Retirement

System for

Employees

and Teachers

of the State

of Maryland

Benefits

hhaannddbbooookk

MARYLAND

STATE RETIREMENT

and PENSION SYSTEM

Revised

July 2010

RETIREMENT SYSTEM

FOR EMPLOYEES AND TEACHERS

OF THE STATE OF MARYLAND

Benefits Handbook

The State Retirement Agency

120 East Baltimore Street

Baltimore, Maryland 21202-6700

410-625-5555

1-800-492-5909

This booklet provides a summary of the features and benefits of your retirement

plan. Retirement provisions outlined in this document are set forth in the

State Personnel and Pensions Article of the Annotated Code of Maryland. If there

are any questions of interpretation, the provisions of the State Personnel and

Pensions Article will control to resolve them.

Prepared by

July 2010

Message from the Board of Trustees

Welcome to the Employees’ and Teachers’ Retirement System, part of the State

Retirement and Pension System of Maryland. This handbook will help you become

acquainted with the benefits and features of your retirement plan.

We designed this handbook to be easy to read, with sample calculations and a glos

sary of important terms. In addition to being a valuable resource for your retirement

planning, this manual also provides detailed information on benefits available to

you and your family during your career.

If you ever need assistance, please contact the State Retirement Agency. Retirement

benefits specialists can be reached at

4106255555 or tollfree at 18004925909.

Useful information about your retirement benefits is also available on our Web site

located at

www.sra.state.md.us.

You should also be aware of other benefits, such as health insurance, which may be

offered through your employer after you retire. Contact your personnel office for

more information.

Each of you has our very best wishes for a productive, challenging career and a

fulfilling retirement.

1. Membership in SRPS

Participation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Three Retirement System Plans . . . . . . . . . . . . . . . 1

Eligibility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Taking an Active Role . . . . . . . . . . . . . . . . . . . . . . . 2

Beneficiary Changes . . . . . . . . . . . . . . . . . . . . . . . . 2

Approved Leave of Absence . . . . . . . . . . . . . . . . . 3

Terminating Membership . . . . . . . . . . . . . . . . . . . . 3

Questions to Ask Before Leaving Membership. . 4

2. How You Earn or Accrue Service Credit

Earned Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Claimed Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Service Earned in Another State System . . . . . 6

Military Service . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Purchased Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Normal Cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Full Cost. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Unused Sick Leave. . . . . . . . . . . . . . . . . . . . . . . . . . 9

3. Your Benefits

Survivor Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Disability Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Vesting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Service Retirement . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Choosing an Allowance Option. . . . . . . . . . . . . 19

Applying for Retirement. . . . . . . . . . . . . . . . . . . . . 21

4. Funding Your Benefits

Types of Contributions . . . . . . . . . . . . . . . . . . . . . . 22

Employer Contributions . . . . . . . . . . . . . . . . . . . 22

Employee Contributions . . . . . . . . . . . . . . . . . . . 22

Supplemental Contributions . . . . . . . . . . . . . . . 23

System Investments . . . . . . . . . . . . . . . . . . . . . . . . . 23

System Safeguards . . . . . . . . . . . . . . . . . . . . . . . . 23

Your Board of Trustees . . . . . . . . . . . . . . . . . . . . 24

5. Calculating Your Benefits

Key Elements of the Benefit Formula . . . . . . . . . . 25

Assumptions Used in Sample Calculations. . . . . 25

Service Retirement . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Early Retirement. . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Vested Benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Ordinary Disability . . . . . . . . . . . . . . . . . . . . . . . . . 27

Accidental Disability . . . . . . . . . . . . . . . . . . . . . . . . 28

Survivor Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

6. Preparing for Retirement

Primary Retirement Forms . . . . . . . . . . . . . . . . . . . 31

Filing Checklist. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

Retirement Checklist . . . . . . . . . . . . . . . . . . . . . . . . 32

7. During Retirement

Method of Payment . . . . . . . . . . . . . . . . . . . . . . . . . 34

Tax Liability. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

CostofLiving Adjustments . . . . . . . . . . . . . . . . . . 34

Address Changes . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Reemployment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Garnishment of Pension Benefits. . . . . . . . . . . . . . 39

Health Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

8. SRPS Resources

Information by Telephone . . . . . . . . . . . . . . . . . . . 43

Counseling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

Inquiries by Letter . . . . . . . . . . . . . . . . . . . . . . . . . . 44

Address Changes . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Newsletter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Web Site . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Personal Statement of Benefits. . . . . . . . . . . . . . . . 45

Seminars . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Your Retirement Coordinator. . . . . . . . . . . . . . . . . 45

Special Communications Concerns. . . . . . . . . . . . 46

Confidentiality . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

Conflicts/Appeals. . . . . . . . . . . . . . . . . . . . . . . . . 46

Glossary of Terms . . . . . . . . . . . . . . . . . . . . . . 47

Appendix: Plan C Benefits. . . . . . . . . . . . . . . A1

TABLE OF CONTENTS

1

MEMBERSHIP IN SRPS

The State Retirement and Pension System (SRPS) has a long, secure history of pro

viding retirement benefits to the employees of the “Free State.” Created in 1927 to

provide retirement benefits to the State’s public school employees, SRPS today cov

ers thousands of employees—from teachers and State personnel to our law makers

in Annapolis.

The system is administered by the State Retirement Agency of Maryland (SRA),

which manages the daytoday operations of the pension fund and handles all

membership matters —from enrollment to the payment of benefits. The Agency

operates under the direction of a 14member Board of Trustees, which establishes

policy, oversees investments, and represents our various employee interests.

Our membership includes close to 200,000 State and municipal employees, educa

tors, law enforcement personnel, judges, and legislators. Each of these employee

groups is covered under individual employee plans, or systems.

This booklet deals with the Employees’ and Teachers’ Retirement Systems. These

systems were closed to new members as of January 1, 1980. The Retirement System,

as it is called, covers State and participating municipal employees and personnel of

Maryland public schools, public libraries, and affiliated State universities and col

leges who were enrolled prior to January 1, 1980, and who have elected to remain a

member of the Retirement System.

Retirement System members participate under one of three options:

Plan A Member elected to pay a higher contribution rate (generally 7% of

pay) to maintain all benefits, including unlimited cost of living

adjustments.

Plan B Member continued pre1984 contribution rate (generally 5% of pay) to

maintain all benefits except unlimited cost of living. Cost of living

adjustments are capped at 5%.

Plan C Member chose a combination, or two part (bifurcated) benefit. The

portion of the service prior to the election is calculated at retirement as

a Retirement System benefit; the portion of service after the election is

calculated at retirement as a Pension System benefit.

1

Participation

Three Retirement

System Plans

Prior to 1980, your employer participated in the State Retirement and Pension

Systems. Because you were employed before January 1, 1980, your membership was

automatic as a permanent employee who works at least 50% of the normal working

time. If you enrolled before January 1, 1974, you may participate regardless of the

percentage of hours you work. Membership began when your employer placed you

on the payroll and submitted your completed enrollment application.

Throughout your career it’s wise to take an active interest in your retirement plan.

That’s why we offer a number of resources to keep you informed of benefit matters

affecting you now and in the future. These include your Personal Statement of

Benefits, which provides an annual summary of your retirement account, and our

quarterly newsletter the Mentor, designed to keep you up to date on important ben

efit news and information, as well as our Internet Web site and automated tele

phone system. See “SRPS Resources” for details on these and other SRPS member

publications and services.

You originally designated your beneficiaries when you enrolled. It is important that

the beneficiary(ies) you have on file with the Retirement Agency be kept current to

reflect any changes in your life. Common reasons for changing beneficiaries include

a change in marital status or the arrival of a new family member. You may update

your beneficiary designation at any time by completing a new Designation of

Beneficiary (Form 4), available through your personnel office. Your new designation

goes into effect as soon as it is received by the State Retirement Agency.

You may designate both primary and contingent beneficiaries during your

membership.

Primary Beneficiary: This is your first choice for the individual(s) who would

receive survivor benefits should you die during membership. Remember,

your spouse must be your sole primary beneficiary as one of the conditions

for the monthly survivor benefit option. See discussion on Survivor Benefits

on page 11 for more information.

Contingent Beneficiary: The individual(s) whom you designate to receive the

onetime benefit in the event that all designated primary beneficiaries prede

cease you.

2

MEMBERSHIP IN SRPS

Eligibility

Taking An

Active Role

Beneficiary

Changes

MEMBERSHIP IN SRPS

At some time in your career, you may need to take an unpaid leave of absence. You

may be eligible for the following specific types of approved leave:

n

Personal illness

n

Careerrelated study

n

Maternity/paternity

n

Governmentsponsored or subsidized employment

n

Adoption

n

Service in a professional or employee organization

The SRPS recognizes only the types of approved leave listed here. If you take an

unpaid leave of absence for reasons other than those noted, your active member

ship ceases during the leave and your accrued service credit may be affected.

FILING FOR LEAVE

It’s extremely important that you file for leave properly. Proper filing ensures that

should you die while away on an approved leave, your survivor benefit remains in

effect. It also makes you eligible to purchase the leave period later on if you wish to

add to your service credit.

Before your leave begins you must file an Application to be Placed on a Qualifying

Approved Leave of Absence (Form 46) with the Retirement Agency. Also, the form 46

is filed in addition to any forms your employer requires to grant your leave

request. Your employer must also certify that the leave has been approved.

PURCHASING CREDIT

To actually purchase the credit, complete a Request to Purchase Previous Service (Form

26) and attach verification of your employment, indicating your entrance and termi

nation dates. You must file a Request to Purchase Previous Service (Form 26) while an

active member or within 60 days of the end of a leave of absence.

Membership ends if the member is separated from employment for more than:

(a) 4 years, if a member of the Employees’ Retirement System; or

(b) 5 years, if a member of the Teachers’ Retirement System.

Other circumstances which end membership are when a member:

(c) withdraws his or her accumulated contributions;

(d) transfers to the Employees’ Pension System or Teachers’ Pension System on

or before December 31, 2004;

(e) becomes a retiree; or

(f) dies.

While we hope you remain an SRPS member for many years to come, you may

leave your job before your planned retirement date due to a career or personal

change. It’s important to review your SRPS benefits before leaving. If you answer

“yes” to any of the following questions, you may be eligible for benefits now or in

the future. Check with your personnel office or contact the Retirement Agency

before your last day of employment.

3

Approved Leave

of Absence

Terminating

Membership

Am I vested? (See page 17)

At least 5 years of eligibility service. ( )YES ( )NO

Do I qualify for normal service retirement?

(See page 18)

Age 60 regardless of service, or

30 years of service credit, regardless of age. ( )YES ( )NO

Do I qualify for early retirement? (See page 18)

At least 25 years of service credit. ( )YES ( )NO

Do I qualify to apply for disability? (See page 12)

General Qualifications: Ordinary Disability

Permanently disabled from performing job duties,

with 5 years of service credit. ( )YES ( )NO

General Qualifications: Accidental Disability

Permanently disabled by an onthejob accident.

While there is no service requirement the accident

must have occurred within 5 years of your

application for disability ( )YES ( )NO

Have I checked with my personnel office regarding

the impact of terminating on other benefits offered

through my employer such as health insurance? ( )YES ( )NO

IMPORTANT: If you feel you are eligible to apply for a disability benefit, please

contact the Retirement Agency immediately.

4

MEMBERSHIP IN SRPS

Questions to ask

yourself about

your benefits

before leaving

membership

2

HOW YOU EARN OR ACCRUE

SERVICE CREDIT

As a member of the Retirement System of the State of Maryland, you earn service

credit toward your retirement benefits for each month your employer submits your

employee contribution. Plan C members earn service credit for their hours worked.

Your employer reports your contribution and hours worked each pay period. The

Retirement Agency then credits your account with the appropriate amount of ser

vice credit. You earn a month of credit for any month in which contributions are

reported. Under Plan C if you work 500 hours, you earn credit for every hour you

are paid in a fiscal year (July 1 to June 30). For more detailed information on Plan C

benefits, see the Appendix.

Your service credits are used to determine both your eligibility for benefits and to

calculate the amount of your benefits. If you make a contribution in any month, you

will receive credit for the entire month. Parttime members receive full credit for

each month of parttime service in which contributions are received.

Attention 10month members: All members of the Teachers’ Retirement System,

whether employed 10, 11 or 12 months, participate as 10month members. Each

month of service is credited as 1/10th of a year, and a full year of service credit is

earned September through June. This rule also applies to certain members of the

Employees’ Retirement System who qualify as 10month employees. A 10month

employee is defined as an employee of a county board of education who works on

a 10month school year basis.

In addition to the service credit you earn through payroll reporting, you may be

eligible to claim additional credit in certain special situations. Please note that it is

your responsibility to claim this credit by completing the required forms, available

through your personnel office or the Retirement Agency. You must be a member to

claim service. See page 3 for when membership ends. No additional credit can be

claimed after you have left membership or have retired.

5

Earned Credit

Claimed Credit—

It’s Up to You

There are two types of service for which you may claim credit:

n

Previous service earned in another system

n

U. S. military service.

SERVICE EARNED IN ANOTHER SRPS SYSTEM OR

IN A LOCAL RETIREMENT OR PENSION SYSTEM

A member may be eligible to transfer previous service credit from a previous retire

ment system to a new retirement system. An example would be a regular state

employee, currently a member of the state’s Employees’ Pension System, who

accepts a position as a state correctional officer, which requires membership in the

state’s Correctional Officers’ System. Another example is a Baltimore City employee,

with membership in Baltimore City’s retirement plan, who becomes a state em

ployee, which requires membership in the state’s Employees’ Pension System.

To transfer credit, you must complete an Election to Transfer Service (Form 37). To

qualify for the transfer of your credit, your employment must be continuous and

you must apply to transfer the credit within one year of becoming a member of the

new system.

MILITARY SERVICE

You may receive retirement credit for eligible military service as long as you have

not (and will not) receive credit for this military service under any other pension

system. This restriction includes military pensions. It does not apply to benefits

paid under Social Security, the National Railroad Retirement Act, any National

Guard or Reserve pension or to benefits received from any disability pension.

Review the following section for eligibility requirements and service credit limits.

Former members who have terminated membership with at least 10 years of cred

itable service may apply for military credit. Retired members who are receiving a

monthly benefit are not eligible to claim military credit.

Military credit claimed and applied to a memberʹs account receives the benefit for

mula multiplier in effect at the time of retirement.

Once retirement credit has been granted for military service, it cannot be removed

at a later date.

Eligible Types of Military Service

For SRPS purposes, eligible military service is limited to the following:

n

Membership in a reserve component of the Armed Forces of the United

States on active duty or ordered or assigned to active duty, or on active or

inactive duty for training that interrupts a member’s service;

n

Enlistment or induction into the Armed Forces of the United States;

n

Membership in the Maryland National Guard;

n

Participation in active duty or inactive duty training while a member of the

National Guard or a reserve component of the Armed Forces of the United

States;

6

HOW YOU EARN OR ACCRUE SERVICE CREDIT

HOW YOU EARN OR ACCRUE SERVICE CREDIT

n

Service in the Merchant Marines from December 7, 1941 to December 31,

1946, or

n

Active duty with the commissioned corps of the Public Health Service, the

National Oceanic and Atmospheric Administration or the Coast and

Geodetic Survey from:

a. December 7, 1941 to December 31, 1946;

b. June 25, 1950 to January 31, 1955, or

c. December 22, 1961 to May 7, 1975.

Active Duty Preceding Membership

You may claim up to a maximum of five years of credit for active military duty

preceding your membership. You must have accrued at least 10 years of creditable

service to apply for credit for military service that preceded SRPS membership.

Service in the Guard and Active/Inactive Duty Training—Preceding and During Membership

Special rules apply for service in the Maryland National Guard and active/inactive

duty training in the National Guard or U.S. Armed Forces Reserves.

Maryland National Guard Service

For service in the Maryland National Guard, four months of military credit

may be credited for each year of Guard service up to a maximum of 36 months

of military credit. A member must still have 10 years of creditable service to

claim this type of service.

Exception: If you are in the Maryland National Guard and are activated, you

can claim this service immediately upon your return to active employment.

Active Duty Training

For active duty training in the National Guard or U.S. Armed Forces Reserves,

one month of military credit may be credited for every 28 days of active duty

training certified. No credit is granted for days less than 28. To claim this ser

vice, a member must have 10 years of creditable service and the active duty

training must have occurred prior to enrollment in SRPS.

Military Duty or Training Interrupting Membership

If you are called to active military duty or assigned active or inactive duty training

while serving in the National Guard or a reserve unit during your membership, you

should file an Application to be Placed on a Qualifying Leave of Absence (Form 46)

before leaving employment. The filing of this form serves only to give your pension

plan notice of your absence for military service.

You may claim a maximum of five years of military credit upon returning to mem

bership provided:

n

You return to work with a participating employer within one year of your

discharge from active duty and

n

You do not accept other permanent employment between your date of dis

charge and your return to work.

How to Apply

To file for military credit, either preceding or interrupting membership, complete a

Claim of Retirement Credit for Military Service (Form 43). Attach a copy of your mili

tary discharge papers (Form DD 214) indicating your active duty entrance and dis

7

charge dates. To claim National Guard or Reserve service, include a retirement

credit record (Form NGB23 or similar form).

Note for bifurcated Plan C members: Effective October 1, 2006, military credit claimed

and applied to a memberʹs account before July 1, 1998, receives the benefit formula

multiplier in effect at the time of retirement. Members retiring prior to October 1,

2006 will retain the multiplier in effect at the time the military service was claimed.

Purchased credit refers to service credit you may buy through direct payment to the

Retirement Agency for specific types of previous employment. If you are contem

plating a purchase of service, you may wish to speak with a retirement benefits spe

cialist for information on how the cost is calculated. Also remember that you must

purchase service prior to retirement. Only members who are on paid employment or

on a State Retirement Agency approved leave of absence may purchase service.

Retirement System costs fall into one of two categories: “normal cost” or “full cost”.

The type of cost is determined by the type of employment service being purchased.

In some cases, a full cost purchase is prohibitively expensive.

NORMAL COST

At any time during membership, a Retirement System member may purchase ser

vice credit at “normal cost” for the following types of service. “Normal cost” is a

rate determined by the contributions that should have been paid for the period in

question, plus the statutory rate of interest, currently 4%, to the date of payment.

n

Retroactive/Missed Service—A period of time during fulltime permanent

employment when contributions were not deducted, either prior to member

ship (retroactive) or during membership (missed). Cost is based on salaries

paid during purchase period plus compounded interest to the date of

payment.

n

SRA Approved Leave of Absence—Approved only for personal illness, study,

paternity, maternity (including adoption), service that is government spon

sored and/or subsidized and service in a professional or employee organiza

tion. Cost is based on salary at the start of leave period plus compounded

interest to the date of payment. In order to be eligible to purchase the leave

time, a member must have filed an Application to be Placed on a Qualifying

Approved Leave of Absence (Form 46) before the leave began.

n

Redeposit—Previous service credit withdrawn from SRPS. Cost is based on the

amount withdrawn plus compounded interest to the date of payment.

n

Any period of membership in the State Police Retirement System during

which the member’s credit was not vested.

In addition, members of the Employees’ Retirement System may purchase service

credits for employment:

n

by the State or a participating governmental unit

n

by the Department of Legislative Reference, the Office of the Attorney

General, or as Secretary to the Speaker of the House of Delegates or President

8

HOW YOU EARN OR ACCRUE SERVICE CREDIT

Purchased Credit

HOW YOU EARN OR ACCRUE SERVICE CREDIT

of the Senate during a session of the General Assembly (a year or part of a

year equals 1 year of service)

n

by a member of the Senate or House of Delegates or the office of the Secretary

of the Senate or the Chief Clerk of the House of Delegates (130 days or more

equals 1 year of service).

An application to purchase credit at normal cost may be made at any time. That’s

because the cost is determined by the contributions that should have been paid for

the period in question at the statutory interest rate, which is currently 4%. You will

need to complete a Request to Purchase Previous Service (Form 26) and attach verifica

tion of your employment, indicating your entrance and termination dates.

FULL COST

In the year of retirement, a member of the Retirement System may purchase service

credits at ʺfullʺ cost for the following:

n

Outofstate public school teaching

n

Public or nonpublic school teaching

n

Postsecondary school teaching (a maximum of five years may be purchased)

n

Federal employment

n

Outofstate municipal employment

n

Instate nonparticipating municipal employment

In addition, members of the Teachersʹ Retirement System may purchase qualified

approved leaves granted by Baltimore City to a teacher while a member of the

Baltimore City Retirement Plan.

An application to purchase service at full cost may only be made within the year of

retirement. The cost is determined by computing the additional reserves needed to

fund the retirement benefit created by the additional purchased credit. A minimum

of one month up to a maximum of 10 years may be purchased, unless noted. You

should apply to purchase service when you submit your Application for an Estimate

of Service Retirement Allowances (Form 9). You will need to complete a Request to

Purchase Previous Service (Form 26) and attach verification of your employment,

indicating your entrance and termination dates.

You must retire within 30 days of terminating employment with a participating

employer to receive additional creditable service for your accumulated unused sick

leave. Since creditable service determines the amount of the benefit, unused sick

leave, accordingly, can increase the amount of your benefit. It does not, however, affect

when you are eligible to retire, nor does it affect the reduction for early retirement.

When you file your retirement application, your employer will verify the total

unused sick leave you have accumulated. You receive one month of additional cred

itable service for each 22 days of unused sick leave reported. If, after calculating

additional credit at the rate of 22 days per month, there are 11 or more days

remaining, you receive an additional month of creditable service.

The maximum number of sick days that can be used to calculate additional service

is 15 days for each year of your membership.

9

Unused Sick

Leave

Important Notes on Unused Sick Leave:

n

Unused sick leave is credited only when calculating the retirement benefit. It

is not used to qualify for retirement benefits.

n

Unused sick leave does not affect the reduction for early retirement.

n

Unused sick leave is not used in the calculation of a vested benefit.

n

Sick leave for 10 month employees such as teachers is credited according to

the table.

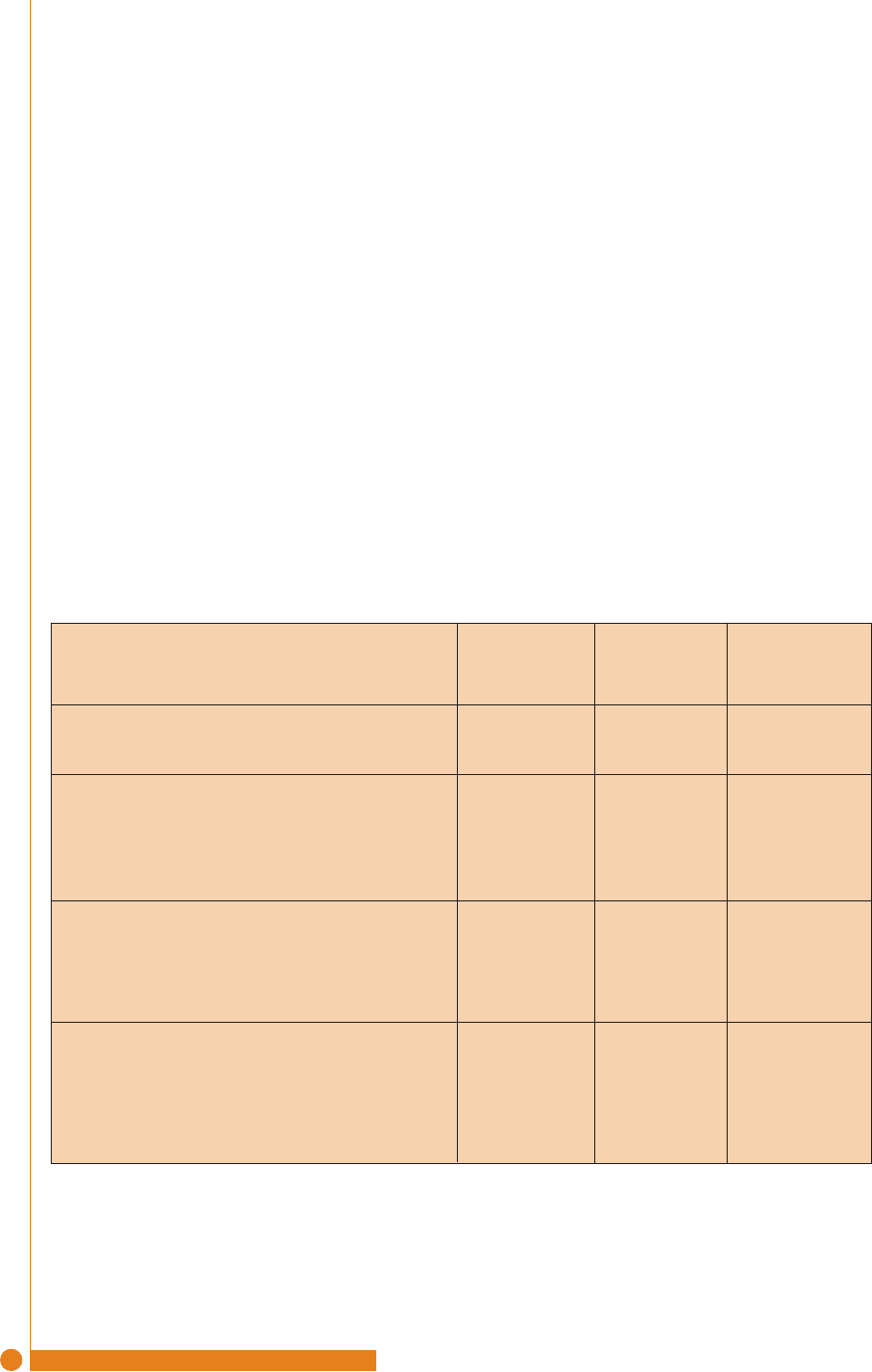

The following table shows how unused sick leave may be converted to retirement

credit.

10

HOW YOU EARN OR ACCRUE SERVICE CREDIT

Sick Leave in Days 10 Month Member 12 Month Member

001–010 0 0

011–032 1 1

033–054 2 2

055–076 3 3

077–098 4 4

099–120 5 5

121–142 6 6

143–164 7 7

165–186 8 8

187–208 9 9

209–230 1 YEAR 10

231–252 1 YEAR 11

253–274 1 YEAR 1 YEAR

275–296 11 13

297–318 12 14

319–340 13 15

341–362 14 16

363–384 15 17

385–406 16 18

407–428 17 19

429–450 18 20

451–472 19 21

473–494 2 YEARS 22

495–516 2 YEARS 23

517–538 2 YEARS 2 YEARS

NOTE: The Teachers’ Retirement System is a 10month system.

Sick Leave Conversion Schedule

3

YOUR BENEFITS

It might surprise you to learn that your retirement plan is not only for the future. In

addition to providing income when you retire, your plan provides important cover

age throughout your career.

Your Benefits Include

Coverage While You Work

n

Survivor protection if you die before retirement.

n

Disability coverage in the event that you are unable to continue working

due to a disabling injury or illness.

Retirement Benefits

n

A basic monthly retirement allowance based on your age, service, and

salary upon retirement.

n

Options for a continuing allowance to your survivor.

n

Annual costofliving adjustments.

Let’s take a look at the eligibility requirements, payment formula, and filing proce

dures for each of these benefits.

ELIGIBILITY REQUIREMENTS

Our survivor protection, also referred to as a death benefit, provides financial

protection to your designated beneficiary(ies) if you die during active membership.

Coverage goes into effect after one year of completed service for nonjob related

death. You are covered from your first day on the job for death in the performance

of duty.

Survivor protection remains in effect as long as you are on payroll or an

SRPSapproved unpaid leave of absence. (To secure your survivor benefit during a

leave of absence, you must have your employer’s prior approval and must file a

special leave form with the Retirement Agency before your leave begins—See

section on Approved Leave of Absence, page 3).

11

Survivor Benefits

YOUR BENEFITS

SPECIAL DEATH BENEFIT

Benefit for Death in the Performance of Duty

If you are killed while a member and your death arises out of or in the course of the

actual performance of duty through no willful negligence on your part, the follow

ing benefit will be paid:

1. A single payment consisting of your contributions with interest to your

designated beneficiary, PLUS

2. An annual benefit for your spouse (paid monthly) equal to twothirds of

your Average Final Compensation. If you have no spouse, your children

under 18 years of age receive this payment until each attains age 18. Or, if

you have no spouse or minor children, this benefit is payable to your

dependent parent for life.

If you have no spouse, minor children, or dependent parent, then the Ordinary

Death Benefit will be paid to your designated beneficiary.

PAYMENT OF ORDINARY DEATH BENEFIT

Onetime

The survivor benefit is normally a onetime payment equal to:

n

your annual salary at date of death,

plus

n

any member contributions with accumulated interest.

SPOUSE OPTION

If you are married, your spouse may elect a monthly benefit instead of a onetime

payment if both of the following conditions are met:

n

member is eligible to retire, or at least age 55 with 15 years of creditable ser

vice upon death and

n

spouse is designated as sole primary beneficiary.

The monthly survivor benefit is equal to the payment your beneficiary would

receive had you retired under Option 2, the 100 percent survivorship option. (See

discussion on Allowance Options, page 19, for more information.)

DEATH WHILE PERFORMING MILITARY SERVICE

If death occurs while you are a member performing qualified military service, a sur

vivor benefit of either the ordinary death benefit or spouse option, if eligible, will

be paid to your designated beneficiary(ies.)

The State Retirement System provides important disability coverage in the unfortu

nate event that a serious injury or illness permanently incapacitates you from per

forming your job duties. While we hope you never have to apply for disability, an

accident, illness or injury due to military action can happen at any time. For this

reason, it is important that you be aware of the disability provisions of your plan.

Your Personal Statement of Benefits provides an estimate of the basic disability

allowance. Additionally, you should contact your personnel office to determine

what impact a disability retirement might have on your health insurance coverage.

12

Disability Benefits

If you are an employee of a State agency who takes a disability retirement, you are

automatically eligible for continued health insurance coverage through the State.

Also, please be aware that disability retirement entails a two step process. Step 1,

applying for disability, is described on page 14. The second step must be carried out

if you are approved for disability benefits. (See page 16). At this point you must file

an application to actually retire.

TYPES OF DISABILITY

Ordinary versus Accidental Disability

The State of Maryland provides benefits for two types of disability: ordinary and

accidental. Ordinary disability covers a permanently disabling medical condition.

Accidental disability applies to a permanently disabling medical condition resulting

from injuries sustained from an accident that occurred on the job. For either type of

disability, the applicant must demonstrate that he or she is completely and perma

nently unable to perform the duties of his or her job, as determined by the

Retirement Agency’s Medical Board and approved by the Board of Trustees.

ELIGIBILITY REQUIREMENTS

Individuals filing for disability must demonstrate that they are completely and per

manently unable to perform the duties of their job, as determined by the Retirement

Agency’s Medical Board and approved by the Board of Trustees. Eligibility require

ments specific to the two types of disability follow.

Two Types of Disability

Ordinary Disability

n

A minimum of five years of service.

n

Permanent incapacity to perform one’s job duties due to medical reasons

(includes occupational disease).

n

Approved by Medical Board and Board of Trustees.

Accidental Disability

There is no service requirement for accidental disability. Coverage is in effect

immediately upon enrollment provided all of the following requirements are

met:

n

You are totally and permanently disabled as the direct result of a specific

accident(s) which occurs at a definite time and place. (Does not include

occupational disease.)

n

Accident occurs while you are performing assigned duties.

n

You are not responsible for the accident through willful negligence.

n

The disabling condition was caused by an accident that occurred within

five years of your application for disability.

n

Your claim is approved by the Medical Board and Board of Trustees

13

YOUR BENEFITS

STEP 1: APPLYING FOR DISABILITY BENEFITS

Filing Requirements

Be aware that you cannot wait indefinitely to file for disability. Members of the

Employees’ Retirement System must apply for both ordinary and accidental disabil

ity benefits while still on payroll or within four years of going off payroll. In special

cases, a 24month filing extension may be granted if you can prove you were men

tally or physically incapacitated from filing within the deadline, due to the disabil

ity itself. In this situation, however, the requirements are difficult to meet.

Members of the Teachers’ Retirement System must file for disability while still on

payroll or within 5 years of going off payroll. A 12month filing extension may be

granted if you can prove you were mentally or physically incapacitated from filing

within the deadline.

How to File A Claim

Filing for a disability benefit can be a lengthy process. (If your case involves a ter

minal medical condition, please contact the Retirement Agency for instructions

on our expedited process.) Several months can go by, from the time you file your

claim to the point where a decision is made by the Medical Board and the Board of

Trustees. Once approved by the Board of Trustees, you must then submit an appli

cation to accept a disability retirement. That’s why you shouldn’t wait until the last

minute to apply. If you feel you may be eligible for disability retirement, contact a

retirement benefits specialist immediately. Also, in the event you are incapacitated,

let your family members know they should contact the Retirement Agency to find

out what options are available to you.

Keep in mind that the medical evaluation is based on the documentation you pro

vide detailing the disabling condition, the diagnosis, and the prognosis. It is in your

best interest to submit as much supporting information as possible. To expedite

your claim, all forms and supporting medical information should be submitted

together. Disability applicants must file the following:

n

Statement of Disability (Form 20): Provides information on the nature and

cause of the disability. It requires your physician’s medical report, which

should include an opinion as to whether or not you are permanently disabled,

and if so, why.

n

Job description: The Medical Board evaluates the medical condition in rela

tion to your job duties. The job description must be signed and dated by your

supervisor.

n

All pertinent medical records: Your doctor(s) will help you submit medical

information in support of your claim (such as Xrays, test results, and hospital

reports). The Form 20 provides a complete list of pertinent medical data.

n

Preliminary Application for Disability Retirement (Form 129) This form pro

tects the disability applicant, should he or she die before submitting an appli

cation to accept a disability retirement. It authorizes the Agency’s Board of

Trustees to decide whether a disability allowance may be paid.

n

Application for an Estimate of Disability Retirement Allowances (Form 21)

This form authorizes the Agency to provide benefit estimates under various

YOUR BENEFITS

14

allowance options. An estimate of the allowance options checked on this form

is automatically generated if you are approved for disability benefits.

n

Notification of Social Security Claim/Award

In addition to the above, for accidental disability, you must provide the following:

n

Accidental Disability Documentation: For accidental disability claims, the

employee must submit evidence to document that the accident was the direct

cause of the disability.

n

Employer’s First Report of Injury

n

Copies of any Workers’ Compensation decisions, awards or pending claims.

QUESTIONS TO GUIDE YOU WHEN FILING A CLAIM FOR DISABILITY

If you answer “yes” to the questions that follow, you may file for disability

benefits. Contact the Retirement Agency immediately.

General Requirements for Disability Benefits

1. Have you met filing requirements?

2. Are you permanently and totally disabled from performing your job

duties?

Additional Requirements for Accidental Disability

1. Is your disabling condition caused by an accident that occurred within

the last five years? (There is a fiveyear statute of limitations on filing

for accidental disability.)

2. Did the accident occur while you were performing your assigned

duties?

3. Was the disability directly caused by the accident?

CLAIM REVIEW/APPROVAL

Disability claims are evaluated by the Retirement Agency’s Medical Board, which

reviews cases on a weekly basis. Currently, the physicians serving on the Board

represent a range of medical specialties. They are appointed by the System’s Board

of Trustees and are not affiliated with the State.

The Medical Board’s recommendation regarding the disability claim is presented to

the Board of Trustees for final action. In some cases, the Medical Board will request

an examination by a consulting physician at the Agency’s expense for the purpose

of providing an additional medical opinion.

NOTIFICATION

The claimant is notified of the claim decision after the Board of Trustees rules on

the action recommended by the Medical Board.

15

YOUR BENEFITS

YOUR BENEFITS

The review for an accidental disability usually takes several months. Reviews for

ordinary disability cases take approximately two to three months. Complicated

cases may take even longer.

STEP 2: IF APPROVED, FILE AN APPLICATION TO ACTUALLY RETIRE

RETIREMENT DATE

Complete Form 1323, Application for Service or Disability Retirement. On the Form 13

23 most retirees select the first day of the month as their retirement date, but it is

not mandatory. Your health situation could dictate otherwise. Please contact a

retirement benefits specialist for further information.

BENEFIT AMOUNT

The information that follows is based on the Basic Allowance, which is the maxi

mum monthly payment available to the retiree, but it provides no beneficiary pro

tection. Other options are available which provide a lower payment to the retiree

depending on the degree of beneficiary protection. See “Choosing an Allowance

Option” in this chapter and “Calculating Your Benefits” for more information.

Ordinary Disability Benefit

The ordinary disability retirement allowance is computed using the service

retirement formula, with a minimum benefit equal to 25% of the average final

compensation. This means that your benefit is computed as a service retirement

benefit without reduction. If you choose one of the optional allowances, the ben

efit will be less.

Accidental Disability Benefit

The accidental disability retirement allowance is equal to two thirds (.6667) of

your average final compensation (average of the three highest years of salary)

plus an annuity based on member contributions with interest. If you choose one

of the optional allowances, the benefit will be less.

Important Note on Workers’ Compensation: It is VERY IMPORTANT that you be

aware of the impact of Workers’ Compensation benefits on an accidental disability

retirement. Disability benefits are “coordinated” with benefits payable from

Workers’ Compensation. This does not reduce or affect your rights to apply for and

receive Workers’ Compensation benefits. If you apply for and receive a Workers’

Compensation award payable while retired, your accidental disability retirement

benefit shall be reduced for an accidental personal injury but not for an occupa

tional disease.

Retirement law directs us to withhold from your disability benefits an amount

equivalent to the Workers’ Compensation award, if the Workers’ Compensation

benefits and disability are based on the same event and are paid over the same

period of time. However, the Retirement Agency does not offset your annuity (por

tion of benefit based on your contributions) and must leave enough benefit to cover

the cost of your health insurance premiums. If you apply for Workers’

Compensation benefits, please inform us immediately. Please include your Workers’

Compensation case number in this notification.

16

REEMPLOYMENT RESTRICTIONS

Only members who retire on ordinary disability are subject to certain earnings

restrictions if they become reemployed by a participating employer. Your earnings

limit is listed on the letter of acknowledgement sent to you upon retirement. If you

exceed your earnings limitation, your retirement allowance is reduced one dollar

for every two earned in excess of your earnings limit. After 10 years of retirement,

the reduction is one dollar for every five exceeding the limit. Earnings restrictions

are lifted on January 1 of the year when you reach retirement age (age 60). (For a

summary of situations which may cause your disability benefit to be suspended,

see “Suspension of Disability Retirement.”)

As an active member, you should also be aware that your accumulated benefits

are protected if you leave the State Retirement System and you are vested (have

accrued five years of creditable service). If you should leave your job for any reason,

you are guaranteed to receive a future benefit for the years and months of service

earned before termination.

ELIGIBILITY

A vested allowance is payable at age 60. In as much as the Retirement System has

been a closed system since January 1, 1980, all active members by now have at least

the minimum five years needed for vesting. If you are vested and return to work for

a participating employer while still classified as a member (membership in the

Employees’ System extends for four years once paid employment ends, Teachers’

System membership extends for five years), you will return to membership in the

Retirement System. If you return after the membership period ends, then you must

join the Pension System. Under those circumstances, you’ll retain your right to a

vested benefit from the Retirement System, while earning benefits from the Pension

System.

If you are in this situation, call a retirement benefits specialist for information on

receiving the vested benefit while continuing to work.

PAYMENT

The calculation of a vested allowance uses the normal service retirement formula.

The calculation uses your average final compensation (three highest years of salary)

and creditable service at termination. Unused sick leave is not included in the calcu

lation of your vested allowance. See “Calculating Your Benefits” for more informa

tion.

If your vested allowance is less than $50 a month, you may elect to receive a lump

sum payment of the allowance in lieu of a monthly benefit.

17

YOUR BENEFITS

Vesting

YOUR BENEFITS

NOTIFICATION

Approximately three months before your 60th birthday, the Retirement Agency

sends a letter and a blank estimate form to the address on record. After you return

the completed form, you’ll receive an estimate of your vested allowance under vari

ous allowance options. That’s why it’s important to keep the Retirement Agency

apprised of any address changes over the years. Please do your part to ensure that

we can contact you when benefits become payable at age 60.

Your eligibility for retirement depends on two factors: how long you’ve been work

ing to earn retirement credit and how old you are. Let’s begin with a normal service

retirement which is retirement with full benefits.

NORMAL SERVICE RETIREMENT

Eligibility Requirements

You qualify for a normal service retirement when you meet either of the following

age or service criteria:

n

age 60, regardless of service

n

30 years eligibility service, regardless of age.

Retirement Allowance

Your annual retirement income is based on your service and average final compen

sation upon retirement. See “Calculating Your Benefits” for more information.

NOTE: With the exception of salary increases due to promotions, salary increases of

20 percent or greater are not automatically included in the calculation of average

final compensation (AFC). These “extraordinary salary increases” are subject to

review by the System’s Board of Trustees on a casebycase basis. Your actual bene

fit cannot exceed either 100% of your average final compensation or the IRC §415

limit.

EARLY SERVICE RETIREMENT

Eligibility Requirements

Some people decide to take an early retirement. Requirements for early retirement

under the State Retirement System are a minimum of 25 years of eligibility service

prior to age 60.

Early Retirement Allowance

Employees who opt for an early retirement receive a smaller pension. The

Retirement System plan provisions provide for a 6% reduction for each year the

payments begin prior to age 60 or 30 years of service, whichever produces the

smaller reduction. The reduction is calculated on a monthly basis which means that

generally, the benefit is reduced by .005 for each month payments begin early.

However, for members who earn service credits on a ten month basis (all teacher

members and some employee members), the reduction for service is .006 for each

month prior to 30 years.

18

Service

Retirement

For example, a member retiring at age 57 with 25 years of eligibility service would

receive an 18% reduction since the member is 3 years from age 60. Credit for

unused sick leave does not affect the reduction for early retirement. Refer to

“Calculating Your Benefits” for more information.

CHOOSING AN ALLOWANCE OPTION

When it comes time to retire, you will be able to choose from a number of payment

plans. These plans range from the Basic Allowance, which provides the highest

monthly allowance for you alone, to options that reduce your monthly payment but

provide varying degrees of protection to your beneficiary(ies) upon your death.

You cannot change your option selection after your first payment becomes normally

due. We urge you to discuss your needs with your family and financial advisor.

Contact the State Retirement Agency if you need assistance in deciding which

option best suits your situation. Also keep in mind that the option you choose may

affect your beneficiary’s eligibility for continued health coverage after your death.

Check with your personnel office.

You should carefully review your personal circumstances before selecting an

option. Think about how much income you will need to maintain an acceptable

standard of living during retirement, as well as the needs of your survivor(s).

The Basic Allowance

This provides the maximum lifetime allowance to the retiree with all payments

ceasing upon the retiree’s death. There is no beneficiary coverage. If you believe

your spouse or other survivor may need some form of income continuation

after your death, you may wish to consider one of the following options.

SingleLife Annuities

These options are classified as singlelife because they provide benefits over the

retiree’s lifetime only. Upon the retiree’s death, any reserve funds remaining in

the account are distributed in a onetime payment to the retiree’s designated

beneficiaries.

Multiple beneficiaries may be named under the SingleLife Annuities. These benefi

ciaries may be changed as often as desired.

OPTION 1—Full Return of Present Value of Retiree’s Basic Allowance

Provides a lower monthly benefit than the Basic Allowance, but guarantees

monthly payments that equal the total of your retirement benefit’s Present

Value. The Present Value of your benefit is figured at the time of your retire

ment. If you die before receiving monthly payments that add up to the Present

Value, the remaining payments will be paid in a single payment to your desig

nated beneficiary or beneficiaries who remain alive.

OPTION 4—Full Return of Employee Contributions

Provides a lower monthly benefit than the Basic Allowance, but guarantees the

return of your accumulated contributions and interest as established when you

retire. If you die before you have recovered the full amount of your accumu

lated contributions and interest, the remainder will be paid in a single pay

ment to your designated beneficiary or beneficiaries who remain alive.

19

YOUR BENEFITS

YOUR BENEFITS

DualLife Annuities

These options pay benefits over two lifetimes. They provide a benefit throughout

the life of the retiree and then provide a continuing monthly benefit to a single sur

viving beneficiary. The benefit amount is based on the retiree’s age and the age of

the beneficiary at the time of the member’s retirement. Because these options pro

vide a continuing monthly payment to a beneficiary, they normally result in a

smaller benefit payment than Option 1 or 4. Again, this is because benefits are

expected to be paid over two lifetimes, the retiree’s and the beneficiary’s, rather than

the retiree’s alone.

Only one beneficiary may be named under the DualLife Annuities. This beneficiary

may be changed, but it will cause a recalculation of the retiree’s benefit amount. In

most cases, the recalculated amount will be less than the current amount.

OPTION 2—100% Survivor’s Benefit

Provides a lower monthly benefit than the Basic Allowance, but guarantees

that after your death the same monthly benefit will continue to be paid to your

surviving beneficiary for his or her lifetime. No further payments will be made

after the deaths of you and your beneficiary. If you choose this option, you

must send proof of your beneficiary’s date of birth with your final retirement

application.

OPTION 3—50% Survivor’s Benefit

Provides a lower monthly benefit than the Basic Allowance, but guarantees that

after your death one half of the monthly benefit paid to you will be paid to your

surviving beneficiary for his or her lifetime. No further payments will be made

after the deaths of you and your beneficiary. If you choose this option, you must

send proof of your beneficiary’s date of birth with your final retirement applica

tion.

OPTION 5—100% Survivor’s Benefit with PopUp Provision

Provides a lower monthly benefit than the Basic Allowance, but guarantees

that after your death the same monthly benefit paid to you will be paid to your

surviving beneficiary for his or her lifetime. It also provides that your monthly

benefit will “popup” to the Basic Allowance for your lifetime if your benefi

ciary dies before you. If your original beneficiary dies and you are collecting

the Basic Allowance and decide to name a new beneficiary, your benefit will be

recalculated under Option 5 based on the new beneficiary designation. If you

choose this option, you must send proof of your beneficiary’s date of birth with

your final retirement application.

OPTION 6—50% Survivor’s Benefit with PopUp Provision

Provides a lower monthly benefit than the Basic Allowance, but guarantees

that after your death one half of the monthly benefit paid to you will be paid

to your surviving beneficiary for his or her lifetime. It also provides that your

monthly benefit will “popup” to the Basic Allowance for your lifetime if your

beneficiary dies before you. If your original beneficiary dies and you are col

20

lecting the Basic Allowance and decide to name a new beneficiary, your benefit

will be recalculated under Option 6 based on the new beneficiary designation.

If you choose this option, you must send proof of your beneficiary’s date of

birth with your final retirement application.

Special Limitation on Beneficiary under Option 2 and Option 5 – Effective January 1, 2006

If you choose Option 2 or Option 5, your beneficiary cannot be more than 10 years

younger than you unless the beneficiary is your spouse or disabled child. If you are

naming your disabled child at retirement, you need to have verification from a

physician of your child’s disability. Form 143 Verification of Retiree’s Disabled Child for

Selection of Option 2/5 Beneficiary must be completed and attached with your applica

tion for retirement.

NOTE: You cannot change your option selection after your first payment becomes

normally due. We urge you to discuss your needs with your family and financial

advisor. Contact the State Retirement Agency if you need assistance in deciding

which option best suits your situation.

Additionally, the option you choose may affect your beneficiary’s eligibility

for continued health coverage after your death. For retirees from State

Agencies, only the selection of a duallife annuity with the spouse as benefi

ciary (Options 2, 3, 5 or 6) continues health program coverage to the surviv

ing spouse (see page 39 for more details). Retirees from other employers

should check with their personnel office.

It is important that you allow yourself sufficient time to make informed decisions

about your retirement and meet the various filing deadlines. You should begin the

application process approximately six months to one year from your desired retire

ment date and review the options available to you before you submit your final

application. Stepbystep instructions on the application process follow. All retire

ment forms mentioned can be obtained through your personnel office or on the

Internet at www.sra.state.md.us. See “Retirement Checklist” for a detailed checklist

that includes some important financial and personal planning matters.

We urge you to take advantage of our member services as you prepare for retire

ment. You should plan to meet with one of our retirement benefits specialists to dis

cuss your situation when you are within one year of your intended retirement date.

Additionally, the Retirement Agency holds preretirement seminars for members

who are within eight years of retirement.

21

YOUR BENEFITS

Applying for

Retirement

4

FUNDING YOUR BENEFITS

EMPLOYER CONTRIBUTIONS

The Employees’ and Teachers’ Retirement Systems are contributory for most mem

bers. Your employer, however, contributes the largest amount necessary to fund

your benefits. The employer contribution rate is established annually by the Board

of Trustees based upon an annual actuarial valuation.

EMPLOYEE CONTRIBUTIONS

Mandatory Contributions

You are required to make an employee contribution based on your selection of Plan

A, Plan B, or Plan C. Members who elected Plan A generally contribute at the rate

of 7%. However, those who were paying less than 5% as of July 1, 1984, received an

increase to their contribution rate of 2% over their 1984 rate.

Members who elected Plan B contribute 5% of salary or continue to pay the rate in

place as of July 1984.

Members who selected Plan C and are eligible for the Contributory Pension System

benefit are required to contribute 2% of their earnable compensation to the System.

Plan C members who are eligible for the NonContributory Pension System benefit

are required to contribute 5% of any portion of their salary that exceeds the Social

Security Wage Base.

Contributions due are determined on the basis of earnings reported for the ending

date of each pay period through the close of the calendar year, regardless of the

date paychecks are issued by the employer. For example, if the pay period ends on

December 31, a retirement contribution is due on those earnings though the actual

pay date is January.

Employer PickUp Contributions

All State agencies and many participating employers have joined the State’s

“employer pickup” program. Under the pickup program, your mandatory

employee contributions are treated as pretax contributions for federal income tax

purposes. That is, your contributions are not subject to federal tax during your

membership. Federal income taxes are deferred until you receive a benefit from the

System.

22

Types of

Contributions

The pickup program affects federal taxes only. Your contributions are still subject

to Maryland income tax during your employment.

SUPPLEMENTAL CONTRIBUTIONS

Your pension benefits, along with Social Security, will provide an important finan

cial foundation for your retirement. These benefits, however, are likely to be only a

part of the total financial picture. You may wish to supplement your retirement sav

ings.

Employer Annuity Programs

You may be eligible to participate in an annuity program offered by your employer.

Some employer programs permit you to make contributions on a taxdeferred or

taxsheltered basis. Check with your personnel office to see if your employer offers

a supplemental annuity program.

Maryland Supplemental Retirement Plans (State Employees Only)

The Maryland Supplemental Retirement Plans offer State employees* a way to save

on their own for retirement—through the Maryland 457 Deferred Compensation

Plan, 401(k) Savings & Investment Plan, and 403(b) Tax Deferred Annuity Plan. All

contributions are made through payroll deductions before Federal and State income

taxes are assessed. The minimum contribution is $5 a biweekly pay. The maximum

varies by plan. Participants have a variety of investment options from which to

choose to direct their contributions.

* For purposes of these plans, in most cases, a State employee is defined as an

employee who is receiving a paycheck from the State of Maryland. Some

exceptions may apply. Note that county teachers are not eligible for participa

tion in these supplemental retirement plans.

For further information, contact the Maryland Teachers’ & State Employees’

Supplemental Retirement Agency by telephone at 4107678740 or 18005435605.

Information also can be obtained from the Web site www.msrp.state.md.us.

Participating employers are required to contribute a certain percentage of payroll

each year to fund pension benefits. The contribution rate is established annually by

the Board of Trustees based upon an annual actuarial valuation. These contribu

tions, along with employee contributions, are invested under the direction of the

System’s Board.

SYSTEM SAFEGUARDS

To safeguard the proper operation and funding of this multibillion dollar pension

fund, operations are monitored both internally and externally. The system’s finan

cial activities are subject to an annual audit by the State’s External Auditor and the

system’s administrative activities are subject to a triannual audit by the State’s

Legislative Auditor. Additionally, the system’s financial and administrative activities

are subject to routing internal audits. Funding requirements are calculated by an

23

FUNDING YOUR BENEFITS

System

Investments

independent actuary, who prepares an annual valuation of the system’s assets and

liabilities. Before investment programs are undertaken by the Board, they are

reviewed by the Board’s Investment Committee, which includes three outside

investment experts. All financial decisions require that assets be invested prudently

and conservatively in the best interest of our members.

A summary of how your assets are being managed is published annually in the

Retirement Agency’s newsletter, the Mentor.

YOUR BOARD OF TRUSTEES

Your Board of Trustees plays an important role in the stewardship of the State

Retirement and Pension System. The Board guides system operations, establishes

investment policies, formulates administrative policy, and oversees the manage

ment of system assets.

Some trustees serve on the Board because of their position in State government;

others are appointed by the Governor because of their particular expertise; while

others are elected by you, our members.

24

FUNDING YOUR BENEFITS

5

CALCULATING

YOUR BENEFITS

This section illustrates how to calculate dollar figures for the various SRPS benefits.

The samples provided are examples only. The Retirement Agency will furnish you

with a precise calculation when you file for benefits.

1. Average Final Compensation (AFC): the average of the three highest annual

salaries during your career.

NOTE: With the exception of a salary increase due to a promotion, any increase

exceeding 20% is excluded from the calculation of average final compensation

unless approved by the Board of Trustees.

2. Creditable Service: your total creditable service (including additional credit

granted for unused sick leave) as of your retirement date.

Each of the following sample calculations is based on the Basic Allowance, which

provides the highest monthly retirement income to the retiree, but provides no ben

eficiary protection. Also, these calculations would apply only to retirement system

members who opted to join Plan A or B. Additionally, the service credit is converted

to years based on a 12 month employee.

For members of Plan C (bifurcated plan), a two part calculation is required. Part of

Plan C benefits are calculated using the Retirement System formula. The remainder

of the benefit is calculated using the Pension System formula. For detailed informa

tion on how Plan C benefits are calculated, see the Appendix.

FORMULA—SRPS guarantees the total Basic Allowance will equal 1/55th of the

average final compensation for each year of creditable service.

25

Assumptions

Used In Sample

Calculations

Key Elements of

the Benefit

Formula

Service

Retirement

CALCULATING YOUR BENEFITS

Service Retirement Benefit =

Total years and months of

creditable service x AFC = Basic Annual Allowance

55 (Guarantee) (divide by 12 for Basic Monthly Allowance)

Example 1A: Service Retirement at Age 60

Let’s now look at how these components fit into the equation by way of example.

You are age 60, with 25 years and 3 months of creditable service. Your average final

compensation is $42,000. The basic benefit is calculated as follows:

25.25 years x $42,000 (AFC) = $19,281.82 (annual allowance)

55

$19,281.82 ÷ 12 = $ 1,606.82 monthly allowance (Basic Allowance)

Example 1B: Service Retirement with 30 Years of Service

If we now assume that you are age 55 with 30 years of service, then the formula is

calculated as follows:

30 years x $42,000 (AFC) = $22,909.09 (annual allowance)

55

$22,909.09 ÷ 12 = $ 1,909.09 monthly allowance (Basic Allowance)

FORMULA—The calculation of an early retirement benefit uses the normal service

retirement formula but with a reduction. As discussed earlier, the reduction is 6%

per year and can be based on either age or service. If based on age, the monthly

reduction is .005 for each month under age 60. If based on service credit, the reduc

tion for members of the Teachers’ System (10 month system) is .006 for each month.

For members of the Employees’ System (12 month system) the monthly reduction is

.005 for each month. Either reduction applies for each month you are under 30

years of service credit. The reduction cannot exceed 30 percent. Also remember that

credit for unused sick leave does not affect the reduction for early retirement.

Example 2: Early Retirement

To illustrate, let’s look at a member who is age 58 and has 25 years of creditable

service. His average final compensation is $42,000. The early retirement calculation

is a twostep process:

STEP 1: Use Normal Service Retirement Formula

25 years x $42,000 (AFC) = $19,090.91

55

$19,090.91 ÷ 12 = $ 1,590.91 (monthly benefit)

26

Early Retirement

STEP 2: Apply Reduction Factor (member under age 60)

Early Retirement reduction factor is .005 x months to age 60 (which is the smaller

reduction when age and service are considered). In this example, since the

employee is exactly age 58, he is taking retirement 2 years earlier than normal.

Thus, the reduction is:

.005 x 24 months = 12%

$1,590.91 (monthly benefit) x 12% (reduction factor) = $190.91 reduction per month

$1,590.91 $190.91 = $1,400.00 monthly allowance (Basic Allowance)

payable at age 58

FORMULA—A vested benefit (deferred allowance) is calculated in the same

manner as the normal retirement benefit. The two key elements in the benefit

formula are:

n

Average final compensation (AFC) at termination of membership

n

Creditable service at termination of membership (does not include unused

sick leave)

Example 3: Vested Retirement (Full Benefit)

Let’s assume that you leave membership with 16 years of creditable service and

your average final compensation is $42,000. Your vested benefit, payable at age 60 is

calculated as follows:

16 years x $42,000 (AFC) = $12,218.18

55

$12,218.18 ÷ 12 = $ 1,018.18 monthly allowance (Basic Allowance)

NOTE: Unused sick leave is not included as additional service in the calculation of

your deferred benefit.

FORMULA—The calculation of an ordinary disability benefit makes use of the nor

mal service retirement formula. The law provides that the minimum benefit

payable for most people is equal to 25% of the average final compensation. Since

the Retirement System has been closed to new members since January 1980, it is

likely that the benefit based on actual service will exceed the minimum 25%.

Example 4: Ordinary Disability Retirement

Here’s how the benefit would be calculated for an employee age 42 with 20 years of

creditable service and an average final compensation of $42,000:

20 years x $42,000 (AFC) = $15,272.73

55

$15,272.73 ÷ 12 = $ 1,272.73 monthly allowance (Basic Allowance)

27

CALCULATING YOUR BENEFITS

Vested Benefit

Ordinary

Disability

CALCULATING YOUR BENEFITS

NOTE: A claim must be approved by the Medical Board and the Board of Trustees

before the Retirement Agency can issue a calculation of benefits. An application for

disability retirement must be filed at that time in order to actually retire. For esti

mates of the Basic Allowance for both ordinary and accidental disability, refer to

your annual Personal Statement of Benefits.

FORMULA—Unlike ordinary disability, accidental disability does not make use of

the normal service retirement formula. The accidental benefit is based on twothirds

of an employee’s average final compensation at the time of disability, plus an annu

ity based on accumulated employee contributions with interest.

Example 5: Accidental Disability Retirement

To illustrate, let’s look at an employee who retires under accidental disability at age

51. His average final compensation is $42,000, and his employee contributions and

interest are $26,928. The two step formula uses a second calculation to determine

the annuity based on the employee contributions.

STEP 1: Determine twothirds of the average final compensation (AFC)

$42,000 (AFC) x .6667 = $28,001.40

$28,001.40 ÷ 12 months = $ 2,333.45 $2,333.45

STEP 2: Calculate the annuity

$26,928.00 x 8.879 = $ 3,032.77 PLUS

(Employee (NAF**)

contributions

plus interest*)

$3,032.77 ÷ 12 months = $ 252.73 $ 252.73

TOTAL $2,586.18

monthly allowance (Basic Allowance)

* Employee contributions plus interest will vary for each employee.

** (NAF) Normal Annuity Factor is a number set according to age. The

Retirement Agency consults an actuarial table (which is published in the

Code of Maryland regulations) for each person’s NAF.

NOTES:

n

A disability claim must be approved by the Medical Board and Board of

Trustees before the Retirement Agency can issue an estimate of benefits.

n

Accidental disability benefits in most cases are offset against Workers’

Compen sation paid or payable for the same accident, over the same period

of time.

28

Accidental

Disability

Example 6: Special Death Benefit

Consider a member who is killed on the job in the performance of duty. The mem

ber’s annual salary is $75,000 and the member has $40,000 of accumulated contribu

tions with interest. The member’s spouse* is his sole primary beneficiary.

$75,000 x .6667 = $50,002.50 annual Basic Allowance

$50,002.50 ÷ 12 = $4,166.88 monthly Basic Allowance

The spouse also receives a single payment of the member’s $40,000

accumulated contributions with interest.

* If the member is unmarried at the time of death, this benefit is payable to the

member’s minor children or, if no children, to the member’s dependent parents. If

the member has no spouse, minor children, or dependent parent, then the Ordinary

Death Benefit will be paid to the member’s designated beneficiary.

Example 7: Ordinary Death Benefit

A member dies at age 57 after 18 years of membership with two primary beneficia

ries listed on the record. The annual salary at time of death is $42,000, with

employee contributions of $22,000.

The salary and the accumulated contributions are divided equally between the

two primary beneficiaries, providing a onetime payment of $32,000 to each

beneficiary.

In lieu of the onetime survivor benefit, a monthly survivor benefit may be paid to

the surviving spouse over the spouse’s life time, if the following conditions are met:

n

At the time of death, the member is eligible to retire or is at least age 55 with

15 years of eligibility service and

n

Spouse is designated as sole primary beneficiary.

Example 8: Spousal Monthly Annuity Option

Same situation as described in example 7, but in this example the spouse is desig

nated as the sole primary beneficiary. Since the conditions for the monthly survivor

benefit are met, the spouse has the choice of the onetime benefit of the annual

salary plus contributions and interest equaling $64,000, or a monthly survivor bene

fit calculated like the benefit payment under an Option 2 allowance for a service

retirement. We will also assume the spouse is age 56.

The monthly survivor benefit is calculated using the normal service retirement for

mula. In the following example, the early reduction factor based on age applies. The

29

CALCULATING YOUR BENEFITS