1

PV O&M Cost Model and Cost

Reduction

Andy Walker, NREL

2017 Photovoltaic Module Reliability Workshop

Lakewood, Colorado

February 28, 2017

NREL/PR-7A40-68023

NREL is a national laboratory of the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy, operated by the Alliance for Sustainable Energy, LLC

A full report was published in June 2020. See https://www.nrel.gov/docs/fy20osti/74840.pdf.

2

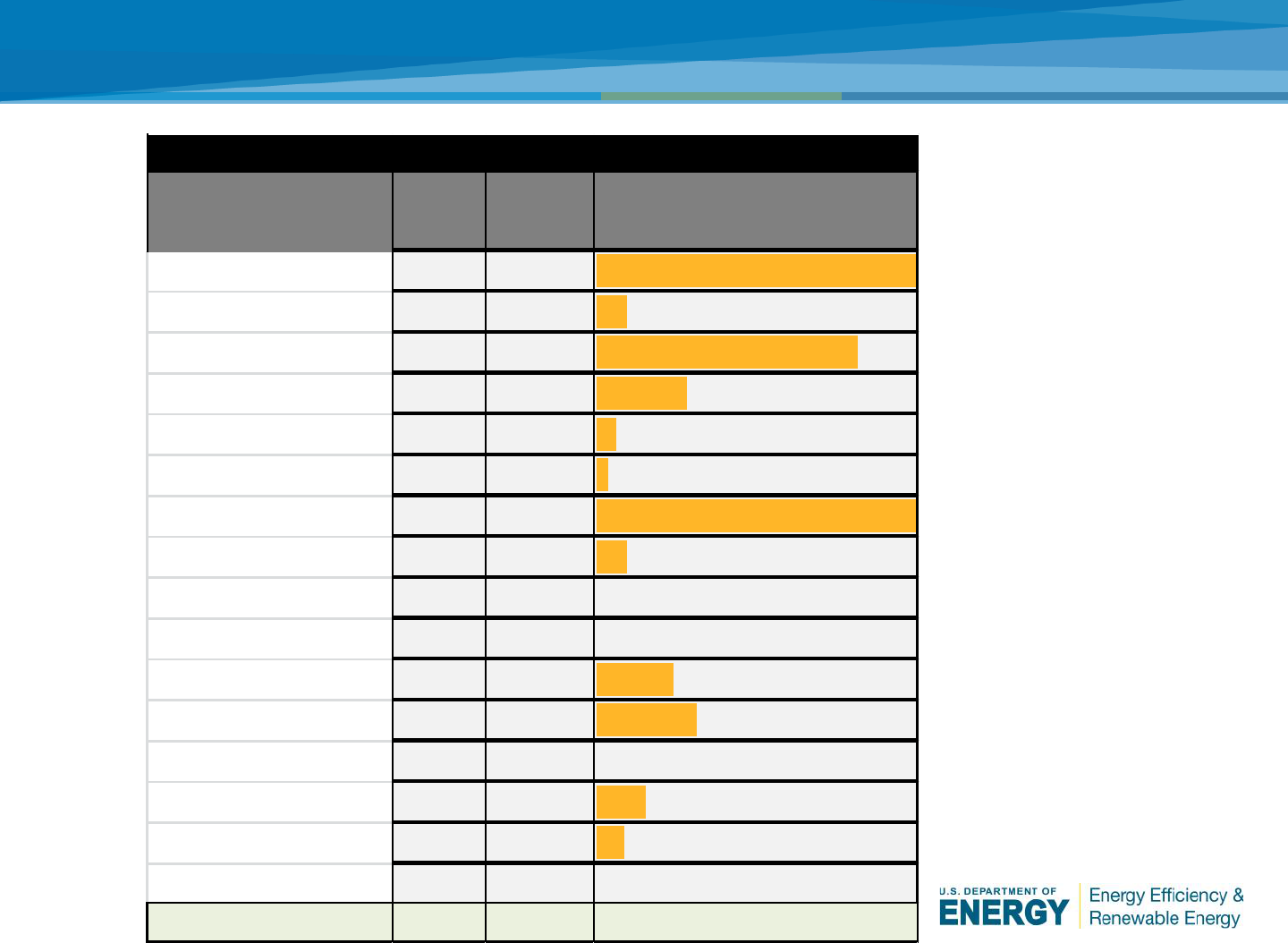

Classifications Involving PV O&M Costs

Category

Administration

Operations

Design

Preventive

Corrective

Decommission

Component

AC Wiring

Asset Management

Cleaning/Veg

DC Wiring

Documents

Electrical

Inverter

Mechanical

Meter

Monitoring

PV Array

PV Module

Roof

Tracker

Transformer

Environmental Conditions

Snow

Humid

Hot

Pollen

High Wind

Hail

Salt Air

Diesel Soot

Industrial Emissions

Bird Populations

Construction Site Nearby

Sand/Dust

High Insolation

Service Category

Administrator

Cleaner

Designer

Inspector

Inverter specialist

Journeyman

electrician

Master electrician

Mechanic

Network/IT

Pest control

PV module/array

Specialist

Roofing

Structural engineer

Mower/Trimmer

Utilities locator

3

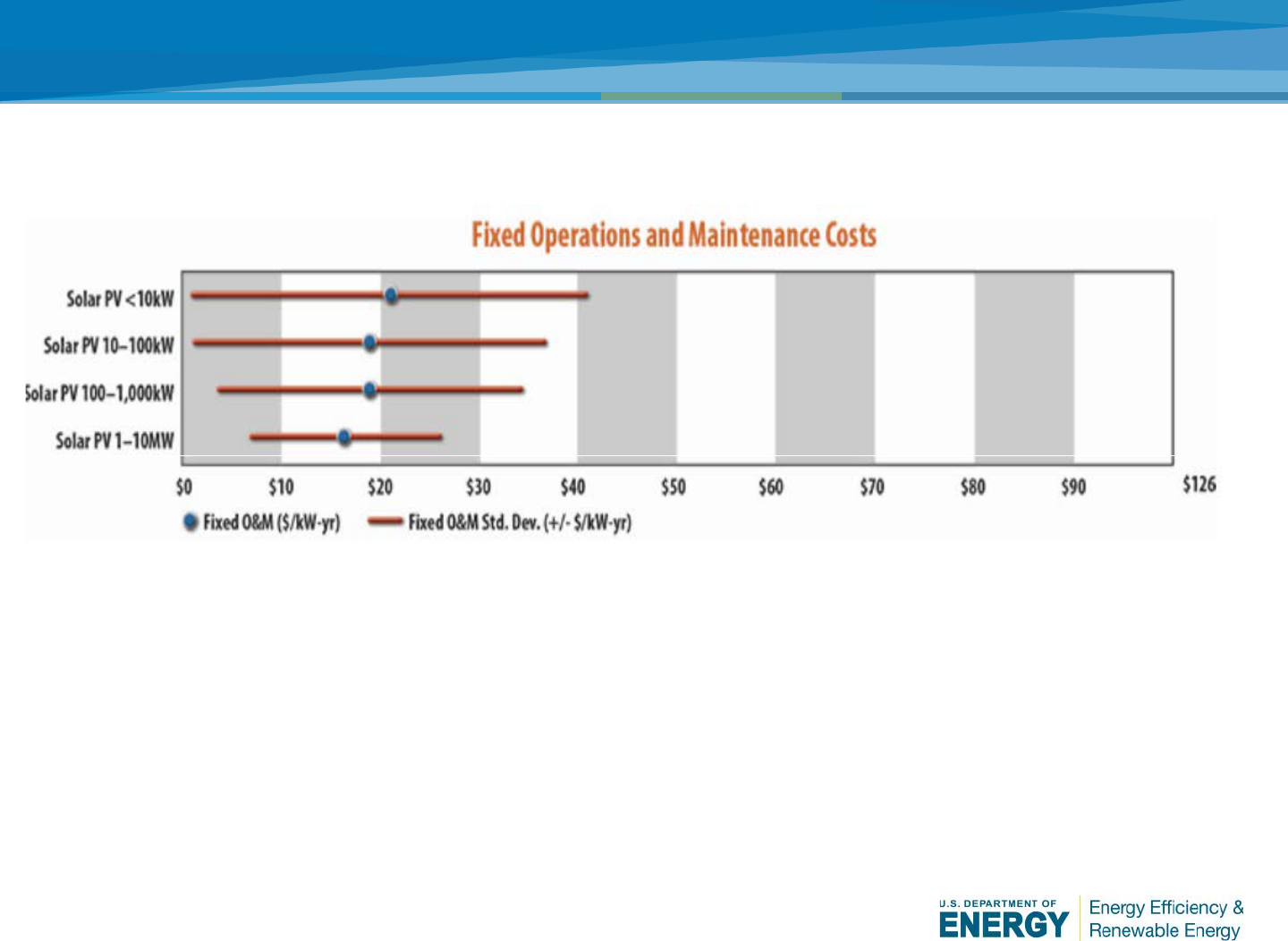

Heuristic PV O&M Costs

Source: FEMP Cost and Performance Matrix , http://www.nrel.gov/analysis/tech_cost_om_dg.html

Annual Technology Baseline, http://www.nrel.gov/docs/fy16osti/66944.pdf

NREL Annual Technology Baseline

• $16.7/kWDC/yr for Utility-Scale

• $20/kWDC/yr for Residential

There is a wide range in the reported data from $0 to $110/kW/year

Often a single annual value is reported per kW or per kWh.

4

The PV O&M Working Group concentrated on three estimates

related to the cost of delivering a PV O&M Program:

o Annual Cash Flows

o Net Present Value, LCOE

o Reserve Account

The working group has developed a PV O&M Cost Model that can

be used to estimate O&M costs.

Estimating PV O&M Costs

5

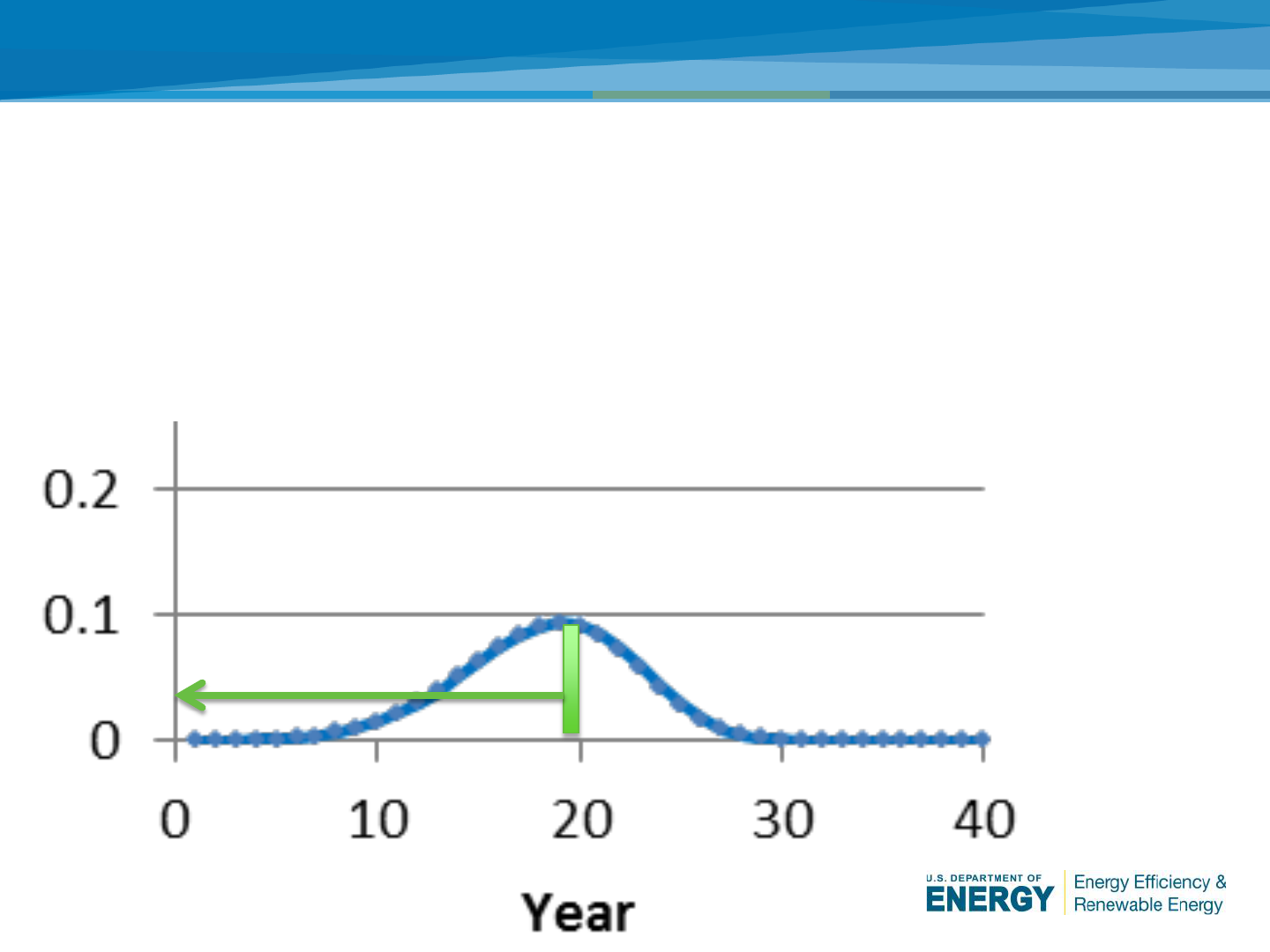

Weibull Failure Distribution

Q, the probability that a component will fail in any given year, y, is

calculated according to the Weibull probability density function.

The equation for the Weibull probability density function is:

=

(−1)

(

−

)

α = the “shape factor” of the distribution, indicating how spread out the probability of

failure is over the years,

β = the “scale factor” of the distribution, indicating over which years of the analysis

period the bulk of the failure distribution lies.

Parameters, α and β, are obtained from heuristic failure data

PV ROM database of failure and reliability data; Sandia National Laboratory.

Source: http://reliawiki.org/index.php/The_Weibull_Distribution

MS Excel function

=WEIBULL.DIST(y,α,β,FALSE).

6

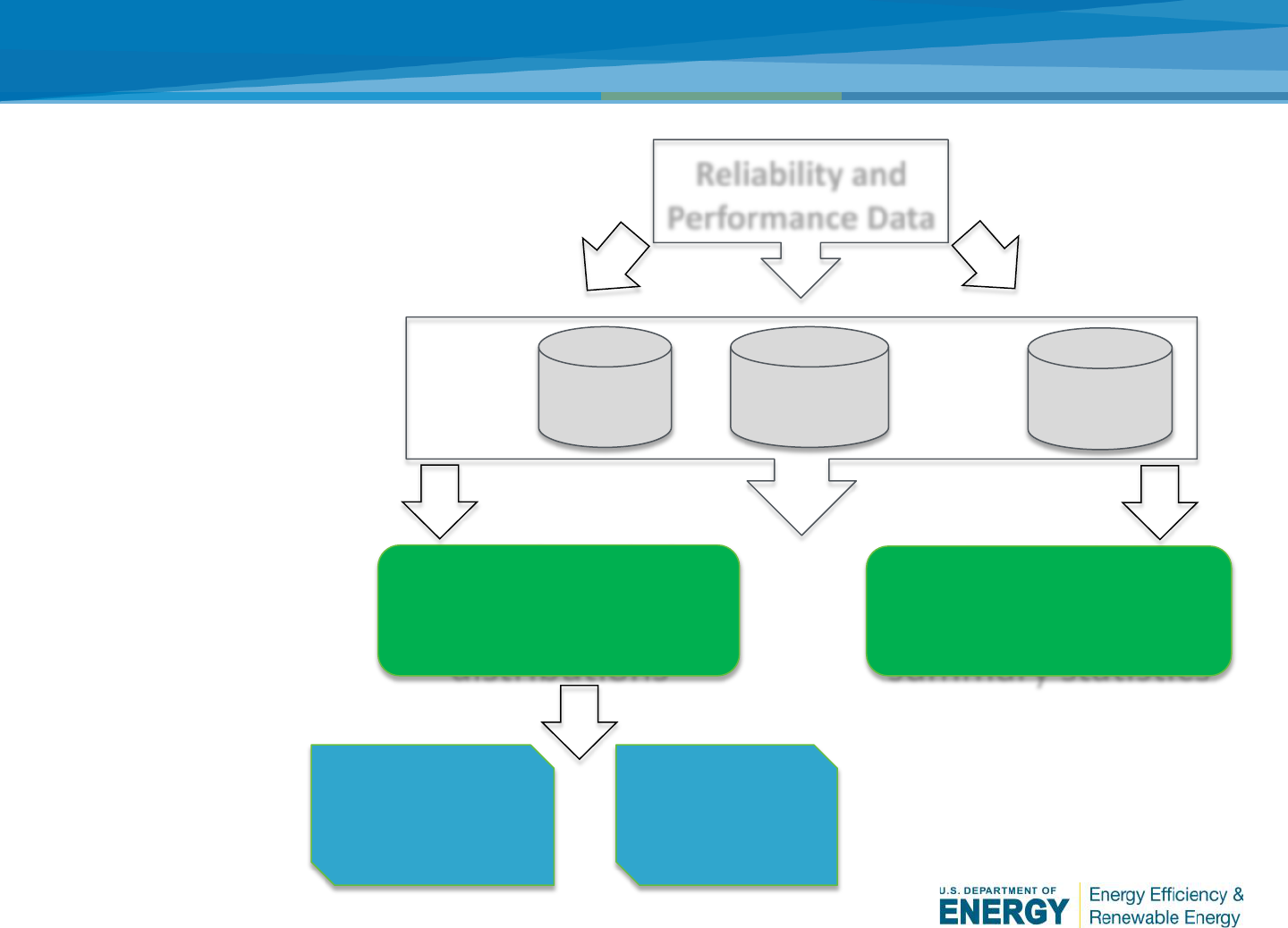

Sandia’s General Process for Evaluating Reliability Impacts

PVROM

Event

Database

Event

Logs

Data

Collection &

Storage

Sandia

Provided

Owner

Provided

Data

Analysis

Reliasoft tools for

reliability

distributions

Other tools for

reliability data

summary statistics

PV O&M

Cost Model

Data

Application

and Further

Analysis

PV

Performance

Model

Raw Data

Generation

Reliability and

Performance Data

Source: Geoff Klise, Sandia National Laboratories

7

Net Present Value of Replacement Cost

Q=failure probability

Replacement cost inflated to year t

Discounted to

present value

C

replacement

= Cost to replace Component in year 1

Q= probability of failure of component in each year t

d=discount rate (%/year)

i=inflation rate (%/year)

t=number of year

Present Value=C

replacement

x Q x (1+i)^t / (1+d)^t

8

Calculation of Reserve Account - Background

• Weibull distribution of failure gives us a good estimate of life-cycle

cost and levelized cost of energy (LCOE), but the method spreads

the costs over the years and show a rather uniform average cost

per year.

• Financiers are asking for a tool that calculates “maximum

exposure”; in other words, what dollar amount of a “reserve

account” or “line of credit” would a bank offer to sell to a

project?”

• Reserve account is calculated for each year of the analysis period.

9

Definition of Terms

• P= the probability that a component will not fail in any

giv

en year, specific to that year only according to the

Weibull distribution of component failure.

• Q= the probability that a component will fail in the same

y

ear;

• (P+Q)=1

• R= the desired probability that the reserve account will

be

sufficient to pay for required replacements in that

year.

• N=the number of a certain type of component (for

ex

ample N=10 inverters, N=500 combiner boxes, or

N=50,000 PV modules)

10

Start With a Simple Example…

Consider two inverters:

N=2

Replacement Cost (Year 1):

C

replacement

=$10,000 each

Weibull Failure Distribution:

Mean Interval (years) β=20

Shape Factor α=5.0

In year 20:

P = probability of non-failure

P = 0.908

Q = probability of failure

Q = 0.092

Weibull distribution

=WEIBULL.DIST (Year, Shape Factor, Mean Interval)

11

Mind Your P’s and Q’s…

• Spare in Reserve for NEITHER of the two inverters:

Reserve Account: $0

P

1

P

2 =

P^N=(0.908)^2=0.824 (you get this level of

availability for free)

• Spare in Reserve for EITHER ONE of the two inverters:

Reserve Account=$10,000

P

1

P

2 +

P

1

Q

2

+ P

2

Q

1

= 0.824+(0.908*0.092)* 2 =0.991

• Spares in reserve for BOTH of the inverters:

Reserve Account= $20,000

P

1

P

2 +

P

1

Q

2

+ P

2

Q

1

+ Q

1

Q

2

=0.824+0.300+ (0.092)^2=1.00

• So in this simple example; the result would be “within a

99.1% chance your maximum exposure any year will be less

than the cost of one inverter”, or $10,000.

• Notice that if we raise the desired probability from 0.99 to

0.999 (three nines), then our maximum exposure would be

the cost of two inverters in the year, or $20,000.

• The cost model is coded such that the desired probability is

an input, with a default of 0.95, and the calculation returns

the required amount of Reserve Account

Desired

Probability

that

Reserve

Account is

Sufficient

Reserve

Account

0.824 $0

0.991 $10,000

1.000 $20,000

12

General Polynomial Expansion

Binomial Theorem, 1666, Sir Isaac Newton

(

P+Q)=1

Total number of components = N

Number of components funded in reserve account=n

(

P+Q)

N

= 1

P

N

+ NP

N-1

Q + N(N-1)P

N-2

Q

2

/2! +….+ Q

N

=1

Add

up the first n+1 terms to find the probability that n components will be

operational (1<n<N).

Polynomial Expansion form changes with N, and computationally intense to

evaluate at large values of N

13

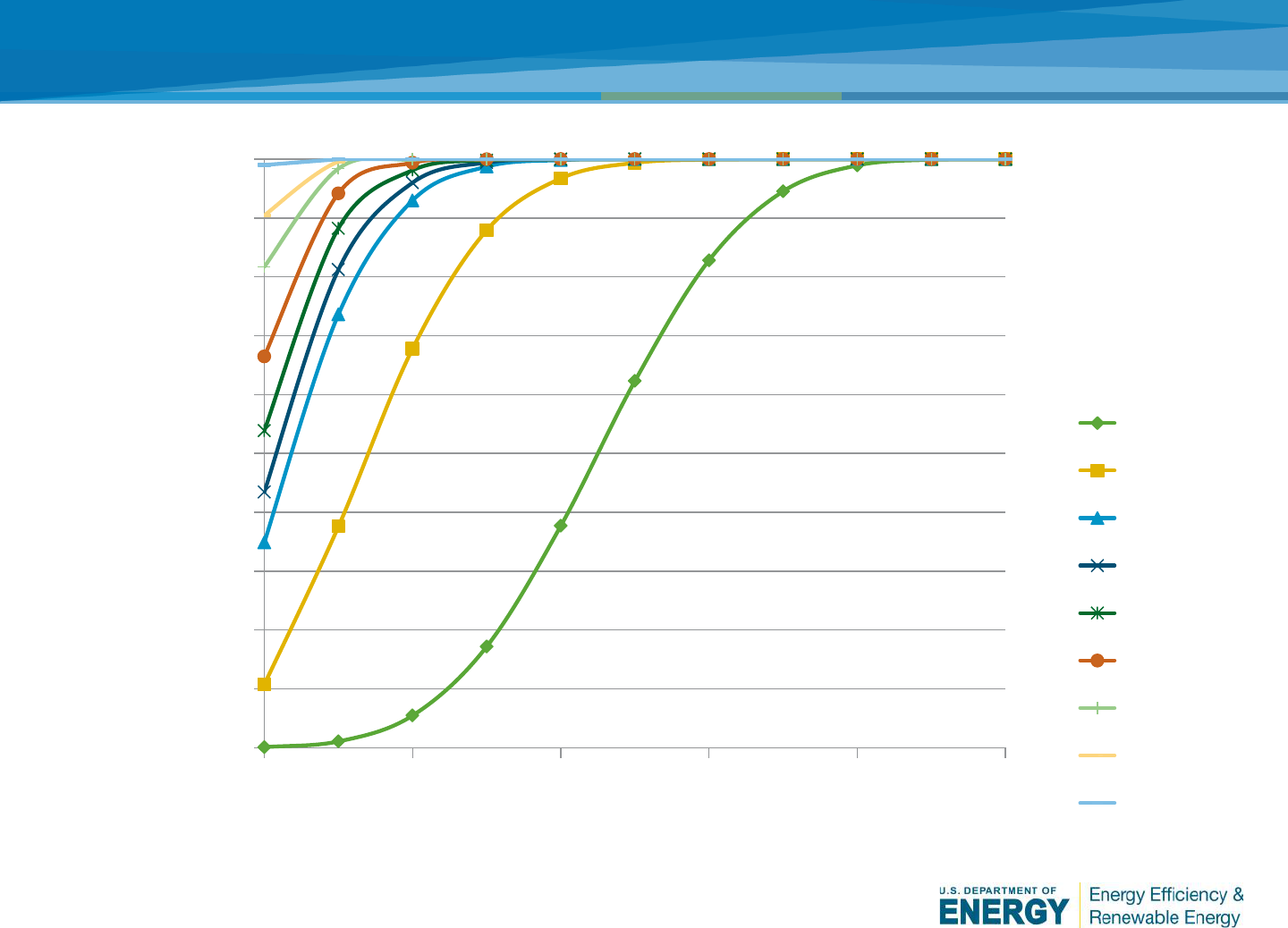

Reserve account graph

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

0 0.2 0.4 0.6 0.8 1

R=probability that reserve account will be

sufficient to cover replacements of a

component

n/N=fraction of total number of a component covered by reserve

account

0.5

0.2

0.1

0.08

0.06

0.04

0.02

0.01

0.001

Q=Probability

that each of a

component will

fail in a given

year; from failure

distribution

14

Example Calculation of Reserve Account

In this example we consider 10 components, each with a replacement cost of $1000 in a

given year, and with a Weibull failure probability of Q=0.05 in this given year.

The desired probability that the reserve account will be sufficient is R=0.999 (99.9%

certainty).

INPUTS

N= 10

C

replacement

= $1,000

Q= 0.05

R= 0.999

OUTPUTS

Required n/N=0.303 (required fraction of total number of component covered by

reserve account in order to achieve desired probability that reserve account will be

sufficient in a given year)

C reserve account = $3,030 (amount in reserve account for this type of component in

this given year)

The resulting dollar amount to keep in

the reserve account to cover failure of

this component in the given year is

(0.303)*(10)*($1000) or $3,030.

15

Implementation of NPV and Reserve Account in Cost Model

Inputs

Number of Inverters: 2

Replacement Cost (each): $10,000

Desired Confidence that Reserve

Account Sufficient: 0.900000

Mean Interval (years): 20.00

Weibull Shape Factor: 5.00

Analysis Period: 25 years

Discount Rate: 7.00% per annum

Inflation Rate: 2.00% per annum

Continue example of two inverters

Outputs

Net Present Value of Replacement Costs $8,284

Maximum Amount Reserve Account $10,501 in year 20

16

Calculation of Net Present Value and Reserve Account

• Annual Cost and Reserve Account both modified by:

o Within analysis period?

o Within warranty period?...type of warranty?

o Fixed interval or Weibull distribution?

o Yearly inflation of costs.

• This is done for each measure in the PV O&M Cost Model (PV

module replacement, inverter replacement…all) and added up to

calculate the total amount in the Reserve Account for each year of

the Analysis Period.

17

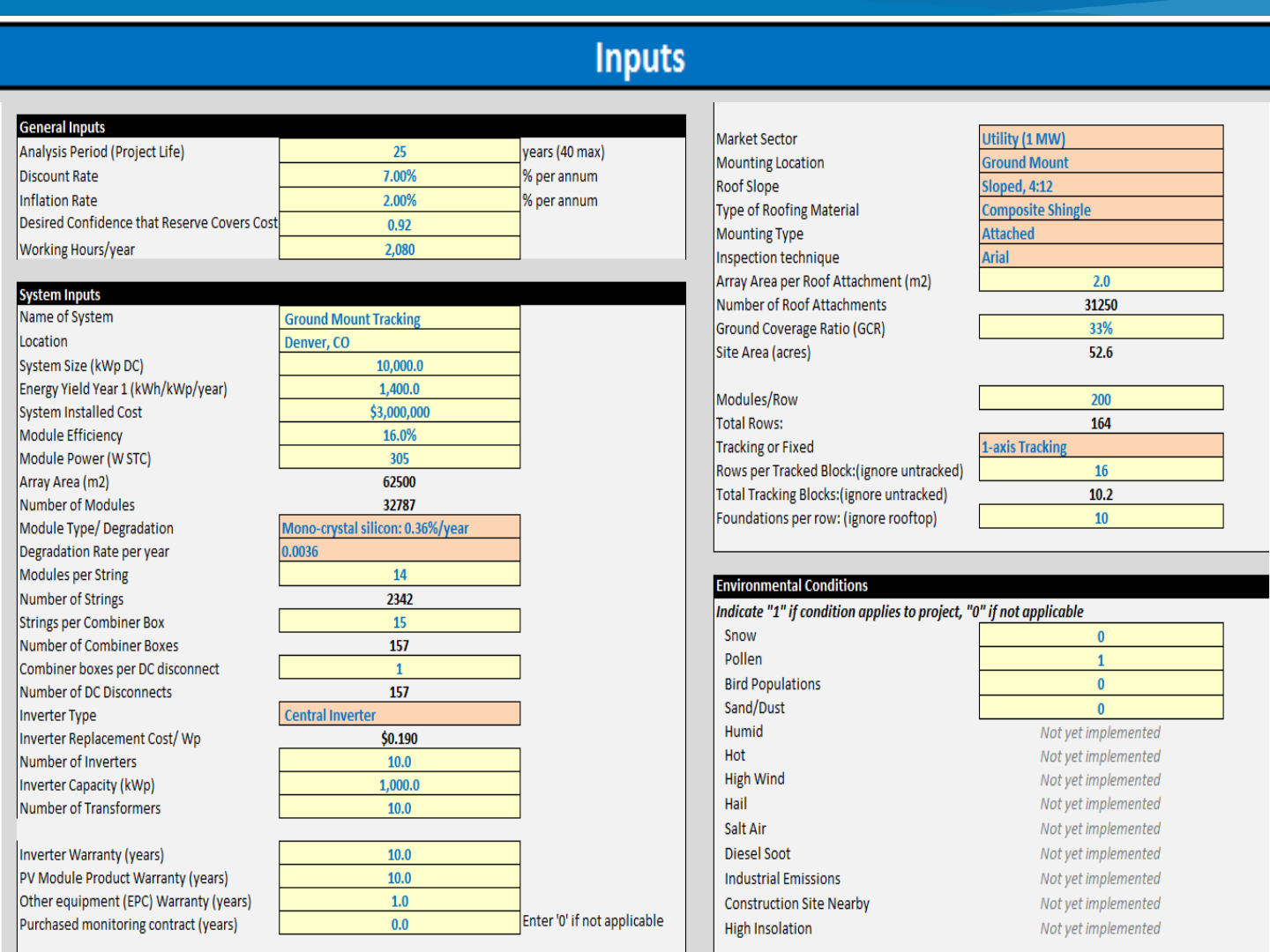

18

PV O&M Cost Model Results

Results

Annualized O&M Costs ($/year)

$126,471

Annualized Unit O&M Costs ($/kW/year)

$12.65

Maximum Reserve Account

$831,685

Net Present Value O&M Costs (project life

$1,800,124

Net Present Value (project life) per Wp

$0.180

NPV Annual O&M Cost per kWh

$0.011

$0.000

$0.005

$0.010

$0.015

$0.020

$0.025

$0.030

$0.035

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39

LCOE ($/kWh)

Annual Cash Flow ($/year)

Year

Annual Cash Flow

Reserve Account

LCOE ($/kWh)

19

High LCOE in Late Performance Period

• Warranties have expired

• Inflation has raised parts and labor prices

• The Weibull failure distributions show high failure rates

in

later years

• The performance had degraded (0.5%/year)

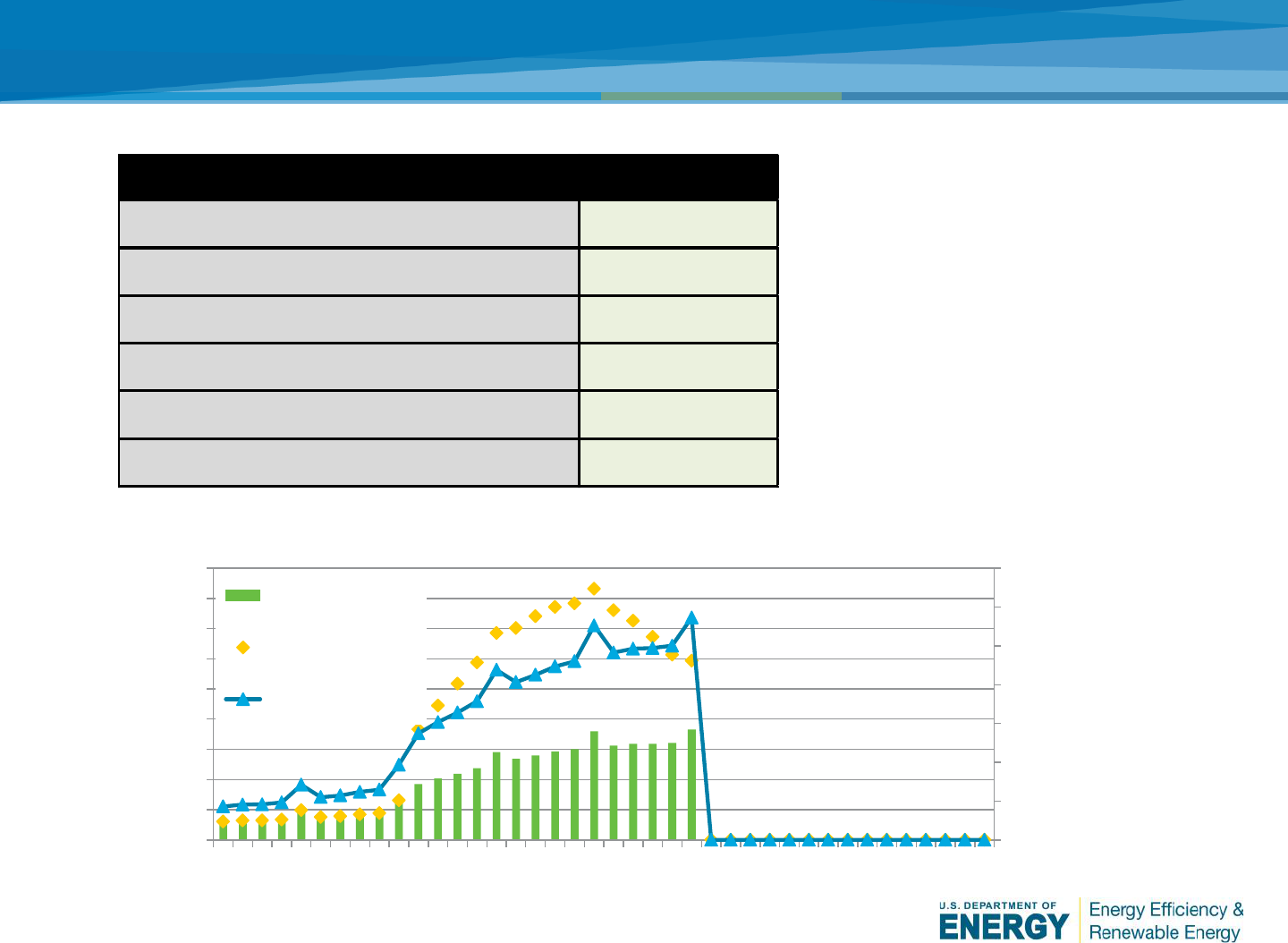

Results by Component

Service Avg. Cost/Yr NPV (Life) % of Total

Administrator $8,139 $88,635 5%

Cleaner $25,239 $274,892 15%

Inverter specialist $71,551 $550,944 31%

Inspector $26,850 $286,646 16%

Journeyman electrician $29,261 $216,399 12%

PV module/array Specialist $14,563 $114,939 6%

Network/IT $186 $1,825 0%

Master electrician $7,223 $53,383 3%

Mechanic $2,132 $14,926 1%

Designer $0 $0 0%

Pest control $1,702 $18,536 1%

Roofing $0 $0 0%

Structural engineer $10 $69 0%

Mower/Trimmer $16,424 $178,884 10%

Utilities locator $6 $44 0%

Total $203,285 $1,800,124 100%

Lifetime NPV by Service Type

21

Results by Service Provider

Component

Avg.

Cost/Yr NPV (Life) % of Total

AC wiring $2,423 $22,299 1%

Asset Management $4,797 $52,249 3%

Cleaning/Veg $41,644 $453,566 25%

DC wiring $19,160 $158,395 9%

Documents $3,286 $35,784 2%

Electrical $1,894 $20,351 1%

Inverter $72,075 $555,708 31%

Mechanical $5,607 $53,304 3%

Meter $19 $205 0%

Monitoring $72 $783 0%

PV Array $12,517 $135,644 8%

PV module $25,036 $175,764 10%

Roof $0 $0 0%

Tracker $7,960 $86,694 5%

Transformer $6,795 $49,377 3%

(blank) $0 $0 0%

Total $203,285 $1,800,124 100%

Lifetime NPV by Component Type

22

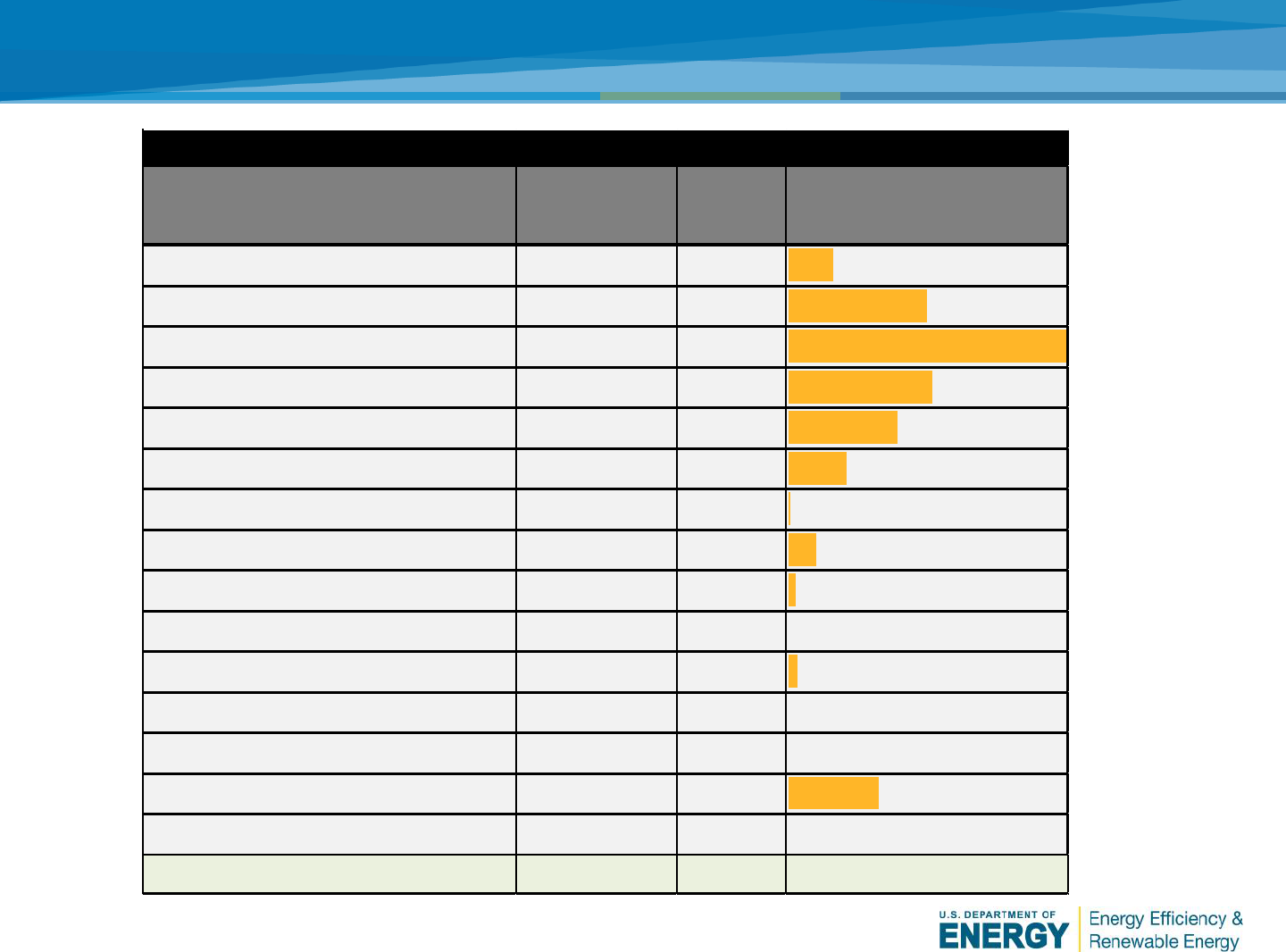

PV O&M Cost Model Example: 10 MW ground-mount

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

$400,000

$450,000

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

Annual O&M Expense ($)

Year

Operations administration (planned)

Inverter replacement reserve (corrective)

Module replacement reserve (corrective)

Component parts replacement (Planned)

System inspection and monitoring (Planned)

Module cleaning and vegetation management

(Planned)

Mike’s Category

Annual $/kW

Component parts replacement (Planned)

$0.58

Inverter replacement reserve (corrective)

$3.84

Module cleaning and vegetation management (Planned)

$3.25

Module replacement reserve (corrective)

$0.91

Operations administration (planned)

$2.80

System inspection and monitoring (Planned)

$1.71

TOTAL

$13.09

23

• Asset Management Software

o Benchmarking performance

o Continuous Performance Index

o Curation and Quality Control on Data

o Efficient business transactions; lower cost

o Improved analytics

o Knowledge management-diagnostics and troubleshooting

o Keep track of preventative maintenance requirements

o Calculate predictive or condition-based maintenance.

Recommendations for Cost Reductions

Recommendations for Cost Reductions

Warranty management practices

• Do not void warranty b

y mishandling

or not observing instructions or

conditions of the warranty.

• Curate data to prove th

at a module

is underperforming,

• Plan for labor t

o remove, ship, and

re-install an underperforming

module.

• Try to get a warranty for the

ma

nufacturer to “repair or replace”

rather than “supplement,”

• Consider Insura

nce Backed

Guarantee (IBG) that provides that

warranty claims will still be processed

in the event of the liquidation,

receivership, or closure of a dealer

Failure to follow “product box handling and

storage requirements” can cause damage when

moved and void a warranty

Photo by Andy Walker, NREL

25

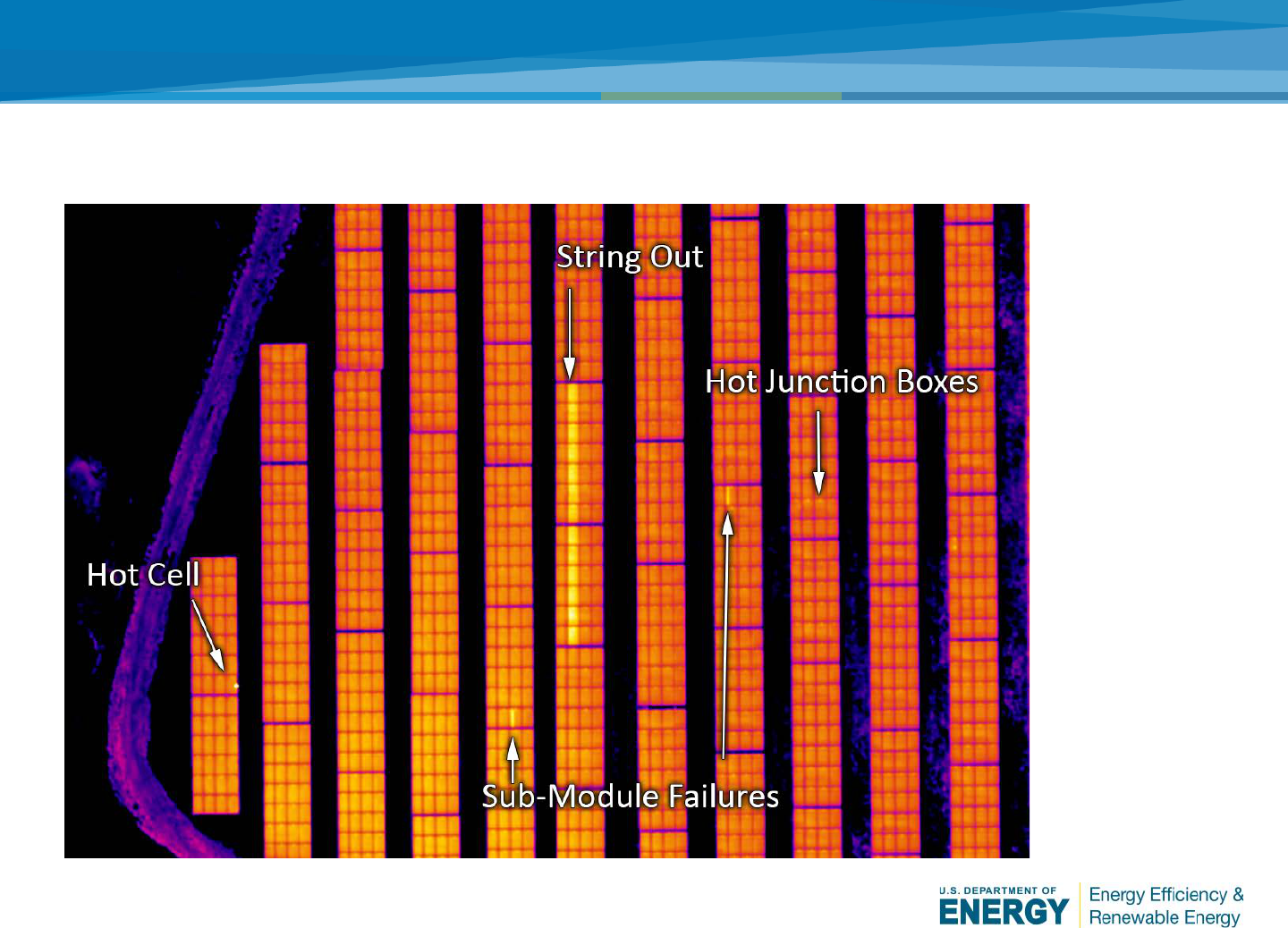

• Remote imaging, Aerial Inspection

Recommendations for Cost Reductions

Image by Rob Andrews, Heliolytics

26

• O&M Business Models

o “The UBER of PV O&M”

o O&M Cooperative business structures

o Shared facilities and inventories

• Module-level power electronics

o Reduced production losses

o Covers rapid shutdown requirements

o Detailed data

o Conventional AC wiring

• Standardization of parts, suppliers, procedures

o Optimized reserve

o Remove obsolete inventory and reduce inventory exceeding

the maximum stocking level to reduce cost to count, move,

store, secure, insure and taxes.

Recommendations for Cost Reductions

Thank You!