Amazon Community Lending Program

Program and Applicaon Guide

Through the Amazon Community Lending program, Amazon, in partnership with

Lendistry, is providing access to aordable nancing for small and medium-sized

businesses selling in the Amazon US store.

Small businesses approved for a loan from Lendistry through the Amazon Community

Lending program can use these funds to grow their business in Amazon’s US store

and to cover other strategic business needs, such as stang and operaons costs,

inventory, product development and manufacturing, and markeng eorts to build

their brands and grow their customer base.

In addion to nancing, program parcipants will be able to leverage specic

supplementary resources from Lendistry, which may include one-on-one consulng,

webinars, and on-demand educaonal classes, curated and tailored to meet the

unique needs of the businesses served by Lendistry.

All U.S.-based Sellers are invited to learn more and determine if nancing

opons from Lendistry are the right t for their business needs. Business owners who

idenfy with communies that Lendistry serves are encouraged to apply. This

includes tradionally low-to-moderate income communies, minority-owned

businesses, and other historically disadvantaged business owners and the communies

they serve.

Introducon

Amazon

Community

Lending

program:

A partnership

between Amazon

and Lendistry.

FAQs

What is Amazon

Community Lending?

Through the Amazon Community Lending program,

Amazon, in partnership with Lendistry, is providing access

to aordable nancing for small and medium-sized

businesses selling in the Amazon US store. This program

supports urban and rural small businesses in socially and

economically distressed communies through short-term

loans at compeve and aordable rates.

Who is Lendistry?

Lendistry is a designated third-party lender oering

loans to sellers through the Amazon Community

Lending program. Lendistry hosts and manages a portal

for the program’s loan applicaon, processes, reviews

and approves each loan applicaon, and provides the

nancing to approved applicants. Lendistry and its

authorized representaves may communicate directly

with applicants to provide nocaons on the status

of their applicaons and to request any addional

informaon or documentaon necessary to help

applicants comply with loan requirements.

Visit lendistry.com to learn more about Lendistry.

1 2

Is this program available

to all sellers?

All U.S.-based Sellers are invited to learn more and

determine if nancing opons from Lendistry are the

right t for their business needs. Business owners who

idenfy with communies that Lendistry aims to serve

are encouraged to apply. This includes tradionally low-

to-moderate income communies, minority-owned

businesses, and other historically disadvantaged business

owners and the communies they serve.

How can my business apply?

Any acve U.S.-based Seller is welcome to express

interest in the program on Seller Central by clicking to

learn more about the program and indicang interest.

If you click on the “Yes, I’m interested” buon on Seller

Central and your business meets Lendistry’s eligibility

criteria, you will see a loan presentment from Lendistry.

However, if your business does not have a loan

presentment aer clicking on the “Yes, I’m interested”

buon, Amazon will nofy you once Lendistry has a loan

presentment for your business.

What are the requirements to get

a loan from Lendistry?

The following are certain key requirements for a business

to be eligible for a loan from Lendistry under the program:

• Must be a current Amazon Seller account in good standing

• Must be an established Amazon Seller with 1 or more

years on Amazon Seller Central

• Must be a U.S. based business with all owners

domiciled within the U.S.

• Must have a U.S. business checking account, and the

authority to apply for credit on behalf of the business

• Must have sasfactory personal credit

Loan terms are provided for reference purposes only and

do not constute an oer for credit. The availability of

any applicable Lendistry business loan product is subject

to certain eligibility requirements, including without

limitaon, the creditworthiness of the business and its

owners, and the applicant’s acceptance of the terms

of loan documentaon to be provided by Lendistry. To

determine eligibility for a Lendistry business loan product,

you will be asked to complete an electronic applicaon

made available through Lendistry’s portal. Neither the

compleon nor the submial of an applicaon will

constute a guarantee of approval for any Lendistry loan

product, and you may be required to submit addional

documentaon and informaon in support of your

3

4

5

applicaon. Please see hps://lendistry.com/aclp-terms-

of-use/ for addional informaon, eligibility requirements

and authorizaons that may be required as a condion to

receiving a Lendistry business loan product through the

Amazon Community Lending program.

What documents will I need

if I decide to move forward

with an applicaon?

An applicant will need a government-issued photo ID and

a copy of their last two months business bank account

statements (if their bank account is unable to be veried

electronically).

Will any data on Amazon be shared

with Lendistry? If yes, what data?

No personal informaon will be shared without your

explicit consent before sharing any data. Amazon will

share your business’s sales and performance data on

Amazon.com with Lendistry aer receiving your consent.

Prior to being redirected to the Lendistry website to apply

for a loan, you will be asked in Seller Central whether you

agree to share your business’s sales data with Lendistry.

Refer to Data Share FAQ for more informaon on the data

Amazon will share with your consent.

Will Lendistry share any

personal informaon used in the

applicaon process with Amazon?

Amazon does not ask Lendistry for your name,

shareholder(s) names, or loan guarantor, nor does Amazon

ask Lendistry for your contact informaon such as phone

number, email, and address. To learn more about what

informaon Lendistry will share with Amazon, refer to the

Data Share FAQ. Any informaon shared with Amazon

will be shared in accordance with Lendistry’s privacy

policy available here.

Will Lendistry share any

personal informaon with

any other third-party?

The security of your personal informaon is of the highest

priority for Lendistry. Lendistry does not sell your personal

informaon to adversers or other third-pares for

nancial gain. Any sharing of personal informaon with

third-pares is done in accordance with Lendistry’s privacy

policy available here, and is primarily for the purposes of

making available and/or providing Amazon Community

Lending program products and services to you.

6

7

8

9

Will I be signing a loan agreement

with Amazon?

No. The seller will sign a loan agreement directly with

Lendistry. Amazon will not be a party to the agreement.

Does Lendistry pull credit reports

as a part of the applicaon process?

Yes, Lendistry does pull personal credit reports through

Experian for the main owner that is applying on the

applicaon with 20% or more of the equity or ownership

of the business.

Note : You must list enough owners on the applicaon whose

combined equity or ownership represents at least 50% of the

ownership of the business. Listed equity/ownership does not

have to total to 100% of ownership.

Can my business’s

interest rate adjust?

No, your business’s interest rate will remain the same

throughout the life of the loan if your business pays on

me. Any future loans could have higher or lower

interest rates depending on your business’s credit

prole at that me.

Is there any prepayment penalty if

I want to pay the loan o early?

No, there is no penalty for paying the loan o early. You

may prepay any amounts outstanding at any me, in

whole or in part. You are able to pay o your loan directly

online, by logging into MyLendistry and following the

instrucons. If you have any quesons, please contact

the Lendistry Program Call Center at 888-216-6445.

Why is Lendistry requiring addional

informaon or documentaon for

the applicaon process?

Since the loan is extended by Lendistry, it determines

what informaon it needs to process an applicaon and

determine your business’s eligibility for credit.

How do you lock a bank account?

In order to lock the account, visit the approved applicaon

in Seller Central by referring to the secon labeled

“Applicaons in progress”. Click the “Lock account” buon

and follow the steps that appear onscreen.

Note : This account will remain locked unl the loan is paid in

full and the loan is closed. For any issues during this process,

please contact [email protected].

10

11

13

14

12

15

Why is locking a bank

account required?

Locking the Seller’s bank account on le with Amazon

may be a prerequisite from the third-party lender.

Once it is locked, the third-party lender veries it

matches what was provided in the loan applicaon.

The account on le with Amazon cannot be changed

aer this step.

How does the bank

account unlock?

The account will be automacally unlocked once

Lendistry conrms that the loan has been paid in full. If

the loan is closed, but a bank account remains locked,

send an email to [email protected]om with

the request and a copy of the payo leer from

Lendistry that the account has been paid o.

Who can I contact with

quesons about the program

or my business loan?

You can contact the Lendistry Program Call Center at

888-216-6445 during the hours of 6:00 am to 5:00 pm

Pacic Time Monday - Friday.

16

17

18

Tips for

Applying

You do not have to complete the applicaon in one session

and will have an opon to save and connue it later.

To make your applicaon process as smooth as possible or

if you experience dicules while applying, these are some

suggesons that may help.

1

2

3

Use the Latest Versions of

Website Browsers

For the best user experience, please use

the latest version of Google Chrome,

Microso Edge, or Safari throughout the

enre applicaon process.

Open Incognito Window

Opening Incognito allows you to enter

informaon privately and prevents your

data from being remembered or cached.

Clear Your Cache

Cached data is informaon that has been

stored from a previously used website or

applicaon and is primarily used to make

the browsing process faster by auto-

populang your informaon.

However, cached data may also include

outdated informaon or informaon you

may have previously entered incorrectly.

4

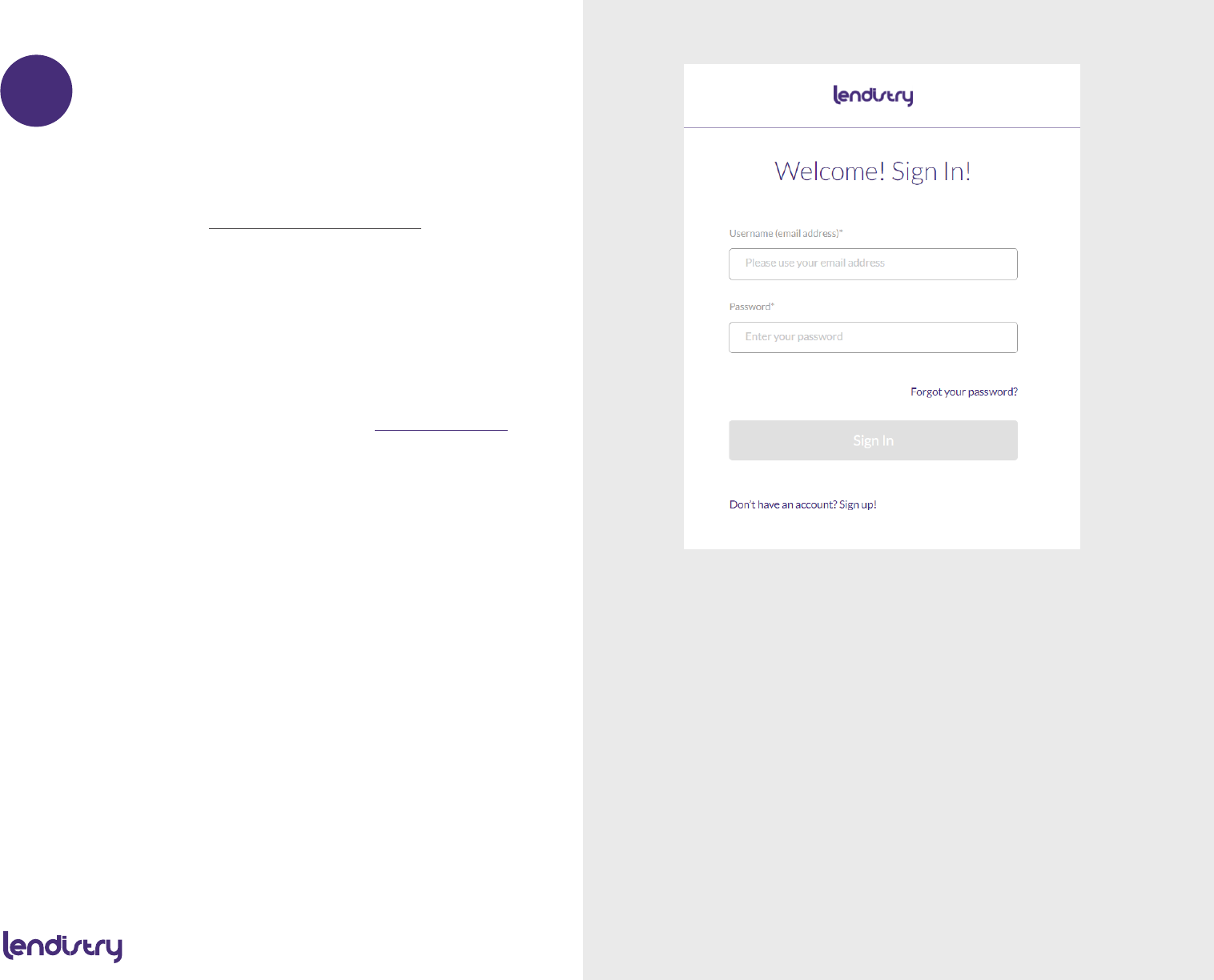

Registering your MyLendistry Account

When registering your account, please

do the following:

• Make sure you pick a strong password

that includes:

– 8 minimum character length

– 1 uppercase character

– 1 lowercase character

– 1 digit

• Add a conrmaon code that you

will be texted with the number

you provide during the registraon

process.

5

How to Unlock your

MyLendistry Account

For your security, when aempng to log

in to MyLendistry if you use the incorrect

password more than ve mes, your

MyLendistry Account will be locked. To

unlock it, you must call the Lendistry

Program Call Center at 888-216-6445.

As a reminder you can reset your

password by going to the MyLendistry

sign-in page and following the

instrucons.

6

What is your Federal Tax ID/Employer

Idencaon Number (EIN)?

An Employer Idencaon Number

(EIN) is also known as a Federal Tax

Idencaon Number, and is used to

idenfy a business enty. Generally,

businesses need an EIN. You may apply

for an EIN in various ways, and may be

able to apply online. This is a free service

oered by the Internal Revenue Service

and you can get your EIN immediately.

Learn more at the IRS website.

7

Providing Ownership Informaon

List all owners of 20% or more of

the equity of the business. You must

list enough owners whose combined

equity represents at least 50% of the

ownership of the business.

Listed equity does not have to total to

100% of ownership.

If an owner is not from the United

States, therefore does not have a social

security number, the owner can enter

their alien card, green card number

instead.

What is Plaid?

Plaid is a quick, seamless way for you to provide what we need to verify your banking informaon.

It replaces you having to scan and upload documents, making it easier for you and giving us an

opportunity to provide you with a decision faster.

Plaid is a third-party technology Lendistry uses to set up Automated Clearing House (ACH)

transfers by connecng accounts from any bank or credit union in the U.S. to an app like

MyLendistry. The third-party does not share your personal informaon without your permission

and does not sell or rent it to outside companies. The use of personal informaon on or through

Plaid is subject to Plaid’s End User Privacy Policy. Lendistry uses this technology to verify and

review your bank statements.

This method of bank vericaon is preferred, but may not be acceptable, including if your banking

instuon is not available through the provider. In this case, you can verify your bank account

using other methods.

8

9

Using Plaid to Verify Your Bank Account in

MyLendistry

When registering in MyLendistry, you will be

prompted to provide bank details and you click

“Start Plaid”.

• First, select your bank account and provide

credenals. It is important that you use

your Amazon Seller Central account when

selecng your bank. Otherwise, it will not be

funded if approved.

• Aer following direcons in Plaid, you will be

back in MyLendistry and if you have more than

one account in that bank, they will all be listed.

You must select and conrm the same Bank

Account you use in Amazon Seller Central,

which must be a business or personal account.

• If you run into errors, you have the opon

to try again. If you connuously run into

errors or your bank instuon is not available

through the provider, you can proceed using

another method, by clicking the link provided.

Video: How to Use Plaid

10

Uploading Required Documents

All documents that are required to be

uploaded have certain requirements,

mainly to make sure informaon is read

accurately.

• Must be in clear, straight format with

no disrupve backgrounds

• File name CANNOT contain

any special characters, such as

!@#%^&*()_+=

• File size must be under 10MB

12

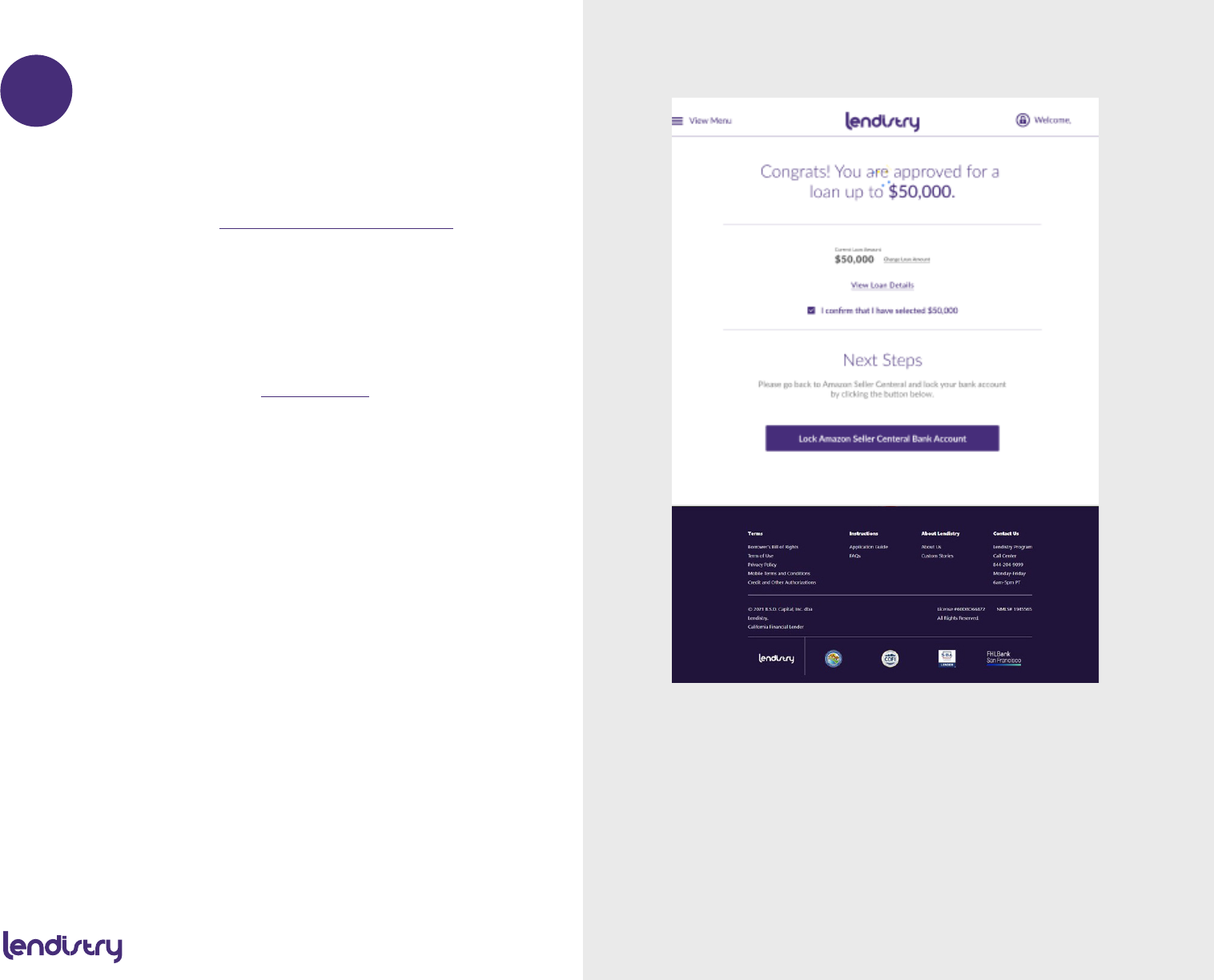

How to Lock Your Amazon Seller

Central Bank Account

If approved, the next step required

to receive funds is to lock your bank

account in Amazon Seller Central.

How to do that and addional quesons

about account locking in Amazon Seller

Central are provided in the FAQ secon,

which you can go to here.

13

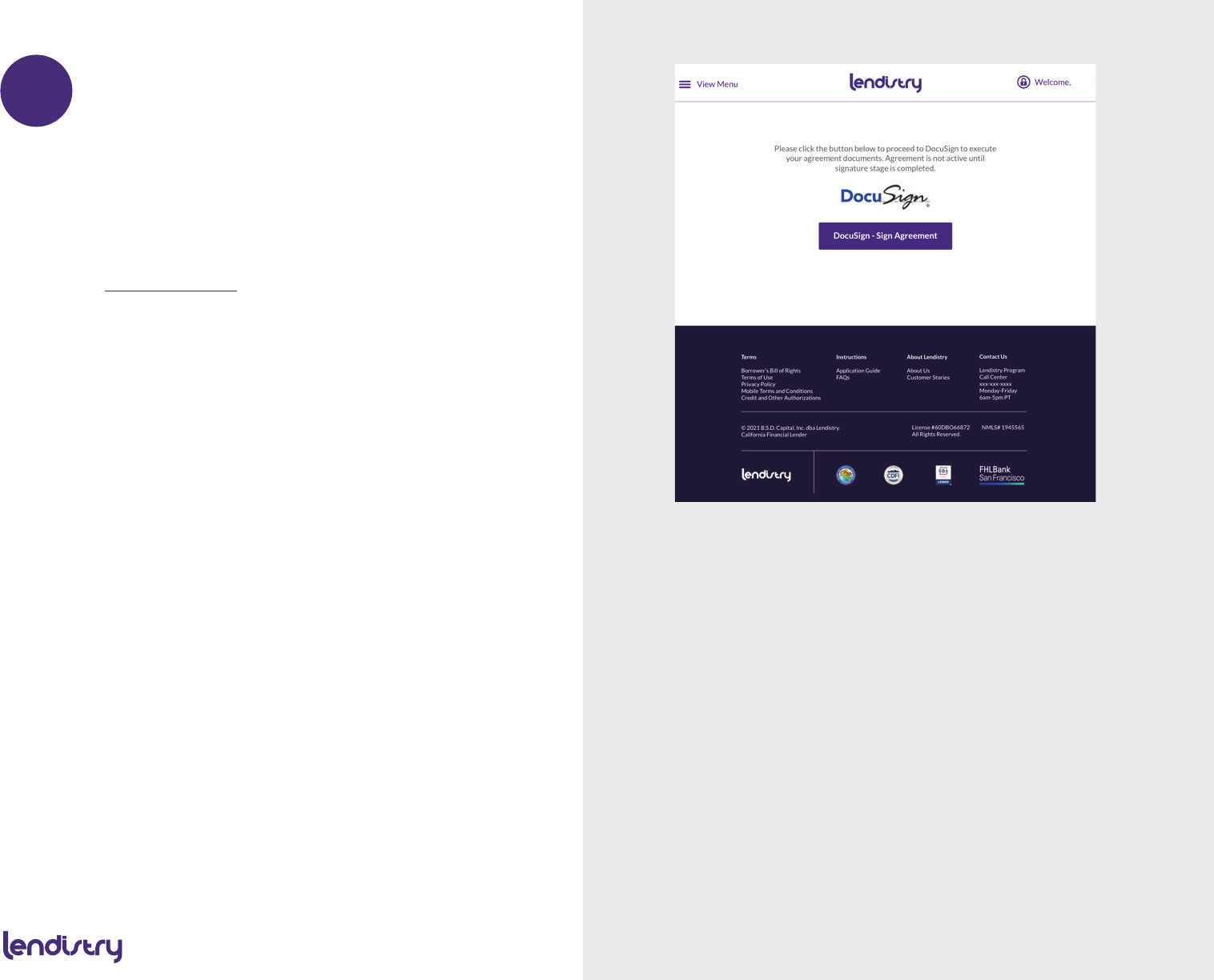

How to DocuSign

Aer successfully locking your Amazon

Seller bank account using your Amazon

Seller Central portal, you should return

to your Lendistry loan applicaon.

When you return to your applicaon on

MyLendistry you should be prompted

to “Sign your agreement” via DocuSign.

This will take you to DocuSign to where

you can review your loan applicaon

and securely sign and nalize your

documents.

If you have issues, please contact

the Lendistry Program Call Center at

888-216-6445.