India’s Clean Power

Revolution

A success story with global implications

Rohit Gadre

Atin Jain

Shantanu Jaiswal

Vandana Gombar

Dario Traum

June 26, 2020

With the support of

1 May 06, 2020

There's no doubt about it: the clean energy revolution is here, and

local, state, and national governments are at the forefront. At

Bloomberg Philanthropies, we believe that these forward-thinking local

leaders can share lessons and strategies as they work to create

strong, sustainable economies and usher us into the clean energy

future. In partnership with BloombergNEF, Bloomberg Philanthropies

has released India’s Clean Power Revolution, outlining the current

successes and future potential of India’s clean energy economy.

India’s commitment to renewable energy has made it the number one

emerging market for clean energy investment, according to BNEF’s

Climatescope. The country has set ambitious renewable energy goals

– 175 GW by 2022 and 450 GW by 2030 – and is making strong

progress towards meeting those targets, thanks to supportive

government policies, openness to investors, and the volume of

renewables auctioned in recent years.

As nations seek to recover and restore economies in the wake of the

COVID-19 pandemic, India’s competitive clean energy auction market

and impressive clean energy progress can offer lessons learned for

economies looking to achieve a green recovery that maximizes

economic, health, and environmental benefits. As this report outlines,

investment in clean energy helps increase energy access and supply,

creates jobs and fosters economic growth, and improves climate and

air quality -- providing health benefits we sorely need right now.

Although challenges remain, India’s renewable energy transition will

serve as a model for transitioning economies all over the world. By

learning from each other, we can continue to expand global

investments in renewable energy, strengthen our economies, and

achieve a sustainable, healthy future.

Antha N. Williams

Global Head of Environmental Programs

Bloomberg Philanthropies

2 May 06, 2020

Source: BloombergNEF, Ministry of New and Renewable Energy. Note:. Solar capacity

shown in AC. Note: Large hydro was excluded from the 175GW target. The breakup of

the 450GW target is not known and it may include large hydro.

Ambitious targets, comprehensive government policies

and economics have placed India amongst the most

vibrant clean energy markets in the world. As the energy

transition accelerates, this decade brings new

challenges and opportunities for all the actors in India’s

clean power revolution.

● Targets: In 2015, India announced a target of building

175GW of clean energy by 2022, a more-than-fourfold

increase in installed capacity in just seven years. By 2030,

Prime Minister Narendra Modi wants India to reach a new

goal of 450GW of renewables.

● Integrating such volumes of variable generation will

require a flexible power system. Apart from battery storage

and peaker gas plants, lessons from around the world

highlight the importance of demand-side measures, grid

investments and market reforms for India.

● India is the world’s largest and most competitive clean

energy auction market, allowing it to procure some of the

cheapest renewable power. New auction designs allow the

replacement of fossil fuels through better integration.

● The 2030 target brings momentum to the goal of capturing

more value from the transition domestically, spelled out in

the ‘Make in India’ strategy. The wind sector has already

seen leading equipment manufacturers open factories to

supply the national and international markets.

Executive summary (1/2)

Renewables need to keep growing to meet national targets

53%

Drop in annual weighted average auction

tariffs for utility

-scale solar, over five years

1

India ranked as the most attractive emerging

market for clean energy investment in

Climatescope 2019

80%

Expected growth in India’s power demand

from now till 2030

39

50

62

75

86

175

450

0

100

200

300

400

500

2015 2016 2017 2018 2019 2022 2030

GW

Solar Wind Small hydro Biomass Renewables

CAGR = 22%

CAGR = 27%

CAGR = 13%

3 May 06, 2020

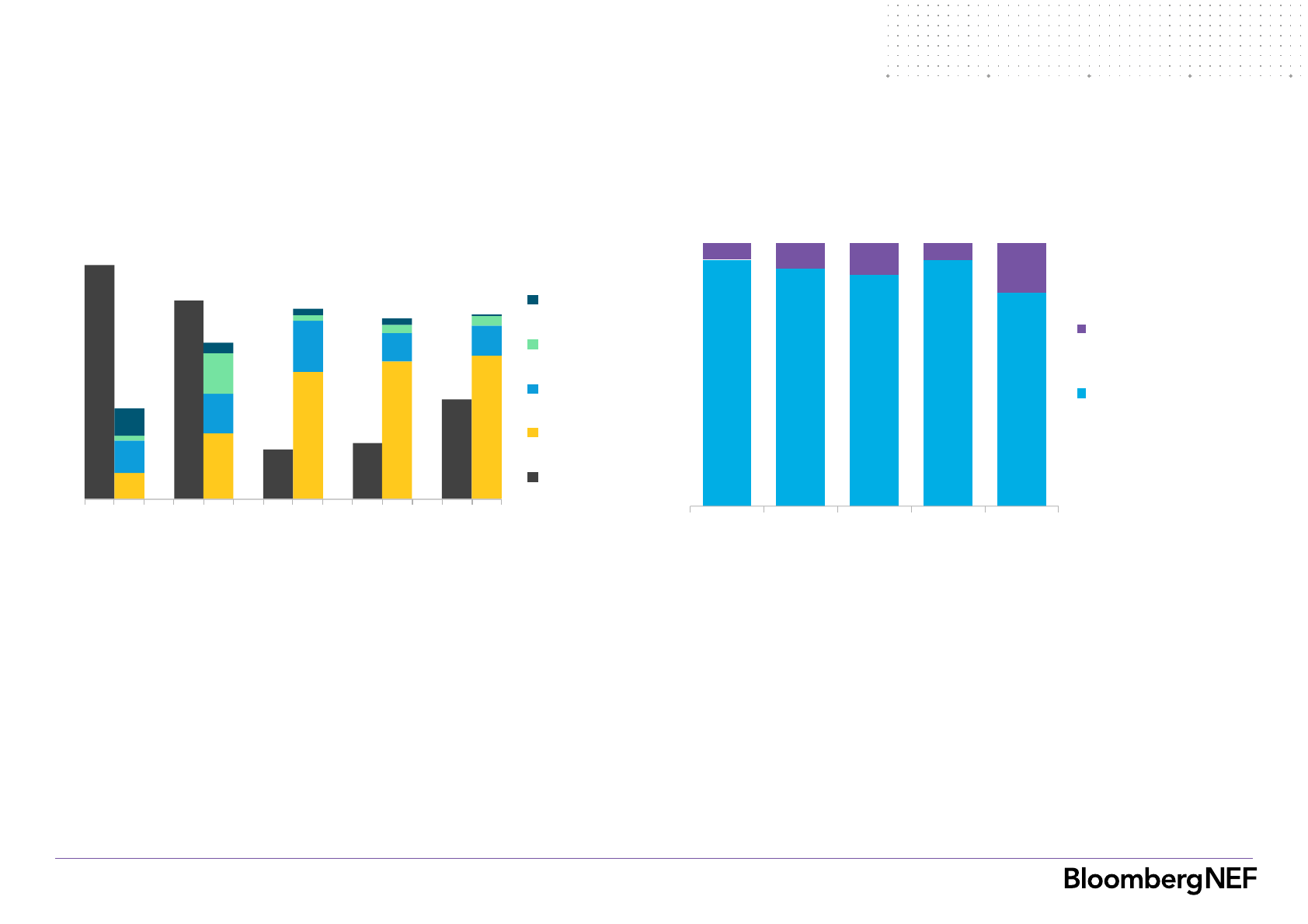

Source: BloombergNEF

● The transformation of India’s power sector in this decade

brings a $633 billion investment opportunity. Capital is

needed to build more power plants, and also to replace

and expand grid infrastructure. Public and private finance

will need to mobilize to deliver these investments.

● Accelerating deployment calls for better coordination on

land issues to ensure that grid availability matches the

commissioning of new power projects. Simplifying land

acquisition procedures and digitizing land records would

remove a bottleneck affecting the sector today.

● The financial health and resiliency of power distribution

companies will also need to be improved to give

investors confidence that they will not face payment

delays and retroactive contract negotiation. Procurement

of clean energy by corporates looking to reduce their

costs provides an opportunity to offer alternative bankable

offtakers for clean energy project developers.

● The continuation of India’s clean power revolution is

critical to global climate efforts. Coal’s role in the mix

will continue to drop despite rising power demand.

Retiring older coal plants will improve utilization rates for

the coal fleet and significantly reduce CO

2

emissions. New

clean power generation will help India avoid more than

499 million tons of CO2 emissions a year by 2030, and

bring peak emissions within reach in the next decade.

Executive summary (2/2)

Projected power sector investments (2021-2030)

Source: BloombergNEF. Note: The values for grid investments are only for poles,

wires, substations and transformers.

NEO 2019 electricity demand and generation mix

78%

76%

57%

24%

43%

778TWh

1,378TWh

2,747TWh

2010 2019 2030

Zero-carbon

Fossil fuels

8

23

44

53

87

137

282

Other flexibility

Peaker gas

Nuclear

Coal

Distribution grid

Transmission grid

Renewables

$ billion (2019, real)

4 May 06, 2020

5 May 06, 2020

Contents

Introduction

6

Explaining the Indian clean power revolution

16

India’s power sector outlook to 2030

28

Opportunities and challenges ahead

40

Conclusion

57

Appendix

61

6 May 06, 2020

Introduction

7 May 06, 2020

Source: BloombergNEF, Power Finance Corporation. Note: Latest available data for

period April 2017 to March 2018 is shown. Data on power usage from privately

owned discoms is excluded, with the exception of Delhi.

Source: BloombergNEF, Central Electricity Authority. Note: CAGR – Compound

Annual Growth Rate. Note: Consumption is shown at utility periphery.

Electricity consumption has risen every year

● India’s power demand continues to rise, due to an

expanding economy and growing population. In 2019, the

country consumed 1,285TWh, up from 851TWh per year

at the beginning of the decade.

● India has become the world’s third-largest power

consumer, behind China and the United States.

● Even as power demand was expanding, the supply deficit

narrowed from 79TWh in 2010 to 6TWh in 2019. This

was a result of rapid expansion of generation capacity,

fast rollout of transmission and distribution infrastructure,

and the connection of millions of people to the grid.

India’s power demand grew by 50%

in the last decade

Households and industries are the top power users

● Domestic and industrial consumers together constitute

56% of power demand, followed closely by agriculture.

● In March 2019, the government achieved 100%

household electrification. The next goal is to deliver

uninterrupted, 24x7 power for all.

● In June 2015, the federal government set a target to have

175GW of renewable generation capacity installed by

2022. Of these, solar PV’s target was 100GW, followed

by 60GW wind, 10GW biomass and 5GW small hydro.

Looking further ahead, the Prime Minister envisions

450GW of renewables by 2030.

851TWh

1,285TWh

2010 2019

CAGR = 4.7%

Domestic

28%

Industrial

28%

Agricultural

23%

Commercial

9%

Others

12%

895TWh

8 May 06, 2020

Source: BloombergNEF, Ministry of New and Renewable Energy. Note: Solar

capacity is in DC.

Source: BloombergNEF, Ministry of New and Renewable Energy, Central Electricity

Authority. Note: Solar capacity is in DC.

Installed capacity is diversifying, but still

dominated by coal

Renewables deployment doubled over five

years, with solar at the heart of this boom

● In the last decade, India’s net power generation capacity

increased by 212GW – nearly the total grid size of

France. Roughly 42% of this addition came from

renewable energy sources including large hydro.

● India’s wind and solar installed capacity quadrupled in a

decade, to reach 82GW by 2019. The two main reasons

for the sharp jump in capacity have been falling

technology costs and proactive government policies to

achieve the target of 175GW renewables by 2022.

To service the demand growth, installed

capacity more than doubled

● Additions of renewables have risen from 2015 levels.

From 2017, 15GW of renewables have been added each

year. More than two-thirds of this came from PV, followed

by wind. Installations of hydro power have remained low

because of long construction timelines, environmental

concerns and social pushback.

● At the end of 2019, the country had 143GW of clean

generating capacity (including large hydro) – representing

about 38% of all the power installed in the country.

2.1

5.3

10.3

11.1

12

3

3

4

2

2

3

2

7

13

15

15

15

2015 2016 2017 2018 2019

GW

Hydro

Biomass

Wind

Solar

169

185

213

236

259

288

317

337

356

380

0

100

200

300

400

2010 2012 2014 2016 2018

GW

Others

Solar

Wind

Hydro

Nuclear

Oil

Gas

Coal

9 May 06, 2020

Private companies are the main investors in

India’s clean power projects

Coal additions dropped while renewables grew

Annual renewables additions

surpassed coal, driven by the private sector

Source: BloombergNEF, Central Electricity Authority, Ministry of New and

Renewable Energy

Source: BloombergNEF

● India has been one of the world’s largest coal markets. At

least 15GW coal generation capacity were added every

year until 2016, driven by plentiful domestic coal supply

and a large power deficit. From 2016 onwards, however,

capacity additions tipped decisively toward clean power.

● The clear shift to renewables capacity is a lasting one as

it is primarily driven by economics. The gap between the

cost of new coal versus clean power generation

continues to widen in favor of the latter.

● The majority of coal power plants in India are owned by

central government companies, such as NTPC Ltd.

(erstwhile National Thermal Power Corp) and a variety of

state government entities active in the power sector.

● In contrast, private independent power producers (IPPs)

have built 90% of the wind and solar power projects in the

past five years. This is a pattern not dissimilar to that of

Europe, where incumbent generators were slow to join

the clean energy sector. Government companies are now

increasingly participating in clean energy auctions too.

19

16

4

4

8

2

5

10

11

12

3

3

4

2

2

3

7

13

15

15

15

2015 2016 2017 2018 2019

GW

Hydro

Biomass

Wind

Solar

Coal

94%

90%

88%

93%

81%

6%

10%

12%

7%

19%

2015 2016 2017 2018 2019

Government

companies

Private power

producers

10 May 06, 2020

Coal power is losing share to renewables

Coal was the dominant fuel for power generation

in 2019

The growth of renewables has started

eating into coal’s share of generation

Source: BloombergNEF, Central Electricity Authority

Source: BloombergNEF, Central Electricity Authority

● Coal remains the workhorse of India’s electricity supply

system, providing close to three-quarters of the country’s

power needs in 2019.

● But 2019 was the first year in which the absolute energy

generated by coal saw a year-on-year decline. Slower

growth in power demand, and record growth in clean

power generation, were behind this fall.

● Renewable energy sources (including large hydro)

supplied 21% of India’s grid electricity needs in 2019.

This share has increased by five percentage points in five

years, driven by combined additions in solar and wind of

between 5GW and 13GW annually.

● The share of gas power generation remains below 5%.

High prices for natural gas, which has to be imported, and

a lack of adequate gas distribution infrastructure make it

more expensive than coal power plants.

72%

4%

3%

12%

1%

5%

3%

1,383 TWh

Coal

Gas

Oil

Nuclear

Hydro

Biomass

Wind

Solar

77%

76%

76%

75%

72%

16% 17% 17% 19% 21%

2015 2016 2017 2018 2019

Renewable

energy

Nuclear

Gas

Coal

11 May 06, 2020

Source: BloombergNEF. Note: The range of the LCOE represents a range of costs

and capacity factors. All LCOE calculations are unsubsidized and exclude

curtailments and tax-credits.

Source: BloombergNEF. Note: The range of the LCOE represents a range of costs

and capacity factors. All LCOE calculations are unsubsidized and exclude

curtailments and tax-credits.

Levelized cost of energy for fixed-axis PV, 1H 2020 Levelized cost of energy for onshore wind, 1H 2020

India’s renewables are now among the

cheapest in the world

23

27

29

29

29

32

35

37

39

48

52

56

58

58

70

73

75

51

45

58

59

80

66

58

56

89

71

110

103

143

128

212

146

153

U.A.E.

India

Chile

China

Australia

Brazil

Spain

U.S.A.

Mexico

Germany

Malaysia

Thailand

Vietnam

Philippines

Japan

S. Korea

Indonesia

$/MWh (nominal)

24

26

29

29

30

31

37

37

40

41

42

59

63

78

83

92

95

44

59

51

51

71

42

57

52

62

62

56

161

157

142

184

156

202

Brazil

U.S.A.

India

Spain

Mexico

Sweden

U.K.

Chile

Germany

China

Netherlands

Philippines

Vietnam

S. Korea

Thailand

Japan

Indonesia

$/MWh (nominal)

12 May 06, 2020

Fundamentals

Source: BloombergNEF

Climatescope ranks India ahead of China, Brazil

and Chile in 2019

India became the most attractive emerging

market for clean energy investment

Analyzed 104 emerging markets

Accounting for 82% of the world’s population

Covering two-thirds of global CO

2

emissions

Each nation was scored on 167 indicators

Power demand, price attractiveness,

short and medium-term prospects

Installed clean energy, historical

investment, state of value supply

chains

Clean energy policies, power sector

structure, regulations and barriers to

renewables

India has ranked in the top 10 of Climatescope ever since

its first assessment in the 2014 edition. After coming second

in the 2018 edition, India took top spots ahead of China for

the first time. The key findings, interactive rankings and full

report are available online at http://global-climatescope.org/

2.93

2.85

2.76

2.59

2.52

2.51

2.49

2.47

2.41

2.39

India

Chile

Brazil

China

Kenya

Jordan

Argentina

Ukraine

Peru

Morocco

Fundamentals Opportunities Experience

Opportunities

Experience

13 May 06, 2020

U.S. data indicate a high renewable future

could create more jobs

Renewable energy employment in India

Renewables have also delivered on the

economic imperative of job creation

Source: Council on Energy, Environment and Water, Natural Resources Defense

Council, and Skill Council for Green Jobs. Note: Solar includes rooftop segment.

FY2019 is the financial year from April 2018 to March 2019.

Source: U.S. Energy and Employment Report, BloombergNEF

● Renewables growth is adding jobs at the fastest pace in

the power sector. At the end of March 2019, 100,000

employees worked in India’s wind and solar sector,

according to a report on growth in green energy.

● On the other hand, efficiency gains and technology are

reducing employment in the coal sector worldwide. The

Council for Energy, Environment and Water together with

the Skill Council for Green Jobs estimated that more than

105,000 jobs were lost in India’s coal sector between the

years 2000 and 2015, due to increasing mechanization.

● A report by the International Climate Initiative forecast

that India’s renewable energy sector could employ five

times more people in 2050 than the entire Indian thermal

generation sector (coal, gas, nuclear) employs in 2020.

The study expects coal sector employment to decline by

52% in the next 30 years.

● Increasing the emphasis on decentralized small

renewables and boosting domestic manufacturing have

the potential to create more employment opportunities.

0.40

0.53

0.68

0.85

1.17

3.84

Gas

Coal

Nuclear

Hydro

Wind

Solar

Number of workers per MW

17

22

23

23

21

36

65

77

38

57

88

100

FY2016 FY2017 FY2018 FY2019

Number of employees (thousands)

Solar

Wind

14 May 06, 2020

● The insistence of electricity offtakers on low tariffs led to

five solar auctions, totaling 4.7GW, being partly or fully

canceled in 2018, after bidding had been completed. This

created uncertainty for participating developers.

● However, the market has continued to grow and

successfully completed auctions eased the concerns

resulting from these cancellations. Newer auction designs

to make power output closely match demand should

reassure discoms.

● In 2019, the southern state of Andhra Pradesh sought to

renegotiate renewable power purchase agreements to

reduce the cost of power for its loss-making discoms.

● The federal Ministry of New and Renewable Energy

strongly opposed the move, warning that future

investment will dry up if contracts are not honored.

● The Andhra Pradesh High Court granted temporary relief

to IPPs and the matter is still sub judice.

● The introduction of a new Goods and Service Tax (GST)

in July 2017 caused temporary confusion for the solar

industry with regards to the applicable tax rate.

● Similarly, the safeguard duty (SGD) for cells and modules

imported from China, Malaysia and developed countries

introduced in July 2018 caused a spike in capex costs.

● IPPs whose projects were under construction complained

that they were unfairly penalized by the GST and SGD

after their tariff had been fixed. These developers are

currently being compensated by the offtakers for the

additional costs arising from these taxes.

● The rapidly falling tariffs at renewable auctions have

raised concerns that IPPs will be forced to build low-

quality projects.

● The continual stream of mergers and acquisitions in

India, typically involving international investors, suggests

that sever under-performance of projects is not common.

● As most projects have been added in the past decade, it

is still too early to make large-scale assessment of their

long-term financial and operational performance.

Auction cancellations Attempts to renegotiate contracts

Uncertainties with new taxes Concerns on asset quality for low tariff projects

However, rapid growth of renewables

also creates some challenges

15 May 06, 2020

Introduction

16 May 06, 2020

Explaining the Indian

clean power

revolution

17 May 06, 2020

Source: BloombergNEF. Note: Figures are cumulative over 2003-19

India is the world’s largest renewables auctions

market (cumulatively till 2019)

Average auction tariffs fell steeply

Record volumes of auctions and

competition have driven down tariffs

Source: BloombergNEF. Note: Volume weighted average tariffs shown. For solar,

only utility-scale tariff based auctions are considered.

● The 2019 average auction tariffs for solar are less than

half of their 2015 levels. The decline has been less steep

for wind, but for both technologies, the average tariff in

2019 was below 3 rupees/kWh ($0.04 in June 2020).

● Extreme competition has led to IPPs optimizing each

stage of project design, construction, maintenance and

operation. They have devised complex financial

strategies to lower their cost of capital, and India’s large

pipeline of tenders gives developers strong bargaining

power when negotiating prices with equipment suppliers.

● In India, utility-scale wind and solar projects are primarily

contracted through competitive auctions. A national target

of having 175GW renewables installed by 2022 has

ensured that the volume of auctions remains high.

● India’s renewables auctions are conducted in a

transparent process that follows standardized guidelines

issued by the federal government. Tenders can go

through multiple rounds of stakeholder consultations and

amendments to encourage participation and help IPPs

make informed bidding decisions.

0

1

2

3

4

5

6

2015 2016 2017 2018 2019

Rupees/kWh (nominal)

Solar

Wind

53% drop

8

8

9

9

11

18

25

31

65

89

Mexico

Turkey

Netherlands

Spain

United Kingdom

France

Germany

Brazil

China

India

GW

Awarded

Announced

18 May 06, 2020

Source: BloombergNEF. Note: Excludes auctions where awards are known to have

been canceled. For solar, only utility-scale tariff based auctions are shown.

Federal auctions have far surpassed volumes of

states’ auctions

Contracting structure for federal auctions

Federal auctions have provided a

strong investment signal to investors

● Federal auctions have overtaken state-level auctions since

2018. The poor financial health of state-government-

owned electricity distribution companies makes IPPs

reluctant to sign contracts directly with them. This led to

state auctions being undersubscribed and delivering

higher tariffs as IPPs factored in the bigger offtaker risks.

● At federal auctions, a federal agency such as Solar

Energy Corp of India (SECI) acts as a intermediate

procurer, and thus protects the IPPs from payment delays,

giving them a quasi-sovereign guarantee.

Federal agency

IPP

Power purchase

agreement

Discom

Power sale

agreement

Avoid direct

contracting

Source: BloombergNEF

● SECI maintains a payment security fund that can absorb

the delay between the moment IPPs need to be paid, and

that where power distribution companies can pay.

● As a last resort, federal agencies can also invoke the

tripartite agreement between itself, India’s central bank

and the state governments. This arrangement allows the

federal government to withhold financial assistance

payments to state governments if distribution companies

repeatedly fail to pay their dues to SECI for delivered

power.

4.8

3.8

12.9

17.9

3.4

1.6 3.6

5.7

3.6

4.4

6.4

7.4

18.6

21.5

2015 2016 2017 2018 2019

GW(AC)

State

Federal

19 May 06, 2020

Source: BloombergNEF. Note: Representative ‘inflation-linked’ tariffs are shown.

Source: BloombergNEF. Note: Representative ‘inflation-linked’ tariffs are shown.

Levelized wind auction tariffs Levelized solar auction tariffs

The levelized tariffs at India’s auctions

are among the lowest in the world

● India’s levelized auction tariffs for both wind and solar are

among the lowest in the world, despite relatively higher

borrowing costs and the absence of hidden subsidies.

● These prices are a reflection of India’s hyper-competitive

auctions and extreme project optimization by its IPPs. It is

not uncommon for auctions in India to attract several

times more bids than the capacity on offer.

What is a levelized auction tariff?

The levelized tariff calculation converts a local currency

structured tariff to a common 2019 $/MWh base after

accounting for inflation, currency of payment, project life

and expected date of commercial operation.

This enables like-for-like comparison between auctions

over time and different geographical locations.

0

20

40

60

80

100

2016 2018 2020 2022 2024

$/MWh (2019, real)

Argentina

Mexico

Brazil

U.K.

Italy

Germany

France

China

India

Commercial operation date

0

20

40

60

80

100

2016 2018 2020 2022

$/MWh (2019, real)

Chile

Mexico

Brazil

Germany

Portugal

Saudi

Arabia

U.A.E.

China

India

Commercial operation date

20 May 06, 2020

• An accelerated depreciation rate of 40% reduces the

investors’ income tax burden.

• This encourages India’s established corporations to

diversify into clean power investments.

Accelerated

depreciation

• Residential rooftop PV installations are eligible for a

20% to 40% upfront investment subsidy.

• Federal aid of 344 billion rupees ($5 billion in June

2020) for small-scale PV in agriculture was

announced in 2019 under the PM-KUSUM scheme.

Capital

subsidy

• The tax rate for new power generators is 17.2%, down

from 34.6% prior to the renewables boom.

• This reduces the levelized cost of electricity of solar

and wind by 8% to 10%.

Lower

corporate

tax

Government policies have helped

renewables become cost-competitive

Source: BloombergNEF. Note: Comparison is done based on the benchmark

levelized cost of energy for projects getting financed in 1H 2020.

Impact of lower tax rates on levelized cost

● Accelerated depreciation attracted companies with

taxable profits from other industries to invest in clean

energy projects. As the sector matured, pure-play

IPPs have taken the lead in building new capacity.

The announcement of a further decrease in the tax

rate will boost investor appetite anew.

● Capital subsidy are still be needed for segments that

are relatively less developed, for example residential

rooftop solar and small scale solar in agriculture.

ISTS waiver

• Wind and solar projects commissioned before 2022

are exempted from Inter-State Transmission System

(ISTS) charges and losses.

• This reduces delivered cost of electricity for offtaker

by up to 0.65 rupees/kWh.

100%

foreign

direct

investment

• Foreign direct investment is allowed without reviews.

• Foreign utilities, VC/PE investors, sovereign wealth

funds, pension funds and oil & gas majors have

participated in India’s clean power boom as a result.

35

33

41

37

0

10

20

30

40

50

pre Sep-19

(34.61% rate)

from Sep-19

(25.17% rate)

from Feb-20

(17.16% rate)

Utility-scale PV Onshore wind

-10%

-8%

$/MWh

21 May 06, 2020

Policies have also created demand for

renewables and attracted investors

• Renewables have priority dispatch, which means they

get access to the grid ahead of other technologies

• Curtailment of renewables generation is not allowed

except when required to preserve grid security.

‘Must-run’

status

• Strengthening the intra-state transmission (ISTS)

network as part of grid enhancement planning, covering

eight states

• In 2017, the federal government sanctioned 40.6 billion

rupees ($630 million) as a financial grant for ISTS.

Green Energy

Corridor

• Government agencies are responsible for identifying the

land and building the grid connection infrastructure.

• This gives IPPs access to large contiguous land zones

without the risks associated with their acquisition.

Solar parks

• Large power users (including discoms) are mandated to

purchase renewables through a portfolio standard

(RPO).

• Although enforcement is weak, RPOs are the top

reason cited for signing contracts for renewable energy

Renewables

Purchase

Obligations

Annual trajectory of national

Renewables Purchase Obligations

Source: BloombergNEF, Ministry of Power. Note: Individual state

regulatory commissions may have mandated different targets. Non-

solar includes wind, biomass and small hydro.

● The federal government’s RPO trajectory has

not been implemented by all states, but it

remains a key driver of distribution companies

signing long-term PPAs for renewables.

● The government is also considering a separate

Hydropower Purchase Obligation to increase the

utilization of existing large hydro plants and

provide investment signals for new capacity.

National

targets

• India’s large and regular wind and solar auctions are

tied to the introduction of the target to reach 175GW of

renewables by 2022, excluding large hydro.

• A larger target of 450GW renewables has been set for

2030, this time with the option to include large hydro.

9%

10%

10% 10% 10%

11%

3%

5%

7%

7%

9%

11%

11.5%

14.3%

17%

17.5%

19%

21%

FY2017 FY2019 FY2021

Non-Solar Solar

22 May 06, 2020

Source: European Space Agency

The renewable energy sector in India has

tremendous potential, and the government

recognizes its ability to transform India’s

energy landscape. Hence it has tried to

create an enabling policy framework to

achieve the aggressive targets it has set for

the sector. From trying to ensure easier

availability of land through solar and wind

parks, to setting up a dedicated public sector

enterprise like SECI, many positive actions

have been taken. The most recent being the

removal of tariff caps on bids, reflecting the

government’s faith in the sector’s maturity.

Sumant Sinha, chairman and

managing director, ReNew Power

“

23 May 06, 2020

Source: BloombergNEF, Central Electricity Authority. Note: FY2020 is the financial

year from April 2019 to March 2020. *FY2020 data is provisional.

Utilization rates of coal plants Official estimates of national power demand

The coal power fleet is increasingly under-

utilized and challenged by renewables

Source: BloombergNEF, Central Electricity Authority. Note: FY 2022 is the financial

year from March 2021 to April 2022. Ex-busbar electricity demand is shown

● India's coal power fleet delivered just over half its

maximum generation output in the fiscal year ending

March 2020. This is a historical low, marking a 21-

percentage point decline in a decade, from 78% in 2010.

● Projects owned by the federal government were used far

more than those owned by private IPPs or state

governments. This is because federal plants typically

have lower fuel costs as they are located closer to the

coal mines.

40

50

60

70

80

90

FY2010 FY2012 FY2014 FY2016 FY2018 FY2020*

%

National average

Federal government

plants

State government

plants

Privately owned

plants

● A key factor behind this overcapacity is the government’s

overestimation of the growth in national power demand,

as seen from the downward revisions made in 2018. This

led to over-investment in new coal capacity, with 96GW of

coal plants added to the grid over 2011-2016 alone.

● At the same time, renewables capacity grew, with the

introduction of the 2022 targets and its falling costs.

Renewables have priority dispatch and the newer

installations have lower levelized costs of energy, helping

them secure a larger share of growth than coal.

1,905

2,710

1,566

2,047

FY 2022 forecast FY 2027 forecast

TWh

2011 report

2018 report

-18%

-24%

24 May 06, 2020

Source: BloombergNEF, Central Electricity Authority.

Status of flue gas desulphurization equipment

(FGD) installations in India at the end of 2019

Cumulative monthly losses in potential power

output caused by water shortage, 2013 to 2016

More stringent emission norms, and water

shortages, impact the outlook for coal

Source: World Resource Institute, BloombergNEF

● India’s emission norms for new coal and gas power

projects are among the strictest in the world, but

enforcement is weak. The initial deadline to meet these

was December 2017. It has now been extended to

December 2022 due to widespread non-compliance.

● The International Institute for Sustainable Development

estimated that India’s coal plants need $12 billion to

install SO2, NOx and particulate matter control

equipment. This may increase tariffs by 0.32-0.72

rupees/kWh, adding to coal’s competitiveness challenge.

● Nearly 90% of India’s thermal fleet depends on freshwater

for cooling and of these units, 39% are installed in high

water-stress regions. The World Resources Institute

calculated that 14 of India’s largest thermal power

companies lost over $1.4 billion in revenue between 2013

to 2016 because of water shortage related disruption.

● A government think-tank report suggests that 600 million

Indians currently face high to extreme water stress. By

2030, the country’s water demand could be twice the

available supply, pointing to severe water scarcity. This

creates risks for water availability for coal plants.

205

167

80

14

6

Installed coal

capacity

Capacity

where FGD is

planned

Tenders

issued

Bids awardedFGD installed

GW

-5

-4

-3

-2

-1

0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

TWh

Lost output higher in the summer

and when monsoon is delayed

25 May 06, 2020

Source: BloombergNEF. Note: LCOE is levelized cost of electricity. Four hour

battery storage is considered and size of the battery is 25% to 100% of the installed

wind/solar capacity. Shaded areas show LCOE range.

LCOE of dispatchable renewables and coal

Historical trend of LCOEs in India

● Renewables need to be associated with storage to

displace coal more widely in the future. We expect that

mid-case new onshore wind and new solar combined with

battery storage will out-compete new coal plants on a

levelized basis by 2023 and 2029 respectively. The coal

LCOE includes the costs of meeting emission norms.

● Li-ion battery prices have fallen by 87% over the past

decade. By 2024, BloombergNEF expects prices to be

below $100/kWh on a volume-weighted average basis..

The falling costs of renewables challenge

the economics of building new coal plants

Source: BloombergNEF. Note: LCOE is levelized cost of electricity. Shaded areas

show LCOE range.

● Solar and wind have been the cheapest sources of bulk

power generation in India for the past three years. Since

2014, the mid-case levelized cost of energy (LCOE) has

dropped by 80% and 66% for solar and wind respectively.

● In theory, the best-in-class wind farms and solar plants

can generate power at $27-29/MWh, a third cheaper than

our LCOE estimate for best-in-class new coal-fired power

stations, at $41/MWh today.

0

50

100

150

200

2014 2015 2016 2017 2018 2019 2020

$/MWh (real 2019)

Fixed-axis PV Onshore wind Coal

0

40

80

120

160

2020 2025 2030 2035 2040 2045 2050

$/MWh (real 2019)

Fixed-axis PV + storage Coal Onshore wind + storage

26 May 06, 2020

India’s clean power revolution from 2015

to 2019, by the numbers

65GW

New renewables capacity built

$50 billion

Asset financing for clean energy

1

India’s global ranking for volume

of renewables auctioned

33%

Compound annual growth rate of

generation from wind and solar

27 May 06, 2020

Source: European Space Agency

India has set an example, by making great

strides towards transforming its energy

sector by ensuring affordable, secure and

clean energy access for all the citizens.

Looking at the expected upswing in the

country's demand for energy, advances in

grid integration, improved flexibility and well

coordinated energy policy at federal and

provincial levels, India will prove to be a great

leader in global climate action.

Upendra Tripathy, director general,

International Solar Alliance

“

28 May 06, 2020

India’s power sector

outlook to 2030

Comparing government projections and

BNEF’s New Energy Outlook 2019

29 May 06, 2020

Source: Central electricity Authority

Government’s view on India’s generation in 2030

The world is looking at how India’s power

system may evolve

● India’s Central

Electricity Authority

(CEA) projected

the optimal

capacity mix to

meet the projected

electricity demand

in the year 2029-30

● It considers

possible/feasible

technology options,

intermittency

associated with

renewables and

other constraints.

● The study aims to

provide a basis for

planning policies

and systems to

meet growing

electricity demand.

Source: BloombergNEF

BloombergNEF’s global long-term analysis

● The New Energy

Outlook (NEO) is

BNEF’s annual

long-term analysis

of the global power

system.

● It is an in-depth

analysis of 20

countries,

evaluating the

economic drivers,

tipping points and

physical constraints

that could shape the

power sector until

2050.

● Our outlook is a

based on least-cost

technology options

to meet future

electricity demand.

30 May 06, 2020

Source: European Space Agency

India pledged in Paris that by 2030, 40% of our

installed capacity will be from non-fossil-fuel

based resources. We have already crossed 37%,

and are expecting to get to 55-60% by 2030.

The question before us as a country, and as the

world, is whether the environment is important or

not, and whether we want to leave behind a

livable world for our great grandchildren.

Shri Raj Kumar Singh, Union Minister of State

(Independent Charge), Ministry of Power and

Ministry of New and Renewable Energy,

and Minister of State, Ministry of Skill

Development and Entrepreneurship

“

31 May 06, 2020

Source: BloombergNEF NEO 2019.

Per-capita electricity use remains low by global

standards even in 2030

India’s power demand is expected to grow

by 80% in ten years

● Despite the rise in power demand, per-capita electricity

consumption in India will continue to remain below that of

many developed and developing economies. Even by

2030, India’s per-capita demand is lower than Brazil’s

today.

● This suggests that there is room for power demand to

grow well beyond 2030, as India catches up with global

trends in per-capita electricity requirements.

Source: BloombergNEF NEO 2019, Central Electricity Authority. Note: CEA

forecasts are interpolated for years not available and offset by three months for

calendar year comparison. CAGR = Compound Annual Growth Rate

Demand projections in NEO and CEA follow

similar trajectory

● India’s power demand in 2030 will be around 2,700TWh,

up from 1,500TWh in 2020.

● Increasing population and GDP per capita will continue to

drive power demand growth in the next decade. Newly

connected rural consumers will also expand their use of

electrical appliances. Rising demand for air conditioning

will push up its power usage by 25% by 2030.

● The share of demand from electric vehicles is less than

0.5% by 2030 , despite early signs of growth by 2030.

0

500

1,000

1,500

2,000

2,500

3,000

2020 2022 2024 2026 2028 2030

TWh

NEO other demand NEO Air conditioning CEA demand forecast

CAGR = 6%

India

Brazil

China

Australia

U.S.

0

3,000

6,000

9,000

12,000

15,000

2012 2020 2030

kWh per capita

32 May 06, 2020

Source: BloombergNEF NEO2019, Central Electricity Authority. Note: Solar capacity

is in AC. An inverter loading ratio of 1.3 is assumed for NEO 2019. CEA’s figure’s

for financial year ending March 2030. Others include batteries, demand response

and oil.

2030 capacity mix 2030 generation mix

Government’s vision is more bullish than

our least-cost system modeling results

Source: BloombergNEF NEO 2019, Central Electricity Authority. Note: CEA’s

figure’s for financial year ending March 2030.

● CEA estimates that the size of the Indian grid will expand

to 838GW by FY2029-2030, compared to NEO 2019’s

projection of a rise to 734GW by 2030. CEA is more

bullish on cumulative solar, wind and coal than BNEF.

● NEO 2019 predicts installed capacity of 204GW(AC) of

solar, 109GW of wind (onshore and offshore) and 234GW

of coal by 2030. By 2030, 62% of installed capacity would

be non-fossil fuel based. This is significantly higher than

the 40% India committed to under the Paris Agreement.

● CEA projects 2,518TWh of gross electricity generation by

FY2029-30, compared to a 9% higher figure of 2,747TWh

for 2030 in NEO 2019. The plant capacity factors are

higher in NEO 2019, leading to more generation from

lower capacity compared to CEA projections.

● CEA expects India to source 54% of electricity from coal,

19% from solar and 12% from wind by 2029-2030. NEO

2019 projects that coal would supply 55%, and solar and

wind just 15% and 11% respectively by 2030.

267

234

70

81

280

204

140

109

838

734

CEA NEO 2019

GW

Others

Biomass

Wind

Solar

Nuclear

Gas

Hydro

Coal

54%

55%

8%

8%

4%

7%

19%

15%

12%

11%

CEA NEO 2019

Biomass

Wind

Solar

Nuclear

Gas

Hydro

Coal

Share of generation

33 May 06, 2020

Source: BloombergNEF NEO 2019.

The next decade will see more generation from

renewables, but also coal

Coal fleet utilization rises by 12 percentage points

● In NEO 2019’s least-cost pathway, generation from solar

and wind grows by 365% and 281% respectively between

2020 and 2030, to reach 26% of all electricity produced.

● Coal power generation also rises, but at a considerably

slower pace of 35% over ten years.

● However, NEO 2019 shows that coal plants’ capacity

factor would improve markedly from now to 2030, as

fewer coal plants are added in a market with rapidly

growing power demand.

● Coal plant portfolio owners may decide to retire older

plants in order to improve the utilization rate, and hence

efficiency and return, of their newer plants.

Coal fleet grows more slowly, but it

is utilized much better

0

500

1,000

1,500

2,000

2,500

3,000

2020 2022 2024 2026 2028 2030

TWh

Biomass

Gas

Nuclear

Wind

Solar

Hydro

Coal

62%

74%

50%

60%

70%

80%

2020 2022 2024 2026 2028 2030

Capacity factor

Source: BloombergNEF NEO 2019.

34 May 06, 2020

Source: BloombergNEF. Note: Annual savings and avoided CO2 emissions are shown based on the

comparison of generation in NEO 2019’s least cost projections and a scenario where no new renewables

are built from 2020 onwards. The cost of transmission, distribution and real time balancing of demand-

supply is not considered.

Keeping the momentum on building renewables produces

rising benefits each year as their cost declines

● We compare the outcomes of a no-new-

renewable build scenario to the least-cost

approach modelled in NEO 2019.

● We find that India saves $78 billion

cumulatively in electricity generation costs

from now to 2030 by following the least-cost

path to meeting electricity demand. This is a

estimate based on the low-case forecast

LCOEs for all technologies. It also does not

account for any additional grid requirements

or balancing for the intermittency of

renewables. To put saving in context, India’s

banks had $79 billion of credit deployed to

the power sector at the end of 2019.

● In addition, India also avoids 2,860 metric

tonnes of CO

2

emissions with the expansion

of renewables capacity. To compare the

scale of abatement, 2,771 MtCO2 were

emitted by all of India’s power plants put

together from March 2017 to March 2019.

● Even at a low nominal carbon price of

$10/tCO

2

, the avoided emissions would be

worth $29 billion over the period.

The least-cost path saves money, and

lowers CO

2

emissions considerably

1.0

2.0

3.2

4.6

6.1

8.0

10.2

12.8

15.9

19.3

23.5

40

76

118

162

210

260

301

348

398

450

499

-600

-500

-400

-300

-200

-100

0

100

200

300

-60

-50

-40

-30

-20

-10

0

10

20

30

2020 2022 2024 2026 2028 2030

$ billion (2019, real)

Savings

from

$10/tCO2

carbon price

Savings by

replacing

fossils with

renewables

Avoided

CO2

emissions

million ton CO

2

35 May 06, 2020

Source: BloombergNEF NEO 2019

Source: BloombergNEF NEO 2019. Note: Flexible capacity includes peaker gas,

pumped hydro, batteries and demand response. Solar capacity is in AC.

2034 – grid connected capacity mix

Typical demand profile on high air conditioner

use day in India in 2034

India builds 450GW renewables by 2034 and

will need 10% flexible capacity in NEO 2019

● NEO 2019 shows that India could reach over 450GW of

renewable energy (excluding hydro) by 2034, close to the

2030 target. About 48% of the total capacity mix could be

made up of solar, wind and biomass by then.

● India’s total grid-connected capacity would reach 934GW

by 2034, with more than 10% made up of flexible capacity

sources which aid in renewables integration.

● India’s power demand is expected to peak at midday by

2030s instead of early evenings today, because of higher

residential and commercial demand for air-conditioning.

● This fundamental shift in peak demand to midday

(coinciding with peak solar generation), from a pre-

dominant evening peak now, will require additional

sources of flexibility. These would preserve system

stability in periods of sharply shifting demand and supply.

250

300

350

400

01:00 04:00 07:00 10:00 13:00 16:00 19:00 22:00

GW

General demand AC demand

27%

2%

4%

9%

2%

15%

31%

10%

934GW

Coal

Gas

Nuclear

Hydro

Biomass

Wind

Solar

Flexible capacity

36 May 06, 2020

Source: BloombergNEF NEO 2019Source: BloombergNEF NEO 2019

Power sector carbon emissions in India Per-capita power sector carbon emissions

450GW of renewables would keep India on

track to meet peak power sector emissions

● High renewable energy penetration in the Indian grid

could help the country reach peak power sector carbon

emissions by 2038.

● India’s emissions trajectory closely follows the fate of its

coal plants, as 98% of current power sector carbon

emissions originate from there.

● Emissions from power plants are expected to rise by 69%

to 1,617MtCO2 by 2038, from an estimated 958MtCO

2

in

2018. By 2050, emissions are expected to decline by

11% from the peak, to 1,437MtCO

2

if India’s energy

sector can continue to invest in more clean capacity.

● High renewable energy penetration would also mean that,

even though India’s absolute power sector carbon

emissions increase, per-capita emissions only rise

marginally to 2038, after which they decline.

0

2

4

6

8

10

2012 2018 2025 2030 2035 2040 2045 2050

tCO

2

/person

India Australia China South Korea U.S.

0

300

600

900

1,200

1,500

1,800

2012 2018 2025 2030 2035 2040 2045 2050

MtCO

2

e

Oil Gas Coal

37 May 06, 2020

Source: BloombergNEF, Ministry of Power. Note: Renewables includes large hydro,

small hydro, biomass, solar and wind.

Share of renewables went up post-lockdown

● The pandemic has given grid operators and discoms the

experience of operating the power system with higher

shares of intermittent generation. This should help them

plan the flexibility requirements and dispatch procedures

for a 450GW renewables future.

● The underlying economic drivers of LCOEs for wind and

solar remain largely unchanged. With the governments

supportive policies, the Covid-19 pandemic is not

expected to alter India’s path to 450GW renewables.

Covid-19: slowing power demand growth,

but not the energy transition

Power demand is recovering slowly

Source: BloombergNEF, Ministry of Power, Power System Operation Corp Ltd.

● India’s power demand fell by 36% in the first week of the

Covid-19 national lockdown as commercial and industrial

users shut operations. Demand started to pick up after

the economy began to gradually re-open.

● The share of renewables in the generation mix before

India’s virus lockdown was 14-18%. After March 25, the

drop in power demand led to lower utilization of coal

plants. Wind and solar generators were protected by their

priority dispatch. This led to the share of renewables

going up to nearly 30%.

0

1,000

2,000

3,000

4,000

5,000

01-Jan 01-Feb 01-Mar 01-Apr 01-May 01-Jun

2013

2014

2015

2016

2017

2018

2019

2020

GWh

March 25:

Lockdown

May 1: Gradual re-

opening of offices

and manufacturing

June 1:

Heat wave

subsides

0%

20%

40%

60%

80%

100%

01-Feb 01-Mar 01-Apr 01-May 01-Jun

Renewables

Nuclear

Gas

Coal

Pre-lockdown

coal's share

was 75-80%

Post-lockdown

coal's share

dropped to 65-

70%

38 May 06, 2020

Source: UNEP, Frankfurt School-UNEP Centre, BloombergNEF. Note: Includes only solar, wind, biomass and geothermal. India has a target of 175GW renewables by 2022.

India’s renewables ambition in

perspective

8.2

8.2

9.4

9.6

9.8

11.5

12.4

13.6

15.7

21.5

22.4

22.6

22.8

26.5

30.6

32.1

59.9

81.9

83.4

124.1

Brazil

Turkey

Belgium

Mexico

Nigeria

Taiwan

Spain

Japan

Netherlands

Algeria

France

South Africa

Italy

U.A.E.

South Korea

U.K.

Saudi Arabia

China

Germany

India

Top 20 largest legislated government renewables additions targets with deadlines between 2020 and 2030

17.21

%

India accounts for nearly a fifth of all

renewables deployment targets to 2030

Rest of the world

721GW

39 May 06, 2020

40 May 06, 2020

Opportunities and

challenges ahead

Fulfilling India’s 2030 ambitions

41 May 06, 2020

450GW

renewables

Source: BloombergNEF

1. Evolution of

auctions

2. Increasing

system flexibility

3. Scaling up

investments

4. Preparing the

grid

5. Coordinating

land acquisition

6. Addressing

discoms’ finances

7. Managing coal

retirements

8. Stepping up

manufacturing

Eight areas of focus to get to 450GW of

renewables

42 May 06, 2020

Source: BloombergNEF. Note: Qualitative assessment where green shows main benefit, yellow shows other benefits, grey is not applicable.

Standalone wind, solar do not

provide high output all year round

● India initially auctioned only standalone wind and solar projects, as the focus

was solely on increasing renewables capacity. Of course, solar projects do

not generate through the night, but wind output is also highly seasonal.

● Load balancing has become more difficult for grid operators and discoms, as

the share of intermittent renewables increased rapidly in the past five years.

At the same time, India’s distribution companies are being pushed by the

regulators to procure more renewable energy to meet the mandated

purchase obligations. Thus, the discoms are now driving the next stage of

auctions through ‘demand-driven’ tenders.

● These new tenders put more responsibility on developers, by defining hours

and volumes of supply and transferring balancing responsibilities to IPPs.

Auction

Configuration

Match supply

to demand

Increase

transmission use

Increase

capacity factor

Reduce

intermittency

Other

reason

Capacity

auctioned

Wind

-solar

hybrid

-

1.440MW in

two auctions

Renewables

peak power

supply

Mandate use

of storage

1,200MW in

one auction

Round

-the-

clock

renewables

Likely to need

storage

400 MW in

one auction

Bundling coal

with renewables

Use stranded

coal plants

Draft policy

published.

New auction designs force renewables

to compete against dispatchable coal

Source: BloombergNEF. Note: 1MW(DC) solar and

1MW wind modelled for a high resource site in Kutch,

Gujarat..

0%

25%

50%

75%

100%

Jan Apr Jul Oct

Solar

Wind

43 May 06, 2020

The renewable industry, especially solar, has

progressed tremendously in the last decade

and is continuously evolving. With the

increase in the renewable energy share in

the energy mix and the drop in storage

prices, the sector is moving rapidly towards

24/7 supply from renewables power sources.

With the recent integrated bids, like RE

hybrids, round-the-clock supply and peaking

power supply, designed to serve the needs of

the grid, the sector is set for a massive leap

forward. Providing dispatchable power to the

grid is the only way the renewables sector

will sustain its growth in years to come.

Ranjit Gupta, CEO, Azure Power

“

Source: European Space Agency

44 May 06, 2020

Source: BloombergNEF

Source: BloombergNEF, tender documents. Note: The round-the-clock auction does

not mandate 24x7 dispatch. It is rather an auction requiring high capacity factors.

Comparing the two auctions in 2020 that move

beyond procuring standalone renewables

IPP strategies to keep tariffs low at the newer

types of auctions for renewable power

Parameter

Peak power supply

auction

Round

-the-clock

auction*

Renewable

capacity

1,200MW with no

constraints on wind

-

solar

ratio

400MW with no

constraints on wind

-

solar

ratio

Energy

storage

Mandatory deployment of

at least 600MWh but no

technology constraints.

Not mandatory, but likely

to be used to meet

capacity factor

requirements.

Supply

requirements

3MWh/MW of project

capacity to be supplied

for six of the nine defined

peak hours. Annual

capacity factor (CF) at

least 35%.

No time

-of-day supply

constraints. Minimum

annual CF 80% with

monthly CF of at least

70%.

Tariff structure

Off

-

peak tariff set at 2,880

rupees ($38.12)/MWh.

Average peak hour tariff

from auction was 6,303

rupees ($83.42)/MWh. No

escalation to tariffs.

Levelized tariff of 3,600

rupees ($47.65)/MWh for

25 years, assuming 9%

discount rate.

India’s auctions are taking renewables

closer to 24x7 power

Financial measures

Lower IRR

expectations for the

first few projects

Benefit from global

price decline for PV

modules and batteries

Lower financing

costs from post Covid-

19 recovery measures

Sell excess power to

third party

Technical measures

Use combination of

wind, solar and energy

storage

Oversize projects to

meet supply

requirements

Locate project across

multiple sites

Deploy mix of

seasonal and short-

term storage

45 May 06, 2020

Source: BloombergNEF NEO 2019

High renewable energy generation week – 2034

Low renewable energy generation week – 2034

Daily and seasonal variation of 450GW

renewables grid highlights flexibility needs

0

100

200

300

400

500

0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18

GW

Battery

Flex

Solar

Wind

Biomass

Hydro

Gas

Coal

Nuclear

Demand

0

100

200

300

400

500

0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18 0 6 12 18

GW

Battery

Flex

Solar

Wind

Biomass

Hydro

Gas

Coal

Nuclear

Demand

46 May 06, 2020

Source: BloombergNEF

Source: BloombergNEF. Note: Data for 2018 shown.

Different global approaches to increase power system flexibility

Measure

Global example

Adoption in India

Interconnection and

larger balancing areas

China’s Gansu province has 8GW ultra-high voltage

transmission line, which is 71% of its 2018 peak load

Limited potential to increase regional interconnection but

need to accelerate work on the Green Energy Corridor

Shorter dispatch

intervals

South Australia dispatch at 5-minute intervals Shortening the current 15-minute dispatch needs changes to

IT infrastructure and market rules

Market pricing for

ancillary services

The U.K. introduced a sub-second frequency

response product in 2016.

India’s reforms of the ancillary services must allow for price

discovery and technology-neutral participation for providers

Demand response California conducts auctions to procure demand

response

Needs wider adoption of dynamic pricing, smart meters and

compensation mechanism for large power users

Energy storage Australia’s market for ancillary services has ensured

batteries are effectively providing frequency control

Clear market rules needed for the different uses of energy

storage – from instantaneous to long-term balancing of

demand-supply.

India can draw on global best practices

to ramp up its system flexibility

South Australia

Flexible

operation

Flexible

demand

Flexible supply

Flexible transmission

U.K.

Flexible

operation

Flexible

demand

Flexible supply

Flexible transmission

California

Flexible

operation

Flexible

demand

Flexible supply

Flexible transmission

Germany

Flexible

operation

Flexible

demand

Flexible supply

Flexible transmission

47 May 06, 2020

Source: BloombergNEF

Source: BloombergNEF NEO 2019. Note: Measured in investment year, not

construction year.

Zero-carbon sources of power attract 80% of

investments from now to 2030

All sources of capital need to pitch in to meet

projected investment needs

Debt

Commercial

banks

Non-banking

financial

companies

Multilaterals

and

development

agencies

Export credit

agencies

Equity

Sponsor/

developer

Insurance,

pension and

sovereign

wealth funds

Private equity,

infrastructure

funds

Venture

capital

Public

markets

Public offering

Bond market:

green, project,

corporate,

sustainability

Infrastructure

trusts

● NEO 2019 projects investment requirement of $410

billion to 2030, of which $281 billion is in renewables.

India attracts 9% of the world’s total investment in

generation and energy storage. This makes it the second-

biggest investment destination after China.

● Wind and solar put together need $188 billion of capital.

To put this in context, new-build asset finance for the two

technologies totaled $77 billion from 2010 to 2019. So,

India will need to mobilize different sources of capital to

finance the power sector’s expansion till 2030.

Over $400 billion will be needed for the

new power plants being built to 2030

Credit

enhancement

products

$189bn

$222bn

0 100 200

2021-25

2026-30

Solar PV

Hydro

Wind

Coal

Nuclear

Peaker gas

Other flexibility

Biomass

48 May 06, 2020

Source: BloombergNEF. Note: These figures are for poles, wires, substations and

transformers only so are likely to underestimate actual spend if we also consider

investment in new software systems and equipment to make the grid smarter and

manage growing numbers of behind-the-meter PV systems, as well as the wider

adoption of electric vehicles.

Cumulative 450GW renewables grid investments

($ real)

A robust grid is essential to integrate

450GW renewables and serve end-users

● We estimate it would need $335 billion of investment in

the grid by 2034 to cater for 450GW of renewables.

Almost 60% of this money would be needed in the

transmission grid, the remainder in distribution network.

● Grid expansion and building of interconnectors for new

generation units will require about $231 billion by 2034.

Meanwhile, replacement of ageing existing transformers,

substations and cables will require another $104 billion.

● A lot of additional investment would be required to

digitalize future grids.

Source: BloombergNEF

State of digitalization of grid and future needs

Decentralized

energy

Generation Transmission

Distribution

C&I Residential

Renewables:

advanced

Thermal: early

stage

Extend asset

lifetime of thermal

generation,

improve

renewables

forecasting

Advanced

Algorithms to

balance supply

and demand, full

roll out of

predictive

maintenance

Early stage

Deployment of

automated tools,

transparency of

behind-the-meter

assets

Early stage

Energy

management

algorithms,

behind-the-

meter

optimization

Retail

Pilot projects

Smart homes

and energy

management,

pairing of smart

devices

Pilot projects

Machine learning

of blockchain

platforms for

automated trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Today

The

challenge

Status today

Future needs

Transmission

Moderately

advanced

Decentralized

energy

Generation Transmission

Distribution

C&I Residential

Renewables:

advanced

Thermal: early

stage

Extend asset

lifetime of thermal

generation,

improve

renewables

forecasting

Advanced

Algorithms to

balance supply

and demand, full

roll out of

predictive

maintenance

Early stage

Deployment of

automated tools,

transparency of

behind-the-meter

assets

Early stage

Energy

management

algorithms,

behind-the-

meter

optimization

Retail

Pilot projects

Smart homes

and energy

management,

pairing of smart

devices

Pilot projects

Machine learning

of blockchain

platforms for

automated trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Today

The

challenge

Distribution

Early stage

Algorithms to balance

supply and demand, full

roll out of predictive

maintenance

Deployment of

automated tools,

transparency of behind-

the-meter assets

Pilot projects

Decentralized

energy

Generation Transmission

Distribution

C&I Residential

Renewables:

advanced

Thermal: early

stage

Extend asset

lifetime of thermal

generation,

improve

renewables

forecasting

Advanced

Algorithms to

balance supply

and demand, full

roll out of

predictive

maintenance

Early stage

Deployment of

automated tools,

transparency of

behind-the-meter

assets

Early stage

Energy

management

algorithms,

behind-the-

meter

optimization

Retail

Pilot projects

Smart homes

and energy

management,

pairing of smart

devices

Pilot projects

Machine learning

of blockchain

platforms for

automated trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Modernizing

power plants,

automating

grid controls

Early

stage

Advanced

algorithms for

optimized

operations

Advanced

Full automation

for grid

stability,

optimization

Early

stage

Fast acting

aggregated

demand

response

Pilot

projects

Virtual power

plants,

aggregated

balancing

Automated

platforms using

machine

learning

Current

state

Next

steps

Early

stage

Pilot

projects

Generators Transmission Distribution Utilities

Prosumers

Trading

Today

The

challenge

Decentralized energy

Machine learning and

blockchain platforms to

enable automated

trading

Decentralized

energy

Generation Transmission

Distribution

C&I Residential

Renewables:

advanced

Thermal: early

stage

Extend asset

lifetime of thermal

generation,

improve

renewables

forecasting

Advanced

Algorithms to

balance supply

and demand, full

roll out of

predictive

maintenance

Early stage

Deployment of