LEVELIZED COST OF ENERGY+

WITH SUPPORT FROM

June 2024

Executive Summary

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

(1) This analysis has been compiled using U.S.-focused data.

Executive Summary—Levelized Cost of Energy Version 17.0

(1)

The results of our Levelized Cost of Energy (“LCOE”)

analysis reinforce what we observe across the Power, Energy & Infrastructure Industry—sizable

and well-capitalized companies that can take advantage of supply chain and other economies of scale, and that have strong balance sheet support to

weather fluctuations in the macro environment, will continue leading the build-out of new renewable energy assets. This is particularly true in a rising

LCOE environment like what we have observed in this year’s analysis. Amplifying this observation, and not overtly covered in our report, are the

complexities related to currently observed demand growth and grid-related constraints, among other factors. Key takeaways from Version 17.0 of

Lazard’s LCOE include:

1. Low End LCOE Values Increase; Overall Ranges Tighten

Despite high end LCOE declines for selected renewable energy technologies, the low ends of our LCOE have increased for the first time ever, driven by the persistence of

certain cost pressures (e.g., high interest rates, etc.). These two phenomena result in tighter LCOE ranges (offsetting the significant range expansion observed last year)

and relatively stable LCOE averages year-over-year. The persistence of elevated costs continues to reinforce the central theme noted above—sizable and well-capitalized

companies that can take advantage of supply chain and other economies of scale, and that have strong balance sheet support to weather fluctuations in the macro

environment, will continue leading the build-out of new renewable energy assets.

2. Baseload Power Needs Will Require Diverse Generation Fleets

Despite the sustained cost-competitiveness of renewable energy technologies, diverse generation fleets will be required to meet baseload power needs over the long term.

This is particularly evident in today’s increasing power demand environment driven by, among other things, the rapid growth of artificial intelligence, data center

deployment, reindustrialization, onshoring and electrification. As electricity generation from intermittent renewables increases, the timing imbalance between peak

customer demand and renewable energy production is exacerbated. As such, the optimal solution for many regions is to complement new renewable energy technologies

with a “firming” resource such as energy storage or new/existing and fully dispatchable generation technologies (of which CCGTs remain the most prevalent). This

observation is reinforced by the results of this year’s marginal cost analysis, which shows an increasing price competitiveness of existing gas-fired generation as compared

to new-build renewable energy technologies. As such, and as has been noted in our historic reports, the LCOE is just the starting point for resource planning and has

always reinforced the need for a diversity of energy resources, including but not limited to renewable energy.

3. Innovation Is Critical to the Energy Transition

Continuous innovation across technology, capital formation and policy is required to fully enable the Energy Transition, which we define to include a generation mix that is

diverse and advanced enough to meet the ongoing reshaping of our energy economy. The Energy Transition will also require continued maturation of selected

technologies not included in our analysis (e.g., carbon capture, utilization and sequestration (“CCUS”), long duration energy storage, new nuclear technologies, etc.). While

the results of this year’s LCOE reinforce our previous conclusions—the cost-competitiveness of renewables will lead to the continued displacement of conventional

generation and an evolving energy mix—the timing of such displacement and composition of such mix will be impacted by many factors, including those outside of the

scope of our LCOE (e.g., grid investment, permitting reform, transmission queue reform, economic policy, continued advancement of flexible load and locally sited

generation, etc.).

I EXECUTIVE SUMMARY

4

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Executive Summary—Levelized Cost of Storage Version 9.0

(1)

The results of our Levelized Cost of Storage (“LCOS”) analysis reinforce what we observe across the Power, Energy & Infrastructure Industry—energy

storage system (“ESS”) applications are becoming more valuable, well understood and, by extension, widespread as grid operators begin adopting

methodologies to value these resources leading to increased transaction activity and infrastructure classification for the ESS asset class. Key

takeaways from Version 9.0 of Lazard’s LCOS include:

1. Increased LCOS Variability

While we saw incremental declines in the low end LCOS as compared to last year’s analysis, the high end increased more noticeably, resulting in a wider range of LCOS

outcomes across the operational parameters analyzed. The decline on the low end was, in part, driven by a noticeable decline in cell prices resulting from increased

manufacturing capacity in China and decreased mineral pricing. However, this was offset by significant increases in engineering, procurement and construction (“EPC”)

pricing driven, in part, by high demand, increased timeline scrutiny, skilled labor shortages and prevailing wage requirements. Also notable is the increased impact of

economies of scale benefits in procurement, mirroring the observations we have seen in the LCOE in recent years.

2. The Power of the IRA Is Clear

Despite the significant increases in wholesale pricing for lithium carbonate and lithium hydroxide observed from 2022 to 2023, the IRA’s grant of ITC eligibility for

standalone ESS assets kept LCOS v8.0 values relatively neutral as compared to LCOS v7.0. One year later, for this year’s LCOS v9.0, ITC implementation, including the

application of energy community adders, is fully underway and the impacts are clear. The ITC, along with lower cell pricing and technology improvements, is leading to an

increasing trend of oversizing battery capacity to offset future degradation and useful life considerations, which is not only extending useful life expectations but is also

increasing residual value and overall project returns. While the ITC and energy community adder are prevalent, the domestic content adder remains uncertain,

notwithstanding the various domestic manufacturing announcements. The lack of clarity related to qualifying for local content is leading to longer lead times and higher

contingencies. Adding to this overall complexity is the recently proposed increase of Section 301 import tariffs on lithium-ion batteries, which many believe will lead to

increased domestic battery supply but with uncertain costs results.

3. Lithium-Ion Batteries Remain Dominant

Lithium-ion batteries remain the most cost competitive short-term (i.e., 2 – 4-hour) storage technology, given, among other things, a mature supply chain and global

market demand. Lithium-ion, however, is not without its challenges. For example, safety remains a concern for utilities and commercial & industrial owners, particularly in

urban areas, and longer-duration lithium-ion use cases can have challenging economic profiles. As such, industry participants have started progressing non-lithium-based

technology solutions, including for longer-duration use cases and applications. Such technologies are targeting new market segments, including industrial applications,

data center deployments and ultra-long duration applications in regions with high penetration of intermittent renewable energy. However, the development of long duration

energy storage still requires clear demonstration of the commercial operation of these technologies, market maturation (including the development of stronger incentives

for long duration projects that could capture capacity revenues in merchant and bilateral markets) and manufacturing scale to realize (long-promised) cost reductions, all

resulting in greater willingness of insurance and financing participants to underwrite these projects.

(1) This analysis has been compiled using U.S.-focused data.

I EXECUTIVE SUMMARY

5

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Hydrogen continues to be regarded as a potential solution for industrial processes that will be difficult to decarbonize through other existing

technologies or alternatives. Hydrogen production in the U.S. primarily comes from fossil fuels through steam-methane reforming (“SMR”) and

methane splitting processes resulting in “gray” hydrogen. The cost of the equipment (i.e., the “electrolyzer”) and the source of the electricity (i.e.,

wind- and solar-derived electricity for “green” hydrogen, nuclear-derived electricity for “pink” hydrogen, etc.) continue to have the greatest impact on

the levelized cost of hydrogen production. Key takeaways from Version 4.0 of Lazard’s Levelized Cost of Hydrogen (“LCOH”) analysis include:

1. A Maturing Industry Drives Declining Costs

Observable declines in the results of our LCOH analysis indicate that the hydrogen electrolyzer industry is continuing to mature and will likely scale over time. Proton

Exchange Membrane (“PEM”) and Alkaline electrolyzers are the dominant technologies, but their higher costs relative to currently available alternatives (e.g., renewables

+ BESS, dispatchable gas-fired generation, etc.) hinder significant market expansion. Notably, there is a considerable price disparity across the market for electrolyzer

equipment, which would be more overtly pronounced had this report included electrolyzers manufactured in China given the significantly lower price expectations. Despite

this price disparity, Western-supplied electrolyzers and related equipment remain competitive given the greater level of performance validation and freedom from the

potential risks of tariff and trade implications.

2. Uncertainty Around IRA Implementation

Implementation challenges for hydrogen projects vary dramatically by markets and use cases. In the U.S., project developers are waiting for final guidance from the

Treasury Department on the IRA 45(V) tax credit to provide clarity on which projects qualify for the production subsidy (up to $3 per kilogram of hydrogen). A key concern

for project developers is how the production costs for green hydrogen will be impacted by hourly matching requirements which would stipulate that renewable power

production must occur in the same hour as hydrogen production. Hourly matching requirements would likely lead to an increase in the results of our LCOH due to higher

renewable power development costs and lower electrolyzer utilization rates. Final guidance from the Treasury Department may impact the competitiveness and adoption

rate for green hydrogen relative to alternatives such as “blue” hydrogen (i.e., hydrogen produced from fossil fuels with CCUS).

3. Use Case Analysis Is Critical

While the scope of our LCOH remains focused on the cost of production, we plan to broaden the LCOH in the coming years to evaluate various use cases (similar to the

expansion of our LCOS analysis and the related “Value Snapshots”). We continue to see growing interest from key hydrogen off-takers in the chemicals industry (e.g.,

ammonia for use in fertilizer) and demand is expected to continue increasing for fuels produced from clean hydrogen to help decarbonize transportation sectors (e.g.,

maritime). In addition, several companies in hard-to-abate industrial sectors (e.g., steel, construction materials, etc.) are considering hydrogen as an alternative to fossil

fuels for some heat-generating applications. Although the technology is broadly available, using hydrogen for power generation (or blending it with natural gas) will likely

require capital-intensive upgrades to current generation assets, storage facilities and pipelines to protect the legacy infrastructure and avoid leakages.

Executive Summary—Levelized Cost of Hydrogen Version 4.0

(1)

(1) This analysis has been compiled using U.S.-focused data.

I EXECUTIVE SUMMARY

6

Lazard’s Levelized Cost of Energy Analysis—Version 17.0

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Introduction

Lazard’s Levelized Cost of Energy analysis addresses the following topics:

• Comparative LCOE analysis for various generation technologies on a $/MWh basis, including sensitivities for U.S. federal tax subsidies, fuel prices, carbon pricing and

cost of capital

• Illustration of how the LCOE of onshore wind, utility-scale solar and hybrid projects compare to the marginal cost of selected conventional generation technologies

• Illustration of how the LCOE of onshore wind, utility-scale solar and hybrid projects, plus the cost of firming intermittency in various regions, compares to the LCOE of

selected conventional generation technologies

• Historical LCOE comparison of various technologies

• Illustration of the historical LCOE declines for onshore wind and utility-scale solar

• Appendix materials, including:

− Deconstruction of the LCOE for various generation technologies by capital cost, fixed operations and maintenance (“O&M”) expense, variable O&M expense and fuel

cost

− An overview of the methodology utilized to prepare Lazard’s LCOE analysis

− A summary of the assumptions utilized in Lazard’s LCOE analysis

Other factors would also have a potentially significant effect on the results contained herein, but have not been examined in the scope of this current analysis. These additional

factors, among others, may include: implementation and interpretation of the full scope of the IRA; economic policy, transmission queue reform, network upgrades and other

transmission matters, congestion, curtailment or other integration-related costs; permitting or other development costs, unless otherwise noted; and costs of complying with

various environmental regulations (e.g., carbon emissions offsets or emissions control systems). This analysis is intended to represent a snapshot in time and utilizes a wide, but

not exhaustive, sample set of Industry data. As such, we recognize and acknowledge the likelihood of results outside of our ranges. Therefore, this analysis is not a forecasting

tool and should not be used as such, given the complexities of our evolving Industry, grid and resource needs. Except as illustratively sensitized herein, this analysis does not

consider the intermittent nature of selected renewables energy technologies or the related grid impacts of incremental renewable energy deployment. This analysis also does not

address potential social and environmental externalities, including, for example, the social costs and rate consequences for those who cannot afford distributed generation

solutions, as well as the long-term residual and societal consequences of various conventional generation technologies that are difficult to measure (e.g., airborne pollutants,

greenhouse gases, etc.)

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

8

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Levelized Cost of Energy Comparison—Version 17.0

Selected renewable energy generation technologies remain cost-competitive with conventional generation technologies under certain circumstances

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Here and throughout this analysis, unless otherwise indicated, the analysis assumes 60% debt at an 8% interest rate and 40% equity at a 12% cost. See page titled “Levelized Cost of Energy Comparison—Sensitivity to Cost of Capital”

for cost of capital sensitivities.

(1) Given the limited public and/or observable data available for new-build geothermal, coal and nuclear projects the LCOE presented herein reflects Lazard’s LCOE v14.0 results adjusted for inflation and, for nuclear, are based on then-

estimated costs of the Vogtle Plant. Coal LCOE does not include cost of transportation and storage.

(2) The fuel cost assumptions for Lazard’s LCOE analysis of gas-fired generation, coal-fired generation and nuclear generation resources are $3.45/MMBTU, $1.47/MMBTU and $0.85/MMBTU respectively, for year-over-year comparison

purposes. See page titled “Levelized Cost of Energy Comparison—Sensitivity to Fuel Prices” for fuel price sensitivities.

(3) Reflects the average of the high and low LCOE marginal cost of operating fully depreciated gas peaking, gas combined cycle, coal and nuclear facilities, inclusive of decommissioning costs for nuclear facilities. Analysis assumes that the

salvage value for a decommissioned gas or coal asset is equivalent to its decommissioning and site restoration costs. Inputs are derived from a benchmark of operating gas, coal and nuclear assets across the U.S. Capacity factors, fuel,

variable and fixed operating expenses are based on upper- and lower-quartile estimates derived from Lazard’s research. See page titled “Levelized Cost of Energy Comparison—New Build Renewable Energy vs. Marginal Cost of

Existing Conventional Generation” for additional details.

(4) Represents the illustrative midpoint LCOE for Vogtle nuclear plant units 3 and 4 based on publicly available estimates. Total operating capacity of ~2.2 GW, total capital cost of ~$31.5 billion, capacity factor of ~97%, operating life of 60 –

80 years and other operating parameters estimated by Lazard’s LCOE v14.0 results adjusted for inflation. See Appendix for more details.

(5) Reflects the LCOE of the observed high case gas combined cycle inputs using a 20% blend of green hydrogen by volume (i.e., hydrogen produced from an electrolyzer powered by a mix of wind and solar generation and stored in a

nearby salt cavern). No plant modifications are assumed beyond a 2% increase to the plant’s heat rate. The corresponding fuel cost is $6.66/MMBTU, assuming ~$5.25/kg for green hydrogen (unsubsidized PEM). See LCOH—Version

4.0 for additional information.

$30

(3)

(1)

$150

(5)

(1)

(1)

$32

(3)

$190

(4)

$85

(3)

Levelized Cost of Energy ($/MWh)

$122

$54

$29

$60

$64

$27

$45

$74

$110

$142

$69

$45

$284

$191

$92

$210

$106

$73

$133

$139

$228

$222

$168

$108

$0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300

Solar PV—Rooftop Residential

Solar PV—Community & C&I

Solar PV—Utility

Solar PV + Storage—Utility

Geothermal

Wind—Onshore

Wind + Storage—Onshore

Wind—Offshore

Gas Peaking

U.S. Nuclear

Coal

Gas Combined Cycle

$190

(4)

Renewable Energy

Conventional Energy

(2)

$71

(3)

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

9

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Renewable Energy

$122

$75

$54

$34

$29

$19

$29

$6

$60

$38

$64

$43

$27

$0

$45

$8

$74

$71

$284

$228

$191

$157

$92

$78

$92

$73

$210

$171

$106

$90

$73

$62

$133

$123

$139

$123

$0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300

Solar PV—Rooftop Residential (ITC)

Solar PV—Community & C&I (ITC)

Solar PV—Utility (ITC)

Solar PV—Utility (PTC)

Solar PV + Storage—Utility (ITC)

Geothermal (ITC)

Wind—Onshore (PTC)

Wind + Storage—Onshore (PTC/ITC)

Wind—Offshore (PTC)

LCOE Subsidized (incl. Energy Community) Subsidized (excl. Energy Community)

(2)

(3)

Levelized Cost of Energy Comparison—Sensitivity to U.S. Federal Tax Subsidies

(1)

The Investment Tax Credit (“ITC”), Production Tax Credit (“PTC”) and Energy Community adder, among other provisions in the IRA, are important

components of the LCOE for renewable energy technologies

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Unless otherwise indicated, this analysis does not include other state or federal subsidies (e.g., domestic content adder, etc.). The IRA is comprehensive legislation that is still being implemented and remains subject to

interpretation—important elements of the IRA are not included in our analysis and could impact outcomes.

(1) This sensitivity analysis assumes that projects qualify for the full ITC/PTC, have a capital structure that includes sponsor equity, debt and tax equity and assumes the equity owner has taxable income to monetize a portion of the

tax credits.

(2) Results at this level are driven by Lazard’s approach to calculating the LCOE and selected inputs (see Appendix A for further details). Lazard’s LCOE analysis assumes, for year-over-year reference purposes, 60% debt at an 8%

interest rate and 40% equity at a 12% cost (together implying an after-tax IRR/WACC of 7.7%). Implied IRRs at this level for Wind—Onshore (PTC) is 13% (i.e., the value of the PTC and Energy Community adder result in an

implied IRR greater than the assumed 12%).

(3) This sensitivity analysis assumes that projects qualify for the full ITC/PTC and also includes an Energy Community adder of 10% for ITC projects and $3/MWh for PTC projects.

Levelized Cost of Energy ($/MWh)

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

10

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

$122

$54

$29

$60

$64

$27

$45

$74

$102

$139

$65

$38

$284

$191

$92

$210

$106

$73

$133

$139

$238

$225

$173

$115

$0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300

Solar PV—Rooftop Residential

Solar PV—Community & C&I

Solar PV—Utility

Solar PV + Storage—Utility

Geothermal

Wind—Onshore

Wind + Storage—Onshore

Wind—Offshore

U.S. Nuclear

Coal

Gas Combined Cycle

LCOE +/- 25% Fuel Price Adjustment

Renewable Energy

Conventional Energy

(1)

(1)

(2)

(3)

Levelized Cost of Energy Comparison—Sensitivity to Fuel Prices

Variations in fuel prices can materially affect the LCOE of conventional generation technologies, but direct comparisons to “competing” renewable

energy generation technologies must take into account issues such as dispatch characteristics (e.g., baseload and/or dispatchable intermediate

capacity vs. peaking or intermittent technologies)

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Unless otherwise noted, the assumptions used in this sensitivity correspond to those used in the LCOE analysis as presented on the page titled “Levelized Cost of Energy Comparison—Version 17.0”.

(1) Assumes a fuel cost range for gas-fired generation resources of $2.59/MMBTU – $4.31/MMBTU (representing a sensitivity range of ± 25% of the $3.45/MMBTU used in the LCOE).

(2) Assumes a fuel cost range for nuclear generation resources of $0.64/MMBTU – $1.06/MMBTU (representing a sensitivity range of ± 25% of the $0.85/MMBTU used in the LCOE).

(3) Assumes a fuel cost range for coal-fired generation resources of $1.10/MMBTU – $1.84/MMBTU (representing a sensitivity range of ± 25% of the $1.47/MMBTU used in the LCOE).

Gas Peaking

Levelized Cost of Energy ($/MWh)

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

11

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

$122

$54

$29

$60

$64

$27

$45

$74

$110

$129

$142

$69

$106

$45

$61

$284

$191

$92

$210

$106

$73

$133

$139

$228

$263

$222

$168

$175

$108

$134

$0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300

Solar PV—Rooftop Residential

Solar PV—Community & C&I

Solar PV—Utility

Solar PV + Storage—Utility

Geothermal

Wind—Onshore

Wind + Storage—Onshore

Wind—Offshore

Gas Peaking

U.S. Nuclear

Coal

Gas Combined Cycle

Carbon pricing is one avenue for policymakers to address carbon emissions; a carbon price range of $40 – $60/Ton

(1)

of carbon would increase the LCOE for

certain conventional generation technologies, as indicated below

Levelized Cost of Energy Comparison—Sensitivity to Carbon Pricing

Levelized Cost of Energy ($/MWh)

LCOE LCOE with Carbon Pricing

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Unless otherwise noted, the assumptions used in this sensitivity correspond to those used in the LCOE analysis as presented on the page titled “Levelized Cost of Energy Comparison—Version 17.0”.

(1) In November 2023, the U.S. Environmental Protection Agency proposed a $204/Ton social cost of carbon.

(2) The low and high ranges reflect the LCOE of selected conventional generation technologies including an illustrative carbon price of $40/Ton and $60/Ton, respectively.

(2)

(2)

(2)

Renewable Energy

Conventional Energy

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

12

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Levelized Cost of Energy Comparison—Sensitivity to Cost of Capital

A key consideration in determining the LCOE for utility-scale generation technologies is the cost, and availability, of capital

(1)

—in practice, this

dynamic is particularly significant because the cost of capital for each asset is directly correlated to its specific operational characteristics and the

resulting risk/return profile

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Analysis assumes 60% debt and 40% equity. Unless otherwise noted, the assumptions used in this sensitivity correspond to those used on the page titled “Levelized Cost of Energy Comparison—Version 17.0”.

(1) Cost of capital as used herein indicates the cost of capital applicable to the asset/plant and not the cost of capital of a particular investor/owner.

(2) Reflects the average of the high and low LCOE for each respective cost of capital assumption.

Average LCOE

(2)

After

-Tax

IRR/WACC

4.2% 5.4% 6.5% 7.7% 8.8% 10.0%

Cost of Equity

6.0% 8.0% 10.0% 12.0% 14.0% 16.0%

Cost of Debt

5.0% 6.0% 7.0% 8.0% 9.0% 10.0%

$70

$74

$79

$85

$91

$98

$46

$50

$55

$61

$67

$74

$40

$43

$46

$50

$54

$59

$88

$97

$107

$118

$130

$143

$66

$69

$72

$76

$80

$85

$137

$148

$158

$169

$181

$193

$125

$142

$161

$182

$204

$226

$84

$90

$98

$107

$116

$127

25

50

75

100

125

150

175

200

225

$250

LCOE

($/MWh)

Gas Peaking

Geothermal

Coal

Gas Combined

Cycle

Solar PV—

Utility

Wind—Onshore

LCOE v17.0

U.S. Nuclear

Wind—Offshore

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

13

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

$29

$19

$6

$60

$38

$27

$0

$45

$8

$39

$31

$28

$23

$92

$78

$73

$210

$171

$73

$62

$133

$123

$130

$33

$113

$37

$0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300

Solar PV—Utility

Solar PV—Utility (ITC)

Solar PV—Utility (PTC)

Solar PV + Storage—Utility

Solar PV + Storage—Utility (ITC)

Wind—Onshore

Wind—Onshore (PTC)

Wind + Storage—Onshore

Wind + Storage—Onshore (PTC/ITC)

Gas Peaking

U.S. Nuclear

Coal

Gas Combined Cycle

Levelized Cost of Energy ($/MWh)

LCOE Subsidized (excl. Energy Community)

Marginal Cost

(1)

(2)

(2)

(2)

(2)

Levelized Cost of Energy Comparison—New Build Renewable Energy vs. Marginal Cost

of Existing Conventional Generation

Certain renewable energy generation technologies have an LCOE that is competitive with the marginal cost of selected existing conventional

generation technologies—notably, as incremental, intermittent renewable energy capacity is deployed and baseload gas-fired generation utilization

rates increase, this gap closes, particularly in low gas pricing and high energy demand environments

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Unless otherwise noted, the assumptions used in this sensitivity correspond to those used on page titled “Levelized Cost of Energy Comparison—Version 17.0”.

(1) Reflects the marginal cost of operating fully depreciated gas, coal and nuclear facilities, inclusive of decommissioning costs for nuclear facilities. Analysis assumes that the salvage value for a decommissioned gas or coal asset

is equivalent to its decommissioning and site restoration costs. Inputs are derived from a benchmark of operating gas, coal and nuclear assets across the U.S. Capacity factors, fuel, variable and fixed O&M are based on upper-

and lower-quartile estimates derived from Lazard’s research.

(2) See page titled “Levelized Cost of Energy Comparison—Sensitivity to U.S. Federal Tax Subsidies” for additional details.

(2)

Subsidized (incl. Energy Community)

Levelized Cost of

New Build Wind

and Solar

Marginal Cost of

Existing

Conventional

Generation

(1)

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

14

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Gas Combined Cycle LCOE v17.0 ($45 – $108/MWh)

Gas Peaking LCOE v17.0 ($110 – $228/MWh)

Levelized Cost of Energy Comparison—Cost of Firming Intermittency

The incremental cost to firm

(1)

intermittent resources varies regionally—as such is defined by the relevant reliability organizations using the current

effective load carrying capability (“ELCC”)

(2)

values and the current cost of adding new firming resources

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Total LCOE, including firming cost, does not represent the cost of building a 24/7 firm resource on a single project site, but, instead, the LCOE of a renewable resource and the additional costs required to achieve the resource

adequacy requirement in the relevant reliability region based on the net cost of new entry (“Net CONE”). ISO ELCC data as of April 2024.

(1) Firming costs reflect the additional capacity needed to supplement the net capacity of the renewable resource (nameplate capacity * (1 – ELCC)) and the Net CONE of a new firm resource (capital and operating costs, less

expected market revenues). Net CONE is assessed and published by grid operators for each regional market. Grid operators use a natural gas peaker as the assumed new resource in MISO ($8.22/kW-mo), SPP ($8.56/kW-mo)

and PJM ($10.20/kW-mo). In CAISO, the assumed new resource is a 4-hour lithium-ion battery storage system ($18.92/kW-mo). For the PV + Storage cases in CAISO and PJM, assumed storage configuration is 50% of PV MW

and 4-hour duration.

(2) ELCC is an indicator of the incremental reliability contribution of a given resource to the electricity grid based on its contribution to meeting peak electricity demand. For example, a 1 MW wind resource with a 15% ELCC provides

0.15 MW of capacity contribution and would need to be supplemented by 0.85 MW of additional firm capacity in order to represent the addition of 1 MW of firm system capacity.

(3) Reflects the average of the high and low of Lazard’s LCOE v17.0 for each technology using the regional capacity factor, as indicated, to demonstrate the regional differences in project costs.

(4) For PV + Storage cases, the effective ELCC value is represented. CAISO and PJM assess ELCC values separately for the PV and storage components of a system. Storage ELCC value is provided only for the capacity that can

be charged directly by the accompanying resource up to the energy required for a 4-hour discharge during peak load. Any capacity available in excess of the 4-hour maximum discharge is attributed to the system at the solar

ELCC. ELCC values for storage range from 90% to 95% for CAISO and PJM.

LCOE Including Levelized Firming Cost ($/MWh)

(3)

(3)

(3) (1)

Solar Wind Solar PV + Storage Wind Solar Wind Solar PV + Storage Wind Solar Wind

ELCC

39% 26% 8% 51%

(4)

14% 57% 19% 42% 72%

(4)

21% 38% 25%

Capacity Factor

18% 34% 23% 23% 23% 21% 39% 18% 18% 42% 23% 33%

Resource Penetration

6% 25% 52% 52% 20% 1% 58% 7% 7% 7% 21% 44%

MISO CAISO SPP PJM

ERCOT

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

15

$62

$53

$49

$107

$80

$55

$47

$63

$137

$44

$50

$56

$53

$38

$42

$68

$75

$47

$29

$54

$87

$25

$42

$42

$100

$91

$78

$63

$153

$146

$162

$123

$177

$172

$75

$67

$67

$49

$106

$97

$160

$110

$69

$50

$78

$71

$81

$67

0

25

50

75

100

125

150

175

200

225

$250

Levelized Cost of Energy ($/MWh)

LCOE Subsidized (excl. Energy Community) Firming Cost

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

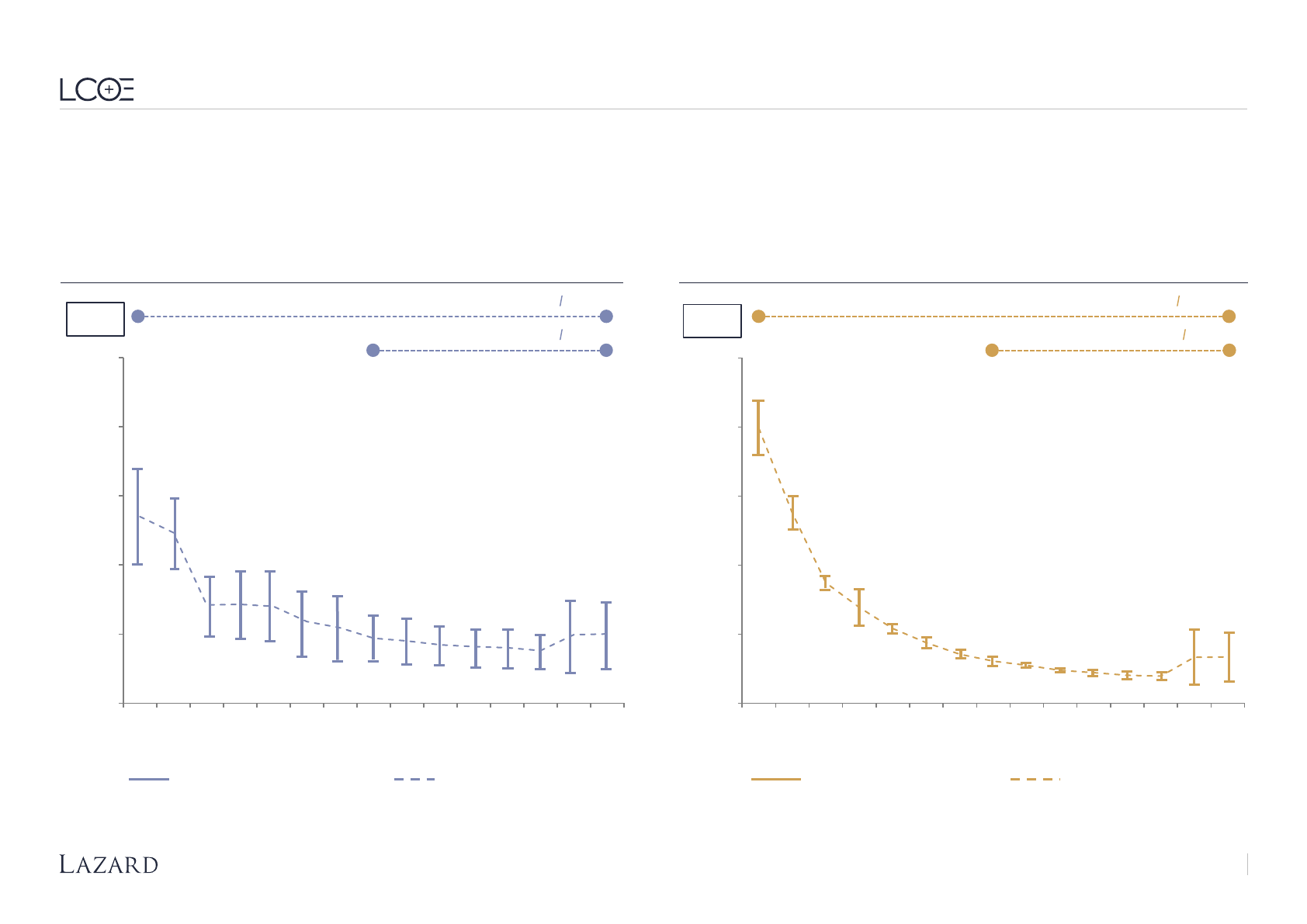

Levelized Cost of Energy Comparison—Historical LCOE Comparison

Lazard’s LCOE analysis indicates significant historical cost declines for utility-scale renewable energy generation technologies, which has begun to

level out in recent years and slightly increased this year

Source: Lazard and Roland Berger estimates and publicly available information.

(1) Reflects the average of the high and low LCOE for each respective technology in each respective year. Percentages represent the total decrease in the average LCOE since Lazard’s LCOE v3.0.

Selected Historical Average LCOE Values

(1)

Solar PV—

Utility

(83%)

$359

$248

$157

$125

$98

$79

$64

$55

$50

$43

$40

$37

$36

$60

$61

$111

$111

$111

$102

$105

$109

$108

$102

$102

$102

$109

$112

$108

$117

$118

$83

$82

$83

$75

$74

$74

$65

$63

$60

$58

$56

$59

$60

$70

$76

$135

$124

$71

$72

$70

$59

$55

$47

$45

$42

$41

$40

$38

$50

$50

$123

$96

$95

$96

$104

$112

$117

$117

$148

$151

$155

$163

$167

$180

$182

$76

$107

$104

$116

$116

$116

$100

$98

$97

$91

$91

$80

$75

$82

$85

$275

$243

$227

$216

$205 $205

$192

$191

$183

$179

$175

$175

$173

$168

$169

20

80

140

200

260

320

$380

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2023 2024

LCOE

($/MWh)

Gas Combined

Cycle

(8%)

Wind—Onshore

(65%)

U.S. Nuclear

49%

Coal

7%

Gas Peaking

(38%)

Geothermal

12%

//

LCOE Version

3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 17.0

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

16

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Solar PV—Utility LCOE Range Solar PV—Utility LCOE AverageWind—Onshore LCOE Range Wind—Onshore LCOE Average

$101

$99

$50

$48

$45

$37

$32 $32

$30

$29

$28

$26

$26

$24

$27

$169

$148

$92

$95 $95

$81

$77

$62

$60

$56

$54

$54

$50

$75

$73

0

50

100

150

200

$250

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2023 2024

LCOE

($/MWh)

Wind—Onshore 2009 – 2023 Percentage Decrease/CAGR: (65%)

(1)

(7%)

(2)

Wind—Onshore 2016 – 2023 Percentage Decrease/CAGR: (1)%

(1)

(0%)

(2)

//

$323

$226

$148

$101

$91

$72

$58

$49

$46

$40

$36

$31

$30

$24

$29

$394

$270

$166

$149

$104

$86

$70

$61

$53

$46

$44

$42

$41

$96

$92

0

90

180

270

360

$450

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2023 2024

LCOE

($/MWh)

Solar PV—Utility 2009 – 2023 Percentage Decrease/CAGR: (83%)

(1)

(12%)

(2)

Solar PV—Utility 2016 – 2023 Percentage Increase/CAGR: 5%

(1)

(1%)

(2)

//

Levelized Cost of Energy Comparison—Historical Renewable Energy LCOE

While the low end of the LCOE for both wind and solar has increased slightly, reflecting current market conditions, the average has remained nearly

flat and the overall range has narrowed, reflecting, among other things, reconciliation of the supply chain challenges that were notable last year

Source: Lazard and Roland Berger estimates and publicly available information.

(1) Reflects the average percentage increase/(decrease) of the high end and low end of the LCOE range.

(2) Reflects the average compounded annual rate of decline of the high end and low end of the LCOE range.

Wind—Onshore Solar PV—Utility

LCOE

Version

3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 17.0

LCOE

Version

3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 17.0

II LAZARD’S LEVELIZED COST OF ENERGY ANALYSIS— VERSION 17.0

17

Lazard’s Levelized Cost of Storage Analysis—Version 9.0

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Introduction

Lazard’s Levelized Cost of Storage analysis

addresses the following topics:

• LCOS Analysis:

− Comparative LCOS analysis for various energy storage systems on a $/MWh basis

− Comparative LCOS analysis for various energy storage systems on a $/kW-year basis

• Energy Storage Value Snapshots:

− Overview of potential revenue applications for various energy storage systems

− Overview of the Value Snapshot analysis and identification of selected geographies for each use case analyzed

− Results from the Value Snapshot analysis

• Appendix Materials, including:

− An overview of the use cases and operational parameters of selected energy storage systems for each use case analyzed

− An overview of the methodology utilized to prepare Lazard’s LCOS analysis

− A summary of the assumptions utilized in Lazard’s LCOS analysis

Other factors would also have a potentially significant effect on the results contained herein, but have not been examined in the scope of this current analysis. These additional

factors, among others, may include: implementation and interpretation of the full scope of the IRA; economic policy, transmission queue reform, network upgrades and other

transmission matters, congestion; curtailment or other integration-related costs; permitting or other development costs, unless otherwise noted; and costs of complying with

various regulations (e.g., federal import tariffs or labor requirements). This analysis also does not address potential social and environmental externalities, as well as the long-

term residual and societal consequences of various energy storage system technologies that are difficult to measure (e.g., resource extraction, end of life disposal, lithium-ion-

related safety hazards, etc.). This analysis is intended to represent a snapshot in time and utilizes a wide, but not exhaustive, sample set of Industry data. As such, we recognize

and acknowledge the likelihood of results outside of our ranges. Therefore, this analysis is not a forecasting tool and should not be used as such, given the complexities of our

evolving Industry, grid and resource needs.

III LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS— VERSION 9.0

19

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Levelized Cost of Storage Comparison—Version 9.0 ($/MWh)

Lazard’s LCOS analysis evaluates standalone energy storage systems on a levelized basis to derive cost metrics across energy storage use cases and

configurations

(1)

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Here and throughout this section, unless otherwise indicated, the analysis assumes 20% debt at an 8% interest rate and 80% equity at a 12% cost, which is a different capital structure than Lazard’s LCOE analysis. Capital costs

are comprised of the storage module, balance of system and power conversion equipment, collectively referred to as the energy storage system, equipment (where applicable) and EPC costs. Augmentation costs are not

included in capital costs in this analysis and vary across use cases due to usage profiles and lifespans. Charging costs are assessed at the weighted average hourly pricing (wholesale energy prices) across an optimized annual

charging profile of the asset. See Appendix B for charging cost assumptions and additional details. The projects are assumed to use a 5-year MACRS depreciation schedule.

(1) See Appendix B for a detailed overview of the use cases and operation parameters analyzed in the LCOS.

(2) This sensitivity analysis assumes that projects qualify for the full ITC and have a capital structure that includes sponsor equity, debt and tax equity and also includes a 10% Energy Community adder.

(3) This sensitivity analysis assumes that projects qualify for the full ITC and have a capital structure that includes sponsor equity, debt and tax equity.

$222

$156

$188

$141

$170

$124

$373

$280

$882

$653

$352

$265

$322

$248

$296

$226

$518

$409

$1,101

$855

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400

Utility-Scale Standalone

(100 MW, 1-hour)

Utility-Scale Standalone

(100 MW, 2-hour)

Utility-Scale Standalone

(100 MW, 4-hour)

C&I Standalone

(1 MW, 2-hour)

Residential Standalone

(0.006 MW, 4-hour)

Levelized Cost of Storage ($/MWh)

LCOS Subsidized (incl. Energy Community) Subsidized (excl. Energy Community)

(3)

(2)

In-Front-of-the-

Meter

Behind-the-Meter

III LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS— VERSION 9.0

20

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

$70

$49

$119

$89

$214

$156

$235

$176

$1,157

$857

$84

$156

$284

$258

$1,122

$111

$203

$374

$326

$1,445

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800

Utility-Scale Standalone

(100 MW, 1-hour)

Utility-Scale Standalone

(100 MW, 2-hour)

Utility-Scale Standalone

(100 MW, 4-hour)

C&I Standalone

(1 MW, 2-hour)

Residential Standalone

(0.006 MW, 4-hour)

Levelized Cost of Storage ($/kW-year)

LCOS Subsidized (incl. Energy Community) Subsidized (excl. Energy Community)

Levelized Cost of Storage Comparison—Version 9.0 ($/kW-year)

Lazard’s LCOS analysis evaluates standalone energy storage systems on a levelized basis to derive cost metrics across energy storage use cases and

configurations

(1)

(3)

(2)

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Here and throughout this section, unless otherwise indicated, the analysis assumes 20% debt at an 8% interest rate and 80% equity at a 12% cost, which is a different capital structure than that used in Lazard’s LCOE analysis.

Capital costs are comprised of the storage module, balance of system and power conversion equipment, collectively referred to as the energy storage system, equipment (where applicable) and EPC costs. Augmentation costs

are not included in capital costs in this analysis and vary across use cases due to usage profiles and lifespans. Charging costs are assessed at the weighted average hourly pricing (wholesale energy prices) across an optimized

annual charging profile of the asset. See Appendix B for charging cost assumptions and additional details. The projects are assumed to use a 5-year MACRS depreciation schedule.

(1) See Appendix B for a detailed overview of the use cases and operation parameters analyzed in the LCOS.

(2) This sensitivity analysis assumes that projects qualify for the full ITC and have a capital structure that includes sponsor equity, debt and tax equity and also includes a 10% Energy Community adder.

(3) This sensitivity analysis assumes that projects qualify for the full ITC and have a capital structure that includes sponsor equity, debt and tax equity.

In-Front-of-the-

Meter

Behind-the-Meter

III LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS— VERSION 9.0

21

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Value Snapshots—Revenue Potential for Selected Storage Use Cases

The numerous potential sources of revenue available to energy storage systems reflect the benefits provided to customers and the grid

• The scope of revenue sources is limited to those captured by existing or soon-to-be commissioned projects—revenue sources that are not clearly

identifiable or without publicly available data have not been analyzed

Use Cases

(1)

Description

Utility-Scale

Standalone

Utility-Scale

PV + Storage

Utility-Scale

Wind + Storage

Commercial &

Industrial

Standalone

Commercial &

Industrial

PV + Storage

Residential

PV + Storage

Residential

Standalone

Wholesale

Demand

Response—

Wholesale

•

Manages high wholesale price or emergency conditions on the

grid by calling on users to reduce or shift electricity demand

Energy

Arbitrage

• Storage of inexpensive electricity to sell later at higher prices

(only evaluated in the context of a wholesale market)

Frequency

Regulation

• Provides immediate (4-second) power to maintain generation-

load balance and prevent frequency fluctuations

Resource

Adequacy

• Provides capacity to meet generation requirements at peak

load

Spinning/ Non-

Spinning

Reserves

• Maintains electricity output during unexpected contingency

events (e.g., outages) immediately (spinning reserve) or within

a short period of time (non-spinning reserve)

Utility

Demand

Response—

Utility

•

Manages high wholesale price or emergency conditions on the

grid by calling on users to reduce or shift electricity demand

Customer

Bill

Management

• Allows reduction of demand charge using battery discharge

and the daily storage of electricity for use when time of use

rates are highest

Backup Power

• Provides backup power for use by residential and commercial

customers during grid outages

Incentives

•

Payments provided to residential and commercial customers to

encourage the acquisition and installation of energy storage

systems

Source: Lazard and Roland Berger estimates, Enovation Analytics and publicly available information.

(1) Represents the universe of potential revenue streams available to the various use cases. Does not represent the use cases analyzed in the Value Snapshots.

III LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS— VERSION 9.0

22

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Value Snapshot Case Studies—Overview

Lazard’s Value Snapshots analyze the financial viability of illustrative energy storage systems designed for selected use cases

Source: Lazard and Roland Berger estimates, Enovation Analytics and publicly available information.

Note: Actual project returns may vary due to differences in location-specific costs, revenue streams and owner/developer risk preferences.

(1) Refers to the California Independent System Operator.

(2) Refers to the Electricity Reliability Council of Texas.

(3) Refers to the Pacific Gas & Electric Company.

(4) Refers to the Hawaiian Electric Company.

Location Description

Storage

(MW)

Generation

(MW)

Storage

Duration

(hours) Revenue Streams

In-Front-of-the-

Meter

Utility-Scale

Standalone

CAISO

(1)

(SP-15)

Large-scale energy storage system 100 – 4

• Energy Arbitrage

• Frequency Regulation

• Resource Adequacy

• Spinning/Non-Spinning Reserves

Utility-Scale

PV + Storage

ERCOT

(2)

(South Texas)

Energy storage system designed to be

paired with large solar PV facilities

50 100 4

Utility-Scale

Wind + Storage

ERCOT

(2)

(South Texas)

Energy storage system designed to be

paired with large wind generation facilities

50 100 4

Behind-the-Meter

Commercial &

Industrial

Standalone

PG&E

(3)

(California)

Energy storage system designed for behind-

the-meter peak shaving and demand charge

reduction for C&I energy users

1 – 2

• Demand Response—Utility

• Bill Management

• Incentives

• Tariff Settlement, Demand

Response Participation, Avoided

Costs to Commercial Customer

and Local Capacity Resource

Programs

Commercial &

Industrial

PV + Storage

PG&E

(3)

(California)

Energy storage system designed for behind-

the-meter peak shaving and demand charge

reduction services for C&I energy users

0.5 1 4

Residential

Standalone

HECO

(4)

(Hawaii)

Energy storage system designed for behind-

the-meter residential home use—provides

backup power and power quality

improvements

0.006 – 4

• Demand Response—Utility

• Bill Management

• Tariff Settlement

• Incentives

Residential

PV + Storage

HECO

(4)

(Hawaii)

Energy storage system designed for behind-

the-meter residential home use—provides

backup power, power quality improvements

and extends usefulness of self-generation

0.006 0.01 4

1

2

3

4

5

6

7

III LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS— VERSION 9.0

23

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Value Snapshot Case Studies—Overview (cont’d)

Lazard’s Value Snapshots analyze the financial viability of illustrative energy storage systems designed for selected use cases

Source: Lazard and Roland Berger estimates, Enovation Analytics and publicly available information.

Note: Project parameters (i.e., battery size, duration, etc.) presented above correspond to the inputs used in the LCOS analysis.

(1) Assumes the project provides services under contract with PG&E.

(2) Assumes the project provides services under contract with HECO.

Honolulu, Hawaii

Residential PV + Storage

(2)

HECO

Project size: 0.006 MW / 0.025 MWh

0.010 MW PV

Residential Standalone

(2)

HECO

Project size: 0.006 MW / 0.025 MWh

Los Angeles, California

Utility-Scale

CAISO

Project size: 100 MW / 400 MWh

San Francisco, California

C&I Standalone

(1)

PG&E

Project size: 1 MW / 2 MWh

C&I PV + Storage

(1)

PG&E

Project size: 0.5 MW / 2 MWh

1 MW PV

Corpus Christi, Texas

Project size: 50 MW / 200 MWh

100 MW PV

Utility-Scale PV + Storage

ERCOT

Project size: 50 MW / 200 MWh

100 MW Wind

Utility-Scale Wind + Storage

ERCOT

1

2

3

4

5

6

7

III LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS— VERSION 9.0

24

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Value Snapshot Case Studies—Results

Project economics evaluated in the Value Snapshot analysis continue to evolve year-over-year as costs change and the value of revenue streams

adjust to reflect underlying market conditions, utility rate structures and policy developments

Source: Lazard and Roland Berger estimates, Enovation Analytics and publicly available information.

Note: Levelized costs presented for each Value Snapshot reflect local market and operating conditions (including installed costs, market prices, charging costs and incentives) and are different in certain cases from the LCOS results

for the equivalent use case on the page titled “Levelized Cost of Storage Comparison—Version 9.0 ($/MWh)”, which are more broadly representative of U.S. storage market conditions as opposed to location-specific conditions.

Levelized revenues in all cases are gross revenues (not including charging costs). Subsidized levelized cost for each Value Snapshot reflects: (1) average cost structure for storage, solar and wind capital costs, (2) charging

costs based on local wholesale prices or utility tariff rates and (3) all applicable state and federal tax incentives, including 30% federal ITC for solar and/or storage, $27.50/MWh federal PTC for wind and 35% Hawaii state ITC for

solar and solar + storage systems. Value Snapshots do not include cash payments from state or utility incentive programs. Revenues for Value Snapshots (1) – (3) are based on hourly wholesale prices from the 365 days prior to

December 15, 2023. Revenues for Value Snapshots (4) – (7) are based on the most recent tariffs, programs and incentives available as of December 2023.

(1) In previous versions of this analysis, Energy Arbitrage was referred to as Wholesale Energy Sales.

Utility-Scale

Standalone

(CAISO)

Utility-Scale

PV + Storage

(ERCOT)

Utility-Scale

Wind + Storage

(ERCOT)

0

50

100

150

200

250

$300

Energy Arbitrage Frequency Regulation

Spinning/Non-Spinning Reserves Resource Adequacy

C&I

Standalone

(PG&E)

C&I

PV + Storage

(PG&E)

Residential

Standalone

(HECO)

Residential

PV + Storage

(HECO)

0

100

200

300

400

500

$600

Local Incentive Payments Bill Management

Demand Response—Utility

13.9%25.5%21.1%28.9% 41.7% 22.2% 37.4%

In-Front-of-the-Meter Revenue Behind-the-Meter Revenue

$/MWh $/MWh

Subsidized IRR

1 2 3 4 5 6 7

Subsidized IRR

(1)

III LAZARD’S LEVELIZED COST OF STORAGE ANALYSIS— VERSION 9.0

25

Lazard’s Levelized Cost of Hydrogen Analysis—Version 4.0

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Introduction

Lazard’s Levelized Cost of Hydrogen analysis addresses the following topics:

• Comparative and illustrative LCOH analysis for various green and pink hydrogen production systems on a $/kg basis

• Comparative and illustrative LCOE analysis for natural gas peaking generation, a potential use case in the U.S. power sector, utilizing a 25% hydrogen blend on a $/MWh

basis, including sensitivities for U.S. federal tax subsidies

• Appendix materials, including:

− An overview of the methodology utilized to prepare Lazard’s LCOH analysis

− A summary of the assumptions utilized in Lazard’s LCOH analysis

Note on Methodology:

• The analysis within includes storage costs paid to a third party but does not include any expenditures related to the transport, construction of pipeline or

construction of storage

• This analysis does not include electrolyzers produced in China, which are currently priced at one third of the price of incumbent electrolyzers, as they

struggle to penetrate the U.S. market due to lack of thorough testing and uncertainty around potential tariffs or other trade disruptions with China

Other factors would also have a potentially significant effect on the results contained herein, but have not been examined in the scope of this current analysis. These additional

factors, among others, could include: implementation and interpretation of the full scope of the IRA; development costs of the electrolyzer and associated renewable energy

generation facility; conversion, storage and transportation costs of the hydrogen once produced; additional costs to produce alternate products (e.g., ammonia); costs to upgrade

existing infrastructure to facilitate the transportation of hydrogen (e.g., natural gas pipelines); electrical grid upgrades; costs associated with modifying end-use

infrastructure/equipment to use hydrogen as a fuel source; potential value associated with carbon-free fuel production (e.g., carbon credits, incentives, etc.). This analysis also

does not address potential environmental and social externalities, including, for example, water consumption and the societal consequences of displacing the various conventional

fuels with hydrogen that are difficult to measure

As a result of the developing nature of hydrogen production and its applications, it is important to have in mind the somewhat limited nature of the LCOH (and related limited

historical market experience and current market depth). In that regard, we are aware that, as a result of our data collection methodology, some will have a view that electrolyzer cost

and efficiency, plus electricity costs, suggest a different LCOH than what is presented herein. The sensitivities presented in our study are intended to address, in part, such views

IV LAZARD’S LEVELIZED COST OF HYDROGEN ANALYSIS— VERSION 4.0

27

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

$4.45

$2.48

$4.33

$2.36

$3.19

$1.22

$3.07

$1.11

$6.05

$4.08

$5.49

$3.52

$4.33

$2.36

$3.86

$1.89

$0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00

PEM

(20 – 100 MW)

Alkaline

(20 – 100 MW)

PEM

(20 – 100 MW)

Alkaline

(20 – 100 MW)

LCOH Subsidized (excl. Energy Community)

Subsidized green and pink hydrogen can reach levelized production costs under $2/kg

(1)

—fully depreciated operating nuclear plants yield higher

capacity factors and, when only accounting for operating expenses, pink hydrogen can reach production costs lower than green hydrogen

Levelized Cost of Hydrogen Comparison—Version 4.0 ($/kg)

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Unless otherwise indicated, this analysis assumes electrolyzer capital expenditure assumptions based on high and low values of sample ranges, with additional capital expenditure for hydrogen storage. Capital expenditure for

underground hydrogen storage assumes $20/kg storage cost, sized at 120 Tons for green hydrogen and 200 Tons for pink hydrogen (size is driven by electrolyzer capacity factors). Pink hydrogen costs are based on marginal

costs for an existing nuclear plant (see Appendix C for detailed assumptions).

(1) In the U.S., ~$2/kg is the cost to produce gray hydrogen using low-cost natural gas.

(2) This sensitivity analysis assumes that projects qualify for the hydrogen PTC but does not include subsidized electricity costs. This analysis assumes projects have a capital structure that includes sponsor equity, debt and tax

equity. The IRA is comprehensive legislation that is still being implemented and remains subject to interpretation—important elements of the IRA are not included in our analysis and could impact outcomes.

Levelized Cost of Hydrogen ($/kg)

(2)

Green

Hydrogen

Pink

Hydrogen

IV LAZARD’S LEVELIZED COST OF HYDROGEN ANALYSIS— VERSION 4.0

28

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational and illustrative purposes only, and it is not intended to be, and should not be construed as, financial

or other advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Levelized Cost of Energy Comparison—Gas Peaking with 25% Hydrogen Blend

While hydrogen-ready natural gas turbines are still being tested, preliminary results, including our illustrative LCOH analysis, indicate that a 25%

hydrogen by volume blend is feasible and cost competitive

Source: Lazard and Roland Berger estimates and publicly available information.

Note: This analysis assumes a fuel blend of 25% hydrogen and 75% natural gas by volume. Results are driven by Lazard’s approach to calculating the LCOE of an illustrative gas peaking plant and selected inputs (see LCOE

Appendix for further details). Natural gas fuel cost is assumed to be $3.45/MMBtu, hydrogen fuel cost based on LCOH $/kg for case scenarios, assumes 8.8 kg/MMBtu for hydrogen. Analysis includes hydrogen storage costs for

a maximum of 8-hour peak episodes for a maximum of 7 days per year, resulting in additional costs of $120/kW (green) and $190/kW (pink). Previous versions of this analysis sensitized only the cost of hydrogen—the current

version sensitizes both the hydrogen production parameters and the gas peaking plant parameters.

(1) This sensitivity analysis assumes that projects qualify for the hydrogen PTC but does not include subsidized electricity costs. This analysis assumes projects have a capital structure that includes sponsor equity, debt and tax

equity. The IRA is comprehensive legislation that is still being implemented and remains subject to interpretation—important elements of the IRA are not included in our analysis and could impact outcomes.

(1)

Levelized Cost of Energy ($/MWh)

Lazard’s LCOE v17.0 Gas Peaking Range

$110 – $228/MWh

IV LAZARD’S LEVELIZED COST OF HYDROGEN ANALYSIS— VERSION 4.0

29

$171

$138

$169

$137

$158

$125

$157

$124

$300

$265

$296

$246

$286

$237

$283

$233

$0 $50 $100 $150 $200 $250 $300 $350

PEM

(20 – 100 MW)

Alkaline

(20 – 100 MW)

PEM

(20 – 100 MW)

Alkaline

(20 – 100 MW)

LCOE Subsidized (excl. Energy Community)

Green

Hydrogen

Pink

Hydrogen

Appendix

LCOE v17.0

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational purposes only, and it is not intended to be, and should not be construed as, financial or other

advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

$112

$48

$25

$56

53

$22

$40

$62

$71

$114

$48

$18

$9

$6

$4

$4

$2

$5

$5

$12

$8

$15

$5

$1

$9

$4

$4

$3

$3

$28

$9

$13

$23

$122

$54

$29

$60

$64

$27

$45

$74

$110

$142

$69

$45

$0 $25 $50 $75 $100 $125 $150 $175

Solar PV—Rooftop Residential

Solar PV—Community & C&I

Solar PV—Utility

Solar PV + Storage—Utility

Geothermal

Wind—Onshore

Wind + Storage—Onshore

Wind—Offshore

Gas Peaking

U.S. Nuclear

Coal

Gas Combined Cycle

Capital Cost Fixed O&M Variable O&M Fuel Cost

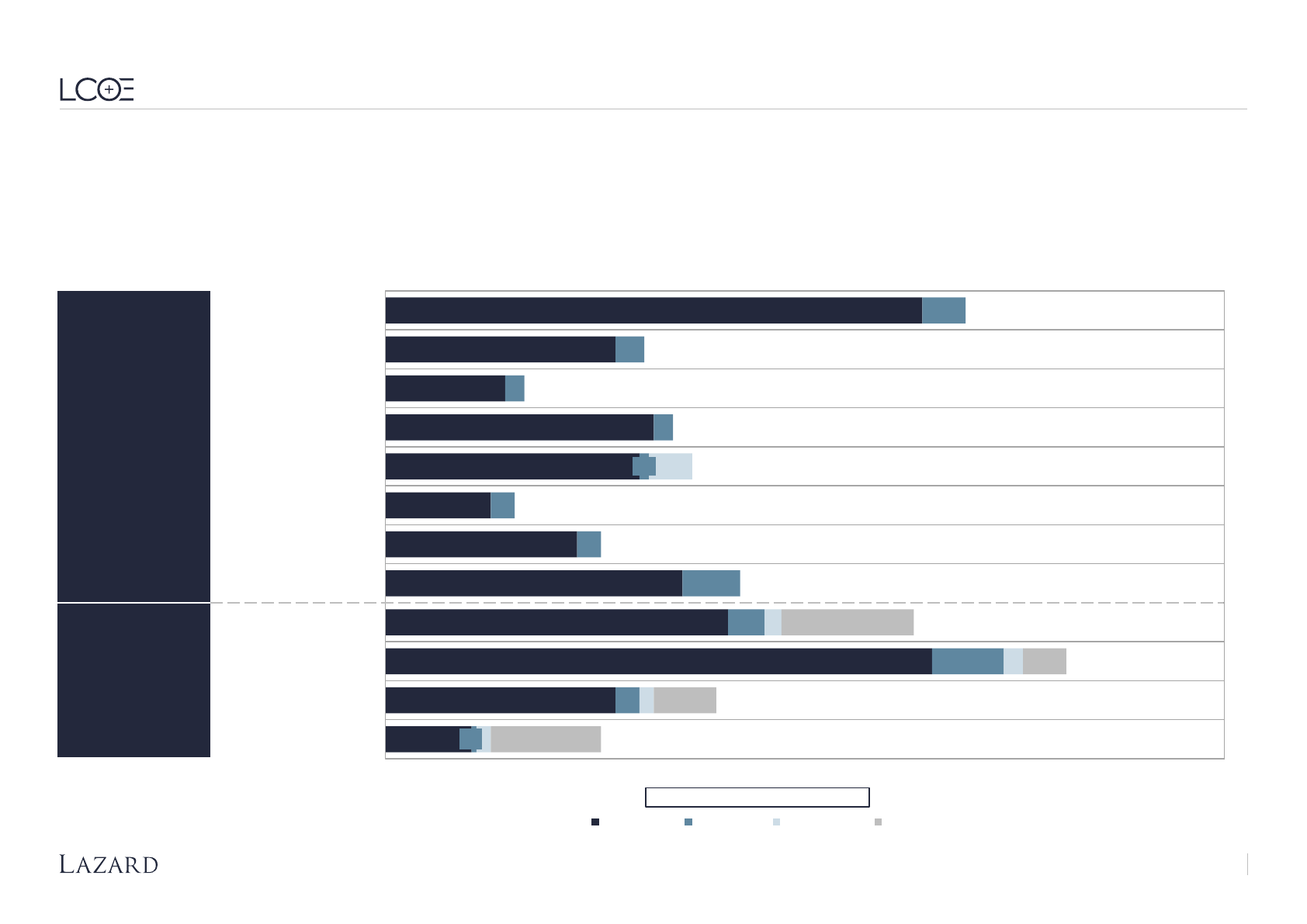

Levelized Cost of Energy Components—Low End

Certain renewable energy generation technologies are already cost-competitive with conventional generation technologies; key factors regarding the

continued cost decline of renewable energy generation technologies are the ability of technological development and Industry scale to continue

lowering operating expenses and capital costs for renewable energy generation technologies

Source: Lazard and Roland Berger estimates and publicly available information.

Notes: Figures may not sum due to rounding.

Levelized Cost of Energy ($/MWh)

Renewable Energy

Conventional Energy

A LCOE V17.0

32

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational purposes only, and it is not intended to be, and should not be construed as, financial or other

advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Levelized Cost of Energy Components—High End

Certain renewable energy generation technologies are already cost-competitive with conventional generation technologies; key factors regarding the

continued cost decline of renewable energy generation technologies are the ability of technological development and Industry scale to continue

lowering operating expenses and capital costs for renewable energy generation technologies

Source: Lazard and Roland Berger estimates and publicly available information.

Notes: Figures may not sum due to rounding.

$269

$176

$82

$199

$79

$58

$118

$116

$170

$191

$128

$67

$15

$15

$11

$11

$2

$15

$15

$23

$19

$17

$17

$10

$25

$5

$5

$6

$5

$34

$9

$18

$26

$284

$191

$92

$210

$106

$73

$133

$139

$228

$222

$168

$108

$0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 $300

Solar PV—Rooftop Residential

Solar PV—Community & C&I

Solar PV—Utility

Solar PV + Storage—Utility

Geothermal

Wind—Onshore

Wind + Storage—Onshore

Wind—Offshore

Gas Peaking

U.S. Nuclear

Coal

Gas Combined Cycle

Capital Cost Fixed O&M Variable O&M Fuel Cost

Levelized Cost of Energy ($/MWh)

Renewable Energy

Conventional Energy

A LCOE V17.0

33

Copyright 2024 Lazard

This analysis has been prepared by Lazard for general informational purposes only, and it is not intended to be, and should not be construed as, financial or other

advice. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of Lazard.

Levelized Cost of Energy Comparison—Methodology

($ in millions, unless otherwise noted)

Lazard’s LCOE analysis consists of creating a power plant model representing an illustrative project for each relevant technology and solving for the

$/MWh value that results in a levered IRR equal to the assumed cost of equity (see subsequent “Key Assumptions” pages for detailed assumptions by

technology)

Source: Lazard and Roland Berger estimates and publicly available information.

Note: Numbers presented for illustrative purposes only.

* Denotes unit conversion.

(1) Assumes half-year convention for discounting purposes.

(2) Assumes full monetization of tax benefits or losses immediately.

(3) Reflects initial cash outflow from equity investors.

(4) Reflects a “key” subset of all assumptions for methodology illustration purposes only. Does not reflect all assumptions.

(5) Economic life sets debt amortization schedule. For comparison purposes, all technologies calculate LCOE on a 20-year IRR basis.

Year 0 1 2

3 4

5 6 7

20 Key Assumptions

Capacity (MW)

(A) 175 175 175 175

175 175 175 175

Capacity (MW) 175

Capacity Factor (B) 55% 55% 55% 55% 55% 55% 55% 55% Capacity Factor 55%

Total Generation ('000 MWh) (A) x (B) = (C)* 843

843 843 843 843 843 843

843 Fuel Cost ($/MMBtu)

$0.00

Levelized Energy Cost ($/MWh)

(D)

$24.4

$24.4

$24.4

$24.4 $24.4 $24.4 $24.4

$24.4 Heat Rate (Btu/kWh) 0

Total Revenues

(C) x (D) = (E)* $20.6 $20.6 $20.6 $20.6

$20.6 $20.6 $20.6 $20.6

Fixed O&M ($/kW-year) $20.0

Variable O&M ($/MWh) $0.0

Total Fuel Cost (F) --

-- -- -- -- -- --

-- O&M Escalation Rate

2.25%

Total O&M (G)* 3.5 3.6 3.7 3.7 3.8 3.9 4.0 5.5 Capital Structure

Total Operating Costs (F) + (G) = (H) $3.5 $3.6 $3.7 $3.7 $3.8 $3.9 $4.0 $5.5 Debt 60.0%

Cost of Debt

8.0%

EBITDA (E) - (H) = (I) $17.1 $17.0 $16.9 $16.8 $16.7 $16.7 $16.6 $15.1 Tax Investors 0.0%