TRADE ADJUSTMENT ASSISTANCE FOR

WORKERS PROGRAM

FY 2019 ANNUAL REPORT

Employment and Training Administration

U.S. Department of Labor

Website: https://www.dol.gov/agencies/eta/tradeact/

2

REPORT TO THE COMMITTEE ON FINANCE OF THE

SENATE AND THE COMMITTEE ON WAYS AND MEANS OF

THE HOUSE OF REPRESENTATIVES

The Department of Labor (Department) submits the following report on the Trade Adjustment

Assistance (TAA) for Workers Program to the Committee on Finance of the Senate and the

Committee on Ways and Means of the House of Representatives. Section 249B(d) of the Trade

Act of 1974, as amended (19 U.S.C. 2323(d)), requires the Department to submit an annual

report including, among other things, summarizing data collected by the Department on the TAA

Program for the preceding Fiscal Year (FY). This report reflects data reported for FY 2019 and

includes supplemental data from FY 2015 through FY 2018.

3

Table of Contents

4

Executive Summary...................................................................................................

Success Stories........................................................................................................... 5

I. Program Description........................................................................................ 9

General Description of TAA Program............................................................. 9

Worker Group Eligibility for Petitions Filed in FY 2019................................ 11

II. Program Background........................................................................................ 15

Petition Processing in FY 2019........................................................................ 15

Industry Sectors in FY 2019............................................................................. 18

Profile of New TAA Participants in FY 2019.................................................. 21

III. Benefits and Services....................................................................................... 25

Benefits and Services Provided During FY 2019............................................ 25

Enrollment in Training Waivers Issued in FY 2019........................................ 27

IV. Performance Outcomes.................................................................................... 32

V. Program Guidance............................................................................................ 39

VI. Funding............................................................................................................ 40

Distributions of FY 2019 Program Funds to States......................................... 43

Process for Providing Funds to States for TRA, ATAA, and RTAA.............. 45

VII. Conclusion........................................................................................................ 48

Appendix A................................................................................................................ 49

Appendix B................................................................................................................ 52

Appendix C................................................................................................................ 54

Table of Contents: Tables.......................................................................................... 72-73

Table of Contents: Figures........................................................................................ 74

4

EXECUTIVE SUMMARY

TAA FOR WORKERS:

TRANSITIONING WORKERS TO TODAY’S CAREERS

The TAA for Workers Program provides federal assistance to workers who are adversely

affected by foreign trade. TAA includes resources and opportunities to obtain the skills,

credentials, and support necessary for successful reemployment in today’s economy. Any

member of a worker group certified by the Department as trade-affected is potentially eligible to

receive TAA Program benefits and services through a local American Job Center (AJC), such as

employment and case management, training, income support in the form of Trade Readjustment

Allowances (TRA), job search allowances, relocation allowances, and a Health Coverage Tax

Credit (HCTC). The Reemployment TAA (RTAA) benefit is also available and provides wage

supplements for eligible reemployed workers, age 50 and over, whose reemployment resulted in

lower wages than those earned in their trade-affected employment.

In FY 2019 (October 1, 2018 – September 30, 2019), 1,235 petitions were filed, a 3 percent

decrease from FY 2018. An estimated 88,001 workers became eligible to apply for TAA, up 14

percent from the previous year, and 28,348 participants received benefits and services, down 18

percent from the previous year. Performance remained at a 5-year high in FY 2019 with 77

percent of TAA participants obtaining new employment within 6 months of completing the

program. While 53 percent of FY 2019 TAA petitions were from the manufacturing industry, 62

percent of participants who exited the program were re-employed in non-manufacturing industry

sectors, coinciding with the general U.S. economic trend of growth in non-manufacturing

industry employment.

Of the 8,251 TAA exiters who received training in FY 2019, approximately 75 percent (6,162)

completed training and about 88 percent (5,446) of training completers received a credential.

The fourth-quarter employment rate of those participants who completed training and received a

credential were higher than those participants who did not, continuing a multi-year trend.

These performance results demonstrate that, in FY 2019, the reauthorized TAA Program

continues to provide important benefits and services to help trade-affected workers obtain

reemployment.

5

SUCCESS STORIES

Francisco “Frank” Manzanedo was a Plant Operator for almost 10 years at a copper and gold

mining company in Arizona when he was laid off

from this position in January 2016. Frank

enrolled in the TAA Program and, after local TAA

staff reviewed his employment history and skills,

it was determined that options in the mining

industry were very scarce and other job

openings required post-secondary

education. Frank decided to pursue an Associate’s

of Applied Science degree in Systems

Administration and Networking/Cyber Security.

Frank began his TAA approved training and

successfully completed his program in

May 2019. Upon graduation, he obtained

employment at a major University as a Stationary

Engineer Senior and is earning more than he was

in adversely affected employment.

6

Milton Salguero worked as an Optical Disc Pre-

Production Operator for a company in California

for approximately 13 years. He enjoyed his job and

thought he would retire from the company, but he

was laid off when his job was offshored in April

2017. Milton enrolled in the TAA Program and,

after working closely with his local TAA Program

staff, decided that obtaining a Machinist credential

would be a great fit for him. He successfully

completed a Machinist Technology training

program in June 2019. Within weeks, he was

reemployed full-time as a Machinist at a

manufacturing company. Milton said, “I am very

grateful for the training opportunity that

was given to me through the TAA Program.”

Kimeontae Asbie-Thomas had been working in the accounting field for about 15 years before

starting a job at a company in Florida. After being at

the company for about a year and a half, Kimeontae

was informed she had lost her job due to an expansion

overseas. Shortly after the layoff, she relocated to

North Carolina and enrolled in the TAA Program. She

was approved to pursue training in Health Information

Technology which, according to her, would provide the

best of both worlds: health and

accounting. Kimeontae went to school full-time,

completed an Associate in Applied Science degree in

May 2019, and received her certification as a

Registered Health Information Technician (RHIT) in

July 2019. Kimeontae is now working full-time as a

Health Consultant Data/Coding Specialist and said, “I am so thankful for the opportunity the

TAA Program has granted me.”

7

Kendra Griffin was working as an Accounts Representative when

she was laid off from her Customer Service job in January 2018. She

had been in Portland, Oregon, only for a few years and had difficulty

finding a job, even though she held an associate degree. Kendra

enrolled in the TAA Program and had always been interested in

honing her technical/grant writing skills and working for a non-profit

agency. She was approved for training and completed her bachelor’s

degree in May 2019, allowing her to land a position at a prestigious

non-profit. Kendra stated that: “I was hired to work at a nonprofit

company in my neighborhood. I can continue to live in my

community, walk to work, and enjoy my quality of life. I cannot say

what will happen tomorrow, but I appreciate what [the TAA

Program] has helped me accomplish today.”

Brian Paul had worked for saw mills most of his career

and was separated from employment when the last mill

closed down in his rural Oregon town. Brian enrolled in

the TAA Program and started training in July 2016.

However, the nearest community college campus was

more than a 120-mile round-trip commute from

home. Through the TAA Program, Brian was provided

with supplemental assistance, including mileage

reimbursement, which made it possible for him to

continue making that trip through March 2019. At the

completion of his program, Brian had not only earned an

Associates in Applied Science degree in Electronics

Technology, but he was also awarded with High

Technology Studies and Electronics Technician

Certificates. He was hired permanently as a Service Technician with a well-respected

company and is now working in his chosen occupational field. When asked about his training

experience, Brian remarked, “Never in my wildest dreams did I think I would continue my

education. I am proof that hard work and perseverance will always succeed.”

8

I. PROGRAM DESCRIPTION

General Description of the TAA Program

The Trade Act of 1974 (Pub. L. No. 93-618), Title II, Chapter 2, as amended (the Act) (codified

at 19 U.S.C. § 2271 et seq.), established the TAA for Workers, Alternative Trade Adjustment

Assistance (ATAA), and the later Reemployment Trade Adjustment Assistance (RTAA)

programs. These programs, collectively referred to as the TAA Program, provide assistance to

workers who have been adversely affected by foreign trade. The Trade Adjustment Assistance

Reauthorization Act of 2015 (TAARA 2015 or 2015 Program), (Pub. L. No. 114-27, Title IV),

reauthorized and changed key provisions of the Act.

During FY 2019, due in part to provisions in TAARA 2015, the Department was administering

four versions of the TAA Program concurrently, referred to as: the 2002 Program, the 2009

Program, the 2011 Program, and the 2015 Program. A detailed description of the differences

between the 2002, 2009, 2011, and 2015 programs is provided in Appendix A of this report.

TAARA 2015 retained the expanded group eligibility provisions and TAA Program benefits and

services available under the 2011 Program. However, as is detailed in Appendix A, there are

differences between these two programs in the funding level for Training and Other Activities

and in performance and reporting requirements. TAARA 2015 revised reporting requirements to

align performance accountability for the TAA Program with that of partner programs under the

Workforce Innovation and Opportunity Act (WIOA) (Pub. L. No. 113-128). Training and

Employment Guidance Letter (TEGL) No. 5-15,

1

and TEGL No. 5-15, Change 1,

2

were issued to

provide operating instructions to states for administration of benefits and services under the 2015

Program.

On June 29, 2015, the Office of Trade Adjustment Assistance (OTAA) began using the group

eligibility criteria under the reauthorized 2015 Program for petition investigations. A participant

certified under the 2015 Program receives benefits and services available under that Program.

1

https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=3863

2

https://wdr.doleta.gov/directives/corr_doc.cfm?docn=8845

9

A participant who is a member of a worker group covered by an existing certification that was

issued under the 2002, 2009, or 2011 programs continues to receive benefits and services

available under the eligibility criteria applicable to those respective programs.

In FY 2019, the overall participation duration in the TAA Program averaged 510 days, and the

duration of training averaged 438 days (illustrated in Table 16). The majority of “exiting”

participants for the fiscal year was from the 2015 Program (illustrated in Table 1), making up

93.5 percent of the total. The term “program exit” means a participant has not received a service

funded by the program or certain other services funded by a partner program for 90 consecutive

calendar days following the last service and is not scheduled for future services. The exit date is

the last date of service and was reported by states on a quarterly basis.

As mentioned previously, the Department is administering four versions of the TAA Program

concurrently, referred to as: the 2002 Program, the 2009 Program, the 2011 Program, and the

2015 Program. Table 1 below shows the percentage for exiting TAA participants by Program.

Table 1: Percentage of Exiting TAA Participants by Program

TAA Exiters by Program

Total Count

Percentage of Total

2002 Program

111

0.8%

2009 Program

128

0.9%

2011 Program

719

4.9%

2015 Program

13,730

93.5%

Note: Some of the 2015 Program participants were members of workers groups certified

as eligible under the Reversion 2014 Program criteria.

In FY 2019, states reported on a quarterly basis through the Participant Individual Record Layout

(PIRL). The PIRL was developed collaboratively by the U.S. Departments of Labor and

Education as part of the WIOA performance accountability-related provisions. The PIRL

represents a set of performance data elements and common definitions that are shared across

multiple programs for performance reporting.

The petition activity, detailed in Section II, shows that the scope of the TAA Program includes

numerous affected industries, employers, regional economies, and communities. An estimated

88,001 workers became eligible to apply for TAA benefits and services in FY 2019.

10

Worker Group Eligibility for Petitions Filed in FY 2019

For a worker to be eligible to apply for TAA Program benefits and services during FY 2019, the

worker must have been part of a group of workers that was the subject of a petition filed with

and certified by the Department. Three workers from a company, a company official, a union or

other duly authorized representative, a state workforce official, or an operator of an American

Job Center (AJC) may file a petition simultaneously with both the Department and the Governor

of the state in which the workers’ firm is located. In response to the filing, the Department

initiates an investigation into whether, in accordance with the statutory criteria, foreign trade was

a contributing cause of the workers’ job loss or threat of job loss.

To meet worker group eligibility requirements, it is required for options 1 through 5 below that a

significant number or proportion of the workers in such workers’ firm (or an appropriate

subdivision of the firm, if option 4 or 5) have become totally or partially separated, or are

threatened to become totally or partially separated, and that the criteria in one or more of the

options are met:

1. Increased Imports

o Sales or production, or both, of such firm have decreased absolutely; and

Imports of

articles or services like or directly competitive with articles

produced or services supplied by such firm have increased; or

articles like or directly competitive with articles into which one

or more component parts produced by such firm are directly

incorporated have increased; or

articles like or directly competitive with articles which are

produced directly using services supplied by such firm have

increased; or

articles directly incorporating one or more component parts

produced outside the U.S. that are like or directly competitive

with imports of articles incorporating one or more component

parts produced by such firm have increased;

o And, the increase in imports contributed importantly to such workers’ separation or threat

of separation and to the decline in the sales or production of such firm.

11

3. Acquisitions from a Foreign Country

o The component parts that the workers’ firm supplied to the firm whose workers received

a TAA certification of eligibility under option 1, 2, 3, or 6, accounted for at least 20

percent of the production or sales of the workers’ firm – OR – a loss of business by the

workers’ firm with the firm described in option 1, 2, 3, or 6, contributed importantly to

the workers’ separation or threat of separation.

2. Shifts to a Foreign Country

o There has been a shift by the workers’ firm to a foreign country in the production of

articles or the supply of services like or directly competitive with articles which are

produced or services which are supplied by such firm;

o And the shift of articles or services contributed importantly to such workers’ separation

or threat of separation.

4. Secondary Component Supplier

o The workers’ firm is a supplier to a firm that employed a group of workers who received

a TAA certification of eligibility under option 1, 2, 3, or 6, and such supply or production

is related to the article or service that was the basis for each certification.

5. Downstream Producer

o The workers’ firm is a downstream producer to a firm that employed a group of workers

who received a TAA certification of eligibility under option 1, 2, 3, or 6, and such supply

or production is related to the article or service that was the basis for such certification;

o And a loss of business by the workers’ firm with the firm described in option 1, 2, 3, or

6, contributed importantly to the workers’ separation or threat of separation.

12

6. International Trade Commission (ITC)

o The workers’ firm is publicly identified by name by the ITC as a member of a

domestic industry in an investigation resulting in A, B, or C

A. An affirmative B. An affirmative C. An affirmative final

determination of serious determination of market determination of material

injury or threat thereof. disruption or threat injury or threat thereof.

thereof.

o And, a petition is filed during the 1-year

period beginning on the date on which:

If A, a summary of the ITC report

submitted to the President is published

in the Federal Register; If B or C, the

notice of an affirmative determination is

published in the Federal Register

o And, the workers have become

totally or partially separated from

the workers’ firm within the 1-year

period from the Federal Register

publication, or during the 1-year

preceding that period.

Upon reaching an affirmative determination (called a certification) based on the above

investigation criteria, the Department promptly issues a notice that identifies the worker group

whose members are eligible to apply for TAA benefits and services. The notice of affirmative

determination is sent out to the states, the petitioner(s), and the workers’ firm. The Department

promptly publishes a summary of the affirmative determination in the Federal Register and on

the Department’s website along with the reasons for making such a determination.

Once a state receives the notice of affirmative determination, it obtains a list of individual

workers in the group covered by the certification and notifies them that they may apply to the

state for benefits and services under the TAA Program through the AJC. An individual worker

must meet separate statutory eligibility criteria in order to qualify for the benefits or services.

13

II. PROGRAM BACKGROUND

Petition Processing in FY 2019

In FY 2019, the Department received 1,235 petitions and certified 799 of those petitions, or 71.7

percent of those where a determination on eligibility was rendered.

3

The certified petitions

covered an estimated 88,001 workers from various industries.

Table 2 shows the number of petitions filed in recent years, the number of denied petitions, and

workers affected under those petitions. Table 2 also shows that the number of petitions filed in

FY 2019 decreased from FY 2018

4

. Petition activity by state is provided in Appendix B, and

petition activity by Congressional District is provided in Appendix C.

Table 2: FY 2015 – FY 2019 Estimated Number of Workers Covered by Petitions Certified and Denied

Fiscal

Year

Petitions

Filed

1

Petitions

Certified

% of

Petitions

Certified

2

Est. # of

Workers

3

Petitions

Denied

4

% of

Petitions

Denied

Est. # of

Workers

5

2015

6

1,073

416

99.8%

58,338

1

0.2%

434

2016

6

1,502

1194

68.0%

127,442

561

32.0%

60,729

2017

1,091

848

78.9%

95,505

227

21.1%

31,766

2018

1,273

902

80.9%

77,494

213

19.1%

16,389

2019

1,235

799

71.7%

88,001

316

28.3%

21,881

1

During any fiscal year, the number of petitions filed may not be the sum of petitions certified and petitions denied for the

following reasons: 1) the processing time for petitions may overlap fiscal years; and 2) petitioners may withdraw a petition once

it has been filed, which results in the termination of an investigation. (Data is inclusive of workers added to petitions after

amendments were filed.)

2

The percentage of petitions certified is determined by the ratio of certified petitions to the sum of certified

and denied petitions.

3

Estimated number of workers covered by a certified petition.

4

Provisions of TAARA 2015 required petitions filed between January 1, 2014 and June 28, 2015 and subsequently denied to be

investigated again under the TAARA 2015 eligibility criteria. Most of these reconsiderations were completed in FY 2016.

5

Estimated number of workers covered by a denied petition.

6

FY 2015 and FY 2016 numbers were affected by statutory reconsideration due to the signing of TAARA 2015.

3

The percentage of 71.7 is determined by the ratio of certified petitions (799) to the sum of certified and denied petitions (1,115).

4

Although the Department issued fewer certifications in FY 2019 compared with last year, the number of workers increased because worker

groups were larger on average.

14

Table 3 shows the median processing times for each category of determinations, which are

certifications, denials, and terminations. From FY 2018 to FY 2019, there was an increase of the

median processing time from 50 to 61 days.

Table 4 shows certifications differentiated by product or service and sorted by certification type,

number of certifications by type, estimated number of adversely affected workers, and

percentage of total certifications by type.

Table 3: FY 2015 – FY 2019 Median Time for Processing Petitions

Fiscal

Year

Median Processing Time

Certifications

Denials

Terminations

1

Total

2015

35 Days

43 Days

34 Days

36 Days

2016

79 Days

173.5 Days

64.5 Days

92 Days

2017

64 Days

122 Days

47 Days

69 Days

2018

43 Days

83 Days

56 Days

50 Days

2019

51 Days

100.5 Days

58 Days

61 Days

Note: Median processing times do not include statutory reconsiderations.

Average processing time was 78.3 days for FY 2019.

1

Petitions may be terminated because the petition requests withdrawal, the petition is deemed invalid, and existing

certification has already been issued, another duplicate investigation is in process, or a negative determination was recently

issued, among others reasons.

15

Table 4: FY 2019 Certified Petitions, Classified by the Basis for Certification

Type

Certification Type

Statutory

Provision Section

222

# of

Certs

Est. # of

Workers

1

% of

Total

Product

Shift in Production to a

Foreign Country

(a)(2)(B)(i)(I)

209

31,398

35.7%

ITC Determination

(e)

55

3,821

4.3%

Customer Imports of Articles

(a)(2)(A)(ii)(I)

44

5,894

6.7%

Acquisition of Articles from a

Foreign Country

(a)(2)(B)(i)(II)

37

2,762

3.1%

Company Imports of Articles

(a)(2)(A)(ii)(I)

25

3,564

4.1%

Secondary Component

Supplier

(b)(2) &

(b)(3)(A)/(b)(3)(B)

17

1,898

2.2%

Increased Aggregate Imports

(a)(2)(A)(ii)(I)

11

5,819

6.6%

Imports of Finished Articles

Containing Like or Directly

Competitive Components

(a)(2)(A)(II)(aa)

5

441

0.5%

Downstream Producer

(b)(2) & (b)(3)(B)

4

568

0.7%

Imports of Finished Articles

Containing Foreign

Components

(a)(2)(A)(III)

1

120

0.1%

Service

Shift in Services to a Foreign

Country

(a)(2)(B)(ii)(I)

272

18,682

21.2%

Acquisition of Services from a

Foreign Country

(a)(2)(B)(i)(II)

96

9,126

10.4%

Secondary Service Supplier

(b)(2) & (b)(3)(B)

12

1,927

2.2%

Customer Imports of Services

(a)(2)(A)(ii)(I)

6

1,514

1.7%

Company Imports of Services

(a)(2)(A)(ii)(I)

5

467

0.5%

Total

799

88,001

100.0%

1

Estimated number of workers covered by a certified petition in FY 2019.

16

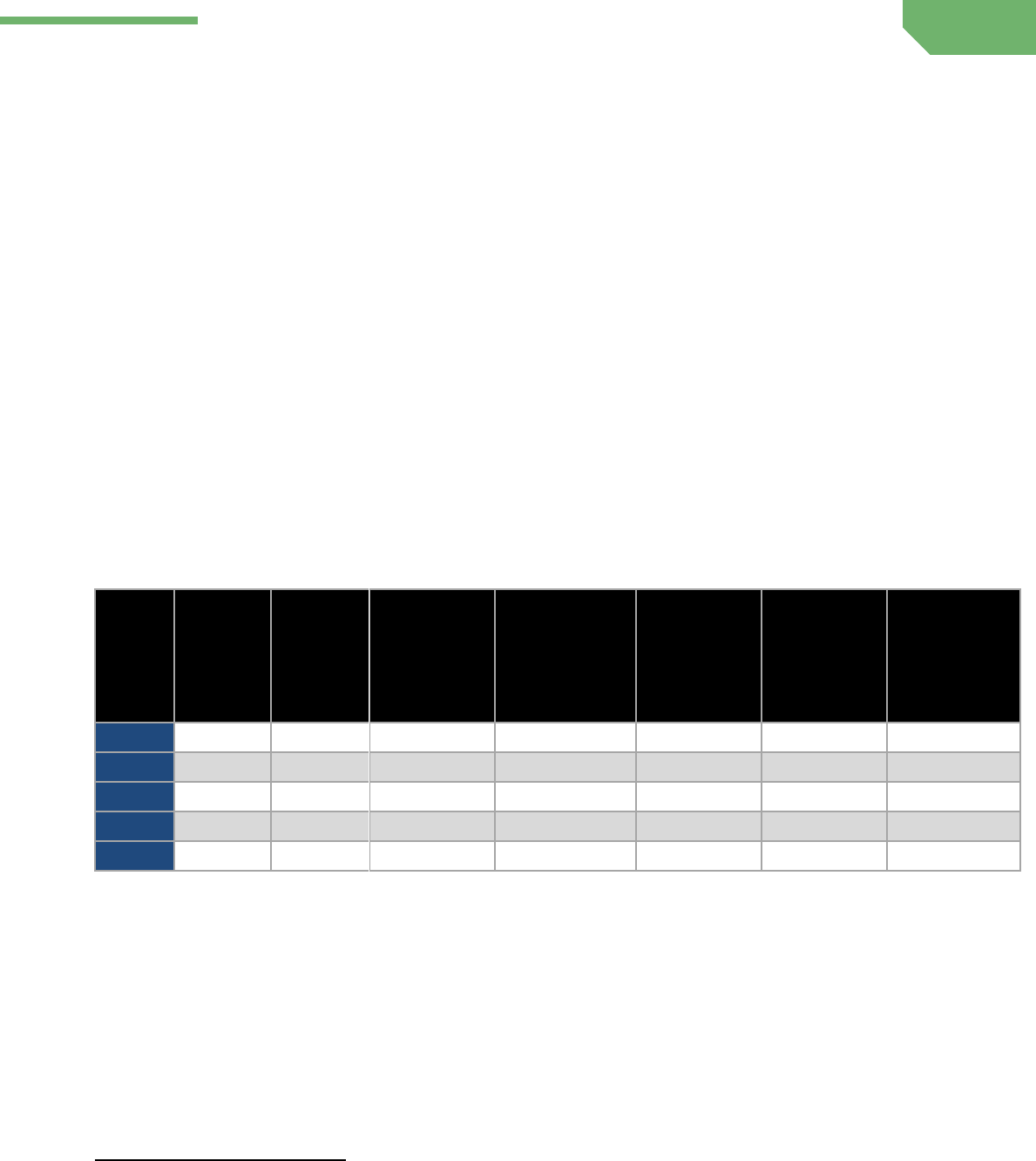

Industry Sectors in FY 2019

In FY 2019, the Department issued 799 TAA certifications that covered 20 industry sectors. As

in prior years, the largest industry sector was manufacturing with 424 certifications covering an

estimated 51,693 workers. Professional, Scientific, and Technical Services represented the

second largest industry sector with 114 certifications covering an estimated 9,299 workers,

nearly 60 percent higher than FY 2018 (5,854).

Figure 1 illustrates the industry sectors with petition certifications during FY 2019.

Figure 1: FY 2019 Petition Certifications by Industry

Manufacturing, 424

Professional,

Scientific, and

Technical Services,

114

Finance and

Insurance, 72

Information, 66

Administrative and

Support and Waste

Management and

Remediation Services,

37

Wholesale Trade, 36

Transportation and

Warehousing, 17

Retail Trade, 12

Other

1

, 21

Note: See Table 5 for FY 2019 petitions certified or denied by industry sector.

1

Represents all the industries with less than 10 certifications.

try

Table 5 shows the amount of petitions certified and denied, identified by the North American

Industry Classification System (NAICS) sectors in which the trade-affected workers were

employed. Manufacturing sector certifications decreased from 512 certifications in FY 2018 to

424 certifications in FY 2019. The manufacturing sector made up 53.1 percent of total

certifications and 58.7 percent of estimated certified workers.

17

Table 5: FY 2019 Petitions Certified and Denied by Industry Sector

Industry Sector

Certifications

Denials

# of

Est. # of

# of

Est. # of

Petitions

Workers

Petitions

Workers

Manufacturing

424

53.07%

51,693

58.74%

101

31.96%

9,105

41.61%

Professional,

Scientific, and

Technical Services

114

14.27%

9,299

10.57%

23

7.28%

673

3.08%

Finance and

Insurance

72

9.01%

5,879

6.68%

13

4.11%

511

2.34%

Information

66

8.26%

6,873

7.81%

28

8.86%

2,054

9.39%

Administrative and

Support and Waste

Management and

Remediation

Services

37

4.63%

5,590

6.35%

15

4.75%

3,800

17.37%

Wholesale Trade

36

4.51%

3,942

4.48%

6

1.90%

218

1.00%

Transportation and

Warehousing

17

2.13%

1,635

1.86%

7

2.22%

883

4.04%

Retail Trade

12

1.50%

1,357

1.54%

112

35.44%

4,083

18.66%

Management of

Companies and

Enterprises

4

0.50%

291

0.33%

0

0.00%

0

0.00%

Health Care and

Social Assistance

4

0.50%

163

0.19%

3

0.95%

152

0.69%

Utilities

3

0.38%

405

0.46%

3

0.95%

109

0.50%

Mining, Quarrying,

and Oil and Gas

Extraction

3

0.38%

459

0.52%

3

0.95%

76

0.35%

Educational

Services

3

0.38%

250

0.28%

0

0.00%

0

0.00%

Construction

2

0.25%

6

0.01%

0

0.00%

0

0.00%

Other Services

(except Public

Administration)

1

0.13%

103

0.12%

0

0.00%

0

0.00%

Accommodation

and Food Services

1

0.13%

56

0.06%

1

0.32%

2

0.01%

Real Estate and

Rental and Leasing

0

0.00%

0

0.00%

1

0.32%

215

0.98%

Agriculture,

Forestry, Fishing

and Hunting

0

0.00%

0

0.00%

0

0.00%

0

0.00%

Arts,

Entertainment, and

Recreation

0

0.00%

0

0.00%

0

0.00%

0

0.00%

Public

Administration

0

0.00%

0

0.00%

0

0.00%

0

0.00%

Total

799

100%

88,001

100%

316

100%

21,881

100%

Note: FY 2019 results exclude Puerto Rico data.

18

Table 6 shows the top five industry sectors for post-participation employment in FY 2019. The

manufacturing industry continues to be the largest industry sector for reemployment.

Table 6: FY 2019 Top Five Industry Sectors for Post-TAA Participation Employment

Industry Sector of Reemployment

Total Count

Manufacturing

4,875

37.9%

Administrative, Support, Waste Management and

Remediation Services

1,534

11.9%

Health Care and Social Assistance

1,075

8.4%

Professional, Scientific, and Technical Services

627

4.9%

Retail Trade

621

4.8%

Note: Industry Sector of Reemployment is based on TAA participants employed in the second quarter after exit as

documented four quarters after exit to allow for time to collect and report data. The FY 2019 Industry Sector of

Reemployment is for participants who exited between October 1, 2017, and September 30, 2018, inclusively.

Table 7 lists the top five subsectors for reemployment in the manufacturing and service industries

in FY 2019.

Table 7: FY 2019 Top Five Subsectors for Reemployment in Manufacturing and Service Industries

Manufacturing

Service

Iron and Steel Mills and Ferroalloy Manufacturing

Temporary Help Services

Railroad Rolling Stock Manufacturing

General Medical and Surgical Hospitals

Aircraft Manufacturing

Elementary and Secondary Schools

Machine Shops

Offices of Physicians (except Mental Health

Specialists)

Heavy Duty Truck Manufacturing

Executive and Legislative Offices, Combined

Note: Industry Sector of Reemployment is based on TAA participants employed in the second quarter after exit as

documented four quarters after exit to allow for time to collect and report data.

The FY 2019 Industry Sector of Reemployment is for participants who exited between October 1, 2017, and

September 30, 2018, inclusively. In addition, it is highly likely that workers reported under Temporary Help

Services may actually be reemployed in the manufacturing sector.

19

Profile of New TAA Participants in FY 2019

The demographic characteristics of new TAA participants who enrolled in the program during

FY 2019 varies slightly over time.

Table 8: FY 2018 – FY 2019 Demographics of New TAA Participants by Gender, Race, Pre-

Program Educational Level, Age, and Employment Tenure

Demographic Description

TAA

Participants

TAA

Participants

FY 2018

FY 2019

Gender

Male

56.6%

52.6%

Female

42.8%

46.9%

Race

White

65.1%

65.9%

Black or African American

15.6%

17.6%

Hispanic/Latino

11.9%

10.0%

Asian

5.5%

6.2%

American Indian or Alaska Native

1.3%

1.1%

Native Hawaiian or Other Pacific

Islander

0.5%

0.3%

Education

High School Diploma, GED or less

53.4%

50.7%

Some Post-Secondary, Associates

27.5%

29.6%

Bachelor’s & Beyond Bachelor’s

19.1%

19.7%

Age (Years)

Average (Mean)

49.7

50.1

Median

52.0

52.0

Tenure of Trade-

Affected Employment

(Years)

Average (Mean)

11.7

12.3

Median

8.0

8.4

Note: This chart reflects new participants in FY 2018 and FY 2019. Race is self-identified and a participant may identify

more than one race. As such, the total of race-identified percentages may be greater than 100 percent. FY 2019 results

exclude Puerto Rico data.

20

Table 8, on the previous page, shows that, compared to FY 2018, new TAA participants are

longer-tenured and more educated, with a larger share of women enrolled. This continues an

historical trend as the percent of new TAA participants who were college graduates has increased

from under 10 percent in FY 2009 to over 19 percent in FY 2019.

Table 9 compares the FY 2019 population served under the TAA Program with the American

Civilian Labor Force (ACLF), which is based on data provided by the Department’s Bureau of

Labor Statistics (BLS). BLS defines the ACLF as:

“All persons in the civilian non-institutional population (Persons 16 years of age and

older residing in the 50 states and the District of Columbia, who are not inmates of

institutions (e.g., penal and mental facilities, homes for the aged), and who are not on

active duty in the Armed Forces) classified as either employed or unemployed.”

As shown in Table 9, new TAA participants continue to have significantly less higher education

experience compared to the ACLF. While 67.2 percent of the ACLF had post-secondary

education, 49.3 percent of TAA participants entered the program with post-secondary education.

Another significant distinction between the ACLF and new TAA participants is their median

tenure of employment. In FY 2019, new TAA participants had a median of 8.4 years of

experience in their adversely affected employment, doubling the median tenure of employment

for ACLF of 4.2 years.

TAA Program participants continue to be older, more diverse, and less likely to have obtained a

higher education than the ACLF at large. These distinctions play a critical role in the design and

implementation of the TAA benefits and services. With relatively limited pre-program higher

educational attainment and long tenures out of the job-market, many TAA participants require

extensive case management and employment services to assist them to become reemployed.

21

When TAA participants enrolled in the program during FY 2019, many of them entered after

benefiting from Rapid Response services. Authorized under WIOA, Rapid Response is a pro-

active, business-focused strategy designed to respond to layoffs and plant closings by quickly

coordinating services and providing immediate aid to companies and their affected workers.

Rapid Response services ensure that workers affected by a layoff are given the best opportunity

to return to work as soon as possible and that employers can obtain the required talent or

workforce solutions to remain competitive. Each year, states reserve a portion of their funds for

WIOA Dislocated Worker activities to support Rapid Response. Under Section 221(a)(2)(A) of

the Trade Act (19 U.S.C. 2271(a)(2)(A)), as amended, states are required to ensure that Rapid

Response and appropriate career services (as described in Section 134 of WIOA, 29 U.S.C.

3174) are made available to workers for whom a petition for TAA has been filed.

As shown in Table 10, Rapid Response was provided to 80.7 percent of participants associated

with FY 2019 new petitions, the highest reported level to date. Table 10 further illustrates that,

from FY 2015 to FY 2019, there was a 16.5 percentage point increase in the number of new

participants receiving Rapid Response and an 18.8 percentage point improvement in the number

of petitions associated with Rapid Response.

Table 9: FY 2019 Demographics of New TAA Participants Compared to the American Civilian Labor

Force, by Gender, Race, Educational Level, Age, and Tenure

Demographic Description

American Civilian

Labor Force

TAA Participants

FY 2019

Gender

1

: Male

53.1%

52.6%

Race

1

: White

77.6%

65.9%

Education

2

: Some College, Associate's

Degree, Bachelor's Degree, or More

67.2%

49.3%

Median Age (Years)

3

42.2

52.0

Median Tenure of Employment (Years)

4

4.2

8.4

Note: for all of these, used “Civilian labor force, not “Civilian non-instituted population.

1

https://www.bls.gov/emp/tables/civilian-labor-force-summary.htm

2

http://www.bls.gov/cps/cpsaat07.pdf

3

http://www.bls.gov/cps/cpsaat11b.pdf

4

https://www.bls.gov/news.release/pdf/tenure.pdf

22

Since Rapid Response is a crucial component of providing TAA benefits and services, the

Department works closely with states and AJCs to encourage cross-training of TAA staff and

Rapid Response teams on implementing legislative or policy updates. The Department also

encourages states to become familiar with TAA investigation forms and ensure Rapid Response

teams are aware of information requested during the TAA investigation process. Further, the

Department provides guidance to affected states during significant mass layoff events to

coordinate efforts and determine any difficulties with the provision of TAA services.

While Rapid Response provides for immediate services, TAA certification allows for trade-

affected workers to obtain TAA Program-specific benefits and services. Section III will discuss

the benefits and services provided to TAA participants during FY 2019.

Table 10: FY 2015 – FY 2019 Rapid Response Rates

Fiscal Year

Participant

Petition

Rapid Response

Rapid Response

Rate

1

Rate

2

2015

64.2%

60.7%

2016

71.8%

70.6%

2017

70.0%

69.5%

2018

79.8%

79.7%

2019

80.7%

79.5%

1

Percentage of new participants who received Rapid Response services

2

Percentage of petitions associated with new participants for which Rapid Response services were

provided.

23

III. BENEFITS AND SERVICES

Benefits and Services Provided During FY 2019

The TAA Program includes a range of benefits and services available under the different

versions of the program. Appendix A provides details on the benefits and services available

under each program.

Table 11 shows the number of FY 2019 participants receiving each type of TAA benefit or

service. Employment and case management services reached an all-time high of 93.3 percent of

participants receiving these services, a significant improvement over FY 2018’s 86.2 percent.

Occupational training remains the largest type of training received with 38.6 percent of

participants receiving this training type. ATAA/RTAA participation fell to 15.0 percent of

participants receiving this TAA benefit in FY 2019 compared to 19.3 percent in FY 2018.

Similar to last year, only a small number of TAA participants were involved in an apprenticeship

opportunity or on-the-job training. Since apprenticeship is a critical and successful component

of America’s workforce strategy, the Department is continuing to help TAA participants find

apprenticeship opportunities and work with states to identify best practices that may lead to the

establishment of additional apprenticeship and other work-based learning opportunities.

24

Table 11: FY 2019 Participants Receiving Each Type of TAA Benefit or Service

Participant Benefit or Service

Number of Participants

FY 2019

Percentage of Participants

FY 2019

TAA (All)

28,348

-

Employment and Case

Management

26,442

93.3%

Training

13,585

47.9%

Occupational

10,948

38.6%

Remedial

921

3.2%

Prerequisite

85

0.3%

Customized

122

0.4%

On the Job

279

1.0%

Apprenticeship

16

0.1%

Pre-Layoff Training

125

0.4%

Training Leading to an

Associate’s Degree

3,271

11.5%

Distance Learning

1,203

4.2%

Part Time Training

369

1.3%

TRA

11,324

39.9%

Basic

7,131

25.2%

Additional

6,713

23.7%

Remedial

481

1.7%

Completion

1,299

4.6%

Job Search Allowances

108

0.4%

Relocation Allowances

195

0.7%

ATAA/RTAA

4,243

15.0%

Previous Certification

1

837

3.0%

Note: TAA participants may receive more than one benefit listed. FY 2019 results exclude Puerto Rico data.

1

Previous certification is not a benefit or service provided, but describes those served this year in compliance with

Sec. 249B(b)(2)€ of the Trade Act, as amended.

25

Table 12 shows the training participation rate from FY 2015 to FY 2019. During FY 2019, the

training participation rate fell to 47.9 percent.

Table 12: FY 2015 – FY 2019 Training Participation Trend

Fiscal Year

Current

Participants

Training

Participants

Training

Participation Rate

2015

45,688

24,564

53.8%

2016

45,570

24,250

53.2%

2017

43,615

23,214

53.2%

2018

34,836

18,313

52.6%

2019

28,348

13,585

47.9%

Note: TAA participants may receive more than one benefit listed. FY 2019 results exclude Puerto Rico data.

Enrollment in Training Waivers Issued in FY 2019

The Trade Act, as amended, authorizes the states to grant waivers, under certain conditions, of

the requirement that a TAA participant be enrolled in training by a certain deadline in order to

receive TRA.

Under the 2002 Program and 2009 Program, six different bases for waivers are available to

participants:

1. Recall – The worker has been notified that the worker will be recalled by the firm from

which the separation occurred.

2. Marketable Skills – The worker possesses marketable skills for suitable employment (as

determined pursuant to an assessment of the worker), and there is a reasonable

expectation of employment at equivalent wages in the foreseeable future.

3. Retirement – The worker is within two years of meeting all requirements for retirement

old-age insurance benefits under title II of the Social Security Act or a private pension

sponsored by an employer or labor organization.

4. Health – The worker is unable to participate in training due to the health of the worker,

except that a waiver shall not be construed to exempt a worker from requirements relating

to availability for work, active search for work, or refusal to accept work under Federal or

State unemployment insurance (UI) laws.

5. Enrollment Unavailable – The first available enrollment date for the approved training

of the worker is within 60 days after the date of the determination, or, if later, there are

extenuating circumstances for the delay in enrollment.

6. Training Not Available – Approved training is not reasonably available to the worker

from either governmental agencies or private sources, no training that is suitable for the

worker is available at a reasonable cost, or no training funds are available.

26

Under the 2011 and 2015 Programs, three waivers are available: Health, Enrollment

Unavailable, and Training Not Available, as described above. See Appendix A for more

information on the different bases for waivers and applicable deadlines for obtaining the waivers

under the 2002, 2009, 2011, and 2015 Programs.

Since FY 2012, the total number of waivers issued by states has been steadily declining due to

the elimination of the Recall, Marketable Skills, and Retirement bases for waivers for 2011 and

2015 Program participants. This trend has continued from FY 2018 to FY 2019 with total

waivers issued by states decreasing from 1,999 in FY 2018 to 1,987 in FY 2019, as seen in Table

13. Most notably, Training Not Available waivers went down considerably, and total waiver

participants are down nearly 60 percent since FY 2015.

Table 14 shows the number of TAA training exiters and average training costs by level of

training completion. In FY 2019, 74.7 percent of TAA exiters who participated in training

completed their training program, and the average training cost per participant was $13,623.

Table 13: FY 2015 – FY 2019 Training Waivers Granted, Classified by Type of Waiver

Training Waiver Type

FY 2015

FY 2016

FY 2017

FY 2018

FY 2019

Recall

1

1

7

3

1

2

Marketable Skills

1

155

81

30

1

3

Retirement

1

2

6

1

0

0

Health

55

29

46

54

39

Enrollment Unavailable

3,531

3,370

3,215

1,130

1,400

Training Not Available

1,176

1,313

1,077

813

543

Waiver Participants (Total)

2

4,858

4,785

4,361

1,999

1,987

1

Recall, Marketable Skills, and Retirement waiver types were eliminated for 2011 and 2015 Program participants.

2

The total waiver participants may be less than the sum of the individual waivers granted in a fiscal year

because a participant’s waiver type may have changed during the time period.

27

Table 15 indicates that 88.4 percent of participants who completed training during FY 2019

earned a post-secondary credential, including an industry-recognized credential or a secondary

school diploma or equivalent.

Table 14: FY 2019 Training Exiters and Average Training Cost by Completion

Training Exiters

Number of

Participants

Percentage of

Participants

Average Training

Cost

FY 2019

FY 2019

Training Participants

8,251

-

$13,623

Training Completed

6,162

74.7%

$15,087

Training Not Completed

2,089

25.3%

$9,304

Part-Time Training Completed

122

1.5%

$12,083

Pre-Layoff Training Completed

37

0.4%

$13,361

Note: The number of participants who completed training and did not complete training may be larger than the total

training participants due to individuals having more than one participation in the period. FY 2019 results exclude

Puerto Rico data.

Table 15: FY 2015 – FY 2019 Credentialing Rate of Participants Who Completed Training

Fiscal Year

Completed Training

(Exiters)

Credentials

Rate of

Credentialing

(Exiters)

2015

10,567

9,610

90.9%

2016

8,754

8,121

92.8%

2017

6,499

5,792

89.1%

2018

7,110

6,671

93.8%

2019

6,162

5,446

88.4%

Note: FY 2019 results exclude Puerto Rico data.

28

Figure 2 further illustrates the five-year trend on the rate of credentialing for participants who

completed training. Since FY 2015, the credentialing rate has varied around 5 percentage points,

never falling below the 87 percent rate.

Figure 2: FY 2015 – FY 2019 Rate of Credentialing for Participants Who Completed Training

70.0%

75.0%

80.0%

85.0%

90.0%

95.0%

100.0%

2015 2016 2017 2018 2019

Note: FY 2019 results exclude Puerto Rico data.

Table 16 shows the average duration of participation in the TAA Program, as well as the average

duration of training, TRA, and employment and case management services. Table 16 identifies

that the average duration for all TAA benefits and services increased by 43 days in FY 2019 as

compared to FY 2018.

Table 16: FY 2018 – FY 2019 Average Duration of TAA Benefits and Services

Benefit or Service

FY 2018 Average

FY 2019 Average

Duration (Days)

Duration (Days)

TAA Training (All Training)

413

438

TAA Training (No Remedial or Prerequisite)

409

435

TAA Training (Completed)

437

459

TAA Training (Not Completed)

353

373

Trade Readjustment Assistance (TRA)

328

350

Employment and Case Management

461

504

TAA Participation (All)

467

510

Note: FY 2018 and FY 2019 results exclude Puerto Rico data.

29

Table 17 shows the percentage of TAA participants exiting in FY 2019 who received either

ATAA or RTAA. In FY 2019, RTAA exiters decreased slightly to 15 percent. Appendix A

illustrates the differences between ATAA and RTAA.

The following section, Section IV, provides greater detail about the performance outcomes of

these participants and examines the credential attainment rate in more detail, as well as

reemployment outcomes for participants who exited the TAA Program in FY 2019.

Table 17: FY 2015 – FY 2019 ATAA and RTAA Participant Trends

Fiscal

Year

Total

Exiters

ATAA

Exiters

1

RTAA

Exiters

2

Percentage of Exiters

Receiving ATAA or

RTAA

2015

22,228

6

3,492

15.7%

2016

17,964

1

3,250

18.1%

2017

16,375

1

2,751

16.8%

2018

17,014

1

2,589

15.2%

2019

14,688

0

2,198

15.0%

Note: FY 2019 results exclude Puerto Rico data.

1

ATAA is available to participants served under the 2002 and Reversion 2014 Programs. Reversion 2014

Program ATAA recipients transitioning to the 2015 Program could access RTAA flexibilities and benefits. If

they did not become RTAA recipients, they remained ATAA recipients as ATAA recipients (TEGL No. 5-15,

Change 1)

2

RTAA is available to participants under the 2009, 2011, and the 2015 Programs..

30

IV. PERFORMANCE OUTCOMES

The Department analyzes participant outcomes to assess the primary indicators of performance

established by Section 239(j) of the Trade Act, as amended, in addition to other outcomes and

measures used by the Department to assess the TAA Program. The performance measures are

the following:

1. Employment Rate in the second quarter after program exit (ERQ2);

2. Employment Rate in the fourth quarter after program exit (ERQ4);

3. Median Earnings in the second quarter after exit (MEQ2);

4. Credential Attainment (CA), which reflects the percentage of exiters who receive a post-

secondary credential within one year of program exit; and

5. Measurable Skills Gains (MSG), which reflects the percentage of participants enrolled in

training who are achieving measurable progress towards a recognized post-secondary

credential or employment.

From FY 2015 through FY 2018, the Department has used state reports submitted through the

Trade Act Participant Report (TAPR) to calculate outcomes. Beginning in FY 2019, the

Department used reports submitted through the Participant Individual Record Layout (PIRL) to

calculate outcomes on Employment Rate in second quarter after program exit, Employment Rate

in fourth quarter after exit, and Median Earnings in second quarter after exit. As seen in Table

18, all three measures have improved since FY 2015.

31

Figure 3 highlights that the three performance results for ERQ2, ERQ4, and MEQ2 in FY 2019

are all at five-year highs.

Table 18: FY 2015 – FY 2019 Performance Results for ERQ2, ERQ4, and MEQ2

Fiscal Year

Performance Results

ERQ2

ERQ4

MEQ2

2015

75.1%

72.9%

$7,475

2016

75.8%

74.7%

$7,723

2017

74.8%

74.0%

$8,039

2018

76.8%

75.8%

$8,960

2019

76.8%

76.8%

$9,666

Note: Employment Rate Quarter 2 (ERQ) is the percentage of TAA participants employed in the second quarter

after program exit as reported in the fourth quarter after exit. FY 2019 ERQ2 is for participants who exited

between October 1, 2016 and September 30, 2018, inclusively.

Employment Rate Quarter 4 (ERQ4) is the percentage of TAA participants employed in the fourth quarter after

program exit as reported in the sixth quarter after exit. FY 2019 ERQ4 is for participants who exited between

April 1, 2016 and Martch 31, 2018, inclusively.

Median Earning Quarter 2 (MEQ2) is the median earning of TAA participants employed in the second quarter

(three month period) after program exit based on data collected four quarters after exit to allow for time to collect

and report data. FY 2019 MEQ2 is for participants who exited between October 1, 2016 and September 30, 2018,

inclusively.

FY 2019 results exclude Puerto Rico data.

Figure 3: FY 2015 – FY 2019 for ERQ2, ERQ4, and MEQ2

Note: ERQ2 and ERQ4 are presented using the scale on the left of the chart. MERQ2 is presented using the

scale on the right of the chart. For specific values, see Table 19. FY 2019 results exclude Puerto Rico data.

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

69.0%

70.0%

71.0%

72.0%

73.0%

74.0%

75.0%

76.0%

77.0%

78.0%

79.0%

80.0%

FY 2015 FY 2016 FY 2017 FY 2018 FY 2019

ERQ2

ERQ4

Median Earnings Q2

32

In order to provide a more in-depth look at program outcomes, results are further analyzed in

Tables 19-24 by age, pre-program educational level, and services provided.

As with prior years, post-participation employment rates are higher for younger groups of

workers in FY 2019. Table 19 details the employment rates, measurable skills gains, and

credential attainment by age at the time of pre-participation (before enrollment in the TAA

Program) separation.

Table 20 shows pre-participation and post-participation earnings by age. As in prior years, wage

replacement is higher for younger age groups because pre-participation wages are substantially

lower. Wage replacement rates for groups under age 50 exceeds 95 percent, but falls sharply

after age 50. As a whole, the wage replacement percentage for all TAA participants remains

strong at 90.5 percent, proving that TAA Program participation helps participants substantially

replace their pre-participation wages.

Table 19: FY 2019 Employment Rates, Skills Gains, and Credential Attainment by Age at

Pre-participation Separation

Age

Percentage of

Participants

1

ERQ2

ERQ4

MSG

CA

Under 30

8.1%

84.9%

85.5%

27.7%

66.4%

30-39

17.0%

83.1%

84.5%

30.9%

68.2%

40-49

22.8%

82.4%

83.9%

32.6%

66.4%

50-59

37.8%

78.7%

77.6%

31.7%

65.9%

60+

14.4%

51.2%

48.1%

33.5%

59.7%

Total

100.0%

76.8%

76.8%

31.6%

65.9%

1Note: FY 2019 results exclude Puerto Rico data. Sum may not equal 100 percent due to rounding.

2

1

Percentage of Participants is based on ERQ2 Exiters.

33

Table 20: FY 2019 Earnings at Pre-Participation and Post-Participation by Age at Pre-

participation Separation

Age

Quarterly

Earnings

Before

Participation

Quarterly

Earnings

After

Participation

(MEQ2)

Wage

Replacement

Percentage

Under 30

$7,986

$9,060

113.5%

30-39

$9,908

$10,190

102.8%

40-49

$10,822

$10,309

95.3%

50-59

$11,439

$9,567

83.6%

60+

$11,877

$8,197

69.0%

Total

$10,683

$9,666

90.5%

Note: FY 2019 results exclude Puerto Rico data.

As shown in Table 21, TAA participants entering with some post-secondary education continue

to have the highest employment rates in FY 2019. Participants entering with a high school

education or less continue to make up the largest percentage of exiters for the TAA Program.

Table 21: FY 2019 Employment Rates, Skills Gains, and Credential Attainment by Education Level

at Program Entrance

Pre-participation Education

Level

Percentage of

Exiters

ERQ2

ERQ4

MSG

CA

High School & Less than High

School

57.5%

77.6%

77.6%

27.7%

64.2%

Associate, Post-Secondary

Certification, Some Post-

Secondary

27.5%

78.3%

78.2%

33.8%

68.3%

Bachelor’s & Beyond Bachelor’s

15.0%

71.3%

70.6%

38.0%

67.9%

Total

100.0%

76.8%

76.8%

31.6%

65.9%

Note: Percentage of Exiters is based on ERQ2. FY 2019 results exclude Puerto Rico data.

Table 22 illustrates that participants with higher pre-program education levels have higher

earnings both before and after participation. However, Table 22 also illustrates that the wage

replacement rate is the lowest for the participants with the highest level of pre-program

education.

34

Table 22: FY 2019 Earnings by Education Level at Program Entrance

Pre-participation Education Level

Quarterly Earnings

Before

Participation

Quarterly

Earnings

After

Participation

(MEQ2)

Wage

Replacement

Percentage

High School & Less than High

School

$9,924

$8,931

90.0%

Associate, Post-Secondary

Certification, Some Post-

Secondary

$10,654

$10,090

94.7%

Bachelor’s & Beyond Bachelor’s

$16,607

$13,692

82.5%

Total

$10,683

$9,666

90.5%

Note: FY 2019 results exclude Puerto Rico data.

Table 23 demonstrates how employment rates and measurable skills gains vary based on the

training services received in FY 2019. TAA participants who receive a credential through

training have the highest employment rates and skills gains. The Department has worked to

ensure training which results in credentials provides long-term employment benefits.

Table 23: FY 2019 Employment Rates and Skills Gains by Training Received

Training Received

Percentage of

Exiters

ERQ2

ERQ4

MSG

Participants Not Enrolled in Training

41.8%

76.5%

76.1%

12.3%

Training: Enrolled But Not Completed

12.4%

74.6%

76.8%

21.2%

Training: Completed, No Credential

6.3%

73.1%

72.8%

33.3%

Training: Received Credential

39.5%

78.6%

78.2%

48.0%

Total

100.0%

76.8%

76.8%

31.6%

Note: Percentage of Exiters is based on ERQ2. FY 2019 results exclude Puerto Rico data.

Figure 4 shows the percentage of TAA exiters by training services received. In FY 2019, the

percentage of exiters for participants who received a credential surpassed the participants who

enrolled but did not complete training and participants who completed training but did not

receive a credential.

35

Figure 4: FY 2019 Percentage of Exiters by Training Received

Note: Percentage of Exiters is based on ERQ2. FY 2019 results exclude Puerto Rico data.

Figure 5 shows the post-participation employment rates by training services received.

Figure 5: FY 2019 Post-Participation Employment Rates by Training Received

Participants Not

Enrolled in

Training

42%

Training: Enrolled

But Not Completed

12%

Training:

Completed, No

Credential

6%

Training: Received

Credential

40%

60.0%

62.0%

64.0%

66.0%

68.0%

70.0%

72.0%

74.0%

76.0%

78.0%

80.0%

ERQ2 ERQ4

Participants Not

Enrolled in Training

Training: Enrolled

But Not Completed

Training:

Completed, No

Credential

Training: Received

Credential

Note: FY 2019 results exclude Puerto Rico data.

36

Table 24 shows the FY 2019 earnings and wage replacement rate by training services received.

The wage replacement percentage among all participants increased from 88.6 percent in FY 2018

to 90.5 percent in FY 2019.

Table 24: FY 2019 Earnings and Wage Replacement by Training Received

Training Received

Quarterly

Earnings Before

Participation

Median

Earnings Q2

(MEQ2)

Wage

Replacement

Percentage

Participants Not Enrolled in

Training

$10,714

$9,600

89.6%

Training: Enrolled But Not

Completed

$9,886

$10,187

103.0%

Training: Completed, No Credential

$10,642

$8,849

83.2%

Training: Received Credential

$10,878

$9,784

89.9%

Total

$10,683

$9,666

90.5%

Note: FY 2019 results exclude Puerto Rico data.

37

V. PROGRAM GUIDANCE

The Department provides oversight and monitoring for the state delivery of TAA benefits and

services through the Employment and Training Administration’s (ETA) Regional Trade

Coordinators and other staff in the six ETA regional offices. OTAA provides overall direction

and technical assistance for the consistent and timely delivery of these benefits and services

nationwide to the regions and the states.

The Department, through ETA, issued guidance relating to funding and other salient topics to

states in the form of Training and Employment Guidance Letters (TEGLs). In FY 2019, the

Department issued five guidance documents, as shown in Table 25.

Table 25: FY 2019 Guidance Documents

Date

Directives

February 27, 2019

TEGL 12-18: Initial Allocation of Fiscal Year (FY) 2019

Trade Adjustment Assistance (TAA) Training and Other

Activities (TaOA) Funds and Process for Requesting TAA

Reserve Funds

February 27, 2019

TEGL 13-18: Fiscal Year (FY) 2019 Trade Adjustment

Assistance (TAA) Training and Other Activities (TaOA) Grant

Management Guidance

March 25, 2019

TEGL 14-18: Aligning Performance Accountability Reporting,

Definitions, and Policies Across Workforce Employment and

Training Programs Administered by the U.S. Department of

Labor (DOL)

July 1, 2019

TEGL 1-19: Trade Adjustment Assistance Data Integrity

(TAADI)

July 12, 2019

TEGL 2-19: Second Distribution of Fiscal Year (FY) 2019

Trade Adjustment Assistance (TAA) Training and Other

Activities (TaOA) Funds and the Process for Requesting TAA

Reserve Funds

38

VI. FUNDING

The Department provides funding to the states to provide benefits and services to adversely

affected workers. Under Section 239 of the Trade Act, as amended, the states provide benefits

and services to eligible workers in the TAA Program. Each state provides these benefits through

one or more state agencies, one of which is designated as the Cooperating State Agency (CSA)

in an agreement between the state’s Governor and the Secretary of Labor, known as the

Governor-Secretary Agreement.

Congress appropriates funds to the Federal Unemployment Benefits and Allowances (FUBA)

account for the TAA Program, and the Department apportions the FUBA appropriation into three

separate budget activities: (1) Training and Other Activities (TaOA), which includes funds for

training, job search allowances, relocation allowances, employment and case management

services, and related state administration; (2) Trade Benefits, which includes funds for TRA

payments; and (3) ATAA and RTAA. Congress separately appropriates discretionary funds to

cover the states’ administrative costs of providing TRA, ATAA, and RTAA from the State

Unemployment Insurance and Employment Security Operations (SUIESO) appropriation. The

Department apportions these funds through the UI Annual Funding Agreement with each state.

The Department of Defense and Labor, Health and Human Services, and Education

Appropriations Act, 2019 and Continuing Appropriations Act, 2019 (Department of Labor

Appropriations Act, 2019), Division B, Title I (Pub. L. 115-245), enacted on September 28,

2018, appropriated $790.0 million in FY 2019 to carry out the TAA Program as follows: TaOA

($450.0 million), TRA ($301.0 million), and ATAA/RTAA ($39.0 million). However, this

amount was subject to a 6.2 percent sequestration reduction ($49.0 million) required by the

Balanced Budget and Emergency Deficit Control Act of 1985 (BBEDCA), as amended (Pub. L.

99-177). Accordingly, the total amount of FUBA funds provided to states in FY 2019 for all

benefits and services was $741.0 million. The Department applied the full sequestration

reduction to the TaOA budget activity, which resulted in a FY 2019 national aggregate amount

of $401.0 million available for distribution to states for TaOA. The Department did not apply

any reduction to funds appropriated for TRA or ATAA/RTAA benefits. Table 26 lists the total

amount of funds distributed for TaOA in FY 2019 ($401.0 million) by type of distribution and by

state.

39

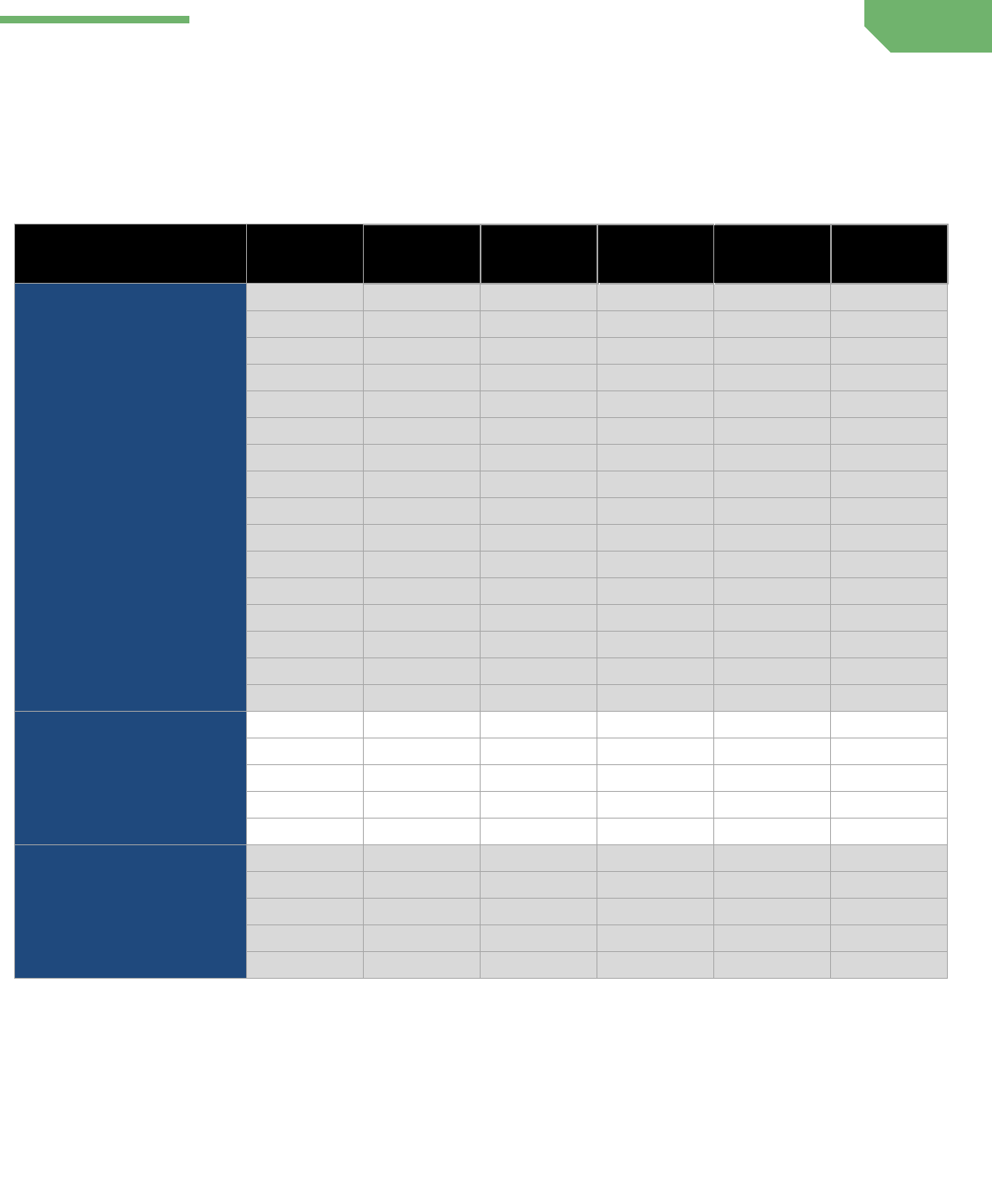

Table 26: FY 2019 Funds for Training and Other Activities Distributed to States

State

Initial Allocation

Reserve

Fund

Distribution

Second

Distribution

Final

Distribution

Total FY 2019

TaOA Funds

AL

$1,050,847

$0

$687,532

$274,035

$2,012,414

AK

$0

$0

$0

$0

$0

AZ

$885,636

$0

$383,317

$152,972

$1,421,925

AR

$1,494,551

$0

$1,419,549

$566,627

$3,480,727

CA

$15,477,446

$0

$7,918,770

$3,159,550

$26,555,766

CO

$3,471,533

$0

$1,235,876

$493,300

$5,200,709

CT

$8,597,418

$0

$3,026,398

$1,209,847

$12,833,663

DE

$0

$0

$0

$0

$0

DC

$0

$0

$0

$0

$0

FL

$2,615,084

$0

$1,343,375

$536,906

$4,495,365

GA

$4,244,119

$0

$2,140,252

$853,322

$7,237,693

HI

$618,177

$0

$228,057

$91,224

$937,458

ID

$1,074,587

$0

$516,623

$206,268

$1,797,478

IL

$13,634,657

$0

$5,037,872

$2,011,343

$20,683,872

IN

$8,002,885

$0

$3,364,403

$1,344,584

$12,711,872

IA

$5,358,443

$0

$1,473,936

$588,834

$7,421,213

KS

$2,293,767

$0

$960,266

$383,481

$3,637,514

KY

$8,972,403

$0

$2,223,717

$888,262

$12,084,382

LA

$604,372

$0

$242,749

$96,949

$944,070

ME

$2,160,963

$0

$448,699

$179,348

$2,789,010

MD

$1,338,507

$0

$289,083

$115,615

$1,743,205

MA

$7,024,288

$0

$3,215,955

$1,284,942

$11,525,185

MI

$8,051,533

$0

$2,019,798

$806,101

$10,877,432

MN

$7,964,531

$0

$3,004,828

$1,200,248

$12,169,607

MS

$626,415

$0

$258,951

$103,415

$988,781

MO

$6,697,624

$0

$3,262,462

$1,302,991

$11,263,077

40

Table 26: FY 2019 Funds for Training and Other Activities Distributed to States

State

Initial Allocation

Reserve

Fund

Distribution

Second

Distribution

Final

Distribution

Total FY 2019

TaOA Funds

MT

$242,273

$0

$95,051

$38,024

$375,348

NE

$1,022,027

$0

$440,981

$175,978

$1,638,986

NV

$0

$225,000

$0

$0

$225,000

NH

$674,562

$0

$203,112

$81,184

$958,858

NJ

$4,888,400

$0

$2,329,885

$929,412

$8,147,697

NM

$2,617,677

$0

$885,689

$354,094

$3,857,460

NY

$3,381,304

$0

$3,887,228

$1,552,798

$8,821,330

NC

$6,132,336

$0

$2,227,987

$889,075

$9,249,398

ND

$182,378

$0

$194,700

$77,802

$454,880

OH

$13,666,837

$0

$5,715,754

$2,281,115

$21,663,706

OK

$4,236,811

$0

$1,201,127

$480,352

$5,918,290

OR

$16,127,955

$0

$6,864,129

$2,743,888

$25,735,972

PA

$28,909,346

$0

$9,072,192

$3,624,975

$41,606,513

PR

$326,689

$0

$411,139

$537

$738,365

RI

$782,285

$0

$161,554

$64,560

$1,008,399

SC

$6,347,833

$0

$2,113,127

$844,387

$9,305,347

SD

$526,712

$0

$453,139

$180,599

$1,160,450

TN

$5,173,335

$0

$1,951,371

$778,163

$7,902,869

TX

$22,923,994

$0

$6,119,229

$2,445,240

$31,488,463

UT

$2,249,100

$0

$543,254

$217,142

$3,009,496

VT

$580,955

$0

$326,361

$130,044

$1,037,360

VA

$2,354,738

$0

$1,705,162

$679,470

$4,739,370

WA

$15,764,034

$0

$5,215,507

$2,085,062

$23,064,603

WV

$3,549,145

$0

$1,778,222

$710,918

$6,038,285

WI

$5,742,488

$0

$1,656,632

$662,017

$8,061,137

WY

$0

$0

$0

$0

$0

Total

$260,663,000

$225,000

$100,255,000

$39,877,000

$401,020,000

41

Distributions of FY 2019 Program Funds to States

In accordance with existing regulations (20 CFR 618.910 through 618.940), which provide both

the timing of the distributions and the formula used for calculating each state’s amount, the

Department made three distributions of TaOA funds to states using the funding formula and one

distribution of funds using the reserve funds process.

The Department issued TEGL No. 12-18

5

to explain the Initial Allocation of TaOA funds,

described in 20 CFR 618.910, and TEGL No. 2-19

6

to explain the Second Distribution of TaOA

funds, described in 20 CFR 618.930. The amounts set out in these TEGLs totaled 90 percent of

the full amount of the FY 2019 TaOA funding. The Department allocated the remaining 10

percent of FY 2019 funds in a Final Distribution. The regulations as explained below describe

the formula by which the Department determined each state’s share of the TaOA funds:

1. Sixty-five percent of the fiscal year funds are to be distributed by formula when the

appropriation for the full fiscal year is available to the Department with 35 percent of the

funds held in reserve for distribution later in the fiscal year (or to be provided to a state in

need of reserve funds at any time during the fiscal year);

2. A hold harmless provision requiring a minimum allocation for the initial distribution is

applied to ensure that a state receives at least 25 percent of the Initial Allocation that was

made available to that state for the previous fiscal year;

3. By July 15 of each fiscal year, at least 90 percent of the funds appropriated for the entire

year must be allocated (in FY 2019, steps 1 and 3 of the funding allocations were

combined and issued simultaneously.); and

4. Formula factors determine each state’s share of funds appropriated for TaOA. Each

state’s dollar amount of TaOA funding was determined using the most recent data

available for the following formula factors, as described in 20 CFR 618.910(f):

5

https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=7890

6

https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=7410

42

1. The trend in number of workers covered by certifications;

2. The trend in number of workers participating in training;

3. The number of workers estimated to be participating in training during the fiscal

year; and

4. The estimated amount of funding needed to provide approved training to such

workers during the fiscal year.