IOOF Holdings Ltd

ABN 49 100 103 722

Level 6, 161 Collins Street

Melbourne VIC 3000

GPO Box 264

Melbourne VIC 3001

Phone 13 13 69

www.ioof.com.au

22 October 2021

IOOF Holdings Ltd - 2021 Annual Report

In accordance with the ASX Listing Rules, IOOF Holdings Ltd attaches the 2021 Annual

Report.

-ENDS-

Authorised for release by the Company Secretary of IOOF Holdings Limited Ltd.

Enquiries:

Cary Helenius

Executive Director

Market Eye

M: +61 403 125 014

E: investorrelations@ioof.com.au

Media enquiries:

Kristen Allen

GM Corporate Affairs & Reputation

IOOF

M: +61 412 759 753

About IOOF Holdings Ltd

IOOF has been helping Australians secure their financial future since 1846. During that time,

we have grown substantially to become one of the largest groups in the financial services

industry.

IOOF provides advisers and their clients with the following services:

• Financial Advice services via our extensive network of financial advisers;

• Portfolio Management and Administration for advisers, their clients and hundreds of

employers in Australia; and

• Investment Management products that are designed to suit any investor’s needs.

Further information about IOOF can be found at www.ioof.com.au

Stronger together

IOOF Annual Report 2021

IOOF Annual Report 2021

|

IOOF Holdings Ltd

At IOOF, we have been helping Australians secure their

nancial future for 175 years.

Today, IOOF is one of the largest nancial

services groups in Australia, an ASX Top

200

company and leading provider of nancial

advice, superannuation, investment and

trustee products and services.

On 31 May 2021, IOOF completed the

acquisition of MLC Wealth, bringing

together two of Australia’s longest-standing

wealth management businesses, to create

Australia’s leading wealth manager.

With more than $450 billion in funds

under management and administration,

the new IOOF proudly serves over 2million

Australians. We administer more than

$180billion of superannuation assets,

making us one of the largest super fund

providers in Australia and one of the largest

advice businesses with 1,975nancial

advisers that have an advice service

relationship with IOOF.

1

The new IOOF has greater scale and

capability, and is focused on building

efciencies that will provide clients

value, choice and accessibility.

1

All gures are at 30 June 2021. Financial adviser numbers include

1,353licensed advisers and 622 self-licensed advisers that we service

in the Alliances, Dealer Associates and Connect business models.

WelcomeWelcome

IOOF proudly acknowledges Australia’s Aboriginal

and Torres Strait Islander peoples and their

rich culture, and pays respect to their Elders

past, present and emerging.

We acknowledge Aboriginal and Torres Strait

Islander peoples as Australia’s rst peoples and as

the Traditional Owners and custodians of the land

and water on which we rely.

We recognise and value the ongoing contribution

of Aboriginal and Torres Strait Islander peoples

and communities to Australian life and how this

enriches us. We embrace the spirit of reconciliation,

working towards equality of outcomes and

ensuring an equal voice.

Contents

02 Our services

04 Chairman’s commentary

06 2021 results at a glance

08 CEO’s commentary

12 Environmental, social and

governance report

31 Directors

33 Financial report

139 Shareholder information

141 Corporate directory

IOOF Holdings Ltd ABN 49 100 103 722

02

Our services

Creating nancial wellbeing for all Australians.

We have a substantial opportunity to improve the nancial

wellbeing of all Australians.

Our broad range of wealth management products and

services means that we have an unparalleled ability

to provide solutions to help our clients achieve their

nancial goals.

Caring about people and providing quality service and

consistent performance are key to our success.

Financial advice

We believe in the value of nancial advice and the importance

of making advice more accessible, engaging and aordable.

Whether provided through the organisations we partner with

or our own extensive adviser network, we believe nancial

advisers have a strong and enduring positive impact on clients

by helping them build, maintain and protect their wealth.

Portfolio administration

We oer nancial advisers, clients and thousands of employers

around Australia leading superannuation and investment

solutions. We oer our own products as well as a selection

of external, leading solutions. This open architecture model

ensures advisers and their clients can choose the solutions

that best suit their individual needs.

Investment management

Our investment capabilities are driven by a

highly skilled team of more than 100 investment

professionals, operating out of four countries,

with a proven investment process that focuses on

delivering strong, consistent returns for our clients.

Investment options include multi-asset and direct asset

management across a range of specialist asset classes

including global and domestic equities, xed income,

private equity and property.

Today, we manage more than $232 billion worth of

assets on behalf of our clients, advisers and institutions.

Theteam also has access to world-leading investment

managers across a broad range of asset classes to assist

clients in achieving their investment goals.

Estate administration

Australian Executor Trustees is part of the IOOF

group and has been providing estate and trustee

services to Australians for more than 140years. Trustee

services include estate planning and administration,

compensation trusts, personal trustee services,

philanthropy and self-managed super fund solutions.

Our diversified model

02

Clients

a

d

m

i

n

i

s

t

r

a

t

i

o

n

a

d

m

i

n

i

s

t

r

a

t

i

o

n

I

n

v

e

s

t

m

e

n

t

F

i

n

a

n

c

i

a

l

a

d

v

i

c

e

P

o

r

t

f

o

l

i

o

E

s

t

a

t

e

m

a

n

a

g

e

m

e

n

t

IOOF Annual Report 2021 03IOOF Annual Report 2021 03

"

We cannot begin to express

our gratitude for your

wonderful, positive decision!

The memory of my husband, and

my son’s father, will be more strongly

cherished, remembering the support and

courage he received in life and in death,

the nancial advice provided and the

positive outcomes even ten years on.

"

IOOF client

Image is stock photography.

04

Welcome to the 2021 nancial

year annual report.

Last year, I described the 2020

nancial year as one of volatility,

change and disruption. As a

nation, we had to contend with

two unprecedented crises:

catastrophic bushres and

then the COVID-19 pandemic.

Itquickly became apparent that

2020 would require a dierent

kind of resilience as the health

and community eects of the

virus, and the economic impacts

of measures taken to contain it,

reshaped our economies and

way of life.

Twelve months on, the prospects

for the world economy have

brightened. In May this year, the

Reserve Bank of Australia noted

that the Australian economy is

transitioning from recovery to the

expansion phase earlier and with

more momentum than anticipated.

2

But this is no ordinary recovery.

Thepandemic has changed the

world, and its eects will last.

Optimistically, and barring

any unexpected catastrophes,

individuals, businesses and society

alike can start to look forward to

shaping the future rather than just

grinding through the present.

In this regard, there are parallels

with the outlook for IOOF. Just as

2021 was a year of global transition,

it also heralded a major transition

for the Group. We are shaping the

future so that all Australians can

access quality nancial advice, and

experience nancial wellbeing.

Environmental, social and

governance priorities

Sustainability and environmental,

social and governance (ESG) issues

aect how all companies do

business – and this is increasingly so

in recent years. We recognise – as do

our investors – that sustainability is a

strategic priority that involves both

business risks and opportunities.

Chairman

s commentary

We are shaping the future so all Australians can access

quality nancial advice, and experience nancial wellbeing.

2

RBA, Statement on Monetary Policy – May 2021.

IOOF Annual Report 2021 05

Addressing climate change

The risks associated with a changing

climate extend across many, if

not all, sectors of the economy.

The Board and I are committed to

deeply understanding and acting

appropriately to address climate

change risk within the business.

Principally, we are guided by:

• the Paris Agreement, which

has the goal of limiting global

warming to well below two

degrees Celsius compared to

pre-industrial levels

• the recommendations of the

Task Force on Climate-related

Financial Disclosures, which were

developed to promote more

informed investment, lending

and underwriting decisions in

response to climate change

• the Hutley opinion on the

potential liability of company

directors in Australia if they

do not adequately manage

climate change risks.

You will nd more information

about IOOF's climate change related

initiatives in the environmental,

social and governance report.

As a Board, we recognise that the

tectonic shift towards sustainable

investing is accelerating. IOOF's

responsible entities are committed

to managing funds in a responsible

manner on behalf of our clients.

Identifying and managing ESG

factors, risks and opportunities

aligns with our clients’ long-term

goals of a secure nancial future.

Through MLC Asset Management,

we are now members of the

Responsible Investment Association

Australasia and the Investor Group

on Climate Change.

Social impact through the

IOOF Foundation

The IOOF Foundation continued

to support outstanding charitable

organisations and invest in our

communities. The past year has

brought great personal challenges

to many, requiring us all to adjust

and support those around us.

In the 2021 nancial year, the

IOOF Foundation contributed

over $700,000 to community

organisations, bringing the total

funds distributed since inception

to more than $16 million. Grants

were awarded in the areas of

mental health, aged care, families

and at-risk children and youth.

Our community partnerships are

numerous and include Ardoch,

the Coleman Foundation,

Ganbina, The Smith Family and

Youth Focus WA, to name a few.

On behalf of the Group, I extend our

gratitude to the Trustee Directors for

their ongoing commitment, led by

the Chair, Ms Angie Dickschen.

Governance in sharp focus

Whether governing through

steady state or signicant

upheaval, a Board’s duty is to

act in the best interests of the

corporation. The challenges that

beset this past year brought into

sharp focus the signicance of

stakeholder governance for the

Board. Stakeholder governance

requires us to identify, engage

with and understand stakeholder

perspectives on key issues,

and then reect on how these

perspectives should be considered

in decision making.

The new IOOF

Our orientation towards clients –

putting them rst, and understanding

and meeting their nancial needs

in a myriad of new, aordable and

accessible ways, and ultimately

providing a sense of nancial

wellbeing – is the essence of our

client-centric philosophy ClientFirst.

We know that Australians who have

been impacted by the COVID-19

pandemic see nancial advice and

planning as essential to wellbeing.

Whether it’s platform enhancement,

business simplication or product

development, each element of

our strategy is focused on clients

and improving the aordability

and accessibility of nancial advice

for the nancial wellbeing of all

Australians – in good times and bad.

In this sense, we are working hard

to not only change ourselves, but

to reshape our industry.

Against this backdrop, I would

like to extend my thanks to the

members of the Board for their

commitment, wisdom and

guidance. I acknowledge the work

of Chief Executive Ocer Renato

Mota and the Executive Team for

their capable management of the

organisation. I also thank all our

colleagues, who are now 5,000

strong, following the successful

acquisition of MLC. Theyhave

worked tirelessly to continue to

position the business for success

today and tomorrow.

Allan Griths

Chairman

The past year

has brought great

personal challenges

to many, requiring

us all to adjust

and support those

around us.

06

2021 results at a glance

Business highlights

2020

JUL

IOOF Community Oer

launched – provided

more than 1,000 hours

of nancial advice and

pro bono support to

over 200 individuals and

50community groups

IOOF Balanced Investor

Trust wins Multi

Asset – Balanced

category at the Money

Management Fund

Manager of the Year

2020 Awards

AUG

Acquisition of

MLC announced

SEPT

Advice 2.0

strategy launched

Wealth Central

purchased

DEC

IOOF MultiMix

Australian Shares Trust

wins Best Australian

Shares Super Product

award, and IOOF

MultiMix Balanced

Growth Trust is named

Best Multi-Sector Fund

(second year in a row) in

Money

magazine’s Best

of the Best Awards 2021

Over $1.4 billion released

to members under the

COVID-19 early release of

superannuation scheme

since April 2020

NOV

The True Value of Advice

research released

– more than 12,500

Australians surveyed

More than 150 colleagues

from ANZ Pensions

and Investments (P&I)

business welcomed

IOOF’s new

principles launched

2021

FEB

First Annual Member

Meetings held for

superannuation members

MAR

IOOF named Managed

Funds Provider of the Year

– Multi-Sector Funds

by Canstar

Another 147 colleagues

from ANZ P&I welcomed

MAY

MLC acquisition approved

by the Australian Prudential

Regulation Authority

IOOF MultiMix Balanced

Growth Fund wins Multi

Asset – Growth category

at the Money Management

Fund Manager of the Year

2021 Awards

ANZ Superannuation wins

Canstar’s Most Satised

Customer – Super Fund

award for 2021

MLC acquisition

completed

JUN

2,600 colleagues and

406 nancial advisers

from MLC welcomed

More than $450billion

FUMA

3

and $180billion

administered in

superannuation assets,

making IOOF one of

the largest wealth

managers in Australia

$5billion and more

than 38,600 accounts

migrated to new

Evolve platform

APR

Wealth Central wins

BestNew Advice Technology

Application award by

Investment Trends, based

on Investment Trends’

2020 Advice Technology

Benchmark Report

IOOF Annual Report 2021 07

Financial results

$147.8m

FUMA

3

UNDERLYING NPAT

4

SUPER

$453.4b

Up +244%

from 30 June 2020

(

$143.5m

)

Including a $200m non-cash

goodwill impairment

charge

NET INFLOWS

STATUTORY NPAT

4

ADVISERS

$3.3b

Net inows into

Evolve retail advisory

platforms

$1.4b

Released under early

access to super scheme

to assist clients

during COVID-19

1,975

Financial advisers

have an advice service

relationship with IOOF

ACQUISITIONS

ACQUIRED FUMA

DIVIDENDS

$296.3b

Additional FUMA at

completion of MLC

acquisition

23.023.0CPSCPS

55

Fully franked

dividends

per share

$55.8m

Cumulative annualised run-

rate synergies from acquiring

ANZ P&I and MLC

IOOF Annual Report 2021 07

3

Funds under management and administration

4

Net prot after tax

5

Cents per share

08

CEOs commentary

We have the strategic intent, the talent and now the scale,

to deliver our advice-led wealth management proposition

to more Australians than ever before.

6

Five-year compound annual growth of total superannuation assets to March 2021 per APRA superannuation statistics.

At the time of writing, we are

in the extraordinary situation

of having more than 16 million

Australians in lockdown as a

result of the COVID-19 pandemic.

I recognise that for many people,

prolonged periods of lockdown

have been dicult. It is against this

backdrop that I would like to start

by acknowledging the incredible

job all our people at IOOF have

done in a dicult and unsettling

environment.

Stronger together

I am pleased to report on the

successful completion of the

MLC transaction on 31 May 2021.

This acquisition positions us as

a leader in a new era of wealth

management in Australia, giving us

a strong platform for future growth.

Wehavethe strategic intent, the

talent and now the scale, to deliver

our advice-led wealth management

proposition to more Australians

than ever before.

IOOF has been transformed

through acquiring ANZ Wealth’s

Pensions and Investments (ANZ P&I)

business and MLC over the past

two years. The new IOOF has more

than 2.2million clients nationally,

$450billion in funds under

management and administration

(FUMA), a network of 1,975advisers

and over 5,000 employees.

While the industry transforms,

the wealth management sector

continues to increase in size, with

ve-year compound annual growth

in superannuation assets of 9%

per annum.

6

A bigger and better

IOOF will be positioned to take

advantage of these opportunities

by being at the forefront of the

industry transformation.

Continued overleaf

IOOF Annual Report 2021 09IOOF Annual Report 2021 09

Transformation with purpose

INNOVATIONCONDUCTCULTURE

Focus

2022–2024

2019–2021

Advice 2.0

Enhanced corporate governance

and education standards across

the adviser base.

Improved productivity and quality

of advice enabled by technology.

Improved sustainability and

protability of the self-employed

channel.

Financial wellbeing

Orient our service proposition

around member needs.

Expand the capability

of technology to shape

member experience and drive

personalisation.

Pursue opportunity to reach the

signicant unadvised segment

ofthe market.

Evolve

Transition IOOF legacy

administration platforms to

the Evolve platform – to be

completed in December.

Adoption of the successful

Evolve blueprint to underpin

further platform rationalisation.

Product simplication

Complete review of entire

product suite.

Commence a structured

consolidation of ANZ P&I and

MLC platforms to the ‘go-forward’

technology.

Continue to enhance the client

experience to remain relevant to

changing client needs.

Acquisition

Completed transformational

acquisitions of ANZ P&I and MLC.

Achieved critical mass and

breadth of oering across

all major segments of advice,

platforms and asset management.

Client engagement

and reputation

Continue review of current suite

of brands.

Focus on client needs and market

engagement.

Grow the client base and market

share, delivering sustainable

shareholder returns.

Simplify

Grow

10

We believe we have a substantial

opportunity to improve the nancial

wellbeing of all Australians. We are

focused on building a protable

and sustainable business model that

delivers accessible and aordable

advice for clients at any stage of life.

Everything we have achieved this

past year is strategically aligned to

that objective.

Importantly, we are integrating

our acquired businesses into one

wealth management business, with

one purpose. And that purpose

is centred on the needs of our

2.2million clients and members.

We want to understand them,

look after their needs and secure

their futures, and our ClientFirst

philosophy underpins all the work

we do to deliver on this purpose.

Financial performance

Our nancial performance over

the past 12 months has been

strong. The nancials highlight

an underlying net prot after tax

of $147.8 million from continuing

operations, which is up 19% on the

2020 nancial year.

After taking into account a non-cash

goodwill write-down and MLC

integration costs, we reported

a statutory net loss after tax of

$143.5million. We delivered a total

dividend for the year of 23cents

per share, with the nal dividend

made up of a 9.5cents per share

ordinary dividend and a 2cents per

share special dividend.

Technology as an enabler

of growth

We believe in owning and

developing technology to assist

our advisers, clients and members

in understanding, looking after and

securing their future.

Our Evolve platform is a state-of-

the-art administration system that

is gaining support from clients and

our advisers, and will form the core

of our oering as we consolidate

the acquired legacy administration

systems into the future.

Our$30million investment in

Wealth Central – an intuitive,

interactive technology – creates

a more ecient and dynamic

interface between the client and

the adviser around fact-nding,

data collection and cash ow

projections in real time, compared

to the previous static and

lengthy process.

This dierentiating technology,

which IOOF owns exclusively, will

benet our adviser network. Itwill

also signicantly improve and

streamline the client experience,

meaning advisers will spend less

time collecting data and more time

creating plans to help clients achieve

their nancial goals. It also reinforces

our commitment to continue to

innovate in the space and build new

advice delivery methods. We have

established an incubator business to

explore the components of nancial

wellbeing and how technology and

humanistic advice will converge to

engage more broadly with clients.

The future of advice

It was pleasing to welcome another

406MLC advisers to our licensed

advice business as we look to create

a leading advice community, for

both advisers and the communities

they support.

As part of our commitment to

delivering a step-change in the

quality and aordability of advice

and constructing a sustainable long-

term advice model, we continued

to improve the eectiveness and

eciency of nancial advice by

delivering insights supported by

newtechnologies.

I believe that for IOOF, the endgame

in nancial advice is the same as

that for the entire industry. We

are

working towards delivering advice

across a multitude of digital channels,

through human and ‘digital’ advisers,

face to face and remotely, for those

just starting out or retiring. We

remain committed to supporting

advisers and their clients by

providing unmatched technologies

and choice.

Transformation through

people and purpose

Over the past year, I have nalised

my leadership structure, ensuring

we have the right talent to take the

company forward. I’m condent we

now have a senior management

team in place that is committed

to stewardship and growth of the

business by supporting Australians

and their communities.

Looking to the future, we see a

tremendous opportunity to improve

the lives of Australians. We will

do this by focusing on nancial

wellbeing, expanding the capability

of technology to shape the member

experience, driving personalisation

and leveraging opportunities to

reach those Australians who do not

currently receive nancial advice.

IOOF has a long history in

supporting Australians and their

nancial wellbeing. Today, it is

through mobilising our talent and

resources that we will continue

to serve our communities and

deliver better outcomes for clients,

members and shareholders alike.

Renato Mota

Chief Executive Ocer

IOOF Annual Report 2021 11IOOF Annual Report 2021 11

"

I have watched your Annual

Member Meeting on the

website and I must let you

know how much I enjoyed it

and how informative I found it.

It has taken away the mystery of the

faceless people in an organisation

and made them feel more like

familyto help me.

"

IOOF client

Image is stock photography.

12

It is important we create a framework that allows us to

measure – and manage – the impact our business has

on the environment and the community.

Maintaining strong environmental, social and governance

(ESG) practices enables us to manage risks and realise

opportunities in a way that creates long-term value for

allstakeholders.

Our purpose as an organisation – Understand me. Look

after me. Secure my future – extends to our clients, our

people, our shareholders and the broader community.

We use the principle of materiality to dene the social and

environmental topics that matter most to our business

and stakeholders. The materiality assessment process is an

opportunity for us to apply a sustainability lens to business

and enterprise risk management processes.

Environmental, social and governance report

At IOOF, we acknowledge that the sustainability of our business

is intrinsically linked to the sustainability of the environment

and the communities in which we operate.

Material matters

We understand that identifying, monitoring and reporting on material ESG risk exposures is vital to IOOF’s success in building trust

and achieving our strategic vision to be Australia’s leading advice-led wealth management and nancial wellbeing provider.

In assessing IOOF’s material exposure, we engage with our stakeholders, including members, investors, employees, industry

bodies, regulators and research partners, to understand key areas of focus.

We have broken up material ESG matters into the following categories.

Our clients

•

ClientFirst

• Support during COVID -19

• Member and client

engagement

• Product simplication

• Value of advice

• Anti-bribery and

corruption

Our business

•

Accelerating governance

• Cybersecurity/privacy

• Financial Accountability

Regime

• Board eectiveness

• Advice review

• Environmental

sustainability

• Tax transparency

Our people

•

Our culture

• Employee wellbeing

• Employee engagement

• Diversity and inclusion

• Growth and development

Our community

•

IOOF Foundation

• Reconciliation Action

Plan

• Modern slavery

• Sta volunteering

/giving

• Community oer

• Responsible investing

OUR ESG PRINCIPLE CATEGORIES

12

E

n

v

i

r

o

n

m

e

n

t

a

l

,

S

o

c

i

a

l

,

G

o

v

e

r

n

a

n

c

e

Understand me

Look after me

Secure my future

C

l

i

e

n

t

s

C

o

m

m

u

n

i

t

y

E

m

p

l

o

y

e

e

s

S

h

a

r

e

h

o

l

d

e

r

s

E

n

v

i

r

o

n

m

e

n

t

a

l

,

s

o

c

i

a

l

,

g

o

v

e

r

n

a

n

c

e

Understand me

Look after me

Secure my future

C

l

i

e

n

t

s

C

o

m

m

u

n

i

t

y

E

m

p

l

o

y

e

e

s

S

h

a

r

e

h

o

l

d

e

r

s

IOOF Annual Report 2021 13

The United Nations Sustainable Development Goals (UN SDGs) provide a shared blueprint for achieving peace and

prosperity for people and the planet, now and into the future. IOOF is committed to supporting the goals and using them

as a framework to guide our ESG principles and initiatives.

While we support all 17 UN SDGs, we have prioritised six goals, given their relevance to our business.

Goal Aims to achieve Our responses

Ensure healthy

lives and promote

wellbeing for all

at all ages

• Extending our nancial wellbeing education program to improve the

lives of Australians

• Investing in and promoting initiatives to support employee mental

and physical health

• Implemented ‘low trac days’ across IOOF to help employees

‘digitally detox’

• Launched ‘Your mind matters’ employee educational program to

manage mental wellness

Ensure inclusive

and equitable

quality education

and promote

lifelong learning

opportunities for all

• Engaged 10,000 members and clients through 1:1 general advice assistance,

nancial wellbeing and education programs

• Delivered over 1,000 hours of pro bono practical nancial guidance and

support to more than 200 individuals and 50 community groups

• Created a community section on the IOOF website as a resource for all

Australians to access educational material or request pro bono support

Achieve gender

equality and

empower all

women and girls

• Improved female representation at Executive and management levels, reaching

our 40% target across Senior Manager and Other Manager levels

• Formed a partnership with Financial Executive Women (FEW)

• Provided nancial sponsorship of the FEW Positive Progression of WomenAwards

Reduce inequality

within and

among countries

• Implemented our Group Modern Slavery policy and action plan

• Developing a new Innovate Reconciliation Action Plan (RAP)

• Noted an increase in positive sentiment around diversity and inclusion in our

engagement survey:

– +9 points: ‘I feel like I belong at IOOF’

– +10 points: ‘Our leaders champion the importance of diversity and inclusion’

Ensure sustainable

consumption and

production patterns

• Changed our printer paper supplier to 100% recycled nationally

• Had nearly 1 tonne of oce equipment collected from Melbourne Head Oce

by Green Collect, to be recycled/removed from landll in the nancial year

• Running a pilot campaign to encourage clients to move to electronic

statements and communications

Take urgent action

to combat climate

change and

its impacts

• Integrated climate change risks into our new Responsible Investment

Statement, available at www.ioof.com.au/about-us/responsible-investment

• Calculating the carbon footprints of investment portfolios every six months

IOOF Annual Report 2021 13

14

Our clients

We exist to deliver what matters to clients.

Our ClientFirst strategy focuses on client

experiences that make a difference in the

lives of more than 2.2 million Australians.

ClientFirst – delivering what matters

By using customer research, data and analytics, we identify insights that

help us improve the client experience. Because many Australians entrust

their futures with us, our ClientFirst approach continues to transform the

way we serve our clients.

Leveraging technology from recently acquired businesses has improved

the way we identify our clients, providing a more seamless experience with

our Contact Centre. We use speech analytics to identify key issues that

matter to our clients, and to improve simpler interactions. We have also

extended automation capabilities to scalable processes, completing more

than 200,000 client transactions over the past year.

As outlined in the following ‘Product simplication’ section, we are evolving

the use of our investment and administration platforms through consolidation.

We have moved more than 38,600 clients onto our leading platform

solutions, and plan to move around 58,000 more clients before the end of

2021. Consistently strong customer satisfaction scores indicate that we have

managed the platform migration without compromising the quality of our

service or causing disruption to clients.

The COVID-19 pandemic

continues to aect the lives

of many in profound ways.

COVID-19 support

Digitisation and accessible advice have

continued to be important themes

throughout the year. Investing in the

mobility of our workforce over the past

year has enabled us to leverage technology

to keep our people safe by working from

home and oered our clients exibility in

how they access our services.

The Australian Government’s early

superannuation release scheme

commenced on 20 April 2020 and

closed to new applications after

31December 2020. The speed and

agility of our people, systems and

processes was important to ensure we

enabled members to eciently access

their retirement savings. In the year

ended 30 June 2021, IOOF released

82,833 early superannuation payments,

totalling $699 million.

IOOF Annual Report 2021 15

Member and client

engagement

Giving our superannuation members

and investment clients access

to relevant nancial wellbeing

information – including factual,

general, scaled and comprehensive

advice – is essential for delivering on

our strategy to improve the nancial

wellbeing of all Australians.

While enabling clients to physically

access education and advice

services has been challenging

throughout the pandemic, we

have provided one-to-one general

advice, and nancial wellbeing and

educations programs, to 10,000

members and clients.

Through the MLC business, we

are working on harmonising and

extending nancial education and

wellbeing programs that benet

our clients and all Australians. Our

current investment in technology

enhancements and applications will

give us the ability to signicantly

extend our reach with these

programs in the 2022 nancial year.

Product simplication –

delivering client value

In the 2021 nancial year, we

continued to focus on consolidating

and simplifying our broad range

of products and services to deliver

greater value for our clients well

into the future. We believe that

scale, coupled with a simpler

operating environment, will allow

us to drive down the cost to serve

while ensuring that we direct our

marginal investment to innovation

and eciently deliver greater value.

Key highlights during 2021 included

the completion of Phase 1 of Project

Evolve21, our initiative to simplify

our platform administration. This

led to the retirement of more than

30superannuation and investment

administration products and six

databases. Clients using these

products were smoothly transitioned

to contemporary and more

administratively ecient oers, with

over 16,000 clients also benetting

from reduced fees in addition to

enhanced features.

As further evidence of the potential

for our scale to enhance value

for clients, two of our largest

superannuation funds completed

a review of the Group insurance

benets oered to members

through competitive tender

processes. Despite a market

environment generally characterised

by substantial insurance premium

rate increases, we successfully

negotiated insurance premium

reductions and a range of improved

insurance terms for a large

proportion of members. In total,

more than 180,000 members will

benet from premium reductions

over the coming years.

We believe that

scale, coupled with

a simpler operating

environment, will

allow us to drive

down the cost

to serve while

ensuring that we

direct our marginal

investment to

innovation and

efciently deliver

greater value.

The True Value of

Advice research

In July 2020, IOOF worked with

global market research agency

CoreData to conduct research for

‘The True Value of Advice’ study.

The research, involving 12,643

Australians, assessed evidence

that nancial advice makes a

meaningful dierence in the lives

of many Australians.

Advised clients reported

the following.

88%

Sound nancial

advice has

reduced their worry

and stress

50%

Sound nancial advice

has improved their

mental health

90%

Accessing nancial advice

has placed them in a better

41%

Sound nancial advice

has improved their

relationships with family

and friends

Our clients

161416

Overwhelmingly, the results show

that advice improves the financial

wellbeing of people who receive

it. Moreover, better financial

wellbeing flows onto better overall

wellbeing, including improved

mental and physical health, and

healthier relationships.

The True Value of Advice

research, July 2020

Our clients

IOOF Annual Report 2021 17

To improve outcomes for our

clients in an environment where

returns on cash were continually

declining, we changed the

underlying investments of the Cash

Account on many of our platform

products, improving net interest

rates for more than 180,000 clients.

Anti-bribery and

anti-corruption

IOOF has zero appetite for bribery,

corruption and facilitation payments.

Honesty, integrity and fairness are

integral to how we operate.

The IOOF Anti-Bribery and

Anti-Corruption Policy prohibits

employees from engaging in any

activity that constitutes bribery

or corruption, and provides a

framework to ensure that related

risks within IOOF’s businesses

are properly identied, mitigated

and managed.

The Policy seeks fair client

outcomes, promotes nancial market

integrity, raises credibility with key

stakeholders (including our clients

)

and supports IOOF’s commitment to

corporate responsibility TheBoard

reviewed and approved the Policy

in April 2021.

Honesty, integrity

and fairness are

integral to how

we operate.

Our unique advice-led financial wellbeing strategy

dierentiates us from our peers and focuses on

delivering quality financial advice to all Australians.

Advocating for quality nancial advice

for all Australians

As one of Australia’s leading wealth management

businesses, we are pleased to be investing in

making nancial advice aordable and accessible

for everyone.

In July 2016, we launched the IOOF Advice

Academy, which is the pre-eminent training and

coaching resource for the nancial planning

industry. Our vision is to create an environment

in which ongoing nancial planning relationships

continue to deliver mutual value and enable

our clients to experience nancial wellbeing at

all stages of life.

Five years on from its inception, the IOOF Advice

Academy continues to lead the way in specialist

coaching for nancial advice businesses. Through

bespoke workshops, in-practice specialist coaching and

implementation, we address the challenges of providing

quality advice through ever-changing technology,

regulations and consumer expectations.

Our clients

18

Our community

IOOF has a rich history of helping Australians secure their nancial

future. The impact of the COVID-19 pandemic on the community

brought into sharp focus the importance of nancial wellbeing.

The IOOF Community Offer

As an advice-led company, we

helped those in need by providing

free and accessible nancial

guidance and support through

theIOOF Community Oer.

In response to the pandemic, IOOF

launched the Community Oer as a

resource for all Australians to access

educational material or pro bono

nancial wellbeing support. Across

our national footprint, 426 nancial

advisers oered to provide guidance

and support to those who need it

most within their communities, from

1 July 2020 to 30 September 2020.

Since then, many of our advisers

have continued to provide pro bono

advice as part of their standard value

proposition for their community.

Through the IOOF Community Oer,

we helped everyday Australians by

providing the following support

and guidance:

• Pro bono support – over

100registered practices of

IOOF-aligned advisers provided

more than 1,000 hours of

pro bono practical nancial

guidance and support to over

200 individuals and more than

50community groups.

• Educational videos and content

– IOOF provided educational

videos and support material

on accessing super early,

the JobSeeker Payment, and

looking after mental health

andwellbeing.

• Wealth Report – more than

300people accessed the Wealth

Report site and used the tools

to produce an online personal

snapshot report.

Crew Training at Reach

not only prepares us to

work with young people,

it positions us to be

better equipped at facing

challenges in our own lives.

In workshops, we walk

alongside young people as

they experience the magic

of Reach’s work. We, as

crew, undergo that same

process of experiencing ‘the

work’ during training.

Photo credit:

Reach Foundation

Location: Collingwood, Victoria

IOOF Annual Report 2021 19

Reconciliation with our

First Nations peoples

Supporting reconciliation means

working to overcome divisions

and inequality between Aboriginal

and Torres Strait Islander people

and non-Indigenous people.

AtIOOF, we focus on how we can

make a dierence in the areas

of inequality in nancial literacy,

access to superannuation and

retirement outcomes.

We are taking our learnings from

our current Innovate RAP with

Shadforth and Australian Executor

Trustees and applying them as we

develop a new Innovate RAP for

the IOOF Group.

Our actions focus on building

awareness and respect for

Aboriginal and Torres Strait Islander

cultures, protocols and languages,

and building relationships with

Aboriginal and Torres Strait Islander

groups within our networks.

Modern slavery

IOOF is committed to combating

modern slavery. By proactively

addressing this issue, IOOF will

raise awareness in the community

that supporting modern slavery

practices (directly or indirectly)

does not align with our business

values or culture.

In response to the Modern

Slavery Act 2018 (Cth) reporting

requirements, IOOF has

established a Modern Slavery

Team to understand and identify

possible modern slavery risks

within our operations and key

supply chain. IOOF conducted

a detailed modern slavery risk

assessment. A small number of

suppliers were unable to provide

appropriate evidence that this risk

was managed and these suppliers

have been placed on IOOF’s

Modern Slavery Watchlist.

IOOF developed a Modern Slavery

Policy, which the Board approved in

May 2021. ThePolicy outlines IOOF’s

approach to reducing the risk of

modern slavery practices within

our operations and supply chain.

We also submitted our Modern

Slavery Statement to the Australian

Border Force via the public online

register in March 2021 after

receiving IOOFBoard approval.

We have developed and

deployed a modern slavery

general awareness training

module. AllIOOF employees must

complete the training, which

incorporates the Modern Slavery

Policy and provides directions to

follow if a suspected or actual case

of modern slavery is observed.

IOOF is committed to improving

response rates from our suppliers

over the next ve years, as well

as enhancing our education

regarding our operations and

supply chains.

Our people raised

more than $100,000

for a range of charities

through our Workplace

Giving Program, Disaster

Relief Appeal and other

fundraising activities.

Employee volunteer,

donate and participate

program

Throughout the year, our people

organised fundraising and

community volunteering activities.

In addition to annual leave,

employees were entitled to take

up to two days’ paid community

service leave per year to perform

duties for specic charities or

community organisations, or an

eligible voluntary emergency

management activity.

Our people raised more than

$100,000 for a range of charities

through our Workplace Giving

Program, Disaster Relief Appeal

and other fundraising activities.

Our matched giving allows

our people to contribute to

causes they care about. These

programs demonstrate that one

of our values, Supporting Our

Communities, extends throughout

the organisation.

In response to the

pandemic IOOF

launched the

Community Offer

as a resource for

all Australians to

access educational

material or access

pro bono nancial

wellbeing support.

Our community

20

Our mission

The Foundation’s mission is to reduce obstacles

people face to help them meaningfully participate

in the community and improve their quality of life.

This past year has been one of the most challenging

for our community since the Foundation began.

The unprecedented impact of the COVID-19 global

pandemic compelled us to reimagine how we

can maintain the highest level of support to those

most in need.

When the pandemic was announced, we reached

out and extended our support to many of our

partners needing to pivot their operations. The

Foundation supported them to transition their

operations to provide services safely via digital

platforms and to develop long-term ‘COVID-normal’

operating models. The implications of the pandemic

are not yet fully known, but we do know that we

need to keep adapting all aspects of how we support

our partners to continue delivering quality outcomes

for our community.

The IOOF Foundation

The IOOF Foundation was established in 2002, when IOOF demutualised,

to recognise the origins of IOOF and the important role it has played in the

Australian community since 1846.

Programs

The Foundation continued to support

outstanding charitable organisations and to

invest in our community.

The past year has brought great challenges, requiring

us all to adapt and change, to support those around

us at home and in the wider community. In the

nancial year 2021, the IOOF Foundation contributed

more than $700,000 to community organisations,

bringing the total funds distributed since its inception

to more than $16 million.

Our grants program oers long-term grants (up to three

years) in areas that have been historically important

to IOOF and also to the wider Australian community.

To date, we have focused on:

• Mental health – we support mental health

prevention programs that deliver evidence-based

initiatives targeted at today’s youth. Prevention

early in life is important since a large proportion

of mental health conditions begin in childhood,

adolescence or early adult life.

• Aged care – we prioritise programs that provide

quality of life for individuals with progressive

neurological and physical diseases and their families.

• Families – our basic needs program supports

community groups assisting families struggling

tobe self-sucient, including by providing

long-term solutions that help families move out

of poverty or avoid a crisis.

• Children and youth – we support education

projects that help break the cycle of disadvantage

and empower young Australians to reach their

potential. We prioritise programs addressing

prevention and early intervention and education,

employment and training for young people.

20

Photo credit:

Aboriginal Literacy

Foundation. Location: Melbourne

Learning Centre, Victoria

Our community

IOOF Annual Report 2021 21

Governance

The Foundation is governed by the IOOF

Holdings Trustee Pty Ltd (Trustee). The role

of the Board of Directors is to determine

the strategic direction of the Foundation.

The Board has two broad purposes:

• Governance – conform to the

Foundation’s legal and nancial

requirements

• Performance – assist the Foundation

to perform to its highest potential.

2021 community partners

The grants that were approved are

innovative, yet sustainable, and will

provide value to the community.

Thishelps ensure that grants have a real

impact and achieve a meaningful result.

The grant recipients were:

• Alithia Learning

• Ardoch

• Coleman Foundation

• Ganbina

• Girls from Oz

• Gotcha4Life

• Lets Talk

• Live4Life

• Mama Lana’s Community Foundation

• Ngarrimili

• Reach Foundation

• Red Dust Role Models

• Righteous Pups Australia

• Rural Aid

• Spinal Research Institute

• The Funding Network

• The Smith Family

• Youth Focus WA

IOOF Annual Report 2021 21

What a year! We were really confident moving

into 2021, knowing that whatever may come,

we can be innovative in the ways we support

our young people. We are so grateful to IOOF

for their funding support in making this year

possible. We also anticipate 2021 will see an

unexpected growth in numbers as young people

recover from the trauma, anxiety and totally

disrupted education year that was 2020.

Righteous Pups Australia

Photo credit: Joanne Baker. Location: Castlemaine, Victoria

Our community

22

Responsible investment

IOOF is committed to managing funds

in a responsible manner on behalf of

our clients. Identifying and managing

ESG factors, risks and opportunities is

very important to us because it aligns

with helping our clients’ achieve their

long-term goals of securing their

nancial future.

Our Responsible Investment

Statement describes the role

responsible investment plays in

assessing, selecting and monitoring

externally appointed managers for

our multi-manager funds. Our asset

consultants support our ESG function,

working together to continually

improve and strengthen our

responsible investment disclosures

and processes.

Additionally, we are enhancing our

engagement with our investment

managers on ESG and climate

change matters. Every six months,

ESG scores and carbon-intensity

footprints are calculated on our

underlying portfolios and the results

are reported to the Investment

Management Committee.

Further, as members of the Responsible

Investment Association Australasia and

the Investor Group on Climate Change,

we contribute to enhancing the ESG

impacts on investing.

7

IOOF Advice Research and ESG

IOOF Advice Research considers ESG

principles and enables advisers and

clients to express their investment

preference. This is done by oering

guidance through an ESG Investment

Philosophy, ESG model portfolios,

and research with an ESG overlay and

assessment of investment products.

Our approach to ESG considers

exclusion strategies, impact strategies

and, in some cases, non-ESG

strategies (for diversication). We

believe that ESG integration should

not necessarily mean that an investor

is prohibited from investing in specic

sectors, countries and companies, or

that portfolio returns are sacriced to

incorporate ESG principles. By taking

this approach, we hope to meet

our clients’ investment objectives

while enabling advisers to align their

investment portfolios with clients’

broad or specic ESG requirements.

Two key approaches we incorporate

in ESG portfolios are:

• Exclusion strategies – these

include funds that negatively

screen investments associated

with specic industries such

as tobacco, alcohol, weapons,

pornography, gambling, animal

testing, genetic engineering,

deforestation, oil and gas,

nuclear power, mining and

climate change.

• Impact investing – this includes

investments that look to generate

positive returns while measuring

an investment’s environmental and

social impact alongside its nancial

return. Funds in this category tend

to be more active when voting

and advising companies. They seek

to positively reward companies

that take a proactive approach to

improving their ESG footprint.

The IOOF Advice Research team

covers ESG investing from three

key angles:

• ESG Investment Philosophy –

this was written for advisers, to

help them give ESG investment

support to clients and build on

clients’ objectives, beyond simply

‘investing in ESG’. Increasingly,

clients are aware of ESG as an

investment approach, but often

have limited understanding of

the issues and available options.

The Investment Philosophy and

other IOOF research collateral

assists advisers to clarify each

client’s personal ESG preferences

and objectives, noting that it is

a space in which values vary in

importance and by issue.

• ESG research – this incorporates

an ESG overlay in the review

of investments (primarily on

managed funds at this stage),

including an ESG sector review

and summary matrix outlining

various exclusions that dierent

investments may incorporate.

• ESG model portfolios – these

provide advisers and clients with

either an implemented solution

(via managed accounts) or an

investment framework (via the

model portfolio), allowing advisers

and their clients to either invest in

an ESG-aware portfolio or tailor a

portfolio in line with their nancial

objectives and specic needs.

An important observation from the

past 12 months is that advisers and

clients are increasingly aware of and

demand that ESG considerations

be incorporated in investment

portfolios. As such, IOOF Advice

Research expects that the advice

oering in relation to ESG research

will continue to grow and evolve in

line with the investment universe

and client requirements.

We are enhancing

our engagement

with our investment

managers on ESG

and climate change

matters.

7

Membership of the Responsible Investment Association Australasia and the Investor Group on Climate Change is via MLC Asset Management.

MLCAsset Management is part of the IOOF Group of companies, comprising IOOF Holdings Ltd and its related bodies corporate.

Our community

IOOF Annual Report 2021 23

Our culture

Our ClientFirst culture means

we put our clients at the centre

of everything we do. It’s why

our purpose is written in the

first person. We strive to create

an environment where all our

people feel connected to this

purpose and empowered to

deliver it every day.

In November 2020, we launched our ‘culture

story’, which has been instrumental in creating

strong alignment among our employees on

the role IOOF plays for our clients. This has also

been vital in dening our ClientFirst culture.

Everyone deserves to

feel confident about

their nancial

future

Be human

Deliver what

matters

Stronger together

Do what’s right,

not what’s easy

We look after

every client

like they’re our

only client

Create

financial

well-being for

every Australian

OUR PURPOSE

Understand me

Look after me

Secure my future

W

h

a

t

w

e

b

e

l

i

e

v

e

W

h

a

t

w

e

d

o

W

h

a

t

w

e

w

a

n

t

t

o

a

c

h

i

e

v

e

H

o

w

w

e

g

e

t

t

h

e

r

e

Keep it simple

Everyone deserves

to feel confident about

their financial

future

Be human

Deliver what

matters

Stronger together

Do what’s right,

not what’s easy

We look after

every client like

they’re our

only client

Create financial

wellbeing for

every Australian

OUR PURPOSE

Understand me

Look after me

Secure my future

W

h

a

t

w

e

b

e

l

i

e

v

e

W

h

a

t

w

e

d

o

W

h

a

t

w

e

w

a

n

t

t

o

a

c

h

i

e

v

e

H

o

w

w

e

g

e

t

t

h

e

r

e

Keep it simple

Our people

At IOOF, we strive to create an environment where our employees

are engaged, inspired and motivated to grow with us.

24

Employee wellbeing

We continue to focus on our

employees’ safety, health and

wellbeing, providing diverse support

and educational opportunities to

ensure they thrive. Examples of new

wellbeing initiatives we provided

over the past 12 months include:

• Your mind matters – an eight-

week educational program

focused on supporting

our people to proactively

manage their mental wellness

through topics such as staying

connected with others,

mindfulness and giving back

to the broader community.

• ‘Move, munch, money, mind’ hub

– a self-service information hub

our employees can access at any

time to support their holistic

wellbeing. It includes thousands

of curated articles, activities,

workouts, recipes and e-learning

resources to support their health

and wellbeing.

We have established the ‘Our

Work Life’ program to support

new ways of working. Most of our

employees continue to enjoy a

hybrid work environment, working

from home and the oce, which

we support and enable – 91%

of our employees feel genuinely

supported to work exibly.

Our employees, licensees and

their families all have access to

one-on-one counselling and

coaching through our employee

assistance program (EAP). Our EAP

provides personalised sessions

on a range of topics, including

nancial and mental wellbeing

and nutrition.

We recently implemented low trac

days across IOOF, encouraging

our people to ‘digitally detox’.

Thisinspires them to minimise

their digital trac and focus on

making progress against strategic

goals and innovation projects, or

take annual leave. We will continue

to focus on integrating time to

reect and genuine downtime

into our wellbeing approach,

acknowledging that these play a

pivotal role in our productivity and

growth as an organisation.

During financial year

2021, we increased

our focus on building

connection and

engagement with

employees, given the

challenges of COVID-19

and integration of

employees from our

acquired businesses.

Employee

engagement

We have fully supported

remote and hybrid working and

have adapted our engagement

approach to cater for this.

We conducted our detailed

annual engagement survey

and three supplementary

‘pulse’ surveys over the course

of the year. These enable our

employee listening strategy,

ensuring we remain connected

to our people and understand

how they are feeling, so we

can support them.

In our annual engagement

survey, we received feedback

from 84% of our people.

Our engagement scores

remained stable year on year,

with nearly three-quarters

of our people ‘engaged’ and

likely to recommend us as

an employer. This score put

us in the top quartile of the

external Insync benchmark for

organisations in the nancial

services industry.

Pleasingly, all governance

and risk indicators measured

through the survey also

increased or remained stable,

reecting our commitment

to embedding a strong

governance and risk culture.

We will continue

to focus on

integrating time to

reect and genuine

downtime into our

wellbeing approach.

Our people

IOOF Annual Report 2021 25

Diversity and inclusion

In August 2020, we initiated a

program to develop a deep

understanding of our culture, taking

a data-based approach. Our in-depth

analysis uncovered that at IOOF

our primary culture motivation is

belonging – creating structures,

processes and an environment in

which our people and clients belong.

This type of culture encourages

people, through behaviour and

ways of working, to be themselves.

It recognises and celebrates the

value of individual dierence.

This applies to employees and

clients alike.

We believe that by creating an

environment that allows people to

bring their whole selves to work,

they will feel more connected to the

organisation and operate at their best,

personally and professionally.

This is a key enabler to sustainable

business success, ensuring we

attract and retain the best people.

All our people are equal at IOOF

and this is reected in our culture

and operations.

Our Diversity and Inclusion Plan

details our vision and the strategy

we will follow to achieve this. The

plan was developed in consultation

with the IOOF Executive Team,

Directors and the IOOF Diversity and

Inclusion Advisory Committee.

Itfocuses on four key pillars:

1 gender balance

2 inclusion and belonging

3 culture, leadership and

environment

4 supporting recruitment

practices.

Key achievements in the diversity and

inclusion space during nancial year

2021 include:

• improving female representation

at Executive, Senior Manager

and Other Manager levels,

reaching our 40% target across

Senior Manager and Other

Manager levels

• making a nancial wellbeing

program accessible to all our

people, including providing funds

for nancial advice

• partnering with FEW, which

provides education and support,

and is accessible to all our employees

• providing nancial sponsorship

for the Positive Progression of

Women Awards

• launching ‘Our leading women’

female talent development program

Continued overleaf

IOOF Annual Report 2021 25

Our new organisational

principles act as the roadmap to

achieve a truly ClientFirst culture

and deliver on our ambition to

‘Create financial wellbeing for

every Australian’.

Our organisational pillars represent our

culture and illustrate the ways our people can

positively contribute through the behaviours

expected of them.

We have embedded our culture story and

principles through activities, including holding

face-to-face roadshows across the country. These

full-day events focus on helping employees feel

connected to IOOF’s purpose and ambition, and

to better understand how they can contribute to

this in their everyday work.

Be

human

Keep it

simple

Stronger

together

Our organisational

principles

Do what’s right,

not what’s easy

Deliver what

matters

Our people

26

• scaling the Diversity and Inclusion

Committee, which represents all

employees and acts as a sounding

board for matters related to the

Diversity and Inclusion Action Plan,

and supports delivery of the plan

• rolling out a compulsory diversity

and inclusion learning module,

supported by Executive-

led webinars

• partnering with Pride in Diversity,

which provides education and

support to all of our people

• conducting detailed gender

pay analysis and implementing

an action plan to address the

gender pay gap

• delivering company-wide

webinars on the Diversity and

Inclusion Plan, reconciliation

with Aboriginal and Torres

Strait Islander peoples and

International Women’s Day

• recording an increase in the

positive sentiment around

diversity and inclusion in our

engagement survey:

– +9 points: ‘I feel like I belong

at IOOF’

– +10 points: ‘Our leaders

champion the importance of

diversity and inclusion’.

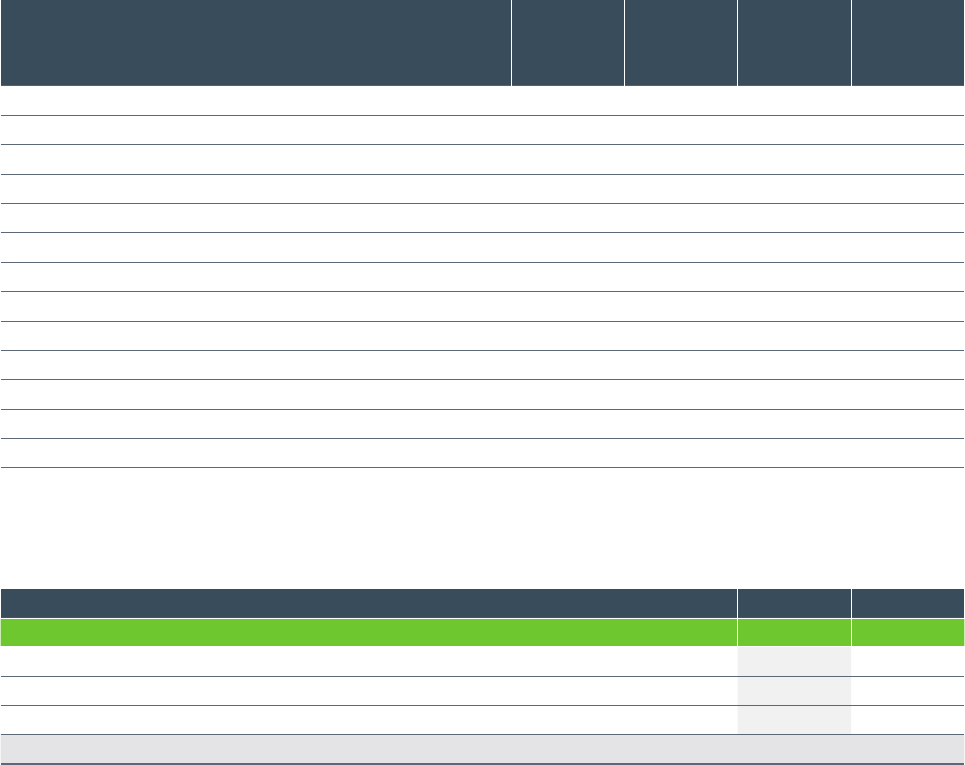

The following table displays the

number of women on the Board

and in Executive and senior

management positions across

the whole workforce.

26

Our in-depth analysis

uncovered that at

IOOF our primary

culture motivation is

̀belonginǵ.

Women in Board,

Executive and senior

management positions,

and across the whole

workforce

Category Female

representation

July 2020 (%)

Female

representation

July 2021 (%)

Board (excluding CEO) 40.00 40.00

Executives (including CEO) 27.27 35.70

Senior managers

1

36.27 45.10

Other managers

2

40.53 41.30

Total workforce 49.12 49.50

1. Senior managers includes all roles reporting to an Executive, excluding administrative support roles.

2. Other managers includes all other managers.

Note. This data set includes leaders who transferred from MLC to IOOF in June 2021.

Our people

IOOF Annual Report 2021 27

Three lines of defence

We apply a ‘three lines of defence’

model to identify and manage risk

and compliance issues.

Our rst line of defence is the

operational areas of the business

that are responsible for identifying,

assessing, mitigating, monitoring

and reporting on risks within their

area. This includes developing and

operating internal controls.

The second line of defence is the

Enterprise Risk and Compliance Team,

which oversees and challenges risk

management and practices by the

rst line. It also provides advice and

support on implementing risk and

compliance frameworks.

Our third line of defence provides

independent assurance on the

eectiveness of our governance

and risk management practices

and control environment across the

whole organisation. We continue

to invest in resources dedicated

to our three lines of defence and

see a maturing of our risk and

compliance culture.

IOOF has adopted ASX Listing Rule

4.10.3, which allows companies to

publish their corporate governance

statement on their website rather

than in their annual report. The

Directors of IOOF have reviewed and

approved the statement. For more

information, visit our website:

www.ioof.com.au/about-us/about-

ioof/corporate-governance.

Our business

Accelerating corporate governance IOOF remains committed

to uplifting and strengthening our governance framework.

We are pleased

to be investing in

making nancial

advice affordable

and accessible for

the benet of all

Australians.

28

Cybersecurity

Cyber risk is one of the top

operational risks faced by the IOOF

Group. In line with our organisational

purpose, we are committed to

keeping our clients’ personal data

secure, by ensuring we have robust

and evolving cybersecurity and

privacy controls in place.

Our cybersecurity strategy,

policies, tactical initiatives and

operational controls are based

on the National Institute of

Standards and Technology security

framework and adhere to APRA

guidelines on information and

cybersecurity. Our Cybersecurity

Team reports to the Board on cyber

incidents, events, readiness and

improvement projects.

Like all business operations,

cybersecurity relies on people,

processes and technologies. Our

people are our rst line of defence

and IOOF has a considerable focus

on enabling and embedding a

‘cybersecurity culture’ throughout

the business. Our people undergo

various levels of awareness training,

including at induction and in

mandatory annual online training,

as well as personal one-on-one

training sessions where there is a

high cybersecurity risk.

All third-party relationships are

established only after a rigorous

due diligence process governed

by our Vendor Management

Policy. Security risk assessments

are conducted at the start of a

contract, and regularly throughout

the course of the contract. This

ensures that IOOF has adequate

assurance over the conduct and

controls third parties have in place

to protect information they hold.

IOOF collaborates with government

bodies and the industry to keep

abreast of cyber trends, and

emerging cybersecurity threats and

controls, and to discuss, collaborate

and share new cybersecurity

strategies and tactics.

IOOF is

an active member of the Joint

Cybersecurity Centre and partners

with Australia’s national Computer

Emergency Response Team and

the Financial Services Information

Sharing and Analysis Center. IOOF

is a founding member of the

Australian chapter of the Global

Cybersecurity Alliance, which is an

international, cross-sector eort

to confront, address and prevent

malicious cyber activity.

The Cybersecurity Team at IOOF is

also a member of industry groups

such as CISO Lens, the Information

Systems Audit and Control

Association and the Australian

Information Security Association.

This ensures the team receives

updates on relevant knowledge

and intelligence into the latest

trends and threats impacting

the Australian and global cyber

landscape.

With the onset of the COVID-19

pandemic in early 2020, we enacted

our Business Continuity Plan and

the workforce switched to working

from home. Appropriate policy,

procedural and technical controls

were implemented to mitigate

the risks introduced by working

from home.

The IOOF Cybersecurity Team is

currently involved in ensuring

security controls are carefully

considered and implemented as the

IOOF and MLC integration continues.

Privacy

Our clients trust us to look after

them by ensuring their personal

information is safe and secure.

The personal information we

collect is handled in accordance

with the IOOF Group Privacy

Policy, which outlines how we

manage personal information.

We have a robust program in

place to ensure privacy awareness

remains at the forefront of our

employees’ minds. Online privacy

awareness training is provided to all

employees annually and targeted

training is delivered several times a

year. We support a strong culture

of privacy compliance, where

reporting and responding to

privacy breaches is second nature.

We are continually looking for ways

to enhance our capabilities, to

ensure our controls remain eective,

and to build privacy awareness.

In May, we entered our seventh

year as an active participant