Faculty and Staff

Benefits

Handbook

Faculty and Staff Benefits Handbook

May 2013

May 2013

B

oston University began in April

1839, when delegates of the

Methodist Episcopal church met

in Boston to found the Newbury

Biblical Institute. The insti tute

opened in Newbury, Vermont;

moved to Concord, New Hampshire;

and then moved to Boston. In

May 1869, the Common wealth of

Massa chusetts granted a charter

to Boston Univer sity, and the

School of Theol ogy became its

first department.

Thus founded, Boston University

grew, both reflecting and leading

the growth of U.S. higher educa-

tion. From the date of its charter,

it admitted women students to

all programs—the first university

in the country to do so. In 1872, it

opened the nation’s first College of

Music as well as the School of Law,

which would become the first to

require three years for a degree.

In the following year, it opened

the College of Liberal Arts and the

School of Medicine; one-quarter

of the first medical students were

women. The Graduate School,

established the following year, had

by 1875 arranged for tuition-free

study abroad at universities in

Athens and Rome.

Schools and Colleges have con-

tinued to be established and to

evolve. Today they number 16,

offering a vast range of programs

in education, medicine, dentistry,

communication, liberal arts, law,

engineering, social work, arts,

allied health professions, theology,

and management. The College of

General Studies offers a two-year

program in an interdisciplinary core

curriculum, and then students con-

tinue working toward a bachelor’s

degree at one of BU’s four-year

undergraduate schools and colleges.

Metropolitan College provides a

wide range of courses and degree

programs primarily for those who

wish to pursue coursework at night

and on weekends.

Boston University is the fourth-

largest independent institution of

higher education in the country,

and one of the world’s leading

research universities, with over

thirty thousand students in Boston

on the Charles River Campus and

the Medical Campus as well as

in a growing number of programs

around the world. The University

has more than four thousand fac-

ulty members who teach, conduct

research, and use their professional

expertise to serve their worldwide

community. The University’s addi-

tional staff of more than six thou-

sand employees support the efforts

of the University.

Boston University is in itself a com-

munity of vast scholarly, academic,

and recreational resources. Its

members enjoy access to a variety

of University health services, rec-

reational facilities, and activities,

as well as a state-of-the-art library

system. Tuition remission enables

many employees and their spouses

and dependents to take University

courses with full or partial subsidy.

Several exhibits are open on cam-

pus every day, and a night seldom

passes during the academic year

without at least one public concert,

theatrical or operatic performance,

lecture, seminar, or athletic event.

Faculty, students, and staff work

closely with public schools, social

services, and other groups in

Boston and beyond.

Enduring commitments to teach-

ing, research, global education, and

community engagement are the

touchstones of Boston University’s

proud past and promising future.

About Boston University

Overview

Your Benefits Handbook 1

Health Plan 3

Blue Cross Blue Shield PPO 8

Network Blue New England 11

BU Health Savings Plan 13

Medco/Express Scripts Health Prescription Drug Coverage 19

Health Plan Comparison 28

Dental Health Plan 31

The BU Dental Health Center Plan 34

The Dental Blue Freedom Plan 37

Long-Term Disability Plan 49

Survivor Insurance 55

Basic Life Insurance Plan 57

Group Supplemental Life Insurance Plan 58

Personal and Family Accident Insurance Plan 61

Travel Accident Insurance Plan 64

Supplemental Death Benefit Plan 66

Retirement Plan 67

Supplemental Retirement and Savings Plan 81

Tuition Remission Program 93

Tuition Exchange Program 101

Flexible Benefits Program & Flexible Spending Accounts 107

Other Benefits 117

Administrative Information 123

Contents

Overview

1

T

he benefits plans contained in your Faculty and Staff Benefits

Handbook are organized into several main sections.

Your benefits plans are designed to provide:

• Protection against the high cost of health and dental care

• Protection of your income in case you become totally and permanently

disabled and cannot work

• Financial assistance for your survivors if you die

• An income for your retirement and other future financial needs

• Assistance with educational expenses for you and your

family members

• Other benefits and opportunities to help you fulfill personal and

professional needs

This handbook explains each benefit plan in detail and will answer ques-

tions you may have now or in the future when you need a particular ben-

efit. You and your family members should review the handbook carefully.

As you read the handbook, please keep in mind that we have summa-

rized your benefits; we have not included every detail. If you have ques-

tions about any of the information in this handbook, contact the Benefits

Sec tion of Human Resources at 617-353-4473 or 4487 or by email at

For information regarding time off from work and other employment poli-

cies, refer to your Employee Handbook, Faculty Handbook, or collective

bargaining agreement.

Your Benefits Handbook

B

oston University began in April

1839, when delegates of the

Methodist Episcopal church met

in Boston to found the Newbury

Biblical Institute. The insti tute

opened in Newbury, Vermont;

moved to Concord, New Hampshire;

and then moved to Boston. In

May 1869, the Common wealth of

Massa chusetts granted a charter

to Boston Univer sity, and the

School of Theol ogy became its

first department.

Thus founded, Boston University

grew, both reflecting and leading

the growth of U.S. higher educa-

tion. From the date of its charter,

it admitted women students to

all programs—the first university

in the country to do so. In 1872, it

opened the nation’s first College of

Music as well as the School of Law,

which would become the first to

require three years for a degree.

In the following year, it opened

the College of Liberal Arts and the

School of Medicine; one-quarter

of the first medical students were

women. The Graduate School,

established the following year, had

by 1875 arranged for tuition-free

study abroad at universities in

Athens and Rome.

Schools and Colleges have con-

tinued to be established and to

evolve. Today they number 16,

offering a vast range of programs

in education, medicine, dentistry,

communication, liberal arts, law,

engineering, social work, arts,

allied health professions, theology,

and management. The College of

General Studies offers a two-year

program in an interdisciplinary core

curriculum, and then students con-

tinue working toward a bachelor’s

degree at one of BU’s four-year

undergraduate schools and colleges.

Metropolitan College provides a

wide range of courses and degree

programs primarily for those who

wish to pursue coursework at night

and on weekends.

Boston University is the fourth-

largest independent institution of

higher education in the country,

and one of the world’s leading

research universities, with over

thirty thousand students in Boston

on the Charles River Campus and

the Medical Campus as well as

in a growing number of programs

around the world. The University

has more than four thousand fac-

ulty members who teach, conduct

research, and use their professional

expertise to serve their worldwide

community. The University’s addi-

tional staff of more than six thou-

sand employees support the efforts

of the University.

Boston University is in itself a com-

munity of vast scholarly, academic,

and recreational resources. Its

members enjoy access to a variety

of University health services, rec-

reational facilities, and activities,

as well as a state-of-the-art library

system. Tuition remission enables

many employees and their spouses

and dependents to take University

courses with full or partial subsidy.

Several exhibits are open on cam-

pus every day, and a night seldom

passes during the academic year

without at least one public concert,

theatrical or operatic performance,

lecture, seminar, or athletic event.

Faculty, students, and staff work

closely with public schools, social

services, and other groups in

Boston and beyond.

Enduring commitments to teach-

ing, research, global education, and

community engagement are the

touchstones of Boston University’s

proud past and promising future.

About Boston University

Overview

Your Benefits Handbook 1

Health Plan 3

Blue Cross Blue Shield PPO 8

Network Blue New England 11

BU Health Savings Plan 13

Medco/Express Scripts Health Prescription Drug Coverage 19

Health Plan Comparison 28

Dental Health Plan 31

The BU Dental Health Center Plan 34

The Dental Blue Freedom Plan 37

Long-Term Disability Plan 49

Survivor Insurance 55

Basic Life Insurance Plan 57

Group Supplemental Life Insurance Plan 58

Personal and Family Accident Insurance Plan 61

Travel Accident Insurance Plan 64

Supplemental Death Benefit Plan 66

Retirement Plan 67

Supplemental Retirement and Savings Plan 81

Tuition Remission Program 93

Tuition Exchange Program 101

Flexible Benefits Program & Flexible Spending Accounts 107

Other Benefits 117

Administrative Information 123

Contents

Overview

1

T

he benefits plans contained in your Faculty and Staff Benefits

Handbook are organized into several main sections.

Your benefits plans are designed to provide:

• Protection against the high cost of health and dental care

• Protection of your income in case you become totally and permanently

disabled and cannot work

• Financial assistance for your survivors if you die

• An income for your retirement and other future financial needs

• Assistance with educational expenses for you and your

family members

• Other benefits and opportunities to help you fulfill personal and

professional needs

This handbook explains each benefit plan in detail and will answer ques-

tions you may have now or in the future when you need a particular ben-

efit. You and your family members should review the handbook carefully.

As you read the handbook, please keep in mind that we have summa-

rized your benefits; we have not included every detail. If you have ques-

tions about any of the information in this handbook, contact the Benefits

Sec tion of Human Resources at 617-353-4473 or 4487 or by email at

For information regarding time off from work and other employment poli-

cies, refer to your Employee Handbook, Faculty Handbook, or collective

bargaining agreement.

Your Benefits Handbook

Health Plan

4

T

he Boston University Health Plan offers various options for medical

coverage for you and your eligible family members. Each option offers

certain benefits to protect you against the medical expenses that would

accompany an illness or injury. There are differences in coverage levels and

how services are obtained in each option. You should give serious consider-

ation to which option will best meet your needs for health care benefits. The

cost of coverage under the Health Plan is shared by you and the University.

The information provided in this section will help you decide which type of

coverage under the Boston University Health Plan is best for you and your

family.

Please note: The descriptions of coverages and benefits in this handbook are

based on the provisions of the Health Plan in effect on the date of this hand-

book. The terms of the Health Plan or the University’s contracts with ven-

dors may change. Actual rights and benefits under the Health Plan are based

on the terms of the official Health Plan documents in effect at any particular

time, and those terms will govern over any inconsistent descriptions in this

handbook.

Furthermore, it is common for annual changes to be made in the Health

Plan. Such annual changes are usually described in the annual enrollment

materials.

5

Eligibility

If you are classified by Boston

University (the “University”) as a

regular employee, work 75% or more

of a full-time schedule, and have

an appointment of nine months’ or

more duration, you and your eligible

family members may participate in

the Boston University Health Plan. If

you are eligible and elect coverage,

it will start on the first day of the

month coincident with or next fol-

lowing your date of hire (depending

on your date of hire).

Your eligible family members include:

• Your legally married spouse

• Under certain circumstances,

your former spouse (see

“Special Provisions for Former

Spouses”)

• To the extent required by law,

your children up to age 26

who are:

o Your biological children

o Your legally adopted children

and children lawfully placed

with you for legal adoption

o Your step-children

• Your unmarried, dependent

children age 26 and over who

are mentally or physically handi-

capped and unable to support

themselves as determined by the

health insurance carrier. (To con-

tinue coverage, your child must

have been handicapped before

age 26 and you must contact

the Benefits Section of Human

Resources before your child’s

26th birthday.)

General Rule—If you become ineligible,

you lose coverage (subject to COBRA).

As an exception, if you drop below 75%,

you may be eligible to continue to par-

ticipate in a health plan option at Boston

University. Please confirm your status with

the Benefits Section of Human Resources.

Coverage Levels

There are four levels of coverage

available under the Health Plan:

• Individual coverage

(yourself only)

• Individual plus spouse

(you and your spouse)

• Individual plus child(ren)

(you and one or more of

your children)

• Family coverage (you and your

eligible family members)

Special Provisions for Former

Spouses

If you have family coverage includ-

ing your spouse and you divorce,

your spouse may continue to be

covered under your family coverage

if the divorce order specifically calls

for this and if neither you nor your

former spouse remarries. If you or

your former spouse remarry, your

former spouse’s eligibility for cover-

age ends. Once coverage ends, your

former spouse may continue cover-

age on an individual basis under

COBRA for the remaining period (if

any) until 36 months have gone by

since your divorce.

If your divorce order specifically

requires coverage for your former

spouse to continue beyond the

COBRA continuation period, your

former spouse may be eligible to

continue coverage under an indi-

vidual plan (if available, under

the Health Plan and the various

vendors providing benefits). This

coverage will continue as long as

you continue to be employed at

the University and have made the

appropriate payment for coverage

or until no longer required by the

divorce order or no longer available.

Special Tax Considerations

Under current tax laws, the value of

your former spouse’s health cover-

age is subject to federal income,

Massachusetts state income, and

Social Security taxes. These tax-

able amounts are based on the full

amount of an individual plan (that

is, employee contribution plus

employer contribution) and are

called imputed income. Imputed

income for your former spouse’s

health coverage will be reported as

income on each paycheck, and will

be included in the taxable earnings

shown on your W-2 Form. Coverage

for your former spouse is subject to

imputed income for tax purposes.

Enrollment

To elect this coverage, new employ-

ees must go to Employee Self Service

at www.bu.edu/buworkscentral.

Alternatively, you may complete a

Benefits Enrollment Form available at

www.bu.edu/hr/files/documents/

enrollment_form.pdf. This form will

authorize a pre-tax reduction in

your pay for your share of the cost

under Section 125 of the Internal

Revenue Code.

If you choose coverage that

includes your spouse or dependent

children, coverage is available only

for the family members who are

listed on your enrollment. If you

wish to enroll newly eligible family

members (for example, a newborn,

an adopted child, or a new spouse),

you may do so by obtaining the

Health Plan

necessary forms from the Human

Resources website at www.bu.edu/

hr/home/forms/benefit-forms.

Alternatively, you may request

a paper form from the Benefits

Section of Human Resources by

email at [email protected].

When Coverage Starts

You have 30 days following your

benefit orientation date to enroll.

If you enroll, coverage will become

eective on the first day of the

month coincident with or follow-

ing the date you become eligible. If

you do not enroll during this period,

your next opportunity to enroll will

be during the next open enrollment

period unless you have a qualifying

change in family status, as deter-

mined by the University.

Cost

You and the University share the

cost of your coverage under the

Health Plan.

Currently, the University pays a

portion of the coverage cost as

determined by the University. Your

share of the cost is the dierence

between the total cost of cover-

age and the amount that Boston

University pays. Costs are subject

to change at the beginning of each

plan year. Also, the University may

change the percentage of the cost

that it will pay.

How Health Plan Contributions

Are Paid

You pay for your portion of the

contributions for your Health Plan

coverage with tax-free dollars. This

is because Boston University auto-

matically reduces your pay by the

amount of your payments—before

federal income taxes, state income

taxes, and Social Security taxes are

taken out.

Automatic before-tax premium pay-

ments are allowed under the provi-

sions of Section 125 of the Internal

Revenue Code. These are explained

in more detail in the “Flexible

Benefits” section of this handbook.

Claim and Appeal Time Frames

for Group Health Claims

Group health claims will be reviewed

and appeals processed by the

applicable Plan Vendor within the

time periods required by law. You

may contact the applicable Plan

Vendor for more information about

claim procedures relating to health

benefits administered by that

Vendor under the Plan. Additional

information about claim and appeal

procedures under a Plan Vendor’s

coverage may also be available in the

Plan Vendor’s benefit description.

Under ERISA claims and appeals

must be decided within a reasonable

time, subject to certain maximum

limits summarized as follows:

Initial Claims After receipt of the

claim, the claim must be decided no

later than:

• As soon as possible but no later

than 72 hours for urgent care

claims

• 15 days for pre-service claims

• 30 days for post-service claims

Claimants have 180 days to appeal

a denied claim.

Appeals of Denied Claims After receipt

of the request for review, the appeal

must be decided no later than:

• As soon as possible but no later

than 72 hours for urgent care

claims

• 30 days for pre-service claims

• 60 days for post-service claims

Special rules apply for the continu-

ation or extension of approved ben-

efits or services to be provided over

time (“concurrent care decisions”).

Individuals receiving approved care

over a period of time must have

an opportunity for review before

benefits are reduced or terminated.

Also, urgent care requests for an

extension of approved benefits must

be decided within 24 hours.

Right to an External Review of

Claims

For certain types of denied claims

(e.g., a claim denied for a lack of

medical necessity), the law provides

that a claimant may be entitled to

request an independent, external

review after the Plan’s final internal

adverse benefit determination. A

claimant may contact the applicable

Plan Vendor with any questions on

his or her rights to external review

by an independent organization.

After a final internal adverse benefit

determination, the applicable Plan

Vendor will advise the claimant of

any right the claimant may have

to an independent external review

and the procedure to request such

a review. If the claimant believes his

or her situation is urgent (generally

one in which the claimant’s health

may be in serious jeopardy or in the

opinion of the claimant’s physician,

the claimant may experience pain

that cannot be adequately con-

trolled while the claimant waits for

a decision on the external review of

his or her claim), the claimant may

request an expedited appeal by con-

tacting the applicable Plan Vendor

for more information.

The claimant or someone the claim-

ant names to act for him or her (the

claimant’s authorized representative)

may file a request for external review.

A claimant may contact the appli-

cable Plan Vendor for information

on how to designate an authorized

representative.

6

Your Health Plan Options

Under Blue Cross Blue Shield, you

may choose one of three options:

1. BCBS PPO is a health care pro-

gram that provides two levels

of coverage: in-network and

out-of-network. You receive the

highest level of benefits under

your health care plan when you

choose preferred providers.

These are called your in-network

benefits. You can also choose

non-preferred providers, but your

out-of-pocket costs are higher.

These are called your out-of-

network benefits.

In-Network Coverage Generally

you have full coverage for most

preferred hospital, physician, and

other provider covered services.

And, for some outpatient ser-

vices, you pay a $20 copayment

for each visit. No claim forms are

required.

Out-of-Network Coverage When

you choose non-preferred

providers you must pay a cal-

endar-year deductible for most

out-of-network services. The cal-

endar-year deductible begins on

January 1 and ends on December

31 each year. The deductible

is $500 for each member (or

$1,000 for all family members

enrolled under the same cover-

age). After you have met your

deductible, you pay 20% coinsur-

ance for most out-of-network

covered services. When the

money you paid for the 20%

coinsurance equals $2,000 (this

is the out-of-pocket limit) for a

member in a calendar year (or

$4,000 for all family members

covered under the same mem-

bership), covered benefits for

that member (or that family) will

be provided in full, based on the

allowed charge, for the rest of

that calendar year (but charges

in excess of reasonable and

customary will not be covered).

Bills for covered outpatient ser-

vices are paid by you and then

submitted on claim forms for

reimbursement.

2. Network Blue New England is

similar to a health maintenance

organization (HMO). An HMO is

a group of aliated physicians,

hospitals, and other health care

providers who have agreed to

provide services at reduced fees.

When you join Network Blue

New England, you select a pri-

mary care physician (PCP) from

the Network Blue New England

network. Your PCP will coordi-

nate your care and refer you for

specialty treatment as needed.

Network Blue New England

provides members with a range

of network benefits, including

routine and preventive services

and hospital care. There are no

deductibles and no claim forms.

Generally, network services

coordinated by your PCP are

covered in full; copayments apply

for doctors’ visits, emergency

room visits, and other services, as

specified by Network Blue New

England. If your PCP is aliated

with Boston Medical Center, your

copayments will generally be less

than if your PCP is a non–Boston

Medical Center physician. Care

that is not approved by your PCP

is generally not covered, except

for emergency treatment.

3. BU Health Savings Plan The BU

Health Savings Plan is a High

Deductible Health Plan that com-

bines the coverage features of a

PPO with the flexibility and tax-

eectiveness of a Health Savings

Account (HSA). Premiums are

lower, but deductibles and out-

of-pocket maximums are higher.

Just like the PPO plan, you are

not required to get referrals from

a primary care provider. You

decide which doctor you want to

see. You pay less when you see

“Preferred Providers” that are

part of our nationwide network,

but the choice is always yours.

In-Network Coverage When you

choose preferred providers you

must pay a calendar-year deduct-

ible for most in-network services.

The calendar-year deductible

begins on January 1 and ends

on December 31 each year. The

deductible is $1,500 for indi-

vidual coverage or $3,000 for

any family coverage. After you

have met your deductible, you

pay 10% coinsurance for most in-

network covered services. When

the money you paid for the 10%

coinsurance equals $3,000 for

individual coverage or $6,000

for any family coverage, benefits

will be provided in full, based on

the allowed charge, for the rest of

that calendar year. Bills for cov-

ered outpatient services are paid

by you and then submitted on

claim forms for reimbursement.

Out-of-Network Coverage When

you choose non-preferred

providers you must pay a cal-

endar-year deductible for most

out-of-network services. The cal-

endar year deductible begins on

January 1 and ends on December

31 each year. The deductible

is $3,000 for individual cover-

age or $6,000 for any family

coverage. After you have met

your deductible, you pay 30%

coinsurance for most out-of-

network covered services. When

the money you paid for the 30%

coinsurance equals $6,000 for

individual coverage or $12,000

for any family coverage, benefits

will be provided in full, based on

7

the allowed charge, for the rest

of that calendar year. Bills for cov-

ered outpatient services are paid

by you and then submitted on

claim forms for reimbursement.

Health Savings Account A Health

Savings Account (HSA) is a tax-

advantaged account used in con-

junction with an HSA-eligible high

deductible health plan (HDHP)

that eligible individuals may

establish to pay for current and

future qualified medical expenses

for themselves, their spouse,

and their qualifying dependents.

The BU Health Savings Plan is an

HSA-eligible HDHP. In connec-

tion with the BU Health Savings

Plan, access is provided to an

HSA administered by Fidelity

Investments if you would like

to make your own pre-tax pay-

roll deductions, and/or wish to

receive the BU HSA contribution.

BCBS PPO

How the BCBS PPO Works

The BCBS PPO is a preferred pro-

vider organization (PPO) that com-

bines the advantages of a national

network with the option to use

physicians and facilities outside the

network, but at a higher cost.

When you join the BCBS PPO, you

are not required to choose a pri-

mary care physician. There are two

levels of coverage. The amount of

coverage depends on where you

receive treatment.

When you receive care from a BCBS

PPO participating provider, you are

covered in full, in and out of the

hospital. You pay only $20 for oce

visits and routine physical exams

and $100 for emergency room care

(this fee is waived if you are imme-

diately hospitalized).

The BCBS PPO also gives you the

option to use non-participating

physicians, specialists, and health

care facilities; your benefits cov-

erage, however, will be lower. If

you receive care outside the plan

network, you will receive 80% cov-

erage for most services (based on

reasonable and customary charges)

after you meet an annual deduct-

ible of $500 (individual coverage)

or $1,00 (family coverage). You pay

the remaining 20% (your coinsur-

ance) and any charges above rea-

sonable and customary limits. Once

your 20% coinsurance reaches

the annual out-of-pocket limit of

$2,000 (individual coverage) or

$4,000 (family coverage), the plan

will pay 100% of covered expenses

for the rest of the calendar year.

In some cases for out-of-network

benefits, you may also have to pay

any balance that is in excess of Blue

Cross Blue Shield’s allowed charge.

Certain expenses do not apply

toward your out-of-pocket limit.

They include the following:

• Charges in excess of reasonable

and customary

• Expenses for services not cov-

ered by the plan

• Charges you incur for not follow-

ing precertification procedures

Emergency Care

Blue Cross Blue Shield provides

benefits for emergency medical ser-

vices whether you are in or outside

of Massachusetts. These emer-

gency medical services may include

inpatient or outpatient services by

providers qualified to furnish emer-

gency medical care and that are

needed to evaluate or stabilize your

emergency medical condition.

In an emergency, such as a sus-

pected heart attack, stroke, or poi-

soning, you should go directly to the

nearest medical facility or call 911

(or the local emergency phone num-

ber). You pay a $100 copayment for

in-network or out-of-network emer-

gency room services. This copay-

ment is waived if you are admitted

to the hospital or for an observation

stay. The out-of-network deductible

does not apply.

Within the Enrollment Area

You will receive full coverage after a

$100 copayment per person per visit

for hospital emergency room treat-

ment you receive at a hospital in the

plan network. This copayment will be

waived, however, if you are immedi-

ately admitted to the hospital.

Outside the Enrollment Area

When you are temporarily outside

the enrollment area, the BCBS PPO

will cover emergency room treat-

ment in full (up to reasonable and

customary charges) after a $100

copayment if the illness or injury

is sudden and life-threatening.

Emergency treatment received at a

physician’s oce outside the enroll-

ment area will be covered in full

after a $20 copayment per person

per visit.

Preventive Care

Preventive care is covered 100% in-

network; and 80% after the deduct-

ible for out-of-network services.

Preventive care includes:

• Well-child care exams, including

routine tests, according to age-

based schedule as follows:

o Ten visits during the first year

of life

o Three visits during the second

year of life

o One visit per calendar year

from age 2 through age 18

• Routine adult physical exams,

including related tests, for mem-

8

bers age 19 or older (one per

calendar year)

• Routine GYN exams, including

related lab tests (one per calen-

dar year)

• Routine hearing exams, including

routine tests

• Routine vision exams (one every

12 months)

• Family planning services (oce

visits)

Home Health Care Benefits

The BCBS PPO pays benefits for

medically necessary home care

services and supplies, such as inter-

mittent skilled nursing care and

physical therapy, at 100% when you

use a participating provider, and at

80% (after the deductible) when

you use an out-of-network provider.

Coverage is also provided for the

following services when deter-

mined to be a medically necessary

component of the intermittent

skilled nursing care or physical

therapy:

• Occupational therapy

• Speech therapy

• Medical social work

• Nutritional consultation

• Home health aide

• Durable medical equipment

Out-of-Network Benefits

You may have to file your claim

when you receive a covered service

from a non-preferred provider in

Massachusetts or a non-preferred

provider outside of Massachusetts

who does not have a payment

agreement with the local Blue

Cross Blue Shield Plan. Claims for

out-of-network services should be

filed, along with Blue Cross Blue

9

Shield claim form (available online

from the Benefits Section of Human

Resources), within two years of the

date charges for the service were

incurred, to:

BCBSMA

P.O. Box 986030

Boston, MA 02298

Note: When you receive cov-

ered services outside the United

States, you must file your claim to

the Blue Card Worldwide Service

Center. (The Blue Card Worldwide

International Claim Form you

receive from Blue Cross Blue Shield

will include the address to mail

your claim.) The service center will

prepare your claim, including the

conversion to US currency, and for-

ward it to Blue Cross Blue Shield for

repayment to you.

Utilization Review Requirements

Utilization Review is an impor-

tant feature of the out-of-network

portion of the BCBS PPO. It helps to

ensure that you receive the appro-

priate medical care in the most

cost-ecient setting—whether it be

the hospital, a specialty facility, or

your own home.

Utilization Review includes:

• Preadmission Review—For all

non-emergency and non-

maternity hospital admissions in

the United States, you must call

1-800-327-6716 in advance to

get your stay approved. Within

two working days of receiving

all necessary information, Blue

Cross Blue Shield will determine

if the health care setting is suit-

able to treat your condition.

Failure to follow the preadmis-

sion review procedure may

result in your having to pay for

expenses that otherwise would

be covered.

• Concurrent Review/Discharge

Planning—This program auto-

matically monitors your stay in

the hospital to help ensure that

you are discharged on time and

receive necessary services once

you are discharged.

Be sure to follow Utilization Review pro-

visions. If you do not follow these provi-

sions, plan benefits will be reduced. The

BCBS PPO benefits are automatically

subject to Utilization Review without

any steps on your part.

Services Not Covered

Under the BCBS PPO, no benefits

are provided for the following:

• Ambulance services unless

necessitated by an emergency

or medical necessity or autho-

rized by Blue Cross Blue Shield

for transfer from one facility to

another

• Any claim submitted more than

two years from the date the ser-

vice was rendered

• Blood and blood products

• Care for military service-

connected disabilities for which

the member is legally entitled

to treatment or services

• Charges in excess of the plan

maximum amount or other limit

• Commercial diet plans or weight-

loss programs

• Cosmetic procedures, except

when medically necessary and

considered medical care under

the Internal Revenue Code

• Cost for any services for which

the member is entitled to treat-

ment at government expense or

under Workers’ Compensation or

occupational disability

• Court-ordered examinations and

services

• Custodial or domiciling care to

assist a member in the activities

of daily living or provide room

and board, training in personal

hygiene, and other forms of self-

care; personal care in the home

except when medically necessary

as part of a treatment plan for a

medical condition

• Dental services, including

periodontal, restorative, and orth-

odontic services

• Educational services (including

problems of school performance)

or testing for developmental,

educational, or behavioral prob-

lems except as medically neces-

sary under an early intervention

program

• Equipment for environmental

control or general household use,

such as air filters, air condition-

ers, air purifiers, liquidizers, bath

seats, bedpans, dehumidifiers,

dentures, elevators, heating pads,

hot water bottles, and humidifiers

• Eyeglasses, contact lenses, and

fittings. This exclusion does not

apply to contact lenses that are

required due to cataract surgery,

covered corneal transplants, and

keratoconus

• Health care services that are not

medically necessary

• Health care services that are

considered experimental

• Health care services that are

considered obsolete and no lon-

ger medically justified

• Health care services furnished to

someone other than the member

• Hearing aids

• Infertility services for members

who are not medically infertile

• Missed appointments

• Nicotine gum

• Non-covered services

• Non-durable medical equipment,

unless used as part of the treat-

ment at a medical facility or as

part of approved home health

care services

• Orthotics

• Osteopathic manipulation,

electrolysis, routine foot care,

biofeedback, pain management

programs, massage therapy, and

acupuncture

• Personal comfort items

• Physical examinations for insur-

ance, licensing, or employment

• Private duty nursing

• Private room unless medically

necessary

• Refractive eye surgery

• Rest or custodial care; personal

comfort or convenience items

• Reversal or attempted reversal

of voluntary sterilization (includ-

ing procedures necessary for

conception following voluntary

sterilization)

• Sensory integrative praxis test;

testing for central auditory

processing

• Services for any person who is

not covered under the plan when

the services are rendered

• Services for which no charges

would have been made in the

absence of coverage under this

plan

• Services incurred after termina-

tion of coverage under the plan

• Services incurred prior to the

eective date of coverage

• Services not specifically

described in this plan document

10

• Services not within the scope

of the physician’s, provider’s, or

hospital’s licensure

• Services or supplies given to

you by anyone related to you by

blood, marriage, or adoption or

who ordinarily lives with you

• Surrogate pregnancy (any form

of surrogacy)

• Temporomandibular joint dys-

function treatment limited to

medical services only

• The portion of the charge for a

service or supply in excess of the

usual, customary, and reasonable

(UCR) charge

• Transsexual surgery, including

related procedures and treat-

ments and reversal of such

procedures

• Weight-loss programs or charges

for weight reduction except when

extreme obesity adversely aects

another medical condition and

treatment is medically necessary

as determined by the plan

For a comprehensive list of services

and conditions not covered by the

BCBS PPO, please refer to the

description for the BCBS PPO avail-

able from the Benefits Section of

Human Resources.

Appealing a Denied Claim

If a claim for benefits is partially or

fully denied, you will receive written

notification, which will include the

reasons for the denial, a description

of any information necessary to com-

plete the processing of your claim,

and information on how to submit

the claim for review.

If you have a question regarding

the payment of a claim, you may

write or call:

Member Grievance Program

Blue Cross Blue Shield

of Massachusetts

One Enterprise Drive

Quincy, MA 02171-2126

Phone: 1-800-472-2689

Fax: 617-246-3616

Email: [email protected]

If you write, be sure to include your

identification number and your

telephone number. Letters will be

answered within 30 days or earlier if

required by law.

You have a right to request a full and

fair review of any claim. If you believe

you or a covered family member

were wrongly denied all or part of

your benefits, you may appeal the

decision. You may submit questions

and comments in writing and review

all pertinent plan documents.

Blue Cross Blue Shield of Mass-

achusetts must review your appeal

and make a final decision within a

reasonable period of time. The final

written decision must state specific

reasons and plan provisions on which

the review decision was based.

Network Blue New England

How Network Blue

New England Works

Network Blue New England is a

health plan with a group of aliated

physicians similar to a health main-

tenance organization. When you

join Network Blue, you and each of

your enrolled family members must

choose a primary care physician

(PCP) from the directory of network

doctors. Your PCP will coordinate

all of your medical care. You may

choose a dierent PCP for each

family member (for example, an

internist for you and a pediatrician

for your children).

Your Primary Care Physician (PCP)

Your copayment for oce visits

will depend on where your PCP

practices.

• If your PCP is aliated with

Boston Medical Center (BMC),

your copayments for oce visits

will be $15 per visit. Oce visits

with a specialist to whom you

are referred by your BMC PCP

will also be $15 per visit.

• If your PCP is not aliated with

Boston Medical Center, your

copayments for oce visits will

be $30 per visit. Oce visits with

a specialist to whom you are

referred by your non-BMC ali-

ated PCP will be $30 per visit.

When you receive care in the

Network Blue New England net-

work, you are covered in full, in and

out of the hospital. You pay $15

BMC PCP/$30 non-BMC PCP for

oce visits or $100 for emergency

room care (this fee is waived if you

are immediately hospitalized). You

receive full coverage for routine

physicals after a copayment. Your

PCP will be part of a team of spe-

cialists aliated with the health

center or hospital where your PCP

practices. If your PCP determines

that you need to see a specialist,

your PCP will refer you to a special-

ist within the plan network. If you

require hospitalization, your PCP

(and specialist, if necessary) will

coordinate your admission, and you

will be covered at 100%.

Urgent vs. Emergency Care

Blue Cross Blue Shield provides ben-

efits for emergency medical services

whether you are in or outside of

Massachusetts. These emergency

medical services may include inpa-

tient or outpatient services by

providers qualified to furnish emer-

gency medical care and that are

needed to evaluate or stabilize your

emergency medical condition. In an

emergency, such as a suspected

heart attack, stroke, or poisoning,

you should go directly to the near-

est medical facility or call 911 (or the

local emergency phone number).

You pay a $100 copayment for

in-network or out-of-network

emergency room services. This

copayment is waived if you are

admitted to the hospital or for an

observation stay.

Routine Physicals

Routine physical exams are covered

in full.

Home Health Care Benefits

People often recover more quickly

when recuperating at home, pro-

vided appropriate care is available.

Needed treatment or therapy—such

as services from nurses or physical

therapists—can be provided in the

comfort of your own home as long

as services are ordered by your PCP

or treating physician and are pro-

vided by a participating Coordinated

Home Health Care agency and as

long as your condition warrants

these services. Network Blue New

England pays benefits for covered

charges made by a participating

Coordinated Home Health Care

agency or a participating Visiting

Nurse Association at 100% when

you use a Network Blue network

provider.

Medically necessary home health

care services and supplies include:

• Part-time home health aide

services, consisting primarily

of care for the patient

• Part-time nursing care

• Physical therapy

11

Services Not Covered

Under Network Blue New England,

no benefits are provided for the

following:

• Ambulance services unless

neces sitated by an emergency or

medical necessity or authorized

in advance by the plan for trans-

fer from one facility to another

• Any claim submitted more than

two years from the date the ser-

vice was rendered

• Blood and blood products

• Care for military service-

connected disabilities for which

the member is legally entitled

to treatment or services

• Charges in excess of the plan

maximum amount or other limit

• Commercial diet plans or weight-

loss programs

• Cosmetic procedures, except

when medically necessary and

considered medical care under

the Internal Revenue Code

• Cost for any services for which

the member is entitled to treat-

ment at government expense or

under Workers’ Compensation

or occupational disability laws

• Court-ordered examinations and

services (unless deemed medi-

cally necessary by the plan)

• Custodial or domiciling care to

assist a member in the activities

of daily living or provide room

and board, training in personal

hygiene, and other forms of self-

care; personal care in the home

except when medically necessary

as part of a treatment plan for a

medical condition

• Dental services, including

periodontal, restorative, and

orthodontic services, and

dentures

• Physical examinations for insur-

ance, licensing, or employment

• Private duty nursing

• Private room unless medically

necessary

• Refractive eye surgery

• Reversal or attempted reversal of

voluntary sterilization (including

procedures necessary for con-

ception following voluntary

sterilization)

• Sensory integrative praxis test;

testing for central auditory

processing

• Services incurred prior to the

eective date of coverage

• Services incurred after termina-

tion of coverage under the plan

• Services for any person who is

not covered under the plan when

the services are rendered

• Services for which no charges

would have been made in the

absence of coverage under this

plan

• Services or supplies from anyone

related to you by blood, mar-

riage, or adoption or who ordi-

narily lives with you

• Services not within the scope

of the physician’s, provider’s, or

hospital’s licensure

• Services that require precertifica-

tion, where the precertification

was not obtained or the precertifi-

cation guidance was not followed

• Services that are not medically

necessary

• Services that are considered

experimental

• Services that are considered

obsolete and no longer medically

justified

• Educational services (including

problems of school performance)

or testing for developmental,

educational, or behavioral prob-

lems except as medically neces-

sary under an early intervention

program

• Equipment for environmental

control or general household use,

such as air filters, air condition-

ers, air purifiers, liquidizers, bath

seats, bedpans, dehumidifiers,

elevators, heating pads, hot water

bottles, and humidifiers

• Eyeglasses, contact lenses, and

fittings. This exclusion does not

apply to eyeglasses and contact

lenses that are required due to

cataract surgery, covered corneal

transplants, and keratoconus

• Hearing aids

• Infertility services for members

who are not medically infertile

• Missed appointments

• Non-covered services even if

precertification was mistakenly

given

• Non-dental medical care ser-

vices only to diagnose and

treat temporomandibular joint

dysfunction

• Non-durable medical equipment,

unless used as part of the treat-

ment at a medical facility or as

part of approved home health

care services

• Non-prescription smoking-

cessation aids

• Orthotics

• Osteopathic manipulation,

electrolysis, routine foot care,

biofeedback, pain management

programs, massage therapy, and

acupuncture

• Personal comfort or convenience

items for rest or custodial care

12

• Services at a residential treat-

ment center

• Surrogate pregnancy (any form

of surrogacy)

• The portion of the charge for a

service or supply in excess of the

usual, customary, and reasonable

(UCR) charge

• Transsexual surgery, including

related procedures and treat-

ments and reversal of such

procedures

• Weight-loss programs or charges

for weight reduction except when

extreme obesity adversely aects

another medical condition and

treatment is medically necessary

as determined by the plan

For a comprehensive list of services

and conditions not covered by

Network Blue New England, please

refer to the description for Network

Blue New England available from

the Benefits Section of Human

Resources.

Appealing a Denied Claim

If a claim for benefits is partially or

fully denied, you will receive written

notification, which will include the

reasons for the denial, a descrip-

tion of any information necessary

to complete the processing of your

claim, and information on how to

submit the claim for review.

If you have a question regarding the

payment of a claim, you may write

or call:

Member Grievance Program

Blue Cross Blue Shield

of Massachusetts

One Enterprise Drive

Quincy, MA 02171-2126

Phone: 1-800-472-2689

Fax: 617-246-3616

Email: [email protected]

If you write, be sure to include

your identification number and

your telephone number. Letters

will be answered within 30 days.

You have a right to request a full

and fair review of any claim. If you

believe you or a covered family

member were wrongly denied all or

part of your benefits, you may appeal

the decision. You may submit ques-

tions and comments in writing and

review all pertinent plan documents.

Blue Cross Blue Shield of Massa-

chusetts must review your ap peal

and make a final decision within

a reasonable period of time. The

final written decision must state

specific reasons and plan provisions

on which the review decision was

based.

Additional information about appeal-

ing a denial of benefits is included

in the “Administrative Information”

section of this handbook.

BU Health Savings Plan

How BU Health Savings

Plan Works

The BU Health Savings Plan is a

high deductible health plan (HDHP)

administered by Blue Cross Blue

Shield of Massachusetts and

Medco/Express Scripts. Participants

in this HDHP have access to a

Health Savings Account (HSA)

administered through Fidelity

Investments.

The BU Health Savings Plan oers

the same network of doctors and

hospitals available under the BCBS

PPO, including BMC and its aliated

providers. The BU Health Savings Plan

prescription drug benefit is adminis-

tered through Medco/Express Scripts

and covers the same prescription

drugs as the other University oerings.

The BU Health Savings Plan provides

both in- and out-of-network cover-

age, just like the preferred provider

organization (PPO) plan. However,

the BU Health Savings Plan works

dierently in these key ways:

• Except for certain in-network pre-

ventive care services, all covered

health expenses are subject to

a plan deductible, including pre-

scription drugs.

• Under employee plus child(ren),

employee plus spouse, and fam-

ily coverage, the entire family

deductible must be met before

benefits are payable for any cov-

ered person.

• There are no copays, just coinsur-

ance (once the deductible is met),

even for oce and emergency

room visits, mental health care,

and prescription drugs.

The Deductible

You must meet the plan-year

deductible before you can receive

coverage for most services under

this plan. Your plan year begins

January 1 and ends on December 31

each year.

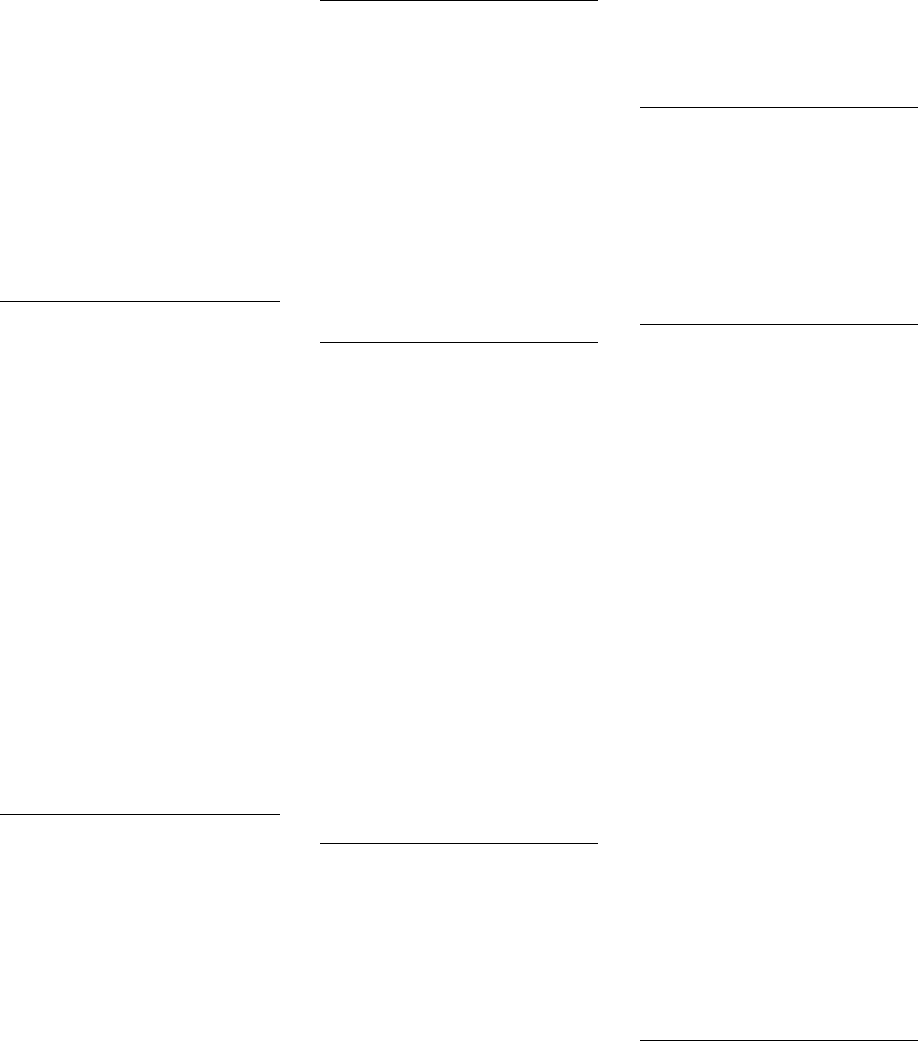

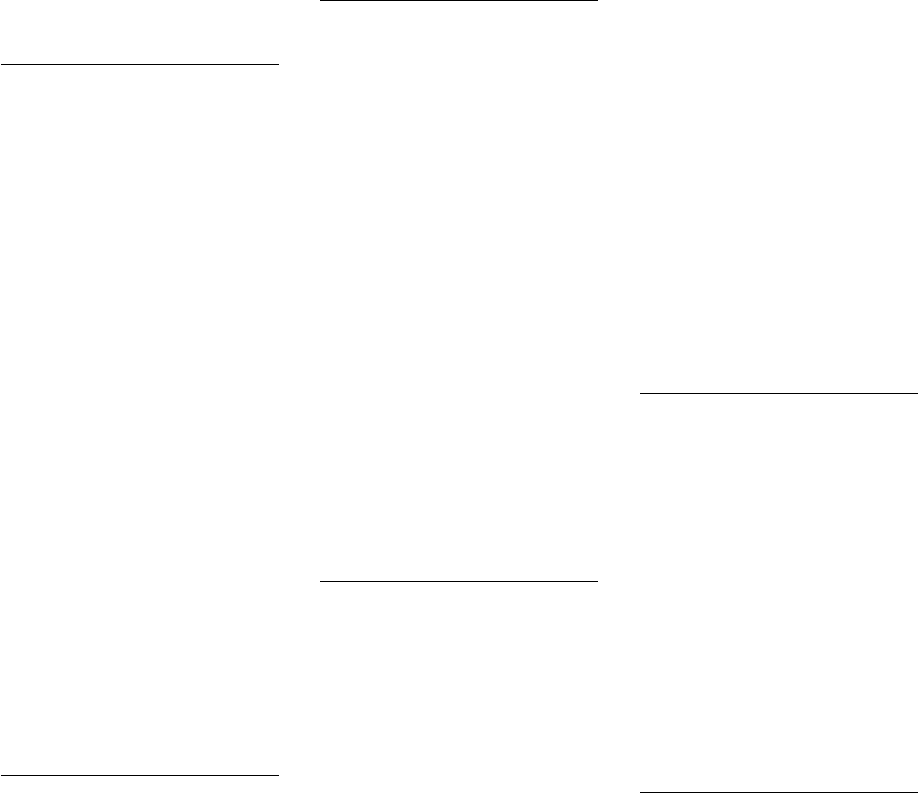

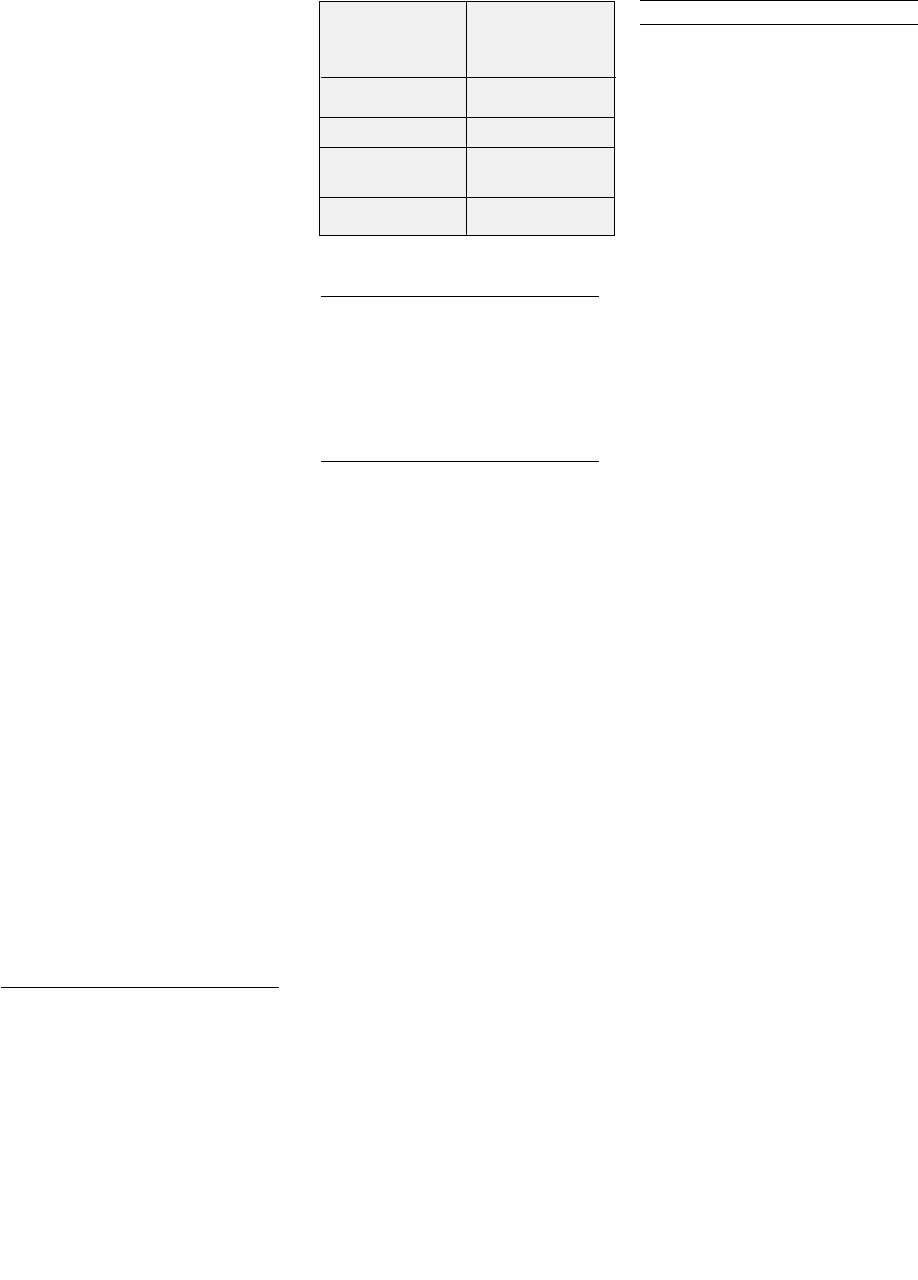

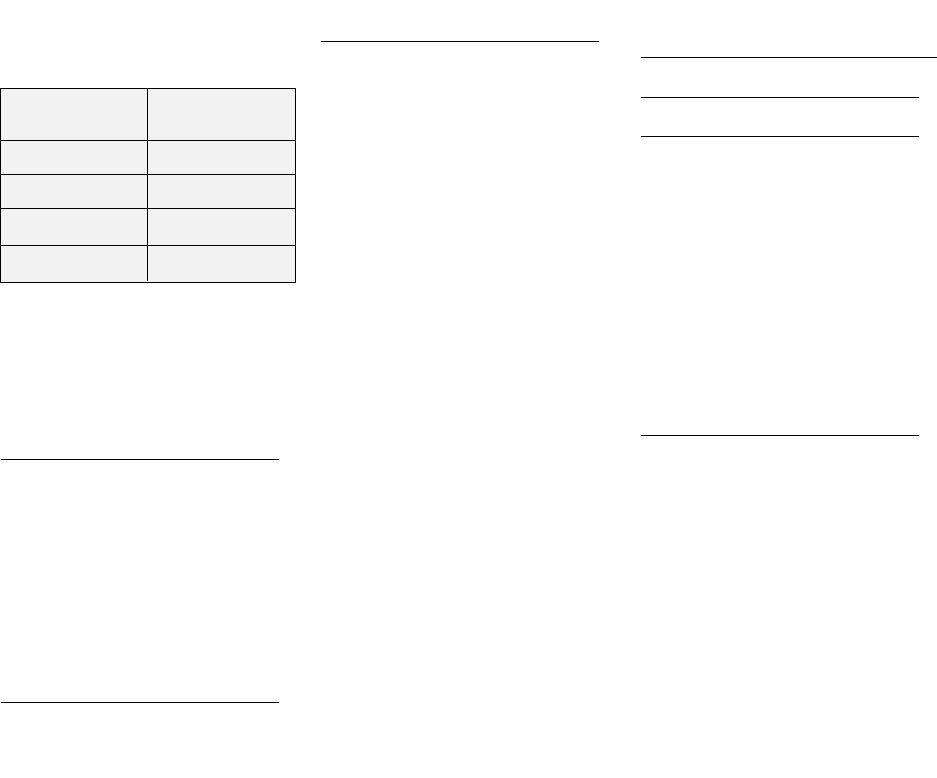

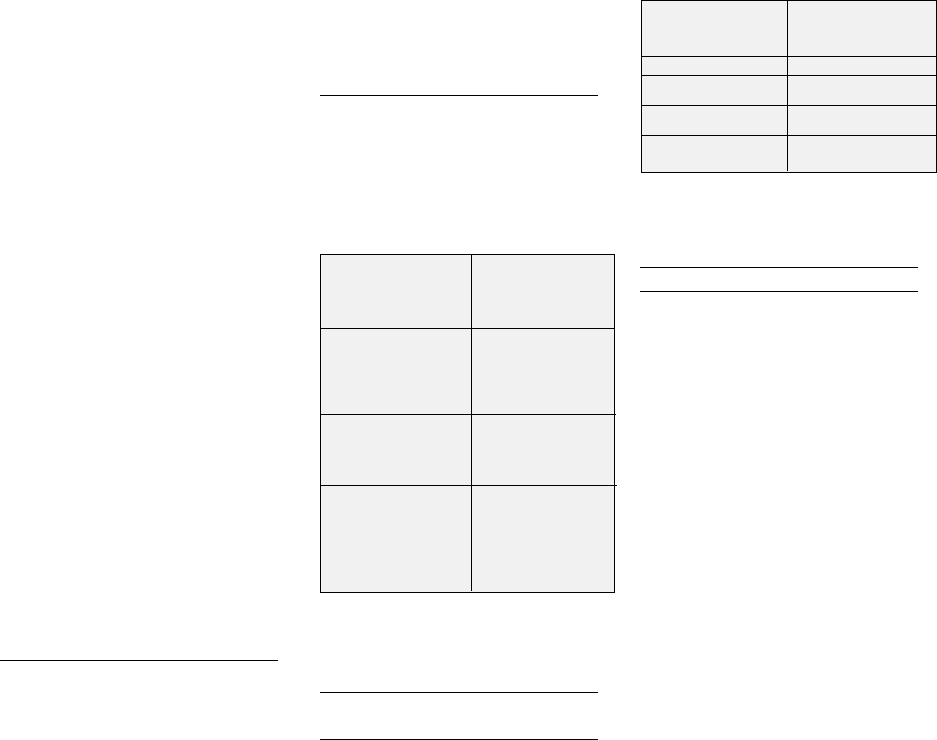

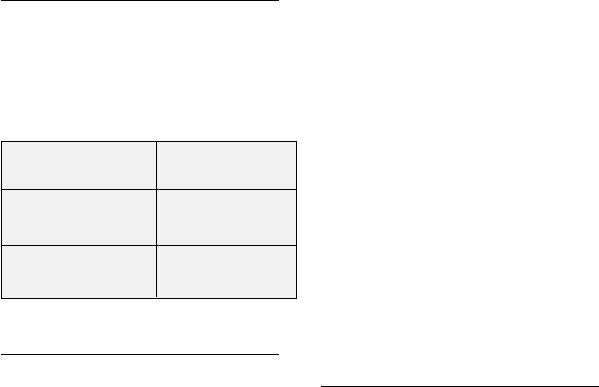

This table shows the deductibles

for in-network and out-of-network

services.

*If you have a plan that covers

employee plus spouse, or employee

plus child(ren), or family, you must

meet the higher family deductible

before you receive coverage.

Services Received from an

In-Network Provider

Once the deductible is met, most

services are covered 90%. You pay

10% coinsurance. When the amount

13

In-Network

Providers

Out-of-Network

Providers

$1,500 for indi-

vidual coverage,

or $3,000 for any

family coverage*

$3,000 for indi-

vidual coverage,

or $6,000 for any

family coverage*

Annual Deductible

you have paid in deductible and

coinsurance reaches $3,000 for an

individual plan, or $6,000 for any

family plan, covered benefits will be

paid in full (i.e., without any addi-

tional deductibles or coinsurance,

but subject to all plan provisions,

limitations, and exclusions) for the

remainder of that plan year.

Services Received from an

Out-of-Network Provider

Once the deductible is met, most out-

of-network services are covered 70%.

You pay 30% coinsurance. When the

amount you have paid in deductible

and coinsurance reaches $6,000 for

an individual plan, or $12,000 for any

family plan, covered benefits will be

paid in full (i.e., without any additional

deductibles or coinsurance, but sub-

ject to all plan provisions, limitations,

and exclusions) for the remainder

of that plan year.

Certain expenses do not apply

toward your out-of-pocket limit and

are excluded under the plan. They

include the following:

• Charges in excess of reasonable

and customary

• Expenses for services not cov-

ered by the plan

• Charges you incur for not follow-

ing precertification procedures

Emergency Care

Blue Cross Blue Shield provides

benefits for emergency medical

services whether you are in or

outside of Massachusetts. These

emergency medical services may

include inpatient or outpatient

services by providers qualified to

furnish emergency medical care

and that are needed to evaluate or

stabilize your emergency medical

condition. In an emergency, such

as a suspected heart attack, stroke,

or poisoning, you should go directly

Coverage is also provided for the

following services when determined

to be a medically necessary compo-

nent of the intermittent skilled nurs-

ing care or physical therapy:

• Occupational therapy

• Speech therapy

• Medical social work

• Nutritional consultation

• Home health aide

• Durable medical equipment

Utilization Review Requirements

Utilization Review is an important

feature of the out-of-network por-

tion of the BU Health Savings Plan.

It helps to ensure that you receive

the appropriate medical care in the

most cost ecient setting—whether

it be the hospital, a specialty facility,

or your own home.

Utilization Review includes:

• Preadmission Review—For

all non-emergency and non-

maternity hospital admissions

in the United States, you must

call the number on your ID card

in advance to get your stay

approved. Within two working

days of receiving all necessary

information, Blue Cross Blue

Shield will determine if the

health care setting is suitable to

treat your condition. Failure to

follow the preadmission review

procedure may result in your

having to pay for expenses that

otherwise would be covered.

• Concurrent Review/Discharge

Planning—This program auto-

matically monitors your stay in

the hospital to help ensure that

you are discharged on time and

receive necessary services once

you are discharged.

14

to the nearest medical facility or

call 911 (or the local emergency

phone number). You pay a 10%

coinsurance after the deductible

for in-network or out-of-network

emergency room services.

Preventive Care

Preventive care is covered 100%

with no deductible for in-network

care.

Out-of-network preventive care is

covered at 70% with no deductible.

• Well-child care exams, including

routine tests, according to age-

based schedule as follows:

o Ten visits during the first year

of life

o Three visits during the second

year of life

o One visit per calendar year

from age 2 through age 18

• Routine adult physical exams,

including related tests, for mem-

bers age 19 or older (one per

calendar year)

• Routine GYN exams, including

related lab tests (one per calen-

dar year)

• Routine hearing exams, including

routine tests

• Routine vision exams (one every

12 months)

• Family planning services (oce

visits)

Home Health Care Benefits

The BU Health Savings Plan pays

benefits for medically necessary

home care services and supplies,

such as intermittent skilled nursing

care and physical therapy, at 90%

(after the deductible) when you use

a participating provider, and at 70%

(after the deductible) when you use

an out-of-network provider.

Be sure to follow Utilization Review pro-

visions. If you do not follow these provi-

sions, plan benefits will be reduced.

Services Not Covered

Under the BU Health Savings Plan,

no benefits are provided for the

following:

• Ambulance services unless

necessitated by an emergency

or medical necessity or autho-

rized by Blue Cross Blue Shield

for transfer from one facility to

another

• Any claim submitted more than

two years from the date the ser-

vice was rendered

• Blood: whole blood; packed red

blood cells; blood donor fees; and

blood storage fees

• Care for military service con-

nected disabilities for which the

member is legally entitled to

treatment or services

• Charges in excess of the plan

maximum amount or other limit

• Commercial diet plans or weight-

loss programs

• Cosmetic procedures, except

when medically necessary and

considered medical care under

the Internal Revenue Code

• Cost for any services for which

the member is entitled to treat-

ment at government expense or

under Workers’ Compensation

or occupational disability

• Court-ordered examinations and

services

• Custodial or domiciling care to

assist a member in the activities

of daily living or provide room

and board, training in personal

hygiene, and other forms of self-

care; personal care in the home

except when medically neces-

sary as part of a treatment plan

for a medical condition

• Dental services, including peri-

odontal, restorative, and orth-

odontic services

• Educational services (includ-

ing problems of school per-

formance) or testing for

developmental, educational, or

behavioral problems except as

medically necessary under an

early intervention program

• Equipment for environmental

control or general household use,

such as air filters, air condition-

ers, air purifiers, liquidizers, bath

seats, bedpans, dehumidifiers,

dentures, elevators, heating

pads, hot water bottles, and

humidifiers

• Eyeglasses, contact lenses, and

fittings. This exclusion does not

apply to contact lenses that are

required due to cataract surgery,

covered corneal transplants, and

keratoconus

• Health care services that are not

medically necessary

• Health care services that are

considered experimental

• Health care services that are

considered obsolete and no lon-

ger medically justified

• Health care services furnished to

someone other than the member

• Hearing aids

• Missed appointments

• Nicotine gum

• Non-covered providers

• Non-covered services

• Non-durable medical equipment,

unless used as part of the treat-

ment at a medical facility or as

part of approved home health

care services

• Orthotics

• Osteopathic manipulation,

electrolysis, routine foot care,

biofeedback, pain management

programs, massage therapy, and

acupuncture

• Personal comfort items

• Physical examinations for insur-

ance, licensing, or employment

• Private duty nursing

• Private room charges

• Refractive eye surgery

• Rest or custodial care; personal

comfort or convenience items

• Reversal or attempted reversal

of voluntary sterilization (includ-

ing procedures necessary for

conception following voluntary

sterilization)

• Sensory integrative praxis test;

testing for central auditory

processing

• Services for any person who is

not covered under the plan when

the services are rendered

• Services for which no charges

would have been made in the

absence of coverage under this

plan

• Services incurred after termina-

tion of coverage under the plan

• Services incurred prior to the

eective date of coverage

• Services not specifically

described in this plan document

• Services not within the scope

of the physician’s, provider’s, or

hospital’s licensure

• Services or supplies given to

you by anyone related to you by

blood, marriage, or adoption or

who ordinarily lives with you

15

Accounts and Other Tax-Favored

Health Plans.” If you have an HSA,

you should carefully review that

publication. If you have legal, tax, or

financial questions about HSAs, you

should consult your own profes-

sional advisor at your own expense.

ERISA does not apply to HSAs and

the University is not a fiduciary of

any HSA.

HSA Eligibility

You are eligible to open a Fidelity

HSA if:

You become covered under the BU

Health Savings Plan, a qualifying

high deductible health plan, and

You are not enrolled in Medicare

and have not received medi-

cal benefits within the last three

months through the Veteran’s

Administration (VA), and

You cannot be claimed as a depen-

dent on another person’s tax return.

You are NOT eligible to open a

Fidelity HSA if:

You are not covered under the BU

Health Savings Plan.

You are enrolled in Medicare or have

received medical benefits within the

last three months through the VA.

You can be claimed as a dependent

on another person’s tax return.

IMPORTANT: You may also not

open an HSA while you are covered

under another health plan that is

not a qualifying HDHP. For exam-

ple, you cannot also be covered

under a health care flexible spend-

ing arrangement (FSA) of your own

or under an FSA of your spouse

through his or her employer. Also,

you cannot be covered as a depen-

dent of your spouse under the

group health plan of your spouse’s

employer if that group health plan

is not a qualifying HDHP.

16

• Surrogate pregnancy (any form

of surrogacy)

• Temporomandibular joint dys-

function treatment limited to

medical services only

• The portion of the charge for a

service or supply in excess of the

usual, customary, and reasonable

(UCR) charge

• Transsexual surgery, including

related procedures and treat-

ments and reversal of such

procedures

• Weight-loss programs or

charges for weight reduction

except when extreme obesity

adversely aects another medi-

cal condition and treatment is

medically necessary as deter-

mined by the plan

Appealing a Denied Claim

If a claim for benefits is partially

or fully denied, you will receive

written notification, which will

include the reasons for the denial, a

description of any information nec-

essary to complete the processing

of your claim, and information on

how to submit the claim for review.

If you have a question regarding the

payment of a claim, you may write

or call:

Member Grievance Program

Blue Cross Blue Shield

of Massachusetts

One Enterprise Drive

Quincy, MA 02171-2126

Phone: 1-800-472-2689

Fax: 617-246-3616

Email: [email protected]

If you write, be sure to include

your identification number and

your telephone number. Letters

will be answered within 30 days.

You have a right to request a full

and fair review of any claim. If

you believe you or a covered fam-

ily member were wrongly denied

all or part of your benefits, you

may appeal the decision. You may

submit questions and comments

in writing and review all pertinent

plan documents.

Blue Cross Blue Shield of Massa-

chusetts must review your ap peal

and make a final decision within

a reasonable period of time. The

final written decision must state

specific reasons and plan provi-

sions on which the review decision

was based.

Additional information about appeal-

ing a denial of benefits is included

in the “Administrative Information”

section of this handbook.

Health Savings Account

(HSA)

A Health Savings Account (HSA)

is a tax-advantaged account used

in conjunction with an HSA-eligible

high deductible health plan (HDHP)

that eligible individuals may estab-

lish to pay for current and future

qualified medical expenses for

themselves, their spouse, and their

qualifying dependents. The BU

Health Savings Plan is an HSA-

eligible HDHP. In connection with

the BU Health Savings Plan, access is

provided to an HSA administered by

Fidelity Investments if you would like

to make your own pre-tax payroll

deductions, and/or wish to receive

the BU HSA contribution. You are,

however, free to choose any HSA

vendor for your own after-tax con-

tributions or move money from your

Fidelity-administered HSA to an

HSA administered by another entity

in accordance with IRS rules.

The legal and tax rules relating to

HSAs can be complicated. A sum-

mary of those rules is contained in

IRS Publication 969 “Health Savings

• When you elect the BU Health

Savings Plan, you may also elect

to open an HSA. If you do, the

University will automatically

deposit $500 as a contribution

to your Fidelity-administered

HSA account.*

• You don’t need to use Fidelity

for the HSA. However, if you

want to automatically have the

HSA contributions come from

your paycheck, you will have to

establish a Fidelity account on

their website NetBenefits® at

netbenefits.com.

• You may elect to contribute to

your HSA, pre-tax, up to the

annual limits. For 2013 the limits

are $3,250 for employee only

and $6,450 if you have fam-

ily coverage. These limits are

reduced by any contributions

by the University to your HSA,

e.g., if the University contributed

$500 to your HSA and you have

employee-only coverage under

the BU Health Savings Plan,

your remaining maximum HSA

contribution for the remainder

of the year would be $2,750

($3,250–$500). If you are age

55 or older in 2013, you may

make additional pre-tax “catch-

up” contributions, up to $1,000

per year.

• You are not required to contrib-

ute to the HSA to participate in

the BU Health Savings Plan.

• You must, however, open a

Fidelity HSA in order to receive

the University contribution to

that HSA.

17

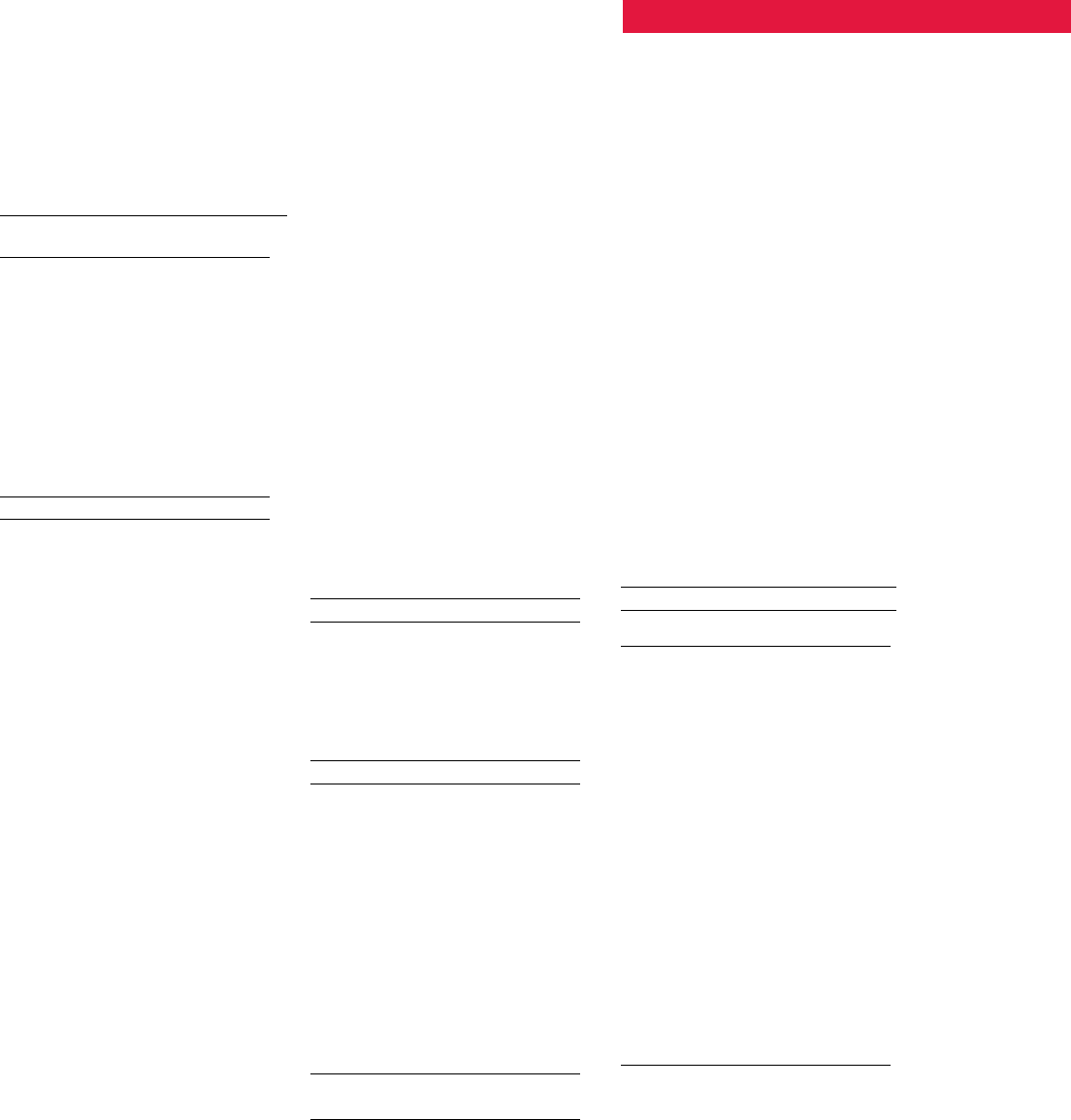

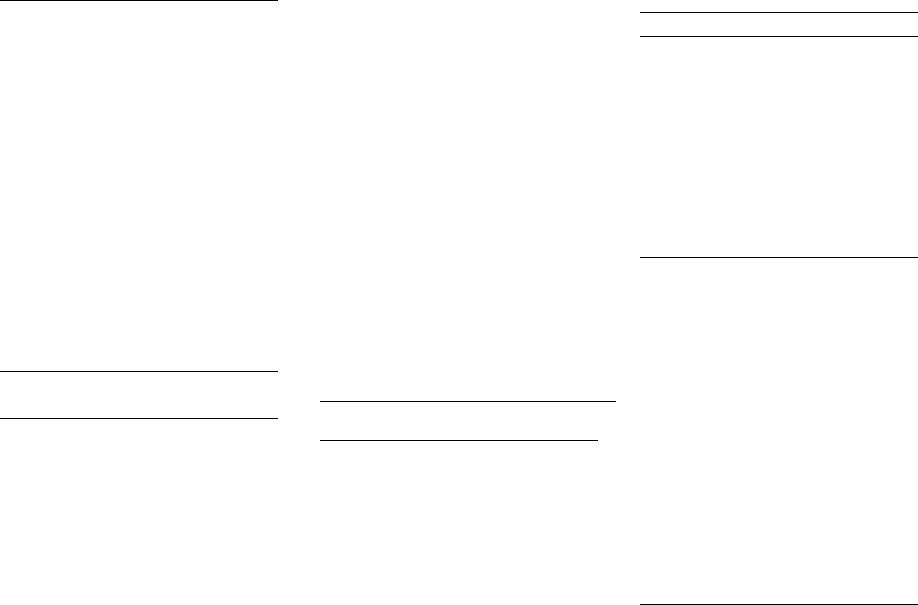

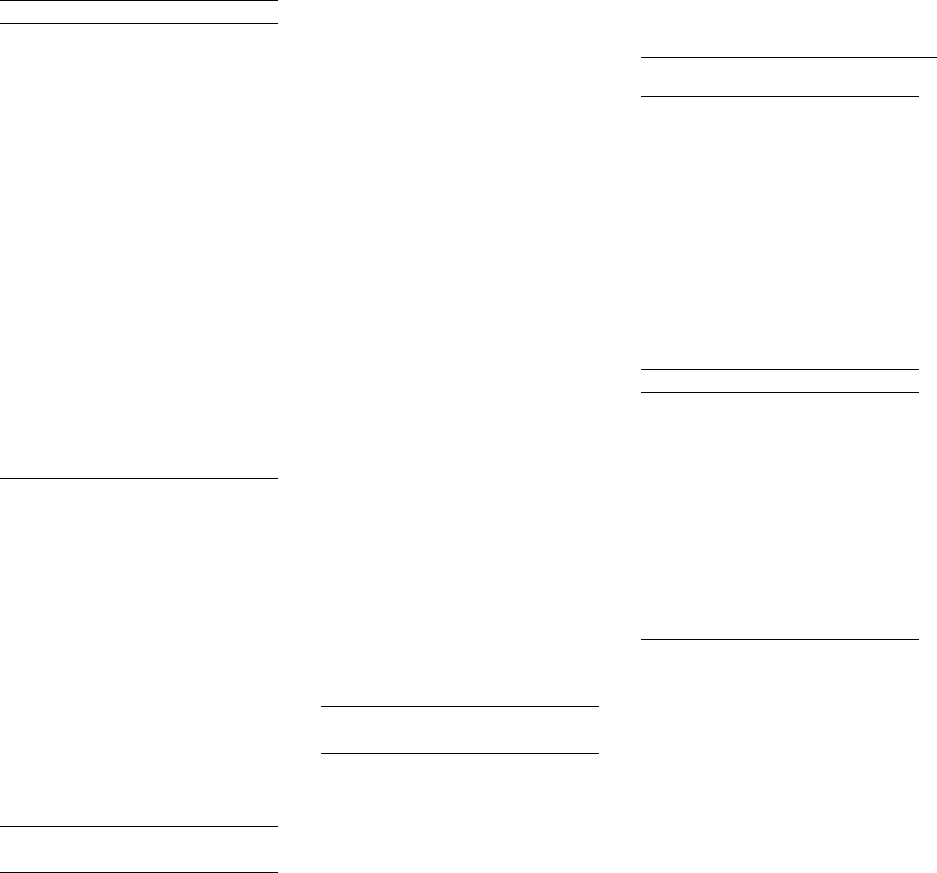

2013 Individual Family

Annual HSA Contribution $3,250 $6,450

Limits

Catch-up Contribution Limit $1,000 $1,000

(for those age 55 and older)

documents/BN_enrollment_

form.pdf.

2. Once you have submitted your

enrollment, your payroll contri-

butions will be set up.

3. Fidelity Investments will be

informed by Human Resources

that you have enrolled and are

eligible to open your Fidelity HSA.

4. Fidelity will contact you via email

or telephone with instructions

to set up your account through

NetBenefits (www.netbenefits.

com).

5. Once you have completed the

account set up, payroll deductions

will begin and your pre-tax contri-

butions will be sent to Fidelity.

6. After your first contribution, BU

will contribute the $500 seed

money. Any money in your HSA

is immediately available for

you to use for qualified medical

expenses.

Your Fidelity HSA Investments

The Fidelity HSA is a Fidelity

brokerage account that has a

“core position” through which all

contributions are deposited and all

disbursements are withdrawn. This

“core position” is an FDIC-Insured

Deposit Sweep. Once your account

balance exceeds $2,500, you can

choose to invest in a broad range

of options, including a full range

of Fidelity mutual funds, more

than 4,000 non-Fidelity funds,

and individual stocks and bonds.

Any earnings on your Fidelity HSA

investments are automatically

reinvested and grow tax free.

Funding Your HSA

• Pre-Tax Contributions—Your pay-

roll deductions are taken on a pre-

tax basis to fund your account.

You may change your payroll

deduction amount on a monthly

• You may also contribute after-

tax funds by check and claim

them as deductions on your

income tax return.

• You may prospectively change

your pre-tax salary reduction

HSA contribution amounts on a

monthly basis.

• You are always 100% vested

in both the amount Boston

University contributes to your

account and in your HSA

contributions.

• You decide whether to save for

qualified expenses you incur now

or in the future; any funds you

withdraw to pay for qualified

medical expenses are tax-free.

• You may request a debit card

and special checkbook to provide

you access to your HSA funds,

and you may use these even if

you terminate employment with

Boston University or drop your

membership in the BU Health

Savings Plan. The debit card

can be requested online at

netbenefits.com or requested

by phone at 800-343-0860.

* The amount (if any) of University

HSA contributions is subject to re-

view and change by the University at

any time. The University reserves the

right, in its sole discretion, to discon-

tinue HSA contributions at any time.

Opening Your Fidelity HSA

You may enroll in the HSA at any

time if you are enrolled in the BU

Health Savings Plan. This is the

process to follow to establish your

account:

1. You may enroll either via

Employee Self Service at www.

bu.edu/buworkscentral or by

completing a paper Benefits

Enrollment Form available

at: www.bu.edu/hr/files/

basis. Total contributions to your

account do not exceed your maxi-

mum annual contribution amount.

• After-Tax Contributions—You may