SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Basic Financial Statements and Schedules

June 30, 2023 and 2022

(With Independent Auditors’ Report Thereon)

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Table of Contents

Page(s)

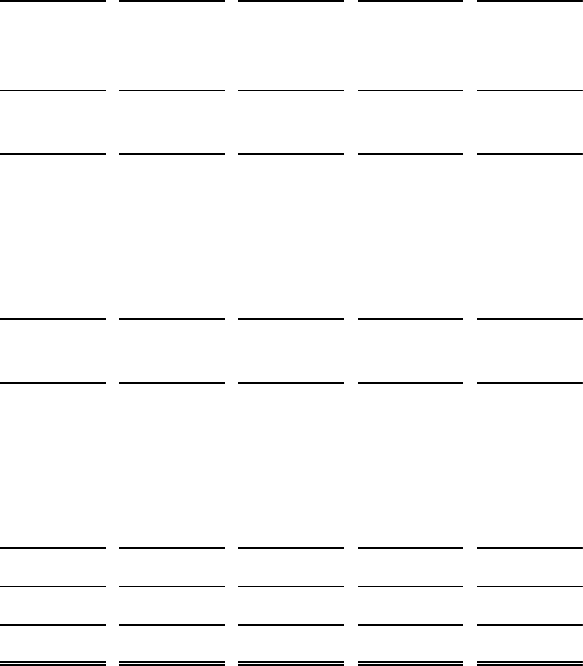

Independent Auditors’ Report 1–3

Basic Financial Statements:

Statements of Net Position – June 30, 2023 and 2022 4

Statements of Revenues, Expenses, and Changes in Net Position – Years ended June 30,

2023 and 2022 5

Statements of Cash Flows – Years ended June 30, 2023 and 2022 6–7

Notes to Basic Financial Statements 8–43

Combining Schedule – Statement of Net Position June 30, 2023 44

Combining Schedule – Statement of Net Position June 30, 2022 45

Combining Schedule – Statement of Revenues, Expenses, and Changes in Net Position

Year ended June 30, 2023 46

Combining Schedule – Statement of Revenues, Expenses, and Changes in Net Position

Year ended June 30, 2022 47

Combining Schedule – Statement of Cash Flows Year ended June 30, 2023 48

Combining Schedule – Statement of Cash Flows Year ended June 30, 2022 49

Supplementary Information:

Schedule of Changes in Total OPEB Liability and Related Ratios 50

Schedule of Changes in Long-Term Debt by Individual Issue 51

Schedule of Changes in Lease Obligations 52

Roster of Management Officials and Board Members (Unaudited) 53

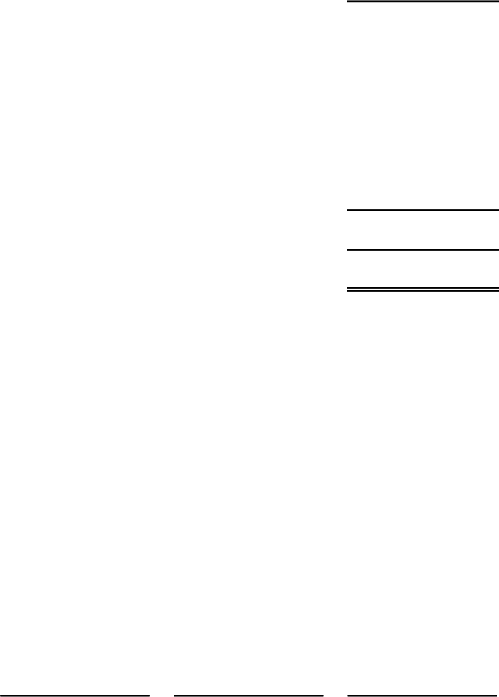

KPMG LLP

Triad Centre III

Suite 450

6070 Poplar Avenue

Memphis, TN 38119-3901

KPMG LLP, a Delaware limited liability partnership and a member firm of

the KPMG global organization of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee.

Independent Auditors’ Report

The Board of Directors

Shelby County Health Care Corporation:

Report on the Audit of the Financial Statements

Opinion

We have audited the basic financial statements of Shelby County Health Care Corporation (d/b/a Regional One

Health), a component of Shelby County, Tennessee, which comprise the statement of net position as of

June 30, 2023 and 2022, and the related statements of revenues, expenses and changes in net position, and

cash flows for the years then ended, and the related notes to the basic financial statements.

In our opinion, the accompanying basic financial statements present fairly, in all material respects, the net

position of the Regional One Health as of June 30, 2023 and 2022, and the changes in net position and cash

flows for the years then ended, in accordance with U.S. generally accepted accounting principles.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of

America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards,

issued by the Comptroller General of the United States. Our responsibilities under those standards are further

described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We

are required to be independent of the Regional One Health and to meet our other ethical responsibilities, in

accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we

have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Emphasis of Matter

As discussed in note 1 of the basic financial statements in 2023 Regional One Health adopted

GASB Statement No. 96, Subscription Based Information Technology Arrangements. Adoption of GASB 96

requires the retrospective application of the standard to the earliest period presented in the basic financial

statements. Our opinion is not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the basic financial statements in

accordance with U.S. generally accepted accounting principles, and for the design, implementation, and

maintenance of internal control relevant to the preparation and fair presentation of basic financial statements

that are free from material misstatement, whether due to fraud or error.

In preparing the basic financial statements, management is required to evaluate whether there are conditions or

events, considered in the aggregate, that raise substantial doubt about the Regional One Health’s ability to

continue as a going concern for one year after the date the financial statements are issued.

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the basic financial statements as a whole are

free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our

opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not

2

a guarantee that an audit conducted in accordance with GAAS and Government Auditing Standards will always

detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from

fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions,

misrepresentations, or the override of internal control. Misstatements are considered material if there is a

substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a

reasonable user based on the basic financial statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

● Exercise professional judgment and maintain professional skepticism throughout the audit.

● Identify and assess the risks of material misstatement of the basic financial statements, whether due to

fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include

examining, on a test basis, evidence regarding the amounts and disclosures in the basic financial

statements.

● Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the Regional One Health’s internal control. Accordingly, no such opinion is expressed.

● Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluate the overall presentation of the basic financial

statements.

● Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise

substantial doubt about the Regional One Health’s ability to continue as a going concern for a reasonable

period of time.

We are required to communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit, significant audit findings, and certain internal control related matters that

we identified during the audit.

Required Supplementary Information

U.S. generally accepted accounting principles requires that the schedule of changes in total OPEB liability and

related ratios on page 50 be presented to supplement the basic financial statements. Additionally, the State of

Tennessee Audit manual requires the schedule of changes in long-term debt by individual issue on page 51

and the schedule of changes in lease obligations on page 52 be presented to supplement the basic financial

statements. Such information is the responsibility of management and, although not a part of the basic financial

statements, is required by the Governmental Accounting Standards Board or the State of Tennessee Audit

Manual whom considers it to be an essential part of financial reporting for placing the basic financial statements

in an appropriate operational, economic, or historical context. We have applied certain limited procedures to the

required supplementary information in accordance with GAAS, which consisted of inquiries of management

about the methods of preparing the information and comparing the information for consistency with

management’s responses to our inquiries, the basic financial statements, and other knowledge we obtained

during our audit of the basic financial statements. We do not express an opinion or provide any assurance on

the information because the limited procedures do not provide us with sufficient evidence to express an opinion

or provide any assurance.

Management has omitted management’s discussion and analysis that accounting principles generally accepted

in the United States of America require to be represented to supplement the basic financial statements. Such

missing information, although not part of the basic financial statements, is required by the Governmental

Accounting Standards Board who considers it to be an essential part of financial reporting for placing the basic

3

financial statements in an appropriate operation, economic, or historical context. Our opinion on the basic

financial statements is not affected by this omitted information.

Supplementary Information

Our audit was conducted for the purpose of forming opinions on the financial statements that collectively

comprise Regional One Health’s basic financial statements. The Roster of Management Officials and Board

Members is presented for purposes of additional analysis and are not a required part of the basic financial

statements. Such information is the responsibility of management and has not been subjected to the auditing

procedures applied in the audit of the basic financial statements, and accordingly, we do not express an opinion

or provide any assurance on it.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated October 27, 2023 on

our consideration of Regional One Health’s internal control over financial reporting and on our tests of its

compliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters.

The purpose of that report is solely to describe the scope of our testing of internal control over financial

reporting and compliance and the results of that testing, and not to provide an opinion on the effectiveness of

the Regional One Health’s internal control over financial reporting or on compliance. That report is an integral

part of an audit performed in accordance with Government Auditing Standards in considering Regional One

Health’s internal control over financial reporting and compliance.

Memphis, Tennessee

October 27, 2023

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Statements of Net Position

June 30, 2023 and 2022

2023 2022

Assets:

Cash and cash equivalents $ 31,265,463 45,922,921

Investments 50,328,950 37,411,306

Patient accounts receivable, net of allowances for uncollectible

accounts of $155,941,000 in 2023 and $158,878,000 in 2022 70,365,952 59,682,336

Other receivables 27,213,379 32,780,544

Other current assets 18,063,146 18,322,544

Total current assets 197,236,890 194,119,651

Restricted cash 2,325,816 14,234,348

Restricted investments 6,634,941

6,584,050

Notes receivable 19,057,900

19,057,900

Right-to-use lease asset, net 17,900,383 21,657,289

Right-to-use subscription-based information technology arrangements (SBITA) asset, net 15,065,118 18,046,813

Capital assets, net 93,250,577 94,478,593

Total assets $ 351,471,625 368,178,644

Liabilities:

Accounts payable $ 30,902,818 24,127,052

Accrued expenses and other current liabilities 58,711,145 65,776,773

Medicare advanced payments —

290,219

Current portion of accrued professional and general liability costs

1,343,000 1,648,000

Current portion of lease liability 3,405,769 4,113,681

Current portion of subscription-based information technology arrangements (SBITA) liability 5,289,535 5,407,746

Other current liabilities 30,000

3,749,660

Total current liabilities

99,682,267 105,113,131

Long-term accrued professional and general liability costs 4,606,000 4,336,000

Other postemployment benefit obligation (OPEB) 5,249,790 5,249,790

Long-term lease liability 16,501,131 18,922,570

Long-term subscription-based information technology arrangements liability 9,213,486 14,503,021

Long-term debt 46,271,864 49,625,637

Total liabilities 181,524,538 197,750,149

Net position:

Net investment in capital assets 61,322,424 61,755,632

Restricted for:

Capital assets 2,206,479

2,173,915

Indigent care 365,483 1,512,252

Education 1,170,251 1,056,047

Palliative Care Program 2,300,000 1,000,000

Unrestricted 102,582,450

102,930,649

Total net position 169,947,087 170,428,495

Total liabilities and net position $ 351,471,625 368,178,644

See accompanying notes to basic financial statements.

4

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Statements of Revenues, Expenses, and Changes in Net Position

Years ended June 30, 2023 and 2022

2023 2022

Operating revenues:

Net patient service revenue, net of contractual adjustments

(including additional incremental reimbursement from various

state agencies for participation in TennCare/Medicaid

programs of approximately $111,835,000 in 2023 and

$81,545,000 in 2022) $ 592,106,069 562,457,048

Provision for uncollectible accounts (59,647,415) (94,131,319)

Net patient service revenue 532,458,654 468,325,729

Other revenue 163,484,573 134,953,074

Total operating revenues 695,943,227 603,278,803

Operating expenses:

Salaries and benefits 266,680,027 249,409,293

Supplies 218,410,502 188,633,099

Physician and professional fees 97,057,816 87,961,254

Purchased medical services 40,841,155 39,207,144

Plant operations 32,243,421 30,399,373

Insurance 2,556,322

1,831,328

Administrative and general

55,436,171 52,770,699

Community services 4,560,802 5,169,390

Depreciation 16,218,668 14,567,335

Total operating expenses 734,004,884 669,948,915

Operating loss (38,061,657) (66,670,112)

Nonoperating revenues (expenses):

Interest expense (3,321,403) (2,852,766)

Investment income (loss) 3,693,737 (4,549,230)

Appropriations from Shelby County 36,989,681 41,008,000

CARES Act grant revenue — 2,825,150

Other 218,234

8,467,406

Total nonoperating revenues, net

37,580,249 44,898,560

Decrease in net position (481,408) (21,771,552)

Net position, beginning of year 170,428,495 192,200,047

Net position, end of year $ 169,947,087 170,428,495

See accompanying notes to basic financial statements.

5

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Statements of Cash Flows

Years ended June 30, 2023 and 2022

2023 2022

Cash flows from operating activities:

Receipts from and on behalf of patients and third-party payors $ 512,482,289 451,951,162

Other cash receipts 160,596,653 115,329,606

Payments to suppliers (396,637,525) (356,880,304)

Payments to employees and related benefits (296,192,494) (281,952,161)

Net cash used in operating activities (19,751,077) (71,551,697)

Cash flows from noncapital financing activity:

Appropriations received from Shelby County 36,989,681 41,008,000

CARES act proceeds — 2,825,150

Other

(3,715,579) 3,205,264

Net cash provided by noncapital financing activity

33,274,102 47,038,414

Cash flows from investing activities:

Purchases of investments (36,252,498) (79,600,575)

Proceeds from sale of investments 26,251,899 138,716,752

Proceeds from sale of Joint Venture 214,154 15,666,667

Note receivable from third party — (19,057,900)

Investment income proceeds 725,797 2,268,592

Net cash (used in) provided by investing activities (9,060,648) 57,993,536

Cash flows from capital and related financing activities:

Capital expenditures (14,990,651) (28,349,520)

Payments for operating leases (3,947,471) 736,905

Payments for SBITA (7,693,592) —

Interest payments (3,404,417) (1,938,582)

Proceeds from notes payable - Term Loan — 19,500,000

Proceeds from notes payable - New Market Tax Credit (NMTC)

Notes A & B — 25,807,500

Proceeds from long-term debt 3,856,372 —

Payments on long-term debt (4,848,608) (2,612,202)

Net cash (used in) provided by capital and related

financing activities (31,028,367) 13,144,101

Net (decrease) increase in cash and cash equivalents (26,565,990) 46,624,354

Cash and cash equivalents, beginning of year 60,157,269 13,532,915

Cash and cash equivalents, end of year $ 33,591,279 60,157,269

(Continued)6

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Statements of Cash Flows

Years ended June 30, 2023 and 2022

2023 2022

Reconciliation of operating loss to net cash used in operating

activities:

Operating loss $ (38,061,657) (66,670,112)

Operating activities:

Depreciation 16,218,668 14,567,335

Changes in operating assets and liabilities:

Patients accounts receivable, net (10,683,616) (834,394)

Other receivables 5,567,165 (8,675,408)

Other current assets 259,398 (4,488,868)

Accounts payable 6,775,766 1,751,786

Accrued expenses and other current liabilities 208,199 (1,514,672)

Deferred FICA payments — (3,500,242)

Accrued professional and general liability costs (35,000) (398,000)

Net postemployment benefit obligation — (1,789,122)

Net cash used in operating activities $ (19,751,077) (71,551,697)

Reconciliation of cash and cash equivalents to the statements of

net position:

Cash and cash equivalents in current assets $ 31,265,463 45,922,921

Restricted cash in total assets 2,325,816 14,234,348

Total cash and cash equivalents $ 33,591,279 60,157,269

Supplemental schedule of noncash investing and financing activities:

Net increase (decrease) in the fair value of investments $ 1,679,407 (6,620,606)

Noncash purchases of capital assets (3,856,372) —

Gain on sale of joint venture 214,154 (5,439,334)

Noncash lease transactions (2,297,150) (3,112,200)

See accompanying notes to basic financial statements.

7

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

8 (Continued)

(1) Organization and Summary of Significant Accounting Policies

Shelby County Health Care Corporation (d/b/a Regional One Health) was incorporated on June 15, 1981,

with the approval of the Board of County Commissioners of Shelby County, Tennessee (the County).

Regional One Health is a broad continuum healthcare provider that operates facilities that are owned by

the County under a long-term lease. The lease arrangement effectively provided for the transfer of title

associated with operating fixed assets and the long-term lease (for a nominal amount) of related real

property. The lease expires in 2063.

Regional One Health is a component unit of the County, as defined by Governmental Accounting

Standards Board (GASB) Statement No. 61, The Financial Reporting Entity: Omnibus – An Amendment of

GASB Statement No. 14 and No. 34. Regional One Health’s component unit relationship to the County is

principally due to financial accountability and financial benefit or burden, as defined in GASB Statement

No. 61. Regional One Health is operated by a 14-member board of directors, all of whom are appointed by

the mayor of the County and approved by the County Commission.

Regional One Health Foundation is a component unit of Regional One Health principally due to Regional

One Health’s financial accountability and financial benefit or burden for Regional One Health Foundation as

defined in GASB Statement No. 61. Regional One Health Foundation is operated by a board of directors,

all of whom are appointed by Regional One Health’s board. Regional One Health Foundation is a blended

component unit of Regional One Health because it provides services entirely to Regional One Health.

GASB Statement No. 34, Basic Financial Statements – and Management’s Discussion and Analysis – for

State and Local Governments, requires a management’s discussion and analysis (MD&A) section providing

an analysis of Regional One Health’s overall financial position and results of operations; however, Regional

One Health has chosen to omit the MD&A from these accompanying financial statements.

The significant accounting policies used by Regional One Health in preparing and presenting its financial

statements are as follows:

(a) Presentation

The financial statements include the accounts of Regional One Health and its wholly owned

subsidiaries. Such subsidiaries include Regional One Health Foundation; Regional One Properties,

Inc.; Regional Med Extended Care Hospital, LLC; Shelby County Health Care Properties, Inc.; and

Regional One Health Investment Company, Inc. The subsidiaries are component units of Regional One

Health principally due to Regional One Health’s financial accountability and financial benefit or burden

for the subsidiaries, as defined by GASB Statement No. 61. All material intercompany accounts and

transactions have been eliminated.

(b) Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting

principles requires that management make estimates and assumptions affecting the reported amounts

of assets, liabilities, revenues, and expenses, as well as disclosure of contingent assets and liabilities.

Actual results could differ from those estimates.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

9 (Continued)

Items subject to estimates and assumptions include the determination of the allowances for contractual

adjustments and uncollectible accounts, reserves for professional and general liability claims, reserves

for employee healthcare claims, net postretirement benefit cost and obligation, and estimated

third-party payor settlements.

In addition, laws and regulations governing Medicare, TennCare, the state of Tennessee’s Medicaid

program providing healthcare to mostly low-income pregnant women, parents or caretakers of a minor

child, children and individuals who are elderly or have a disability, and Medicaid programs are

extremely complex and subject to interpretation. As a result, there is at least a reasonable possibility

that recorded estimates related to these programs will change by a material amount in the near term.

(c) Enterprise Fund Accounting

Regional One Health’s financial statements are prepared using the economic resources measurement

focus and accrual basis of accounting.

(d) Cash and Cash Equivalents

Regional One Health considers investments in highly liquid debt instruments purchased with an original

maturity of three months or less to be cash equivalents.

Regional One Health and its component units are subject to State of Tennessee statute, which requires

that deposits be made with financial institutions with a branch in Tennessee authorized to accept

deposits, and must be secured and collateralized by such institutions. If deposits are greater than the

federal deposit insurance corporation (FDIC) limit, the deposits must be backed by collateral with a

total minimum market value of 105% of the value of the deposits placed in the institutions, less the

amount protected by the FDIC. Collateral requirements are not applicable for financial institutions that

participate in the State of Tennessee’s collateral pool.

(e) Investments and Investment Income

Investments are carried at fair value, principally based on quoted market prices. Investment income

(including realized and unrealized gains and losses) from investments is reported as nonoperating

revenue (expense) on the accompanying statements of revenues, expenses and changes in net

position.

Regional One Health applies GASB Statement No. 72, Fair Value Measurement and Application, which

defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an

ordinary transaction between market participants. Additional disclosures are made about fair value

measurements, the level of fair value hierarchy and valuation techniques. Additional disclosures are

required regarding investments that are valued by net asset per share.

(f) Inventories

Inventories, consisting principally of medical supplies and pharmaceuticals, are stated at the lower of

cost (first-in, first-out method) or net realizable value.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

10 (Continued)

(g) Equity Investments

Equity investments consist of Regional One Health’s equity interests in investments as measured by its

ownership interest if Regional One Health has an ongoing financial interest in or ongoing financial

responsibility for the equity investee. The investments are initially recorded at cost and are

subsequently adjusted for additional contributions, distributions, undistributed earnings and losses, and

impairment losses.

(h) Capital Assets

Capital assets are recorded at cost, if purchased, or at fair value at the date of donation. Depreciation

is provided over the useful life of each class of depreciable asset using the straight-line method.

Maintenance and repairs are charged to operations. Major renewals and betterments are capitalized.

When assets are retired or otherwise disposed of, the cost and related accumulated depreciation are

removed from the accounts and the gain or loss, if any, is included in nonoperating revenues

(expenses) in the accompanying statements of revenues, expenses, and changes in net position.

All capital assets other than land are depreciated using the following lives:

Land improvements 5 to 25 years

Buildings and improvements 10 to 40 years

Fixed equipment 5 to 25 years

Movable equipment 3 to 20 years

Software 3 to 7 years

Regional One Health applies GASB Statement No. 83, Certain Asset Retirement Obligations, which

provides accounting and financial reporting guidance for certain asset retirement obligations (ARO).

Regional One Health has no legally enforceable liabilities associated with the retirement of its tangible

capital assets that meet the definition of an ARO under the standard as of June 30, 2023 and 2022.

(i) Impairment of Capital Assets

Capital assets are reviewed for impairment when service utility has declined significantly. If such assets

are no longer used, they are reported at the lower of carrying value or fair value. If such assets will

continue to be used, the impairment loss is measured using the method that best reflects the

diminished service utility of the capital asset. No charge related to impairment matters was required

during 2023 or 2022.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

11 (Continued)

(j) Compensated Absences

Regional One Health’s employees accumulate vacation, holiday, and sick leave at varying rates,

depending upon years of continuous service and payroll classification, subject to maximum limitations.

Upon termination of employment, employees are paid all unused accrued vacation and holiday time at

regular rate of pay up to a designated maximum number of days. Since the employees’ vacation and

holiday time accumulates and vests, an accrual for this liability is included in accrued expenses and

other current liabilities in the accompanying statements of net position. An accrual is recognized for

unused sick leave expected to be paid to employees eligible to retire.

(k) Net Postemployment Benefit Obligation

Regional One Health applies GASB issued Statement No. 75, Accounting and Financial Reporting for

Postemployment Benefits Other than Pensions, which establishes standards for recognizing and

measuring liabilities, deferred outflows of resources, deferred inflows of resources, and

expense/expenditures of postemployment benefit obligations. See note 14 for additional disclosures

regarding Regional One Health’s postemployment benefit obligation.

(l) Net Position

Net position of Regional One Health is classified into the following components:

• Net investment in capital assets consists of capital assets net of accumulated depreciation, net of

the related debt.

• Restricted includes those amounts with limits on their use that are externally imposed (by creditors,

grantors, contributors, or the laws and regulations of other governments).

• Unrestricted represents remaining amounts that do not meet either of the above definitions.

When Regional One Health has both restricted and unrestricted resources available to finance a

particular program, it is Regional One Health’s policy to use restricted resources before unrestricted

resources.

Regional One Health Foundation historically, and to date, does not maintain donor-restricted

endowment funds, or any board-designated endowments. Regional One Health Foundation’s Board

has interpreted Tennessee’s State Prudent Management of Institutional Funds Act as requiring the

preservation of the fair value of the original gift as of the gift date of the donor-restricted endowment

funds, absent explicit donor stipulations to the contrary. In all material respects, income from Regional

One Health Foundation’s donor-restricted pledges are restricted to specific donor-directed purposes,

and are therefore accounted for within restricted amounts until expended in accordance with the

donor’s wishes. Regional One Health Foundation oversees individual donor-restricted pledges to

ensure that the fair value of the original gift is preserved.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

12 (Continued)

(m) Statement of Revenues, Expenses, and Changes in Net Position

For purposes of presentation, transactions deemed by management to be ongoing, major, or central to

the provision of healthcare services, other than financing costs, are reported as operating revenues

and operating expenses. Other transactions, such as investment income, interest expense,

appropriations from Shelby County are reported as nonoperating revenues and expenses.

(n) Net Patient Service Revenue

Net patient service revenue is reported at estimated net realizable amounts from patients, third-party

payors, and others for services rendered, including estimated retroactive revenue adjustments due to

future audits, reviews, and investigations. Retroactive adjustments are considered in the recognition of

revenue on an estimated basis in the period the related services are rendered and such amounts are

adjusted in future periods as adjustments become known or as years are no longer subject to such

audits, reviews, and investigations. Changes in estimates related to prior cost reporting periods

resulted in an increase in net patient service revenue of approximately $2,450,000 in 2023 and a

decrease in net patient service revenue of approximately $880,000 in 2022.

(o) Charity Care

Regional One Health provides care to patients who meet certain criteria under its charity care policy

without charge or at amounts less than its established rates. Because Regional One Health does not

pursue collection of amounts determined to qualify as charity care, they are not reported as revenue.

When defining charity care, Regional One Health employs the Federal Poverty Guideline (FPG) to

determine the level of discount uninsured patients receive. The level by which assistance is determined

is through the scale set by the Department of Health and Human Services, which includes factors such

as residents per household and income. Regional One Health’s methodology includes all patients that

fall at or below the 150% FPG baseline. Additionally, Regional One Health’s charity care guidelines

provide for an expansive definition of charity care patients, including an upfront discount from standard

charges for uninsured patients.

(p) CARES Act and other funding

In December 2019, illnesses associated with novel coronavirus disease of 2019 (COVID-19) were

reported and the virus subsequently caused widespread and significant disruptions to daily life and

economies across geographies. The World Health Organization classified the outbreak as a pandemic.

On March 27, 2020, the CARES Act was signed into law due to the global pandemic. Under the

CARES Act, Regional One Health received $2,825,150 in 2022, from the Department of Health and

Human Services included as other nonoperating revenue in the statements of revenues, expenses, and

changes in net position. Regional One Health did not receive any funding related to COVID-19 for the

year ended June 30, 2023. The funding was used for keeping the facilities operational in order to

respond to healthcare needs regardless of whether or not the expenses were directly associated with

responding to COVID-19.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

13 (Continued)

(q) Income Taxes

Regional One Health is a not-for-profit corporation organized by the approval of the Board of County

Commissioners of the County and qualifies as a governmental entity not subject to federal income tax,

by reason of being integral parts of a state or political subdivision. Regional One Health also qualifies

as a tax-exempt entity under Internal Revenue Code (IRC) Section 501(a) as organizations described

in IRC Section 501(c)(3) (dual-tax exempt status). Therefore, related income is generally not subject to

federal or state income taxes, except for tax on income from activities unrelated to its exempt purpose,

as described in IRC Section 512(a). Thus, no provision for income taxes has been recorded in the

accompanying financial statements.

(r) Appropriations

The County has historically appropriated funds annually to Regional One Health to partially offset the

cost of medical care for indigent residents of the County. Appropriations for indigent residents from the

County were $36,989,681 and $41,008,000 for the years ended June 30, 2023 and 2022, respectively.

Included in these total appropriations was $7,500,000 for capital investment in the years ended

June 30, 2023 and 2022. Appropriations from the County are reported as nonoperating revenue in the

accompanying statements of revenues, expenses, and changes in net position.

(s) Leases

Regional One Health applies GASB issued Statement No. 87, Leases, which requires the recognition

of certain lease assets and liabilities for leases that previously were classified as operating leases and

recognized as inflows of resources or outflows of resources based on the payment provisions of the

contract. Under the statement, a lessee is required to recognize a lease liability and an intangible right-

to-use lease asset, and a lessor is required to recognize a lease receivable and a deferred inflow of

resources

(t) Recent Accounting Pronouncements

In May 2020, the GASB issued Statement No. 96, Subscription-Based Information Technology

(SBITA), which provides guidance on accounting and financial reporting best practices for

subscription-based information technology arrangements. Under the statement, a user is required to

recognize a right-to-use subscription asset and a corresponding subscription liability. The new standard

is effective for Regional One Health beginning after June 15, 2022. Regional One Health adopted

GASB 96 effective July 1, 2022 using the modified retrospective approach. The primary effect of the

new standard was a $18,449,213 increase in the right-to-use SBITA asset and SBITA liability. See

additional discussion on the adoption of GASB Statement No. 96 in note 8.

(u) Subsequent Events

Regional One Health has evaluated subsequent events through October 27, 2023, the date on which

the financial statements were issued. No additional events were noted which warrant adjustments to, or

disclosures in, the basic financial statements and related notes.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

14 (Continued)

(2) Deposits, Investments

(a) Deposits and Investments

The composition of cash and cash equivalents is as follows:

2023 2022

Cash $ 31,244,123 45,902,339

Money market funds 21,340 20,582

$ 31,265,463 45,922,921

Investments and restricted investments include amounts held by both Regional One Health and

Regional One Health Foundation.

The composition of investments and restricted investments is as follows:

2023 2022

U.S. agencies $ 8,295,161 8,459,163

U.S. treasury bills 39,662 —

Certificates of deposit 618,681 533,118

Corporate bonds 18,337,976 18,551,435

Demand deposit accounts and money market funds 11,118,724 305,826

U.S. government funds 167,511 857,159

Common stock 3,069,890 2,148,951

Bond funds 744,886 728,952

Equity funds 14,380,059 12,231,068

Accrued interest 191,341 179,684

$ 56,963,891 43,995,356

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

15 (Continued)

The fair value hierarchy of investments is as follows:

2023

Level 1 Level 2 Level 3 Total

U.S. agencies $ — 8,295,161 — 8,295,161

U.S. treasury bills — 39,662 — 39,662

Certificates of deposit — 618,681 — 618,681

Corporate bonds — 18,337,976 — 18,337,976

Demand deposits

accounts and

money market funds — 11,118,724 — 11,118,724

U.S. government funds — 167,511 — 167,511

Common stock 3,069,890 — — 3,069,890

Bond funds 744,886 — — 744,886

Equity funds 14,380,059 — — 14,380,059

Accrued interest 191,341 — — 191,341

$ 18,386,176 38,577,715 — 56,963,891

2022

Level 1 Level 2 Level 3 Total

U.S. agencies $ — 8,459,163 — 8,459,163

Certificates of deposit — 533,118 — 533,118

Corporate bonds — 18,551,435 — 18,551,435

Demand deposits

accounts and

money market funds — 305,826 — 305,826

U.S. government funds — 857,159 — 857,159

Common stock 2,148,951 — — 2,148,951

Bond funds 728,952 — — 728,952

Equity funds 12,231,068 — — 12,231,068

Accrued interest 179,684 — — 179,684

$ 15,288,655 28,706,701 — 43,995,356

At June 30, 2023, Regional One Health and Regional One Health Foundation had investments in debt

securities with the following maturities:

Less than 6 months

Fair value 6 months to 1 year 1–5 years Over 5 years

U.S. agencies $ 8,295,161 99,866 479,213 5,135,820 2,580,262

Corporate bonds 18,337,976 807,554 96,519 9,925,513 7,508,390

$ 26,633,137 907,420 575,732 15,061,333 10,088,652

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

16 (Continued)

At June 30, 2022, Regional One Health and Regional One Health Foundation had investments in debt

securities with the following maturities:

Less than 6 months

Fair value 6 months to 1 year 1–5 years Over 5 years

U.S. agencies $ 8,459,163 74,318 134,614 6,314,213 1,936,018

Corporate bonds 18,551,435 364,562 986,762 8,747,705 8,452,406

$ 27,010,598 438,880 1,121,376 15,061,918 10,388,424

Other than investments issued or explicitly guaranteed by the U.S. government, there was one

investment in IShares S&P 500 Index Fund Class G of $9,765,367 and $8,166,752 that represented

5% or more of total investments for Regional One Health as of June 30, 2023 and 2022, respectively.

There were no investments that represented 5% or more of total investments for Regional One Health

Foundation as of June 30, 2023 or June 30, 2022.

Regional One Health and Regional One Health Foundation have separate investment policies that are

included below. The summary of investments throughout the financial statements includes the

combined investment totals of Regional One Health and Regional One Health Foundation.

At June 30, 2023, Regional One Health’s and Regional One Health Foundation’s corporate bonds,

collectively, had the following credit ratings per Moody’s Investor Service:

Moody's ratings Fair value

A1 $ 2,630,091

A2 3,406,509

A3 3,497,842

Aa1 96,276

Aa2 206,633

Aa3 186,369

Aaa 1,880,522

Baa1 2,329,500

Baa2 2,532,421

Baa3 495,103

NR 1,076,710

$ 18,337,976

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

17 (Continued)

At June 30, 2022, Regional One Health’s and Regional One Health Foundation’s corporate bonds,

collectively, had the following credit ratings per Moody’s Investor Service:

Moody's ratings Fair value

A1 $ 2,421,775

A2 4,042,591

A3 3,821,359

Aa1 99,388

Aa2 212,586

Aa3 689,201

Aaa 1,823,344

Ba1 207,828

Baa1 1,818,668

Baa2 2,373,538

Baa3 788,769

BBB+ 99,553

NR 152,835

$ 18,551,435

As of June 30, 2023, Regional One Health’s investment objectives are to safeguard and preserve the

real purchasing power of the portfolio while earning investment returns that are commensurate with

Regional One Health’s risk tolerance and sufficient to meet its operational requirements.

The specific investment objectives and established asset allocation, as approved by the Finance

Committee, for the operating fund, short-term fund and the long-term reserve fund are set forth below:

Regional One Health Investment Policy

(i) Operating Fund

The operating fund shall be invested with the objective of preserving assets to cover shorter term,

ongoing programmatic and operational expenses requiring immediate liquidity for the

approximately zero (0) to six (6) months period. Operating fund assets should be highly liquid and

may be maintained in the checking account that Regional One Health uses for day-to-day

operations and may be invested in other cash equivalent investments, such as savings accounts,

money market accounts, certificates of deposit (with maturities appropriate for expected needs),

treasury bills, short-term investment funds, and other investments that have zero credit risk, zero

basis risk, zero duration risk, and zero macro risks. Capital preservation is the primary goal of the

operating fund.

Asset class Lower limit Target allocation Upper limit

Cash and cash equivalents 100 % 100 % 100 %

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

18 (Continued)

(ii) Short-Term Fund

The short-term fund shall be invested with the objective of preserving assets to cover Regional One

Health’s ongoing, programmatic and operational expenses, but requiring near-term liquidity for the

approximately six (6) to twelve (12) months period. Short-term fund assets should be highly liquid

and may be invested in similar investments as the assets in the operating fund, but with the

flexibility of adding very short duration and investment grade fixed income investments, but

minimizing credit risk, basis risk, and duration risk with zero emerging market and zero high yield

risk.

Asset class Lower limit Target allocation Upper limit

Cash and cash equivalents — % 20 % 40 %

Investment grade fixed income 60 80 100

(iii) Long-Term Reserve Fund

The long-term reserve fund shall be invested with the objective of preserving the long-term real

purchasing power of the long-term reserve fund’s assets while seeking an appropriate level of

investment return. More specifically, Regional One Health’s investment objectives and constraints

for the long-term reserve fund include preservation of purchasing power, long-term growth, time

horizon, risk tolerance, and liquidity requirements.

Asset class Lower limit Target allocation Upper limit

Investment grade government or

corporate fixed income 40 % 55 % 65 %

Non-investment grade government or

corporate fixed income — % 5 % 10 %

U.S. equity 15 % 30 % 40 %

Non U.S. equity

— % 10 % 15 %

The Board has delegated to the Finance Committee, as its liaison, the primary oversight responsibilities

of the portfolio, however, the Board still has responsibility for overseeing this Policy and any significant

modifications recommended by management and/or the Finance Committee, including major changes

in asset allocations.

Management, Regional One Health’s investment adviser (the ”Investment Adviser”), and the

investment managers (the ”Investment Managers”) are charged with implementing this Policy.

Restrictions on investments as approved by the Finance Committee are as follows:

• All purchases of securities must be for cash and there will be no leveraged purchasing or margin

transactions except for pooled investment vehicles.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

19 (Continued)

• No short sales.

• No investment will be made in direct investments in corporations with more than 25% of revenues

derived from the manufacture and sale of firearms, ammunition and ammunition magazines to the

general citizenry.

• Any investment that has the potential for generating unrelated business taxable income (UBTI)

shall require prior approval of management.

These above restrictions will not be applied to the underlying holdings of any investments in

commingled vehicles such as mutual funds or LLC structures.

The authorized investments are as follows:

1. Commercial Paper – Any commercial paper issued by a domestic corporation with a maturity of

270 or less days that carries at least the second highest rating by a recognized investor service,

preferably Moody’s Investor Service.

2. U.S. Treasury Securities – U.S. Treasury notes, bills, and bonds.

3. Bank Obligations – Any certificate of deposit (CD), time deposit, Eurodollar CDs issued by a foreign

branch of a U.S. bank, bankers’ acceptance, bank note, or letter of credit issued by a (U.S.) bank

possessing at least the second highest rating by a recognized investor services, preferably

Moody’s Investor Service. In addition, brokered CDs may be purchased from institutions,

irrespective of the institutions’ debt ratings, so long as the obligations are fully backed by the FDIC.

4. Repurchase Agreements – Any repurchase agreement purchased from one of the top 25

U.S. banks or one of the primary dealers regulated by the Federal Reserve System that is at least

102% collateralized by U.S. government obligations.

5. Money Market Funds – Any open-end money market fund regulated by the U.S. government under

Investment Company Act Rule 2a-7 and any investment fund regulated and advised by a

Registered Investment Advisor under Rule 3c-7. Such fund investment guidelines must state that

“the fund will seek to maintain a $1 per share net asset value.”

6. United States Government Obligations – Any obligation issued or backed directly by federal

agencies of the U.S. government.

7. Corporate Bonds – Obligations of U.S. and foreign corporations (including trusts and municipalities

of the U.S.) that are recognized as investment grade by a rating service, preferably Moody’s

Investor Service.

8. Bond Mutual Funds – Any publicly available investment registered under the Investment Company

Act of 1940 as an open-end mutual fund that is managing a portfolio of debt obligations

9. Equity Mutual Funds – Any publicly available investment registered under the Investment Company

Act of 1940 as an open-end mutual fund that is managing a portfolio of equity securities.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

20 (Continued)

10. Debt Buy Back – Any debt obligation backed directly by Regional One Health may be purchased so

long as it is purchased at a discount.

Guidelines

Investment Grade Fixed Income – Refers to investments that are rated BBB and above and provide a

defined, regular income stream, usually over a set term, with return of capital at the end of this term. The

target duration for the investment grade fixed income portfolio is four years with a maximum of

six years.

Noninvestment Grade Corporate Fixed Income Funds – Refers to corporate bonds held in bond funds

investments that are rated below BBB and provide a defined, regular income stream, usually over a set

term, with return of capital at the end of this term.

Parameters of Noninvestment Grade Corporate Bonds:

• Maximum 10% of the portfolio

• Maximum of 2% of the overall portfolio for Corporate Bonds rated below B.

Total Portfolio Guidelines

• Public Equities: Public equity may not comprise more than 40% of the total portfolio.

• Corporate Bonds: Investment grade corporate bonds may not represent more than 40% of the total

portfolio.

• Non-U.S. Corporate Bonds: Non-U.S. corporate bonds may not comprise more than 20% of the

total portfolio.

• United States Government Agency Obligations: No more than 25% of the total portfolio may be

invested in obligations of one federal agency.

• Repurchase Agreements: No more than 25% of the total portfolio may be invested in repurchase

agreements.

• Residential Mortgage-Backed Securities (“RMBS”): No more than 25% of the total portfolio may be

invested in RMBS.

• Multi-family Mortgage-Backed Securities (“CMBS”): No more than 25% of the total portfolio may be

invested in CMBS.

• Municipal Securities – General Obligations (“GO”) and Revenue Bonds (“RB”): No more than 30%

of the total portfolio may be invested in either Municipal GOs or Municipal RBs.

Regional One Health Foundation Investment Policy

As of June 30, 2023 and 2022, Regional One Health Foundation utilized one investment manager. This

manager is required to make investments in adherence to Regional One Health Foundation’s current

investment policy and objectives.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

21 (Continued)

Regional One Health Foundation follows an investment strategy focused on maximizing total return

(i.e., aggregate return from capital appreciation and dividend and interest income) while adhering to

certain restrictions designed to promote a conservative portfolio.

Specifically, the primary objective of Regional One Health Foundation’s investment management

strategy is to maintain an investment portfolio designed to generate a high level of current income with

above-average stability.

Guidelines for investments and cash equivalents for Regional One Health Foundation are as follows:

1. Regional One Health Foundation’s assets may be invested only in investment grade bonds rated

Baa or higher as determined by Moody’s Investors Service, or the equivalent by another

acceptable rating agency.

2. The overall market-weighted quality rating of the bond portfolio shall be no lower than A.

3. Regional One Health Foundation’s assets may be invested only in commercial paper rated P-2 (or

equivalent) or higher by Moody’s Investors Service or by another acceptable rating agency.

4. The market-weighted maturity of the base portfolio shall be no longer than 10 years.

5. Quality of the equity securities will be governed by the Federal Employee Retirement and Income

Security Act, the Tennessee guidelines for investing trust funds and the “prudent man rule.”

6. Conservative option strategies may be used, with a goal of increasing the stability of the portfolio.

Regional One Health Foundation limits investments in common stock to 40% of its investment portfolio.

The remainder of the portfolio is to be invested in fixed-income investments.

(b) Investment (loss) income comprises the following:

2023 2022

Dividend and interest income $ 1,408,640 1,275,727

Net increse (decrease) in fair value of investments 2,285,097 (5,824,957)

$ 3,693,737 (4,549,230)

(3) Business and Credit Concentrations

Regional One Health grants credit to patients, substantially all of whom are local area residents. Regional

One Health generally does not require collateral or other security in extending credit to patients; however, it

routinely obtains assignment of (or is otherwise entitled to receive) patients’ benefits payable under their

health insurance programs, plans, or policies (e.g., Medicare, Medicaid, Blue Cross, and commercial

insurance policies).

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

22 (Continued)

The mix of receivables from patients and third-party payors is as follows, before application of related

valuation allowances:

2023 2022

Patients 28 % 38 %

Commercial insurance 30 24

Medicare 19 16

Medicaid/TennCare 23 22

100 % 100 %

(4) Other Receivables

The composition of other receivables is as follows:

2023 2022

Accounts receivable from University of Tennessee Center for

Health Services $ 25,998 3,400,858

Accounts receivable from the State of Tennessee 8,462,283 7,547,201

Grants receivable 725,837 524,603

Accounts receivable from UT Regional One Physicians 1,453,974 433,536

Pharmacy receivable 3,632,150 3,770,578

Accounts receivable from correctional facilities 7,888,827 12,676,816

Other 5,024,310 4,426,952

$ 27,213,379 32,780,544

(5) Other Current Assets

The composition of other current assets is as follows:

2023 2022

Inventories

$ 10,044,354 9,874,736

Prepaid expenses 8,018,792 8,447,808

$ 18,063,146 18,322,544

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

23 (Continued)

(6) Capital Assets

Capital assets and related activity consist of the following:

Balances at Balances at

June 30, 2022 Additions Retirements Transfers June 30, 2023

Capital assets not being depreciated:

Construction in progress $ 16,034,628 14,990,652 (23,608,199) 7,417,081

Land 4,313,278 — — — 4,313,278

Total book value of capital assets

not being depreciated 20,347,906 14,990,652 — (23,608,199) 11,730,359

Capital assets being depreciated:

Land improvements 7,669,743 — — 10,220 7,679,963

Buildings and improvements 68,284,062 — — 1,864,517 70,148,579

Fixed equipment 161,214,067 — — 12,670,902 173,884,969

Movable equipment 193,460,755 — — 4,808,713 198,269,468

Software 73,065,499 — — 4,253,847 77,319,346

Total book value of capital assets

being depreciated 503,694,126 — — 23,608,199 527,302,325

Less accumulated depreciation for:

Land improvements (7,103,387) (90,681) — — (7,194,068)

Buildings and improvements (69,474,674) (590,664) — — (70,065,338)

Fixed equipment (124,987,667) (4,373,079) — — (129,360,746)

Movable equipment (170,822,814) (6,079,210) — — (176,902,024)

Software (57,174,897) (5,085,034) — — (62,259,931)

Total accumulated depreciation (429,563,439) (16,218,668) — — (445,782,107)

Capital assets being depreciated, net 74,130,687 (16,218,668) — 23,608,199 81,520,218

Capital assets, net $ 94,478,593 (1,228,016) — — 93,250,577

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

24 (Continued)

Balances at Balances at

June 30, 2021 Additions Retirements Transfers June 30, 2022

Capital assets not being depreciated:

Construction in progress $ 4,012,765 28,180,488 (169,551) (15,989,074) 16,034,628

Land 4,313,278 — — — 4,313,278

Total book value of capital assets

not being depreciated 8,326,043 28,180,488 (169,551) (15,989,074) 20,347,906

Capital assets being depreciated:

Land improvements 7,669,743 — — — 7,669,743

Buildings and improvements 67,332,164 169,032 — 782,866 68,284,062

Fixed equipment 157,011,615 — — 4,202,452 161,214,067

Movable equipment 183,701,725 — (9,980) 9,769,010 193,460,755

Software 71,830,753 — — 1,234,746 73,065,499

Total book value of capital assets

being depreciated 487,546,000 169,032 (9,980) 15,989,074 503,694,126

Less accumulated depreciation for:

Land improvements (6,983,705) (119,682) — — (7,103,387)

Buildings and improvements (68,968,132) (506,542) — — (69,474,674)

Fixed equipment (121,268,900) (3,718,767) — — (124,987,667)

Movable equipment (165,569,077) (5,256,077) 2,340 — (170,822,814)

Software (52,208,630) (4,966,267) — — (57,174,897)

Total accumulated depreciation (414,998,444) (14,567,335) 2,340 — (429,563,439)

Capital assets being depreciated, net 72,547,556 (14,398,303) (7,640) 15,989,074 74,130,687

Capital assets, net $ 80,873,599 13,782,185 (177,191) — 94,478,593

(7) Leases

Regional One Health leases equipment and office, storage, and radio tower space, the terms of which

expire in various years starting in 2024 through 2029. The FMV of the leases were measured based on

hypothetical interest rates provided by one of the hospital’s financial institutions. The hospital had lease

assets of $28,438,762 and $31,643,984 and accumulated amortization of $10,538,379 and $9,986,695 for

the years ended June 30, 2023 and 2022, respectively. The hospital recognized $4,609,351 and

$5,092,157 in lease amortization, which is included and administrative and general expense, and

$1,048,476 and $1,284,091 in interest expense on the statements of revenues, expenses and changes in

net position for the years ended June 30, 2023 and 2022, respectively.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

25 (Continued)

Lease assets are initially recorded at the initial measurement of the lease liability, plus lease payments

made at or before the commencement of the lease term, less any lease incentives received from the lessor

at or before the commencement of the lease, plus initial direct costs that are ancillary to place the asset

into service. Leases with an initial term of twelve months or less are not recorded on the combined balance

sheets. Regional One Health recognizes lease expense in the period incurred for the lease with a valuation

of $5,000 or less based on the greater of the right-of-use lease asset or liability balance. Most leases have

upfront monthly lease payment amounts, but some are made up of annual commitments and service

agreements with equipment provided at zero additional cost and the amounts are calculated by sourcing

the value of the leased equipment over the life of the agreement. Lease assets are amortized on a

straight-line basis over the shorter of the lease term or the useful life of the underlying asset and do not

have any residual values.

Lease assets and related activity consist of the following:

Balances at Balances at

June 30, 2022 Additions Retirements June 30, 2023

Right-to-use lease assets

Buildings $ 21,101,579 7,689 — 21,109,268

Equipment 10,191,184 3,019,618 (6,279,005) 6,931,797

Other 351,221 84,893 (38,419) 397,695

Right-to-use lease assets 31,643,984 3,112,200 (6,317,424) 28,438,760

Less accumulated amortization for:

Buildings (4,695,551) (2,475,509) — (7,171,060)

Equipment (5,082,428) (2,035,508) 4,027,924 (3,090,012)

Other (208,716) (98,333) 29,744 (277,305)

Total accumulated

amortization (9,986,695) (4,609,350) 4,057,668 (10,538,377)

Right-to-use lease assets, net $ 21,657,289 (1,497,150) (2,259,756) 17,900,383

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

26 (Continued)

Balances at Balances at

June 30, 2021 Additions Retirements June 30, 2022

Right-to-use lease assets

Buildings $ 19,747,288 1,354,291 — 21,101,579

Equipment 9,248,325 942,859 — 10,191,184

Other 351,221 — — 351,221

Right-to-use lease assets 29,346,834 2,297,150 — 31,643,984

Less accumulated amortization for:

Buildings (2,209,641) (2,485,910) — (4,695,551)

Equipment (2,597,535) (2,484,893) — (5,082,428)

Other (87,362) (121,354) — (208,716)

Total accumulated

amortization (4,894,538) (5,092,157) — (9,986,695)

Right-to-use lease assets, net $ 24,452,296 (2,795,007) — 21,657,289

Lease liabilities and related activity consist of the following:

Amounts due

Balances at Balances at within

June 30, 2022 Additions

Remeasurements

Deductions June 30, 2023 one year

Lease liabilities $ 23,036,251 3,112,200 32,443 (6,273,994) 19,906,900 3,405,769

Amounts due

Balances at Balances at within

June 30, 2021 Additions

Remeasurements

Deductions June 30, 2022 one year

Lease liabilities $ 25,094,350 2,297,150 — (4,355,249) 23,036,251 4,113,681

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

27 (Continued)

The following is a schedule by year of payments under the leases as of June 30, 2023:

Total to be paid Principal Interest

Year(s) ending June 30:

2024

$ 4,352,218 3,405,769 946,449

2025

3,714,642 2,942,029 772,613

2026

3,480,781 2,863,014 617,767

2027

2,871,341 2,388,243 483,098

2028

2,445,830 2,075,337 370,493

2029 – 2030 6,685,895 6,232,508 453,387

$ 23,550,707 19,906,900 3,643,807

(8) Subscription based information technology arrangements

(a) Subscription Assets

Subscription assets are initially recorded at the initial measurement of the subscription liability, plus

subscription payments made at or before the commencement of the subscription-based information

technology arrangement (SBITA) term, less any SBITA vendor incentives received from the SBITA

vendor at or before the commencement of the SBITA term, plus capitalizable initial implementation

costs. Subscription assets are amortized on a straight-line basis over the shorter of the SBITA term or

the useful life of the underlying IT asset.

Subscription assets and related activity for the years ended June 30, 2023 and 2022, were:

Balances at Balances at

June 30, 2022 Additions Retirements June 30, 2023

Subscription IT asset $ 22,363,850 2,285,846 — 24,649,696

Less accumulated amortization (4,317,037) (5,267,541) — (9,584,578)

Subscription assets, net

$ 18,046,813 (2,981,695) — 15,065,118

Balances at Balances at

July 1, 2021 Additions Retirements June 30, 2022

Subscription IT asset $ 18,449,213 3,914,637 — 22,363,850

Less accumulated amortization — (4,317,037) — (4,317,037)

Subscription assets, net

$ 18,449,213 (402,400) — 18,046,813

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

28 (Continued)

(b) Subscription Liabilities

Regional One Health has various subscription-based information technology arrangements (SBITAs),

the terms of which expire in various years through 2030. Variable payments based upon the use of the

underlying asset are not included in the subscription liability because they are not fixed in substance.

Subscription liabilities and related activity for the years ended June 30, 2023 and 2022, were:

Balances at Balances at Amounts due

June 30, June 30, within

2022 Additions Deductions 2023 one year

Subscription IT liabilities $ 19,910,767 2,285,846 (7,693,592) 14,503,021 5,289,535

Balances at Balances at Amounts due

July 1, June 30, within

2021 Additions Deductions 2022 one year

Subscription IT liabilities $ 18,449,213 3,914,637 (2,453,083) 19,910,767 5,407,746

The following is a schedule by year of payments under the subscriptions as of June 30, 2023:

Total to be paid Principal Interest

Year(s) ending June 30:

2024

$ 6,032,571 5,289,535 743,036

2025

3,283,052 2,820,388 462,664

2026

1,950,693 1,634,302 316,391

2027

1,593,313 1,363,186 230,127

2028

1,239,205 1,083,236 155,969

2029 – 2030 2,443,312 2,312,374 130,938

$ 16,542,146 14,503,021 2,039,125

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

29 (Continued)

(9) New Market Tax Credit Program and Long-Term Debt

(a) New Market Tax Credit Program

Regional One Health entered into a transaction with Truist Community Capital, LLC on December 10,

2021 to obtain financing through the New Market Tax Credit (NMTC) Program sponsored by the

Department of Treasury. The NMTC Program permits certain corporate tax payors to receive a credit

against federal income taxes for making qualified equity investments (QEI) in community development

entities. The credit provided to the investor totals 39% of the initial value of the QEI and is claimed over

a seven-year credit allowance period.

Regional One Health established ROH Investment Co., Inc. as a supporting organization to help

facilitate the NMTC transaction. Regional One Health secured a term loan with Truist Bank in the

amount of $19,500,000 and provided initial funding to ROH Investment Co., Inc. with a donation in the

amount of $19,057,900.

As part of this transaction, ROH Investment Co., Inc. and SunTrust Community Capital, LLC

contributed approximately $19,057,900 and $6,749,600, respectively, to ROH Memphis Investment

Fund, LLC, an entity created to provide funding for investments in special purposes entities called

community development entities (CDEs). ROH Investment Co., Inc. provided funding and received a

notes receivable as part of the NMTC Program, totaling $19,057,900, which is included in the

statement of net position as of June 30, 2023.

Notes receivable $ 19,057,900

The notes receivable require interest only payments of 2.00% annually on the unpaid principal balance,

which is due quarterly beginning March 10, 2022 through March 31, 2029. Beginning on June 10, 2029,

principal and interest payments will be due and will continue annually until the maturity of the notes

receivable on September 30, 2056.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

30 (Continued)

The CDE’s loaned Regional One Health, $25,807,500, made up of Notes A & B, which were

$19,057,900 and $6,749,600, respectively. Long-term debt related to the NMTC Program is

summarized as follows:

2023 2022

Note payable to CHHS Subsidiary CDE 52, LLC, interest paid

interest rate of 1.98711%, the maturity date is

December 31, 2051 $ 11,433,500 11,433,500

Note payable to CHHS Subsidiary CDE 52, LLC, interest paid

interest rate of 1.98711%, the maturity date is

December 31, 2051 4,329,000 4,329,000

Note payable to Pathway Lending CDE 1, LLC, interest paid

interest rate of 1.98711%, the maturity date is

December 31, 2051 3,956,400 3,956,400

Note payable to Pathway Lending CDE 1, LLC, interest paid

interest rate of 1.98711%, the maturity date is

December 31, 2051 1,188,600 1,188,600

Note payable to UACD Sub CDE 57, LLC, interest paid

interest rate of 1.98711%, the maturity date is

December 31, 2051 3,668,000 3,668,000

Note payable to UACD Sub CDE 57, LLC, interest paid

interest rate of 1.98711%, the maturity date is

December 31, 2051 1,232,000 1,232,000

$ 25,807,500 25,807,500

(b) Long-Term Debt

(i) Cerner EMR Financing

On January 27, 2017, Regional One Health entered into a $15,400,000 contract with Cerner

Corporation for the purpose of financing the licensing and implementation of electronic medical

record software. The payment schedule under the contract is based upon 0% interest with the first

payment made upon execution of the contract, on January 27, 2017, and semiannual payments

required starting September 30, 2017, which were converted to annual payments starting July 1,

2021 and ending July 1, 2023. The debt was secured by the software being purchased through the

contractual agreement.

(ii) Baxter Infusion Pumps

On December 11, 2017, Regional One Health entered into $1,500,000 million contract with Baxter

Healthcare Corporation for the purpose of financing the licensing, equipment, and implementation

of an infusion pump system. The payment schedule under the contract is based on 0% interest with

the first payment made after installation and training was completed and the last payment made

60 months after. The debt was secured by a purchase money security interest in the equipment.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

31 (Continued)

On September 1, 2020, Regional One Health entered into a $1,700,000 dollar contract with Baxter

Healthcare Corporation for the purpose of financing the licensing equipment and implementation of

the infusion pump system. The payment schedule under the contract is based on 0% interest with

the first payment made December 22, 2020 and last payment scheduled for August 31, 2025.

(iii) Morrison Healthcare Financing

On November 1, 2020, Regional One Health entered into a $1,570,000 contract with Morrison

Healthcare for the purpose of financing the equipment, renovations, and software necessary to

operate the cafeteria on campus. The payment schedule under the contract has two separate

notes, which are both based upon 0% interest with the first payment made at the execution of the

contract, on November 1, 2020. Note A totals $946,000 and has a total of 116 payments to be

made monthly for $9,723 for 36 months and $7,567 thereafter through June 30, 2030, with

payments due 14 days after being invoiced. Note B is listed in the contract but not directly charged

to ROH but is instead amortized over the life of the contract, the note totals $626,000 with monthly

amortization of $5,316 for 116 months through June 30, 2030. Per the agreement, should Regional

One Health or Morrison Healthcare terminate the agreement early, for any reason, all outstanding

amounts are due in full immediately.

(iv) Insightec Financing

On December 31, 2019, Regional One Health entered into a $1,950,000 contract with Insightec

Corporation for the purpose of financing an exablate neuro system. An initial payment of

$1,000,000 was made at signing with the remaining to be paid based on neuravive procedures

performed each month at $4,500 per procedure at 0% interest. The contract does not require any

specific monthly payment or minimum procedure performance but instead requires that all

payments must be made until the $1,500,000 contract has been filled and there is no final due

date. ROH has elected to estimate the amount of the payments per month as an average of the

current volume of procedures performed. The debt is secured by the equipment being purchased

through the contractual agreement.

(v) Truist Term Loan

On December 3, 2021, Regional One Health entered into a $19,500,000 term loan with Truist

Bank. The loan bears interest at 3.137% and payments are due quarterly starting March 5, 2022.

The payments are interest only until September 5, 2023, at which time the payment will include

equal principal amounts of $487,500 plus interest and continue through February 28, 2029 with a

final principal payment of $8,775,000 due on March 1, 2029. The debt is secured through

investments. Default is defined by the agreement as failure of any one of the following: meet the

debt covenants, pay principal and interest due no later than 5 days late, pay any other lenders

within their grace periods, pay within 30 days any judgement levied against the company, as well

as any of the following occurrences: Bankruptcy, transfer of control, insolvency, or material adverse

changes in financial condition. Truist may, at its discretion, apply a 4% penalty, call the debt, or

seize assets in any bank accounts held with them.

SHELBY COUNTY HEALTH CARE CORPORATION

(A Component Unit of Shelby County, Tennessee)

Notes to Basic Financial Statements

June 30, 2023 and 2022

32 (Continued)

(vi) Cerner ROSI Financing

On July 1, 2021, Regional One Health entered into a $2,598,578 contract with Cerner Corporation

for the purpose of financing the licensing and implementation of major additions to the current

electronic medical record software to allow for oncology. The payment schedule under the contract

is based upon 5.45% interest with the first payment made upon execution of the contract, on July 1,

2021, and quarterly payments required starting October 1, 2021 and ending April 1, 2025. The debt

is secured by the software being purchased through the contractual agreement. Payments from

July 1, 2021 through October 1, 2022 were treated as pre-payments on the debt as there was no

underlying asset in existence to record against it.

(vii) Masimo Americas Financing

On July 1, 2021, Regional One Health entered into a $945,158 contract with Masimo Americas for

the purpose of financing patient monitoring and pulse oximetry equipment. The payment schedule

under the contract uses an internally estimated interest rate of 5.34%. Payments are recognized

based on consumables spend for Masimo products with the contract ending on June 1, 2026.

(viii) Johnson & Johnson Financing

On June 1, 2023, Regional One Health entered into a $82,940 contract with Johnson & Johnson for

the purpose of financing ligasure equipment. The payment schedule under the contract uses an

internally estimated interest rate of 5.42%. Payments are recognized based on consumables spend

for specific Johnson & Johnson products with the contract ending on June 1, 2026.

(ix) Edwards Life Sciences Financing