Market Volatility and the

Anatomy of Mortgage Rates

MARCH 17, 2020

1

ANDREW DAVIDSON & CO., INC. © 2020

MARKET VOLATILITY AND THE ANATOMY OF MORTAGE RATES

Introduction

Extreme volatility in mortgage rates has surprised consumers and mortgage professionals alike. Over the last

month, Treasury rates began falling, and mortgage rates followed, signaling a refi boom coming out of

February. More recently, though, the unknown threats of the Coronavirus began to materialize and in the last

week and a half, the 10-year plunged below one percent. Mortgage rates initially dipped but are now at even

higher levels than before the 10-year rallied to an unprecedented low yield. This has led to the widest spread

between the primary mortgage rate and the 10-year Treasury yield in decades. While a record number of

borrowers managed to lock rates, further refi activity may be stifled. Time series data of spreads in liquid

financial markets can signal the extent of balance or strain. Current spread levels signal a much more serious

problem; inadequate private capital to fund mortgages, even federally backed ones. By this measure, the

mortgage market is currently in a 99% stress event; it was in a typical range two weeks ago. We at Andrew

Davidson & Co., Inc. (AD&Co) do not expect spreads to quickly recover on their own. In this article, AD&Co and

Optimal Blue explore the recent behavior and dynamics of primary market mortgage rates and their

determining factors.

Figure 1. Optimal Blue Mortgage Market Indices™

Source: Optimal Blue

Background

During the past two weeks, changes in financial markets have been fast and furious. The Coronavirus and the

sudden oil price war have combined to generate extreme economic and financial uncertainty that has led to

record variability in rates and prices in financial markets over the last month.

•

The S&P 500 has dropped almost 25%.

•

The VIX is up from 13 to 75.

•

Oil prices have fallen from $51 to $31.

•

High yield corporate debt spreads have widened 400 bps to 750.

•

The Fed cut short rates by 125 bps.

•

10-year Treasury rates fell 100 bps to a record low then rose 30, ending at about .84%.

•

Mortgage rates fell but then returned to beginning levels of 3.7%: if not higher.

2

ANDREW DAVIDSON & CO., INC. © 2020

Record low Treasury rates would ordinarily lead to lower mortgage rates and, at this level, record levels of

refinancing. Refinances were expected to nearly double from earlier MBA projections to around $1.23 trillion.

However, current mortgage security spreads to Treasury and primary to secondary market spreads are their

widest in decades. Therefore, borrowers are facing atypically high mortgage rates, given Treasury rates and a

lower incentive to refinance than volume estimates might have implied only a couple weeks ago. Where these

spreads settle will be a key determinant of future volume, prepayment rates, and valuations of MBS in the

secondary markets, which in turn feed back into determinations of future primary market mortgage rates.

Figure 2. Mortgage Spreads Widen while Treasury Rates Fall

The recent behavior of mortgage rates relative to Treasury rates seems to confuse many mortgage

practitioners pondering how the pandemic, Treasury rate changes, credit concerns, and operational factors will

combine to form mortgage rate expectations now that long-standing patterns have broken. Lenders have been

overwhelmed with applications, while simultaneously, corporate credit spreads spiked, and the health crisis

creates uncertainty in the economic system. Much of the mortgage origination and servicing infrastructure is

now composed of non-banks who don’t have federal funding and are thus more exposed to strains in

corporate credit markets. In the sections that follow we examine recent mortgage origination activity and

explain the determinants of mortgage rates with the aim of rationalizing expectations.

3

ANDREW DAVIDSON & CO., INC. © 2020

Origination Pendulum

Mortgage rate locks in the Optimal Blue Marketplace Platform, a leading indicator of mortgage originations,

rose to all-time highs in early March before rapidly retreating. Mortgage rates fell as low as 3.221% for 30-year

conforming loans, prompting a refinancing wave that has tested the capacity of the originator community.

Many lenders have seen their pipelines grow by over 50% as borrower demand rapidly outpaced available

supply. In response, mortgage rates have climbed back to levels seen prior to the impact of recent

macroeconomic events, despite record low Treasury rates.

Figure 3. Mortgage Rates vs. Origination Activity

Source: Optimal Blue

While refinancing drove the flood of new rate lock production, purchase loan volume was also unseasonably

high through the first half of the month. However, both refi and purchase loan rate lock volumes have trended

lower with rising mortgage rates and a volatile economic climate. Purchase loan volume, a traditionally

steadier origination source for lenders, is particularly vulnerable to the spread of the virus as concerns grow

about showing homes.

300

4.2%

250

4.0%

200

3.8%

150

3.6%

100

3.4%

50

3.2%

0

3.0%

Total Rate Lock Volume

OBMMI 30-YR Conforming Rate

Volume Indexed to Feb 3rd Levels

4

ANDREW DAVIDSON & CO., INC. © 2020

300

250

200

150

100

50

0

Purchase Locks Refi Locks

Figure 4. Refi vs. Purchase Activity

Source: Optimal Blue

The One Factor Model Myth

A popular (but naïve) view of mortgage rates is that they move in approximate lockstep with the 10-year

Treasury yield. If one forecasts the level of mortgage rates as a simple linear function of the level of 10-year

Treasury yields, the model “appears” to fit well with a correlation of 98% and a 25-bp standard deviation of

prediction error. This model, however, predicts that mortgage rates should be 2.44% currently, an estimate

that is off by over 100 bps, or three or more standard deviations.

Volume Indexed to Feb 3rd Levels

5

ANDREW DAVIDSON & CO., INC. © 2020

0.60

-0.

50

7.00

6.00

5.00

4.00

3.00

2.00

1.00

3.00

4.00

5.00

6.00

7.00

R² = 0.959

8.00

y = 1.011x + 1.7251

9.00

Figure 5. Mortgage Rates vs. 10-Year CMT

However, a quick look at weekly pairs of changes in the 10-year Treasury and primary mortgage rates

illustrates that a simple approach fails. A simple linear model fit through this data shows a 58% correlation

between 10-year changes and mortgage rate changes. Something is clearly missing.

Figure 6. Changes in Rates: Mortgage Rates vs. 10-Year CMT

y =

0.5

81x -

0.

R² = 0.33

0016

0.40

0.20

0.00

50

-

0.

40

-

0.

30

-

0.

20

-

0.

10

0.

-0.20

00

0.

10

0.

20

0.

30

0.

40

0.

-0.40

-0.60

6

ANDREW DAVIDSON & CO., INC. © 2020

Figure 7 demonstrates that primary mortgage rates have a more complicated and varied relationship with 10-

year Treasury rates. Since the year 2000, the mean spread between mortgage rates and the 10-year has

averaged 176 bps with a median of 170 bps, a high of 297 bps, a low of 120 bps, and a standard deviation of

about 26 bps. That spread now lies at a 265 bps, a level that is the widest in 30 years except for a brief period

during the financial crisis.

Figure 7. Mortgage Rates Spread to 10-Year Treasury Yield

0.00

0.00

0.50

1.00

2.00

1.00

3.00

1.50

4.00

2.00

5.00

2.50

2.65

6.00

3.00

2.97

7.00

3.50

8.00

Mortgage Rate Spread to 10-Year Tsy

DGS10

10 Year Tsy Yield

Rates Spread

7

ANDREW DAVIDSON & CO., INC. © 2020

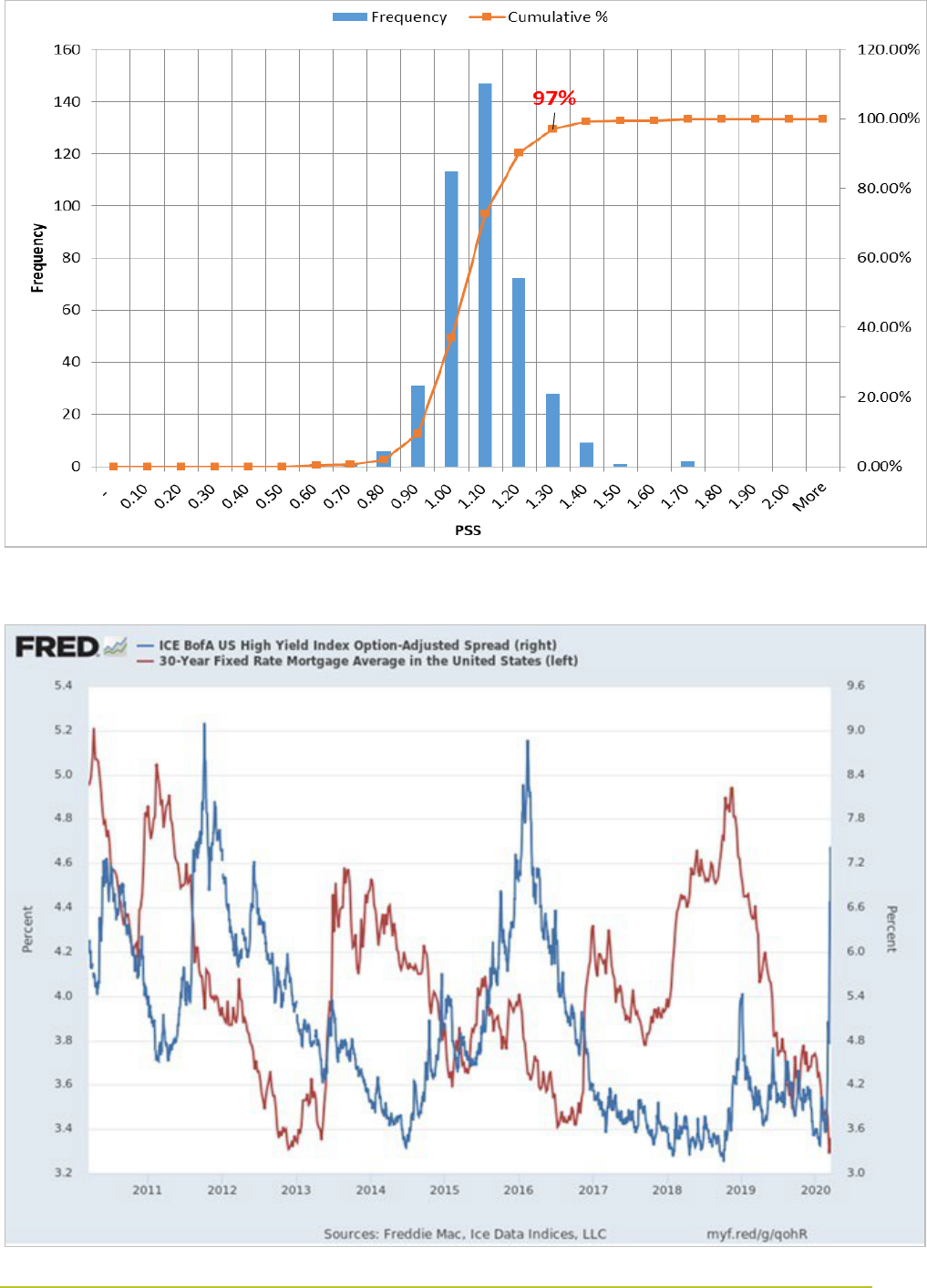

Figure 8 shows the distribution of nominal mortgage spreads to 10-year Treasuries weekly for the last 20

years; spreads are now at the 99

th

percentile. Rational expectations for future mortgage rates require

forecasting this spread. Changes in 10-year Treasuries alone will be a poor guide.

Figure 8. Distribution of Mortgage Rate Spreads to 10-Year Treasury, 2000-Current

Primary Mortgage Rate Determinants

Mortgage rates are properly analyzed by considering the three determining factors presented below. Note that

the same formulation can be applied using the rates on interest rate swaps as a basis.

Primary Rates = Treasury Rates + MBS Spread to Treasury + Primary Secondary Spread to MBS

8

ANDREW DAVIDSON & CO., INC. © 2020

Figure 9. Determinants of Primary Mortgage Rates

Figure 10 illustrates how these factors have varied over time and combine to determine primary mortgage

rates. Mortgage rates are about 3.7% as of this writing, a level reached handful of times over the last eight

years. However, 10-year Treasuries were never less than 1.5%, so nominal spreads are at least 50 bps wider

right now, having precipitously jumped in just the last week or two.

Figure 10. Economic Components of Mortgage Rates

9

ANDREW DAVIDSON & CO., INC. © 2020

MBS Spread to Treasury

MBS, interest rate swaps, and Treasury securities are competing investments whose relative yields are

determined by supply and demand in the bond markets. As a general matter, MBS trade at a yield premium to

Treasuries and swaps by the value of the embedded mortgage prepayment option and other liquidity factors.

These risk factors vary with economic conditions and shape investor views on the MBS yield premium or

spread they require.

Historical data on MBS current coupon yield spreads to the 10-year Treasury, and MBS option-adjusted

spread (OAS) are presented in Figure 11. They reveal that the sudden gapping out of MBS spreads to

Treasury was a major driver pushing mortgage rates up recently while Treasury rates went down. This is

because MBS prices have dramatically underperformed 10-year Treasury note prices. 10-year Treasury

notes fell 70 bps in yield on the week and gained 6.5 points in price. At the same time, current coupon

MBS, which would ordinarily rise in a rally, lost approximately 4 points. The chart shows that the resultant

MBS spread to the 10-year Treasury spiked from 82 bps on February 20

th

, to 140 bps (99

th

percentile) at

the end of last week. This spread has averaged 73 bps over the last eight years. Reasons for the

underperformance of MBS range from concerns with investor demand to dislocation in the economy.

Figure 11. Current Coupon MBS Yield To 10-Year Treasury Yield Spread and CC OAS

10

ANDREW DAVIDSON & CO., INC. © 2020

Figure 12. MBS Current Coupon Yield Spread to 10-Year Treasury

The OAS of MBS measures the return of MBS fully adjusted for prepayment risk and interest-rate

volatility. The recent decrease in MBS prices relative to Treasury prices caused MBS OAS to spike to 105

bps by the end of last week, a record high. Spreads are up from 59 bps a week earlier and from 43 bps a

month prior. Such OAS widening can be seen across the MBS coupon stack and for all GSE MBS. Recent

news articles feature market makers advocating for the Federal Reserve to step in and start buying MBS

again. The rate at which MBS nominal spreads to Treasury and OAS-based returns revert toward historical

norms, if they do, will greatly affect primary market rates. Given current volatility, it’s very hard to predict

what spreads will do going forward, but it is true they are currently at extremely high levels.

11

ANDREW DAVIDSON & CO., INC. © 2020

Figure 13. MBS Current Coupon OAS Histogram: May 2012 Forward

Primary-Secondary Spread

Primary-Secondary Spread (PSS) is the portion of the mortgage rate that lenders charge on mortgages over and

above the yields that investors require on ‘default free’ MBS in the secondary market. This spread reflects

guarantee fees and servicing fees, supply and demand in the primary market for loans, lender financing and

operational costs, and profit margin.

In theory, PSS reflects primary market conditions, operational capacity, competitive states, and margin earned

on origination. One expects PSS to widen when volume overwhelms, leading perhaps to gain on sale increases.

Such increases in margin would tend to abate over time as volume subsides and competition increases. PSS

may also be influenced at this time by any financial strains that non-bank originators and servicers are under

with respect to capital calls, warehouse line limits, declining MSR values, or increases in funding cost.

Figure 14 shows the distribution of the PSS spread since 2012. The PSS is currently 133 bps which is

approximately two standard deviation away from the PSS mean of 104 bps since 2012. Lenders appear to be

capturing higher margins in the current market. This may be a result of favorable competitive conditions and

added pricing power or may reflect concerns about increased risk and funding costs. In either case, the

increase in PSS is a factor in the elevated mortgage rates we see in the market today.

12

ANDREW DAVIDSON & CO., INC. © 2020

Figure 14. Primary-Secondary Spread Distribution 2012 Forward

Figure 15. Corporate Credit Spreads and Mortgage Rates

13

ANDREW DAVIDSON & CO., INC. © 2020

In practical use, the AD&Co PSS model is reflective of the facts that, typically, there is a time lag between

changes in the secondary rate and the primary rate and the primary rate does not usually fully adjust to

changes in the secondary rate. Figure 16 follows current AD&Co forecasts for primary market mortgage rates

from our PSS model. The blue line forecast assumes benchmark rates freeze today’s level. The orange line uses

rates implied by the forward curve. The model shows that empirically, mortgage rates may not change much

over the next 12 to 36 months unless current market conditions substantially change.

Figure 16. Primary Rate Projection

Conclusions

•

Mortgage originators have pushed rates higher to manage capacity and take advantage of profit

opportunity during a period of unprecedented volume.

•

Mortgage spreads to Treasury are the widest in decades because both components of the spread are

historically wide.

•

MBS spreads to Treasury are historically wide and suggest a potentially very serious systemic liquidity

problem in investor demand for mortgage securities amidst the health crisis.

•

The large and sudden jump in corporate credit spreads has probably contributed to primary market

spread widening because large segments of the origination and servicing markets are not banks and

rely on the capital markets for financing.

•

Changes in 10-year Treasury rates alone are a poor predictor of primary market mortgage rates.

•

Mortgage rates are best understood by analyzing the three components: Treasury rates, the spread

premium from Treasuries to MBS, and the Primary to Secondary Yield Spread that originators add to

MBS current coupon yields to determine mortgage rates.

14

ANDREW DAVIDSON & CO., INC. © 2020

About Andrew Davidson & Co., Inc.

Andrew Davidson & Co., Inc. (AD&Co) was founded in 1992 by Andy Davidson, an international leader in the

development of financial research and analytics, mortgage-backed securities product development, valuation

and hedging, housing policy and GSE reform and credit-risk transfer transactions. Since its inception, the

company has provided institutional fixed-income investors and risk managers with high quality models,

applications, consulting services, research and thought leadership, aimed at yielding advanced, quantitative

solutions to asset management issues. AD&Co’s clients include some of the world's largest and most successful

financial institutions and investment managers. For more information, visit www.ad-co.com.

About Optimal Blue

Optimal Blue’s Marketplace Platform connects the industry’s largest network of originators, investors, and

providers. More than $750 billion of transactions are processed across the platform each year, facilitating a

broad set of secondary market interactions like pricing, locking, hedging, and trading of mortgage loans. For

more information, please visit www.optimalblue.com.

For more information, please contact:

Rose Barnabic, Andrew Davidson & Co., Inc., rose@ad-co.com

Brennan O’Connell, Optimal Blue, boconnell@optimalblue.com

This publication is believed to be reliable, but its accuracy, completeness, timeliness and suitability for any purpose are not guaranteed. All opinions are

subject to change without notice. Nothing in this publication constitutes (1) investment, legal, accounting, tax, or other professional advice or (2) any

recommendation or solicitation to purchase, hold, sell, or otherwise deal in any investment. This publication has been prepared for general informational

purposes, without consideration of the circumstances or objectives of any particular investor. Any reliance on the contents of this publication is at the

reader’s sole risk. All investment is subject to numerous risks, known and unknown. Past performance is no guarantee of future results. For investment

advice, seek a qualified investment professional. Note: An affiliate of Andrew Davidson & Co., Inc. engages in trading activities in securities that may be

the same or similar to those discussed in this publication.