ANNUAL REPORT 2022-23

THE MASTERS OF

INDIAN ROADS

MRF Limited

No.114, Greams Road, Chennai - 600 006.

Tel: +91 44 28292777 Fax: +91 44 28295087

CIN: L25111TN1960PLC004306

E-mail: [email protected] | Website: www.mrftyres.com

52300542_MRF AR22-23_Cover.pdf___1 / 2

52300542_MRF AR22-23_Cover.pdf___2 / 2

PAGE

1. CHAIRMAN’S MESSAGE 1

2. NEW PRODUCT LAUNCH 2-4

3. MRF T & S 5

4. AWARDS AND ACCOLADES 6

5. ESG 7

6. MRF CORP 8

7. MOTORSPORT 9

8. GROWTH STORY 10-11

9. BOARD OF DIRECTORS 12

10. 13

PAGE

12. REPORT ON CORPORATE GOVERNANCE 37

13. BUSINESS RESPONSIBILITY

AND SUSTAINABILITY REPORT 54

14. STANDALONE FINANCIAL STATEMENTS 80

15. BALANCE SHEET 92

16. STATEMENT OF PROFIT AND LOSS 93

17. NOTES FORMING PART OF THE

FINANCIAL STATEMENTS 102

18. CONSOLIDATED FINANCIAL STATEMENTS 150

19. FORM AOC-1 212

CONTENT

ANNUAL REPORT 2022 - 2023

MANAGEMENT DISCUSSION AND ANALYSIS

BOARD’S REPORT

11. 33

K.M. MAMMEN

Chairman & Managing Director

Dear Shareholders,

In the closing stages of last financial year we were still in the midst of a raw material crisis. The prices of raw

materials were continually increasing necessitating increasing our prices too. Fortunately, over a period of time the

raw material prices have stabilised and this has helped business in the current year.

In the current year we have recorded an all-time high consolidated total income of Rs.23,261 crores which is an

increase of Rs.3,627 crores over the previous year. This huge increase in consolidated total income reveals

the strength of MRF and its products. One of the resounding success of last year was the launching of our Scooter

tyre Zapper C1. It has received excellent response from the customers and it has helped in increasing our

2 wheeler tyre sales.

Last year’s problem of the semi-conductors shortage has more or less disappeared and the production level of

automobile industries have reflected this. Electric vehicles are now coming out in each of the categories and it will

take some time before we can see how this trend plays out.

The Tractor tyre sales, which was rather muted last year, has shown encouraging results in the current year. With

MRF leading in product preference in Farm tyres, this has also helped increase our sale.

Brand Finance, the world’s leading brand valuation consultancy has released the Automotive Industry 2023 study

and ranked MRF Tyres as the 2nd Strongest Tyre Brand in the World.

As we continue to be the market leader, it is essential for us to play an active role in decarbonizing our operations

thereby helping India meet the target of Net Zero emission by 2070. To support this goal, we have set phase-wise

targets and commitments to improve our sustainability performance in the coming years.

I wish to thank the Shareholders, Investors, Central and State Governments, Lenders, Suppliers and Customers for

their great support during these trying times. I also thank all my colleagues on the board for their continued

support.

Best Wishes,

CHAIRMAN’S MESSAGE

∙ 01 ∙ ANNUAL REPORT 2022 - 2023

∙

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___1 / 12

MRF PERFINZA

New sizes were introduced in the premium and luxury MRF Perfinza

series of tyres for Audi, BMW, Jaguar, Mercedes-Benz and Volvo cars in

245/50 ZR18, 245/40 ZR18 and 235/55 ZR17 sizes.

PASSENGER CAR TYRES

NEW PRODUCT LAUNCH

∙ 02 ∙ANNUAL REPORT 2022 - 2023 ∙

MRF MARKUS

New sizes were introduced in the premium SUV tyre brand MRF Markus

for the premium SUV’s of Audi, BMW, Mercedes-Benz, Volvo, Jeep, Hyundai

and VW in 225/50 R18, 225/55 R18 and 235/50 R18 sizes.

MRF CITIBUS

MRF Citibus was introduced exclusively for the Force Traveller and Toyota

Innova. The tyre delivers outstanding comfort, superior grip in all road

conditions and high mileage.

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___2 / 12

110/70-12, 90/90-12, 100/80-12

MRF ZAPPER N TL

Tubeless tyre developed for Electric Scooters.

TWO WHEELER TYRES

NEW PRODUCT LAUNCH

Block pattern rear tube-type tyre developed for Royal Enfield Classic 350.

110/90-18

MRF MOGRIP METEOR M TT

∙ 03 ∙ ANNUAL REPORT 2022 - 2023

∙

Tubeless rear tyre for Yamaha Fascino125 BS6 scooter.

110/90-10

MRF ZAPPER TL

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___3 / 12

COMMERCIAL VEHICLE TYRES

NEW PRODUCT LAUNCH

MRF SUPER LUG FIFTY PLUS R

7.00-15 and 195/80 D15 tyres were launched under the Super Lug Fifty

Plus R brand, improving on overall tyre life and load carrying capability.

MRF SAVARI EXTRA

MRF Savari Extra is a long-life tyre for SCV’s with a premium skid depth

and dual tread compound for cooler running. The footprint has been

optimised for even wear. The sipe integrated 5-rib pattern delivers

excellent dry and wet traction.

MRF SUPER MILER 99 PLUS

Steer-axle tyre with a superior compound for cooler running and higher

tread mileage. Strong casing for better retreadability. Specially designed

shoulder and tread for faster heat dissipation. Available in 10.00-20 and

295/95-D20 sizes.

∙ 04 ∙ANNUAL REPORT 2022 - 2023 ∙

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___4 / 12

∙ 05 ∙

ANNUAL REPORT 2022 - 2023

∙

MRF T&S

DELIGHTING THE CUSTOMER

WITH WORLD-CLASS TYRE

CARE SERVICES

MRF T&S (Tyres & Service) is a world-class sales

and service outlet offering a unique tyre buying

and service experience. MRF T&S outlets stock

the entire range of MRF tyres and tubes and are

equipped to provide services like computerized

wheel balancing and alignment, automated tyre

changing, nitrogen filling and tubeless tyre

repairs by MRF trained service personnel in a

comfortable air-conditioned ambience.

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___5 / 12

∙ 06 ∙

ANNUAL REPORT 2022 - 2023

∙

AWARDS AND ACCOLADES

ISUZU MOTORS INDIA

MRF received the Supplier Quality Award 2023 for Best Quality

Performance for the year 2022-23.

BRAND FINANCE AUTOMOTIVE

INDUSTRY 2023

Brand Finance an International Brand Valuation consultancy

has ranked MRF Tyres as the 2nd strongest tyre brand in the

world and the most valuable Indian tyre brand. MRF Tyres was

also ranked as the second fastest growing tyre brand in the

world. In Sustainability Perceptions Value, Brand MRF is

ranked among the Top 10 brands globally in the Tyre Sector.

MARUTI SUZUKI INDIA LIMITED

MRF was recognized for Overall Performance for the year

2022-23.

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___6 / 12

ESG

∙ 07 ∙

ANNUAL REPORT 2022 - 2023

∙

SOCIAL

MRF continued its focus on employee well-being including their health, safety and upskilling. As a responsible

corporate citizen, MRF carried out several CSR projects in education, health care, skill development and

infrastructure for the communities in which it operates.

Formal processes are in place to oversee key ESG initiatives. MRF continues to work towards creating

sustained long-term value for its stakeholders by adopting prudent fiscal practices and sound business

strategy.

GOVERNANCE

ENVIRONMENT

Renewable Energy

Agreements have been signed for purchasing solar power for the plants in Tamil Nadu and hybrid power

(solar and wind) for the Gujarat plant which will reduce the carbon footprint.

Alternative Fuel

Replacement of furnace oil-based steam generation with alternate gas-based steam generation and use

of biomass as alternate fuel for boilers have been initiated.

Water Conservation

Construction of waste water treatment facility in several plants is underway. Agreements have been signed

for using treated municipal sewage water at the Perambalur plant. The treated water will be used in the

manufacturing process.

Sustainable Sourcing

Most of MRF's purchases are from suppliers in the A and A+ categories (who are governed by MRF’s

Supplier Sustainable Policy and Green Procurement Policy) as well as from B category suppliers who are

ISO 14001 certified.

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___7 / 12

MRF Corp has achieved a value growth of 32% over the

preceding year. The annual plant capacity utilization

rose by 35% over the previous year. MRF Corp launched

various new products like Zameen 2KPU Floor Coat,

Altura Metalic, Vilasa Wall Putty, WoodCoat Total Matt

and Italia.

MRF CORP

THE PAINT DIVISION

∙ 08 ∙

ANNUAL REPORT 2022 - 2023

∙

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___8 / 12

MOTORSPORT

MRF TRIUMPHS IN EUROPE

Motorsports in 2022-2023 saw Team MRF Tyres win the acclaimed FIA

European Rally Championship (ERC) for the first time against

International competition in the third year of participating in this top

level competition. Efren Llarena and Sara Fernandez created history for

MRF Tyres by winning the Championship.

DOMESTIC NATIONAL

CHAMPIONSHIPS

MRF Drivers not only shone abroad but were able to bring home

the prestigious Indian National Rally Championships for the third

consecutive Championship in 2022 thereby proving their mettle both

abroad and at home.

MRF promoted motorsports across the country by conducting the

National Championships for Indian Motorcycles in the Indian National

Motorcycle Racing Championship, Indian National 2-Wheeler Rally

Championship, the MRF Mogrip National Supercross Championship and

the ever growing Indian National Car Racing Championships. This was

promoting our Indian riders and drivers to achieve National level highs

before going on to attempt International Championships.

∙ 09 ∙

ANNUAL REPORT 2022 - 2023

∙

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___9 / 12

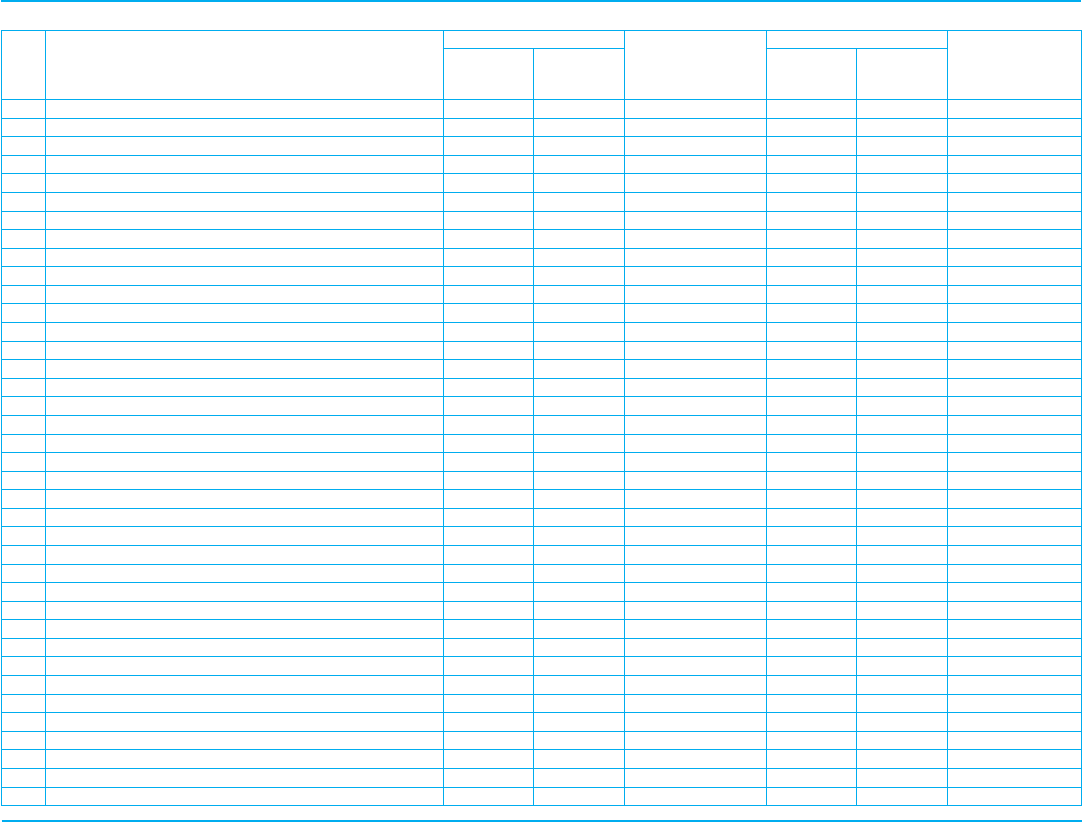

GROWTH STORY

PROFIT BEFORE TAXATION

Standalone

`

in crores

`

in crores

RESERVES

Standalone

2013

SEP

2016*

MAR

2018

MAR

2020

MAR

2022

MAR

2014

SEP

2019

MAR

2021

MAR

2023

MAR

2017

MAR

13773

1227

1339

1602

1609

1399

1700

879

1119

2013

SEP

2016*

MAR

2018

MAR

2020

MAR

2022

MAR

2014

SEP

2019

MAR

2021

MAR

2023

MAR

2017

MAR

*

For the 18 months period ended 31.03.2016

14505

13175

12000

10649

9600

8540

7157

4513

3641

2066

3606

∙ 10 ∙

ANNUAL REPORT 2022 - 2023

∙

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___10 / 12

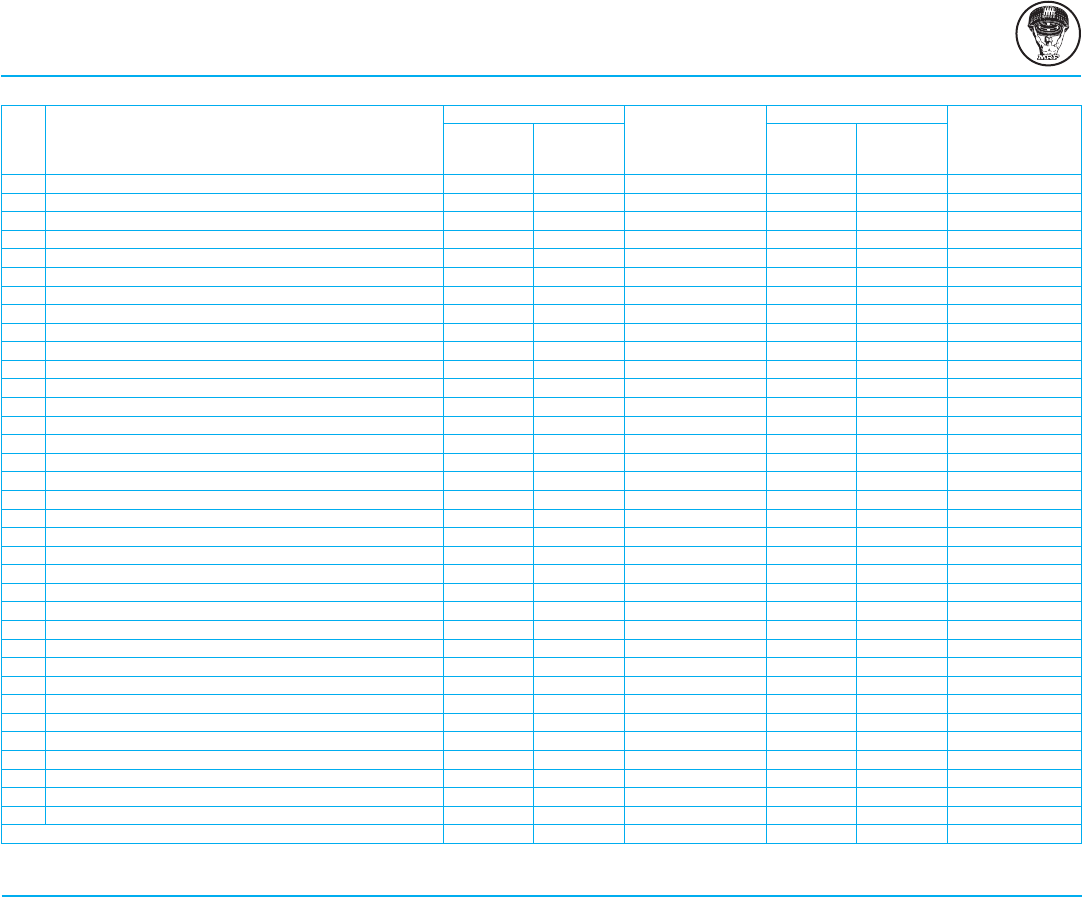

GROWTH STORY

`

in crores

`

in crores

*

For the 18 months period ended 31.03.2016

REVENUE FROM OPERATIONS

Standalone

NET WORTH

Standalone

12131

22162

15991

18989

15181

13198

15837

15922

22578

14749

2013

SEP

2016*

MAR

2018

MAR

2020

MAR

2022

MAR

2014

SEP

2019

MAR

2021

MAR

2023

MAR

3645

7161

12004

13777

9604

4518

8544

10653

13179

14509

2013

SEP

2016*

MAR

2018

MAR

2020

MAR

2022

MAR

2014

SEP

2019

MAR

2021

MAR

2023

MAR

2017

MAR

2017

MAR

∙ 11 ∙

ANNUAL REPORT 2022 - 2023

∙

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___11 / 12

BOARD OF DIRECTORS

K.M. MAMMEN

Chairman & Managing Director

ARUN MAMMEN

Vice Chairman & Managing Director

RAHUL MAMMEN MAPPILLAI

Managing Director

SAMIR THARIYAN MAPPILLAI

Whole-Time Director

VARUN MAMMEN

Whole-Time Director

Company Secretary

S. DHANVANTH KUMAR

Auditors

M M NISSIM & CO LLP, Mumbai

SASTRI & SHAH, Chennai

Registered Office: No.114, Greams Road, Chennai - 600 006.

ASHOK JACOB

V. SRIDHAR

VIJAY R. KIRLOSKAR

RANJIT I. JESUDASEN

Dr. SALIM JOSEPH THOMAS

JACOB KURIAN

Dr. CIBI MAMMEN

AMBIKA MAMMEN

VIMLA ABRAHAM

VIKRAM TARANATH HOSANGADY

RAMESH RANGARAJAN

DINSHAW KEKU PARAKH

ARUN VASU*

VIKRAM CHESETTY*

PRASAD OOMMEN*

*w.e.f. 09.05.2023

∙ 12 ∙

ANNUAL REPORT 2022 - 2023

∙

52300542_MRF AR22-23_4 Clr_Pg01-12.pdf___12 / 12

13

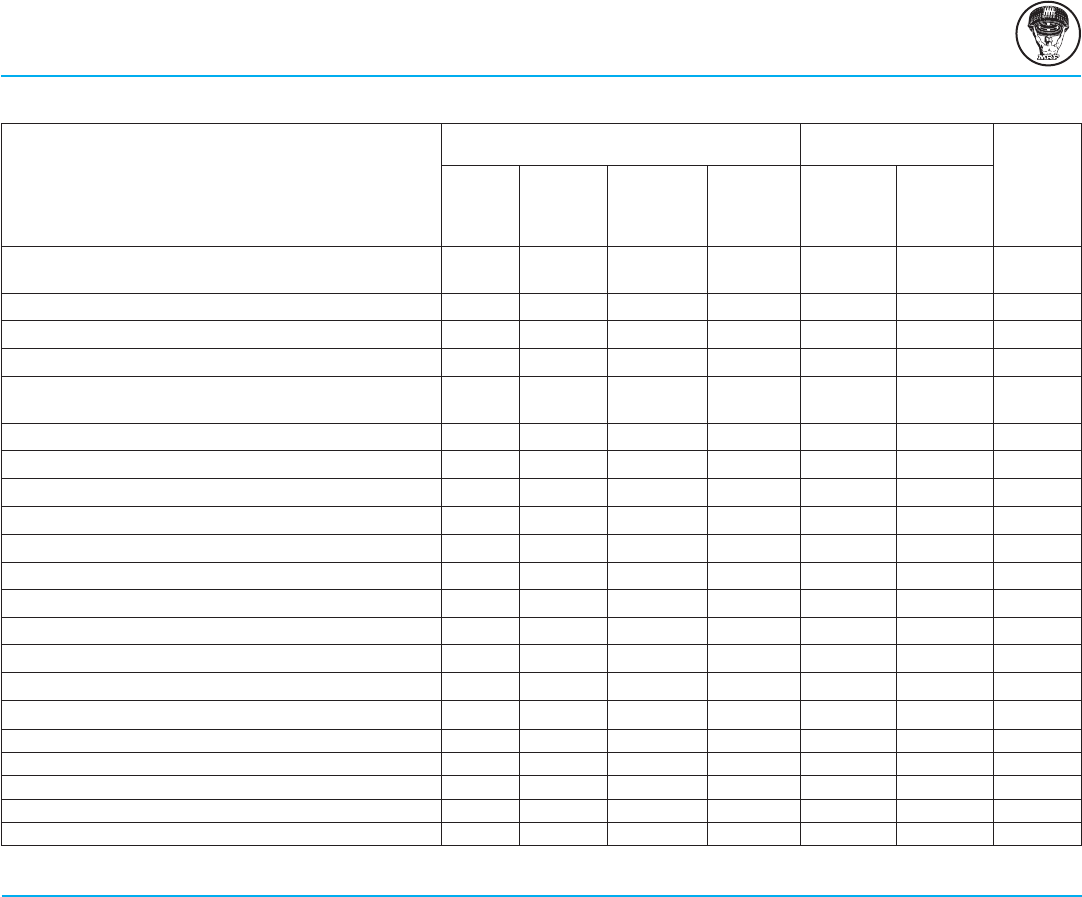

Ten Year Financial Summary (Standalone) 2023 2022 2021 2020 2019 2018 2017 2014-16 2014 2013

` Crores Revenue from Operations 22578 18989 15922 15991 15837 15181 14749 22162 13198 12131

Other Income 248 315 207 331 417 329 329 321 65 29

Total Income 22826 19304 16129 16322 16254 15510 15078 22483 13263 12160

Profit Before Taxation 1119 879 1700 1399 1609 1602 2066 3606 1339 1227

Provision for Taxation 303 232 451 4 512 510 615 1132 441 425

Profit after Taxation 816 647 1249 1395 1097 1092 1451 2474 898 802

Share Capital 4.24 4.24 4.24 4.24 4.24 4.24 4.24 4.24 4.24 4.24

Reserves 14505 13773 13175 12000 10649 9600 8540 7157 4513 3641

Net Worth 14509 13777 13179 12004 10653 9604 8544 7161 4518 3645

Fixed Assets Gross 19930 16442 15018 14133 10780 9028 7560 6307 6954 5834

BOARD’S REPORT

Your Directors have pleasure in presenting to you the Sixty Second Annual

Report and the Audited Financial Statements for the financial year ended

31st March, 2023.

Standalone Financial Results

` Crores

2022-2023 2021-2022

Total Income 22826 19304

Profit before tax 1119 879

Provision for taxation 303 232

Profit for the year 816 647

Performance Overview

During the financial year ended 31st March, 2023, your Company’s total

income was ` 22826 crores as against ` 19304 crores in the previous year,

recording a growth of 18%. The profit before tax stood at ` 1119 crores

for the year as against ` 879 crores for the previous financial year. The net

provision for tax (current tax and deferred tax) for the year is `303 crores

(previous year ` 232 crores). After making provision for income tax, the

net profit for the year ended 31st March, 2023 is ` 816 crores as against

` 647 crores for the previous financial year.

The Company’s exports (including Indian Rupee Exports) stood at ` 1866

crores for the financial year ended 31st March, 2023, as against ` 1779

crores for the previous year.

Revenue from operations for 2022-23 registered good growth over the

previous year. The increase in sales was a result of growth in all product

groups. The unprecedented increase in raw material prices, which was

witnessed during financial year 2021-22 due to the COVID pandemic and

also the war in Ukraine, extended into the current financial year. Despite

efforts being taken to pass on the cost increases in a graduated manner,

the profitability continued to be low during the first three quarters of the

year. With easing of raw material prices during the later part of the year,

the benefits of lower raw material cost resulted in better profitability in the

fourth quarter.

It is a matter of pride that Brand Finance, which is one of the world’s

leading independent brand valuation and strategy consultancy, with

headquarters in London, has rated MRF as the second strongest Tyre brand

in the world besides being the most valued Tyre brand in India.

As required under regulation 34 of the SEBI (Listing Obligations and

Disclosure Requirements) Regulations, 2015, the Management Discussion

and Analysis Report is attached and forms part of this Report.

14

Dividend

Two interim dividends of ` 3/- each per share (30% each) for the financial

year ended 31st March, 2023 were declared by the Board of Directors on

8th November, 2022 and on 9th February, 2023. The Board of Directors

is pleased to recommend a final dividend of ` 169/- (1690%) per share

of ` 10 each on the paid up equity share capital of the Company, for

consideration and approval of the shareholders at the forthcoming Annual

General Meeting which shall be subject to deduction of applicable

income tax at source. The total dividend for the financial year ended

31st March, 2023 works out to ` 175/- (1750%) per share of ` 10 each.

The above dividend declared by the Company is in accordance with

dividend distribution policy of the Company.

The Directors recommend that after considering provision for taxation

and the dividend paid during the year, an amount of ` 753 crores be

transferred to general reserve. With this, the Company’s Reserves and

Surplus stands at ` 14505 crores.

Industrial Relations

Overall, the industrial relations in all our manufacturing units have been

harmonious and cordial. Long term wage settlements have been concluded

in our factories at Thiruvottiyur in Tamil Nadu, Goa and Ankenpally in

Telangana. Both production and productivity were maintained at the

desired levels throughout the year in all Plants.

Consolidated Financial Results and Performance of Subsidiaries

The consolidated financial statements of the Company prepared in accordance

with the Companies Act, 2013 and applicable accounting standards form part

of the Annual Report. The consolidated total income for 2022-23 was `23261

Crores and consolidated profit before tax was `1070 Crores.

Pursuant to the provisions of section 136 of the Companies Act, 2013,

the financial statements, consolidated financial statements along with the

relevant documents and audited accounts of subsidiaries are available on

the website of the Company.

The Company has four subsidiaries viz. MRF Corp Limited,

MRF International Limited, MRF Lanka (P) Ltd. and MRF SG PTE. LTD.

The aggregate turnover of all four subsidiaries in equivalent Indian Rupees

during the financial year ended 31st March, 2023 was `2326 crores and

the aggregate Loss for the year was ` 48 crores. This is due to MRF SG

PTE. LTD, paying a sum of ` 82 crores, being the price adjustment under

Bilateral Advance Pricing Arrangement (BAPA) payable to MRF Limited for

the financial year 2015-16 to 2023-24.

A statement in Form AOC-1, containing the salient features of the financial

statements of the Company’s subsidiaries is attached with the financial

statements. The statement provides details of performance and financial

position of each of the subsidiaries.

The contribution of the subsidiaries to the overall performance of the

company is given in note 25d of the consolidated financial statements.

During the year under review, your Company has entered into transactions

with MRF SG PTE. LTD, a wholly owned subsidiary of your Company for

purchase of raw materials and the total value of transactions executed

during financial year 2022-2023, exceeded the materiality threshold

adopted by the Company. These transactions were in the ordinary course

of business and were on an arms length basis, details of which are provided

in Annexure IV of the Board’s Report as required under Section 134(3)

(h) of the Companies Act, 2013 read with Rule 8(2) of the Companies

(Accounts) Rules, 2014.

Directors’ Responsibility Statement

As required under section 134(3)(c) of the Companies Act, 2013, your

Directors state that:

a) In the preparation of the annual accounts, the applicable Accounting

Standards have been followed and that there are no material

departures;

b) They have, in selection of the accounting policies, consulted the

statutory auditors and applied them consistently, making judgments

and estimates that are reasonable and prudent so as to give a true

and fair view of the state of affairs of the Company at the end of the

financial year and of the profit of the Company for the year ended

31st March, 2023;

c) Proper and sufficient care has been taken for the maintenance of

adequate accounting records in accordance with the provisions

of the Companies Act, 2013 for safeguarding the assets of the

Company and for preventing and detecting fraud and other

irregularities;

15

d) Annual accounts have been prepared on a going concern basis;

e) Internal financial controls had been laid down and followed by the

Company and such internal financial controls are adequate and

were operating effectively; and

f) Proper systems to ensure compliance with the provisions of all

applicable laws have been devised and such systems were adequate

and operating effectively.

Risk Management

The company has developed and implemented a detailed risk management

policy for the Company including identification therein of elements of

risk, if any, which in the opinion of the Board may threaten the existence

of the Company as required under the Companies Act, 2013 read with

Regulation 21 of the Listing regulations. The Company has constituted

a Risk Management Committee of the Board comprising of executive

directors and an independent director of the Company as required

under Securities and Exchange Board of India (Listing Obligations and

Disclosure Requirements) Regulations, 2015. The Committee reviews the

risk management initiatives taken by the Company on a half yearly basis

and evaluate its impact and the plans for mitigation. During the year the

Committee met on 9th September, 2022 and 3rd March, 2023.

Adequacy of Internal Financial Control

Internal financial control means the policies and procedures adopted by

the Company for ensuring the orderly and efficient conduct of its business,

including adherence to Company’s policies, the safeguarding of its assets,

timely prevention and detection of frauds and errors, the accuracy and

completeness of the accounting records, and the timely preparation of

reliable financial information. The Company has put in place well defined

procedures, covering financial and operating functions. Delegation of

authority and segregation of duties are also addressed to ensure that the

financial transactions are properly authorized. Further the Company has

an integrated ERP system connecting head office, plant and other locations

to enable timely processing and proper recording of transactions. Physical

verification of fixed assets is carried out on a periodical basis. The Internal

audit department reviews the effectiveness of the internal control systems

and key observations are reviewed by the Audit Committee. These, in the

view of the Board, are designed to collectively provide an adequate system

of internal financial control with reference to the financial statements

commensurate with the size and nature of business of the Company.

Conservation of Energy, Technology Absorption and Foreign Exchange

Earnings and Outgo

Information as required to be given under section 134(3)(m) read with Rule

8(3) of the Companies (Accounts) Rules, 2014 is provided in Annexure I,

forming part of this Report.

Corporate Social Responsibility (CSR)

As required under section 135 of the Companies Act, 2013, the CSR

Policy was formulated by the CSR Committee and thereafter approved

by the Board. CSR Policy is available on the Company’s website:

https://www.mrftyres.com/investor-relations/corporate-social-

responsibilty The details of the CSR initiatives undertaken during the

financial year ended 31st March, 2023 and other details required

to be given under section 135 of the Companies Act, 2013 read with

the Companies (Corporate Social Responsibility Policy) Rules, 2014 as

amended are given in Annexure II forming part of this Report.

Board and Key Management Personnel

During the year under review, the following Managing Directors / Whole-

time Directors were re-appointed:

1. Mr. Rahul Mammen Mappillai (DIN: 03325290) as Managing

Director for a term of five years with effect from 4th May, 2022. The

aforesaid appointment was approved by the shareholders by postal

ballot on 3rd May, 2022.

2. Mr. Samir Thariyan Mappillai (DIN: 07803982) and Mr.Varun

Mammen (DIN: 07804025) as Whole-time Directors of the

Company for a term of five years with effect from 4th August, 2022.

The aforesaid appointment was approved by the shareholders at the

Annual General Meeting of the Company held on 4th August, 2022.

3. Mr. Arun Mammen (DIN: 00018558) as Managing Director of the

Company (with the designation “Vice Chairman and Managing

Director” or such other designation as approved by the Board from

time to time) for a term of five years with effect from 1st April 2023.

The aforesaid appointment was approved by the shareholders by

postal ballot on 31st March, 2023.

Further, in November 2022, the Board decided to induct new Independent

Directors taking into consideration that six of the serving Independent

Directors (viz. Mr. Ashok Jacob, Mr. V Sridhar, Mr. Vijay R Kirloskar,

16

Mr. Ranjit I Jesudasen, Dr. Salim Joseph Thomas and Mr. Jacob Kurian) are

due to retire in September 2024. Since these six Independent Directors are

serving their second term, they will retire in September 2024 and will be

stepping down from the Board. Therefore, as part of the plan for orderly

succession to the Board of Directors and to facilitate a smooth transition,

the Board at its meeting held on 8th November 2022 decided to induct

three new Independent Directors and subsequently at its meeting held on

9th February 2023 three more Independent Directors. The details of these

new Independent Directors are given below:

1. Mr. Vikram Taranath Hosangady (DIN: 09757469), Mr. Ramesh

Rangarajan (DIN: 00141701) and Mr. Dinshaw Keku Parakh

(DIN: 00238735) were appointed as Independent Directors by the

shareholders of the Company by postal ballot on 21st December

2022. The appointment of the said Independent Directors took effect

from 7th February 2023.

2. Mr. Arun Vasu (DIN: 00174675), Mr. Vikram Chesetty (DIN:

01799153) and Mr. Prasad Oommen (DIN: 00385082) were also

appointed as Independent Directors by the shareholders of the

Company by postal ballot on 31st March, 2023. The appointment

of the said Independent Directors will take effect upon receipt of

requisite regulatory approvals.

As required under Section 152 of the Companies Act, 2013, Mr Varun

Mammen (DIN: 07804025), Whole time Director and Mrs. Ambika

Mammen (DIN: 00287074), Director of the Company, retire by rotation at

the forthcoming Annual General Meeting and being eligible have offered

themselves for re-appointment.

The Company has received declarations of independence from all

the Independent Directors confirming that they meet the criteria of

independence as prescribed under section 149(6) of the Companies

Act, 2013 and SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015 and that they are independent from Management.

The Board is of the opinion that all the Independent Directors of the

Company are person’s of integrity and possess relevant expertise and

experience (including the proficiency) to act as Independent Directors

of the Company. The Independent Directors of the Company have

confirmed that they have been registered with the Indian Institute of

Corporate Affairs, Manesar and have included their name in the databank

of Independent Directors within the statutory timeline as required under

Rule 6 of the Companies (Appointment and Qualification of Directors)

Rules, 2014. Out of the above new Independent Directors, two Directors

are required to appear for the online proficiency test within a period of

two years.

Performance evaluation of the Board, its Committees and Directors

The Board of Directors has made a formal annual evaluation of its own

performance and that of its committees pursuant to the provisions of

the Companies Act, 2013 and SEBI (Listing Obligations and Disclosure

Requirements) Regulation, 2015. The evaluation was done based on

the evaluation criteria formulated by Nomination and Remuneration

Committee which includes criteria such as fulfilment of specific functions

prescribed by the regulatory framework, adequacy of meetings, attendance

and effectiveness of the deliberations etc.

The Board also carried out an evaluation of the performance of the

individual Directors (excluding the Director who was evaluated) based

on their attendance, participation in deliberations, understanding the

Company’s business and that of the industry and in guiding the Company

in decisions affecting the business and additionally in case of Independent

Directors based on the roles and responsibilities as specified in Schedule

IV of the Companies Act, 2013 and fulfilment of independence criteria

and independence from management.

Corporate Governance

In accordance with Regulation 34 of the SEBI (Listing Obligations and

Disclosure Requirements) Regulations, 2015, a Report on Corporate

Governance along with the Auditors’ Certificate confirming compliance

is attached and forms part of this Report.

Following information required to be disclosed as per the Companies Act,

2013 are set out in the Corporate Governance Report:

a) Number of Board meetings held - Para 2(c) of the Corporate

Governance Report.

b) Constitution of the Audit Committee and related matters - Para 3(ii)

and 14(o) of the Corporate Governance Report.

c) Remuneration Policy of the Company (including directors

remuneration)- Para 7a of the Corporate Governance Report.

17

d) Company’s policy on directors’ appointment including criteria

for determining qualifications, positive attributes, independence

of a director and other matters provided under sub-section (3) of

section 178 - Para 5, 6 of the Corporate Governance Report. The

nomination and remuneration policy is also available on the website

of the Company. https://www.mrftyres.com/downloads/download.

php?filename=nominatio-%20and-remuneration-policy.pdf

e) Related Party Transactions - Para 14(a) of the Corporate Governance

Report.

f) Vigil Mechanism - Para 14 (c) of the Corporate Governance Report

The details of related party transactions are given in note 28d of the

financial statements.

Business Responsibility and Sustainability Report

Pursuant to Regulation 34 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015, the Business Responsibility and

Sustainability Report of the Company for the financial year ended

31st March 2023 in the prescribed format, giving an overview of the

initiatives taken by the Company from an environmental, social and

governance perspective, forms part of this Annual Report.

Particulars of Employees

Disclosures with respect to the remuneration of the Directors, KMP’s

and Employees as required under Section 197(12) of the Companies

Act, 2013 read with Rule 5 (1) of the Companies (Appointment and

Remuneration of Managerial Personnel) Rules, 2014 are given in

Annexure V to this Report.

Further, the disclosures pertaining to remuneration of employees as

required under Section 197(12) of the Companies Act, 2013 read with

Rule 5 (2) and (3) of the Companies (Appointment and Remuneration

of Managerial Personnel) Rules, 2014 have been provided in the

appendix forming part of this report. Having regard to the provisions

of Section 136(1) read with relevant provisions of the Companies Act,

2013, the Annual Report excluding the aforesaid information is being

sent to the members of the Company. The said information is available

for inspection at the Registered Office of the Company during working

hours and any member interested in obtaining such information may

write to the Company Secretary and the same will be furnished to the

members.

During the financial year under review, the Company has not received

any complaint under The Sexual Harassment of Women at Workplace

(Prevention, Prohibition and Redressal) Act, 2013. Further, Company

has complied with provisions relating to the constitution of Internal

Complaints Committee under the Sexual Harassment of Women at

Workplace (Prevention, Prohibition and Redressal) Act, 2013.

Deposits

Your Company had discontinued acceptance of fixed deposits with

effect from 31st March, 2019 and all deposits have been repaid. No fresh

deposits have been accepted subsequently.

Auditors

M M Nissim & CO LLP, Chartered Accountants, (Firm Regn No. 107122W

/ W100672), Mumbai and Messrs. Sastri & Shah, Chartered Accountants

(Firm Regn No.: 003643S), Chennai were appointed as joint statutory

auditors of the Company for a term of 5 (five) consecutive years, at the

Annual General Meeting of the company held on 12th August, 2021 and

4th August, 2022.

Auditors Report to the shareholders for the financial year ended

31st March, 2023, does not contain any qualification.

Cost Audit

The Board of Directors, on the recommendations of the Audit Committee,

has approved the re-appointment of Mr. C. Govindan Kutty, Cost Accountant

(Mem. No. 2881), as Cost Auditor of the Company for the financial year

ending 31st March, 2024, under section 148 of the Companies Act, 2013,

and recommends ratification of his remuneration by the shareholders at the

forthcoming Annual General Meeting of the Company.

Secretarial Audit

Pursuant to provisions of Section 204 of the Companies Act, 2013

read with rule 9 of the Companies (Appointment and Remuneration of

Managerial Personnel) Rules, 2014, your Company engaged the services

of Mr K Elangovan, Elangovan Associates, Company Secretaries, Chennai

to conduct the Secretarial Audit of the Company for the financial year

18

ended 31st March, 2023. The Secretarial Audit Report (in Form MR-3) is

attached as Annexure-III, to this Report. The Secretarial Auditor’s Report

to the shareholders does not contain any qualification.

Annual Return

The Annual Return as required under Section 92 and Section 134

of the Companies Act, 2013 read with Rule 12 of the Companies

(Management and Administration) Rules, 2014 is available on the

Company’s website: www.mrftyres.com. Weblink:https://www.

mrftyres.com/investor-relations/annual-return

Other Matters

There are no material changes and commitments affecting the financial

position of the Company between the financial year ended 31st March,

2023 and the date of this report.

During the year under review, there were no material and significant

orders passed by the regulators or courts or tribunals impacting the going

concern status and the Company’s operations in future.

The Competition Commission of India (‘CCI’) had on 2nd February, 2022

released its order dated 31st August, 2018, imposing penalty on certain

tyre manufacturers including the Company and also the Automotive Tyre

Manufacturers’ Association, concerning the breach of the provisions of the

Competition Act, 2002, during the year 2011-12. A penalty of `622.09

Crores was imposed on the Company. The appeal filed by the company before

National Company Law Appellate Tribunal (NCLAT) has been disposed

of by remanding the matter to CCI for review after hearing the parties. In

February 2023 CCI has filed an appeal against the order of NCLAT before

the Hon’ble Supreme Court and the same is pending disposal.

Details of investments as required under section 134 of the Companies

Act, 2013 is given in note 3 to the financial statements.

During the year under review, the Board confirms that the Company has

complied with the applicable Secretarial Standards issued by the Institute

of Company Secretaries of India.

During the year under review, no fraud has been reported by the auditors

to the audit committee or the board.

During the year under review, there is no change in the nature of business

of your Company.

During the year under review, the Company has allotted 15,000 listed,

unsecured, rated, redeemable, taxable, non-convertible debentures

aggregating to ` 150 Crores on a private placement basis.

As regards Cost Audit Records, it is confirmed that the Company is covered

by Cost Audit Records Rules under section 148(1) of the Companies

Act, 2013 and accordingly, such accounts and all relevant records are

maintained by the Company.

Appreciation

Your Directors place on record their appreciation of the invaluable

contribution made by the Company’s employees which made it possible

for the Company to achieve these results. They would also like to take

this opportunity to thank customers, dealers, suppliers, bankers, financial

institutions, business associates and valued shareholders for their

continued support and encouragement.

On behalf of the Board of Directors

Chennai K M MAMMEN

03rd May, 2023 Chairman & Managing Director

DIN: 00020202

19

ANNEXURE I TO THE BOARD’S REPORT

A. CONSERVATION OF ENERGY

Energy Conservation continuous to be a key focus area for the

manufacturing plants and related functions. Scheduled monthly

performance review, continuous improvement program help to

optimize, reduce specific consumption of fuel, power and water.

Benchmarking of best performance, base lining of best consumption

and identification of losses is considered for setting targets. Energy

Monitoring system section wise data is analysed to arrive at

mitigation plans and improvements on renewable energy, alternate

fuels, bio-fuels and clean sources of energy are being evaluated for

immediate and future requirements.

(i) The steps taken or impact on energy conservation:

The following measures implemented to reduce specific fuel

consumption.

a) Identifying losses in process lines and correction of leaks

to reduce the steam consumption.

b) Improving utilization by isolation of lower utilized

process lines to minimize thermal energy losses.

c) Targets were set based on best shift energy consumption

from energy monitoring system.

d) Deployment of nitrogen based cure process to minimize

the process energy requirement.

e) Reduction of process steam requirement by modifying

the reduced process pipe lines.

f) Participation of process owners in data analysis

from energy monitoring system to improve energy

performance.

g) Utilization of process waste heat to improve steam

generation efficiency.

The following measures were implemented to reduce specific

power consumption.

a) Introduction of energy efficient air compressors for base

load operation to optimize power requirements.

b) Air leak study, continuous monitoring and correction of

air leaks in plants to reduce the compressor energy.

c) Replacement of old motors with new energy efficient

motors.

d) Close monitoring of optimized scheduling in production

equipment to avoid equipment idle time and to reduce

the specific energy through Energy monitoring system.

e) Parallel implementation of pneumatic based system to

hydraulic based system to reduce the compressor energy.

(ii) The following steps were taken by company to increase

utilization/ alternate source of energy.

• a) Usage of clean fuels like CNG for boilers.

• b) Sourcing of more power from renewable energy and

clean fuels with focus on reduction of carbon foot prints.

c) Installation of solar based outdoor lightings under

consideration.

d)• Evaluation of bio mass based steam generation in place

of coal based steam generation.

e) Installation of waste water treatment plants to reuse in the

process.

(iii) Capital Investment on Energy conservation projects:

Investments have been carried out for energy conservation

proposals resulting in long term saving impact and reduction

of losses in the system.

Key projects initiated are listed below.

a) Extension of nitrogen system to reduce the energy

consumption.

b) Reduction of process steam and power consumption by

process changes.

c) PLC based control system for evacuating hot air from the

process.

d) Conversion of pneumatic based system to hydraulic

based system to reduce the compressor energy.

Key On-going proposals are as listed below

a) Recycling of municipal waste water, effluent treatment

plant (ETP) and sewage treatment plant (STP) to reuse in

process.

b) Blending of bio fuel in coal based steam generation system.

c) Identifying lower specific energy consuming machines

and utilizing to maximum level to reduce total energy

consumption.

20

d) Increased rain water recovery to optimize the sourcing

water requirement.

e) Undertaking of sustainability and net zero carbon

initiatives to achieve targets.

B. TECHNOLOGY ABSORPTION, ADAPTATION AND INNOVATIONS

1. Efforts made towards technology absorption, adaptation and

innovation:

a. Joint R&D with Indian and foreign universities and research

institutes:

Our company has a robust in-house R&D for technology and

product excellence. However, towards continued excellence

in the ever-evolving tyre technology, we work on R&D

projects with Institutions of Eminence in India and abroad.

The projects cover a broad range of comprehensive scientific

understanding of the interfaces in tyres, materials and design

parameters on noise-vibration-harshness (NVH), exploration

of new-and sustainable (bio-derived) materials, and nano-

and nanostructured materials with the overall stated aim of

the company to continuously advance green and sustainable

tyre technologies. The joint R&D programs result in PhDs,

international publications and patents.

b. New product and material development, elimination of

hazardous materials, etc.:

To improve sustainability of products, our company is working

on the multipronged 4R strategy, that is reduce (reduction in

CO

2

emission by low RR tyres) – recycle (usage of recycled

materials from end-of-life tyres as raw materials for new tyres)

– reuse (by making multiple re-treadable tyres and doing

the retreading process by itself) and renewable (critical raw

materials with lower carbon footprint from environmentally

sustainable sources such as biomass, waste, etc.).

Towards import substitution, we have initiated joint

development programs for raw materials such as sulphur,

resource-formaldehyde resin, accelerators, antioxidants, butyl

rubber, halo butyl rubber, microcrystalline wax, super tackifier

resin, etc. with domestic suppliers.

c. Key product developments:

Our company has adopted sustainability as an integral part

of our business policy. We have improved the share of

sustainable raw materials in all our tyres. To meet the emission

norms under R117 and AIS 142 standards, we developed

several low RR tyres which were approved by Indian and

global passenger car OEMs. Similar activities are underway in

tyres for commercial vehicles as well. Our company is in the

process of adopting sustainability goals and targets in-line with

the net-zero target of Govt. of India, Paris Climate Change

Agreement and COP resolutions.

2. Benefits derived as a result of the above efforts:

The in-house and joint R&D programs resulted in knowledge and

confidential information to maintain technological superiority in

the market. Development of low rolling resistance tyres with an

increased share of renewable materials resulted in more sustainable

tyres. Efforts towards import substitution of raw materials such as

resins, rubber, accelerators, antioxidants, wax, process aids, etc.

resulted in cost-saving as well as a positive direction towards the

Atmanirbhar Bharat initiative of the Govt. of India.

3. Details of imported technology (imported during last 3 years

reckoned from the beginning of the financial year).

No technology was imported during the last 3 years and MRF is self

reliant with regard to tyre technology for several decades.

4. Expenditure incurred on Research and Development:

(` Crores)

2022-2023

R & D Expenses

(a) Capital 25.15

(b) Recurring 109.92

C. FOREIGN EXCHANGE EARNINGS & OUTGO

(` Crores)

2022-2023

Foreign Exchange Earnings 1763.33

Foreign Exchange Outgo 5117.88

On behalf of the Board of Directors

K M MAMMEN

Chennai Chairman & Managing Director

03rd May, 2023 DIN: 00020202

21

ANNEXURE II TO THE BOARD’S REPORT

ANNUAL REPORT ON CSR ACTIVITIES FOR FINANCIAL YEAR ENDED 31ST MARCH, 2023

1. Brief outline on CSR Policy of the Company:

The CSR activities carried out by the Company are in accordance with the CSR Policy, as formulated by the CSR Committee and approved by the Board.

The broad objectives, as stated in the CSR Policy, includes supporting causes concerning healthcare, education, rural development, provide safe drinking

water, skill development, sports training, disaster management and environmental protection.

2. Composition of CSR Committee:

Sl. No. Name of Director Designation/Nature of Directorship Number of meetings

of CSR Committee

held during the year

Number of meetings of

CSR Committee attended

during the year

1 Mr. K M Mammen Chairman & Managing Director & Chairman of CSR

Committee

4 4

2 Mr. Arun Mammen Vice Chairman & Managing Director & Member of CSR

Committee

4 4

3 Mr. Rahul Mammen Mappillai Managing Director & Member of CSR Committee 4 4

4 Mr. Ranjit I Jesudasen Independent Director & Member of CSR Committee 4 4

3. Provide the web-link where Composition of CSR committee, CSR Policy and CSR projects approved by the board are disclosed on the website of the

company : https://www.mrftyres.com/investor-relations/corporate-social-responsibilty

4. Provide the executive summary along with the web link of Impact assessment of CSR projects carried out in pursuance of sub rule (3) of rule 8, if

applicable: Weblink : https://www.mrftyres.com/investor-relations/corporate-social-responsibilty

As per Rule 8(3) of the Companies (CSR) Policy Rules, 2014, an impact assessment is required to be carried for projects whose outlay exceeds `1 crore

after a period 12 months from the completion of the project. Accordingly impact assessment was carried out in respect of the MRF Pace Foundation and

MRF Institute of Driver Development for the financial year 2020-21. The executive summary in respect of these assessments are given below:-

Executive Summary of Impact Assessment Report

Pace Foundation: Cricket is a religion and the most followed sport in India. MRF Pace Foundation was established by MRF Limited, as an Academy

in 1988 to train pace bowlers, who eventually will get a chance to represent the country. This is the only exclusive pace academy in the world. Many

trainees have represented the country or state. Mr. Glenn McGrath came to Pace Foundation as trainee (under exchange programme). Eventually now,

he heads the academy as Director.

From the beginning of 2020-21, the Foundation’s activities were impacted by Covid Pandemonium. Despite the same, the Foundation continued its

training activities in a limited way by taking the support of digital platform to monitor training activities of wards, correcting, motivating and fine tuning

their abilities for betterment. These initiatives helped to keep the bowling skills of the trainees honed and thereby helped them get back to pre-COVID

levels of fitness and performance within a short time after COVID restrictions were eased and tournaments restarted.

Three trainees represented country in 2021 viz. Mr. Prasidh Krishna, Mr. Chetan Sakariya and Mr. Sandeep Warrier.

22

9 trainees represented various franchisees in the Indian Premier League in 2021 viz. Mr. K M Asif, Mr. Avesh Khan, Mr. Chetan Sakariya, Mr. Kaleel

Ahmed, Mr. Prasidh Krishna, Mr. Akash Singh, Mr. Sandeep Warrier, Mr. Basil Thampi and Mr. Kamalesh Nagarkoti.

Driver Development: Having understood the risk of road driving and encouraging safe driving for commercial vehicles, MRF Ltd. started an institute MRF

Institute of Driver Development (“MIDD”) in 1988. The objective was to improve the driving skills especially of commercial vehicle drivers. They lacked

basic awareness and etiquettes for safe driving despite having better road conditions and sophisticated vehicles.

From the beginning of 2020-21, MIDD could not conduct the regular courses due to lockdowns and Covid restrictions between March 2020 and October

2020. The new governmental regulations restricted the intake of students per course as all driving schools had to implement social distancing norms due

to Covid.

During 2020-21, 9 courses were conducted and 69 trainees were imparted training. The trainees benefited in terms of improved driving skills and

personal etiquette. The trainees displayed higher levels of confidence after the training. Their chances of employability also improved significantly.

5. (a) Average net profit of the company as per section 135(5) : `1456,60,56,631

(b) Two percent of average net profit of the company as per section 135(5) : ` 29,13,21,133

(c) Surplus arising out of the CSR projects or programmes or activities of the previous financial years : Not Applicable

(d) Amount required to be set off for the financial year, if any : Not Applicable

(e) Total CSR obligation for the financial year ((b)+(c)-(d)) : ` 29,13,21,133

6. (a) Amount spent on CSR projects (both Ongoing project and other than ongoing project): ` 16,56,88,195

(b) Amount spent in Administrative Overheads: ` 82,84,400

(c) Amount spent on Impact Assessment, if applicable: ` 9,08,128

(d) Total amount spent for the Financial Year ( (a) + (b) + (c) ): `17,48,80,723

(e) CSR Amount spent or unspent for the Financial Year:

Total Amount Spent for

the Financial Year

(in `)

Amount Unspent

Total Amount transferred to Unspent CSR

Account as per section 135(6)

Amount transferred to any fund specified under Schedule VII as per

second proviso to section 135(5).

Amount

(in `)

Date of transfer Name of the Fund Amount Date of Transfer

17,48,80,723 11,64,40,410 25.04.2023 NIL NA NA

(f) Excess amount for set off, if any: NIL

23

7. Details of Unspent Corporate Social Responsibility amount for the preceding three financial years:

Sl.

No

Preceding Financial

Year(s)

Amount transferred

to Unspent CSR

Account u/s 135 (6)

( In `)

Balance amount

in unspent CSR

account u/s 135(6)

(In `)

Amount spent in the

reporting financial

year ( In `)

Amount transferred to any fund specified

under schedule VII as per section 135(5),

if any

Amount remaining

to be spent in

succeeding financial

years (In `)

Deficiency If any

Amount (In `)

Date of transfer

1 2021-22 16,30,55,986 7,21,40,000 9,09,15,986 NIL NA 7,21,40,000 NA

2 2020-21 NIL NIL NIL NIL NA NIL NA

3 2019-20

NIL

NIL NIL NIL

NA

NIL

NA

8. Whether any capital assets have been created or acquired through Corporate Social Responsibility amount spent in the financial year: Yes.

If yes, enter the number of capital assets created/ acquired – 29 nos.

Furnish the details relating to such assets so created or acquired through corporate social responsibility amount spent in the Financial Year:

Sl.

No.

Short Particulars of the Asset(s)

[including complete address and location of

the property]

PIN code of

the Property/

Assets

Date of

Creation/

Acquisition of

Assets

CSR amount

spent

(In `)

Details of Entity or Authority or

Beneficiary of the registered owner

CSR Registration

number, if applicable

Name Registered Address

1

School Bus.

Satguru Foundations, Educational

Institute, Kundaim, Ponda, Goa.

403115 24.03.2023 25,01,673 CSR00007732

The Principal,

Satguru

Foundations

Satguru Foundations ,

Reg. No.1083/Goa/2011,

Kundaim Industrial Estate,

Kundaim, Ponda, Goa,

Pin-403115, India.

2

Construction of Building.

(Lower Ground Floor)

Sai Nursing Institute, Near PHC,

Bicholim Taluka, Sanquelim, Goa, India

403505 17.01.2023 94,70,000 CSR00016606

The Director Sai

Nursing Institute

Director, Sai Nursing

Institute, Sanquelim, Goa,

Pin-403505.

India

3

Vehicle, Kichen Appliances, Furniture

& Digital Attendance Register.

MRF Pace Foundation, Plot No. 3144,

2nd Street, AH Block, Anna Nagar,

Chennai.

600040 23.03.2023 10,69,055 CSR00001396 The Trustee

MRF Foundation, No.114,

Greams Road, Chennai

600006, Tamil Nadu, India.

4

Medical Equipment.

Mundakapadam Mandiram Hospital,

Manganam, Kalathilpady, Puthuppally

Road, Kottayam, Kerala.

686018 22.12.2022 15,00,000 CSR00006814 Chairman

Mundakapadam Mandirams

Society, Manganam PO,

Kottayam – 686018

Kerala State, India.

24

5

Ambulance.

Dr.Roque Ferreiras Memorial Hospital,

Vascoda Gama, Verna S.O, Sacete,

Goa, India

403722 23.01.2023 17,41,334 CSR00054656

President,

Dr.Roque Ferreiras

Memorial Hospital

Congregation of SRS of

St. Joseph of Cluny, Cluny

Convent, Vascoda Gama,

Verna S.O, Sacete, Goa,

Pin-403722, India

6(a)

E-Auto Rickshaw for imparting

Training to Women Drivers.

Government Automobile Workshops,

Gnanapragasam Nagar, Saram,

Puducherry, Tamil Nadu, India.

605013

16.01.2023 6,70,330 NA

Transport

Commissioner

The Transport

Commissioner, Govt. of

Puducherry, 100 feet Road,

Mudaliyarpet, Puducherry

605004, India.

6(b)

E-Auto Rickshaw for imparting training

to Women Drivers.

Government Automobile Workshop,

No. 7, Kirambuthottam Street,

Karaikal, Puducherry, India

609602

7(a)

Medical Equipment.

Government Hospital Arakonam,

Ranipet District, Tamil Nadu.

631001

08.05.2022 18,61,875 NA

Chief Medical

Officer

The Chief Medical Officer,

Government Hospital,

Gandhi Road, Arakonam,

Pin-631001, Tamil Nadu,

India.

7(b)

Medical Equipment.

Govt. Primary Health Centre,

Banavaram, Ranipet District,

Tamil Nadu.

632505

8

Motorized Wheelchair.

Rehabilitation Institute, Department of

Physical Medicine & Rehabilitation,

Christian Medical College, Vellore.

Tamil Nadu, India

632002 25.04.2022 10,46,450 CSR00001924

Head of

Department-

Department of

Physical Medicine

& Rehabilitation

Head of Department,

Department of Physical

Medicine & Rehabilitation,

Christian Medical College,

Ida Scudder Road, Vellore.

632002, Tamil Nadu, India.

9

Smart Class Room Equipment.

Tagore Educational Institute, Surla

Village, Kothambi, Amona, Bicholim,

North Goa, Goa, India

403105 28.03.2023 7,13,438 NA Chairman

Tagore Educational Institute,

Kothambi-Surla Village,

Kothambi, Amona, Bicholim

District, North Goa, Goa,

Pin-403105, India

25

10

Construction of School Building

including Computer Lab, Dining Hall

& Turf playground.

KG to PG School, Gambhiraopet,

Rajanna, Siricilla Dist, Karimnagar,

Telangana State, India.

505301 15.11.2022 4,00,00,000 NA The Principal

KG to PG School,

Gambhiraopet, Rajanna,

Siricilla District,

Pin-505301,

Telangana, India

11

Computer Systems.

Indira Gandhi Medical College &

Research Institute, Vazhudavur Road,

Kadthirkaman, Puducherry, India.

605009 29.03.2023 27,53,530 NA Director

Director, IGMC & RI, Govt.

of Puducherry Institution,

Vazhudavur Road,

Kadthirkaman,

Puducherry-605009, India

12

Drinking Water Facility.

Venkata Subba Reddiar Government

Girls Higher Secondary School,

Maducarai, Puducherry, India

605105 08.03.2023 1,77,281 NA Vice Principal

Venkata Subba Reddiar

Government Girls Higher

Secondary School,

Maducarai, Puducherry,

Pin-605105, India

13

Construction of Class Rooms.

Government Arts and Science College

For Women, Veppur, Perambalur Dist,

Tamil Nadu, India.

621717 02.02.2023 85,00,000 NA

Regional Joint

Director of

College Education

Regional Joint Director

of Collegiate Education,

Khajamlai, Trichy 620023,

Tamil Nadu, India.

14

96 CCTV Cameras in Arakonam Sub-

division.

Deputy Superintendent of Police,

Arakonam Sub-Division, Arakonam,

Ranipet District, Tamil Nadu, India

631001 23.08.2022 13,69,824 NA

Assistant

superintendent of

Police.

Assistant Superintendent of

Police, Arakonam Sub-

Division, Arakonam-631001,

Ranipet District,

Tamil Nadu, India.

15

Computer Systems & Accessories,

Tables, Benches, Construction of

toilets and bore-well.

Government Higher Secondary School,

Kumbinipet, Arakonam Taluka,

Ranipet District. Tamil Nadu, India.

631003 21.03.2023 16,08,472 NA Head Master

Government Higher

Secondary School,

Kumpinipet-631003,

Arakonam. TK. Ranipet

District, Tamil Nadu, India.

16

100 CCTV Cameras & its Surveillance

System.

Police Station, Sadashivpet,

Sangareddy District, Telangana, India

502291 21.03.2023 36,26,140 NA Inspector of Police

Inspector of Police, S.H O ,

Sadasivpet P S, Sangareddy-

District, Telangana State,

Pin-502291, India

26

17

Office Equipment & Electronic

Equipment.

Police Office Control Room, Deputy

Superintendent of Police Office,

Arakonam Sub-Division, Arakonam,

Ranipet District. Tamil Nadu, India

631001 25.03.2023 6,42,876 NA

Assistant

superintendent of

Police

Assistant Superintendent of

Police, Arakonam Sub-

Division, Arakonam-631001,

Ranipet District,

Tamil Nadu, India

18

College Bus.

Ponda Educational Society, Farmagudi,

Ponda, Goa, India

403401 03.02.2023 19,37,451 NA

Secretary, Ponda

Education Society

Ponda Educational Society,

Farmagudi, Ponda,

Pin-403401, Goa, India

19

Computer Systems & Furniture.

Tara Government College

(Autonomous), Sangareddy District,

Jogipet, Sangareddy Road, Medak,

Telangana, India.

502001 28.03.2023 33,48,250 NA

The Principal,

Tara Government

College

Tara Government College

(Autonomous), Sangareddy

District, Jogipet Sangareddy

Road, Medak,

Telangana 502001, India

20

Smart Class Room Equipment.

Govt. Primary School, Maducaraipet.

Zone- IV, Villianur, Puducherry, India.

605105 23.03.2023 6,99,083 NA Head Mistress

Head Mistress,

Subramani Govt. Primary

School, Maducaraipet,

Zone-IV, Villianur,

Puducherry-605105, India.

21

Medical Equipment.

Government Primary Health Centre,

Thuraiyur Road, Super Nagar,

Perambalur, Tamil Nadu., and 19 other

Primary Health Centres in Perambalur

District.

621212 16.02.2023 4,95,600 NA

Deputy Director of

Medical Services

(TB)

Deputy Director of Medical

Services (TB), Government

Primary Health Centres-

Peramblur District,

Pin -621212, Tamil Nadu,

India

22

Mobile Toilet Facility and Rectification

of Rain Water Gutter.

Upper Bazar, Ponda Market, Ponda

Municipality, Goa, India.

403401 17.01.2023 6,67,608 NA

Municipal

Commissioner

Municipal Commissioner,

Ponda Municipal Council,

Upper Bazar, Ponda Market.

Pin-403401

23

Garbage Collection Vans.

Greater Chennai Corporation,

Zone-7, (Ambattur) Division-88,

No.536,Thiruvalluvar Road, Ambattur,

Chennai, Tamil Nadu, India.

600053 03.03.2023 12,93,798 NA

The

Commissioner,

Greater Chennai

Corporation

The Commissioner, Greater

Chennai Corporation, Ripon

Building, Chennai, 600003,

Tamil Nadu, India.

24

Battery Operated Garbage Disposal

Vehicle.

Tiruttani Municipality, Tiruttani, Tamil

Nadu, India.

631209 10.11.2022 6,10,500 NA

Municipal

Commissioner

Municipal Commissioner,

Tiruttani Municipality,

Tiruttani-631209, Tiruvallur

District, Tamil Nadu, India.

27

25

Steel Barricade Trollies.

Ponda Police Station, Usgao

Panchayat, Goa, India

403406 29.07.2022 3,87,335 NA Inspector of Police

Ponda Police Station,

Usgao Panchayat, Goa,

Pin-403406, India

26

Computer Systems & Printer.

Puducherry Fire Station, Subbaiya

Salai, (Beach Road), Puducherry and

9 other offices of Fire Department in

Puducherry.

605001 20.12.2022 6,77,320 NA

Divisional Fire

Officer

Divisional Fire Officer,

Fire Service Department,

Puducherry, 607402, India.

27

Computers Systems & Laser Printer.

Office of the Commissioner,

Nettapakkam Commune Panchayat,

Nettapakkam, Puducherry, India

605106 03.08.2022 1,38,969 NA

Panchayat

Commissioner

Commissioner, Office of the

Panchayat Commissioner,

Nettapakkam Commune

Panchayat, Nettapakkam,

Puducherry-605106, India

28

Setting up of Public Park (Civil &

Horticultural Work).

Arakonam Municipality, Jothi Nagar,

Near Taluk Office Arakonam, Ranipet

District, Tamil Nadu, India.

631001 10.04.2022 47,87,552 NA

Municipal

Commissioner

Municipal Commissioner,

Arakonam Municipality,

Jothi Nagar, Near Taluk

Office Arakonam,

Pin-631001, Ranipet District,

Tamil Nadu, India

29

Construction of Dining Room

including Furniture & Equipment.

Office of The Superintendent of Police,

Perambalur Dist. Perambalur, Tamil

Nadu, India.

621212 06.12.2022 29,71,713 NA

Superintendent of

Police

Superintendent of Police, SP

Office, Dist. Collectorate,

Perambalur Dist. Perambalur

621212,Tamil Nadu, India

9. Specify the reasons, if the company has failed to spend two percent of the average net profit as per sub-section (5) of section 135.

The shortfall in CSR expenditure was on account of delay in implementation of projects and the project duration extending beyond one financial year

as per their original schedule of implementation. The unspent amount has been transferred to the Unspent CSR Account and the same will be spent in

accordance with the CSR rules on the ten Ongoing projects.

K M MAMMEN ARUN MAMMEN

Chairman and Managing Director Vice Chairman & Managing Director

Chennai and Chairman of CSR Committee and Member of CSR Committee

03rd May, 2023 DIN: 00020202 DIN: 00018558

28

ANNEXURE III TO THE BOARD’S REPORT

FORM NO. MR - 3

SECRETARIAL AUDIT REPORT

FOR THE FINANCIAL YEAR ENDED 31ST MARCH, 2023

(Pursuant to Section 204(1) of the Companies Act, 2013 and

Rule 9 of the Companies (Appointment and Remuneration of

Managerial Personnel) Rules, 2014)

To,

The Members,

MRF Limited, Chennai - 600 006.

I have conducted the secretarial audit of the compliance of applicable

statutory provisions and the adherence to good corporate practices by

MRF LIMITED, Chennai – 600 006 (CIN: L25111TN1960PLC004306)

(hereinafter called the Company), in a manner that provided me

a reasonable basis for evaluating the corporate conducts/statutory

compliances and I am expressing my opinion thereon.

Based on my verification of the Company’s books, papers, minutes books,

forms and returns filed and other records maintained by the company

and also the information provided by the company, its officers, agents

and authorized representatives during the conduct of secretarial audit,

I hereby report that in my opinion, the Company has, during the audit

period covering the financial year ended 31st March, 2023 has complied

with the statutory provisions listed hereunder and also that the Company

has proper Board processes and compliance mechanism in place to the

extent and in the manner subject to the reporting made hereunder.

I have examined the books, papers, minutes books, forms and returns

filed and other records maintained by the Company for the financial year

ended 31st March, 2023 according to the provisions of:

(i) The Companies Act, 2013 (the Act) and the rules made thereunder;

(ii) The Securities Contracts (Regulation) Act, 1956 and the rules made

thereunder;

(iii) The Depositories Act, 1996 and the Regulations and bye-laws

framed thereunder;

(iv) Foreign Exchange Management Act, 1999 and the rules and

regulations made thereunder to the extent of Foreign Direct

Investment, Overseas Direct Investment and external commercial

borrowings;

(v) The following Regulations and Guidelines prescribed under the

Securities and Exchange Board of India Act, 1992 (wherever

applicable):

a) The Securities and Exchange Board of India (Substantial Acquisition

of Shares and Takeovers) Regulations, 2011;

b) The Securities and Exchange Board of India (Prohibition of Insider

Trading) Regulations, 2015;

c) The Securities and Exchange Board of India (Issue of capital and

disclosure requirements) Regulations, 2018;

d) The Securities and Exchange Board of India (Issue and Listing of

Non-Convertible Securities) Regulations, 2021;

e) The Securities and Exchange Board of India (Registrars to an issue

and Share Transfer Agents) Regulations, 1993 regarding the Act and

dealing with client;

f) The Securities and Exchange Board of India (Delisting of Equity

Shares) Regulations, 2021; and

g) The Securities and Exchange Board of India (Buy Back of Securities)

Regulations, 2018.

I have also examined compliance with the applicable clauses of the

following:

1. Secretarial Standards issued by the Institute of Company Secretaries

of India;

2. The Listing Agreements entered into by the Company with Bombay

Stock Exchange Ltd. and National Stock Exchange of India Ltd.;

3. The Securities and Exchange Board of India (Listing Obligations and

Disclosure Requirements) Regulations, 2015.

During the period under review, the Company has complied with the

provisions of the Act, Rules, Regulations, Guidelines, Standards etc.,

mentioned above.

I have reviewed the systems and mechanisms established by the Company

for ensuring compliance under applicable Acts, Rules, Regulations and

other legal requirements of the Central, State and other Government and

local authorities concerning the business and affairs of the Company

categorized under the following major heads/groups, and report that there

are adequate systems and processes in the Company, commensurate with

the size and operations of the Company to monitor and ensure compliance

with applicable laws, rules, regulations and guidelines:

29

1. Factories Act, 1948;

2. Labour laws and other incidental laws related to labour and

employees appointed by the Company including those on

contractual basis as relating to wages, gratuity, prevention of sexual

harassment, dispute resolution, welfare, provident fund, insurance,

compensation etc.;

3. Industries (Development & Regulation) Act, 1951;

4. The Rubber Act, 1947 & Rubber Rules, 1955;

5. Acts and Rules relating to consumer protection;

6. Acts and Rules prescribed under prevention and control of pollution;

7. Acts and Rules relating to environmental protection and energy

conservation;

8. Acts and Rules relating to hazardous substances and chemicals;

9. Acts and Rules relating to electricity, fire, petroleum, motor vehicles,

explosives, boilers etc.;

10. Acts and Rules relating to protection of IPR;

11. Acts and Rules relating to the industry to which this Company

belongs;

12. Other local laws as applicable to various plants and offices.

I further report that –

The Board of Directors of the Company is duly constituted with proper

balance of Executive Directors, Non-Executive Directors, Independent

Directors and Women Directors in compliance with Rules and provisions

of the Companies Act, 2013, the regulations and directives of Securities

Exchange Board of India (SEBI).

Special Resolutions were passed by Postal Ballot by voting through

electronic means on 21st December 2022 for appointment of the following

Independent Directors:

Sl. No. DIN Name of the Director Designation

1. 09757469 Mr Vikram Taranath

Hosangady

Independent Director

2. 00141701 Mr Ramesh Rangarajan Independent Director

3. 00238735 Mr Dinshaw Keku

Parakh

Independent Director

Special Resolutions were passed by Postal Ballot by voting through

electronic means on 31st March 2023 for appointment of the following

Independent Directors:

Sl.No DIN Name of the Director Designation

1. 00174675 Mr. Arun Vasu Independent Director

2. 01799153 Mr. Vikram Chesetty Independent Director

3. 00385082 Mr. Prasad Oommen Independent Director

Adequate notice was given to all directors on schedule of the Board

Meetings, agenda and detailed notes on agenda were sent at least seven

days in advance, and a system exists for seeking and obtaining further

information and clarification on the agenda items before the meeting and

for meaningful participation at the meeting. All decisions carried are duly

recorded in the minutes of the Meeting.

The Competition Commission of India (“CCI”) had on 2nd February,2022

released its order dated 31st August, 2018, imposing penalty on certain

Tyre Manufacturers including the Company and also the Automotive Tyre

Manufacturers’ Association, concerning the breach of the provisions of

the Competition Act 2002, during the year 2011-12. A penalty of `622.09

Crores was imposed on the Company. The appeal filed by the company

before National Company Law Appellate Tribunal (NCLAT) has been

disposed of by remanding the matter to CCI for review after hearing the

parties. In February 2023, CCI has filed an appeal against the order of

NCLAT before Hon’ble Supreme Court and the same is pending disposal.

I further report that there are adequate systems and processes in the

Company commensurate with the size and operations of the Company to

monitor and ensure compliance with applicable laws, rules, regulations

and guidelines.

K ELANGOVAN

Company Secretary in Practice

Place: Chennai FCS No.1808, CP No. 3552, P R No. 892/2020

Date: 03rd May, 2023 UDIN: F001808E000217463

30

This report is to be read with my testimony of even date which is annexed

as Annexure A and forms an integral part of this report.

Annexure A

To,

The Members

MRF Limited, Chennai 600006.

My report of even date is to be read along with this letter.

1. Maintenance of secretarial record is the responsibility of the

management of the company. My responsibility is to express an

opinion on these secretarial records based on our audit.

2. I have followed the audit practices and processes as were appropriate

to obtain reasonable assurance about the correctness of the contents

of the Secretarial records. The verification was done on test basis to

ensure that correct facts are reflected in secretarial records. I believe

that the processes and practices I followed provide a reasonable

basis for my opinion.

3. I have not verified the correctness and appropriateness of financial

records and Books of Accounts of the company.

4. Wherever required, I have obtained the Management representation

about the compliance of laws, rules and regulations and happening

of events etc.

5. The compliance of the provisions of Corporate and other

applicable laws, rules, regulations, standards is the responsibility

of management. My examination was limited to the verification of

procedures on test basis.

6. The Secretarial Audit report is neither an assurance as to

the future viability of the company nor of the efficacy or

effectiveness with which the management has conducted the

affairs of the company.

K ELANGOVAN

Company Secretary in Practice

Place: Chennai FCS No.1808, CP No. 3552, P R No. 892/2020

Date: 03rd May, 2023 UDIN: F001808E000217463

31

ANNEXURE IV TO THE BOARD’S REPORT

Form No. AOC–2

(Pursuant to clause (h) of sub-section (3) of section 134 of the Act and Rule 8(2) of the Companies (Accounts) Rules, 2014)

Form for disclosure of particulars of contracts/arrangements entered into by the Company with related parties referred to in sub-section (1) of section 188

of the Companies Act, 2013 including certain arms length transactions under third proviso thereto.

1. Details of contracts or arrangements or transactions not at arms length basis-

There were no contracts or arrangements or transactions entered into during the year ended 31st March, 2023, which were not at arms length basis.

2. Details of material contracts or arrangement or transactions at arms length basis-

The details of material contracts or arrangements or transactions at arms length basis for the year ended 31st March, 2023 is as follows:

(a) Name(s) of the related party & Nature of Relationship: MRF SG PTE. LTD (Wholly Owned Subsidiary of the Company).

(b) Nature of transactions: Purchase of raw materials.

(c) Duration of transactions: April 2022-March 2023.

(d) Salient terms of transactions including transactions value: `1970.03 Crores. Price - Transactional Net Margin Method (TNMM), Payment – As per

applicable credit terms.

(e) Date of approval by the board: Since these related party transactions are in the ordinary course of business and are at arms length basis, approval of

the Board is not required. Necessary approvals were granted by the Audit Committee on 10th February, 2022, 10th May, 2022, 9th August, 2022

and 8th November, 2022.

(f) Amount paid in advance: Nil.

On behalf of the Board of Directors

K M MAMMEN

Chennai Chairman & Managing Director

03rd May, 2023 DIN: 00020202

32

ANNEXURE V TO THE BOARD’S REPORT