United States Residential

Property Buying Guide

Sponsored by

For Foreign Buyers & Investors

Published by

WORLD PROPERTY CHANNEL

®

World Property Channel

Introduction

T

he United States welcomes

property buyers who are

not U.S. citizens, offering a

transaction system that is clearly

defined and transparent, by

global standards. But it is still a

lengthy and complicated process

with many pitfalls, which can

cost foreign buyers thousands of

dollars and many headaches, if

not handled correctly.

To many new buyers, the process

might seem rigid and frustrating.

Every purchase includes mounds

of paperwork and bureaucratic

hurdles. One missing piece of

paper can delay a purchase for

days or weeks. Miss a deadline

and a deal can collapse. But

almost every requirement is de-

signed to protect both the buyer

and seller, eliminating many of

the dangers found in property

deals in other parts of the world.

The World Property Channel

U.S. Residential Property Buying

Guide is designed to give you all

the basic information you need

to search for a home, negotiate

a deal and buy the property.

Every prospective buyer should

seek out experts and advisers to

protect their interests in the deal,

but an understanding of the process

can eliminate surprises and save

you money.

Through every step, buyers in the

U.S. have distinct advantages

not available in many countries.

Background information is readily

available on all homes, including

sales data. Sellers are required

to disclose existing problems.

Agents and most participants in

the deal are licensed and must

conform to industry standards.

The search for a home in the

United States should be fun and

invigorating. Buyers can spend

months looking for the right

house in the right neighborhood.

The most coveted properties may

only spend a day or two on the

market before attracting bidders.

Other shoppers utilize the array of

easily available resources to find

detailed information on available

properties and find their dream

house in a few days.

We hope you find this guide to be

a helpful and informative resource.

-WPC NEWS Editors

United States Residential Buying Guide

Published by

2

MARKET SNAP

SHOT

3

Many newcomers are often daunted by the size and

diversity of the United States, which is split into 50

states and five distinct regions –- Northeast, South-

east, Mid-West, Southwest and West. Economic,

society and cultural norms can differ tremendously

between state and regions. Each jurisdiction will

have its own restrictions, legal requirements, taxes

and fees. Prices can also vary from region to region.

For example, at one point, the median price for

a home in the Midwest was $160,000, while the

median price in the West was $276,000.

The most popular states for international buyers are

Florida, California, Texas and Arizona, according

to an annual study of international buyers by the

National Association of Realtors. In 2013, those

four states accounted for 58% of the international

clients in the United States, with the rest scattered

across a variety of states, including Nevada (home

to Las Vegas), New York, Georgia and Virginia.

Each state draws its own audience. South Ameri-

cans tend to focus on Florida and Miami, NAR’s

research found. Canadians head to the warm climates

of Florida and Arizona. Buyers from Mexico are

mostly found in Arizona and Texas. Asian buyers

prefer the proximity of California. And buyers from

India preferred California, Tennessee, Connecticut

and New Jersey.

DISTRIBUTION OF INTERNATIONAL SALES BY STATE

ARIZONA

FLORIDA

GEORGIA

NEVADA NEW

YORK TEXAS VIRGINIA

CALIFORNIA

35%

30%

25%

20%

15%

10%

0%

5%

7%

13%

23% 1%

1% 2%

11%

3%

11%

12%

22%

5% 3% 4% 8%

2%

6%

12% 31% 2% 2%

3%

9%

2%

7%

11%

26%

4%

2% 4%

7%

1%

9%

17%

23%

2%

2%

3% 9%

3%

2009

2010

2011

2012

2013

FACT

About 53 percent of Realtors who work with

international clients say the main factors

influencing the decision to purchase in the

U.S. are profitability and security.

National Association of REALTORS® 2013 Profile of International Home Buying Activity

The United States is known as “the melting pot”

for its acceptance of immigrants from around the

world, but foreign buyers tend to cluster in specific

locations based on their countries of origin. As a

result, many culturally-specific neighborhoods are

sprinkled around the country, “probably based

on word-of-mouth and shared experiences and

likely because of the shorter geographic distance

from their home country to the state location,”

NAR concludes. Miami, for example, has strong,

entrenched communities from Cuba, Venezuela

and Colombia. San Francisco is famous for its

vibrant Chinese communities; Chicago is home

to a large Polish community. Your native country’s

embassy or an agent can help identify cities and

neighborhoods that might interest you.

The top five international buyers in the U.S. are

from Canada, China (PRC, Hong Kong, Taiwan),

Mexico, India and the United Kingdom, accounting

for about 53% of international deals.

CANADA

CHINA

GERMANY

ARGENTINA

ISRAEL

AUSTRALIA

KOREA

BRASIL

FRANCE

VENEZUELA

MEXICO

INDIA

RUSSIA

UNITED

STATES

23%

12%

8%

5%

5%

3%

3%

3%

2%

2%

2%

2%

2%

2%

TOP COUTRIES OF ORIGIN FOR INTERNATIONAL TRANSACTIONS

4

National Association of REALTORS® 2013 Profile of International Home Buying Activity

International buyers typically account for anywhere

from 6 to 8% of existing home sales, making them

an important clientele for the industry. About half

of international buyers in the United States are

permanent residents of other countries and they

buy property in the U.S. as an investment or second

home, according to NAR data. (Non-resident for-

eigners are typically limited to six-month stays.) The

other half of buyers are recent immigrants or tempo-

rary visa holders who are intending to stay for more

than six months.

NAR has identified several unique characteristics of

foreign buyers. About 63% of purchases by interna-

tional buyers are all-cash deals, compared to about

30% for domestic buyers. The median price for

homes purchased by non-U.S. citizens is typically

50 percent higher than the overall median price

for existing homes. Chinese buyers were reported

to be buying homes in the upper range, with the

median price at $425,000, followed by India

($300,000), the United Kingdom ($250,000),

Canada ($183,000) and Mexico ($156,250).

About 64% of international buyers purchase single

family homes, with condominiums and apartments

the second-most popular category, accounting for

21% of sales.

5

FACT

Top reasons international clients cited for

choosing not to purchase property: cost/

taxes, insurance and financing issues.

National Association of REALTORS® 2013 Profile of International Home Buying Activity

Other

6%

Condo

/

Apartment

21%

Townhouse

/

row house

9%

Detached

single-family

64%

TYPE OF PROPERTY PURCHASED

With so many international buyers intending to stay for more than six months, usually for

education or professional reasons, it’s not surprising that 42% of the respondents in the NAR

study said they intend to use the home as a primary residence. About 20% plan to use the

property as a vacation home, while 17% cited investment as the reason for buying.

NAR also spotted a distinct trend concerning where international buyers choose to

purchase homes. About half of international buyers prefer suburban areas and about

a quarter choose to move into cities. About 14 percent locate in a

resort area.

6

National Association of REALTORS® 2013 Profile of International Home Buying Activity

Don’t know

Both of the above

Primary

residence

42%

3%

4%

Commercial

rental property

for investment

20%

Residential

rental property

for investment

14%

Vacation home

for family

& friends

17%

INTENDED USE OF PROPERTY

National Association of REALTORS® 2013 Profile of International Home Buying Activity

Resort area

14%

Small town

/

rural area

11%

Suburban area

50%

Central city/

urban area

25%

TYPE OF AREA

TIP SHEET

For foreign buyers the variety of jurisdictions involved

in a property may be unexpected -- federal, state,

county and municipality. Each will have its own spe-

cific fees, taxes and legal requirements. This is one

of the most important points for a potential buyer to

clarify before selecting a location. Property taxes in

some states are much less than in others; some states

have fewer regulations. In California and New York,

two of the locations most desired by foreign buyers,

the taxes and fees may be far higher than in other

parts of the country.

Even if the foreign buyer doesn’t live in the property,

he will be responsible for local property and school

taxes. A quality school district can often mean much

higher education fees. If the property is to be rented,

the price per month charged by the foreign owner

needs to consider the many different expenses and

fees associated with the property, which can affect

profitability.

a few key points to keep in mind as you start to dive into the process.

In the U.S., the calculations used to determine the value of a home are largely based on the

value of the surrounding property. Recent sales are used for comparison, often referred to

simply as “comps.” As a result, it is extra important to evaluate the attributes and maintenance

levels of a neighborhood, not only the property to be purchased.

Agents in the United States must be licensed to sell real estate. Members of the National

Association of Realtors (NAR) are called Realtors and they must meet standards for education

and best practices to maintain their license to sell real estate. You are not required to use a

Realtor, but if you do make sure they are certified by NAR.

It is important to understand the goals for buying the property and evaluate the purchase

based on those goals. Is it a second home? An investment? Do you want to rent it? Do you

want to live in the house one day? Are schools important? Public transportation?

If you are looking at a house as an investment it is important to evaluate the sales and

pricing history of each neighborhood and region. Even within cities, neighborhoods perform

differently. Fortunately, information is readily available, particularly if you are working with

a Realtor.

Do you have at least 30% of the purchase price available in cash? Most lenders require at

least a 30% down payment from non U.S. citizens.

[

[

[

[

[

7

QUICK TIP:

The cost of living varies dramatically from state to

state, which may impact the financial calculations

on a property. The U.S. State Department makes

information on cost of living available on this site:

http://www.state.gov/m/fsi/tc/79700.htm

Nevertheless, there are complexities unique to foreign buyers. If the foreign buyer is looking for financing,

extra time and documentation may be required. Mortgages are available, but the process may take many

weeks, during which the buyer pays for an appraisal, inspection, and other expenses with no guarantee

that he will receive a mortgage. Some foreign buyers may be surprised at the amount of information they

must provide about their private finances; they may find the requirements excessive, but it’s impossible for

a foreigner to receive a mortgage or FIL (Foreign Investor Loan) without extensive disclosure. Most foreign

buyers prefer to arrange loans in their home country and/or get pre-approved for a loan before starting

the search for a home

a few other potential landmines:

It’s important for foreign buyers to understand that although federal rules apply for visas

and investment taxes, each state has its own requirements and tax structure, separate from

the federal tax structure governed by the Internal Revenue Service of the U.S. government.

Although this may sound complicated, in practice it is relatively easy, and most filings can

be done online. Accountants and other tax preparers are available throughout the country.

Co-ops may cause a problem. Buildings organized as cooperatives, which are particularly

common in New York, often have strict restrictions on foreign buyers. Every buyer must be

approved by the co-op before they can purchase a unit.

Make sure the property is protected in case of death. If the owner dies, a federal tax of 50

percent may be collected on the sale of the property, unless it has been placed in a trust.

Estate planning with a tax professional should be an important part of the process.

The Foreign Investment in Real Property Tax Act (FIRPTA) requires that foreign owners put 10

percent of the sale price in a special account when they sell the property to ensure they pay

the capital gains tax. (However, there are tax treaties between the U.S. and certain countries

that can alter this rule.)

[

[

[

[

8

Property experts agree that it is important to consult with a lawyer and tax accountant before you begin

looking for property to buy – regardless of what kind of property and where it is located. All fully-executed

agreements and contracts are legally binding. You should be very careful and enlist a professional to review

any documents before signing.

Most of the requirements for foreign buyers are no different than for U.S. citizens. You will be responsible

for filing annual tax returns and paying capital gains tax when you sell the property. Foreign property

buyers must have a visa to enter the U.S., but there are no restrictions on the type of visa necessary to

buy a home.

THE BASICS

How a foreign buyer evaluates the costs and hassles of buying property in the U.S. depends on their

country of origin and experiences in other markets. Buyers from Hong Kong or London, for example, tend

to find U.S. taxes and fees reasonable, especially since property may be much cheaper. A buyer familiar

with Greece or Spain might find the U.S. system transparent and easy to navigate, even if there is a mound

of paperwork connected with every purchase.

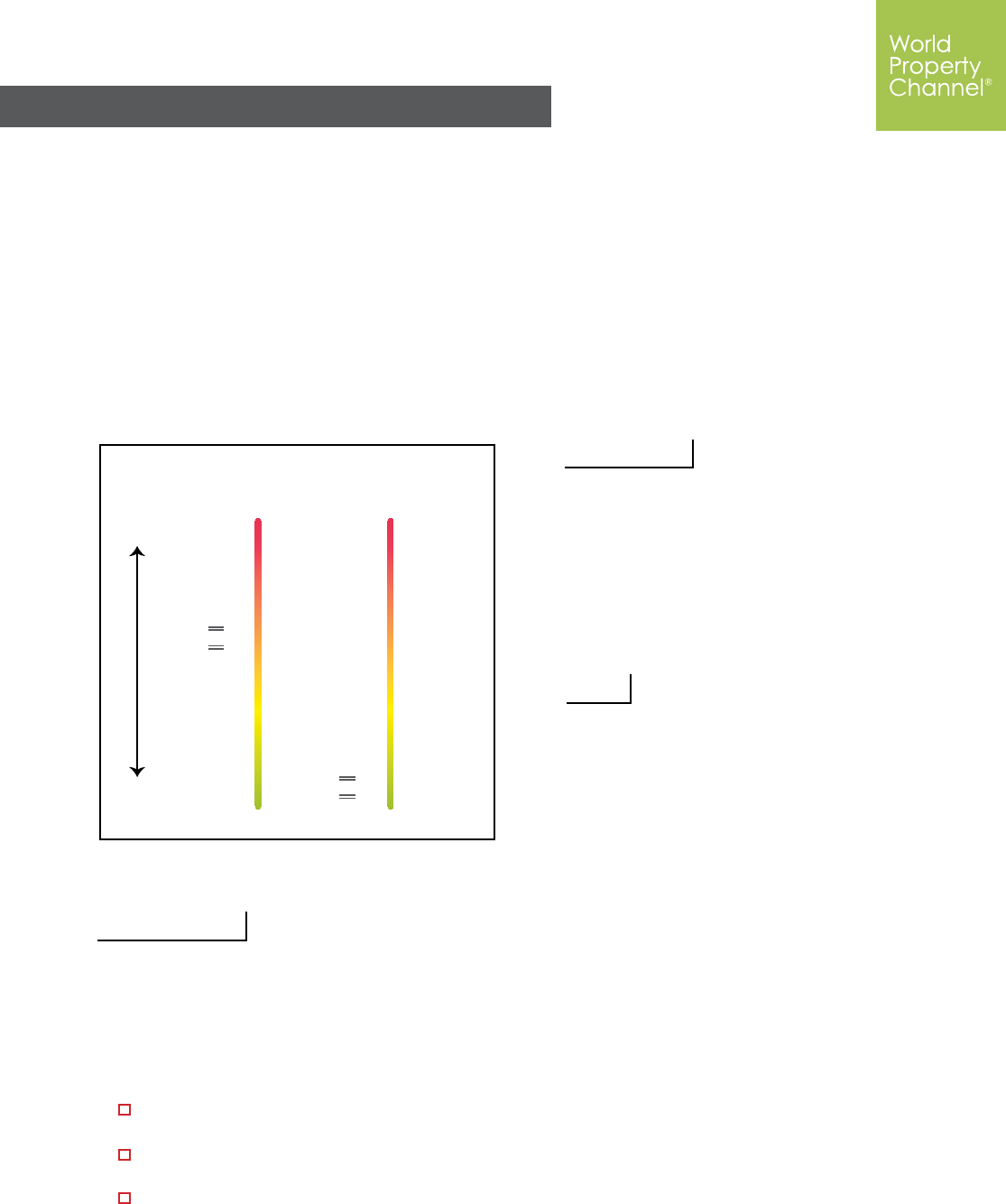

U.S. taxes and fees are considered higher than many countries. A 2013 report by consultant Knight Frank

listed New York the eighth most-expensive major city in the world in terms of added purchasing costs, but

the number one most expensive for annual costs, such as property taxes.

Most

expensive

Least

expensive

PURCHASE COST ANNUAL COST

1

2

3

4

5

12

13

14

15

6

6

8

9

10

11

HONG

KONG

SINGAPORE

LONDON

SYDNEY

BAHAMAS

CAPE

TOWN

NAIROBI

MOSCOW

NEW

YORK

GENEVA

DUBAI

BARBADOS

MONACO

MIAMI

PARIS

1

2

3

4

5

12

13

14

14

6

7

8

9

10

11

NEW

YORK

BAHAMAS

MIAMI

BARBADOS

MOSCOW

GENEVA

SYDNEY

MONACO

PARIS

DUBAI

SINGAPORE

LONDON

CAPE

TOWN

NAIROBI

HONG

KONG

U.S dollar in coins (1 cent, 5, 10, 25, 50, $1, $2)

and paper ($1, 5, 10, 20, 50, 100, 1000). Changing

money into dollars is more difficult in the U.S. than

in most other countries. You should pay very careful

attention to exchange rates and shop for the best way

to transfer funds from your native currency to American

dollars to buy your home.

Each property transaction includes a variety of fees

and required costs that can add thousands of dollars

to the deal, depending on the location and age of the

home. Some jurisdictions require special inspections

for anything from lead paints to termites. During the

process, the buyer typically pays for a variety of

required appraisals, inspections and survey maps. Your

representative should explain all the specific fees up

front before a contract is signed.

The U.S. doesn’t offer government health care for nonresident aliens. Visitors to the U.S. – and a foreign buyer is

in that category unless he or she qualifies for an E-series visa – may buy commercial health insurance that covers

them while they are in the U.S. Some companies that offer visitor insurance include US Netcare, Insurance Services

of America, and American Visitor Insurance. Insurance can also be found via an insurance broker – lists of brokers

are available from the Chamber of Commerce or Better Business Bureau where the property is located.

http://www.usnetcare.com/

http://www.immigrationhealth.com/

http://americanvisitorinsurance.com/wordpress/

9

currency

health care

fees

Knight Frank Prime Global Cities Index

10

homeowner associations

pre-construction/off plan sales

retirement benefits for foreign buyers

liens and easements

measurements

Many condominiums and planned neighborhoods are

organized around homeowners associations (HOAs),

which are responsible for the maintenance of the

project and common areas. The homeowners

association is typically governed by a board elected

by the homeowners. The HOA administers the

covenants, conditions and restrictions (CC & Rs) for

the community, which may restrict everything from the

color of homes to what you can put on your front lawn.

It’s important to review a copy of the CC & Rs before

buying and evaluate if the HOA is properly main-

taining the neighborhood or building.

Monthly homeowner association fees can add

significant cost to a property. And if the HOA fees

have not been paid on a property, it can hold up a sale.

Before buying a property, it is essential for the title

company to research any potential liens or easements

that might restrict usage of the property. The sale pack-

age will need to include a detailed survey map of the

property, showing the exact boundaries of the property.

U.S. measurements are typically communicated in feet,

not meters. Homes are measured in square feet; land

in acres.

Unlike Costa Rica, Panama and the Philippines, for

example, the U.S. doesn’t have a retirement visa

program for foreign home buyers. Such a program

has been proposed by Realtors’ associations and

others, but it has not received widespread political

support.

The pre-construction sale of new homes, known as “off

plan” sales in many countries, is not as common in

the United States as other parts of the world. The one

exception is Miami, where many residential projects

are actively marketed before construction.

Buying off plan in the United States is not substan-

tially different than other countries, except for the

safeguards of the legal system. But specific deals and

buying procedures vary tremendously, depending on

the developer and the state. Traditionally many

developers allowed buyers to reserve a unit for as

little as a 20 percent deposit, but these days they

often ask for 40 to 50 percent up-front, with addi-

tional payments due as the project hits construction

milestones.

Purchasing off plan offers the buyer a lower price

and a chance to pick the best units. But the buyer is

assuming more risk. Depending on the contract, the

developer may be able to spend deposits on build-

ing and marketing costs, which leaves nothing left

to return to buyers if the project doesn’t happen. By

the time the project is completed the market may

have changed. There is no guarantee the property

will appreciate in value, easily rent or quickly resell,

despite the assurances of the developer.

Anybody considering buying off plan should care-

fully research the history of the developer, the status

of the project and the sales history of the market.

Buyers should consider using an attorney to review

the details of all documents.

federal

state

taxes

Every city offers a wide array of accountants and tax consultants who can advise on the best way to

handle the tax situation. Many foreign buyers choose to set up a trust or LLC to buy property, which

can impact the tax situation. Also keep in mind that tax laws change often. But here are a few basics:

The U.S. offers two ways for foreign buyers of

property to calculate federal taxes each year.

The Fixed Determinable Annual Periodical method

(FDAP) is 30% of gross rental income with no

deductions. The Effectively Connected Income

method (ECI) allows deductions for costs associ-

ated with renting the property. The foreign buyer

must select the method he will use to calculate

federal tax when he files the first tax return by

March 15 of the year of purchase or the follow-

ing year if the purchase is made after the first

quarter.

Before filing the first federal tax return on Form

1042-S, every foreign buyer of U.S. property

must file Form W-7 with the Internal Revenue

Service to apply for a Taxpayer Identification

Number (TIN).

Every year the foreign owner of U.S. property

must file Form 1042-S with the IRS by March

15 in order to fulfill federal tax reporting obliga-

tions. State tax is usually due to the state taxing

authority at the same time.

Most American states tax income with the rates

varying dramatically from state to state. Seven

U.S. states do not tax income: Alaska, Florida,

Nevada, South Dakota, Texas, Washington and

11

Wyoming. Property taxes can also vary wildly

from state to state and county to county. Local

property taxes associated with assessment of

property value are collected from the owner or

renter and often pay for schools and infrastruc-

ture improvements.

special assessments

Some cities and counties have unique special

assessments to support schools or public services.

It’s always important to get a full rundown of

the monthly fees in the neighborhood.

transfer

When buying or selling a property, the buyer

or seller - or sometimes both - is often charged

a transfer tax. The amount is a percentage of

the price and varies according to the state

where the transaction is taking place. Several

states do not charge a transfer tax.

capital gains

When you sell the property in the U.S., you

are liable for capital gains tax. The original

purchase price is deducted from the selling

prices, as well as tax deductible expenses

related to the property. The remainder is typi-

cally taxed at the rate of 30%.

12

Foreign home buyers need entry visas to come to the U.S. and must apply for green

cards and citizenship if they want to stay longer. All visas are acquired at the U.S.

Embassy in the buyer’s home country. The types of visas are described on the U.S.

State Department website

Here are a few possibilities for foreign property buyers:

B1 – visa for business purposes that do not involve earning money

from U.S. sources

B2 – visa for tourism, entertainment, medical purposes and does not

involve being paid for work

Visa Waiver Program – no visa needed for up to 90 days in the

U.S. for citizens of 37 countries who will not be working in the US dur-

ing their visit. Here is a link to the list of countries: http://travel.state.

gov/visa/temp/without/without_1990.html#citizen

E1-E4 - Employment Based Immigrant visas. See the categories:

http://travel.state.gov/visa/immigrants/types/types_1323.html

[

[

[

[

EB-5 Visas

The EB-5 program provides a popular path to residency visa for investors. Launched

in 1990, the program is designed to encourage foreign investment in projects that

create jobs. A non-U.S. citizen who invests $500,000 in a job-creating develop-

ment in a targeted area, or $1 million in a project in a non-targeted area, will be

eligible to apply for a special residency visa.

The detailed rules for an EB-5 visa can be found at www.uscis.gov

http://travel.state.gov/visa/visa_1750.html

visas

13

Foreigners looking for a property in the U.S. should determine long before they visit the country what they are

looking for and where. Unless they come from Russia or Canada, they will be used to living in a smaller country.

Probably they will be used to better public transportation than is typical in the U.S. The ideal location will be

related to what the buyer is trying to achieve: Requirements for a vacation home may be different than for a rental

property. Is the buyer ready to travel several hours by car to the property or should it be reachable by metro or bus

transportation?

FINDING A PROPERTY

the search

Unlike in other countries, almost every property for

sale in the U.S. is listed in something called the Mul-

tiple Listings Service or MLS. MLS are available in

every state and city, but accessed only by a licensed

real estate agent. Although properties are often

listed on publicly accessible sites, unless a foreigner

receives a tip from a relative or friend living in the

U.S., he is unlikely to access all available proper-

ties unless he contacts a real estate agent.

Finding the right Realtor is a key part of the process.

Although they are licensed, Realtors still represent

a wide range of

experience and

skill sets. Some

are experts on

certain neighbor-

hoods or certain

types of property.

Others only rep-

resent buyers. It is

important to find

the one that best

suits your needs.

It is possible in

the U.S. to buy

property without

an agent. In some

cases, buyers find

properties before they are formally listed and use

a lawyer to handle the transaction. Some sellers

choose not to use an agent and market their proper-

ties independently as “For Sale by Owner” (FSBO).

There are also agents who will offer minimal service

for a slashed commission. Any buyer who doesn’t

use an agent should hire an attorney to protect their

interests. The potential danger for a foreigner is

considerable if not represented by a qualified agent

or attorney.

The best agents will keep a constant lookout for prop-

erties that best meet your needs. In many areas, the

best properties are pounced on when they become

available. Buyers can also hunt on their own, using

sites such as Trulia.com and Zillow.com, which

allow sellers to list properties and link potential

buyers with the agents handling those properties.

These sites also typically offer information about

the neighborhood, recent sales and other public

data.

researching property

Once the buyer has found one or more possible

properties, the listing will provide the history of

each property and give an idea of recent selling

prices in the neighborhood. Many Web sites offer

detailed records of a property and the neighbor-

hood, and can be found by entering the address of

the property in Google search.

Property sale prices are public information in the

U.S. Every community, city, county and state keeps

records that show how much properties sold for,

when it was sold and the tax rates. These records

can be accessed through the local clerks office or

library.

Property sellers are also required by law to notify

prospective buyers of any relevant flaws, liens or

problems with a property. These disclosures are

made early in the process.

QUICK TIP:

Many Realtors have gone

through special courses

on international prop-

erty transactions to earn

a Certified International

Property Specialist (CIPS)

designation from NAR.

Certified Realtors will

usually display the CIPS

logo on their business

cards and advertisements.

14

making an offer

Once the buyer has checked into the back-

ground of the property and knows how similar

properties in the same area are priced, he or

she is ready to make an offer. An offer is a

conditional obligation – usually not more than

two or three pages – identifying the property

and defining what the buyer is ready to pay for

the property.

The offer will also stipulate the commissions to be

paid to the agents. In many deals, the starting

point is a 3 percent commission for the buyer’s

agent and a 3 percent commission for the seller’s

agent. The seller is responsible for paying the

commissions, which are usually factored into the

sale price. But many agencies offer special com-

mission deals and the commissions can become

part of the negotiation process.

Several conditions and contingencies can be

written into the initial offer, including the ability

of the house to pass inspection and meet time

limits for assessments and financing. The offer

is valid for an agreed upon time period, typically

30 to 60 days, during which conditions have to

be satisfied. Having financing approved may

also be a condition of the offer. The offer may

be the same as the asking price, or it could

be considerably less if the property has been

available for a long time—or it can be higher, if

there is competition for the house.

An offer can outline improvements the buyer

wants to the property or additional equipment

supplied by the seller within a specified period of

time. The offer should also be very specific about

what is covered in the offer price. If the buyer wants

to purchase anything that is not part of the structure

of the property—such as furniture, art work or

curtains—it must be specified in the offer.

When the offer is submitted, the buyer must also

pay a small deposit known as “earnest money.”

The earnest money, which is often 2% of the purchase

price, is held in escrow. In competitive situations, the

buyer might offer more earnest money to show seri-

ousness of intent. If the property sale is closed, the

deposit is applied to the purchase price. If the buyer

does not fulfill all contract obligations, the deposit may

be forfeited.

The seller will either agree to the offer, reject it or

file a counter offer. The counter offer will address all

issues of the original offer, including price and any

stipulations imposed by the seller. Any aspect of the

agreement is open for negotiation, including:

The dates for closing the deal and taking

possession of the property. The seller might

have special requirements

Inclusion of furniture, appliances or other

elements of the property not considered part

of the property

Payment for repairs required by your lender

Payment of taxes, utilities and rents

Payment of title search and insurance

Payment of survey, transfer taxes and

recording fees

Payment of general and termite inspections

Payment of attorney fees

This written give and take continues until there is

either a signed agreement or an unresolved impasse.

While the process may be cumbersome, it assures

that every detail of the agreement is spelled out. But

it also increases the importance of making sure that

every aspect of the deal is addressed, in writing.

[

[

[

[

[

[

[

[

15

WHEN THE O

FF

ER IS ACCEPTED

After approval by the seller, the buyer puts from 10 to 30% of the offering price in escrow pending

fulfillment of the conditions. At that point a new process starts as the buyer and seller move to meet the

conditions outlined in the offer.

For the seller, that means making repairs within the agreed-upon period and fulfilling any other obligations

spelled out in the agreement. The buyer uses this time to perform due diligence, including an inspection of

the property, prepare financing and ensure that all the necessary title and legal documents are properly

prepared for the close of the sale.

The buyer is typically not mandated by law to hire a

professional inspector to investigate the property, but

it is highly recommended --- and it is required by mort-

gage companies. (Note: Inspections are common for

single family homes, but not common for apartments

or condominiums.) The names of licensed experts can

be supplied by the realtor or agent, but the buyer is

under no obligation to use their suggestions. You can

find your own inspectors through the local Chamber of

Commerce or Better Business Bureau. It is essential to

find a reputable expert with a confirmed record of thor-

oughness and a detailed understanding of local codes.

An inspection can range anywhere from a basic fee to

several hundred dollars. The inspector should examine

every aspect of the property from the foundation to the

chimney, including all the heating and cooling systems,

appliances and any other mechanical elements. Espe-

cially in warmer parts of the country, the inspector will

also look for damage to wood by termites and other

pests. (Many areas may require a termite inspection.)

After examining the property, the inspector produces a

report for the buyer and mortgage provider that iden-

tifies all problems with the property. Based on that,

buyer and seller agree who will pay for repairs. It is

essential that the buyer address any problems areas at

this point in the process. If the buyer and seller cannot

agree on repairs, the buyer may lower the offer price.

If the lower price isn’t accepted, he can withdraw the

offer and his down payment is released from escrow.

The results of the inspection will become part of the

mortgage application.

inspections appraisal

The buyer also pays for an assessment or valua-

tion of the property, a key part of the process. It

is the buyer’s responsibility to determine the true

market value of the property. If the valuation is

found to be less than what the buyer has offered,

it might be difficult to arrange financing and it

could end the deal. For investors, the appraised

value may determine if the property is really a

good investment.

Much like the inspection process, it is essential to

find a trusted licensed appraiser who is familiar

with the neighborhood. Often mortgage compa-

nies recommend appraisers they have worked

with in the past. The appraiser will inspect the

property and prepare a detailed analysis of the

recent sales market, comparing the age, size

and condition of the property to similar proper-

ties that have sold in the area in recent months. It

is important to notify the appraiser of any special

conditions or improvements that might affect the

value of the property.

Finding the appraised value is a science, but an

inexact science. Foreclosures or liens on the prop-

erty can complicate issues. For properties that

have had a single owner for a lengthy period of

time, the property may be worth far more than

its last selling price; conversely a downturn in the

market might mean the property is valued at far

less than expected.

16

Buyers who pay cash in this process have an

advantage over buyers who require a mort-

gage. A mortgage company may nix a deal if

the valuation doesn’t meet their requirements,

but cash buyers

can make their own choice

about whether or not to move forward with

the deal. If the buyer offers a lower price and

the seller refuses, the deal is off, the buyer has

to look elsewhere, and the down payment is

released from escrow.

When the seller accepts the buyer’s offer, the

buyer usually has 30 to 60 days to provide the

money or financing. That period can be ex-

tended if the seller agrees. Generally, getting a

mortgage approved takes longer than 30 days,

so the buyer should insist on 60 days or longer

to complete the financing. If financing isn’t ap-

proved, the offer expires unless the buyer can

find the money another way.

Mortgages are available from some American

banks and other mortgage lenders. However,

foreigners may be expected to put as much as

50 percent of the price down, although deals

for 30 percent can be found. Foreigners often

are asked to put the first year’s mortgage pay-

ments (including principal, interest, taxes, and

property insurance) into escrow as further guar-

antee for the lending institution.

Even if you are trying to buy the property through

an offshore corporation, you will be asked for

personal financial information and sometimes a

guarantee. Documents required to prove income

may need to be notarized – for a foreign buyer,

foreign bank and similar documents may have

to be attested by the Foreign Ministry or other

government body in the buyer’s home country.

Sometimes the Embassy of the buyer’s home

financing

homeowner insurance

country in Washington D.C. can do this. But typically a

letter from your bank is acceptable.

If the buyer’s bank in the home country has operations

in the U.S., it may be willing to finance purchase of

American property. When the buyer works with a Realtor

affiliated with a major brokerage, the Realtor may be

able to offer a mortgage through an affiliated lender.

Documentation requirements vary from state to state--

and often within a state, depending on the lending

institutions. Typically, the foreign borrower will be asked

to supply certain documents -- translated into English as

needed -- in application for a mortgage

.

Three (3) letters of reference from creditors

(bank, credit card company, mortgage lender)

Personal financial statements for past two years

Income tax returns for past two years

Bank statements from past year

Letters of reference from at least two banks

International credit report

Property appraisal

Copy of passport and visa

[

[

[

[

[

[

[

[

Lenders require buyers to take out an insurance

policy to cover the property in case of catastrophic

damage. Proof of insurance must be obtained before

the financing deal can close. Rates and packages

vary from state to state, and many companies offer

discounts on auto and health insurance if they are

included in the package. Costs are much higher in

states that are susceptible to national disasters, such as

Florida. It’s best to shop around.

lawyers

notaries

mortgage insurance

title insurance

17

Anyone who buys a property with a mortgage

and pays less than 20 percent as a down payment

must buy mortgage insurance or PMI. PMI is paid

as part of the monthly mortgage payment and can

add anywhere from a few hundred to thousands of

dollars to the monthly payment. Buyers who pay at

least 20 percent down are typically not required to

pay PMI.

In some states a property buyer is required to have

a lawyer. In other states it is not required, but it is

always a good idea for a foreign buyer. The lawyer

will make sure his client’s rights are protected in the

sale contract and the mortgage procedure, if there

is one, as well as determining tax obligations. A

lawyer can also advise on nuances of the detail

specific to foreign citizens.

Notaries are not as important in the U.S. as in

countries where they perform duties of lawyers.

However, property documents including mortgage

applications usually have to be stamped by a

notary who guarantees the identity of the person

who has signed the documents. Most banks have

notaries on duty. Some notaries work independently

in their own offices and can be found through the

local Chamber of Commerce and the Better Business

Bureau. Realtors often have a notary working in

their office.

Title insurance protects the buyer and lender from

any claims that might arise from the ownership

history of the property. If there are any doubts about

the legal background, title insurance provides pro-

tection against any losses. Title insurance is usually

covered by a one-time fee paid at closing and is

valid for as long as the insured owns the property.

The American Bar Association hosts an app on its

website that allows anyone to access legal help.

First visit

http://apps.americanbar.org/legalservices/findlegalhelp/home.cfm

and then click on the state where the property is located.

18

C

LOSING THE DEAL

QUICK TIP:

You don’t have to be in the U.S. to close the

deal. A representative can be formally

granted “Power of Attorney,” giving them

the right to sign papers for you.

After the conditions in the offer have been satisfied and financing – if required – has been

obtained, the sale of property is concluded during a settlement meeting. All aspects of the

transaction will be completed at the settlement meeting and every piece of the deal must be

in place. At the meeting, which is often hosted by the escrow company, the buyer will be

greeted with a large stack of papers, each with a specific meaning and legal significance,

including documents required by the local jurisdiction.

Most of the documents are prepared prior

to the closing and distributed to the buyer

and seller. If any document is not prepared

correctly for the closing, it could affect the

ability of the deal to close. The settlement

will include paying your closing costs, legal

fees, property adjustments and transfer

taxes.

While every city, county and state has its own

specific requirements, certain documents are

typically required at closing.

[

[

[

[

[

[

Payoffs of other mortgages: evidence that any existing liens on the property are paid off before

a new mortgage can be issued as a first mortgage on the property

Payoffs of other creditors: any existing debts on credit cards or unsecured lines of credit must be

paid before the new mortgage can be issued

Termite letter: a statement from a pest control company dated within 30 to 90 days of the

closing that property is free of pests and there is no damage from prior infestation

Survey: a drawing of the property boundaries including any improvements that have been

made to the fencing or other edging updated within 30-90 days of the closing

Flood insurance: if any part of the property is within a flood zone – buyer pays first year’s

premium at closing

Hazard insurance: unless the condominium association already pays for it – buyer pays first

year’s premium at closing

QUICK TIP:

Before the settlement conference, make

sure the seller is prepared to hand over all

keys and remote controls, not just the door

keys. That includes garage door openers

and keys for window shutter locks and

storage compartments.

19

[

[

[

[

[

[

Septic letter: if property isn’t connected to a public sewer, letter from local health authority

certifying that septic tank is in order and working properly

Well letter: if property isn’t connected to public water supply, letter from local health authority

certifying that water quality is adequate and reliable

Home buyer’s warranty: usually paid for by

seller and guarantees service for systems

and appliances in the house for one year

Proof of title: a title company researches the

,history of ownership of the property and

determines that no money is owed on the

property by seller or a previous owner

Power of Attorney: if buyer cannot attend the

closing

Bank check or bank transfer: if buyer or seller has to bring money to the closing, only bank checks

or transfers are accepted; no personal checks.

When all the paperwork is signed, ownership is transferred to the buyer. The buyer will receive

the property title, copies of all documentation pertaining to the purchase—and the keys.

20

M

OVING IN

Moving to another country includes all the normal problems of moving from one location

to another, plus the additional ones of dealing with a new situation where the rules may be

quite different. Taking furniture and personal goods out of one’s own country involves an

export procedure. Bringing them into a second country where one is a foreigner involves an

import procedure that can be more complicated.

The most important thing is to select a moving and shipping company in one’s own country

with an office in the U.S. Some moving companies that call themselves international do not

have offices in the U.S.; they use unrelated companies to execute the most difficult parts of

the process: Customs procedures and delivery of your belongings to the new location.

bringing the pets

dogs

cats

birds

A general certificate of health is not required

by Centers for Disease Control, although

some airlines or states require an International

Health Certificate from your vet, completed

within 10 days of departure. This certificate

states that your pet is in good health and OK

to fly. Pet dogs are subject to inspection at

ports of entry and may be denied entry into

the United States if they have evidence of an

infectious disease that can be transmitted to

humans. Dogs must have a certificate show-

ing they have been vaccinated against rabies

at least 30 days prior to entry into the United

States. These requirements apply equally to

service animals such as Seeing Eye dogs.

Like dogs, many airlines require your cat

to have an International Health Certificate

from your vet completed within 10 days of

departure, although a general certificate of

health is not required by CDC. Cats are also

subject to inspection at ports of entry and

may be denied entry into the United States if

they have evidence of an infectious disease

that can be transmitted to humans. Cats are

not required to have proof of rabies vacci-

nation for importation into the United States,

however some states require vaccination of

cats for rabies, so it is a good idea to check

with state and local health authorities at

your final destination.

To bring in a pet bird, you must first obtain

a USDA Import Permit and provide a current

health certificate issued by a full-time salaried

veterinarian employed for the agency respon-

sible for animal health of the national govern-

ment in the exporting country of origin. Then

the bird must be quarantined, at the owner’s

expense, in a USDA animal import center.

For full details on importing animals, go to

the Centers for Disease Control site,

http://www.cdc.gov/animalimportation/bringinganimaltous.html

Immigrating your pets can be one of the most stressful parts of a move.

21

electricity and gas

telephone

customs

household goods and personal items

Household goods including furniture, dishes,

and decorations as well as clothes and per-

sonal items may be brought in duty free as

long as they have been used. The owner

must provide one of the following Customs

Forms (CF) with contents of the shipment

itemized:

CF 6059B Customs Declaration if

traveling with the goods by ship or car

CF 3299 Declaration for Free Entry of

Unaccompanied Articles

Moving and shipping companies fill out

these forms in the home country, create the

lists of goods, identify them for Customs

inspection, and delivery them to the owner

in the US.

importing a car

Importing a car into the U.S. requires

filling out the HS-7 Declaration that the ve-

hicle conforms to Department of Transpor-

tation (DOT) standards for bumpers, theft

prevention and emissions. If it does not, the

vehicle will have to be modified by a DOT

Registered Importer (RI). The procedure can

be costly.

Before trying to bring a nonconforming vehicle

into the U.S., the owner should check the

National Highway Traffic Safety Administra-

tion’s (NHTSA) website (www.nhtsa.dot.gov/cars/

rules/import) for a list of cars that can be modi-

fied. Since cars and used cars are probably

cheaper in the U.S. than in the buyer’s home

country, most decide it is more sensible to

buy than to import.

food

U.S. authorities are reluctant to allow food

into the country unless it is canned. It is advis-

able not to import any kind of food. Travelers

often see international visitors at U.S. airports

being forced to give up delicacies they have

brought from home.

alcohol

Alcohol may be imported, but it is subject to

duties once the limit for travelers of one or

two liters is exceeded. In addition, states have

varying duties on alcohol so the foreigner

would also pay the duty for the state to which

the goods are being delivered.

If you’re buying a property where someone

has been living or working, electricity and

gas are usually still operational. You should

contacts the local company supplying the

power directly to have the account changed

into your name. Often you won’t even have

to go to the office. The Realtor or seller can

provide this information. To get service, you

may have to provide a refundable deposit.

Wireless telephony is everywhere in the

U.S., and the number of homes with fixed

lines is declining, although many people still

maintain a landline phone at home as insur-

ance against outages during bad weather.

Most service is regional. The biggest company

22

tv and data

is AT&T, once the sole provider in the U.S.,

now one of many. Verizon, T-Mobile and

Sprint are among the companies that offer

nationwide service. Both GSM and CDMA

networks cover the U.S. and different carriers

use different networks. Most companies offer

special deals on new phones if the customer

agrees to a two- or three-year contract. A

deposit may be required for the first year of

service.

TV service is provided by cable and satellite

companies like Comcast, Time Warner and

DirecTV, and also by internet companies

such as AT&T and Verizon. You will need to

learn what services and companies oper-

ate in your local area. Deposits are often

required for the first year until the client has

shown himself to be a reliable customer

who pays bills on time. Another option for

internet service available in the U.S. is the

wireless mobile hotspot, a box half the size

of an iPod that provides internet service

anywhere.

The U.S. Post Office provides home delivery six

days a week (although there are proposals to

eliminate Saturday delivery). Branches of the

post office are found in most communities and

usually offer mailboxes for rent. If you’re mov-

ing from another location in the U.S., the post

office offers easy change of address cards to

forward your mail. There are also many small

private companies that rent mail boxes and

offer mail services (although many won’t

forward mail, after you move). In a rural or

remote area, it’s a good idea to visit the nearest

post office and to meet the manager who will

let the mail carriers know about a new resident.

Important personal letters and almost all letters

connected with business are sent by private

carriers like FedEx, DHL, and UPS. Their offices

can be found in every state and city

mail

telephone cont.

FACT:

The U.S. is the third largest country in the

world by population, roughly one fourth the

size of China or India. It is also third largest

in area, just after Canada and about half

the size of Russia.

23

RESO

U

R

C

E

S

economy

government agencies research firms

T

he U.S. economy – the largest in the world -- is carefully monitored at home and abroad.

The US Bureau of Labor Statistics (BLS) provides a monthly update on the percentage of

unemployment. BLS also monitors the Consumer Price Index (CPI) which in May 2013 stood

at 0.1 of the base years 1982-84, showing that inflation is still low, another positive sign for

the recovery.

Internal Revenue Service:

Collects income taxes from individuals

and companies. Offices are found in

Washington D.C. and regional centers

around the country.

Individuals: 1-800-829-1040

Businesses: 1-800-829-4933

www.irs.gov

Department of State:

Organizes U.S. relations with other countries

and controls visa process.

Washington D.C. and embassies in many

countries.

Visas: 202-663-1225

www.state.gov

US Customs and Border Protection:

Controls entry points into the U.S. by land,

sea, and air and sets regulations for entry of

persons and goods. Washington D.C. and

borders, ports, airports.

In the US: 1-877-229-5511

From overseas: 202-325-8000

www.cbp.gov

The Danter Company:

Specializes in market research and consulting

for personal and commercial investment.

Columbus, Ohio...... 614-221-9096

www.danter.com

Reis, Inc.:

Provides information and analysis on

commercial real estate

New York, NY...... 212-901-

1932

www.reis.com

Green Street Advisors:

Publishes reports on personal and

commercial real estate and property trends.

Newport Beach, CA...... 949-640-8780

www.greenstreetadvisors.com

National Association of Realtors:

Tracks monthly housing data, as well as

international sales.

Chicago, Illinois...... 800-874-

6500

http://www.realtor.org/

24

RealtyTrac:

Follows foreclosures and other trends

in specific markets.

Irvine, Ca...... 800-550-4802

http://www.realtytrac.com/

Taxation of Non Resident Foreigners (NRs)

The Internal Revenue Services, the agency overseeing federal taxes (www.irs.gov) has

several sites devoted to different aspects of taxation on non-residents.

www.irs.gov/Individuals/International-Taxpayers/Foreign-Persons-Receiving-Rental-Income-From-U.S.-Real-Property

www.irs.gov/Individuals/International-Taxpayers/Taxation-of-Nonresident-Aliens

www.irs.gov/Individuals/International-Taxpayers/FIRPTA-Withholding

www.irs.gov/Individuals/International-Taxpayers/Effectively-Connected-Income-%28ECI%29

www.irs.gov/Individuals/International-Taxpayers/Fixed,-Determinable,-Annual,-Periodical-%28FDAP%29-Income

Real Estate Tax Center

www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Real-Estate-Tax-Center

Visas

The Department of State

www.travel.state.gov/visa/

25

united states in numbers

U.S. Population 316,668,567

Land area 9,826,675 sq km

Lowest Point Death Valley, California -86 meters

Highest Point Mount McKinley (Denali), Alaska, 6,194 meters

Land Use Arable land: 16.19%

Permanent crops: 0.26%

Other: 83.44%

Ethnic Background White 79.96%

Hispanic 15.1%

Black 12.85%

Asian 4.43%

Amerindian and Alaska native 0.97%

Native Hawaiian and other Pacific Islander 0.18%

Note: The U.S. Census Bureau considers Hispanic to mean persons of Spanish/Hispanic/

Latino origin including those of Mexican, Cuban, Puerto Rican, Dominican Republic, Spanish,

and Central or South American origin living in the U.S. who may be of any race or ethnic

group (white, black, Asian, etc.) .

Religions Protestant 51.3%

Roman Catholic 23.9%

Mormon 1.7%

Other Christian 1.6%

Jewish 1.7%

Buddhist 0.7%

Muslim 0.6%,

Unaffiliated 12.1%

None 4% (2007 est.)

26

united states in numbers cont.

Language English 82.1%

Spanish 10.7%

Other Indo-European 3.8%

Asian and Pacific island 2.7%

Age Structure: 0-14 years: 20%

15-24 years: 13.7%

25-54: 40.2%

55-64 years: 12.3%

65 and older: 13.9%

Population Growth Rate: 0.9%

Literacy

(Age 15 and over can read and write): 99%

Urbanization:

Urban populations: 82% of total population (2010)

Rate of urbanization: 1.2% annual (2010-2015 estimate)

(Source CIA World Factbook)

© Copyright 2013 World Property Channel Networks, Inc.

All Rights Reserved.

27

O

U

R

SPONSOR

Douglas Elliman is the #4 ranked real estate company in the United States.

Today, Douglas Elliman is the largest regional metro New York City brokerage firm with a

network with over 4,000 real estate professionals and 675 employees working in more

than 70 offices in Manhattan, Brooklyn, Queens, Long Island, the Hamptons/North Fork,

Westchester, and now South Florida.

Phone: 1-800-Elliman

Web: www.Elliman.com

Email: [email protected]