -4.543** -1.329*** -3.099*** -6.202*** -2.813** -3.273** -2.828* -3.228**

(0.389) (1.775) (0.398) (1.090) (1.734) (1.224) (1.322) (1.437) (1.466)

Expected inflation × policy rate cyclicality 0.321 -4.809 2.662

(2.419) (4.570) (2.380)

Unexpected inflation × policy rate cyclicality 2.208 6.317 3.345

(2.457) (4.079) (2.736)

Expected inflation × countercyclical policy dummy -1.995 -9.920*** -0.568

(1.366) (2.385) (1.400)

Unexpected inflation × countercyclical policy dummy 0.636 -0.363 1.314

(1.935) (2.862) (2.180)

Industrial production growth rate 1.408*** 1.391*** 1.392*** 1.213*** 1.130*** 1.279*** 1.228*** 1.117*** 1.284***

(0.197) (0.264) (0.224) (0.139) (0.188) (0.180) (0.138) (0.182) (0.181)

M2 growth rate 0.983*** 0.0724 1.061*** 0.777*** 0.317 0.875*** 0.750*** 0.344 0.838***

(0.225) (0.377) (0.245) (0.211) (0.394) (0.223) (0.208) (0.370) (0.227)

Improvement in financial risk rating 0.0101 -0.00795 0.0195** 0.0128* -0.00613 0.0186** 0.0122* -0.00700 0.0183**

(0.00941) (0.0115) (0.00780) (0.00714) (0.0111) (0.00745) (0.00703) (0.0115) (0.00726)

U.S 3-month Treasury bill yield rate -0.0357*** -0.0164 -0.0336** -0.0171 -0.0302* -0.0103 -0.0164 -0.0273* -0.00937

(0.0128) (0.0157) (0.0141) (0.0115) (0.0175) (0.0138) (0.0115) (0.0163) (0.0141)

VIX -0.0138*** -0.0121*** -0.0139*** -0.0154*** -0.0156*** -0.0149*** -0.0146*** -0.0144*** -0.0145***

(0.00361) (0.00331) (0.00411) (0.00323) (0.00319) (0.00340) (0.00325) (0.00304) (0.00349)

Constant 0.334*** 0.523*** 0.259** 0.398*** 0.606*** 0.325*** 0.402*** 0.591*** 0.329***

(0.0892) (0.0895) (0.100) (0.0847) (0.0893) (0.0854) (0.0812) (0.0809) (0.0843)

Sample full AM EM full AM EM full AM EM

Observations 871 370 501 603 211 392 603 211 392

R-squared 0.3052 0.3648 0.3207 0.4311 0.4608 0.4506 0.4381 0.4999 0.4467

Number of countries 40 20 20 27 11 16 27 11 16

Note: Driscoll-Kraay standard errors in parentheses. *** p < 0.01; ** p < 0.05; * p < 0.1.

28

Table 5: Regressions on Real Stock Returns by Monetary Policy Framework: Inflation Targeting, 1990-2014

Dependent variable: real stock return (1) (2) (3) (4) (5) (6) (7) (8) (9)

Expected inflation -4.289*** -8.474*** -2.344*** -3.545*** -3.179** -2.386*** -3.020*** -5.543*** -2.452**

(1.000) (2.032) (0.800) (0.784) (1.534) (0.812) (0.942) (1.593) (1.071)

Unexpected inflation -3.680*** -4.975** -2.592*** -3.022*** 0.781 -2.686*** -2.663** -3.518 -2.452**

(0.694) (1.898) (0.615) (0.574) (3.093) (0.646) (1.048) (3.284) (1.089)

Expected inflation × policy rate cyclicality -4.510** -15.28** 0.631

(2.219) (5.891) (1.249)

Unexpected inflation × policy rate cyclicality -3.833 -18.32** -1.309

(2.337) (8.075) (1.491)

Expected inflation × countercyclical policy dummy -2.422* -3.919 0.281

(1.375) (2.533) (1.288)

Unexpected inflation × countercyclical policy dummy -1.521 -1.457 -0.555

(2.049) (4.225) (2.011)

Industrial production growth rate 0.967*** 0.936*** 1.139*** 1.042*** 1.240*** 1.142*** 1.001*** 0.977*** 1.140***

(0.212) (0.216) (0.252) (0.219) (0.222) (0.254) (0.219) (0.229) (0.257)

M2 growth rate -0.466 -0.534 -0.422* -0.408 -0.348 -0.426* -0.428 -0.448 -0.423*

(0.305) (0.503) (0.232) (0.282) (0.415) (0.236) (0.293) (0.482) (0.230)

Improvement in financial risk rating 0.0125** 0.00316 0.0180*** 0.0126*** 0.00154 0.0182*** 0.0120** 0.00164 0.0182***

(0.00478) (0.00723) (0.00559) (0.00474) (0.00643) (0.00546) (0.00464) (0.00731) (0.00557)

U.S 3-month Treasury bill yield rate 0.0151 0.0205 0.00806 0.0152 0.0191 0.00813 0.0159 0.0222 0.00809

(0.0124) (0.0141) (0.0143) (0.0122) (0.0128) (0.0144) (0.0123) (0.0140) (0.0144)

VIX -0.0137*** -0.0123*** -0.0137*** -0.0132*** -0.0125*** -0.0137*** -0.0134*** -0.0124*** -0.0137***

(0.00248) (0.00202) (0.00300) (0.00241) (0.00200) (0.00308) (0.00247) (0.00204) (0.00315)

Constant 0.477*** 0.476*** 0.442*** 0.463*** 0.488*** 0.443*** 0.466*** 0.480*** 0.443***

(0.0913) (0.0830) (0.0907) (0.0861) (0.0807) (0.0928) (0.0875) (0.0859) (0.0936)

Sample full AM EM full AM EM full AM EM

Observations 1,214 564 650 1,202 552 650 1,202 552 650

R-squared 0.409 0.4843 0.403 0.424 0.5388 0.4038 0.4191 0.5043 0.4033

Number of countries 30 14 16 29 13 16 29 13 16

Note: Driscoll-Kraay standard errors in parentheses. *** p < 0.01; ** p < 0.05; * p < 0.1.

29

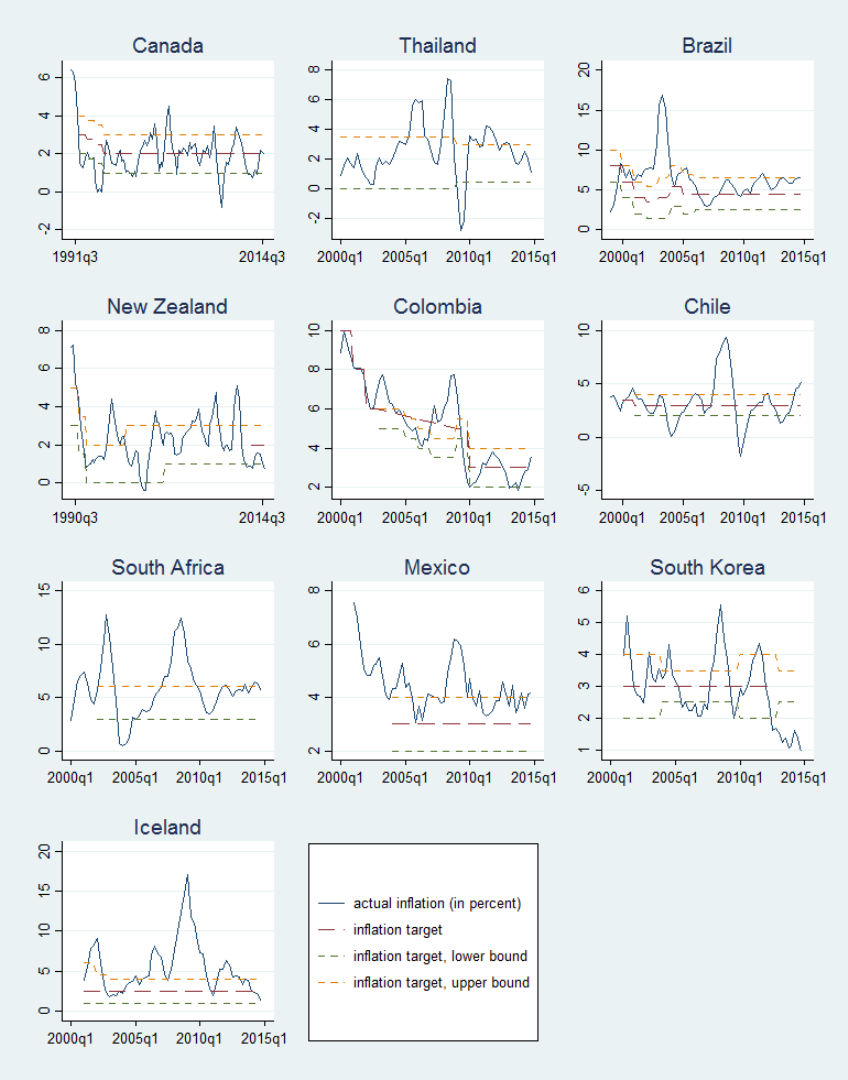

Figure 6: Performance of Inflation Targeting Countries: Top Group

30

Figure 7: Performance of Inflation Targeting Countries: Bottom Group

31

Table 6: Performance of Inflation Targeting Countries: Percent of Time Inflation

within the Announced Range

Top inflation targeters Bottom inflation targeters

Canada 70% Peru 44%

Thailand 65% Australia 40%

Brazil 64% Czech Republic 40%

New Zealand 61% Indonesia 38%

Colombia 60% Philippines 38%

Chile 57% Israel 35%

South Africa 50% Turkey 28%

Mexico 48% Poland 27%

South Korea 46% Serbia 18%

Iceland 46% Romania 18%

Results from Table 5 indicate that the assumption is well-grounded. For inflation

targeting countries, the results are more pronounced, compared to the baseline re-

sult. When only inflation targeting countries are considered, the estimated effects

are larger and statistically more significant. On average, real stock returns respond

more negatively to expected and unexpected inflation, and this is true in both ad-

vanced and emerging markets. When the interaction terms between inflation and

policy rate cyclicality are included, the estimated coefficients are extremely negative

and statistically significant for advanced markets, but not for emerging markets. This

may reflect the fact that the credibility of the central banks differ in advanced and

emerging markets.

To understand why stock returns do not respond to monetary policy cyclicality in

emerging market inflation targeters, I further explore central banks’ track record of

controlling inflation by examining inflation performance with respect to central banks’

inflation target bands. While many central banks target medium-term inflation and

no central bank intends to keep inflation within the announced band at every point

in time, a persistent period of inflation falling outside the target band raises concerns

about a central bank’s capacity and credibility in controlling inflation. My approach

to classify inflation targeting countries is similar to the idea of coding countries by

their de facto exchange rate regime. To the extent of my knowledge, no academic

study has done such exercise before. Among the 30 inflation targeting countries in

the sample, 24 of them have more than 5 years of experience, and 20 of them have

32

Table 7: Regressions on Real Stock Returns by Monetary Policy Framework: Inflation Targeting, Continued.

Dependent variable: real stock return (1) (2) (3) (4) (5) (6) (7) (8) (9)

Expected inflation -2.506*** -3.743*** -2.066** -3.675*** -1.746 -3.645*** -0.984 -0.888 -0.548

(0.866) (0.865) (0.977) (0.935) (1.287) (0.942) (2.402) (5.557) (1.362)

Unexpected inflation -2.912*** -3.390*** -1.704 -3.882*** -0.541 -3.812*** 0.0113 5.859 -3.897**

(0.856) (0.591) (1.362) (0.755) (1.685) (1.326) (2.995) (4.990) (1.843)

Expected inflation × policy rate cyclicality 0.628 -4.278* -11.51** 0.385 -3.543 3.347 -25.13***

(1.379) (2.450) (4.539) (1.621) (8.354) (13.07) (5.278)

Unexpected inflation × policy rate cyclicality -1.550 -4.016 -10.18** -1.520 -7.596 3.035 -17.15**

(1.937) (2.581) (4.952) (1.750) (8.925) (14.12) (7.337)

Exp. inflation × countercyclical policy dummy -5.088** -0.181

(2.478) (1.087)

Une. inflation × countercyclical policy dummy -5.644* 0.0974

(3.237) (2.010)

Industrial production growth rate 1.085*** 1.140*** 1.218*** 0.987** 1.143*** 0.980** 1.455*** 1.302*** 1.449***

(0.275) (0.240) (0.188) (0.400) (0.194) (0.399) (0.261) (0.415) (0.464)

M2 growth rate -0.254 -0.430 -0.570 -0.237 -0.606 -0.232 0.224 -1.506*** -0.924

(0.217) (0.296) (0.479) (0.187) (0.512) (0.184) (0.258) (0.475) (0.566)

Improvement in financial risk rating 0.0193*** 0.0172*** 0.0135** 0.0174* 0.0134* 0.0172* 0.0264*** 0.0436** -0.00714

(0.00572) (0.00504) (0.00656) (0.00968) (0.00719) (0.00969) (0.00652) (0.0207) (0.00666)

U.S 3-month Treasury bill yield rate 0.0109 0.0164 0.0204 0.00786 0.0216 0.00818 0.0187 -0.00126 0.0167

(0.0147) (0.0129) (0.0127) (0.0173) (0.0132) (0.0172) (0.0137) (0.0170) (0.0218)

VIX -0.0118*** -0.0125*** -0.00882*** -0.0171*** -0.00916*** -0.0170*** -0.00845*** -0.00395 -0.00856***

(0.00272) (0.00262) (0.00196) (0.00414) (0.00200) (0.00414) (0.00269) (0.00556) (0.00271)

Constant 0.408*** 0.470*** 0.424*** 0.511*** 0.439*** 0.512*** 0.241** 0.297** 0.590***

(0.0819) (0.0910) (0.0857) (0.104) (0.0932) (0.105) (0.110) (0.113) (0.112)

Sample Long-term all IT top IT bottom IT top IT bottom IT top IT top IT top IT

EM IT w/ band in band in band in band in band π within range π below range π above range

Observations 558 918 530 388 530 388 292 57 153

R-squared 0.3966 0.4287 0.4599 0.4544 0.4287 0.4537 0.3585 0.3994 0.6359

Number of countries 11 18 9 9 9 9 9 7 9

Note: Driscoll-Kraay standard errors in parentheses. *** p < 0.01; ** p < 0.05; * p < 0.1.

33

announced explicit inflation bands to the public. I divide these 20 countries into two

groups based on the percent of time inflation remains in the range announced by the

central bank (Figures 6 and 7).

15

The results are reported in Table 6 and they reveal

staggering differences in central banks’ tendency in managing inflation.

16

Canada

as the top performer keeps inflation within the target band for 70% of the time.

On the other hand, the central bank in Romania has faced overwhelming difficulties

in steering inflation towards their target band and as a result inflation is within

the announced range for only 18% of the period. The threshold is 45% to separate

the sample into top and bottom groups. Results in Column 1 of Table 7 shows

that emerging market inflation targeters with more than 10 years of experience in

general are not successful in shaping market perceptions. It is the history of inflation

targeting record rather than the length of the record that matters. Announcing the

inflation band helps a little bit in shaping market perceptions, as shown in Column

2. Furthermore, markets are reacting to monetary policy cyclicality in the top group,

but not so in the bottom group. This means that central banks’ ability to maintain

inflation within their target bans is key to shape market perceptions.

The inflation targeting countries in the top group, which include both advanced

and emerging markets, maintain inflation within their target bands most of the time,

and markets pay attention to monetary policy cyclicality. Instead, the inflation tar-

geting countries in the bottom group are struggling to keep inflation in the announced

bands. As a result, markets do not pay much attention to monetary policy cyclical-

ity.

17

15

In reality, this calculation is complicated by the fact that central banks use different underlying

inflation measures (for example, headline CPI vs. core CPI), various target horizons (1 year or

mid-term), revisions in targets at certain points in time, and adjustments made by authorities to

account for structural breaks such as one-off tax changes. Nevertheless, given the nature of the

study, and the way countries are grouped into two categories, this approach illustrates the point of

central bank credibility and capability, and serves the purpose well.

16

It is worth noting idiosyncrasies in inflation targeting bands in different countries. Certain

countries have set themselves more difficult tasks due to tighter bands. For instance, Australia’s

inflation target band is 1 percentage point wide (2–3 percent), while Canada’s is 2 percentage points

wide (1–3 percent). If Australia’s target range had instead been a 2 percentage points, we would have

seen a higher share of the time within that range for Australia. Nevertheless, this paper adopts a

fact-based approach that only uses central banks’ official inflation bands to assess inflation targeting

countries.

17

Ilzetzki, Reinhart and Rogoff (2017) make a similar argument that inflation targeting countries

are heterogeneous and far less distinctive as one group than advertised. Using event studies and

estimating an augmented Taylor rule for the inflation targeting group, they show that inflation

targeting central banks differ in the degree of stabilzing inflation and managing exchange rates.

34

Finally, for the top inflation targeters, I split the results by looking at scenarios

when inflation is within, below or above the target band. In these countries, when

inflation is outside the target band, it is three times more likely to see inflation is

above the band (153 observations in regression) than inflation is below the band (57

observations in regression). Regression results indicate that the interaction terms are