Offsetting Policy Feedback Effects:

Evidence from the Affordable Care Act

∗

William Hobbs

†

Daniel J. Hopkins

‡

This Draft: October 11, 2019

∗

The authors gratefully acknowledge research assistance from Tiger Brown, Isaiah Gaines, Matt Garber, Saleel

Huprikar, Louis Lin, Sydney Loh, Sam Mitchell, Owen O’Hare, Kalind Parish, Bhavana Penmetsa, Georgia Ray,

Gabby Rothschild, Samantha Washington, and Elena Zhao as well as helpful comments from Robert Erikson, Josh

Kalla, Luke Keele, Dorothy Kronick, Julie Lynch, Marc Meredith, Andrew Reeves, and seminar participants at the

University of Wisconsin’s American Politics Workshop and the 2019 Summer Meeting of the Society for Political

Methodology (MIT). They also express sincere thanks to the Kaiser Family Foundation (especially Mollyann Brodie,

Bianca DeJulio, Liz Hamel, Ashley Kirzinger, Cailey Munana, Elise Sugarman, and Bryan Wu) and the Leonard

Davis Institute of Health Economics at the University of Pennsylvania (especially Daniel Polsky, Yuehan Zhang, and

Jane Zhu) for sharing data and expertise. The panel data reported herein were collected thanks to financial support

from the Annenberg Public Policy Center, the Institute for the Study of Citizens and Politics, the University of

Pennsylvania School of Arts and Sciences and University Research Foundation, and the Russell Sage Foundation

(Awards 94-17-01 and 94-18-07 to Hopkins and Hobbs and 87-11-01 to Seth Goldman and Diana Mutz).

†

Assistant Professor, Department of Human Development and Department of Government, Martha Van Rens-

‡

Professor, Department of Political Science, University of Pennsylvania, 133 S. 36th Street, Philadelphia PA,

Electronic copy available at: https://ssrn.com/abstract=3366994

Abstract

Can politicized, market-based policies generate policy feedbacks? The Affordable Care

Act (ACA) is complex, relying partly on new exchanges, subsidies, and penalties to increase

health insurance enrollment. Yet prior research focuses on changes to Medicaid, a pre-existing

program. We employ several data sets—including a rolling cross-sectional survey (n=117,000)

and a novel, population-based panel—to assess the impacts of the exchanges and individual

mandate on public opinion. Descriptive analyses demonstrate that exchange users are more

supportive of the ACA. However, subsequent analyses using various inferential strategies

indicate that the exchanges’ overall causal effects were limited. These limited feedback effects

are due to heterogeneity, not invisibility: exchange users connected positive experiences with

ACA opinions, but these were offset by price spikes and concentrated, negative attitude

changes among the uninsured.

0

Electronic copy available at: https://ssrn.com/abstract=3366994

Political scientists have long documented the varied ways public policies can reconfigure the

political landscape at the elite and mass levels (Patashnik, 2008; Campbell, 2012). While policies

that are directly implemented by governments commonly generate feedback effects on public opin-

ion (Soss, 1999; Campbell, 2003; Mettler, 2005; Lerman and Weaver, 2014; Nall, 2018), policies

that rely on indirect mechanisms such as private markets or the tax code often do not (Howard,

1999; Mettler, 2011; Morgan and Campbell, 2011; Galvin and Thurston, 2017; Mettler, 2018). In

part, that is because policies which are provided through private actors or the tax code are often

lower in visibility and less easily politicizied (Howard, 1999; Mettler, 2011). These claims are

bolstered by a separate body of research concluding that self-interest typically has limited effects

on public opinion (Citrin and Green, 1990).

Would market-based policies produce feedback effects on mass opinion if they were more

salient? Or would indirect provision remain too difficult to attribute to government-provided

benefits, especially within a highly politicized and polarized context?

We consider these questions within the context of the 2010 Affordable Care Act (ACA). The

ACA was widely considered the most important American social policy reform in decades. Its pri-

mary goal was to expand access to health insurance, as nearly 50 million people lacked insurance

upon enactment (Kaiser Health News, 2012). Unlike certain existing programs such as traditional

Medicare, key elements of the ACA were designed to act principally through market-based mech-

anisms. Its centerpiece was the creation of exchanges on which Americans could purchase private

health insurance. Initially, 75% of the total gains in health insurance enrollment were expected

to come from the exchanges (Congressional Budget Office, 2010). The exchanges were potentially

pivotal not only in expanding access to insurance but also in broadening the ACA’s political sup-

port. The exchanges were designed to serve a large and middle-class constituency, which when

combined with the Medicaid expansion offered the possibility of fostering a cross-class coalition in

support of the law.

The ACA is similar to previously studied market-based policies in that it relies on incremental

policy levers, many of which are individually low-salience measures affecting small and distinct

sub-populations (Patashnik and Oberlander, 2018). Yet, unlike other market-based policies, the

ACA was an extraordinarily salient and politicized initiative that has been at the forefront of

political debates since it was drafted (Hopkins, 2018). The ACA also had profound impacts

1

Electronic copy available at: https://ssrn.com/abstract=3366994

on many Americans that were unlikely to go unnoticed: comprehensive health insurance is a

substantial benefit that significantly improves individuals’ financial security, health care access,

and recipients’ mental health (Finkelstein et al., 2012; Sommers, Gawande and Baicker, 2017).

The law employed sticks as well as carrots, as it entailed substantial new taxes and regulation

(Jacobs and Mettler, 2018) that might be viewed favorably or unfavorably depending on personal

circumstances. It thus has the potential to generate negative policy feedbacks as well, especially

if the offerings on the exchanges were unsatisfactory or disappointing. Whether positively or

negatively, this combination of political visibility and real-world impact may make the ACA’s

exchanges more influential than other market-based policies. Yet to date, research on the ACA’s

impacts has focused primarily on its Medicaid expansion (Clinton and Sances, 2017; Haselswerdt,

2017; Hopkins and Parish, 2019) or its overall impacts (McCabe, 2015; Jacobs and Mettler, 2016,

2018) while research isolating the exchanges’ impacts has been quite limited (but see Hosek, 2016).

1

The paper’s next two sections develop these hypotheses, first briefly sketching how the ex-

changes operate and then using prior research to explain our hypotheses. It subsequently turns to

three sections which evaluate these conflicting predictions empirically. Our tests exploit various

population-based data sets to estimate the impact of the exchanges’ implementation on the ACA

attitudes of those most likely to use them. Specifically, we focus on those who purchase their own

insurance (whether via the exchanges or not) or who lack insurance.

Our initial results are descriptive and set the stage for subsequent causal inferences. Those who

purchase their own insurance became more favorable at precisely the moment when the exchanges

opened. At approximately the same time, those without insurance became less favorable toward

the ACA. To account for the heterogeneity of experiences on the exchanges, we also provide

descriptive results from separate KFF surveys of the non-group insured and Kentucky residents

in the SI.

2

Those using the exchanges who received subsidies felt more positively toward the law.

Do the cross-sectional differences reflect causal effects, or are they instead the products of se-

1

Existing research has also considered exchange enrollment as a dependent variable, demon-

strating that Republicans are less likely to use the exchanges (Lerman, Sadin and Trachtman,

2017; Sances and Clinton, 2019).

2

Kentucky saw the largest initial gains in insurance post-ACA (Hopkins and Parish, 2019),

making it a valuable state to analyze.

2

Electronic copy available at: https://ssrn.com/abstract=3366994

lection into different types of insurance? Building on the call in Campbell (2012) to conduct more

policy feedbacks research focusing on causal inference, one central contribution of this manuscript

is to provide estimates of the exchanges that are credibly causal effects and not subject to alterna-

tive explanations based on selection bias. Rather than relying on a single, decisive test, we assess

the impact of the exchanges through several analyses.

In one, we make use of over-time variation. Evidence from a novel, population-based panel

uncovers no evidence that exchange users overall became disproportionately more positive toward

the ACA after implementation. However, the panel evidence illustrates that those who become

uninsured also become dramatically less supportive of the ACA.

Next, to account for selection into purchasing on the exchanges, we consider whether those

demographically most likely to use the exchanges became more favorable toward the ACA after

implementation. They do not. And we further find that those most likely to be uninsured were

significantly less favorable toward the ACA—and even less likely to identify as Democrats—after

its implementation.

Among its regulations, the ACA limited the premiums that insurers could charge older respon-

dents, making those in their early 60s a most-likely case for positive feedback effects. A regression

discontinuity analysis demonstrates positive changes in attitudes among those with newly capped

premiums. The ACA helped close the previously observed gap between 64-year-olds (who typi-

cally rely on private insurance) and 65-year-olds (who often use Medicare) (Lerman and McCabe,

2017). Finally, using administrative data on exchange pricing and geo-coded HTS respondents,

we find that citizens who purchase insurance via the exchanges become more negative when prices

on their local exchanges spike.

Overall, these results suggest that Americans shifted their attitudes and even partisanship

in response to perceived benefits or costs from the ACA. Feedback effects, however, partially

cancelled out in aggregate, due to concentrated perceived costs and backlash among those likely

to go without insurance. It’s not that the ACA’s market-oriented features were politically invisible.

Instead, their effects were heterogeneous, varying across places and people.

3

Electronic copy available at: https://ssrn.com/abstract=3366994

Background on the ACA’s Exchanges

Some social policies can be summarized succinctly—the ACA cannot be. It is thus valuable to

provide background on the ACA’s design and goals. Doing so enables us to develop targeted

hypotheses about its potential feedback effects, contextualize and justify potential estimation

strategies, and underscore the law’s complexity.

The pre-ACA system of health insurance provision was already a patchwork of public and

private insurance, with private insurance typically tax-subsidized and provided primarily through

employers (Hacker, 2002). While there was a separate insurance market for individuals, insurers

could reject applicants with pre-existing conditions, and the individual market was at once small

and highly variable in the products available (Jones, 2017). On the public side, Medicare was

a federal program that insured a majority of those over 64, while Medicaid was a means-tested

federal-state partnership targeting households with children and varying markedly across states

(Michener, 2018).

Rather than develop or expand a single program, the ACA sought to fill in gaps in the existing

system. The law’s centerpiece was arguably the establishment of exchanges on which individuals

could purchase private insurance. Insurers were only allowed to charge older customers three times

as much as younger customers, and they could no longer deny coverage due to health histories.

Initial projections indicated that by 2019, 24 million Americans would be insured through the

exchanges and 16 million through the Medicaid expansion (Congressional Budget Office, 2010).

As enacted, the law also expanded Medicaid to 138% of the federal poverty line and allowed adults

to participate irrespective of family status. Separate elements ended lifetime caps on insurance

company payments, defined essential health benefits plans must include, and enabled children to

remain on their parents’ insurance until 26.

The exchanges themselves were comprised of various policy levers. As enacted, the exchanges

were bolstered by a new tax penalty or “individual mandate” for Americans who didn’t have

qualifying health insurance, a mandate intended to limit adverse selection. In 2016, 5 million tax

returns made such payments, with a mean payment of $727 (Internal Revenue Service, 2019). The

federal exchanges also had a notoriously rocky roll-out. The healthcare.gov website was plagued

by long waiting times and other technical difficulties during its fall 2013 opening.

4

Electronic copy available at: https://ssrn.com/abstract=3366994

By contrast, for Americans making below 400% of the poverty line, the federal government

provided subsidies in the form of the Advanced Premium Tax Credit (APTC). In 2016, 6.1 million

American households received this credit, with a mean subsidy of approximately $4,000 (Internal

Revenue Service, 2019).

3

Prior Research and Hypotheses

Research on policy feedbacks is well established (Campbell, 2012). The developed state of prior

research enables us to begin by stating hypotheses on the ACA’s exchanges specifically.

One study which considers whether market-based policy levers can produce mass-level feedback

effects is Morgan and Campbell’s 2011 analysis of the 2003 Medicare Modernization Act (MMA).

Like the ACA, the MMA was a health policy reform that relied substantially on market-based

mechanisms, though the MMA sought to add a prescription drug benefit to Medicare. Partly using

panel data, Morgan and Campbell show that the MMA’s impacts on public opinion were limited:

its implementation did not lead beneficiaries to support more market-based policies generally, nor

did it improve perceptions of Republicans’ handling of health policy.

Is the imprint of the ACA’s exchanges on public opinion likely to differ from the MMA’s?

Although the ACA’s exchanges rely on private insurers to deliver a government-defined benefit,

the ACA diverges from the MMA in its political profile and benefits provided. The law overall was

the subject of sustained, highly salient political battles that lasted for years after implementation,

a fact which may heighten its salience (see also Gollust et al., 2014; Fowler et al., 2017; Hopkins,

2018). And prior research provides extensive evidence that acquiring health insurance can shape

ACA attitudes, whether through Medicare (Lerman and McCabe, 2017), the ACA overall (Mc-

Cabe, 2015; Jacobs and Mettler, 2016, 2018), or the Medicaid expansion (Hopkins and Parish,

2019).

3

Notably, those with access to qualifying health insurance through employers were ineligible

for subsidies on the exchanges. Separately, people whose incomes prove higher than expected are

required to repay the excess subsidy.

5

Electronic copy available at: https://ssrn.com/abstract=3366994

Potential Limits on the Exchanges’ Feedback Effects

Despite the ACA’s sometimes sizable benefits, there are several reasons the exchanges might

generate muted or even negative feedbacks. We consider three such hypotheses.

First, even if the exchanges benefited the vast majority of users, those benefits might not be

attributed to the ACA. The government’s role in facilitating the provision of insurance is not a

salient feature of the exchanges’ design. The exchanges are simply a marketplace: once customers

are enrolled, their primary interactions are not with government but a private insurer.

Other aspects of the exchanges’ operation are even more opaque, further reducing citizens’ ca-

pacity to trace elements of their insurance back to government action (see also Kogan and Wood

2018; on other policies, see Mettler 2011; Morgan and Campbell 2011; Campbell 2012). For exam-

ple, citizens may not be aware of the ways that government regulations structure the marketplaces,

especially by preventing discrimination based on pre-existing conditions. By contrast, the ACA’s

design might have inadvertently heightened the salience and traceability of one of the law’s least

popular elements, its individual mandate (see also Jacobs and Mettler, 2018). While citizens may

be very aware of the personal costs from the individual mandate, they may not recognize that

the mandate was intended to prevent adverse selection on the exchanges and so keep prices down

while protecting people with pre-existing conditions.

Second, the exchanges provide much more substantial benefits to some than others. The

experiences of those who use the exchanges are likely to differ dramatically depending on their

health care utilization, their eligibility for subsidies, the quality of their state’s exchange, the

options available in their market, and other factors (Chattopadhyay, 2018). A person forced to

buy comprehensive coverage or, conversely, who pays a lot for insurance that leaves her exposed

to significant costs may sour on the ACA; someone with a serious pre-existing condition who

can get heavily subsidized insurance may feel quite differently. Prices on the exchanges also vary

dramatically across the country, meaning that similar people can pay very different premiums

depending on where they live (Kamal et al., 2018). This hypothesis yields an observationally

distinctive prediction from that above, as it leads us to expect that exchange users with different

experiences will differ in their ACA attitudes, too. The exchanges’ impacts will not be null but

heterogeneous.

Third, even if the people on the exchanges both benefited from the exchanges and attributed

6

Electronic copy available at: https://ssrn.com/abstract=3366994

the benefits to the ACA, the population of Americans using the exchanges was relatively small.

As the percentage of an overall population which uses a given policy declines, that policy becomes

“distant” to a large fraction of the electorate, meaning that relatively few people have direct

experience with it (Soss and Schram, 2007). That, in turn, makes citizens more reliant on media

portrayals and partisan cues in generating attitudes (Jacobs and Mettler, 2018).

Moreover, the ACA’s exchanges were one element in a complex package of reforms. Campbell

(2003), Soss and Schram (2007), and Campbell (2012) note that policy feedbacks are more likely

when the policy’s beneficiaries are concentrated in ways which encourage them to identify as a

coherent group and act on their shared interests. But the ACA’s complex, multi-faceted design

means that key beneficiaries have a stake only in specific, often disparate provisions (see also

B´eland, Rocco and Waddan, 2018; Chattopadhyay, 2018). This complexity may fragment the

beneficiary population, reducing its capacity to generate a cohesive identity.

Research Design and Data Sets

Prior research leads us to expect substantial selection bias, as those who anticipate higher health

care bills or are not Republican are more likely to enroll via the exchanges (Lerman, Sadin and

Trachtman, 2017). As a result, any straightforward comparison of people who did or did not use

the exchanges is almost certainly biased.

How, then, to evaluate the exchanges’ impact? Descriptive analyses serve as a useful start-

ing point, since we should expect causal effects to generate associations at a minimum. Cross-

sectionally, it is valuable to know whether those who use the exchanges or receive subsidies think

differently about the ACA than those without insurance or with insurance from elsewhere. Know-

ing which groups of Americans are more likely to use the exchanges also helps identify promising

discontinuities or other strategies for causal inference. In addition, our descriptive analyses allow us

to consider temporal variation: did attitudes toward the ACA among different sub-groups shift at

the time of its implementation? In places, we are able to use panel data to track within-respondent

changes before and after the ACA’s implementation.

Armed with a knowledge of various statistical associations, we then proceed to estimates that

are credibly causally identified. Instead of providing a single, decisive test, we employ multiple

tests with different samples, estimands, outcomes, strengths, and weaknesses. Below, we discuss

7

Electronic copy available at: https://ssrn.com/abstract=3366994

each test in detail; here, we motivate the tests collectively. To help readers keep track of the

various tests, both descriptive and causal, Table 1 lists them.

Question Data: Variables and Subgroups

1. Cross-sectional association

Is there an association between ACA

favorability, purchasing health insurance on

exchanges?

Favorability ratings among:

1) HTS respondents

2) KFF non-group respondents

3) KFF Kentucky respondents

2. Temporal correspondence

Did attitudes change with ACA’s implementa-

tion?

ACA favorability in HTS

Panel-based estimates from [name redacted]

Was change in insurance status in the

post-implementation period related to ACA

favorability?

Association between ACA favorability, insur-

ance source in panel data from [name redacted]

3. Dose-dependence

Is association between ACA

favorability, exchange use related

to level of personal benefit?

Associations between favorability ratings and

subsidies: KFF non-group, KFF Kentucky

4. Within-group change (causal tests)

Was likely benefit from the exchanges related

to ACA favorability?

Association between ACA favorability, insur-

ance source scores over time among HTS respon-

dents under 65

Did ACA’s implementation reduce ACA favora-

bility gap at age 65?

Regression discontinuity using older HTS re-

spondents before, after Jan. 2014

5. Partisan integration

Were those using exchanges favorable toward

the ACA before its implementation?

HTS

Was likely benefit from the exchanges related to

party ID?

Causal tests from above with party ID as out-

come

6. Heterogeneity in exchange effects

Did price changes on local exchanges influence

ACA favorability?

HTS merged with exchange pricing, plan data

Table 1: Research questions, tests, and data sources.

8

Electronic copy available at: https://ssrn.com/abstract=3366994

Data Sources

For these tests, we use a range of available data. One primary source is the KFF’s HTS, a rolling

cross-sectional telephone survey of adults’ attitudes about the ACA and health policy. This

survey has been conducted in most months between 2009 and the present; here, we report results

for 117,234 respondents surveyed between February 2009 and September 2017. On account of its

extraordinary sample size, these surveys provide a unique opportunity to observe the evolution of

Americans’ ACA attitudes, as well as the possibly differing trajectories of key sub-groups.

Our descriptive analyses supplement the HTS with separate KFF surveys of the non-group

insured in 2014, 2015, and 2016 as well as a 2015 survey of Kentucky residents, all of which are

presented in the Supplemental Information (SI). For our causal estimates, we return to the HTS

when using the difference-in-difference estimation strategy based on insurance source scores as

well as that employing a regression discontinuity design for those near the Medicare age threshold.

We also merge a geo-coded version of the HTS with administrative data on exchange pricing to

estimate the effects of local price changes on ACA favorability.

4

Last, we draw on the [name redacted] panel survey administered via Knowledge Networks/GfK.

This panel is unique, as it tracks a nationally representative, probability-based sample which was

recruited through address-based sampling and random-digit dialing over ten years. Specifically,

the panel has 13 separate waves: 5 waves in 2007-2008, 2 waves in 2012 (which included the first

questions about the ACA specifically), 2 waves in 2014, 3 waves in 2016, and 1 wave in 2018.

Table 1 summarizes the data sets employed for each test. See the SI for details.

Descriptive Statistics on ACA Exchanges & Attitudes

To understand the exchanges’ impacts on public opinion, we first need to identify who actually

uses them. In a given year, only a small fraction of American adults enroll through the exchanges,

and those who do have distinctive demographic profiles. Through these descriptive analyses, this

section lays the groundwork for subsequent analyses, as we will be better positioned to identify

confounding variables and promising strategies for causal estimation. In later analyses, we will

4

Specifically, we obtained the administrative data on plan pricing and offerings by geography

for 2014-2017 via the Robert Wood Johnson Foundation’s National Narrow Network Project.

9

Electronic copy available at: https://ssrn.com/abstract=3366994

examine attitudes among people who purchased on the exchanges, as well as the much broader

set of people with demographics similar to those who purchased on the exchanges, compared to

individuals with other insurance sources and their demographically similar cohorts.

Demographic Differences by Insurance Type

SI Figure A1 uses the HTS to illustrate the distribution of types of health insurance before and

after the ACA’s primary provisions came into effect. It shows the decline in the uninsured rate

from 14.4% before January 2014 to 9.7% after. It also shows the uptick in Medicaid receipt that

followed the expansion of Medicaid in some states, from 3.7% to 6.6%.

But overall, these changes are marginal: the basic contours of health care provision in the

U.S. remain much as they were before the ACA. What’s more, the share of U.S. adults who

reported using the exchanges is on average only 2% of the surveyed population after their creation.

Categories of insurance that were less overtly affected by the ACA—employer-provided insurance

and Medicare—remain far and away the largest sources of insurance. These patterns alone place

important limits on the ACA’s direct policy feedback effects: people in the parts of the insurance

market most influenced by the ACA represent a small minority of citizens.

How does the small share of Americans who purchase insurance via the exchanges compare to

other groups? SI Table A1 summarizes the means of several key variables by source of insurance for

post-January 2014 respondents. Consistent with Lerman, Sadin and Trachtman (2017) and Sances

and Clinton (2019), those who bought insurance through the exchanges were more Democratic

than the population overall. Medicaid recipients and those who used the exchanges had similar

partisanship, even though those using the exchanges had higher incomes and were more likely to

be White. This indicates that any causal analyses will have to be wary about selection biases,

especially given the general stability of partisan identification. Jointly, the table and figure also

show that exchange enrollees had lower incomes and were younger than the population overall.

Trends in ACA Attitudes by Insurance Type

Having provided descriptive statistics for our key independent variables, we now do the same for

our dependent variable. Descriptively, is there evidence that ACA favorability differs depending

on Americans’ sources of health insurance?

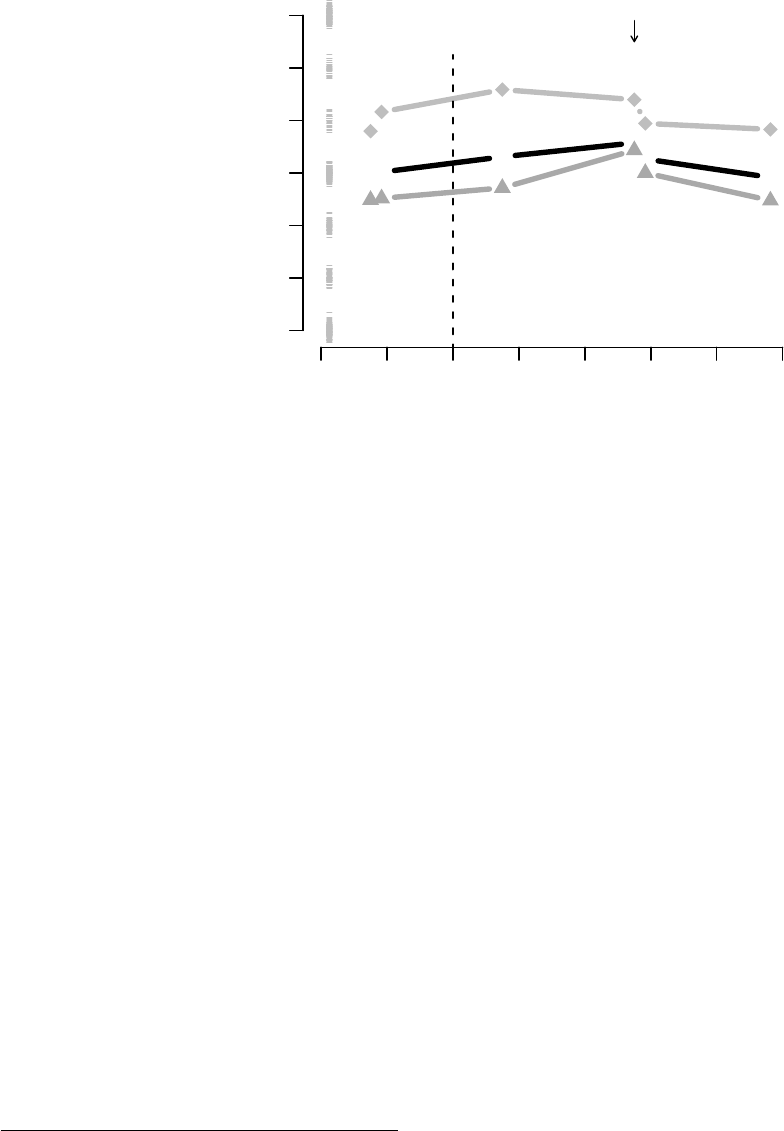

Figure 1 summarizes the trends in a dichotomized measure of ACA favorability by insurance

10

Electronic copy available at: https://ssrn.com/abstract=3366994

Year

Percent Favorable on ACA

Employer−

Provided

10 12 14 16 18

25

50

75

Medicaid

Medicare

Exchanges Open

Year

25

50

75

10 12 14 16 18

Uninsured

Purchased

Used

Exchanges

Exchanges Open

Figure 1: Dichotomized ACA favorability by health insurance status and source over time. The

survey question for “used exchanges” was introduced in 2014, and it is a subset of “self-purchased”.

It measures whether an individual purchased insurance through the exchanges.

type. The left side illustrates that respondents insured through Medicaid are always more favor-

able toward the ACA than those insured through Medicare or employers, with 61% of Medicaid

recipients reporting favorable attitudes versus 47% for those with employer-provided insurance

and 45% for those on Medicare. The over-time patterns for these groups are roughly similar, with

growing favorability between 2016 and 2018, although the smallest group (Medicaid recipients) is

understandably more variable.

On the right, we see the trends for the insurance categories for whom the ACA’s exchanges

and mandate are especially impactful: those who lack insurance, buy insurance themselves, and

buy insurance via the exchanges. In the period before ACA implementation, those without in-

surance are consistently more favorable toward the ACA than those purchasing insurance on

the individual market. The average ACA favorability for those without insurance is 52% in the

pre-implementation period, as compared to 41% who are self-insured.

But the groups switch places almost immediately after implementation. Favorability among

the uninsured drops sharply in the run-up to implementation and averages just 42% in post-

implementation surveys. By contrast, favorability among those on the individual market rises,

and averages 47% after implementation (see also McCabe, 2015). Such changes could reflect

people’s experiences, as those without insurance faced a newly implemented tax penalty while

those needing to self-insure instead enjoyed a range of new options and protections, alongside

11

Electronic copy available at: https://ssrn.com/abstract=3366994

subsidies in some cases. These sudden attitudinal changes thus provide a valuable motivation for

subsequent analyses. However, such changes might also reflect selection effects.

Finally, we show in the right panel that those who purchased on the exchanges felt partic-

ularly favorably toward the ACA. Like Medicaid recipients, this group is small and so favora-

bility over time is noisy. In the SI, we use a regression model of respondents’ attitudes pre-

implementation to show that exchange users are markedly more favorable—and the uninsured

markedly less favorable—than we would expect based on demographics alone.

Attitudes among the Non-Group Insured

Within the broad categories of insurance status identified above, there are sure to be substantial

variations in people’s experiences. After all, enrollees’ experiences with government-funded pro-

grams like Medicaid can vary substantially (Michener, 2018; Tallevi, 2018), and the variation in

experiences with private insurance is potentially wider still. As a next step, in SI section A.2.1 and

in SI Table A3, we consider the predictors of ACA support among those who were insured through

the non-group insurance market post-implementation. The core descriptive result of those analyses

is that while exchange users generally are no more favorable toward the ACA than others without

group-based insurance like Medicare or employer-provided insurance, those who received subsidies

are a bit more favorable toward the ACA, especially in its first year of full implementation.

Panel-Based Estimates of Trends in ACA Attitudes by Insurance

Figure 1 shows that around the time of the ACA’s implementation, the relationship between peo-

ple’s insurance status and their ACA attitudes shifted: people who purchased their own insurance

became more favorable while the uninsured became less so. But it is quite possible that individuals

who already felt favorably toward the ACA shifted from one insurance source to another.

Panel data provides one way to avoid this challenge, as the same individuals report their

attitudes in multiple waves conducted over time. Here, we draw on the 2012-2018 [name redacted]

panel to evaluate Americans’ attitudes toward the ACA over time.

To be sure, there simply aren’t many respondents who fall into the self-purchased or uninsured

categories. Of the 589 panelists who completed both the November/December 2016 wave and the

October 2018 wave, 38—or 6%—reported in January 2016 that they purchased their insurance

12

Electronic copy available at: https://ssrn.com/abstract=3366994

themselves, and not all used the exchanges. Another 35 panelists—also 6%—reported being

uninsured at that time, an estimate that is lower than the 2016 national benchmark of 11%

(Witters, 2019). But the panel nonetheless provides a critical advantage, as it allows us to observe

how those respondents’ attitudes shifted relative to the population overall. We also get increased

statistical precision from making comparisons within individuals. In these analyses, our outcome

comes from a question the panel has asked since 2012: “Some people think the health care reform

law should be kept as it is. Others want to repeal the entire health care law. Still others are

somewhere in between.” Respondents could reply on a 1-7 scale, with 1 indicating the “health

care reform law should be kept as it is” and 7 indicating that “entire health care law should be

repealed.”

As Figure 2 illustrates, the groups defined by insurance status in 2016 differ at baseline but

largely move in parallel. In particular, there is no evidence that those who purchased insurance

themselves differ markedly in the trajectory of their ACA attitudes compared to other insured

groups, though there is a significant uptick in support for repealing the ACA just after the 2012

election among those without insurance in 2016. Overall, there is little evidence that respondents

who purchased their own insurance in 2016 had a distinctive trajectory. Note, however, that for

those without insurance, there is somewhat less evidence of an improvement in ACA attitudes

between 2016 and 2018.

5

We next estimate OLS models which more fully leverage the panel data set by analyzing

shifts in insurance status as a predictor of shifts in ACA attitudes. This approach tests whether

changes in insurance status are associated with changes in ACA attitudes generally in the post-

implementation era, rather than focusing on changes immediately after implementation.

Specifically, we model 2018 respondents’ views of the ACA as a function of their fall 2018

insurance status, their January 2016 insurance status, attitudes toward the ACA in 2012 and

2016, 2012 partisan identification, and a series of basic demographics such as gender, education

and income. Such models are well suited to isolate the extent to which changes in insurance

status predict subsequent shifts in ACA attitudes. However, they are a conservative test, as we

are isolating people who became uninsured only after 2016, nearly three years after the ACA’s

5

Specifically, those without insurance in January 2016 shifted toward the ACA by 0.30 while

for those with insurance the pro-ACA shift was 0.53.

13

Electronic copy available at: https://ssrn.com/abstract=3366994

●

●

●

●

●

●

Date

ACA Attitudes

Keep ACA 3 4 5 Repeal ACA

2012 2014 2016 2018

Not Covered

All

Self−Purchased

Exchanges

Open

Based on 2016

insurance sources

Figure 2: This figure reports estimates for respondents to the 2012-2018 [name redacted] panel

who completed the November/December 2016 and October 2018 waves conducted through GfK’s

Knowledge Panel. N=589. Insurance status is as of January 2016. The gray horizontal lines at

left report the distribution of the outcome variable for the October 2012 survey.

implementation. As a result, those who were uninsured in the first few years after the ACA’s 2014

implementation will not influence our estimate.

The core results are presented graphically in Figure 3, while SI Table A8 provides the full,

fitted model. Most of the indicators of different insurance statuses are not predictive of 2018

ACA attitudes. Importantly, those who purchased insurance plans themselves in 2018 are not

much more or less supportive of the ACA. However, respondents who were uninsured in 2018

are dramatically less supportive of the ACA, even accounting for 2016 insurance status. The

coefficient is 1.23 (SE=0.43), meaning that those who became uninsured between 2016 and 2018

also downgraded their opinion of the ACA by a whopping 1.23 on a 1-7 scale. That effect is

61% of a standard deviation. It is strongly suggestive of a causal relationship between becoming

uninsured and thinking more negatively toward the ACA.

6

6

As Table A9 illustrates, we reach very similar conclusions with an alternative model specifi-

cation that examines the change in attitudes among those uninsured in January 2016, indicating

14

Electronic copy available at: https://ssrn.com/abstract=3366994

−2 −1 0 1 2

Coefficient on ACA REPEAL Attitudes

●

Uninsured

2016

Uninsured

2018

Figure 3: This figure reports coefficients for being uninsured in 2016 and 2018 (included in the

same model) when predicting 2018 support for ACA repeal using the [name redacted] panel.

Causal Estimates

The following analyses are designed to remove the effects of selection from our estimates to identify

the causal effects of changes in insurance status.

Over-time Changes by Predicted Insurance Source

One common research design for assessing a policy introduced at a specific moment in time is

difference-in-difference estimation. Such estimators isolate whether there were disproportionate

changes in a treated group after the treatment’s administration. Yet when analyzing the HTS,

which was administered as a rolling cross section, we are barred from employing classical difference-

in-difference estimation because there is no fixed control group. There were no federal exchanges

or people using them prior to the ACA’s implementation. What’s more, the exchanges are likely

that this result is robust to alternative specifications.

15

Electronic copy available at: https://ssrn.com/abstract=3366994

to have had system-wide effects, as they may have influenced the insurance status and experiences

of people who were previously uninsured as well as those who previously purchased insurance for

themselves and others. Most importantly, we should avoid using actual insurance status (as we did

in Figure 1) because the people who chose to use the exchanges may have already felt favorably

toward the law.

We attempt to overcome selection concerns by using predicted insurance scores coupled with

temporal variation to estimate the causal impact of using the exchanges (and later of being unin-

sured). In essence, we model who in the data set is more or less likely to use the exchanges

(rather than who chose to), construct synthetic cohorts of likely users, and then evaluate whether

over-time shifts in ACA attitudes were more pronounced among those whom the model flags as

especially likely to be exchange users. In doing so, we are guided by prior work on causal infer-

ence including Athey and Imbens (2006), Heckman and Vytlacil (2007), and Frangakis and Rubin

(2002).

Note that this analysis relies on the timing of implementation, and mimics a difference in

difference design – one where we consider changes in attitudes among those with demographics

similar to those with given insurance sources. In the language of an encouragement design, we

assign intention-to-treat status for all individuals in time periods after 2013 and a probability

of complying – taking up the treatment – based on their demographics, whether or not they

actually purchase a given insurance source. Like in difference-in-difference analyses, we look

for parallel trends (or, more precisely, parallel slopes for likely vs unlikely to purchase) before

the implementation and examine relative changes in attitudes after implementation. Those with

predicted insurance scores close to zero we expect to never take advantage of the exchanges,

and those with lower scores will be more likely to do so. We do not construct matched cohorts

that have very similar attitudes before implementation. We also do not predict insurance source

using variables that could plausibly be changed by the introduction of the exchanges, including

partisanship (we will show changes in partisanship later in the paper).

As an initial step, we isolate respondents who were at all likely to use the exchanges or be

affected by the individual mandate. In practice, this means excluding respondents over 64 (who

are likely on Medicare) or with incomes under $40,000 per year (who are more likely to be on

16

Electronic copy available at: https://ssrn.com/abstract=3366994

Medicaid, for which there is a competing effect).

78

Next, we estimate three separate insurance source scores to identify the types of respondents

who are especially likely to 1) use the exchanges, 2) purchase their own insurance, or 3) be unin-

sured in the post-2014 period. Estimating the probability of self-purchasing allows us to consider

the effects of changing conditions among self-purchasers on ACA attitudes without requiring that

survey respondents link their insurance to government-operated markets. The uninsured score

analysis is important because it considers the possibility of negative feedback effects from the

individual mandate or other sources.

9

These insurance source scores provide one-number summaries of respondents’ probabilities of

falling into specific ACA-related categories given their demographic characteristics.

Health insurance was not available via the exchanges until January 2014, so we use logistic re-

gression to model the predictors of enrolling via the exchanges in that period alone.

1011

Americans’

experiences with the exchanges varied substantially across states (B´eland, Rocco and Waddan,

2016; Jones, 2017), so the insurance source score model includes indicators for respondents’ state of

residence alongside 5 polynomials of respondents’ age in years, indicators for years of educational

attainment, and identification as Asian American, Black, Hispanic, female, or retired. Subsidies

and exchange usage are closely connected to respondents’ incomes, so the insurance source score

7

The minimum income cutoff to remove likely Medicaid recipients varies by state. For sim-

plicity, we set this cutoff at the Medicaid expansion level for all states. Reducing this cutoff to

include lower-income people in non-expansion states does not meaningfully alter our results.

8

Very few people who previously received Medicare or Medicaid transferred into the individual

market post-ACA. In fact, 53% of all respondents who used the exchanges in 2014 had previously

lacked health insurance, and another 19% had previously purchased a plan themselves. See espe-

cially SI Table A2, which reports the shares of people with non-group insurance by their previous

insurance status.

9

Those with higher uninsured scores might also be those who are especially vulnerable to the

erosion of insurance offerings through their employers.

10

To be coded as using the ACA exchanges, respondents answered that they purchased insurance

“From healthcare.gov or [state marketplace name]”.

11

Using linear regression to produce the insurance source scores does not alter our results.

17

Electronic copy available at: https://ssrn.com/abstract=3366994

model also includes measures of respondents’ income, income squared, and income cubed. From

this model, we can then estimate any respondent’s probability of using the exchanges based on

her background characteristics, regardless of whether the exchanges were actually operating when

she was surveyed.

12

SI Table A11 shows the correlations for the three insurance source scores. As expected, given

that those using the exchanges are a subset of those purchasing their own insurance, the scores

for self-purchasing and using the exchanges are correlated at 0.5. Correlations between using

the exchanges and being uninsured (0.14) and self-purchasing and being uninsured (-0.08) are

substantially smaller. Critically, our second-stage estimates depend on the first-stage predictions—

the better we predict in the first stage, the more effectively we isolate those likely to use the

exchanges. SI Table A12 shows the first stage of each model.

Results from Predicted Insurance Score Analyses

To distinguish ACA experiences from long-term shifts, we examine over time associations be-

tween likely insurance use and ACA favorability. Effects driven by the ACA should be apparent

discontinuously in 2013 (when the exchanges first opened) and 2014.

We include the insurance source scores in OLS models predicting dichotomized ACA favora-

bility in each of the six-month increments between early 2010 (when the ACA was passed) and

late 2017. Accordingly, Figure 4 shows 16 separate correlations between ACA favorability and

respondents’ estimated probability of using the exchanges.

13

If the experience of buying insur-

ance via the exchanges shifted ACA attitudes, the insurance source scores should become stronger

predictors of ACA support after the exchanges opened.

Figure 4 illustrates the correlations for a 10 percentage-point change in probability of using the

exchanges, self-purchasing, or going without insurance for each six-month window of time.

14

On

the right side of each graphic, we report the mean change in the effect for estimates after January

12

Because partisan identification is potentially endogenous, and also because it is strongly as-

sociated with health care attitudes (Kriner and Reeves, 2014), we repeat these analyses with

partisanship as the dependent variable below.

13

The minimum sample size for these six-month periods is 1,739 while the maximum is 6,227.

14

One empirical challenge is that even among those under 65, most people making more than

$40,000 per year have access to employer-provided insurance, so the variation in the estimated

18

Electronic copy available at: https://ssrn.com/abstract=3366994

2014. Neither the scores for using the exchanges nor those for self-purchasing are associated with

meaningful changes in ACA favorability after implementation. On balance, people more likely to

use the exchanges or self-insure don’t show different over-time trends.

However, the scores for being uninsured are associated with markedly more negative ACA

attitudes after implementation. This uninsured score is a catch-all. It identifies both respondents

who actually chose to forego insurance and demographically similar respondents who would have

foregone purchasing on the individual markets had they not had some other source of insurance.

Regardless of the specific mechanisms at work, these results reinforce the claim that the ACA

induced negative experiences for at least some Americans.

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

−0.2 0.0 0.1 0.2

Exchange Score

respondents under 65, income over 40K

ACA Favorability

10 11 12 13 14 15 16 17

Pre−Exchanges Post−Exchanges

−0.03

0.47

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

−0.20 −0.05 0.10

Uninsured vs Self−Purchased Score

respondents under 65, income over 40k

ACA Favorability

10 11 12 13 14 15 16 17

Pre−Exchanges Post−Exchanges

Self−insured

−0.00

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

Uninsured vs Self−Purchased Score

respondents under 65, income over 40k

ACA Favorability

10 11 12 13 14 15 16 17

Pre−Exchanges Post−Exchanges

Uninsured

−0.05***

Figure 4: Over-time associations between insurance source scores, ACA attitudes. These figures

show the effect of increasing the average insurance source score by 10 percentage points.

To formally test the impact of the exchanges’ introduction, we estimate a multi-level model

predicting ACA favorability using the same insurance source scores and timeframe shown in Figure

4, with respondents clustered by the six-month period of their response. We also include an

interaction between the insurance source score and whether the response comes after January 1st,

insurance source scores is relatively small, as illustrated in SI Table A10. Accordingly, we generate

multiple estimates from the second stage over-time models. In some cases, we show the effect of

a 10 percentage point increase in the likelihood of using the exchanges (or of self-purchasing or

going uninsured); in others, we report the effect of a full change from 0 to 1 in the insurance source

score (the typical interpretation of the coefficients), even though this is an extrapolation outside

the range of the observed scores.

19

Electronic copy available at: https://ssrn.com/abstract=3366994

2014, which provides a formal measure of any change in the mapping between the probability of

using the exchanges and ACA favorability. In this test, we use the typical scaling for such models

in which the estimated probability shifts from 0 to 1. The estimates in SI Table A13 otherwise

mirror those presented graphically in Figure 4.

Beyond reporting the same results as in Figure 4, Table A13 provides an additional, if more

peripheral, take-away: the attitudes among those purchasing on the exchanges appeared to be

extremely positive before the ACA’s implementation. This indicates possible ceiling effects that

limit the potential for further increases in favorability.

Expected Insurance Source & Partisanship

We now replicate the insurance source score tests from above using partisan identification as the

outcome. ACA attitudes are strongly associated with partisan identification (e.g. Kriner and

Reeves, 2014), and since partisan identification is strongly resistant to change (Green, Palmquist

and Schickler, 2002), partisanship could limit the extent to which improvements in personal cir-

cumstances can increase favorability toward a politicized policy (Jacobs and Mettler, 2018). At the

same time, any changes in partisan identification induced by the ACA might have far-reaching ef-

fects, since partisan identification can influence a range of political opinions and behaviors (Achen

and Bartels, 2016).

In this, we follow extensive research by considering partisan identification to be causally prior

to ACA attitudes (Green, Palmquist and Schickler, 2002). Democrats are more likely to favor the

ACA and Republicans the reverse. Here, we consider whether changes in exposure to the ACA

and the resulting changes in ACA attitudes correspond with changes in partisanship.

As in some tests above, we use a linear probability model with an indicator for Democratic

identification as the outcome when analyzing the insurance source scores. In select models, we also

show the effect of controlling for ACA favorability on any associations between insurance source

and partisanship. This is an informal mediation analysis. If the standard assumptions hold

15

, the

15

The assumptions underpinning causal mediation analysis are similar to those underpinning

linear regressions, but there are additional assumptions about lack of unmeasured confounding

(or, at minimum, “deconfounding”) along the expanded causal pathway (Pearl, 2013). In our

analysis, for example, a joint effect on ACA favorability and partisanship in the year or so after

20

Electronic copy available at: https://ssrn.com/abstract=3366994

decrease in the size of the partisan identification coefficient after controlling for ACA favorability

roughly corresponds to the size of the mediated effect.

16

In Figure 5, we show that respondents who are more likely to use the exchanges or purchase

insurance do not differ disproportionately in their partisanship after January 2014. However, those

who were more likely to be uninsured shifted disproportionately away from the Democrats and

toward identification as independents. A 10 percentage-point increase in the likelihood of going

without insurance was associated with 3 percentage point decrease (SE=0.7 percentage points) in

the probability of being a Democrat after 2014 compared to before 2014.

17

Not identifying with either major party was also positively associated with the uninsured

scores. Put differently, people whose demographics made them more likely to be uninsured were

also more likely to identify as independents after 2014. At the same time, those predicted to

purchase their own insurance were more likely to identify with a party.

Overall, these results mirror the earlier findings. We find that the people who were relatively

likely to go without insurance shifted away from the Democrats, and those likely to purchase

their own insurance were polarized rather than shifting uniformly toward either party. In other

words, the ACA’s implementation resulted in both positive and negative policy feedback effects,

and these heterogeneous experiences partly cancelled out.

the 2012 election that is not due to the ACA would be such a confounder, and would be especially

concerning if it were concentrated among individuals with high likelihoods of having the insurance

sources considered here. Such a confounder would prove problematic not only for our analyses

but for much of the extant research on the effects of the ACA on political attitudes.

16

If the ACA’s rollout did change partisan identification with the Republicans or Democrats, the

absence of mediation would perhaps be more surprising than the presence of mediation. After all,

such a finding would imply that the ACA had shifted partisanship without influencing attitudes

toward the ACA itself.

17

Note that for the estimates in Figure 5, we are using the full 0 to 1 probability as our inde-

pendent variable. Dividing the y axis by 10 keeps the estimates closer to the observed variability

in our data. For simplicity, the 3 percentage-point decrease above corresponds to a dependent

variable coded 1 for Democrats and 0 otherwise.

21

Electronic copy available at: https://ssrn.com/abstract=3366994

−0.5 0.0 0.5

Insurance Source Scores

Change in Partisanship

2014 on vs. 2013 and earlier

●

●

●

●

●

●

Exchanges Uninsured Self−insured

●

●

DV: Became Democrat

(D=1; I=0.5; R=0)

DV: Became Independent

Control ACA

favorability

Figure 5: Partisanship & Insurance Status Scores. This figure shows estimates for pre- vs. post-

implementation associations between partisanship and the insurance status scores. In each case,

the first estimate is the change in the partisanship-insurance source score association after imple-

mentation while the second reports the same association conditioning on ACA attitudes. Over-

time estimates are shown in the supporting information.

The Discontinuity in Medicare Eligibility

The ACA used various policy levers to modify the availability of health insurance, so we continue

assessing its causal impacts by analyzing its overall impact on older Americans. Specifically, the

ACA provided valuable new opportunities and protections for those in their early 60s: it created

exchanges on which non-elderly adults could purchase insurance—sometimes with subsidies—

while also mandating that insurers not discriminate on the basis of pre-existing conditions. It

also limited premiums for older customers to no more than 3 times those of younger customers.

Some in their early 60s became newly eligible for Medicaid. At the same time, the ACA did not

entail substantial consumer-facing changes to Medicare, the program which insures 68% of adults

65 and older according to the HTS. To the extent that the ACA affected Americans directly, it

was substantially more likely to affect those under 65.

18

18

Policies targeting those 65 and older included free preventative care (for certain services), and

the gradual, partial closing of the “donut hole” in prescription drug coverage between 2010 and

2020.

22

Electronic copy available at: https://ssrn.com/abstract=3366994

We thus assess the ACA’s impacts on those in their early 60s relative to those 65 or slightly

older. There is a precedent for this research design. Studying the period before the ACA’s full im-

plementation, Lerman and McCabe (2017) sought to understand whether Americans’ experiences

with publicly provided insurance through Medicare changed their health policy attitudes.

Our goal is to use regression discontinuity designs to estimate the difference in ACA attitudes

associated with Medicare eligibility both before and after the ACA’s full implementation and

then to compare those estimates. To do so, we turn back to the HTS. We first calculate the

Imbens-Kalyanaraman optimal bandwidth to be 2.42 (Imbens and Kalyanaraman, 2012), so our

initial analyses include respondents ages 62-68. After confirming that key variables do not differ

across the discontinuity

19

we then estimate reduced-form equations in which we regress the four-

category measure of ACA favorability on several variables, including measures picking up time

trends as well as respondents’ age in years; Medicare eligibility via age; levels of education; self-

identification as male, Black, Hispanic, or Asian American; income; and a five-category measure

of partisan identification. In the pre-implementation surveys, we find that being under 65 and

not yet eligible for Medicare produces a coefficient of -0.12 (SE=0.06),

20

meaning that Medicare

eligibility has a nearly significant positive effective on ACA attitudes that averages 10% of the

dependent variable’s standard deviation, consistent with Lerman and McCabe (2017).

A majority of Americans shift their insurance status at 65 with Medicare eligibility, so the key

estimate is not the change at 65 but the extent to which the ACA’s implementation modified that

change. We thus estimate a parallel OLS model for respondents after the ACA’s January 1 2014

implementation, finding that the reduced-form impact of being under 65 became 0.01 (SE=0.06).

Post-implementation, those who are under 65 and so more directly affected by the ACA are no

more supportive than people just slightly older.

For our purposes, the key question is the extent to which the effect declined after the ACA was

implemented, and Figure 6 presents that differenced estimate using dots. Using triangles, Figure

6 shows the comparable estimates via an estimator that does not condition on any variables other

than age. In both cases, the estimated difference is positive, as it varies between 0.13 (SE=0.087)

with controls to 0.183 (SE=0.095) without. Given the four-category dependent variable, the ACA’s

19

See SI Figure A16.

20

See SI Table A15 for the full fitted model.

23

Electronic copy available at: https://ssrn.com/abstract=3366994

●

●

−0.4 −0.2 0.0 0.2

Under 65 favorability

compared to 65 or over

Pre−Implementation Post−Implementation

Effect

Diff.=0.13

SE=0.087

−0.4 −0.2 0.0 0.2

Diff.=0.183

SE=0.095

Figure 6: This figure illustrates the change in ACA attitudes associated with turning 65 and

becoming Medicare eligible for HTS respondents before and after the ACA was implemented. Es-

timates from models conditioning on various potential confounders are shown using dots; estimates

from models without such controls are depicted using triangles.

implementation had a detectable but substantively small overall impact closing the attitudinal gap

between those who were and were not Medicare eligible.

21

Given the ACA’s regulations about age

and insurance pricing, this group is likely to have been more positively affected by the exchanges

than others.

Geographic Variability in Exchange-based Insurance Prices

Do those who use the exchanges largely ignore their personal experience when assessing the ACA,

or they do use personal experience but in different ways depending on their experiences? The

results above show that the ACA’s implementation had heterogeneous effects, suggesting that

limited feedback effects were not due to citizens’ difficulty attributing their experiences to govern-

ment policy. Here, we use price shocks on the ACA exchanges to further differentiate hypotheses

21

This result is of course compatible with a larger effect on the small number of people most

directly affected.

24

Electronic copy available at: https://ssrn.com/abstract=3366994

about the difficulties of political attribution from those emphasizing heterogeneous personal ex-

periences.

Here, we use geographic variation in exchange pricing as leverage to estimate the attitudinal

effects of price changes on local markets. Specifically, customers on the exchanges are divided into

geographic rating areas; in 2017, there were 504 such rating areas across the country. We acquired

data on the insurance options and their prices for rating area and year between 2014 and 2017.

We then developed a crosswalk which enables us to match KFF respondents based on their ZIP

codes and/or counties of residence to their rating area and the corresponding options and prices

available to them.

22

In addition, we also used respondents’ ZIP codes or county of residence to

merge in basic county-level Census demographic information.

Given how few people in the survey use the exchanges—the sample sizes by year for exchange

users are 157, 134, and 151—we fit a multi-level model to borrow strength across the three years

and estimate the effects of price shocks jointly. This multilevel model conditions on the total

number of plans available on each market as well as the mean premium for that year and the

mean change in premiums from the prior year.

23

It also includes random effects for each of

the three years as well as various individual- and county-level covariates. Shown in Table 2,

and in full in the SI, the model suggests that rising average premiums on the ACA exchanges

are associated with sizable declines in ACA favorability for respondents who actually use the

exchanges. The estimated coefficient is −0.19 (SE=0.07), meaning that an increase of one standard

deviation in the mean monthly premium change ($33) is associated with a −0.19 drop on the ACA

favorability scale. That shift is substantively meaningful, as it is a change of -7.6 percentage points

in the dichotomized ACA favorability scale. However, this relationship does not hold for other

respondents or for the uninsured, as the other columns of Table 2 demonstrate. These finding

bolsters the claim that we are detecting the effects of experience with the markets, and not simply

22

Data are missing for 2014 in some rating areas, but overall, we are able to identify the 2014

market conditions for 64% of respondents, 2015 conditions for 91% of respondents, and 2016 and

2017 conditions for 96% of respondents.

23

Note that our interest in the change in premiums from the prior year requires us to exclude

2014.

25

Electronic copy available at: https://ssrn.com/abstract=3366994

ACA favorability

Non-Market Market Uninsured

Number of plans

(logged, in sd’s)

0.00 −0.07 −0.00

(0.01) (0.06) (0.03)

Mean Premium

(in sd’s)

0.00 0.04 0.05

(0.01) (0.07) (0.03)

Mean Change in

Premium (in sd’s)

0.00 −0.19

∗∗

−0.02

(0.01) (0.07) (0.04)

Observations 15,987 442 1,772

Month FEs Y Y Y

County-Level Demographics Y Y Y

Clusters (Year) 3 3 3

∗

p<0.05;

∗∗

p<0.01;

∗∗∗

p<0.001

Table 2: This table presents the results of multi-level models fit to KFF respondents from 2015,

2016, and 2017 in which certain insurance market conditions (and various other independent

variables) predict ACA favorability, measured on a 1 to 4 scale.

spurious county-level associations.

24

Conclusion

Which features of policy designs make feedbacks on public opinion more or less likely? Prior

research on other market-based health policies (Morgan and Campbell, 2011)—and on the more

general class of policies administered through back-door mechanisms including private markets and

the tax code (Howard, 1999; Mettler, 2011, 2018)—indicates that they typically do not produce

strong imprints on public opinion. Such policies can be relatively invisible, making them difficult

to trace back to government action.

Key elements of the ACA were administered via market-based mechanisms, making it possible

that the ACA’s exchanges and its individual mandate might leave a similarly faint imprint on

public opinion. Yet the ACA was also highly salient and contentious, so much so that citizens’

partisan predispositions shaped their willingness to enroll via the exchanges. In this paper, we

24

Our respondents are distributed across many counties—in 2015, for example, the 359 respon-

dents using the markets were in 208 counties. As a consequence, we cannot employ county fixed

effects.

26

Electronic copy available at: https://ssrn.com/abstract=3366994

employed a wide range of data sets and analyses to test these competing influences on possible

policy feedback effects.

Overall, we find that while the net effect of the ACA’s core, market-based features was muted,

the ACA’s exchanges and its individual mandate did influence the opinions of those most likely

to be affected. Specifically, differenced regression discontinuity estimates indicate that the ACA

reduced the gap in ACA favorability between those who are 64 and 65. Yet those in their early

60s were among those who benefited most from the ACA, and separate analyses using predicted

insurance sources indicate that the types of people most likely to be uninsured became less favor-

able toward the ACA around the time of its introduction. A conservative test using panel data

demonstrates that those who became uninsured between 2016 and 2018 also became substantially

less favorable toward the ACA. In addition, local price spikes on the ACA exchanges reduced

support for the law, another indication that Americans were able to link their experiences with

their ACA attitudes. Different groups in different places had quite different experiences with the

ACA’s exchanges and its mandate. One key factor limiting the ACA’s mass-level policy feedbacks

was heterogeneity, not invisibility.

The politics of the ACA abound in puzzles and paradoxes. One such puzzle is especially

relevant here: why were Republican repeal efforts in 2017 more successful when it came to ending

the market-based individual mandate than scaling back the Medicaid expansion? Public opinion

is certainly not the sole answer, or even necessarily the most important one (Hertel-Fernandez,

Skocpol and Lynch, 2016; Jones, 2017; Hacker and Pierson, 2018; Patashnik and Oberlander, 2018).

Still, the results uncovered here do suggest a partial explanation: while the Medicaid expansion

induced heightened support for the ACA (Sances and Clinton, 2019; Hopkins and Parish, 2019),

the overall impacts of the ACA’s exchanges and its individual mandate were ambiguous. Those

findings, in turn, may help explain why some of the ACA’s more conservative, market-based

elements were also among the most politically vulnerable.

27

Electronic copy available at: https://ssrn.com/abstract=3366994

References

Achen, Christopher and Larry Bartels. 2016. Democracy for Realists. Princeton University Press.

Athey, Susan and Guido Imbens. 2006. “Identification and inference in nonlinear difference-in-

differences models.” Econometrica 74(2):431–497.

B´eland, Daniel, Philip Rocco and Alex Waddan. 2016. Obamacare wars. University Press of

Kansas.

B´eland, Daniel, Philip Rocco and Alex Waddan. 2018. “Policy Feedback and the Politics of the

Affordable Care Act.” Policy Studies Journal .

Campbell, Andrea. 2003. How policies make citizens. Princeton University Press.

Campbell, Andrea Louise. 2012. “Policy makes mass politics.” Annual Review of Political Science

15:333–351.

Chattopadhyay, Jacqueline. 2018. “Is the Affordable Care Act Cultivating a Cross-Class Con-

stituency?” Journal of Health Politics, Policy and Law 43(4).

Citrin, Jack and Donald Philip Green. 1990. “The Self-Interest Motive in American Public Opin-

ion.” Research in Micropolitics 3(1):1–28.

Clinton, Joshua D and Michael W Sances. 2017. “The Politics of Policy.” American Political

Science Review pp. 1–19.

Congressional Budget Office. 2010. “Letter to Speaker Nancy Pelosi: Estimated Budgetary

Impact of H.R. 3590.”.

URL: https://www.cbo.gov/sites/default/files/111th-congress-2009-

2010/costestimate/amendreconprop.pdf

Finkelstein, Amy, Sarah Taubman, Bill Wright, Mira Bernstein, Jonathan Gruber, Joseph P

Newhouse, Heidi Allen, Katherine Baicker and Oregon Health Study Group. 2012. “The Oregon

health insurance experiment.” The Quarterly journal of economics 127(3):1057–1106.

28

Electronic copy available at: https://ssrn.com/abstract=3366994

Fowler, Erika Franklin, Laura Baum, Coleen Barry, Jeff Niederdeppe and Sarah Gollust. 2017.

“Media Messages and Perceptions of the Affordable Care Act during the Early Phase of Imple-

mentation.” Journal of Health Politics, Policy and Law 42(1):167–195.

Frangakis, Constantine E. and Donald B. Rubin. 2002. “Principal stratification in causal infer-

ence.” Biometrics 58:21–29.

Galvin, Daniel and Chloe Thurston. 2017. “The Democrats’ Misplaced Faith in Policy Feedback.”

The Forum 15(2):333–343.

Gollust, Sarah E., Colleen L. Barry, Jeff Niederdeppe, Laura Baum and Erika Franklin Fowler.

2014. “First Impressions.” Journal of Health Politics, Policy and Law 39(6):1253–1262.

Green, Donald, Bradley Palmquist and Eric Schickler. 2002. Partisan Hearts and Minds. New

Haven, CT: Yale University Press.

Hacker, Jacob S. 2002. The divided welfare state. Cambridge University Press.

Hacker, Jacob S and Paul Pierson. 2018. “The Dog That Almost Barked.” Journal of Health

Politics, Policy and Law 43(4).

Haselswerdt, Jake. 2017. “Expanding Medicaid, Expanding the Electorate.” Journal of health

politics, policy and law 42(4):667–695.

Heckman, James and Edward Vytlacil. 2007. “Econometric evaluation of social programs, part

II.” Handbook of econometrics 6:4875–5143.

Hertel-Fernandez, Alexander, Theda Skocpol and Daniel Lynch. 2016. “Business associations,

conservative networks, and the ongoing republican war over Medicaid expansion.” Journal of

health politics, policy and law 41(2):239–286.

Hopkins, Daniel. 2018. “The Exaggerated Life of Death Panels?” Political Behavior 40(3):681–709.

Hopkins, Daniel J and Kalind Parish. 2019. “The Medicaid Expansion and Attitudes toward the

Affordable Care Act.” Public Opinion Quarterly .

29

Electronic copy available at: https://ssrn.com/abstract=3366994

Hosek, Adrienne. 2016. “Insuring Obamacare on the Health Insurance Marketplace.”. Manuscript,

University of California Davis.

URL: https: // drive. google. com/ file/ d/ 0BwLuq-FTY_ zebWVGYjhZUDZHOEU/ view

Howard, Christopher. 1999. “American Welfare State, or States?” Political Research Quarterly

52(2):421–42.

Imbens, Guido and Karthik Kalyanaraman. 2012. “Optimal bandwidth choice for the regression

discontinuity estimator.” The Review of economic studies 79(3):933–959.

Internal Revenue Service. 2019. “Tax Statistics: Affordable Care Act Items.”.

URL: https: // www. irs. gov/ statistics/ soi-tax-stats-individual-statistical-tables-by-size-of-adjusted-gross-income

Jacobs, Lawrence and Suzanne Mettler. 2016. “Liking Health Reform But Turned Off By Toxic

Politics.” Health Affairs 35(5):915–922.

Jacobs, Lawrence and Suzanne Mettler. 2018. “When and How New Policy Creates New Politics.”

Perspectives on Politics 16(2):345–363.

Jones, David. 2017. Exchange politics. Oxford University Press.

Kaiser Health News. 2012. “KHN Morning Briefing: Thursday, September 13th.”.

URL: https://khn.org/morning-breakout/census-numbers-2/

Kamal, Rabah, Cynthia Cox, Michelle Long, Ashley Semanskee, Marco Ramirez and Larry

Levitt. 2018. “2019 Premium Changes on the ACA Exchanges.”.

URL: https://www.kff.org/health-costs/issue-brief/tracking-2019-premium-changes-on-aca-

exchanges/

Kogan, Vladimir and Thomas Wood. 2018. “Obamacare Implementation and the 2016 Elec-

tion.”. Available at SSRN 3075406. https://papers.ssrn.com/sol3/papers.cfm?abstract_

id=3075406.

Kriner, Douglas and Andrew Reeves. 2014. “Responsive Partisanship.” Journal of Health Politics,

Policy and Law 39(4):717–749.

30

Electronic copy available at: https://ssrn.com/abstract=3366994

Lerman, Amy E and Katherine T McCabe. 2017. “Personal Experience and Public Opinion.” The

Journal of Politics 79(2):624–641.

Lerman, Amy, Meredith Sadin and Samuel Trachtman. 2017. “Policy Uptake as Political Behav-

ior.” American Political Science Review 111(4):755–770.

Lerman, Amy and Vesla Weaver. 2014. Arresting citizenship. University of Chicago Press.

McCabe, Katherine T. 2015. “Attitude Responsiveness and Partisan Bias: Direct Experience with

the Affordable Care Act.” Political Behavior pp. 1–22.

Mettler, Suzanne. 2005. Soldiers to citizens: The GI Bill and the making of the greatest generation.

Oxford University Press on Demand.

Mettler, Suzanne. 2011. The Submerged State. University of Chicago Press.

Mettler, Suzanne. 2018. The Government-Citizen Disconnect. Russell Sage Foundation.

Michener, Jamila. 2018. Fragmented Democracy. New York, NY: Cambridge University Press.

Morgan, Kimberly and Andrea Campbell. 2011. The Delegated Welfare State. Oxford University

Press.

Nall, Clayton. 2018. The road to inequality. New York: Cambridge University Press.

Patashnik, Eric. 2008. Reforms at risk. Princeton, NJ: Princeton University Press.